Exhibit 99.3

Korn Ferry and Hay Group Combination

Transaction Overview

Forward Looking Statements and Non-GAAP Measures

Forward Looking Statements

This presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of United States Private Securities Litigation Reform Act of 1995. Forward looking statements may be identified with the use of words like “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook” and “project” and other similar expressions that predict or indicate that future events or trends or that are not statements of historical matters. Such forward looking statements include, but are not limited to, statements related to the timing of the transaction, the expected benefits of the transaction, including future financial and operating results, expected synergies, and the combined companies plans, objectives, expectations and intentions. Such statements are based on current expectations and are subject to numerous risks and uncertainties many of which are outside the control of Korn Ferry. For a more detailed description of such risks and uncertainties, please refer to Korn Ferry’s filings with the Securities and Exchange Commission.

Non-GAAP Financial Measures

This presentation contains financial information calculated other than in accordance with U.S.

Generally Accepted Accounting Principles (“GAAP”). In particular, it includes projected EBITDA margin of the combined Hay Group and Leadership & Talent Consulting segment. This non-GAAP disclosure has limitations as an analytical tool, should not be viewed as a substitute for financial information determined in accordance with GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies.

1

Our Vision

The Preeminent Global People and Organizational Advisory Firm

Korn ferry

Hay group

2

Transaction Highlights

Brings Together Two World Class Brands and Creates a Leading Global People and Organizational Advisory Firm

Hay Group is a Global People and Organizational Advisory Firm with Over

70 Years Experience Serving Clients Across Every Major Industry

Known for the Quality of its Research, Hay Group has a Strong Portfolio of Intellectual Property Including Several of the World’s Most Comprehensive Licensed Management and Compensation Databases

Strengthens Korn Ferry’s Intellectual Property, Enhances Geographic Presence, Adds Complimentary Capabilities to Further Leverage Search Relationships, and Broadens Capabilities in Assessment and Development

Allows Korn Ferry to Broaden the Conversation with its Clients Regarding Products and Services and Increases Cross-Selling Opportunities

3

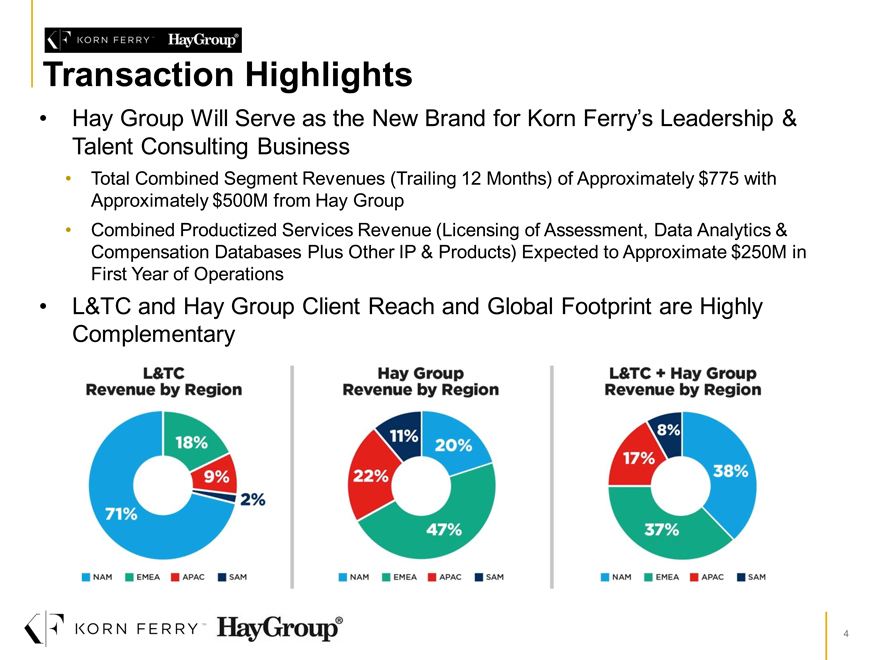

Transaction Highlights

Hay Group Will Serve as the New Brand for Korn Ferry’s Leadership & Talent Consulting Business

Total Combined Segment Revenues (Trailing 12 Months) of Approximately $775 with Approximately $500M from Hay Group

Combined Productized Services Revenue (Licensing of Assessment, Data Analytics & Compensation Databases Plus Other IP & Products) Expected to Approximate $250M in First Year of Operations

L&TC and Hay Group Client Reach and Global Footprint are Highly Complementary

4

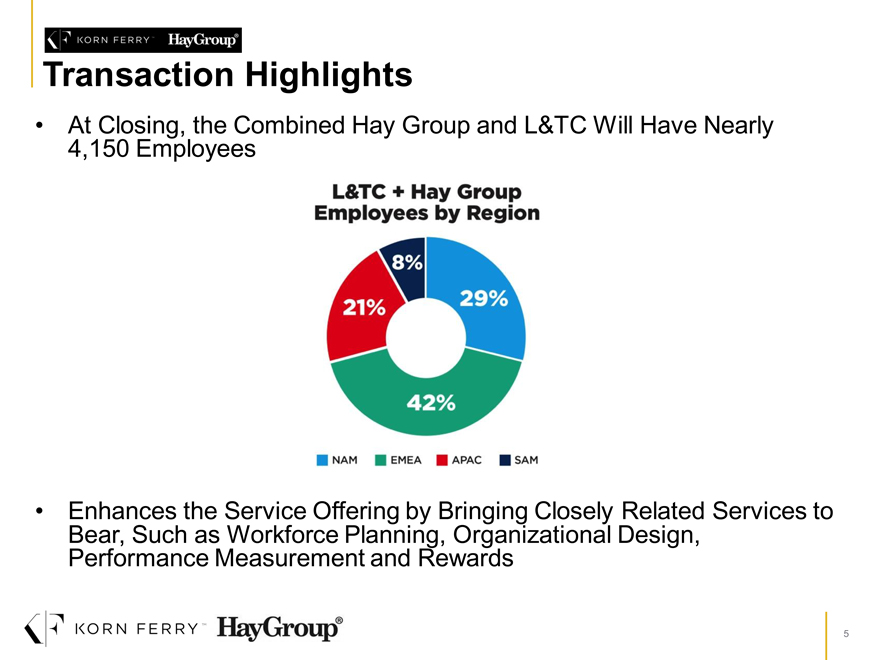

Transaction Highlights

At Closing, the Combined Hay Group and L&TC Will Have Nearly 4,150 Employees

Enhances the Service Offering by Bringing Closely Related Services to Bear, Such as Workforce Planning, Organizational Design, Performance Measurement and Rewards

5

Financial Highlights

Korn Ferry to Acquire Hay Group for Aggregate Purchase Price of Approximately $452M Consisting of Approximately $252M of Cash (Net of Estimated Acquired Cash and After Giving Effect to Other Estimated Purchase Price Adjustments) and $200M of KFY Stock (Subject to a 3 Year Lock-up Agreement) in Addition to a Commitment to Key Employee Retention

Expected Close is Before the End of Calendar Year 2015 and is Subject to Hay Group Shareholder Approval and Receipt of Antitrust Clearance and Other Customary Conditions

Transaction to be Structured to Allow the Use of a Portion of KF’s Current Foreign Cash Reserves for Purchase Consideration and to Allow for the Tax Efficient Repatriation of Future Foreign Earnings

Hay Group is Currently Generating Approximately $500M of Annual Revenue and Adjusted EBITDA (Including All Compensation Associated With Hay Group Partners, but Excluding Historical Expenses that will not Continue in the Combined Segment) of $40M

Post Close, the Combined Firm is Targeting a Minimum of $20M of Annual Cost Synergies Within the First 12 Months and Longer Term EBITDA Margins for the Combined Segment of Approximately 14% to 18% (Operating Margins of 9% to 13%)

Targeted Cost Synergies to Be Achieved By Leveraging Technology Platforms, Eliminating Redundant SG&A Spend, Eliminating Redundant Activities and Real-Estate Consolidation

Transaction is Expected to be Accretive to Earnings per Share in the First Full Year After Adjusting For Purchase Accounting Deferred Revenue Write-Offs, Intangible Asset Amortization, Retention Bonuses and Restructuring and Transaction Costs

6

Financial Highlights—Continued

In Connection with the Transaction, Korn Ferry Has Entered into an Amended Credit Agreement with Wells Fargo Bank Which Expands Korn Ferry’s Existing Senior Credit Line from $150M to $250M ($100M Revolving Credit Line Plus a $150M Delayed Draw Term Loan)

Korn Ferry Plans to Partially Draw Down on this Facility to Finance a Portion of the Acquisition Cash Consideration

7

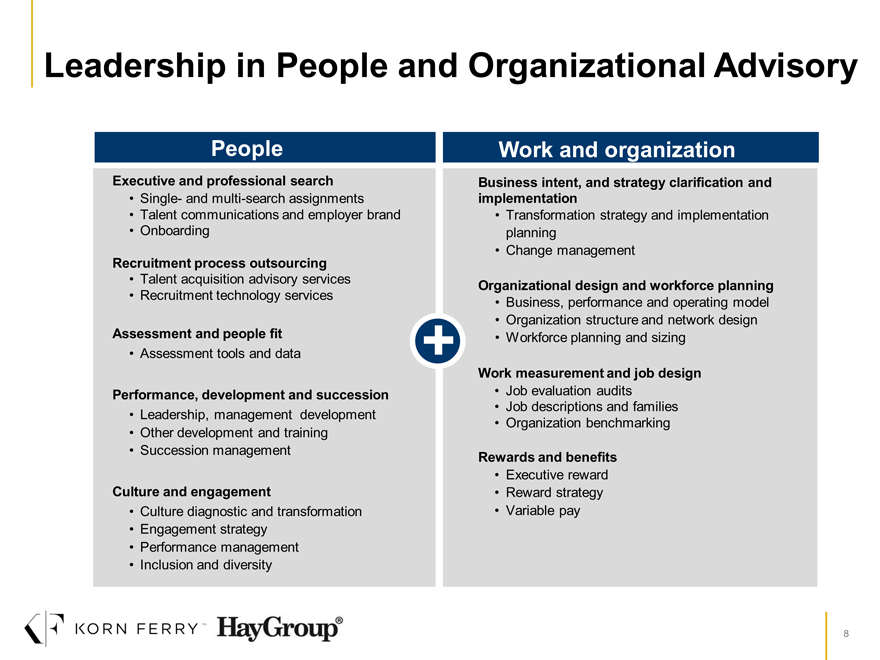

Leadership in People and Organizational Advisory

People

Executive and professional search

Single- and multi-search assignments

Talent communications and employer brand

Onboarding

Recruitment process outsourcing

Talent acquisition advisory services

Recruitment technology services

Assessment and people fit

Assessment tools and data

Performance, development and succession

Leadership, management development

Other development and training

Succession management

Culture and engagement

Culture diagnostic and transformation

Engagement strategy

Performance management

Inclusion and diversity

Work and organization

Business intent, and strategy clarification and implementation

Transformation strategy and implementation planning

Change management

Organizational design and workforce planning

Business, performance and operating model

Organization structure and network design

Workforce planning and sizing

Work measurement and job design

Job evaluation audits

Job descriptions and families

Organization benchmarking

Rewards and benefits

Executive reward

Reward strategy

Variable pay

8

HayGroup