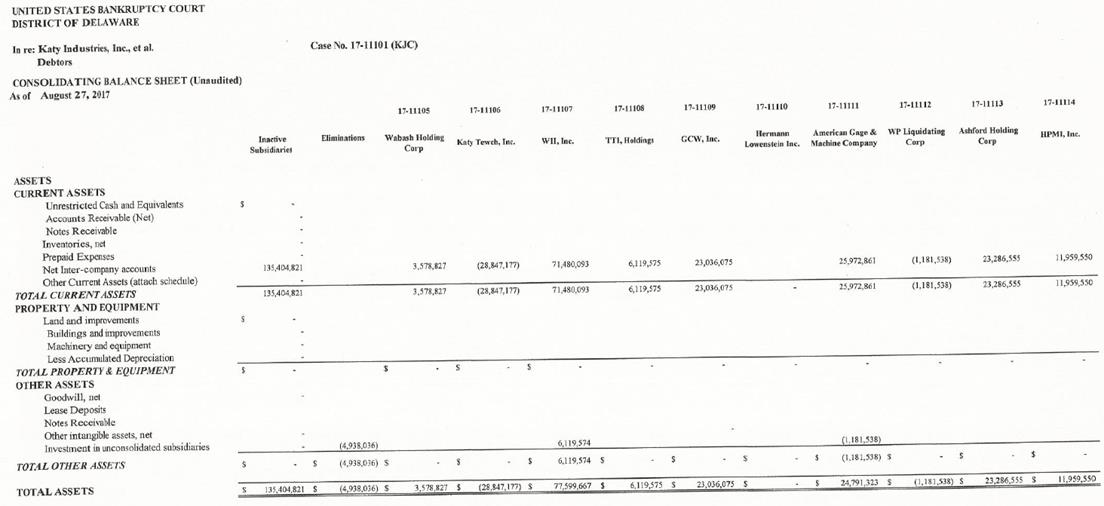

UN ITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE In re:Katy lndustries, Inc., ct al. Debtors CONSOLIDATING BALANCE SH EET (Unaudited) As of August 27,2017 Cose No.17-11101 (KJC) 17-lliOS 17-11106 171·!107 17-11108 17-11109 17-11110 17-11111 17-11112 17-11113 17-11114 Inactive Subsidia ries [ .liminati ons Wabash lloldiog Corp Hennann Lowenstein Inc. American Ga&e & Machine Company WP Liquidating Corp Ashford Holdine Corp rn,Holdinzs Wll,lnc. Kai)' Tewch , lnt:. GC\V,lnc.. HPMI,Im:. LIABIUTIES AND OWNE R EQUITY LiABILITIES Current Liabilities Accounts Payable Accrued Expenses Accrued Compensation Accrued Interest TOTAL CURRENT LIABILITIES DEBT Revolver Senior Tenn Notes Subordinated Debt Capital Leases Shareholder Notes Total Debt NON-CURRENT LIABILITIES Post retirernent benefits Deferred Compensation Deferred taxes GAAP Lease Obligations s s $ $ 396,077 396,077 396,077 396,077 . s . s s - s - s - s . s 49,982 49,982 TOTAL NON-CURRENT LIABILITIES 49,982 49,982 - TOTAL LIABILITIES 446,059 446,059 SHAREHOLDERS EQUITY Convertible Preferred Stock Common Stock Additional Paid-In Ca pital Accumulated other comprehensive loss Retained Earnings-Pre-Petition Retained Earnings-Post-Petition Treasury Stock TOTALSIIAREHOLDERS EQUITY 5,150,000 1,203,000 57,942,973 (570,716) 70,939,t83 294,322 2,650,000 200,000 6,275,443 2,500,000 1,000,000 1,236,t28 1 ,000 t94,716 (500,000) (7,782,tl5) 1,000 6, t34,502 (397,537) (2,464,930) 305,792 1,000 500,000 44,t02,184 (56,432) 33,522,477 31,438 1,782,135 (116,747) 23,t95,730 (42,908) 3,344,099 (I ,662,560) 15,219,821 (1,681,538) 18,550,427 t l ,763,834 (28,848,177) (4,938,036) s (28,847,177) s 23,036,075 s s s s s s s s 6,tt9,S75 s 6,t19,575 s 23,286,555 11,959,550 t34,958,762 3,578,827 77,599,667 24,345,264 (t,l81,538) .',•..•,0•£ I:C_II.: .• s135,404,821 s (4,938,036) s (28,847,177) s 23,036,075 s s s TOTAL LIABILITIES AND OWNERS' EQUITY 3,578,827 77,599,667 24,791,323 (1,181,538) • 1 1,959,550 FORMMOR-1 (04107)