Exhibit 99.3

2005 Investor Meeting October 17, 2005

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Statements in this meeting regarding the business of UnumProvident Corporation which are not historical facts are “forward-looking statements” that involve risks and uncertainties. For a discussion of such risks and uncertainties, which could cause actual results to differ materially from those contained in the forward-looking statements, see the Company’s latest annual report on Form 10-K filed with the Securities and Exchange Commission and subsequently filed 10-Qs. The forward-looking statements are being made as of the presentation date and the Company expressly disclaims any obligation to update any forward-looking statement contained herein.

2

Welcome

3

Agenda

Welcome Tom White

New Reporting Format

CEO State of the Company Address Tom Watjen

The New Paradigm Joe Zubretsky

Financial Goals

Performance and Capital Management Investment and Interest Rate Management Regulatory Update

LUNCH

The Business Reviews

U.S. Brokerage Kevin McCarthy

Group Income Protection All Major Lines

Colonial Randy Horn

Unum Limited (UK) Susan Ring

Closed Disability Block Joe Zubretsky

Looking Forward - The Next Chapter Tom Watjen

4

The New Reporting Format

5

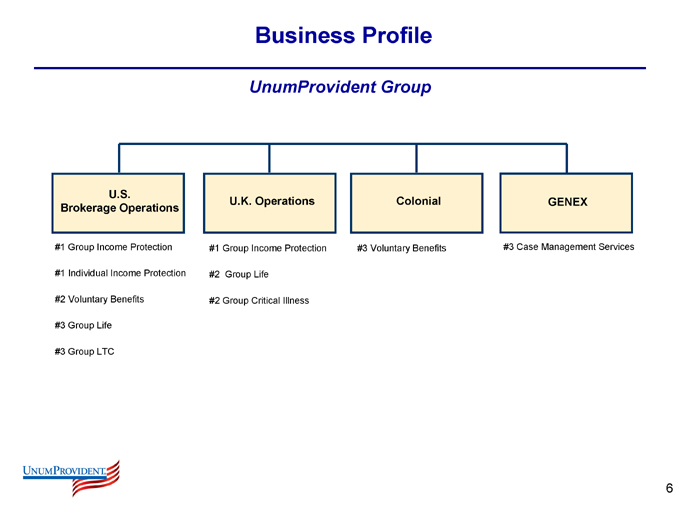

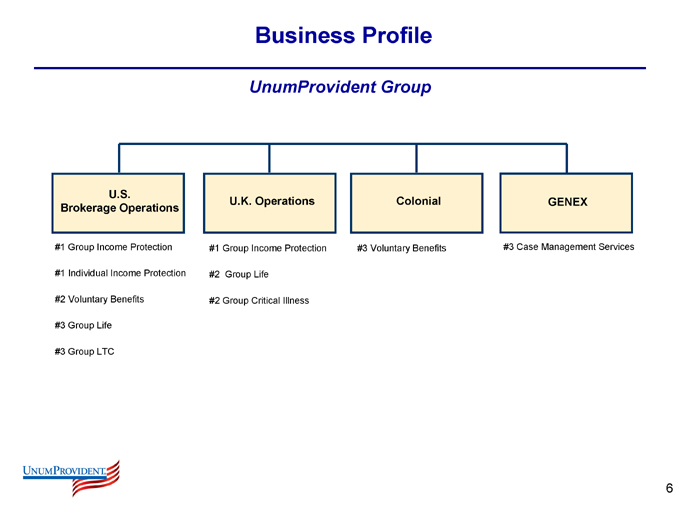

Business Profile

UnumProvident Group

U.S.

Brokerage Operations

U.K. Operations

Colonial

GENEX

#1 Group Income Protection #1 Individual Income Protection #2 Voluntary Benefits #3 Group Life #3 Group LTC

#1 Group Income Protection

#2 Group Life

#2 Group Critical Illness

#3 Voluntary Benefits

#3 Case Management Services

6

The New Reporting Format

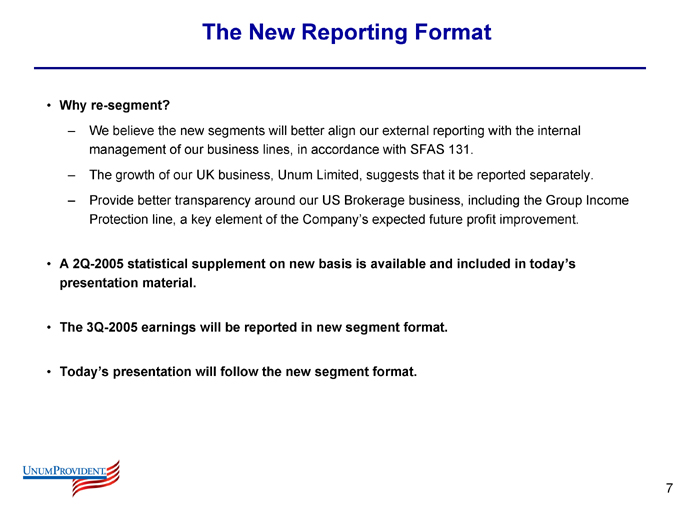

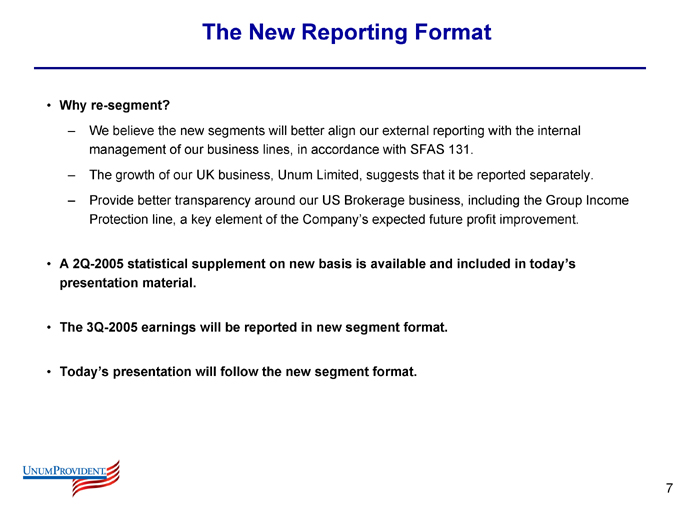

Why re-segment?

We believe the new segments will better align our external reporting with the internal management of our business lines, in accordance with SFAS 131.

The growth of our UK business, Unum Limited, suggests that it be reported separately. Provide better transparency around our US Brokerage business, including the Group Income Protection line, a key element of the Company’s expected future profit improvement.

A 2Q-2005 statistical supplement on new basis is available and included in today’s presentation material.

The 3Q-2005 earnings will be reported in new segment format.

Today’s presentation will follow the new segment format.

7

The New Reporting Format

The New Reporting Format

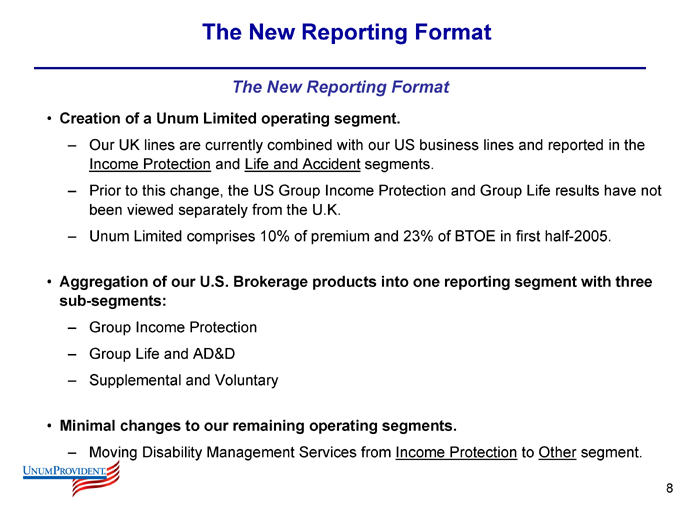

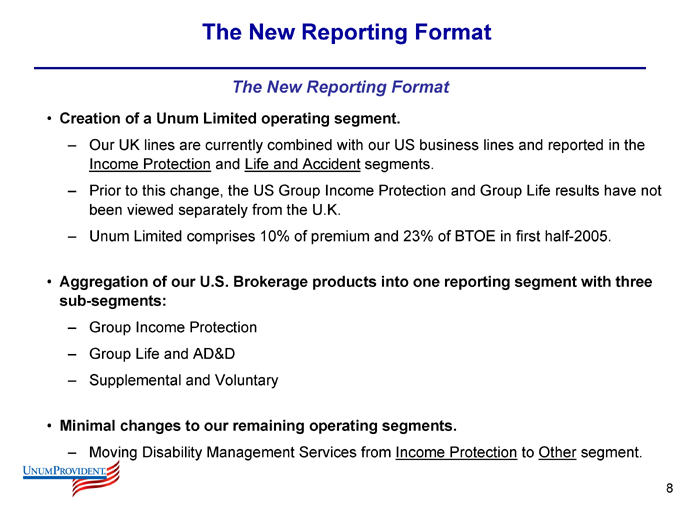

Creation of a Unum Limited operating segment.

Our UK lines are currently combined with our US business lines and reported in the Income Protection and Life and Accident segments.

Prior to this change, the US Group Income Protection and Group Life results have not been viewed separately from the U.K.

Unum Limited comprises 10% of premium and 23% of BTOE in first half-2005.

Aggregation of our U.S. Brokerage products into one reporting segment with three sub-segments:

Group Income Protection Group Life and AD&D Supplemental and Voluntary

Minimal changes to our remaining operating segments.

Moving Disability Management Services from Income Protection to Other segment.

8

The New Reporting Format

New Segments

U.S. Brokerage Unum Limited (UK) Colonial (No Change)

Closed Disability Block (No Change)

Other (Former Other segment plus Disability Management Services from Income Protection)

Corporate (No Change)

9

The New Reporting Format

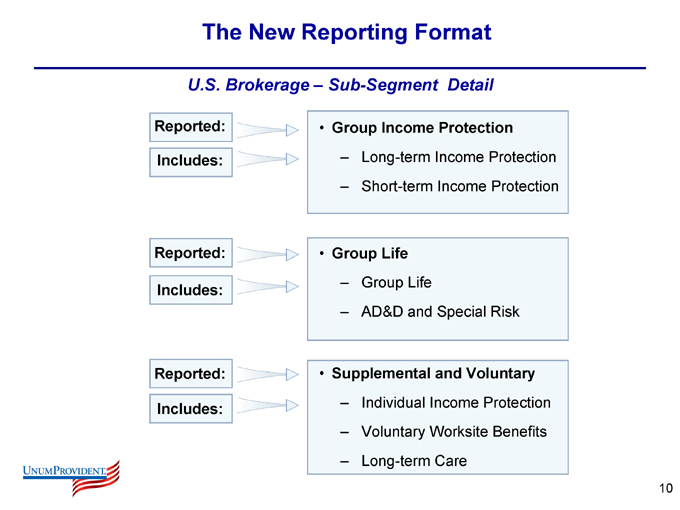

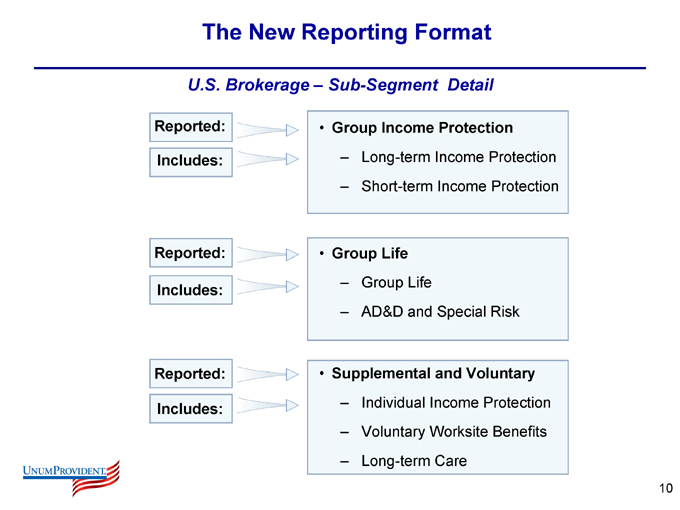

U.S. Brokerage – Sub-Segment Detail

Reported:

Includes:

Group Income Protection

Long-term Income Protection Short-term Income Protection

Reported:

Includes:

Group Life

Group Life

AD&D and Special Risk

Reported:

Includes:

Supplemental and Voluntary

Individual Income Protection Voluntary Worksite Benefits Long-term Care

10

The New Reporting Format

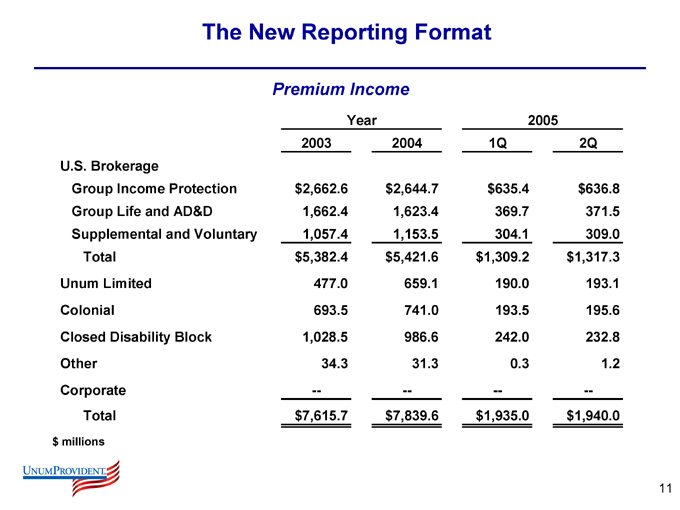

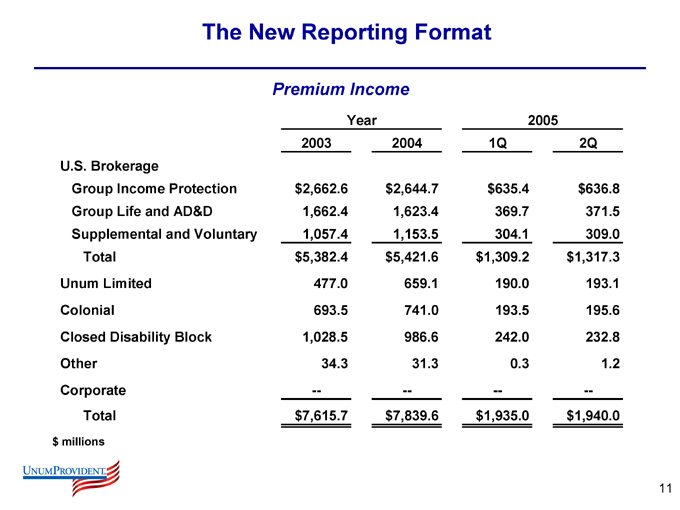

Premium Income

Year 2005

2003 2004 1Q 2Q

U.S. Brokerage

Group Income Protection $2,662.6 $2,644.7 $635.4 $636.8

Group Life and AD&D 1,662.4 1,623.4 369.7 371.5

Supplemental and Voluntary 1,057.4 1,153.5 304.1 309.0

Total $5,382.4 $5,421.6 $1,309.2 $1,317.3

Unum Limited 477.0 659.1 190.0 193.1

Colonial 693.5 741.0 193.5 195.6

Closed Disability Block 1,028.5 986.6 242.0 232.8

Other 34.3 31.3 0.3 1.2

Corporate — — — —

Total $7,615.7 $7,839.6 $1,935.0 $1,940.0

$millions

11

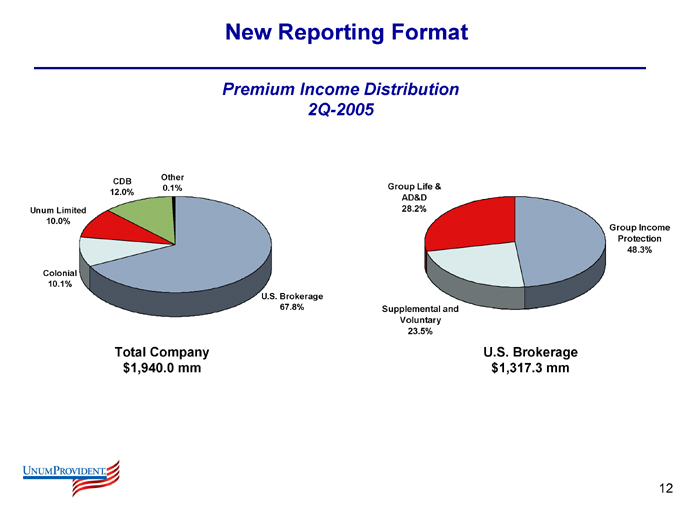

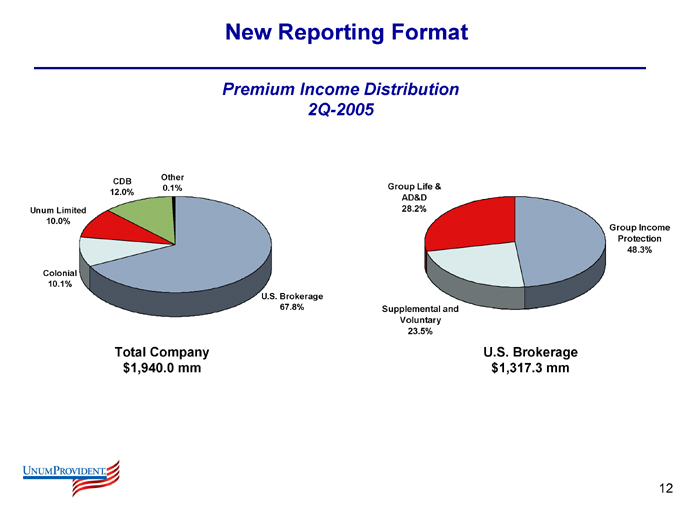

New Reporting Format

Premium Income Distribution 2Q-2005

Other 0.1%

CDB 12.0%

Unum Limited 10.0%

Colonial 10.1%

Total Company $1,940.0 mm

U.S. Brokerage 67.8%

Group Life & AD&D

28.2%

Supplemental and Voluntary 23.5%

U.S. Brokerage $1,317.3 mm

Group Income Protection 48.3%

12

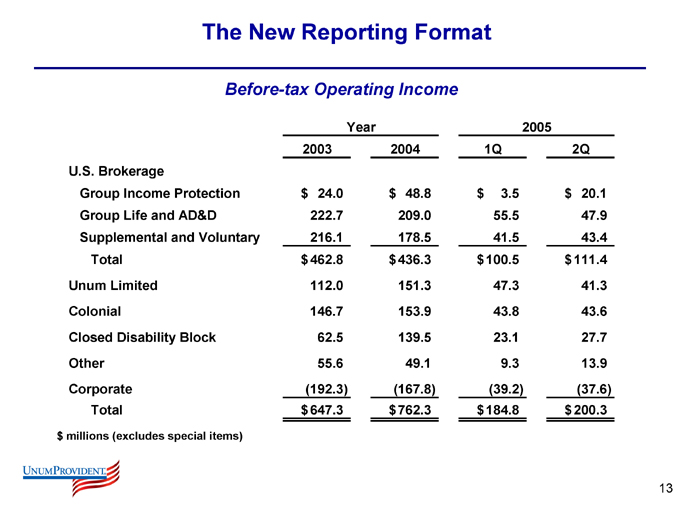

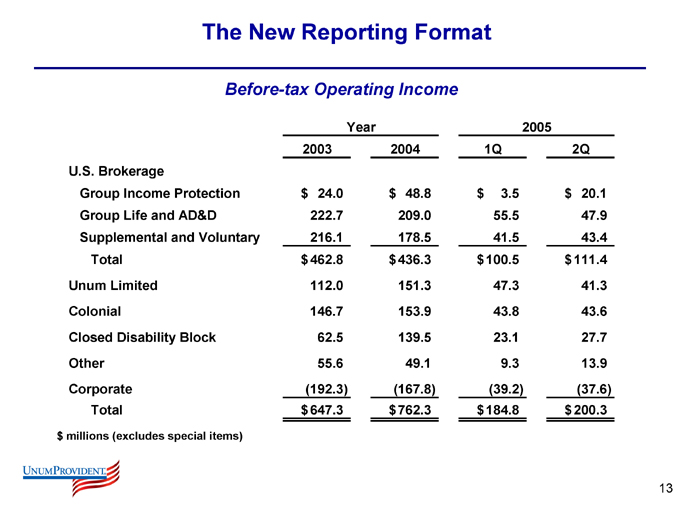

The New Reporting Format

Before-tax Operating Income

Year 2005

2003 2004 1Q 2Q

U.S. Brokerage

Group Income Protection $24.0 $48.8 $3.5 $20.1

Group Life and AD&D 222.7 209.0 55.5 47.9

Supplemental and Voluntary 216.1 178.5 41.5 43.4

Total $462.8 $436.3 $100.5 $111.4

Unum Limited 112.0 151.3 47.3 41.3

Colonial 146.7 153.9 43.8 43.6

Closed Disability Block 62.5 139.5 23.1 27.7

Other 55.6 49.1 9.3 13.9

Corporate (192.3) (167.8) (39.2) (37.6)

Total $647.3 $762.3 $184.8 $200.3

$millions (excludes special items)

13

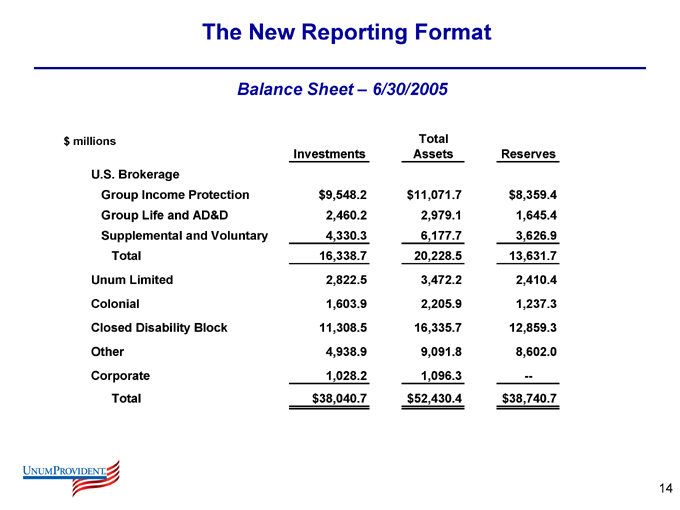

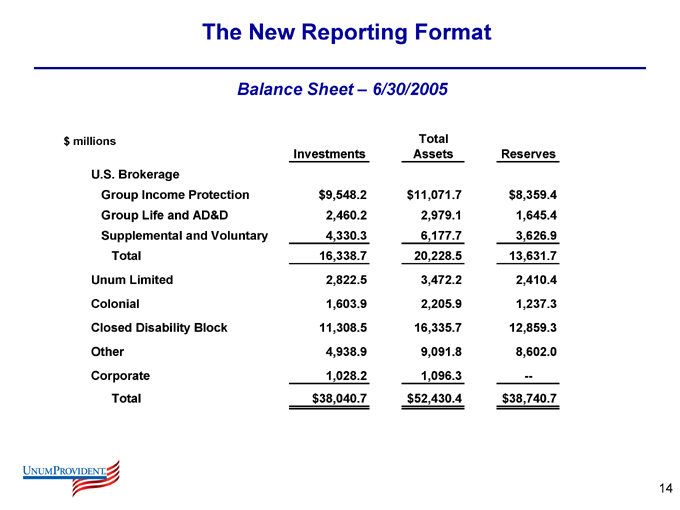

The New Reporting Format

Balance Sheet – 6/30/2005

$millions Total

Investments Assets Reserves

U.S. Brokerage

Group Income Protection $9,548.2 $11,071.7 $8,359.4

Group Life and AD&D 2,460.2 2,979.1 1,645.4

Supplemental and Voluntary 4,330.3 6,177.7 3,626.9

Total 16,338.7 20,228.5 13,631.7

Unum Limited 2,822.5 3,472.2 2,410.4

Colonial 1,603.9 2,205.9 1,237.3

Closed Disability Block 11,308.5 16,335.7 12,859.3

Other 4,938.9 9,091.8 8,602.0

Corporate 1,028.2 1,096.3 —

Total $38,040.7 $52,430.4 $38,740.7

14

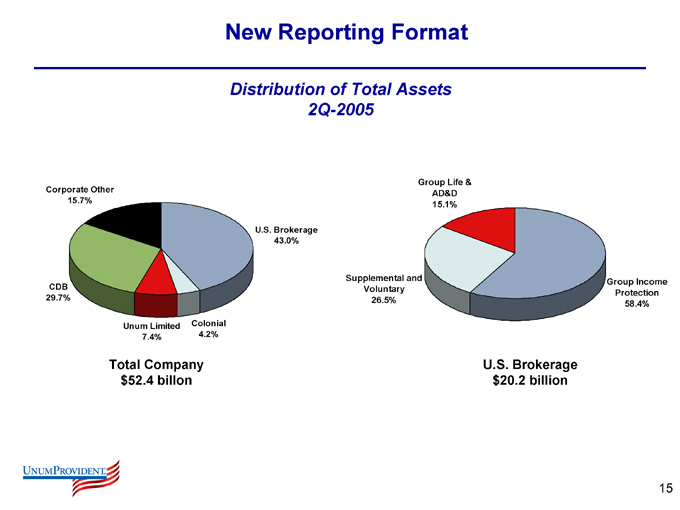

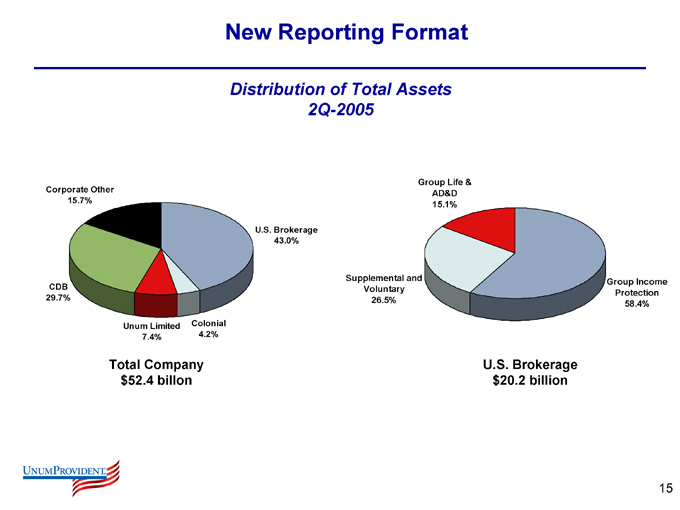

New Reporting Format

Distribution of Total Assets 2Q-2005

Corporate Other 15.7%

CDB 29.7%

Unum Limited Colonial 7.4% 4.2%

U.S. Brokerage 43.0%

Total Company $52.4 billon

Group Life & AD&D

15.1%

Supplemental and Voluntary 26.5%

U.S. Brokerage $20.2 billion

Group Income Protection 58.4%

15

2005 Investor Meeting October 17, 2005

State of the Company Address CEO Update

17

CEO Update

Rebuilding the Industry Leader Unfinished Business Outlook

18

CEO Update

Rebuilding the Industry Leader

Strengthening Financial Foundation

Improving Company Risk Profile

Business Investment

Positioning Service as a Differentiator

Leveraging our Human Capital

Changing Governance and Improving Regulatory/Compliance

19

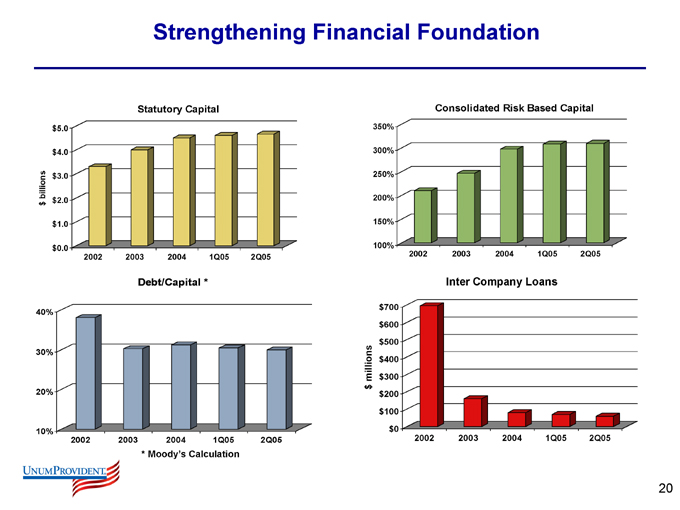

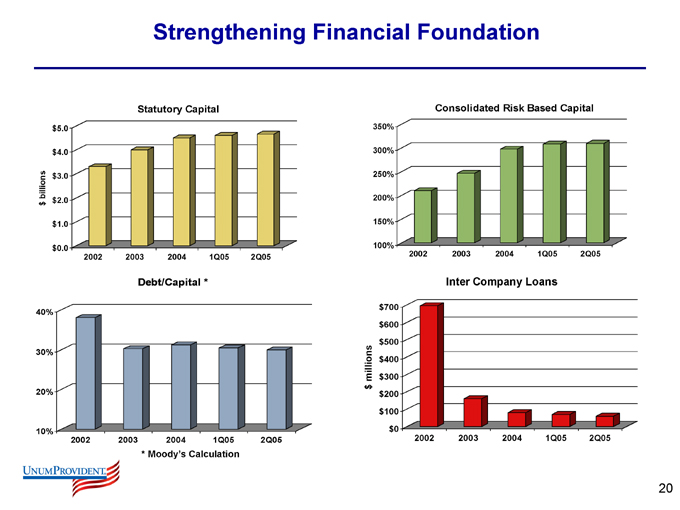

Strengthening Financial Foundation

Statutory Capital $5.0 $4.0 $3.0 $2.0 $1.0 $0.0 $billions

2002 2003 2004 1Q05 2Q05

Consolidated Risk Based Capital

350% 300% 250% 200% 150% 100%

2002 2003 2004 1Q05 2Q05

Debt/Capital *

40% 30% 20% 10%

2002 2003 2004 1Q05 2Q05

Inter Company Loans

* Moody’s Calculation $millions $700

$600 $500

$400

$300 $200

$100

$0

2002 2003 2004 1Q05 2Q05

20

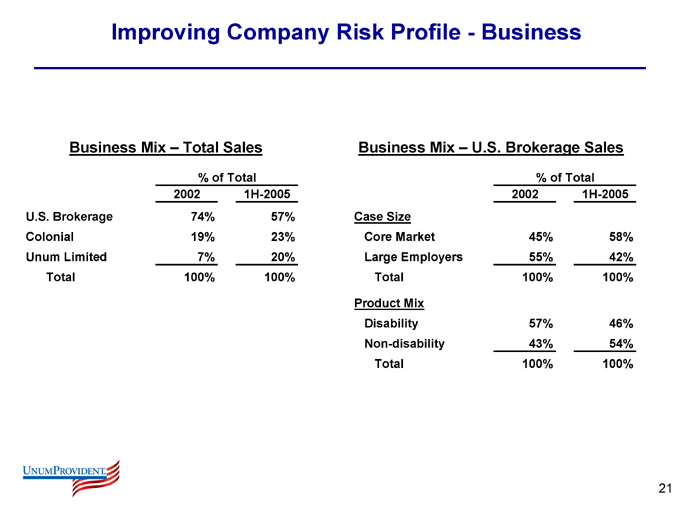

Improving Company Risk Profile - Business

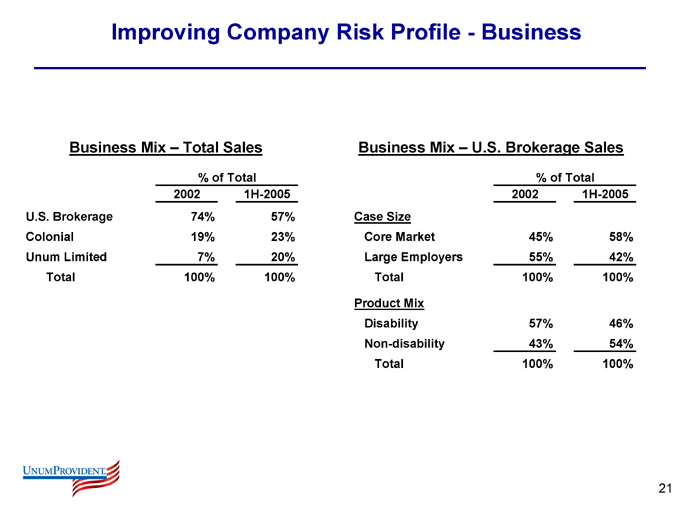

Business Mix – Total Sales

% of Total

2002 1H-2005

U.S. Brokerage 74% 57%

Colonial 19% 23%

Unum Limited 7% 20%

Total 100% 100%

Business Mix – U.S. Brokerage Sales

% of Total

2002 1H-2005

Case Size

Core Market 45% 58%

Large Employers 55% 42%

Total 100% 100%

Product Mix

Disability 57% 46%

Non-disability 43% 54%

Total 100% 100%

21

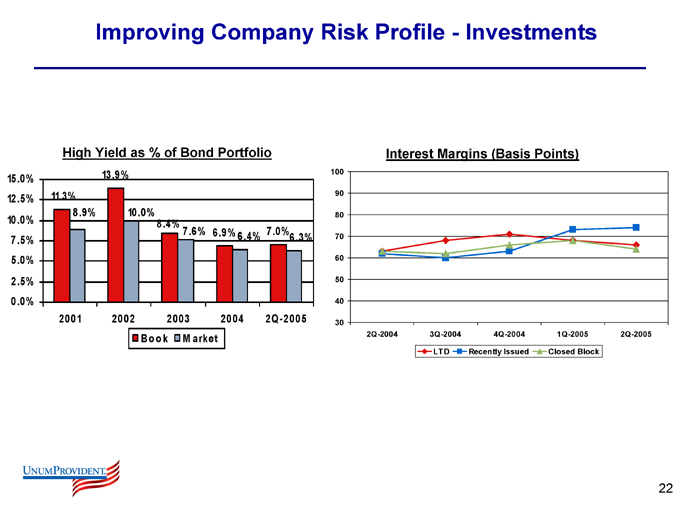

Improving Company Risk Profile - Investments

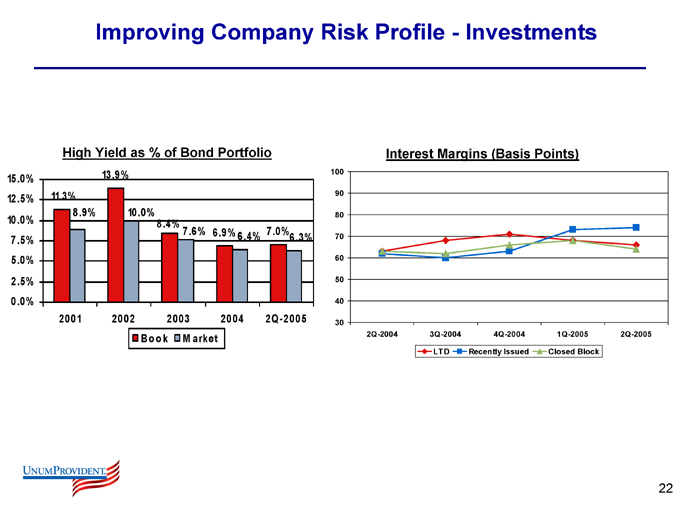

High Yield as % of Bond Portfolio

15.0% 12.5% 10.0% 7.5% 5.0% 2.5% 0.0%

11.3%

8.9%

13.9%

10.0%

8.4%

7.6%

6.9%

6.4%

7.0% 6.3%

2001 2002 2003 2004 2Q-2005

Book

Market

Interest Margins (Basis Points)

100 90 80 70 60 50 40 30

2Q-2004 3Q-2004 4Q-2004 1Q-2005 2Q-2005

LTD

Recently Issued

Closed Block

22

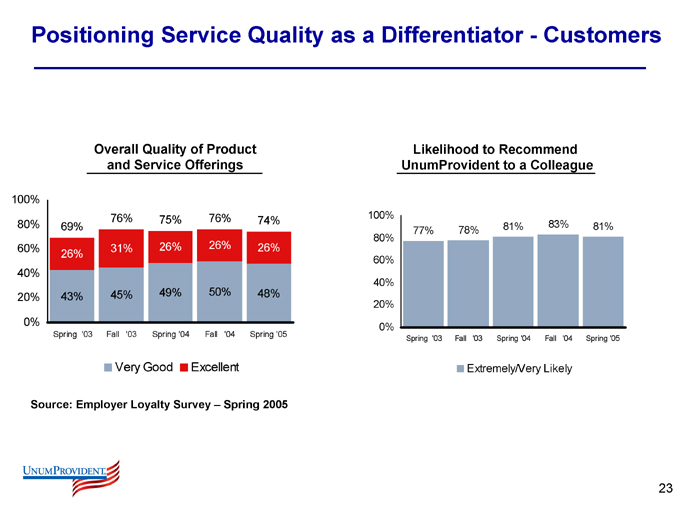

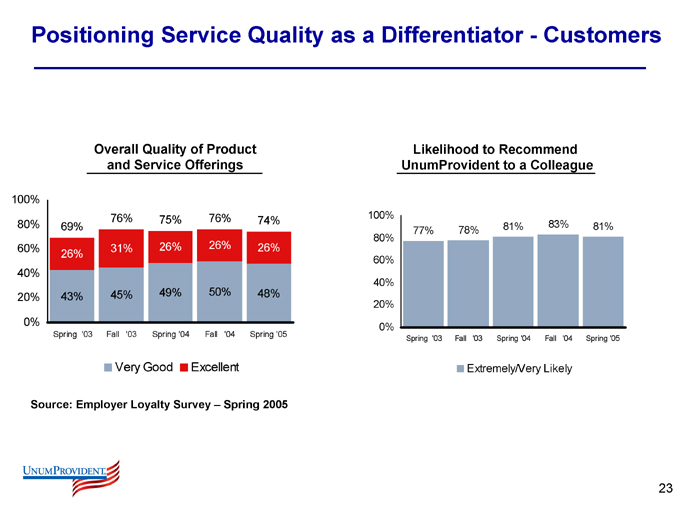

Positioning Service Quality as a Differentiator - Customers

Overall Quality of Product and Service Offerings

100% 80% 60% 40% 20% 0%

69%

26%

43%

76%

31%

45%

75%

26%

49%

76%

26%

50%

74%

26%

48%

Spring ‘03 Fall ‘03 Spring ‘04 Fall ‘04 Spring ‘05

Very Good

Excellent

Source: Employer Loyalty Survey – Spring 2005

Likelihood to Recommend UnumProvident to a Colleague

100% 80% 60% 40% 20% 0%

77%

78%

81%

83%

81%

Spring ‘03 Fall ‘03 Spring ‘04 Fall ‘04 Spring ‘05

Extremely/Very Likely

23

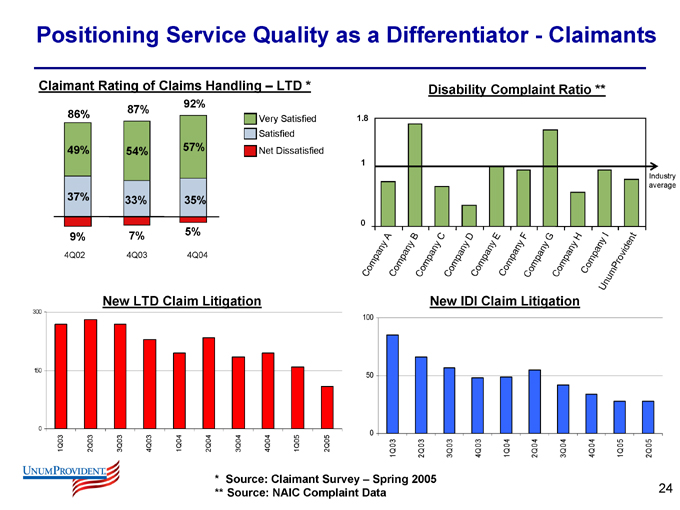

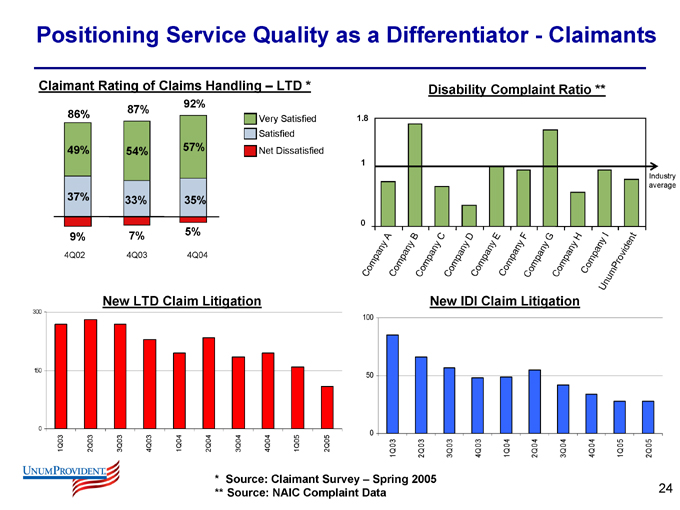

Positioning Service Quality as a Differentiator - Claimants

Claimant Rating of Claims Handling – LTD *

86%

49%

37%

9%

87%

54%

33%

7%

92%

57%

35%

5%

4Q02 4Q03 4Q04

Very Satisfied Satisfied Net Dissatisfied

New LTD Claim Litigation

300

150

0

1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05

Disability Complaint Ratio **

1.8

1

0

Industry average

Company A

Company B

Company C

Company D

Company E

Company F

Company G

Company H

Company I

UnumProvident

New IDI Claim Litigation

100

50

0

1Q 03 2Q 03 3Q 03 4Q 03 1Q 04 2Q 04 3Q 04 4Q 04 1Q 05 2Q 05

* Source: Claimant Survey – Spring 2005 ** Source: NAIC Complaint Data

24

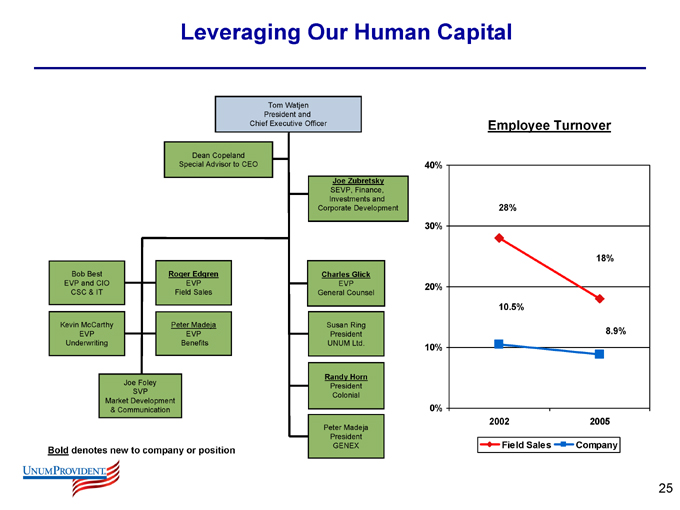

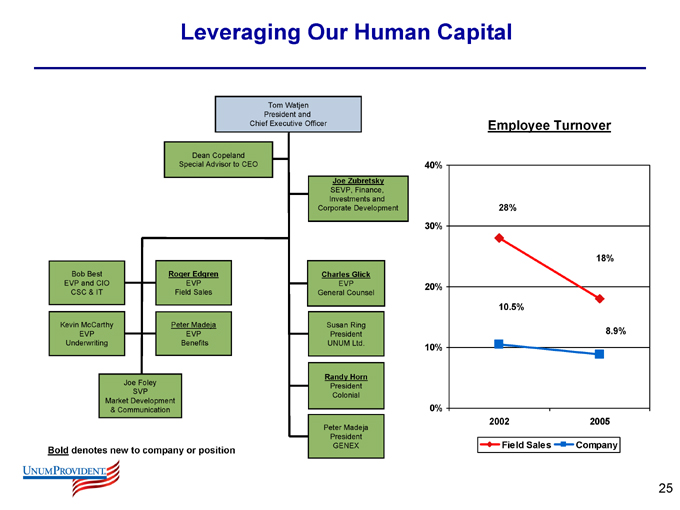

Leveraging Our Human Capital

Tom Watjen President and Chief Executive Officer

Dean Copeland Special Advisor to CEO

Joe Zubretsky

SEVP, Finance, Investments and Corporate Development

Bob Best EVP and CIO

CSC & IT

Roger Edgren

EVP Field Sales

Kevin McCarthy EVP

Underwriting

Peter Madeja EVP

Benefits

Joe Foley SVP

Market Development & Communication

Charles Glick

EVP General Counsel

Susan Ring President UNUM Ltd.

Randy Horn

President Colonial

Peter Madeja President GENEX

Bold denotes new to company or position

Employee Turnover

40% 30% 20% 10% 0%

28%

18%

10.5%

8.9%

2002 2005

Field Sales

Company

25

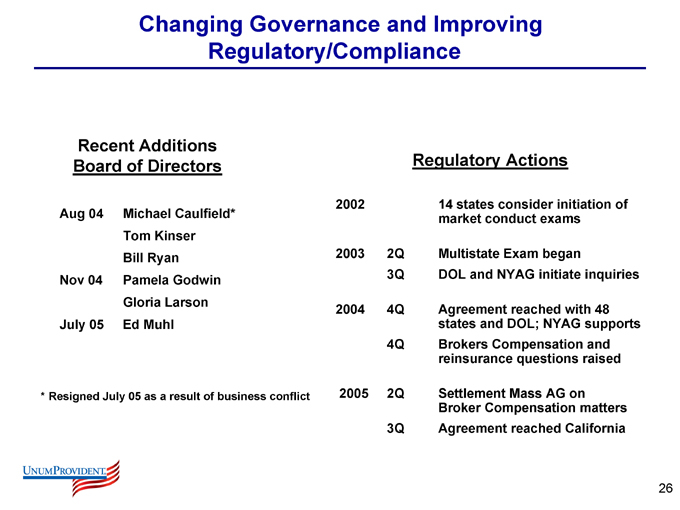

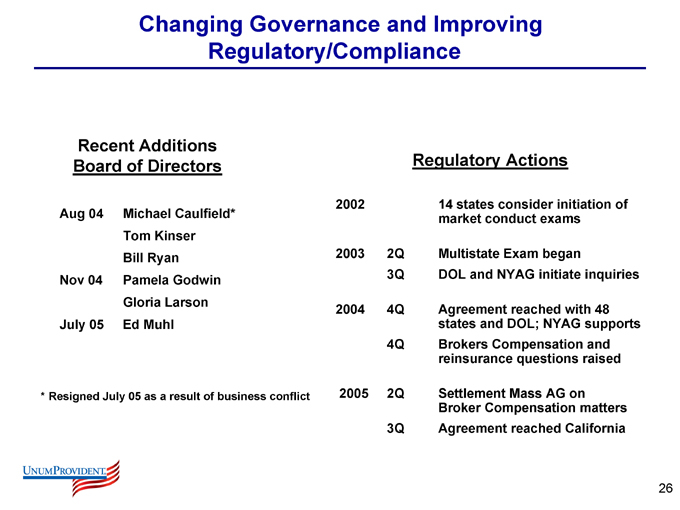

Changing Governance and Improving Regulatory/Compliance

Recent Additions Board of Directors

2002

Aug 04 Michael Caulfield*

Tom Kinser

Bill Ryan 2003

Nov 04 Pamela Godwin

Gloria Larson

2004

July 05 Ed Muhl

* Resigned July 05 as a result of business conflict 2005

Regulatory Actions

14 states consider initiation of

market conduct exams

2Q Multistate Exam began

3Q DOL and NYAG initiate inquiries

4Q Agreement reached with 48

states and DOL; NYAG supports

4Q Brokers Compensation and

reinsurance questions raised

2Q Settlement Mass AG on

Broker Compensation matters

3Q Agreement reached California

26

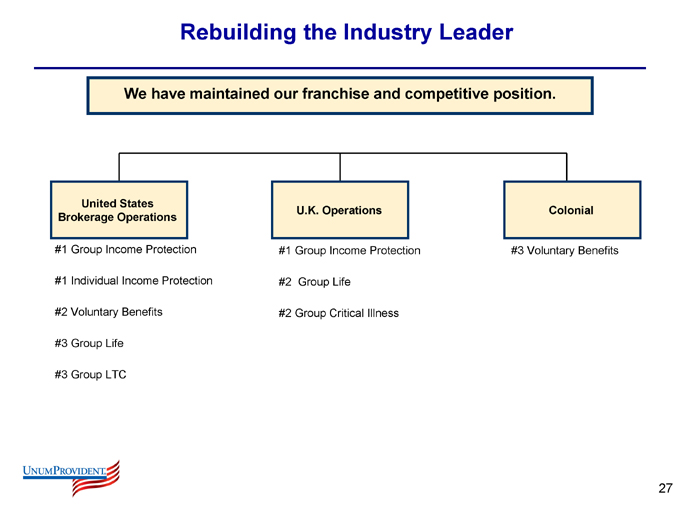

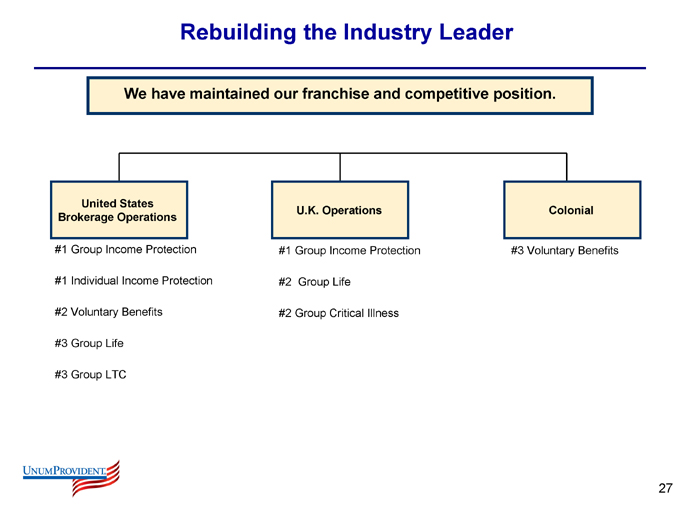

Rebuilding the Industry Leader

We have maintained our franchise and competitive position.

United States Brokerage Operations

U.K. Operations

Colonial

#1 Group Income Protection #1 Individual Income Protection #2 Voluntary Benefits #3 Group Life #3 Group LTC

#1 Group Income Protection

#2 Group Life

#2 Group Critical Illness

#3 Voluntary Benefits

27

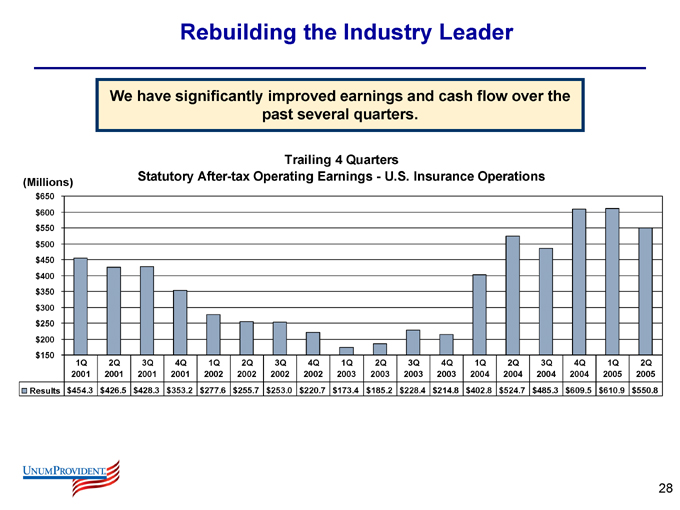

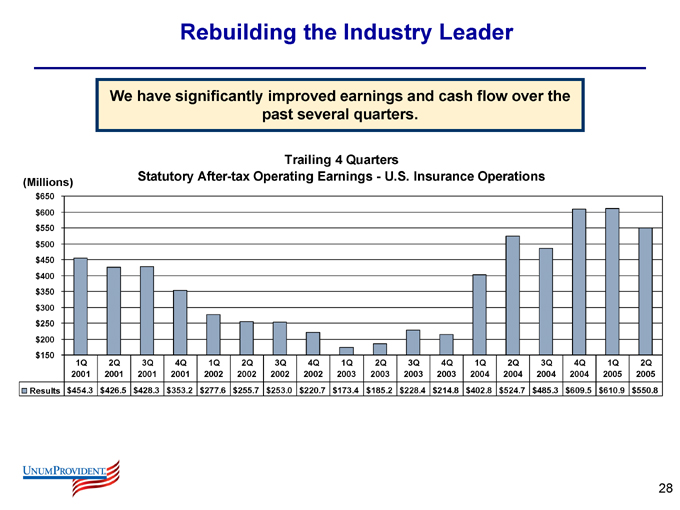

Rebuilding the Industry Leader

We have significantly improved earnings and cash flow over the past several quarters.

Trailing 4 Quarters

Statutory After-tax Operating Earnings—U.S. Insurance Operations

(Millions) $650 $600 $550 $500 $450 $400 $350 $300 $250 $200 $150

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q

2001 2001 2001 2001 2002 2002 2002 2002 2003 2003 2003 2003 2004 2004 2004 2004 2005 2005 Results $454.3 $426.5 $428.3 $353.2 $277.6 $255.7 $253.0 $220.7 $173.4 $185.2 $228.4 $214.8 $402.8 $524.7 $485.3 $609.5 $610.9 $550.8

28

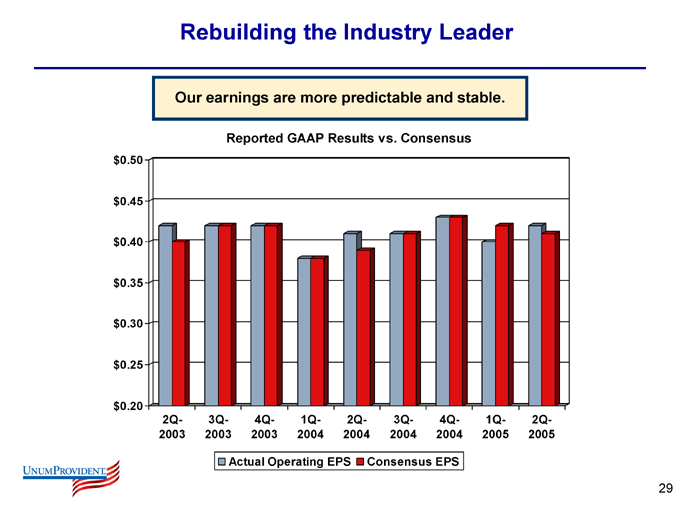

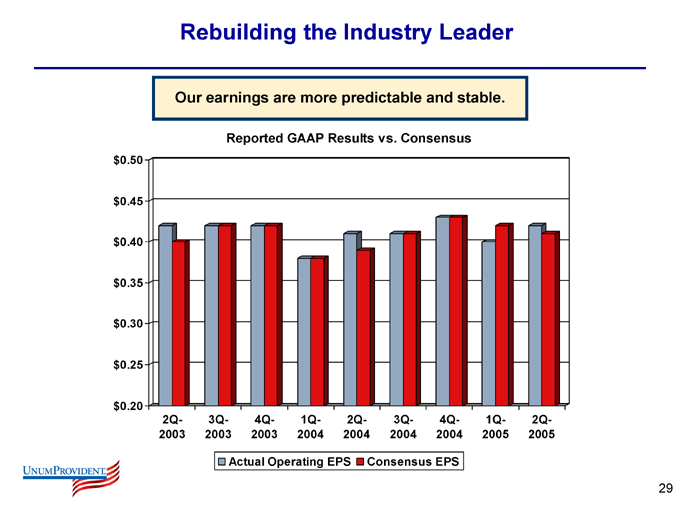

Rebuilding the Industry Leader

Our earnings are more predictable and stable.

Reported GAAP Results vs. Consensus $0.50 $0.45 $0.40 $0.35 $0.30 $0.25 $0.20

2Q- 3Q- 4Q- 1Q- 2Q- 3Q- 4Q- 1Q- 2Q-2003 2003 2003 2004 2004 2004 2004 2005 2005

Actual Operating EPS

Consensus EPS

29

Unfinished Business

Key Areas of Focus

Continued operating improvement

Particular focus on U.S. Brokerage Group Income Protection

Improve Ratings

Develop appropriate capital management plan

Improve perception of Company with regulators/media

Continue to reduce business volatility

Consistent execution of everything we do

30

Outlook

Financial Goals

Operational improvement expectations:

Double digit BTOE growth over the next three years, primarily driven by margin improvement in Group Income Protection line Stable performance in other major lines ROE expansion from current 8.7% to a range of 9%—11% over the next three years prior to capital management decisions

ROE and EPS growth improvement impacted by:

Continued de-leveraging Build up of excess capital

Dilution from ACEs equity conversion

31

Outlook

Financial Goals (cont.)

Deployment of excess capital offers opportunity to enhance ROE beyond that created by operational improvements

Potential for generation of $1 billion of excess capital over 3 year timeframe Deployment of capital could enhance ROE by 75 to 100 basis points

We are comfortable with the current consensus estimates

Substantial de-risking and improved capital position underlies this earnings improvement

32

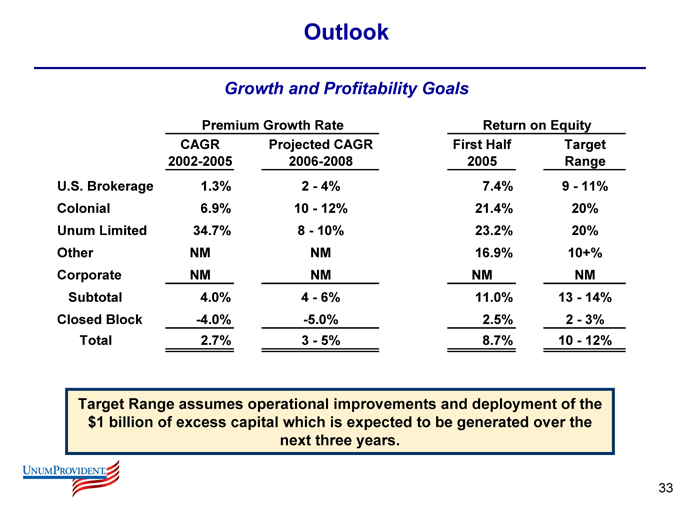

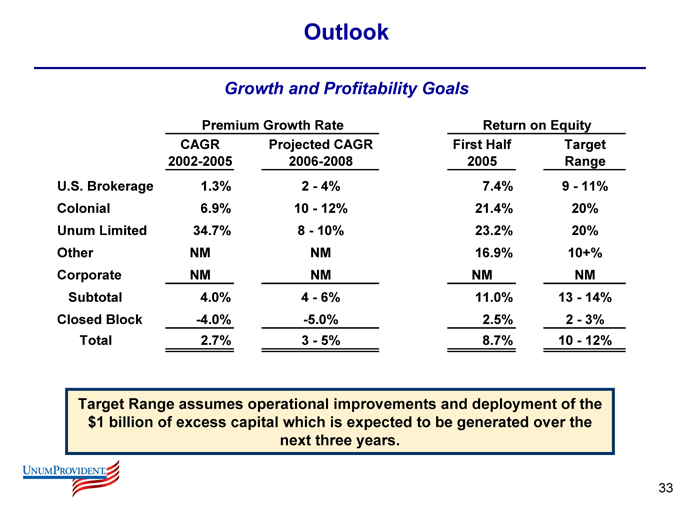

Outlook

Growth and Profitability Goals

Premium Growth Rate

CAGR Projected CAGR

2002-2005 2006-2008

U.S. Brokerage 1.3% 2 - 4%

Colonial 6.9% 10 - 12%

Unum Limited 34.7% 8 - 10%

Other NM NM

Corporate NM NM

Subtotal 4.0% 4 - 6%

Closed Block -4.0% -5.0%

Total 2.7% 3 - 5%

Return on Equity

First Half Target

2005 Range

7.4% 9 - 11%

21.4% 20%

23.2% 20%

16.9% 10+%

NM NM

11.0% 13 - 14%

2.5% 2 - 3%

8.7% 10 - 12%

Target Range assumes operational improvements and deployment of the $1 billion of excess capital which is expected to be generated over the next three years.

33

Outlook

Greatest Risks Facing Company

Claims performance during this period of transition Economic – interest rates and general economic strength Maintain disciplined plan and consistent execution

34

Outlook

Operating Segment Outlook

U.S. Brokerage

Strong franchise and market position retained VWB presents a profitable growth opportunity

Intense focus on improving profitability of Group Income Protection

Colonial

Solid VWB play – complementary distribution and customer base Objective is to reach “market” growth rate.

Predictable earnings and cash flow, and above average returns

Unum Limited (UK)

Significant leadership business in core product lines Modest growth with above average returns Strong cash flow and dividend capacity

35

The New Paradigm

36

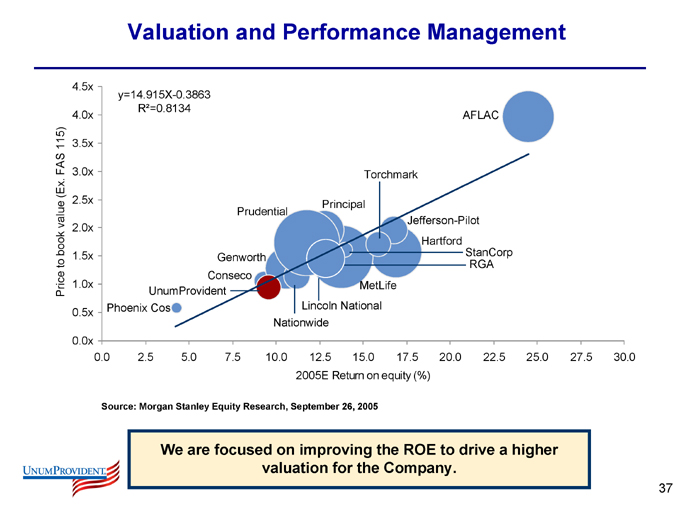

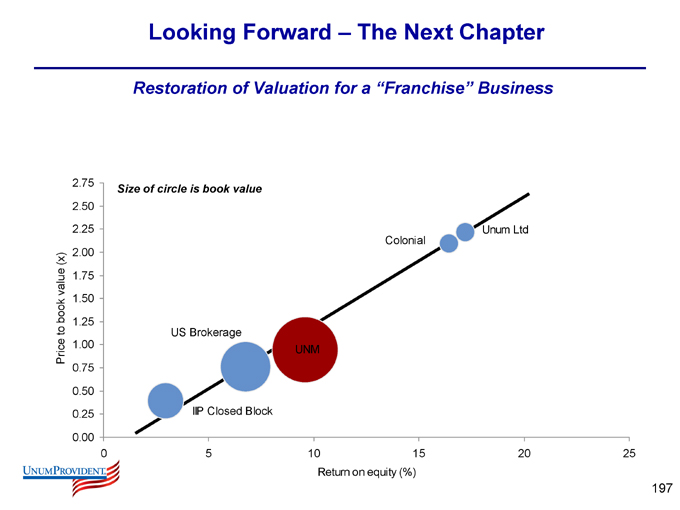

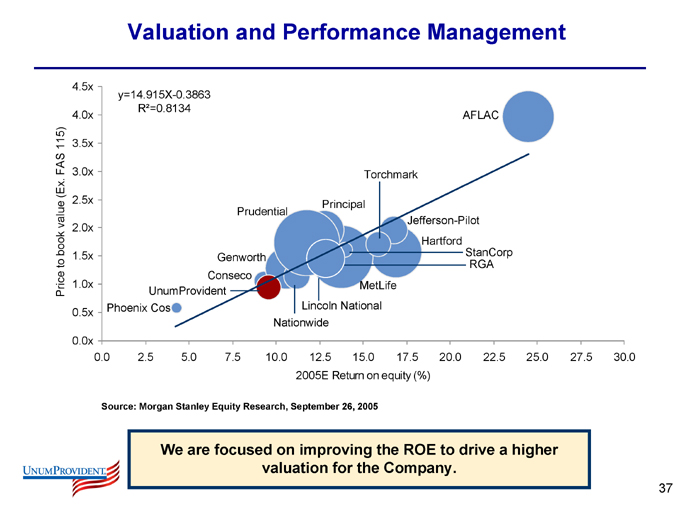

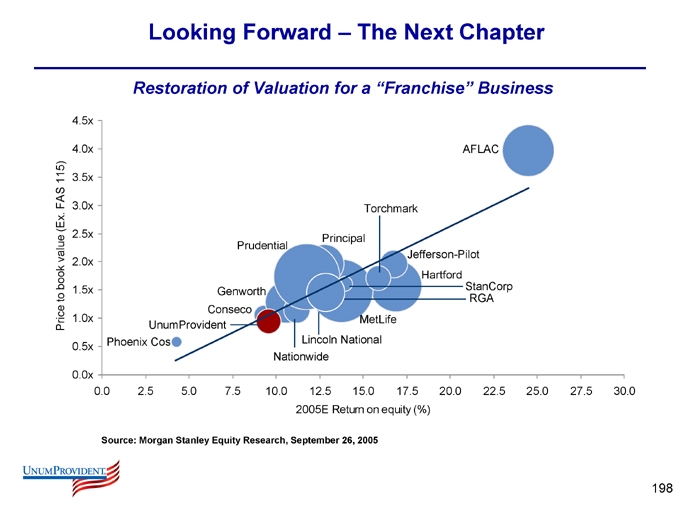

Valuation and Performance Management

Price to book value (Ex. FAS 115)

4.5x

4.0x

3.5x

3.0x

2.5x

2.0x

1.5x

1.0x

0.5x

0.0x

0.0

2.5

5.0

7.5

10.0

12.5

15.0

17.5

20.0

22.5

25.0

27.5

30.0 y=14.915X-0.3863 R²=0.8134

Phoenix Cos

UnumProvident

Conseco

Genworth

Prudential

Principal

Torchmark

AFLAC

Nationwide

Lincoln National

MetLife

StanCorp RGA

Hartford

Jefferson-Pilot

2005E Return on equity (%)

Source: Morgan Stanley Equity Research, September 26, 2005

We are focused on improving the ROE to drive a higher valuation for the Company.

37

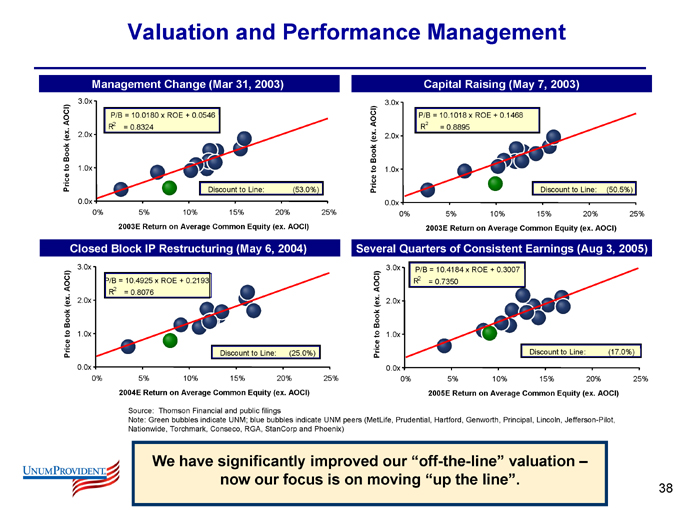

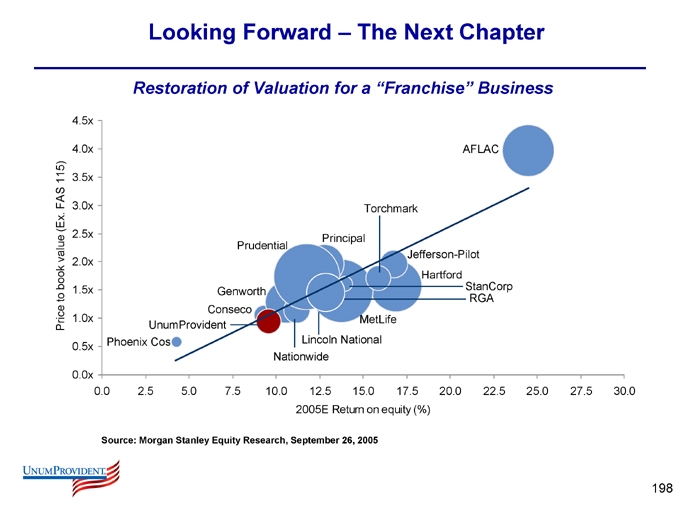

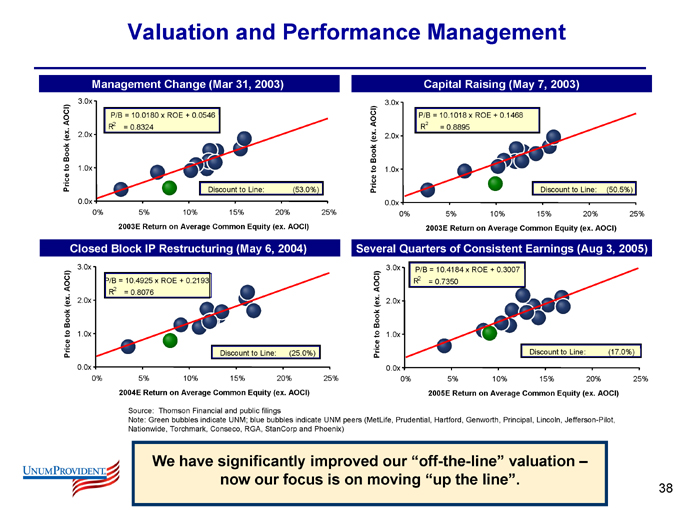

Valuation and Performance Management

Management Change (Mar 31, 2003)

Price to Book (ex. AOCI)

3.0x

2.0x

1.0x

0.0x

0%

5%

10%

15%

20%

25%

P/B = 10.0180 x ROE + 0.0546 R2 = 0.8324

Discount to Line: (53.0%)

2003E Return on Average Common Equity (ex. AOCI)

Price to Book (ex. AOCI)

3.0x

2.0x

1.0x

0.0x

0%

5%

10%

15%

20%

25%

P/B = 10.1018 x ROE + 0.1468 R2 = 0.8895

Discount to Line: (50.5%)

2003E Return on Average Common Equity (ex. AOCI)

Capital Raising (May 7, 2003)

Closed Block IP Restructuring (May 6, 2004)

Price to Book (ex. AOCI)

3.0x

2.0x

1.0x

0.0x

0%

5%

10%

15%

20%

25%

P/B = 10.4925 x ROE + 0.2193 R2 = 0.8076

Discount to Line: (25.0%)

2004E Return on Average Common Equity (ex. AOCI)

Several Quarters of Consistent Earnings (Aug 3, 2005)

Price to Book (ex. AOCI)

3.0x

2.0x

1.0x

0.0x

0%

5%

10%

15%

20%

25%

P/B = 10.4184 x ROE + 0.3007 R2 = 0.7350

Discount to Line: (17.0%)

2005E Return on Average Common Equity (ex. AOCI)

Source: Thomson Financial and public filings

Note: Green bubbles indicate UNM; blue bubbles indicate UNM peers (MetLife, Prudential, Hartford, Genworth, Principal, Lincoln, Jefferson-Pilot, Nationwide, Torchmark, Conseco, RGA, StanCorp and Phoenix)

We have significantly improved our “off-the-line” valuation – now our focus is on moving “up the line”.

38

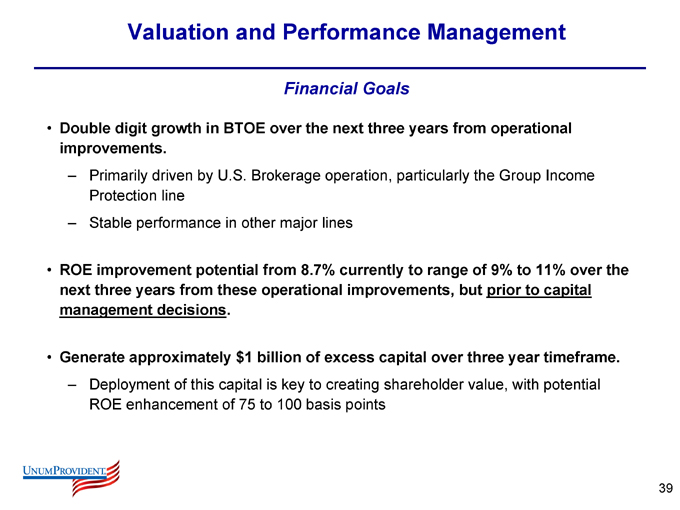

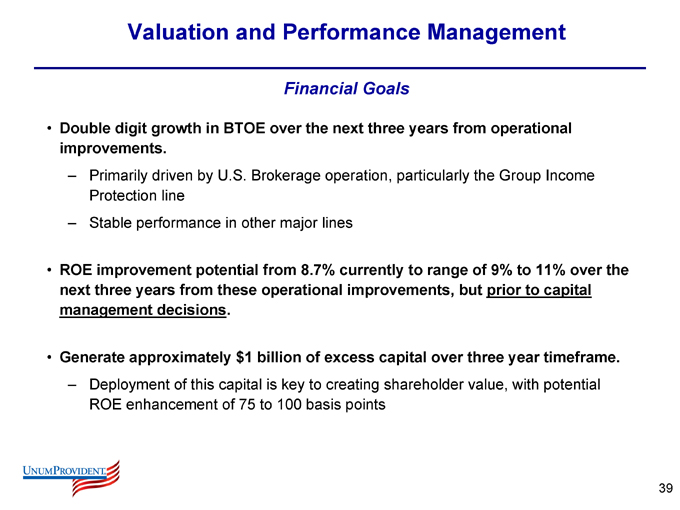

Valuation and Performance Management

Financial Goals

Double digit growth in BTOE over the next three years from operational improvements.

Primarily driven by U.S. Brokerage operation, particularly the Group Income Protection line Stable performance in other major lines

ROE improvement potential from 8.7% currently to range of 9% to 11% over the next three years from these operational improvements, but prior to capital management decisions.

Generate approximately $1 billion of excess capital over three year timeframe.

Deployment of this capital is key to creating shareholder value, with potential ROE enhancement of 75 to 100 basis points

39

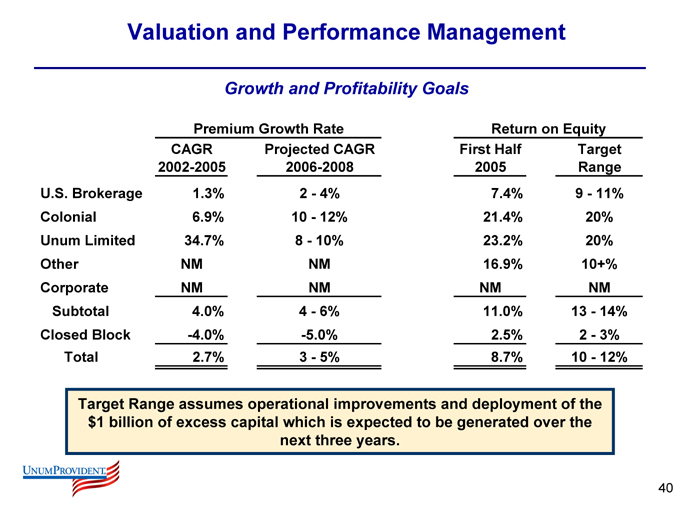

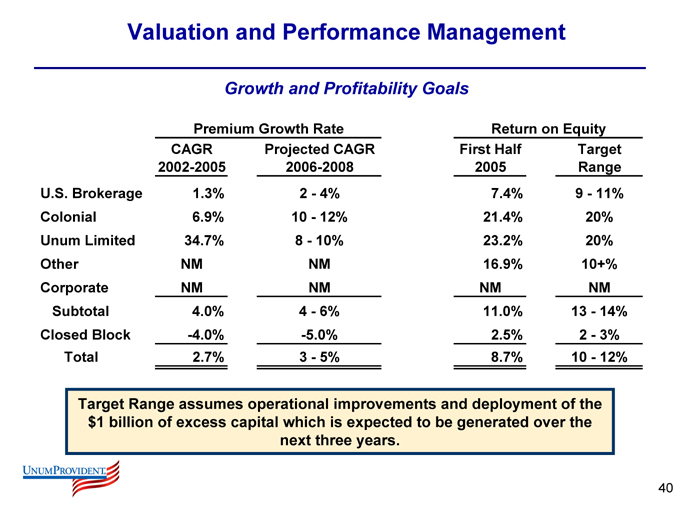

Valuation and Performance Management

Growth and Profitability Goals

Premium Growth Rate Return on Equity

CAGR Projected CAGR First Half Target

2002-2005 2006-2008 2005 Range

U.S. Brokerage 1.3% 2 - 4% 7.4% 9 - 11%

Colonial 6.9% 10 - 12% 21.4% 20%

Unum Limited 34.7% 8 - 10% 23.2% 20%

Other NM NM 16.9% 10+%

Corporate NM NM NM NM

Subtotal 4.0% 4 - 6% 11.0% 13 - 14%

Closed Block -4.0% -5.0% 2.5% 2 - 3%

Total 2.7% 3 - 5% 8.7% 10 - 12%

Target Range assumes operational improvements and deployment of the $1 billion of excess capital which is expected to be generated over the next three years.

40

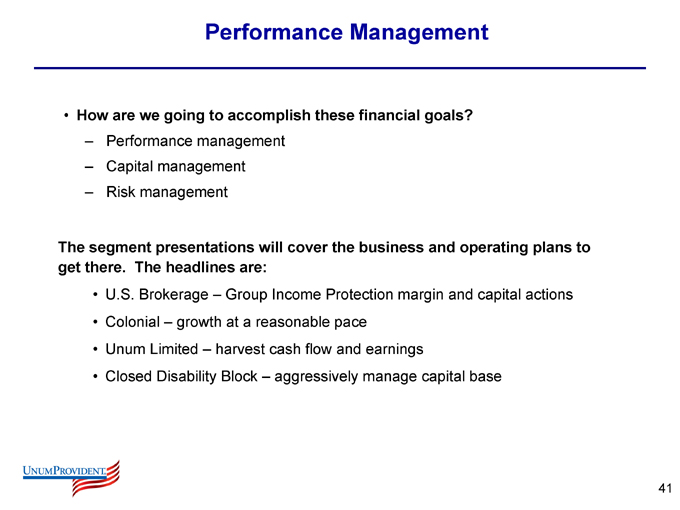

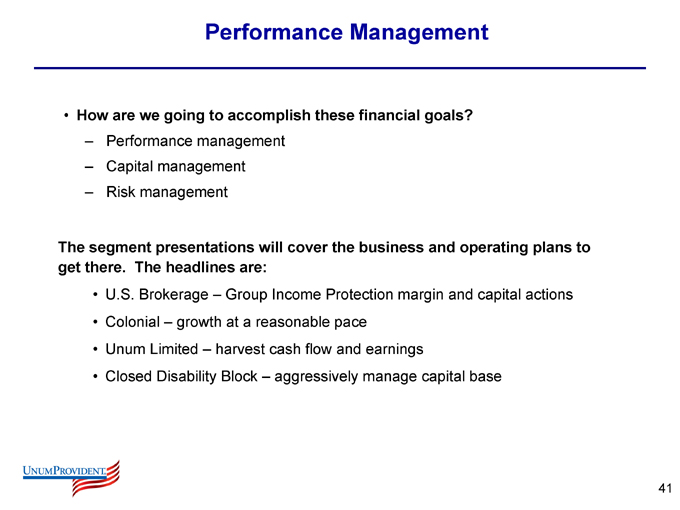

Performance Management

How are we going to accomplish these financial goals?

Performance management Capital management Risk management

The segment presentations will cover the business and operating plans to get there. The headlines are:

U.S. Brokerage – Group Income Protection margin and capital actions

Colonial – growth at a reasonable pace

Unum Limited – harvest cash flow and earnings

Closed Disability Block – aggressively manage capital base

41

Performance Management

42

Performance Management

Managing the Numerator

Our New Performance Management System

Focuses on the key business levers

Results in resource allocations to high ROE levers and initiatives Focuses and measures on revenue quality; Measures and manages volatility and cyclicality Action oriented: When off course… correct.

43

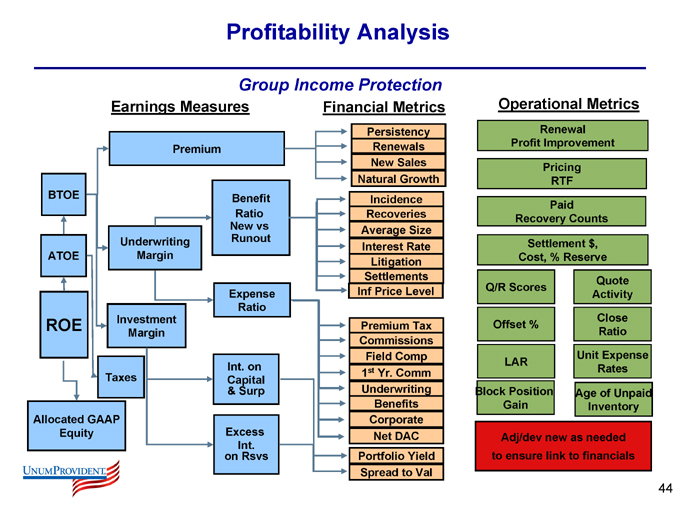

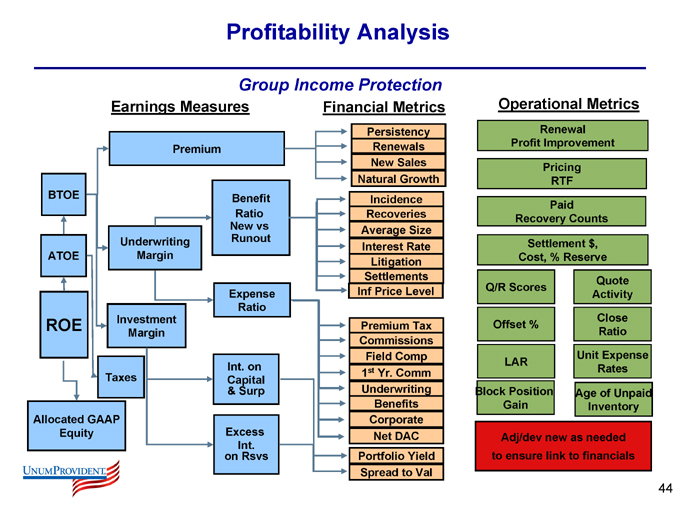

Profitability Analysis

Group Income Protection

Earnings Measures

Premium

BTOE

ATOE

ROE

Allocated GAAP

Equity

Underwriting Margin

Investment Margin

Taxes

Benefit Ratio New vs Runout

Expense Ratio

Int. on Capital & Surp

Excess Int. on Rsvs

Financial Metrics

Persistency Renewals New Sales Natural Growth

Incidence Recoveries Average Size Interest Rate Litigation Settlements Inf Price Level

Premium Tax Commissions Field Comp 1st Yr. Comm Underwriting Benefits Corporate Net DAC Portfolio Yield Spread to Val

Operational Metrics

Renewal Profit Improvement

Pricing RTF

Paid Recovery Counts

Settlement $, Cost, % Reserve

Q/R Scores

Offset %

LAR

Block Position Gain

Quote Activity

Close Ratio

Unit Expense Rates

Age of Unpaid Inventory

Adj/dev new as needed to ensure link to financials

44

Capital Management

45

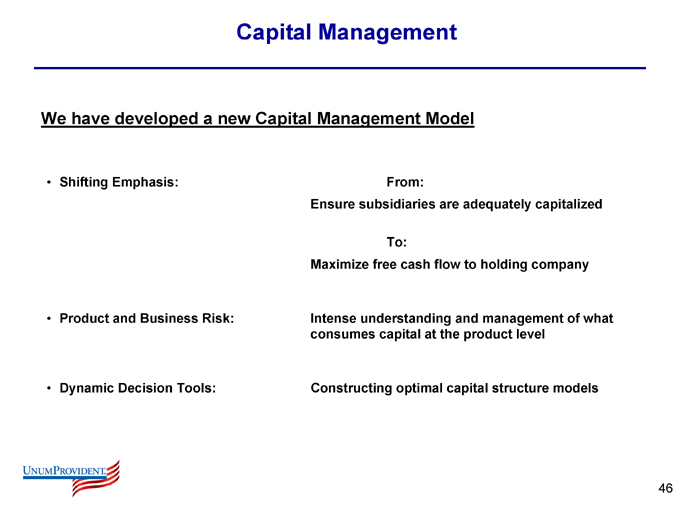

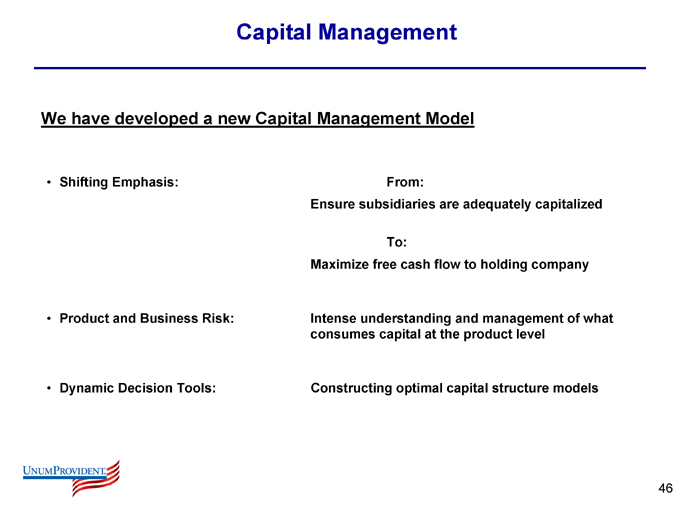

Capital Management

We have developed a new Capital Management Model

Shifting Emphasis: From:

Ensure subsidiaries are adequately capitalized

To:

Maximize free cash flow to holding company

Product and Business Risk: Intense understanding and management of what consumes capital at the product level

Dynamic Decision Tools: Constructing optimal capital structure models

46

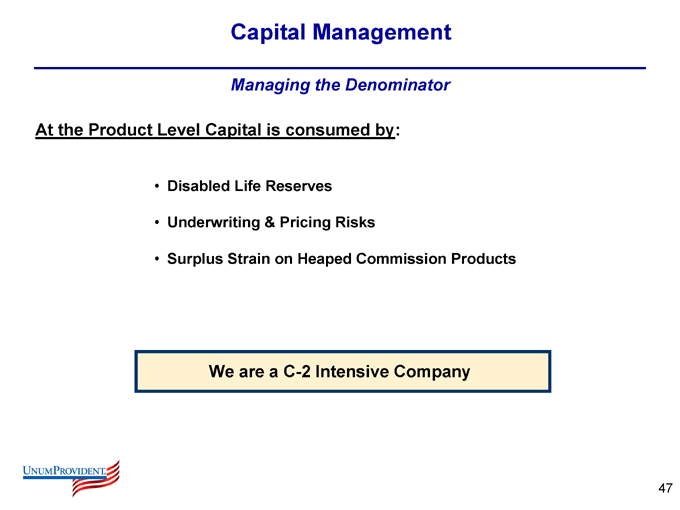

Capital Management

Managing the Denominator

At the Product Level Capital is consumed by:

Disabled Life Reserves

Underwriting & Pricing Risks

Surplus Strain on Heaped Commission Products

We are a C-2 Intensive Company

47

Capital Management

Managing the Denominator

We are managing the holding company to create shareholder value:

Dividend capacity from insurance subsidiaries Drive to investment grade from high yield Optimal mix of debt, hybrids, pure equity

Debt Structure; balance: Maturity Laddering

Cost Rate-roll risk

Managing to “An Efficient Frontier”

48

Capital Management

These capital events, together with the recurring cash flows, underpin the Company’s Capital Plan:

ACES Notes Remarketing

ACES Equity Conversion

49

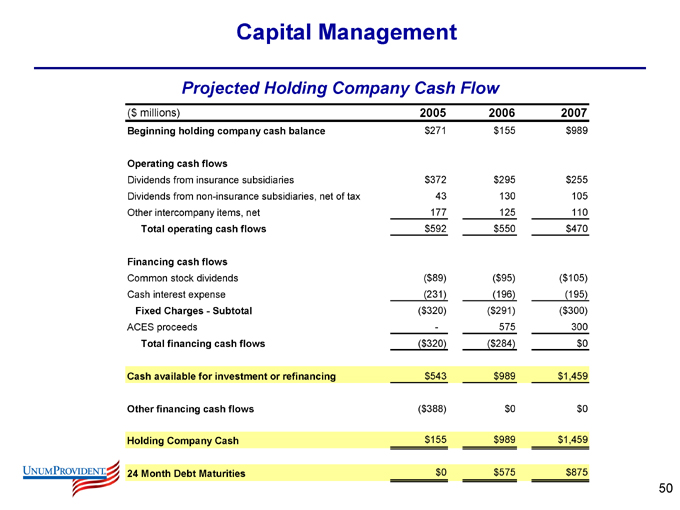

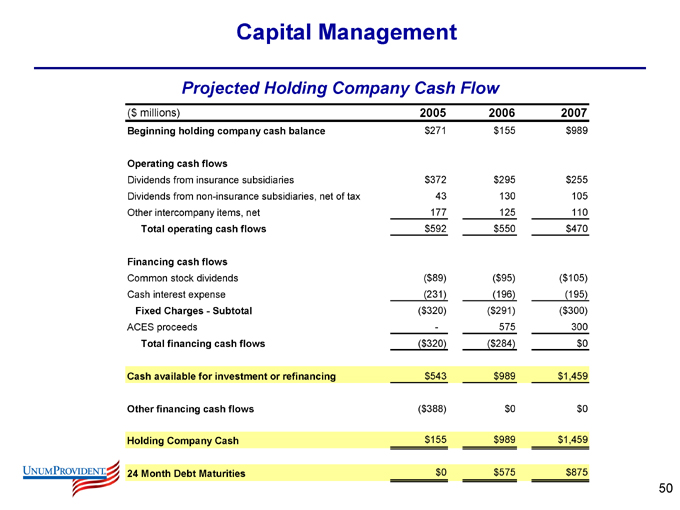

Capital Management

Projected Holding Company Cash Flow

($millions) 2005 2006 2007

Beginning holding company cash balance $271 $155 $989

Operating cash flows

Dividends from insurance subsidiaries $372 $295 $255

Dividends from non-insurance subsidiaries, net of tax 43 130 105

Other intercompany items, net 177 125 110

Total operating cash flows $592 $550 $470

Financing cash flows

Common stock dividends ( $89) ( $95) ($105)

Cash interest expense (231) (196) (195)

Fixed Charges - Subtotal ($320) ($291) ($300)

ACES proceeds — 575 300

Total financing cash flows ($320) ($284) $0

Cash available for investment or refinancing $543 $989 $1,459

Other financing cash flows ($388) $0 $0

Holding Company Cash $155 $989 $1,459

24 Month Debt Maturities $0 $575 $875

50

Capital Management

Capital planning objectives - 2006:

Maintain 300% consolidated RBC ratio

Reduce leverage ratio to 25% (based on Moody’s calculation assuming 50% equity credit for ACEs)

Maintain liquidity to meet 24 month maturities

Hold excess cash at holding company

51

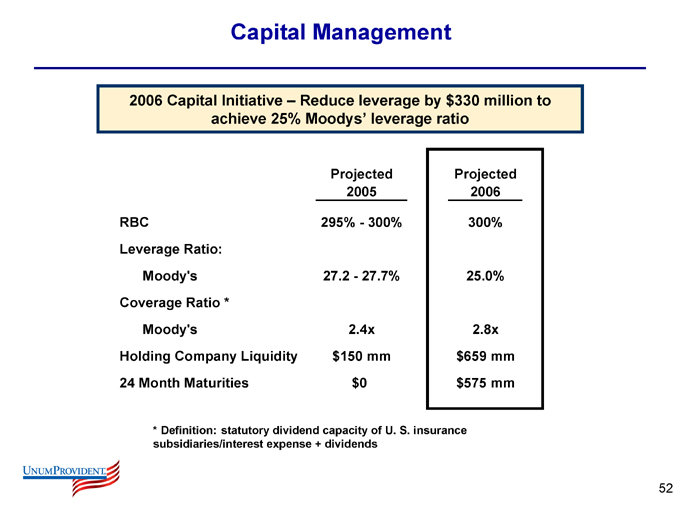

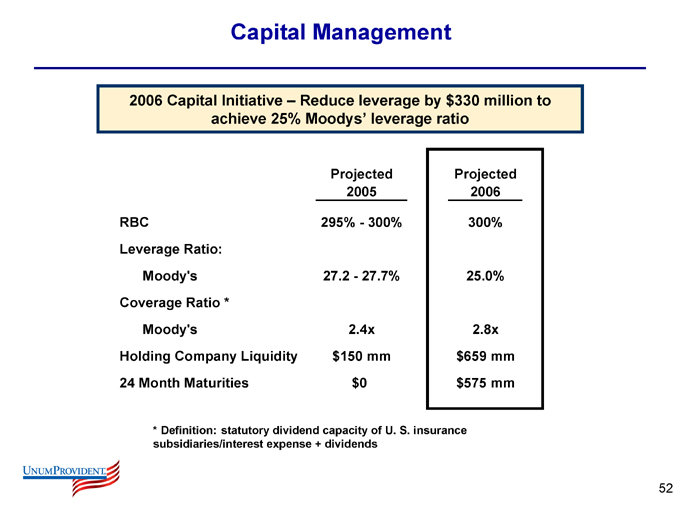

Capital Management

2006 Capital Initiative – Reduce leverage by $330 million to achieve 25% Moodys’ leverage ratio

Projected Projected

2005 2006

RBC 295% - 300% 300%

Leverage Ratio:

Moody’s 27.2 - 27.7% 25.0%

Coverage Ratio *

Moody’s 2.4x 2.8x

Holding Company Liquidity $150 mm $659 mm

24 Month Maturities $0 $575 mm

* Definition: statutory dividend capacity of U. S. insurance subsidiaries/interest expense + dividends

52

Capital Management

Capital planning objectives - 2007:

Maintain 300% consolidated RBC ratio Maintain leverage ratio at 25% Maintain liquidity to meet 24 month maturities

Hold excess cash at holding company and evaluate alternative uses

53

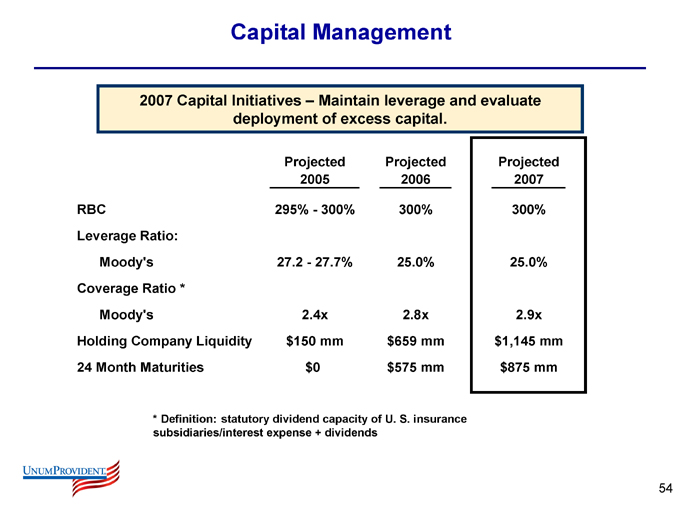

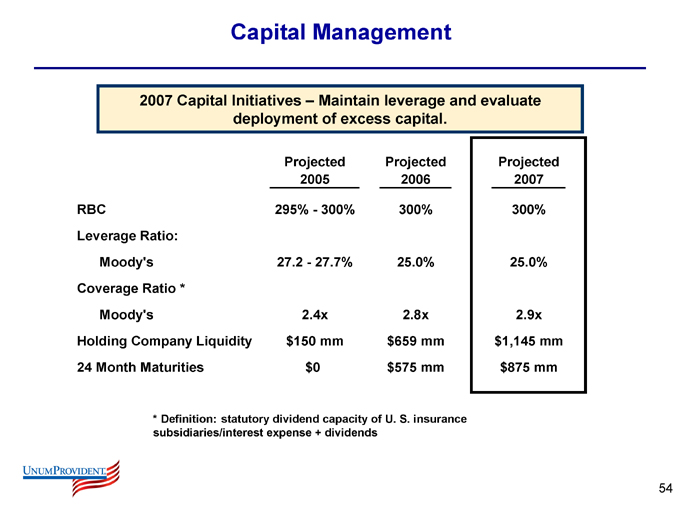

Capital Management

2007 Capital Initiatives – Maintain leverage and evaluate deployment of excess capital.

Projected Projected Projected

2005 2006 2007

RBC 295% - 300% 300% 300%

Leverage Ratio:

Moody’s 27.2 - 27.7% 25.0% 25.0%

Coverage Ratio *

Moody’s 2.4x 2.8x 2.9x

Holding Company Liquidity $150 mm $659 mm $1,145 mm

24 Month Maturities $0 $575 mm $875 mm

* Definition: statutory dividend capacity of U. S. insurance subsidiaries/interest expense + dividends

54

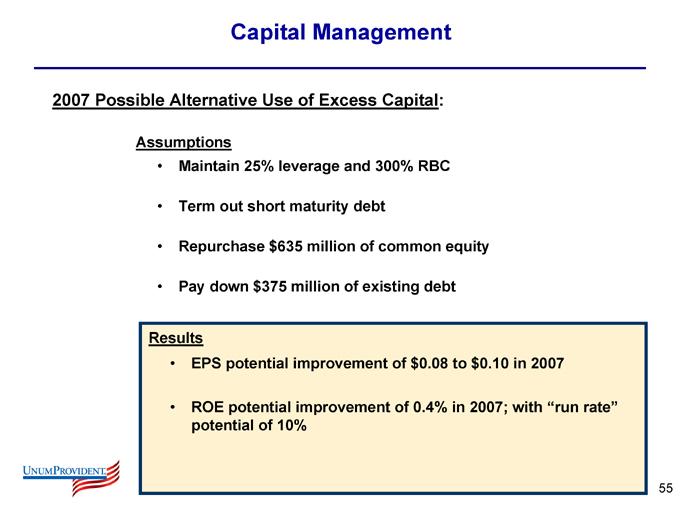

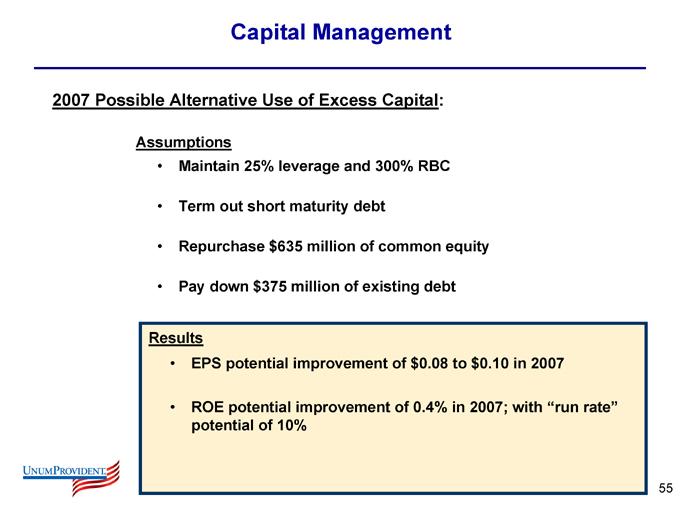

Capital Management

2007 Possible Alternative Use of Excess Capital:

Assumptions

Maintain 25% leverage and 300% RBC Term out short maturity debt Repurchase $635 million of common equity Pay down $375 million of existing debt

Results

EPS potential improvement of $0.08 to $0.10 in 2007

ROE potential improvement of 0.4% in 2007; with “run rate” potential of 10%

55

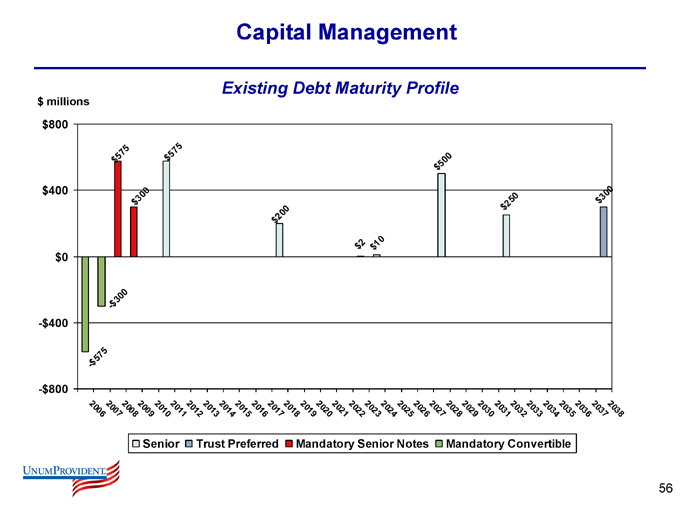

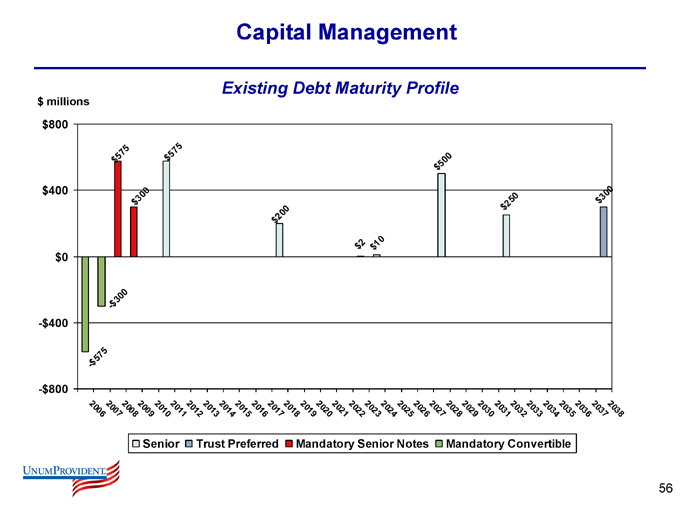

Capital Management

Existing Debt Maturity Profile $ millions $800 $400 $0

$ millions

$800 $400 $0

-$400

-$800

$575

$308

$575

$200

$2

$10 $500

$250

$300

-$575

-$300

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

2036

2037

2038

Senior

Trust Preferred

Mandatory Senior Notes

Mandatory Convertible

56

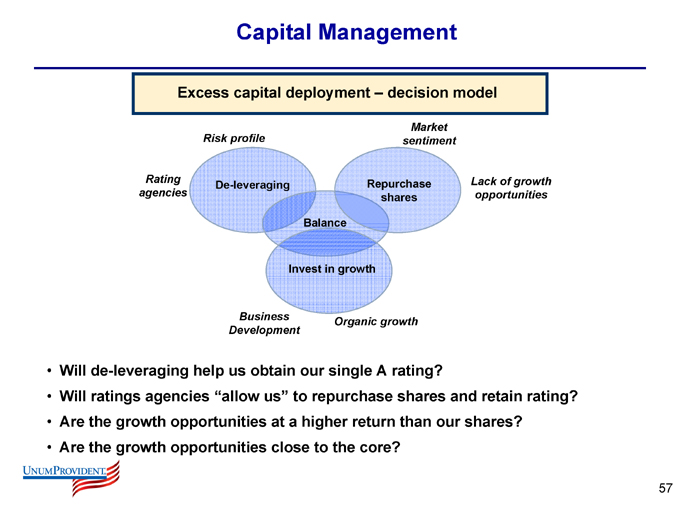

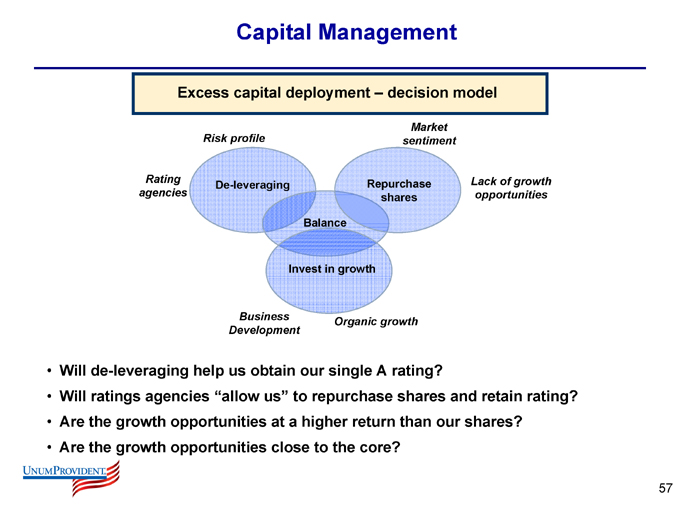

Capital Management

Excess capital deployment – decision model

Risk profile

Rating agencies

De-leveraging

Balance

Invest in growth

Repurchase shares

Market sentiment

Lack of growth opportunities

Business Development

Organic growth

Will de-leveraging help us obtain our single A rating?

Will ratings agencies “allow us” to repurchase shares and retain rating? Are the growth opportunities at a higher return than our shares? Are the growth opportunities close to the core?

57

Capital Management

Opportunities for Shareholder Value

Centre Re Recapture – completed

U.K. Dividend Repatriation – under consideration

Risk adjusted capital allocation to Closed Block – in development

Risk adjusted capital deployment to claim tail – in development

58

Capital Management

Rating Agency Outlook

Improving the A.M. Best rating and re-gaining investment grade debt status are important objectives for us.

With questions around investment portfolio and capital largely addressed, we believe the rating agencies are focused on:

Consistent operating performance/profitability Coverage ratios

We believe our plans are “rating agency friendly” as they focus on:

U.S. Group Income Protection profitability Further de-leveraging Building financial flexibility

While our business has held up well though the recent downgrades, we believe that ratings upgrades are an important element of our future success.

59

Investment and Interest Rate Management

60

Investment and Interest Rate Management

Economic Conditions

U.S. Government 2-Year and 10-Year Treasuries

Yield

7 6 5 4 3 2 1

2001 2002 2003 2004 2005

Source: LehmanLive.com

U.S. 2-Year

U.S. 10-Year

Dramatic flattening of Treasury yield curve. 10-Year Treasury remains low.

61

Investment and Interest Rate Management

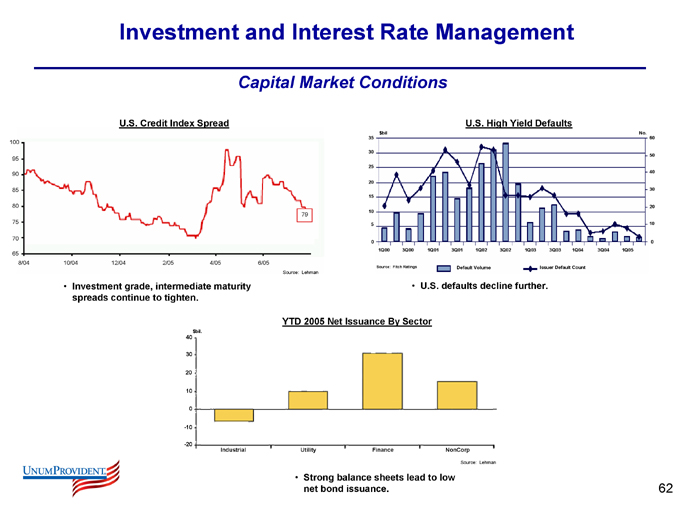

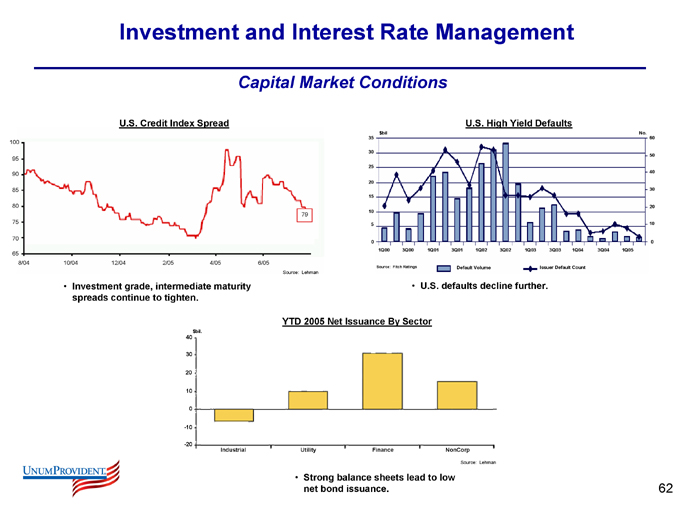

Capital Market Conditions

U.S. Credit Index Spread

100

95

90

85 80 75

70

65

8/04 10/04 12/04 2/05 4/05 6/05

79

Source: Lehman

Investment grade, intermediate maturity spreads continue to tighten.

U.S. High Yield Defaults $bil

35 30 25 20 15 10 5 0

1Q00 3Q00 1Q01 3Q01 1Q02 3Q02 1Q03 3Q03 1Q04 3Q04 1Q05

No.

60 50 40 30 20 10 0

Source: Fitch Ratings

Default Volume

Issuer Default Count

U.S. defaults decline further.

YTD 2005 Net Issuance By Sector $bil.

40 30 20 10 0 -10 -20

Industrial

Utility

Finance

NonCorp

Source: Lehman

Strong balance sheets lead to low net bond issuance.

62

Investment and Interest Rate Management

Risk Management:

Disciplined duration match; no interest rate bets

Maintain a 50 to 60 bp spread between portfolio rate and average reserve discount rates

Target low single –A average credit quality Manage to book yield Core Holding; Corporate Bonds Yield enhancing alternative investment classes

63

Investment and Interest Rate Management

Duration Matching:

Core duration management tool; forward starting swaps Occasional swaption to protect downside Dynamic decision model: When to hedge?

Time Value Volatility Risk Appetite

Accounting Constraints

64

Investment and Interest Rate Management

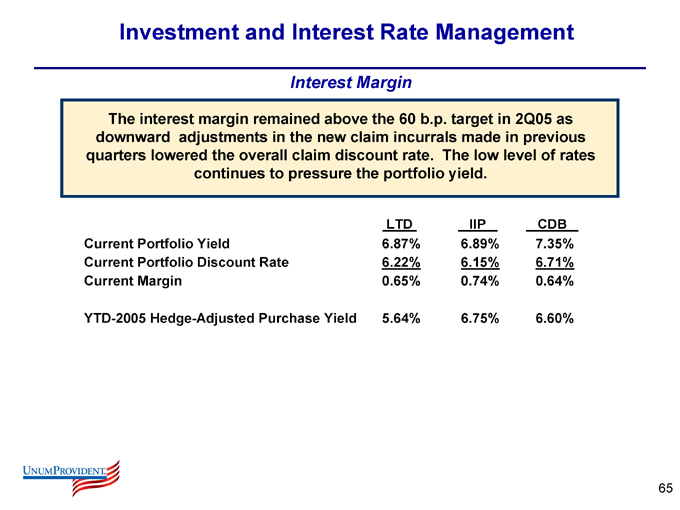

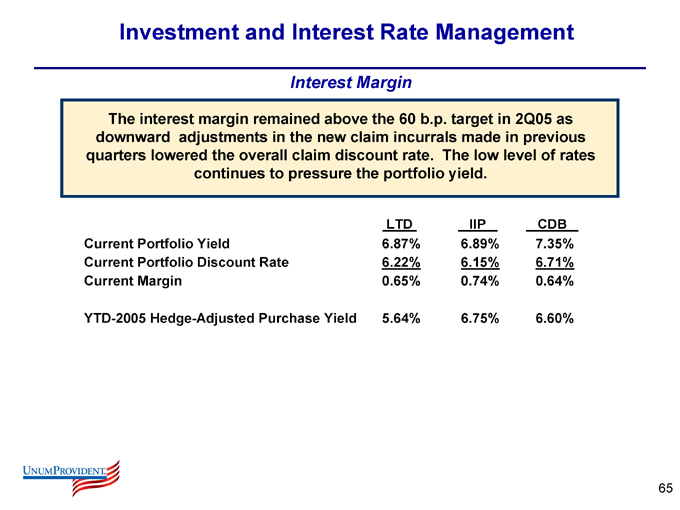

Interest Margin

The interest margin remained above the 60 b.p. target in 2Q05 as downward adjustments in the new claim incurrals made in previous quarters lowered the overall claim discount rate. The low level of rates continues to pressure the portfolio yield.

LTD IIP CDB

Current Portfolio Yield 6.87% 6.89% 7.35%

Current Portfolio Discount Rate 6.22% 6.15% 6.71%

Current Margin 0.65% 0.74% 0.64%

YTD-2005 Hedge-Adjusted Purchase Yield 5.64% 6.75% 6.60%

65

Investment and Interest Rate Management

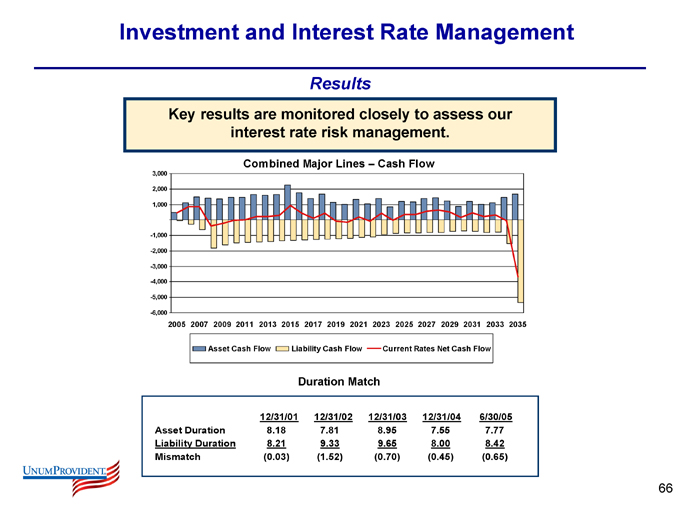

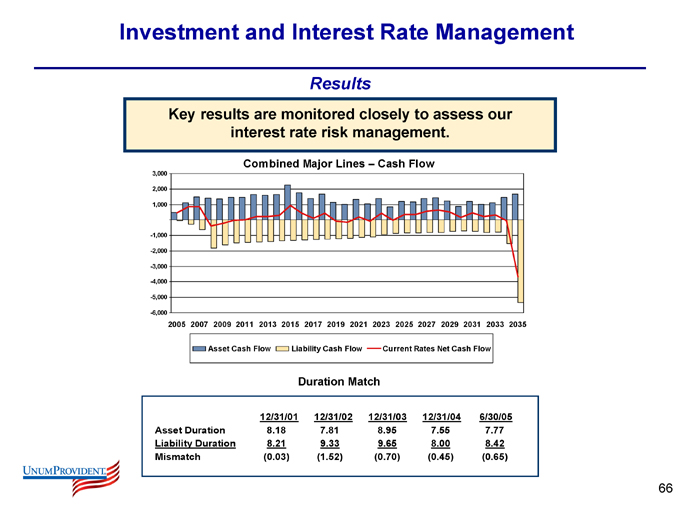

Results

Key results are monitored closely to assess our interest rate risk management.

Combined Major Lines – Cash Flow

3,000 2,000 1,000

-1,000 -2,000 -3,000 -4,000 -5,000 -6,000

2005 2007 2009 2011 2013 2015 2017 2019 2021 2023 2025 2027 2029 2031 2033 2035

Asset Cash Flow

Liability Cash Flow

Current Rates Net Cash Flow

Duration Match

12/31/01 12/31/02 12/31/03 12/31/04 6/30/05

Asset Duration 8.18 7.81 8.95 7.55 7.77

Liability Duration 8.21 9.33 9.65 8.00 8.42

Mismatch (0.03) (1.52) (0.70) (0.45) (0.65)

66

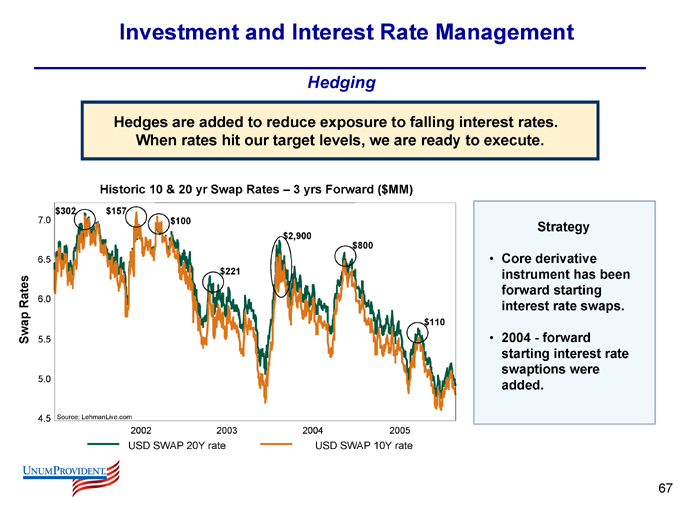

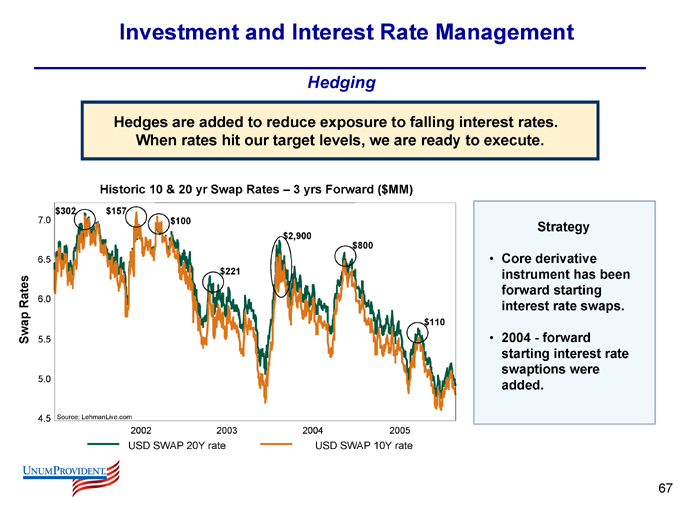

Investment and Interest Rate Management

Hedging

Hedges are added to reduce exposure to falling interest rates.

When rates hit our target levels, we are ready to execute.

Historic 10 & 20 yr Swap Rates – 3 yrs Forward ($MM) $302 $157 $100 $221 $2,900 $800 $110

Swap Rates

7.0 6.5 6.0 5.5 5.0 4.5

Source: LehmanLive.com

2002

2003

2004

2005

USD SWAP 20Y rate

USD SWAP 10Y rate

Strategy

Core derivative instrument has been forward starting interest rate swaps.

2004 - forward starting interest rate swaptions were added.

67

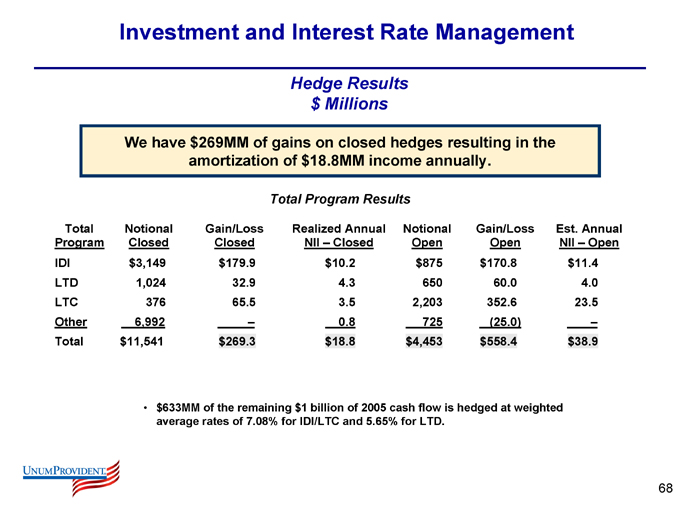

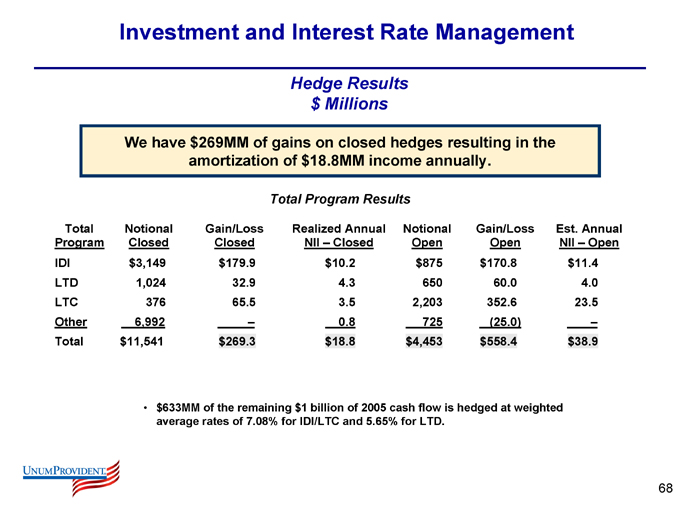

Investment and Interest Rate Management

Hedge Results $ Millions

We have $269MM of gains on closed hedges resulting in the amortization of $18.8MM income annually.

Total Program Results

Total Notional Gain/Loss Realized Annual Notional Gain/Loss Est. Annual

Program Closed Closed NII – Closed Open Open NII – Open

IDI $3,149 $179.9 $10.2 $875 $170.8 $11.4

LTD 1,024 32.9 4.3 650 60.0 4.0

LTC 376 65.5 3.5 2,203 352.6 23.5

Other 6,992 – 0.8 725 (25.0) –

Total $11,541 $269.3 $18.8 $4,453 $558.4 $38.9

$633MM of the remaining $1 billion of 2005 cash flow is hedged at weighted average rates of 7.08% for IDI/LTC and 5.65% for LTD.

68

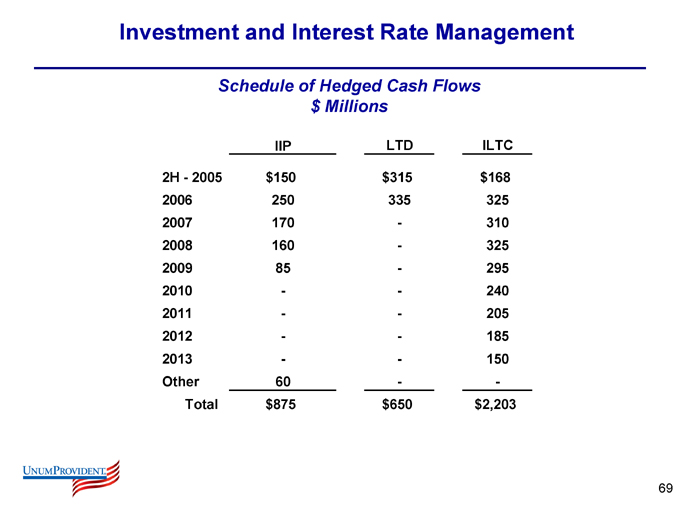

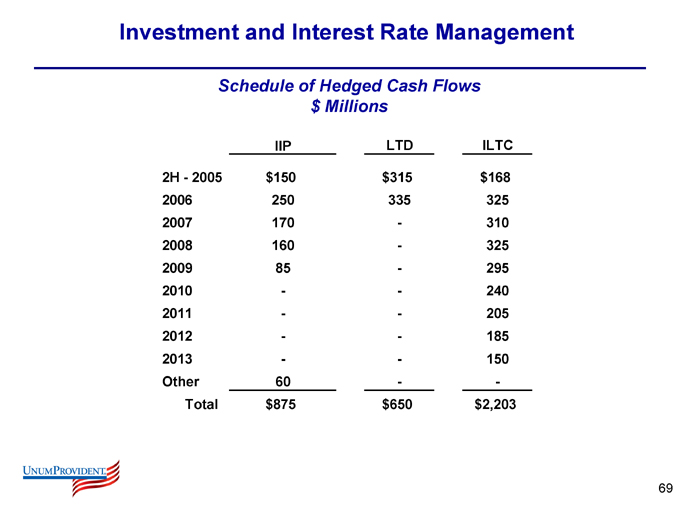

Investment and Interest Rate Management

Schedule of Hedged Cash Flows $ Millions

IIP LTD ILTC

2H - 2005 $150 $315 $168

2006 250 335 325

2007 170 — 310

2008 160 — 325

2009 85 — 295

2010 — — 240

2011 — — 205

2012 — — 185

2013 — — 150

Other 60 — —

Total $875 $650 $2,203

69

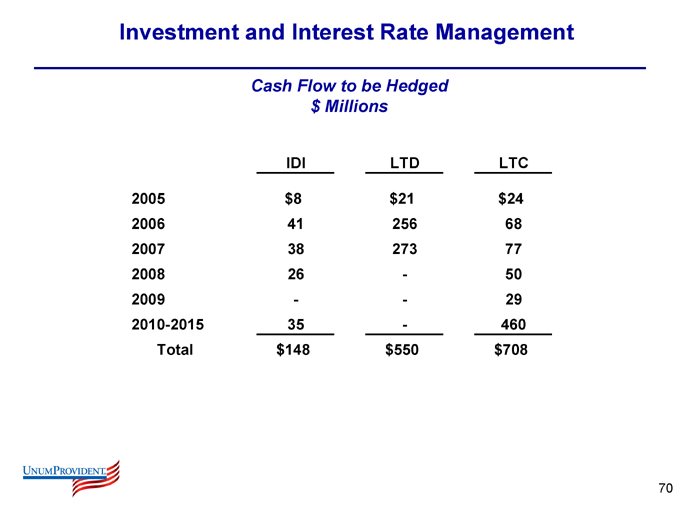

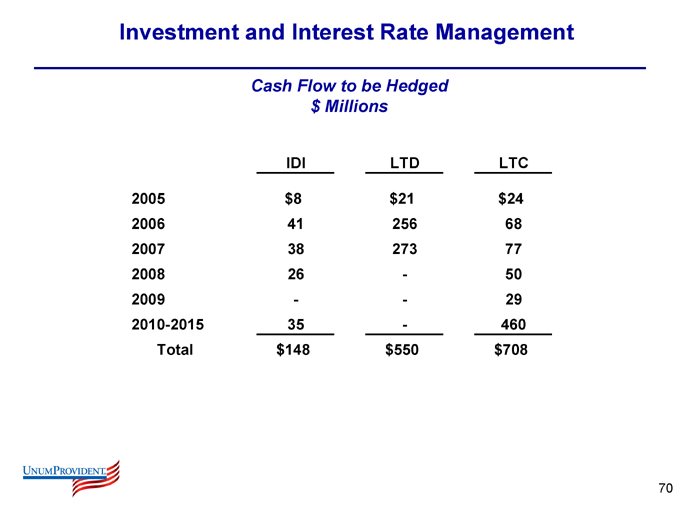

Investment and Interest Rate Management

Cash Flow to be Hedged $ Millions

IDI LTD LTC

2005 $8 $21 $24

2006 41 256 68

2007 38 273 77

2008 26 — 50

2009 — — 29

2010-2015 35 — 460

Total $148 $550 $708

70

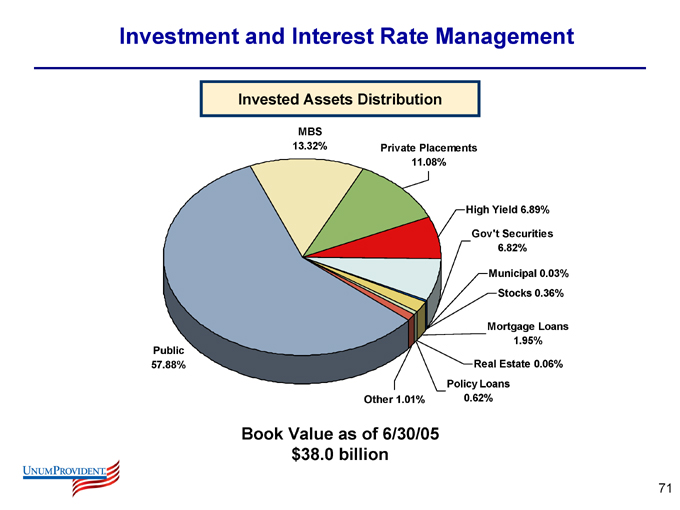

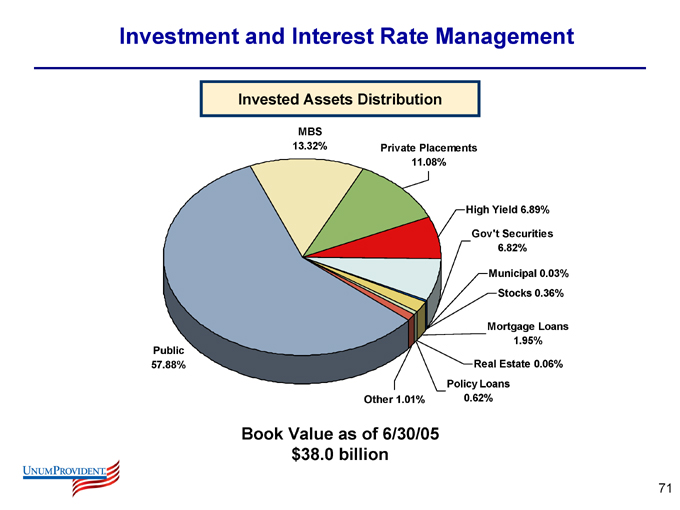

Investment and Interest Rate Management

Invested Assets Distribution

MBS 13.32%

Private Placements 11.08%

High Yield 6.89%

Gov’t Securities 6.82%

Municipal 0.03%

Stocks 0.36%

Mortgage Loans 1.95%

Real Estate 0.06%

Policy Loans 0.62%

Other 1.01%

Public 57.88%

Book Value as of 6/30/05 $38.0 billion

71

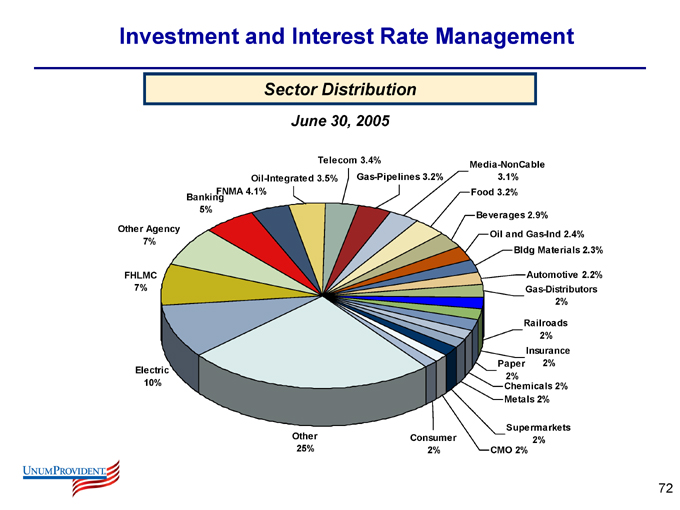

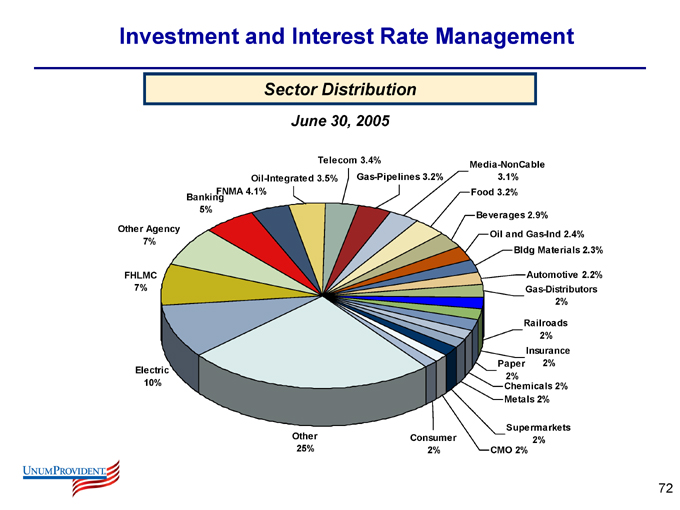

Investment and Interest Rate Management

Sector Distribution

June 30, 2005

Electric 10%

FHLMC

7%

Other Agency 7%

FNMA 4.1% Banking 5%

Oil-Integrated 3.5%

Telecom 3.4%

Gas-Pipelines 3.2%

Media-NonCable 3.1%

Food 3.2%

Beverages 2.9%

Oil and Gas-Ind 2.4%

Bldg Materials 2.3%

Automotive 2.2% Gas-Distributors 2%

Railroads 2%

Insurance 2%

Paper 2%

Chemicals 2%

Metals 2%

Supermarkets 2%

CMO 2%

Consumer 2%

Other 25%

72

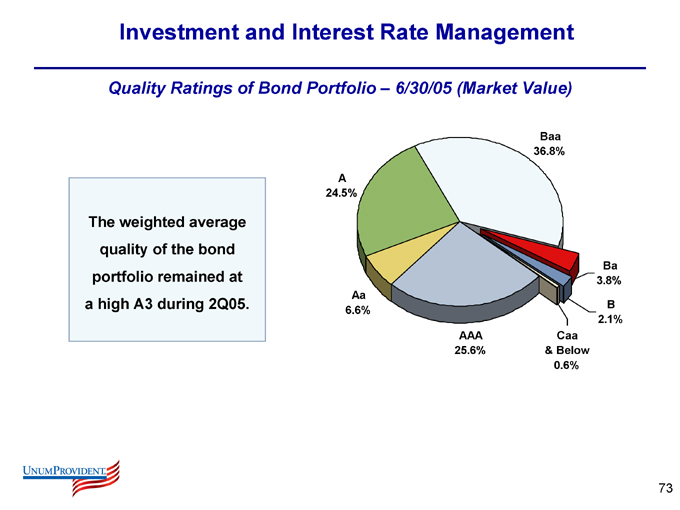

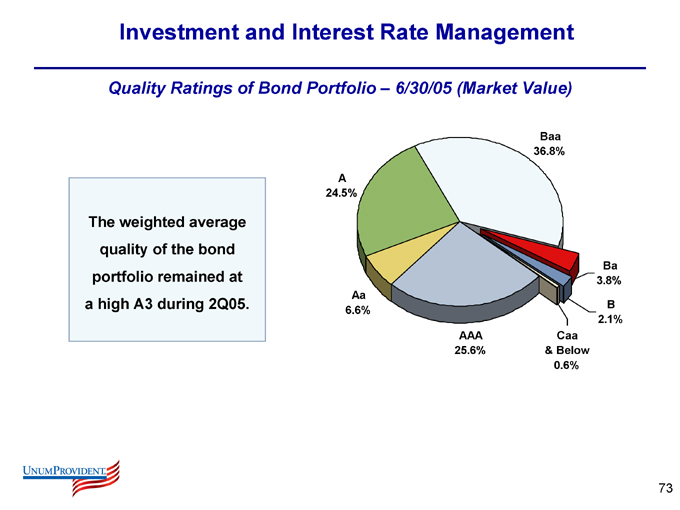

Investment and Interest Rate Management

Quality Ratings of Bond Portfolio – 6/30/05 (Market Value)

The weighted average quality of the bond portfolio remained at a high A3 during 2Q05.

A 24.5%

Aa 6.6%

AAA 25.6%

Caa & Below 0.6%

B 2.1%

Ba 3.8%

Baa 36.8%

73

Regulatory Update

74

California Settlement

Summary

Key terms of settlement:

Fine

Reassessment of 1997-2005 and changed claim practices

New policy forms – Group LTD and IIP approved for use November 1, 2005

California Department of Insurance intention to apply same standards to entire insurance industry

Non-recurring charge of $51.6 million after-tax

California Specific

Expenses to administer the re-assessment (approximately 26,000 claims)

Additional benefits to be paid under new total disability guidelines and other policy interpretations on existing open claims Benefit costs and reserves reopened from the reassessment Disruption due to implementation Fine of $8 million

Multi-State Agreement

Amendments to the multi-state agreement to include notice to certain 1997-1999 claims (approximately 29,500 claims)

Additional Reassessments

Reassessment of reinsurance assumed and ASO business (approximately 24,000 claims)

75

California Settlement

Summary

(cont.)

On-going Impact:

New interpretations will pressure California based earnings for UNM and entire industry. New interpretations suggest price increases are needed on LTD.

Clients will either pay higher premium or buy a product with reduced benefits to offset increased costs.

We have built monitoring mechanisms for:

Claims activity: What claim outcomes are we experiencing Renewal activity: What rate levels are sticking Sales activity: bid/ask spread on quotes

Cost reductions are likely to help offset the expected profit pressure on California business.

76

California Settlement

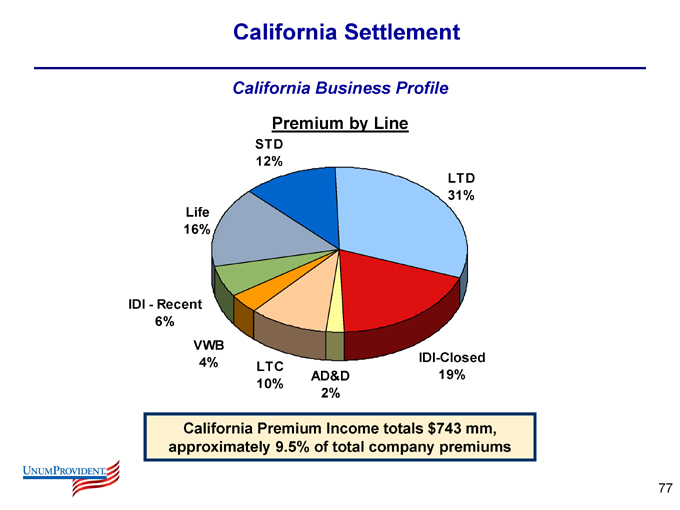

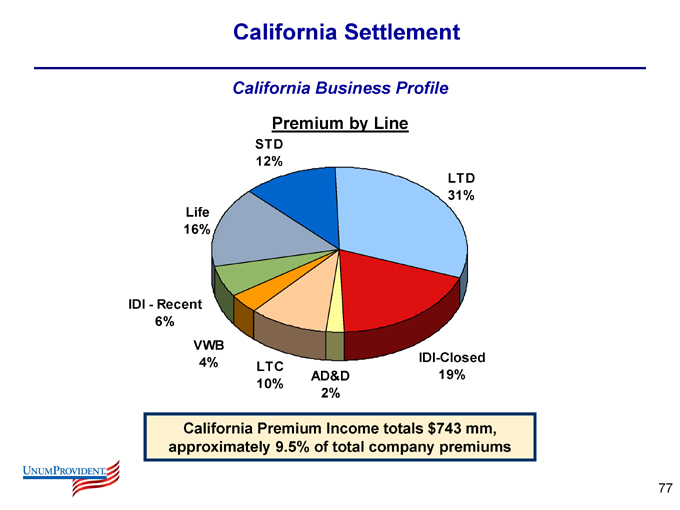

California Business Profile

Premium by Line

STD 12%

Life 16%

IDI - - Recent 6%

VWB 4%

LTC 10%

AD&D

2%

IDI-Closed 19%

LTD 31%

California Premium Income totals $743 mm, approximately 9.5% of total company premiums

77

Reassessment Update

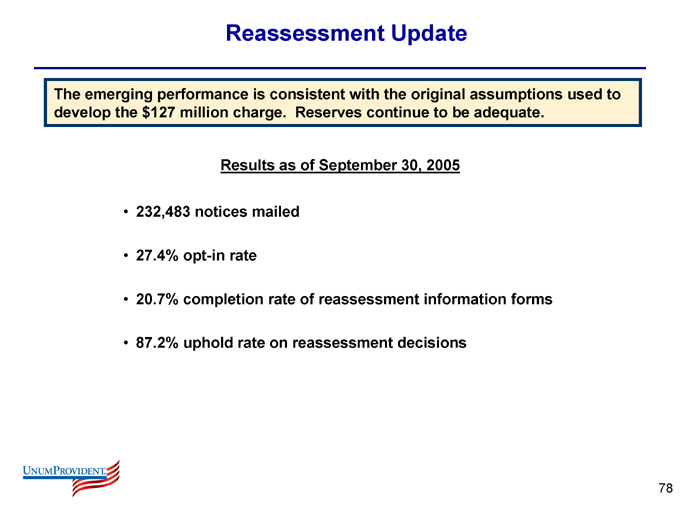

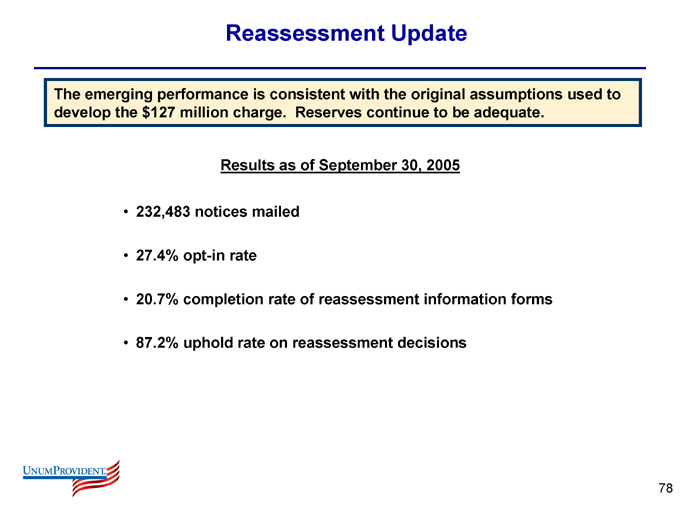

The emerging performance is consistent with the original assumptions used to develop the $127 million charge. Reserves continue to be adequate.

Results as of September 30, 2005

232,483 notices mailed

27.4% opt-in rate

20.7% completion rate of reassessment information forms

87.2% uphold rate on reassessment decisions

78

Summary

79

Summary

Financial goals of double digit BTOE growth over the next three years from operational improvements while generating $1 billion of excess capital

Performance Manage U.S. Brokerage

Optimize capital allocations to various businesses Free Cash Flow First to Leverage Continue Disciplined Risk Management

80

Questions

81

2005 Investor Meeting October 17, 2005

The Business Reviews

Business Review - U.S. Brokerage

84

Business Review – U.S. Brokerage

Introduction

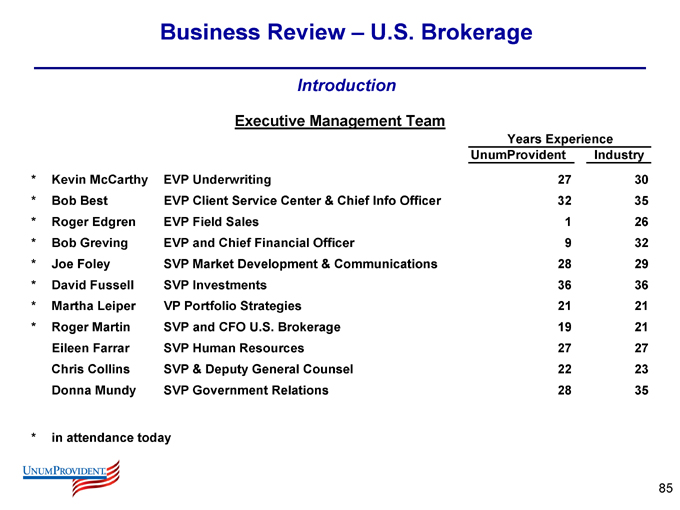

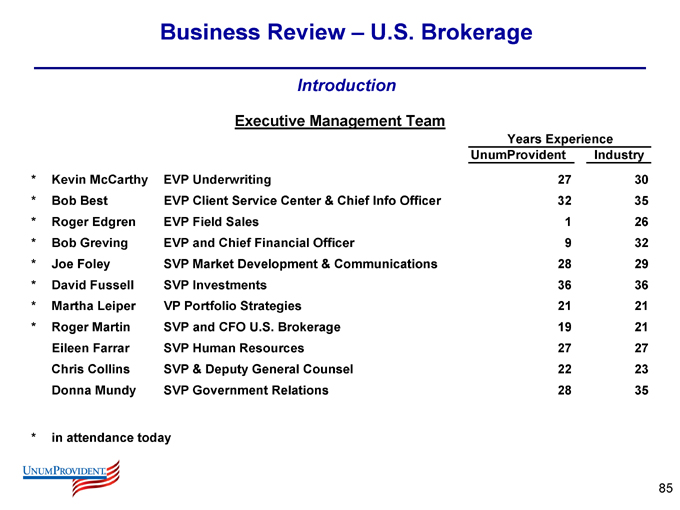

Executive Management Team

Years Experience

UnumProvident Industry

Kevin McCarthy EVP Underwriting 27 30

Bob Best EVP Client Service Center & Chief Info Officer 32 35

Roger Edgren EVP Field Sales 1 26

Bob Greving EVP and Chief Financial Officer 9 32

Joe Foley SVP Market Development & Communications 28 29

David Fussell SVP Investments 36 36

Martha Leiper VP Portfolio Strategies 21 21

Roger Martin SVP and CFO U.S. Brokerage 19 21

Eileen Farrar SVP Human Resources 27 27

Chris Collins SVP & Deputy General Counsel 22 23

Donna Mundy SVP Government Relations 28 35

in attendance today

85

Business Review – U.S. Brokerage

Introduction

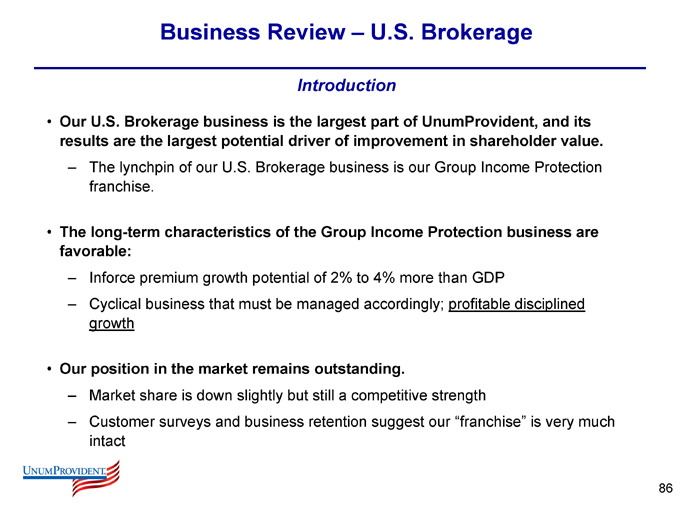

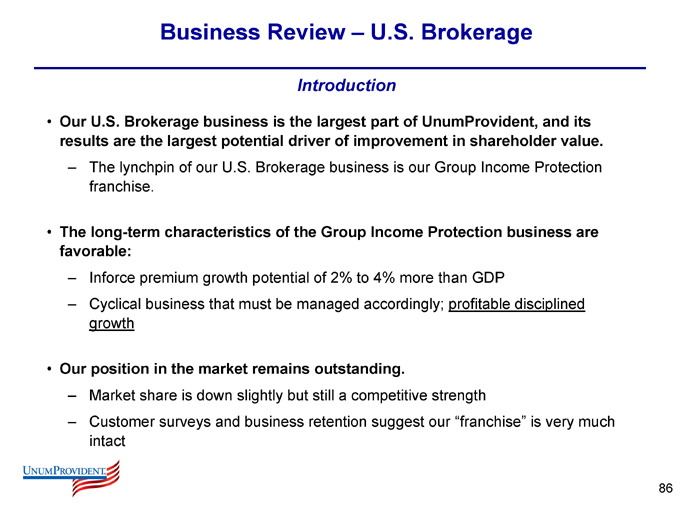

Our U.S. Brokerage business is the largest part of UnumProvident, and its results are the largest potential driver of improvement in shareholder value.

The lynchpin of our U.S. Brokerage business is our Group Income Protection franchise.

The long-term characteristics of the Group Income Protection business are favorable:

Inforce premium growth potential of 2% to 4% more than GDP

Cyclical business that must be managed accordingly; profitable disciplined growth

Our position in the market remains outstanding.

Market share is down slightly but still a competitive strength

Customer surveys and business retention suggest our “franchise” is very much intact

86

Business Review – U.S. Brokerage

Introduction

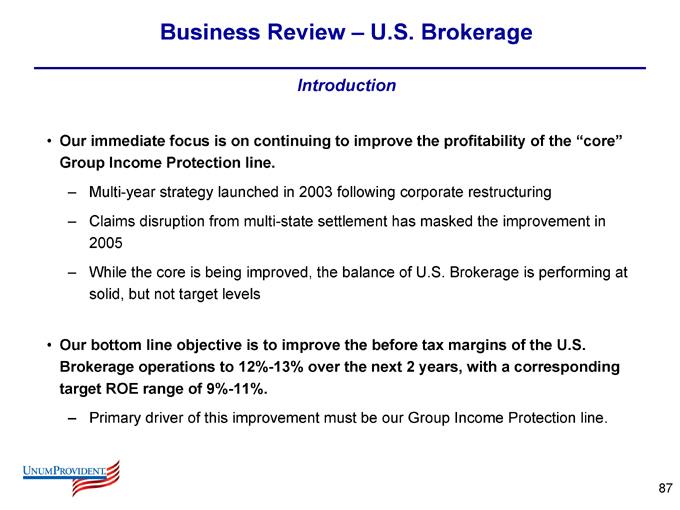

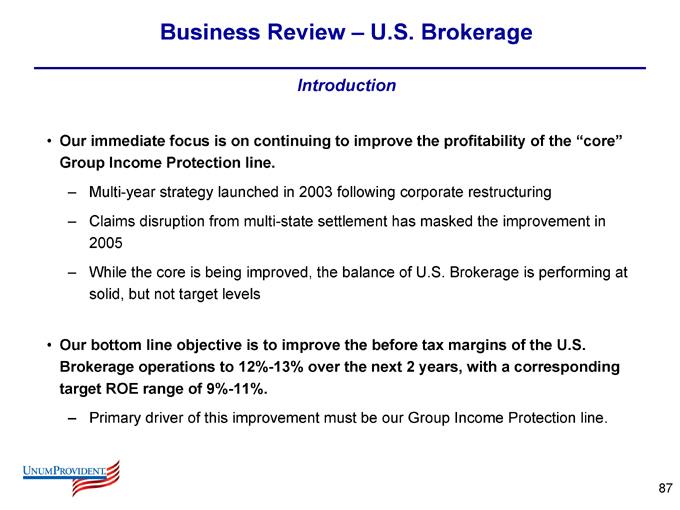

Our immediate focus is on continuing to improve the profitability of the “core” Group Income Protection line.

Multi-year strategy launched in 2003 following corporate restructuring

Claims disruption from multi-state settlement has masked the improvement in 2005 While the core is being improved, the balance of U.S. Brokerage is performing at solid, but not target levels

Our bottom line objective is to improve the before tax margins of the U.S. Brokerage operations to 12%-13% over the next 2 years, with a corresponding target ROE range of 9%-11%.

Primary driver of this improvement must be our Group Income Protection line.

87

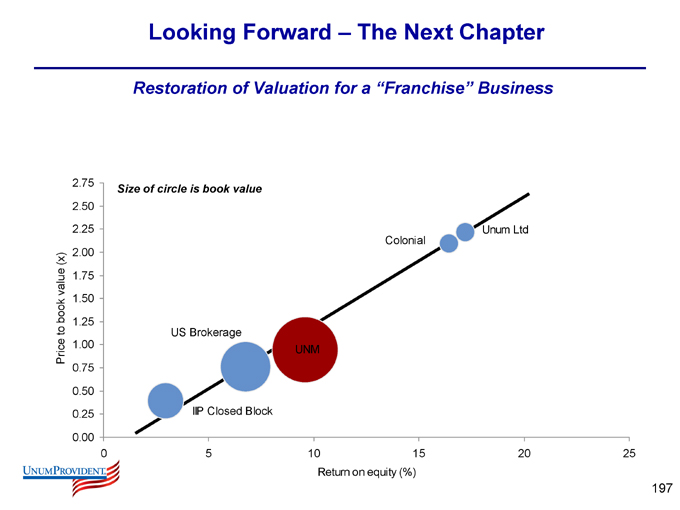

Business Review – U.S. Brokerage

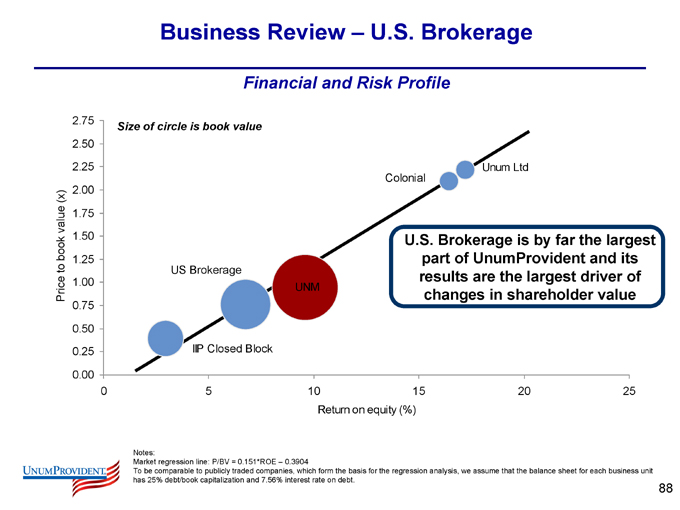

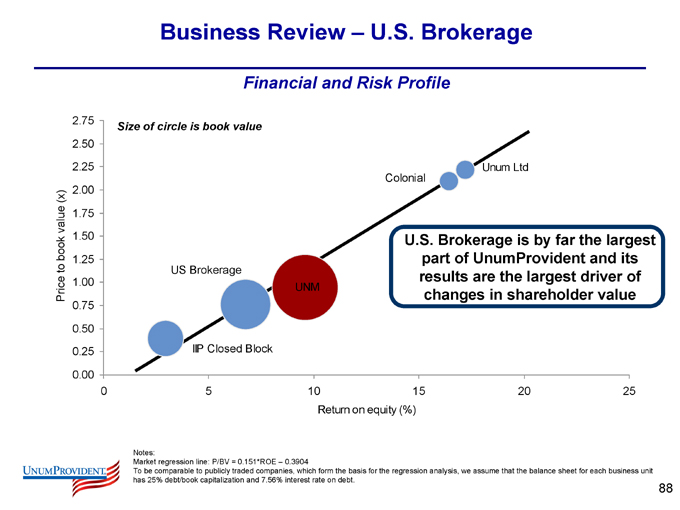

Financial and Risk Profile

Price to book value (x)

2.75

2.50

2.25

2.00

1.75

1.50

1.25

1.00

0.75

0.50

0.25

0.00

0

5

10

15

20

25

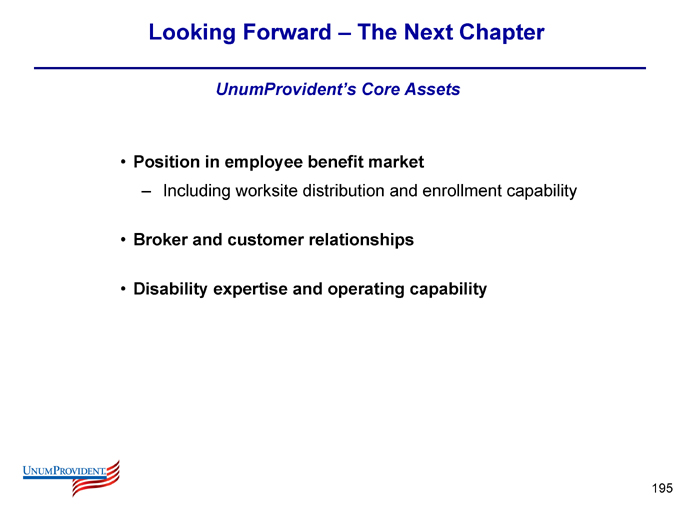

Size of circle is book value

US Brokerage

Colonial

Unum Ltd

UNM

IIP Closed Block

U.S. Brokerage is by far the largest part of UnumProvident and its results are the largest driver of changes in shareholder value

Return on equity (%)

Notes:

Market regression line: P/BV = 0.151*ROE – 0.3904

To be comparable to publicly traded companies, which form the basis for the regression analysis, we assume that the balance sheet for each business unit has 25% debt/book capitalization and 7.56% interest rate on debt.

88

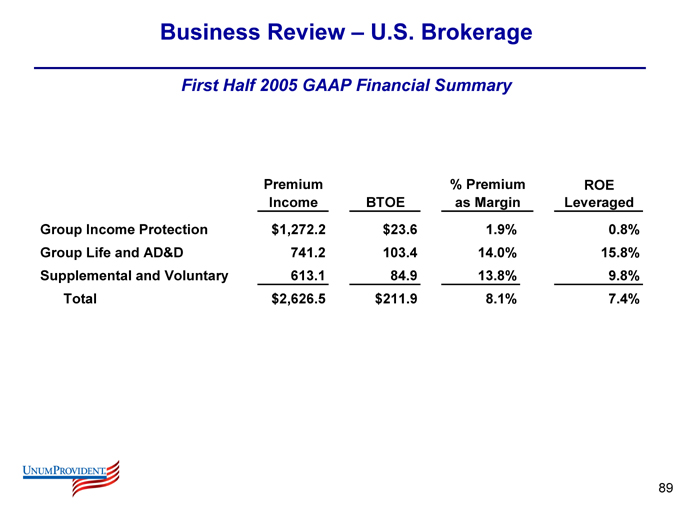

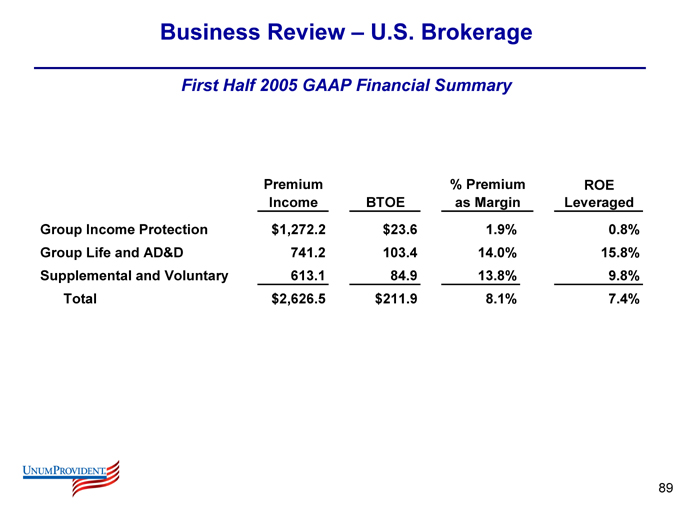

Business Review – U.S. Brokerage

First Half 2005 GAAP Financial Summary

Premium Income

% Premium ROE

BTOE as Margin Leveraged

Group Income Protection $1,272.2 $23.6 1.9% 0.8%

Group Life and AD&D 741.2 103.4 14.0% 15.8%

Supplemental and Voluntary 613.1 84.9 13.8% 9.8%

Total $2,626.5 $211.9 8.1% 7.4%

89

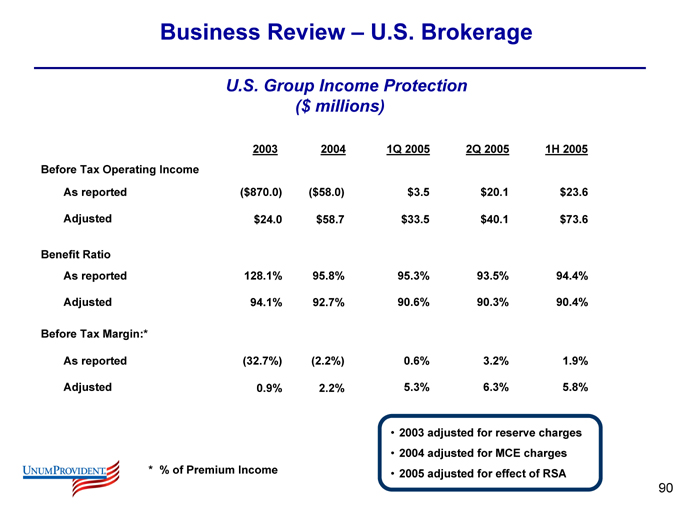

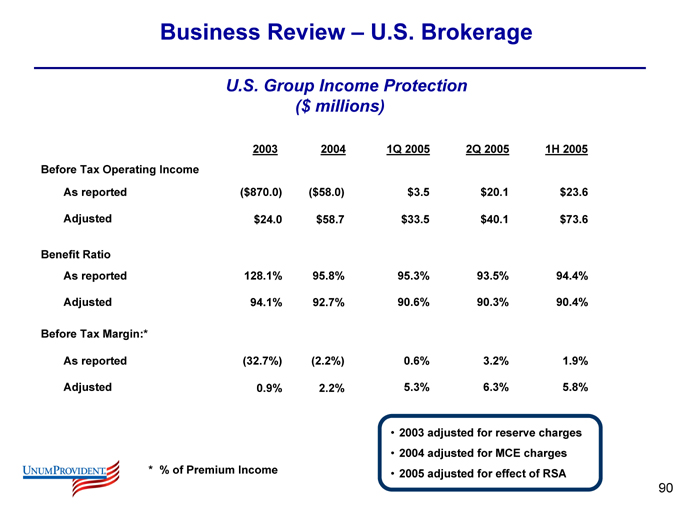

Business Review – U.S. Brokerage

U.S. Group Income Protection ($millions)

2003 2004 1Q 2005 2Q 2005 1H 2005

Before Tax Operating Income

As reported ($870.0) ($58.0) $3.5 $20.1 $23.6

Adjusted $24.0 $58.7 $33.5 $40.1 $73.6

Benefit Ratio

As reported 128.1% 95.8% 95.3% 93.5% 94.4%

Adjusted 94.1% 92.7% 90.6% 90.3% 90.4%

Before Tax Margin:*

As reported (32.7%) (2.2%) 0.6% 3.2% 1.9%

Adjusted 0.9% 2.2% 5.3% 6.3% 5.8%

% of Premium Income

2003 adjusted for reserve charges 2004 adjusted for MCE charges 2005 adjusted for effect of RSA

90

Operational Plans

91

Business Review – U.S. Brokerage

Operational Plans

Where will the margin improvement come from?

Stable benefit center performance at our long-range expectations Underwriting initiatives Operating effectiveness

92

Business Review – U.S. Brokerage

Operational Plans

Stable Benefit Center Performance at our long range expectations

Our immediate focus is on reducing the disruption associated with the implementation of the Regulatory Settlement Agreement.

Operating performance improved in 2Q compared to 1Q with monthly improvement in the quarter.

Disruption will continue in 2H-2005, but expected to continue to decline.

Our business plans to return to long-range performance include:

Improve inventory management and performance tracking.

Align resources with opportunity areas throughout the claims organization. Minimize process content within the Disability Benefit Specialist (DBS) role. Implement changes from California agreement.

93

Business Review – U.S. Brokerage

Operational Plans

Stable Benefit Center Performance at our long range expectations

Reassessment mailing and claims review continue to progress.

Early results consistent with expectations.

Continue efforts toward achieving quality and performance.

Reduce operating costs – NOT at the expense of quality and performance.

94

Business Review – U.S. Brokerage

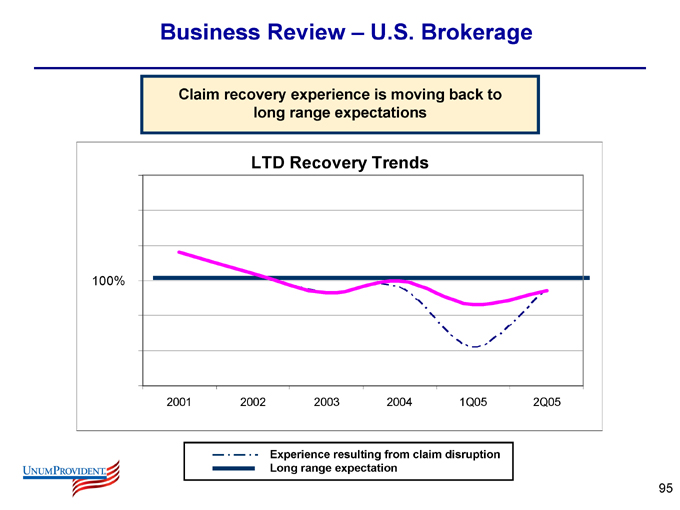

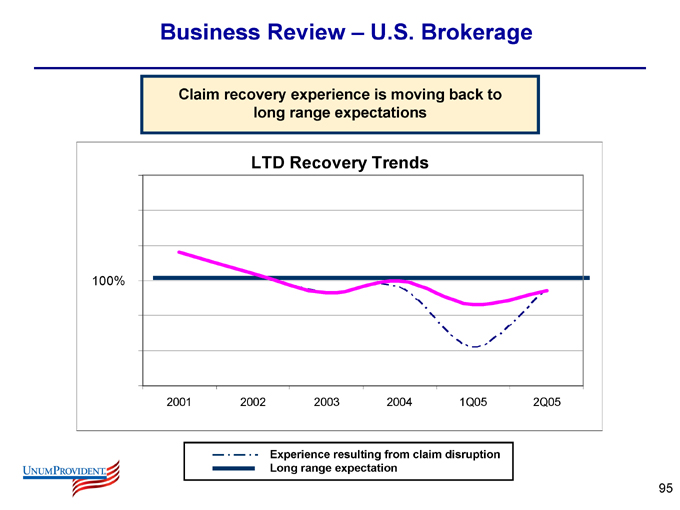

Claim recovery experience is moving back to long range expectations

LTD Recovery Trends

100%

2001

2002

2003

2004

1Q05

2Q05

Experience resulting from claim disruption Long range expectation

95

Business Review – U.S. Brokerage

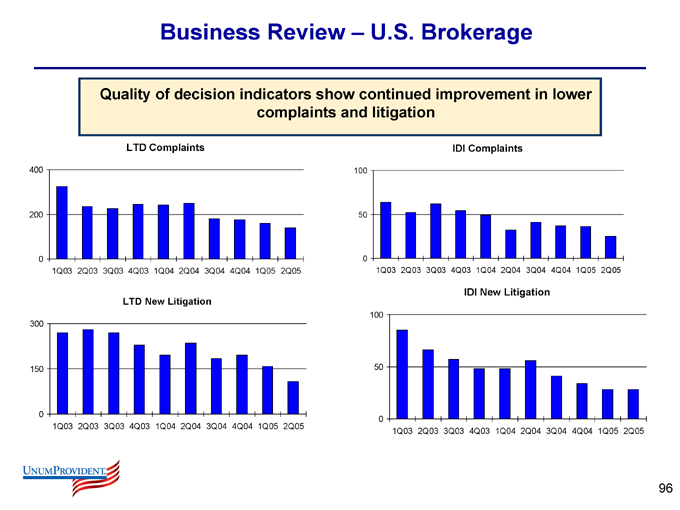

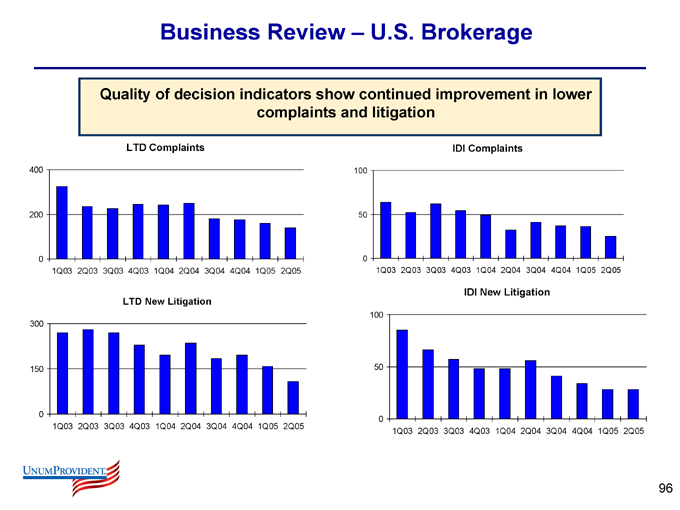

Quality of decision indicators show continued improvement in lower complaints and litigation

LTD Complaints

400

200

0

1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05

IDI Complaints

100

50

0

1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05

LTD New Litigation

300

150

0

1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05

IDI New Litigation

100

50

0

1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05

96

Business Review – U.S. Brokerage

Underwriting Initiatives

Our underwriting strategy: Continue to stay the course

Selectively increase new business pricing Execute renewal program Manage persistency Shift new sales toward desired segments Increased emphasis on segmentation

97

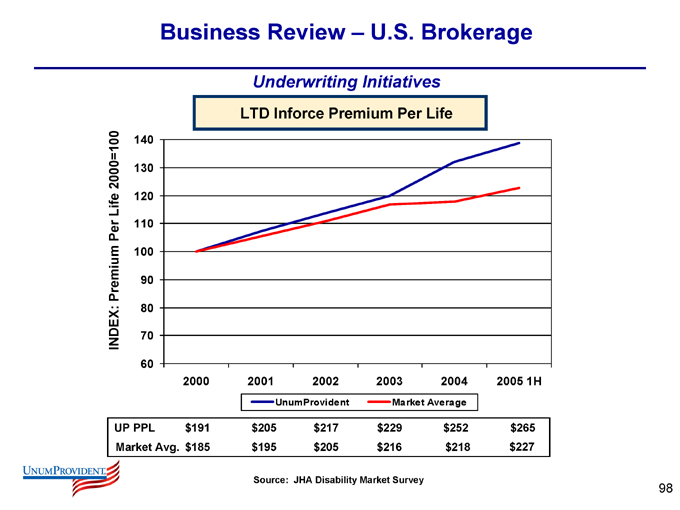

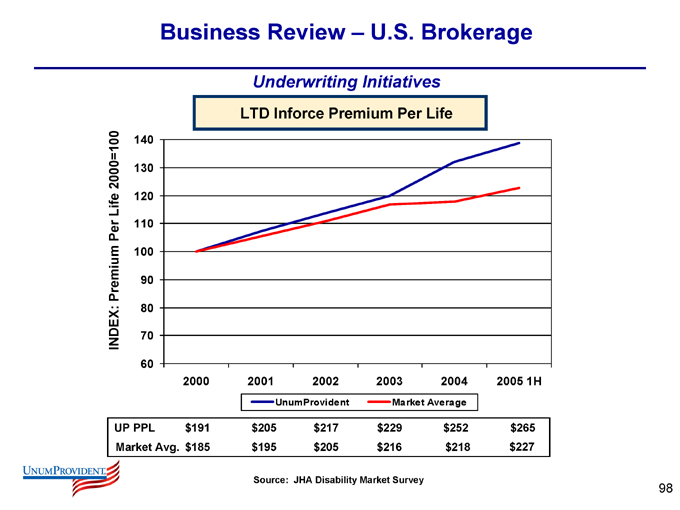

Business Review – U.S. Brokerage

Underwriting Initiatives

LTD Inforce Premium Per Life

INDEX: Premium Per Life 2000=100

140

130

120

110

100

90

80

70

60

2000

2001

2002

2003

2004

2005 1H

UnumProvident

Market Average

UP PPL

$191 $205 $217 $229 $252 $265

Market Avg.

$185 $195 $205 $216 $218 $227

Source: JHA Disability Market Survey

98

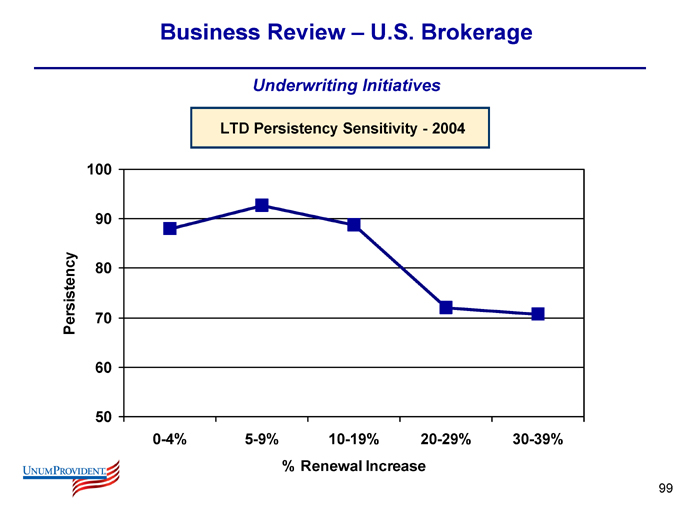

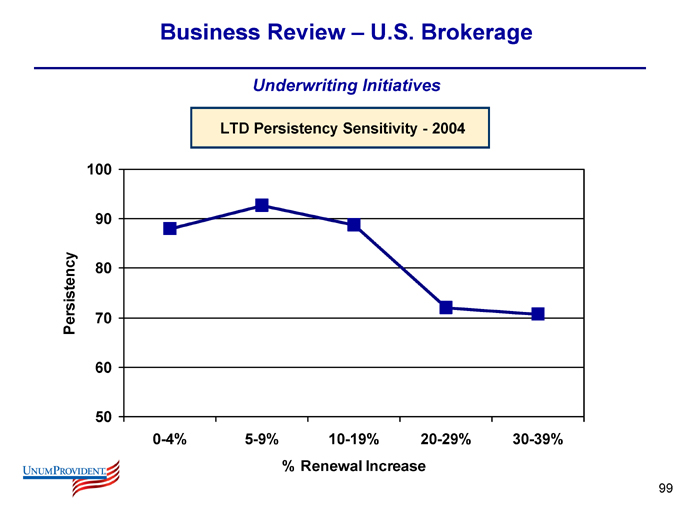

Business Review – U.S. Brokerage

Underwriting Initiatives

LTD Persistency Sensitivity - 2004

Persistency

100

90

80

70

60

50

0-4%

5-9%

10-19%

20-29%

30-39%

% Renewal Increase

99

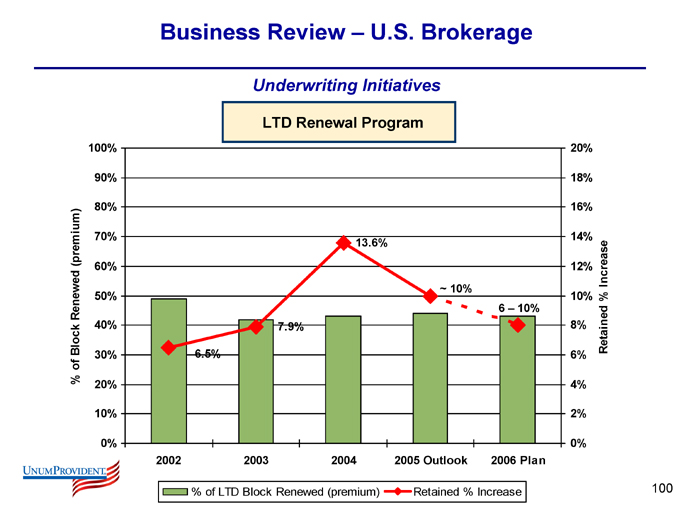

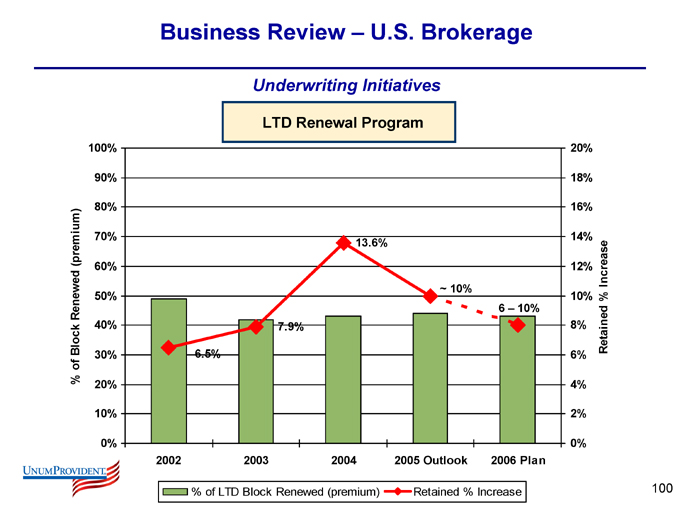

Business Review – U.S. Brokerage

Underwriting Initiatives

LTD Renewal Program

% of Block Renewed (premium)

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

6.5%

7.9%

13.6%

~ 10%

6 – 10%

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

Retained % Increase

2002

2003

2004

2005 Outlook

2006 Plan

% of LTD Block Renewed (premium)

Retained % Increase

100

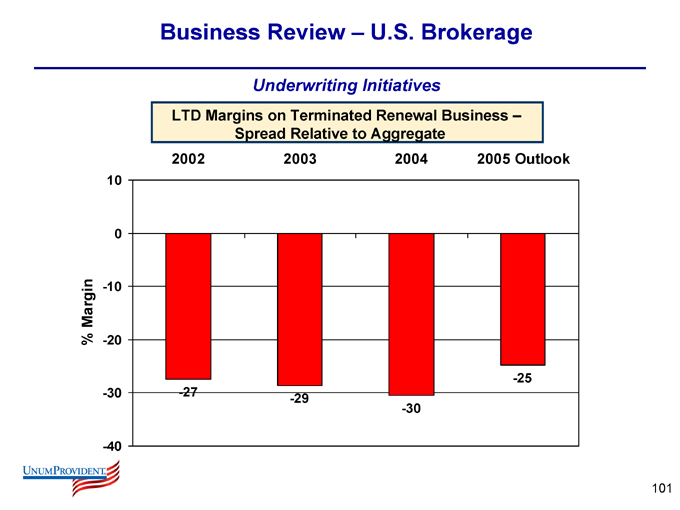

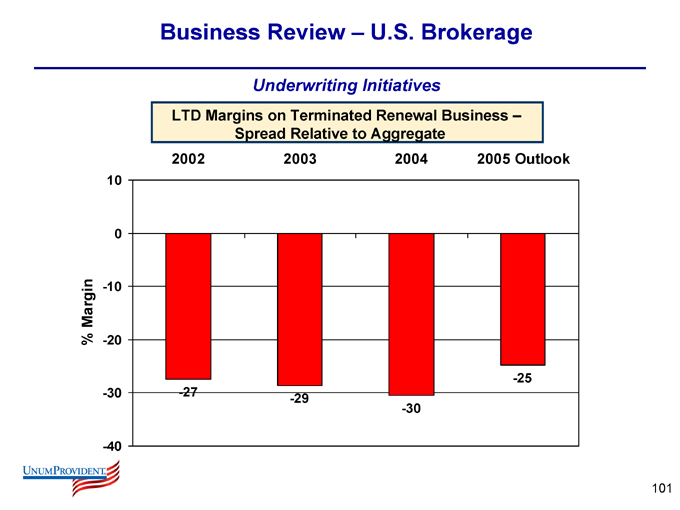

Business Review – U.S. Brokerage

Underwriting Initiatives

LTD Margins on Terminated Renewal Business – Spread Relative to Aggregate

2002 2003 2004 2005 Outlook

% Margin

10 0 -10 -20 -30 -40

-27

-29

-30

-25

101

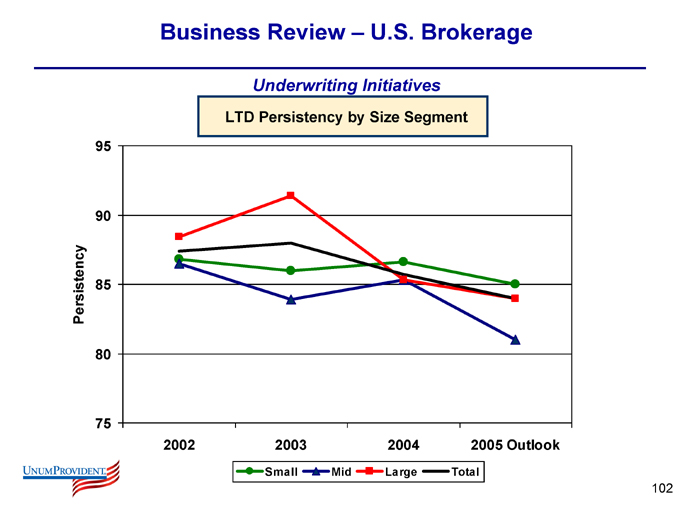

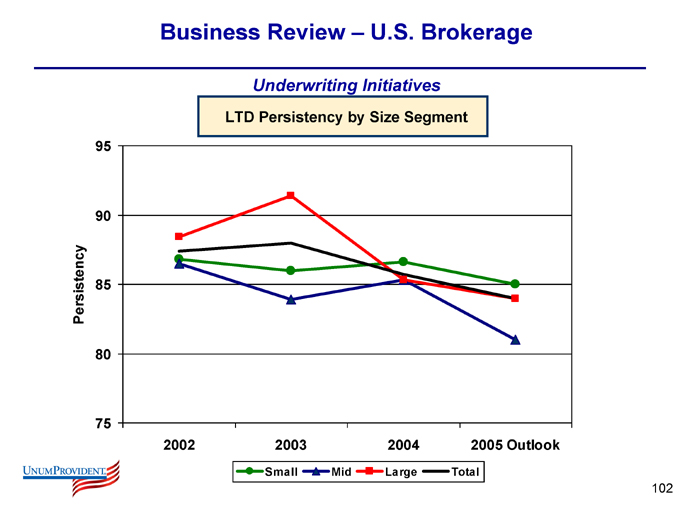

Business Review – U.S. Brokerage

Underwriting Initiatives

LTD Persistency by Size Segment

Persistency

95 90 85 80 75

2002

2003

2004

2005 Outlook

Small

Mid

Large

Total

102

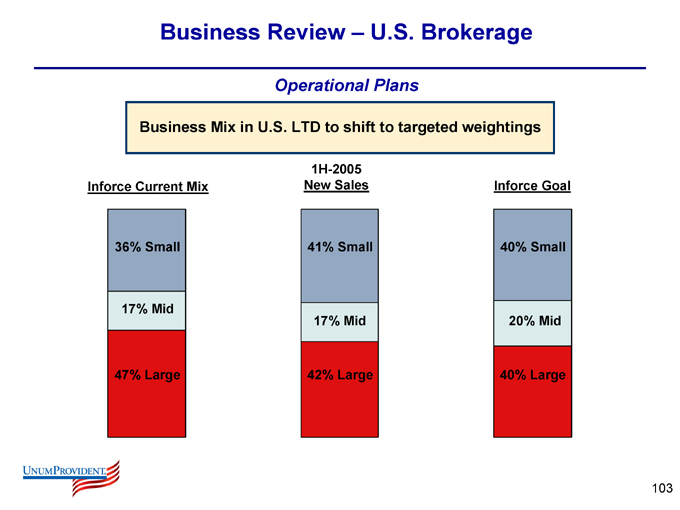

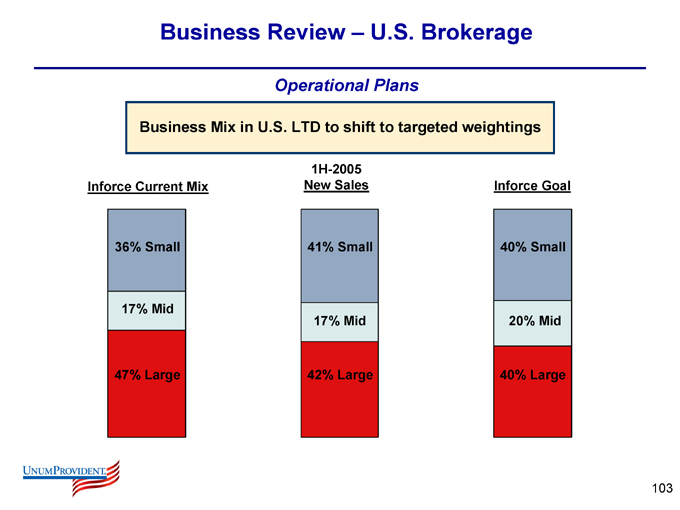

Business Review – U.S. Brokerage

Operational Plans

Business Mix in U.S. LTD to shift to targeted weightings

Inforce Current Mix

36% Small

17% Mid

47% Large

1H-2005 New Sales

41% Small

17% Mid

42% Large

Inforce Goal

40% Small

20% Mid

40% Large

103

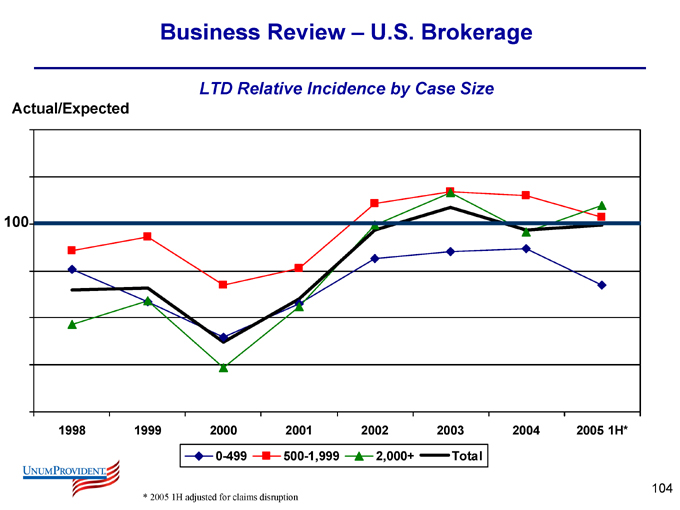

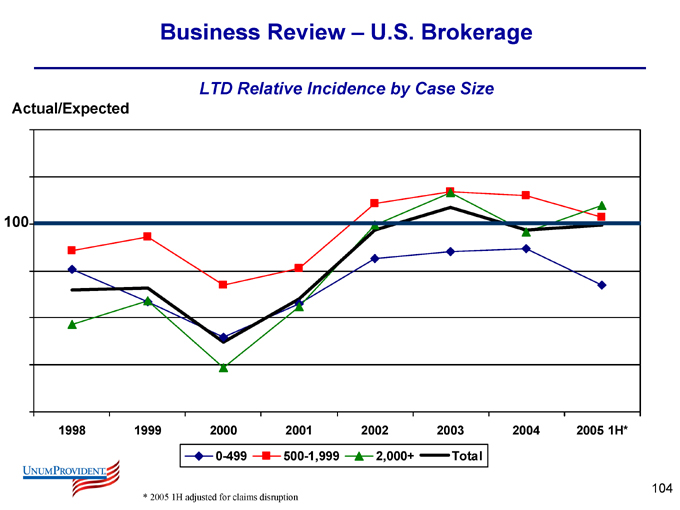

Business Review – U.S. Brokerage

LTD Relative Incidence by Case Size

Actual/Expected

100

1998

1999

2000

2001

2002

2003

2004

2005 1H*

0-499

500-1,999

2,000+

Total

* 2005 1H adjusted for claims disruption

104

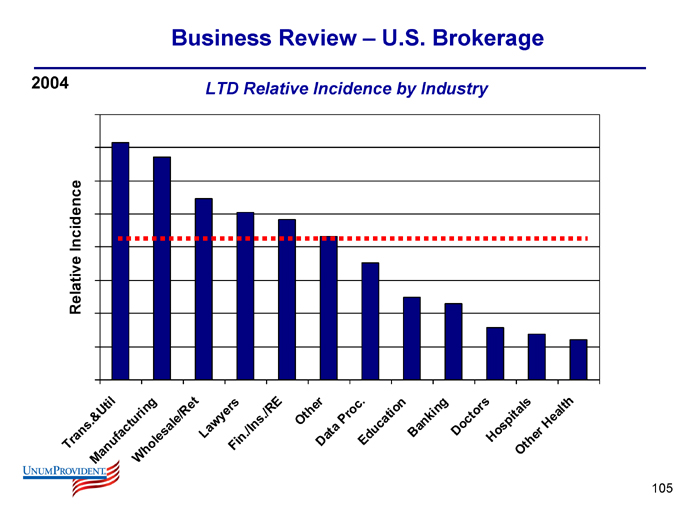

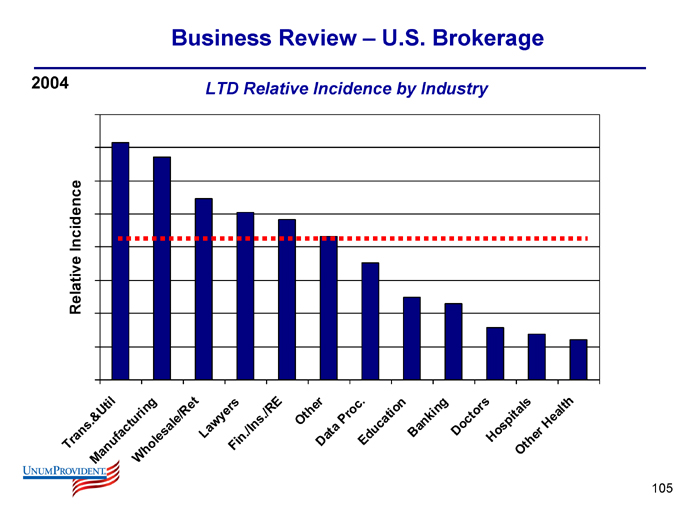

Business Review – U.S. Brokerage

2004

LTD Relative Incidence by Industry

Relative Incidence

Trans. &Util

Manuf acturing

Wholesale/Ret

Lawyers

Fin.

/Ins.

/RE

Other

Data

Proc.

Education

Banking Doctors

Hospitals

Other

Health

105

Business Review – U.S. Brokerage

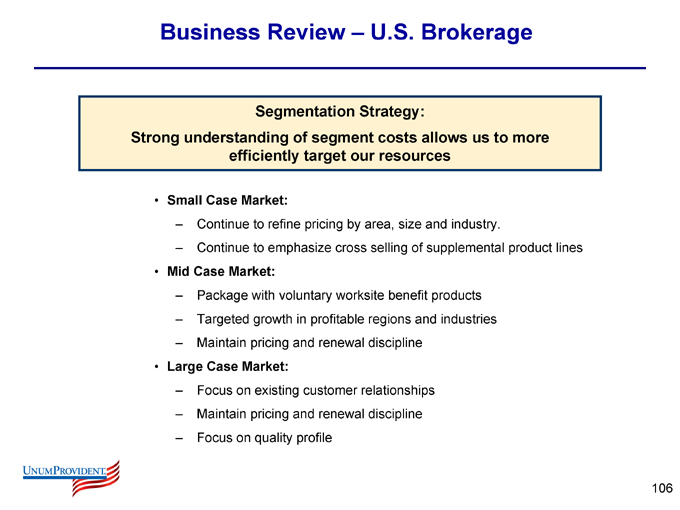

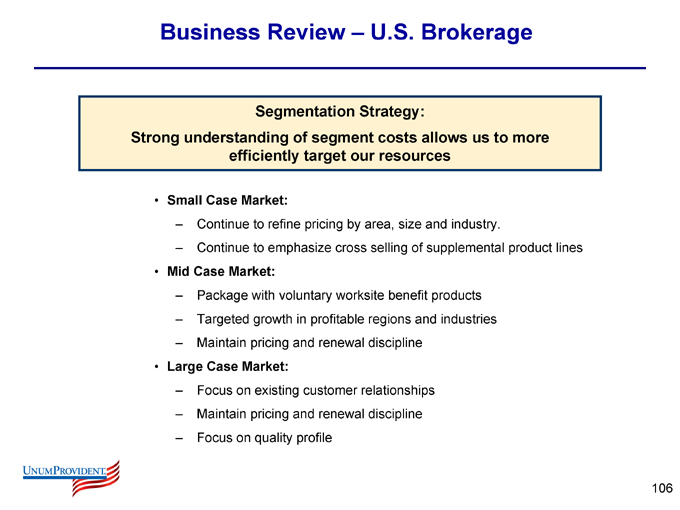

Segmentation Strategy:

Strong understanding of segment costs allows us to more efficiently target our resources

Small Case Market:

Continue to refine pricing by area, size and industry.

Continue to emphasize cross selling of supplemental product lines

Mid Case Market:

Package with voluntary worksite benefit products

Targeted growth in profitable regions and industries

Maintain pricing and renewal discipline

Large Case Market:

Focus on existing customer relationships

Maintain pricing and renewal discipline

Focus on quality profile

106

Operating Effectiveness

107

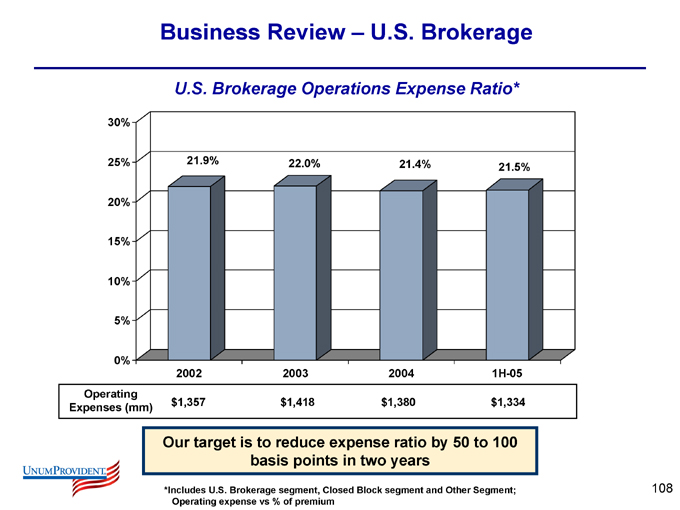

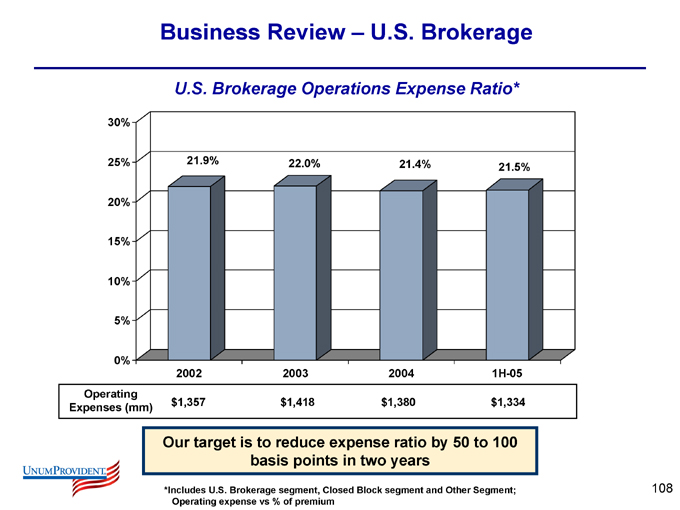

Business Review – U.S. Brokerage

U.S. Brokerage Operations Expense Ratio*

30% 25% 20% 15% 10% 5% 0%

21.9%

22.0%

21.4%

21.5%

2002

2003

2004

1H-05

Operating Expenses (mm) $1,357 $1,418 $1,380 $1,334

Our target is to reduce expense ratio by 50 to 100 basis points in two years

*Includes U.S. Brokerage segment, Closed Block segment and Other Segment; Operating expense vs % of premium

108

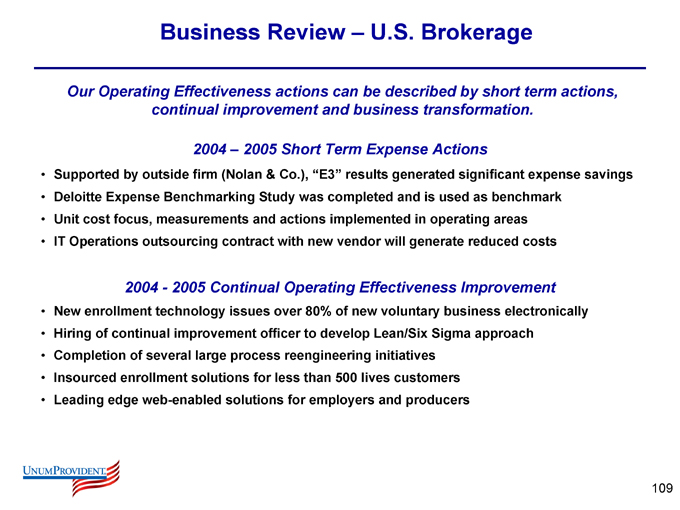

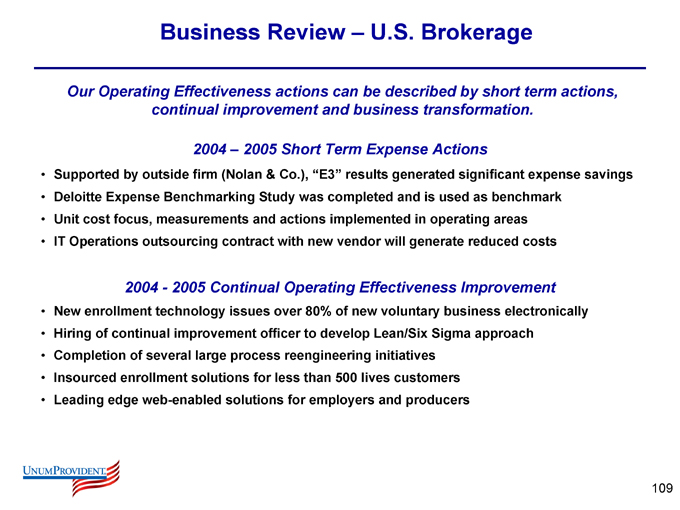

Business Review – U.S. Brokerage

Our Operating Effectiveness actions can be described by short term actions, continual improvement and business transformation.

2004 – 2005 Short Term Expense Actions

Supported by outside firm (Nolan & Co.), “E3” results generated significant expense savings

Deloitte Expense Benchmarking Study was completed and is used as benchmark

Unit cost focus, measurements and actions implemented in operating areas

IT Operations outsourcing contract with new vendor will generate reduced costs

2004—2005 Continual Operating Effectiveness Improvement

New enrollment technology issues over 80% of new voluntary business electronically

Hiring of continual improvement officer to develop Lean/Six Sigma approach

Completion of several large process reengineering initiatives

Insourced enrollment solutions for less than 500 lives customers

Leading edge web-enabled solutions for employers and producers

109

Business Review – U.S. Brokerage

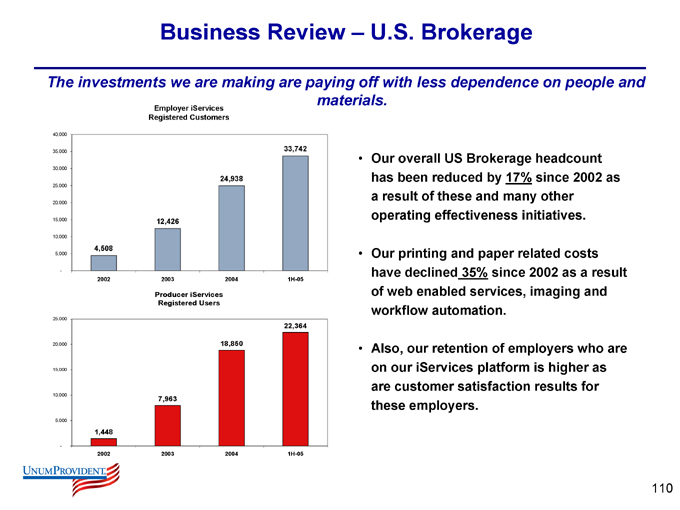

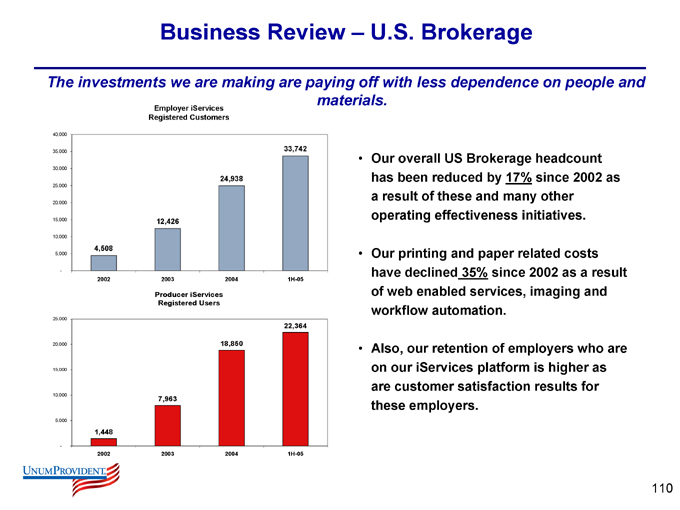

The investments we are making are paying off with less dependence on people and materials.

Employer iServices Registered Customers

40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 -

4,508

12,426

24,938

33,742

2002

2003

2004

1H-05

Producer iServices Registered Users

25,000 20,000 15,000 10,000 5,000 -

1,448

7,963

18,850

22,364

2002

2003

2004

1H-05

Our overall US Brokerage headcount has been reduced by 17% since 2002 as a result of these and many other operating effectiveness initiatives.

Our printing and paper related costs have declined 35% since 2002 as a result of web enabled services, imaging and workflow automation.

Also, our retention of employers who are on our iServices platform is higher as are customer satisfaction results for these employers.

110

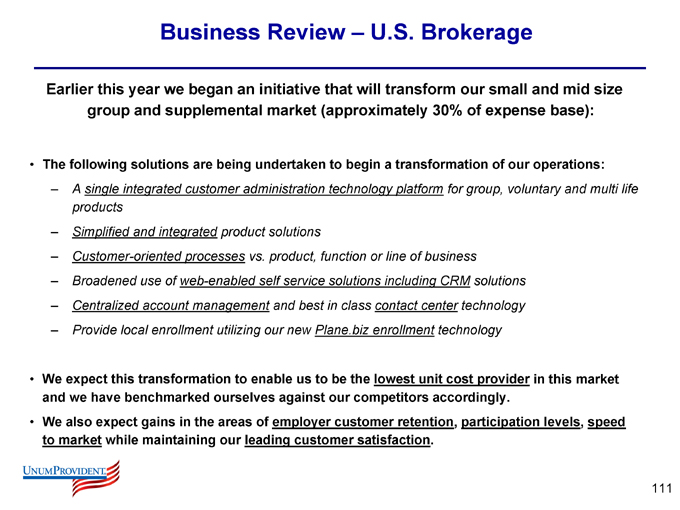

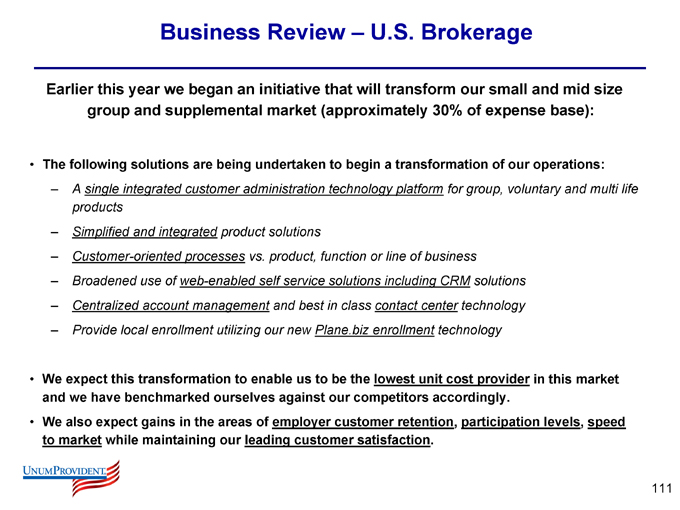

Business Review – U.S. Brokerage

Earlier this year we began an initiative that will transform our small and mid size group and supplemental market (approximately 30% of expense base):

The following solutions are being undertaken to begin a transformation of our operations:

A single integrated customer administration technology platform for group, voluntary and multi life products

Simplified and integrated product solutions

Customer-oriented processes vs. product, function or line of business

Broadened use of web-enabled self service solutions including CRM solutions

Centralized account management and best in class contact center technology

Provide local enrollment utilizing our new Plane.biz enrollment technology

We expect this transformation to enable us to be the lowest unit cost provider in this market and we have benchmarked ourselves against our competitors accordingly.

We also expect gains in the areas of employer customer retention, participation levels, speed to market while maintaining our leading customer satisfaction.

111

Other U.S. Brokerage Product Lines

112

Business Review – U.S. Brokerage

Other U.S. Brokerage Product Lines

Group Life and AD&D

Supplemental and Voluntary

Individual Income Protection

Long-term Care

Voluntary Worksite Benefits

Whole life

ISTD

Critical Illness

Accident

MedSupport

113

Business Review – Other U.S. Brokerage Product Lines

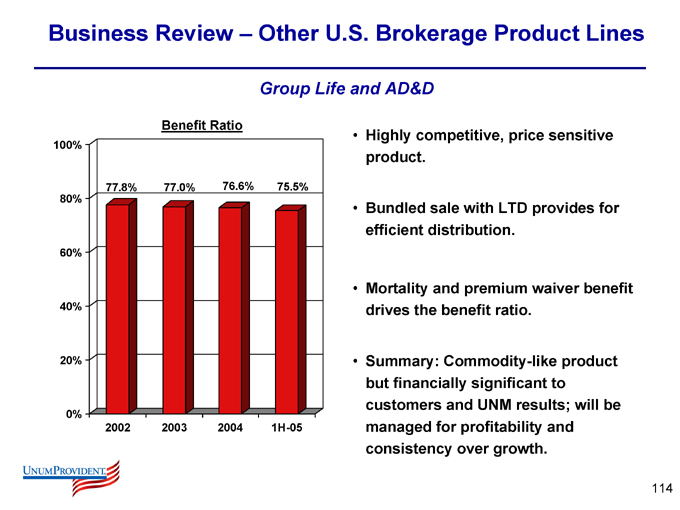

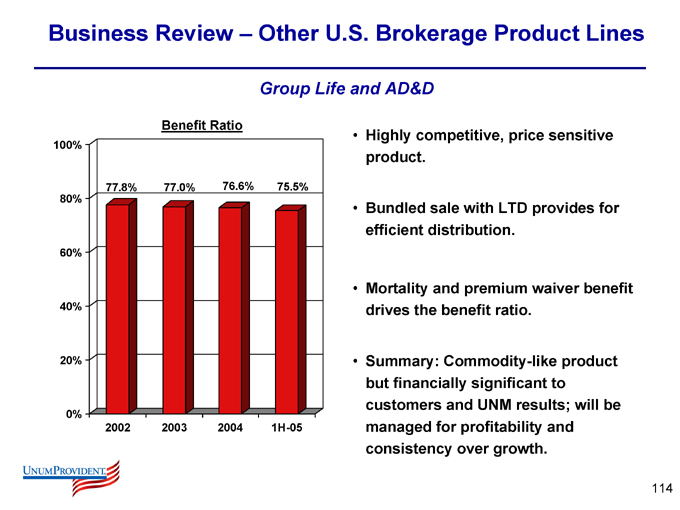

Group Life and AD&D

Benefit Ratio

100% 80% 60% 40% 20% 0%

77.8%

77.0%

76.6%

75.5%

2002

2003

2004

1H-05

Highly competitive, price sensitive product.

Bundled sale with LTD provides for efficient distribution.

Mortality and premium waiver benefit drives the benefit ratio.

Summary: Commodity-like product but financially significant to customers and UNM results; will be managed for profitability and consistency over growth.

114

Business Review – Other U.S. Brokerage Product Lines

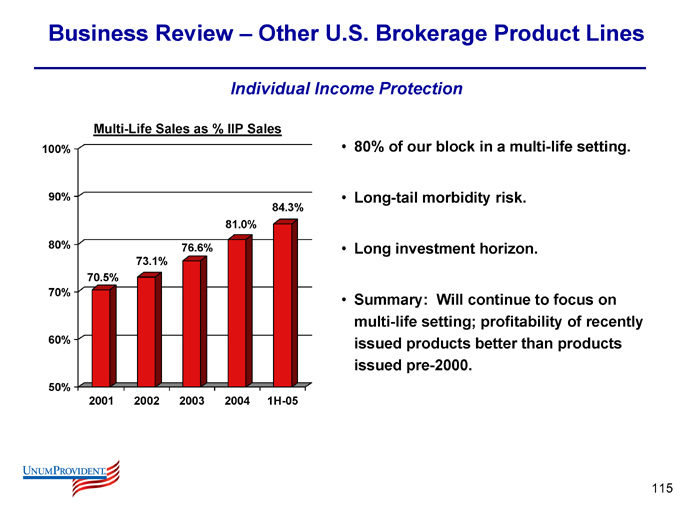

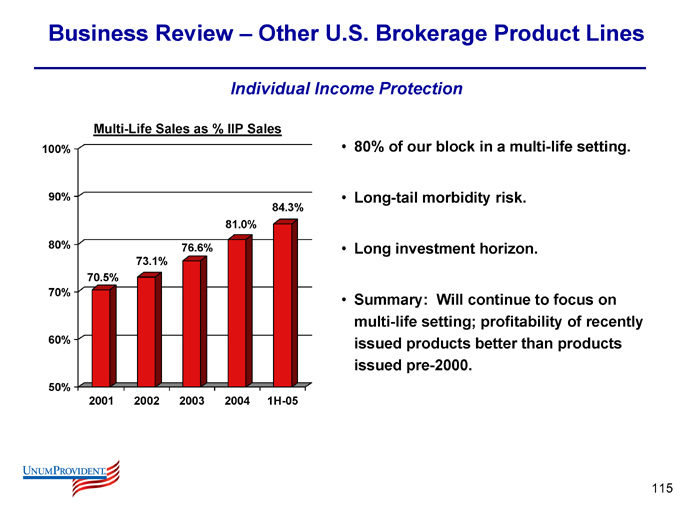

Individual Income Protection

Multi-Life Sales as % IIP Sales

100% 90% 80% 70% 60% 50%

70.5%

73.1%

76.6%

81.0%

84.3%

2001

2002

2003

2004

1H-05

80% of our block in a multi-life setting.

Long-tail morbidity risk.

Long investment horizon.

Summary: Will continue to focus on multi-life setting; profitability of recently issued products better than products issued pre-2000.

115

Business Review – Other U.S. Brokerage Product Lines

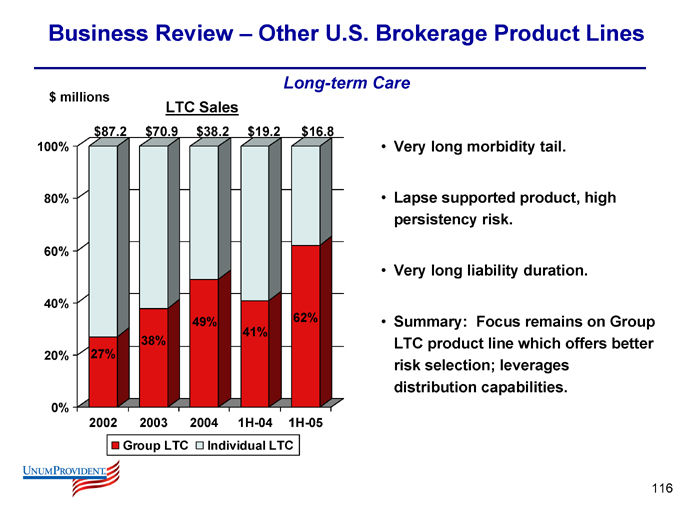

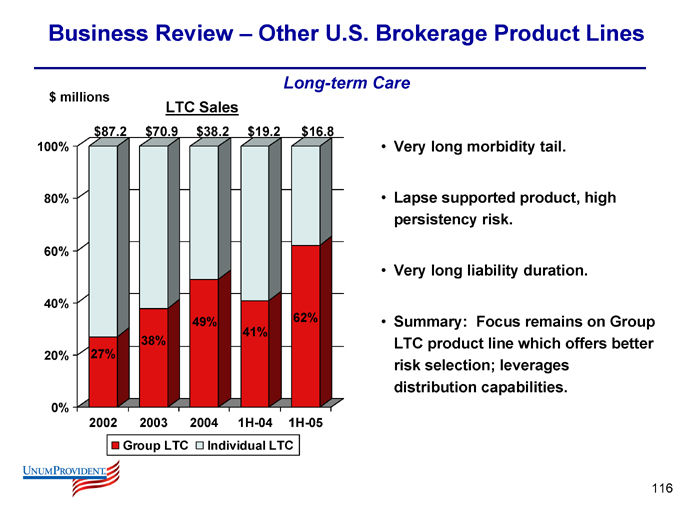

Long-term Care $ millions

LTC Sales

100% 80% 60% 40% 20% 0% $87.2 $70.9 $38.2 $19.2 $16.8

27%

38%

49%

41%

62%

2002

2003

2004

1H-04

1H-05

Group LTC

Individual LTC

Very long morbidity tail.

Lapse supported product, high persistency risk.

Very long liability duration.

Summary: Focus remains on Group LTC product line which offers better risk selection; leverages distribution capabilities.

116

Business Review – Other U.S. Brokerage Product Lines

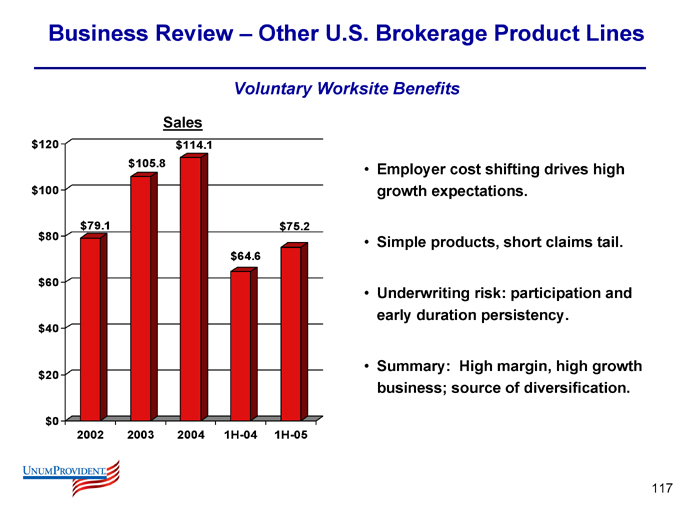

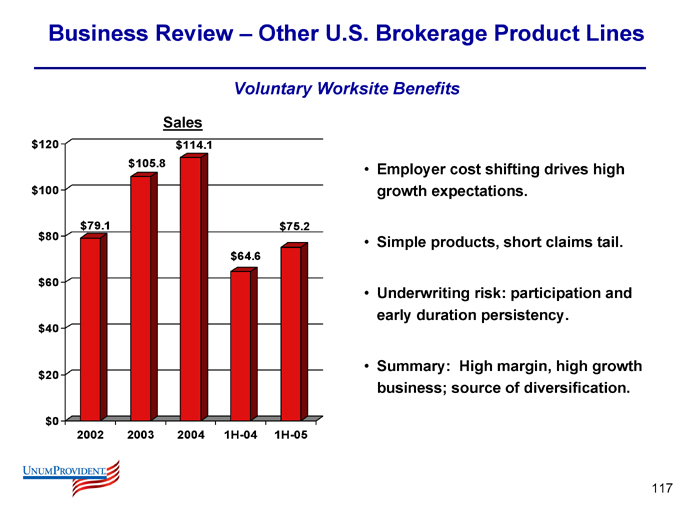

Voluntary Worksite Benefits

Sales $120 $100 $80 $60 $40

$20

$0 $79.1 $105.8 $114.1 $64.6 $75.2

2002

2003

2004

1H-04

1H-05

Employer cost shifting drives high growth expectations.

Simple products, short claims tail.

Underwriting risk: participation and early duration persistency.

Summary: High margin, high growth business; source of diversification.

117

Competitive Position

118

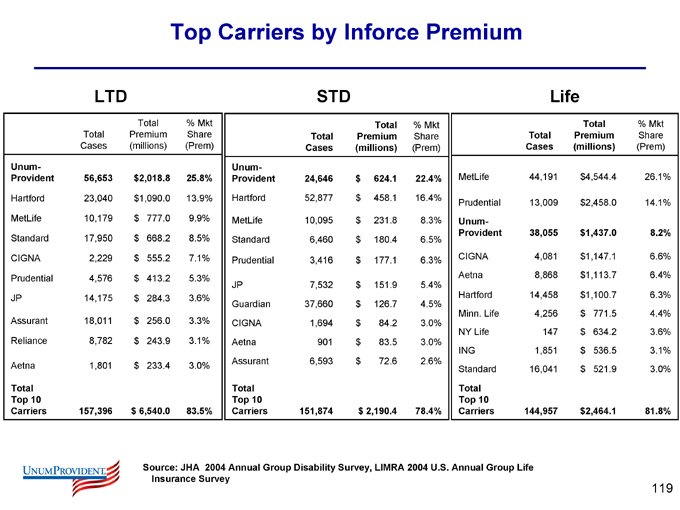

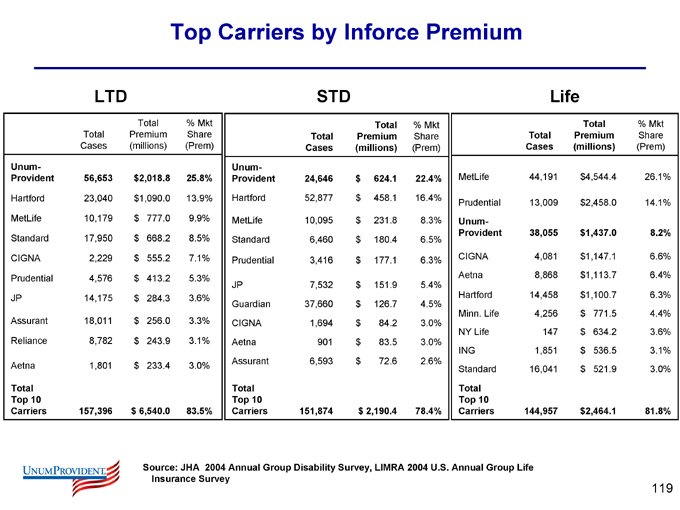

Top Carriers by Inforce Premium

LTD

Total Cases Total Premium (millions) % Mkt Share (Prem)

Unum- Provident 56,653 $2,018.8 25.8%

Hartford 23,040 $1,090.0 13.9%

MetLife 10,179 $777.0 9.9%

Standard 17,950 $668.2 8.5%

CIGNA 2,229 $555.2 7.1%

Prudential 4,576 $413.2 5.3%

JP 14,175 $284.3 3.6%

Assurant 18,011 $256.0 3.3%

Reliance 8,782 $243.9 3.1%

Aetna 1,801 $233.4 3.0%

Total Top 10 Carriers 157,396 $6,540.0 83.5%

STD

Total Cases Total Premium (millions) % Mkt Share (Prem)

Unum- Provident 24,646 $624.1 22.4%

Hartford 52,877 $458.1 16.4%

MetLife 10,095 $231.8 8.3%

Standard 6,460 $180.4 6.5%

Prudential 3,416 $177.1 6.3%

JP 7,532 $151.9 5.4%

Guardian 37,660 $126.7 4.5%

CIGNA 1,694 $84.2 3.0%

Aetna 901 $83.5 3.0%

Assurant 6,593 $72.6 2.6%

Total Top 10 Carriers 151,874 $2,190.4 78.4%

Life

Total Cases Total Premium (millions) % Mkt Share (Prem)

MetLife 44,191 $4,544.4 26.1%

Prudential 13,009 $2,458.0 14.1%

Unum-

Provident 38,055 $1,437.0 8.2%

CIGNA 4,081 $1,147.1 6.6%

Aetna 8,868 $1,113.7 6.4%

Hartford 14,458 $1,100.7 6.3%

Minn. Life 4,256 $771.5 4.4%

NY Life 147 $634.2 3.6%

ING 1,851 $536.5 3.1%

Standard 16,041 $521.9 3.0%

Total Top 10 Carriers 144,957 $2,464.1 81.8%

Source: JHA 2004 Annual Group Disability Survey, LIMRA 2004 U.S. Annual Group Life

Insurance Survey

119

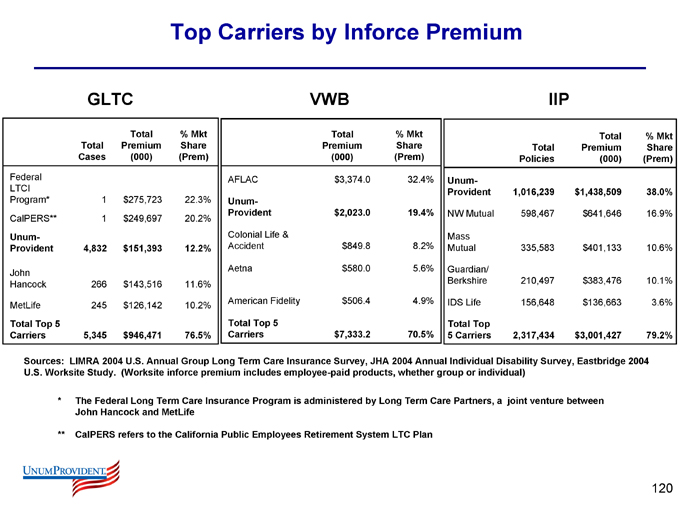

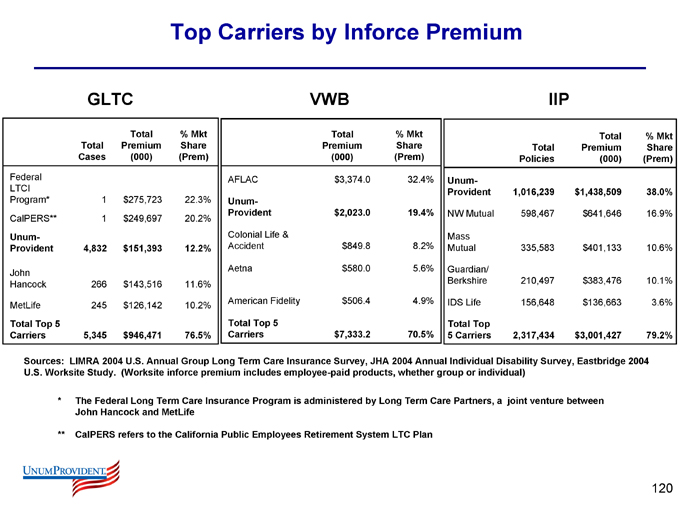

Top Carriers by Inforce Premium

GLTC

Total Cases Total Premium (000) % Mkt Share (Prem)

Federal LTCI Program* 1 $275,723 22.3%

CalPERS** 1 $249,697 20.2%

Unum-

Provident 4,832 $151,393 12.2%

John

Hancock 266 $143,516 11.6%

MetLife 245 $126,142 10.2%

Total Top 5 Carriers 5,345 $946,471 76.5%

VWB

Total Premium (000) % Mkt Share (Prem)

AFLAC $3,374.0 32.4%

Unum- Provident $2,023.0 19.4%

Colonial Life &

Accident $849.8 8.2%

Aetna $580.0 5.6%

American Fidelity $506.4 4.9%

Total Top 5 Carriers $7,333.2 70.5%

IIP

Total Policies Total Premium (000) % Mkt Share (Prem)

Unum- Provident 1,016,239 $1,438,509 38.0%

NW Mutual 598,467 $641,646 16.9%

Mass

Mutual 335,583 $401,133 10.6%

Guardian/

Berkshire 210,497 $383,476 10.1%

IDS Life 156,648 $136,663 3.6%

Total Top 5 Carriers 2,317,434 $3,001,427 79.2%

Sources: LIMRA 2004 U.S. Annual Group Long Term Care Insurance Survey, JHA 2004 Annual Individual Disability Survey, Eastbridge 2004 U.S. Worksite Study. (Worksite inforce premium includes employee-paid products, whether group or individual)

* The Federal Long Term Care Insurance Program is administered by Long Term Care Partners, a joint venture between John Hancock and MetLife

** CalPERS refers to the California Public Employees Retirement System LTC Plan

120

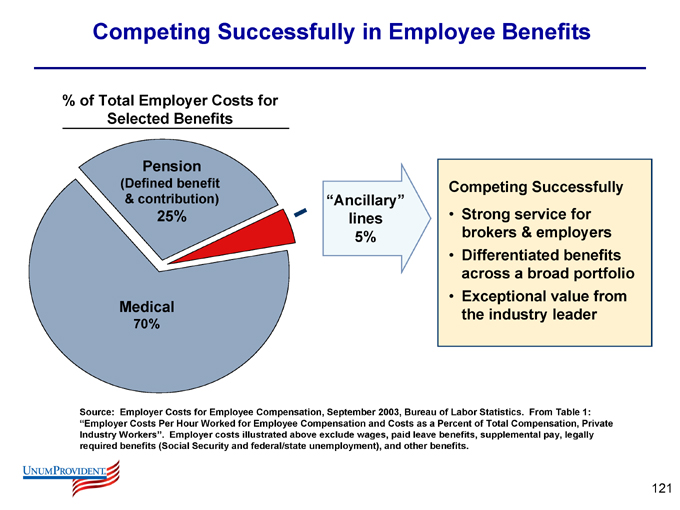

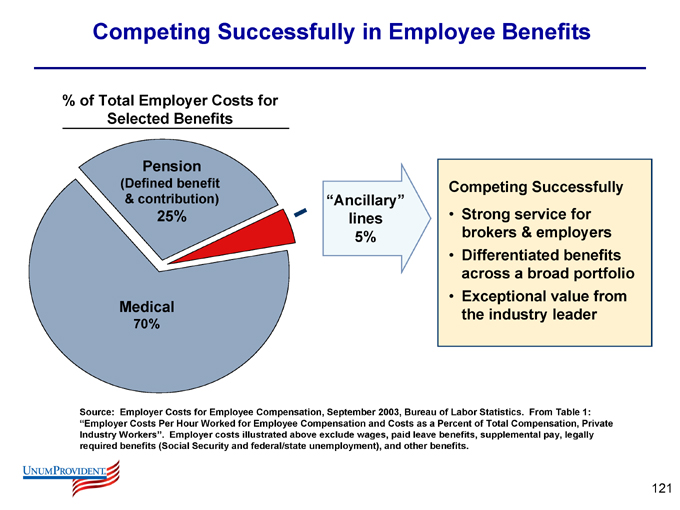

Competing Successfully in Employee Benefits

% of Total Employer Costs for Selected Benefits

Pension

(Defined benefit & contribution)

25%

Medical

70%

“Ancillary” lines 5%

Competing Successfully

Strong service for brokers & employers

Differentiated benefits across a broad portfolio

Exceptional value from the industry leader

Source: Employer Costs for Employee Compensation, September 2003, Bureau of Labor Statistics. From Table 1: “Employer Costs Per Hour Worked for Employee Compensation and Costs as a Percent of Total Compensation, Private Industry Workers”. Employer costs illustrated above exclude wages, paid leave benefits, supplemental pay, legally required benefits (Social Security and federal/state unemployment), and other benefits.

121

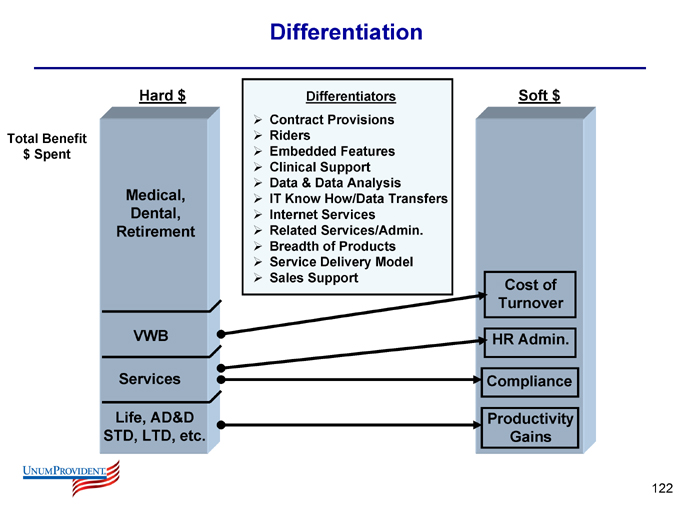

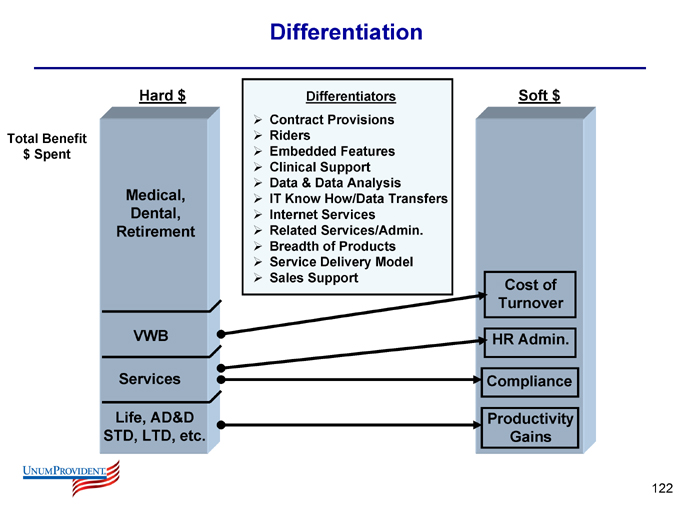

Differentiation

Hard $

Total Benefit $ Spent

Medical, Dental, Retirement

VWB

Services

Life, AD&D STD, LTD, etc.

Differentiators

Contract Provisions

Riders

Embedded Features

Clinical Support

Data & Data Analysis

IT Know How/Data Transfers

Internet Services

Related Services/Admin.

Breadth of Products

Service Delivery Model

Sales Support

Soft $

Cost of Turnover

HR Admin.

Compliance

Productivity Gains

122

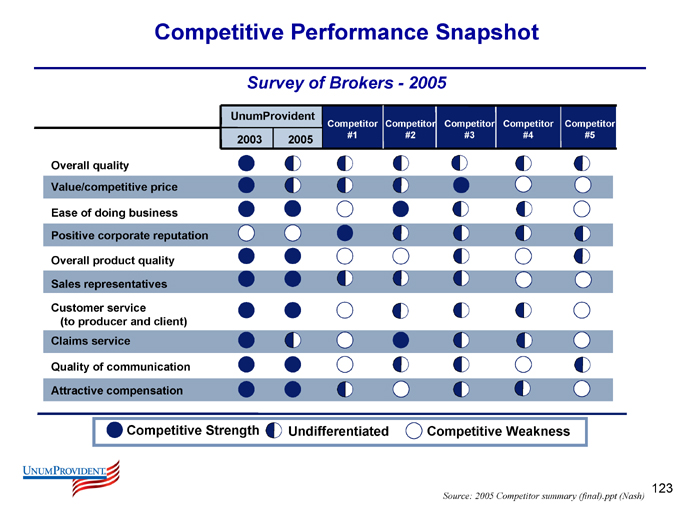

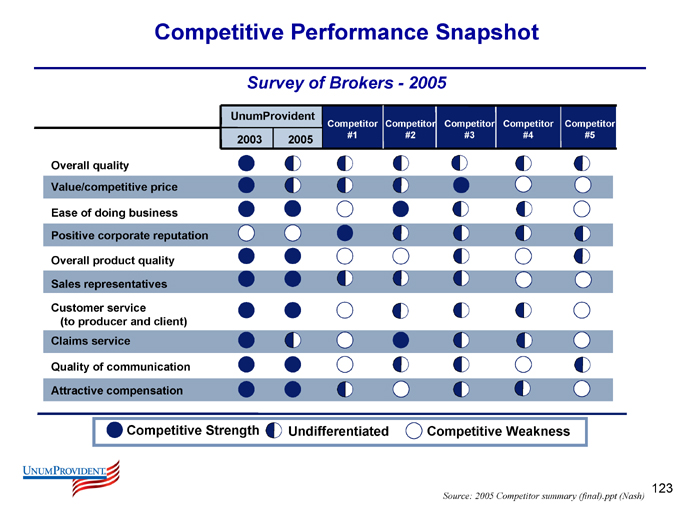

Competitive Performance Snapshot

Survey of Brokers - 2005

UnumProvident

Competitor Competitor Competitor Competitor Competitor 2003 2005 #1 #2 #3 #4 #5

Overall quality

Value/competitive price

Ease of doing business Positive corporate reputation

Overall product quality

Sales representatives

Customer service (to producer and client) Claims service

Quality of communication

Attractive compensation

Competitive Strength

Undifferentiated

Competitive Weakness

Source: 2005 Competitor summary (final).ppt (Nash)

123

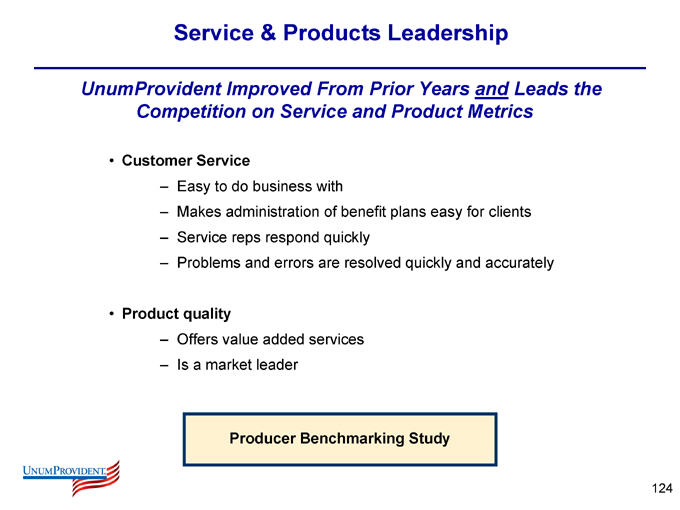

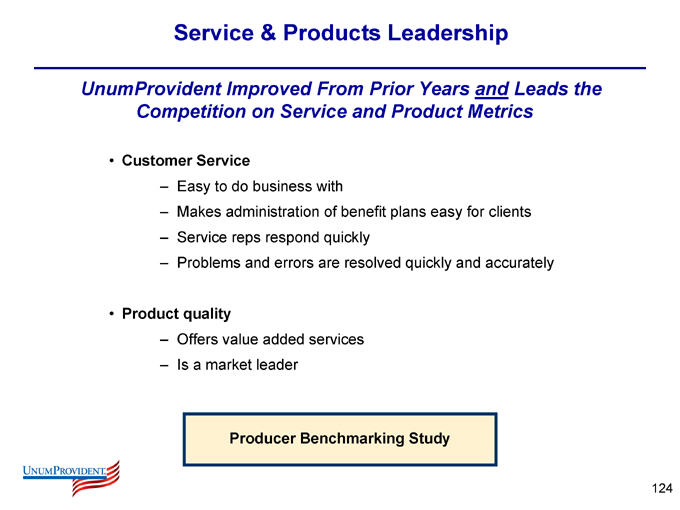

Service & Products Leadership

UnumProvident Improved From Prior Years and Leads the Competition on Service and Product Metrics

Customer Service

Easy to do business with

Makes administration of benefit plans easy for clients

Service reps respond quickly

Problems and errors are resolved quickly and accurately

Product quality

Offers value added services

Is a market leader

Producer Benchmarking Study

124

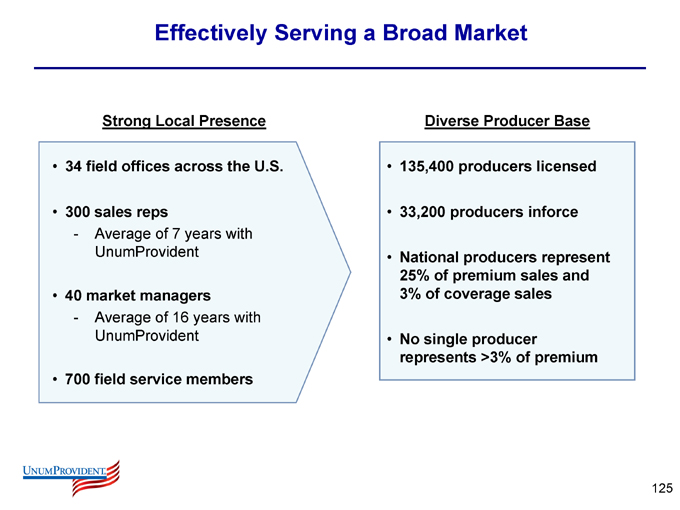

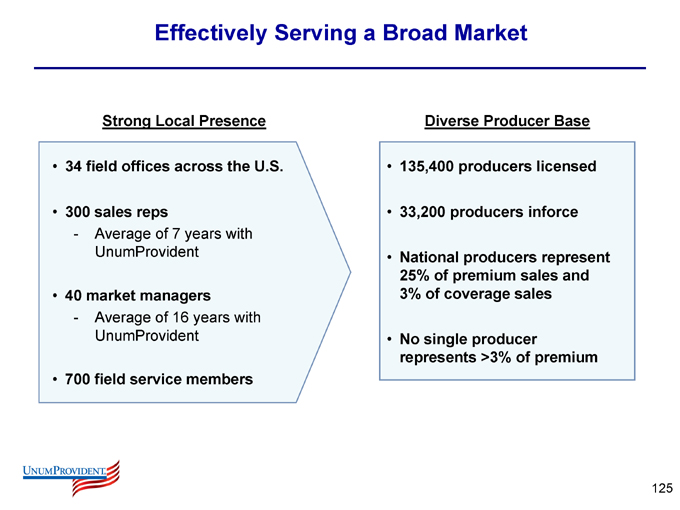

Effectively Serving a Broad Market

Strong Local Presence

34 field offices across the U.S.

300 sales reps

Average of 7 years with UnumProvident

40 market managers

Average of 16 years with UnumProvident

700 field service members

Diverse Producer Base

135,400 producers licensed

33,200 producers inforce

National producers represent 25% of premium sales and 3% of coverage sales

No single producer represents >3% of premium

125

Strength of Sales Team is Critical

UnumProvident Improved From Prior Years and Leads the Competition on Sales Support to Brokers

Sales Rep Relationship

Overall quality of services and support from sales rep

Sales rep is very knowledgeable and well-trained

Sales rep follows through on commitments

Sales rep was proactive

Average Sales Rep Tenure

Years with UP

5.43

5.97

6.78

7.11

2Q02

2Q03

2Q04

2Q05

126

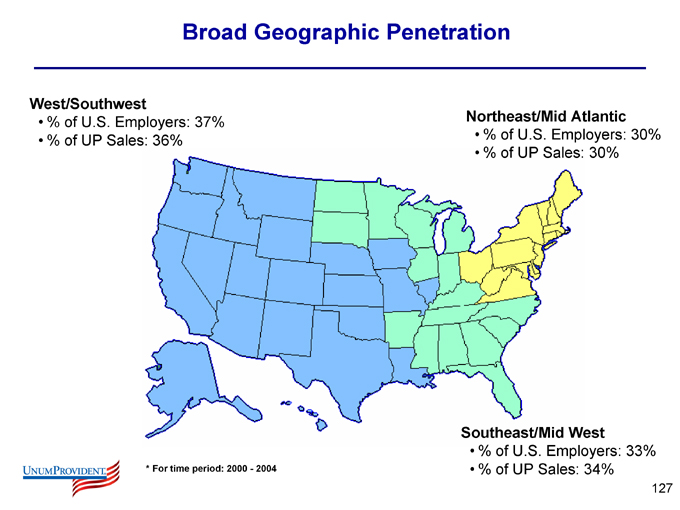

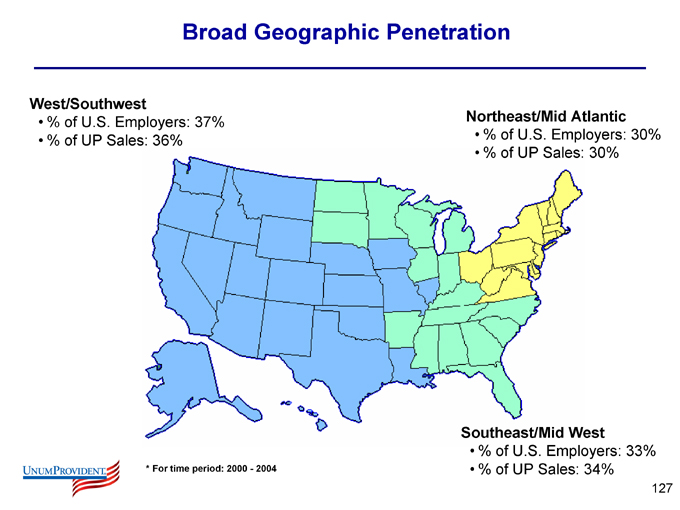

Broad Geographic Penetration

West/Southwest

% of U.S. Employers: 37%

% of UP Sales: 36%

Northeast/Mid Atlantic

% of U.S. Employers: 30%

% of UP Sales: 30%

Southeast/Mid West

% of U.S. Employers: 33%

% of UP Sales: 34%

* For time period: 2000 - 2004

127

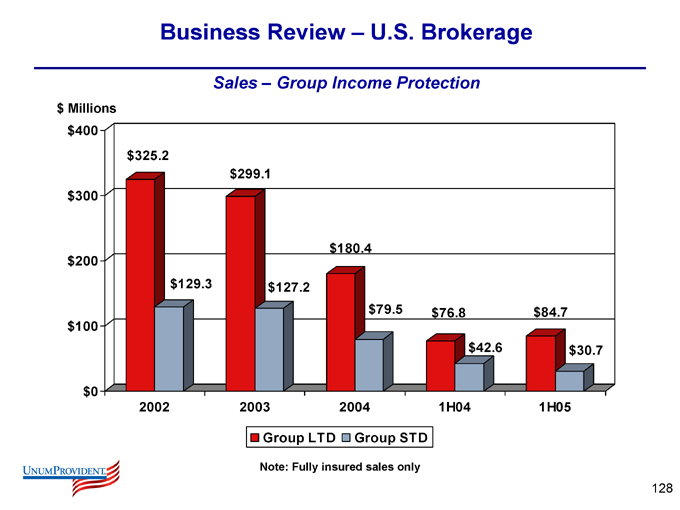

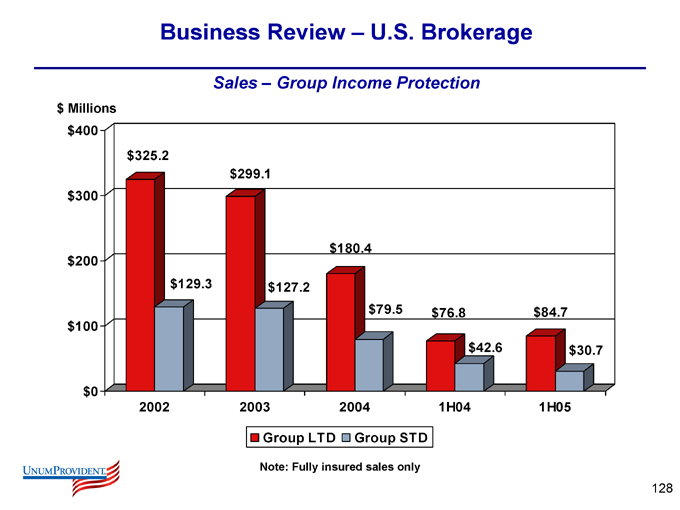

Business Review – U.S. Brokerage

Sales – Group Income Protection $ Millions $400 $300 $200 $100 $0 $325.2 $129.3 $299.1 $127.2 $180.4 $79.5 $76.8 $42.6 $84.7 $30.7

2002

2003

2004

1H04

1H05

Group LTD

Group STD

Note: Fully insured sales only

128

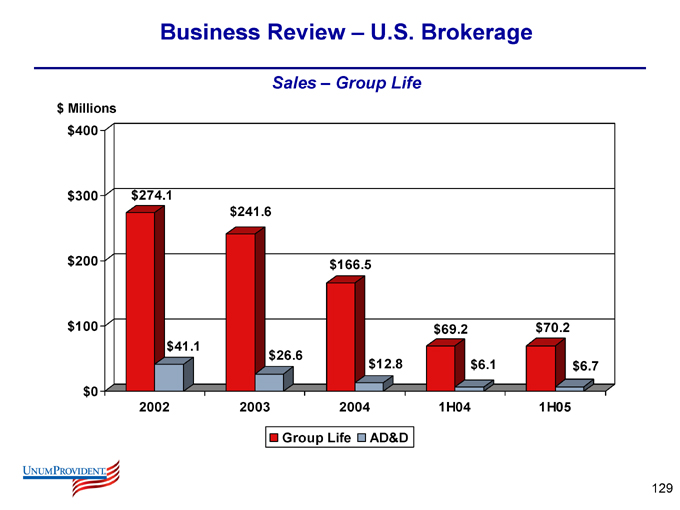

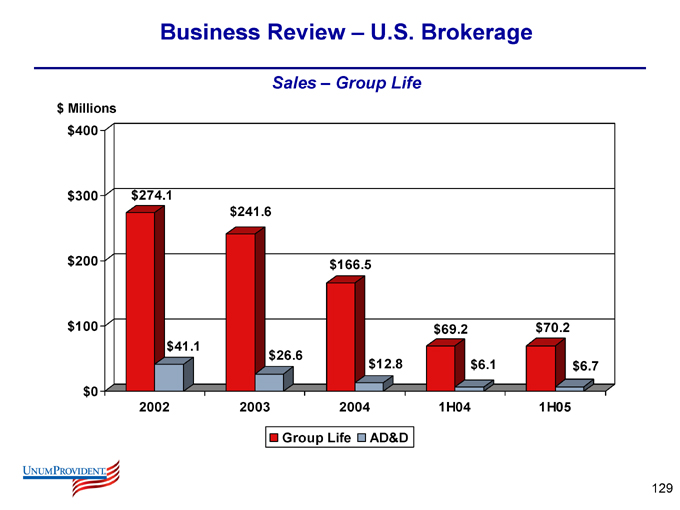

Business Review – U.S. Brokerage

Sales – Group Life $ Millions $400 $300 $200 $100 $0 $274.1 $41.1 $241.6 $26.6 $166.5 $12.8 $69.2 $6.1 $70.2 $6.7

2002

2003

2004

1H04

1H05

Group Life

AD&D

129

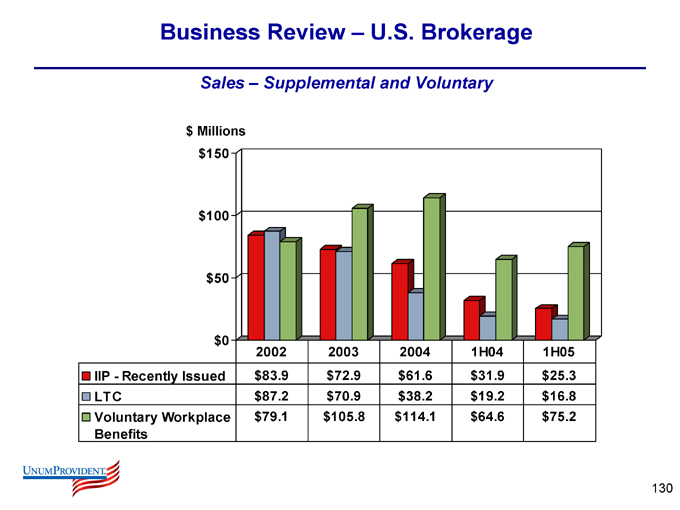

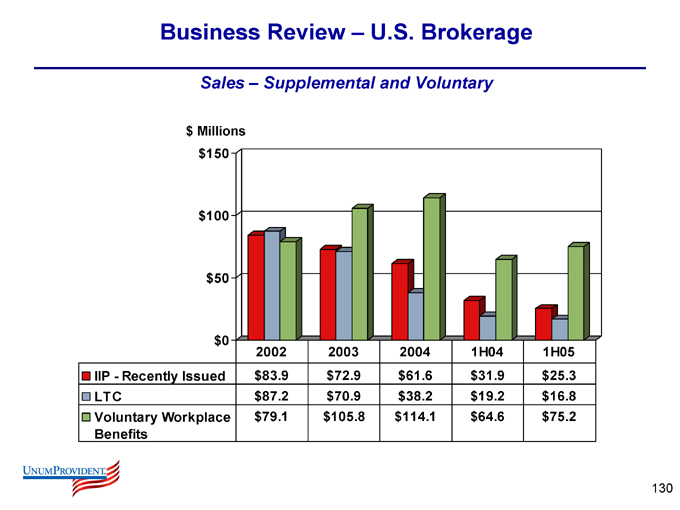

Business Review – U.S. Brokerage

Sales – Supplemental and Voluntary $ Millions $150 $100 $50 $0

2002 2003 2004 1H04 1H05

IIP - Recently Issued $83.9 $72.9 $61.6 $31.9 $25.3

LTC $87.2 $70.9 $38.2 $19.2 $16.8

Voluntary Workplace Benefits $79.1 $105.8 $114.1 $64.6 $75.2

130

Summary

131

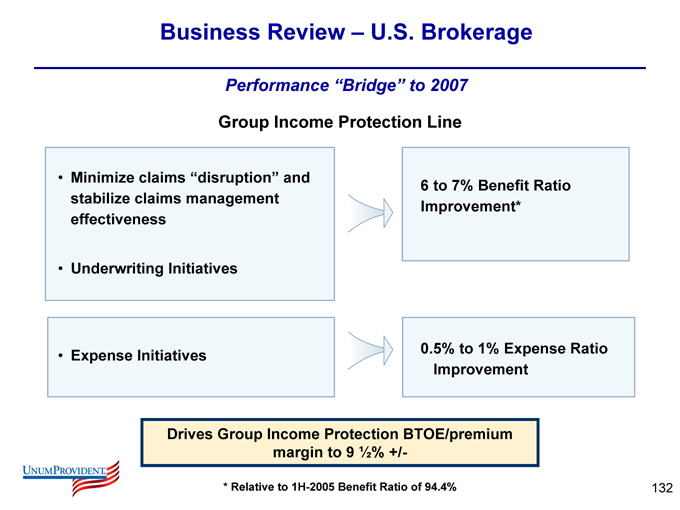

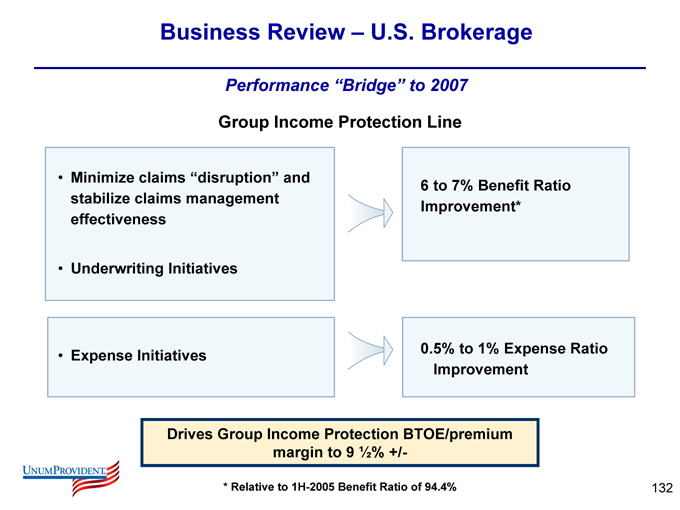

Business Review – U.S. Brokerage

Performance “Bridge” to 2007

Group Income Protection Line

Minimize claims “disruption” and stabilize claims management effectiveness

Underwriting Initiatives

Expense Initiatives

6 to 7% Benefit Ratio Improvement*

0.5% to 1% Expense Ratio Improvement

Drives Group Income Protection BTOE/premium margin to 9 1/2% +/-

* Relative to 1H-2005 Benefit Ratio of 94.4%

132

Business Review – U.S. Brokerage

Summary

Our U.S. Brokerage business is the cornerstone of UnumProvident.

Lynchpin is Group Income Protection franchise

Growing voluntary worksite business provides opportunity for growth and diversification

Plans for driving margin improvement in Group Income Protection focus on:

Stable benefit center performance at long-range expectations

Underwriting initiatives

Operating effectiveness

Our progress in 2005 has been masked by claims disruption.

Impact is manageable and expected to continue to subside

Overall franchise and market position remain strong.

133

Questions

134

Business Review - Colonial

135

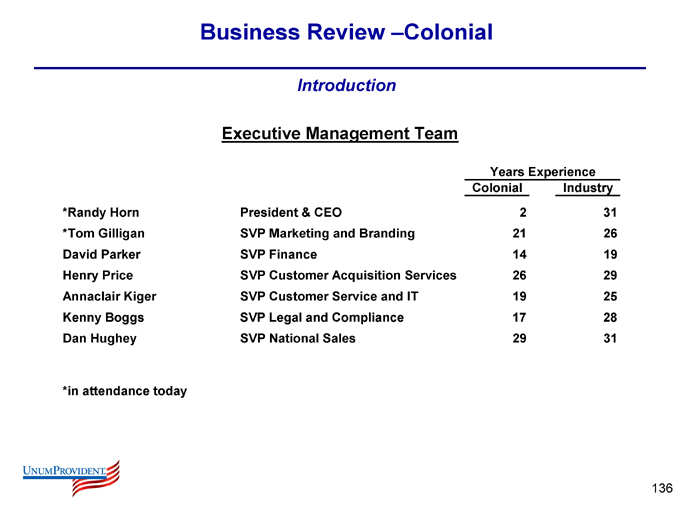

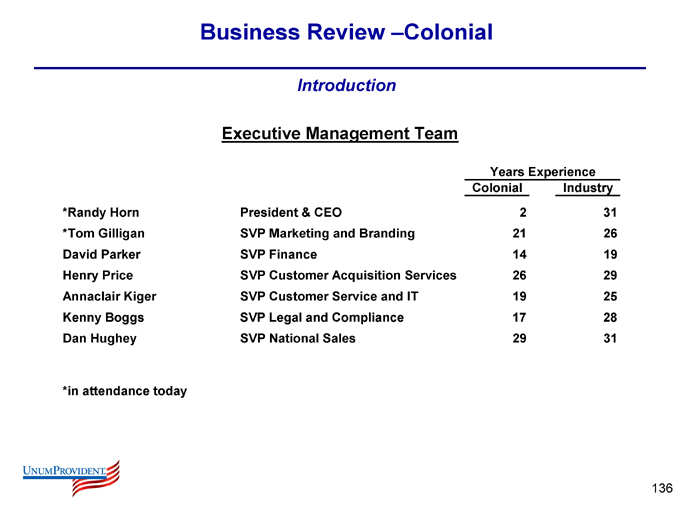

Business Review –Colonial

Introduction

Executive Management Team

Years Experience Colonial Industry

*Randy Horn President & CEO 2 31

*Tom Gilligan SVP Marketing and Branding 21 26

David Parker SVP Finance 14 19

Henry Price SVP Customer Acquisition Services 26 29

Annaclair Kiger SVP Customer Service and IT 19 25

Kenny Boggs SVP Legal and Compliance 17 28

Dan Hughey SVP National Sales 29 31

*in attendance today

136

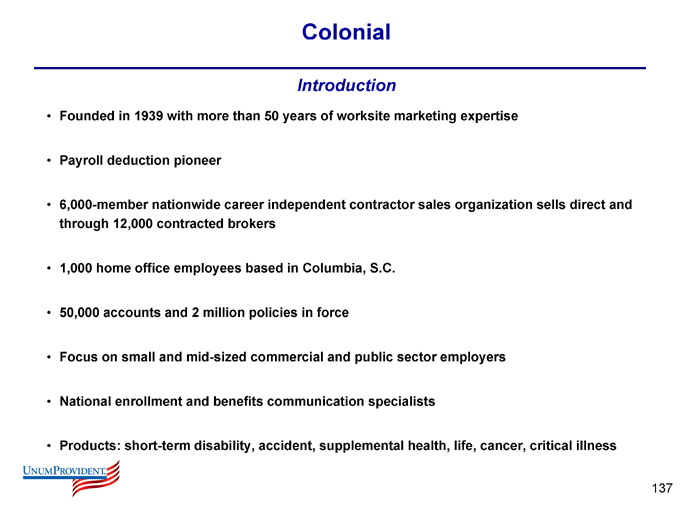

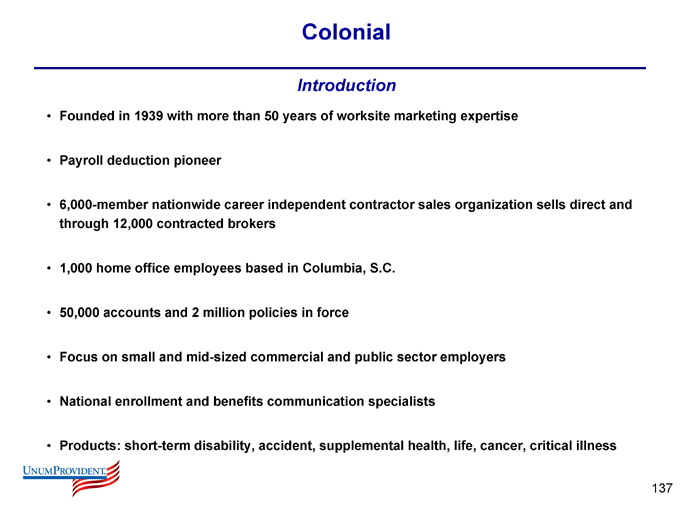

Colonial

Introduction

Founded in 1939 with more than 50 years of worksite marketing expertise

Payroll deduction pioneer

6,000-member nationwide career independent contractor sales organization sells direct and through 12,000 contracted brokers

1,000 home office employees based in Columbia, S.C.

50,000 accounts and 2 million policies in force

Focus on small and mid-sized commercial and public sector employers

National enrollment and benefits communication specialists

Products: short-term disability, accident, supplemental health, life, cancer, critical illness

137

Our Vision

Colonial will be the company of choice for voluntary benefits programs offered through the workplace.

Our Mission

Colonial is committed to helping working Americans and their families minimize personal financial risk with a comprehensive offering of voluntary benefits through the workplace.

We strive to fulfill this mission through:

A broad portfolio of products designed to meet customers’ needs.

Personal benefits communications and enrollment capabilities.

Individual attention and commitment to service.

Easy and convenient access to products and services.

138

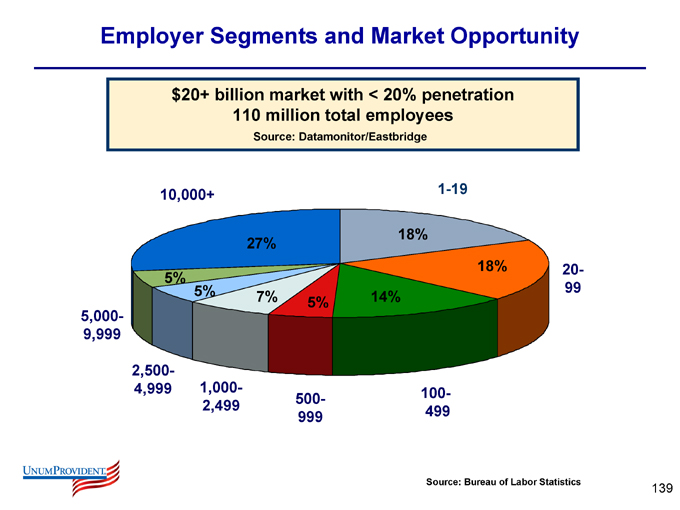

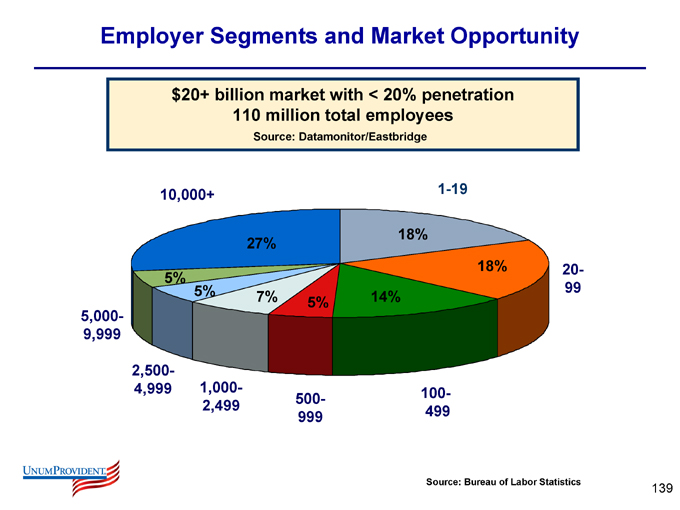

Employer Segments and Market Opportunity $20+ billion market with < 20% penetration 110 million total employees

Source: Datamonitor/Eastbridge

1-19

20-99

100-499

500-999

1,000-2,499

2,500-4,999

5,000-9,999

10,000+

18%

18%

14%

5%

7%

5%

5%

27%

Source: Bureau of Labor Statistics

139

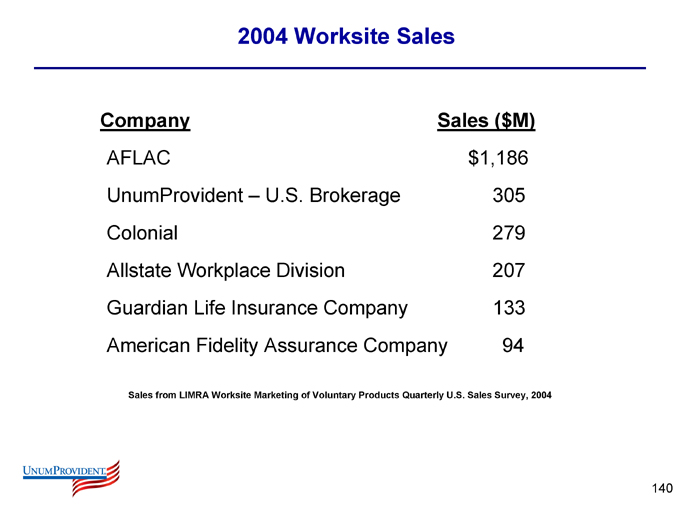

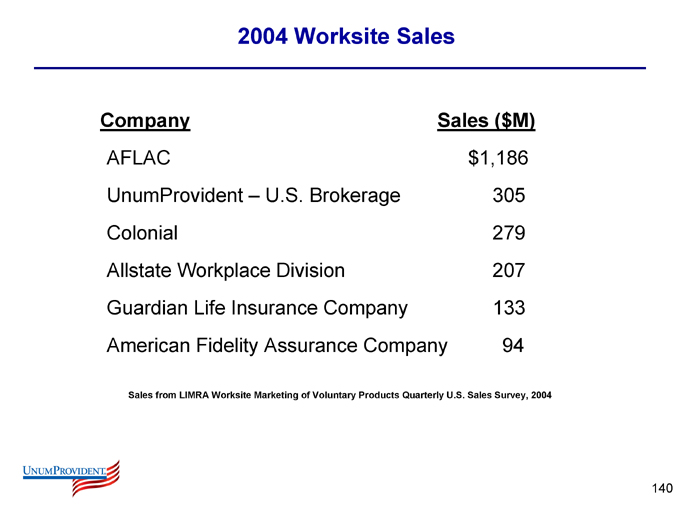

2004 Worksite Sales

Company Sales ($M)

AFLAC $1,186

UnumProvident – U.S. Brokerage 305

Colonial 279

Allstate Workplace Division 207

Guardian Life Insurance Company 133

American Fidelity Assurance Company 94

Sales from LIMRA Worksite Marketing of Voluntary Products Quarterly U.S. Sales Survey, 2004

140

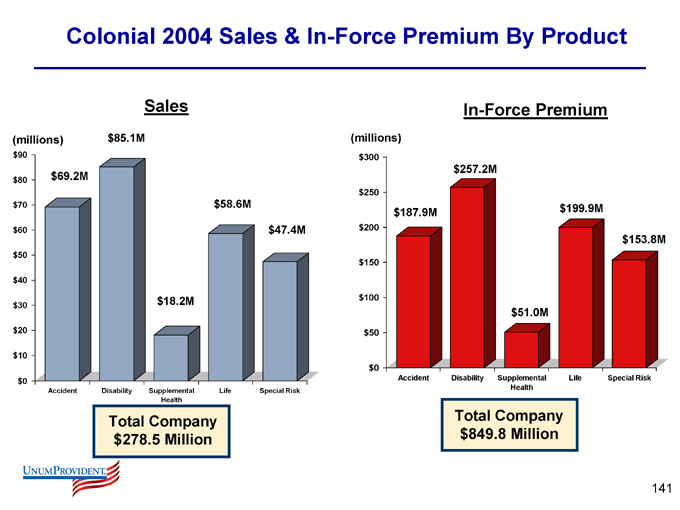

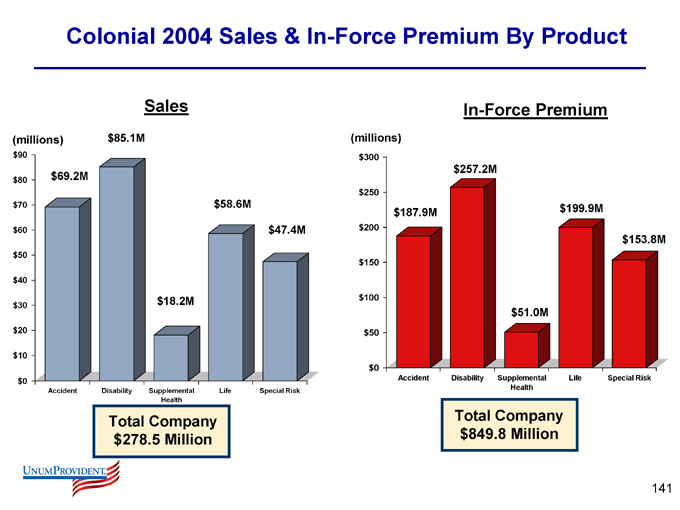

Colonial 2004 Sales & In-Force Premium By Product

Sales

(millions) $90 $80 $70 $60 $50 $40 $30 $20 $10 $0 $69.2M $85.1M $18.2M $58.6M $47.4M

Accident

Disability

Supplemental Health

Life

Special Risk

Total Company $278.5 Million

In-Force Premium

(millions) $300 $250 $200 $150 $100 $50 $0 $187.9M $257.2M $51.0M $199.9M $153.8M

Accident

Disability

Supplemental Health

Life

Special Risk

Total Company $849.8 Million

141

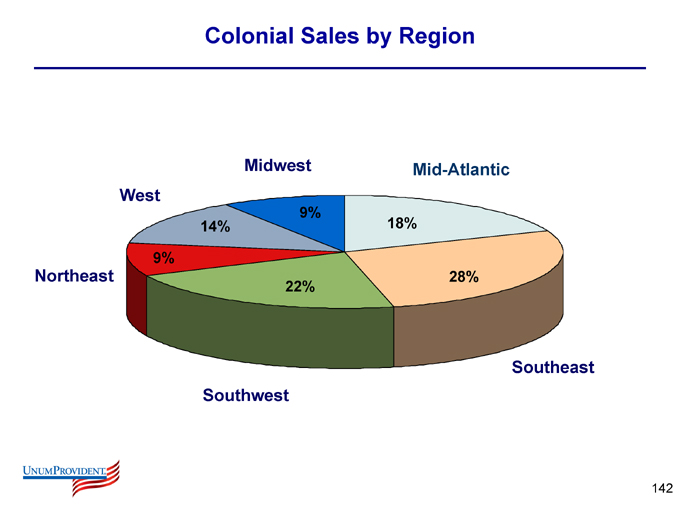

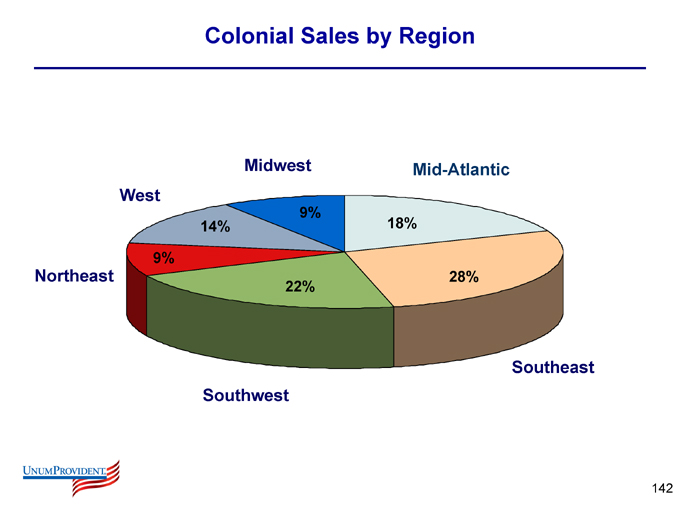

Colonial Sales by Region

Mid-Atlantic

Southeast

Southwest

Northeast

West

Midwest

18%

28%

22%

9%

14%

9%

142

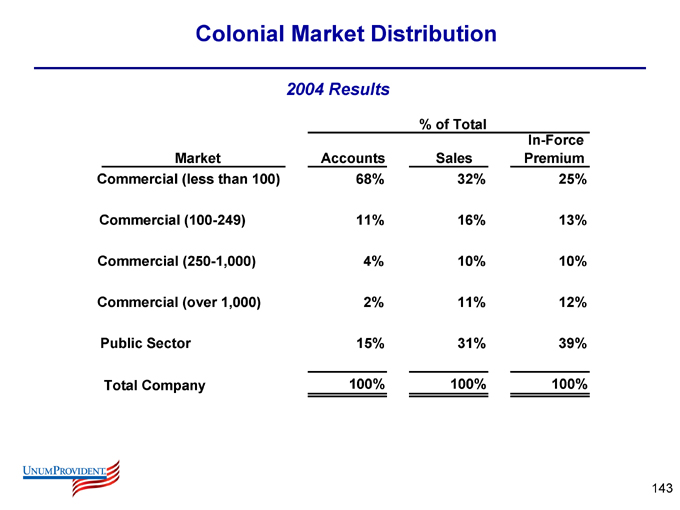

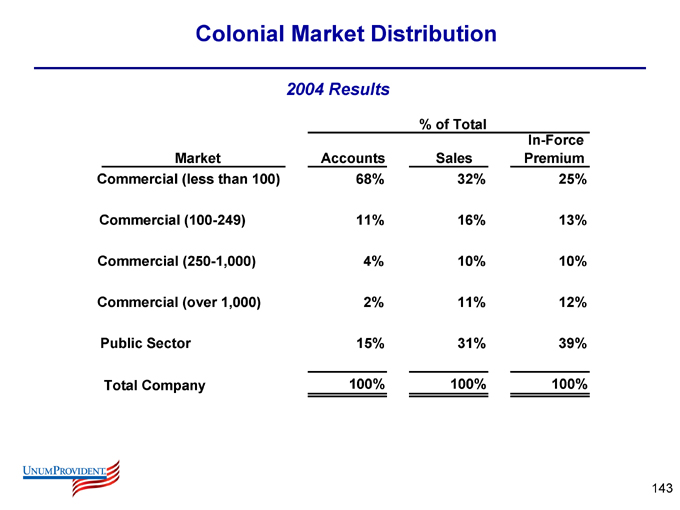

Colonial Market Distribution

2004 Results

% of Total

Market Accounts Sales In-Force Premium

Commercial (less than 100) 68% 32% 25%

Commercial (100-249) 11% 16% 13%

Commercial (250-1,000) 4% 10% 10%

Commercial (over 1,000) 2% 11% 12%

Public Sector 15% 31% 39%

Total Company 100% 100% 100%

143

Growth Initiatives

Implement Agency Growth System across the field organization

144

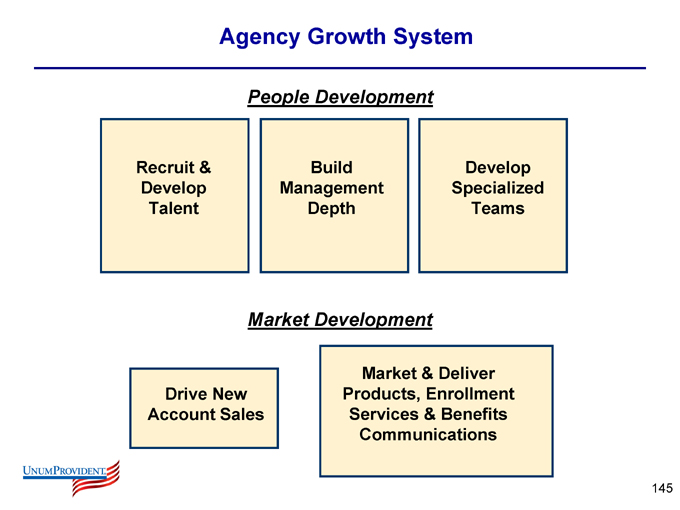

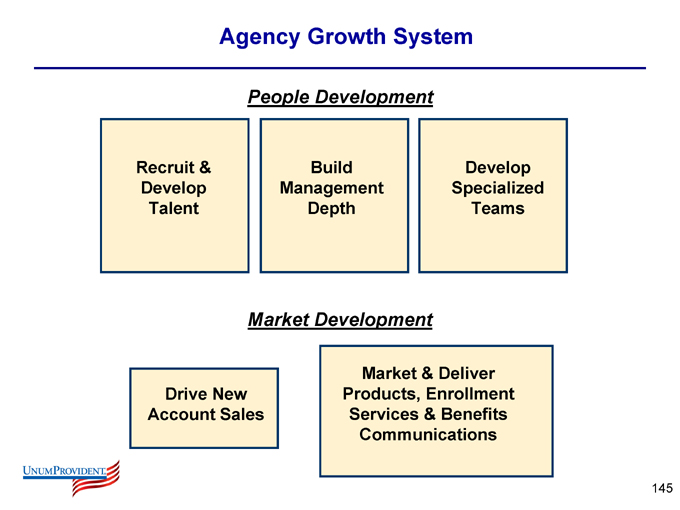

Agency Growth System

People Development

Recruit & Develop Talent

Build Management Depth

Develop Specialized Teams

Market Development

Drive New Account Sales

Market & Deliver Products, Enrollment Services & Benefits Communications

145

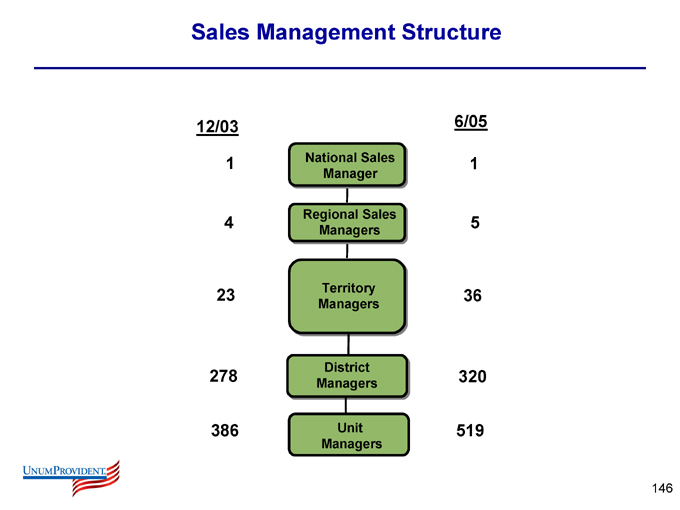

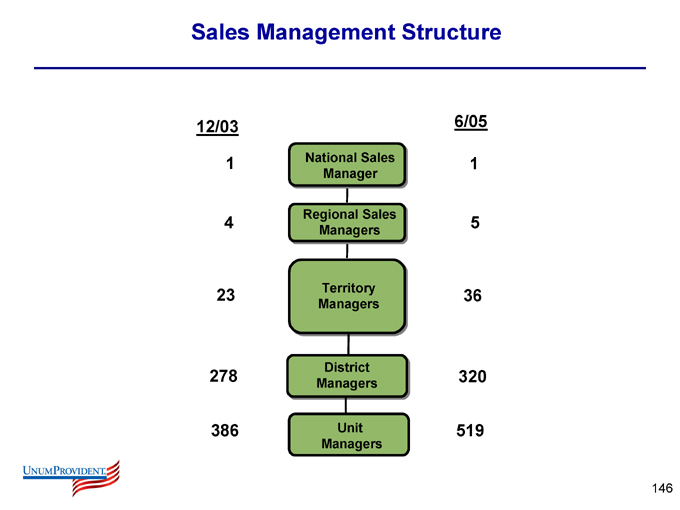

Sales Management Structure

12/03

1

4

23

278

386

National Sales Manager

Regional Sales Managers

Territory Managers

District Managers

Unit Managers

6/05

1

5

36

320

519

146

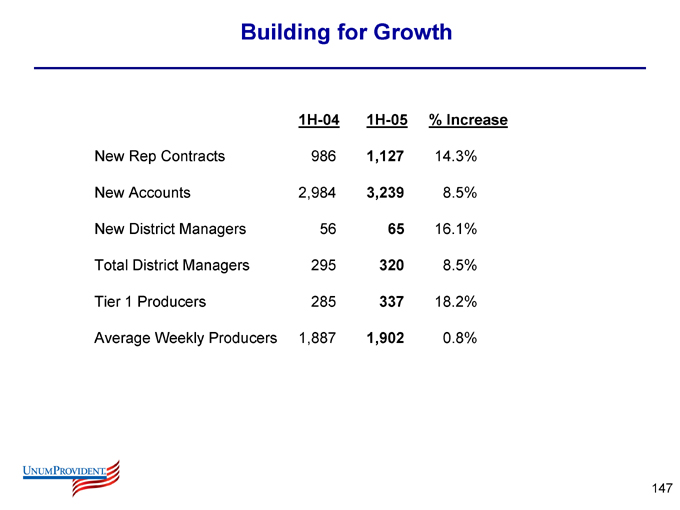

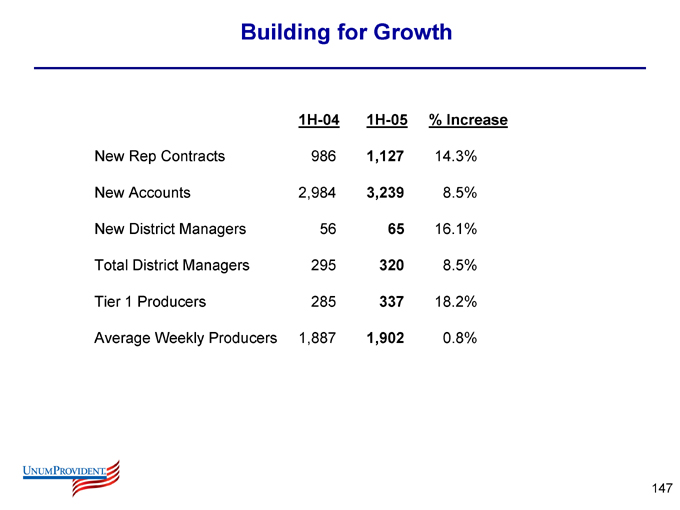

Building for Growth

1H-04 1H-05 % Increase

New Rep Contracts 986 1,127 14.3%

New Accounts 2,984 3,239 8.5%

New District Managers 56 65 16.1%

Total District Managers 295 320 8.5%

Tier 1 Producers 285 337 18.2%

Average Weekly Producers 1,887 1,902 0.8%

147

Growth Initiatives

Implement Agency Growth System across the field organization

Focus on small to medium-sized employer markets

Leverage position in the Public Sector market

Expand and refresh product platform

Leverage enrollment and benefits communication capabilities

148

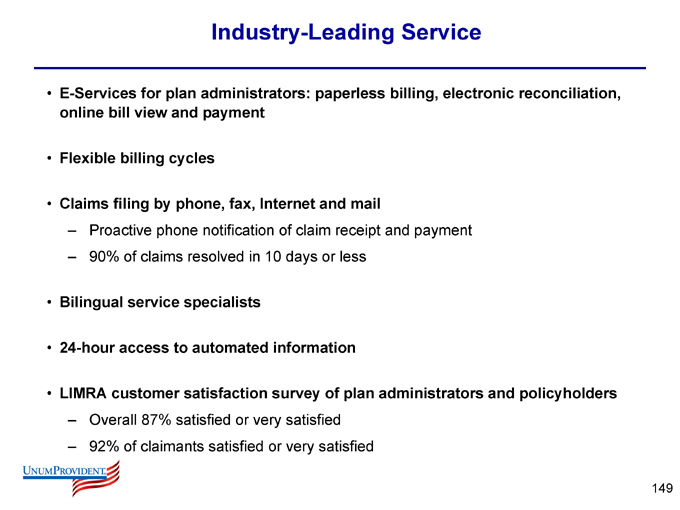

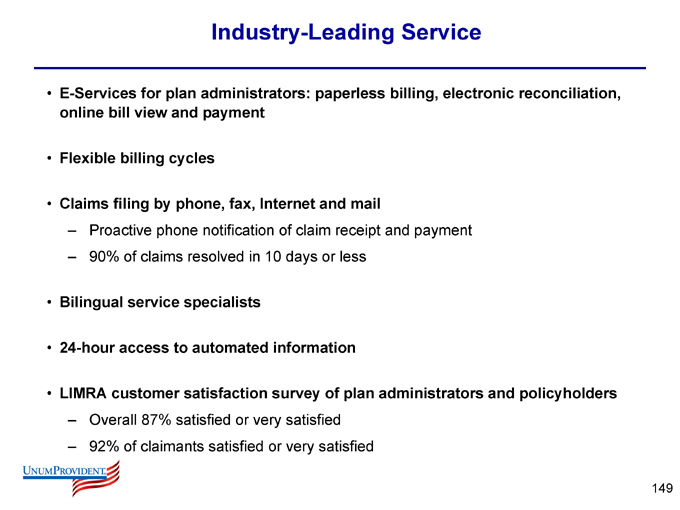

Industry-Leading Service

E-Services for plan administrators: paperless billing, electronic reconciliation, online bill view and payment

Flexible billing cycles

Claims filing by phone, fax, Internet and mail

Proactive phone notification of claim receipt and payment

90% of claims resolved in 10 days or less

Bilingual service specialists

24-hour access to automated information

LIMRA customer satisfaction survey of plan administrators and policyholders

Overall 87% satisfied or very satisfied

92% of claimants satisfied or very satisfied

149

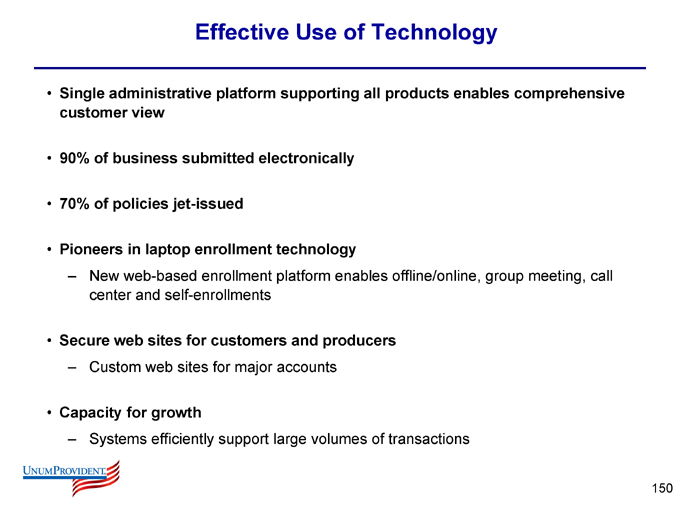

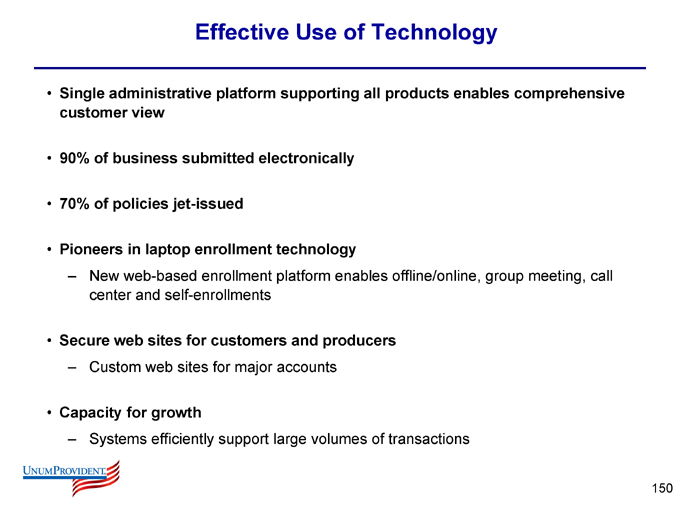

Effective Use of Technology

Single administrative platform supporting all products enables comprehensive customer view

90% of business submitted electronically

70% of policies jet-issued

Pioneers in laptop enrollment technology

New web-based enrollment platform enables offline/online, group meeting, call center and self-enrollments

Secure web sites for customers and producers

Custom web sites for major accounts

Capacity for growth

Systems efficiently support large volumes of transactions

150

The Colonial Advantage

Benefits communication solutions

Competitive supplemental insurance products

Enrollment services

151

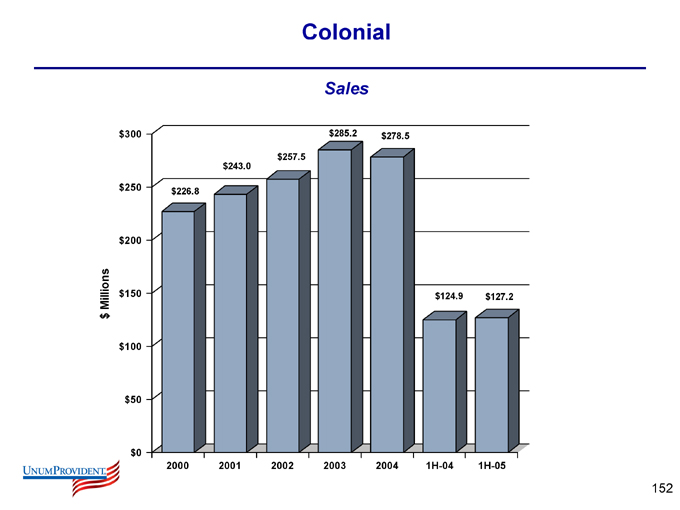

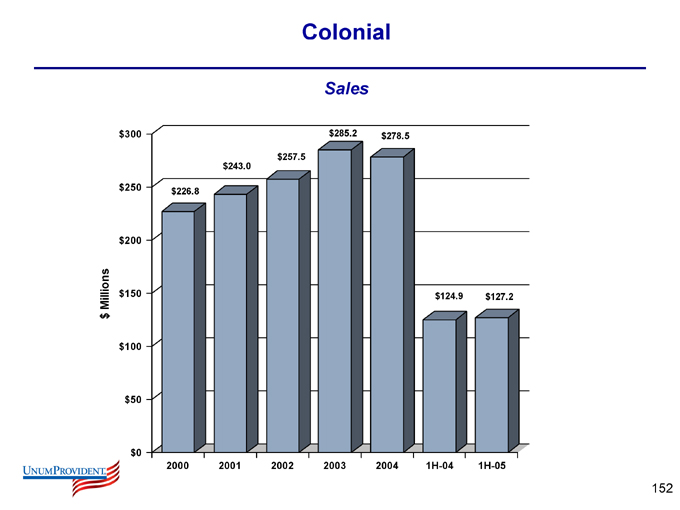

Colonial

Sales $ Millions $300 $250 $200 $150 $100 $50 $0 $226.8 $243.0 $257.5 $285.2 $278.5 $124.9 $127.2

2000

2001

2002

2003

2004

1H-04

1H-05

152

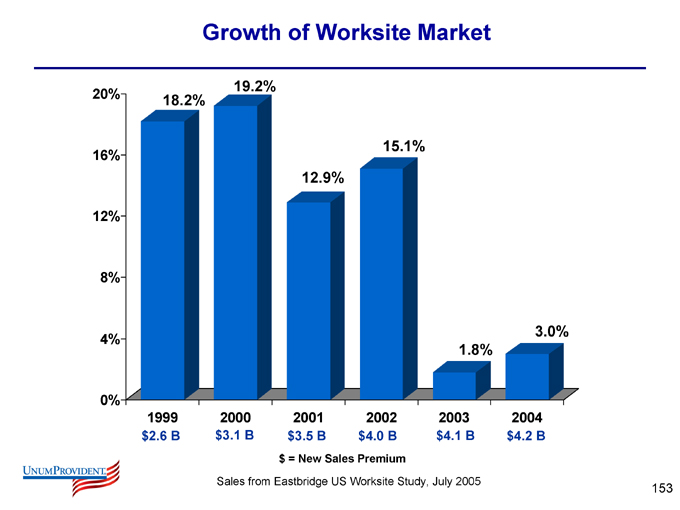

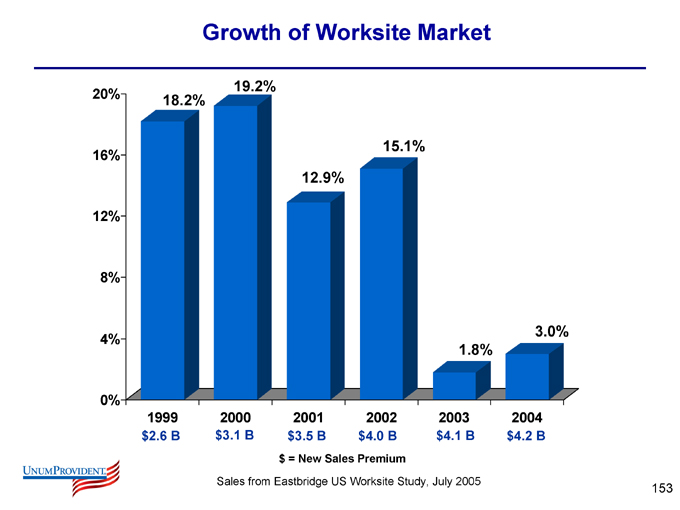

Growth of Worksite Market

20% 16% 12% 8% 4% 0%

18.2%

19.2%

12.9%

15.1%

1.8%

3.0%

1999 $2.6 B

2000 $3.1 B

2001 $3.5 B

2002 $4.0 B

2003 $4.1 B

2004 $4.2 B $ = New Sales Premium

Sales from Eastbridge US Worksite Study, July 2005

153

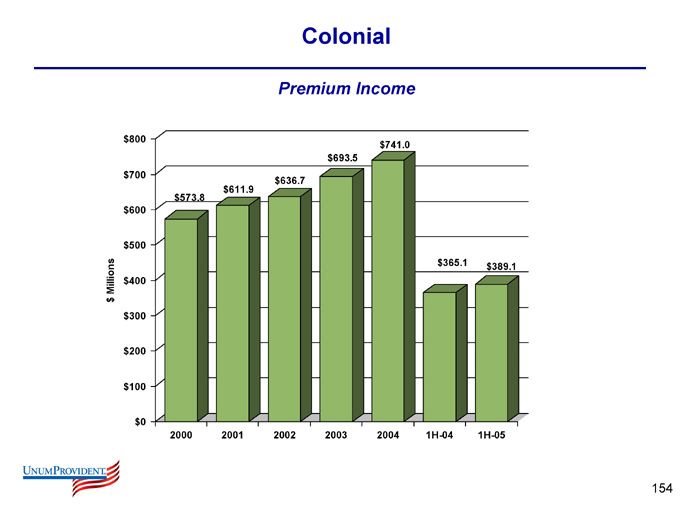

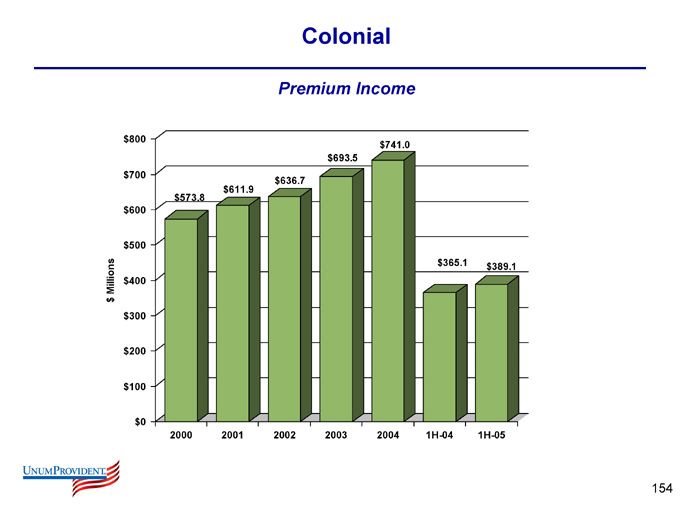

Colonial

Premium Income $ Millions $800 $700 $600 $500 $400 $300 $200 $100 $0 $573.8 $611.9 $636.7 $693.5 $741.0 $365.1 $389.1

2000

2001

2002

2003

2004

1H-04

1H-05

154

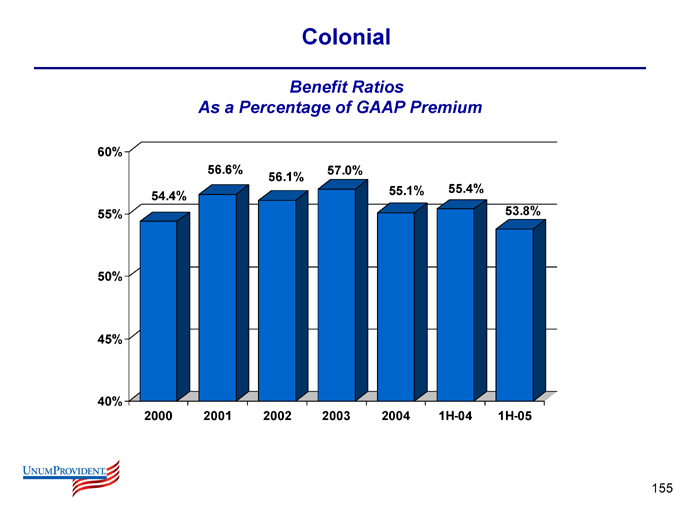

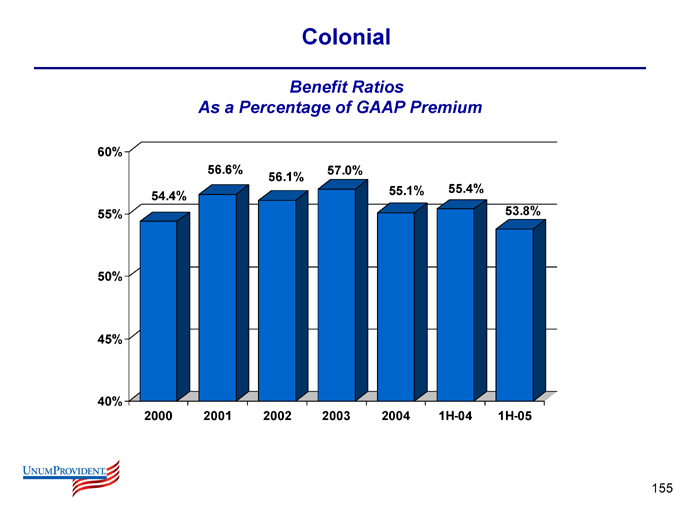

Colonial

Benefit Ratios

As a Percentage of GAAP Premium

60% 55% 50% 45% 40%

54.4%

56.6%

56.1%

57.0%

55.1%

55.4%

53.8%

2000

2001

2002

2003

2004

1H-04

1H-05

155

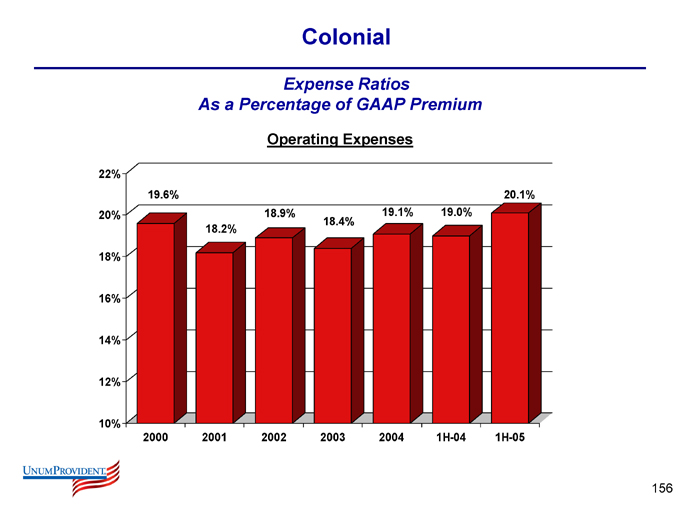

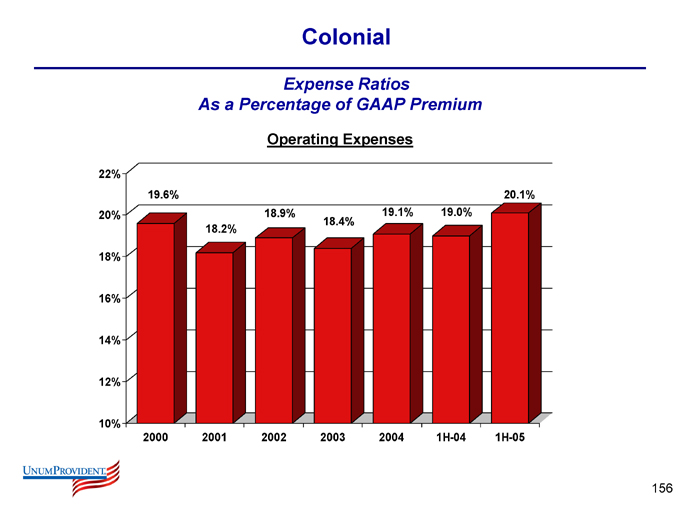

Colonial

Expense Ratios

As a Percentage of GAAP Premium

Operating Expenses

22% 20% 18% 16% 14% 12% 10%

19.6%

18.2%

18.9%

18.4%

19.1%

19.0%

20.1%

2000

2001

2002

2003

2004

1H-04

1H-05

156

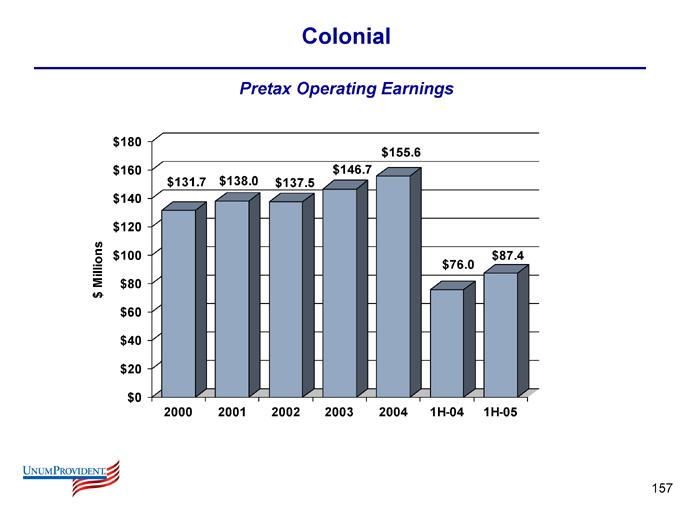

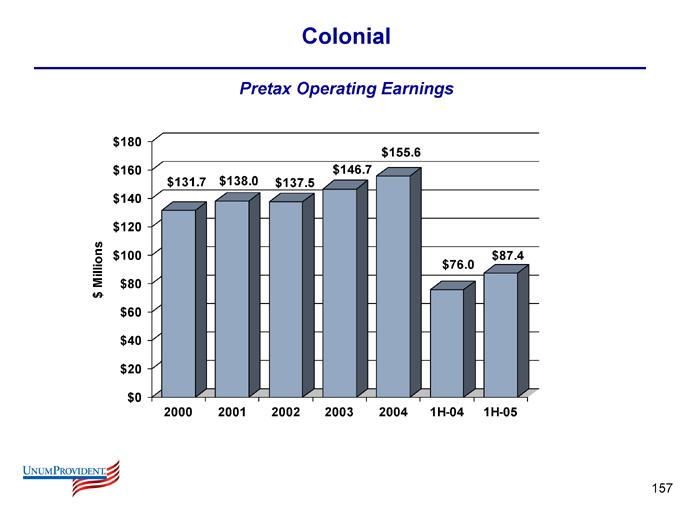

Colonial

Pretax Operating Earnings $ Millions $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 $131.7 $138.0 $137.5 $146.7 $155.6 $76.0 $87.4

2000

2001

2002

2003

2004

1H-04

1H-05

157

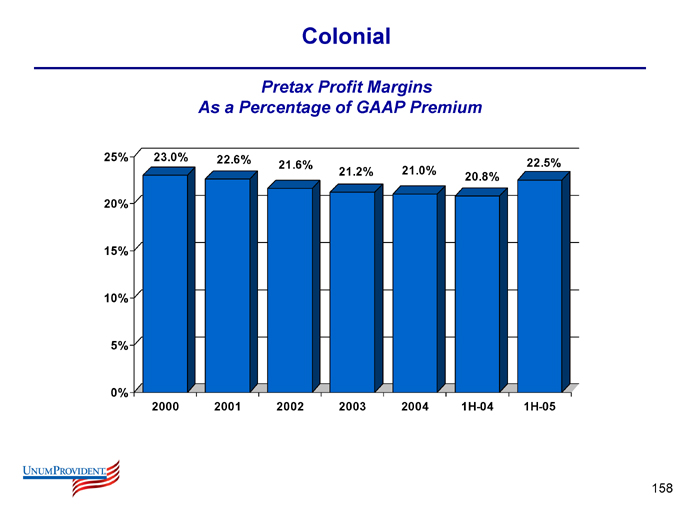

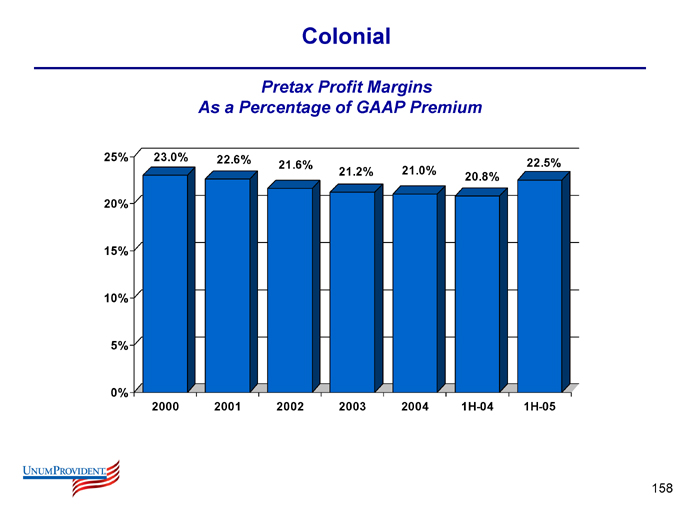

Colonial

Pretax Profit Margins As a Percentage of GAAP Premium

25% 20% 15% 10% 5% 0%

23.0%

22.6%

21.6%

21.2%

21.0%

20.8%

22.5%

2000

2001

2002

2003

2004

1H-04

1H-05

158

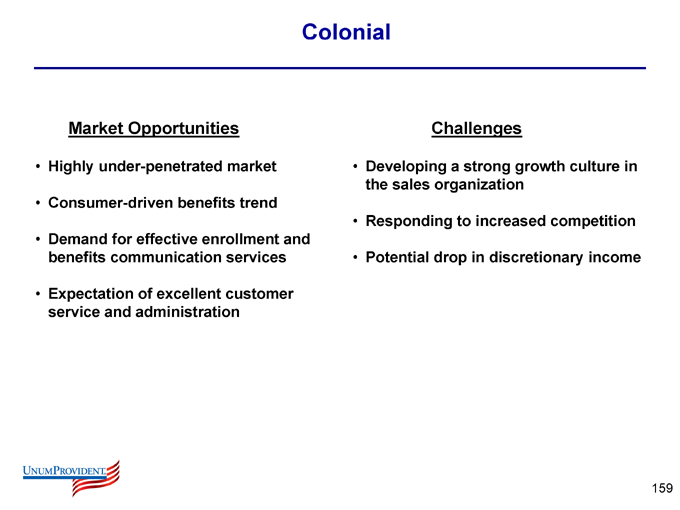

Colonial

Market Opportunities

Highly under-penetrated market

Consumer-driven benefits trend

Demand for effective enrollment and benefits communication services

Expectation of excellent customer service and administration

Challenges

Developing a strong growth culture in the sales organization

Responding to increased competition

Potential drop in discretionary income

159

Colonial

Summary

Strong market position and business model.

Well positioned to capitalize on growth opportunities.

Focused on maintaining financial stability while growing the business.

Providing diversification and predictable cash flows for parent company.

160

Questions

161

Business Review – Unum Limited (UK)

162

Business Review – Unum Limited

Introduction

Executive Management Team

Years Experience

Unum Industry

*Susan Ring Chairman & Managing Director 10 23

*Andrew Stacy Chief Operating Officer 5 25

Paul Davies Marketing & Business Development Director 2 20

Peter Dewis Customer Care Director 5 21

Joanne Hindle Corporate Services Director 4 20

Graham Hockings Chief Actuary 33 33

Jonathan Plumtree Finance Director 8 16

Cheryl Brewer Customer Solutions Director 29 29

Nick Gleeson Director of Corporate Development 5 18

Andy Cross Director of Human Resources 4 12

Phil Evans Director of Management Services 1 22

Paul Restall Director of Customer Services 1 25

*in attendance today

163

Unum Limited

Introduction

Unum Corporation (UNM) acquired Unum Limited in 1990.

840 employees in 3 operational centers; 7 regional offices.

Unum Limited is well positioned as the leader in the group risks market in the UK, with significant market positions in the Group Income Protection and Group Life markets.

Unum Limited has produced a strong record of sustained profitable growth over the past several years with solid underlying growth strongly enhanced by acquisitions.

We believe we are well positioned to continue to deliver sustainable profitable growth.

164

Unum Limited

The Market

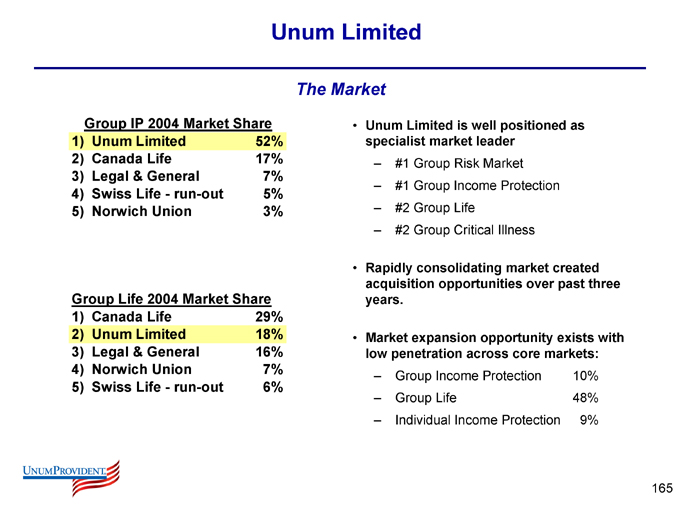

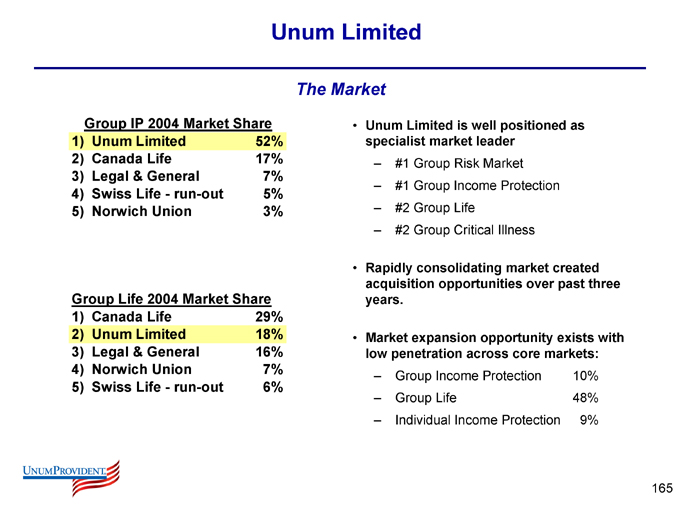

Group IP 2004 Market Share

1) Unum Limited 52%

2) Canada Life 17%

3) Legal & General 7%

4) Swiss Life - run-out 5%

5) Norwich Union 3%

Group Life 2004 Market Share

1) Canada Life 29%

2) Unum Limited 18%

3) Legal & General 16%

4) Norwich Union 7%

5) Swiss Life - run-out 6%

Unum Limited is well positioned as specialist market leader

#1 Group Risk Market

#1 Group Income Protection

#2 Group Life

#2 Group Critical Illness

Rapidly consolidating market created acquisition opportunities over past three years.

Market expansion opportunity exists with low penetration across core markets:

Group Income Protection 10%

Group Life 48%

Individual Income Protection 9%

165

Unum Limited - Strategy

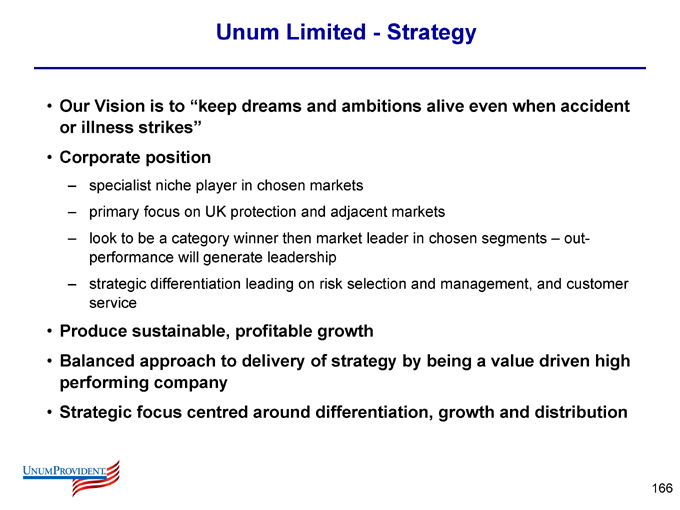

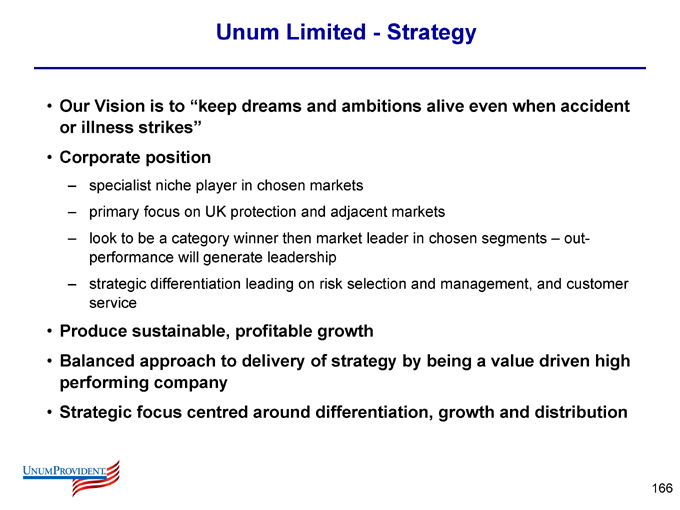

Our Vision is to “keep dreams and ambitions alive even when accident or illness strikes”

Corporate position specialist niche player in chosen markets primary focus on UK protection and adjacent markets look to be a category winner then market leader in chosen segments – outperformance will generate leadership strategic differentiation leading on risk selection and management, and customer service

Produce sustainable, profitable growth

Balanced approach to delivery of strategy by being a value driven high performing company

Strategic focus centred around differentiation, growth and distribution

166

Unum Limited – Strategic Focus

Corporate differentiation

Continue to develop a clearly understood, valued and unique corporate proposition/position around

Pricing for risk

Risk selection

Claims management

Customer service

Business growth

Growing the group and individual markets and our share of market both organically and non-organically

Moving into profitable adjacent markets

Securing distribution

Strengthen our ability to reach and access new and existing customers

Retaining our existing customers

Developing a balanced distribution strategy

167

Our Principal Brokers

Mercer Human Resource Consulting

168

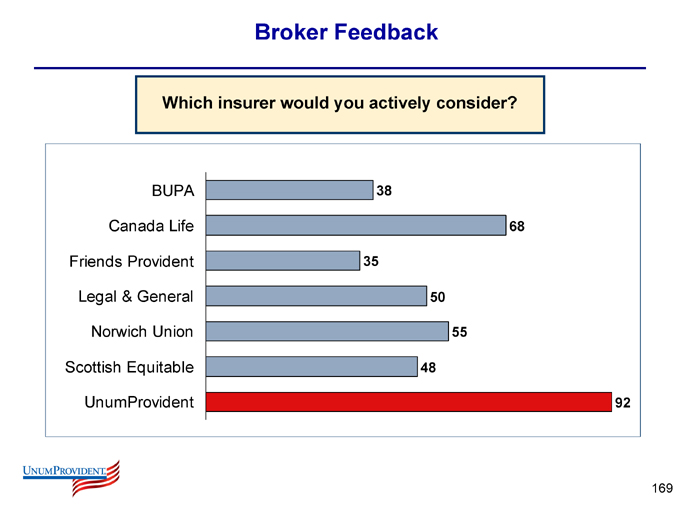

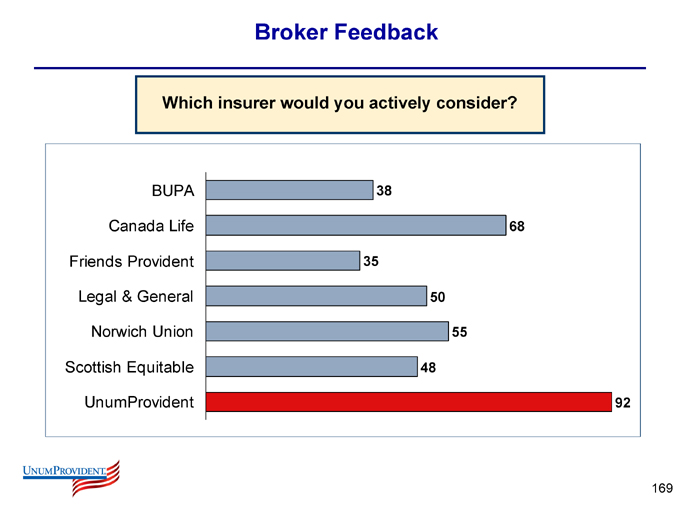

Broker Feedback

Which insurer would you actively consider?

BUPA

Canada Life

Friends Provident

Legal & General

Norwich Union

Scottish Equitable

UnumProvident

38

68

35

50

55

48

92

169

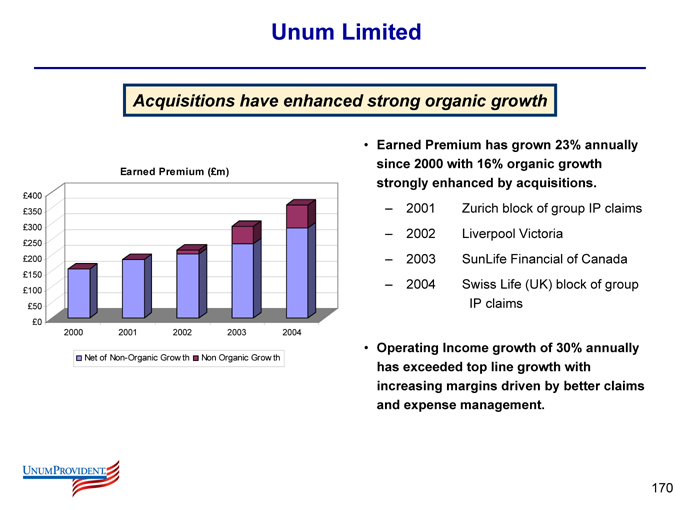

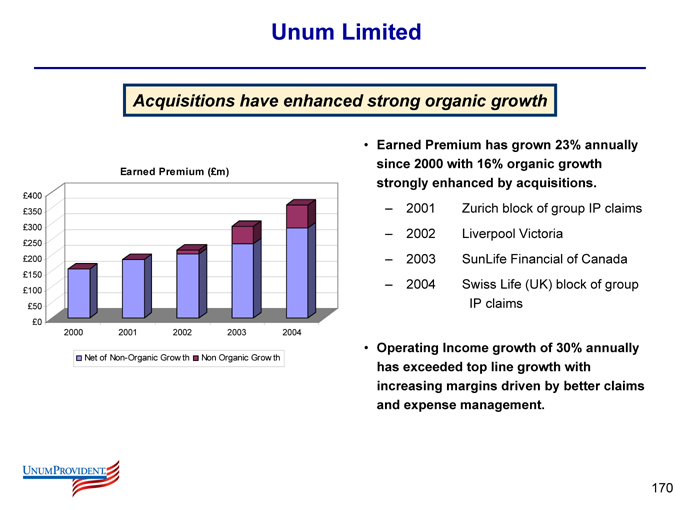

Unum Limited

Acquisitions have enhanced strong organic growth

Earned Premium (£m)

£400 £350 £300 £250 £200 £150 £100 £50 £0

2000

2001

2002

2003

2004

Net of Non-Organic Growth

Non Organic Growth

Earned Premium has grown 23% annually since 2000 with 16% organic growth strongly enhanced by acquisitions.

2001 Zurich block of group IP claims

2002 Liverpool Victoria

2003 SunLife Financial of Canada

2004 Swiss Life (UK) block of group

IP claims

Operating Income growth of 30% annually has exceeded top line growth with increasing margins driven by better claims and expense management.

170

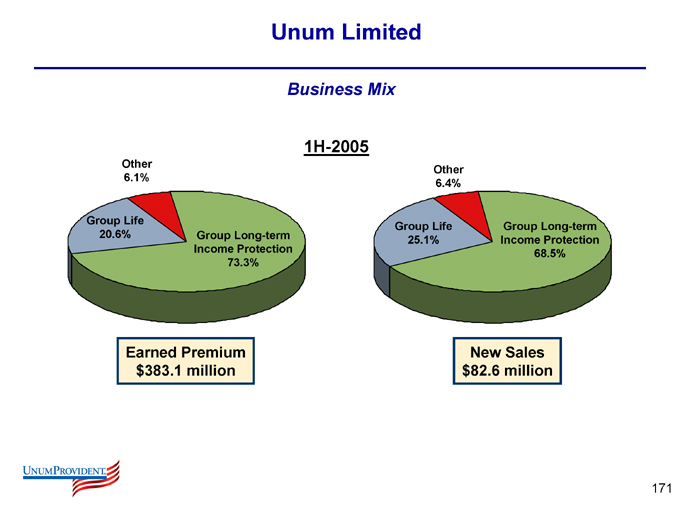

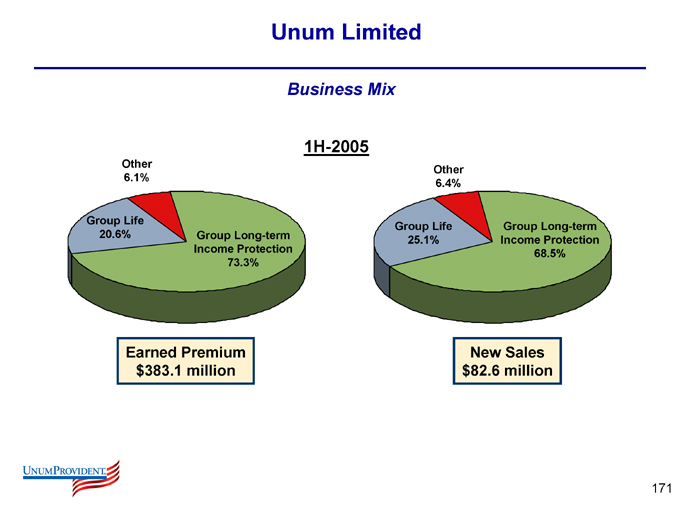

Unum Limited

Business Mix

1H-2005

Other 6.1%

Group Life 20.6%

Group Long-term Income Protection 73.3%

Earned Premium $383.1 million

Other 6.4%

Group Life 25.1%

Group Long-term Income Protection 68.5%

New Sales $82.6 million

171

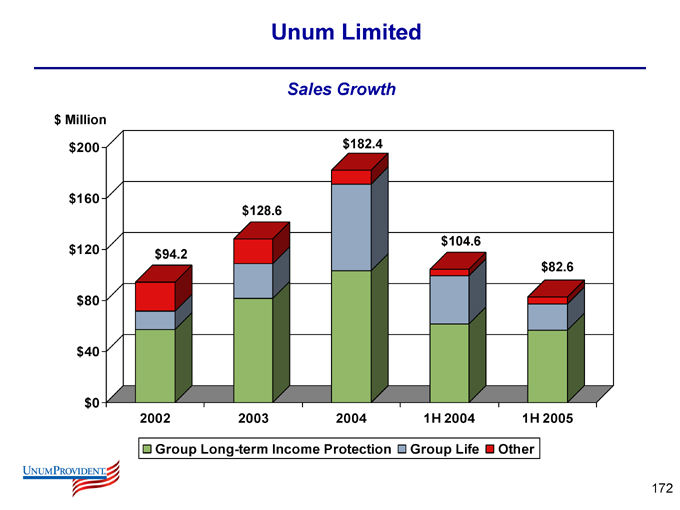

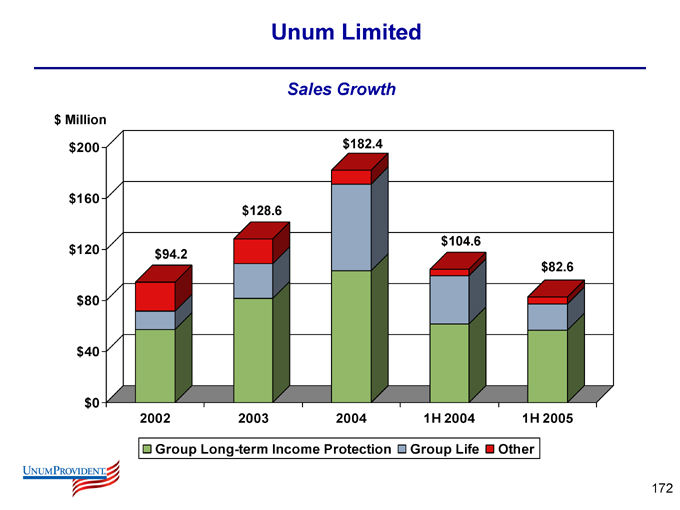

Unum Limited

Sales Growth $ Million $200 $160 $120 $80 $40 $0 $94.2 $128.6 $182.4 $104.6 $82.6

2002

2003

2004

1H 2004

1H 2005

Group Long-term Income Protection

Group Life

Other

172

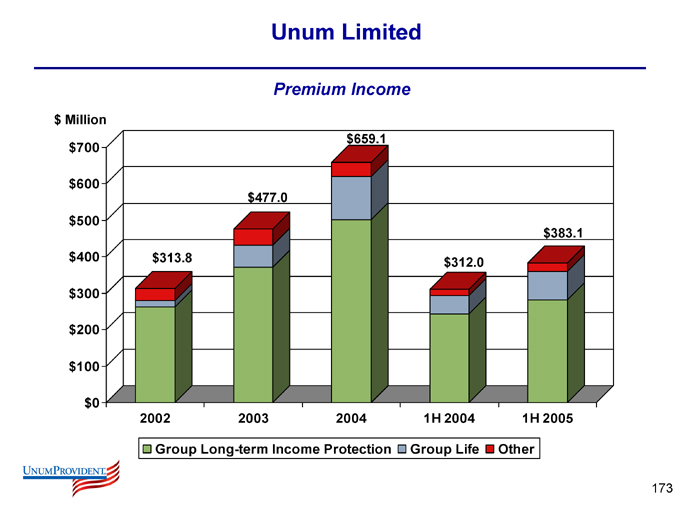

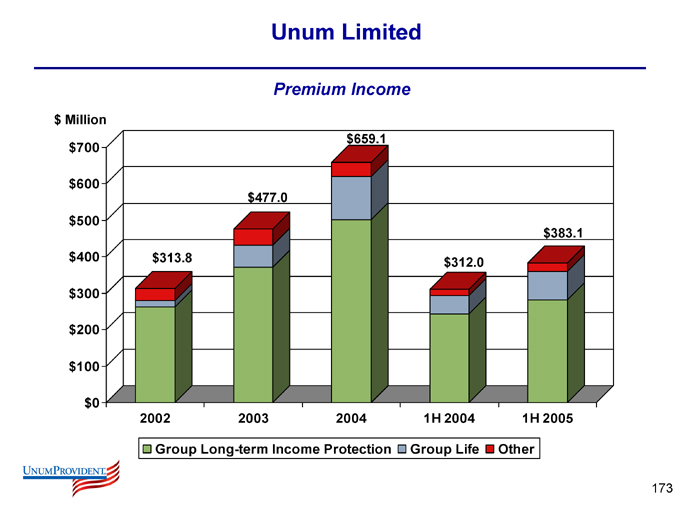

Unum Limited

Premium Income $ Million $700

$600

$500

$400

$300

$200

$100

$0 $313.8 $477.0 $659.1 $312.0 $383.1

2002

2003

2004

1H 2004

1H 2005

Group Long-term Income Protection

Group Life

Other

173

Unum Limited

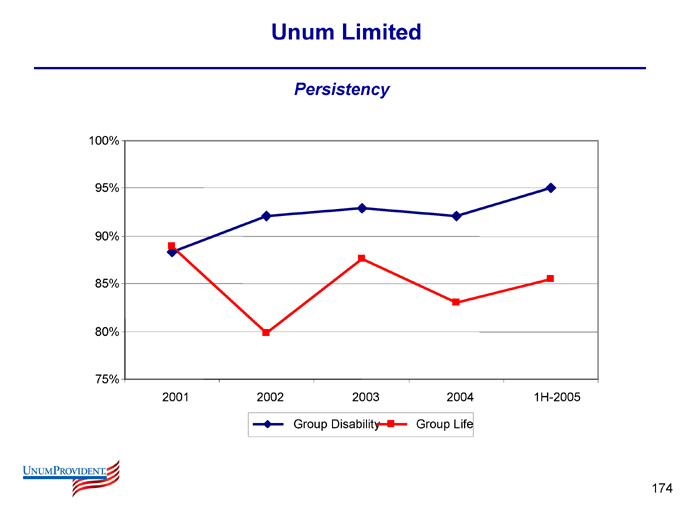

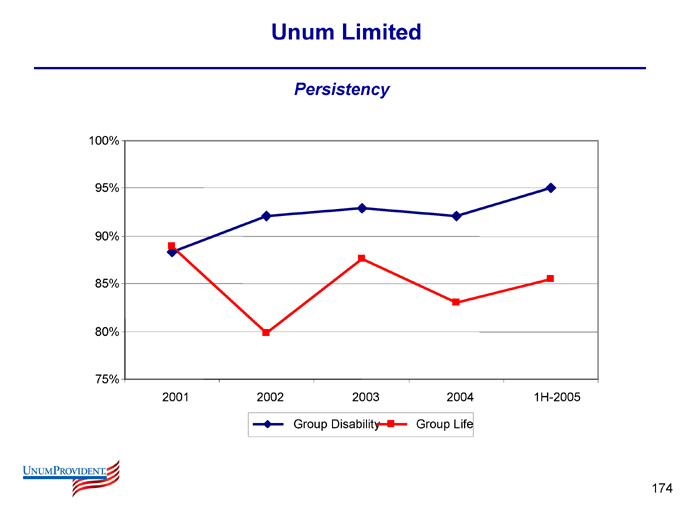

Persistency

100% 95% 90% 85% 80% 75%

2001

2002

2003

2004

1H-2005

Group Disability

Group Life

174

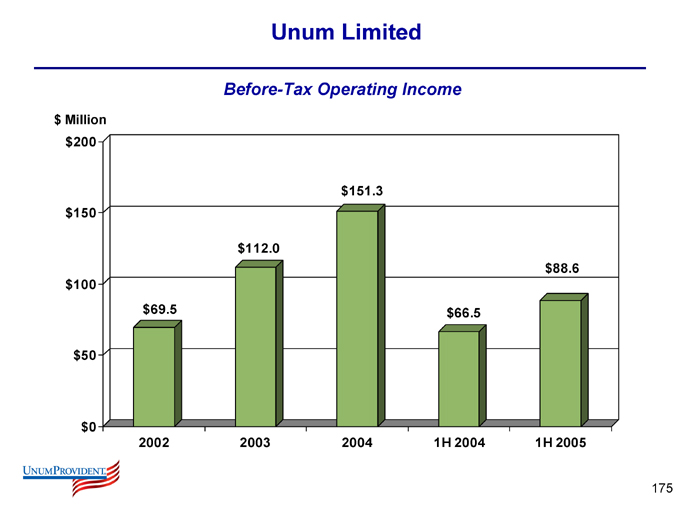

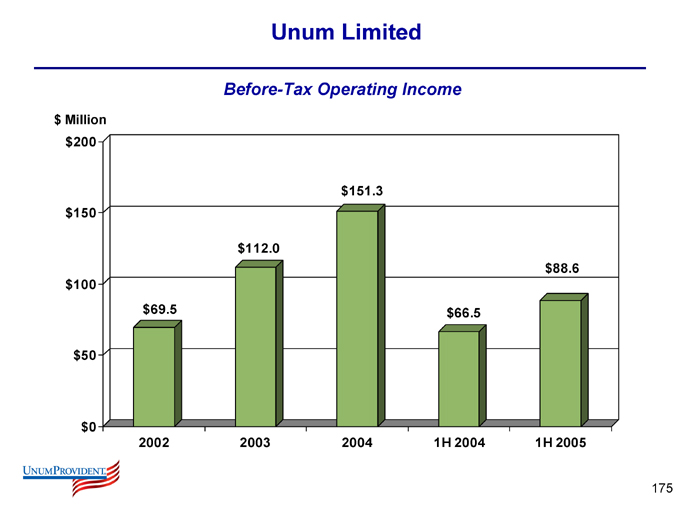

Unum Limited

Before-Tax Operating Income $ Million $200 $150 $100 $50 $0 $69.5 $112.0 $151.3 $66.5 $88.6

2002

2003

2004

1H 2004

1H 2005

175

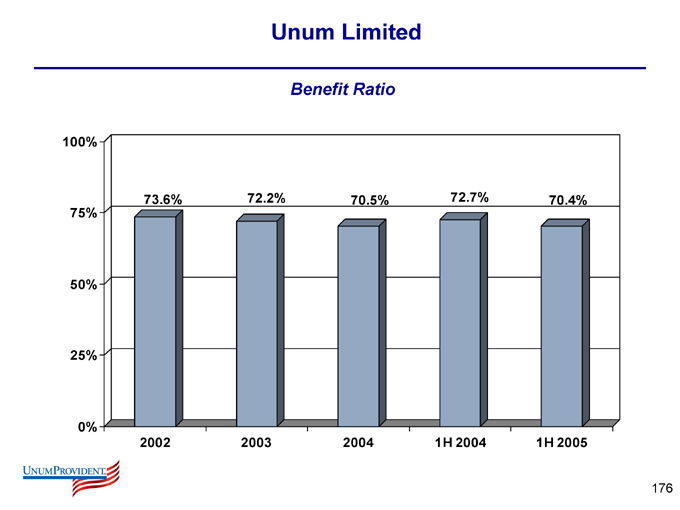

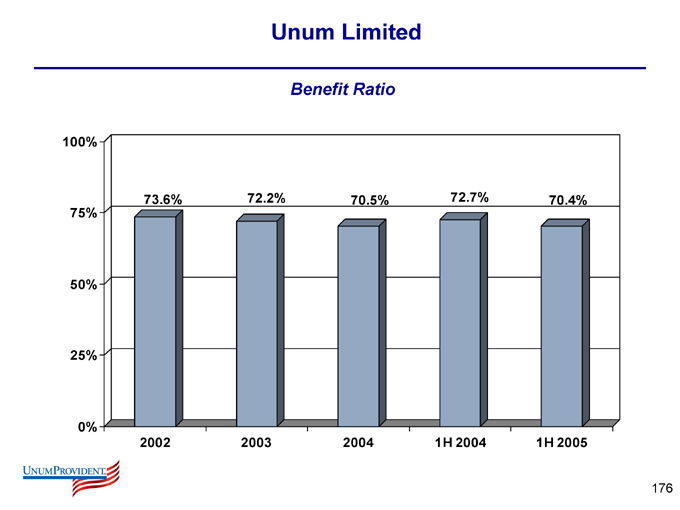

Unum Limited

Benefit Ratio

100% 75% 50% 25% 0%

73.6%

72.2%

70.5%

72.7%

70.4%

2002

2003

2004

1H 2004

1H 2005

176

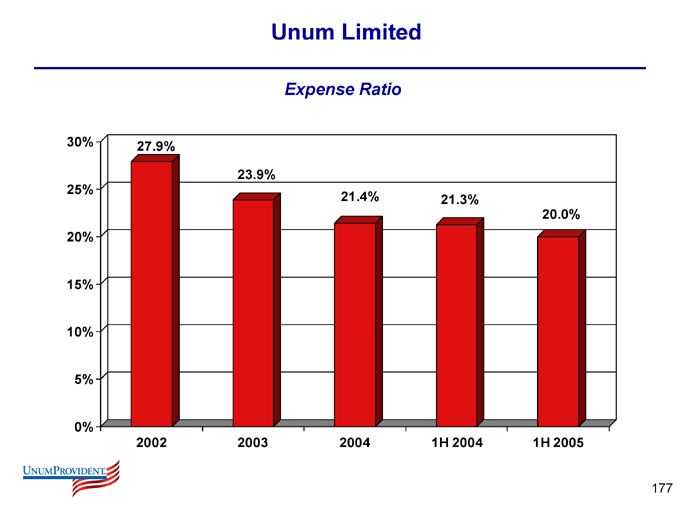

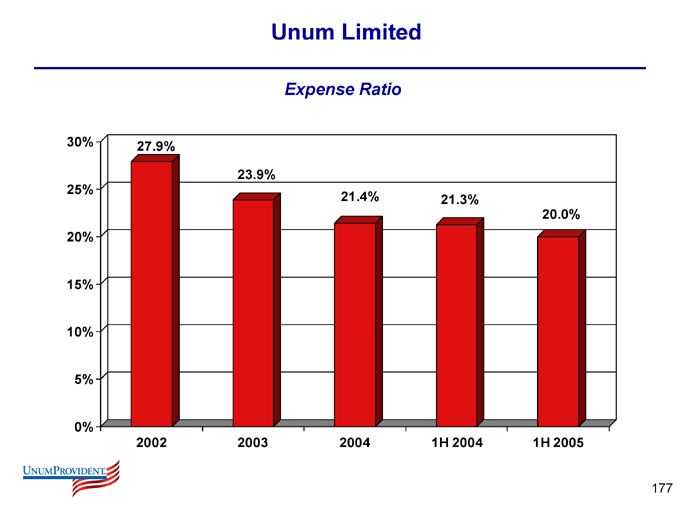

Unum Limited

Expense Ratio

30% 25% 20% 15% 10% 5% 0%

27.9%

23.9%

21.4%

21.3%

20.0%

2002

2003

2004

1H 2004

1H 2005

177

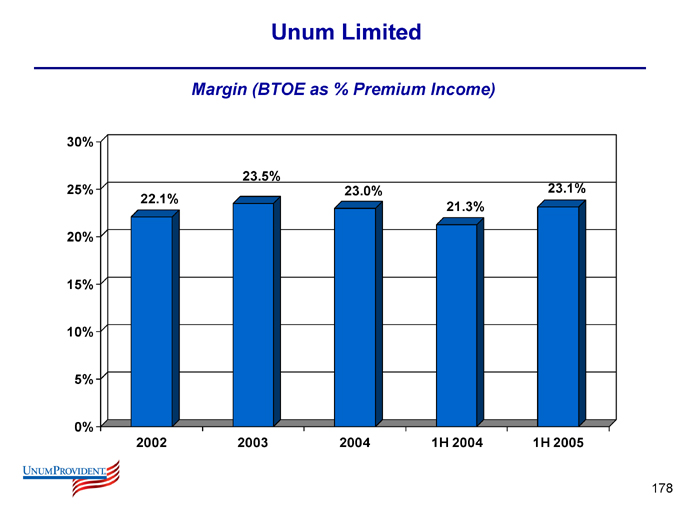

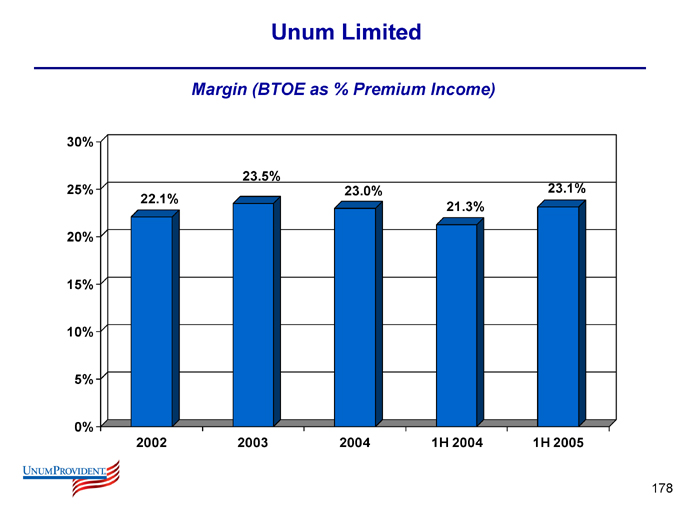

Unum Limited

Margin (BTOE as % Premium Income)

30% 25% 20% 15% 10% 5% 0%

22.1%

23.5%

23.0%

21.3%

23.1%

2002

2003

2004

1H 2004

1H 2005

178

Unum Limited

Market Opportunities

Capitalizing on withdrawals from individual market.

Taking attractive income protection claims block acquisition opportunities.

Identifying any opportunities related to “pension simplifications”.

Leveraging infrastructure improvements to benefit quality, efficiency and control.

Challenges