- KEX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Kirby (KEX) DEF 14ADefinitive proxy

Filed: 7 Mar 25, 5:00pm

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under §240.14a-12 | |

| ☒ | No fee required | |||

| ☐ | Fee paid previously with preliminary materials | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

KIRBY | 2025 PROXY STATEMENT

|

PROXY SUMMARY

|

|

1

|

|

TABLE OF CONTENTS

| 2 | ||

| 3 | ||

| 4 | ||

| 5 | ||

| 5 | ||

| 7 | ||

| 8 | ||

| 9 | ||

| 10 | ||

| 12 | ||

| 13 | ||

| 14 | ||

| 15 | ||

| 18 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 25 | ||

| 25 | ||

| 26 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| 29 | ||

| 30 | ||

| 30 | ||

| 30 | ||

| 31 | ||

| 32 | ||

| 32 | ||

| 32 | ||

2

|

KIRBY | 2025 PROXY STATEMENT

|

March 7, 2025

DEAR FELLOW STOCKHOLDERS,

On behalf of the Board of Directors (the “Board”), we cordially invite you to attend Kirby Corporation’s (“Kirby” or the “Company”) 2025 Annual Meeting of Stockholders. Information concerning the matters to be voted upon at the meeting is contained in this Notice of the 2025 Annual Meeting and our Proxy Statement.

2024 was a record year for Kirby. We experienced strong performance across the marine transportation (“KMT”) segment, and continued to strategically pivot within the Distribution and Services (“KDS”) business towards electrification and power generation. We are pleased with our financial results. No year is without challenges, and we did experience weather related headwinds, continuing inflationary pressures and supply chain issues. Our employees remained focused, resilient and successfully achieved strong operating and financial results. We stayed true to “No Harm to People, No Harm to Equipment, and No Harm to the Environment.”

In the KMT segment, despite seasonal weather challenges, inland marine had a positive year driven by strong demand, increased term and spot contract pricing, steady customer demand, and strong barge utilization. The first half of the year was impacted by normal winter weather conditions that drove an increase in delay days and impacted our operations. However, our team successfully navigated these challenges and managed to achieve operating margins in the low 20% range. The second half of the year did see some headwinds primarily due to a pause in refinery activity in Q4, but strong pricing and utilization allowed for inland marine to conclude the year with strong operating margins. In our coastal marine business, strong customer demand and limited supply of vessels, created a strong market dynamic that allowed the business to conclude 2024 with operating margins in the low teens.

In the KDS segment, we saw a year of mixed demand across our markets. Due to a slowdown in traditional fracturing equipment, our team continued to pivot towards electric equipment and the power generation business which has continued to see success and new growth. While there was softness in on-highway trucking, marine repair was strong and was able to offset that decline. Even despite some market headwinds, the KDS segment was able to conclude 2024 with operating margins in the high single digits.

During the year, Kirby continued to advance its sustainability journey impacting different areas of the Company at all levels. A focus on safety, adherence to human rights through training, and a commitment to positive environmental stewardship, all pushed our sustainability efforts forward.

While the Company is mindful of challenges moving into 2025 such as an acute mariner shortage, on-going inflationary pressures, supply chain issues, and unknown impacts from tariff negotiations, with the right focus and work ethic, we can still achieve great results. I’m proud of our teams who have successfully and proactively addressed new market opportunities.

We do anticipate another year of strong financial growth from the KMT business as we expect positive market dynamics. For KDS, we expect the year to remain flat as our power generation business will offset a decline in the traditional oil and gas market. I want to thank our employees for a great year and thank our stockholders for supporting us.

Your vote is important to us, regardless of the number of shares you hold or whether you plan to attend the Annual Meeting. Once you have reviewed the proxy materials and have made your decisions, please vote your shares using one of the methods outlined in the Proxy Statement. Thank you for your continued support and for investing in Kirby Corporation.

| Sincerely,

DAVID W. GRZEBINSKI Chief Executive Officer |

KIRBY | 2025 PROXY STATEMENT

|

3

|

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

Dear Fellow Stockholders:

|

| |||

| On behalf of the Board of Directors, we cordially invite you to attend the 2025 Annual Meeting of Stockholders of Kirby Corporation to be held at: 55 Waugh Drive, Suite 1100, Houston, Texas 77007 on Tuesday, April 29, 2025, at 10:00 a.m. (CDT) at Kirby’s principal executive offices.

| ||||

| Proposals to be voted on at the Kirby Corporation 2025 Annual Meeting of Stockholders are as follows:

| ||||

| 1. | Election of three Class III directors;

| |||

| 2. | Ratification of the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for 2025; and

| |||

| 3. | Advisory vote on the approval of the compensation of Kirby’s named executive officers.

| |||

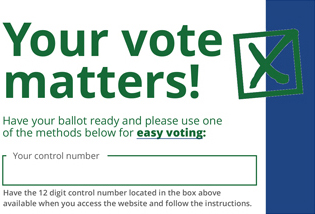

You have the right to receive this notice and vote at the Annual Meeting if you were a stockholder of record at the close of business on March 3, 2025. Please remember that your shares cannot be voted unless you sign and return a paper proxy card, vote during the Annual Meeting, or vote your shares via the phone or internet. All participants who attend the Annual Meeting will be allowed to ask questions to management during the meeting.

Important Notice Regarding the Availability of Proxy Materials for Our 2025 Annual Meeting of Stockholders

We are pleased to take advantage of Securities and Exchange Commission (the “SEC”) rules that allow us to furnish our proxy materials, including this Proxy Statement, a proxy card or voting instruction form, and our Annual Report on Form 10-K (collectively, the “Proxy Materials”), over the Internet. As a result, we are mailing to most of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of paper copies of the Proxy Materials. The Notice contains instructions on how to access those documents over the Internet and how to submit your proxy via the Internet. The Notice also contains instructions on how to request a paper copy of the Proxy Materials. All stockholders who do not receive the Notice will receive a paper copy of the Proxy Materials by mail or an electronic copy of the Proxy Materials by e-mail. This process allows us to provide our stockholders with the information they need in a timelier manner, while reducing the environmental impact and lowering the costs of printing and distributing the Proxy Materials. The Notice is first being sent to stockholders and the Proxy Materials are first being made available to stockholders at www.proxydocs.com/KEX on or about March 18, 2025.

Your Vote Is Important

Your vote is important. Whether you intend to attend the meeting or not, please ensure that your shares will be represented by completing, signing, and returning your proxy card, or by voting via the phone or internet.

|  |  |  | |||||

| At the Meeting | Telephone 866-430-8285 | Internet www.proxypush.com/KEX | Fill out your proxy card and submit by mail. |

Sincerely,

AMY D. HUSTED

Executive Vice President, General Counsel and Secretary

4

|

KIRBY | 2025 PROXY STATEMENT

|

PROXY MATERIALS

This booklet contains the notice of the Annual Meeting and the Proxy Statement, which contains information about the proposals to be voted on at the meeting, Kirby’s Board of Directors and its committees, and certain executive officers. This year you are being asked to:

| 1. | Elect three Class III directors; |

| 2. | Ratify the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for 2025; and |

| 3. | Cast an advisory vote on executive compensation. |

General Information

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Kirby Corporation to be voted at the Annual Meeting of Stockholders to be held on April 29, 2025, at 10:00 a.m. (CDT). Stockholders of record at the close of business on March 3, 2025, will be able to attend the 2025 Annual Meeting at Kirby’s executive offices located at 55 Waugh Drive, Suite 1100, Houston, Texas 77007.

The mailing address of Kirby’s principal executive offices is P.O. Box 1745, Houston, Texas 77251-1745 and the office number is 713-435-1000.

Whenever we refer in this Proxy Statement to the Annual Meeting, we are also referring to any meeting that results from an adjournment or postponement of the Annual Meeting.

Unless the context requires otherwise, the terms “Kirby,” “the Company,” “our,” “we,” “us,” and similar terms refer to Kirby Corporation, together with its consolidated subsidiaries.

KIRBY | 2025 PROXY STATEMENT

|

PROXY SUMMARY

|

5

|

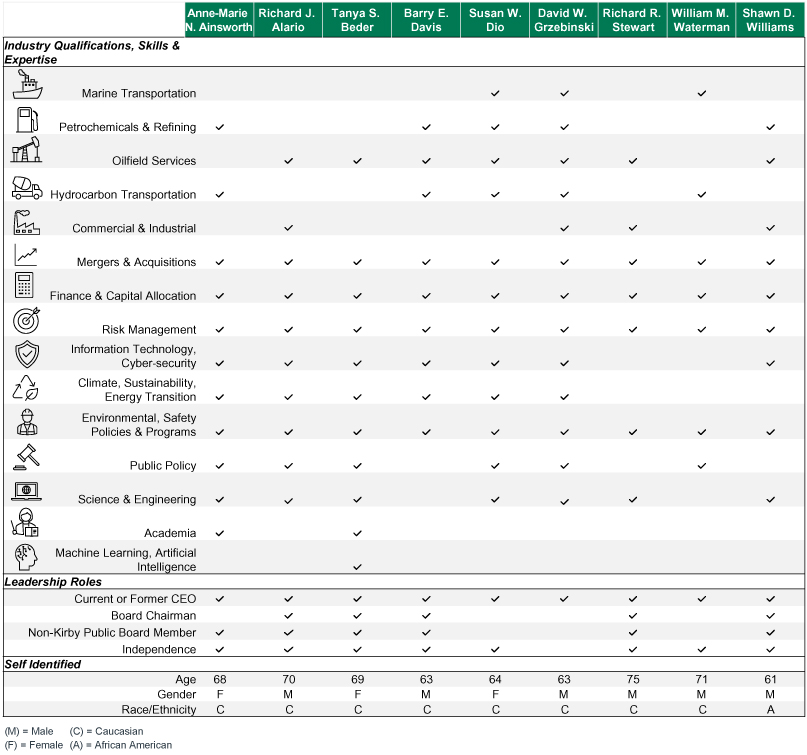

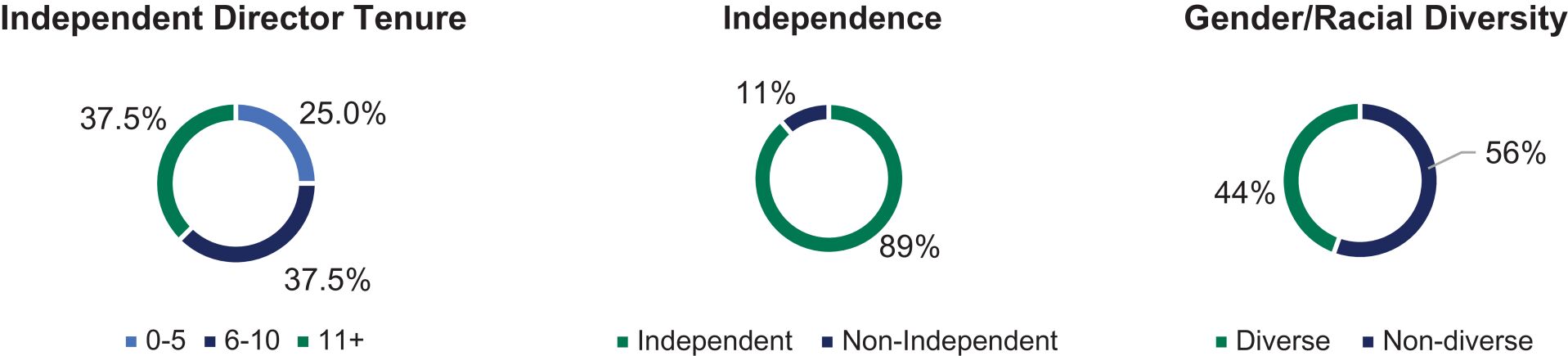

BOARD COMPOSITION AND EXPERIENCE

The following matrix displays the most significant skills and qualifications that each Director, who is either nominated for election or continuing in office, possesses. The Environmental, Social and Governance (“ESG”) and Nominating Committee reviews the composition of the Board as a whole periodically to ensure that the Board maintains a balance of knowledge and experience and to assess the skills and characteristics that the Board may find valuable in the future and in the long-term interest of stockholders. The Board seeks to achieve diversity and recognizes the importance of Board refreshment to ensure that it benefits from fresh ideas and perspectives. The following charts illustrate the Board’s continued commitment to diversity of backgrounds and Board refreshment.

6

|

PROXY SUMMARY

|

KIRBY | 2025 PROXY STATEMENT

|

The ESG and Nominating Committee recommends to the Board the qualifications for Board membership and for identifying, assessing and recommending qualified Director candidates for the Board’s consideration. Directors should have the following attributes:

| • | A commitment to building stockholder value; |

| • | Business acumen and broad experience and expertise in the skills, qualifications and experience represented in the above skills matrix; |

| • | Sufficient time to effectively carry out duties as a Director; and |

| • | Independence (at least a majority of the Board must consist of Independent Directors, as defined by the New York Stock Exchange (“NYSE”) Corporate Governance Standards). |

The ESG and Nominating Committee also considers such other factors as the it deems appropriate, given the current and anticipated needs of the Board and the Company, to maintain a balance of knowledge, experience, background, and capability.

KIRBY | 2025 PROXY STATEMENT

|

PROXY SUMMARY

|

7

|

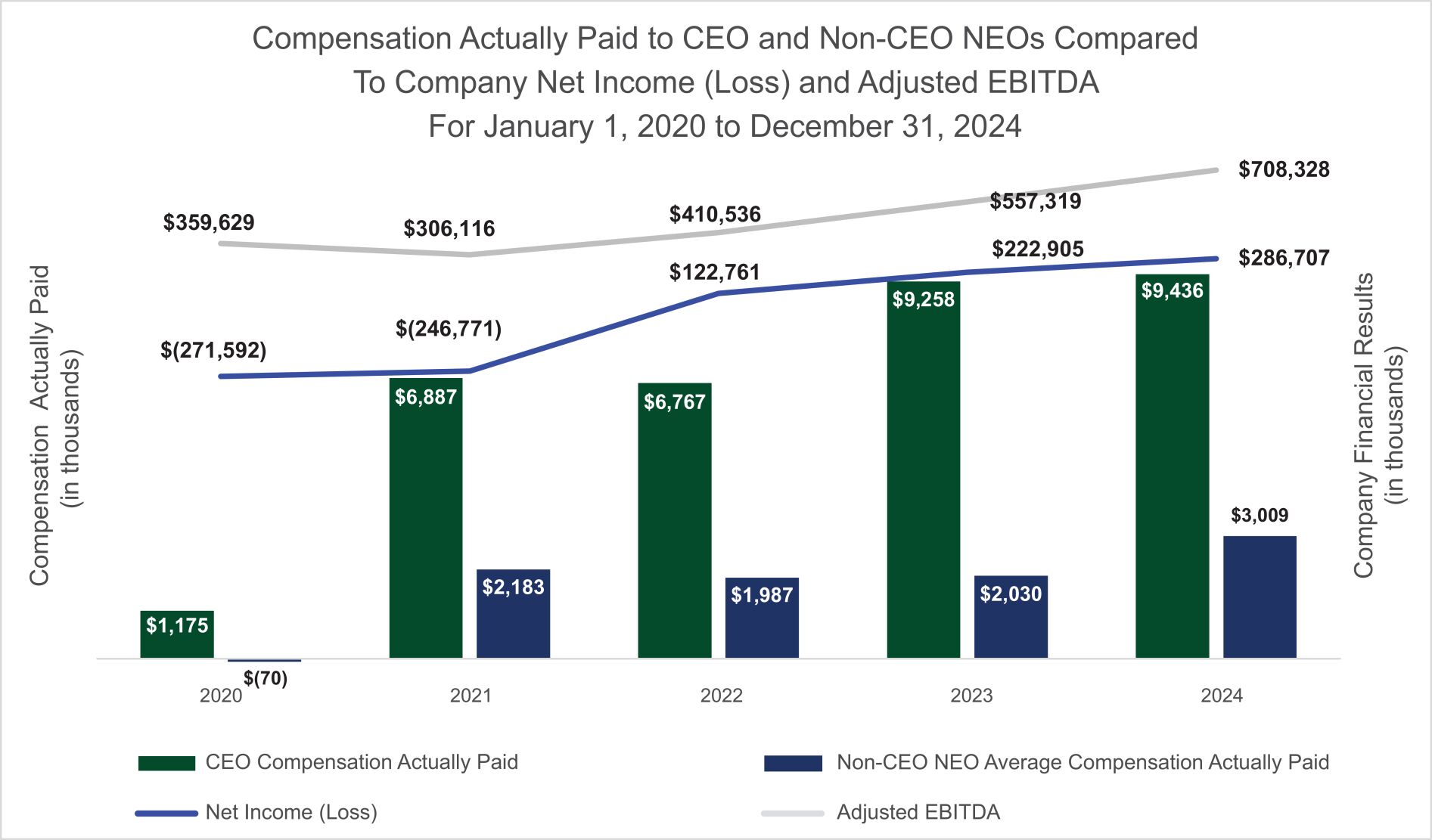

2024 FINANCIAL SUMMARY

Consolidated revenues increased 6% in 2024 to $3.3 billion. The year-over-year improvement was driven by improved pricing and steady demand in the marine transportation segment and strong demand for our power generation equipment in the distribution and services segment. Net earnings attributable to Kirby in 2024 were $286.7 million or $4.91 per share. Net earnings attributable to Kirby, excluding one-time items,¹ were $318.8 million or $5.46 per share in 2024.

Marine transportation revenues increased 11% to $1.9 billion during 2024. The strong growth was primarily due to a 10% increase in inland marine revenues driven by increased term and spot contract pricing, steady demand, and strong barge utilization. Inland marine market conditions remained steady throughout 2024 despite seasonal challenges, headwinds from lock closures, and a temporary slowdown in refinery activity in the fourth quarter. The first quarter was impacted by normal winter weather conditions, including significant wind and fog along the Gulf Coast, that drove an increase in delay days and impacted our operations. In the second quarter, inland marine operating conditions improved and combined with strong utilization to push operating margins into the low 20% range. In the third quarter, strong market conditions continued and led to spot market prices increasing year-over-year in the low double-digit range and term contracts renewing up in the high single digits year-over-year. While refinery activity paused at the start of the fourth quarter, it steadily improved by the end of the quarter and kept our barge utilization in the 90% range. Inland marine was able to conclude the year with operating margins right at 20%. The inland marine market is expected remain strong in 2025, driven by limited new barge construction, steady customer demand, and improved pricing partially offset by inflationary pressures, labor shortages, and the high cost of new equipment.

In coastal marine, revenues increased 18% year-over-year as market conditions were favorable throughout the year due to solid customer demand and limited availability of vessels. In the first quarter, strong market conditions continued to push prices higher which drove operating margins to high single to low double-digit range. During the second quarter, steady customer demand and limited vessel capacity resulted in further price increases year-over-year on term contract renewals and operating margins in the low teens range. In the third quarter, business fundamentals remained strong and pushed operating margins into the mid-teens range. In the fourth quarter, with a high number of planned shipyards in the quarter, our team executed well and was able to keep margins in the low teens. The coastal marine business was able to finish the year with operating margins averaging in the low teens. In 2025, coastal marine is expected to continue seeing positive market dynamics with steady customer demand and limited availability of vessels.

In distribution and services, revenues decreased 1% year-over-year, as a result of mixed demand across the different parts of the segment. Our power generation business experienced a strong pace of order growth throughout the year with several large project wins in data centers, backup power and other industrial applications. Power generation ended 2024 with 20% growth in revenues year-over-year and operating margins in the high single digits. In the commercial and industrial market, while demand was strong in marine repair, the business did experience softness in on-highway truck service and repair. Despite the softness in on-highway trucking, commercial and industrial ended the year with operating income growth of 21% year-over-year and had operating margins in the high single digits. In the oil and gas market, while revenues were down 28% year-over-year due to the conventional diesel fracturing market slow down, the business continued to see growth in electric fracturing and related equipment. Overall, the KDS segment concluded the year with operating margins in the high single digits. In 2025, KDS is expected to see continued growth in power generation which is expected to mostly offset lingering softness in other areas.

From a cash flow and balance sheet perspective, Kirby generated $756 million in cash flow from operations in 2024 which was used to fund capital expenditures, buy back shares, pay down debt, and fund a small number of acquisitions. Total capital spending in 2024 was down 15% year-over-year to $343 million. Throughout the year, the Company remained committed to reducing debt and repaid $144 million of debt. At the end of 2024, Kirby’s total long-term debt had declined to $875 million, with the debt-to-capitalization ratio improving to 20.7%. During the year, Kirby also returned capital to stockholders by buying back 1.6 million shares at an average price of $106.40 for $174.6 million.

| (1) | Net earnings attributable to Kirby, excluding one-time items, is a non-GAAP financial measure. Please refer to Appendix A for additional information and a reconciliation to the most directly comparable generally accepted accounting principles (“GAAP”) financial measures. |

8

|

PROXY SUMMARY

|

KIRBY | 2025 PROXY STATEMENT

|

CORPORATE GOVERNANCE

The Board of Directors provides guidance to and oversight of management with respect to Kirby’s business strategy throughout the year. The Board represents the stockholders’ interest and is responsible for overseeing Company management, which includes monitoring the effectiveness of management practices and decisions, corporate performance, the integrity of the Company’s financial controls, and the effectiveness of its enterprise risk management programs. To that end, the Board has established governance practices including the guidelines and charters described below which are reviewed by the Board at least annually and changes are made as necessary.

Risk Oversight

The full Board is responsible for the oversight of key risks to Kirby’s business and reviews with management the Company’s business, including identified risk factors. The Board periodically visits Kirby operations sites. These visits enable the directors to observe and provide input on practices, performance, technology, industry and corporate standards. The Board oversees a broad spectrum of interrelated risks with assistance from its committees. The Board has designated the Audit Committee, the Compensation Committee, and the ESG and Nominating Committee certain responsibilities to provide assistance in fulfilling the Board’s responsibilities. A particular risk will be monitored and evaluated by the Board committee with primary responsibility in the area of the subject matter involved. For example, the Compensation Committee reviews the risks related to the Company’s compensation policies and practices and the Audit Committee receives regular reports and updates on cybersecurity issues. See page 24 for further detail on risk oversight by the Board and its committees.

Business Ethics Guidelines

The Board has adopted Business Ethics Guidelines that apply to all directors, officers, and employees of the Company, including the Company’s chief executive officer, chief financial officer, chief accounting officer or controller, or persons performing similar functions. A copy of the Business Ethics Guidelines is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Documents. The Company is required to make prompt disclosure of any amendment to or waiver of any provision of its Business Ethics Guidelines that applies to any director or executive officer including its chief executive officer, chief financial officer, chief operating officer, chief accounting officer or controller, or persons performing similar functions. The Company will make any such disclosure that may be necessary by posting the disclosure on its website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Documents.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines. The Corporate Governance Guidelines are reviewed regularly and updated as appropriate. A copy of the guidelines is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Documents.

Communication with Directors

Interested parties, including stockholders, may communicate with the full Board or any individual director, including the Chairmen of the Audit, Compensation, and Governance Committees, the Chairman of the Board, the lead independent director, if any, or the non-management or independent directors as a group, by writing to them c/o Kirby Corporation, P.O. Box 1745, Houston, Texas 77251-1745. The Company will refer the communication to the appropriate addressee(s). Complaints about internal controls and accounting or auditing matters should be directed to the Chairman of the Audit Committee at the same address. All communications will be forwarded to the person(s) to whom they are addressed.

Website Disclosures

The following documents and information are available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Documents:

| • | Audit Committee Charter |

| • | Compensation Committee Charter |

| • | ESG and Nominating Committee Charter |

| • | Criteria for the Selection of Directors |

| • | Business Ethics Guidelines |

| • | Corporate Governance Guidelines |

| • | Communication with Directors |

| • | Clawback Policy |

| • | Insider Trading Policy |

| • | Supplemental Insider Trading Policy |

KIRBY | 2025 PROXY STATEMENT | PROXY SUMMARY | 9 |

TOPIC | PRACTICE | |

| Independence | • Eight out of nine directors are independent • Board committees are composed entirely of independent directors | |

| Diversity | • Four out of nine directors are female or racially/ethnically diverse | |

| Executive Sessions | • Non-management directors meet regularly without management | |

| Majority Voting | • Majority of votes cast is required for the election of directors | |

| Director Evaluations | • Evaluations of the full board and each committee are conducted annually | |

| Stock Ownership | • Stock ownership guidelines established for directors and executive officers | |

| Single Voting Class | • Kirby has a single class of voting stock | |

| Hedging and Pledging of Stock | • Hedging and pledging of Company stock by directors, officers, and employees is prohibited | |

| Business Ethics Guidelines | • Ethics guidelines apply to all our directors, officers, and employees | |

| Clawback Policy | • We have a clawback policy in place for executive officers | |

| Insider Trading Policy | • Our insider trading policy applies to all our directors, officers, and employees, with a supplemental policy applicable to directors, executive officers and certain key employees | |

| Board Oversight | • The ESG and Nominating Committee oversees environmental risks including climate-related, and the Company’s ESG/Sustainability program on a quarterly basis. Assists the Board in fulfilling its oversight of risks that may arise in connection with the Company’s governance and social practices and processes. Discusses risk management in the context of general governance matters, including topics such as Board succession planning to ensure desired skills and attributes are represented. • The Audit Committee oversees the risk management, employee hotline/ whistleblower, and cybersecurity programs and processes and reviews material legal matters on a quarterly basis to evaluate the Company’s risk exposure and tolerance. • The Compensation Committee assists the Board in fulfilling its oversight of risks that may arise with the Company’s compensation programs and practices. Reviews executive compensation which is designed to promote accountability to maximize stockholder value over the long term. | |

10

|

PROXY SUMMARY

|

KIRBY | 2025 PROXY STATEMENT

|

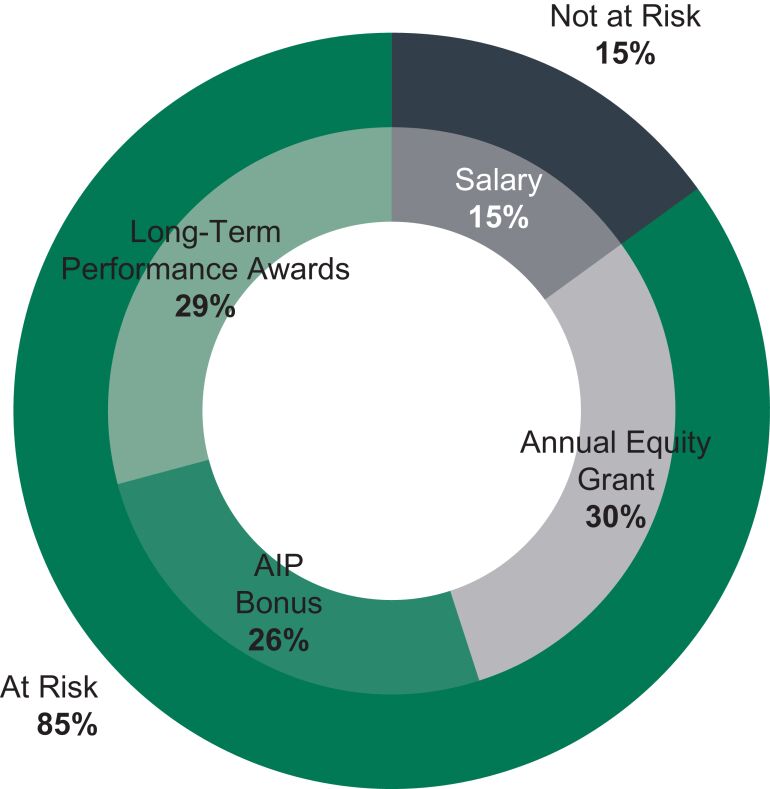

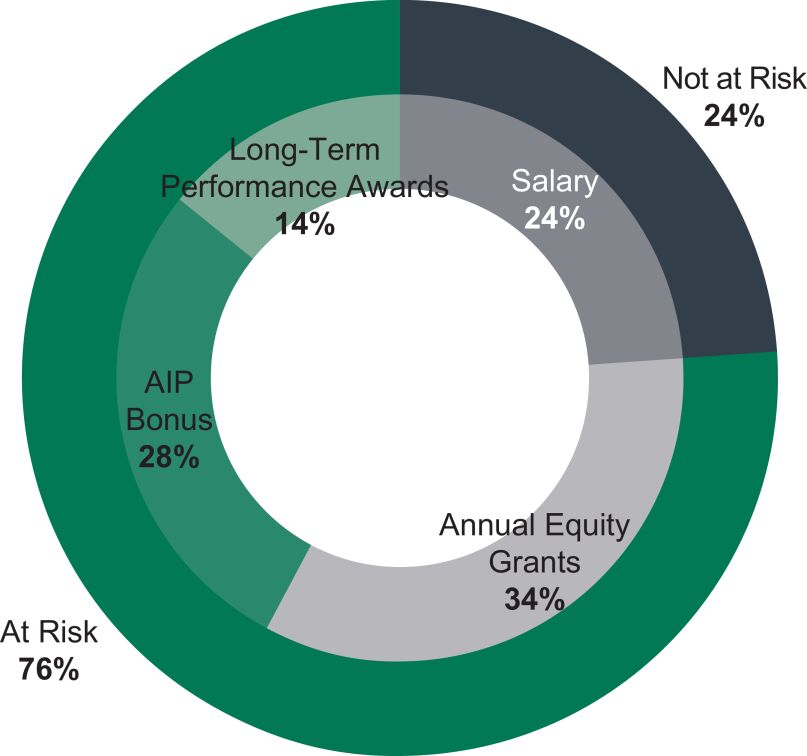

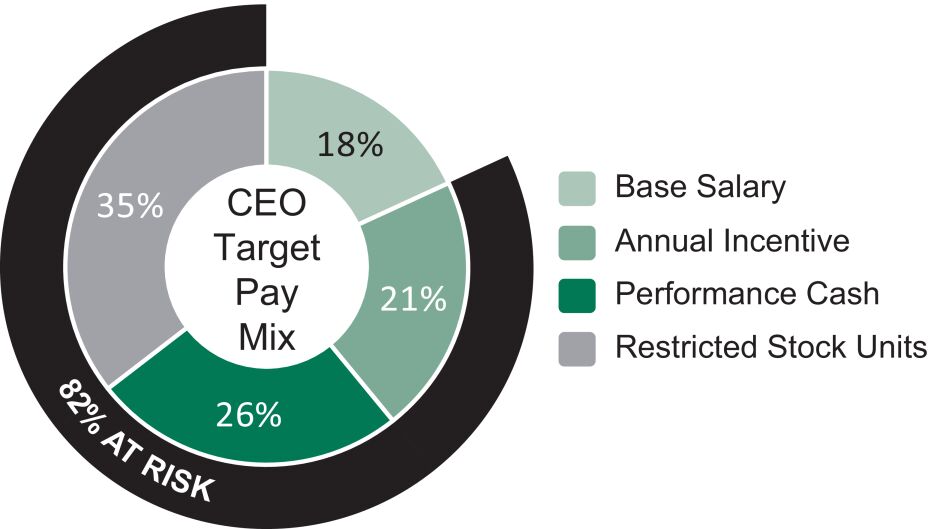

COMPENSATION HIGHLIGHTS

Our executive compensation philosophy has been consistent and focused on the creation of value for our stakeholders. A significant portion of our named executive officers’ compensation is tied to “At Risk” or pay-for-performance components. The pie charts on the following page depict how each element of compensation was weighted for our named executive officers in 2024.

Our executive compensation program is designed to attract and retain talented executive officers, motivate consistent performance over time, and encourage performance that results in increased profitability and stockholder returns. Our executive compensation program has historically received high levels of stockholder support, generally coming in well above 90%. However, in 2024, stockholder support was not as strong a level of support as we normally receive, and some investors voiced concerns over a one-time, special circumstances acceleration and cash settlement of unvested equity for a departing named executive officer (“NEO”). The Company explicitly sought feedback from stockholders as it is not our normal practice to provide such enhanced benefits to executives upon retirement. For 2025, based in part upon stockholder feedback, and in part upon the Board’s desire to maintain alignment with our pay philosophy, emerging market trends and the interests of our stockholders, the Company increased participation in performance-based long-term incentive (“LTI”) awards and expanded disclosure of annual incentive compensation.

Including EBITDA in both short-term and long-term metrics is also reflective of stockholder feedback and engagement. EBITDA is a key metric for operating and financial performance and is used as a metric to assess value being created in a company. Stockholders use EBITDA as a key metric in their valuation analysis, and have indicated widespread support for this metric in both short term and long-term incentives. Including the metric in both short-term and long-term incentives aligns at risk compensation with stockholder feedback. Further, it aligns short-term performance as well as long-term performance at all levels of the Company as not all employees participate in the long-term performance awards. Reflecting this, under our 2024 AIP, EBITDA accounts for 40% of potential payout, whereas EBITDA is weighted 50% under our long-term performance awards.

2024 Metrics

|

Short-Term Earnings per share – 30% EBITDA – 40% Return on total capital – 10% Operating Performance/ESG – 20% |

Long-Term Performance Awards Return on total capital – 50% EBITDA – 50% |

Listed below are some of the highlights of our compensation policies and practices:

Topic

| Practice

| |

| Pay-for-Performance Focus | • Performance-based cash annual incentive compensation rewards current year financial and operational success | |

• Performance-based cash and equity long-term incentive awards incentivize future growth and profitability | ||

| Annual Say-on-Pay Vote | • We annually ask stockholders to provide an advisory vote on executive compensation | |

| Equity Ownership Guidelines | • Stock ownership guidelines are established for executive officers | |

• CEO stock ownership requirement of 5x salary | ||

| Independent Compensation Consultant | • The Compensation Committee has retained a nationally recognized compensation consulting firm to serve as its independent compensation consultant | |

| Double-Trigger Vesting | • We have adopted double-trigger vesting of equity awards upon a change in control | |

| Clawback Policy | • We have a clawback policy in place for executive officers | |

| Excise Tax Gross-Ups | • We do not provide executive officers with excise tax gross-ups | |

| Re-pricing Stock Options | • We do not buy out or exchange underwater options, or re-price stock options | |

| Evergreen Equity Plans | • We do not have any automatic share replenishment or “evergreen” provisions in our equity compensation plans | |

KIRBY | 2025 PROXY STATEMENT

|

PROXY SUMMARY

|

|

11

|

|

CEO | OTHER NEO | |

TOTAL COMPENSATION

| TOTAL COMPENSATION

| |

|  | |

NOTE: Includes total direct compensation as referred to in the Compensation Discussion and Analysis beginning on page 32. “Long-term Performance Awards” includes cash payments for the 2022-2024 performance period under the long-term incentive compensation program. Performance-based variable compensation is deemed “At Risk.” For additional information, reference the Summary Compensation Table on page 45.

12

|

PROXY SUMMARY

|

KIRBY | 2025 PROXY STATEMENT

|

CORPORATE SUSTAINABILITY

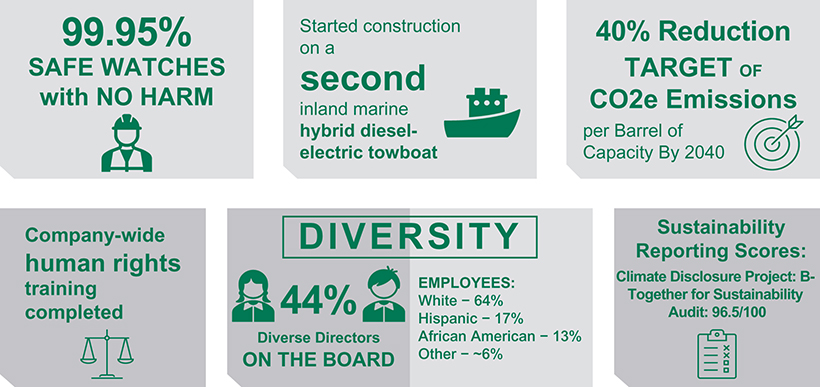

In 2024, Kirby continued to create value for our customers and stockholders while staying focused on its sustainability objectives. Safety, People, Excellence, Community, and Integrity, all core values of the ‘Kirby Way’, have been the foundation of Kirby’s success. These values help guide decisions and create a culture that embraces a sustainable direction. Treating our employees, customers and vendors well, lifting the communities in which we operate and respecting the environment are not just good for business, but ensure integrity is behind all our actions. From oversight at the Board and management level, down to the employees, the Company has been strategic in its environmental, social and governance journey.

While the ESG narrative has evolved, Kirby has remained steadfast in its commitments to “No Harm to People, No Harm to Equipment and No Harm to the Environment.” Safety, one of our core values, is paramount to the business and has continued to be priority number one. The Company emphasizes its safety commitment through programs oriented toward extensive monitoring of safety performance, initiating corrective action, and for continuously improving employee safety behavior and results. Treating all people, including employees, customers, vendors and others in our community, well is of great importance. This past year the Company set a goal to have human rights training completed company wide and this target was achieved. Kirby is committed to making a positive contribution to human rights and society and we encourage partners, suppliers and other third parties to adopt similar standards with respect to human dignity. In addition to human rights training, the Company also had employees take training for Business Ethics Guidelines to ensure the reputation of Kirby is respected and to also hold our employees to high ethical standards in all they do. In addition, adhering to these rules, ensures excellence and pushes employees to provide high quality service and products for our customers.

In 2024, the Company continued to advance its commitment to environmental protection and responsibility through several programs and initiatives. This commitment extends across all levels of the Company reinforcing the importance of environmental stewardship as important and necessary. From having comprehensive internal environmental policies with board and management oversight down to monitoring employee performance to conducting environmental audits, these practices direct us towards better environmental protection. From an external perspective the Company has continued to participate in organizations such as the American Waterways Operators Responsible Carrier program, which drives continuous improvement towards reducing the barge industry’s already low impact on the environment to being a founder and member of the Blue-Sky Maritime Coalition which focuses on reducing greenhouse gas emissions. In addition, we are proud to share the M/V Green Diamond has continued to perform and exceed operational performance, and construction on another diesel electric hybrid has commenced.

Kirby will continue to prioritize our core values that contribute to best business practices and initiatives for our employees, customers and the communities in which we operate.

Please note some of our Sustainability Highlights below. To learn more about these programs and initiatives, please visit the Sustainability section of our website at www.kirbycorp.com.

KIRBY | 2025 PROXY STATEMENT

|

PROXY SUMMARY

|

|

13

|

|

STAKEHOLDER ENGAGEMENT

The Board and executive management team prioritize fostering long-term and institution-wide relationships with stockholders and other stakeholders. In 2024, Kirby continued to prioritize stakeholder engagement as members of the management team met with key stakeholders to ensure that their voices were heard, perspectives understood, and interests were addressed. The Company believes that regular dialogue provides essential feedback to ensure that the Board and management understand the issues that are important to our stakeholders.

Throughout the year, the investor relations team engaged in extensive stockholder outreach in which members of management met with over 60% of our 35 largest stockholders (by share ownership) at some point in the year to discuss financial performance, capital allocation priorities, strategy, and other topics of interest. In addition, Kirby hosted tours of our facilities and offices to provide stockholders and other stakeholders an opportunity to see our operations in the Houston Ship Channel as well as other key operating facilities. The investor relations team continued engagement throughout the year by attending numerous conferences and conducted in person non-deal roadshows.

Beyond stockholder engagement, Kirby met with other key stakeholders in our industries and regions. Across the Company, employees are significantly involved in trade associations and community nonprofits where they serve in various leadership roles. It is important for Kirby to develop these relationships to understand the needs of our customers, and the communities in which we operate.

Engaged with:

|

Engaged through:

|

Engagements include:

|

Sustainability & Financial Engagements:

| |||

✓ Institutional Investors ✓ Nongovernmental Organizations ✓ Proxy Advisory Firms ✓ Sustainability Rating Firms | ✓ Individual and Group Investor Meetings ✓ Company Update and Facility Tour ✓ Quarterly Earnings Calls ✓ Investor Conferences ✓ Annual Stockholder Meeting ✓ Stockholder Webcasts ✓ Stakeholder Outreach | ✓ CEO / CFO ✓ Senior Management ✓ Subject Matter Experts ✓ Other Employees | ✓ 30+ meetings representing over 70% of outstanding shares ✓ Sustainability-focused governance calls |

14

|

KIRBY | 2025 PROXY STATEMENT

|

VOTING ITEM 1:

ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board shall consist of no fewer than three nor more than fifteen members and that, within those limits, the number of directors shall be determined by the Board. The Bylaws further provide that the Board shall be divided into three classes, with the classes being as nearly equal in number as possible and with one class being elected each year for a three-year term. Since April 26, 2024, the size of the Board has been set at nine directors.

Three Class III directors are to be elected at the 2025 Annual Meeting to serve until the Annual Meeting of Stockholders in 2028. Each nominee named below is currently serving as a director and, if elected, each has consented to serve for the new term. If any nominee becomes unable to serve as a director, an event currently not anticipated, the persons named as proxies in the enclosed proxy card intend to vote for a nominee selected by the present Board to fill the vacancy.

In addition to satisfying, individually and collectively, the Company’s Criteria for the Selection of Directors discussed under the “THE BOARD OF DIRECTORS — ESG and Nominating Committee” below, each of the directors has extensive experience with the Company or in a business similar to one or more of the Company’s principal businesses or the principal businesses of significant customers of the Company. The brief biographies of each of the nominees and continuing directors below include a summary of the particular experience and qualifications that led the Board to conclude that he or she should serve as a director.

KIRBY | 2025 PROXY STATEMENT

|

15

|

NOMINEES FOR ELECTION (PROPOSAL 1)

The Board of Directors of the Company unanimously recommends that you vote “FOR” the election of each of the following nominees as a director.

Nominees for Election as Class III Directors, serving until the Annual Meeting of Stockholders in 2028

ANNE-MARIE N. AINSWORTH | ||

Retired President and CEO, Oiltanking Partners and Oiltanking Holding Americas

Age: 68

Independent Director since 2015

Committees:

• Audit

• ESG and Nominating, Chair

| Experience

• President and Chief Executive Officer, Oiltanking Partners, L.P. and of Oiltanking Holding Americas, Inc. (2012-2014)

• Senior Vice President of Refining, Sunoco, Inc. (2009-2012)

• General Manager of Norco, LA refinery, Motiva Enterprises, LLC (2006-2009)

• Director of Process Safety Management (2003-2006), Shell USA, Inc.; Vice President of Technical Assurance (2000-2003), Shell Deer Park Refining Company

• Adjunct Professor, Rice University (2000-2009)

Education

• BS in Chemical Engineering, University of Toledo

• MBA, Rice University

• Graduate, Institute of Corporate Directors Education Program (Haskayne School of Management, University of Calgary)

• Holds the ICD.D designation

Other Boards/Organizations

• Pembina Pipeline Corporation, member of its Safety, Environment & Operational Excellence Committee and its Governance, Nominating & Corporate Social Responsibility Committee (2014 – present)

• HF Sinclair, Chair of the Environmental, Health, Safety, and Public Policy Committee and a member of its Finance Committee (2017 – present)

• Archrock, Inc., Chair of its Nominating and Corporate Governance Committee and a member of its Audit Committee (2015 – present)

Qualifications

• Ms. Ainsworth provides expertise in Petrochemicals and Refining and Hydrocarbon Transportation gained over her 35 years of experience in executive and managerial positions in the United States refining industry with companies providing services for products that included crude oil and refined petroleum products. These products constitute a significant percentage of the cargoes carried by the Company’s marine transportation business.

• Her industry experience also gained her expertise in Risk Management, Information Technology/Cybersecurity, Environmental, Safety Policies and Programs, Public Policy, Finance, Science, and Engineering. Ms. Ainsworth also has Academia experience gained through her years as an Adjunct Professor. | |

16

|

KIRBY | 2025 PROXY STATEMENT

|

WILLIAM M. WATERMAN | ||

Retired President and CEO, Penn Maritime

Age: 71

Independent Director since 2012

Committees:

• Compensation

• ESG and Nominating

| Experience

• President and Chief Executive Officer, Penn Maritime Inc., a coastal tank barge operator, transporting primarily refinery feedstocks, asphalt, and crude oil along the East Coast and Gulf Coast of the United States (1983-2012 when Penn was acquired by the Company)

Education

• BA in Economics, Union College in Schenectady, New York

Other Boards/Organizations

• The American Waterways Operators, the national trade association for the United States barge industry, former director and past Chairman

Qualifications

• Mr. Waterman has over 40 years of experience in the coastal tank barge business with Penn and its predecessor companies, building Penn into one of the largest coastal tank barge operators in the United States. Mr. Waterman’s extensive experience in that business and knowledge of its markets and customers have provided him expertise in Marine Transportation and Hydrocarbon Transportation which are valuable to the Board in its oversight of the Company’s coastal business and complement the inland marine transportation, midstream energy services, and petrochemical industry experience of other Company directors.

• Further, his time at Penn has provided him with expertise in Environmental, Safety Policies and Programs, Public Policy and Finance. | |

KIRBY | 2025 PROXY STATEMENT

|

17

|

SHAWN D. WILLIAMS | ||

Executive Chairman, Covia Holdings

Age: 61

Independent Director since 2021

Committees:

• Compensation

• ESG and Nominating

| Experience

• Executive Chairman of the Board (January 2022-present); Chief Executive Officer (June 2021-Dec. 2021), Chairman of the Board (Dec. 2020-Dec. 2021), Covia Holdings LLC, a provider of minerals-based solutions serving the industrial and energy markets

• Chief Executive Officer, Nexeo Plastics Holdings, Inc., a global plastics distributor, (2019-2020)

• Executive Vice President-Plastics (2017-2019); SVP-Plastics (2012-2017), Nexeo Solutions, Inc.

• President, Momentive Global Sealants, a global specialty sealants business, President, Momentive Performance Materials, a silicone specialty materials business (2007-2012)

• Spent 22 years working in leadership roles leading a variety of industrial and material businesses globally, General Electric Company

Education

• BS in Engineering, Purdue University

• MBA, University of California, Berkeley

• Holds a CERT certification in Cybersecurity Oversight from the National Association of Corporate Directors

Other Boards/Organizations

• Covia Holdings LLC, Chairman and member of the Audit and Compensation Committees (2020-present)

• TETRA Technologies, Inc., member of its Audit Committee and Human Capital Management and Compensation Committee (2021-present)

• Marathon Oil Corporation, member of its Audit and Finance Committee and Corporate Governance and Nominating Committee (February 2023-November 2024)

Qualifications

• Mr. Williams has over 30 years of experience in executive and managerial positions in the United States and global industrial markets. Mr. Williams’ extensive experience in various industrial markets, and his expertise in Petrochemicals and Refining, Oilfield Services, Commercial and Industrial, and Environmental, Safety Policies and Programs is valuable to the Board in its oversight of the Company’s distribution and services business and complements the marine transportation and petrochemical industry experience of a number of the Company’s other directors.

• His extensive career, including as Chief Executive Officer, has provided him with experience in Risk Management, Information Technology/Cybersecurity, Finance, Science, and Engineering. | |

18

|

KIRBY | 2025 PROXY STATEMENT

|

DIRECTORS CONTINUING IN OFFICE

Continuing Class I directors, serving until the Annual Meeting of Stockholders in 2026

RICHARD J. ALARIO | ||

Chairman of the Board, Kirby

Chairman of the Board, DNOW Inc.

Retired Chairman of the Board and CEO, Key Energy Services

Age: 70

Independent Director since 2011

Committees:

• ESG and Nominating

• Compensation

| Experience

• Chairman of the Board (April 2021-present), Director (May 2014-present), Interim Chief Executive Officer (November 2019-June 2020); Interim Executive Vice Chairman (June 2020-October 2020), DNOW Inc.

• Chairman of the Board and Chief Executive Officer, Key Energy Services, Inc., a publicly traded oilfield service company (2004-2016)

• Vice President, BJ Services Company, an oilfield service company (2002-2004)

• Served for over 21 years in various capacities, most recently Executive Vice President, of OSCA, Inc., also an oilfield service company

Education

• BA, Louisiana State University

Other Boards/Organizations

• DNOW Inc., Chairman of the Board, Member of its Compensation Committee, and a member of the Environmental, Social, Governance, and Nominating Committee (2014-present)

• Key Energy Services, Inc., Chairman of the Board (2004-2016)

• National Ocean Industries Association, former Chairman

Qualifications

• Mr. Alario has over 35 years of experience in Oilfield Services, serving as Chief Executive Officer with both operating and financial responsibility for one of the largest oilfield service companies in the United States. That experience is valuable to the Board in its oversight of the Company’s distribution and services business which serves the oilfield services industry as a significant part of its customer base.

• His experience as an executive, including Chief Executive Officer, in oilfield service companies, has provided Mr. Alario with expertise in Risk Management, Cybersecurity, Environmental, Safety Policies and Programs, Commercial and Industrial, Public Policy, Science, Engineering, Machine Learning, Artificial Intelligence and Finance. | |

KIRBY | 2025 PROXY STATEMENT

|

19

|

DAVID W. GRZEBINSKI | ||

Chief Executive Officer, Kirby Corporation

Age: 63

Director since 2014

Committees:

• None

| Experience

• Chief Executive Officer (April 2024 - Present); President and Chief Executive Officer (April 2014 - April 2024); President and Chief Operating Officer (January 2014-April 2014); Executive Vice President (2010-2014); Chief Financial Officer (2010-2014); Chairman of the Company’s principal offshore marine transportation subsidiary (2012-2013); joined in 2010, Kirby Corporation

• Served in various operational and financial positions, FMC Technologies Inc., a global provider of advanced technology systems and products for the energy industry

• Employed by The Dow Chemical Company in manufacturing, engineering, and financial roles

Education

• BS, Chemical Engineering, University of South Florida

• MBA, Tulane University

• Chartered Financial Analyst

Other Boards/Organizations

• The Coast Guard Foundation, Director

• American Bureau of Shipping, Director

• UK Protection & Indemnity Association, Director

• Blue-Sky Maritime Coalition, Director

Qualifications

• Mr. Grzebinski has primary responsibility for the business and strategic direction of the Company and is an essential link between the Board and the Company’s day-to-day operations. He has overall knowledge of all aspects of the Company, its operations, customers, financial condition, and strategic planning. His experience at Kirby provides expertise in critical areas including Marine Transportation, Petrochemicals and Refining, Oilfield Services, Commercial and Industrial, and Hydrocarbon Transportation, as well as Risk Management and Environmental, Safety Policies and Programs.

• Through his service at FMC and Dow, he has gained expertise in Public Policy, Finance, Science, Engineering and Information Technology/Cybersecurity. | |

20

|

KIRBY | 2025 PROXY STATEMENT

|

RICHARD R. STEWART | ||

Retired President and CEO, GE Aero Energy

Age: 75

Independent Director since 2008

Committees:

• Audit, Chair

| Experience

• President and Chief Executive Officer, GE Aero Energy, a division of GE Energy, and as an officer of General Electric Company, (1998-2006)

• Served in various positions, Stewart & Stevenson, including Group President and member of the Board of Directors (1972-1998)

Education

• BBA in Finance, University of Texas

Other Boards/Organizations

• Eagle Materials Inc., member of its Audit Committee and former Chairman (2006-present)

• Exterran Corporation (2015-2018)

Qualifications

• During a 35-year business career, Mr. Stewart has been the principal executive officer with both operating and financial responsibility for the diesel engine and gas turbine power and service businesses at Stewart & Stevenson and then at GE Aero Energy. Mr. Stewart’s extensive experience including in Commercial and Industrial in the engine and power products business and expertise in Oilfield Services is valuable to the Board in its oversight of the Company’s distribution and services business and complements the marine transportation and petrochemical industry experience of a number of the Company’s other directors.

• Mr. Stewart’s extensive career has also provided him with expertise in Risk Management, Environmental, Safety Policies and Programs and Finance. | |

KIRBY | 2025 PROXY STATEMENT

|

21

|

Continuing Class II directors, serving until the Annual Meeting of Stockholders in 2027

TANYA S. BEDER | ||

Chairman and CEO, SBCC Group ‘Strategy Building and Crisis Control’

Age: 69

Independent Director since 2019

Committees:

• Audit

• ESG and Nominating

| Experience

• Founder, Chairman, and Chief Executive Officer of SBCC Group, ‘Strategy Building and Crisis Control’, an e-family office (present)

• Previously, Chief Executive Officer, Tribeca Global Management, a subsidiary of Citigroup, and Managing Director and Head of the Strategic Quantitative Investment Division, Caxton Associates; and President and Co-Founder of Capital Market Risk Advisors. In these roles she led the implementation of neural networks and other machine learning techniques to trading and risk management

• Held various positions with The First Boston Corporation (now UBS) where she was a derivatives trader and was on the mergers and acquisitions team in New York and London

• Ms. Beder is a Fellow in Practice at the Yale University International Center for Finance, and was previously a lecturer of public policy at Stanford University and previously a member of the Mathematical Finance Advisory Board at New York University

• Holds a certificates in Cybersecurity Oversight from Carnegie Mellon University Software Engineering Institute, Gaming Cyber and Information Operations from MORS (Military Operations Research Society), and Machine Learning in Business from the Massachusetts Institute of Technology

Education

• BA in Mathematics and Philosophy, Yale University

• MBA, Harvard Business School

Other Boards/Organizations

• Nabors Industries, Chair of the Compensation Committee, a qualified financial expert on the Audit Committee, and a member of the Technology & Safety Committee (2017-present)

• American Century Investments, Chair of the Board, Member of the Technology & Risk Committee and member of the Portfolio Committee (2011-present)

• Formerly, Advisory Board of the Columbia University Financial Engineering Program, and a trustee at the Institute for Pure and Applied Mathematics at UCLA

Qualifications

• Ms. Beder brings to the Board extensive asset management experience providing expertise in Finance, vast knowledge of operational and Risk Management, and experience serving as a director for both public and private companies. Ms. Beder’s audit and risk oversight committee experience adds valuable perspective to the collective experience of the independent directors including in the areas of machine learning, Information Technology/Cybersecurity, Oilfield Services, Climate and Sustainability, and Machine Learning and Artificial Intelligence, and Environmental, Safety Policies and Programs.

• She has Academia experience through her time as a Fellow In Practice at Yale and lecturer in Public Policy at Stanford, and her service on various university advisory boards. She also provides Science and Engineering expertise. | |

22

|

KIRBY | 2025 PROXY STATEMENT

|

BARRY E. DAVIS | ||

Chairman, Pattern Energy Group LP

Retired Chairman and CEO, EnLink Midstream

Age: 63

Independent Director since 2015

Committees:

• Compensation, Chair

• Audit

| Experience

• Pattern Energy Group LP, Chairman; Chair of the Nominating, Governance & Compensation Committee, (2024 – present)

• Chairman and Chief Executive Officer (2019-2022); Executive Chairman (2018-2019); President, Chief Executive Officer and Director (2014-2018), EnLink Midstream, LLC

• Chairman, Chief Executive Officer and President, Crosstex Energy (1996-2014 when EnLink Midstream was formed through the combination of Crosstex Energy and substantially all of the United States midstream assets of Devon Energy)

• Held management roles with other companies in the energy industry beginning in 1984

Education

• BBA in Finance, Texas Christian University

Other Boards/Organizations

• Eiger Resources LLC, Director (2023 – present)

• Natural Gas and Electric Power Society, former President

• Dallas Wildcat Committee, former Chairman

• Texas Christian University, Board of Trustees

Qualifications

• Mr. Davis has extensive knowledge and experience in Hydrocarbon Transportation, which is the primary business of EnLink Midstream and its predecessors. EnLink Midstream provides midstream energy services, including gathering, transmission, processing, fractionation, brine services and marketing of natural gas, natural gas liquids, condensate, and crude oil. EnLink Midstream’s assets include an extensive pipeline network, processing plants, fractionation facilities, storage facilities, rail terminals, barge and truck terminals, and an extensive fleet of trucks.

• His more than 40 years’ experience including as a senior executive at energy industry companies has provided him with Petrochemicals and Refining and Oilfield Services expertise, as well as Risk Management, Environmental, Safety Policies and Programs, Energy Transition, Information Technology/Cybersecurity, and Finance. | |

KIRBY | 2025 PROXY STATEMENT

|

23

|

SUSAN W. DIO | ||

Retired Chairman and President, BP America

Age: 64

Independent Director since 2023

Committees:

• Audit

| Experience

• Chairman and President, BP America Inc. (2018-2020)

• Chief Executive Officer, BP Shipping (2015-2018)

• Head, Audit, Refining and Marketing, BP (2013-2015)

• Served for over 36 years at BP in global, technical, and operational roles

Education

• BS, Chemical Engineering – University of Mississippi

Other Boards/Organizations

• Avina Clean Hydrogen, Advisory Board Member (2023-present)

• Britannia Steam Ship Insurance Associations, Ltd. (2018-2020), Independent Director

• Oil Companies International Marine Forum (2018-2020), Director and Vice-Chair

• International Tanker Owners Pollution Federation, Director and Advisory Committee Member

• Methodist Hospital – The Woodlands, Trustee

• Irving Oil Board, Independent Director (2021-present)

Qualifications

• Ms. Dio has over 35 years of experience in Shipping and Petrochemicals, serving as Chairman and President of one of the largest oil and gas companies in the world, BP America, and Chief Executive Officer of BP Shipping. At BP she served in various commercial, engineering, petrochemical and refining roles. As BP’s Head of Audit for Refining and Marketing she had oversight of operational risk management. As CEO of BP’s global shipping business, she managed the fleet of BP-operated and chartered vessels across the world. That experience is valuable to the Board in its oversight of the Company’s marine transportation business and distribution and services business.

• Her experience as an executive, including Chief Executive Officer, has provided Ms. Dio with expertise in Risk Management, Operational Management, Marine Transportation, Safety Policies and Programs, Finance, Public Policy, and Climate/Sustainability. | |

24

|

KIRBY | 2025 PROXY STATEMENT

|

THE BOARD OF DIRECTORS

The Company’s business is managed under the oversight and direction of the Board, which is responsible for strategic oversight, broad corporate policy, and monitoring the effectiveness of Company management. Members of the Board are kept informed about the Company’s businesses by participating in meetings of the Board and its committees, through operating and financial reports made at Board and committee meetings by Company management, through various reports and by visiting Company facilities. The Board’s development includes onsite meetings at key operating facilities which include interaction with employees at those locations.

Director Independence

NYSE listing standards require listed companies to have at least a majority of independent directors. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with the Company.

The Board has determined that the following incumbent directors have no relationship with the Company except as directors and stockholders and are independent within the meaning of the NYSE listing standards:

| Anne-Marie N. Ainsworth | Barry E. Davis | William M. Waterman | ||||||

| Richard J. Alario | Susan W. Dio | Shawn D. Williams | ||||||

| Tanya S. Beder | Richard R. Stewart | |||||||

Our Chief Executive Officer, Mr. Grzebinski, has certified to the NYSE that the Company is in compliance with NYSE corporate governance listing standards.

Risk Oversight

The Board is responsible for the risk oversight function and has designated the Audit Committee, the Compensation Committee, and the ESG and Nominating Committee certain responsibilities to provide assistance in fulfilling the Board’s responsibilities. The Board seeks to align risk oversight with its disclosure controls and procedures, and a particular risk will be monitored and evaluated by another Board committee with primary responsibility in the area of the subject matter involved. For example, the Compensation Committee reviews the risks related to the Company’s compensation policies and practices and the Audit Committee receives regular reports and updates on cybersecurity issues. On a quarterly basis, management prepares and reviews with the Audit Committee and the Board the risks outlined in the Company’s most recent Annual Report on Form 10-K, any new risks identified in the Company’s most recent Quarterly Report on Form 10-Q, and annually a comprehensive assessment of the identified internal and external risks of the Company that includes evaluations of the potential impact of each identified risk, its probability of occurrence and the effectiveness of the controls that are in place to mitigate the risk. The Audit Committee and the Board also receive regular reports of any events or circumstances involving risks outside the normal course of business of the Company. The ESG and Nominating Committee oversees the Company’s ESG programs, including environmental risk, including climate change, as well as the Corporate Sustainability report, Task Force on Climate-Related Financial Disclosures, and Sustainability Accounting Standards Board disclosures. The Board and its committees also review potential emerging risks as they seek to anticipate future threats and trends that may impact the Company. Management and, where appropriate, internal and external experts provide reports on risks in their respective areas of responsibility or expertise. Frequency of updates and discussion of risks varies depending on the immediacy or severity of the risk, with more immediate or severe risks being updated and reviewed more frequently.

Board Leadership Structure

The Board has no set policy concerning the separation of the positions of Chairman of the Board and Chief Executive Officer, but retains the flexibility to decide how the two positions should be filled based on the circumstances existing at any given time. Currently, the positions of Chairman of the Board and Chief Executive Officer are separated.

KIRBY | 2025 PROXY STATEMENT

|

25

|

Joseph H. Pyne, Kirby’s Chairman of the Board since 2010, retired from the board at the 2024 Annual Meeting of Stockholders. The Board determined that Mr. Alario would succeed Mr. Pyne as the Chairman of the Board effective as of the 2024 Annual Meeting. Mr. Alario has been a member of the Board since 2011 and served as the Company’s Lead Independent Director since 2015, presiding at the regular executive sessions of the non-management directors that are held at least quarterly. An executive session with only independent directors is held at least once per year. As Lead Independent Director, Mr. Alario also served as a liaison between the independent directors and management on certain matters that were not within the area of responsibility of a particular committee of the Board. When Mr. Alario succeeded Mr. Pyne as Chairman of the Board, that role is now held by an independent director, so there was no longer a separately designated Lead Independent Director.

Board Committees

The Board has established three standing committees, including the Audit Committee, the Compensation Committee, and the ESG and Nominating Committee. All of the members of each committee are independent, as that term is defined in applicable SEC and NYSE rules. The member composition and a brief description of the principal functions of each committee is briefly described below.

| Board Member | Member Type | Audit Committee | Compensation Committee | ESG and Nominating Committee | ||||

| Anne-Marie N. Ainsworth(1) | Independent | M | C | |||||

| Richard J. Alario(1) | Independent | M | M | |||||

| Tanya S. Beder | Independent | M | M | |||||

| Barry E. Davis | Independent | M | C | |||||

| Susan W. Dio(2) | Independent | M | ||||||

| Richard R. Stewart | Independent | C | ||||||

| William M. Waterman | Independent | M | M | |||||

| Shawn D. Williams | Independent | M | M | |||||

| (1) | Ms. Ainsworth was elected to serve as Committee Chair of the ESG and Nominating Committee to replace Mr. Alario on April 26, 2024. |

| (2) | Ms. Dio was elected to serve on the Audit Committee effective April 26, 2024. |

C – Committee Chair

M – Committee Member

Audit Committee

The Board has determined that all of the members of the Audit Committee are “audit committee financial experts,” as that term is defined in SEC rules. The Audit Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/ Governance Documents.

PRINCIPAL FUNCTIONS

|

Monitor the Company’s financial reporting, accounting procedures, and systems of internal controls |

Select the independent auditors for the Company |

Review the Company’s audited annual and unaudited quarterly financial statements with management and the independent auditors |

Monitor the independence and performance of the Company’s independent auditors and internal audit function |

Monitor the Company’s compliance with legal and regulatory requirements |

Review with management the Company’s policies with respect to risk assessment and risk management, including review of cybersecurity processes, procedures, and safeguards |

26

|

KIRBY | 2025 PROXY STATEMENT

|

Compensation Committee

All of the members of the Compensation Committee are “Non-Employee Directors” and “outside directors” as defined in relevant federal securities and tax regulations. The Compensation Committee operates under a written charter adopted by the Board. The Committee oversees compensation for Kirby’s senior executives (including salary, bonus, and performance share awards), as well as succession planning for key executive positions. A copy of the charter is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Documents.

PRINCIPAL FUNCTIONS

|

Determine the compensation of executive officers of the Company |

Reviews and approves the corporate goals and objectives |

Administer the Company’s annual incentive bonus program |

Administer the Company’s stock option, restricted stock, restricted stock units (“RSUs”), and long-term incentive plans and grant stock options, restricted stock, RSUs, and long-term performance awards under such plans |

Reviews and approves the Compensation Discussion and Analysis (“CD&A”) and recommends to the Board the inclusion of the CD&A in the proxy statement |

ESG and Nominating Committee

The ESG and Nominating Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Documents.

PRINCIPAL FUNCTIONS

|

Reviews corporate governance policies annually |

Recommend candidates for election to the Board |

Review all related person transactions |

Oversee the operation and effectiveness of the Board |

Lead the annual review of the Board and management performance, including the CEO

Oversees and monitors the Company’s environmental, including climate-related, risks and review and assess the Company’s environmental and sustainability policies and strategies and oversees publication of the Company’s sustainability report |

The ESG and Nominating Committee will consider director candidates recommended by stockholders or proposed by stockholders in accordance with the Company’s Bylaws. Recommendations may be sent to the Chairman of the ESG and Nominating Committee, Kirby Corporation, P.O. Box 1745, Houston, Texas 77251-1745, accompanied by biographical information for evaluation. The Board of the Company has approved Criteria for the Selection of Directors which the ESG and Nominating Committee will consider in evaluating director candidates. The criteria address compliance with SEC and NYSE requirements relating to the composition of the Board and its committees, as well as character, integrity, experience, understanding of the Company’s business, and willingness to commit sufficient time to the Company’s business. The criteria are available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/ Governance Documents.

In addition to the above criteria, the Corporate Governance Guidelines and ESG and Nominating Committee Charter include provisions concerning the consideration of diversity in business experience, professional skills, gender, race, and ethnic background in selecting nominees for director. The Company and ESG and Nominating Committee are committed to having a Board that reflects diverse perspectives and actively seeks out highly qualified candidates that include women and individuals from minority groups when board nominees are chosen. The ESG and Nominating Committee took these provisions into account in electing new members to the Board in 2019, 2021 and 2023.

When there is a vacancy on the Board (i.e., in cases other than the nomination of an existing director for reelection), the Board and the ESG and Nominating Committee have considered candidates identified by executive search firms, candidates recommended by stockholders and candidates recommended by other directors. The ESG and Nominating Committee will continue to consider candidates from any of those sources when future vacancies occur. The ESG and Nominating Committee accepts stockholder recommendations of director candidates and evaluates such candidates in the same manner as other candidates. Stockholders who wish to submit a candidate for consideration by the ESG and Nominating Committee for election at our Annual Meeting may do so by submitting in writing the candidate’s name, together with the information described under the Company’s Bylaws.

KIRBY | 2025 PROXY STATEMENT

|

27

|

Attendance at Meetings

It is the Company’s policy that directors are expected to attend Board meetings and meetings of committees on which they serve and are expected to attend the Annual Meeting of Stockholders of the Company. During 2024, the Board met four times, the Audit Committee met eight times, the Compensation Committee met five times and the ESG and Nominating Committee met four times. Each director then serving attended more than 75% of the aggregate number of the meetings of the Board and of all the committees on which he or she served. All directors then serving attended the 2024 Annual Meeting of Stockholders of the Company.

Director Compensation

Directors who are employees of the Company receive no additional compensation for their service on the Board. Compensation of nonemployee directors is determined by the full Board, which may consider recommendations of the Compensation Committee. Past practice has been to review director compensation when the Board believes that an adjustment may be necessary in order to remain competitive with director compensation of comparable companies. Management of the Company periodically collects published survey information on director compensation for purposes of comparison.

Each nonemployee director receives an annual fee of $85,000. A director may elect to receive the annual fee in cash, stock options or restricted stock. The Chairman of the Board receives an additional annual fee of $150,000, the Chairman of the Audit Committee receives an additional annual fee of $20,000, the Chairman of the Compensation Committee receives an additional annual fee of $15,000, and the Chairman of the ESG and Nominating Committee receives an additional annual fee of $10,000. If not the Chairman of the Board, the lead independent director or presiding director at executive sessions of the non-management directors receives an additional annual fee of $20,000. In addition, each director receives an annual fee of $7,500 for each committee of the Board on which he or she serves. All fees are payable in four equal quarterly payments made at the end of each calendar quarter. The annual director fee is prorated for any director elected between annual stockholder meetings and the Chairman of the Board, committee chairman, lead independent or presiding director, and committee member fees are prorated for any director who is elected to such position between annual meetings of the Board. Directors are reimbursed for reasonable expenses incurred in attending meetings.

Prior to 2024, each nonemployee director received a fee of $3,000 for each board meeting attended, in person or by telephone, in excess of six meetings in any one calendar year. Also, prior to 2024, each member of a committee of the board received a fee of $3,000 for each committee meeting attended, in person or by telephone, in excess of ten meetings in any one calendar year in the case of the Audit Committee, in excess of eight meetings in any one calendar year in the case of the Compensation Committee and in excess of eight meetings in any one calendar year in the case of the ESG and Nominating Committee. In 2024, additional director and committee meeting fees were eliminated when the annual fee was raised.

In addition to the fees described above provided to the directors, the Company has a stock award plan for nonemployee directors of the Company which provides for the issuance of stock options and restricted stock. The director plan provides for automatic grants of restricted stock to nonemployee directors after each annual meeting of stockholders. Each director receives restricted shares of the Company’s common stock after each annual meeting of stockholders. The number of shares of restricted stock issued is equal to (a) $167,500 divided by (b) the fair market value of a share of stock on the date of grant multiplied by (c) 1.2. The director plan also provides for discretionary grants of up to an aggregate of 10,000 shares in the form of stock options or restricted stock. In addition, the director plan allows for the issuance of stock options or restricted stock in lieu of cash for all or part of the annual director fee at the option of the director. A director who elects to receive stock options in lieu of the annual cash fee will be granted an option for a number of shares equal to (a) the amount of the fee for which the election is made divided by (b) the fair market value per share of the common stock on the date of grant multiplied by (c) 3. A director who elects to receive restricted stock in lieu of the annual cash fee will be issued a number of shares of restricted stock equal to (a) the amount of the fee for which the election is made divided by (b) the fair market value per share of the common stock on the date of grant multiplied by (c) 1.2. The exercise price for all stock options granted under the director plan is the fair market value per share of the Company’s common stock on the date of grant. The restricted stock issued after each annual meeting of stockholders vests six months after the date of issuance. Stock options granted and restricted stock issued in lieu of cash director fees vest in equal quarterly increments during the year to which they relate. The stock options generally remain exercisable for ten years after the date of grant.

The Board has established stock ownership guidelines for officers and directors of the Company. Nonemployee directors must be in compliance within five years after first election as a director, but are expected to accumulate the required number of shares ratably over the applicable five-year period. Under the guidelines, nonemployee directors are required to own common stock of the Company having a value equal to a multiple of the annual cash director fee, which was raised from four to five in January 2024. As of December 31, 2024, all directors were in compliance with the then current stock ownership guidelines. The ESG and Nominating Committee of the Board will monitor compliance with the guidelines and may recommend modifications or exceptions to the Board.

28

|

KIRBY | 2025 PROXY STATEMENT

|

The following table summarizes the cash and equity compensation for nonemployee directors for the year ended December 31, 2024:

Nonemployee Director Compensation for 2024

| NAME | FEES EARNED OR PAID IN CASH | STOCK AWARDS(1)(2) | OPTION AWARDS(1)(2) | TOTAL | ||||||||||||||||

| Anne-Marie N. Ainsworth | $ | 105,000 | $ | 201,062 | $ | — | $ | 306,062 | ||||||||||||

| Richard J. Alario | 217,500 | 201,062 | — | 418,562 | ||||||||||||||||

| Tanya S. Beder | 97,500 | 201,062 | — | 298,562 | ||||||||||||||||

| Barry E. Davis | 93,750 | 201,062 | — | 294,812 | ||||||||||||||||

| Susan W. Dio | 88,125 | 201,062 | — | 289,187 | ||||||||||||||||

| Joseph H. Pyne(3) | 56,250 | — | — | 56,250 | ||||||||||||||||

| Richard R. Stewart | 110,000 | 201,062 | — | 311,062 | ||||||||||||||||

| William M. Waterman | 78,750 | 201,062 | — | 279,812 | ||||||||||||||||

| Shawn D. Williams | 97,500 | 201,062 | — | 298,562 | ||||||||||||||||

| (1) | The amounts included in the “Stock Awards” and “Option Awards” columns represent the grant date fair value related to restricted stock and option awards to the directors, computed in accordance with FASB ASC Topic 718. For a discussion of valuation assumptions, see Note 8, Stock Award Plans, in the Company’s consolidated financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2024. |

| (2) | Mss. Ainsworth, Beder and Dio and Messrs. Alario, Davis, Stewart, Waterman, and Williams were each granted 1,828 shares of restricted stock on April 29, 2024 at a value of $109.99 per share. In 2024, none of the directors elected to receive the annual director fee in the form of restricted stock or stock options. |

| (3) | Mr. Pyne also received $11,130 in payments for office rent and administrative support, pursuant to his agreement effective on April 30, 2018 upon his retirement from the Company as an employee. Mr. Pyne retired from the Board on April 26, 2024. |

| (4) | Mr. Rocky B. Dewbre concluded his board service on April 26, 2024. He elected to take his annual director fee for the April 2023-2024 service period in the form of stock options and was granted 3,100 shares on May 1, 2023 at an exercise price of $72.65 per share. As his compensation for the period was in the form of stock options, there is no compensation for 2024 to be reflected in the table above. |

Nonemployee Director Outstanding Equity at December 31, 2024 and Grant Date Fair Value of Equity Awarded During 2024

The following table shows the aggregate number of shares of unvested restricted stock and stock options outstanding for each nonemployee director as of December 31, 2024, as well as the grant date fair value of restricted stock awards made during 2024:

| NAME | AGGREGATE SHARES OF UNVESTED RESTRICTED STOCK AS OF DECEMBER 31, 2024 | AGGREGATE STOCK OPTIONS OUTSTANDING AS OF DECEMBER 31, 2024 | GRANT DATE FAIR VALUE OF RESTRICTED STOCK DURING 2024 | ||||||||||||

Anne-Marie N. Ainsworth | — | — | $ | 201,062 | |||||||||||

Richard J. Alario | — | — | 201,062 | ||||||||||||

Tanya S. Beder | — | — | 201,062 | ||||||||||||

Barry E. Davis | — | 8,480 | | 201,062 | |||||||||||

Susan W. Dio | — | — | | 201,062 | |||||||||||

Richard R. Stewart | — | — | 201,062 | ||||||||||||

William M. Waterman | — | — | | 201,062 | |||||||||||

Shawn D. Williams | — | — | 201,062 | ||||||||||||

KIRBY | 2025 PROXY STATEMENT

|

29

|

TRANSACTIONS WITH

RELATED PERSONS