November 10, 2022 Q3 2022 1 Exhibit 99.2

Click here or press enter for the accessibility optimised version PRESENTATION DISCLOSURES

Management believes that the non-GAAP (Generally Accepted Accounting Principles) information excluding the 2021 gain on the fair value changes of the investment in Persol Holdings, the 2022 loss on disposal, the 2022 goodwill impairment and the 2021 restructuring adjustments, are useful to understand the Company's fiscal 2022 financial performance and increases comparability. Specifically, Management believes that removing the impact of these items allows for a meaningful comparison of current period operating performance with the operating results of prior periods. Management also believes that such measures are used by those analyzing performance of companies in the staffing industry to compare current performance to prior periods and to assess future performance. Management uses Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation and amortization) and Adjusted EBITDA Margin (percent of total GAAP revenue) which Management believes is useful to compare operating performance compared to prior periods and uses it in conjunction with GAAP measures to assess performance. Our calculation of Adjusted EBITDA may not be consistent with similarly titled measures of other companies and should be used in conjunction with GAAP measurements. These non-GAAP measures may have limitations as analytical tools because they exclude items which can have a material impact on cash flow and earnings per share. As a result, Management considers these measures, along with reported results, when it reviews and evaluates the Company's financial performance. Management believes that these measures provide greater transparency to investors and provide insight into how Management is evaluating the Company's financial performance. Non-GAAP measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. NON-GAAP MEASURES 3

SAFE HARBOR STATEMENT This release contains statements that are forward looking in nature and, accordingly, are subject to risksand uncertainties. The principal important risk factors that could cause our actual performance and future events and actions to differ materially from such forward- looking statements include, but are not limited to, changing market and economic conditions, the impact of the novel coronavirus (COVID-19) outbreak, competitive market pressures including pricing and technology introductions and disruptions, disruption in the labor market and weakened demand for human capital resulting from technological advances, competition law risks, the impact of changes in laws and regulations (including federal, state and international tax laws), unexpected changes in claim trends on workers’ compensation, unemployment, disability and medical benefit plans, or the riskof additional tax liabilities in excess of our estimates, our ability to achieve our business strategy, our ability to successfully develop new service offerings, material changes in demand from or lossof large corporate customers as well as changes in their buying practices, risks particular to doing business with government or government contractors, the risk of damage to our brand, our exposure to risks associated with services outside traditional staffing, including business process outsourcing, services of licensed professionals and services connecting talent to independent work, our increasing dependency on third parties for the execution of critical functions, our ability to effectively implement and manage our information technology strategy, the risks associated with past and future acquisitions, including risk of related impairment of goodwill and intangible assets, risks associated with conducting business in foreign countries, including foreign currency fluctuations, risks associated with violations of anticorruption, trade protection and other laws and regulations, availability of qualified full-time employees, availability of temporary workers with appropriate skills required by customers, liabilities for employment-related claims and losses, including class action lawsuits and collective actions, our ability to sustain critical business applications through our key data centers, risks arising from failure to preserve the privacy of information entrusted to us or to meet our obligations under global privacy laws, the riskof cyberattacks or other breaches of network or information technology security, our ability to realize value from our tax credit and net operating loss carryforwards, our ability to maintain specified financial covenants in our bank facilities to continue to access credit markets, and other risks,uncertainties and factors discussed in this report and in our other filingswith the Securities and Exchange Commission. Actual results may differ materially from any forward-looking statements contained herein, and we undertake no duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations. 4

Click here or press enter for the accessibility optimised version FINANCIALS

Third Quarter 2022 Takeaways. Demand for specialty talent continues amid growing economic uncertainty and continuing inflationary pressures • Q3 revenue declined by 2.3% on a reported basis, up 0.3% in constant currency(1) Includes 130 bps favorable impact from the acquisition of RocketPower and Pediatric Therapeutic Services ("PTS") Includes 250 bps(1) unfavorable impact from the sale of our Russian operations • Delivered 7.6%(1) year-over-year gross profit growth reflecting a GP rate of 20.6% Favorable product mix delivers structural improvements as growth in permanent placement fees flattens Near-term steps to capitalize on continued demand for specialty talent and build resiliency • Addressing talent supply in high demand specialties to meet customer needs and accelerate revenue growth • Every business unit is focusing on actionable strategies to deliver improving top-line results aligned to our specialty growth strategy and proactively aligning resources with growth opportunities Continued focus on our future • Commencing a board-approved $50 million share repurchase program highlighting our flexible and balanced capital allocation strategy, as well as confidence in our ability to deliver specialty growth • Ongoing deployment of technology investments in both the Americas and EMEA 6 (1)Constant Currency ("CC") represents year-over-year changes resulting from translating 2022 financial data into USD using 2021 exchange rates.

Third Quarter 2022 Financial Summary. (1)See reconciliation of Non-GAAP Measures included in Form 8-K dated November 10, 2022; (2)Constant Currency ("CC") represents year-over-year changes resulting from translating 2022 financial data into USD using 2021 exchange rates. 7 $1.2B (2.3%) 0.3% CC(2) 0.3% CC(2) Gross Profit Rate 20.6% 140 bps 140 bps ($21.4M) NM 7.5% NM CC(2) 21.0% CC(2) Adjusted EBITDA $19.1M 10.1% Adjusted EBITDA Margin 1.6% 20 bps Change Increase/(Decrease) As Reported As Adjusted(1) Revenue Loss from Operations Actual Results (2.3%)

Third Quarter 2022 Revenue Trends. (1)Reported and Constant Currency revenue includes the 2022 results of RocketPower and PTS, which were acquired as of March 7, 2022 and May 2, 2022, respectively. RocketPower was included in the reported results of operations in Outsourcing & Consulting and PTS was included in the reported results of operations in Education, from the date of acquisition; (2)Constant Currency represents year-over- year changes resulting from translating 2022 financial data into USD using 2021 exchange rates; (3)Organic revenue excludes the 2022 results of RocketPower and PTS, which were acquired as of March 7, 2022 and May 2, 2022, respectively, as well as the results of our Russian operations following the completion of the sale transaction in the third quarter of 2022. 8 Reported(1) Constant Currency(1),(2) Organic(2),(3) Total (2.3%) 0.3% 1.5% Professional & Industrial (9.7%) (9.4%) (9.4%) Science, Engineering & Technology 5.0% 5.2% 5.2% Education 56.6% 56.6% 44.5% Outsourcing & Consulting 4.5% 5.9% (0.3%) International (16.1%) (5.4%) 6.8%

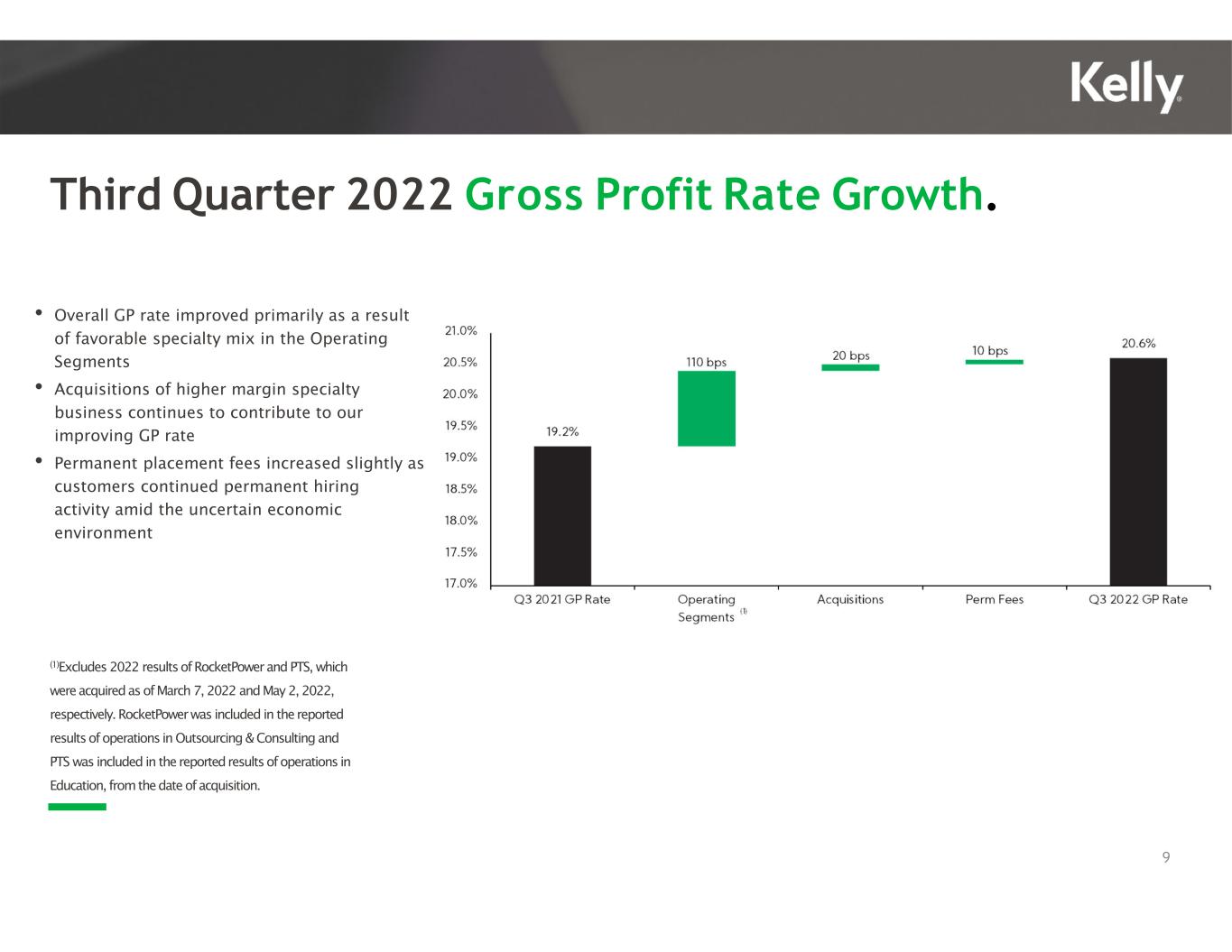

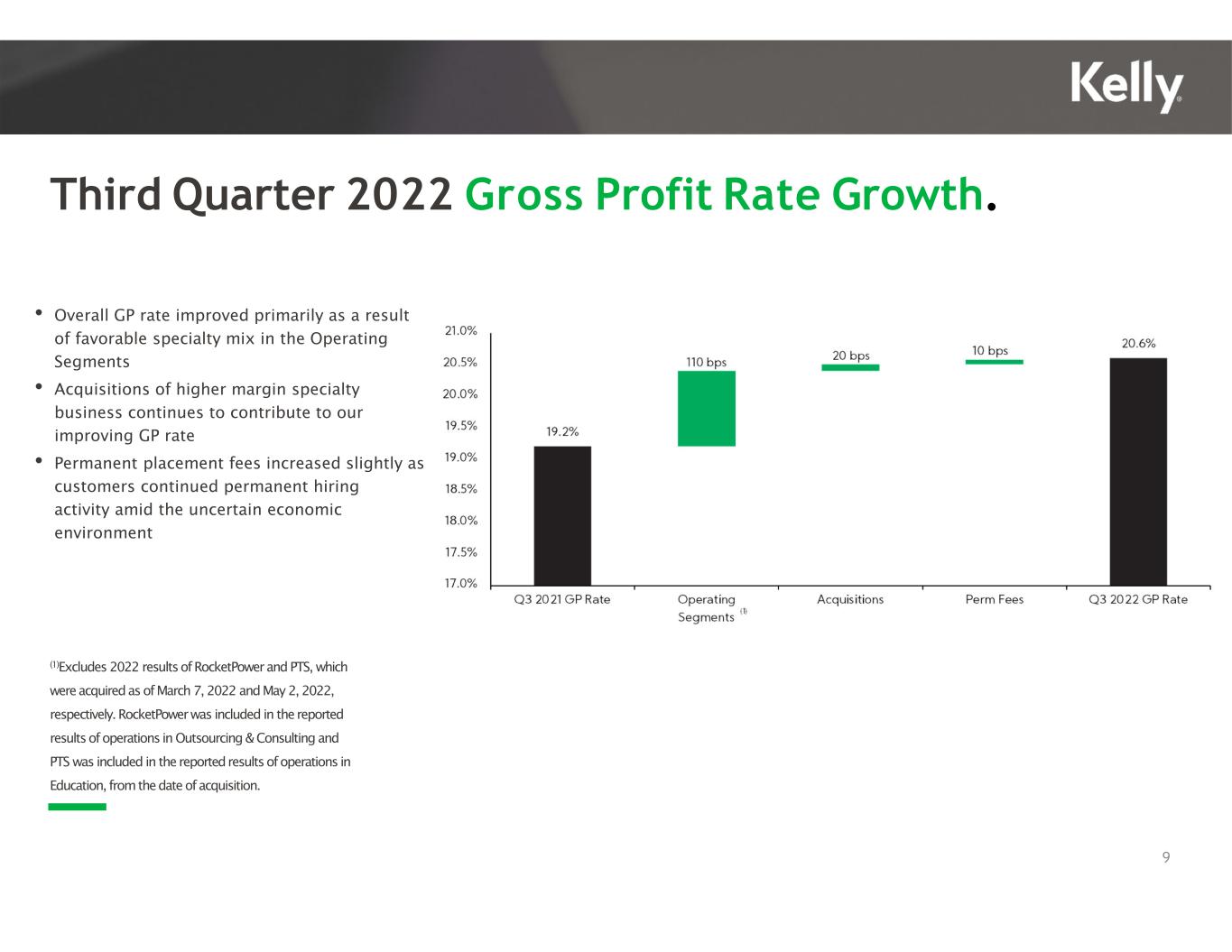

Third Quarter 2022 Gross Profit Rate Growth. • Overall GP rate improved primarily as a result of favorable specialty mix in the Operating Segments • Acquisitions of higher margin specialty business continues to contribute to our improving GP rate • Permanent placement fees increased slightly as customers continued permanent hiring activity amid the uncertain economic environment (1)Excludes 2022 results of RocketPower and PTS, which were acquired as of March 7, 2022 and May 2, 2022, respectively. RocketPower was included in the reported results of operations in Outsourcing & Consulting and PTS was included in the reported results of operations in Education, from the date of acquisition. 9

Third Quarter 2022 SG&A. $inmillions (1)Excludes 2022 results of RocketPower and PTS, which were acquired as of March 7, 2022 and May 2, 2022, respectively. RocketPower was included in the reported results of operations in Outsourcing & Consulting and PTS was included in the reported results of operations in Education, from the date of acquisition. 10 • Expenses in the Operating Segments, excluding recent acquisitions of RocketPower and PTS, increased primarily due to higher compensation-related expenses for our full- time talent. We have added headcount in line with revenue growth in selected specialties and provided market-driven compensation adjustments to attract and retain talent • Expenses from our recent acquisitions of RocketPower and PTS include amortization expense related to acquired intangible assets • Corporate expenses increased due primarily to higher performance-based incentive compensation expenses • Earnout Adjustment primarily represents the impact of a 2021 adjustment related to the acquisition of Greenwood/Asher & Associates

Third Quarter 2022 Revenue & Gross Profit Mix. 11 Gross Profit mix by segmentRevenue mix by segment International

Third Quarter 2022 EPS Summary. (1)Gain on investment in Persol Holdings of $35.5 million, $24.6 million net of tax, or $0.62 per share in Q3 2021; (2)Goodwill impairment charge of $30.7 million, $25.4 million net of tax, or $0.67 per share in Q3 2022; (3)Loss on disposal related to the sale of our Russian operations of $0.2 million, $0.2 million net of tax, or $0.01 per share in Q3 2022; (4)Restructuring charges of $0.1 million, $0.1 million net of tax, or $0.00 per share in Q3 2021. 12 $inmillions except per share data Amount Per Share Amount Per Share Net earnings (loss) ($16.2) ($0.43) $34.8 $0.87 Goodwill impairment charge, net of taxes(2) 25.4 0.67 - - Loss on disposal, net of taxes(3) 0.2 0.01 - - Restructuring charges, net of taxes(4) - - (0.1) - Adjusted net earnings $9.4 $0.25 $10.1 $0.25 2022 2021 (Gain) loss on investment in Persol Holdings, net of taxes(1) - - (24.6) (0.62)

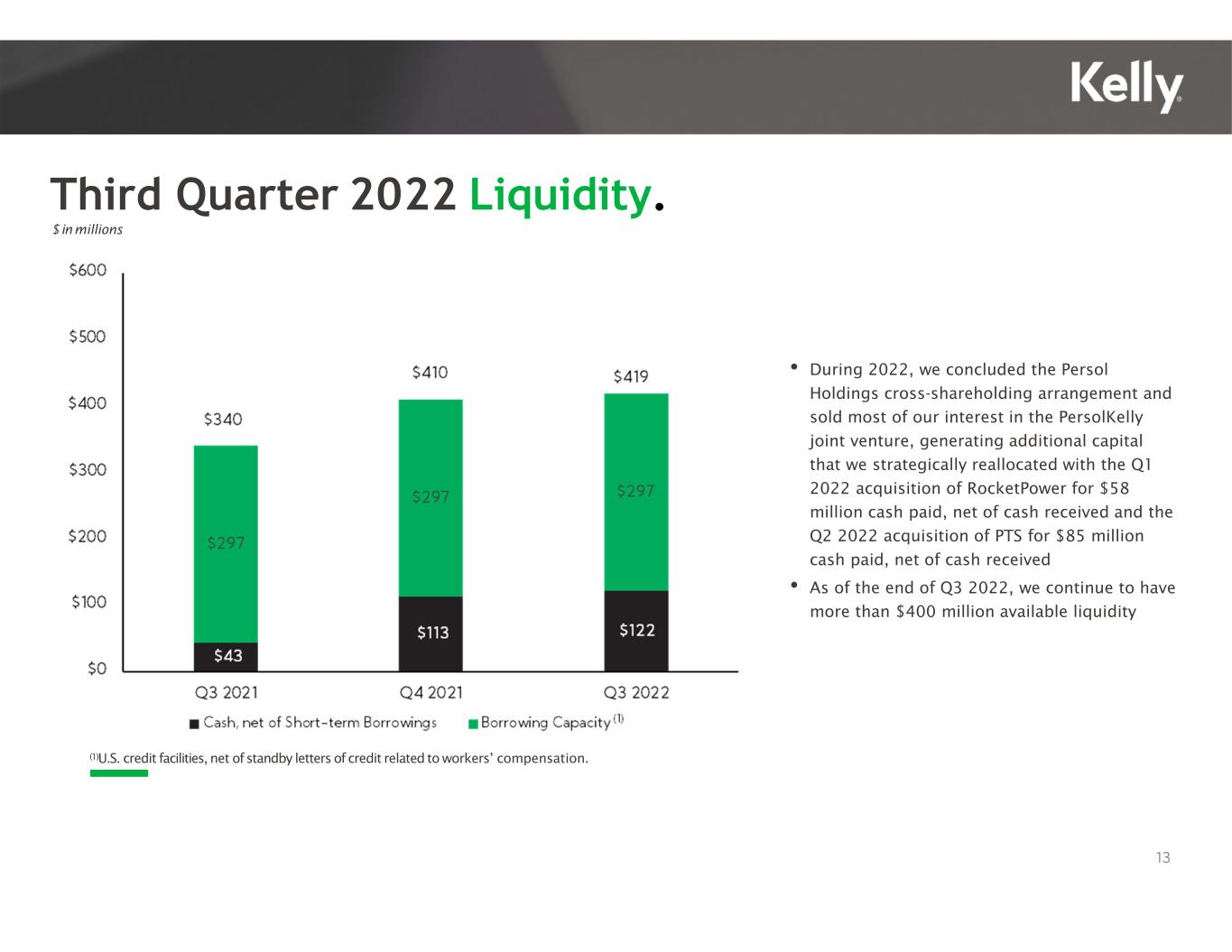

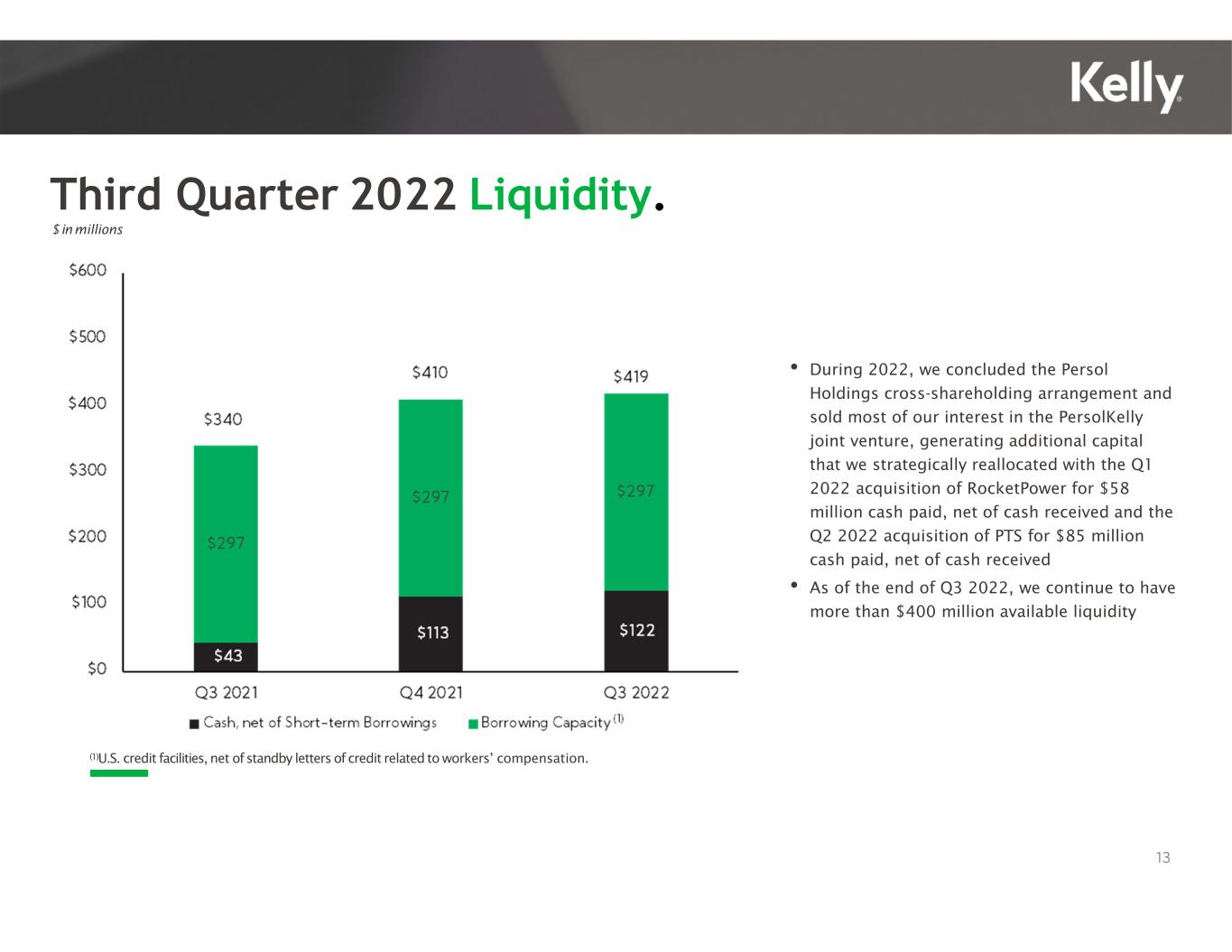

Third Quarter 2022 Liquidity. • During 2022, we concluded the Persol Holdings cross-shareholding arrangement and sold most of our interest in the PersolKelly joint venture, generating additional capital that we strategically reallocated with the Q1 2022 acquisition of RocketPower for $58 million cash paid, net of cash received and the Q2 2022 acquisition of PTS for $85 million cash paid, net of cash received • As of the end of Q3 2022, we continue to have more than $400 million available liquidity 13 $inmillions (1)U.S. credit facilities, net ofstandby letters of credit related to workers’ compensation.

Q4 2022 Outlook. Revenue • Flat to up 1.0% YOY on a reported basis, up 3.3% to 4.3% on organic constant currency basis Unfavorable FX impact (-230 bps) Impact of the sale of our Russian operations (-250 bps) 2022 acquisitions accelerate revenue growth (+150 bps) GP Rate and GP • 20.4% GP rate - up YOY approximately 70 bps 2022 acquisitions add 20 bps Expect continued shift to higher margin specialties and deceleration in permanent placement fees GP up 4% YOY based on structural GP rate improvement Adjusted SG&A • Up 2.5% to 3.0% on a nominal basis Reflects increasing inflationary pressure including compensation expenses to attract and retain the workforce necessary to deliver future growth and impact of 2022 acquisitions and sale of Russian operations Adjusted EBITDA Margin • Up 30 bps Reflects expected structural GP rate and SG&A productivity improvements and 2022 acquisitions Adjusted Tax Rate • Effective rate in the low 50% range Impacted by non-deductible losses on life insurance policies used to fund certain retirement liabilities 14

Recent Acquisitions. RocketPower • RocketPower is a provider of Recruitment Process Outsourcing (RPO) and other outsourced talent solutions to customers including high growth U.S. tech companies. Headquartered in Silicon Valley, CA, RocketPower will continue to operate under its own brand with its current leadership team and staff as part of KellyOCG, the outsourcing and consulting business of Kelly Expands KellyOCG’s RPO delivery offering Creates growth opportunities in the high-tech industry Pediatric Therapeutic Services • PTS is a specialty firm that provides state and federally mandated in-school therapy services including occupational therapy, physical therapy, speech- language pathology, and mental and behavioral health services. Headquartered in suburban Philadelphia, PTS currently supports schools throughout Pennsylvania and Delaware and will continue to operate under its own brand as part of Kelly Education Expands Kelly Education's industry-leading K-12 solutions offering Creates growth opportunities in the $20-billion therapeutic services segment 15

Our operating model aligns to these specialties. We have redesigned our operating model to drive profitable growth in our chosen specialties. Kelly size and margin profiles are based on 2021 full year results; (1)Kelly SET revenue and GP rate was $1.2B and 22.3%, respectively, including the results of Softworld on a proforma basis; (2)Kelly Education revenue and GP rate was $0.5B and 16.8%, respectively, including the results of PTS on a proforma basis; (3)Kelly OCG revenue and GP rate was $0.5B and 33.4%, respectively, including the results of RocketPower on a proforma basis; (4)Managed Service Provider (“MSP”); Recruitment Process Outsourcing (“RPO”); Professional Payroll Outsourcing (“PPO”). 16 Kelly Professional & Industrial Kelly Science, Engineering, Technology & Telecom Kelly Education Kelly OCG Kelly International Revenue $1.8B $1.2B(1) $0.4B(2) $0.4B(3) $1.1B GP Rate 16.9% 21.9%(1) 15.6%(2) 32.7%(3) 13.9% Geography North America North America U.S. Global EMEA & Mexico Specialties • Industrial • Contact Center • Office Clerical • Engineering • Science & Clinical • Technology • Telecom • Early Childhood • K-12 • Special Ed/Needs • Tutoring • Higher Education • Executive Search • MSP(4) • RPO(4) • PPO(4) • Consulting • Life Sciences • IT • Finance • Other Local Professional Niches

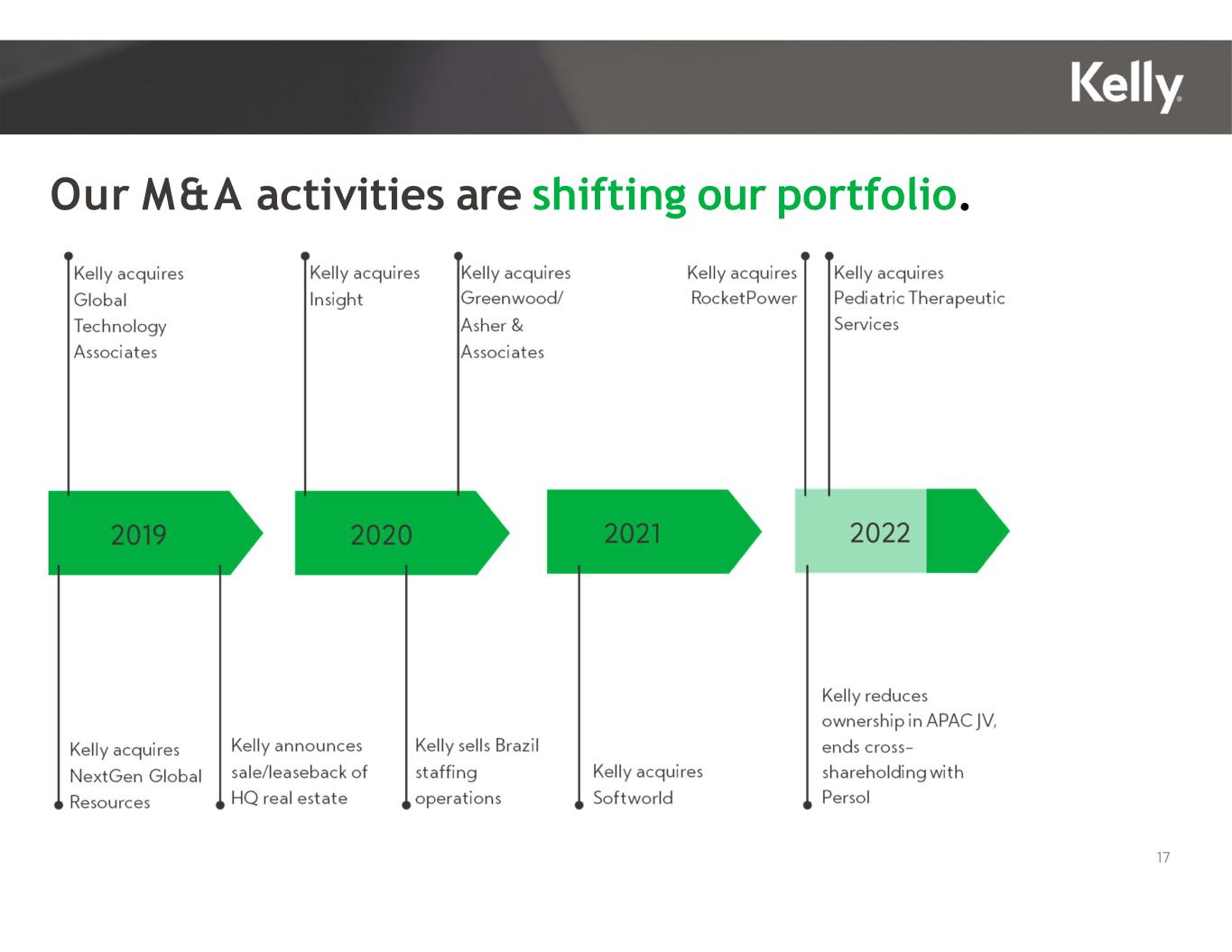

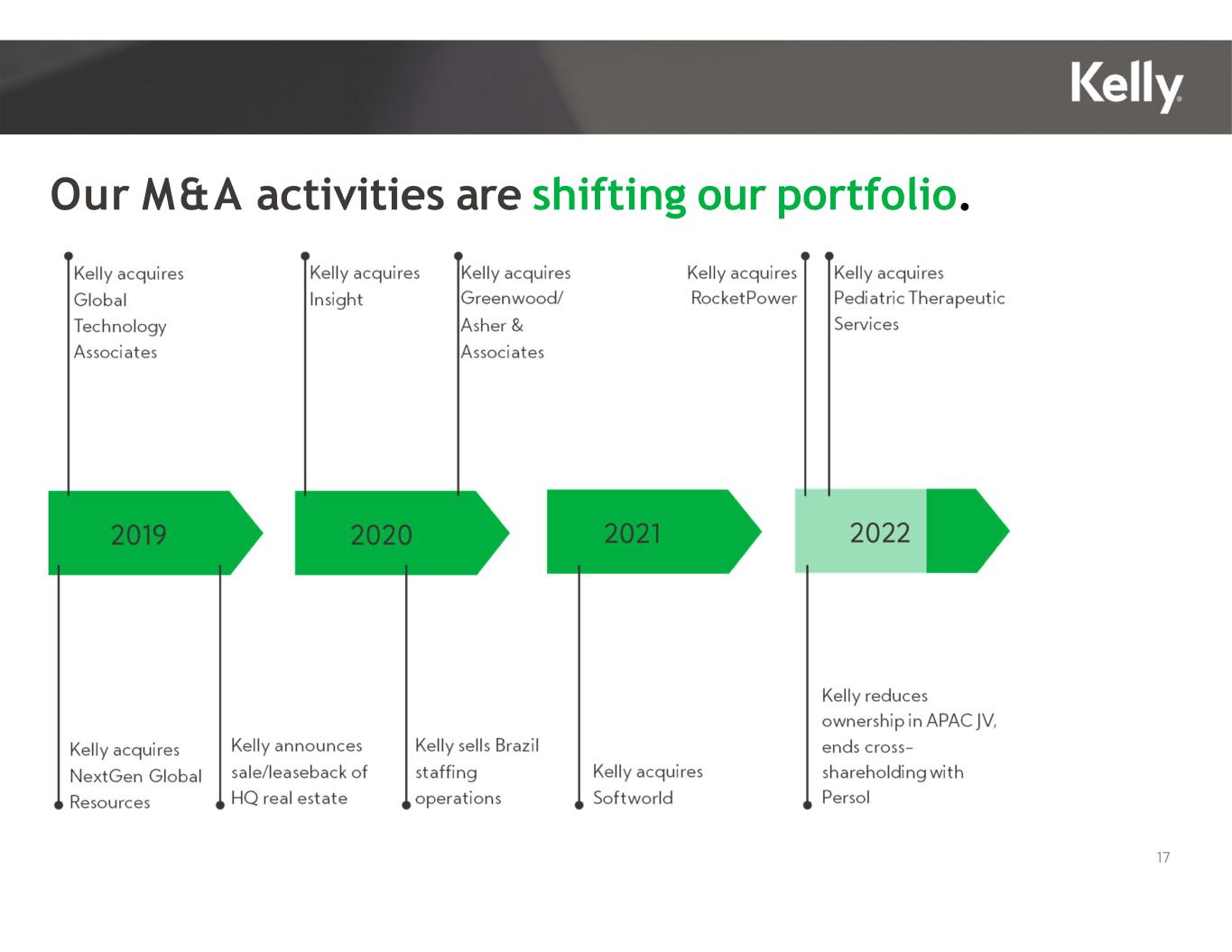

Our M&A activities are shifting our portfolio. 17

Thank you for reading Q3 2022 Earnings