Exhibit 99.2

Summary of Rate Application

May 2, 2005

Forward Looking Disclosure

The following presentation contains some “forward-looking statements” with respect to Westar Energy Inc.’s (“Westar”) future plans, expectations and goals, including management’s expectations with respect to future operating results and the outcome of Westar’s pending rate review. The Private Securities Litigation Reform Act of 1995 has established that these statements qualify for safe harbors from liability.

Although we believe that the expectations and goals reflected in such forward-looking statements are based on reasonable assumptions, all forward-looking statements involve risk and uncertainty. Therefore, actual results could vary materially from what we expect. Please review our 2004 annual report on Form 10-K for important risk factors that could cause results to differ materially from those in any such forward-looking statements. Additionally, many of such forward-looking statements are subject to the outcome of our pending rate review with the Kansas Corporation Commission. Any forward-looking statement speaks only as of the date such statement was made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement was made except as required by applicable laws or regulations.

Contents

Page

Overview 4

Kansas Retail Case Highlights 5

Depreciation Rate Change 7

Fuel Adjustment Clause/Off-System Sales Sharing 8

Transmission Formula Rate 9

Environmental Cost Recovery Rider 10

Other Significant Adjustments 12

Reliability-Based Sharing Proposal 13

Timeline 17

Overview

On May 2, Westar filed two rate applications

Retail rate review with Kansas Corporation Commission (KCC)

Fulfills July 2003 agreement as part of approved debt reduction plan

FERC formula transmission rate

Unbundles transmission service from retail rates

Consistent with Southwest Power Pool (SPP) RTO membership

Allows for ROE premium

By Kansas statute, KCC must issue an order no later than December 28, 2005

FERC transmission rate likely to be effective by December 2005

Simultaneous filing allows opportunities for retail and transmission rates to be effective at same time

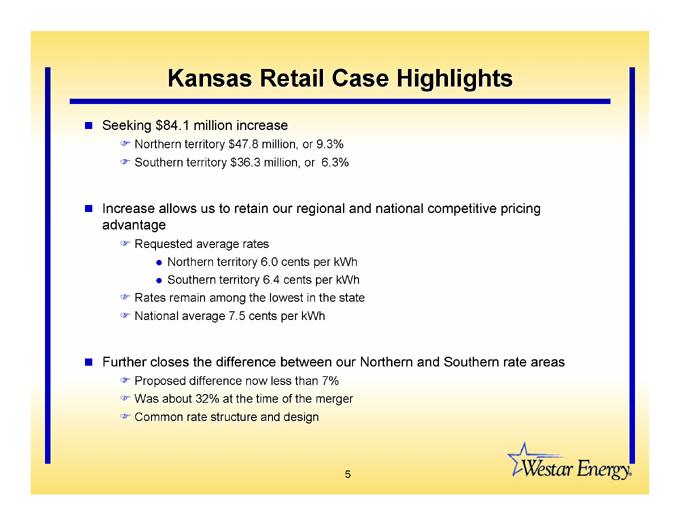

Kansas Retail Case Highlights

Seeking $84.1 million increase

Northern territory $47.8 million, or 9.3%

Southern territory $36.3 million, or 6.3%

Increase allows us to retain our regional and national competitive pricing advantage

Requested average rates

Northern territory 6.0 cents per kWh

Southern territory 6.4 cents per kWh

Rates remain among the lowest in the state

National average 7.5 cents per kWh

Further closes the difference between our Northern and Southern rate areas

Proposed difference now less than 7%

Was about 32% at the time of the merger

Common rate structure and design

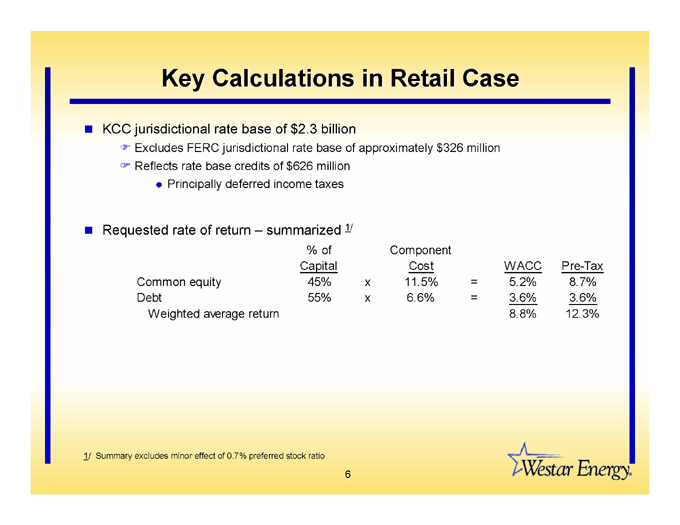

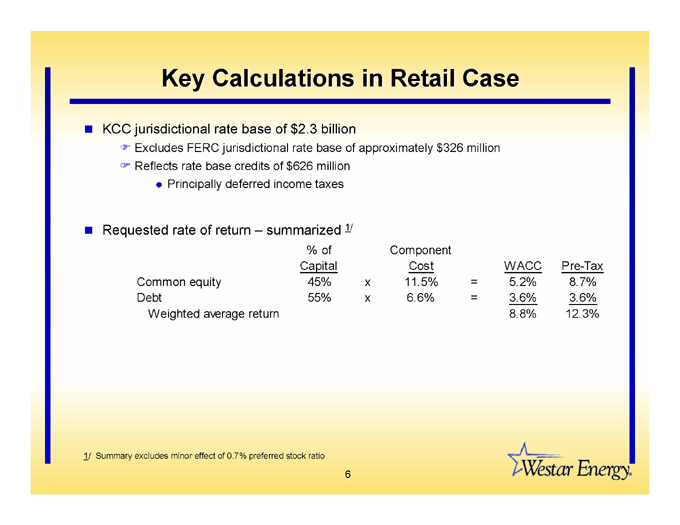

Key Calculations in Retail Case

KCC jurisdictional rate base of $2.3 billion

Excludes FERC jurisdictional rate base of approximately $326 million

Reflects rate base credits of $626 million

Principally deferred income taxes

Requested rate of return – summarized 1/

| | | | | | | | | | | | |

| | | % of

Capital | | | Component

Cost | | | WACC | | | Pre-Tax | |

Common equity | | 45 | % | | x

11.5

= |

%

| | 5.2 | % | | 8.7 | % |

Debt | | 55 | % | | x

6.6

= |

%

| | 3.6 | % | | 3.6 | % |

Weighted average return | | | | | | | | 8.8 | % | | 12.3 | % |

1/ Summary excludes minor effect of 0.7% preferred stock ratio

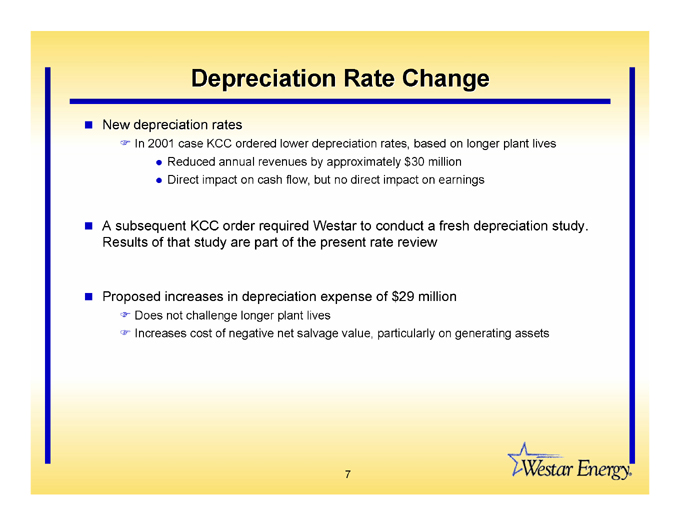

Depreciation Rate Change

New depreciation rates

In 2001 case KCC ordered lower depreciation rates, based on longer plant lives

Reduced annual revenues by approximately $30 million

Direct impact on cash flow, but no direct impact on earnings

A subsequent KCC order required Westar to conduct a fresh depreciation study. Results of that study are part of the present rate review

Proposed increases in depreciation expense of $29 million

Does not challenge longer plant lives

Increases cost of negative net salvage value, particularly on generating assets

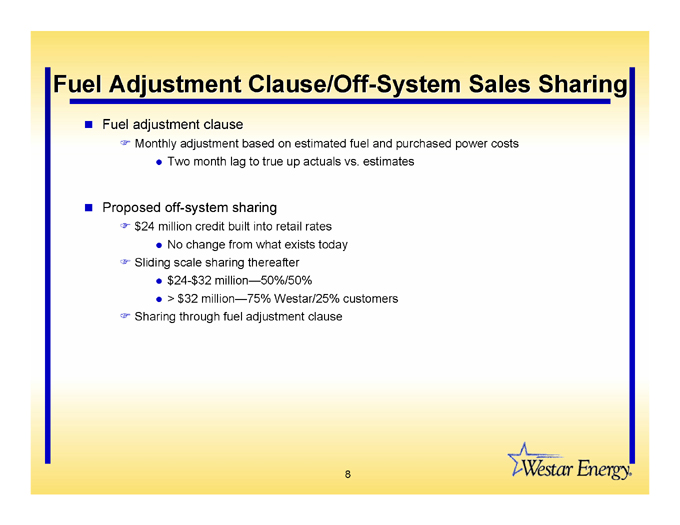

Fuel Adjustment Clause/Off-System Sales Sharing

Fuel adjustment clause

Monthly adjustment based on estimated fuel and purchased power costs

Two month lag to true up actuals vs. estimates

Proposed off-system sharing

$24 million credit built into retail rates

No change from what exists today

Sliding scale sharing thereafter

$24-$32 million—50%/50%

$>32 million—75% Westar/25% customers

Sharing through fuel adjustment clause

Transmission Formula Rate

Transmission formula rate

Revenue requirement associated with the transmission function is removed from bundled retail rates

FERC filing to create a FERC-approved formula transmission rate

Retail revenue requirement will include a “line item expense” equal to FERC formula rate and SPP charges

Will appear as an unbundled line item on retail bills

Authorized by Kansas statute

Simultaneous FERC filing

Includes FERC formula ROE plus 50 basis point premium for RTO membership

Rate expected to be effective December 2005

Environmental Cost Recovery Rider

Pending environmental rules, regulations, statutes and litigation will cause Westar to invest significantly to further reduce emissions

SOX

NOX

Mercury

Particulates

Uncertain legislative and regulatory outcomes result in wide range of potential expenditures

We have identified the potential for up to $660 million (nominal dollars) of expenditures for environmental projects over approximately 10 years

Expenditures could be significantly lower

First projects are likely to include scrubbers and SCR for our 50% of LaCygne Unit 1 (operated by KCPL (GXP))

Follow-on projects may include

Low NOX burners at Jeffrey Energy Center (JEC)

Potential rebuild of scrubbers at JEC

Other projects as needed

Environmental Cost Recovery Rider

Propose a tracking mechanism to recover associated costs of environmental compliance

Revenue requirement related to environmental costs would be recovered as a line item on retail bills

True up and rebundle costs in subsequent rate reviews

Advantages

Adequate and timely cost recovery

Avoid more frequent rate cases

Send proper price signals with regard to the cost of environmental compliance

Minimizes total cost to customer by avoiding AFUDC

Present case seeks to establish the rider prior to Westar having to make significant investments in environmental controls

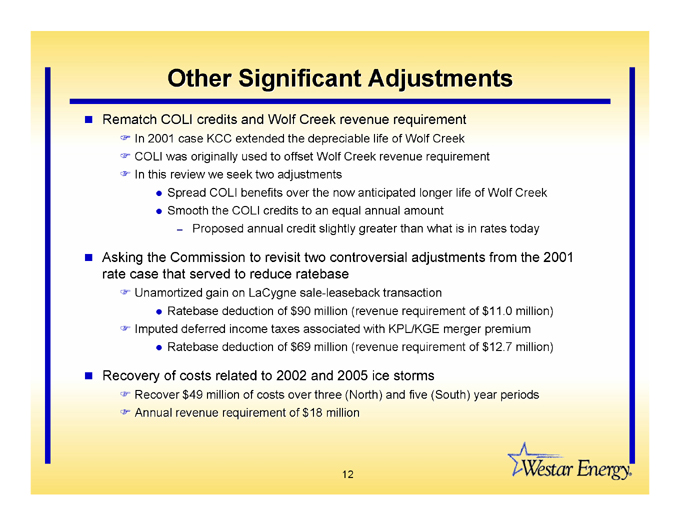

Other Significant Adjustments

Rematch COLI credits and Wolf Creek revenue requirement

In 2001 case KCC extended the depreciable life of Wolf Creek

COLI was originally used to offset Wolf Creek revenue requirement

In this review we seek two adjustments

Spread COLI benefits over the now anticipated longer life of Wolf Creek

Smooth the COLI credits to an equal annual amount – Proposed annual credit slightly greater than what is in rates today

Asking the Commission to revisit two controversial adjustments from the 2001 rate case that served to reduce ratebase

Unamortized gain on LaCygne sale-leaseback transaction

Ratebase deduction of $90 million (revenue requirement of $11.0 million)

Imputed deferred income taxes associated with KPL/KGE merger premium

Ratebase deduction of $69 million (revenue requirement of $12.7 million)

Recovery of costs related to 2002 and 2005 ice storms

Recover $49 million of costs over three (North) and five (South) year periods

Annual revenue requirement of $18 million

Reliability-Based Sharing Proposal

(Alternative Ratemaking Proposal)

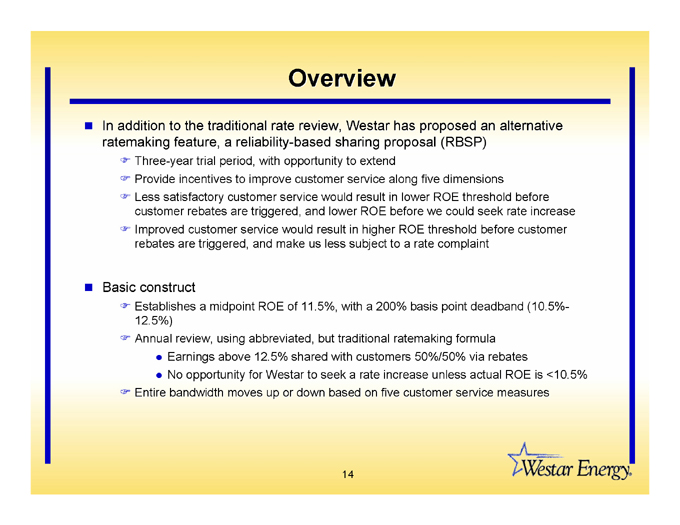

Overview

In addition to the traditional rate review, Westar has proposed an alternative ratemaking feature, a reliability-based sharing proposal (RBSP)

Three-year trial period, with opportunity to extend

Provide incentives to improve customer service along five dimensions

Less satisfactory customer service would result in lower ROE threshold before customer rebates are triggered, and lower ROE before we could seek rate increase

Improved customer service would result in higher ROE threshold before customer rebates are triggered, and make us less subject to a rate complaint

Basic construct

Establishes a midpoint ROE of 11.5%, with a 200% basis point deadband (10.5%-12.5%)

Annual review, using abbreviated, but traditional ratemaking formula

Earnings above 12.5% shared with customers 50%/50% via rebates

No opportunity for Westar to seek a rate increase unless actual ROE is <10.5%

Entire bandwidth moves up or down based on five customer service measures

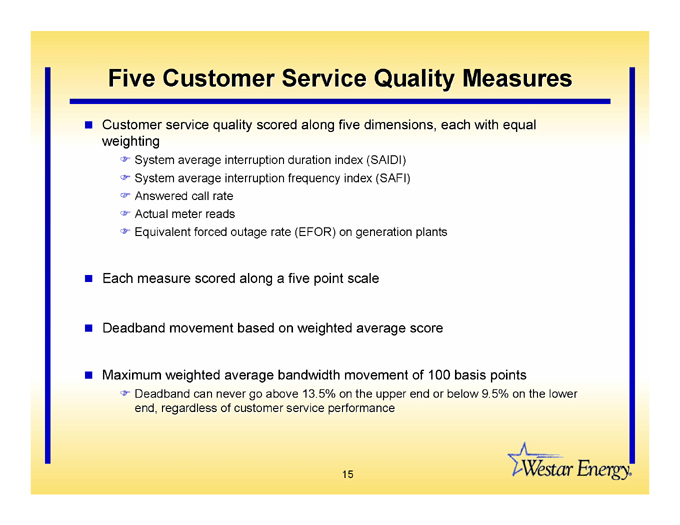

Five Customer Service Quality Measures

Customer service quality scored along five dimensions, each with equal weighting

System average interruption duration index (SAIDI)

System average interruption frequency index (SAFI)

Answered call rate

Actual meter reads

Equivalent forced outage rate (EFOR) on generation plants

Each measure scored along a five point scale

Deadband movement based on weighted average score

Maximum weighted average bandwidth movement of 100 basis points

Deadband can never go above 13.5% on the upper end or below 9.5% on the lower end, regardless of customer service performance

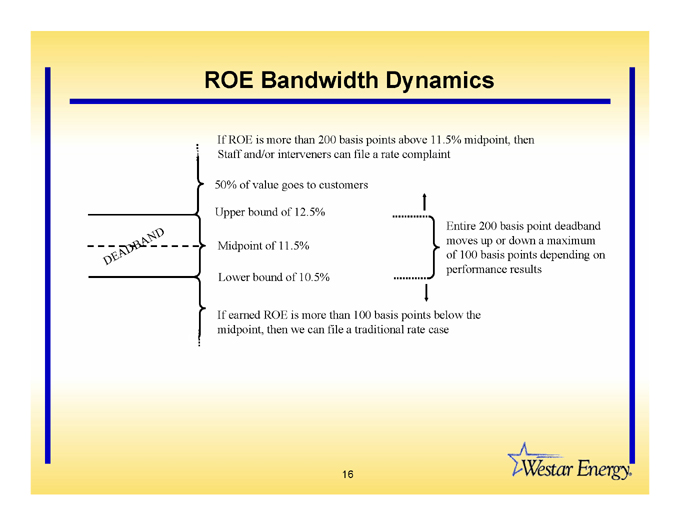

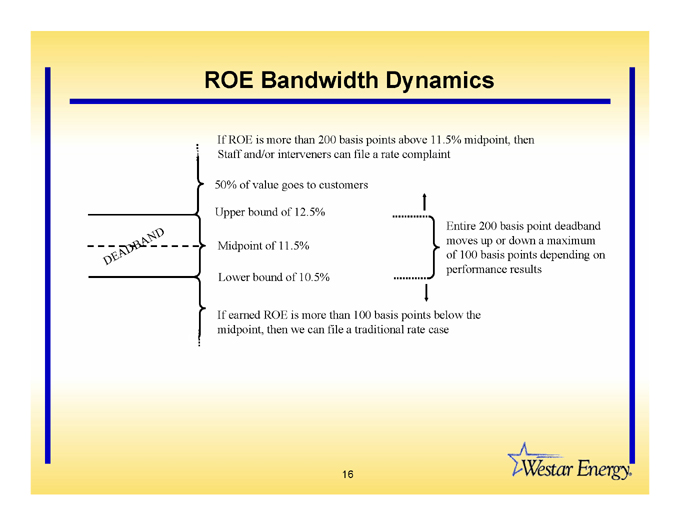

ROE Bandwidth Dynamics

If ROE is more than 200 basis points above 11.5% midpoint, then Staff and/or interveners can file a rate complaint

50% of value goes to customers

Upper bound of 12.5%

Midpoint of 11.5%

Lower bound of 10.5%

If earned ROE is more than 100 basis points below the midpoint, then we can file a traditional rate case

Entire 200 basis point deadband moves up or down a maximum of 100 basis points depending on performance results

DEADBAND

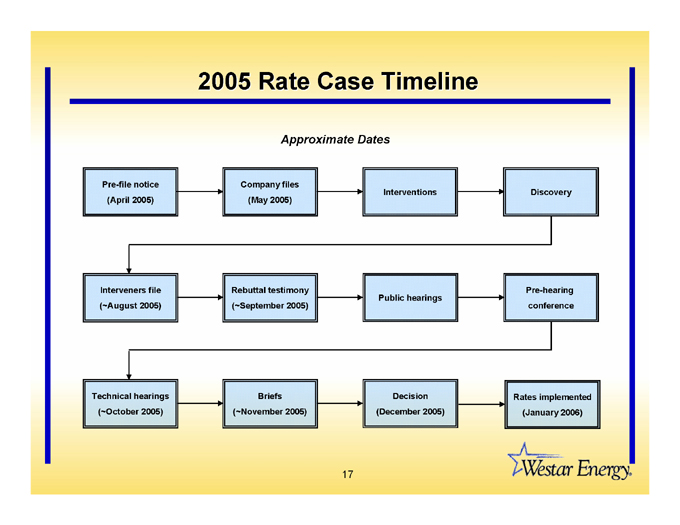

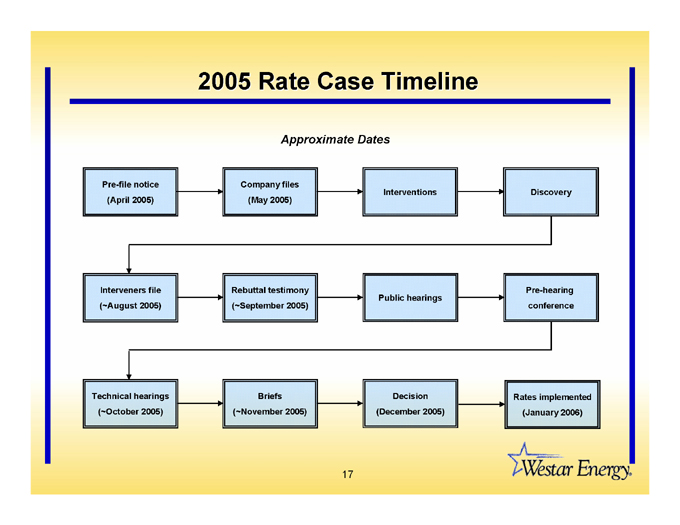

2005 Rate Case Timeline

Approximate Dates

Pre-file notice

(April 2005)

Company files

(May 2005)

Interventions

Discovery

Interveners file

(~August 2005)

Rebuttal testimony

(~September 2005)

Public hearings

Pre-hearing

Conference

Technical hearings

(~October 2005)

Briefs

(~November 2005)

Decision

(December 2005)

Rates implemented

(January 2006)