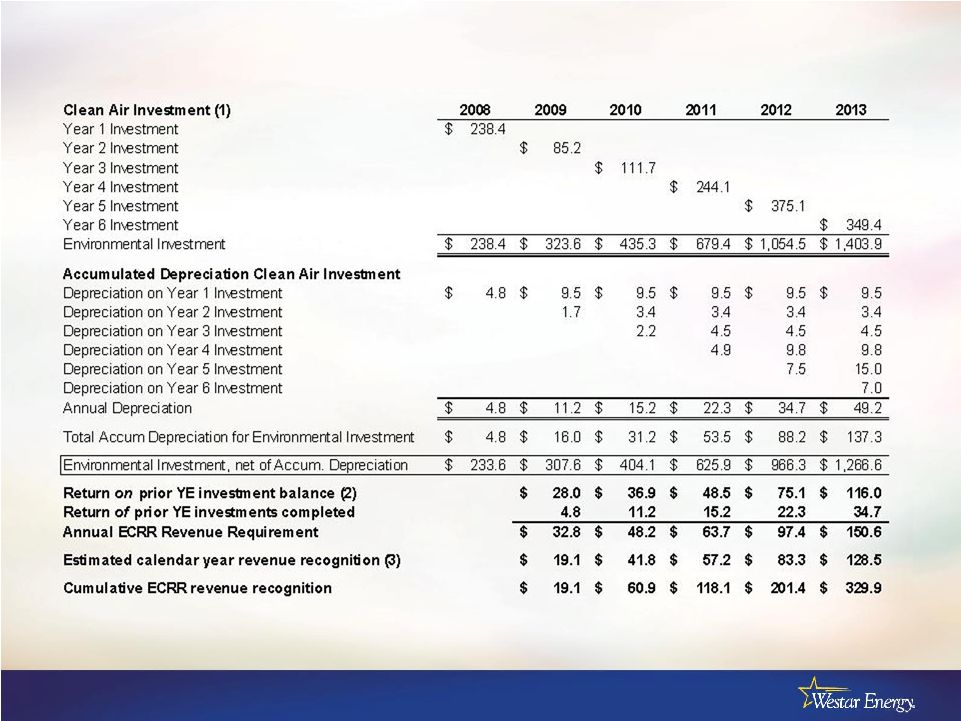

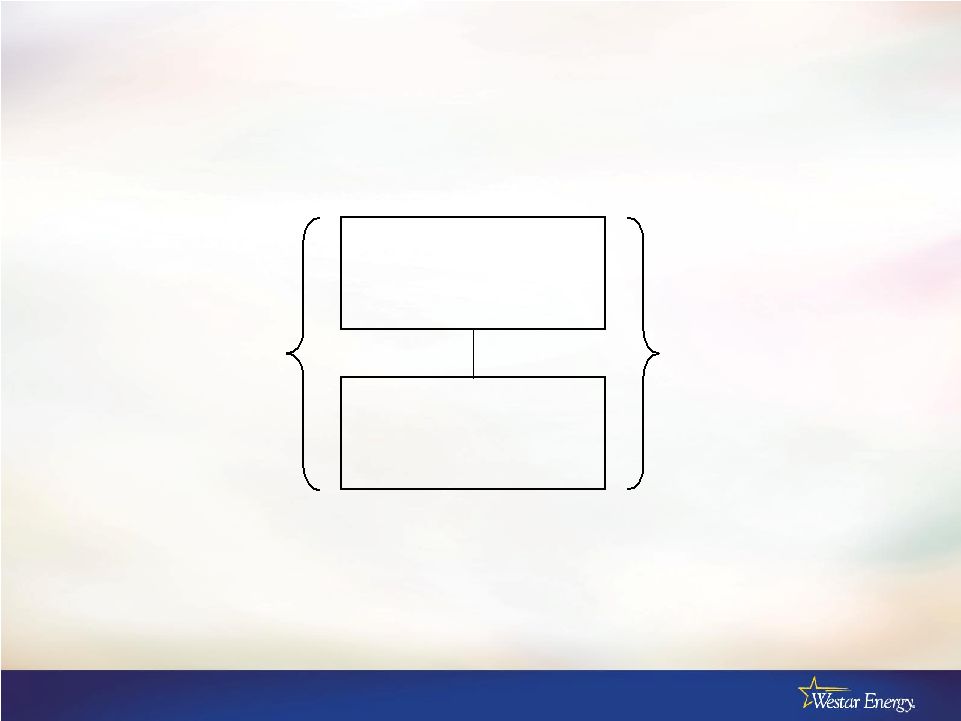

31 Methods of Cost Recovery Revenue Requirement Method of Recovery Comment 1. Fuel, purchased power and environmental consumables Quarterly adjustment based on forecasted cost, with annual true-up Adjusts prices for actual costs, protecting both customers and investors from mispricing 2. Environmental capital Environmental Cost Recovery Rider adjusts annually Allows annual price adjustment to reflect capital costs for investments in emission controls 3. Transmission rate recovery FERC formula rate adjusts annually; companion retail tariff to reflect current revenue requirement Timely recovery of transmission system operating and capital costs 4. General capital investments Traditional rate case, but with predetermination and CWIP Typical rate case reflects current level of operating expenses and most recent plant investment 5. Property taxes Annual adjustment to reflect current property taxes Allows timely recovery of actual property tax costs in current rates 6. Extraordinary storm damages Traditionally deferred accounting treatment as rate base Smoothes period expenses for extraordinary storm restoration costs 7. Pension expenses Deferred as a regulatory asset for subsequent recovery Smoothes period expenses in excess of amount in base rates 8. Energy efficiency programs Deferred as a regulatory asset for subsequent recovery Smoothes period expenses for energy efficiency programs Citi Utility Conference June 2, 2011 |