- PNRG Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

PrimeEnergy Resources (PNRG) DEF 14ADefinitive proxy

Filed: 27 Apr 22, 10:06am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary proxy statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive proxy statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

PRIMEENERGY RESOURCES CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing proxy statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF

PrimeEnergy Resources Corporation

TO BE HELD ON

June 8, 2022

Notice is hereby given that the Annual Meeting of Stockholders of PrimeEnergy Resources Corporation (the “Company”) will be held on Wednesday, June 8, 2022, at 9:00 a.m., CDT, at the offices of the Company at 9821 Katy Freeway, Houston, Texas 77024, for the following purposes:

1. To elect a Board of Directors of five (5) persons as nominated in the accompanying Proxy Statement, such Directors to hold office until the next annual meeting of stockholders and until their successors are elected;

2. An advisory (non-binding) vote to approve our executive compensation as described in the accompanying Proxy Statement;

3. To transact such other procedural business as may properly be brought before the Meeting or at any adjournment or adjournments thereof.

The Meeting may be adjourned from time to time without other notice than by announcement at the Meeting, or at any adjournment thereof, and any and all business for which the Meeting is hereby noticed may be transacted at any such adjournment.

The Board of Directors has fixed April 12, 2022, as the date for the taking of a record of the stockholders entitled to notice of and to vote at the Meeting and at any adjournment or adjournments thereof. The stock transfer books will not be closed.

Enclosed is a form of proxy solicited by the Board of Directors of the Company. Stockholders who do not plan to attend the Meeting in person are requested to date, sign and return the enclosed proxy in the enclosed envelope, to which no postage need be affixed if mailed in the United States. Your proxy may be revoked at any time before it is exercised and will not be used if you attend the Meeting and prefer to vote in person.

| BY ORDER OF THE BOARD OF DIRECTORS |

| /S/ VIRGINIA M. FORESE |

| Virginia M. Forese |

| Corporate Secretary |

April 27, 2022

Important Notice Regarding Internet Availability of

Proxy Materials for the Annual Meeting of Stockholders

to be held on June 8, 2022

The proxy material for this Annual Meeting and the Company’s 2021 Annual Report

to Stockholders are available at www.proxydocs.com/PNRG

TABLE OF CONTENTS

| 1 | ||||

| 1 | ||||

| 1 | ||||

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 3 | |||

| 4 | ||||

| 4 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 17 | ||||

PrimeEnergy Resources Corporation

9821 Katy Freeway

Houston, Texas 77024

PROXY STATEMENT

Solicitation by the Board of Directors of Proxies from

Stockholders for Annual Meeting of Stockholders

June 8, 2022

The Board of Directors of PrimeEnergy Resources Corporation, a Delaware corporation (hereinafter called the “Company”) solicits your proxy in the enclosed form which, if you do not plan to attend the Annual Meeting of Stockholders of the Company on Wednesday, June 8, 2022, you are requested to fill out, sign as indicated and return to the Company in the enclosed self-addressed envelope, which requires no postage if mailed in the United States. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is exercised by notice (i) in person by the stockholder’s oral revocation at the Annual Meeting or (2) in writing to the Company at 9821 Katy Freeway Houston, Texas 77024 (Attention: Corporate Secretary), if the proxy was executed and returned. The approximate date on which the proxy statement and form of proxy will be sent to security holders is April 30, 2021.

Proxies are being solicited by mail and all expenses of solicitation have been or will be borne by the Company. In addition, arrangements may be made with brokerage houses and other custodians, nominees and fiduciaries to send proxies and proxy materials to their principals and the Company will reimburse them for their expenses in so doing.

Only stockholders of record at the close of business on April 12, 2022 (the “Record Date”), are entitled to vote at the 2022 Annual Meeting and any adjournment thereof. There were 1,980,889 shares of common stock (“Common Stock”) outstanding on the Record Date. Each holder of Common Stock is entitled to vote on the proposals presented in this proxy statement for each share held, each share entitling the record holder thereof to one vote.

Matters To Be Voted On At The Annual Meeting

There are two (2) proposals that are scheduled to be voted on at the Annual Meeting. Shareholders are being asked to vote on (1) the election of five (5) Directors named herein to the Board of Directors of the Company, and (2) an advisory (non-binding) vote to approve the executive compensation paid as described in this Proxy Statement

All shares of the Company represented by proxies received in time and in proper form and condition and not revoked will be voted as specified in the proxy; or in the absence of specific direction, the proxy will be voted by the person designated therein:

FOR the election as Directors of the Company of the five (5) nominees named herein, to hold office until the next annual meeting of stockholders and until their respective successors shall be duly elected; and

FOR the approval of executive compensation paid as described in this Proxy.

In the event any of the nominees should become unable to serve as a Director, it is intended that, pursuant to the accompanying form of proxy, votes will be cast for a substitute nominee designated by the Board of Directors.

1

The election of Directors will require the affirmative votes of a plurality of the shares of the Common Stock voting in person or by proxy at the Annual Meeting. The Company’s transfer agent will tabulate all votes that are received prior to the date of the Annual Meeting. The Company will appoint two inspectors of election, who may be officers or employees of the Company, to receive the transfer agent’s tabulation, to tabulate all other votes, and to certify the results of the elections. Abstentions and broker non-votes are each included in the determination of the number of shares present and voting (i.e., for quorum purposes), but shall not be counted for the purposes of the election of Directors.

Management of the Company knows of no matters to be submitted to the 2022 Annual Meeting with respect to which the stockholders are entitled to vote other than the election of Directors and the approval and adoption of the Amended and Restated Certificate of Incorporation, but if procedural matters do properly come before the Meeting, the persons named in the proxy will vote according to their best judgment.

2

SECURITIES OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number and percentage of shares of the Common Stock of the Company owned beneficially by any person, including any “group” as that term is defined in Section 12d (3) of the Securities Exchange Act of 1934, known to the Company to be the beneficial owner of five percent (5%) or more of the Common Stock, as of April 12, 2022. Information as to beneficial ownership is based upon statements furnished to the Company by such persons. Except as indicated, all shares are held directly, with full voting and dispositive powers, and percentages are calculated on the basis of the shares issued and outstanding, and with respect to those named persons holding options presently exercisable or within 60 days of April 12, 2022, includes the number of shares to be issued upon exercise of such options.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||

Charles E. Drimal, Jr. | 1,218,145(1) | 45.45 | ||||

9821 Katy Freeway Houston, Texas 77024 | ||||||

| ||||||

Amrace, Inc | 387,696(2) | 19.57 | ||||

1251 Avenue of the Americas 27th Floor New York, New York 10020 | ||||||

| ||||||

Clint Hurt | 175,978(4) | 8.88 | ||||

107 North N Street Midland, Texas 79701 | ||||||

| ||||||

Ebersole Gaines Wehrle | 144,016(3) | 7.27 | ||||

11444 West Olympic Avenue, 11th Floor Los Angeles, California 90065 | ||||||

Jan K. Smeets | 115,997 | 5.86 | ||||

48 Country Road Mamaroneck, New York 10543-1110 | ||||||

| (1) | Includes 520,645 shares as to which Mr. Drimal has sole voting and investment power, 697,500 shares subject to options, all presently exercisable. |

| (2) | Includes 387,534 shares as to which Robert de Rothschild, and Nicolas de Croisset have shared voting and investment power. Robert de Rothchild disclaims beneficial ownership except to the extent of his pecuniary interest in the shares. Nicolas de Croisset has no pecuniary interest in the shares. |

| (3) | Includes 85,470 shares in The 2011 Gaines Wehrle Revocable Trust and 58,546 shares in The Gaines Wehrle 2008 Family Trust, both of which Mr. Wehrle has sole voting and investment power. |

| (4) | Includes 300 shares as to which Mr. Hurt has sole voting and investment power and 175,678 shares held of record by Clint Hurt & Associates, Inc., a private company controlled by Mr. Hurt as to which Mr. Hurt has sole voting and investment power. |

3

The following table sets forth information at April 12, 2022, with respect to the shares of the Company’s Common Stock beneficially owned by the Directors and the executive officers of the Company, individually, and as a group:

| Name | Amount Beneficially Owned(1) | Percent of Class(1) | ||

| Beverly A. Cummings | 75,000(2) | 3.66 | ||

| Charles E. Drimal, Jr. | 1,218,145(3) | 45.48 | ||

| H. Gifford Fong | 55,322 | 2.79 | ||

| Thomas S. T. Gimbel | 1,000 | 0.05 | ||

| Clint Hurt | 175,978(4) | 8.88 | ||

| All Directors and executive officers as a group | 1,525,445 (2)(3)(4) | 55.50 |

| (1) | Unless otherwise indicated, all shares are owned directly and the holder thereof has sole voting and investment powers with respect thereto, and percentages are calculated on the basis of the shares issued and outstanding, and with respect to those persons, or group, holding options presently exercisable or within 60 days, includes the number of shares to be issued upon exercise of such options. |

| (2) | Includes 5,000 shares as to which Ms. Cummings has shared voting and investment power and 70,000 shares subject to options, all presently exercisable. |

| (3) | Includes 520,645 shares as to which Mr. Drimal has sole voting and investment power and 697,500 shares subject to options, all presently exercisable. |

| (4) | Includes 300 shares as to which Mr. Hurt has sole voting and investment power and 175,678 shares held of record by Clint Hurt & Associates, Inc., a private company controlled by Mr. Hurt as to which Mr. Hurt has sole voting and investment power. |

Mr. Drimal is the only Director who has pledged Common Stock as security.

[PROPOSAL NO. 1]

The Board of Directors has nominated for election as Directors at the 2022 Annual Meeting, the five (5) nominees whose names, together with biographical information and information concerning their qualifications, business experience and skills are set forth below. All of the nominees were elected to their present term of office by the stockholders at the Annual Meeting last year and are presently serving as Directors of the Company. Each of the nominees has served continuously as a Director since the date indicated below and his or her present term will expire at the 2022 Annual Meeting. All of the nominees are proposed for election for a one-year term expiring in 2023. Three of the nominees for Directors qualify as independent directors within the meaning of applicable regulatory standards. There is no family relationship between any nominee for Director or the executive officers of the Company. In the event any of the nominees shall become unable to serve as a Director, it is intended that the proxy will be voted for a substitute nominee designated by the Board of Directors. Currently, the Board of Directors is not aware of any circumstance that would render any nominee unavailable to serve as a director of the Company’s Board of Directors.

4

Beverly A. Cummings | Director since February 1988 |

Beverly A. Cummings, age 69 is a Certified Public Accountant and holds a Bachelor of Science degree from the State University of New York and a Master of Business Administration from Rutgers University. She was elected Vice President, Chief Financial Officer and Treasurer of the Company in October, 1987, and Executive Vice President in May, 1991, and serves as the Principal Financial Officer of the Company. Ms. Cummings holds similar positions with the Company’s subsidiaries. The attributes that prompted Ms. Cummings’ election to the Board were her significant financial skills and experience, as well as her understanding of oil and gas operations, and in particular those of PrimeEnergy. Those qualifications continue to contribute to her effective service as a director today.

Charles E, Drimal, Jr. | Director since October 1987 |

Charles E. Drimal, Jr., age 74, has served as President and Chief Executive Officer of the Company since October 1987, and holds the position of Chairman of the Board of Directors. He also holds similar positions with the Company’s subsidiaries. Mr. Drimal is a graduate of the University of Maryland and Samford University School of Law and is a retired member of the New York State Bar. The leadership skills, experience and thorough knowledge of the oil and gas industry that uniquely qualified Mr. Drimal to become the President and Chief Executive Officer in 1987 have continued to make him an invaluable member and Chairman of the Board of Directors.

H. Gifford Fong | Director from May 1994 - June 2019 and from June 2020 |

Mr. Fong, age 78, is president of Gifford Fong Associates, an investment technology consulting firm located in Lafayette, California. Mr. Fong holds a Bachelor of Science, a Master of Business Administration and a Juris Doctor degree from the University of California. Mr. Fong is the editor of The Journal of Investment Management and is the author and a frequent contributor to numerous trade journal publications. Mr. Fong’s expertise in transaction valuation, portfolio risk management and asset management is an important resource for the Board. His substantial knowledge and experience in financial matters and business operations fully qualify him to serve as a member of the Board of Directors.

Thomas S. T. Gimbel | Director since March 1989 |

Thomas S. T. Gimbel, age 67, is the Executive Managing Director at Optima Asset Management LLC, an investment advisory and asset management firm registered with the Securities and Exchange Commission, with offices in New York City. He previously served as CEO of American Farmland Company, a REIT Listed on the NYSE Market. Prior to that, he served as Vice President and a director of that company since its inception in 2009, while at the same time serving in his management role at Optima Fund Management. Prior to joining Optima Fund Management in 2004, Mr. Gimbel was Managing Director for Hedge Fund Investments at Credit Suisse Asset Management, LLC, an Investment Management firm. Prior to joining Credit Suisse, Mr. Gimbel was head of the Hedge Fund Department at Donaldson, Lufkin & Jenrette, which provided investment banking and security brokerage services prior to being acquired by Credit Suisse. Earlier in his career, Mr. Gimbel was Vice President and Treasurer of Smith Barney’s real estate acquisition and syndication subsidiary. He is a Director of Prime Energy Resources Corporation and Lighthouse Guild, where he also serves on the Investment Committee, and is a member of other not for profit Boards and a member of their Investment Committees as well. Mr. Gimbel received a BA in economics from Bowdoin College and an MBA in finance from Columbia Business School.

Clint Hurt | Director since February 1988 |

Clint Hurt, age 86 is president of Clint Hurt & Associates, Inc., a private oil and gas exploration company located in Midland, Texas. He is past president of the Independent Oil & Gas Association of West Virginia and is a

5

former director of Chase Bank of Texas, in Midland, Texas. Mr. Hurt’s expertise in the oil and gas industry and his unique insight into the trends and developments in the industry made him an excellent candidate for the Board. Those attributes have also enabled him to make an important contribution to the Company in his 30+ years of service to the Board.

The Board of Directors recommends a vote FOR the election of all Nominees

(Proposal No. 1)

Information about the Executive Officers (for information regarding Ms. Cummings and Mr. Drimal, see the descriptions on page 5).

Mr. Drimal and Ms. Cummings were elected by the Board of Directors to their respective offices in June 2021, at the annual meeting of the Board. Each will hold their respective offices until his or her successor is elected by the Board.

Board Independence and Composition

The core responsibility of the Board of Directors is to provide objective, independent judgment in its management oversight function and the Board’s composition reflects that principle. The Board is composed of a majority of independent directors. A Director’s independence is determined in accordance with the definition set forth in National Association of Securities Dealers Automated Quotations (“NASDAQ”) listing standards and other pertinent and applicable legal and regulatory standards. The Board of Directors annually reviews the financial and other relationships between non-management Directors and the Company to determine whether those Directors are independent. Applying those standards in 2021, the Board has determined that each of the following Directors meet the independent standards: Clint Hurt, Thomas S.T. Gimbel, H. Gifford Fong.

The Board of Directors, in its discretion, may elect a Chairman of the Board. The Chairman leads the Board and presides at all Board meetings and is responsible for delivery of information for the Board’s informed decision-making.

Based upon the structure that best serves the interests of the Company, the Board determines whether the role of the Chairman of the Board and the Chief Executive Officer should be held by one individual or should be separated. Currently, the Board believes that the role of Chairman of the Board and Chief Executive Officer should be held by the same person because the combined position has served the Company well in the past and Charles E. Drimal, Jr. is highly qualified to serve in that role.

The Directors have also determined that it is not necessary to appoint a lead independent director at this time.

The Board’s Role in Risk Oversight

The senior management team of the Company is responsible for assessing and managing the Company’s various exposures to risk on a day-to-day basis, including the creation of appropriate risk management policies to identify, manage and mitigate significant risks. The Board of Directors is responsible for overseeing management’s execution of its responsibilities and for assessing the Company’s approach to risk management. The Board exercises those responsibilities periodically as part of its meetings by having the Chief Executive

6

Officer, the Chief Financial Officer and others in management roles of the Company review with the Board areas of material operational, financial and regulatory risk, the likelihood of such risks coming to fruition and management’s response thereto. This approach provides the Board with a thorough understanding of the relative magnitude of such risks and the ability to assess and influence the management and mitigation strategies undertaken by the Company to address those risks.

The Board of Directors met three (3) times in 2021. All directors attended those meetings of the Board of Directors and the committee or committees thereof on which such director served during 2021 in person or by telephone conference.

Board Attendance at Annual Meeting

The Company does not have a policy that requires members of the Board of Directors to attend the Annual Meeting. All members of the Board of Directors are encouraged to attend the Annual Meeting. All of the members of the Board of Directors attended the Annual Meeting of the Company held in June 2021 in person or by telephone conference.

The Board of Directors has an Executive Committee, an Audit Committee and a Compensation Committee.

The Executive Committee, composed of Messrs. Drimal, Jr., Hurt, and Ms. Cummings, is empowered to exercise all the authority of the Board between Board meetings, in the business and affairs of the Company, except as limited by applicable law. The Executive Committee met three times during 2021 in person or by telephone conference and informally, by telephone conference, on a nearly monthly basis during the year.

The Audit Committee, composed of Messrs. Fong, Gimbel and Hurt, met twice in 2021. All members of the Audit Committee were independent under NASDAQ listing standards and other pertinent legal and regulatory standards. The Board of Directors has determined that Mr. Fong meets the qualifications of an “audit committee financial expert” within the meaning of the regulations of the Securities and Exchange Commission and NASDAQ listing standards. The Committee selects the independent auditors to audit the financial statements of the Company and approves the scope of the services to be provided by the auditors for the upcoming year. The Committee is also responsible for reviewing reports of the Company’s results, audits, financial policies and internal control procedures. The report of the Audit Committee is included in this proxy statement on page 11.

The Board of Directors and the Audit Committee have adopted a written charter for the Audit Committee, a copy of which is attached as Exhibit A to this proxy statement.

The Compensation Committee, composed of Messrs. Gimbel and Hurt, met one time in 2021. All members of the Compensation Committee were independent under NASDAQ listing standards and other pertinent legal and regulatory standards. The charter of the Compensation Committee requires that members of the Committee also qualify as “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code and as “non-employee” directors within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, as amended. The Committee annually reviews the Company’s goals, objectives and policies relevant to the

7

compensation of the Company’s executive officers and directors. The Committee evaluates the performance of the executive officers in light of those goals, objectives and policies and makes its recommendations to the Board of Directors for the salaries, bonuses and other compensation to be paid to the executive officers. The Committee also recommends to the Board of Directors the compensation to be paid to members of the Company’s Board of Directors. Mr. Drimal and Ms. Cummings participate in discussions with the Compensation Committee and make recommendations to the Committee with respect to the compensation of executive officers and directors. Neither Mr. Drimal nor Ms. Cummings participates in the deliberations or approval of the Committee concerning their respective compensation.

The Compensation Committee has the authority to retain outside compensation consultants to advise the Committee on market practices and the compensation policies of the Company. The Committee has not engaged any outside consultants or advisors for such services, nor have such services been engaged by the Company’s Board of Directors.

The Board of Directors and the Compensation Committee have adopted a written charter for the Compensation Committee. A copy of the charter, as most recently amended in May 2013, is attached as Exhibit B to this proxy statement.

The Board as Nominating Committee

The Company does not have a standing nominating committee. The Board of Directors acts as the nominating committee, with Mr. Drimal and Ms. Cummings abstaining. The majority of the Directors of the Company, Messrs. Fong, Gimbel and Hurt, who function as a nominating committee, are believed to satisfy applicable regulatory requirements for director independence. Those Directors are responsible for collecting and analyzing information with regard to directors’ “independence” as defined by NASDAQ listing standards and other pertinent legal and/or regulatory standards in effect at the time. They are also responsible for making recommendations concerning committee membership and ensuring that committee members satisfy the criteria for membership on a particular committee and have the skills to effectively participate in a particular committee.

The Directors who function as the nominating committee are also responsible for identifying and evaluating prospective nominees for vacancies on the Board of Directors. The Board of Directors will consider meritorious director candidates submitted to it by members of the Board and by stockholders of the Company, without regard to race, religion, gender, national origin or disability. The Board does not have a formal policy with regard to considering diversity in its evaluation of director nominations. Candidates for election must be willing to devote the time necessary to serve as a director and must possess the level of education, experience, and expertise, both with respect to financial matters and the oil and gas industry in general, necessary to effectively perform the duties of a member of the board of directors of a public company, and in particular of the Company. The Board of Directors strive to recommend candidates that further its objective of having a board that draws from a broad range of talents and expertise and reflects a diversity of background, experience and perspectives. The procedure to be followed by a stockholder to submit a nominee to the Board of Directors is set forth in “Stockholder Proposals and Nominations” in this proxy statement.

The Board of Directors believes that this procedure is adequate in the process of selecting persons for election as Directors of the Company. All of the Directors of the Company currently serving as Directors, are designated as nominees for re-election at the 2022 Annual Meeting of Stockholders.

8

EXECUTIVE AND DIRECTOR COMPENSATION

The Company has been guided by its Chief Executive Officer, Charles E. Drimal, Jr., and Chief Financial Officer, Beverly A. Cummings since 1987. The Board of Directors attributes much of the success of the Company to Mr. Drimal’s and Ms. Cummings’ leadership, skills and their dedication to the Company and its stockholders. In order to retain such highly skilled and experienced professionals for its senior management team, the Board of Directors must offer highly competitive compensation packages. At the same time, the Board of Directors is mindful that the primary goal of the Company is to build long-term stockholder value. Therefore, the alignment of the executive officers’ compensation with the Company’s performance results is a critical component of the analysis made by the Compensation Committee in determining the executive officers’ compensation each year.

The Board of Directors believes that the Compensation Committee’s approach in determining the compensation paid to the executive officers has been endorsed by the stockholders, who in 2019 supported by a vote of 83% the Board of Director’s resolution to approve the executive compensation paid in the prior year and chose to hold advisory voting on executive compensation once every three years thereafter. In light of those positive endorsements, the Compensation Committee continued to adhere to the same approach to determine executive compensation for this past year.

There are three elements of the compensation paid to the executive officers, to wit: (i) base salary; (ii) bonus (cash incentive) compensation, and (iii) equity awards. The base salaries that were provided to the executive officers were based upon a number of considerations including each executive officer’s level of responsibility, changes in their responsibilities from year to year, experience, skills and leadership ability. The Compensation Committee reviewed the base salary paid in the most recent years and the percentage change in salary from year to year. The Compensation Committee used their judgment and discretion rather than relying on a specific numerical metrics formula for results. The Compensation Committee assessed the challenges faced and overcome by the executive officers in advancing the Company through the year. The Compensation Committee recommended each of the executive officers be provided with the same percentage increase to each of their salaries. The base salary paid to each executive officer in 2021 is set forth in the “Salary” column of the Summary Compensation Table set forth in this proxy statement.

The Company awarded options to purchase shares of the Company’s common stock to the executive officers in May 1989. The objective of the award was to retain high level officers and to motivate them to continue their relationship with the Company and thereby align their interests with the long-term interests of the Company’s stockholders. The options that were awarded have been fully exercisable by the executive officers since May 1994. The Compensation Committee believes the options awarded to the executive officers continue to represent a significant stake in the Company. The Committee recommended to the Board of Directors that no additional options or other types of equity compensation be awarded to the executive officers in 2021.

9

The following table discloses compensation for the fiscal years ended December 31, 2021 and 2020, received by the Company’s Principal Executive Officer and Principal Financial Officer (1) (2).

| Annual Compensation | ||||||||||||||||||||

| Name and Principal Position(2) | Year | Salary($) | Bonus($) | All Other Compensation($) | Total($) | |||||||||||||||

Charles E. Drimal, Jr. Chairman, Chief Executive | 2021 | 700,000 | — | 87,762(4) | 787,762 | |||||||||||||||

Officer and President; Principal Executive Officer | 2020 | 700,000 | 2,750,000 | 72,572(3) | 3,522,572 | |||||||||||||||

Beverly A. Cummings Executive Vice President, | 2021 | 700,000 | — | 68,762(6) | 768,762 | |||||||||||||||

Treasurer and Director; Principal Financial Officer | 2020 | 700,000 | 1,100,000 | 53,162(5) | 1,853,162 | |||||||||||||||

| (1) | Columns for “Stock Awards”, “Option Awards”, “Non-Equity Incentive Plan Compensation” and “Nonqualified Deferred Compensation Earnings” are omitted as the Company has no such compensation awards or plans. |

| (2) | Mr. Drimal and Ms. Cummings hold similar positions with the Company’s subsidiaries and also serve as directors of each of the subsidiaries. |

| (3) | Includes $15,000 Director’s fees; $11,400 as the Company’s contribution to its 401(k) plan; club dues $24,000; long term disability insurance premium $11,120; and life insurance premiums $11,052. |

| (4) | Includes $30,000 Director’s fees; $11,600 as the Company’s contribution to its 401(k) plan; club dues $24,400; long term disability insurance premium $10,710; and life insurance premiums $11,052. |

| (5) | Includes $15,000 Director’s fees; $11,400 as the Company’s contribution to its 401(k) plan; club dues, $12,000; long term disability insurance premium $9,428; and life insurance premiums $5,334. |

| (6) | Includes $30,000 Director’s fees; $11,600 as the Company’s contribution to its 401(k) plan; club dues, $12,400; long term disability insurance premium $9,428; and life insurance premiums $5,334. |

10

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

There were no stock options granted by the Company to the named executive officers during the fiscal year ended December 31, 2021, no options were exercised by any of such persons and there were no stock awards to such persons. The following table sets forth information with respect to all unexercised options held by the named executive officers of the Company at December 31, 2021. All unexercised options are fully exercisable. There are no options which are not fully exercisable, nor are there any unearned options, stock awards or equity incentive plan awards.

Number of Unexercised Options at Fiscal Year-End(1) | Option Exercise Price | Option Expiration Date | ||||||||||||||||||||||||||||

| Name | All Exercisable | |||||||||||||||||||||||||||||

Charles E. Drimal, Jr. | | 523,125 174,375 | $ $ | 1.00 1.25 | | Non-expiring Non-expiring | ||||||||||||||||||||||||

Beverly A. Cummings | | 52,500 17,500 | $ $ | 1.00 1.25 | | Non-expiring Non-expiring | ||||||||||||||||||||||||

| (1) | All options described in this table vested in May 1994. |

The Company’s Directors each receive $10,000 for each Board of Directors meeting, but do not receive any fee for attending Committee meetings. The Directors are reimbursed for travel and related expenses in connection with attendance at Board and Committee meetings. All Directors as a group of five received an aggregate of $150,000 as Directors’ fees for the fiscal year ended December 31, 2021. The Directors do not receive any compensation in the form of Common Stock or option awards of Common Stock, nor do they participate in any Non-Equity Incentive Compensation or Non-Qualified Deferred Compensation plans. None of the Directors received compensation or other payment from any person or entity other than the Company for their services as a director of the Company.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management including a discussion of the quality and the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. These include, but are not limited to, those matters under Auditing Standard No. 1301, as amended and adopted by the Public Company Accounting Oversight Board. In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from management and the Company

11

including the matters in the written disclosures required by the Public Company Accounting Oversight Board. The Company’s auditors do not perform financial information system design and implementation services, internal audit or tax services for the Company.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audits. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2021, for filing with the Securities and Exchange Commission.

Audit Committee |

H. Gifford Fong, Chairman |

Thomas S. T. Gimbel |

Clint Hurt |

This report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

CODE OF BUSINESS CONDUCT AND ETHICS

The Company is committed to observing sound, ethical principles in the conduct of its business and operations and by our officers and employees in the course of their duties. The Code of Business Conduct and Ethics adopted by the Company was last amended in December, 2011. The Code, as amended, is available at the Company’s website at www.primeenergy.com. The Code of Conduct is applicable to the Company’s operations and to all of its employees, including the Company’s principal executive officer, principal financial officer and Directors. Any amendments to or waivers of the Code, to the extent applicable to the Company’s principal executive officers, will be posted on the Company’s website.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended requires the Company’s executive officers and Directors, and persons who own more than ten percent of a registered class of the Company’s equity securities (collectively, “Reporting Persons”), to file reports of ownership and changes in ownership of such securities with the Securities and Exchange Commission and to furnish the Company with copies of such reports. To the Company’s knowledge, based solely on review of the copies of such reports furnished to the Company with respect to the fiscal year ended December 31, 2021, there were no instances of untimely filing of any of our beneficial owners.

INDEPENDENT PUBLIC ACCOUNTANTS—FEES AND SERVICES

The Company engaged Grassi & Co., CPA, P.C. (“Grassi & Co.”) as the principal accountants for the Company with respect to the audit of the Company’s financial statements for the years ended December 31, 2021

12

and 2020. There were no disagreements with Grassi & Co on any matters of accounting principles or practices, financial statement disclosure or auditing scope or procedures in connection with their audits. Representatives of Grassi & Co are not expected to be present at the 2022 Annual Meeting of Stockholders, but will be available by speaker telephone during the meeting and will have the opportunity to make a statement if they desire to do so, and to answer stockholders’ questions.

The audit fees for professional audit services provided by Grassi & Co, for the audit of the Company’s annual financial statements for each of the years ended December 31, 2021 and December 31, 2020 were $293,000 and $282,000, respectively. No fees were billed or paid by the Company for internal audit, tax or other services for the years ended December 31, 2021 or 2020.

STOCKHOLDERS’ PROPOSALS AND NOMINATIONS

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, stockholders may present proper proposals for inclusion in the Company’s proxy statement and form of proxy and for consideration at its annual meeting of stockholders by submitting their proposals to the Company in a timely manner. In order to be so included for the 2023 Annual Meeting, stockholder proposals must be received by the Company at its principal executive offices at 9821 Katy Freeway, Houston, Texas 77024, no later than December 31, 2022, and must otherwise comply with the requirements of Rule 14a-8.

In addition, our Amended and Restated Bylaws contain notice procedures for stockholders to nominate a person as director and to propose business to be considered at an annual meeting when such matter is not submitted for inclusion in our proxy statement. Generally, notice of such a nomination or proposal must be delivered to the Company no later than the 90th day nor earlier than the 120th day, prior to the first anniversary of the preceding year’s annual meeting. Accordingly, Stockholder proposals and nominations of directors to be brought before the 2023 Annual Meeting, made outside the Rule 14a-8 processes, must be submitted to the Company pursuant to Rule 14a-8, no earlier than February 29, 2023 and no later than March 11, 2023 or will be considered untimely and entitle the Company to refuse to acknowledge or include such matters for consideration, at the 2023 meeting.

If a stockholder desires to recommend an individual as a nominee for director to the Board of Directors, the stockholder shall mail the recommendation to the Secretary of the Board of Directors. The recommendation must include the name, address (business and personal) and the occupation of the nominee. The recommendation must also include such other information regarding the nominee as may reasonably be required by the Company.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Stockholders may communicate with the members of the Board of Directors by mailing their communications to the Company, at PrimeEnergy Resources Corporation, 9821 Katy Freeway, Houston, Texas 77024. All communications addressed to the attention of a particular director shall be forwarded to the director.

13

ANNUAL REPORT AND FINANCIAL STATEMENTS

The Annual Report of the Company for its fiscal year ended December 31, 2021, accompanies this proxy statement. The audited financial statements of the Company are included in such Annual Report.

It is important that proxies be returned promptly. Stockholders are requested to date, sign and return the enclosed proxy in the enclosed envelope, to which no postage need be affixed if mailed in the United States. If you attend the 2022 Annual Meeting, you may revoke your proxy and vote in person if you so desire, otherwise your proxy will be voted for you.

BY ORDER OF THE BOARD OF DIRECTORS |

/S/ Virginia M. Forese |

VIRGINIA M. FORESE |

Corporate Secretary |

Houston, Texas

April 29, 2022

14

AUDIT COMMITTEE CHARTER

PRIMEENERGY RESOURCES CORPORATION

CHARTER AND POWERS OF THE AUDIT COMMITTEE

RESOLVED, that the charter and powers of the Audit Committee of the Board of Directors (the “Audit Committee”) shall be:

| • | Overseeing that management has maintained the reliability and integrity of the accounting policies and financial reporting and disclosure practices of the Company; |

| • | Overseeing that management has established and maintained processes to assure that an adequate system of internal control is functioning within the Company; |

| • | Overseeing that management has established and maintained processes to assure compliance by the Company with all applicable laws, regulations and Company policy; |

RESOLVED, that the Audit Committee shall have the following specific powers and duties:

| 1. | Holding such regular meetings as may be necessary and such special meetings as may be called by the Chairman of the Audit Committee or at the request of the independent accountants; |

| 2. | Creating an agenda for ensuing year; |

| 3. | Reviewing the independence and performance of the independent accountants and making recommendations to the Board of Directors regarding the appointment or termination of the independent accountants; |

| 4. | Conferring with the independent accountants concerning outside auditor’s accountability to the Board of Directors and the audit committee, and the scope of their examinations of the books and records of the Company and its subsidiaries; reviewing and approving the independent accountants annual engagement letter; directing the special attention of the auditors to specific matters or areas deemed by the Committee or the auditors to be of special significance; and authorizing the auditors to perform such supplemental reviews or audits as the Committee may deem desirable; |

| 5. | Reviewing with management and the independent accountants significant risks and exposures, audit activities and significant audit findings; |

| 6. | Reviewing the range and cost of audit and non-audit services performed by the independent accountants; |

| 7. | Reviewing the Company’s audited annual financial statements and the independent accountants’ opinion rendered with respect to such financial statements, including reviewing the nature and extent of any significant changes in accounting principles or the application therein; |

| 8. | Reviewing the adequacy of the Company’s systems of internal control; |

| 9. | Obtaining from the independent accountants their recommendations regarding internal controls and other matters relating to the accounting procedures and the books and records of the Company and its subsidiaries and reviewing the correction of controls deemed to be deficient; |

| 10. | Providing independent, direct communication between the Board of Directors and independent accountants; |

| 11. | Reviewing with appropriate Company personnel the actions taken to ensure compliance with the Company’s Code of Conduct and the results of confirmations and violations of such Code; |

| 12. | Reviewing the programs and policies of the Company designed to ensure compliance with applicable laws and regulations and monitoring the results of these compliance efforts; |

| 13. | Reviewing the procedures established by the Company that monitor the compliance by the Company with its loan and indenture covenants and restrictions; |

15

| 14. | Reporting through its Chairman to the Board of Directors following the meetings of the Audit Committee; |

| 15. | Maintaining minutes or other records of meetings and activities of the Audit Committee; |

| 16. | Reviewing the powers of the Committee annually and reporting and making recommendations to the Board of Directors on these responsibilities; |

| 17. | Conducting or authorizing investigations into any matters within the Audit Committee’s scope of responsibilities. The Audit Committee shall be empowered to retain independent counsel, accountants, or others to assist it in the conduct of any investigation; |

| 18. | Considering such other matters in relation to the financial affairs of the Company and its accounts, and in relation to the internal and external audit of the Company as the Audit Committee may, in its discretion, determine to be advisable. |

16

COMPENSATION COMMITTEE CHARTER

PRIMEENERGY RESOURCES CORPORATION

COMPENSATION COMMITTEE CHARTER

The Compensation Committee is appointed by the Board of Directors to discharge the Board’s responsibilities relating to compensation of the Company’s directors and officers. The Committee has overall responsibility for approving and evaluating the director and officer compensation plans, policies and programs of the Company. The Compensation Committee is also responsible for producing an annual report on executive compensation for inclusion in the Company’s proxy statement.

The Compensation Committee shall consist of no fewer than two members. The members of the Compensation Committee will meet the requirements that he/she is a “non-employee director” for purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended; will satisfy the requirements of and “outside director” for purposes of Section 162(m) of the Internal Revenue Code; will meet the independence requirements of the applicable regulatory standards; will be appointed by the Board; and may be replaced by the Board.

The Compensation Committee shall have the sole authority to retain, at the Company’s expense, and terminate any compensation consultant to be used to assist in the evaluation of director, CEO or senior executive compensation and shall have sole authority to approve the consultant’s fees and other retention terms. The Compensation Committee shall also have authority to obtain advice and assistance from internal or external legal, accounting or other advisors.

The Compensation Committee shall annually review and make recommendations to the Board with respect to the compensation of all directors, officers and other key executives, including incentive-compensation plans and equity-based plans.

The Compensation Committee shall annually review and approve, for the CEO and the senior executives of the Company, (a) the annual base salary level, (b) the annual incentive opportunity level, (c) the long-term incentive opportunity level, (d) employment agreements, severance arrangements, and change in control agreements/provisions, in each case as, when and if appropriate, and (e) any special or supplemental benefits. The CEO and senior executives of the Company shall not be present during voting or deliberations on his or her compensation.

The Compensation Committee may form and delegate authority to subcommittees when appropriate.

The Compensation Committee shall make regular reports to the Board, review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval and annually reviews of its own performance.

17

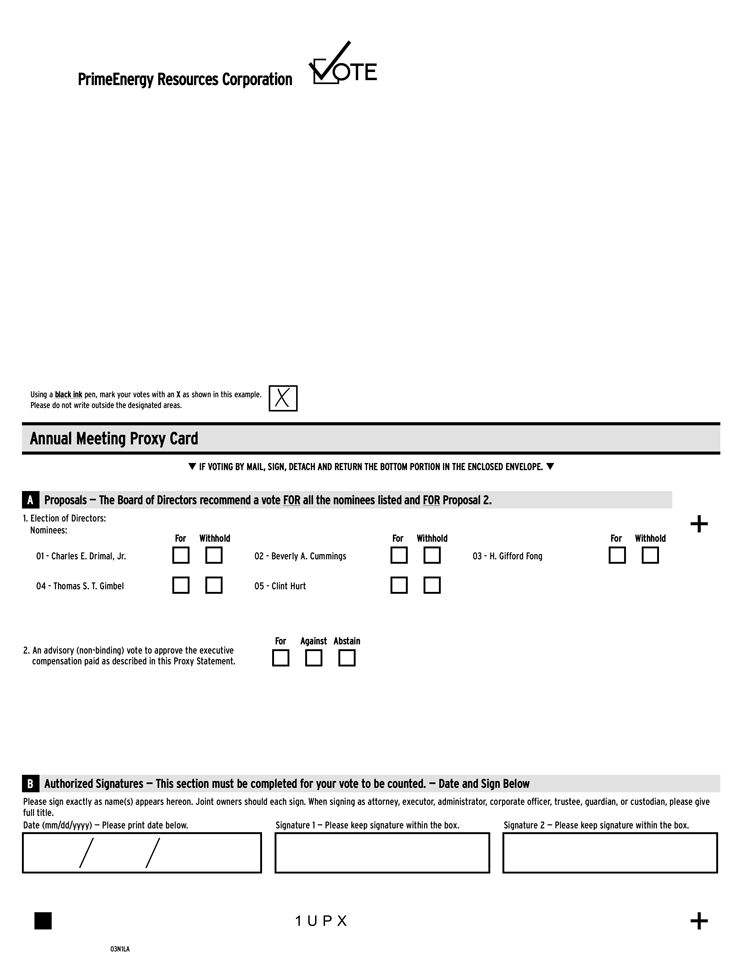

For Withhold For Withhold For Withhold 1 U P X Nominees: 01 - Charles E. Drimal, Jr. 04 - Thomas S. T. Gimbel 02 - Beverly A. Cummings 05 - Clint Hurt 03 - H. Gifford Fong PrimeEnergy Resources Corporation Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. 03N1LA + + Proposals — The Board of Directors recommend a vote FOR all the nominees A listed and FOR Proposal 2. 1. Election of Directors: Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. B Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below qIF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.q Annual Meeting Proxy Card 2. An advisory (non-binding) vote to approve the executive compensation paid as described in this Proxy Statement. For Against Abstain

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS Proxy Solicited by Board of Directors for Annual Meeting — June 8, 2022 The undersigned shareholder of PrimeEnergy Resources Corporation (the “Company”), revoking all prior proxies, does by these presents name, constitute and appoint Charles E. Drimal, Jr. and Beverly A. Cummings each of them, the true and lawful proxy and attorney-in-fact of the undersigned, with full power of substitution, to vote all shares of the Common Stock, par value $.10 per share, of the Company standing in the name of the undersigned on the books of the Company at the close of business on April 12, 2022, or in respect of which the undersigned is entitled to vote at the Company’s Annual Meeting of Stockholders to be held on Wednesday, June 8, 2022, at 9:00 a.m., CT, at the Office of Prime Operating Company, 9821 Katy Freeway, Suite 1050, Houston, Texas 77024, and at any and all adjournments of said meeting, hereby granting to said proxies and attorneys-in-fact, and each of them, full power and authority to vote in the name of the undersigned at said meeting, and at any and all adjournments thereof, on the matters set forth on reverse side. PLEASE SIGN ON REVERSE SIDE AND RETURN PROMPTLY. (Continued and to be signed and dated on reverse side.) Proxy — PrimeEnergy Resources Corporation qIF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.