- KMT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Kennametal (KMT) DEF 14ADefinitive proxy

Filed: 14 Sep 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

KENNAMETAL INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

| | KENNAMETAL INC. 600 Grant Street Suite 5100 Pittsburgh, Pennsylvania 15219 |

|

Notice of Annual Meeting of Shareowners

Tuesday, October 31, 2017

To the Shareowners of Kennametal Inc.:

The Annual Meeting of Shareowners (“Annual Meeting”) of Kennametal Inc. (the “Company”) will be held at the Quentin C. McKenna Technology Center, located at 1600 Technology Way (on Route 981 South), Latrobe, Unity Township, Pennsylvania, on Tuesday, October 31, 2017 at 2:00 p.m. (Eastern Time) to consider and act upon the following matters:

1. The election of seven directors for terms to expire in 2018;

2. The ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2018;

3. Anon-binding (advisory) vote to approve the compensation paid to the Company’s named executive officers, as disclosed in this Proxy Statement; and

4. Anon-binding (advisory) vote on the frequency of future advisory votes on executive compensation.

Shareowners also will be asked to consider such other business as may properly come before the meeting. The Board of Directors has fixed Friday, September 1, 2017 as the record date (the “Record Date”). Only shareowners of record at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting.

We are utilizing a U.S. Securities and Exchange Commission Rule that allows companies to furnish their proxy materials over the Internet rather than in paper form. We believe that this delivery process will reduce our environmental impact and over time lower the costs of printing and distributing our proxy materials. We believe that we can achieve these benefits with no impact on our shareowners’ timely access to this important information. If you have received a Notice and you would prefer to receive proxy materials (including a proxy card) in printed form by mail or electronically by email, please follow the instructions contained in the Notice.

If you plan to attend the Annual Meeting, please note that each shareownermust present valid picture identification, such as a driver’s license or passport. Additionally, shareowners holding stock in brokerage accounts (“street name” holders)must bring a copy of a brokerage statement reflecting stock ownership as of the Record Date to be admitted into the Annual Meeting. No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, please vote by telephone, via the Internet or complete, date and sign and return a proxy card to ensure your shares are voted at the Annual Meeting.

| By Order of the Board of Directors | ||||

| Michelle R. Keating | ||||

| Vice President, Secretary | ||||

| and General Counsel | ||||

September 14, 2017

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF SHAREOWNERS TO BE HELD

OCTOBER 31, 2017

This Proxy Statement and the 2017 Annual Report are available for viewing at

www.envisionreports.com/KMT

PROXY SUMMARY

2017 Proxy Summary

This 2017 Proxy Summary highlights certain information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider before voting, and we strongly encourage you to carefully read the entire proxy statement before voting.

General Information About the 2017 Annual Meeting of Shareowners

• Date and Time: | Tuesday, October 31, 2017 at 2:00 p.m. (Eastern Time) | |

• Location: | Quentin C. McKenna Technology Center, located at 1600 Technology Way (on Route 981 South), Latrobe, Unity Township, Pennsylvania, 15650 | |

• Record Date: | September 1, 2017 | |

• Voting: | For all matters, shareowners as of the Record Date have one vote for each share of capital stock held by such person on the Record Date |

Proposals to be Considered and Board Recommendations

| Proposal | Board Voting Recommendation | Page Reference (for more detail) | ||

• Election of seven directors with terms expiring in 2018 | FOR EACH DIRECTOR NOMINEE | 7 | ||

• Ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2018 | FOR | 30 | ||

• Non-binding (advisory) vote to approve the compensation paid to the Company’s named executive officers, as disclosed in this Proxy Statement | FOR | 83 | ||

• Non-binding (advisory) vote on the frequency of future advisory votes on executive compensation

| ANNUAL FREQUENCY | 87 | ||

| KENNAMETAL INC. 2017 Proxy Statement | | i |

PROXY SUMMARY

Board Nominees

Director Since | Committee Memberships | Other Public Company Boards | ||||||||||||||||||||||||||

| Name | Age | Occupation | Independent | AC | CC | N/CG | ||||||||||||||||||||||

Cindy L. Davis | 55 | 2012 | Board of Directors, Buffalo Wild Wings and Kennametal Inc. | Yes | X | — | X | Buffalo Wild Wings | ||||||||||||||||||||

William J. Harvey | 66 | 2011 | Retired President, DuPont Packaging & Industrial Polymers (a global business unit of E.I. DuPont de Nemours & Company) | Yes | — | X | X | — | ||||||||||||||||||||

William M. Lambert | 59 | 2016 | Chairman and CEO, MSA Safety, Inc. | Yes | X | — | X | MSA Safety, Inc. | ||||||||||||||||||||

Timothy R. McLevish | 62 | 2004 | Executive Chairman, Lamb Weston Holdings Inc. | Yes | X | — | X | Lamb Weston Holdings Inc. | ||||||||||||||||||||

Sagar A. Patel | 51 | 2016 | President, Aircraft Turbine Systems (a global business unit of Woodward, Inc.) | Yes | X | X | — | — | ||||||||||||||||||||

Christopher Rossi | 53 | 2017 | President and CEO, Kennametal Inc. | No | — | — | — | — | ||||||||||||||||||||

Steven H. Wunning | 66 | 2005 | Retired Group President and Executive Office member of Caterpillar Inc. | Yes | X | X | — | — | ||||||||||||||||||||

| AC | Audit Committee |

| CC | Compensation Committee |

| N/CG | Nominating/Corporate Governance Committee |

| • | Attendance: In Fiscal 2017, each of our director nominees serving on the Board in that year attended at least 75% of the Board and committee meetings on which he or she sat during his or her tenure as a director. In Fiscal 2018, Mr. Rossi was named President and Chief Executive Officer of Kennametal Inc., beginning on August 1, 2017, in conjunction with Mr. De Feo being named Executive Chairman of Kennametal Inc. |

| • | Director Elections: Directors are elected by a majority of votes cast; meaning that the number of votes cast “for” such director nominee must exceed the number of votes cast “against” such nominee in order for a director to be elected. |

Corporate Governance Highlights

Our Board has a strong commitment to ethical conduct and good corporate governance, which promotes the long-term interests of shareowners, strengthens Board and management accountability and helps build public trust in the Company. The dashboard below provides a snapshot of the Company’s current corporate governance policies.

| • | Declassified the Board of Directors — At its meeting on July 26, 2016, the Board of Directors (“Board”) approved an amendment to the Company’sBy-laws removing the classification of the Board of Directors. As such, beginning at the Annual Meeting of Shareowners in October 2016, each nominated Director will be elected for only one year. The remaining Directors shall serve out their respective terms and upon their next nomination to the Board, if elected, shall serve for a period of one year. |

| ii | | KENNAMETAL INC. 2017 Proxy Statement |

PROXY SUMMARY

| • | Changed from Plurality Voting to Majority Voting in Director Elections — At the Annual Meeting of Shareowners held on October 28, 2014, the shareowners approved a change to the voting standard in director elections from plurality voting to majority voting and to eliminate cumulative voting. |

| • | Separation of CEO and Chairman — On November 17, 2014, the Board approved the separation of the roles of the Chief Executive Officer and the Chairman of the Board. |

| • | Equity Plan Changes Eliminate Single Trigger Vesting Provisions — On January 27, 2015, the Compensation Committee of the Board of Directors approved an amendment to the then existing Kennametal Inc. Stock and Incentive Plan of 2010 (as Amended and Restated October 22, 2013) as well as an amendment to the Executive Retirement Plan (“ERP”) (as amended December 30, 2008). Each of the amendments was to (i) modify the definition of “Change in Control”; and (ii) eliminate single-trigger vesting of future awards under the Stock and Incentive Plan or accrued benefits under the ERP for prospective plan participants. Consistently, the Company’s 2016 Stock and Incentive Plan includes a double-trigger vesting provision. |

| • | Governance Guidelines — The Board has established Corporate Governance Guidelines which provide a framework for the effective governance of the Company. The guidelines address matters such as the Board’s mission, a Director’s responsibilities, Director qualifications, determination of Director independence, Board committee structure, Executive Chairman and Chief Executive Officer performance evaluations and management succession. The Board regularly reviews developments in corporate governance and updates the Corporate Governance Guidelines and other governance materials as it deems necessary and appropriate. |

| • | Independent Directors — Our Board is comprised of all independent directors, other than our President and Chief Executive Officer and our Executive Chairman. |

| • | Independent Directors Regularly Meet — Our independent directors meet in executive sessions, led by our independent Lead Director of the Board, at each regularly scheduled Board meeting. |

| • | Independent Board Committees — We have three standing Board committees with only independent directors serving as members. |

| • | Annual Board and Committee Self-Evaluation — Our Board and Board committees engage in a self-evaluation process annually. |

| • | High Rate of Board Attendance — Our Board members attended more than 75% of all Board meetings in Fiscal 2017 during their tenure as a director. |

| • | No Poison Pill — The Company currently does not have a poison pill in place. |

| • | Strong Stock Ownership Guidelines for Directors and Executive Officers — We have adopted Stock Ownership Guidelines for directors, executives and key managers to effectively link the interests of management and our shareowners and to promote an ownership culture throughout our organization. We believe that stock should be acquired and held in quantities that encourage management to make decisions and take actions that will enhance Company performance and increase its value. |

| • | Anti-hedging, Anti-pledging and Anti-shorting Policy — Our insider trading policy prohibits the hedging of Company stock by directors, executives and other key managers without the prior approval and express authorization of the Company’s General Counsel. Further, this policy also prohibits the pledging of Company stock by directors, executives and other key managers unless the General Counsel has granted an exception to the individual. An exception to this |

| KENNAMETAL INC. 2017 Proxy Statement | | iii |

PROXY SUMMARY

| prohibition may be granted where an individual wishes to pledge Company stock as collateral for a loan (not including margin debt) and clearly demonstrates the financial capacity to repay the loan without resorting to the pledged stock. |

Fiscal 2017 Financial Results Summary

The Company achieved the following performance in sales, profitability and returns for Fiscal 2017 (see Appendix A for a reconciliation of thesenon-GAAP financial measures to the comparable GAAP measures):

| • | Return on Invested Capital for Fiscal 2017 was 4.3% compared with negative 10.4% in Fiscal 2016. Adjusted Return on Invested Capital (“ROIC”) for Fiscal 2017 was 8.8% compared with Adjusted ROIC of 6.0% in Fiscal 2016. |

| • | Net income for Fiscal 2017 was $52 million compared to a net loss of $223.9 million in Fiscal 2016. |

| • | Earnings Before Interest and Taxes (“EBIT”) for Fiscal 2017 was $110 million, 5.3% margin (as adjusted to exclude restructuring and related charges: $186 million, 9.0% margin). |

| • | Net cash flow provided by operating activities was $192 million for Fiscal 2017 compared to $219 million in Fiscal 2016. Free Operating Cash Flow (“FOCF”) was $79 million for Fiscal 2017 compared to $115 million in Fiscal 2016. |

| • | Sales of $2.1 billion for Fiscal 2017 compared with $2.1 billion in Fiscal 2016. |

Compensation Highlights for Fiscal 2017

The following are the highlights of our 2017 compensation program:

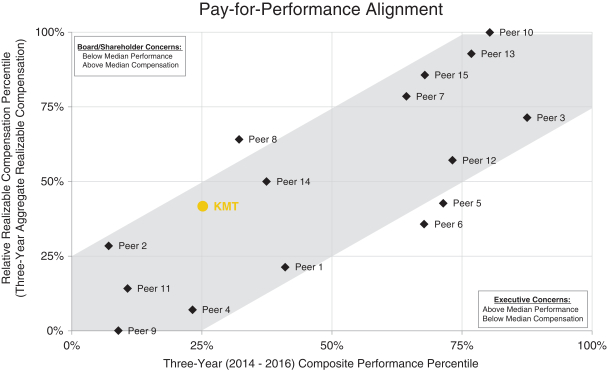

| • | Our Compensation Committee has adopted a strongpay-for-performance philosophy which is tested on an annual basis through a realizablepay-for-performance alignment assessment conducted by the Committee’s independent consultant. |

| • | Compensation is paid in a mix of base salary; annual cash-based incentives under our Annual Incentive Plan (“AIP”); and equity-based long-term incentive awards (consisting of restricted stock units and performance stock units). |

| • | Compensation is tied mainly to Company financial and stock performance, so that a substantial portion of the compensation provided to our executive officers is at risk. |

| • | Payment of annual cash-based incentives under the AIP is based on achieving critical measures of Company performance, consistent with ourpay-for-performance philosophy. AIP payments for Fiscal 2017 performance were based on achievement of three performance metrics — EBIT, Free Operating Cash Flow (“FOCF”), and individual performance. |

| • | Our equity-based long-term incentive program is intended to drive the achievement of critical long-term business objectives, align management’s interests with those of our shareowners and foster retention of key executives. In Fiscal 2017, 60% of the target value of each executive’s long-term incentive opportunity was granted as performance stock units and 40% was granted as restricted stock units (all are settled in stock). |

| • | Vesting of Fiscal 2017 performance units is based on the attainment of an Adjusted ROIC financial performance goal (100% weight) with a Relative Total Shareholder Return (“TSR”) multiplier. Performance stock units are subject to an additional continuous service requirement, which provides that award recipients must remain employed by the Company through the |

| iv | | KENNAMETAL INC. 2017 Proxy Statement |

PROXY SUMMARY

| payout date in order to receive the payout, generally three years after the grant date. Restricted stock units time vest based on continuous service with the Company. |

| • | Our Fiscal 2017 financial performance had the following effects on the performance-based awards held by our NEOs: |

Fiscal 2017 AIP

| • | Component (1) of 2017 Target AIP awards was based on achievement of Kennametal Inc. financial metrics of EBIT and FOCF. For all NEOs other than Mr. De Feo, EBIT was weighted at 45% and FOCF was weighted at 35%. For Mr. De Feo, EBIT was weighted at 48.2% and FOCF was weighted at 37.5%. Based on the Company’s Fiscal 2017 performance results, Mr. De Feo was paid a cash incentive equal to 77% of targeted award for EBIT performance and 26% of targeted award for FOCF performance and Messrs. van Gaalen, Dragich, Byrnes and Clemens were paid a cash incentive equal to 72% of targeted award for EBIT performance and 24% of targeted award for FOCF performance. |

| • | Component (2) of 2017 Target AIP awards was based on achievement of certain individual performance goals weighted at 14.3% for Mr. De Feo as determined and approved by the Compensation Committee of the Board of Directors and weighted at 20% for Messrs. van Gaalen, Dragich, Byrnes and Clemens. Based on Mr. De Feo’s Fiscal 2017 individual performance results, Mr. De Feo was paid a cash incentive equal to 28.6% of targeted award based on Fiscal 2017 individual performance for Messrs. van Gaalen, Dragich, Byrnes and Clemens were paid 27%, 36%, 27% and 27%, respectively. |

Performance Stock Units

| • | The first tranche ( 1⁄3) of the 2017 performance stock units, as measured by ROIC performance were achieved at 119.7% multiple of target with the Relative TSR multiplier yet to be calculated for the three year period ending June 30, 2019. |

| • | The second tranche ( 1⁄3) of the 2016 performance stock units, as measured by ROIC performance were achieved at 80% multiple of target with the second tranche ( 1⁄4) as measured by Relative TSR at 200% multiple of target with the third tranche to be determined for both ROIC and Relative TSR and the cumulative three year Relative TSR. |

| • | The third tranche ( 1⁄3) of the 2015 performance stock units, as measured by ROIC performance were achieved at 80% of target and the third tranche ( 1⁄4) Relative TSR performance at 200% of target, and the cumulative three year tranche ( 1⁄4) Relative TSR at 0%, for an aggregate 46.7% multiple of target Fiscal 2015 performance stock units to vest. |

| KENNAMETAL INC. 2017 Proxy Statement | | v |

| 1 | ||||

| 7 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 20 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 24 | ||||

| 28 | ||||

| 30 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 35 | ||||

| 37 | ||||

| 41 | ||||

| 53 | ||||

| 59 | ||||

ANALYSIS OF RISK INHERENT IN OUR COMPENSATION POLICIES AND PRACTICES | 60 | |||

| 61 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

| 71 | ||||

| 83 | ||||

OWNERSHIP OF CAPITAL STOCK BY DIRECTORS, NOMINEES AND EXECUTIVE OFFICERS | 84 | |||

| 86 | ||||

PROPOSAL IV.NON-BINDING (ADVISORY) VOTE ON FREQUENCY OF VOTE ON EXECUTIVE COMPENSATION | 87 | |||

| 88 | ||||

| 89 | ||||

| 89 | ||||

APPENDIX A — ADJUSTED EBIT, FOCF AND ADJUSTED ROIC RECONCILIATIONS | A-1 | |||

GENERAL INFORMATION

When and where is the 2017 Annual Meeting?

The 2017 Annual Meeting of shareowners (the “Annual Meeting”) will be held on Tuesday, October 31, 2017 at 2:00 p.m. (Eastern Time) at the Quentin C. McKenna Technology Center, located at 1600 Technology Way (on Route 981 South), Latrobe, Unity Township, Pennsylvania, 15650.

Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set paper copy of this Proxy Statement and the 2017 Annual Report?

We are utilizing an SEC rule that allows companies to furnish their proxy materials over the Internet rather than in paper form. This rule allows a company to send some or all of its shareowners a Notice regarding Internet availability of proxy materials (“Notice”). Instructions on how to access the proxy materials over the Internet or how to request a paper copy of proxy materials may be found in the Notice.

If you have received a Notice and you would prefer to receive proxy materials (including a proxy card) in printed form by mail or electronically by email, please follow the instructions contained in the Notice.

Why didn’t I receive a Notice in the mail regarding the Internet availability of proxy materials?

The SEC rules that allow us to furnish our proxy materials over the Internet rather than in paper form do not require us to do so for all shareowners. We may choose to send certain shareowners the Notice, while sending other shareowners a full set paper copy of our Proxy Statement, 2017 Annual Report, Notice and proxy card.

How can I access the proxy materials over the Internet?

The Notice contains instructions on how to view the proxy materials on the Internet, vote your shares on the Internet and obtain printed or electronic copies of the proxy materials. An electronic copy of this Proxy Statement and the 2017 Annual Report are available atwww.envisionreports.com/KMT.

When was the Notice or other proxy materials mailed to shareowners?

The Notice of this Proxy Statement was first mailed to shareowners on or about September 14, 2017. Once the Notice is received, Shareowners have the option of (1) accessing the proxy materials, including instructions on how to vote, online; or (2) requesting that those materials be sent to the Shareowner in paper. Opting to receive your proxy materials online will save the Company the cost of producing and mailing documents to your home or business, and will also give you an electronic link to the proxy voting site.

Why did I receive a Notice or a copy of this Proxy Statement?

The Board of Directors of Kennametal Inc. (“we,” “us,” “Kennametal” or the “Company”) is soliciting proxies to be voted at the Annual Meeting to be held on October 31, 2017, and at any adjournment of the Annual Meeting. When we ask for your proxy, we must provide you with a proxy statement that contains certain information specified by law.

What will the shareowners vote on at the Annual Meeting?

The Board of Directors has submitted four proposals for your consideration at this meeting:

| • | The election of seven directors for terms to expire in 2018; |

| KENNAMETAL INC. 2017 Proxy Statement | | 1 |

GENERAL INFORMATION

| • | The ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2018; |

| • | Anon-binding (advisory) vote to approve the compensation paid to the Company’s named executive officers, as disclosed in this Proxy Statement; and |

| • | Anon-binding (advisory) vote on the frequency of future advisory votes on executive compensation. |

Will there be any other items of business on the agenda?

We do not expect any other items of business to be presented at the meeting. However, in case there is an unforeseen need, your proxy also gives discretionary authority to the named proxy holders with respect to any other matters that might be brought before the meeting. Those proxy holders intend to vote your proxy on any such matter in accordance with their best judgment.

Who is entitled to vote?

Shareowners as of the close of business on Friday, September 1, 2017 (the “Record Date”) may vote at the Annual Meeting. For all matters, you have one vote for each share of capital stock you hold on the Record Date, including shares:

| • | Held directly in your name as the shareowner of record |

| • | Held for you in an account with a broker, bank or other nominee |

| • | Attributed to your account in one of our Company-sponsored 401(k) plans |

What constitutes a quorum?

A majority of the outstanding shares, present or represented by proxy, constitutes a quorum for the Annual Meeting. As of the Record Date, 80,951,144 shares of our capital stock were issued and outstanding. Abstentions and brokernon-votes (which are explained below) will be counted for purposes of determining a quorum, but will not be counted as votes cast.

How many votes are required for the approval of each item?

| • | The seven nominees for director for terms expiring in 2018 are elected by a majority of votes cast; meaning that the number of votes cast “for” such director nominee must exceed the number of votes cast “against” such nominee in order for a director to be elected. Abstentions, brokernon-votes and instructions to withhold authority to vote for one or more of the nominees will result in those nominees receiving fewer votes but will not count as votes against the nominee. |

| • | The ratification of the selection of the independent auditors will be approved if the proposal receives the affirmative vote of at least a majority of the votes cast by shareowners present, in person or by proxy, at the meeting. Abstentions will not be counted as votes cast either for or against the proposal. |

| • | The compensation paid to our named executive officers, as disclosed in this Proxy Statement, will be approved (on anon-binding advisory basis) if the proposal receives the affirmative vote of at least a majority of the votes cast by shareowners present, in person or by proxy, at the meeting. Abstentions and brokernon-votes will not be counted as votes cast either for or against the proposal. |

| • | The alternative receiving the greatest number of votes (every one year, two years or three years) regarding the frequency of future advisory votes on executive compensation is the frequency that our shareholders approve (on anon-binding advisory basis) measured by the votes cast by shareowners present, in person or by proxy, at the meeting. Abstentions and brokernon-votes will not be counted as votes cast either for or against the proposal. |

What are “BrokerNon-Votes?”

If your shares are held by a broker (in street name), the broker will ask you how you want your shares to be voted. If you give the broker

| 2 | | KENNAMETAL INC. 2017 Proxy Statement |

GENERAL INFORMATION

instructions, your shares will be voted as you direct. If you do not give instructions to your broker, one of two things can happen, depending on the type of proposal. For the ratification of the selection of the independent auditors, which is considered a “routine” matter, the broker may vote your shares in its discretion.

Brokers do not have the discretion to vote your shares for the election of directors or for thenon-binding advisory vote to approve the compensation paid to our named executive officers, or for thenon-binding advisory vote on the frequency of future advisory votes on executive compensation, because these proposals are considered to be“non-routine” matters. If you do not provide voting instructions to your broker for thesenon-routine matters, the broker may not vote your shares on these proposals at all. When that happens, it is called a “brokernon-vote.”

How do I vote?

If you are a shareowner of record, you may vote your shares by any one of the following methods:

| • | By Internet. You may vote online atwww.envisionreports.com/KMT. You may follow the instructions on the Notice or in the proxy card. Voting on the Internet has the same effect as voting by mail. If you vote on the Internet, you do not need to return a proxy card. Internet voting will be available until 11:59 p.m. Eastern Time on October 30, 2017. |

| • | By telephone. You may vote by telephone by dialing1-800-652-8683. Follow the instructions on your Notice or proxy card. Voting by telephone has the same effect as voting by mail. If you vote by telephone, you do not need to return a proxy card. Telephone voting will be available until 11:59 p.m. Eastern Time on October 30, 2017. |

| • | By mail. The Notice includes directions on how to request paper copies of this Proxy Statement, the 2017 Annual Report and a proxy card. Once you receive a paper proxy card, you may vote your shares by signing and dating each proxy card that you receive and returning it in |

the prepaid envelope. Sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as anattorney-in-fact, executor, administrator, guardian, trustee or the officer or agent of a corporation or partnership), please indicate your name and your title or capacity. If the stock is held in custody for a minor (for example, under the Uniform Transfers to Minors Act), the custodian should sign, not the minor. If the stock is held in joint ownership, one owner may sign on behalf of all owners. |

| • | Voting In Person. If you are a shareowner of record, you may vote your shares in person by ballot at the Annual Meeting. However, we encourage you to vote by proxy card, by telephone or on the Internet even if you plan to attend the Annual Meeting. |

How do I vote shares that are held by my broker?

If you own shares held by a broker or other nominee (i.e., its “street name”), you may instruct your broker or other nominee to vote your shares by following the instructions that your broker or nominee provides to you. Most brokers offer voting by mail, by telephone and on the Internet.

How do I vote my shares in the 401(k) plan?

You will receive voting instructions from the plan trustee. You may instruct the plan trustee on how to vote your shares in the 401(k) plan in writing, or by other means available.

How can I revoke a proxy or change my vote?

You have the right to revoke your proxy and change your vote at any time before the meeting by (1) notifying our Secretary in writing or (2) delivering a later-dated proxy card by telephone, on the Internet or by mail. If you are a shareowner of record, you may also revoke your proxy by voting in person at the Annual Meeting.

| KENNAMETAL INC. 2017 Proxy Statement | | 3 |

GENERAL INFORMATION

Who are “Named Proxies” and how will they vote my shares?

Our Board of Directors selected the persons named on the Notice and proxy card (the “Named Proxies”) to act as proxies for the Annual Meeting. If you specify a voting choice, the shares will be voted in accordance with that choice. If you vote your shares, but do not indicate your voting preferences, the Named Proxies will vote on your behalf for the election of the nominees for director listed below, for the ratification of the selection of the independent auditors, for the approval (on anon-binding advisory basis) of the compensation paid to our named executive officers, and for the approval (on anon-binding advisory basis) of the frequency of future advisory votes on executive compensation.

How will the advisory vote related to executive compensation be treated?

Although the advisory vote to approve the compensation paid to our named executive officers isnon-binding, our Board of Directors will review the results of this vote and, consistent with our strong record of shareowner engagement, will take the results of the votes into account in making future determinations concerning executive compensation.

What does it mean if I receive more than one Notice, proxy card or voting instruction?

It means that you hold shares in more than one account. To ensure that all of your shares are voted, please vote as instructed in each Notice or sign and return each proxy card (if you have requested and received paper copies of this Proxy Statement and a proxy card). If you vote by telephone or on the Internet, you will need to vote once for each Notice, proxy card or voting instruction card you receive.

Who tabulates the votes?

The votes are tabulated by Computershare, which acts as an independent inspector of election.

What should I do if I want to attend the Annual Meeting?

If you plan to attend the Annual Meeting, youmust present valid picture identification, such as a driver’s license or passport. If you hold your shares in a brokerage account, youmust also bring a copy of a brokerage statement reflecting stock ownership as of the Record Date to be admitted to the Annual Meeting. Please do not bring cameras, recording equipment, electronic devices, large bags, briefcases or packages with you. You will be asked to check in with our security personnel and none of these items will be permitted in the Annual Meeting.

In addition to the identification and brokerage statement, (i) if you plan to attend the Annual Meeting as a proxy for a registered shareholder, you must also present a written legal proxy to you signed by the registered shareholder or (ii) if you plan to attend the Annual Meeting as a proxy for a street name shareholder, you must present a written legal proxy from a broker or bank that is assignable and signed by the street name holder with an indication by the street name holder that you are the person authorized to seek admission.

If you have questions about directions, admittance or parking, you may call724-539-5000.

Can I view the Proxy Statement and 2017 Annual Report electronically?

Yes. Copies of this Proxy Statement and our 2017 Annual Report to Shareowners (the “2017 Annual Report”) are available free of charge for electronic (online) access and viewing atwww.envisionreports.com/KMT.

You may also view the Proxy Statement and 2017 Annual Report free of charge on our website at www.kennametal.com in the “Investor Relations” section under the “SEC Filings” tab.

What is “householding”?

We have adopted “householding,” a procedure under which shareowners of record

| 4 | | KENNAMETAL INC. 2017 Proxy Statement |

GENERAL INFORMATION

who have the same address and last name and do not receive proxy materials electronically will receive only one copy of our Annual Report and Proxy Statement unless one or more of these shareowners notifies us that they wish to continue receiving individual copies. This procedure saves printing and postage costs by reducing duplicative mailings. Shareowners who participate in householding will continue to receive separate proxy cards. Householding will not affect dividend check mailings. Beneficial shareowners can request information about householding from their banks, brokers or other holders of record.

What if I want to receive a copy of the Annual Report and Proxy Statement?

You may request a Proxy Statement or Annual Report via our website,www.kennametal.com, under “About Us,” “Investor Relations.” If you prefer, you may call our Secretary at412-248-8309 or write to Kennametal Inc., Attention: Vice President, Secretary and General Counsel, 600 Grant Street, Suite 5100, Pittsburgh, Pennsylvania 15219:

| • | If you participate in householding and wish to receive a separate copy of the 2017 Annual Report, Proxy Statement, or Notice of Internet Availability of Proxy Materials, or |

| • | If you do not participate in householding, but would like a print copy of either the 2017 Annual Report or Proxy Statement, or would like to participate in householding with regard to the Annual Report, Proxy Statement, or Notice of Internet Availability of Proxy Materials, or |

| • | If you wish to receive separate copies of future annual reports and proxy statements. |

We will deliver the requested documents to you promptly upon your request at no charge.

How can I contact the Company, the Board of Directors, the Executive Chairman, or Lead Director of the Board or any of the Independent Directors?

The address of our principal executive offices is 600 Grant Street, Suite 5100, Pittsburgh, Pennsylvania 15219.

You can send written communications to any of our Board members, addressed to:

Kennametal Inc.

c/o Michelle R. Keating

Vice President, Secretary and General Counsel

600 Grant Street, Suite 5100

Pittsburgh, Pennsylvania 15219

We will forward any communication we receive to the relevant director(s), except for advertisements, solicitations or other matters unrelated to the Company.

What are the procedures for submitting a shareowner proposal or nomination for the 2018 Annual Meeting?

We expect to hold our 2018 Annual Meeting in October 2018. If a shareowner wishes to have a proposal considered for inclusion in next year’s proxy statement, such shareowner must submit the proposal in writing so that we receive it by May 17, 2018. Proposals should be addressed to our Vice President, Secretary and General Counsel at Kennametal Inc., 600 Grant Street, Suite 5100, Pittsburgh, Pennsylvania 15219. Proposals must comply withRule 14a-8 of Regulation 14A of the proxy rules and must contain certain information specified in the Company’sBy-Laws.

In addition, ourBy-Laws provide that any shareowner wishing to propose any other business at the 2018 Annual Meeting must give

| KENNAMETAL INC. 2017 Proxy Statement | | 5 |

GENERAL INFORMATION

the Company written notice no earlier than May 1, 2018 and no later than June 30, 2018. That notice must provide certain other information as described in theBy-Laws.

Shareowner nominations for directors to be elected at the 2018 Annual Meeting must be submitted to the Vice President, Secretary and General Counsel in writing no earlier than May 1, 2018 and no later than June 30, 2018. TheBy-Laws contain certain requirements for the information that must be provided in any shareowner nomination, including information about the nominee and the nominating shareowner. Please see “Committee Functions — Nominating/Corporate Governance Committee” under the “Board of Directors and Board Committees” section of this Proxy Statement for additional information regarding shareowner nominations to be considered by the Nominating/Corporate Governance Committee.

Any shareowner may obtain a copy of theBy-Laws or any of our corporate governance materials by submitting a written request to the Vice President, Secretary and General Counsel at Kennametal Inc., 600 Grant Street, Suite 5100, Pittsburgh, Pennsylvania 15219.

Who pays for the solicitation of proxies?

Kennametal pays all costs related to the Company’s solicitation of proxies. We may solicit

proxies by mail, or our directors, officers or employees may solicit proxies personally, by telephone, facsimile or the Internet. We have retained the services of Morrow & Co., LLC, 470 West Avenue, Stamford, CT 06902, to assist in soliciting proxies from brokerage houses, custodians, nominees, other fiduciaries and other shareowners of the Company. We will pay all fees and expenses of Morrow & Co., LLC in connection with the solicitation; we do not expect those fees and expenses to exceed $10,000. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonableout-of-pocket expenses for sending proxy materials to shareowners and obtaining their votes.

What is the Company’s Fiscal Year?

Kennametal’s fiscal year begins each year on July 1 and ends on the following June 30. Any reference to a “year” in this Proxy Statement is to a fiscal year. For example, references to “2017,” “fiscal year 2017,” or “Fiscal 2017” mean the fiscal year beginning July 1, 2016 and ending June 30, 2017.

| 6 | | KENNAMETAL INC. 2017 Proxy Statement |

PROPOSAL I. ELECTION OF DIRECTORS

Proposal I. Election of Directors

Kennametal seeks directors with strong reputations and experience in areas relevant to the strategy and operations of our businesses, particularly industries and growth segments that we serve, as well as key geographic markets where we operate.

At its meeting on July 26, 2016, our Board of Directors unanimously agreed to amend the Kennametal Inc.By-Laws to remove the classification of directors into the three classes. Accordingly, each person elected as a director of the Corporation at or after this Annual Meeting, whether elected to succeed a person whose term of office as a director has expired (including the expiration of such person’s term) or to fill any vacancy, shall be elected for a term expiring at the next annual meeting of shareowners. From the date of the 2018 annual meeting of the shareowners, and thereafter, the Board of Directors shall no longer be classified with respect to the time for which they hold office.

Our Board of Directors has nominated seven of our current directors, Cindy L. Davis, William J. Harvey, William M. Lambert, Timothy R. McLevish, Sagar A. Patel, Christopher Rossi and Steven H. Wunning, forre-election to serve as directors with a term that will expire in 2018. Each of the nominees for election as a director at the Annual Meeting and each of the

Company’s current directors hold or have held senior executive positions in large, complex organizations and have operating experience that meets our objectives, as described below. In these positions, they have also gained experience in core management skills, such as strategic and financial planning, public company financial reporting, corporate governance, risk management and leadership development. Included in each Director nominee’s biography below is an assessment of the specific qualifications, attributes, skills and experience of such nominee based on the qualifications described above.

We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted for another person nominated as a substitute by the Board.

The Board believes that the combination of the various qualifications, skills and experiences of the Director nominees would contribute to an effective and well-functioning Board and that, individually and as a whole, the Director nominees possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management.

| KENNAMETAL INC. 2017 Proxy Statement | | 7 |

PROPOSAL I. ELECTION OF DIRECTORS

The following table highlights each director’s specific skills, knowledge and experience. A particular director may possess additional skills, knowledge or experience even though they are not indicated below.

Director Skills and Experience Matrix

|  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||||||||||

SKILLS / EXPERIENCE | ||||||||||||||||||||||||||||||||||||||||

Current or recent executive experience | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||

Public company finance | X | X | X | X | ||||||||||||||||||||||||||||||||||||

Capital intensive industry | X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||

Public company executive compensation | X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||

Legal — Litigation | X | X | X | |||||||||||||||||||||||||||||||||||||

Legal — Transactions | X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||

Risk Management | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||

Diversity | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||

Government / Military | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||

Technology / Engineering | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||

Sales & Marketing | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||

Strategic Planning | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||

International | X | X | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||

Environmental / Health / Safety | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||

Public Company Board Experience | X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||

| 8 | | KENNAMETAL INC. 2017 Proxy Statement |

PROPOSAL I. ELECTION OF DIRECTORS

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION

OF EACH OF THE NOMINEES.

We have provided additional information about each nominee and each director whose term of office will continue after the Annual Meeting below, including the specific characteristics and traits that we believe qualify these individuals to serve as directors of our Company.

| CINDY L. DAVIS | Age: 55 | Director since 2012 | ||||

| Ms. Davis is a member of the Board of Directors of Buffalo Wild Wings, a position she has held since November 2014. Ms. Davis retired from her position as the Vice President, Nike, Inc., and President, Nike Golf (a global leading innovator in athletic footwear, apparel, equipment and accessories) in January, 2015, a position she held since 2008. Ms. Davis joined Nike, Inc. in 2005 as General Manager, Nike Golf USA after holding a variety of marketing and executive positions for companies such as the Arnold Palmer Golf Company and The Golf Channel. Ms. Davis earned an MBA in marketing and finance at the University of Maryland, and a bachelor of arts in economics at Furman University in Greenville, South Carolina.

Qualifications: Ms. Davis’ winning track record of driving innovation and profitable growth, globally, positions her as an excellent fit to our Board of Directors.

| |||||

| WILLIAM J. HARVEY | Age: 66 | Director since 2011 | ||||

| Mr. Harvey is the retired President — DuPont Packaging & Industrial Polymers (a multi-billion dollar global business unit of E.I. DuPont de Nemours & Company), having served in that position from 2009 through 2015. Mr. Harvey joined DuPont in 1977. After leaving DuPont in 1992 to become General Manager of the Peroxygen Chemical Division of FMC Corporation, Mr. Harvey rejoined DuPont in 1996 and was appointed Global Business Director for DuPont Packaging & Industrial Polymers. Since that time Mr. Harvey held various management-level positions with DuPont including Vice President and General Manager of the DuPont Advanced Fiber businesses — Kevlar and Nomex Fibers, Vice President — DuPont Corporate Operations and Vice President — DuPont Corporate Plans. Mr. Harvey holds a bachelor’s degree in economics from Virginia Commonwealth University and a master’s degree from the University of Virginia Darden Graduate School of Business. Mr. Harvey also serves on the boards of Bridgestone Americas, Inc. and Origin Materials. He is also a Trustee of Washington College where he serves on the Executive Committee and chairs the Admissions and Financial Aid Committee. Mr. Harvey previously held Board of Trustee positions at the Darden School at the University of Virginia and Delaware State University.

Qualifications: Mr. Harvey brings to the Board keen strategic insight and commercial expertise. His wealth of global experience and business acumen make an excellent contribution to our Board.

| |||||

| KENNAMETAL INC. 2017 Proxy Statement | | 9 |

PROPOSAL I. ELECTION OF DIRECTORS

| WILLIAM M. LAMBERT | Age: 59 | Director since 2016 | ||||

| Mr. Lambert is Chairman and Chief Executive Officer of MSA Safety, Inc. (“MSA”), as of June 2017. Mr. Lambert previously held the Chairman position of MSA since May 2015 and the President and Chief Executive Officer position since 2008, and has been a member of the board of directors of MSA since 2007. Mr. Lambert joined MSA in 1981 as a design engineer and over the years has served the company in a variety of capacities. Mr. Lambert holds a Bachelor’s degree in mechanical engineering from Penn State University and a Master’s degree in industrial administration from Carnegie Mellon University.

Qualifications:Mr. Lambert has extensive experience leading a global manufacturing company and he brings to the board extensive experience in business strategy, product development, marketing and finance.

| |||||

| TIMOTHY R. MCLEVISH | Age: 62 | Director since 2004 | ||||

| Mr. McLevish serves as the Executive Chairman of Lamb Weston Holdings, Inc., a global leader in processing frozen potatoes for food service, quick serve restaurants and retail, a position he has held since November 2016. From 2015 until 2016, Mr. McLevish served as Senior Advisor to the Chief Executive Officer of Walgreens Boots Alliance, Inc., a retail drug store chain. Prior to that, he served as Executive Vice President and Chief Financial Officer, Walgreens Co., from 2014 to 2015. From 2007 to 2014, Mr. McLevish held various positions within Kraft Foods Group and its predecessor company Kraft Foods Inc., manufacturers and marketers of packaged food products, including serving as Executive Vice President and Chief Financial Officer of Kraft Foods Group from 2012 to 2013, Executive Vice President and advisor to the Chief Executive Officer of Kraft Foods Inc. from 2011 until 2013 and as Chief Financial Officer of Kraft Foods Inc. from 2007 until 2011. From 2002 until 2007, Mr. McLevish was the Senior Vice President and Chief Financial Officer of Ingersoll-Rand Company Limited, a diversified industrial company. Mr. McLevish was the Vice President and Chief Financial Officer of Mead Corporation, a manufacturer of wood products, from 1999 to 2002. Mr. McLevish currently sits on the Board of Directors of R.R. Donnelley & Sons Company, where he serves as Chairman of the Audit Committee. Mr. McLevish holds a bachelor’s degree in accounting from the University of Minnesota and a master in business administration from Harvard Business School.

Qualifications: Mr. McLevish’s experience as chief financial officer of multiple multinational companies brings deep financial and global business experience to the Board. He is an “audit committee financial expert” based on his experience as chief financial officer of public companies and brings deep knowledge of financial reporting, internal controls and procedures and risk management to our Board. Mr. McLevish also has considerable corporate governance experience gained through his years of experience on other public company boards, including serving as the Executive Chairman of the Board of Lamb Weston Holdings, Inc.

| |||||

| 10 | | KENNAMETAL INC. 2017 Proxy Statement |

PROPOSAL I. ELECTION OF DIRECTORS

| SAGAR A. PATEL | Age: 51 | Director since 2016 | ||||

| Mr. Patel is the President of Aircraft Turbine Systems of Woodward, Inc., a position he has held since June 2011. Before joining Woodward, Mr. Patel worked at General Electric, where he last served as President, Mechanical Systems, GE Aviation in Cincinnati, Ohio. At GE’s Aviation and Transportation businesses, Mr. Patel held roles with increasing responsibilities in engineering, operations, services and P&L management. Earlier in his career, he also worked in a utility company in India for three years. Mr. Patel served as Chairman of the Rockford Area Economic Development Council (RAEDC) in Rockford, Illinois, in addition to serving on the Illinois Governor’s Innovation Advisory Council. Mr. Patel holds a master’s degree in Electrical Engineering from the University of Pittsburgh and a bachelor’s degree in Controls and Instrumentation Engineering from Gujarat University in India.

Qualifications:Mr. Patel has more than 25 years’ experience in the aerospace, transportation and energy industries, bringing to our Board extensive experience in product and advanced manufacturing innovation, global operations and strategic growth areas.

| |||||

| CHRISTOPHER ROSSI | Age: 53 | Director since 2017 | ||||

| Mr. Rossi is President and Chief Executive Officer and a member of the Board of Directors of Kennametal Inc., positions he has held since August 2017. Previously, Mr. Rossi served as Chief Executive Officer of Dresser-Rand at Siemens Aktiengesellschaft, from September 2015 to May 2017. From September 2012 to August 2015, Mr. Rossi served as Executive Vice President of Global Operations at Dresser-Rand Group Inc., where he was responsible for Product Manufacturing Operations and certain related functions. Mr. Rossi held various leadership positions with Dresser-Rand Group Inc., its affiliates and predecessor companies since he joined in 1987, having been responsible for the areas of Engineering, Production, Supply Chain Management, Sales and Business Development. From January 2009 to September 2012, Mr. Rossi served as Vice President, Technology and Business Development. Prior to that, he was the Executive Vice President of Product Services Worldwide, where he served from February 2007 to December 2008. In that capacity, Mr. Rossi assumed worldwide responsibility for sales of the aftermarket parts and services business. From October 2003 to February 2007, Mr. Rossi served as the Vice President and General Manager of North American Operations, where he was responsible for all U.S. plants and worldwide development engineering. Mr. Rossi was Vice President and General Manager, Painted Post Operation from February 2001 to October 2003, and a Vice President, Supply Chain Management Worldwide, from March 1998 to January 2001. Mr. Rossi holds a Bachelor of Science in Mechanical Engineering from Virginia Tech and an M.B.A. in Corporate Finance and Operations Management from the University of Rochester’s Simon School of Business.

Qualifications: Mr. Rossi has extensive experience leading and managing a complex global manufacturing company, having held positions of progressive responsibility at Dresser-Rand. As a former Chief Executive Officer of Dresser-Rand, Mr. Rossi brings diverse manufacturing, technology, and strategy experience and leadership skills to Kennametal Inc.

| |||||

| KENNAMETAL INC. 2017 Proxy Statement | | 11 |

PROPOSAL I. ELECTION OF DIRECTORS

| STEVEN H. WUNNING | Age: 66 | Director since 2005 | ||||

| Mr. Wunning is the retired Group President and Executive Office member of Caterpillar Inc. (a global manufacturer of construction, mining, and industrial equipment), having served in those positions from January 2004 to January 2015. In that capacity, he had administrative responsibility for the Resource Industries Group, which included its Advanced Components & Systems Division, Integrated Manufacturing Operations Division, Mining Products Division, Mining Sales & Marketing Division, and Product Development & Global Technology Division. Mr. Wunning joined Caterpillar in 1973, and has held numerous positions there with increasing responsibility, including Vice President and then President of Cat Logistics, Corporate Vice President of the Logistics & Product Services Division, and Corporate Vice President of Cat Logistics. Mr. Wunning is also a member of the Board of Directors of The Sherwin Williams Company, Summit Materials, Inc., Black & Veatch Holding Company and Neovia Logistics Services, LLC. He has a bachelor’s degree from the University of Missouri Rolla — now Missouri University of Science and Technology — and an Executive MBA from the University of Illinois. Mr. Wunning serves on the Board of Trustees of Missouri University of Science and Technology.

Qualifications: Mr. Wunning brings to our Board his extensive operational and management experience in the areas of quality, manufacturing, product support and logistics for a complex, global organization. He has a deep understanding of the challenges of managing a global manufacturing organization and is able to provide valuable insight and perspective with respect to operations, supply chain logistics and customer relations. Mr. Wunning currently serves as the Chair of our Compensation Committee.

| |||||

Nominees for Directors of the Second Class With a Term to Expire in 2018

| RONALD M. DE FEO | Age: 65 | Director since 2001 | ||||

| Mr. De Feo is the Executive Chairman of the Board of Directors of Kennametal Inc., a position he has held since August 2017. Mr. De Feo served as President and Chief Executive Officer and a member of the Board of Directors of Kennametal Inc. from February 2016 to August 2017, and as a director since November 2001. Previously, Mr. De Feo served as the Chairman of the Board and Chief Executive Officer of Terex Corporation (a global manufacturer of machinery and industrial products), having served in those positions from March 1998 and March 1995, respectively, through December 31, 2015. From October 1993 through December 2006, Mr. De Feo was also the President and Chief Operating Officer of Terex. He joined Terex in 1992 as the President of the Heavy Equipment Group and later assumed responsibility for Terex’s former Clark Material Handling Company subsidiary. Before joining Terex, Mr. De Feo was a Senior Vice President of J.I. Case Company, the former Tenneco farm and construction equipment division and also served as a Managing Director of Case Construction Equipment throughout Europe. While at J.I. Case Company, Mr. De Feo was also a Vice President of North American Construction Equipment Sales and General Manager of Retail Operations. Mr. De Feo serves as a Trustee for Iona College and also served on the Board of the Association of Equipment Manufacture and as Chairman of Bridgeport Hospital Foundation, a term which ended in 2016. Mr. De Feo holds a bachelor’s of arts degree in Economics and Philosophy from Iona College.

Qualifications: Mr. De Feo has extensive experience in leading and managing manufacturing companies that operate globally, such as ours. As the Chairman and former Chief Executive Officer of a U.S.-based, public, industrial company, Mr. De Feo brings strong leadership skills and deep knowledge of the manufacturing industry to the Board, as well as valuable perspective from serving on the Board of Terex Corporation.

| |||||

| 12 | | KENNAMETAL INC. 2017 Proxy Statement |

PROPOSAL I. ELECTION OF DIRECTORS

| LAWRENCE W. STRANGHOENER | Age: 63 | Director since 2003 | ||||

| Mr. Stranghoener serves as independent Lead Director of the Board of Directors for Kennametal Inc., and he has been serving in that capacity since August 2017. Previously, Mr. Stranghoener served as Chairman of the Board of Directors of Kennametal Inc. from October 2015 to July 2017. He is the retired Executive Vice President, Strategy and Business Development of the Mosaic Company (a crop nutrition company), a position he held from August 30, 2014 until his retirement in January 2015. Mr. Stranghoener previously served as Chief Executive Officer of that company from June 1, 2014 through August 30, 2014, and prior to that served as the company’s Executive Vice President and Chief Financial Officer, a position he held from September 2004 until June 2014. Before joining Mosaic, Mr. Stranghoener was the Executive Vice President and Chief Financial Officer of Thrivent Financial (a Fortune 500 financial services company) from 2001 to 2004. Prior to that, Mr. Stranghoener spent 17 years at Honeywell Inc. where he served in a variety of positions in the U.S. and in Europe, including three years as Chief Financial Officer until Honeywell merged with Allied Signal Inc. in 1999. Mr. Stranghoener started his career as an Investment Analyst at Dain Rauscher. Mr. Stranghoener serves on the board of directors of Aleris International, where he chairs the audit committee, and he also serves as chairman of the board of trustees for Goldman Sachs Closed End Funds and Exchange Traded Funds. He holds a bachelor of arts degree from St. Olaf College and a master of business administration degree from Northwestern University.

Qualifications: Mr. Stranghoener has extensive experience as a Chief Financial Officer for a variety of organizations. He brings strong leadership skills and a deep understanding of financial reporting and risk management to our Board. His knowledge of the financial and capital markets enables him to provide guidance and valuable insight to our Board and management on these matters. In his capacity as independent Lead Director of the Board, he serves as the independent liaison between our management, our shareowners and the Board. He works closely with our Executive Chairman and President and Chief Executive Officer on matters affecting the company, our business, the Board and all of our shareholders.

| |||||

Director retiring from the Board at the 2017

Annual Meeting

| PHILIP A. DUR | Age: 73 | Director since 2006 | ||||

| Mr. Dur is the retired Corporate Vice President and President, Ship Systems Sector of Northrop Grumman Corporation (a global defense company), having served in those positions from October 2001 to December 2005. Prior to that, he was the Vice President of Program Operations at the Electronic Sensors and Systems Sector for Northrop Grumman. Mr. Dur joined Northrop Grumman in 1999 following five years with Tenneco, Inc. (a global manufacturer of products for the automobile industry), where he held a number of strategic and executive positions, with the latest being Vice President, Worldwide Business Development and Strategy. Mr. Dur also had a long and distinguished career in the U.S. Navy, ultimately rising to the rank of Rear Admiral. He is a former Director of TechPrecision Corporation (a provider of specialty and large-scale metallic fabrication, machining and assembly), having retired in December 2016. Mr. Dur was recently appointed a Trustee of Florida Polytechnic University by the Governor of Florida. Mr. Dur holds a bachelor’s and master’s degree from the University of Notre Dame and a master’s degree and doctorate from Harvard University.

Qualifications: Mr. Dur brings to our Board extensive executive experience in operations and keen strategic insight into the transportation industry and future business opportunities for our Company. He also brings valuable perspective from his service on the board of Tech Precision Corporation, a public company. Mr. Dur currently serves as the Chair of our Nominating/Corporate Governance Committee.

| |||||

| KENNAMETAL INC. 2017 Proxy Statement | | 13 |

ETHICS AND CORPORATE GOVERNANCE

Ethics and Corporate Governance

All of our directors, officers and employees, including our Executive Chairman, Chief Executive Officer, Chief Financial Officer and Corporate Controller, must strictly adhere to our Code of Conduct (sometimes referred to as the “Code”).

The Code is designed to:

| • | Proactively promote ethical behavior; |

| • | Protect our valued reputation and the reputations of our directors, officers and employees; |

| • | Assist all employees to act as good corporate citizens around the world; and |

| • | Continue to demonstrate that we, and the individuals we employ, can be successful while maintaining the values which have served us well over the years. |

We view violations of the Code very seriously. Personal consequences for violations can be severe and can include termination and/or legal action. Directors, officers and employees who know of or suspect a violation of the Code must report the matter to us promptly. Any of these individuals can report a concern or potential violation of the Code:

| • | By approaching or telephoning such person’s immediate supervisor or manager, another supervisor or manager, such person’s local Human Resource professional, the Office of the General Counsel or the Office of Ethics & Compliance; |

| • | In writing directed to the Vice President, Secretary and General Counsel, Kennametal Inc., 600 Grant Street, Suite 5100, Pittsburgh, Pennsylvania 15219 or by email:k-corp.ethics@kennametal.com; |

| • | By calling the Office of Ethics & Compliance at412-248-8275; |

| • | By calling the Company’s toll-free HELPLINE(1-877-781-7319). The HELPLINE is accessible twenty-four (24) hours a day. Concerned persons can |

utilize the HELPLINE on a confidential and anonymous basis (where allowed by law); or |

| • | By accessing the Company’sweb-based HELPLINE portal located on our website at www.kennametal.com on the “Ethics and Compliance” page which is accessible under the “About Us” tab. |

The Code is posted on our website atwww.kennametal.com on the “Ethics and Compliance” page, which is accessible under the “About Us” tab. We will disclose any future amendments to the Code that relate to our directors or executive officers on our website, as well as any waivers of the Code that relate to directors and executive officers.

Our Board of Directors adopted the Kennametal Inc. Corporate Governance Guidelines (the “Guidelines”) to assist the Board in the exercise of its duties and responsibilities and to serve the best interests of the Company. The Guidelines reflect the Board’s commitment to monitor the effectiveness of policy and decision-making both at the Board and management level.

A complete copy of the Guidelines is available on our website atwww.kennametal.com on the “Corporate Governance” page, which is accessible under the “Investor Relations” page under the “About Us” tab. Any changes to the Guidelines in the future will also be posted on our website. Following is a summary that provides highlights of our Guidelines and many related corporate governance matters:

Selection of New Director Candidates and Criteria for Board Membership

| • | Kennametal believes that the Board as a whole should encompass a range of talent, skill, diversity and expertise that enable it to provide sound guidance with respect to our operations and interests. Board nominees are identified, screened and recommended by the Nominating/Corporate Governance Committee and |

| 14 | | KENNAMETAL INC. 2017 Proxy Statement |

ETHICS AND CORPORATE GOVERNANCE

| approved by the full Board. The Nominating/Corporate Governance Committee evaluates and ultimately selects director nominees on the basis of a number of criteria, including independence, integrity, diversity, business and industry experience, areas of expertise, ability to exercise sound judgment in areas relevant to our businesses, and willingness to commit sufficient time to the Board. In addition to considering a candidate’s background and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of our businesses. |

| • | The Nominating/Corporate Governance Committee strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee the Company’s businesses. |

| • | Although the Nominating/Corporate Governance Committee does not have a formal policy with respect to consideration of diversity in identifying director candidates, as noted above, diversity is one of the many important factors considered in any evaluation of a director or director nominee. The Nominating/Corporate Governance Committee believes the term “diversity” encompasses a broad array of personal characteristics, including traditional concepts such as age, gender, race and ethnic background. Equally important to any evaluation of diversity, however, are characteristics such as geographic origin and exposure, skills and training, education, viewpoint, industry exposure and professional experience. The Nominating/Corporate Governance Committee recognizes that diversity of all types can bring distinctive skills, perspectives and experiences to the Board. |

| • | The Nominating/Corporate Governance Committee will consider any director candidate nominated by a shareowner in accordance with ourBy-Laws and applicable law. For further information on |

shareowner nominating procedures, please refer to the response to the question “What are the procedures for submitting a shareowner proposal or nomination for the 2018 Annual Meeting?” under the “General Information” section of this Proxy Statement. |

| • | All Board members are expected to ensure that other existing and planned future commitments do not materially interfere with their service as a director of the Company. |

Board Composition and Independence

| • | A majority of Board members must qualify as independent directors under the listing standards of the New York Stock Exchange (“NYSE”), the rules and regulations of the Securities and Exchange Commission (the “SEC”) and the requirements of any other applicable regulatory authority. Currently, Mr. De Feo, our Executive Chairman and Mr. Rossi, our President and Chief Executive Officer, are the only two directors on our Board who are not independent. |

| • | Only those directors who the Board affirmatively determines have no material relationship with the Company, either directly or indirectly, will be considered independent directors. The Board’s determination is based on the requirements for independence set forth under the listing standards of the NYSE and those of any other applicable regulatory authority and also on additional qualifications set forth in the Guidelines regarding: |

| • | Indebtedness of the director, or his or her immediate family members or affiliates, to the Company; |

| • | Indebtedness of the Company to affiliates of the director; and |

| • | A director’s relationships with charitable organizations. |

| • | In June and July 2017, our management compiled and summarized our directors’ |

| KENNAMETAL INC. 2017 Proxy Statement | | 15 |

ETHICS AND CORPORATE GOVERNANCE

| responses to a questionnaire asking them to disclose any relationships they (or any of their immediate family members or affiliates) have with the Company and any other potential conflicts of interest. Their responses, along with materials provided by management related to transactions, relationships or arrangements between the Company and the directors or parties related to the directors was presented to the Nominating/Corporate Governance Committee for its review and consideration. The Nominating/Corporate Governance Committee determined that none of ournon-employee directors, all of whom are listed below, has had during the last three years (i) any of the relationships described above; or (ii) any other material relationship with the Company that would compromise his or her independence under the listing standards of the NYSE, the rules and |

regulations of the SEC and/or the requirements set forth in our Guidelines. The table below includes a description of the transactions, relationships or arrangements considered by the Nominating/Corporate Governance Committee in reaching its determination. The Nominating/Corporate Governance Committee presented its findings to the Board at its July 2017 meeting. Based upon the conclusions and recommendation of the Nominating/Corporate Governance Committee, the Board determined that allnon-employee directors then considered are independent, and that all of the members of the Audit, Compensation and Nominating/Corporate Governance Committees also meet the independence tests referenced above. |

Name | Independent | Transactions/Relationships/Arrangements Considered | ||

Cindy L. Davis | Yes | None | ||

Ronald M. De Feo | No | Executive Chairman | ||

Philip A. Dur | Yes | None | ||

William J. Harvey | Yes | Commercial relationships between E.I. DuPont de Nemours & Company and its subsidiaries and Kennametal Inc. (Kennametal as supplier) — immaterial | ||

William M. Lambert | Yes | Commercial relationships between MSA and Kennametal Inc. (MSA as a supplier to Kennametal) — immaterial | ||

Timothy R. McLevish | Yes | None | ||

Sagar A. Patel | Yes | Commercial relationships between Woodward, Inc. and its subsidiaries and Kennametal Inc. (Kennametal as a supplier) — immaterial | ||

Christopher Rossi | No | President and Chief Executive Officer | ||

Lawrence W. Stranghoener | Yes | None | ||

Steven H. Wunning | Yes | None |

Outside Board Membership

Management directors are required to seek and obtain the approval of the Board before accepting outside board memberships.Non-management directors must advise the independent Lead Director of the Board and the Chair of the Nominating/Corporate Governance

Committee in advance of accepting an invitation to serve on another board. Sitting on another public company’s board should not create a conflict of interest or impair the director’s ability to provide sufficient time to carry out his or her duties as a director of the Company.

| 16 | | KENNAMETAL INC. 2017 Proxy Statement |

ETHICS AND CORPORATE GOVERNANCE

Retirement Age

Unless otherwise determined by the Nominating/Corporate Governance Committee due to special circumstances, no director may be nominated forre-election orre-appointment to the Board if he or she would be age seventy-three (73) or older at the time of election or appointment.

Conflicts of Interest

Directors must avoid any action, position or interest that conflicts with an interest of the Company, or gives the appearance of conflict. We solicit information annually from directors in order to monitor potential conflicts of interest. Any potential conflict of interest must be immediately reported to the independent Lead Director and the Chair of the Nominating/Corporate Governance Committee. If a director has a personal interest in a matter before the Board, the director must disclose the interest to the Board, excuse himself or herself from participation in the matter and not vote on the matter.

Directors Orientation and Continuing Education

| • | Each new director must participate in the Company’s orientation program, which should be conducted within two (2) months of the meeting at which the new director is elected. |

| • | Directors are encouraged to participate in continuing education programs, as appropriate, to maintain the skills necessary to perform their director duties and responsibilities. |

Board Compensation

| • | In accordance with our Stock Ownership Guidelines (which are applicable to our directors, executives and key managers), directors are required to hold meaningful equity ownership positions in the Company in order to further the direct correlation of directors’ and shareowners’ economic interests. Please see “Equity Ownership by Directors” under the “Board of Directors and Board Committees” section of this Proxy Statement for additional information regarding our Stock |

Ownership Guidelines, as they apply to our directors. |

| • | Directors who serve on the Audit Committee, Compensation Committee and/or Nominating/Corporate Governance Committee do not receive any compensation from us other than director fees (including fees paid for service on Board committees). |

| • | Directors who are employees (currently only Executive Chairman, Mr. De Feo and President and Chief Executive Officer, Mr. Rossi) do not receive additional cash compensation for their service as a director. |

Board Leadership Structure

OurBy-Laws and Guidelines give the Board the flexibility to determine whether the roles of Chief Executive Officer and Board Chairman should be held by the same person or by two separate individuals. When the roles of Chairman and Chief Executive Officer are combined in one individual, the Board also has the ability to designate a Lead Director to provide additional leadership and guidance to the Board. Based on these current characteristics, the company has determined that the leadership structure is appropriate including for purposes of efficient and effective corporate governance. Currently, the roles of Chief Executive Officer and Executive Chairman are separate. However, because the Executive Chairman is also a member of management, the Board has elected Mr. Stranghoener as Lead Director to be the independent liaison between management and the Board.

Currently, our Board is led by Mr. De Feo, our Executive Chairman of the Board, who has served in that capacity since August 2017, with Mr. Stranghoener acting as our independent Lead Director.

Our Executive Chairman of the Board, Mr. De Feo and our independent Lead Director of the Board, Mr. Stranghoener, set agendas and establish Board priorities and procedures. Mr. Stranghoener, our independent Lead Director, presides over executive sessions of thenon-management directors and acts as the principal liaison between thenon-management

| KENNAMETAL INC. 2017 Proxy Statement | | 17 |

ETHICS AND CORPORATE GOVERNANCE

directors, the Executive Chairman, and the Chief Executive Officer. Our Guidelines contain a list of the various responsibilities with which Mr. Stranghoener, as independent Lead Director, is tasked. In addition to the responsibilities described above, the Lead Director also:

| • | Consults with the Compensation Committee in connection with the annual evaluation of the Executive Chairman and Chief Executive Officer’s performance and, together with the Chair of the Compensation Committee, meets with the Executive Chairman and Chief Executive Officer to discuss that evaluation; |

| • | Provides feedback to the Executive Chairman and Chief Executive Officer with respect to the quality, quantity and timeliness of the flow of information from management to thenon-management directors; and |

| • | Assists the Board and management in assuring implementation of and compliance with the Guidelines and our Code of Conduct. |

Selection of Agenda Items for Board Meetings