Edison Electric Institute

38th Annual Financial Conference

October 27-29, 2003

Forward-Looking Statements

Disclosure

The following presentation contains some “forward-looking statements” with respect to

Westar’s future plans, expectations and goals, including management’s expectations with

respect to the execution of Westar’s restructuring plan and the implementation of

recommendations resulting from the Special Committee investigation. The Private Securities

Litigation Reform Act of 1995 has established that these statements qualify for safe harbors from

liability.

Although we believe that the expectations and goals reflected in such forward-looking

statements are based on reasonable assumptions, all forward-looking statements involve risk

and uncertainty. Therefore, actual results could vary materially from what we expect. Please

review our quarterly report on Form 10-Q for second quarter 2003 and our 2002 annual report on

Form 10-K for important risk factors that could cause results to differ materially from those in any

such forward-looking statements.

Any forward-looking statement speaks only as of the date such statement was made, and

we do not undertake any obligation to update any forward-looking statement to reflect events or

circumstances after the date on which such statement was made except as required by

applicable laws or regulations.

Strategy & Restructuring Plan

Strategy

Westar is returning to its roots as an

integrated electric utility in Kansas.

New Leadership

Executive Management

CEO, Jim Haines

22 years of utility experience; 16 years in Kansas

5 years as CEO of El Paso Electric

COO, Bill Moore

23 years of utility experience; all in Kansas

Both operational and financial experience

CFO, Mark Ruelle

17 years of utility experience; 11 years in Kansas

Both operational and financial experience

Corporate officers as a group average nearly 20 years of utility

industry experience

New Leadership

Board of Directors

New independent directors

Mollie Hale Carter (agriculture & banking interests, ADM board member)

Art Krause (retired CFO, Sprint)

Mike Morrissey (retired Ernst & Young audit partner)

Restructuring Plan

Reduce debt

Return to being a pure Kansas electric utility

Divest non-utility assets by year-end 2004

Dramatically simplify current corporate structure

On February 6th Westar Energy Inc. filed a restructuring

plan with the Kansas Corporation Commission (KCC)

On July 25th the KCC approved the Plan

as modified by a settlement agreement

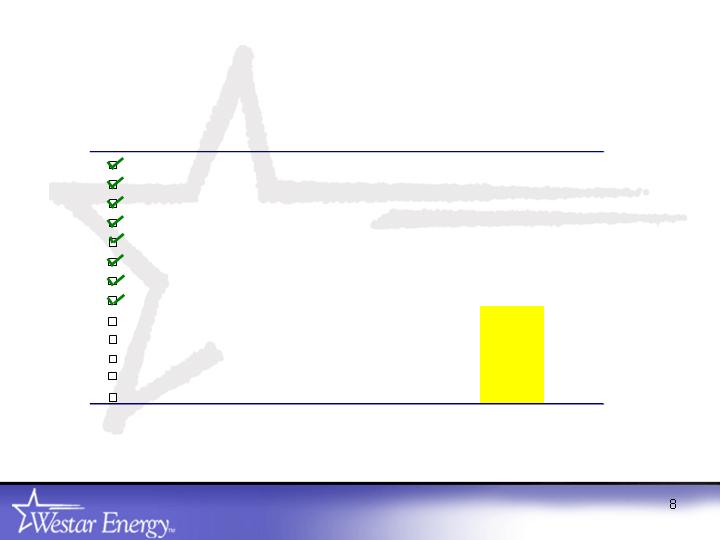

Debt Reduction Progress

Expected

Expected Debt

Actual

Status

Timing

Debt Reduction Plan Component

Reduction (mm)

Results

Completed

Sale of ONEOK Stock - Tranche 1

$244

$244

Completed

Obtain relief from legal order to restructure

Completed

Obtain relief for Protection One interim support

Completed/Ongoing

Common Dividend Reduction

55*

On track

Completed

Sale of Protection One Europe

50-100

114

Completed

Obtain KCC approval of Debt Reduction Plan

Completed

Sale of ONEOK Stock - Tranche 2

180-290**

244

Completed

Sale of Utility Assets to Midwest Energy

N/A

24

Late '03 - Early '04

Sale of Protection One

500 - 650

1st Half 2004

Sale of ONEOK Stock - Tranche 3

115-150**

2nd Half 2004

Sale of ONEOK Stock - Tranche 4

115-150**

2003-04/Ongoing

Cash Flow From Operations

150-200

Late 2004

Possible Equity Issuance

0-250

* Savings expected through 2004

** Expected debt reduction amounts adjusted, assume remaining disposition in 2 equal tranche offerings

Note: All debt reduction figures are net of expected tax expense or benefit

Remaining Steps

Dispose of remaining ONEOK Holdings

13.7 million shares (14.5%)

Current market value approximately $285 million

Dispose of Protection One

Estimated range of value for debt reduction: $500 - $650 million

POI debt balance

Intercompany debt $216 million

Non-affiliate debt $333 million

$26 million held by Westar

Potential equity issuance

Manage amount and timing

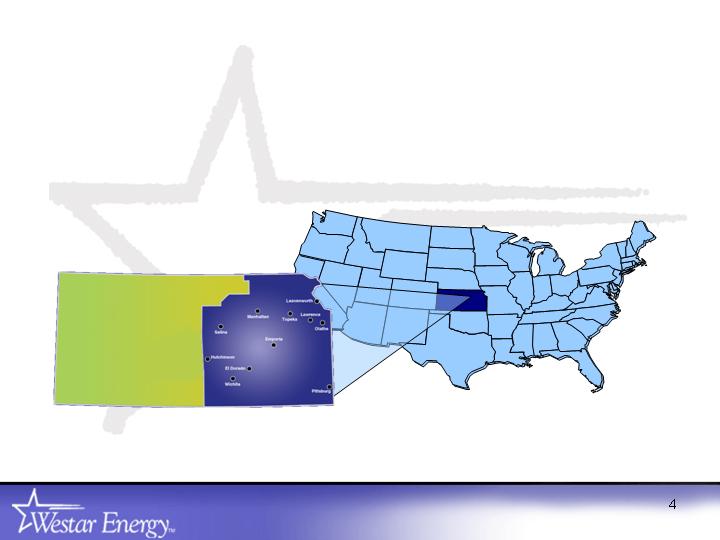

Utility Operations

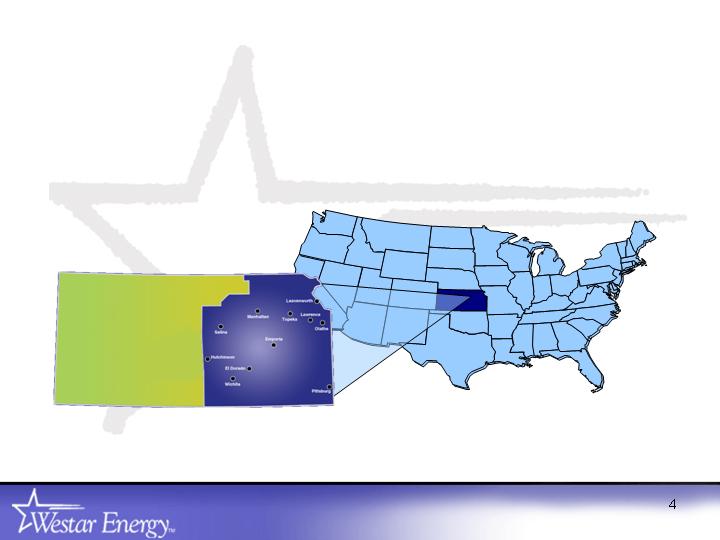

Westar Utility Operations

Kansas’ largest electric provider

647,000 customers

11,000 square mile service

territory

Nearly 6,000 MW of generation

Peak load of 4,655 MW

34,800 miles of T & D

About 2,000 employees

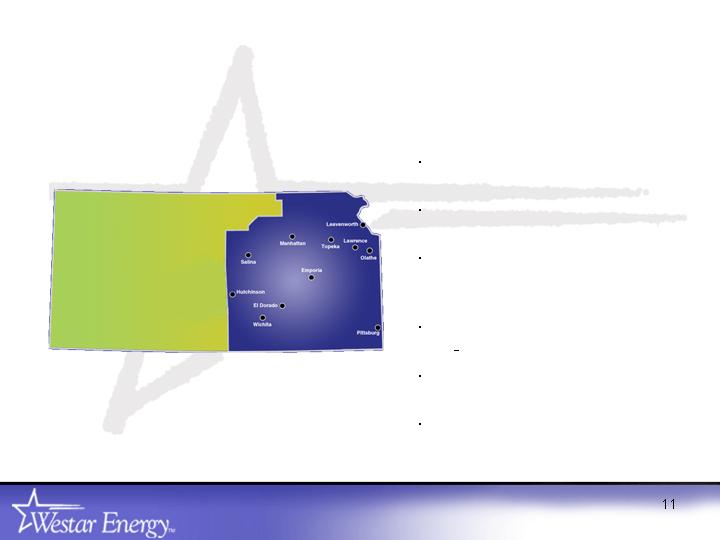

Service Territory

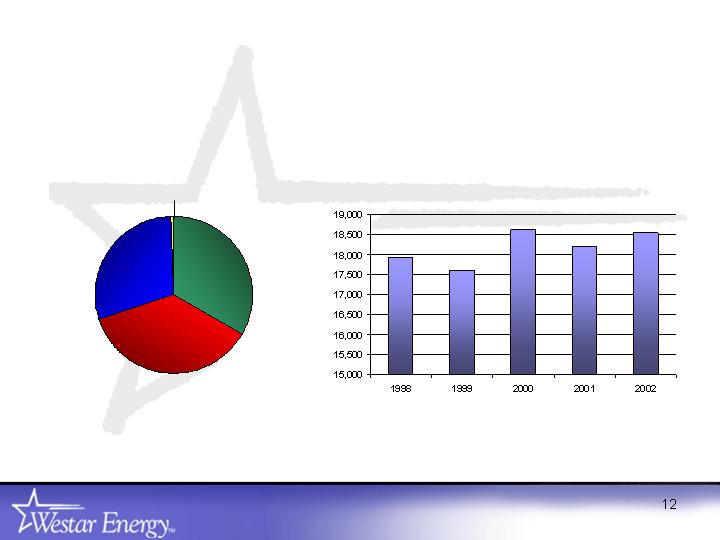

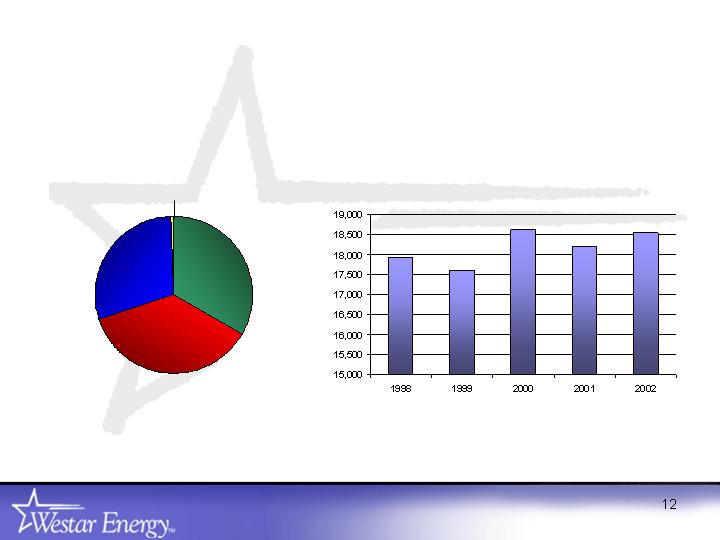

Diverse Customer Base

Retail MWh by Year

Retail Sales by Class

Year end 2002

Commercial

37%

Residential

33%

Industrial

29%

Other

1%

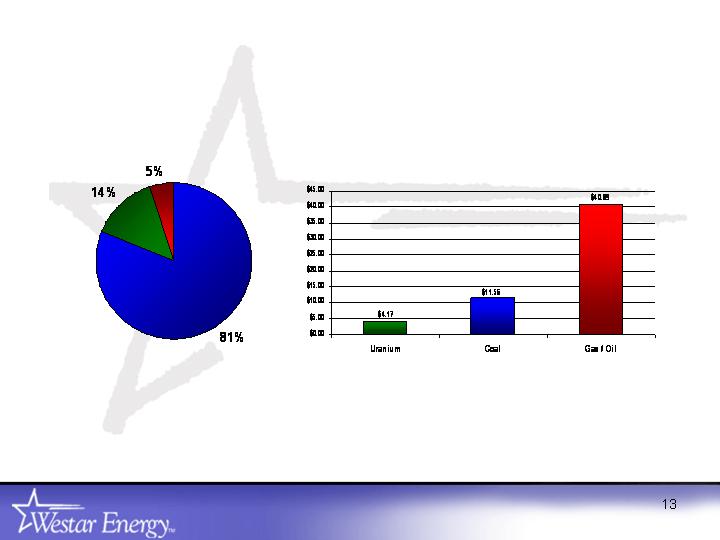

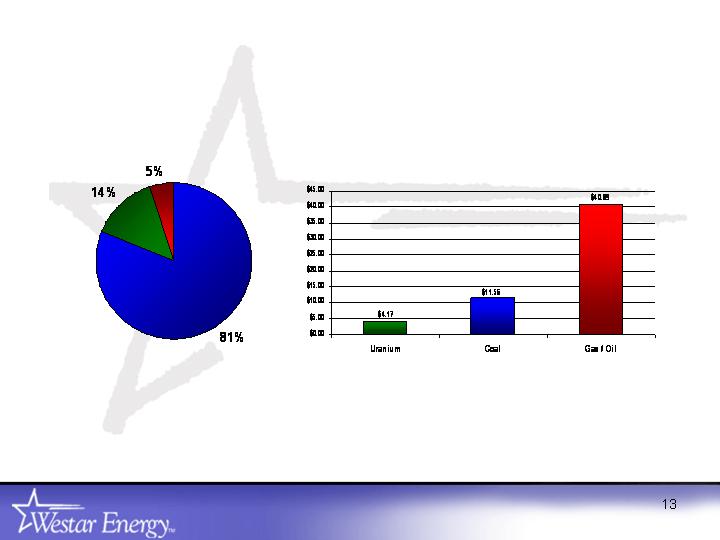

Generation Cost by Fuel Type

95% of the electricity generated is fueled by coal or uranium

Energy Sources

Fuel Cost by Source

$/MWh

Generation Performance

12 months ended September 2003

Capacity

Forced

Factor

Outage Rate

Availability

Coal

77%

3%

91%

Nuclear

101%

1%

99%

Gas/Oil

7%

10%

94%

2001

2002

2003

Net Generating Capacity

5,534

5,517

5,398

System Peak Responsibility

4,282

4,218

4,414

Capacity Margin

1,252

1,299

984

Reserve Margin

23%

24%

18%

Wolf Creek

NRC oversight indicators are “green”

More than four years with no violations

Received a “2” rating (Exemplary) in April 2003 INPO assessment

Operations Training Program accreditation renewed by the Nuclear

Accrediting Board in January 2003

2003 refueling outage began October 17

Generation and Marketing

Power Marketing

Value at Risk (VaR) limit of $2.4 million

Risk controls consistently applied

Trades occur only in areas we can physically send and receive power

(SPP, MAIN, ECAR, MAPP, SERC)

Power sales and purchases physically backstopped by what we can

consume or produce

Wholesale margins integral to rate-setting process

$19 million asset-based wholesale margins imputed to retail rates

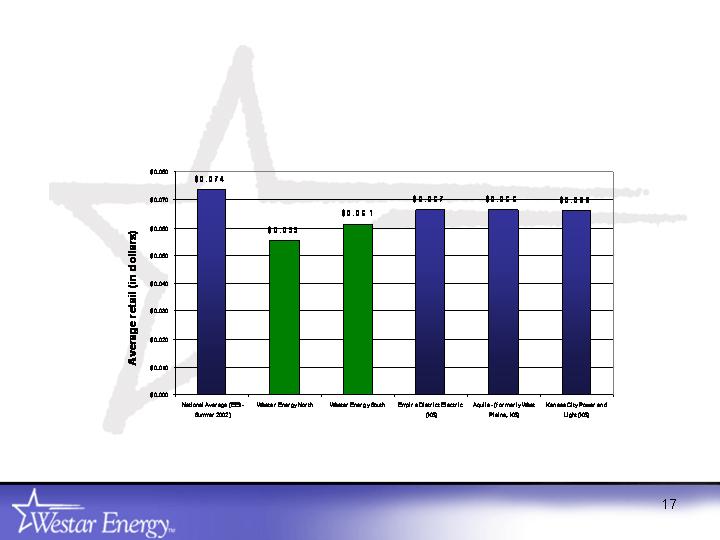

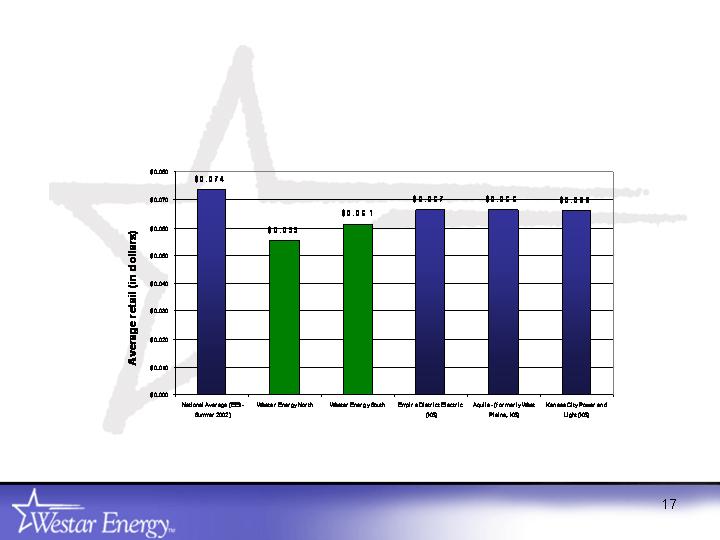

Total Retail Rate Comparison

Source: EEI, Jan. 1, 2003

Rate & Regulatory Matters

Kansas rate case to be filed May 1, 2005

Based on 2004 test year

New rates to be effective January 2006

Two rebates to retail customers:

$10.5 million May 1, 2005

$10 million January 1, 2006

Amortized at $707K/month through December 2005

EPA New Source Review

Market Response &

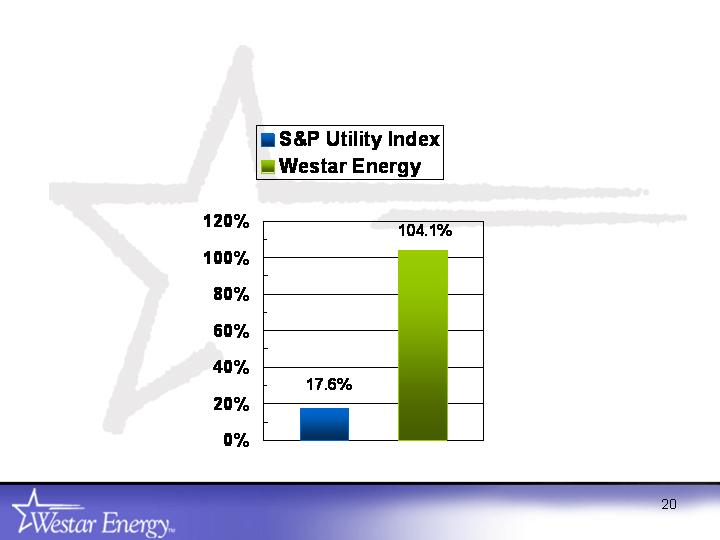

Investment Considerations

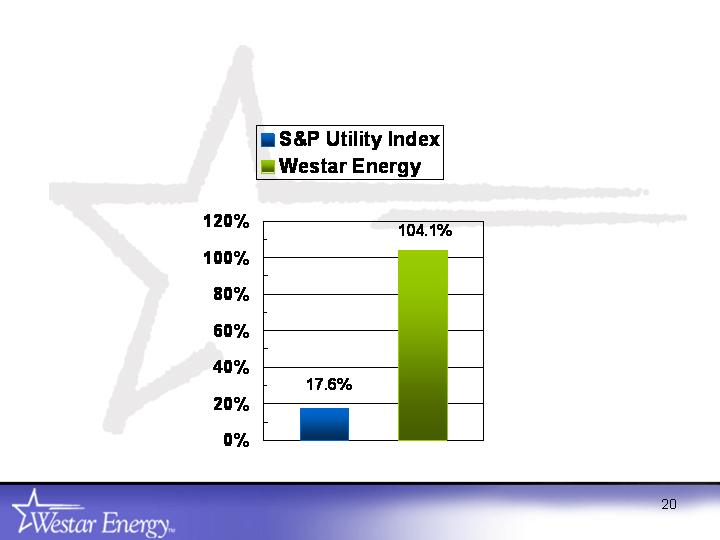

Year to Date Total Returns

Through 10/17/03

Frequently Asked Questions

Is there still value in the remaining steps of our

restructuring plan?

Is this a stock with dividend growth potential?

Illustrative Stock Valuation

Key valuation drivers

Results from remaining divestitures

Equity issuance

On-going utility operations

* Bloomberg 10/17/03

Dividend

Market/

P/E

Yield

Book

2004

S&P Utilities Index *

4.0%

1.6

X

13.5

X

Westar Energy ($19.46)

3.9%

1.3

X

Investment Thesis

Value

Potential for remaining value as recovery unfolds

Low dividend pay-out with opportunity for growth

Stable environment

Adequate, low-cost internal generation to meet load

Appropriate approach to off-system sales with rate-based generation

Stable, traditionally predictable service area economy

Strong utility management team

Regulatory environment

Significantly restored regulatory relations

Clear rate path through 2005

Kansas offers traditionally fair treatment when accompanied by traditional utility

behavior

Single state regulation

Appendix

Corporate Governance

Non-executive chairman of the board

All directors other than CEO are independent

Directors with diverse backgrounds and experience

Executive sessions of independent directors held regularly

No employee directors serve on the audit, finance, nominating,

compensation or corporate governance committees

All committees of the board have and maintain current charters

Corporate Governance (Cont.)

Board has and maintains a senior management succession plan

Independent board members have regular access to senior management

Internal audit/corporate compliance officer reports directly to audit

committee

Independent auditors perform only audit and audit related work

Disclosure committee formed from cross section of management

Disclosure controls reviewed quarterly

Whistleblower hotline established and actively managed by compliance

officer

Other Matters

U.S. Attorney investigation

SEC informal inquiry

Adequacy of proxy disclosures related to compensation

2002 financial restatements

FERC investigation

Shareholder lawsuits

Class action complaints and derivative lawsuit filed in early 2003

Arbitration proceeding with former management

Westar claims against former management exceed $100 million

Potential reversal of $53 million accounting reserve pending outcome

3rd Quarter 2003 Items

Cooling degree days

6.8% below 3rd quarter 2002 for Westar North service area

2.3% below 3rd quarter 2002 for Westar South service area

Utility sales volumes

Retail sales 2.0% below 2002

Total sales 2.9% below 2002

Utility revenues

2003 $438.2 million

2002 $442.1 million

Gain on sale of utility assets - $12.3 million

Charge for settlement of call option - $14.2 million

Gain on August 2003 ONEOK stock sale - $38.5 million

Potential additional write-down of Protection One Investment

Westar Energy

Investor Contact

Bruce Burns

Director Investor Relations

785-575-8227

bruce_burns@wr.com