UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Katy Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| | | | |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | | | |

| | | | |

| |

| | (5) | | Total fee paid: |

| |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| |

| | | | |

| | | | |

| |

| | (2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| | | | |

| |

| | (3) | | Filing Party: |

| |

| | | | |

| | | | |

| |

| | (4) | | Date Filed: |

| |

| | | | |

| | | | |

KATY INDUSTRIES, INC.

2461 South Clark Street, Suite 630

Arlington, Virginia 22202

(703) 236-4300

April 29, 2008

Dear Stockholders:

You are cordially invited to attend the 2008 annual meeting of stockholders of Katy Industries, Inc. (the “Company” or “Katy”), which will be held at 10:00 a.m. local time on Thursday, June 26, 2008, at the Holiday Inn Mount Kisco, located at One Holiday Inn Drive, Mount Kisco, New York.

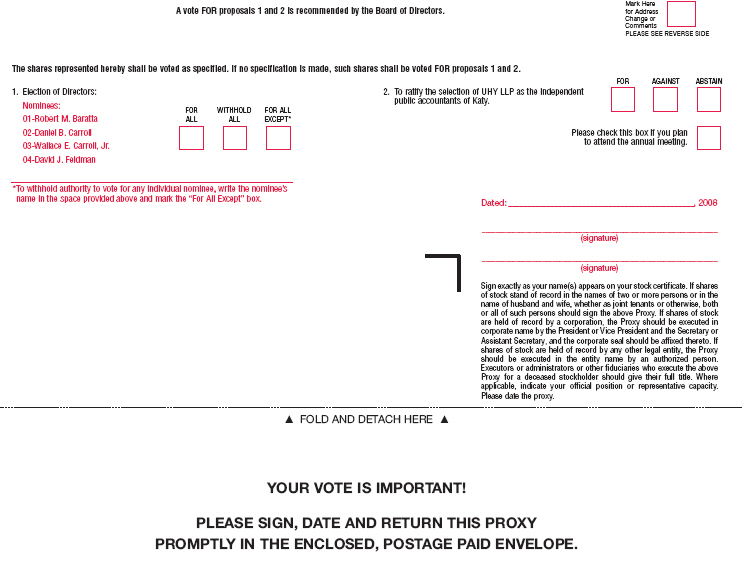

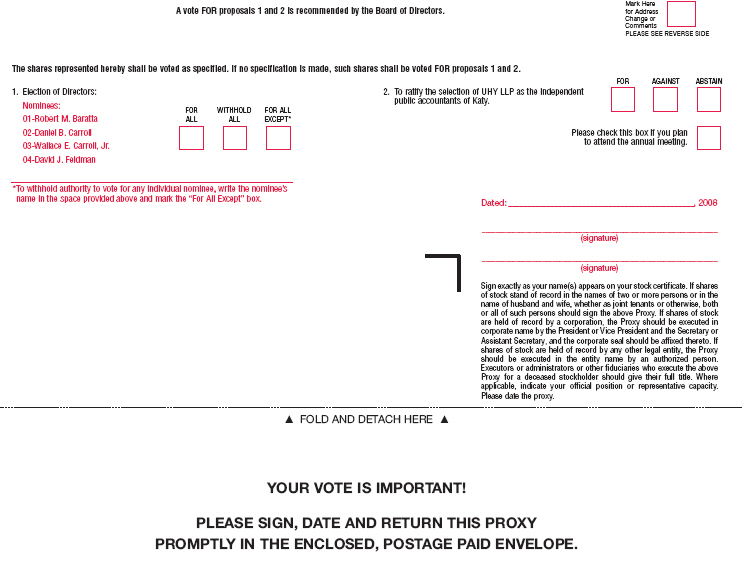

The principal business of the annual meeting will be (i) the election of four Class I directors, and (ii) the ratification of the appointment by the Company’s Audit Committee of the Board of Directors of UHY LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2008. We will also review our results for the past fiscal year and report on significant aspects of our operations during the first quarter of 2008.

It is important that your shares are represented at the annual meeting. If you do not attend the annual meeting, you may vote your shares by mail by signing and returning the enclosed proxy card. Whether or not you plan to attend the annual meeting, we encourage you to vote by executing and returning the enclosed proxy card so that your shares will be voted at the annual meeting. If you decide to attend the annual meeting, you may revoke your proxy and personally cast your vote.

Thank you, and we look forward to seeing you at the annual meeting or receiving your proxy vote.

Sincerely yours,

William F. Andrews

Chairman of the Board of Directors

KATY INDUSTRIES, INC.

2461 South Clark Street, Suite 630

Arlington, Virginia 22202

(703) 236-4300

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Katy Industries, Inc.:

We are holding the annual meeting of stockholders of Katy Industries, Inc. (“Katy”) on June 26, 2008 at 10:00 a.m. local time. The meeting will be held at the Holiday Inn Mount Kisco, located at One Holiday Inn Drive, Mount Kisco, New York. The meeting is called for the following purpose:

| 1. | | To elect four Class I directors for a two-year term; |

| |

| 2. | | To ratify the appointment by the Audit Committee of the Board of Directors of UHY LLP as Katy’s independent registered public accounting firm for the fiscal year ending December 31, 2008; and |

| |

| 3. | | To transact such other business as may properly come before the meeting. |

The Proxy Statement that we are delivering with this notice contains important information concerning the proposals to be considered at the annual meeting. You will be entitled to vote at the annual meeting if you were a stockholder of Katy at the close of business on April 28, 2008.

YOUR VOTE AT THE ANNUAL MEETING IS IMPORTANT.

PLEASE INDICATE YOUR VOTE ON THE ENCLOSED PROXY CARD AND RETURN

IT IN THE ENCLOSED ENVELOPE AS SOON AS POSSIBLE, EVEN IF YOU PLAN TO

ATTEND THE MEETING.

IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AT ANY TIME

PRIOR TO THE TIME IT IS VOTED.

By Order of the Board of Directors

Amir Rosenthal

Secretary

Arlington, Virginia

April 29, 2008

TABLE OF CONTENTS

| | | | | |

| Section | | Page | |

| | | 2 | |

| | | | | |

| | | 2 | |

| | | | | |

| | | 2 | |

| | | | | |

| | | 3 | |

| | | | | |

| | | 5 | |

| | | | | |

| | | 5 | |

| | | | | |

| | | 5 | |

| | | | | |

| | | 6 | |

| | | | | |

| | | 7 | |

| | | | | |

| | | 8 | |

| | | | | |

| | | 8 | |

| | | | | |

| | | 10 | |

| | | | | |

| | | 11 | |

| | | | | |

| | | 12 | |

| | | | | |

| | | 15 | |

| | | | | |

| | | 17 | |

| | | | | |

| | | 17 | |

| | | | | |

| | | 17 | |

| | | | | |

| | | 18 | |

| | | | | |

| | | 18 | |

| | | | | |

| | | 18 | |

| | | | | |

| | | 20 | |

| | | | | |

| | | 22 | |

| | | | | |

| | | 23 | |

| | | | | |

| | | 23 | |

| | | | | |

| | | 23 | |

| | | | | |

| | | 28 | |

| | | | | |

| | | 29 | |

| | | | | |

| | | 32 | |

| | | | | |

| | | 33 | |

| | | | | |

KATY INDUSTRIES, INC.

2461 South Clark Street, Suite 630

Arlington, Virginia 22202

(703) 236-4300

PROXY STATEMENT

Approximate date of mailing — May 12, 2008

For the Annual Meeting of Stockholders

to be held June 26, 2008

INFORMATION ABOUT THE ANNUAL STOCKHOLDERS MEETING

The 2008 annual meeting of stockholders of Katy Industries, Inc. (the “Company” or “Katy”) will be held at 10:00 a.m. local time on June 26, 2008 at the Holiday Inn Mount Kisco, located at One Holiday Inn Drive, Mount Kisco, New York.

This Proxy Statement is furnished by and on behalf of the board of directors (the “Board of Directors”) of Katy in connection with the Company’s solicitation of proxies for use at the annual meeting and at any adjournments or postponements thereof. This Proxy Statement includes information that Katy is required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and is intended to assist you in voting your shares. On or about May 12, 2008, Katy will begin mailing this Proxy Statement and the enclosed proxy card to all people who, according to our stockholder records, owned shares of the Company’s common stock at the close of business on April 28, 2008 (the “Record Date”). As of the Record Date, there were 7,951,176 shares of our common stock issued and outstanding.

Katy will pay the cost of soliciting these proxies. Katy’s directors, officers and employees may request proxies in person or by telephone, mail, facsimile or letter.

VOTING

VOTING SHARES AND REVOCABILITY OF PROXIES

You are entitled to one vote at the annual meeting for each share of Katy’s common stock that you owned of record at the close of business on the Record Date. The number of shares you own (and may vote) is listed on the enclosed proxy card.

You may vote your shares of common stock at the annual meeting in person or by proxy. To vote in person, you must attend the annual meeting and obtain and submit a ballot. Katy will provide you with a ballot at the annual meeting. To vote by proxy, you must complete and return the enclosed proxy card. By completing and returning (and not revoking) the enclosed proxy card, you will be directing the representatives designated on the proxy card to vote your shares at the annual meeting in accordance with the instructions you give on the proxy card. Your proxy card will be valid only if you sign, date and return it before the annual meeting. The submission of a signed proxy will not affect your right to attend and vote in person at the annual meeting.

2

IF YOU COMPLETE THE PROXY CARD EXCEPT FOR THE VOTING INSTRUCTIONS, THEN YOUR SHARES WILL BE VOTED “FOR” THE BOARD OF DIRECTORS RECOMMENDATIONS SET FORTH IN THIS PROXY STATEMENT.

You may revoke your proxy at any time before it is voted by any of the following means:

| | • | | Notifying the Secretary of Katy in writing addressed to our principal corporate offices at Katy Industries, Inc., 2461 South Clark Street, Suite 630, Arlington, Virginia 22202, that you wish to revoke your proxy. |

| |

| | • | | Submitting a proxy bearing a later date than your original proxy. |

| |

| | • | | Attending the annual meeting and voting in person. Merely attending the annual meeting will not by itself revoke a proxy; you must vote your shares of common stock at the annual meeting to revoke the proxy. |

The Board of Directors does not expect any matter other than the proposals discussed in this Proxy Statement to be presented at the annual meeting. However, if any other matter properly comes before the annual meeting, executed and returned proxies will be voted in a manner deemed by the proxy representatives named therein to be in the best interests of Katy and its stockholders.

QUORUM AND VOTES REQUIRED FOR APPROVAL

The presence in person or by proxy of holders of a majority of the outstanding shares of our common stock will constitute a quorum for the annual meeting. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, the stockholders who are present at the annual meeting in person or by proxy and who abstain are considered stockholders who are present and entitled to vote and they count toward the quorum. Abstentions and shares of record held by a broker or its nominee that are voted on any matter are included in determining whether a quorum is present. Broker shares that are not voted on any matter will not be included in determining whether a quorum is present.

Each share of common stock is entitled to one vote on each matter to come before the annual meeting. With regard to the election of directors, you may vote for a candidate or withhold your vote. Under Delaware law, directors will be elected by a plurality of the votes of the shares of common stock entitled to vote and present in person or represented by proxy at a meeting where a quorum is present. Under “plurality” voting, the nominees who receive the largest number of votes cast will be elected as directors, up to the maximum number of directors to be elected at the annual meeting. Only votes actually cast will be counted for the purpose of determining whether a particular nominee received more votes than the persons, if any, nominated for the same seat on the Board of Directors. Consequently, any shares not voted (whether by abstention or withholding authority) will have no impact on the election of directors, except to the extent the failure to vote for one candidate results in another candidate receiving a larger number of votes.

3

If a quorum is present, the approval of the proposal ratifying the appointment of UHY LLP requires the affirmative vote of the holders of a majority of the shares of common stock present, in person or by proxy, at the annual meeting. With respect to these matters, a stockholder may (i) vote “For” the matter, (ii) vote “Against” the matter, or (iii) “Abstain” from voting on the matter. A vote to abstain from voting on this proposal has the same effect as a vote against such matter.

Under rules of self-regulatory organizations governing brokers, brokers holding shares of record for customers generally are entitled to vote on routine matters without voting instructions from their customers. The election of directors and the ratification of the appointment of UHY LLP are considered routine matters. On non-routine matters, brokers must obtain voting instructions from customers. If a broker does not receive voting instructions from a customer on non-routine matters and accordingly does not vote on these matters, this is called a broker non-vote. Broker non-votes will be counted for the purposes of establishing a quorum to conduct business at the meeting and are not counted as votes cast, but because the election of directors and the ratification and appointment of UHY LLP are routine matters for which specific instructions from beneficial owners will not be required, no broker non-votes will arise in the context of these proposals.

4

PROPOSAL 1 — ELECTION OF DIRECTORS

Katy’s business is managed under the direction of its Board of Directors. There are currently nine directors, divided into two classes serving staggered terms. The classes are as nearly equal in number as possible with three Class I directors, elected to two-year terms at the 2006 annual meeting, and five Class II directors, elected to two-year terms at the 2007 annual meeting. In addition, one Class I director was appointed to the Board of Directors on April 21, 2008. Stockholders will elect four Class I directors at this year’s annual meeting to serve for a two-year term ending at the time of the 2010 annual meeting.

The Board of Directors has nominated the following nominees for election as Class I directors to the Board of Directors, each to serve until the 2010 annual meeting or until their successors are duly elected and qualified or until his death, resignation or removal:

Robert M. Baratta

Daniel B. Carroll

Wallace E. Carroll, Jr.

David J. Feldman

All of the nominees are current directors of the Company and have indicated their willingness to serve as directors. The five Class II directors of Katy are: Christopher W. Anderson, William F. Andrews, Samuel P. Frieder, Christopher Lacovara, and Shant Mardirossian. The Class II directors are not up for re-election at the annual meeting, as their terms do not expire until the time of the 2009 annual meeting.

REQUIRED VOTE

Directors are elected by the affirmative vote of a plurality of the votes cast in the election.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPROVAL OF PROPOSAL 1. IF ANY NOMINEE BECOMES UNAVAILABLE TO SERVE ON THE BOARD OF DIRECTORS FOR ANY REASON, YOUR PROXY WILL BE VOTED FOR A PERSON OR PERSONS TO BE SELECTED BY THE BOARD OF DIRECTORS. PROXIES CANNOT BE VOTED FOR A NUMBER OF NOMINEES GREATER THAN THE NUMBER OF CLASS II DIRECTORS.

5

INFORMATION CONCERNING NOMINEES STANDING FOR ELECTION — CLASS I DIRECTORS

The following table shows information about the nominees to Katy’s Board of Directors who are currently Class I directors and previously elected by the Company’s stockholders at prior annual meetings, except for David J. Feldman who was appointed to the Board of Directors effective April 21, 2008:

| | | | | | | | | | | |

| | | | | | | Principal Occupation and | | | | Period of |

| | | | | | | Business Experience | | Other | | Service as Katy |

| Name | | Age | | During the Past Five Years | | Directorships | | Director |

| | | | | | | | | | | |

| Robert M. Baratta | | | 78 | | | 2001 to Present: Director of Katy | | None | | 2001 to Present |

| | | | | | | | | | | |

| Daniel B. Carroll (1) | | | 72 | | | 2003 to Present: Private Investor | | None | | 1994 to Present |

| | | | | | | 1994 to Present: Partner of Newgrange L.P., a components supplier to the global footwear industry |

| | | | | | | 1985 to Present: Member and Manager of ATP Manufacturing, LLC, a manufacturer of molded poly-urethane components |

| | | | | | | 1985 to 2003: Vice President of ATP Manufacturing, LLC | | | | |

| | | | | | | | | | | |

| Wallace E. Carroll, Jr. (1) | | | 70 | | | 2005 to Present: Private Investor | | None | | 1991 to Present |

| | | | | | | 1992 to 2005: Chairman of CRL, Inc., a diversified holding company | | | | |

| | | | | | | | | | | |

| David J. Feldman | | | 49 | | | 2008 (April) to Present: Chief Executive Officer, President, and a Director of Katy | | None | | 2008 (April) to Present |

| | | | | | | 2007 to 2008: President and Chief Operating Officer of Airserv Corporation, a service provider to the U.S. aviation industry |

| | | | | | | 2006 to 2007: Private Investor |

| | | | | | | 2002 to 2006: President of Cooper Lighting, a division of Cooper Industries, Inc., a manufacturer of electrical products | | | | |

| | | |

| (1) | | Daniel B. Carroll and Wallace E. Carroll, Jr. are first cousins. |

6

INFORMATION CONCERNING DIRECTORS NOT STANDING FOR ELECTION — CLASS II DIRECTORS

The following directors were elected to two-year term at the 2007 annual meeting, and are not nominees for re-election at the 2009 annual meeting:

| | | | | | | | | | | |

| | | | | | | Principal Occupation and | | | | Period of |

| | | | | | | Business Experience | | Other | | Service as Katy |

| Name | | Age | | During the Past Five Years | | Directorships | | Director |

| | | | | | | | | | | |

| Christopher W. Anderson | | | 33 | | | 2005 to Present: Principal of Kohlberg & Co., L.L.C., a U.S. private equity firm | | None | | 2001 to Present |

| | | | | | | 1998 to 2005: Associate at Kohlberg & Co., L.L.C. | | | | |

| | | | | | | | | | | |

| William F. Andrews | | | 76 | | | 2004 to Present: Chairman of Singer Worldwide, a leading seller of consumer and artisan sewing machines | | Corrections Corp.

of America TREX Corp. O’Charley’s Inc. | | 1991 to Present |

| | | | | | | 2001 to Present: Chairman of Katy | | | | |

| | | | | | | 2001 to 2005: Chairman of Allied Aerospace Industries, Inc., an aerospace and defense engineering firm and provider of comprehensive aerospace and defense products and services | | | | |

| | | | | | | 2000 to Present: Chairman of Corrections Corp. of America, a private sector provider of detention and correction services | | | | |

| | | | | | | 1997 to Present: Consultant with Kohlberg & Co., L.L.C., a U.S. private equity firm | | | | |

| | | | | | | | | | | |

| Samuel P. Frieder | | | 43 | | | 2006 to Present: Co-Managing Partner of Kohlberg & Co., L.L.C., a U.S. private equity firm | | Kohlberg Capital

Corporation | | 2001 to Present |

| | | | | | | 1989 to 2006: Principal of Kohlberg & Co., L.L.C. | | | | |

| | | | | | | | | | | |

| Christopher Lacovara | | | 43 | | | 2006 to Present: Co-Managing Partner of Kohlberg & Co., L.L.C., a U.S. private equity firm | | Kohlberg Capital

Corporation | | 2001 to Present |

| | | | | | | 1988 to 2006: Principal of Kohlberg & Co., L.L.C. | | | | |

| | | | | | | | | | | |

| Shant Mardirossian | | | 40 | | | 2005 to Present: Principal and CFO of Kohlberg & Co., L.L.C., a U.S. private equity firm | | None | | 2007 to Present |

| | | | | | | 1999 to 2005: CFO of Kohlberg & Co., L.L.C. | | | | |

7

BOARD OF DIRECTORS STRUCTURE

The Board of Directors met seven times during 2007. Each director in office at the time of such meeting attended at least 75% of the Board of Directors meetings and the meetings of the Board of Directors committees of which he is a member. The non-management directors meet in executive session without members of management present at every regular Board of Directors meeting. At these meetings, the presiding director rotates through each non-management director based on the alphabetical order of the directors’ last names. The Board of Directors has not adopted a formal policy regarding director attendance at annual meetings of the stockholders, but encourages such attendance. Nine directors attended the 2007 annual meeting.

Katy’s bylaws provide for an Executive Committee to which the Board of Directors has assigned all powers delegable by law. The Board of Directors also has an Audit Committee, a Compensation Committee and a Nominating and Governance Committee, each of which is a standing committee of the Board of Directors. All of the members of these three Board of Directors committees are independent within the meaning of SEC regulations (as applicable), the listing standards of the New York Stock Exchange (“NYSE”) and Katy’s Corporate Governance Guidelines. While we are not a listed company on the NYSE, we have elected to continue to comply with the governance listing requirements of the NYSE as a matter of good corporate governance.

BOARD OF DIRECTORS COMMITTEES

Executive Committee

The Executive Committee presently consists of Christopher Lacovara, Christopher W. Anderson and David J. Feldman. The Executive Committee met informally through numerous telephone conferences at intervals between meetings of the full Board of Directors, and acted by unanimous consent without formal meetings.

Audit Committee

The Audit Committee consists of Daniel B. Carroll (Chairman), Christopher Lacovara and William F. Andrews, each of whom the Board of Directors has determined to be “independent” as defined by the relevant provisions of the Sarbanes-Oxley Act of 2002, the NYSE listing standards and the Company’s Corporate Governance Guidelines. The Committee’s Charter provides that the Committee’s primary function remains review and oversight of: (A) major issues regarding accounting principles and financial statement presentations, including significant changes in the selection or application of accounting principles, and major issues as to the adequacy of the Company’s internal controls and any special audit steps adopted in light of material control deficiencies; (B) analyses prepared by management and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection with the preparation of financial statements, including analyses of the effects of alternative generally accepted accounting principles (“GAAP”) methods on financial statements; (C) the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of the Company; (D) the type and presentation of information to be included in earnings press releases (paying particular attention to any use of “pro forma” or “adjusted” non-GAAP information), as well as any financial information and earnings guidance provided to analysts and rating agencies; (E) the Company’s compliance with laws and regulations; and (F) maintenance of an effective and efficient audit of the Company’s annual financial statements by a qualified and independent auditor.

8

The Audit Committee met five times during 2007. The Board of Directors has determined that each of the members of the Committee is qualified to serve on the Audit Committee in accordance with the criteria specified in rules issued by the SEC and the NYSE. The Board of Directors has determined that Mr. Lacovara, a member of the Audit Committee, qualifies as an “audit committee financial expert” as that term is defined by SEC rules. As mentioned above, the Board of Directors has determined that Mr. Lacovara qualifies as an independent director under the NYSE listing standards.

The Audit Committee’s Charter, as updated in April 2008, is posted on the Company’s website, atwww.katyindustries.com.

Compensation Committee

The Compensation Committee consists of Wallace E. Carroll, Jr. (Chairman), Christopher Lacovara and Christopher W. Anderson. This Committee, which has the primary responsibility for developing and overseeing the implementation of the Company’s philosophy with respect to the compensation of executive officers and directors, met four times during 2007. The Compensation Committee is appointed by the Board of Directors to discharge the Board of Directors’ responsibilities relating to compensation of the Company’s directors and officers. The Committee has overall responsibility for designing, approving and evaluating the director and officer compensation plans, policies and programs of the Company, including without limitation any annual and long-term incentive plans, as set forth in the Committee’s Charter. The Committee makes decisions on executive officer compensation and reports its decisions to the Board of Directors. It also seeks the Board of Directors’ approval on the Chief Executive Officer’s (“CEO”) compensation. See the Compensation Discussion and Analysis for a further discussion of the compensation practice and philosophy in effect.

The Compensation Committee’s Charter, as updated in April 2008, is posted on the Company’s website, atwww.katyindustries.com.

Nominating and Governance Committee

The Nominating and Governance Committee consists of Samuel P. Frieder (Chairman), William F. Andrews and Daniel B. Carroll. This Committee met three times during 2007. The Nominating and Governance Committee is responsible for developing and implementing policies and practices relating to corporate governance, including reviewing and monitoring implementation of Katy’s Corporate Governance Guidelines, and sets and reviews policies and procedures in place throughout various disciplines within the Company to ensure high ethical standards are practiced. In addition, the Committee makes recommendations to the Board of Directors regarding candidates for the Board of Directors. The Committee reports its findings and recommendations to the Board of Directors.

The Nominating and Governance Committee’s Charter, as updated in April 2008, is posted on the Company’s website, atwww.katyindustries.com.

The entire Board of Directors considers and selects nominees for directors on the basis of recommendations from the Nominating and Governance Committee. The Nominating and Governance Committee considers candidates for Board of Directors membership suggested by its members and other Board of Directors members, as well as management. Additionally, subject to compliance with the requirements of our bylaws, the Nominating and Governance Committee will consider nominations from stockholders. The Committee has not established specific minimum qualifications, or specific qualities or skills, for directors. Rather, the Committee recommends candidates based on its overall assessment of their skills and qualifications, and the composition of the Board of Directors as a whole.

9

Once the Nominating and Governance Committee has identified a prospective nominee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the Committee with the recommendation of the prospective candidate, as well as the Committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board of Directors members to fill vacancies or expand the size of the Board of Directors and the likelihood that the prospective nominee can satisfy the Committee’s evaluation factors. The Committee’s evaluation factors are:

| | • | | the ability of the prospective nominee to represent the interests of the stockholders of the Company; |

| |

| | • | | the prospective nominee’s standards of integrity, commitment and independence of thought and judgment; |

| |

| | • | | the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards; and |

| |

| | • | | the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board of Directors. |

The Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board of Directors, the balance of management and independent directors, the need for Audit Committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the Committee determines whether to interview the prospective nominee, and if warranted, one or more members of the Committee, and others as appropriate, will interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Committee makes a recommendation to the full Board of Directors as to the persons who should be nominated by the Board of Directors, and the Board of Directors determines the nominees after considering the recommendation and report of the Committee.

Pursuant to the advance notice provision of Katy’s bylaws, stockholder nominations for directors must be received by Katy not less than 50 days or more than 90 days before the 2008 annual meeting. Any nominations for directors made by stockholders must include the following information regarding the nominee: name; age; business address; residence address; principal occupation or employment; class and number of shares of Katy beneficially owned; and any other information required to be disclosed in a proxy solicitation for the election of directors. Additionally, the stockholder making such nomination must provide his or her name and address, and the number of shares of the Company beneficially owned by such stockholder. No person is eligible for election as a director of the Company unless he or she is nominated (i) by the Board of Directors or (ii) in accordance with the foregoing requirements.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee of the Board of Directors consists of Wallace E. Carroll, Jr. (Chairman), Christopher Lacovara and Christopher W. Anderson. No member of the Compensation Committee was an employee of Katy during the last fiscal year or an officer of Katy during any prior period. There are no Compensation Committee interlocks between Katy and other entities involving Katy’s executive officers and members of the Board of Directors who serve as an executive officer or board member of such other entities.

10

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Corporate Governance Guidelines adopted by the Board of Directors meet or exceed the standards adopted by the New York Stock Exchange even though the Company is currently listed on the Over-the-Counter Bulletin Board (“OTC BB”), which does not have any required corporate governance standards. The full text of the Corporate Governance Guidelines, as updated in April 2008, can be found in the Corporate Governance section of the Company’s website (atwww.katyindustries.com).

Director Independence

Pursuant to the Company’s Corporate Governance Guidelines, the Board of Directors undertook its annual review of director independence in August, 2007. During this review, the Board of Directors considered transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates, including those reported under“Certain Relationships and Related Transactions” below. The Board of Directors also examined transactions and relationships between directors or their affiliates and members of the Company’s senior management or their affiliates. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

As a result of this review, the Board of Directors has affirmatively determined that each director is “independent” of the Company and its management as defined in the NYSE listing standards and as set forth in the Corporate Governance Guidelines, with the exception of David J. Feldman. Mr. Feldman is considered a non-independent inside director because of his employment as a senior executive of the Company.

Certain Relationships and Related Transactions

The charter of our Audit Committee, as updated in April 2008, requires that the Audit Committee review and discuss with management and the independent auditors any related-party transactions or other courses of dealing with parties related to Katy which are significant in size or involve terms or other aspects that differ from those that would likely be negotiated with independent, third-parties and which are relevant to an understanding of Katy’s financial statements.

During 2007, Katy paid Kohlberg & Co. $500,000 for ongoing management advisory services. Katy expects to pay $500,000 per year for these services, as outlined in the Recapitalization Agreement of June 2, 2001. Samuel P. Frieder and Christopher Lacovara are Co-Managing Partners of Kohlberg & Co. Christopher W. Anderson and Shant Mardirossian are Principals of Kohlberg & Co. William F. Andrews, Chairman of the Board of Directors, is a consultant, or “Operating Principal,” with Kohlberg & Co.

Code of Ethics

Katy has adopted a Code of Business Conduct and Ethics for directors, executive officers and employees. A copy of the Code of Business Conduct and Ethics, as updated April 2008, is available on Katy’s website atwww.katyindustries.com.

11

DIRECTOR COMPENSATION

The following table summarizes the compensation for service to the Board of Directors and its committees during 2007 for directors who are not employed by Katy or its subsidiaries.

| | | | | | | | | | | | | |

| | | Fees Earned or | | | | | | | |

| | | Paid in Cash | | | Option Awards | | | Total | |

| Name | | ($) | | | ($)(1)(2) | | | ($) | |

| Christopher W. Anderson | | $ | — | | | $ | — | | | $ | — | |

| William F. Andrews | | $ | — | | | $ | — | | | $ | — | |

| Robert M. Baratta | | $ | 26,700 | | | $ | 3,095 | | | $ | 29,795 | |

| Daniel B. Carroll | | $ | 39,200 | | | $ | 2,583 | | | $ | 41,783 | |

| Wallace E. Carroll, Jr. | | $ | 36,700 | | | $ | 2,583 | | | $ | 39,283 | |

| Samuel P. Frieder | | $ | — | | | $ | — | | | $ | — | |

| Christopher Lacovara | | $ | — | | | $ | — | | | $ | — | |

| Shant Mardirossian | | $ | — | | | $ | — | | | $ | — | |

| | | |

| (1) | | The value of the awards, stock appreciation rights, shown in the table represents the expense reported for financial reporting purposes in 2007 as described in Note 13 to the Company’s consolidated financial statements included in the 2007 Annual Report on Form 10-K. |

12

| | | |

| (2) | | As of December 31, 2007, the directors held options and SARs to acquire shares granted to them under the Company’s stock-based compensation plans as follows: |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Option / SAR | | | | | | | No. | | | Total | |

| Name | | Grant Date | | | Exercise Price | | | No. Vested | | | Not Vested | | | Outstanding | |

| | | | | | | | | | | | | | | | | | | | | |

| William F. Andrews | | | 05/20/98 | | | $ | 18.13 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/20/99 | | | $ | 17.31 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/10/00 | | | $ | 10.50 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | 6,000 | | | | — | | | | 6,000 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Robert M. Baratta | | | 12/10/99 | | | $ | 9.88 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 02/26/00 | | | $ | 9.50 | | | | 8,000 | | | | — | | | | 8,000 | |

| | | | 05/30/02 | | | $ | 5.15 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 11/22/02 | | | $ | 3.15 | | | | 8,250 | | | | — | | | | 8,250 | * |

| | | | 07/11/03 | | | $ | 4.31 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/27/04 | | | $ | 5.91 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/26/05 | | | $ | 3.69 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 08/30/06 | | | $ | 2.08 | | | | 2,000 | | | | — | | | | 2,000 | * |

| | | | 05/31/07 | | | $ | 1.10 | | | | 2,000 | | | | — | | | | 2,000 | * |

| | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | 30,250 | | | | — | | | | 30,250 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Daniel B. Carroll | | | 05/20/98 | | | $ | 18.13 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/20/99 | | | $ | 17.31 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/10/00 | | | $ | 10.50 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 06/29/01 | | | $ | 4.74 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/30/02 | | | $ | 5.15 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 11/25/02 | | | $ | 3.11 | | | | 7,000 | | | | — | | | | 7,000 | |

| | | | 07/11/03 | | | $ | 4.31 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/27/04 | | | $ | 5.91 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/26/05 | | | $ | 3.69 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 08/30/06 | | | $ | 2.08 | | | | 2,000 | | | | — | | | | 2,000 | * |

| | | | 05/31/07 | | | $ | 1.10 | | | | 2,000 | | | | — | | | | 2,000 | * |

| | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | 27,000 | | | | — | | | | 27,000 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Wallace E. Carroll, Jr. | | | 05/20/98 | | | $ | 18.13 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/20/99 | | | $ | 17.31 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/10/00 | | | $ | 10.50 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 06/29/01 | | | $ | 4.74 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/30/02 | | | $ | 5.15 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 11/25/02 | | | $ | 3.11 | | | | 7,000 | | | | — | | | | 7,000 | |

| | | | 07/11/03 | | | $ | 4.31 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/27/04 | | | $ | 5.91 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 05/26/05 | | | $ | 3.69 | | | | 2,000 | | | | — | | | | 2,000 | |

| | | | 08/30/06 | | | $ | 2.08 | | | | 2,000 | | | | — | | | | 2,000 | * |

| | | | 05/31/07 | | | $ | 1.10 | | | | 2,000 | | | | — | | | | 2,000 | * |

| | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | 27,000 | | | | — | | | | 27,000 | |

| | | | | | | | | | | | | | | | | | |

13

For 2007, directors who were not employed by Katy or its subsidiaries or Kohlberg & Co. received: (i) an annual retainer of $10,000; (ii) an annual stock appreciation right (“SAR”) grant of 2,000 stock appreciation rights under the Stand-Alone Stock Appreciation Rights Agreement (see below); (iii) the cash equivalent of 2,000 shares of the Company’s common stock at the closing price the day prior to the annual meeting; and (iv) $2,500 for attending personally, $1,000 for attending telephonically, each meeting of the Board of Directors. This group of directors also received in 2007: (i) an annual retainer of $6,000 if they chaired the Compensation Committee or the Audit Committee, and (ii) $1,000 for attending personally, $500 for attending telephonically, each meeting of a Board of Directors committee. Class II directors and those directors that are also officers do not receive the compensation described in this section for their service on the Board of Directors.

Under the Katy Industries, Inc. Stand-Alone Stock Appreciation Rights Agreement (the “Stand-Alone Stock Appreciation Rights Agreement”), each non-employee director who is not a Class II director receives an annual SAR grant of 2,000 SARs at the annual meeting date of the Board of Directors each year. The initial value is the fair market value on the date of grant. The director may exercise these SARs at any time during the ten years from the date of grant.

Directors receiving compensation for their services may also participate in the Directors’ Deferred Compensation Plan which became effective June 1, 1995 (the “Directors’ Deferred Compensation Plan”). Under this Plan, a director may defer directors’ fees, retainers and other compensation paid for services as a director until the later of the director’s attainment of age 62 or ceasing to be a director. Each director has 30 days before the beginning of a Plan Year (as defined in the Directors’ Deferred Compensation Plan) in which to elect to participate in the Directors’ Deferred Compensation Plan. Directors may invest these amounts in one or more investment alternatives offered by Katy. Directors may elect to receive distributions of deferred amounts in a lump sum or five annual installments.

In 1993, the Company’s Board of Directors approved a retirement compensation program for certain officers and employees of the Company and a retirement compensation arrangement for the Company’s then Chairman and Chief Executive Officer. The Board of Directors approved a total of $3.5 million to fund such plans. Participants are allowed to defer 50% of their annual compensation as well as be eligible to participate in a profit sharing arrangement in which they vest over a five year period. In 2001, the Company limited participation to existing participants as well as discontinued any profit sharing arrangements. Participants can withdraw from the plan upon the latter of age 62 or termination from the Company. The obligation created by this plan is partially funded. Assets are held in a rabbi trust invested in various mutual funds. Gains and/or losses are earned by the participant. For the unfunded portion of the obligation, interest is accrued at 4% each year.

The following table provides information with respect to the above deferred compensation plans for the following directors, who participated in the plans when they were officers of Katy.

| | | | | | | | | | | | | |

| | | Aggregate | | | Aggregate | | | Aggregate | |

| | | Earnings in | | | Withdrawals / | | | Balance at | |

| | | Last FY | | | Distributions | | | Last FYE | |

| Name | | ($) | | | ($) | | | ($) | |

| Robert M. Baratta | | $ | 1,295 | | | $ | 29,286 | | | $ | 30,581 | |

| Wallace E. Carroll, Jr. | | $ | 19,129 | | | $ | — | | | $ | 255,624 | |

No contributions were made by either the Company or the directors in 2007. The balance of Wallace E. Carroll, Jr.’s account was distributed in April, 2008.

14

PROPOSAL 2 — RATIFICATION OF APPOINTMENT OF THE INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

As part of the Audit Committee’s oversight of the Company’s independent registered public accountants, the Committee conducted a competitive process to review the selection of the Company’s independent registered public accounting firm. Based on the results of that process, the Audit Committee appointed UHY LLP as our independent registered public accounting firm to audit the consolidated financial statements of the Company for the year ending December 31, 2008. PricewaterhouseCoopers LLP (“PwC”), the Company’s independent registered public accounting firm for the fiscal years ended December 31, 2007 and 2006, was dismissed on March 28, 2008. UHY LLP was engaged as the Company’s independent registered public accounting firm on March 28, 2008.

The reports of PwC on the Company’s consolidated financial statements as of and for the fiscal years ended December 31, 2007 and 2006 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principle.

During the fiscal years ended December 31, 2007 and 2006, and through March 28, 2008, there were no disagreements between the Company and PwC on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PwC, would have caused PwC to make reference thereto in their reports on the financial statements of the Company for such years. During the fiscal years ended December 31, 2007 and 2006, and through March 28, 2008, there were no “reportable events” as such term is defined in Item 304(a)(1)(v) of Regulation S-K, except as discussed below. Pursuant to disclosures in the Item 9A section of the Form 10-K/A of the Company for the year ended December 31, 2006, in the Item 4 section of Forms 10-Q of the Company for the quarters ended September 30, 2007 and June 30, 2007 and in the Item 4 section of the Form 10-Q/A of the Company for the quarter ended March 31, 2007, the Company disclosed the following material weaknesses in internal controls over financial reporting and disclosure controls and procedures:

| | • | | The Company did not maintain a proper level of segregation of duties, specifically the verification process of physical raw material inventory on hand and the operational handling of this inventory; and |

| |

| | • | | The Company did not maintain sufficient oversight of the raw material inventory counting and reconciliation process. |

Management of the Company believes that the two material weaknesses disclosed above resulted in the restatement of the consolidated financial statements of the Company as of and for the years ended December 31, 2005 and 2006 and as of and for the quarter ended March 31, 2007.

As a matter of good corporate governance, the Audit Committee has requested the Board of Directors to submit the selection of UHY LLP to stockholders for ratification. If the appointment of UHY LLP is not ratified by stockholders, the Audit Committee will re-evaluate its selection and will determine whether to maintain UHY LLP as the Company’s independent registered public accounting firm or to appoint another independent registered public accounting firm. If prior to the 2009 Annual Meeting of Stockholders, UHY LLP ceases to act as the Company’s independent registered public accounting firm or if the Audit Committee removes UHY LLP as the Company’s independent registered public accounting firm, then the Audit Committee will appoint another independent registered public accounting firm. A representative of UHY LLP is expected to be present at the Annual Meeting. Such representative will have the opportunity to make a statement if he so desires and is expected to be available to respond to appropriate questions.

15

PwC billed Katy for audit services and certain other professional services during 2007 and early 2008. These amounts are divided into the following four categories, and are detailed below. The only services provided by UHY LLP was a review of the financial results for the three month period ended March 31, 2008. UHY LLP had not performed any other services prior to 2008.

| | | | | | | | | |

| | | 2007 | | | 2006 | |

| | | | | | | | | |

| Audit Fees | | $ | 707,752 | | | $ | 625,857 | |

| Audit-Related Fees | | | 5,000 | | | | 27,789 | |

| Tax Fees | | | — | | | | 10,976 | |

| All Other Fees | | | — | | | | — | |

| | | | | | | |

| | | | | | | | | |

| Total | | $ | 712,752 | | | $ | 664,622 | |

| | | | | | | |

Audit Fees

Fees for professional services rendered by PwC for the audit of the Company’s annual financial statements for 2007 were $707,752, of which an aggregate amount of $701,752 had been billed through the Record Date.

PwC billed the Company $625,857 of fees for the audit of the Company’s annual financial statements in 2006.

Audit-Related Fees

Fees for audit-related services rendered by PwC for 2007 were $5,000, all of which had been billed through the Record Date. Audit-related fees in 2007 were for agreed-upon procedures associated with one of the Company’s divestitures in 2007.

PwC billed the Company $27,789 of audit-related fees in 2006. Audit-related fees in 2006 were for agreed-upon procedures associated with one of the Company’s divestitures in 2006.

Tax Fees

There were no fees billed to the Company by PwC for tax compliance and advisory services in 2007.

PwC billed the Company $10,976 for tax compliance and advisory services in 2006.

All Other Fees

There were no fees billed to the Company by PwC for all other services in 2007 or 2006.

16

APPROVAL OF THE INDEPENDENT REGISTERED ACCOUNTING FIRM’S SERVICES

The Audit Committee has adopted pre-approval policies and procedures for audit and permissible non-audit procedures provided by all auditors (including our independent registered public accounting firm), consistent with the requirements of SEC regulations. The policy provides that all audit and non-audit services provided by all auditors must be individually pre-approved by the Audit Committee. In determining whether to pre-approve services, the Audit Committee considers whether such services are consistent with the rules of the SEC on auditor independence. The Audit Committee delegates to its members the authority to address any requests for pre-approval of services between Audit Committee meetings. Any pre-approval determination by a member of the committee must be reported to the Audit Committee at its next scheduled meeting. There is no delegation of the Audit Committee’s pre-approval authority to management. Requests or applications to provide services that require pre-approval by the Audit Committee must be submitted to the Audit Committee by both the independent registered public accounting firm and the Chief Financial Officer, Treasurer or Assistant Treasurer of the Company, and must include a joint statement as to whether, in their view, the request or application is consistent with the SEC’s rules on auditor independence. 100% of the services provided by Katy’s independent registered public accounting firm listed in the table above were approved pursuant to Katy’s pre-approval policies and procedures.

REQUIRED VOTE

Approval of this proposal to ratify the appointment of UHY LLP requires the affirmative vote by the majority of the outstanding shares of common stock present, in person, or by proxy, at the annual meeting.

Although the ratification of the independent registered public accounting firm is not required to be submitted to a vote of the stockholders, the Company believes that such ratification should be presented as a matter of good corporate practice. Notwithstanding stockholder approval of the ratification of the independent registered public accounting firm, the Audit Committee, in its discretion, may direct the appointment of a new independent registered public accounting firm at any time during the year, if the Audit Committee believes that such a change would be in the best interest of Katy and its stockholders. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether to appoint UHY LLP as independent registered public accounting firm for the fiscal year ending December 31, 2008.

The firm of UHY LLP acts as our principal independent registered public accounting firm. Through and as of April 29, 2008, UHY LLP had a continuing relationship with UHY Advisors, Inc. (“Advisors”) from which it leased auditing staff who were full-time, permanent employees of Advisors and through which UHY LLP’s partners provide non-audit services. UHY LLP has only a few full-time employees. Therefore, few, if any, of the audit services performed were provided by permanent, full-time employees of UHY LLP. UHY LLP manages and supervises the audit services and audit staff, and is exclusively responsible for the opinion rendered in connection with its examination.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPROVAL OF PROPOSAL 2.

17

INFORMATION ABOUT KATY STOCK OWNERSHIP

OUTSTANDING SHARES

The only outstanding class of Katy voting securities is its common stock. As of the Record Date, there were 7,951,176 shares of common stock outstanding and 1,322,200 options to acquire shares of common stock exercisable within the next 60 days.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table and accompanying footnotes set forth information concerning the beneficial ownership of Katy’s issued and outstanding common stock by those persons or entities known by management of Katy to own beneficially more than 5% of Katy’s issued and outstanding common stock (including certain members of the family of Wallace E. Carroll, former Chairman of the Board of Directors, since deceased (the “Carroll Family”)). Except as otherwise indicated in the footnotes below, such information is provided as of the Record Date. According to rules adopted by the SEC, a person is the “beneficial owner” of securities if he or she has or shares the power to vote them or to direct their investment or has the right to acquire beneficial ownership of such securities within 60 days through the exercise of an option, warrant or similar right, the conversion of a security or otherwise.

| | | | | | | | | | | | | |

| | | Amount and Nature of | | | | | | | Percent | |

| Name and Address of Beneficial Owner | | Beneficial Ownership | | | Notes | | | of Class | |

| | | | | | | | | | | | | |

Wallace E. Carroll, Jr. and

| | | 3,112,149 | | | | (1) | | | | 39.0% | |

the WEC Jr. Trusts

c/o CRL, Inc.

7505 Village Square Drive, Suite 200

Castle Rock, CO 80104 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Amelia M. Carroll and

| | | 3,112,149 | | | | (2) | | | | 39.0% | |

the WEC Jr. Trusts

c/o CRL, Inc.

7505 Village Square Drive, Suite 200

Castle Rock, CO 80104 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Anthony T. Castor III

| | | 510,000 | | | | (3) | | | | 6.0% | |

2461 South Clark Street, Suite 630

Arlington, VA 22202 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Dimensional Fund Advisors, LP

| | | 429,518 | | | | (4) | | | | 5.4% | |

1299 Ocean Avenue

11th Floor

Santa Monica, CA 90401 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Gabelli Funds, LLC, GAMCO Asset

| | | 1,848,573 | | | | (5) | | | | 23.2% | |

Management Inc., MJG Associates,

Inc., Gabelli Advisers, Inc.

One Corporate Center

Rye, NY 10580-1435 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Supplemental Disclosure Regarding Convertible Preferred Stock | | | | | | | | | | | | |

| | | | | | | | | | | | | |

KKTY Holding Company, L.L.C.

| | | * | | | | (6) | | | | * | |

111 Radio Circle

Mount Kisco, NY 10549 | | | | | | | | | | | | |

18

| | | |

| (1) | | Wallace E. Carroll, Jr. directly holds 171,839 shares and options to acquire 23,000 shares. He is a trustee of trusts for his and his descendants’ benefit (the “WEC Jr. Trusts”) which collectively hold 804,635 shares. He and certain of the WEC Jr. Trusts own all the outstanding shares of CRL, Inc. which holds 2,071,036 shares. He is also a trustee of the Wallace Foundation which holds 32,910 shares. Wallace E. Carroll, Jr. also beneficially owns 8,729 shares directly owned by his wife, Amelia M. Carroll. Amounts shown for Wallace E. Carroll, Jr. and Amelia M. Carroll reflect multiple counting of shares where more than one of them is a trustee of a particular trust and is required to report beneficial ownership of shares that these trusts hold. |

| |

| (2) | | Amelia M. Carroll holds 8,729 shares directly. She is a trustee of the WEC Jr. Trusts which collectively own 804,635 shares, and the Wallace Foundation which holds 32,910 shares. Wallace E. Carroll, Jr., her husband, and certain of the WEC Jr. Trusts, of which she is a trustee, own all the outstanding shares of CRL, Inc., which holds 2,071,036 shares. Amelia M. Carroll also beneficially owns 171,839 shares and options to acquire 23,000 shares directly owned by her husband. Amounts shown for Amelia M. Carroll and Wallace E. Carroll, Jr. reflect multiple counting of shares where more than one of them is a trustee of a particular trust and is required to report beneficial ownership of shares that these trusts hold. |

| |

| (3) | | Anthony T. Castor III holds 10,000 shares directly and options to acquire 500,000 shares. Effective April 18, 2008, Anthony T. Castor III resigned as President and Chief Executive Officer. Mr. Castor further resigned as a member of the Company’s Board of Directors. Mr. Castor has thirty days from his resignation date to exercise his vested shares. |

| |

| (4) | | Information obtained from Schedule 13G dated December 31, 2007 filed by Dimensional Fund Advisors LP for the calendar year 2007. |

| |

| (5) | | Information obtained from Schedule 13D dated December 27, 2007, filed by GAMCO Investors, Inc. (“GBL”). That Schedule 13D was filed by Mario Gabelli and various entities which he directly or indirectly controlled or for which he acted as chief investment officer. The reporting persons beneficially owning the stock shown in the chart are as follows: Gabelli Funds, LLC (“Gabelli Funds”) 570,390 shares, GAMCO Asset Management Inc. (“GAMCO”) 1,084,183 shares, MJG Associates, Inc. (“MJG”) 100,000 shares, and Gabelli Advisers, Inc. (“Gabelli Advisers”) 94,000 shares. Mario Gabelli, GBL and GGCP, Inc. (“GGCP”) are all deemed to have beneficial ownership of the securities owned beneficially by each of these persons. Each of the reporting persons has the sole power to vote or direct the vote and sole power to dispose or to direct the disposition of the securities reported for it, except that (i) GAMCO does not have the authority to vote 15,000 of the reported shares, and (ii) Gabelli Funds has sole dispositive and voting power with respect to the shares of Katy held by the funds so long as the aggregate voting interest of all joint filers does not exceed 25% of their total voting interest in Katy, and, in that event, the proxy voting committee of each fund shall vote that funds shares, (iii) the proxy voting committee of each fund may take and exercise in its sole discretion the entire voting power with respect to the shares held by such fund under special circumstances such as regulatory considerations, and (iv) the power of Mario Gabelli, GBL and GGCP is indirect with respect to securities beneficially owned directly by other reporting persons. |

19

| | | |

| (6) | | KKTY Holding Company, L.L.C., a Delaware limited liability company, currently owns 1,131,551 shares of the Company’s convertible preferred stock, which is convertible into 18,859,183 shares of the Company’s common stock. The preferred stock, at the option of the holder, is convertible upon the earlier of June 28, 2006 or the occurrence of certain fundamental changes in Katy. Until December 31, 2004 (except under certain circumstances), the holders of the convertible preferred stock were entitled to a paid-in-kind (“PIK”) stock dividend. KKTY Holding Company is controlled by several entities, which have Kohlberg Management IV, L.L.C., a Delaware limited liability company (“KMIV”), as their general partner. Christopher W. Anderson, Samuel P. Frieder, Christopher Lacovara, and Shant Mardirossian, all of whom are members of the Board of Directors of Katy, are members of KMIV. Each of Messrs. Anderson, Frieder, Lacovara, and Mardirossian disclaim beneficial ownership of these securities for purposes of Section 16 of the Exchange Act and any other purpose. If the preferred shares were converted into common stock, based upon the ownership level of convertible preferred stock on the Record Date, the disclosed percentage ownerships of the Katy common stock in the above table would change as follows: |

| | | | | |

| | | Ownership | |

| | | Percentage | |

| Name of Beneficial Owner | | Upon Conversion | |

| | | | | |

| Wallace E. Carroll, Jr. | | | 11.6% | |

| | | | | |

| Amelia M. Carroll | | | 11.6% | |

| | | | | |

| Anthony T. Castor III | | | 1.9% | |

| | | | | |

| Dimensional Fund Advisors, Inc | | | 1.6% | |

| | | | | |

| Gabelli Funds, GAMCO, MJG, Gabelli Advisers | | | 6.9% | |

| | | | | |

| KKTY Holding Company, L.L.C. | | | 70.3% | |

SECURITY OWNERSHIP OF DIRECTORS AND MANAGEMENT

The following tables show (i) the number of shares of common stock and (ii) the number of shares of Convertible Preferred Stock beneficially owned by directors and certain executive officers and owned by directors and executive officers as a group. Except as otherwise indicated in the footnotes below, such information is provided as of the Record Date. According to rules adopted by the SEC, a person is the “beneficial owner” of securities if he or she has or shares the power to vote them or to direct their investment or has the right to acquire beneficial ownership of such securities within 60 days through the exercise of an option, warrant or right, the conversion of a security or otherwise.

20

Common Stock

| | | | | | | | | | | | | |

| | | Amount and Nature | | | | | | | | |

| | | of Beneficial | | | | | | | Percent | |

| Name | | Ownership | | | Notes | | | of Class | |

| Christopher W. Anderson | | | — | | | | | | | | — | |

| William F. Andrews | | | 11,000 | | | | (1) | | | | * | |

| Robert M. Baratta | | | 40,735 | | | | (1) | | | | * | |

| Douglas A. Brady | | | 100,000 | | | | (1) | | | | 1.2% | |

| Daniel B. Carroll | | | 28,400 | | | | (1) | | | | * | |

| Wallace E. Carroll, Jr. | | | 3,112,149 | | | | (1)(2) | | | | 39.0% | |

| Anthony T. Castor III | | | 510,000 | | | | (1) | | | | 6.0% | |

| David C. Cooksey | | | 30,400 | | | | (1) | | | | * | |

| Samuel P. Frieder | | | — | | | | | | | | — | |

| Robert A. Gail | | | — | | | | | | | | — | |

| Christopher Lacovara | | | — | | | | | | | | — | |

| Shant Mardirossian | | | — | | | | | | | | — | |

| Joseph E. Mata | | | 20,400 | | | | (1) | | | | * | |

| Keith Mills | | | 3,000 | | | | (1) | | | | * | |

| Philip D. Reinkemeyer | | | 20,000 | | | | (1) | | | | * | |

| Amir Rosenthal | | | 260,000 | | | | (1) | | | | 3.2% | |

| | | | | | | | | | | | | |

| All directors and executive officers of Katy as a group (16 persons) | | | 4,136,084 | | | | (1)(2) | | | | 46.2% | |

| | | |

| * | | Indicates beneficial ownership of 1% or less |

Convertible Preferred Stock

| | | | | | | | | | | | | |

| | | Amount and Nature | | | | | | | | |

| | | of Beneficial | | | | | | | Percent | |

| Name | | Ownership | | | Notes | | | of Class | |

| Christopher W. Anderson | | | — | | | | (3) | | | | * | |

| Samuel P. Frieder | | | — | | | | (3) | | | | * | |

| Christopher Lacovara | | | — | | | | (3) | | | | * | |

| Shant Mardirossian | | | — | | | | (3) | | | | * | |

| | | | | | | | | | | | | |

| All directors and executive officers of Katy as a group (4 persons) | | | — | | | | (3) | | | | * | |

| | | |

| * | | Indicates beneficial ownership of 1% or less |

21

| | | |

| (1) | | Includes options to acquire the following number of shares within 60 days: |

| | | | | |

| William F. Andrews | | | 6,000 | |

| Robert M. Baratta | | | 18,000 | |

| Douglas A. Brady | | | 100,000 | |

| Daniel B. Carroll | | | 23,000 | |

| Wallace E. Carroll, Jr. | | | 23,000 | |

| Anthony T. Castor III | | | 500,000 | |

| David C. Cooksey | | | 30,000 | |

| Joseph E. Mata | | | 20,000 | |

| Keith Mills | | | 3,000 | |

| Philip D. Reinkemeyer | | | 20,000 | |

| Amir Rosenthal | | | 250,000 | |

| | | |

| (2) | | Includes shares deemed beneficially owned by Wallace E. Carroll, Jr. in his capacity as trustee of certain trusts for the benefit of members of the Carroll Family (see notes (1) and (2) under “Security Ownership of Certain Beneficial Owners.”). |

| |

| (3) | | Christopher W. Anderson, Samuel P. Frieder, Christopher Lacovara, and Shant Mardirossian have membership interests in Kohlberg Management IV, L.L.C., a Delaware limited liability company (“KMIV”). KMIV is the general partner of several entities with ownership interests in KKTY Holding Company, which currently owns 1,131,551 shares of the Company’s convertible preferred stock, which is convertible into 18,859,183 shares of the Company’s common stock. The preferred stock, at the option of the holder, is convertible upon the earlier of June 28, 2006 or the occurrence of certain fundamental changes in Katy. Through December 31, 2004 (except under certain circumstances) the holders of the convertible preferred stock were entitled to a paid-in-kind (“PIK”) stock dividend. KKTY Holding Company is controlled by several entities, which have KMIV as their general partner. Each of Messrs. Anderson, Frieder, Lacovara, and Mardirossian disclaim beneficial ownership of these securities. |

SECTION16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Exchange Act of 1934, as amended, Katy’s directors, executive officers and persons beneficially owning more than 10% of Katy’s shares of equity securities must file reports of ownership and changes in ownership with the SEC. These persons are also required by SEC regulations to furnish Katy with copies of all such forms they file. Based solely on a review of copies of the Section 16(a) reports furnished to Katy and written representations that no other reports were required, Katy believes that all persons subject to the reporting requirements of Section 16(a) filed the reports on a timely basis for the year ended December 31, 2007, except as follows: (i) the May 31, 2007 SAR grants for Messrs. Baratta, Carroll and Carroll, Jr.; and (ii) the August 30, 2007 rabbi trust share disposal for Amelia Carroll and the beneficial ownership impact to Wallace Carroll, Jr.

22

EXECUTIVE COMPENSATION

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board of Directors has reviewed and discussed the section of this proxy statement entitled “Compensation Discussion and Analysis” with management and, based on such review and discussion, the Committee recommended that it be included in this proxy statement.

Compensation Committee of the Board of Directors

Wallace E. Carroll, Jr. (Chairman)

Christopher Lacovara

Christopher W. Anderson

The Compensation Committee Report shall not be deemed to be incorporated by reference as a result of any general incorporation by reference of this Proxy Statement or any part hereof in the Company’s 2007 Annual Report to Stockholders, its Annual Report on Form 10-K for the year ended December 31, 2007 or any other filings with the SEC.

COMPENSATION DISCUSSION AND ANALYSIS

Overview

Katy’s Compensation Committee determines the objectives of our company’s compensation program for executives and directors. The policies and procedures of the Compensation Committee are:

| | • | | To review and approve annually corporate goals and objectives relevant to the Company’s Chief Executive Officer (“CEO”); evaluate the CEO’s performance in light of those goals and objectives; and determine and approve the CEO’s compensation level based on this evaluation; |

| |

| | • | | To review and make recommendations to the Board of Directors with respect to the compensation of all directors, officers and other key executives of the Company. This includes the review and approval annually, for the CEO and the senior executives of the Company, of (a) the annual base salary level, (b) the annual incentive opportunity level, (c) the long-term incentive opportunity level, (d) employment agreements, severance agreements and change in control agreements, and (e) any special or supplemental benefits; |

| |

| | • | | To make recommendations to the Board of Directors with respect to non-CEO compensation, incentive-compensation plans and equity-based plans; and |

| |

| | • | | To prepare any report on executive compensation as required by the Securities and Exchange Commission (“SEC”). |

Katy’s compensation programs are designed to attract, retain and motivate our executive officers and other employees, to match annual and long-term cash and stock incentives to achievement of measurable corporate, business unit and individual performance objectives and to align executives’ incentives with those of shareholders. We believe that in the long run, positive earnings growth has the highest correlation with long-term equity value. As a result, the primary objective of our compensation program is to increase the overall equity value of our company by rewarding sustainable growth in earnings. In this context, we seek to offer total compensation packages at levels we consider to be competitive in the marketplace in which we compete. We further seek to establish a compensation program that fosters a team approach to company profit improvement and provides higher levels of bonus compensation to more senior executives to illustrate the financial rewards of promotion.

23

EXECUTIVE COMPENSATION POLICY

Compensation Program Components

Annual compensation for Katy’s Chief Executive Officer and other executive officers (including the Named Executive Officers) consists of two cash compensation components: base salary and annual cash bonuses. A third component, stock options and stock appreciation rights (“SARs”), is currently used to attract new key employees. Overall, the Compensation Committee attempts to achieve approximately ten percent ownership (on a fully-diluted basis) via stock, options and SARs by directors and executive management.

These elements are designed to reward corporate and individual performance. Corporate performance is generally measured by reference to earnings before interest, taxes, depreciation and amortization (“EBITDA”) levels, certain operational metrics and adherence to corporate values. Individual performance is evaluated based on individual expertise, ethics and achievement of personal performance commitments. We have no pre-established policy or target for allocation between cash and non-cash components.

Base Salary.The base salaries for our executives are fixed annually and reflect job responsibility, the Compensation Committee’s judgments of experience, effort and performance, and Katy’s financial and market performance (in light of the competitive environment in which Katy operates). The base salary is also designed to provide our executive team with steady cash flow during the course of the year that is not contingent on short term variation in our operating performance. Annual base salaries are also influenced by comparable companies’ compensation practices, as determined by Compensation Committee members and their experiences with other companies, so that Katy remains reasonably competitive in the market. However, it is not the practice of Katy’s Compensation Committee to hire any outside consulting firms to confirm the compensation practices of comparable companies or to assess the Committee’s own policies and practices. While competitive pay practices are important, the Compensation Committee believes that the most important considerations are individual merit and Katy’s financial and market performance. In considering Katy’s financial and market performance, the Compensation Committee reviews, among other things, net income, cash flow, working capital and revenues and share price performance relative to historical performance.

The base salaries for Katy’s executive officers for the year ended December 31, 2007 were generally established in March 2007 by considering the performance and contribution of each officer.

Annual Bonuses.The annual cash bonuses we offer to our executive officers are intended to provide incentives to increase the Company’s performance and the individual employee’s performance. Evaluation of the Company’s performance is based on the achievement of pre-established EBITDA goals, as set by the Compensation Committee at the beginning of the year. Evaluation of individual performance is based on attainment of personal performance goals and objectives.

Each year, the Compensation Committee establishes a potential bonus payout for each officer that is expressed as a percentage of the officer’s base salary. In 2007, the bonus targets for the Named Executive Officers were as follows as percentage of base salary: Anthony T. Castor III — 70%, Amir Rosenthal — 50%, Douglas A. Brady — 50%, Keith Mills — 40% and Philip D. Reinkemeyer — 40%. Overall the weighting between the Company’s and individual performance of the total potential bonus payout is 75% and 25%, respectively. An employee achieves the target bonus opportunity if he or she meets 100% of pre-established performance goals. A higher or lower bonus is earned if performance exceeds or falls short of the target levels. For 2007, any bonuses paid represent attainment of individual performance goals, since Company-wide goals were not met, or certain discretionary awards determined by the Compensation Committee.

24

Cash bonuses, as opposed to equity grants, are designed to more immediately reward annual performance against the key performance metrics for the Company. We believe that cash bonuses are an important factor in motivating our management team as a whole and as individual executives, in particular, to perform at their highest level toward achievement of established goals. We also believe establishing cash bonus opportunities are an important factor in both attracting and retaining the services of qualified executives.

Stock Options and Stock Appreciation Rights.The third compensation component is a stock option and SAR program, implemented under the Company’s Long-Term Incentive Plan, 1997 Long-Term Incentive Plan and 2002 Stock Appreciation Plan. Under Katy’s current stock option and SAR program, the Board of Directors may provide compensation in the form of incentive stock options, non-qualified stock options, stock appreciation rights, restricted stock, performance units or shares, and other incentive awards. The Compensation Committee believes that the stock option and SAR programs currently should be used to attract and retain key employees. We further believe that vesting feature of our stock option and SAR programs provide an incentive for our executive officers to remain in our employment during the vesting period.

The awards are granted on the first date of employment at the exercise price of the Company’s common stock at the close of business the date prior to first date of employment. The Company has no formal policy as to coordination of the release of material non-public information and grants of stock options and stock appreciation rights. Given the limitation of available stock options under the above plans, most awards are given in SARs. During 2007, no stock options or SARs were granted to Named Executive Officers. Stock options or SAR awards were given to newly-hired key operational management.

Other Benefits

We believe establishing competitive benefit packages for our employees, including our management team, is an important factor in attracting and retaining highly qualified personnel. Our benefit plans, such as our group health plan, are generally not performance-based and offer our employees affordable access to health care and the sense of security that accompanies that type of access. We also offer our management team a 401(k) plan with a company match that encourages the saving of money for retirement and other permissible needs on a tax-deferred basis.

We established a Supplemental Retirement and Deferral Plan (the “Supplemental Deferral Plan”), for the benefit of our management team and directors, which among other things, allows participants to voluntarily defer up to 100% of their annual bonus and up to 50% of their base salary until retirement or termination of his or her employment. Katy invests voluntary deferrals and profit sharing allocations at the employee’s election in several investment alternatives offered by Katy. The above plan was frozen for any new officers in 2001. As a result, only Keith Mills participates in the Supplemental Deferral Plan.

25

Termination Events

We have provided our Named Executive Officers, who we consider to be our most senior executives, with severance benefits under certain circumstances to provide them with a sense of security while devoting their professional career to our company. As a general matter, we have defined “cause” to include (a) willful failure or neglect to perform the assigned duties; (b) the conviction of a felony, embezzlement or improper use of corporate funds by the employee; or (c) self dealing detrimental to the Company or any attempt to obtain personal profit from any transaction in which the Company has an interest.

We have defined “change of control” to include (i) a sale of 100% of Katy’s outstanding capital stock, (ii) a sale of all or substantially all of Katy’s operating subsidiaries or assets or (iii) a transaction or transactions in which any third party acquires Katy stock in an amount greater than that held by KKTY Holding Company and in which KKTY Holding Company relinquishes its right to nominate a majority of the candidates for election to the Board of Directors.