2015 Outlook Meeting December 16, 2014 | New York Exhibit 99.2 |

2 Safe Harbor Statement and Non-GAAP Financial Measures Certain information in this presentation constitutes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those not based on historical information, but rather relate to our outlook, future operations, strategies, financial results, or other developments and speak only as of the date made. These forward-looking statements, including statements about growth in after-tax operating income per share, anticipated reserve increases, the loss associated with the pension payout, weighted average risk-based capital ratios and cash and marketable securities, premium income growth, and share repurchases are subject to numerous assumptions, risks, and uncertainties, many of which are beyond our control. The following factors, in addition to other factors mentioned from time to time, may cause actual results to differ materially from those contemplated by the forward-looking statements: (1) unfavorable economic or business conditions, both domestic and foreign; (2) sustained periods of low interest rates; (3) fluctuation in insurance reserve liabilities and claim payments due to changes in claim incidence, recovery rates, mortality rates, and offsets due to, among other factors, the rate of unemployment and consumer confidence, the emergence of new diseases, epidemics, or pandemics, new trends and developments in medical treatments, the effectiveness of our claims operational processes, and changes in government programs; (4) legislative, regulatory, or tax changes, both domestic and foreign, including the effect of potential legislation and increased regulation in the current political environment; (5) investment results, including, but not limited to, changes in interest rates, defaults, changes in credit spreads, impairments, and the lack of appropriate investments in the market which can be acquired to match our liabilities; (6) the failure of cyber or other information security systems, as well as the occurrence of events unanticipated in our disaster recovery systems; (7) ineffectiveness of our derivatives hedging programs due to changes in the economic environment, counterparty risk, ratings downgrades, capital market volatility, changes in interest rates, and/or regulation; (8) increased competition from other insurers and financial services companies due to industry consolidation, new entrants to our markets, or other factors; (9) changes in our financial strength and credit ratings; (10) damage to our reputation due to, among other factors, regulatory investigations, legal proceedings, external events, and/or inadequate or failed internal controls and procedures; (11) actual experience that deviates from our assumptions used in pricing, underwriting, and reserving; (12) actual persistency and/or sales growth that is higher or lower than projected; (13) changes in demand for our products due to, among other factors, changes in societal attitudes, the rate of unemployment, consumer confidence, and/or legislative and regulatory changes, including healthcare reform; (14) effectiveness of our risk management program; (15) contingencies and the level and results of litigation; (16) changes in accounting standards, practices, or policies; (17) fluctuation in foreign currency exchange rates; (18) ability to generate sufficient internal liquidity and/or obtain external financing; (19) availability of reinsurance in the market and the ability of our reinsurers to meet their obligations to us; (20) recoverability and/or realization of the carrying value of our intangible assets, long-lived assets, and deferred tax assets; and (21) terrorism, both within the U.S. and abroad, ongoing military actions, and heightened security measures in response to these types of threats. For further discussion about risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see Part I, Item 1A of our annual report on Form 10-K for the year ended December 31, 2013, and our subsequently filed Form 10-Qs. The forward-looking statements in this press release are being made as of the date of this press release, and the Company expressly disclaims any obligation to update or revise any forward-looking statement contained herein, even if made available on our website or otherwise. In analyzing performance, Unum sometimes uses non-GAAP financial measures that differ from what is reported under GAAP. This presentation contains non-GAAP financial measures, including operating earnings per share, operating return on equity, book value per share (excluding accumulated other comprehensive income, or AOCI), and before tax operating income. Please refer to the Appendix for a reconciliation of the non-GAAP financial measures used in this presentation to the most directly comparable GAAP measures. |

3 Today’s Participants Business Segment Presidents Rick McKenney President and Chief Executive Officer Tom Watjen Executive Vice President and Chief Financial Officer Tom White Senior Vice President, Investor Relations Mike Simonds President and Chief Executive Officer, Unum US Peter O’Donnell President and Chief Executive Officer, Unum UK Randy Horn Chief Executive Officer, Colonial Life Jack McGarry President and Chief Executive Officer, Closed Block Tim Arnold President, Colonial Life |

4 Agenda Introduction State of the Business Financial Performance Investment Performance Closed Block 2015 Outlook Questions & Answers Core Business Segment Overviews Unum US Unum UK Colonial Life Closing Comments Questions & Answers Appendix |

Introduction |

Introduction A TRACK RECORD OF CONSISTENCY AND PREDICTABILITY… 6 $0.00 $1.00 $2.00 $3.00 $4.00 2004* 2005* 2006* 2007* 2008 2009 2010 2011 2012 2013 2014 * Does not reflect impact of ASU 2010-26. +5-10% OPERATING EPS 7.2% CAGR * * December 31, 2007 common shares outstanding 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 31.9% 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 DIVIDEND HISTORY $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 1.0% CAGR 14.4% CAGR BOOK VALUE PER SHARE (ex AOCI) $19.37 $20.77 $20.74 $20.99 $20.84 $23.20 $25.69 $26.33 $29.55 $32.32 $34.52 2004* 2005* 2006* 2007* 2008 2009 2010 2011 2012 2013 3Q14 9.2% CAGR * Does not reflect impact of ASU 2010-26. 2.7% CAGR STOCK REPURCHASE HISTORY (CUMULATIVE % OF FLOAT*) |

Sales Growth* Premium Growth* Introduction 12-Month Rolling Sales ($MM) (CAGR: 8.8%) * Core Operations, Excludes the Closed Block * Core Operations, Excludes the Closed Block Year-over-Year Change (CAGR: 2.9%) … AND THE EMERGENCE OF PROFITABLE GROWTH $1,100 $1,150 $1,200 $1,250 $1,300 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 7 Strong Momentum |

8 Introduction WHY ... ATTRACTIVE BUSINESSES * 9 months 2014 Operating Return on Equity 78% 84% 90% 91% 66% 27% 92% 65% 76% In the US In the UK Yet 13.5% 17.1% 18.2% Operating ROE* Percent Purchased at Workplace P AYCHECK TO P AYCHECK L IFE D ISABILITY R ETIREMENT SAVINGS H EALTHCARE U NUM US C OLONIAL L IFE U NUM UK NEED FOR COVERAGE WORKPLACE IS A POWERFUL DISTRIBUTION CHANNEL CAPABLE OF GENERATING ATTRACTIVE FINANCIAL RETURNS L ACK B ASIC D ISABILITY LACK BASIC DISABILITY OF CONSUMERS LIVE LACK SUFFICIENT LIFE LACK SUFFICIENT LIFE |

9 Introduction WHY… EXPERIENCED MANAGEMENT TEAM AND HIGHLY ENGAGED EMPLOYEES Years with Unum Company Leaders * Current Position Total Years In Financial Services Tom Watjen, President & CEO 12 Yrs 20 Yrs 33 Yrs Rick McKenney, Chief Financial Officer 5 Yrs 5 Yrs 21 Yrs Jack McGarry, CEO, Closed Block 2 Yrs 29 Yrs 33 Yrs Mike Simonds, CEO, Unum US 1 Yr 17 Yrs 20 Yrs Peter O’Donnell, CEO, Unum UK 2 Yrs 4 Yrs 27 Yrs Randy Horn, CEO, Colonial Life 11 Yrs 11 Yrs 40 Yrs Tim Arnold, President, Colonial Life <1 Yr 30 Yrs 30 Yrs Breege Farrell, EVP, Chief Investment Officer 4 Yrs 4 Yrs 28 Yrs Joe Foley, SVP, Corp Marketing & PR 8 Yrs 35 Yrs 35 Yrs Roger Martin, CFO, US Finance 3 Yrs 29 Yrs 29 Yrs Steve Mitchell, SVP, LTC Actuary 1 Yr 29 Yrs 29 Yrs Tom White, SVP, Investor Relations 14 Yrs 32 Yrs 32 Yrs * Represents those leaders in attendance at Investor Meeting ENGAGEMENT |

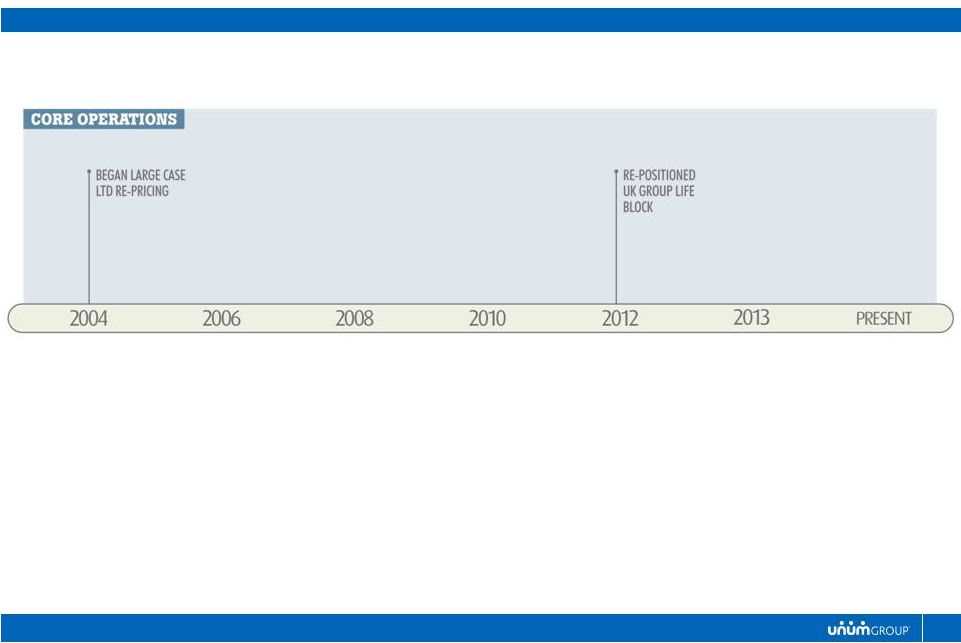

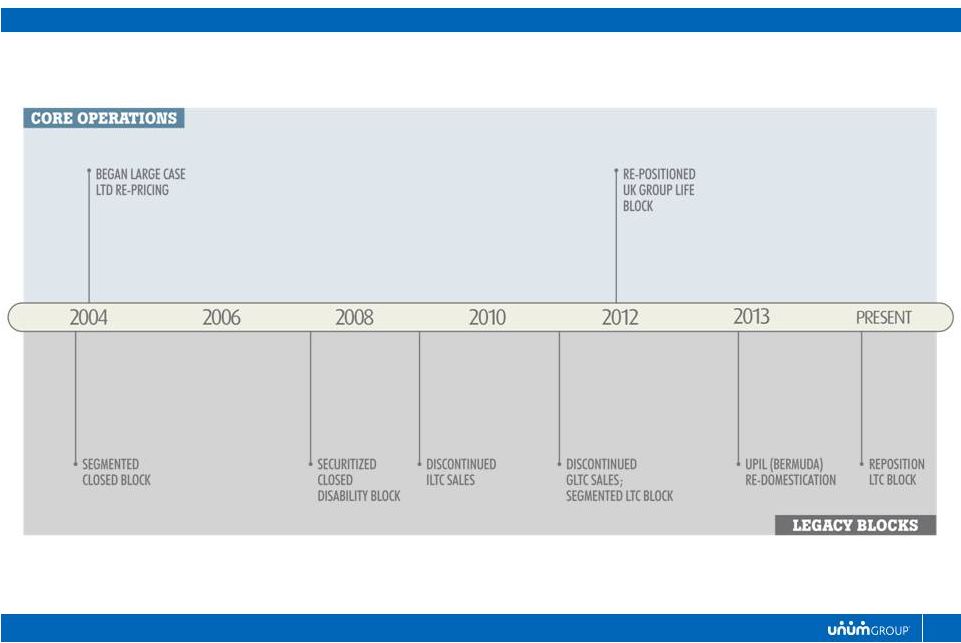

10 Introduction WHY… A HISTORY OF TRANSPARENCY AND ADDRESSING ISSUES AS THEY EMERGE |

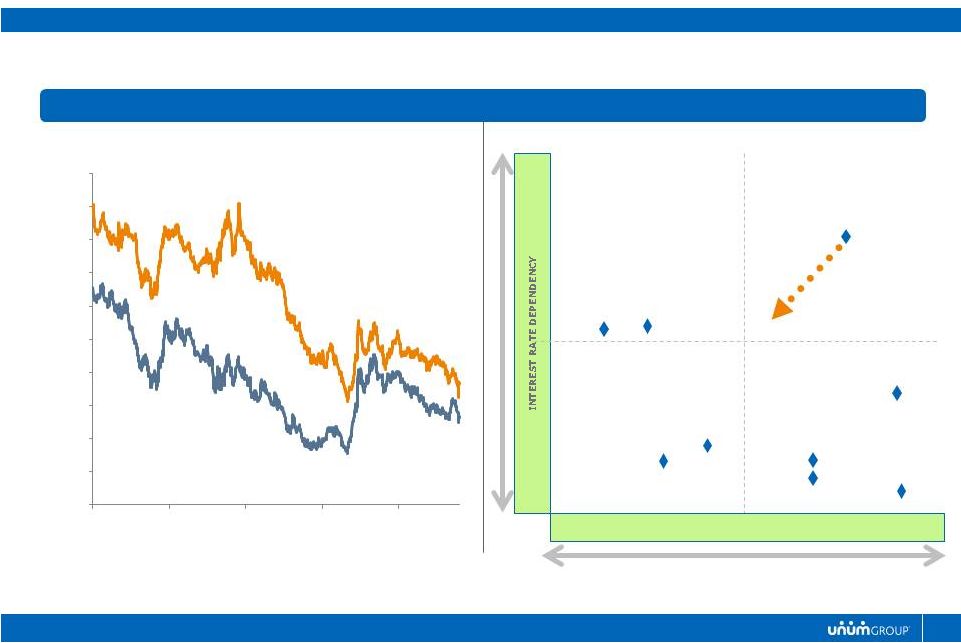

11 Rate Environment Management Actions Introduction OPERATING IN A LOW INTEREST RATE ENVIRONMENT… Source: Barclays Capital; U.S. Credit 7-10 years yield to worst, Sterling Corporate 7-10 years yield to worst UK-LTD US-LTD US-Grp Life UK-Grp Life LTC US-VWB Colonial Life CDB ID-RI HIGH RE-PRICING FLEXIBILITY LOW HIGH LOW 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 2010 2011 2012 2013 2014 US UK |

12 Introduction WHY… A HISTORY OF TRANSPARENCY AND ADDRESSING ISSUES AS THEY EMERGE |

13 Action Expected in 4Q2014 Strengthen Long-term care GAAP reserves by $600 to $800 million Implications Year-end 2014 capital metrics remain within or above our original 2014 outlook range Includes First Unum (New York) statutory reserve increase of approximately $150 million No on-going impact on Core Operations (and minimal impact on Closed Block) 2015 capital management outlook remains generally consistent with 2014 Introduction REPOSITION LTC BLOCK… ACTION AND IMPLICATIONS |

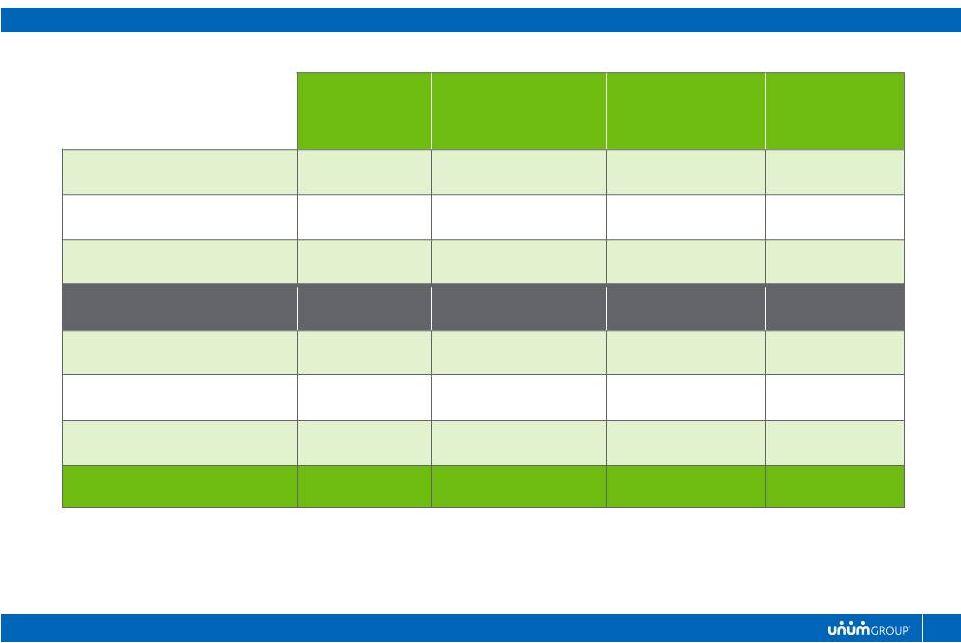

14 Introduction CONTINUED STRONG OUTLOOK * Consolidated After-Tax Operating Earnings including Corporate Segment 2015 Outlook Sales Growth Premium Growth Operating Earnings Growth Operating ROE 2015 Normalized 2015 Normalized 2015 Normalized 2015 Normalized Unum US 2-4% 8-10% 4-6% 4-7% 1-3% 4-7% 12-14% 12-14% Unum UK (£) 7-9% 10-12% 0-2% 4-7% 1-3% 4-7% 16-18% 15-20% Colonial Life 5-8% 6-8% 2-4% 5-7% 2-4% 4-6% 15-17% 15-17% Core Operations 4-6% 8-10% 4-6% 4-7% 1-3% 4-7% 13-14% 14-16% Closed Block (4-6)% (4-6)% (10-12)% (4-6)% 2-3% 2-3% Total Operations * 2-4% 3-5% 0-2% 4-7% 10-12% 10-12% Capital Management 2-3% 4-5% 0-1% 0-1% TOTAL 2-5% 8-11% 11-12% 11-13% |

State of the Business |

Financial Performance |

17 We continue to expect 2014 full year operating earnings per share growth in our range of 5% to 10% 4Q2014 operating trends Sales and premium growth trends remain solid, with continued momentum Generally solid risk results Continued pressure on net investment income o Includes 50 basis point reduction in LTD new claim discount rate Potential LTC reserve review implications Strengthen GAAP reserves by $600 to $800 million Solid capital position; within or above our original outlook Includes First Unum (New York) reserve strengthening of approximately $150 million Solid capital generation and return to shareholders $300 million share repurchases (no share repurchases in 4Q2014) 14% dividend increase Financial Performance 2014 OUTLOOK |

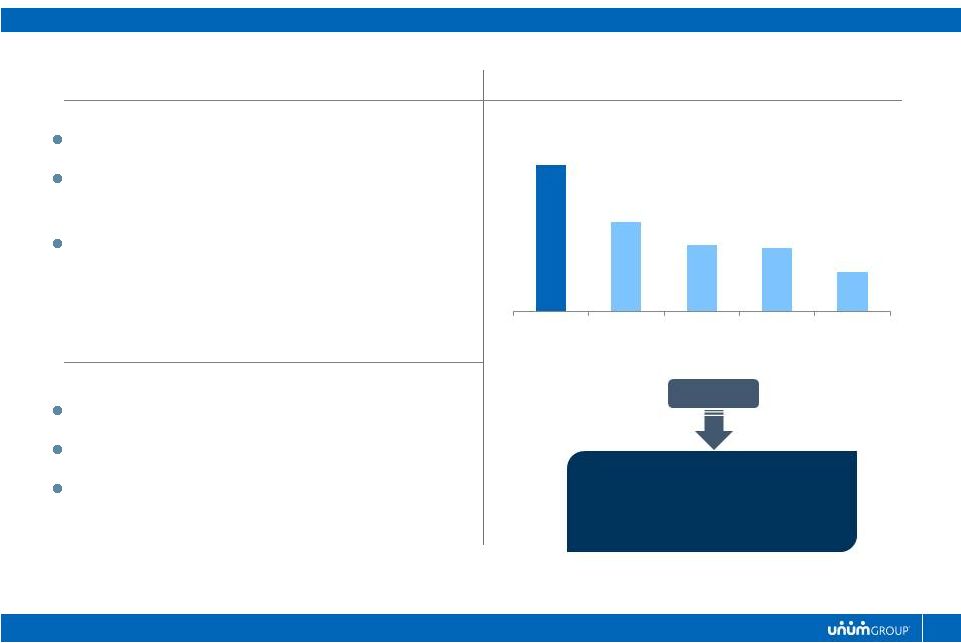

18 OPERATING EARNINGS GROWTH Original 2014 Outlook 5% to 10% Premium Growth Risk Interest Rates + + - - Current 2014 Outlook 5% to 10% Financial Performance DRIVERS OF 2014 FINANCIAL PERFORMANCE |

19 Financial Performance CONSISTENTLY STRONG RETURNS YTD 2014 Operating Return on Equity (as of 9/30/14) 18% 12% 20% 8% 14% 34% YTD % AVERAGE CONSOLIDATED GAAP EQUITY Unum US Group Disability Unum US Group Life and AD&D Unum US Supplemental & Voluntary Unum UK Colonial Life Closed Block 12.1% 16.4% 13.1% 18.2% 17.1% 2.9% 3Q14 YTD Actual Total 11.0% Average equity excludes negative allocation of corporate deficit and will therefore not add to 100% |

20 Premium Growth 2014 Outlook YTD Actual Unum US 0 – 2% 2.3% Unum UK (£) 0 – 2% 1.4% Colonial Life 2 – 4% 3.1% Total * 1 – 3% 3.1% Financial Performance IMPROVING GROWTH IN OUR CORE BUSINESSES Sales Growth 2014 Outlook YTD Actual Unum US 7 – 10% 18.3% Unum UK (£) 4 – 7% 0.0% Colonial Life 4 – 7% 9.0% Total * 5 – 9% 14.7% * Total Core Business Segments |

21 Sales Growth* Premium Growth* Financial Performance IMPROVING GROWTH IN OUR CORE BUSINESSES 12-Month Rolling Sales ($MM) (4-Year CAGR: 3.5%) * Core Operations, Excludes the Closed Block Trendline: 3Q10 – 1Q13 * Core Operations, Excludes the Closed Block Year-over-Year % Change (4-Year CAGR: 2.3%) ACA Distraction $1,050 $1,100 $1,150 $1,200 $1,250 $1,300 $1,350 3.0% 2.0% 1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% Strong Momentum ACA Distraction - - - |

22 Financial Performance STEADY, FAVORABLE RISK EXPERIENCE *Year to Date through September 30, 2014 UNUM UK UNUM US COLONIAL LIFE BENEFIT RATIOS † 73.4% 72.5% 72.7% 71.6% 70.3% 2010 2011 2012 2013 2014* 49.7% 51.9% 52.5% 52.5% 51.7% 2010 2011 2012 2013 2014* 67.0% 71.8% 77.9% 74.3% 71.7% 2010 2011 2012 2013 2014* † † Excluding Reserve Adjustments |

23 ($ millions) Combined Statutory Net Income * Financial Performance CAPITAL GENERATION * Statutory Net Income for traditional US Insurance Companies † Estimate ($ millions) Capital Generation Model 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014† $0.6 -$8.2 $64.1 $58.3 $141.2 -$102.0 -$16.9 $21.1 -$25.3 -$33.0 - - - - $574.0 $689.4 $850.3 $682.0 $741.2 $645.7 $664.0 $649.8 $617.5 ~ $650.0 After- tax Operating Income Net Realized Investment Gains (Losses) |

24 Financial Performance ACTIVE CAPITAL DEPLOYMENT 2008 2009 $700 million --- 2010 2011 $356 million $620 million $104 million $105 million $115 million $121 million 2012 $500 million $134 million TOTAL $2,796 million* $883 million 2013 $319 million $147 million 2014 $301 million* $157 million *December 31, 2007 common shares outstanding; Through September 30, 2014. 8.3% 8.3% 12.8% 19.9% 26.4% 29.5% 31.9% --- +10.0% +23.3% +40.0% +73.3% +93.3% +120.0% † 3Q quarterly dividend paid Cumulative % of shares* Cumulative increase † Share Repurchases Dividends Paid |

25 Risk Based Capital Holding Companies’ Cash and Marketable Securities Year-End 2013 405% $514 million September 2014 400% $720 million Original 2014 Outlook 375% - 400% >$500 million Financial Performance STRONG CAPITAL POSITION |

Investment Performance |

27 Asset Quality Interest Rate Management Investment Performance |

(Book Value - $42.4B) Invested Asset Distribution Credit Losses Relative to Moody’s Index Investment Performance ASSET QUALITY Investment grade corporate bonds remain our core holding. 1 Formerly 5.12% due to Lehman; Moody’s has subsequently removed it Investment Grade Private Placements 11.9% High Yield 7.9% Cash, Government Agencies 7.2% Municipals 4.1% Investment Grade Corporate 57.3% Mortgage- Backed Securities & Other Securitized Assets 5.4% Secuirites & Commercial Mortgage Loans 4.3% Other Investments 1.9% 0.30% 0.30% 0.30% 0.20% 0.40% 0.45% 0.64% 0.02% 0.05% 0.05% 0.00% 0.00% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 2008 2009 2010 2011 2012 2013 3Q14 Market Unum 2.21% 2.63% 1 28 |

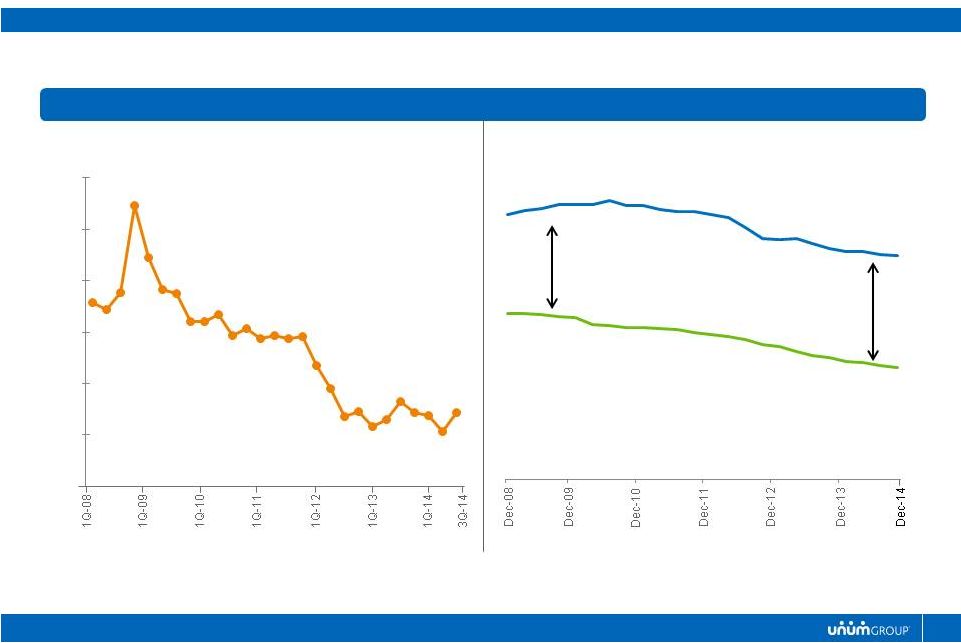

Barclays Single-A Intermediate OAS 10-Year Treasury Investment Grade Bond Spreads Investment Performance IMPLICATIONS OF LOW INTEREST RATES 3.00% 2.50% 1.00% 0.00% 3.50% 2.00% 1.50% 0.50% 2.50% 1.00% 0.00% 2.00% 1.50% 0.50% 29 |

30 Pricing Flexibility Discount Rate Adjustments Manageable Investable Cash Flows Disciplined Asset Selection Investment Performance MANAGING LOW INTEREST RATES |

31 Investment Performance PRODUCT LINE SENSITIVITIES UK-LTD US-LTD US-Grp Life UK-Grp Life LTC US-VWB Colonial Life CDB ID-RI LOW HIGH LOW HIGH R E - P R I C I N G F L E X I B I L I T Y |

32 (Target Margin = 60 bps) Total Portfolio Purchase Yields Unum US LTD Investment Performance PURCHASE YIELDS AND MARGINS 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% Portfolio Yield Liability Discount Rate 81 bps 91 bps |

33 Investment Performance MANAGEABLE INVESTABLE CASH FLOW Unum US - LTD Colonial ID – Closed Block Long-term Care $8.8 billion $900 million $45.6 billion $240 million $8.2 billion $2.6 billion $270 million $9.1 billion $75 million Unum - Combined Unum US – ID - Recently Issued $2.1 billion $90 million $3.0 billion Portfolio Size 2015 Investable Cash Flow Portfolio Size 2015 Investable Cash Flow Portfolio Size 2015 Investable Cash Flow Portfolio Size 2015 Investable Cash Flow Portfolio Size 2015 Investable Cash Flow Portfolio Size 2015 Investable Cash Flow |

Closed Block |

35 Closed Block BUSINESS SNAPSHOT Legacy Discontinued Blocks Individual Disability Long Term Care Distribution IDI Sales discontinued in mid-1990’s ILTC Sales discontinued in 2009 GLTC Sales discontinued in 2011 Size and Scale Total Reserves of $29 billion GAAP Equity of $2.9 billion 325 Claims Management resources Closed Block * Premium Income $1.3 billion Before Tax Operating Income $119 million Operating Return on Equity 2.8% * 4 Quarters Ending 9/30/2014 50% 50% Premium Distribution * ($m) Individual Disability Long Term Care |

36 We are conducting a comprehensive review of all assumptions underlying our Long Term Care reserves. Potential GAAP Impacts: Before-tax charge of $600 million to $800 million anticipated. Primarily attributable to reduction in the discount rate in response to current low interest rate environment. Potential Statutory Impacts: First Unum (New York) reserve strengthening of approximately $150 million. Negligible impact on future statutory earnings and free cash flow generation. Closed Block 2014 LONG TERM CARE RESERVE REVIEW |

37 Operational Effectiveness High quality claims management Cost efficient customer service capabilities Effective implementation of approved rate increases LTC Rate Increases Continue to pursue justified rate increases Offer enhanced policyholder options Lead regulatory outreach program Financial Analysis Use new experience analysis tools to manage the blocks Capital Management Invest in modeling and analytical capabilities Monitor capital markets development Closed Block 2015 KEY PRIORITIES |

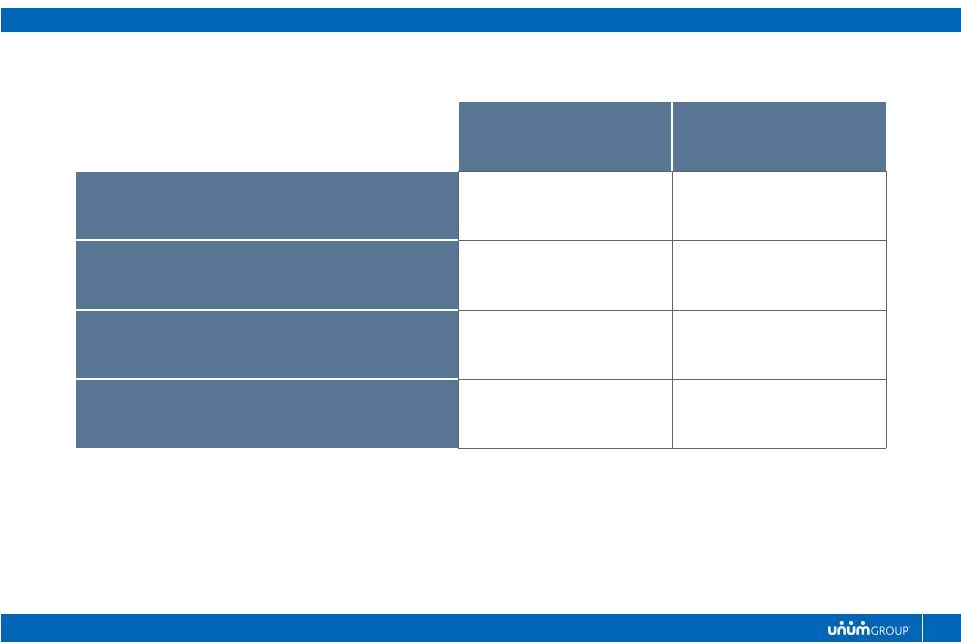

38 Closed Block 2015 FINANCIAL OUTLOOK 2015 Outlook Normalized Sales Growth N/A N/A Premium Growth (4 - 6)% (4 - 6)% Operating Earnings Growth (10 – 12)% (4 - 6)% Operating ROE 2 - 3% 2 - 3% |

2015 Outlook |

40 Continued favorable premium growth trends Persistency remains stable Expect generally stable risk results through disciplined pricing, risk selection and renewals Full year impact of Group LTD 4Q discount rate adjustment Continued Pressure on net investment income from lower investment yields Operating EPS growth of 2% to 5% Continued steady capital generation and deployment: $400 to $600 million of share repurchases Increasing dividend 2015 Outlook KEY MESSAGES |

41 2015 Outlook FACTORS IMPACTING OUR 2015 OUTLOOK +2-3% +4-5% (3-4)% 0-(1)% 2% to 5% Growth 0% Premium Growth and Favorable Risk Yield and Discount Rate Pressure Closed Block, Tax and Other Capital Management 2015 Outlook |

42 2015 Outlook CAPITAL OUTLOOK Capital Management Criteria Sept 2014 2014 Projection 2015 Projection Risk-Based Capital Ratio for Traditional U.S. Insurance Companies 400% ~400% Holding Companies’ Cash and Marketable Securities ($ millions) $720 >$500 >$500 375% - 400% |

43 2015 Outlook BUSINESS SEGMENT OUTLOOK * Consolidated After-Tax Operating Earnings including Corporate Segment Sales Growth Premium Growth Operating Earnings Growth Operating ROE Unum US 2 - 4% 4 - 6% 1 - 3% 12 - 14% Unum UK (£) 7 - 9% 0 - 2% 1 - 3% 16 - 18% Colonial Life 5 - 8% 2 - 4% 2 - 4% 15 - 17% Core Operations 4 - 6% 4 - 6% 1 - 3% 13 - 14% Closed Block (4 - 6)% 2 - 3% Total Operations* 2 - 4% 0 - 2% 10 - 12% Capital Management 2 - 3% 0 - 1% Total 2 - 5% 11 - 12% (10 - 12)% |

Questions & Answers |

Core Business Segment Overviews |

Unum US |

47 Unum US BUSINESS SNAPSHOT Employee Benefits Group Long Term and Short Term Disability Group Life and AD&D Voluntary Benefits Individual Disability Benefits Market Characteristics Top 3 market share position across all major product categories Strong need for financial protection, increasing due to healthcare changes Technology enabling new distribution Unum US * Earned Premium $4.6 billion Before Tax Operating Income $861 million Operating Return on Equity 13.6% * 4 Quarters Ending 9/30/2014 +18% Growth 44% 21% 28% 7% Sales Distribution* (Trailing 4 Quarters Growth) Core Group (<2,000 ee's) Large Employer Group (>2,000 ee's) Voluntary Benefits IDI-Recently Issued +5% Growth +15% Growth +17% Growth |

48 Broad & Diverse Client Base Strong service – 93% client satisfaction Unmatched expertise – 2,500 benefits professionals Disciplined pricing & underwriting using largest, most diverse private data set Strong persistency – 90% YTD 2014 Predictable benefit ratios Accelerating growth with additional opportunity in existing client base; ~2.5 products per client today vs ~7 per fully integrated client Unum US UNIQUE IN FINANCIAL PROTECTION EMPLOYEE BENEFITS Industry Leading Performance Industry Leading Capabilities LTD Employer Clients for Top 5 Carriers <100 Employees 44% of Fortune 100 With Unum Benefits Source: GenRe 2013 AND 44,000 27,000 20,000 19,000 12,000 UNM #2 #3 #4 #5 |

49 Unum US GROWTH BY ENGAGING CLIENTS AND THEIR EMPLOYEES ACA Distraction % of Sales with Employee Contribution 12-Month Rolling Sales ($MM) % of Sales from Existing Clients Opportunities Within Existing Client Base 6.5% (CAGR) Market Moving to Employee Pay Improving Sales Momentum 100% 100% $600 $650 $700 $750 $800 $850 $900 52% 56% 60% 63% 63% 2010 2011 2012 2013 3Q14 46% 31% 54% 69% 2003 2013 Employer Employee |

50 Strong growth momentum Continued strong persistency with deeper relationships Strong sales growth within existing clients, partially offset by our expectation that new large case sales will not duplicate 2014 Stable risk environment as the economy gradually improves Operating Efficiency gains based on service model and cross-business centers of excellence Continued pricing discipline to mitigate interest rate pressures Continued investment in our franchise Active client management and a differentiated integrated experience across Group, VB and IDI Consumer marketing, new enrollment and self service technologies Building on key product and distribution partnerships including 40+ benefit administration/enrollment platform connects Unum US 2015 BUSINESS OUTLOOK |

51 2015 Growth Outlook Unum US INTEREST RATE IMPACT TO 2015 OUTLOOK 2014 BTOE Growth Risk & Operating Expense NII & Discount Rate 2015 BTOE 4%-6% 4%-6% (7%-9%) 1%-3% |

52 Unum US 2015 FINANCIAL OUTLOOK * 6-8% excluding large employer group 2015 Outlook Normalized Sales Growth* 2 - 4% 8 - 10% Premium Growth 4 - 6% 4 - 7% Operating Earnings Growth 1 - 3% 4 - 7% Operating ROE 12 - 14% 12 - 14% |

Unum UK |

54 Unum UK BUSINESS SNAPSHOT Primary Products Group Income Protection Group Life and Group Dependents Supplementary and Voluntary products: Group Critical Illness, Individual Income Protection (Closed) Market Share # 1 Group Income Protection # 4 Group Life # 3 Group Critical Illness Market Scope Over 10,000 employers served Over 1.5 million employees insured * * Calculated in U.S. dollars * 4 Quarters Ending 9/30/2014 69% 21% 10% Premium Distribution * (£m) Group Income Protection Group Life and Critical Illness Supplemental and Voluntary Unum UK * £360 million Before Tax Operating Income £88 million Operating Return on Equity 18.6%** Earned Premium |

55 Unum UK STRATEGY Deliver Industry-leading Customer Experience Grow Group Income Protection Market Grow Group Risk Block Introduce Related Products and Services Simplify our Processes and Operations Develop Talent and Leadership Capital Management Strategy |

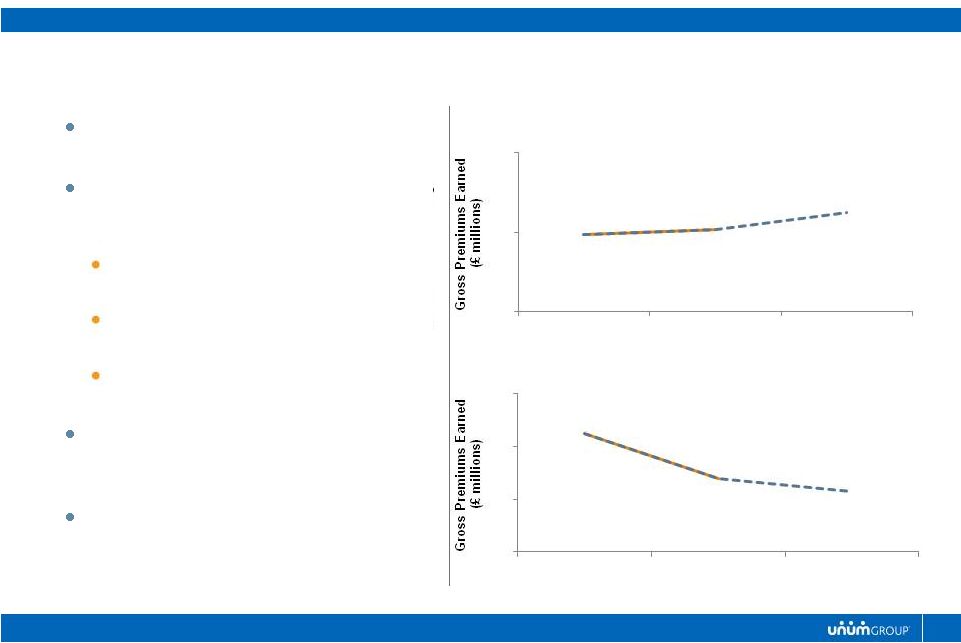

56 Unum UK 2015 BUSINESS OUTLOOK Primary focus remains expanding the UK Group Income Protection market. Re-pricing and re-positioning of our group life block is complete. We are now looking to grow our group risk business: Develop the UK short-term disability market via Sick Pay Insurance product Prudently target attractive segments of the Group Life market Launch updated value proposition to grow our Group Critical Illness block We will explore opportunities outside the traditional UK product and distribution channel to expand our offering We will continue to deploy reinsurance where appropriate and economic to help manage risk During 2015 we are investing in the technology required to accelerate growth and improve operational efficiencies, while continuing to place rate to offset interest rate pressures. 225 250 275 2013 2014 (FC) 2015 (P) Group Income Protection 70 90 110 130 2013 2014 (FC) 2015 (P) Group Life (ex Dependents) |

57 Unum UK 2015 KEY PRIORITIES Expand the Market Focus on education and CRM to grow the Group Income Protection market Become provider of choice for brokers across all group risk products Explore portfolio diversification opportunities Build Capabilities to Enable Profitable Growth Simplify and streamline our operations Enhance the productivity of our brokerage distribution channel Explore demand-generation approaches, partnerships and new products Leverage corporate expertise and capabilities Risk Management Maintain efficient and economical reinsurance arrangements Prepare the business for transition to Solvency II capital requirements starting in 2016 Continue underwriting and pricing discipline to mitigate interest rate pressures |

58 Unum UK 2015 FINANCIAL OUTLOOK 2015 Outlook Normalized Sales Growth 7 - 9% 10 - 12% Premium Growth 0 - 2% 4 - 7% Operating Earnings Growth 1 - 3% 4 - 7% Operating ROE 16 - 18% 15 - 20% |

Colonial Life |

60 Colonial Life BUSINESS SNAPSHOT Colonial Life *** Earned Premium $1.26 billion Before Tax Operating Income $295 million Operating Return on Equity 16.9% * * Sales Premium as of 9/30/2014 * * * 4 Quarters Ending 9/30/2014 * Market share based on Eastbridge U.S. Worksite /Voluntary Carrier Sales Report for 2013 +5% Growth +4% Growth +29% Growth 38% 32% 12% 18% Sales Distribution ** (YTD 2014 Growth) Small Commercial (< 100 ee's) Med. Commercial (100 to 999 ee's) Large Commercial (1,000+ ee's) Public Sector +12% Growth Primary Products Accident, Sickness and Disability Life (Term, UL, WL) Cancer and Critical Illness Market Share * # 5 Voluntary Carrier with 6% market share Product Sales: o # 2 in STD and Cancer o # 3 in Accident o # 4 in Hospital Indemnity, UL & WL, and Critical Illness Size and Scale Over 80,000 businesses served Over 3 million policies in force Over 10,000 career agents and 14,000 brokers under contract |

61 Colonial Life 2015 BUSINESS OUTLOOK Our 2014 sales success points to execution of our strategic initiatives and investments in sales leadership, distribution effectiveness and sales support. Strong sales fundamentals through third quarter 2014: o New accounts up 9% o New account sales up 17% and existing account sales up 6% o New rep recruits up 19% o New rep sales up 42% Positive sales trends are continuing into fourth quarter Key drivers in our 2015 plan: Current market environment offers considerable opportunities to meet emerging needs of employers, brokers, and consumers. Positive sales momentum from 2014 and the potential in our target markets. Sustained improvement in distribution effectiveness. Four key areas of focus – growth, customer experience, productivity, and talent. Achieving our 2015 growth objectives will be supported by a continued focus on third- party connectivity, enrollment solutions, service capabilities and operational excellence. 2015 operating earnings growth is expected to be in the 2-4% range, with continued strong profit margins and operating ROE levels. |

62 Colonial Life 2015 PLAN DRIVERS - MARKETPLACE Provide solutions for employers to contain costs, administer benefits and help employees make benefits decisions Focus on small employers to expand the market and offset broker exit Employers Leverage broad expertise and partnerships to offer flexible, turnkey enrollment solutions Attract local and regional brokers adding voluntary to their portfolios Brokers Improve decision support tools and package products to drive participation and penetration Invest in customer service and mobile capabilities to improve retention Consumers |

63 Colonial Life 2015 KEY PRIORITIES Grow distribution footprint through sales organization and alliances Achieve balanced sales among target markets Introduce new and updated products Growth Reduce customer effort for consumers and partners Enhance administration capabilities for group and individual products Deliver better experiences through web-based services Customer Experience Leverage cross-enterprise assets Improve tools to incrementally drive efficiency Enable partners to more easily connect with us Productivity Build upon investment in sales leadership and talent profiles Drive leadership development throughout the organization Emphasis on collaboration and empowerment Talent |

64 Colonial Life 2015 FINANCIAL OUTLOOK 2015 Outlook Normalized Sales Growth 5 - 8% 6 - 8% Premium Growth 2 - 4% 5 - 7% Operating Earnings Growth 2 - 4% 4 - 6% Operating ROE 15 -17% 15 -17% |

Closing Comments |

66 Good operating businesses with positive long-term trends An intense focus on the management of our closed block Solid financial foundation and predictable cash flow remain an asset We are confident we are taking the actions needed to continue to build value Closing Comments • …and a commitment to disciplined growth • …consistent with our history with these types of issues • …leading to significant financial flexibility • …just as we have done in the past |

67 Closing Comments CONTINUED STRONG OUTLOOK * Consolidated After-Tax Operating Earnings including Corporate Segment 2015 Outlook Sales Growth Premium Growth Operating Earnings Growth Operating ROE 2015 Normalized 2015 Normalized 2015 Normalized 2015 Normalized Unum US 2-4% 8-10% 4-6% 4-7% 1-3% 4-7% 12-14% 12-14% Unum UK (£) 7-9% 10-12% 0-2% 4-7% 1-3% 4-7% 16-18% 15-20% Colonial Life 5-8% 6-8% 2-4% 5-7% 2-4% 4-6% 15-17% 15-17% Core Operations 4-6% 8-10% 4-6% 4-7% 1-3% 4-7% 13-14% 14-16% Closed Block (4-6)% (4-6)% (10-12)% (4-6)% 2-3% 2-3% Total Operations * 2-4% 3-5% 0-2% 4-7% 10-12% 10-12% Capital Management 2-3% 4-5% 0-1% 0-1% TOTAL 2-5% 8-11% 11-12% 11-13% |

Questions & Answers |

Appendix Reconciliation of Non-GAAP Financial Measures |

70 Appendix RECONCILIATION OF NON-GAAP FINANCIAL MEASURES After-Tax Average Operating Allocated Annualized Earnings (Loss) Equity* Operating Return On Equity Nine Months Ended September 30, 2014 Unum US Group Disability 138.9 $ 1,528.2 $ 12.1% Group Life and Accidental Death and Dismemberment 119.8 974.7 16.4% Supplemental and Voluntary 163.2 1,655.9 13.1% Total Unum US 421.9 4,158.8 $ 13.5% Unum UK 87.1 636.4 18.2% Colonial Life 146.9 1,148.6 17.1% Closed Block 61.1 2,780.1 2.9% Corporate (35.4) (461.1) Total 681.6 $ 8,262.8 $ 11.0% * Excludes unrealized gain on securities and net gain on cash flow hedges and is calculated using the stockholders' equity balances presented below. (in millions) Nine Months Ended September 30, 2014* 2013 2012 2011 2010 2009 2008 2007** 2006** 2005** 2004** After-tax Operating Earnings 2.64 $ 3.32 $ 3.15 $ 2.98 $ 2.73 $ 2.64 $ 2.54 $ 2.25 $ 1.85 $ 1.69 $ 1.78 $ Net Realized Investment Gain (Loss), Net of Tax 0.10 0.02 0.13 (0.01) 0.05 - (0.89) (0.12) 0.01 (0.02) 0.06 Non-operating Retirement-related Loss, Net of Tax (0.01) (0.08) (0.11) (0.07) (0.06) (0.09) (0.03) (0.04) (0.05) (0.05) (0.04) Costs Related to Early Retirement of Debt, Net of Tax (0.04) - - - - - - - - - - Deferred Acquisition Costs and Reserve Charges for Closed Block, Net of Tax - - - (2.04) - - - - - - (2.37) Regulatory Reassessment Charges, Net of Tax - - - - - - - (0.10) (0.79) (0.16) (0.29) Special Tax Items and Debt Extinguishment Costs - - - 0.08 (0.03) - - (0.10) 0.23 0.14 0.17 Unclaimed Death Benefits Reserve Increase, Net of Tax - (0.24) - - - - - - - - - Group Life Waiver of Premium Benefit Reserve Reduction, Net of Tax - 0.21 - - - - - - - - - Other, Net of Tax - - - - - - - - (0.04) 0.01 0.01 Income from Continuing Operations 2.69 3.23 3.17 0.94 2.69 2.55 1.62 1.89 1.21 1.61 (0.68) Income from Discontinued Operations - - - - - - - 0.02 0.02 0.03 (0.18) Net Income (Loss) 2.69 $ 3.23 $ 3.17 $ 0.94 $ 2.69 $ 2.55 $ 1.62 $ 1.91 $ 1.23 $ 1.64 $ (0.86) $ * Assuming dilution per share. ** Does not reflect the impact of ASU 2010-26. September 30 2014 2013 2012 2011 2010 2009 2008 2007** 2006** 2005** 2004** Total Stockholders' Equity (Book Value) 36.69 $ 33.30 $ 31.87 $ 27.91 $ 26.80 $ 24.25 $ 17.94 $ 22.28 $ 22.53 $ 24.66 $ 24.36 $ Net Unrealized Gain (Loss) on Securities 1.83 0.52 3.23 2.11 1.31 1.16 (2.53) 0.99 1.56 3.49 4.41 Net Gain on Cash Flow Hedges 1.52 1.52 1.48 1.39 1.14 1.12 1.38 0.50 0.57 0.91 0.80 Subtotal 33.34 31.26 27.16 24.41 24.35 21.97 19.09 20.79 20.40 20.26 19.15 Foreign Currency Translation Adjustment (0.27) (0.18) (0.26) (0.41) (0.34) (0.23) (0.52) 0.35 0.34 0.07 0.33 Subtotal 33.61 31.44 27.42 24.82 24.69 22.20 19.61 20.44 20.06 20.19 18.82 Unrecognized Pension and Postretirement Benefit Costs (0.91) (0.88) (2.13) (1.51) (1.00) (1.00) (1.23) (0.55) (0.68) (0.58) (0.55) Total Stockholders' Equity, Excluding Accumulated Other Comprehensive Income 34.52 $ 32.32 $ 29.55 $ 26.33 $ 25.69 $ 23.20 $ 20.84 $ 20.99 $ 20.74 $ 20.77 $ 19.37 $ Year Ended December 31* December 31 (per share) |

71 Appendix RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Nine Months Ended September 30, 2014 After-tax Operating Earnings 681.6 $ Net Realized Investment Gain, Net of Tax 24.0 Non-operating Retirement-related Loss, Net of Tax (2.7) Costs Related to Early Retirement of Debt, Net of Tax (10.4) Net Income 692.5 $ Four Quarters Ended September 30, 2014 (in millions) Operating Income (Loss) by Segment Unum US 861.0 $ Unum UK 145.5 Colonial Life 295.3 Closed Block 119.4 Corporate (142.7) Total Before Tax Operating Earnings 1,278.5 Net Realized Investment Gain 42.7 Non-operating Retirement-related Loss (6.6) Costs Related to Early Retirement of Debt (13.2) Unclaimed Death Benefits Reserve Increase (95.5) Group Life Waiver of Premium Benefit Reserve Reduction 85.0 Income Tax (377.2) Net Income 913.7 $ After-Tax Average Operating Allocated Annualized Earnings (Loss) Equity* Operating Return On Equity Four Quarters Ended September 30, 2014 Unum US 564.2 $ 4,153.4 $ 13.6% Unum UK 116.8 629.6 18.6% Colonial Life 192.0 1,138.5 16.9% Closed Block 78.2 2,747.9 2.8% Corporate (45.8) (547.5) Total 905.4 $ 8,121.9 $ * Excludes unrealized gain on securities and net gain on cash flow hedges and is calculated using the stockholders' equity balances presented below. (in millions) |

72 Appendix RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Four Quarters Ended September 30, 2014 (in millions) After-tax Operating Income 905.4 $ Net Realized Investment Gain, Net of Tax 29.8 Non-operating Retirement-related Loss, Net of Tax (4.2) Costs Related to Early Retirement of Debt, Net of Tax (10.4) Unclaimed Death Benefits Reserve Increase, Net of Tax (62.1) Group Life Waiver of Premium Benefit Reserve Reduction, Net of Tax 55.2 Net Income 913.7 $ September 30 December 31 September 30 2014 2013 2013 Total Stockholders' Equity, As Reported 9,244.0 $ 8,659.1 $ 8,669.9 $ Net Unrealized Gain on Securities 462.0 135.7 427.4 Net Gain on Cash Flow Hedges 383.5 396.3 397.2 Total Stockholders' Equity, As Adjusted 8,398.5 $ 8,127.1 $ 7,845.3 $ Average Stockholders' Equity Excluding Net Unrealized Gain on Securities and Net Gain on Cash Flow Hedges: YTD September 30, 2014 8,262.8 $ Four Quarters Ended September 30, 2014 8,121.9 $ benefit ratio benefit ratio Year Ended December 31, 2013 Premium Income 4,517.1 $ 1,232.2 $ Benefits and Change Reserves for Future Benefits 3,222.4 667.0 Unclaimed Death Benefits Reserve Increase (75.4) (20.1) Group Life Waiver of Premium Benefit Reserve Reduction 85.0 - Benefits and Change in Reserves for Future Benefits, Excluding Reserve Adjustments 3,232.0 71.6% 646.9 52.5% Unum US Colonial Life (in millions) |