2019 Outlook Meeting December 12, 2018 | New York 1

Safe Harbor Statement and Non-GAAP Financial Measures Certain information in this presentation constitutes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those not based on historical information, but rather relate to our outlook, future operations, strategies, financial results, or other developments and speak only as of the date made. These forward-looking statements, including statements about our 2019 outlook for sales, premium income, adjusted operating earnings, and adjusted operating return on equity, under current market conditions, as well as about weighted average risk-based capital ratios, holding company cash and marketable securities and share repurchases are subject to numerous assumptions, risks, and uncertainties, many of which are beyond our control. The following factors, in addition to other factors mentioned from time to time, may cause actual results to differ materially from those contemplated by the forward-looking statements: (1) sustained periods of low interest rates; (2) fluctuation in insurance reserve liabilities and claim payments due to changes in claim incidence, recovery rates, mortality and morbidity rates, and policy benefit offsets due to, among other factors, the rate of unemployment and consumer confidence, the emergence of new diseases, epidemics, or pandemics, new trends and developments in medical treatments, the effectiveness of our claims operational processes, and changes in governmental programs; (3) unfavorable economic or business conditions, both domestic and foreign, that may result in decreases in sales, premiums, or persistency, as well as unfavorable claims activity; (4) changes in or interpretations of laws and regulations, including tax laws and regulations; (5) investment results, including, but not limited to, changes in interest rates, defaults, changes in credit spreads, impairments, and the lack of appropriate investments in the market which can be acquired to match our liabilities; (6) a cyber attack or other security breach could result in the unauthorized acquisition of confidential data; (7) the failure of our business recovery and incident management processes to resume our business operations in the event of a natural catastrophe, cyber attack, or other event; (8) execution risk related to our technology needs; (9) increased competition from other insurers and financial services companies due to industry consolidation, new entrants to our markets, or other factors; (10) changes in our financial strength and credit ratings; (11) damage to our reputation due to, among other factors, regulatory investigations, legal proceedings, external events, and/or inadequate or failed internal controls and procedures; (12) actual experience in the broad array of our products that deviates from our assumptions used in pricing, underwriting, and reserving; (13) changes in accounting standards, practices, or policies; (14) effectiveness of our risk management program; (15) contingencies and the level and results of litigation; (16) availability of reinsurance in the market and the ability of our reinsurers to meet their obligations to us; (17) ineffectiveness of our derivatives hedging programs due to changes in the economic environment, counterparty risk, ratings downgrades, capital market volatility, changes in interest rates, and/or regulation; (18) fluctuation in foreign currency exchange rates; (19) ability to generate sufficient internal liquidity and/or obtain external financing; (20) recoverability and/or realization of the carrying value of our intangible assets, long-lived assets, and deferred tax assets; and (21) terrorism, both within the U.S. and abroad, ongoing military actions, and heightened security measures in response to these types of threats. For further discussion of risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see Part I, Item 1A “Risk Factors” of our annual report on Form 10-K for the year ended December 31, 2017 and, to the extent applicable, our subsequently filed quarterly reports on Form 10-Q. The forward-looking statements in this presentation are being made as of the date of this presentation, and the Company expressly disclaims any obligation to update or revise any forward-looking statement contained herein, even if made available on our website or otherwise. We analyze our performance using non-GAAP financial measures which exclude or include amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. This presentation contains non-GAAP financial measures, including after-tax adjusted operating earnings, after-tax adjusted operating earnings per share, adjusted operating return on equity, and book value per share (excluding accumulated other comprehensive income, or AOCI). Refer to the Appendix for a reconciliation of the non-GAAP financial measures used in this presentation to the most directly comparable GAAP measures. 2

Today’s Participants Rick McKenney President and Chief Executive Officer Jack McGarry Executive Vice President and Chief Financial Officer Tom White Senior Vice President, Investor Relations Business Segment Leaders Mike Simonds President and Chief Executive Officer, Unum US Tim Arnold President and Chief Executive Officer, Colonial Life Peter O’Donnell Executive Vice President and Chief Executive Officer, Unum UK Steve Zabel President, Closed Block Operations Other Corporate Officers Steve Mitchell Chief Financial Officer, US Finance Breege Farrell Executive Vice President, Chief Investment Officer Puneet Bhasin Executive Vice President, Chief Information and Digital Officer 3

Agenda Overview Financial Performance 2019 Outlook State of the Business ● Unum US ● Colonial Life ● Unum International ● Closed Block Closing Comments Questions and Answers Appendix 4

Overview 5

Overview INTRODUCTION A trusted provider of employee benefits Leading positions in our markets Strong margins and a growing core business Strong capital generation and financial flexibility Disciplined operator with a reputation of consistency * Excludes Corporate; Last Nine Months Ending September 30, 2018 6

Overview A FOCUSED STRATEGY 7

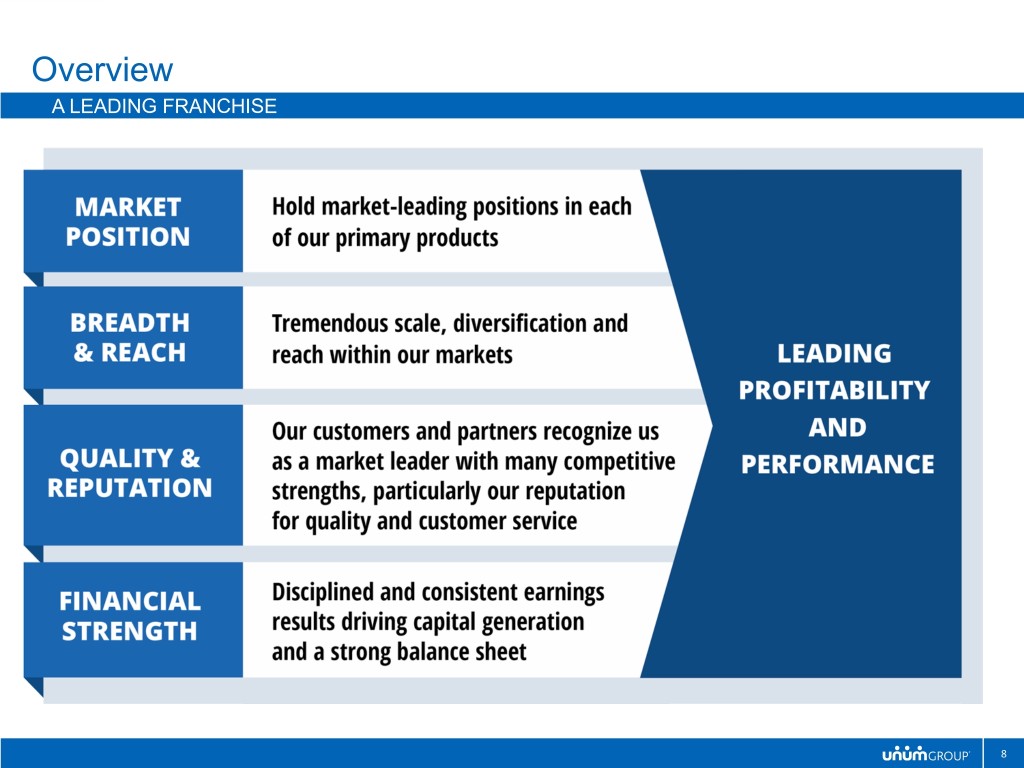

Overview A LEADING FRANCHISE 8

Overview DELIVERING FOR OUR CUSTOMERS 9

Overview ADVANCING OUR STRATEGIC GROWTH PLANS Product line expansion ● Dental and Vision ● Stop Loss Geographic expansion ● Acquisition of Pramerica Życie ● Dental and Voluntary in UK Premium income for our core businesses ● Growth driven by sales and strong persistency * Last Twelve Months Ending September 30 10

Overview 2018 OUTLOOK UPDATE Adjusted operating earnings per share growth trending toward higher end of our 17% to 23% outlook Annualized adjusted operating ROE of over 13% (over 18% in core businesses) Capital deployment – acquisitions, share repurchase, dividend increase Active year managing Closed Block/LTC Capital position remains strong in changing environment 11

Overview 2019 EXECUTION STRATEGY 12

Overview OUR APPROACH TO DIGITAL We are accelerating our digital pace Enhancing the Expanding our Enabling a growth customer experience footprint platform Journey-driven Integrations with Development of digital approach for benefit administration digitally-enabled customers platforms sales and quoting Process and digital Investments in human tools streamlining of capital management Digital-first sales and service (HCM) approach for new interaction offerings 13

Overview 2019 OUTLOOK SUMMARY Outlook Adjusted operating earnings per share growth 4% to 7% Continued solid core business segment premium growth and return on equity Maintaining strong margins and cash flow generation Capital deployment remains steady Continued focus on effectively managing the Closed Block 14

Overview CLOSING COMMENTS Consistent results, positioned for the future $42.92 Leading positions in attractive markets Strong core operations Financial flexibility Resilient franchise * Last Nine Months Ending September 30, 2018 15

Financial Performance 16

Financial Performance 2018 – A DYNAMIC YEAR Strong core business segment performance overshadowed by LTC concerns LTC addressed with reserve update, cash contributions, and increased disclosure of our block demographics, reserve assumptions and sensitivities Adjusted operating EPS growth expected at high end of our 17% to 23% outlook Tax reform improved cash flow generation but created near-term pressure on capital metrics, which we view as largely non-economic Our share repurchase activity reflects our belief in Unum’s attractive valuation 17

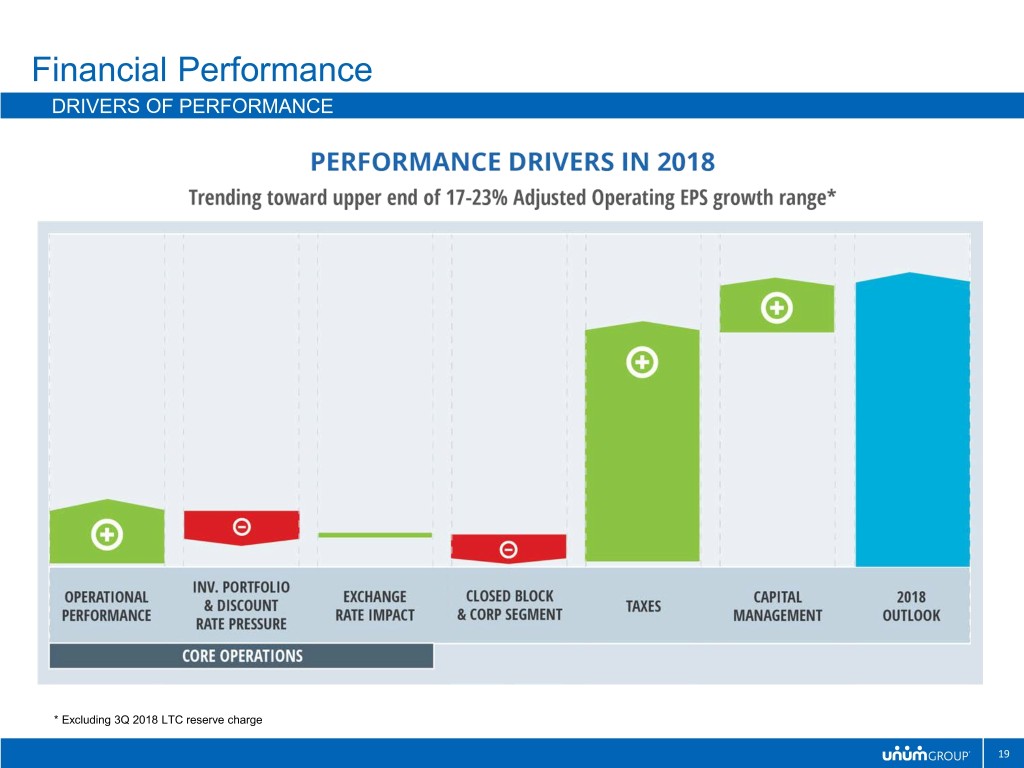

Financial Performance 2018 OUTLOOK UPDATE 4Q 2018 operating results, including long-term care, tracking in-line with our outlook and consensus Full year 2018 adjusted operating earnings per share growth tracking toward upper end of our 17% to 23% outlook range (excluding LTC charge) Unum Poland results will be included with Unum UK in the Unum International reporting segment Capital return to shareholders ● Full year share repurchases anticipated to be $350 million ● 13% dividend increase approved in May 18

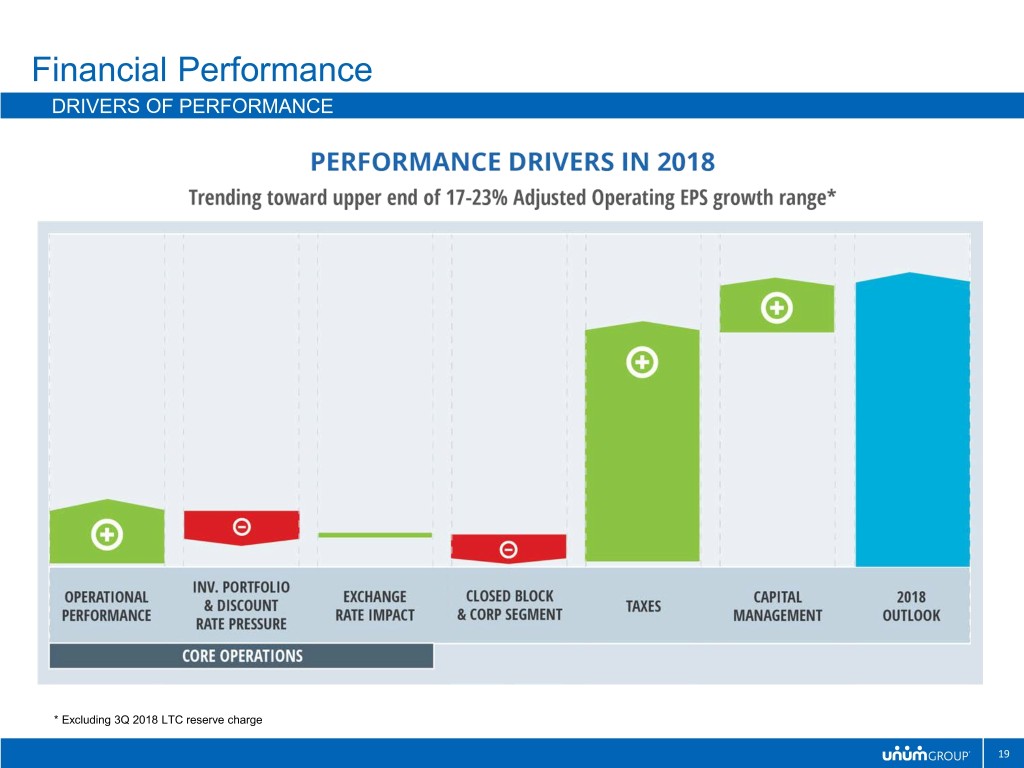

Financial Performance DRIVERS OF PERFORMANCE * Excluding 3Q 2018 LTC reserve charge 19

Financial Performance STRONG CORE BUSINESS PREMIUM GROWTH In millions of US dollars and British pounds, as indicated 20

Financial Performance STABLE BENEFITS EXPERIENCE † Excluding UDB Reserve Increase * Last Nine Months Ending September 30, 2018 21

Financial Performance EXCELLENT ADJUSTED OPERATING RETURN ON EQUITY 22

Financial Performance STRONG STATUTORY EARNINGS DRIVES FREE CASH FLOW † Our traditional U.S. life insurance companies are Provident Life and Accident Insurance Company, Unum Life Insurance Company of America, The Paul Revere Life Insurance Company, Colonial Life & Accident Insurance Company, Provident Life and Casualty Insurance Company, First Unum Life Insurance Company, Unum Insurance Company, and Starmount Life Insurance Company * Last twelve months ending September 30, 2018 23

Financial Performance Topics Long-term Care Capital Management Investment Portfolio FASB Long Duration Targeted Improvements 24

Financial Performance LONG-TERM CARE Actions taken in 2018: ● Updated reserve assumptions to reflect current trends and relevant industry data ● Capital contributions ● Refreshed our rate increase request strategy ● Active voice in the industry Provided substantial disclosure to assist investors ● Characteristics of Unum block ● Reserve assumptions ● Sensitivities Comfortable with our LTC reserve position and expect to deliver loss ratios within our range in 2019 25

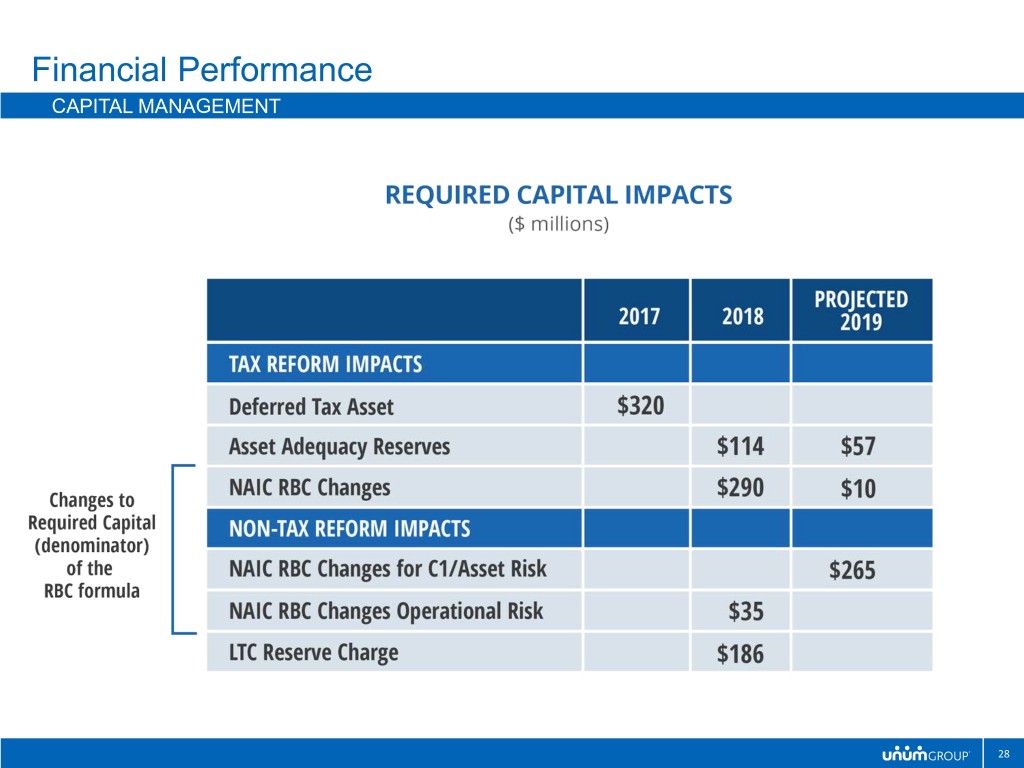

Financial Performance CAPITAL MANAGEMENT Our capital positions remain in good shape ● 2018 YE estimates: Risk-Based Capital 370% to 375% Holding Company Cash $550 to $600 million Our targets for capital metrics going forward include: ● Maintain RBC above 350% ● Maintain holding company cash above 1x fixed costs We will support the growth of our business and return capital to shareholders through share buybacks and dividends as appropriate At 370% RBC, the Total Adjusted Capital is consistent with 390% RBC prior to tax reform 26

Financial Performance CAPITAL MANAGEMENT Strong, Consistent Sources of Capital Our sources of holding company cash remain healthy ● Dividends generated by our US traditional insurance companies ● The ongoing benefits of tax reform to our statutory earnings ● Services agreements ● Dividends from the UK subsidiary † Our traditional U.S. life insurance companies are Provident Life and Accident Insurance Company, Unum Life Insurance Company of America, The Paul Revere Life Insurance Company, Colonial Life & Accident Insurance Company, Provident Life and Casualty Insurance Company, First Unum Life Insurance Company, Unum Insurance Company, and Starmount Life Insurance Company * Last twelve months ending September 30, 2018 27

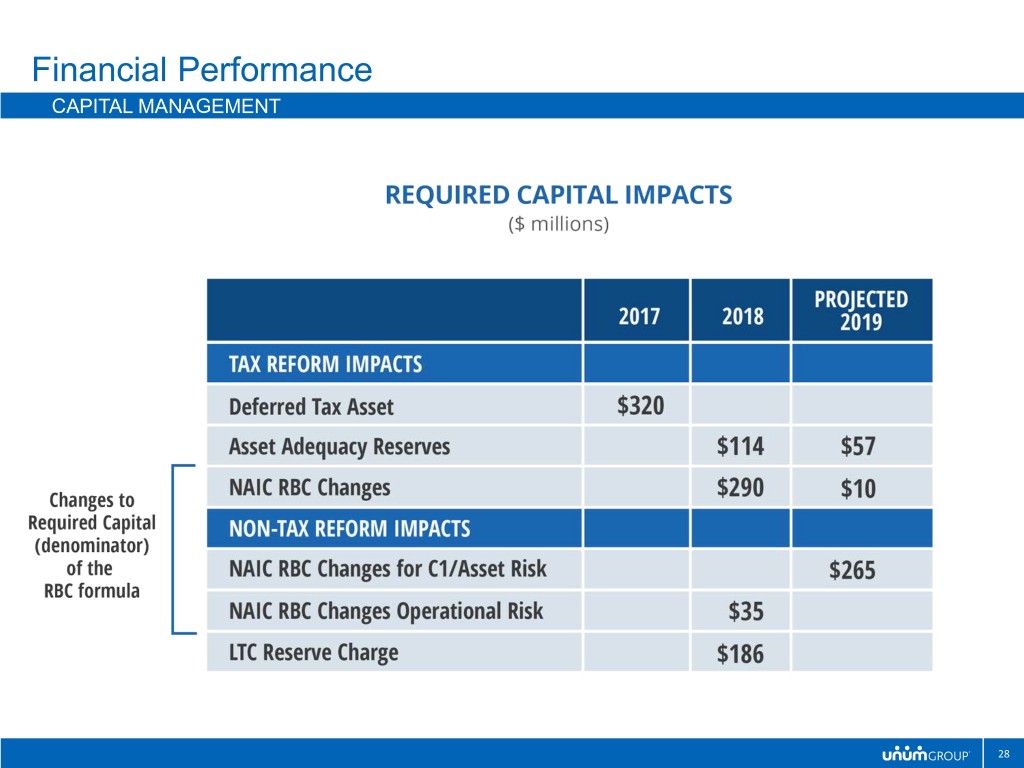

Financial Performance CAPITAL MANAGEMENT 28

Financial Performance CAPITAL MANAGEMENT Summary Points Total Adjusted Capital remains strong Much of the tax reform and RBC factor impacts have been non-economic Much of the tax reform-related impacts are reflected in our year-end 2018 capital metrics 2019 impacts are expected to be lower than 2018 We anticipate returning to historic levels of cash flow generation after 2019 29

Financial Performance INVESTMENT PORTFOLIO UNUM INVESTMENT PORTFOLIO* Portfolio Management Strategy Tax- Advantaged Cash & Cash Prtnrshp. 0.2% Equiv. 2.8% The portfolio is designed to perform Commercial Other Mortgage Investments through cycles over the long term Loans 5.0% 2.0% Municipals 4.6% The business mix leads to a long- Foreign Gov't duration, primarily fixed-income portfolio Securities 1.5% US Gov't Inv. Grade Strong focus on corporate credit – a Securities & Corporate Agencies 3.8% 57.3% fundamental “bottoms-up” credit High Yield approach 7.3% Inv. Grade We can withstand market value Private Placements Mortgage- fluctuations without indicating risk to 11.9% Backed Securities & Other our business Securitized Assets 3.6% ● Limited disintermediation risk ● Limited catastrophe risk Investment grade bonds remain our core holding *Excludes Policy Loans 30

Financial Performance INVESTMENT PORTFOLIO Excellent default record in 2008-2010 recession Active management of High Yield exposure – downgrades offset by upgrades in 2018 Favorable default experience in 2015-2016 during “energy crisis” ● Manageable impact from ratings migration ● Current energy exposure only 1% above Barclays Index Overweight utilities; underweight financial services 1 Formerly 5.12% due to Lehman; Moody’s has subsequently removed it * Trailing 12 month default rates 31

Financial Performance FASB LONG-DURATION TARGETED IMPROVEMENTS The new standard was recently finalized and we continue to evaluate; implementation scheduled for 1Q 2021 The new standard does not affect the economics of our business, the cash flows, or statutory accounting No modification for disabled life reserves, which comprise 60% +/- of our total net reserves Biggest impact will come from change in discount rates on our policy reserves; impact reported through other comprehensive income No/minimal exposure to market risk benefits Book Value, As Reported will be impacted, but Book Value, Ex. AOCI expected to remain constant Some leverage ratios could be impacted but coverage ratios expected to remain at healthy levels 32

2019 Outlook 33

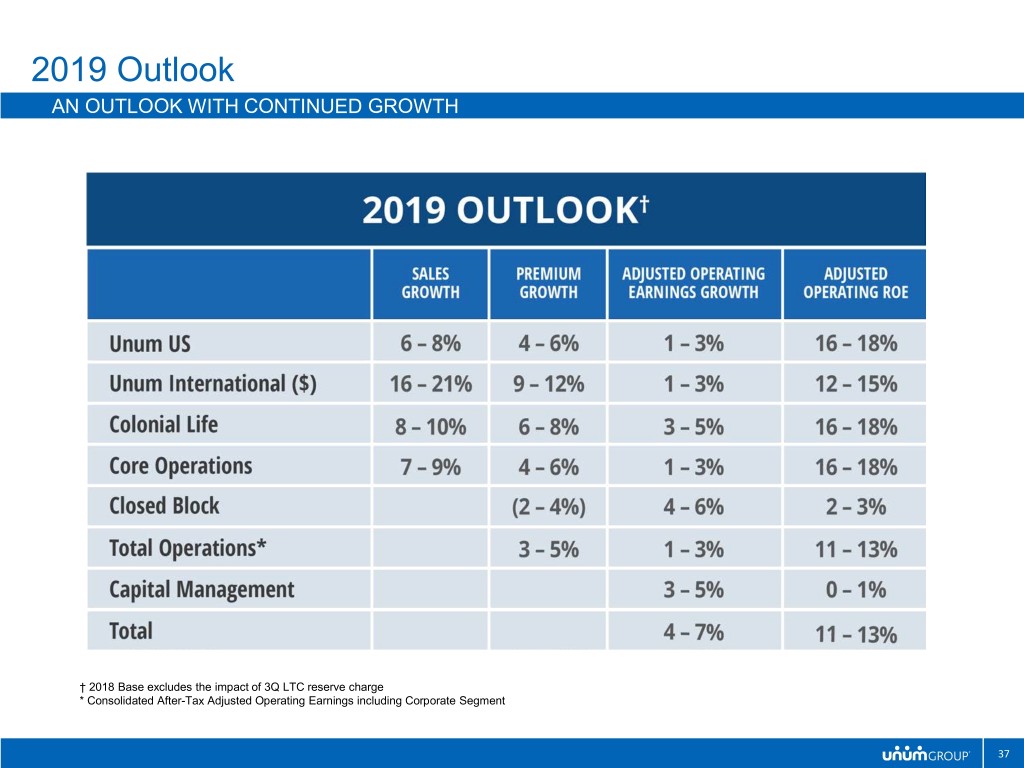

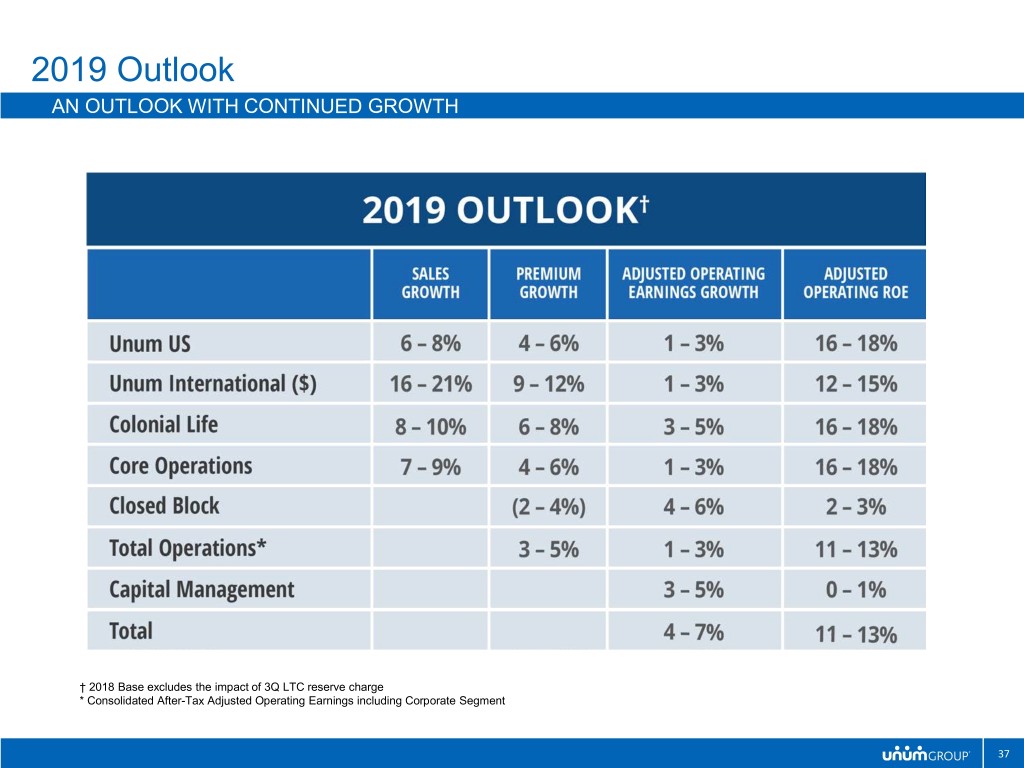

2019 Outlook KEY MESSAGES Expect continued solid performance from our US core business segments − Good premium growth from disciplined sales growth and strong persistency − Stable benefits experience − Continued investments in growth and customer experience Unum International − Brexit impacting UK business environment − Poland contribution to results Ongoing interest rate impacts − Improving new money yields, but remain below portfolio yields − New money yields exceed discount rate assumptions Anticipate tax rate in 20% to 21% range − Tax reform beneficial to earnings and cash flow Anticipate adjusted operating EPS growth of 4% to 7% Strong cash generation drives deployment flexibility − 2019 share repurchase trend similar to past years − LTC cash contributions anticipated in our plans 34

2019 Outlook OUTLOOK FOR 4% TO 7% GROWTH * Growth is based off 2018 estimated adjusted operating earnings per share excluding the 3Q LTC reserve increase 35

2019 Outlook 2019 CAPITAL PLANS Strong operating performance and tax reform expected to drive strong statutory earnings and cash flow Maintain RBC Ratio above 350% Total adjusted capital at stronger levels Maintain holding company cash above 1x fixed charges Continue current pace of share buybacks Maintain flexibility to deal with unexpected stresses or opportunities 36

2019 Outlook AN OUTLOOK WITH CONTINUED GROWTH ** † 2018 Base excludes the impact of 3Q LTC reserve charge * Consolidated After-Tax Adjusted Operating Earnings including Corporate Segment 37

2019 Outlook CLOSING COMMENTS 4% to 7% Operating EPS Growth Generally consistent operating trends ●Stable margins in core business segments ●Challenging UK business environment ●Reduced drag from interest rates Good leverage over time to stronger economy, higher wage inflation and rising interest rates Expect continuation of recent trends for capital return to shareholders 38

State of the Business 39

Unum US 40

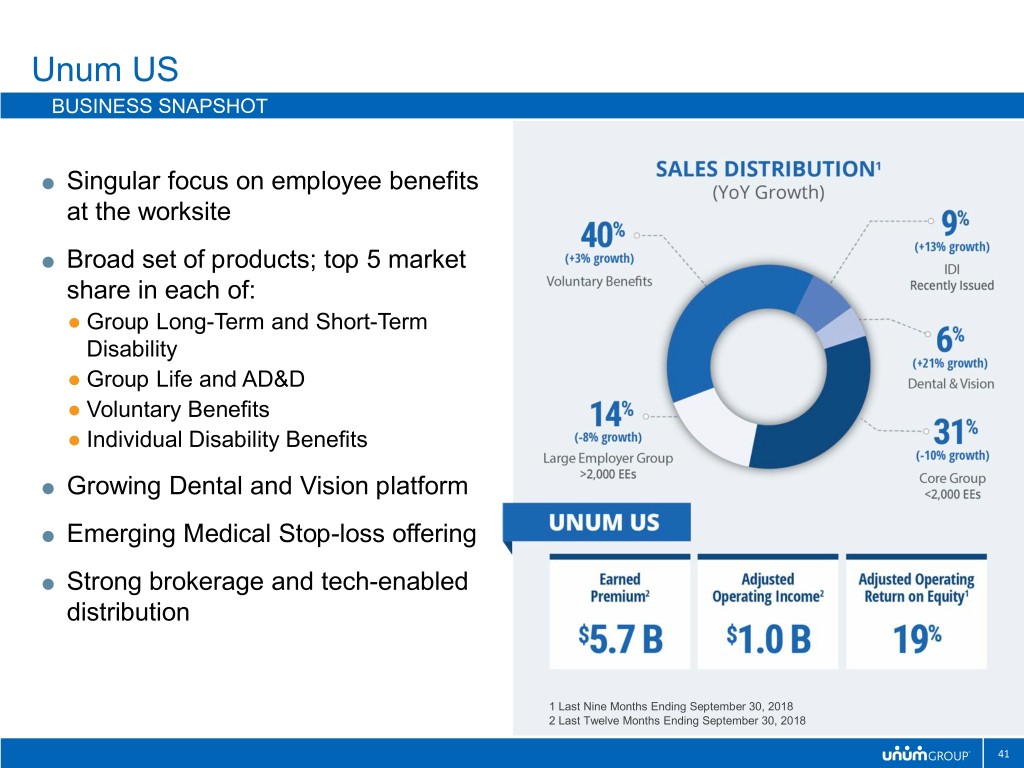

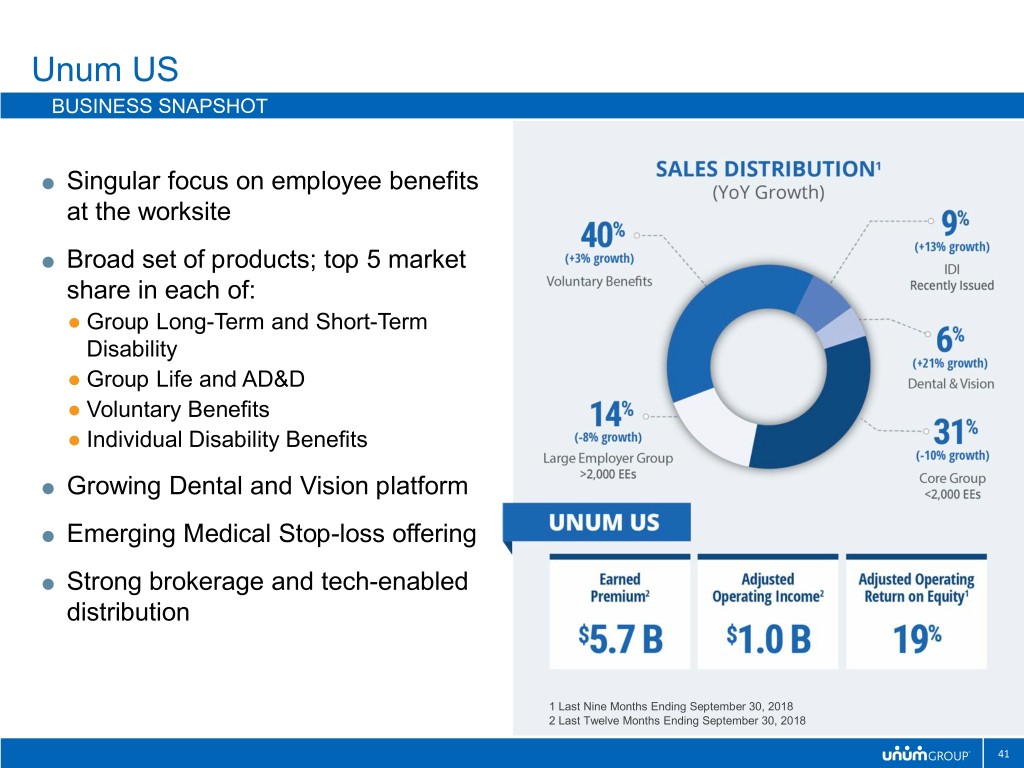

Unum US BUSINESS SNAPSHOT Singular focus on employee benefits at the worksite Broad set of products; top 5 market share in each of: ● Group Long-Term and Short-Term Disability ● Group Life and AD&D ● Voluntary Benefits ● Individual Disability Benefits Growing Dental and Vision platform Emerging Medical Stop-loss offering Strong brokerage and tech-enabled distribution 1 Last Nine Months Ending September 30, 2018 2 Last Twelve Months Ending September 30, 2018 41

Unum US BUSINESS STRATEGY OVERVIEW 42

Unum US KEY MESSAGES We continue to generate strong and consistent returns through disciplined distribution, underwriting and risk management In the context of a declining expense ratio, we are investing in capabilities to drive long-term growth, efficiency and customer experience Near-term earnings growth will be moderated by lower investment income from declining yields on our portfolio and improved capital efficiency; ROE remains strong Earnings growth will migrate closer to revenue growth in the mid term as new growth platforms reach scale and portfolio yields level 43

Unum US DISCIPLINED UNDERWRITING 44

Unum US INVESTMENTS & EXPENSE Favorable trend in the operating expense ratio Baseline expenses to “run” the business are flat as lean and automation take hold Investment spending increasing over the period, focused on: ● Client experience ● Dental & Vision platform ● New Supplement & Voluntary product enhancements ● HCM & Leave Management 45

Unum US FOCUS ON CLIENT EXPERIENCE Building digital transformation based on customer journeys Simplifying and harmonizing product portfolio Investing in brand that * Last Nine Months Ending September 30, 2018 promises simplicity, expertise and empathy 46

Unum US GROWING DENTAL PLATFORM Strong outlook for our US dental franchise with Unum and Colonial Life brand and distribution leverage Dental sales and premium increases expected to contribute: ● 3% to our 2019 Unum US sales growth ● 1% to 2020 earned premium growth Measurable adjusted before tax operating earnings (BTOE) impact beginning in 2021 as platform reaches operating scale #12 network DHMO among Group acquired Dental carriers in CA 47

Unum US NEW SUPPLEMENTAL & VOLUNTARY PRODUCT ENHANCEMENTS New Voluntary Accident & Critical Illness products designed for Group packaging New Individual Disability Product for middle market earners utilizing digital acquisition process Expanded Medical Stop Loss offering ● Data-focused strategy ● Growing from 3 to 7-9 dedicated wholesalers over next 24 months ● Sales of $8-10M in first full year with more than double that planned for 2019 ● Meaningful contributor to 2020 sales growth 48

Unum US LARGE & MID-SIZED EMPLOYER SOLUTIONS Leave Management Services Integration with SaaS HCM 1st platform launched January 2018 (Workday) ● Evidence of insurability from days to seconds ● Payment with one click ● Real-time access to leave data ● 80% close ratios for prospects 2019: $1B+ in premium tied to Unum who viewed the demo clients with leave services ● ~$50M in new sales (persistency 3-4% higher) 2nd platform to be announced LeaveLogic acquisition provides strong consumer planning capability January 2019 New joint Leave & Disability model for 2019 * Last Nine Months Ending September 30, 2018 49

Unum US SHORT & MID-TERM EARNINGS GROWTH Net investment income is anticipated to pressure 2019 earnings: ● Efficient capital management leads to lower asset balances ● Lower yields expected on these asset balances ● Favorable miscellaneous investment income unlikely to persist In 2019, we anticipate a continuation of healthy underwriting results, though Voluntary Benefits favorable volatility unlikely to persist Net result is expected modest pressure on 2019 BTOE growth Earnings growth will migrate closer to revenue growth over the next 2-3 years as new growth platforms reach scale and portfolio yields level *Projected 50

Unum US 2019 FINANCIAL OUTLOOK 51

Colonial Life 52

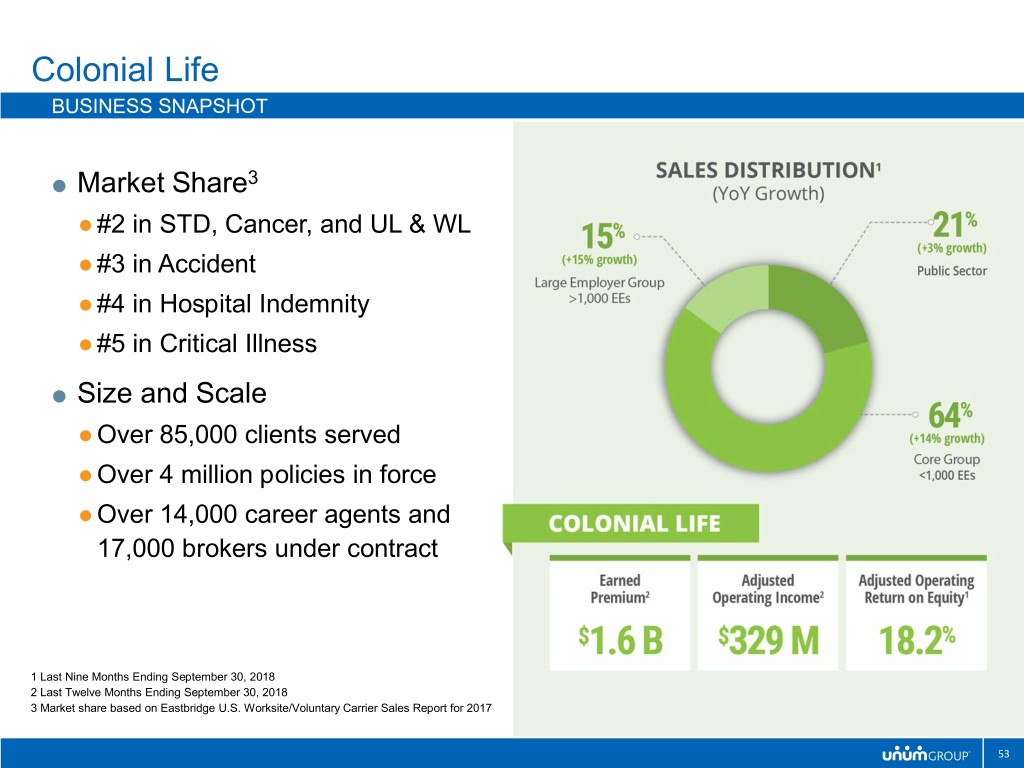

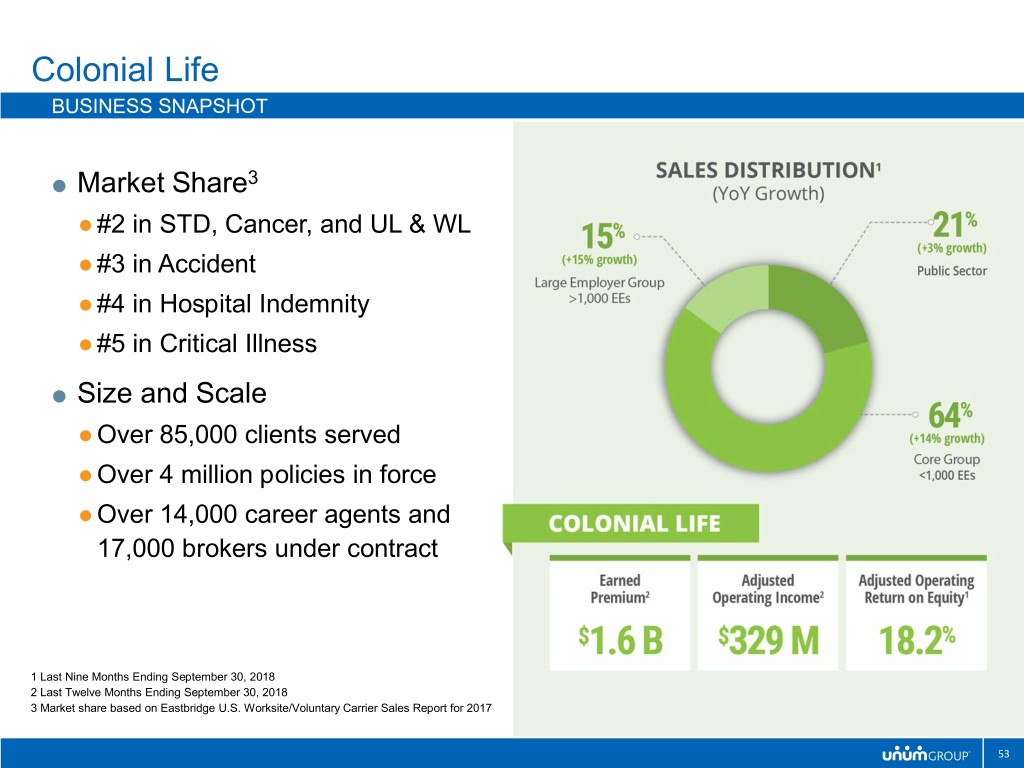

Colonial Life BUSINESS SNAPSHOT Market Share3 ● #2 in STD, Cancer, and UL & WL ● #3 in Accident ● #4 in Hospital Indemnity ● #5 in Critical Illness Size and Scale ● Over 85,000 clients served ● Over 4 million policies in force ● Over 14,000 career agents and 17,000 brokers under contract 1 Last Nine Months Ending September 30, 2018 2 Last Twelve Months Ending September 30, 2018 3 Market share based on Eastbridge U.S. Worksite/Voluntary Carrier Sales Report for 2017 53

Colonial Life STRATEGY 54

Colonial Life KEY MESSAGES Remain confident in our strategy and ability to deliver on our business plan given recent performance and market growth opportunities Colonial Life’s sales and premium growth expectations will continue to outpace the market while yielding profit margins above our peer group To achieve our aggressive top-line and bottom-line growth objectives, Colonial Life will balance investments in distribution expansion, customer-centric experiences, digital capabilities, operational excellence and talent Continued strong sales growth will be driven primarily by investments in distribution growth, agency development and a differentiated offering in the market 55

Colonial Life 2019 KEY PRIORITIES 56

Colonial Life TERRITORY EXPANSION We continue to expand our geographic footprint to more effectively reach customers, opening 3 new territories in 2018 We expect to continue adding 2-4 new territories per year for the foreseeable future to drive longer-term growth 57

Colonial Life CAPITALIZING ON NEW DENTAL OFFERING Launched PPO product in 40 states late-March ● Currently 46 states (all 50 states soon) Provides our distribution a uniquely designed, highly demanded core benefit Strong initial results, accounting for over 5% of YTD* sales Opening doors on new cases plus offering cross sell opportunities to existing clients * Last Nine Months Ending September 30, 2018 58

Colonial Life 2019 DIGITAL CAPABILITIES Customer Experience – investing in digital capabilities to simplify the experience for consumers plan administrators and our agents ●New mobile app allowing our agents to manage all aspects of the sales process up to the time of enrollment ●Increasing adoption of electronic claims submissions ●Enhanced online invoice management capabilities 59

Colonial Life OPERATING EFFICIENCY 60

Colonial Life PREMIUM GROWTH Colonial Life will continue to deliver strong premium income growth in 2019 driven primarily by sales growth and stable persistency levels Over the last 3 years, Colonial Life’s sales growth rate has outpaced the industry growth rate1; premium growth has been more than 1.5x the industry growth rate1 1 Data from Eastbridge U.S. Worksite/Voluntary Carrier Sales Report for 2015, 2016, 2017 61

Colonial Life SUMMARY Colonial Life continues to deliver consistent results with good growth trends and very strong margins We continue to invest in our future growth: ● New, or enhanced, products and offerings ● New territory expansion ● New and advanced capabilities ● Improved customer experience While competition in the worksite marketing/voluntary benefits space continues to increase, our competitive advantages, including our size and scale, distribution, and customer service capabilities, will continue to support our ability to achieve our 2019 and longer-term goals 62

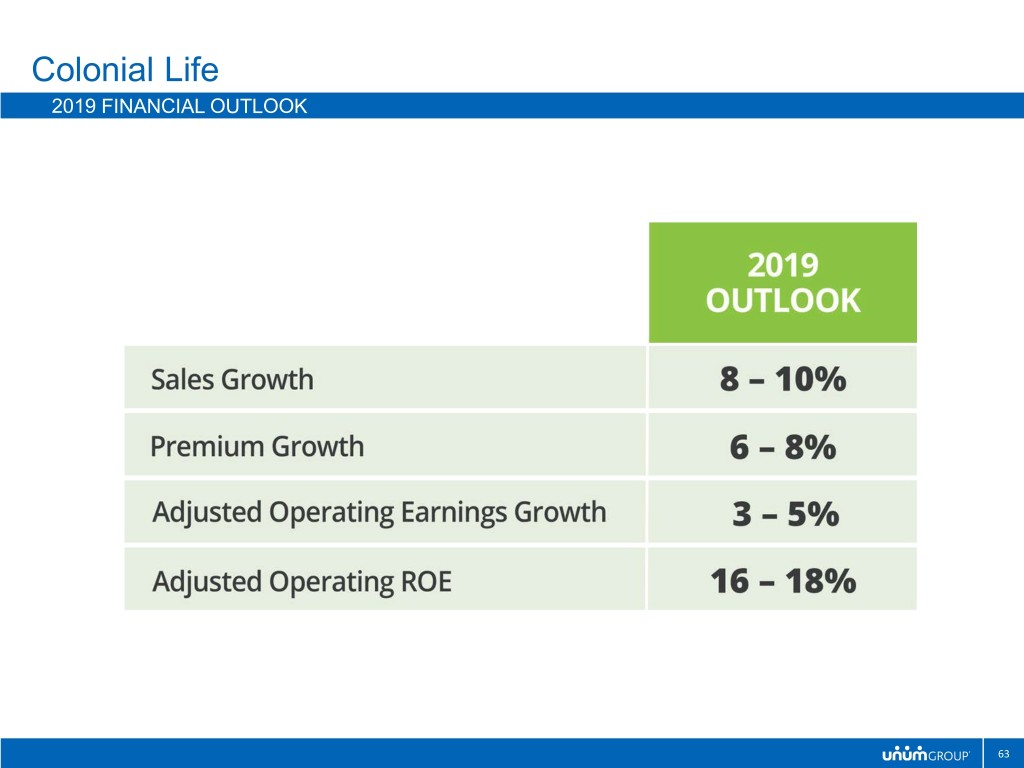

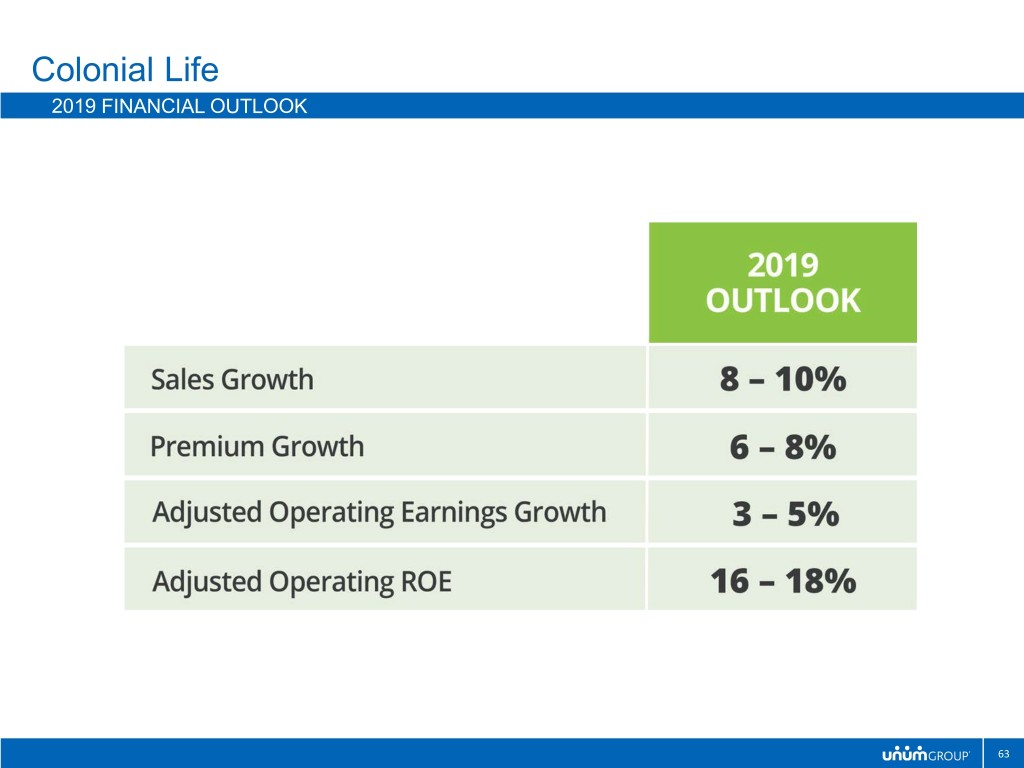

Colonial Life 2019 FINANCIAL OUTLOOK 63

Unum International 64

Unum International BUSINESS SNAPSHOT Primary Products ● Group Income Protection ● Group Life ● Supplementary and Voluntary products (Group Critical Illness, Dental, Individual Life) Market Share ● #1 Group Income Protection ● #5 Group Life ● #3 Group Critical Illness ● Top 3 UK Dental business ● Poland: presence in Individual and Group markets Market Scope ● Over 10,000 employers served ● 2 million customers insured 1 Unum UK ONLY - Last Nine Months Ending September 30, 2018 2 Unum UK ONLY - Last Twelve Months Ending September 30, 2018 65

Unum International BUSINESS STRATEGY OVERVIEW 66

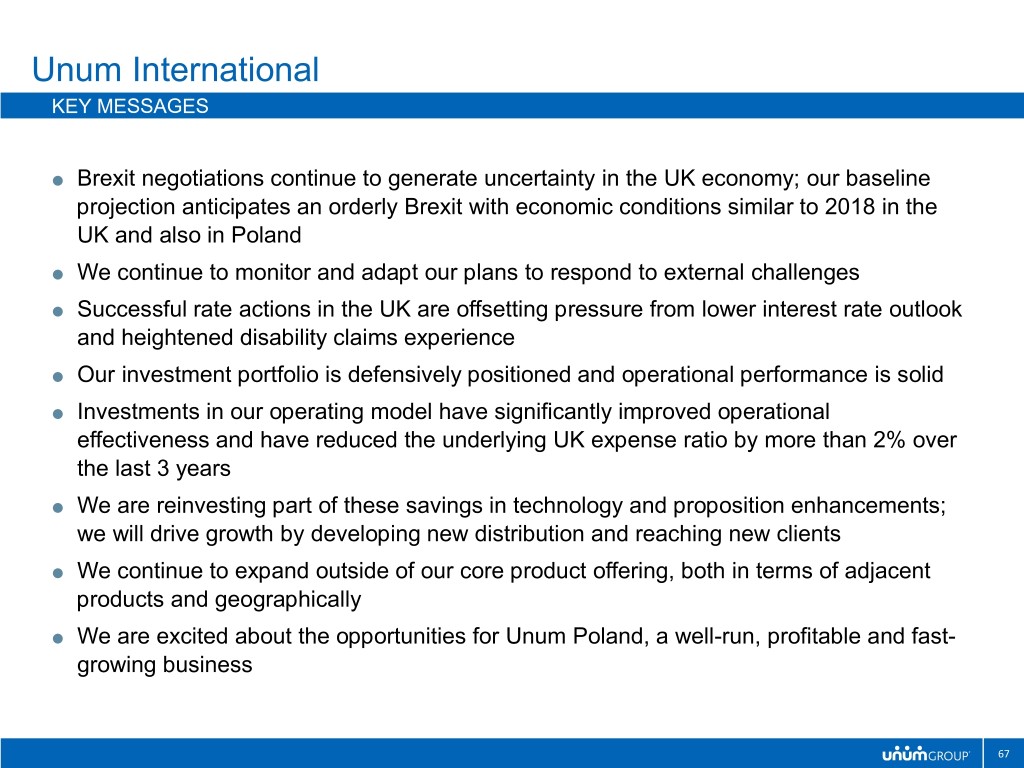

Unum International KEY MESSAGES Brexit negotiations continue to generate uncertainty in the UK economy; our baseline projection anticipates an orderly Brexit with economic conditions similar to 2018 in the UK and also in Poland We continue to monitor and adapt our plans to respond to external challenges Successful rate actions in the UK are offsetting pressure from lower interest rate outlook and heightened disability claims experience Our investment portfolio is defensively positioned and operational performance is solid Investments in our operating model have significantly improved operational effectiveness and have reduced the underlying UK expense ratio by more than 2% over the last 3 years We are reinvesting part of these savings in technology and proposition enhancements; we will drive growth by developing new distribution and reaching new clients We continue to expand outside of our core product offering, both in terms of adjacent products and geographically We are excited about the opportunities for Unum Poland, a well-run, profitable and fast- growing business 67

Unum International INTRODUCTION TO UNUM ŻYCIE (POLAND) Purchase of Pramerica Życie completed on October 1, 2018 Business being rebranded as Unum Poland Poland is an attractive economy, with significant growth prospects in the employee benefits market Business provides individual and group financial protection products, distributed via a network of agents and brokers It is a well-run and solidly profitable business, with a strong management team Written premium income of approximately $65 million in 2018 (9% increase vs. 2017) New business priced to an IRR of > 15% Opportunity to bring Unum’s distribution and benefits expertise to augment Unum Poland’s existing capabilities 68

Unum International OPERATING ENVIRONMENT 69

Unum International 2019 KEY PRIORITIES UK POLAND Continue to focus on being easy to do business with by Complete the integration of the improving our service, simplifying our customer journeys business, including rebranding and accelerating the digitalization of our business and IT separation Optimize financial management through disciplined Support the execution of the pricing, underwriting, capital and expense management current strategy Diversify our product portfolio – Continue strong Introduce new products and momentum in strategic growth areas of GCI and Dental expertise to accelerate growth in future years Continue to invest in expanded distribution, including non-broker and voluntary capabilities, to drive sustainable Marketing campaigns to medium- and long-term growth establish the Unum brand Increase participation and first-time buyers through Grow the existing distribution improved communication, marketing and propositions in channels by sharing our Dental, SME & GCI marketing and distribution expertise in the US and UK Be a place that people aspire to work by demonstrating we are an employer who cares; focus on building a high- performance culture with positive employee experience 70

Unum International 2019 FINANCIAL OUTLOOK * 2019 Earnings and ROE are adversely impacted by one-off Poland acquisition costs 71

Closed Block 72

Closed Block BUSINESS SNAPSHOT Legacy Discontinued Blocks Closed Disability Block ● Mature block with sales discontinued in mid-1990s ● Block largely in claim status ● Average attained age of ALR is 60 Closed LTC Block ● Discontinued ILTC sales in 2009 & GLTC in 2011 ● Largely group plans o 52% employer-paid o 33% employee-paid o 15% individual 1 Last Nine Months Ending September 30, 2018 In $ Million, as of September 30, 2018, excludes MV (FAS 115) adjustment 2 Last Twelve Months September 30, 2018 * % of Total Gross Reserves 3 Excludes 3Q-2018 LTC reserve charge 73

Closed Block STRATEGY 74

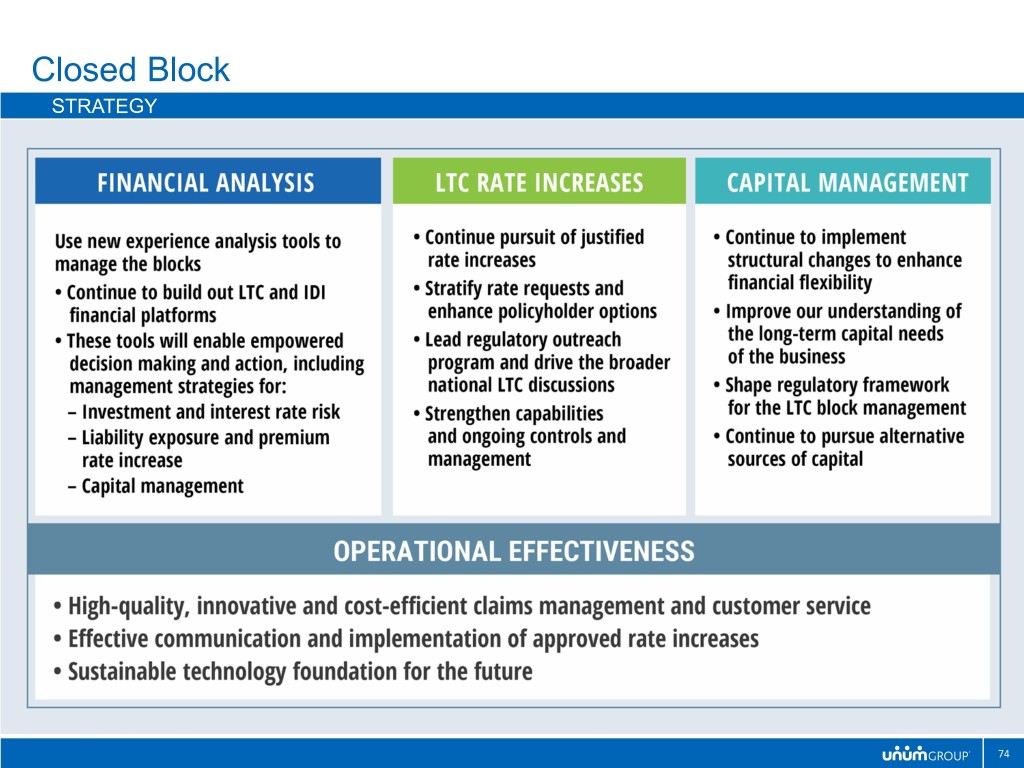

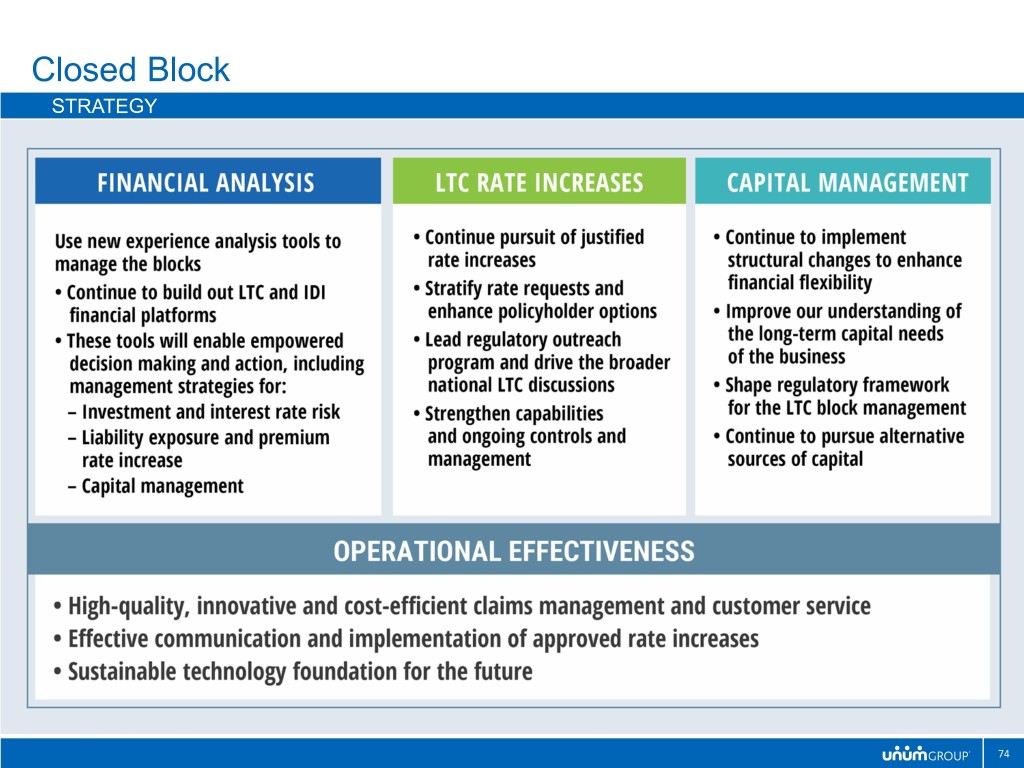

Closed Block 2019 KEY PRIORITIES Our strategy for the Closed Block remains unchanged and we are making strong progress in our focus areas ● Our near-term focus will be on executing LTC rate increases, while also continuing to enhance our day-to-day operational effectiveness and financial analysis by investing in technological improvements and diversifying our talent footprint ● Our LTC block has recently undergone a comprehensive experience analysis update, forming the basis of our updated reserves for this product ● Active capital management remains a key tool for both our longer-term success and shorter-term strategic initiatives 75

Closed Block LONG-TERM CARE DEMOGRAPHICS PROFILE (as of 9/30/2018) Our LTC block is predominantly group-sponsored plans These group policies generally have higher lapse rates and less rich benefits (less lifetime benefits, lower avg. daily benefits and less inflation protection) 76

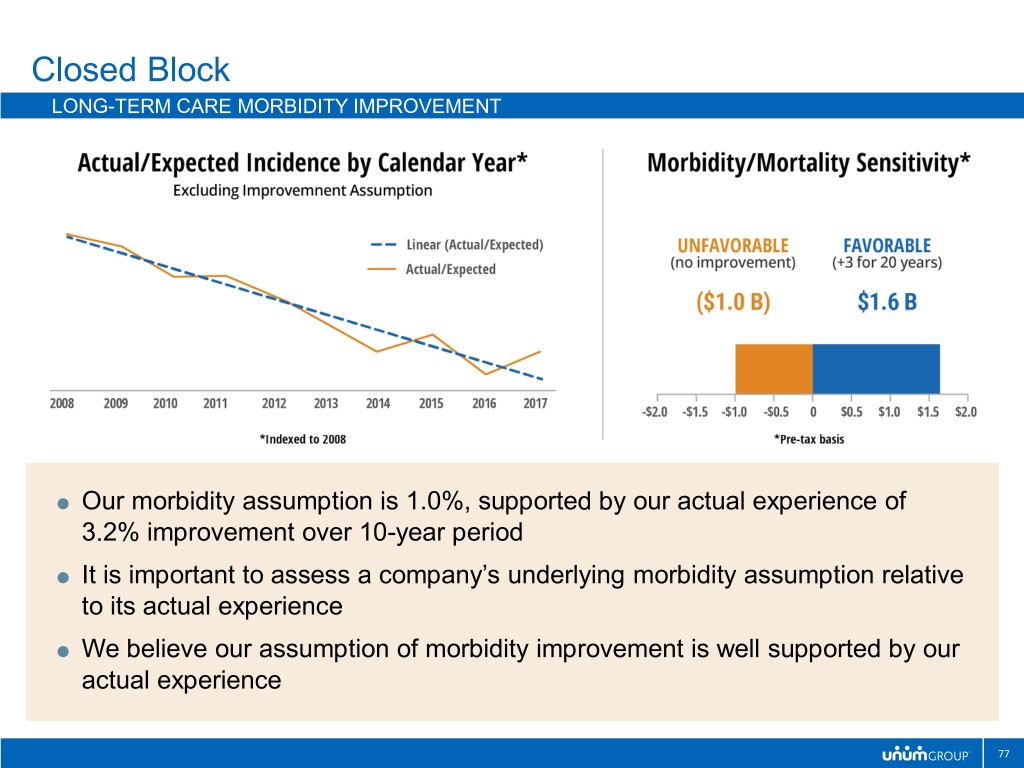

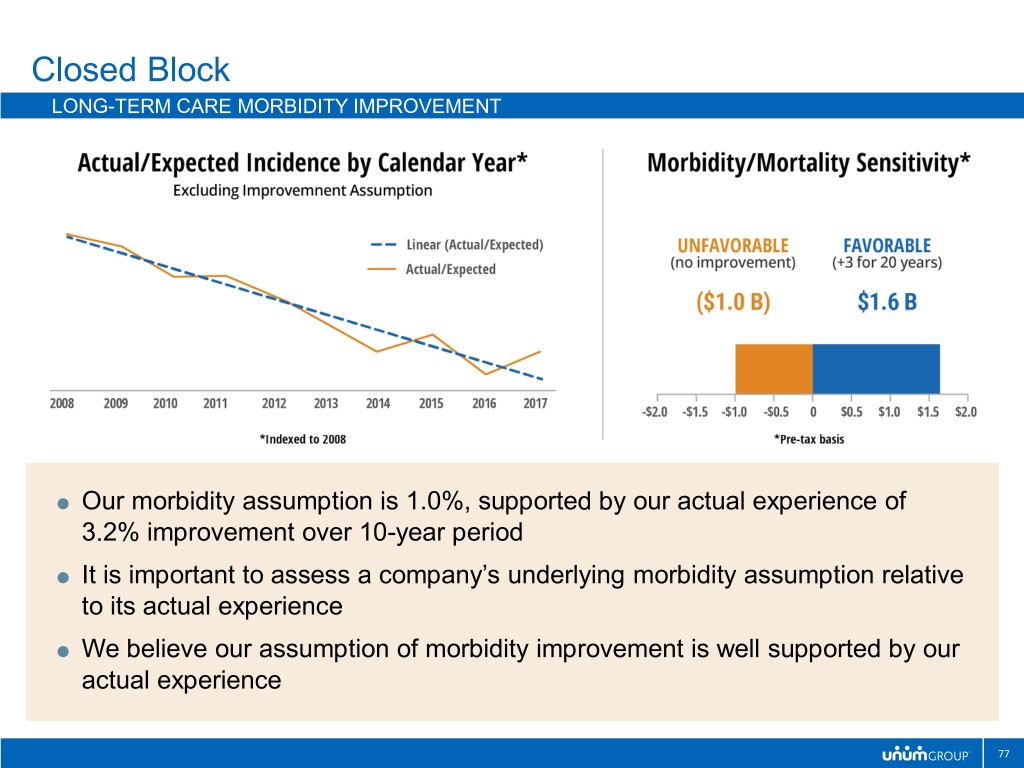

Closed Block LONG-TERM CARE MORBIDITY IMPROVEMENT Our morbidity assumption is 1.0%, supported by our actual experience of 3.2% improvement over 10-year period It is important to assess a company’s underlying morbidity assumption relative to its actual experience We believe our assumption of morbidity improvement is well supported by our actual experience 77

Closed Block 2018 RATE INCREASE STRATEGY UPDATE The success rate assumed in our 2018 rate increase filings is informed by our historical experience Our 2018 rate increase program focuses on GLTC policies California filings are important for achieving our target 78

Closed Block CLOSED INDIVIDUAL DISABILITY BLOCK Northwind Securitization The Northwind securitization continues to perform as expected Non-recourse debt currently $155 million, with payoff expected in 2021 Cash flows in excess of Northwind debt service available as dividend to Unum Group 79

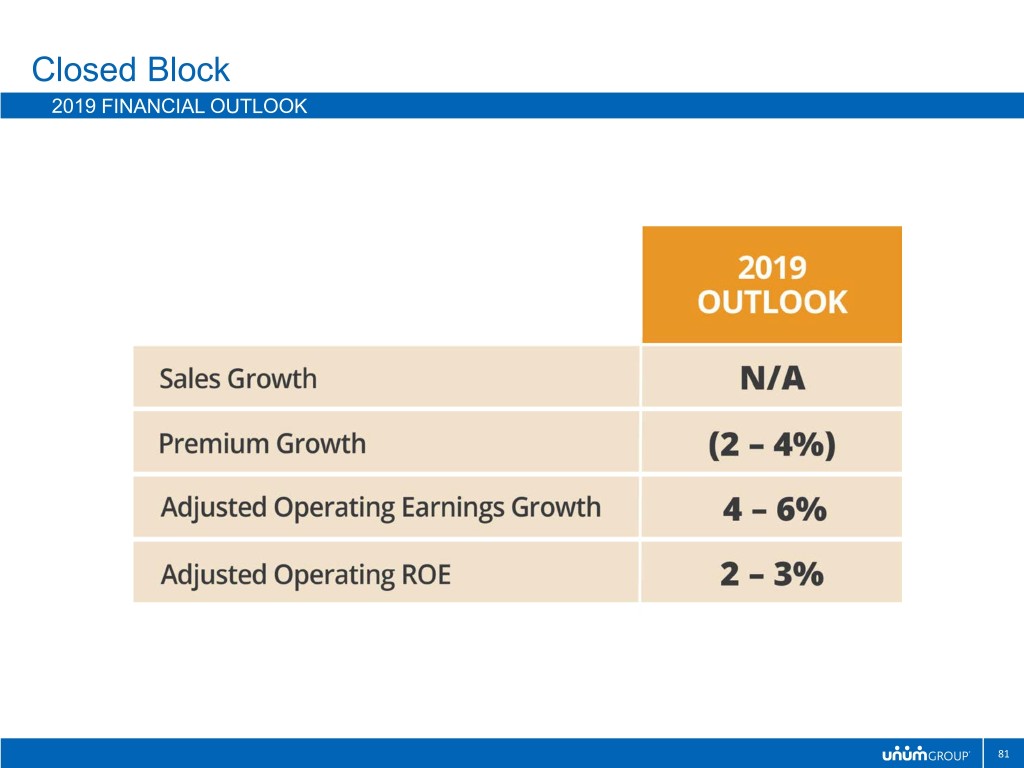

Closed Block SUMMARY Earnings for the Closed Block for 2019 are expected in-line to slightly higher than 2018 Net investment income will create quarterly volatility for this business segment The Closed Disability Block continues to wind down as expected, highlighting the predictability of this aged block Our recent LTC reserve review incorporated our most recent experience and relevant industry data; reviewed by outside actuarial firm Unum has dedicated significant resources over the past several years to manage these blocks 80

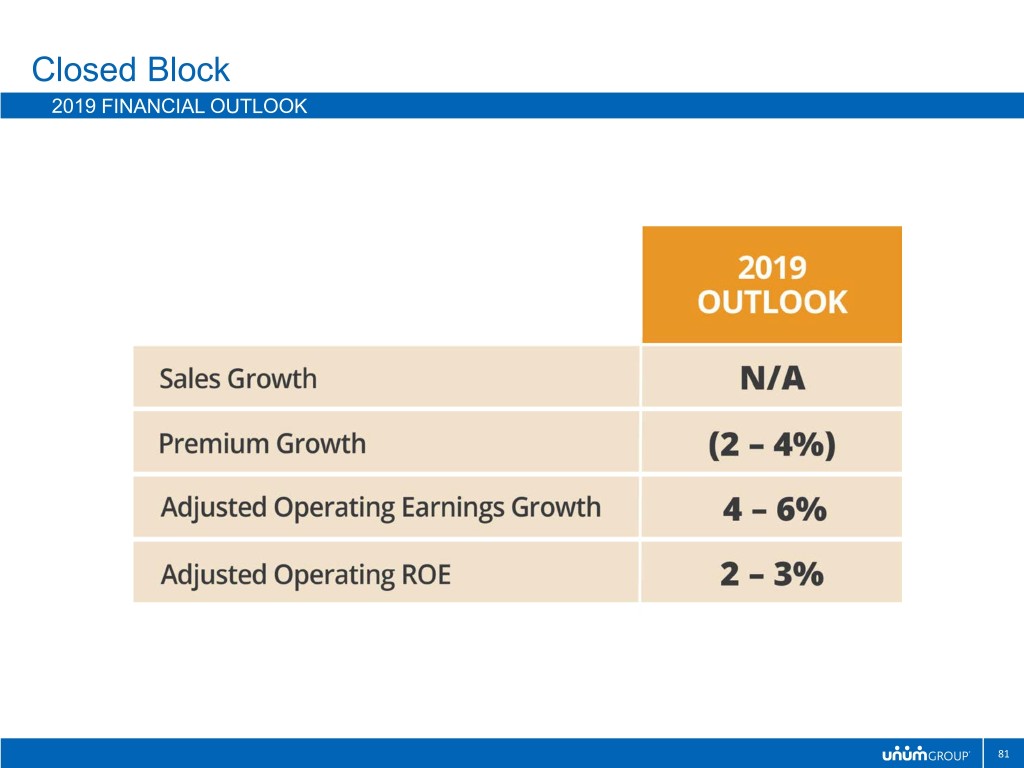

Closed Block 2019 FINANCIAL OUTLOOK 81

Closing Comments 82

Closing Comments KEY TAKEAWAYS We remain confident in our businesses, our strategy, and our financial outlook Our core businesses are delivering strong operating results, excellent margins and profitability, and significant cash generation We continue to actively manage the legacy LTC block Our capital position remains strong as we manage through impacts of tax reform and RBC factor changes The cash generation from our core businesses supports the legacy block capital needs while returning capital to shareholders through repurchases and dividends 83

Questions and Answers 84

Appendix Reconciliation of Non-GAAP Financial Measures 85

Appendix RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Non-GAAP Financial Measures We analyze our performance using non-GAAP financial measures which exclude or include amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. We believe the following non-GAAP financial measures are better performance measures and better indicators of the revenue and profitability and underlying trends in our business: • After-tax adjusted operating income or loss, which excludes realized investment gains or losses and certain other items, as applicable; • Adjusted operating return on equity, which is calculated using after-tax adjusted operating income or loss and excludes from equity the unrealized gain or loss on securities and net gain on hedges; and • Book value per common share, which is calculated excluding accumulated other comprehensive income (AOCI). Realized investment gains or losses and unrealized gains or losses on securities and net gains on hedges depend on market conditions and do not necessarily relate to decisions regarding the underlying business of our Company. Book value per common share excluding certain components of AOCI, certain of which tend to fluctuate depending on market conditions and general economic trends, is an important measure. We also exclude certain other items from our discussion of financial ratios and metrics in order to enhance the understanding and comparability of our operational performance and the underlying fundamentals, but this exclusion is not an indication that similar items may not recur and does not replace the comparable GAAP measures in the determination of overall profitability. For a reconciliation of the most directly comparable GAAP measures to these non-GAAP financial measures, refer to the "Reconciliation of Non-GAAP Financial Measures" beginning on the following page. 86

Appendix RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Annualized After-tax Adjusted Average Adjusted Operating Operating Income Allocated Equity(1) Return (in millions) on Equity Nine Months Ended September 30, 2018 Unum US $ 606.1 $ 4,251.9 Unum UK 67.6 632.5 Colonial Life 197.5 1,444.1 Core Operating Segments 871.2 6,328.5 18.4% Closed Block 88.9 3,269.1 Corporate (96.8) (943.5) Consolidated $ 863.3 $ 8,654.1 13.3% (1) Excludes net unrealized gain on securities and net gain on hedges and is calculated using the adjusted stockholders' equity balances presented below. 9/30/2018 12/31/2017 (in millions) Total Stockholders' Equity, As Reported $ 8,518.2 $ 9,574.9 Excluding: Net Unrealized Gain (Loss) on Securities (340.7) 607.8 Net Gain on Hedges 250.0 282.3 Total Stockholders' Equity, As Adjusted $ 8,608.9 $ 8,684.8 Average Equity, As Adjusted Nine Months Ended September 30, 2018 $ 8,654.1 87

Appendix RECONCILIATION OF NON-GAAP FINANCIAL MEASURES September 30 December 31 2018 2017 2016 2015 2014 2013 (in millions) (per share) (in millions) (per share) (in millions) (per share) (in millions) (per share) (in millions) (per share) (in millions) (per share) Total Stockholders' Equity, As Reported (Book Value) $ 8,518.2 $ 38.95 $ 9,574.9 $ 43.02 $ 8,968.0 $ 39.02 $ 8,663.9 $ 35.96 $ 8,521.9 $ 33.78 $ 8,639.9 $ 33.23 Excluding: Net Unrealized Gain (Loss) on Securities (340.7) (1.56) 607.8 2.73 440.6 1.92 204.3 0.84 290.3 1.15 135.7 0.52 Net Gain on Hedges 250.0 1.15 282.3 1.27 327.5 1.42 378.0 1.57 391.0 1.55 396.3 1.52 Subtotal 8,608.9 39.36 8,684.8 39.02 8,199.9 35.68 8,081.6 33.55 7,840.6 31.08 8,107.9 31.19 Excluding: Foreign Currency Translation Adjustment (284.0) (1.30) (254.5) (1.15) (354.0) (1.54) (173.6) (0.72) (113.4) (0.45) (47.1) (0.18) Subtotal 8,892.9 40.66 8,939.3 40.17 8,553.9 37.22 8,255.2 34.27 7,954.0 31.53 8,155.0 31.37 Excluding: Unrecognized Pension and Postretirement Benefit Costs (493.8) (2.26) (508.1) (2.28) (465.1) (2.02) (392.6) (1.63) (401.5) (1.59) (229.9) (0.88) Total Stockholders' Equity, Excluding AOCI $ 9,386.7 $ 42.92 $ 9,447.4 $ 42.45 $ 9,019.0 $ 39.24 $ 8,647.8 $ 35.90 $ 8,355.5 $ 33.12 $ 8,384.9 $ 32.25 December 31 2012 2011 2010 2009 2008 (in millions) (per share) (in millions) (per share) (in millions) (per share) (in millions) (per share) (in millions) (per share) Total Stockholders' Equity, As Reported (Book Value) $ 8,604.6 $ 31.84 $ 8,168.0 $ 27.91 $ 8,483.9 $ 26.80 $ 8,045.0 $ 24.25 $ 5,941.5 $ 17.94 Excluding: Net Unrealized Gain (Loss) on Securities 873.5 3.23 614.8 2.11 416.1 1.31 382.7 1.16 (837.4) (2.53) Net Gain on Hedges 401.6 1.48 408.7 1.39 361.0 1.14 370.8 1.12 458.5 1.38 Subtotal 7,329.5 27.13 7,144.5 24.41 7,706.8 24.35 7,291.5 21.97 6,320.4 19.09 Excluding: Foreign Currency Translation Adjustment (72.6) (0.26) (117.6) (0.41) (107.1) (0.34) (75.3) (0.23) (172.8) (0.52) Subtotal 7,402.1 27.39 7,262.1 24.82 7,813.9 24.69 7,366.8 22.20 6,493.2 19.61 Excluding: Unrecognized Pension and Postretirement Benefit Costs (574.5) (2.13) (444.1) (1.51) (318.6) (1.00) (330.7) (1.00) (406.5) (1.23) Total Stockholders' Equity, Excluding AOCI $ 7,976.6 $ 29.52 $ 7,706.2 $ 26.33 $ 8,132.5 $ 25.69 $ 7,697.5 $ 23.20 $ 6,899.7 $ 20.84 88

Appendix RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Nine Months Ended September 30, 2018 Year Ended December 31, 2017 (in millions) per share* (in millions) per share* Net Income $ 274.3 $ 1.24 $ 994.2 $ 4.37 Excluding: Net Realized Investment Gain (net of tax expense (benefit) of $(2.2); $15.0) 4.1 0.01 25.3 0.11 Long-term Care Reserve Increase (net of tax benefit of $157.7; $-) (593.1) (2.68) - - Loss from Guaranty Fund Assessment (net of tax benefit of $-; $7.2) - - (13.4) (0.06) Unclaimed Death Benefits Reserve Increase (net of tax benefit of $-; $13.6) - - (25.4) (0.11) Net Tax Benefit for Impacts of TCJA - - 31.5 0.14 After-tax Adjusted Operating Income 863.3 3.91 976.2 4.29 Excluding: Unum US Individual Disability Reserve Release (net of tax expense of $-; $6.8) - - 12.7 0.05 After-tax Adjusted Operating Income, Excluding Unum US Individual Disability Reserve Release $ 863.3 $ 3.91 $ 963.5 $ 4.24 *Assuming dilution. 89