Kirby Corporation

Putting America’s Waterways to Work

NYSE: KEX

February 2006

Statements contained in this presentation with respect to the future are forward-looking statements. These statements reflect management’s reasonable judgement with respect to future events. Forward-looking statements involve risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including cyclical or other downturns in demand, significant pricing competition, unanticipated additions to industry capacity, changes in the Jones Act or in U.S. maritime policy and practice, fuel costs, interest rates, weather conditions and the timing, magnitude and the number of acquisitions made by Kirby. Forward-looking statements are based on currently available information and Kirby assumes no obligation to update such statements. A list of additional risk factors can be found in Kirby’s annual report on Form 10-K for the year ended December 31, 2004, filed with the Securities and Exchange Commission.

Kirby reports its financial results in accordance with generally accepted accounting principles (GAAP). However, Kirby believes that certain Non-GAAP financial measures are useful in managing Kirby’s businesses and evaluating Kirby’s performance. This presentation contains two Non-GAAP financial measures, adjusted net earnings and EBITDA. Please see the Appendix for a reconciliation of GAAP to Non-GAAP financial measures.

Forward Looking Statement

Non-GAAP Financial Measures

Kirby... Business Operations

NYSE: K E X

Current Price (February 13, 2006) | $54.67 |

Number of Shares O/S | 26.2M |

Market Capitalization | $1,435M |

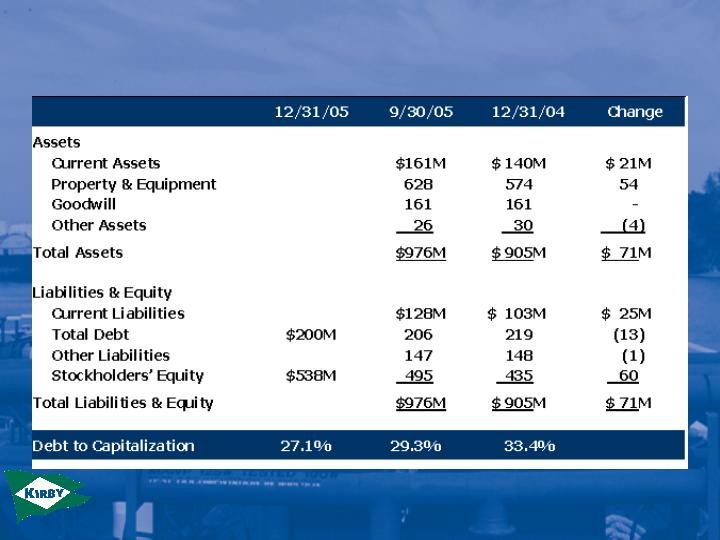

Debt (December 31, 2005) | $200M |

Enterprise Value | $1,635M |

Employees | 2,400 |

Kirby…Public Market Facts

Kirby Facts

•

Largest inland tank barge operator

•

Operates 897 barges and 242 towing vessels

•

Sustainable competitive advantages:

–

Lowest cost due to economies of scale

–

Best positioned for growth opportunities

–

“One Stop Shop” for customers

•

70% of Kirby’s business is under contract,

30% spot market

•

Successful integration of 24 acquisitions

Towboats Only

Date | No. of

Tank

Barges | Description |

1986 | 5 | Alliance Marine |

1989 | 35 | Alamo Inland Marine Co. |

1989 | 53 | Brent Towing Company |

1991 | 3 | International Barge Lines, Inc. |

1992 | 38 | Sabine Towing & Transportation Co. |

1992 | 26 | Ole Man River Towing, Inc. |

1992 | 29 | Scott Chotin, Inc. |

1992 | | South Texas Towing |

1993 | 72 | TPT, Division of Ashland |

1993 | | Guidry Enterprises |

1993 | 53 | Chotin Transportation Company |

1994 | 96 | Dow Chemical (transportation assets) |

Date | No. of

Tank

Barges | Description |

1999 | 270 | Hollywood Marine, Inc. Stellman Alamo Barge Lines Ellis Towing Arthur Smith Koch Ellis Mapco |

2002 | 15 | Cargo Carriers |

2002 | 64 | Coastal Towing, Inc. (barge

management agreement for 54

barges) |

2002 | 94 | Dow/Union Carbide (transportation

assets) |

2003 | 64 | SeaRiver Maritime (ExxonMobil) |

2005 | 10 | American Commercial Lines (black oil

fleet) |

Shipper Owned (Blue)

Independent (Red)

Acquisitions in Core Business

17% growth

rate from

1988-2005

Revenue... Business Operations

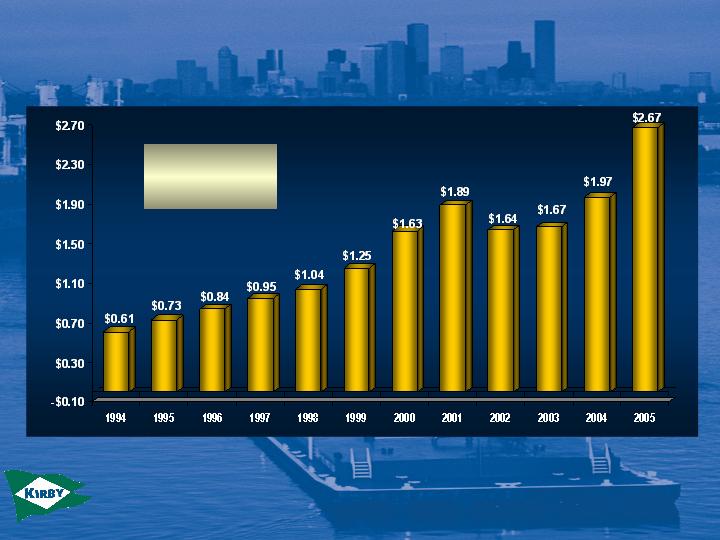

1994-2001 adjusted to exclude goodwill amortization expense

2002 adjusted to exclude impairment charges of $12.5 million, net of taxes, or $.51 per share

See Appendix for reconciliation of GAAP to Non-GAAP earnings per share

14.4% growth

rate from

1994 - 2005

Earnings Per Share From Continuing Operations Before Adjustments

Earnings Per Share…

St. Paul

Sioux City

Chicago

Pittsburgh

Charleston

St. Marks

Tulsa

Corpus Christi

New Orleans

St. Louis

Cincinnati

Mobile

Brownsville

Houston

Texas and Louisiana

account for

80% of the

total U.S. production of

chemicals and

petrochemicals

12,000 miles of navigable

waterways linking America’s

heartland to the world

Kirby is one of the few

operators offering distribution

throughout the Mississippi

River System and Gulf

Intracoastal Waterway

Putting America’s Waterways to Work

Inland Waterway System

Industry Facts

•

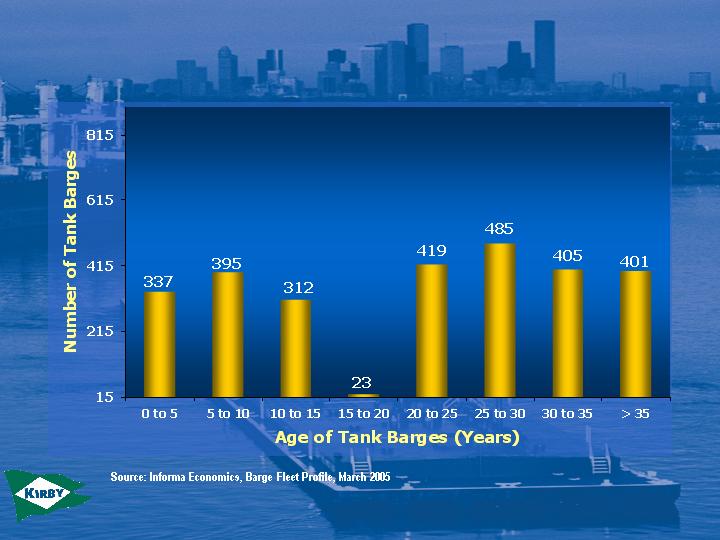

Approximately 18,300 dry cargo barges, 2,800 liquid tank

barges. Kirby in the liquid cargo business only.

•

No competition from foreign companies due to a U.S. law

known as the Jones Act

•

Always a market to move product by barge on inland

waterways

•

Equipment not subject to economic obsolescence because

draft and lock restrictions limit the size of barges

•

Barges are mobile, carry wide range of cargoes, and service

different geographic markets

•

Inland waterway system plays a vital role in the U.S. economy

•

Inland waterway system is an environmentally friendly mode

of transportation

For the years 1993 through 2004

Number of Inland Tank Barges

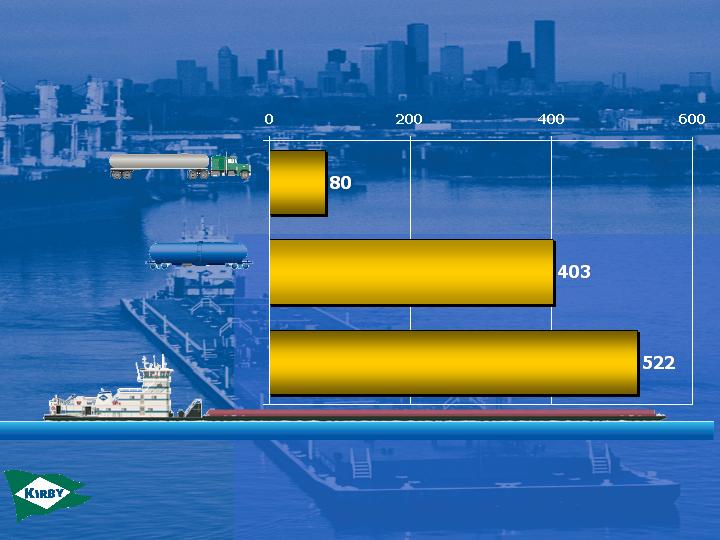

90,000 bbl. three-barge tow is equivalent to:

Kirby’s fleet capacity of 16.7 million bbls. equates

to 83,500 trucks, or 22,200 rail cars

Barges Compete Successfully

With Rails and Trucks

One gallon of fuel in a barge can move one ton of freight 522 miles,

compared to 403 miles by rail and only 80 miles for a truck.

Barge

Rail

Truck

Barges…

Efficient

While moving one ton of freight 1,000 miles:

•

Smog is a major problem in most major cities

•

Oxides of nitrogen are the chemicals that produce smog

Trains produce 3.5 times as much oxides of

nitrogen as barges

Trucks produce 19 times as much oxides of

nitrogen as barges

Barges…

Environmentally Friendly

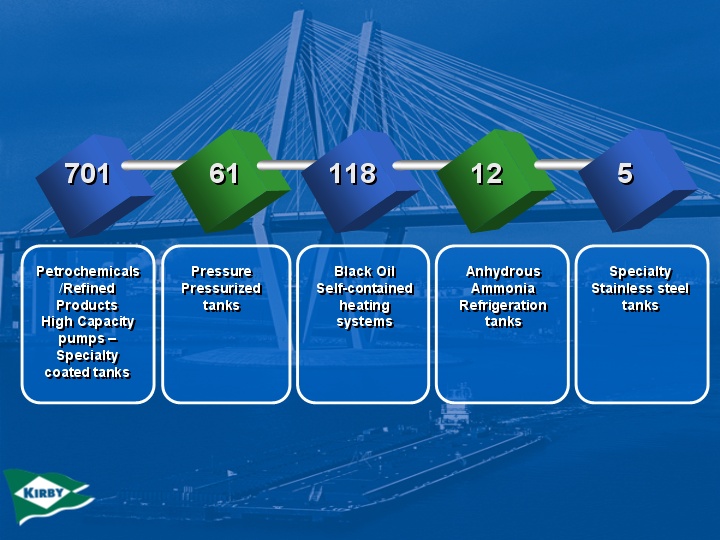

Largest Inland Tank Barge

Operator

High Tech and Diverse Fleet

897 Active Tank Barges

Fleet Size and Diversity…

Better Asset Utilization

•

Better Asset Utilization

–

More backhaul

opportunities

–

Faster barge

turnarounds

–

More efficient use of

horsepower

–

Barges positioned

closer to cargos

•

Lower Incremental Costs

–

Enhanced purchasing

power

–

Minimal incremental

G&A from fleet

additions

–

Less cleaning due to

more barges with

compatible prior cargos

Shipper Owned Independent | Tank

Barges

Operated | Dry Cargo

Barges

Operated |

Kirby Corporation | 897 | - |

American Commercial Lines LLC | 369 | 2,861 |

Marathon Ashland Petroleum | 167 | - |

Ingram Barge Company | 165 | 3,468 |

Canal Barge Company, Inc. | 150 | 226 |

Florida Marine | 103 | - |

American River Transportation

Co | 84 | 1,892 |

Blessey Enterprises | 83 | - |

Higman Barge Lines, Inc. | 77 | - |

Cenac Towing Company, Inc. | 69 | - |

Magnolia Marine Transport Co | 60 | - |

PPG Industries, Inc. | 59 | - |

Martin Midstream Partners | 55 | - |

Southern Towing Company | 53 | - |

Settoon Towing, LLC | 49 | - |

LeBeouf Brothers Towing Co | 43 | - |

John W. Stone Oil | 31 | - |

Dupont | 30 | - |

Olin Corporation | 26 | - |

Buffalo Marine Service, Inc. | 22 | - |

River City Towing Services | 19 | - |

Rhodia, Inc. | 19 | - |

Lyondell Chemical Company | 17 | - |

Shipper Owned Independent | Tank Barges

Operated | Dry Cargo

Barges

Operated |

Dynegy Midstream Services | 16 | - |

Waxler Towing Company, Inc. | 15 | - |

Highland Towing | 15 | - |

ConocoPhillips Company | 15 | - |

Plaquemine Towing Corp. | 13 | - |

Houston Marine Services, Inc. | 13 | - |

Devall Towing | 12 | - |

Chem Carriers, Inc. | 11 | - |

Westlake/GA&O Corporation | 10 | - |

Merichem Company | 8 | - |

Grifco | 8 | - |

Apex Towing | 7 | - |

Golding Barge Lines, Inc. | 6 | - |

Republic of Texas | 6 | - |

American Milling | 5 | 17 |

Barge Management, Inc. | 5 | - |

Mon River Towing, Inc. | 4 | 142 |

Reilly Industries | 4 | - |

Memphis Barge Lines | 2 | - |

Cytec Industries | 2 | - |

Jantran, Inc. | 1 | 3 |

Other dry cargo carriers | - | 9, 670 |

TOTAL | 2,825 | 18,279 |

Informa Economics, Barge Fleet Profile, March 2005

Kirby Outpaces the Competition

Tank Barge Owners By Number of Tank Barges

Revenue

Distribution | Products Moved | Products | Drivers |

67% | Petrochemicals and

Chemicals | Benzene, Styrene, Methanol,

Acrylonitrile, Xylene, Caustic Soda,

Butadiene, Propylene | Housing, Consumer Goods,

Autos, Clothing |

20% | Black Oil Products | Residual Fuel, No. 6 Fuel Oil, Coker

Feed, Vacuum Gas, Asphalt | Road Construction, Feed

Stock for Refineries and Fuel

for Power Plants and Ships |

9% | Refined Products | Gasoline, Jet Fuel, Diesel Fuel,

Naphtha | Vehicle Usage, Air Travel,

Weather |

4% | Agricultural

Chemicals | Anhydrous Ammonia,

Nitrogen-based Liquid Fertilizer,

Industrial Ammonia | Corn, Cotton and Wheat

Production |

End Uses of Products…

Demand Drivers

•

Committed to dedicating adequate

resources to achieve safety

objectives

–

Extensive company-owned and

operated training facility

–

Seamen’s Church Institute

(Towboat Simulator)

•

Industry leader

–

First winner of Benkert Award,

highest award given by

Department of Transportation for

safety and environmental

protection

Strong Emphasis on Safety…

Safety Is Our Franchise To Operate

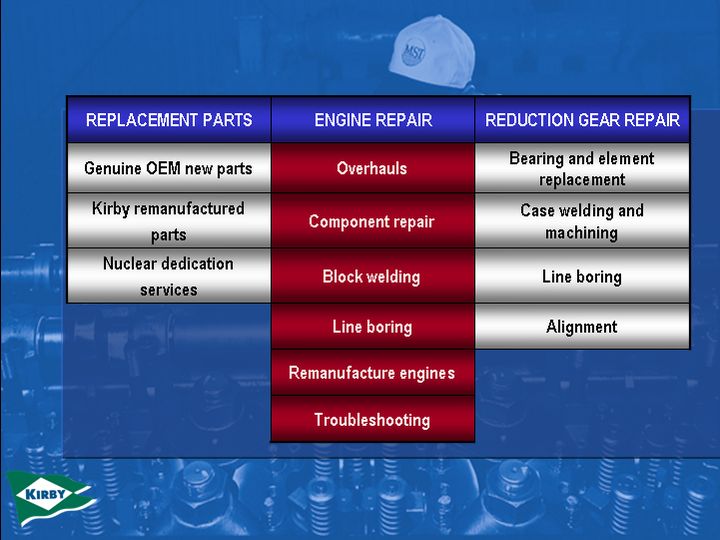

Diesel Engine Services Markets

•

Marine (59%)

–

Inland River Carriers – Dry and Liquid

–

Offshore Towing – Dry and Liquid

–

Offshore Oilfield Services – Drilling Rigs &

Supply Boats

–

Harbor Towing

–

Dredging

–

Great Lakes Ore Carriers

•

Power Generation, Nuclear and Industrial (20%)

–

Standby Power Generation

–

Pumping Stations

–

Industrial Reduction Gears

•

Railroad (21%)

–

Passenger (Transit Systems)

–

Class II

–

Shortline and Industrial

Acquisitions and Internal

Growth

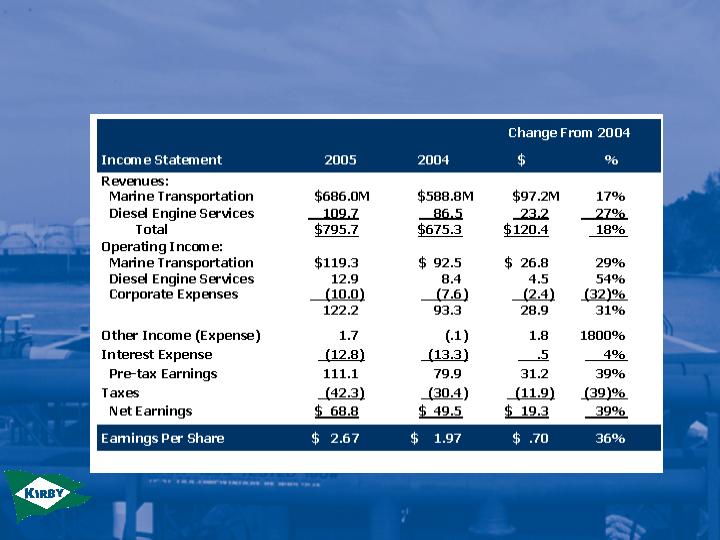

•

Record revenues, net earnings, earnings per share and EBITDA

•

Petrochemical and black oil products markets remained strong

•

Winter weather conditions in January and February. Favorable

conditions in March, second quarter and fourth quarter

•

Hurricanes Katrina and Rita negatively impacted the third

quarter by an estimated $.10 per share

•

Contract rates up 4% to 6%. Spot market rates higher than

contract and up 20% over 2004

•

Diesel engine services – strong service and direct parts sales,

coupled with increased prices for both service and parts

Market Conditions

2005 Year

•

2006 first quarter earnings per share guidance of $.64 to

$.70, compared with $.52 for 2005 first quarter

•

Guidance based on:

•

Petrochemical and black oil volumes will remain strong

•

Expect increased delay days from winter weather conditions

•

2006 year earnings per share guidance of $2.95 to $3.15,

compared with $2.67 for 2005

2006 First Quarter and Year

Outlook

Future Growth Opportunities

•

Acquire inland tank barge operations

–

Kirby operates more efficiently due to size and distribution system

–

Competitors face fleet replacement decisions

–

Outsourcing by shippers provides growth opportunities

–

Customers seek to single source their requirements

•

Expand services related to marine operations

–

Purchased two-thirds interest in Osprey Line, a provider of container

on barge feeder service

–

Manage or acquire marine facilities

•

Expand diesel engine service operations

–

Existing geographic foot print presents opportunities for expansion

–

Continue to develop exclusive parts distribution relationships

Osprey Line, LLC

•

Purchased one-third interest in April 2004

•

Increased ownership to two-thirds in January

2006

•

Transports containers on barge on U.S. inland

waterway system and Gulf of Mexico

•

Future growth opportunity as U.S. contends

with congestion problems

•

Provides attractive alternative to rail and

truck

•

Very complementary to Kirby’s existing

distribution system and customer base

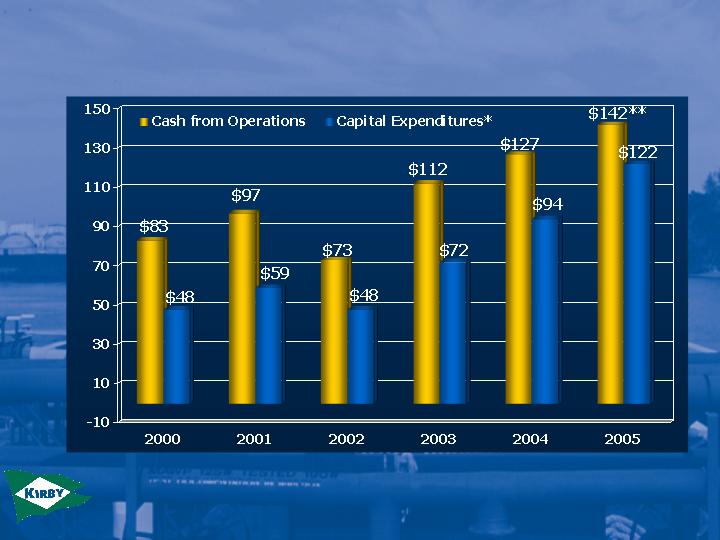

For Year Ended December 31, 2005

11.9% growth

rate from

1994 - 2005

See Appendix for reconciliation of GAAP net earnings to Non-GAAP EBITDA

EBITDA Per Share Growth

Excluding acquisitions

* Unaudited

Cash Flows

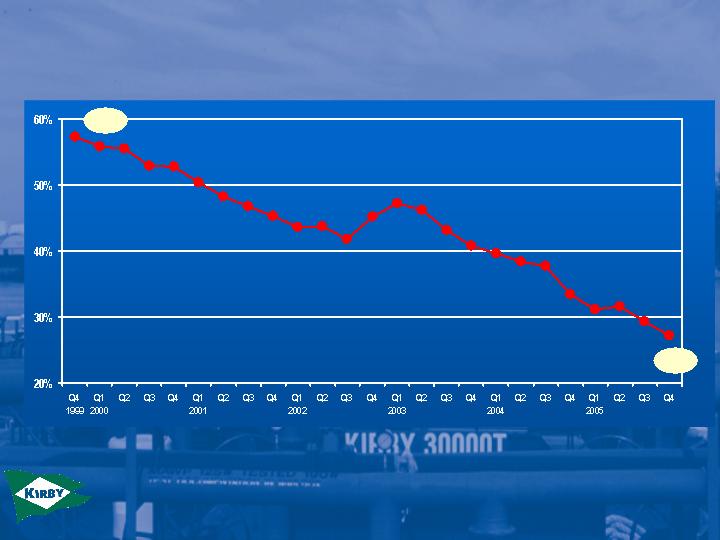

27.1%

57.3%

Debt / Capitalization

•

Investment grade public debt

–

Standard & Poor’s – BBB+

–

Moody’s – Baa3

•

8-year unsecured Private Placement due 2013

–

$200 million outstanding

–

Floating rate of LIBOR +0.5%

–

No required principal payments until maturity

•

$150 Million Revolving Credit Facility

–

Accordion feature added to allow maximum amount to

increase to $225 million without amendment

•

Protection against interest rate increases

–

$150 million of interest rate swaps

Financial Strength

•

Consistent long-term record of success in core

businesses

•

Excellent business fundamentals

•

Strong free cash flow

•

Internal and external growth opportunities in core

businesses

•

Strong operating leverage with every 1% increase

in marine transportation segment margin adds $.16

per share to earnings; for diesel segment, adds $.03

per share to earnings

•

Fleet expansions will improve asset utilization,

operating efficiencies and reduce costs

Why Invest in Kirby?

Thank You For Listening to Our Story

Kirby Corporation

Putting America’s

Waterways to Work

KIRBY CORPORATION

Reconciliation of GAAP to Non-GAAP Financial Measures

Kirby reports its financial results in accordance with generally accepted accounting principles (GAAP). However, Kirby believes that certain non-GAAP financial measures are useful in managing Kirby’s businesses and evaluating Kirby’s performance. Two such non-GAAP financial measures are adjusted net earnings and EBITDA.

Adjusted net earnings and adjusted net earnings per share exclude non-recurring adjustments in order to present a measure of earnings that facilitates a comparison of results from one period to results from another period on a more consistent basis, since the non-recurring items are materially different in nature and amount from one period to another. The adjustments generally represent items that are outside normal business operations and are therefore difficult to predict for future periods.

EBITDA, which Kirby defines as net earnings before interest expense, taxes on income, depreciation and amortization, is used because of its wide acceptance as a measure of operating profitability before nonoperating expenses (interest and taxes) and noncash charges (depreciation and amortization). EBITDA is one of the performance measures used in Kirby’s incentive bonus plan. EBITDA is also used by rating agencies in determining Kirby’s credit rating and by analysts publishing research reports on Kirby, as well as by investors and investment bankers generally in valuing companies.

These non-GAAP financial measures are not a substitute for GAAP financial results and should only be considered in conjunction with Kirby’s financial information that is presented in accordance with GAAP.

Quantitative reconciliations of adjusted net earnings to GAAP net earnings and of EBITDA to GAAP net earnings are provided in the following tables.

KIRBY CORPORATION

Reconciliation of GAAP Net Earnings and Earnings Per Share to Adjusted Non-GAAP

Net Earnings and Adjusted Earnings Per Share

| | | For the years ended December 31, | |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | |

| | | (In millions, except per share amounts) | |

| | | | | | | | | | | | | | | | | | | | | | |

Net earnings from continuing operations, GAAP | | $ | 68.8 | | $ | 49.5 | | $ | 40.9 | | $ | 27.4 | | $ | 39.6 | | $ | 34.1 | | $ | 21.4 | | $ | 10.1 | | $ | 22.7 | | $ | 21.2 | |

Adjustments or charges, net of taxes: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Impairment of assets | | | - | | | - | | | - | | | 12.5 | | | - | | | - | | | .7 | | | 5.4 | | | - | | | - | |

Amortization of goodwill expense | | | - | | | - | | | - | | | - | | | 6.3 | | | 5.9 | | | 1.7 | | | .6 | | | .7 | | | .5 | |

Loss on sale of Universal Insurance Company | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | 6.9 | | | - | | | - | |

Merger related charges | | | - | | | - | | | - | | | - | | | - | | | .1 | | | 2.9 | | | - | | | - | | | - | |

| | | | - | | | - | | | - | | | 12.5 | | | 6.3 | | | 6.0 | | | 5.3 | | | 12.9 | | | .7 | | | .5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted net earnings from continuing operations, Non-GAAP | | $ | 68.8 | | $ | 49.5 | | $ | 40.9 | | $ | 39.9 | | $ | 45.9 | | $ | 40.1 | | $ | 26.7 | | $ | 23.0 | | $ | 23.4 | | $ | 21.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net earnings per share from continuing operations, GAAP | | $ | 2.67 | | $ | 1.97 | | $ | 1.67 | | $ | 1.13 | | $ | 1.63 | | $ | 1.39 | | $ | 1.01 | | $ | .46 | | $ | .92 | | $ | .82 | |

Adjustments or charges per share, net of taxes | | | - | | | - | | | - | | | .51 | | | .26 | | | .24 | | | .24 | | | .58 | | | .03 | | | .02 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted net earnings per share from continuing operations, Non-GAAP | | $ | 2.67 | | $ | 1.97 | | $ | 1.67 | | $ | 1.64 | | $ | 1.89 | | $ | 1.63 | | $ | 1.25 | | $ | 1.04 | | $ | .95 | | $ | .84 | |

KIRBY CORPORATION

Reconciliation of GAAP Net Earnings to Non-GAAP EBITDA

| | | For the years ended December 31, | |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | |

| | | (In millions, except per share amounts) | |

| | | | | | | | | | | | | | | | | | | | | | |

Net earnings from continuing operations, GAAP | | $ | 68.8 | | $ | 49.5 | | $ | 40.9 | | $ | 27.4 | | $ | 39.6 | | $ | 34.1 | | $ | 21.4 | | $ | 10.1 | | $ | 22.7 | | $ | 21.2 | |

Interest expense | | | 12.8 | | | 13.3 | | | 14.6 | | | 13.7 | | | 19.0 | | | 23.9 | | | 12.8 | | | 11.9 | | | 13.4 | | | 13.3 | |

Provision for taxes on income | | | 42.3 | | | 30.4 | | | 25.1 | | | 18.0 | | | 27.5 | | | 23.7 | | | 14.0 | | | 6.9 | | | 13.8 | | | 12.9 | |

Depreciation and amortization | | | 57.4 | | | 55.1 | | | 53.4 | | | 45.5 | | | 50.3 | | | 48.2 | | | 31.3 | | | 27.4 | | | 28.1 | | | 28.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA from continuing operations, Non-GAAP | | | 181.3 | | | 148.3 | | | 134.0 | | | 104.6 | | | 136.4 | | | 129.9 | | | 79.5 | | | 56.3 | | | 78.0 | | | 75.8 | |

Adjustments or charges: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Impairment of assets | | | - | | | - | | | - | | | 18.9 | | | - | | | - | | | 1.1 | | | 8.3 | | | - | | | - | |

Loss on sale of Universal Insurance Company | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | 10.6 | | | - | | | - | |

Merger related charges | | | - | | | - | | | - | | | - | | | - | | | .2 | | | 4.5 | | | - | | | - | | | - | |

| | | | - | | | - | | | - | | | 18.9 | | | - | | | .2 | | | 5.6 | | | 18.9 | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA from continuing operations, after adjustments, Non-GAAP | | $ | 181.3 | | $ | 148.3 | | $ | 134.0 | | $ | 123.5 | | $ | 136.4 | | $ | 130.1 | | $ | 85.1 | | $ | 75.2 | | $ | 78.0 | | $ | 75.8 | |

KIRBY CORPORATION

Reconciliation of GAAP Net Earnings to Non-GAAP EBITDA

| | | Three months ended | |

| | | March 31, | | June 30, | | September 30, | | December 31, | | Year | |

| | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | |

| | | (In millions, except per share amounts) | |

| | | | | | | | | | | | | | | | | | | | | | |

Net earnings, GAAP | | $ | 13.3 | | $ | 9.0 | | $ | 18.4 | | $ | 13.8 | | $ | 17.3 | | $ | 13.3 | | $ | 19.8 | | $ | 13.4 | | $ | 68.8 | | $ | 49.5 | |

Interest expense | | | 3.1 | | | 3.4 | | | 3.2 | | | 3.3 | | | 3.0 | | | 3.3 | | | 3.5 | | | 3.3 | | | 12.8 | | | 13.3 | |

Provision for taxes on income | | | 8.1 | | | 5.5 | | | 11.3 | | | 8.4 | | | 10.6 | | | 8.2 | | | 12.3 | | | 8.3 | | | 42.3 | | | 30.4 | |

Depreciation and amortization | | | 15.0 | | | 13.8 | | | 14.0 | | | 13.6 | | | 13.7 | | | 14.0 | | | 14.7 | | | 13.7 | | | 57.4 | | | 55.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA, Non-GAAP | | $ | 39.5 | | $ | 31.7 | | $ | 46.9 | | $ | 39.1 | | $ | 44.6 | | $ | 38.8 | | $ | 50.3 | | $ | 38.7 | | $ | 181.3 | | $ | 148.3 | |

KIRBY CORPORATION

MARINE TRANSPORTATION PERFORMANCE MEASUREMENTS

| | | 2002 | | 2003 | | 2004 | | 2005 | |

| | | Year | | 1st Qtr | | 2nd Qtr | | 3rd Qtr | | 4th Qtr | | Year | | 1st Qtr | | 2nd Qtr | | 3rd Qtr | | 4th Qtr | | Year | | 1st Qtr | | 2nd Qtr | | 3rd Qtr | | 4th Qtr | | Year | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ton miles (in millions) (1) | | | 13,377 | | | 3,455 | | | 3,991 | | | 4,021 | | | 4,115 | | | 15,582 | | | 3,735 | | | 4,321 | | | 4,238 | | | 3,938 | | | 16,232 | | | 3,738 | | | 4,135 | | | 4,027 | | | 4,241 | | | 16,141 | |

Revenues/Ton mile (cents/tm) (2) | | | 3.4 | | | 3.6 | | | 3.4 | | | 3.3 | | | 3.3 | | | 3.4 | | | 3.6 | | | 3.5 | | | 3.6 | | | 3.8 | | | 3.6 | | | 4.2 | | | 4.1 | | | 4.3 | | | 4.4 | | | 4.3 | |

Towboats operated (3) | | | 201 | | | 229 | | | 226 | | | 222 | | | 224 | | | 225 | | | 233 | | | 237 | | | 237 | | | 235 | | | 235 | | | 239 | | | 241 | | | 243 | | | 242 | | | 242 | |

Delays days (4) | | | 5,974 | | | 2,583 | | | 1,268 | | | 1,001 | | | 1,610 | | | 6,462 | | | 2,359 | | | 1,822 | | | 1,658 | | | 2,553 | | | 8,392 | | | 3,289 | | | 1,790 | | | 2,080 | | | 1,863 | | | 9,022 | |

| | (1) | Ton miles indicate fleet productivity by measuring the distance (in miles) a loaded tank barge is moved. Example: A typical 30,000 barrel tank barge loaded with 3,300 tons of liquid cargo is moved 100 miles, thus generating 330,000 ton miles. |

| | (2) | Marine transportation revenues divided by ton miles. Example: 4th quarter 2005 revenues of $185,788,000 divided by 4,241,000,000 ton miles = 4.4 cents. |

| | (3) | Towboats operated is the average number of owned and chartered towboats operated during the period. |

| | (4) | Delay days measures the lost time incurred by a tow (towboat and tank barges) during transit. The measure includes transit delays caused by weather, lock congestion and other navigational factors. |

5