appropriate external and internal auditor focus each year on the company’s IT environment and controls, which in 2020 included internal audit plan coverage of cyber audits, information security and privacy risk as common scope elements of all audits, and an annual SOC 2 assessment.

The company’s internal audit function, under the direction of the chief auditor, reports directly to the Committee, which is responsible for the oversight of the work performed by the internal auditors. The internal auditors are responsible for, among other matters, conducting internal audits designed to evaluate the company’s system of internal controls. The Committee reviewed and discussed with the company’s internal auditors, and received regular status reports from them concerning the overall scope and plans for their audits. The Committee met with the internal auditors, with and without management present, to discuss their audit observations and findings, management’s responses, and their evaluation of the effectiveness of the company’s internal control over financial reporting.

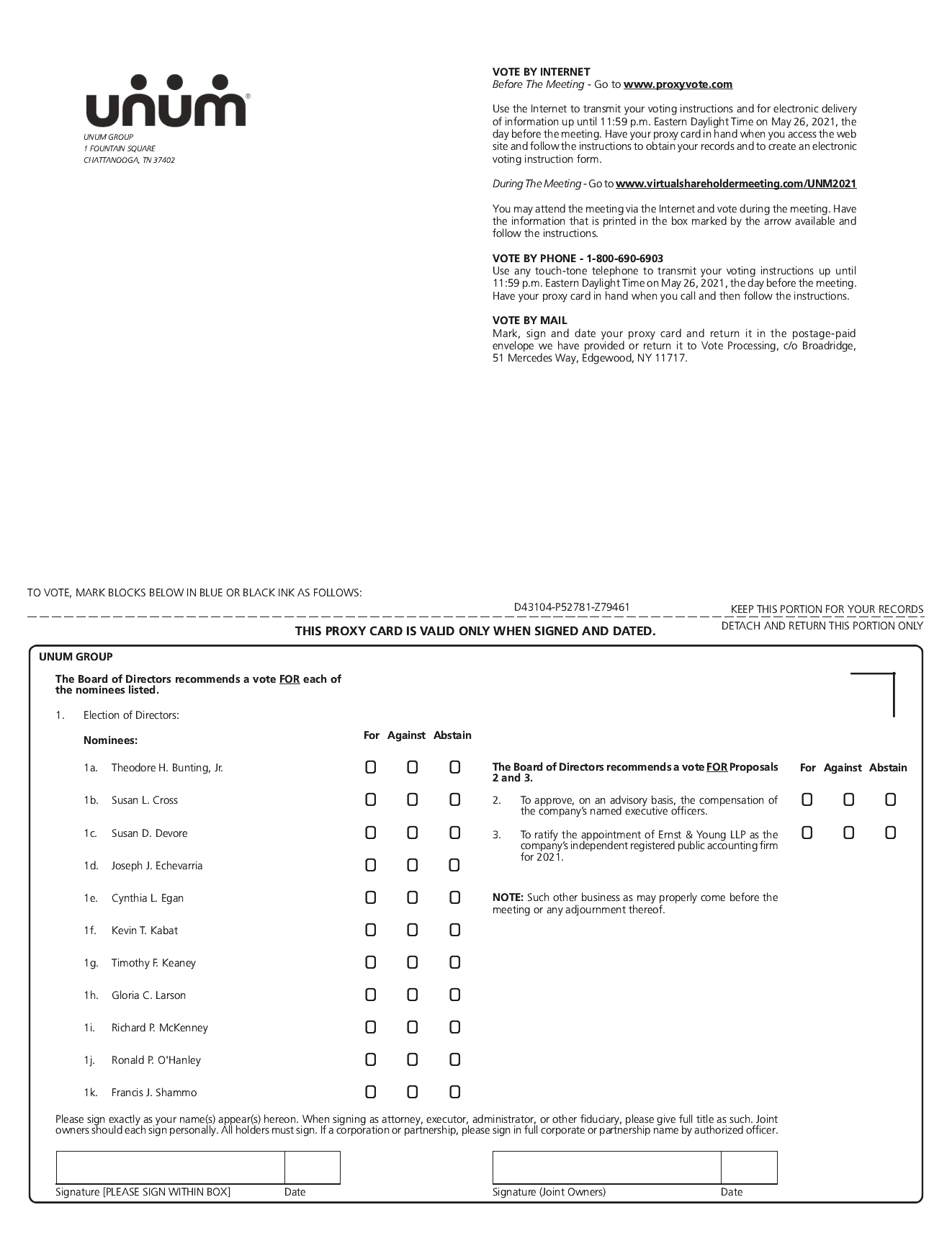

The Committee reviewed and discussed with management the company’s audited financial statements for the year ended December 31, 2020, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant estimates and assumptions that could impact the amounts reported in the company’s financial statements, and the clarity of disclosures in the financial statements. The Committee reviewed and discussed with the independent auditor the overall scope and results of the independent audit and its judgments of the quality and acceptability of the company’s accounting principles. The Committee also engaged in discussions with management and the independent auditor concerning, among other matters, management’s assessment of reserve adequacy across all major business lines, which is presented to the Committee each year. The Committee discussed with the independent auditor the matters required to be discussed by applicable standards of the PCAOB. Under PCAOB standards requiring discussion of critical audit matters (CAMs) in auditor reports, the independent auditor discussed with the Committee one CAM relating to the company's reserves for long-term care policy and contract benefits and a second relating to the accounting for reinsurance of Closed Block individual disability insurance. Both CAMs are described in the independent auditor's report on the company's 2020 financial statements. During 2020, the Committee also discussed with management and the independent auditor emerging accounting standards and associated implementation plans. The Committee received the written disclosures and the letter from the independent auditor required by applicable requirements of the PCAOB regarding the auditor’s communications with the Committee concerning independence. In addition, the Committee discussed with the independent auditor matters relating to its independence, including consideration of whether the independent auditor’s provision of non-audit services to the company is compatible with the auditor’s independence.

Each year, the Committee evaluates the performance of its independent auditor, including the senior audit engagement team, and considers whether to retain the current independent auditor or consider rotating the engagement to a different audit firm. In doing so, the Committee takes into consideration a number of factors, including the professional qualifications of the firm and the lead audit partner, the quality and candor of the firm’s communications with the Committee and the company, and evidence supporting the firm’s independence, objectivity, and professional skepticism. The Committee and its chair are also directly involved in the selection of the independent auditor's lead engagement partner, who is required to rotate off the engagement after five years of service. Before the current lead engagement partner assumed this role in 2019 (at that time, a candidate), Committee members held discussions with the exiting partner, the candidate, and company management concerning the candidate's experience and qualifications for the role.

Based on its evaluation, the Committee has determined that the continued retention of Ernst & Young to serve as the company’s independent auditor is in the best interests of the company and its shareholders. Accordingly, the Committee appointed Ernst & Young as the company’s independent auditor for 2021. Ernst & Young has served as the company’s independent auditor since the merger of Unum and Provident in 1999, and before that served at various times as the independent auditor for the