Exhibit 99.1

Visit us at:

www.kns.com

KULICKE & SOFFA

Corporate Overview

December 2008

Confidential Name Kulicke & Soffa®

Safe Harbor Statement

This presentation contains forward-looking statements, including forecasts of future market share and future Company performance, and often contain words such as “expect”, “intend”, “believe”, “seek”, or “will.” These statements are subject to risks and uncertainties that could cause actual results to materially differ from those projected. Further discussions of risk factors are available in the Company’s most recent SEC filings including the annual report on form 10-K for the fiscal year ended 9/29/07.

This presentation may also contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gaging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. For a reconciliation of non-GAAP measures presented in this document, see the accompanying information posted to the Investor Relations section of our website at www.kns.com

December 8, 2008

KLIC Investor Day 2 Kulicke & Soffa®

Visit us at:

www.kns.com

Kulicke & Soffa:

A Leader in Semiconductor Assembly Equipment & Materials

Provides Cutting Edge Technology & Process Solutions in:

Ball Bonding

Die Bonding

Wedge Bonding

Enables customers to assemble next generation devices at increased production and reliability levels.

Confidential Name Kulicke & Soffa®

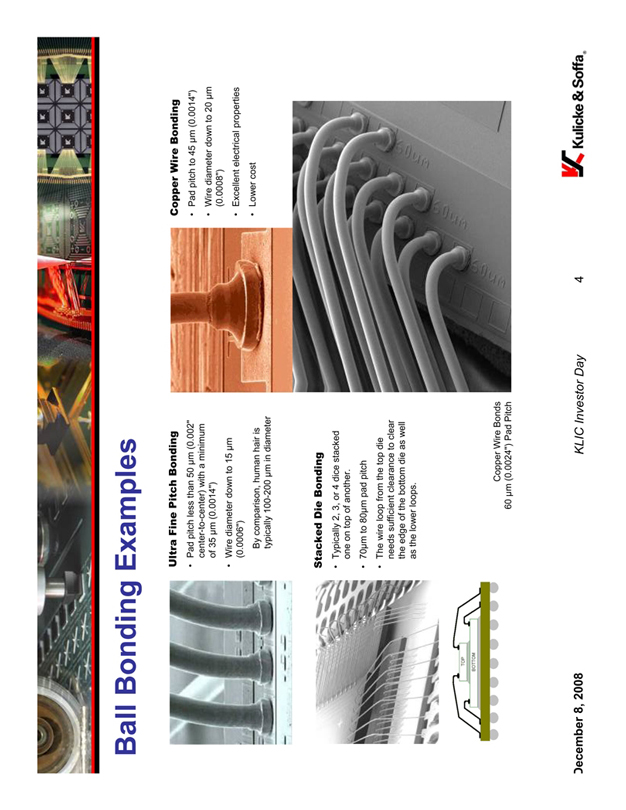

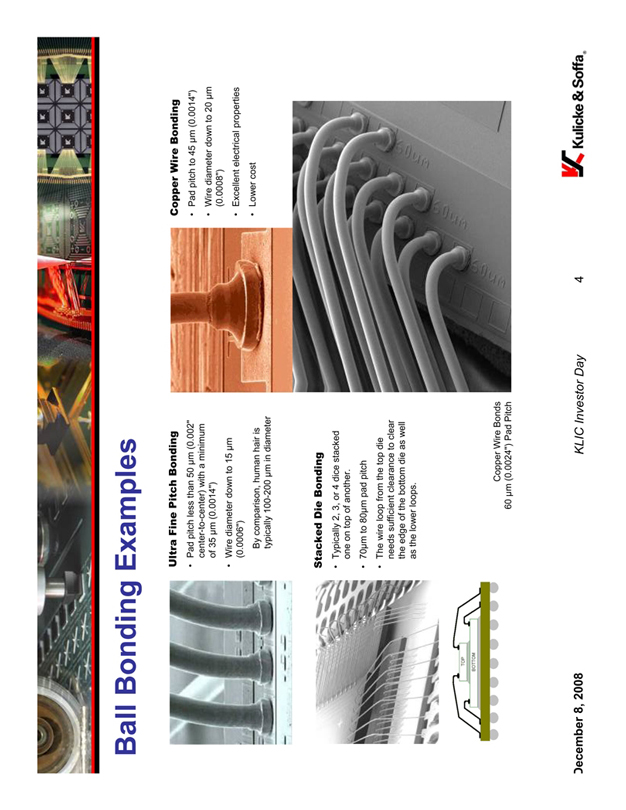

Ball Bonding Examples

Ultra Fine Pitch Bonding

Pad pitch less than 50 µm (0.002" center-to-center) with a minimum of 35 µm (0.0014")

Wire diameter down to 15 µm (0.0006")

By comparison, human hair is typically 100-200 µm in diameter

Copper Wire Bonding

Pad pitch to 45 µm (0.0014")

Wire diameter down to 20 µm (0.0008")

Excellent electrical properties

Lower cost

Stacked Die Bonding

Typically 2, 3, or 4 dice stacked one on top of another.

70µm to 80µm pad pitch

The wire loop from the top die needs sufficient clearance to clear the edge of the bottom die as well as the lower loops.

Copper Wire Bonds

60 µm (0.0024") Pad Pitch

December 8, 2008 KLIC Investor Day 4 Kulicke & Soffa®

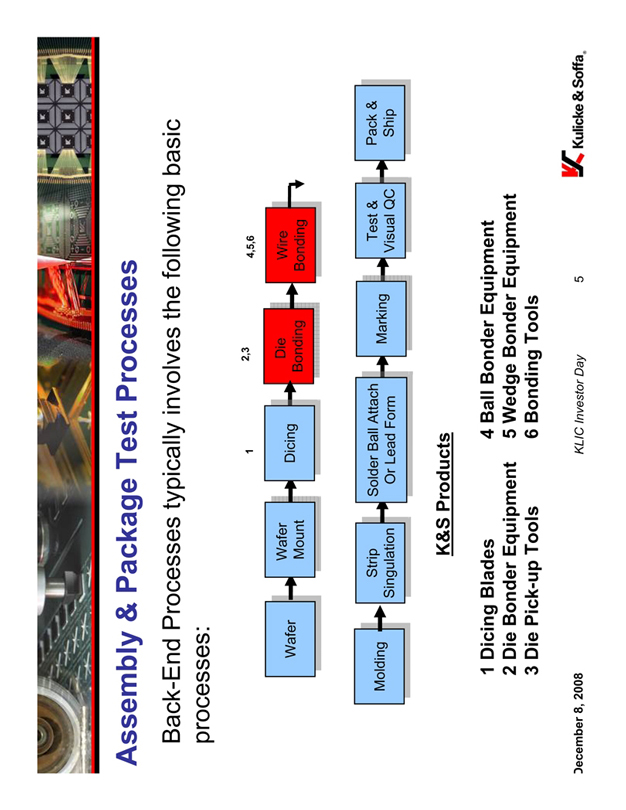

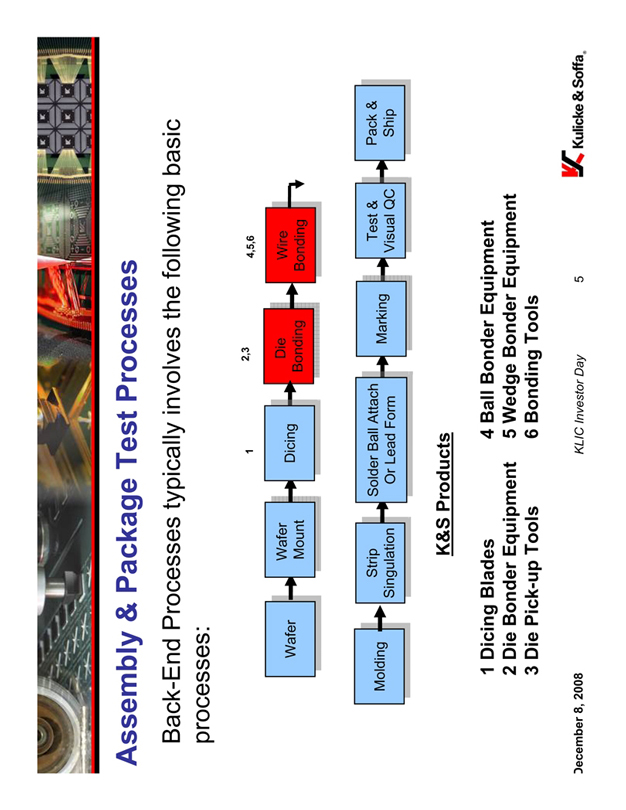

Assembly & Package Test Processes

Back-End Processes typically involves the following basic processes:

1

2,3

4,5,6

Wafer

Wafer Mount

Dicing

Die Bonding

Wire Bonding

Molding

Strip Singulation

Solder Ball Attach Or Lead Form

Marking

Test & Visual QC

Pack & Ship

K&S Products

1 Dicing Blades

2 Die Bonder Equipment

3 Die Pick-up Tools

4 Ball Bonder Equipment

5 Wedge Bonder Equipment

6 Bonding Tools

December 8, 2008 KLIC Investor Day 5 Kulicke & Soffa®

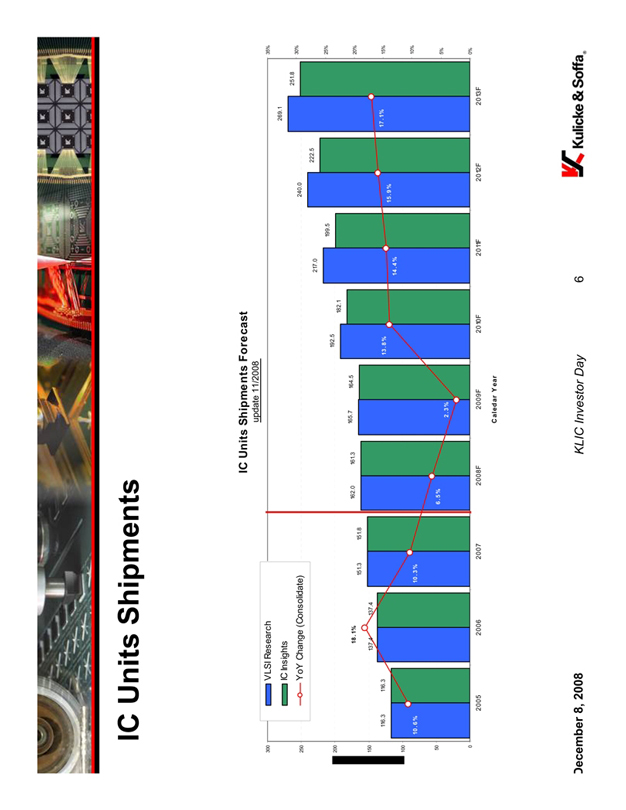

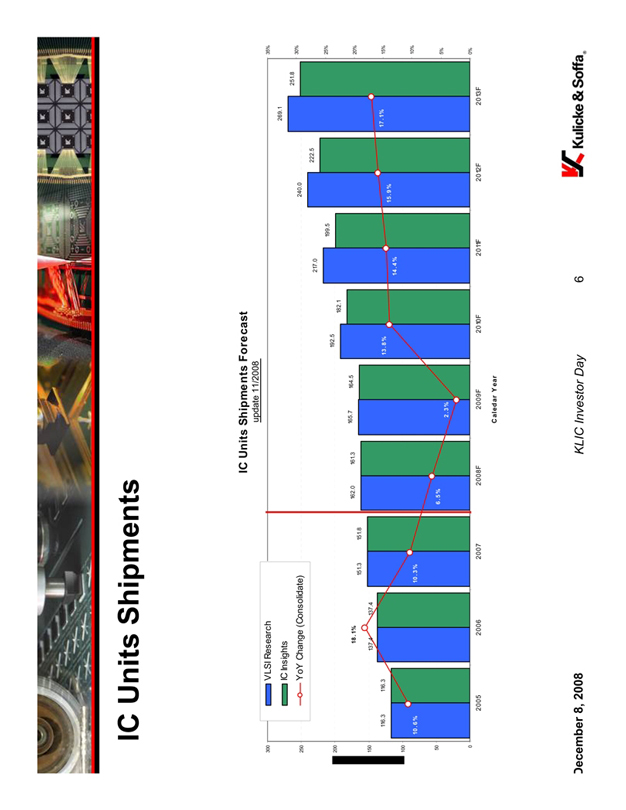

IC Units Shipments Forecast

update 11/2008

VLSI Research

IC Insights

YoY Change (Consolidate)

300 250 200 150 100 50 0

116.3 116.3 137.4 137.4 151.3 151.8 162.0 161.3 165.7 164.5 192.5 182.1 217.0 199.5 240.0 222.5 269.1 251.8

10.6% 18.1% 10.3% 6.5% 2.3% 13.8% 14.4% 15.9% 17.1%

35% 30% 25% 20% 15% 10% 5% 0%

2005 2006 2007 2008F 2009F 2010F 2011F 2012F 2013F

Caledar Year

December 8, 2008 KLIC Investor Day 6 Kulicke & Soffa®

Growth Strategies – Recent History

Focus New Equipment Markets

Divestiture of Wire Business September 2008

Acquired Orthodyne October 2008

Discovery Die Bonder Launch Winter 2009

Technology Leadership

IConn & ConnX Launched 2008

Solidified Technology Leadership in Ball Bonding

Enabling Copper Bonding Solutions

Process Expertise

Copper Upgrade Kits

December 8, 2008 KLIC Investor Day 7

Kulicke & Soffa®

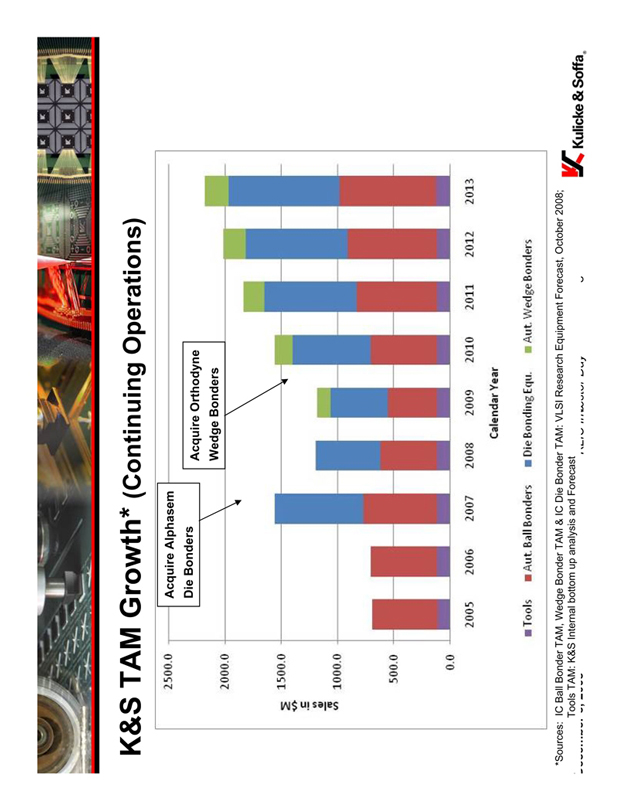

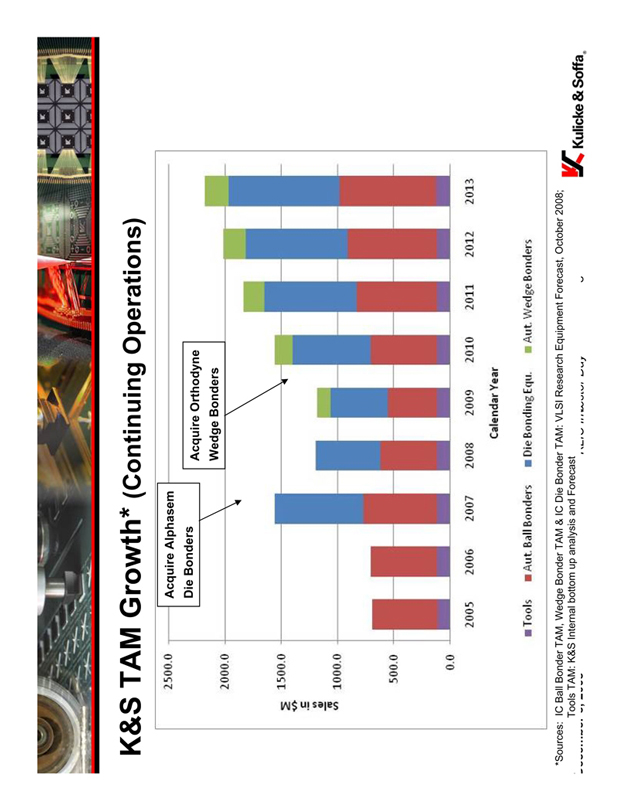

K&S TAM Growth* (Continuing Operations)

Sales in $M

2500.0

2000.0

1500.0

1000.0

500.0

0.0

Acquire Alphasem Die Bonders

Acquire Orthodyne Wedge Bonders

2005

2006

2007

2008

2009

2010

2011

2012

2013

Calendar Year

Tools

Aut. Ball Bonders

Die Bonding Equ.

Aut. Wedge Bonders

*Sources: IC Ball Bonder TAM, Wedge Bonder TAM & IC Die Bonder TAM: VLSI Research Equipment Forecast, October 2008;

Tools TAM: K&S Internal bottom up analysis and Forecast

Kulicke & Soffa®

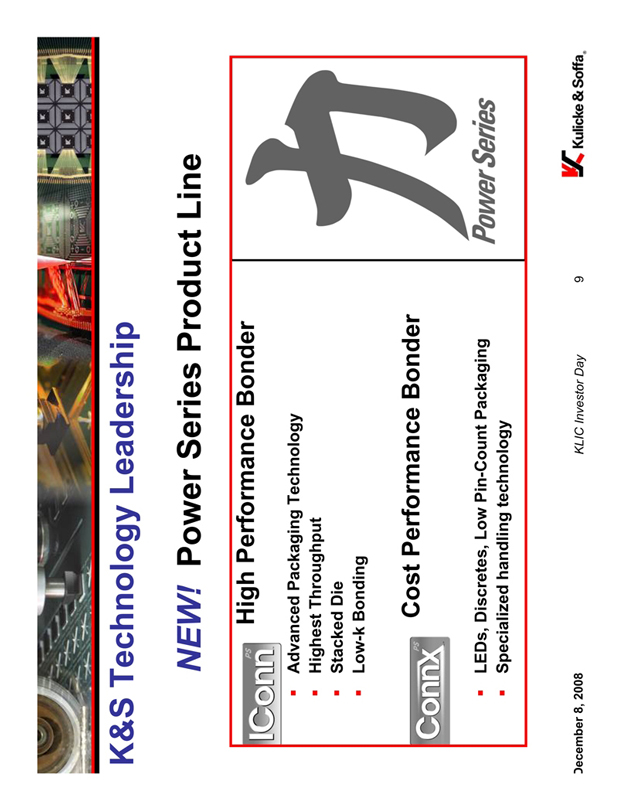

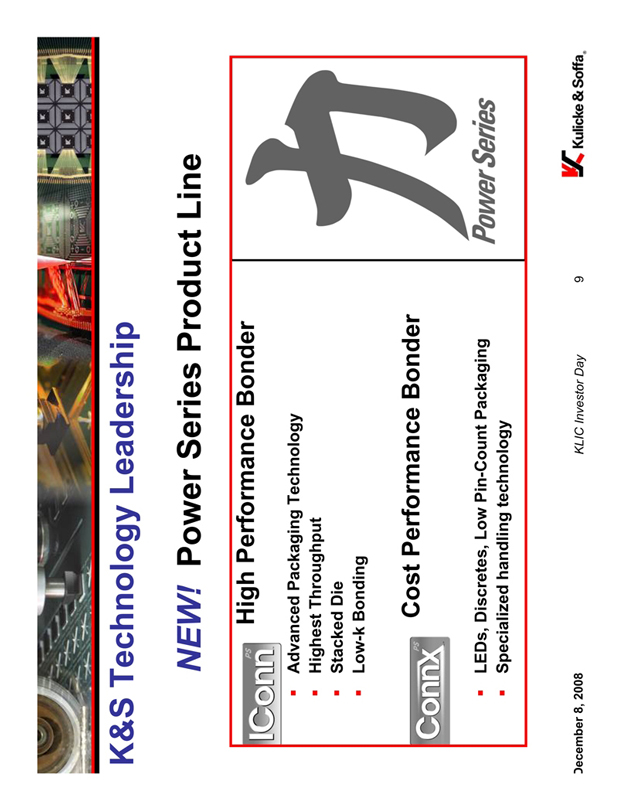

K&S Technology Leadership

NEW! Power Series Product Line

PS

Iconn

High Performance Bonder

Advanced Packaging Technology

Highest Throughput

Stacked Die

Low-k Bonding

PS

Connx

Cost Performance Bonder

LEDs, Discretes, Low Pin-Count Packaging

Specialized handling technology

Power Series

December 8, 2008 KLIC Investor Day 9

Kulicke & Soffa®

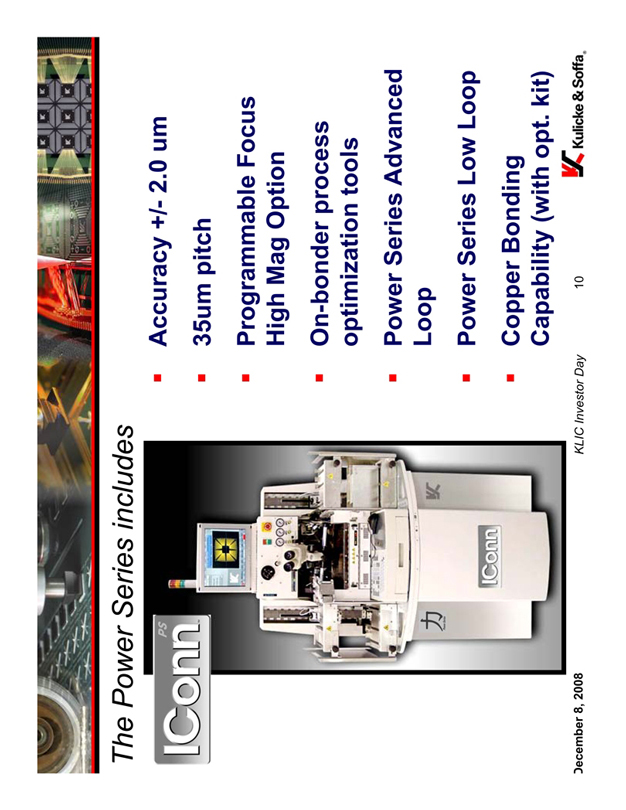

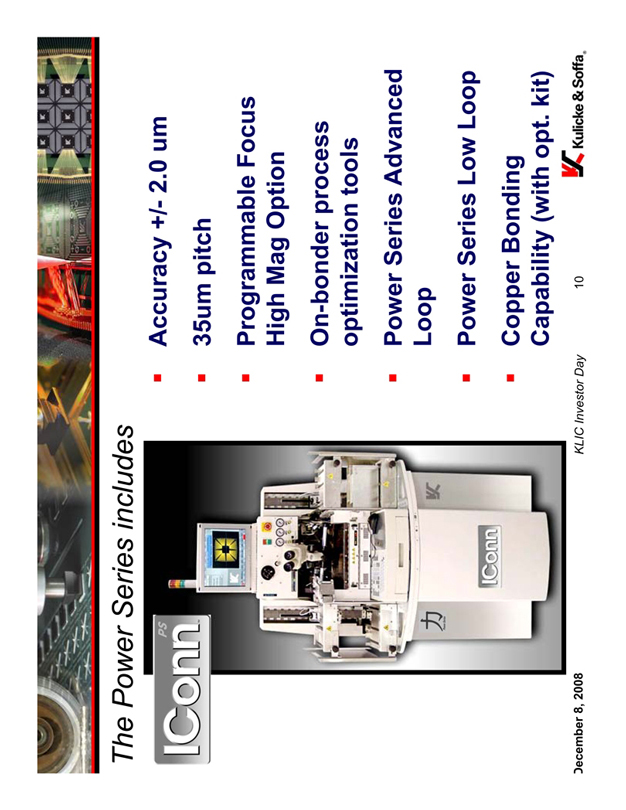

The Power Series includes

PS

Iconn

Accuracy +/- 2.0 um 35um pitch Programmable Focus High Mag Option On-bonder process optimization tools Power Series Advanced Loop Power Series Low Loop Copper Bonding Capability (with opt. kit)

December 8, 2008 KLIC Investor Day 10

Kulicke & Soffa®

The Power Series includes

PS

Connx

Accuracy +/- 3.0 um

Look Ahead Algorithms for matrix devices

Copper Bonding

Capability (with opt. kit)

December 8, 2008 KLIC Investor Day 11

Kulicke & Soffa®

Next-Generation Wire Bonders

PS Iconn

PS Connx

Enthusiastic Responses at Semicon China & Semicon Taiwan

Higher ASPs and Margins

Customers Qualifying these New Bonders for Production

December 8, 2008 KLIC Investor Day 12

Kulicke & Soffa®

Industry Leading Production Capability

December 8, 2008 KLIC Investor Day 13

Kulicke & Soffa®

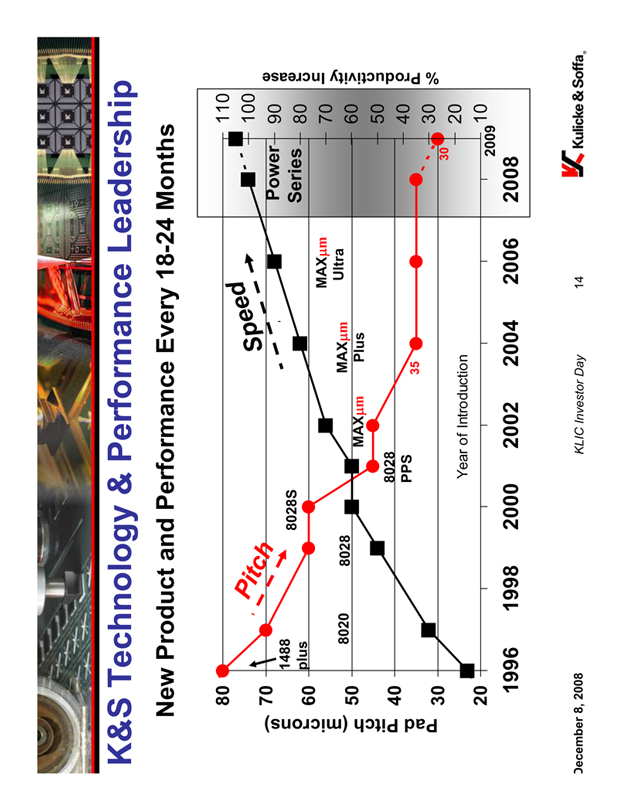

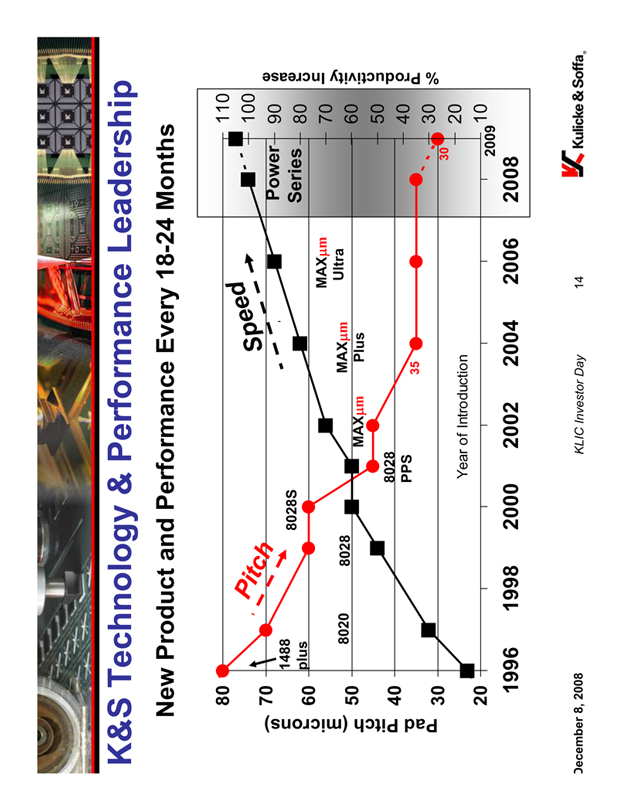

K&S Technology & Performance Leadership

New Product and Performance Every 18-24 Months

Pad Pitch (microns)

80 70 60 50 40 30 20

1488 plus

8028S

Pitch

Speed

8020

8028

8028

PPS

MAXµm

MAXµm

PLUS

MAXµm

ULTRA

Power Series

110 100 90 80 70 60 50 40 30 20 10

% Productivity Increase

35 30

Year of Introduction

2009

1996

1998

2000

2002

2004

2006

2008

December 8, 2008 KLIC Investor Day 14

Kulicke & Soffa®

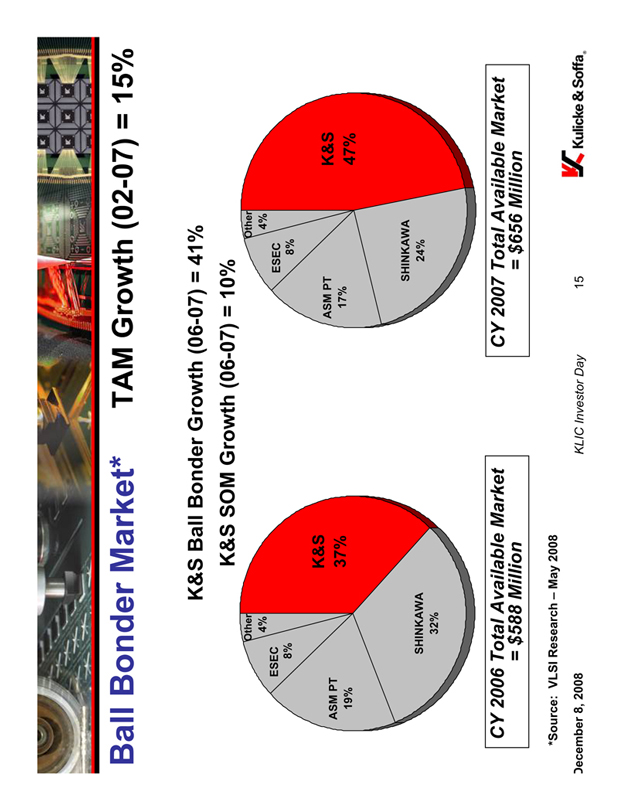

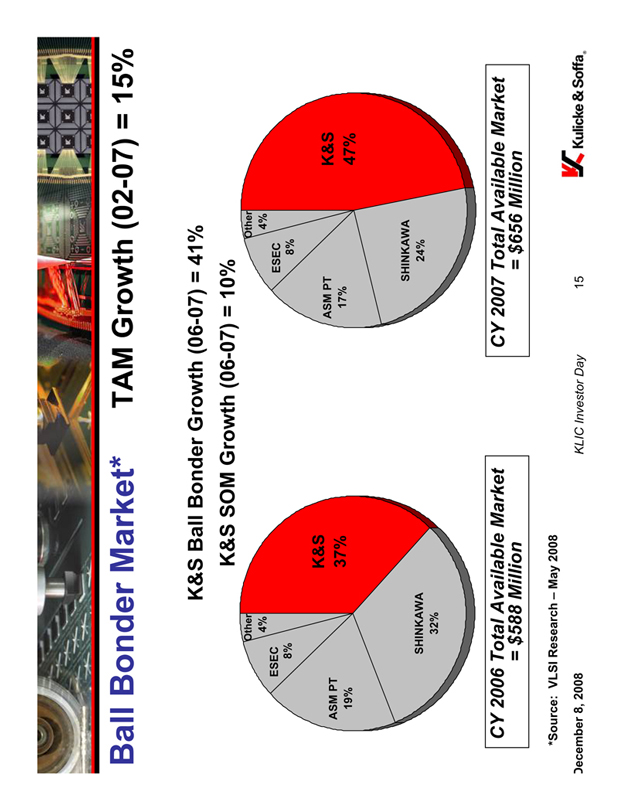

Ball Bonder Market* TAM Growth (02-07) = 15%

K&S Ball Bonder Growth (06-07) = 41% K&S SOM Growth (06-07) = 10%

ASM PT 19%

ESEC

8%

Other

4%

K&S

37%

SHINKAWA

32%

CY 2006 Total Available Market

= $588 Million

ASM PT 17%

ESEC

8%

Other

4%

K&S 47%

SHINKAWA 24%

CY 2007 Total Available Market

= $656 Million

*Source: VLSI Research – May 2008

December 8, 2008 KLIC Investor Day 15

Kulicke & Soffa®

Ball Bonder Growth Strategies

Expand in Specific Sub-Markets with Targeted Capabilities

Advanced Packaging Requirements

LED & Low Pin Count Markets

Specific Growth Market Segments (Copper)

December 8, 2008 KLIC Investor Day 16

Kulicke & Soffa®

Visit us at

www.kns.com

Technology Expansion into Die Bonding

Acquired Alphasem 2006

Launch Discovery 2009 – Next Generation Die Bonder

Confidential Name

Visit us at

www.kns.com

New Die Bonder Platform

Confidential Name

Kulicke & Soffa®

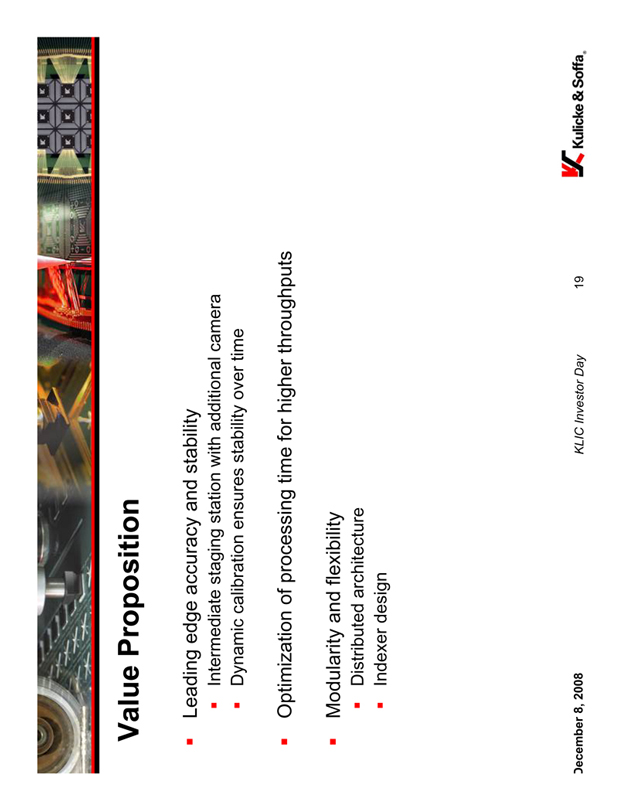

Value Proposition

Leading edge accuracy and stability

Intermediate staging station with additional camera

Dynamic calibration ensures stability over time

Optimization of processing time for higher throughputs

Modularity and flexibility

Distributed architecture

Indexer design

December 8, 2008 KLIC Investor Day 19

Kulicke & Soffa®

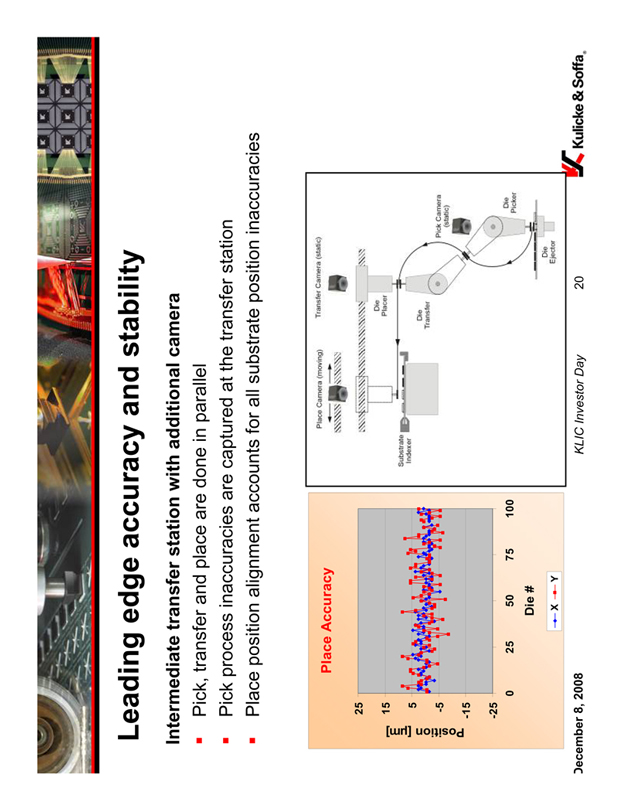

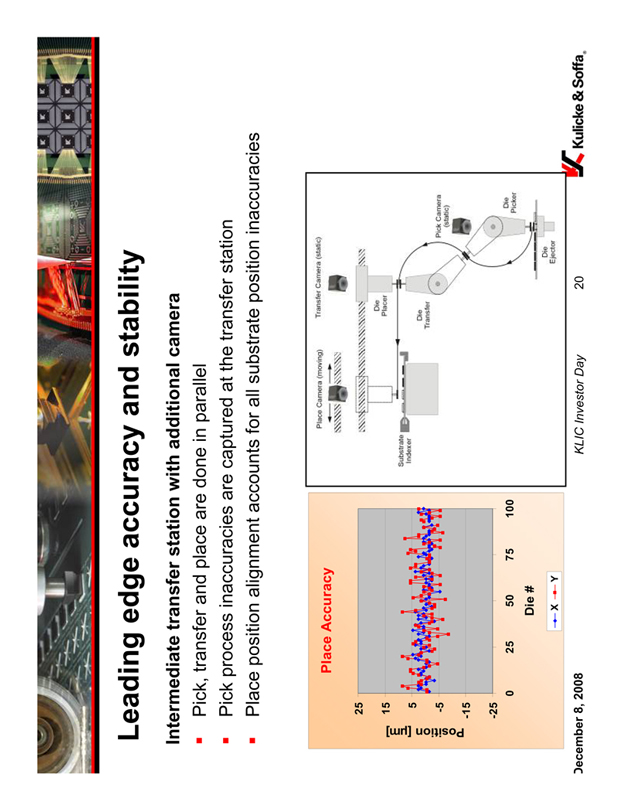

Leading edge accuracy and stability

Intermediate transfer station with additional camera

Pick, transfer and place are done in parallel

Pick process inaccuracies are captured at the transfer station

Place position alignment accounts for all substrate position inaccuracies

Place Accuracy

Position [µm]

25 15 5 -5 -15 -25

0 25 50 75 100

Die #

X Y

Place Camera (moving)

Transfer Camera (static)

Diet Placer

Substrate Indexer

Die Transfer

Pick Camera (static)

Die Picker

Die Ejector

December 8, 2008 KLIC Investor Day 20

Kulicke & Soffa®

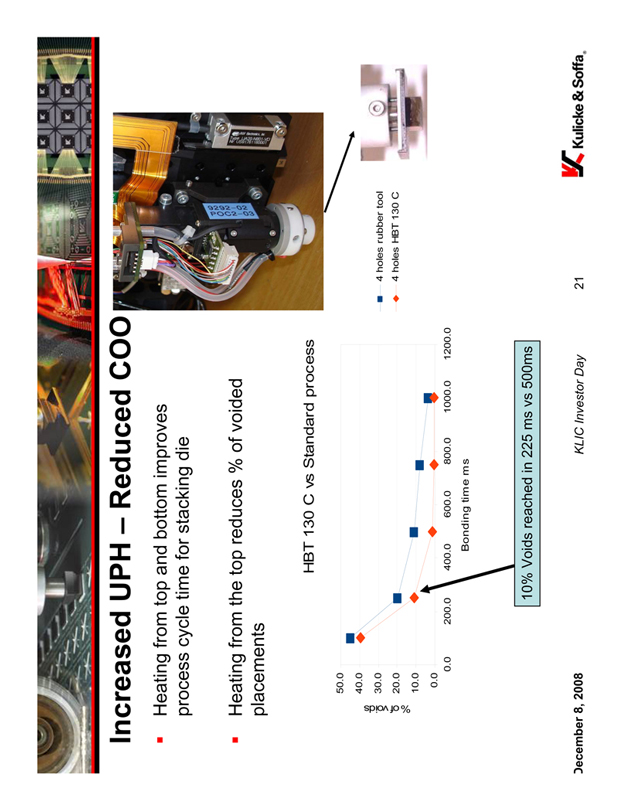

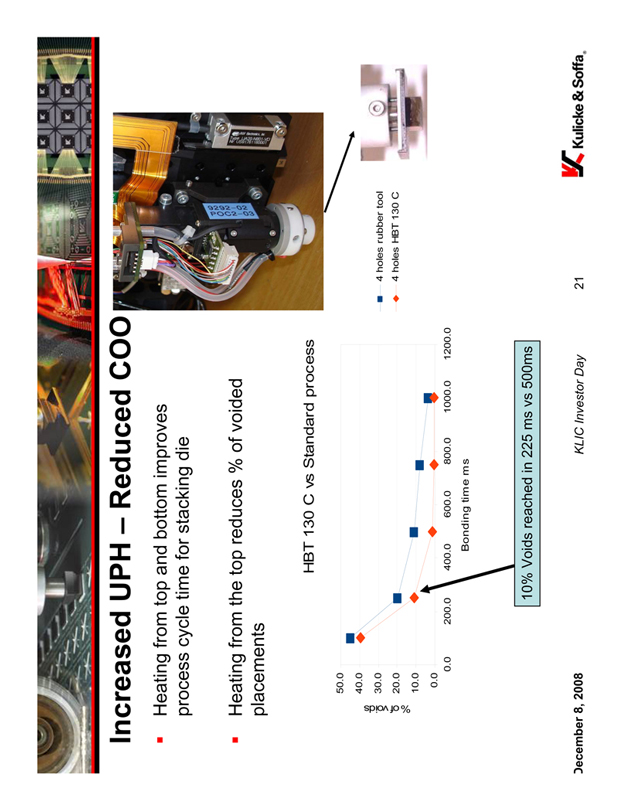

Increased UPH – Reduced COO

Heating from top and bottom improves process cycle time for stacking die

Heating from the top reduces % of voided placements

HBT 130 C vs Standard process

% of voids

50.0

40.0

30.0 20.0

10.0

0.0

0.0 200.0 400.0 600.0 800.0 1000.0 1200.0

Bonding time ms

4 holes rubber tool 4 holes HBT 130 C

10% Voids reached in 225 ms vs 500ms

December 8, 2008 KLIC Investor Day 21

Kulicke & Soffa®

Schedule

Schedule

Launch in April 2009

Show at Semicon Korea (January 20th- 22nd)

First 3 Qualifications Identified

December 8, 2008 KLIC Investor Day 22

Kulicke & Soffa®

Die Bonders: Product - Easyline

Maintain Existing Die Bonder Products Through EOL

Support K&S Mindshare Among Customers

December 8, 2008 KLIC Investor Day 23

Kulicke & Soffa®

Visit us at

www.kns.com

Wedge Bonding Technologies

Confidential Name

Kulicke & Soffa®

Introduction

ORTHODYNE ®

ELECTRONICS

A Division of

A Thumbnail

We manufacturer Interconnection equipment for the Power Electronic device industry. Our core markets include:

Power Semiconductors

Power Hybrid and Electronic Modules

Power Electronic devices are the building blocks that determine how efficient energy is managed, controlled, converted, distributed, or generated. Common end market uses include:

Transportation:

Alternate Energy Sources: Solar, Wind Farm

Consumer White Goods:

Industrial:

Heating / Cooling

Lighting

December 8, 2008 KLIC Investor Day 25

Kulicke & Soffa®

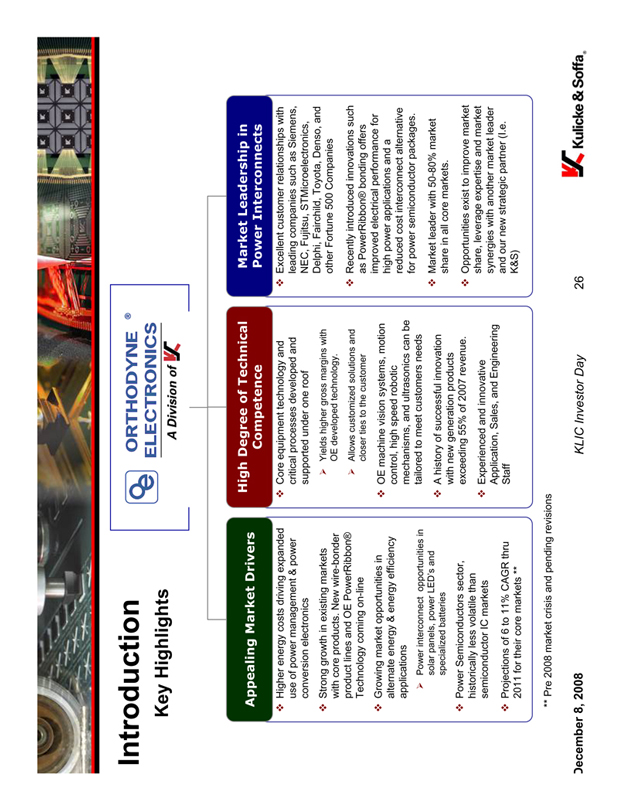

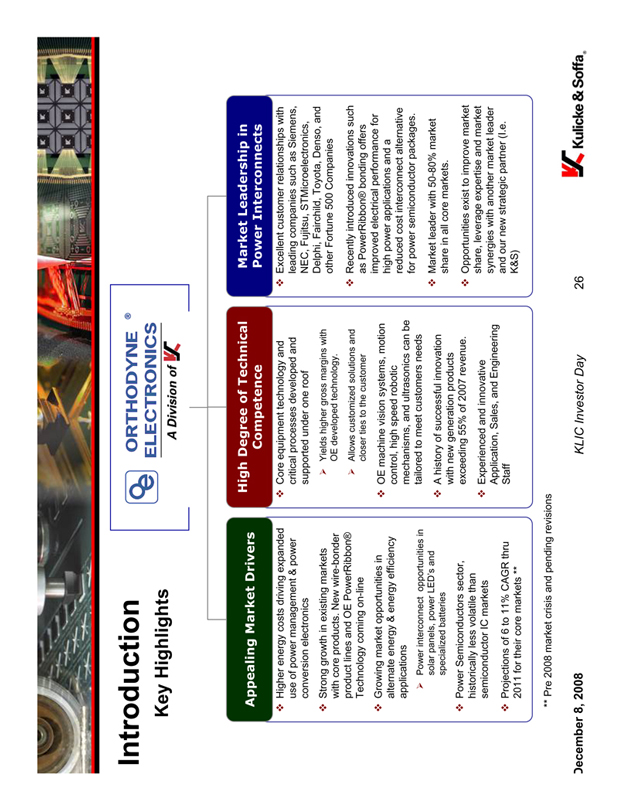

Introduction

Key Highlights

ORTHODYNE ®

ELECTRONICS

A Division of

Appealing Market Drivers

Higher energy costs driving expanded use of power management & power conversion electronics

Strong growth in existing markets with core products. New wire-bonder product lines and OE PowerRibbon® Technology coming on-line

Growing market opportunities in alternate energy & energy efficiency applications

Power interconnect opportunities in solar panels, power LED’s and specialized batteries

Power Semiconductors sector, historically less volatile than semiconductor IC markets

Projections of 6 to 11% CAGR thru 2011 for their core markets **

High Degree of Technical Competence

Core equipment technology and critical processes developed and supported under one roof

Yields higher gross margins with OE developed technology.

Allows customized solutions and closer ties to the customer

OE machine vision systems, motion control, high speed robotic mechanisms, and ultrasonics can be tailored to meet customers needs

A history of successful innovation with new generation products exceeding 55% of 2007 revenue.

Experienced and innovative Application, Sales, and Engineering Staff

Market Leadership in Power Interconnects

Excellent customer relationships with leading companies such as Siemens, NEC, Fujitsu, STMicroelectronics, Delphi, Fairchild, Toyota, Denso, and other Fortune 500 Companies

Recently introduced innovations such as PowerRibbon® bonding offers improved electrical performance for high power applications and a reduced cost interconnect alternative for power semiconductor packages.

Market leader with 50-80% market share in all core markets.

Opportunities exist to improve market share, leverage expertise and market synergies with another market leader and our new strategic partner (i.e. K&S)

** Pre 2008 market crisis and pending revisions

December 8, 2008 KLIC Investor Day 26

Kulicke & Soffa®

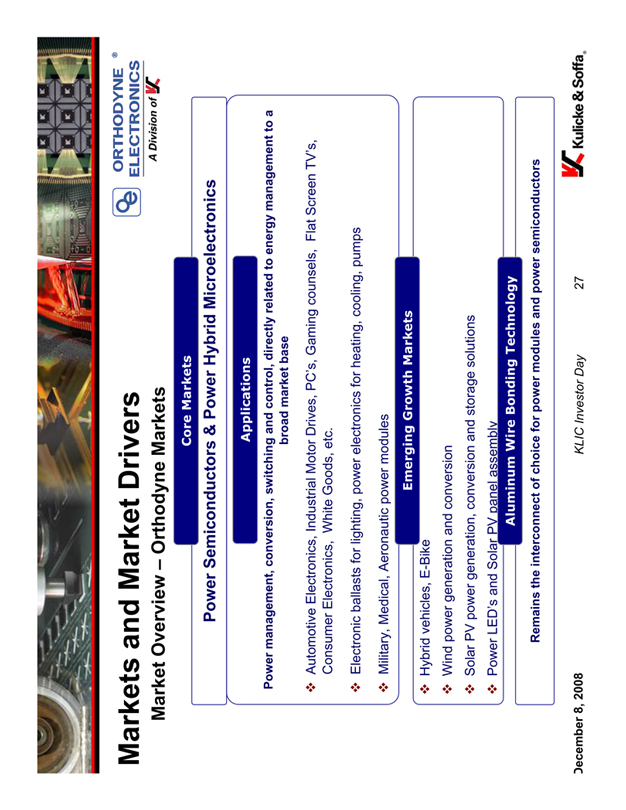

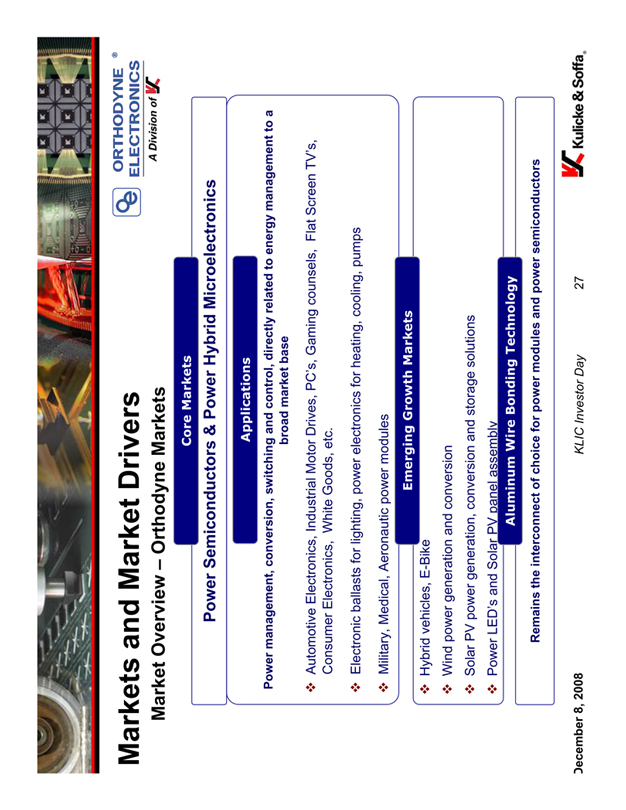

Markets and Market Drivers

Market Overview – Orthodyne Markets

ORTHODYNE ®

ELECTRONICS

A Division of

Core Markets

Power Semiconductors & Power Hybrid Microelectronics

Applications

Power management, conversion, switching and control, directly related to energy management to a broad market base

Automotive Electronics, Industrial Motor Drives, PC’s, Gaming counsels, Flat Screen TV’s, Consumer Electronics, White Goods, etc.

Electronic ballasts for lighting, power electronics for heating, cooling, pumps

Military, Medical, Aeronautic power modules

Emerging Growth Markets

Hybrid vehicles, E-Bike

Wind power generation and conversion

Solar PV power generation, conversion and storage solutions

Power LED’s and Solar PV panel assembly

Aluminum Wire Bonding Technology

Remains the interconnect of choice for power modules and power semiconductors

December 8, 2008 KLIC Investor Day 27

Kulicke & Soffa®

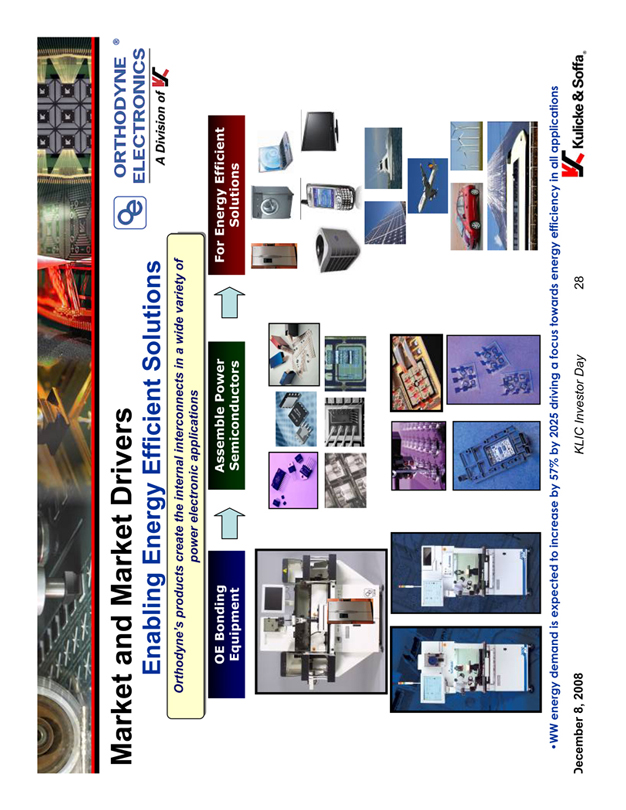

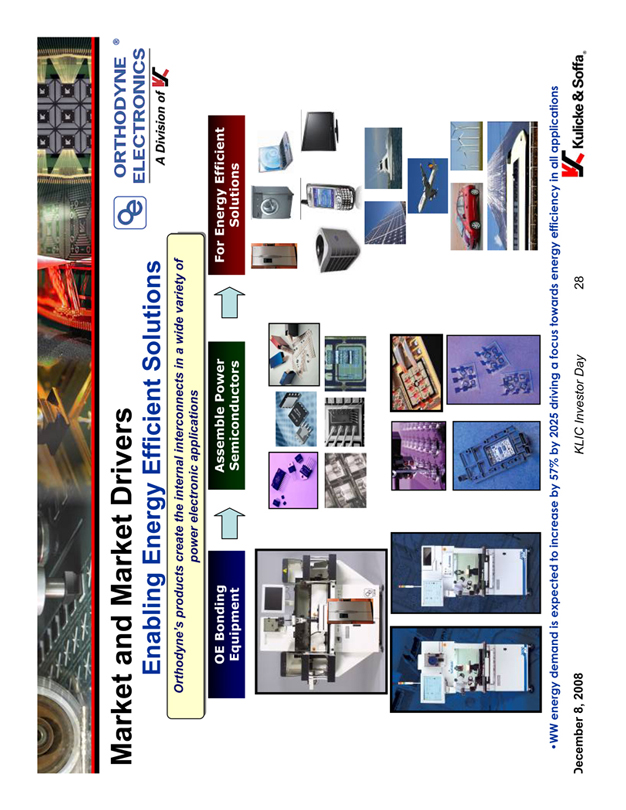

Market and Market Drivers

Enabling Energy Efficient Solutions

ORTHODYNE ®

ELECTRONICS

A Division of

Orthodyne’s products create the internal interconnects in a wide variety of power electronic applications

OE Bonding Equipment

Assemble Power Semiconductors

For Energy Efficient Solutions

WW energy demand is expected to increase by 57% by 2025 driving a focus towards energy efficiency in all applications

December 8, 2008 KLIC Investor Day 28

Kulicke & Soffa®

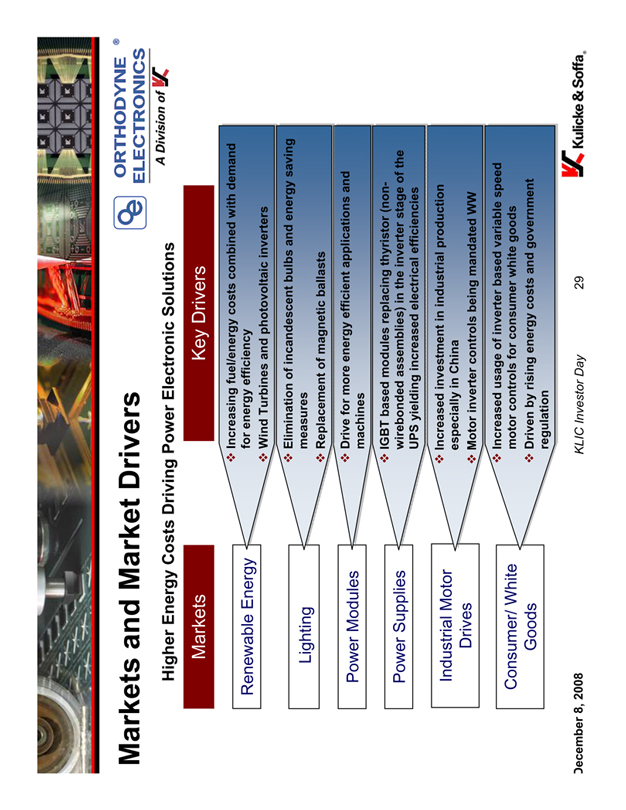

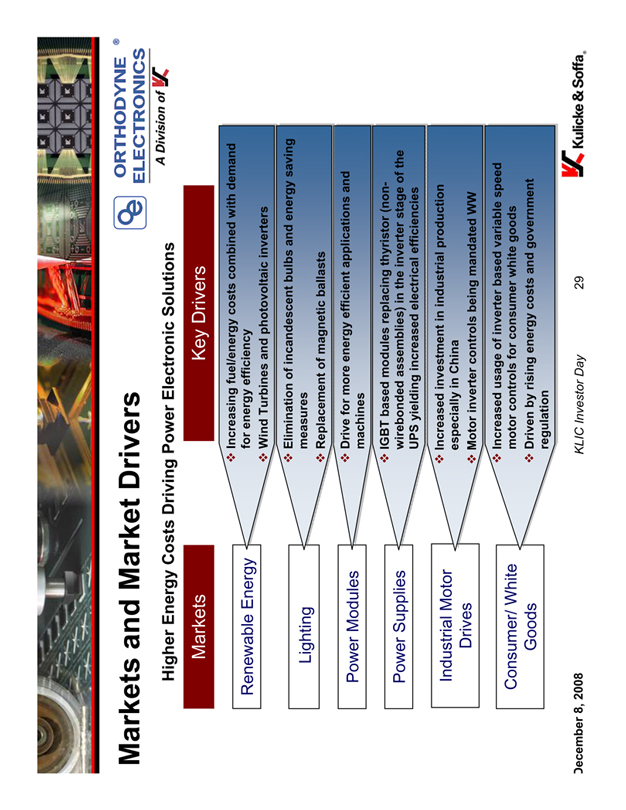

Markets and Market Drivers

ORTHODYNE ®

ELECTRONICS

A Division of

Higher Energy Costs Driving Power Electronic Solutions

Markets

Renewable Energy

Lighting Power Modules Power Supplies

Industrial Motor Drives

Consumer/ White Goods

Key Drivers

Increasing fuel/energy costs combined with demand for energy efficiency

Wind Turbines and photovoltaic inverters

Elimination of incandescent bulbs and energy saving measures

Replacement of magnetic ballasts

Drive for more energy efficient applications and machines

IGBT based modules replacing thyristor (non-wirebonded assemblies) in the inverter stage of the UPS yielding increased electrical efficiencies

Increased investment in industrial production especially in China Motor inverter controls being mandated WW

Increased usage of inverter based variable speed motor controls for consumer white goods

Driven by rising energy costs and government regulation

December 8, 2008 KLIC Investor Day 29

Kulicke & Soffa®

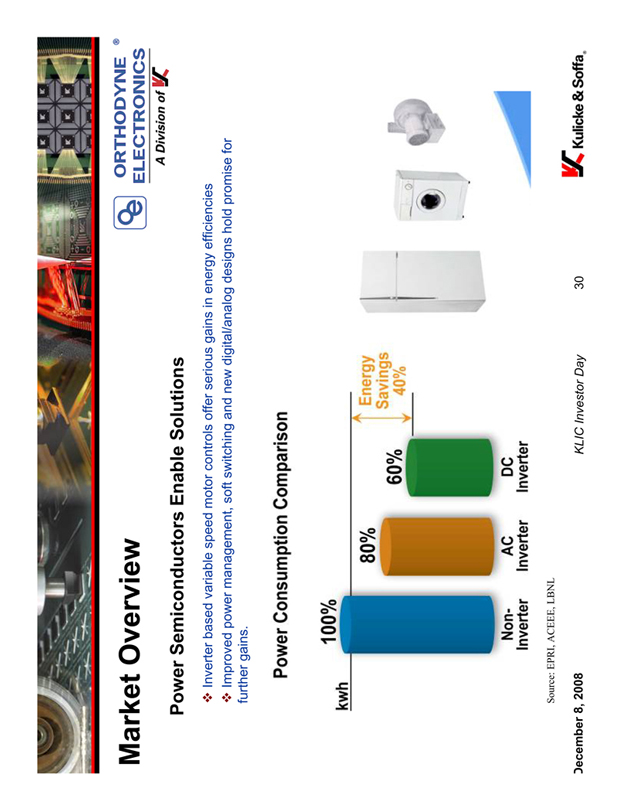

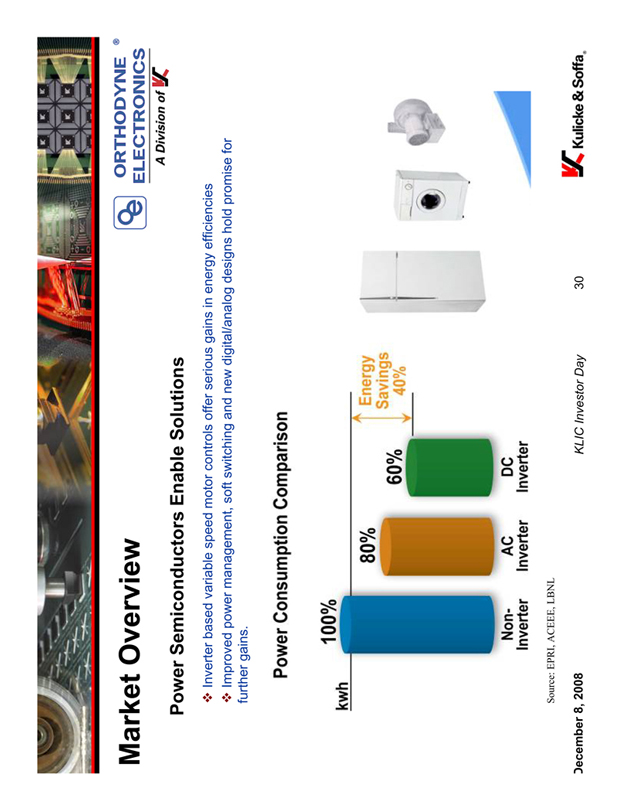

Market Overview

ORTHODYNE ® ELECTRONICS

A Division of

Power Semiconductors Enable Solutions

Inverter based variable speed motor controls offer serious gains in energy efficiencies

Improved power management, soft switching and new digital/analog designs hold promise for further gains.

Power Consumption Comparison

kwh

100%

80%

60%

Energy Savings 40%

Non-Inverter

AC Inverter

DC Inverter

Source: EPRI, ACEEE, LBNL

December 8, 2008 KLIC Investor Day 30

Kulicke & Soffa®

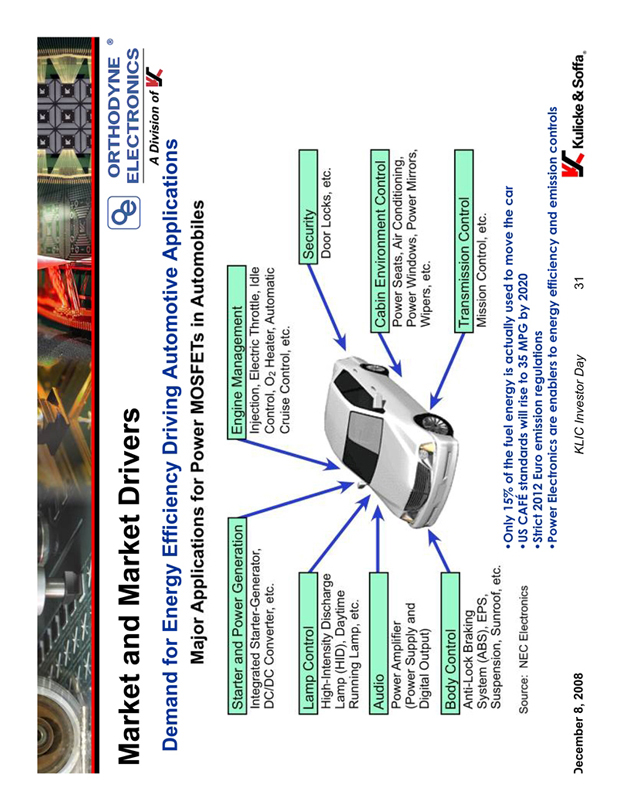

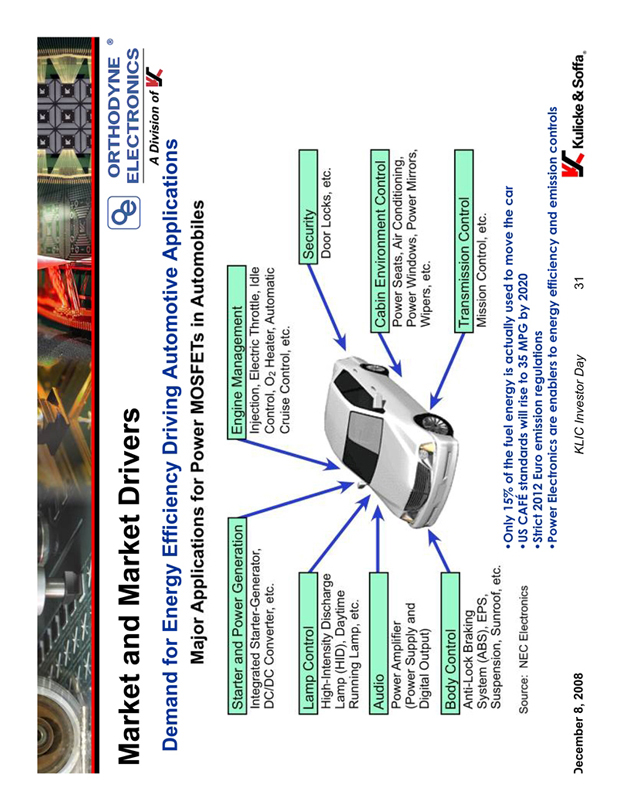

Market and Market Drivers

ORTHODYNE ® ELECTRONICS

A Division of

Demand for Energy Efficiency Driving Automotive Applications

Major Applications for Power MOSFETs in Automobiles

Starter and Power Generation

Integrated Starter-Generator, DC/DC Converter, etc.

Lamp Control

High-Intensity Discharge

Lamp (HID), Daytime

Running Lamp, etc.

Audio

Power Amplifier

(Power Supply and Digital Output)

Body Control

Anti-Lock Braking

Systems (ABS), EPS, Suspension, Sunroof, etc.

Engine Management

Injection, Electric Throttle, Idle Control, O2 Heater, Automatic Cruise Control, etc.

Security

Door Locks, etc.

Cabin Environment Control

Power Seats, Air Conditioning, Power Windows, Power Mirrors, Wiper, etc.

Transmission Control

Mission Control etc.

Source: NEC Electronics

Only 15% of the fuel energy is actually used to move the car

US CAFÉ standards will rise to 35 MPG by 2020

Strict 2012 Euro emission regulations

Power Electronics are enablers to energy efficiency and emission controls

December 8, 2008 KLIC Investor Day 31

Kulicke & Soffa®

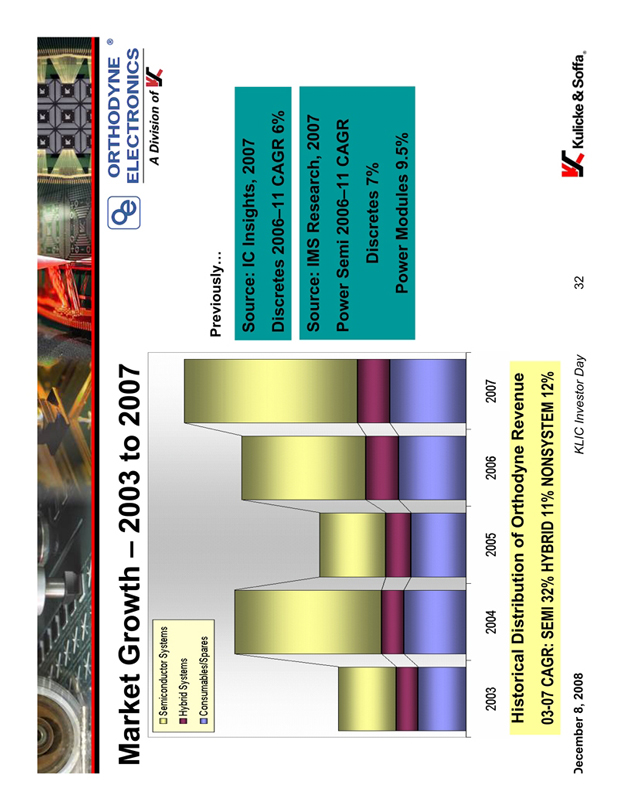

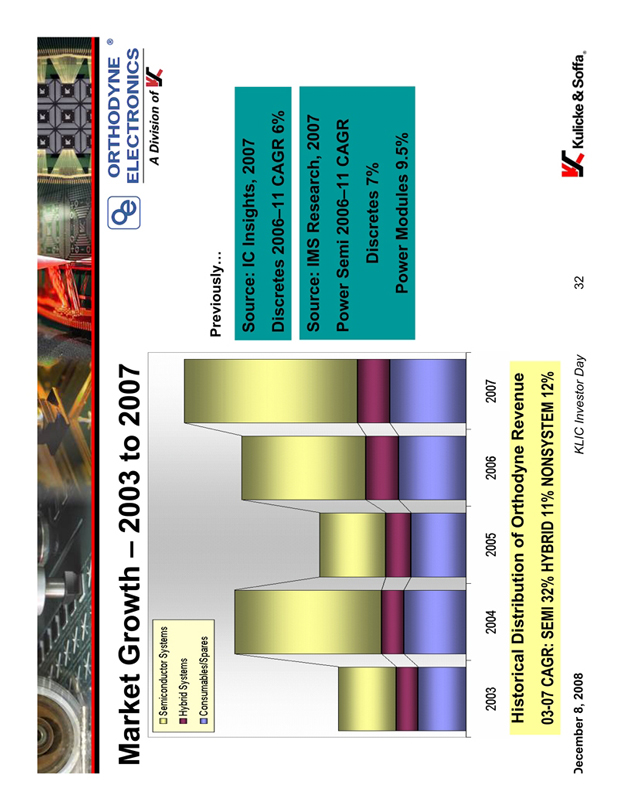

aket Growth – 2003 to 2007

ORTHODYNE ® ELECTRONICS

A Division of

Semiconductor Systems

Hybrid Systems

Consumables/Spares

2003

2004

2005

2006

2007

Historical Distribution of Orthodyne Revenue

03-07 CAGR: SEMI 32% HYBRID 11% NONSYSTEM 12%

Previously…

Source: IC Insights, 2007 Discretes 2006–11 CAGR 6%

Source: IMS Research, 2007 Power Semi 2006–11 CAGR

Discretes 7% Power Modules 9.5%

December 8, 2008 KLIC Investor Day 32

Kulicke & Soffa®

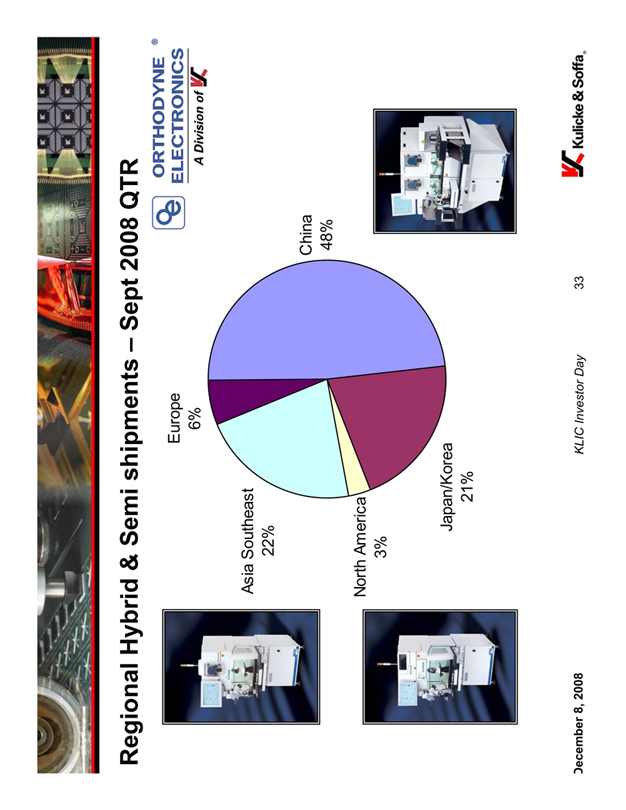

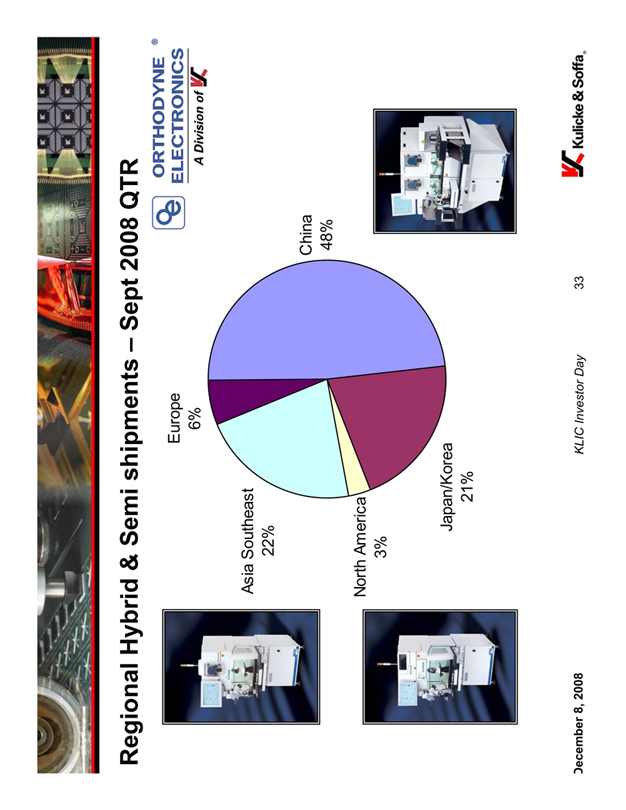

Regional Hybrid & Semi shipments – Sept 2008 QTR

ORTHODYNE ® ELECTRONICS

A Division of

Europe 6%

Asia Southeast 22%

North America 3%

Japan/Korea 21%

China 48%

December 8, 2008 KLIC Investor Day 33

Kulicke & Soffa®

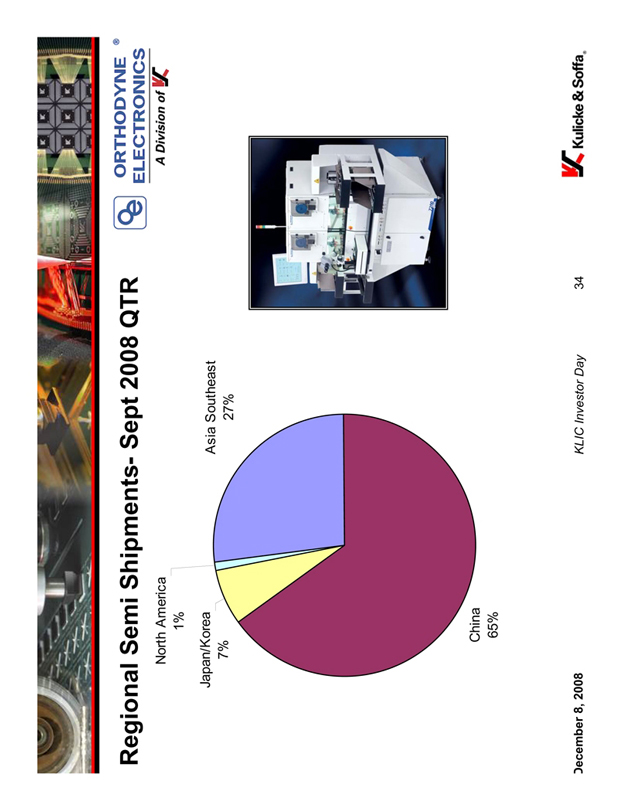

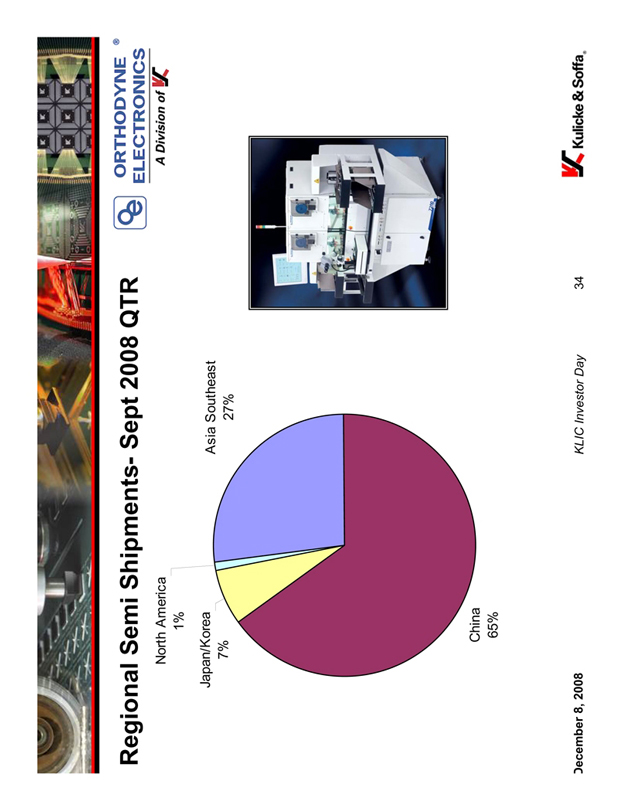

Regional Semi Shipments- Sept 2008 QTR

ORTHODYNE ® ELECTRONICS

A Division of

North America 1%

Japan/Korea 7%

China 65%

Asia Southeast 27%

December 8, 2008 KLIC Investor Day 34

Kulicke & Soffa®

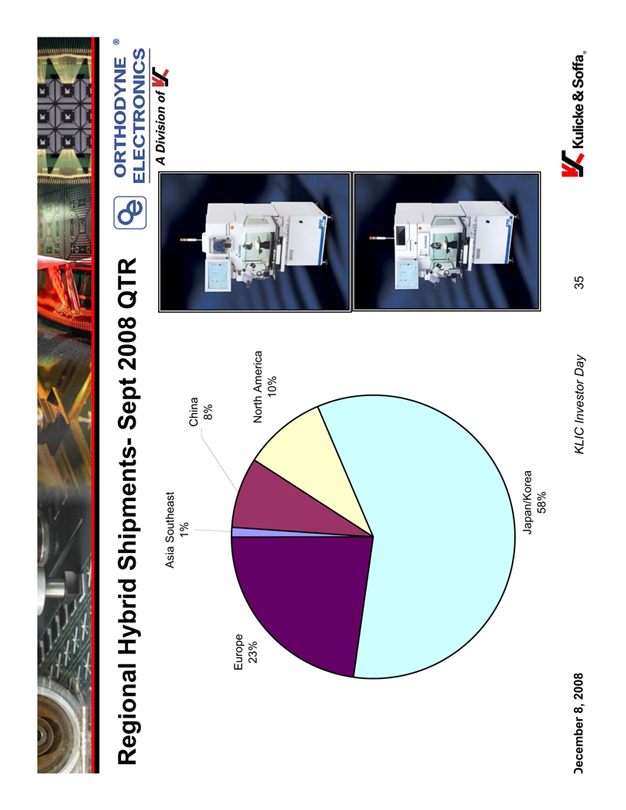

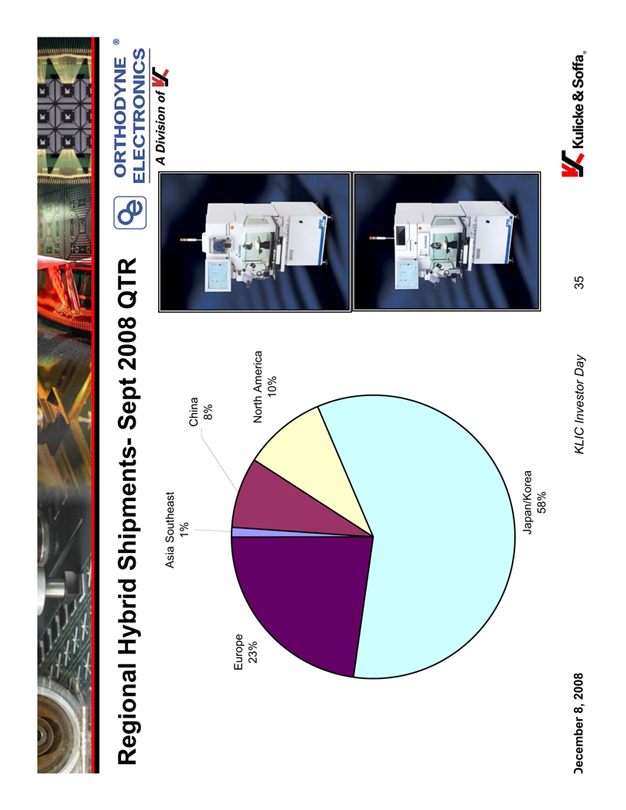

Regional Hybrid Shipments- Sept 2008 QTR

ORTHODYNE ® ELECTRONICS

A Division of

Asia Southeast 1%

Europe 23%

Japan/Korea 58%

China 8%

North America 10%

December 8, 2008

KLIC Investor Day 35

Kulicke & Soffa®

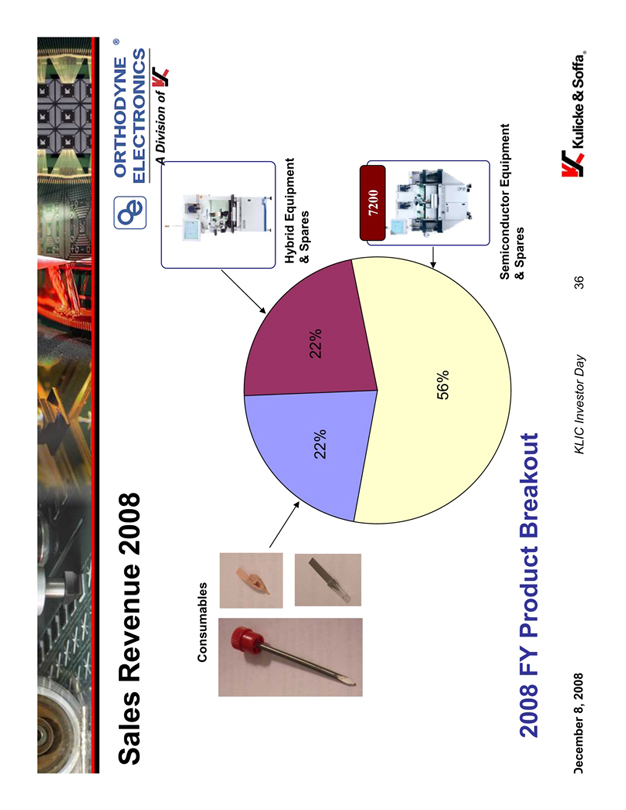

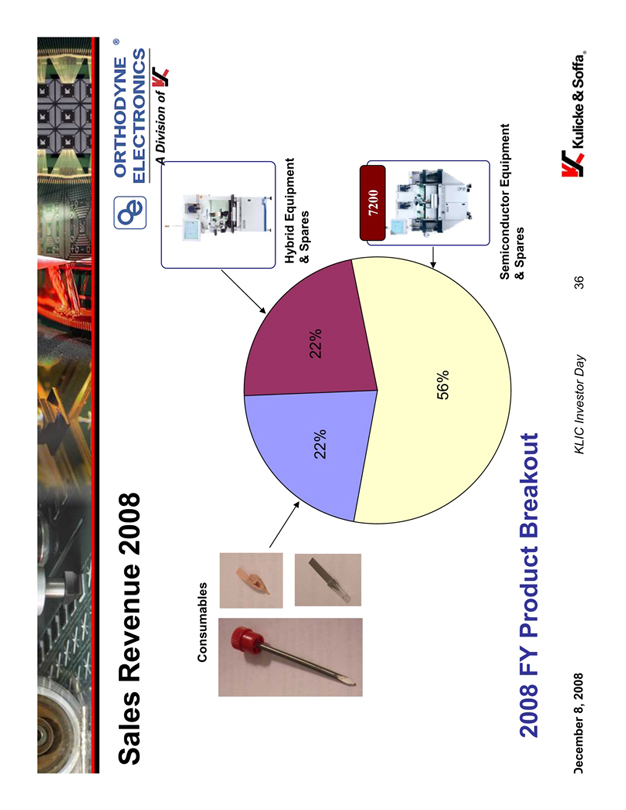

Sales Revenue 2008

ORTHODYNE ® ELECTRONICS

A Division of

Consumables

22%

22%

56%

Hybrid Equipment

& Spares

Semiconductor Equipment

& Spares

2008 FY Product Breakout

December 8, 2008 KLIC Investor Day 36

Kulicke & Soffa®

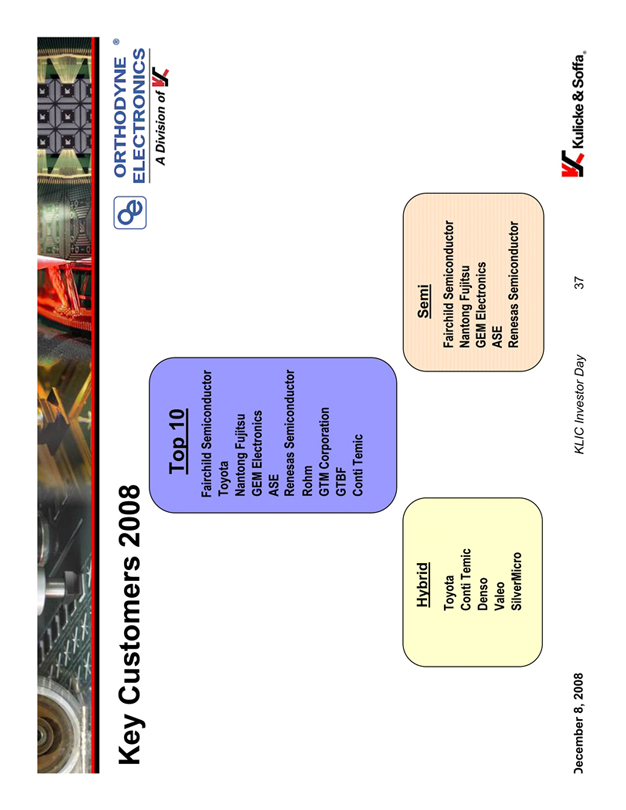

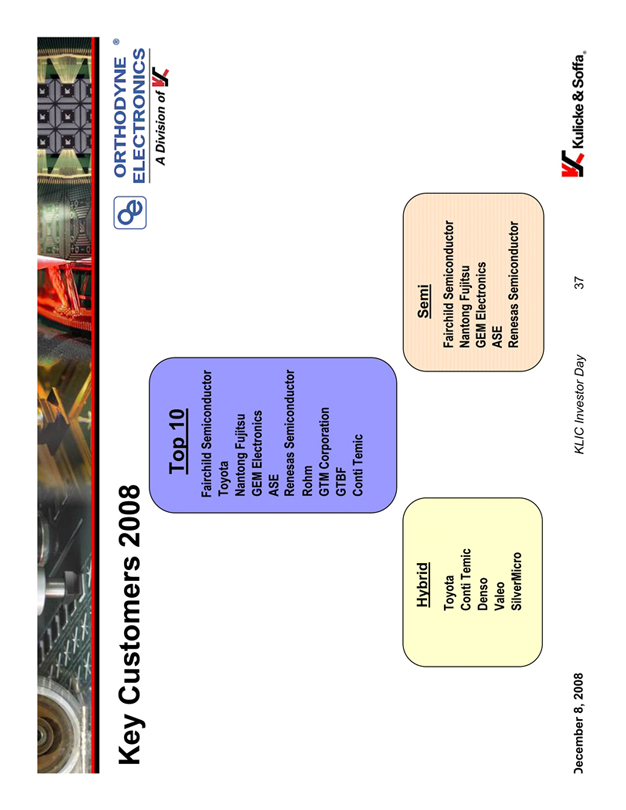

Key Customers 2008

ORTHODYNE ® ELECTRONICS

A Division of

Top 10

Fairchild Semiconductor

Toyota

Nantong Fujitsu

GEM Electronics

ASE

Renesas Semiconductor

Rohm

GTM Corporation

GTBF

Conti Temic

Hybrid

Toyota

Conti Temic

Denso

Valeo

SilverMicro

Semi

Fairchild Semiconductor

Nantong Fujitsu

GEM Electronics

ASE

Renesas Semiconductor

December 8, 2008 KLIC Investor Day 37

Kulicke & Soffa®

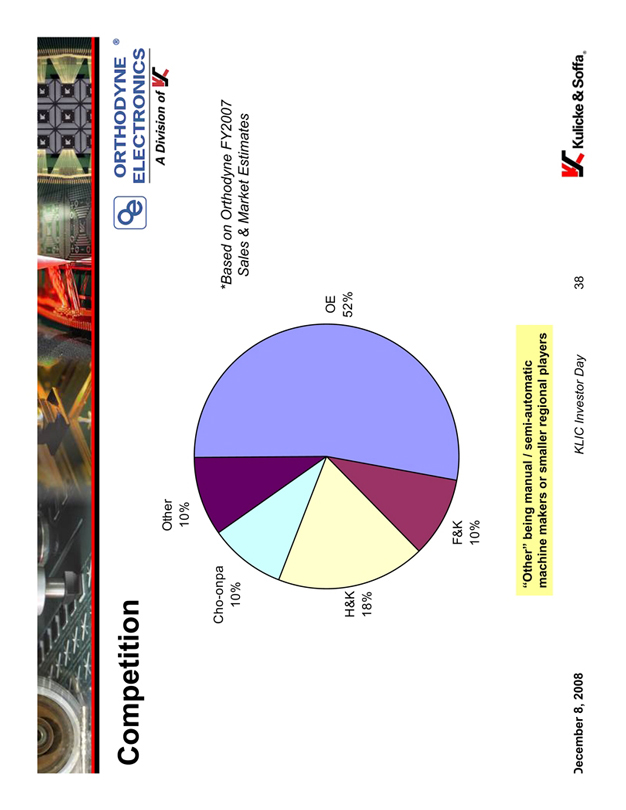

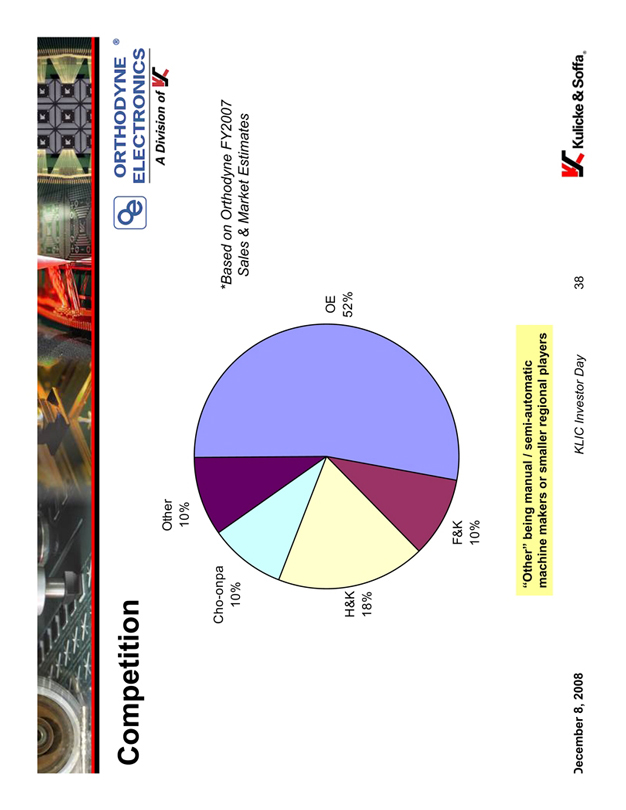

Competition

ORTHODYNE ®

ELECTRONICS

A Division of

Other 10%

Cho-onpa 10%

H&K 18%

F&K 10%

OE 52%

*Based on Orthodyne FY2007 Sales & Market Estimates

“Other” being manual / semi-automatic machine makers or smaller regional players

December 8, 2008 KLIC Investor Day 38 Kulicke & Soffa®

Product Overview

7200Plus

Multi-head Power

Semiconductor wedge wire bonder with leadframe handler.

Large Wire

Small Wire

Ribbon

3600PLus

Hybrid wire wedge bonder, with automatic handler options

Large Wire

Ribbon

3700Plus

Hybrid wedge wire bonder, with automatic handler options

Small Wire

PowerRibbon®

PowerRibbon™ combines the flexibility and robustness of the large aluminum wire bonding process with higher productivity and performance.

ORTHODYNE ®

ELECTRONICS

For more than 40 years, Orthodyne Electronics has been a leader in the design, manufacture and marketing of wire bonding equipment for the semiconductor, automotive, and industrial markets worldwide. Orthodyne currently manufactures wire bonders that ultrasonically weld aluminum wires ranging from 1.0-20 mil/25-500 microns in diameter.

Model 20

Manual Wedge wire bonder

Large Wire

Small Wire

Ribbon

Consumables/Spares/ After Sales Services

7600

Single Head Power Semiconductor wedge wire bonder with leadframe handler.

Large Wire

Small Wire

Ribbon

December 8, 2008 KLIC Investor Day 39 Kulicke & Soffa®

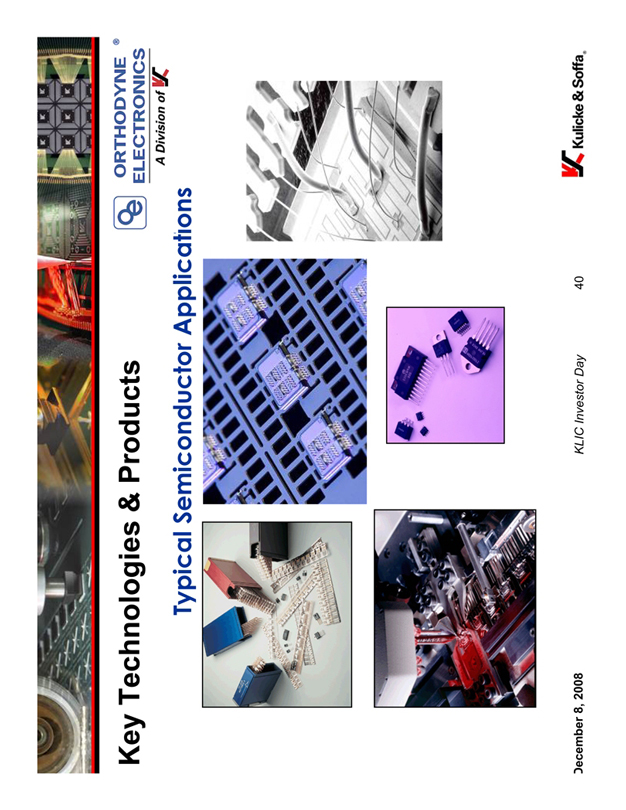

Key Technologies & Products

ORTHODYNE ®

ELECTRONICS

A Division of

Typical Semiconductor Applications

December 8, 2008 KLIC Investor Day 40 Kulicke & Soffa®

Key Technologies & Products

ORTHODYNE ®

ELECTRONICS

A Division of

7200 Plus with Large Wire, Small Wire and Ribbon Bonding

ORTHODYNE ®

ELECTRONICS

December 8, 2008 KLIC Investor Day 41 Kulicke & Soffa®

Market Overview

ORTHODYNE ®

ELECTRONICS

A Division of

Hybrid Packaging Examples

Alternate Energy Generation, Conversion – Inverter modules for Solar, Wind power, Solar Panel Interconnects

Hybrid vehicle transportation – Power conversion, battery management, electronic controls and regulation for Hybrid, Fuel Cell and Electric Cars, E-Bikes, and other forms of transport.

Industrial – Motor control modules for heating / cooling, pumps, lighting, automation, power suppliers / distribution etc.

Automotive – Engine control modules, Passenger convenience, Safety, Entertainment, Navigation, Diagnostics

Medical – Pacemakers

Aerospace – Flight / Guidance controls, safety, engine management, passenger convenience / entertainment, heating / cooling , pumps, lighting

Consumer White Goods – Power Supply, Power Management, Motor Inverter Modules, etc.

December 8, 2008 KLIC Investor Day 42 Kulicke & Soffa®

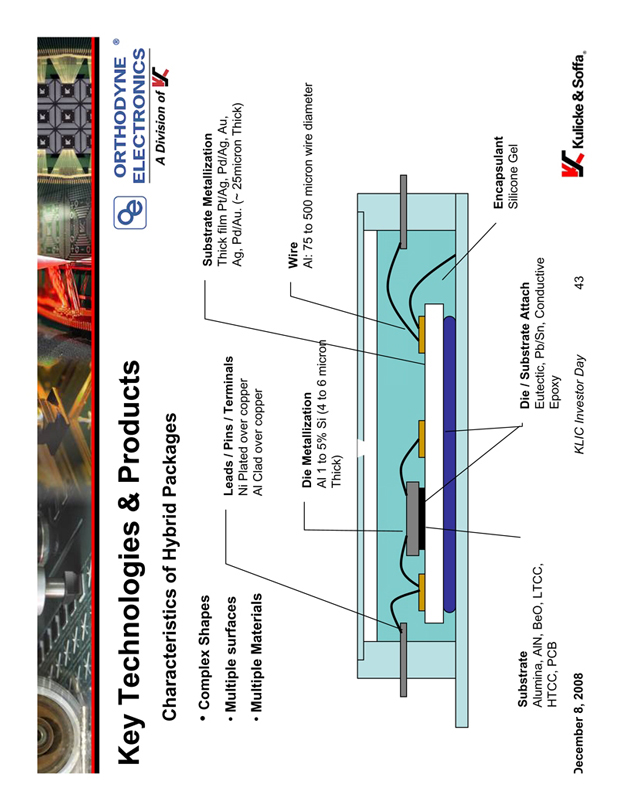

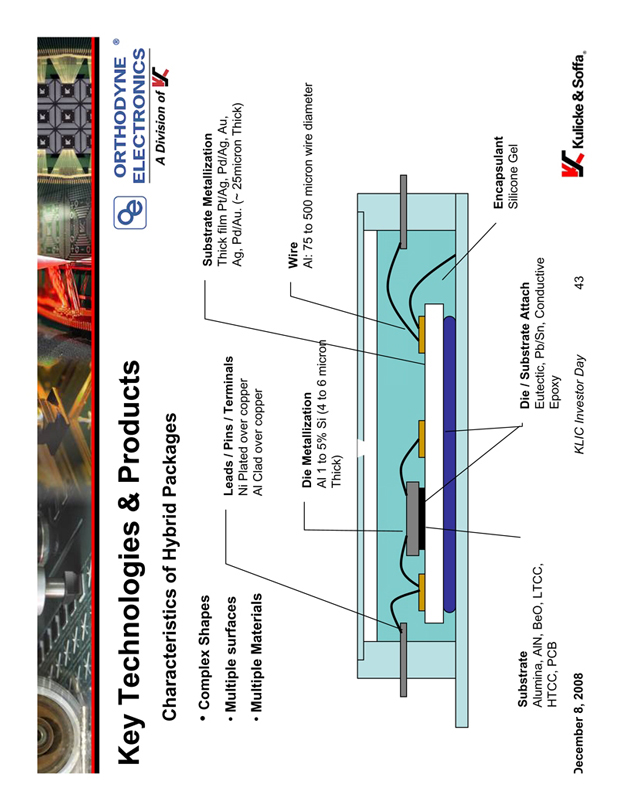

Key Technologies & Products

ORTHODYNE ®

ELECTRONICS

A Division of

Characteristics of Hybrid Packages

Complex Shapes

Multiple surfaces

Multiple Materials

Leads / Pins / Terminals

Ni Plated over copper Al Clad over copper

Die Metallization

Al 1 to 5% Si (4 to 6 micron Thick)

Substrate Metallization

Thick film Pt/Ag, Pd/Ag, Au, Ag, Pd/Au. (~ 25micron Thick)

Wire

Al: 75 to 500 micron wire diameter

Substrate

Alumina, AlN, BeO, LTCC, HTCC, PCB

Die / Substrate Attach

Eutectic, Pb/Sn, Conductive Epoxy

Encapsulant

Silicone Gel

December 8, 2008 KLIC Investor Day 43 Kulicke & Soffa®

Key Technologies & Products

ORTHODYNE ®

ELECTRONICS

A Division of

3600 Plus Bonding Power Conversion / Inverter Modules

Solar Wind power conversion modules, Hybrid Vehicles Modules, Motor AC/DC Controllers, Inverter Modules, Smart Pump Modules

December 8, 2008 KLIC Investor Day 44 Kulicke & Soffa®

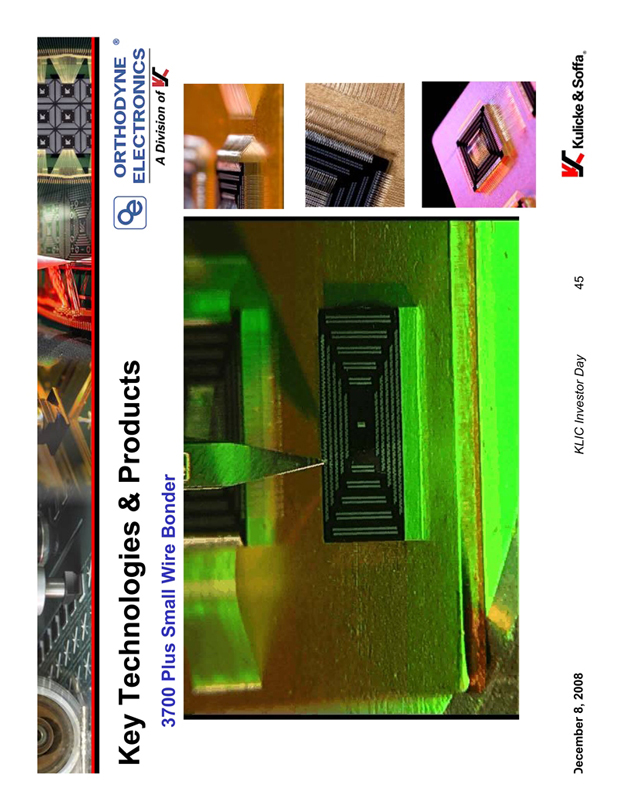

Key Technologies & Products

ORTHODYNE ®

ELECTRONICS

A Division of

3700 Plus Small Wire Bonder

December 8, 2008 KLIC Investor Day 45 Kulicke & Soffa®

Key Technologies & Products

ORTHODYNE ®

ELECTRONICS

A Division of

Power Ribbon Advantages - Hybrid Modules

More Power – Fewer Connections

Increased Productivity

Increased Connection Robustness

Increased Die Performance

Increased Connection Reliability

Lower Cost

10 Large Wire Wedge Bonds

Replaced with 4 Large Ribbon Bonds

December 8, 2008 KLIC Investor Day 46 Kulicke & Soffa®

Key Technologies & Products

ORTHODYNE ®

ELECTRONICS

A Division of

3600 Plus Ribbon Bonder

Power Interconnects for Power Hybrids, Power Semiconductors, Solar Panels, etc.

December 8, 2008 KLIC Investor Day 47 Kulicke & Soffa®

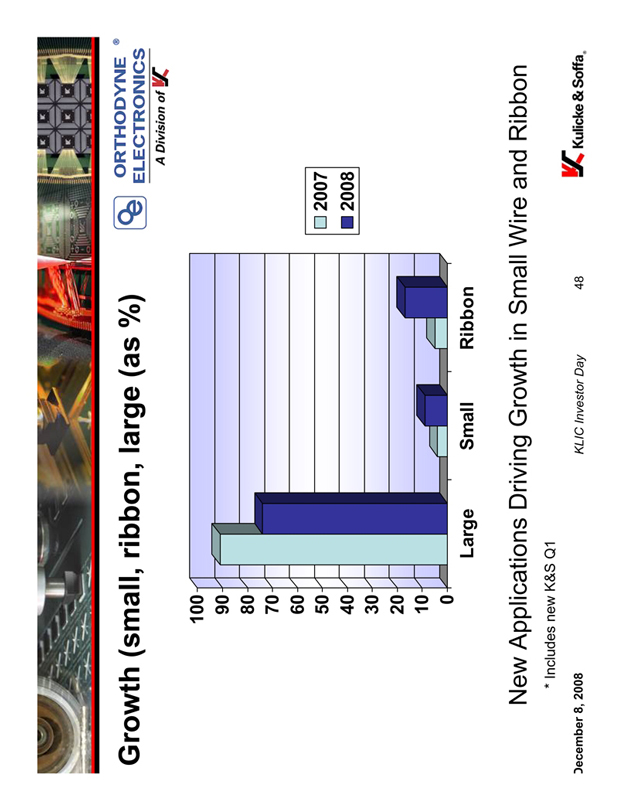

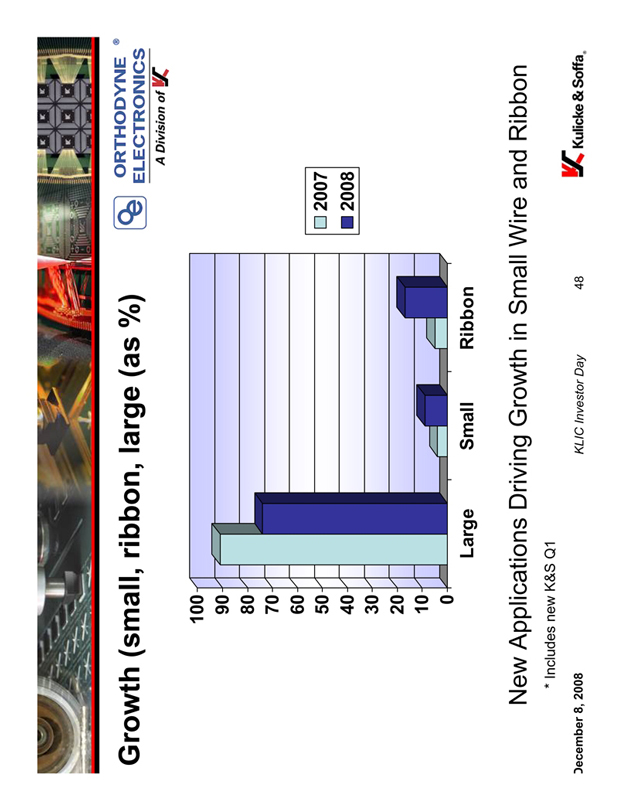

Growth (small, ribbon, large (as %)

ORTHODYNE ®

ELECTRONICS

A Division of

100 90 80 70 60 50 40 30 20 10 0

Large Small Ribbon

2007 2008

New Applications Driving Growth in Small Wire and Ribbon

* Includes new K&S Q1

December 8, 2008 KLIC Investor Day 48 Kulicke & Soffa®

7600 Product Launch

ORTHODYNE ®

ELECTRONICS

A Division of

Product launch at Semicon Japan

First ‘Beta’ site with Renesas Kofu.

Application: SRPF (Diode) Reel–to–Reel

General Sales Order Availability for 7600: March 2009

Target Applications:

High Density, small power packages such as SO8, PQFN, Multi chip

Leadframe Handling Options:

Magazine–to–Magazine and Reel-to–Reel

2009 sales potentials: Renesas, Panasonic, Rohm, Mitsubishi

December 8, 2008 KLIC Investor Day 49 Kulicke & Soffa®

Consumable Sales Overview

ORTHODYNE ®

ELECTRONICS

A Division of

Wedge Bonding equipment generate ongoing consumable sales opportunities. These consumables are typically designed to address a given wire, bond pad size, or package clearance requirement.

Wire Cutter

Cuts the wire at a precise location and with a tightly controlled force

Bond Tool

Ultrasonically bonds wire to surface by transferring the ultrasonic energy

Wire Guide

Guides and places the wire at a required location for bonding

December 8, 2008 KLIC Investor Day 50 Kulicke & Soffa®

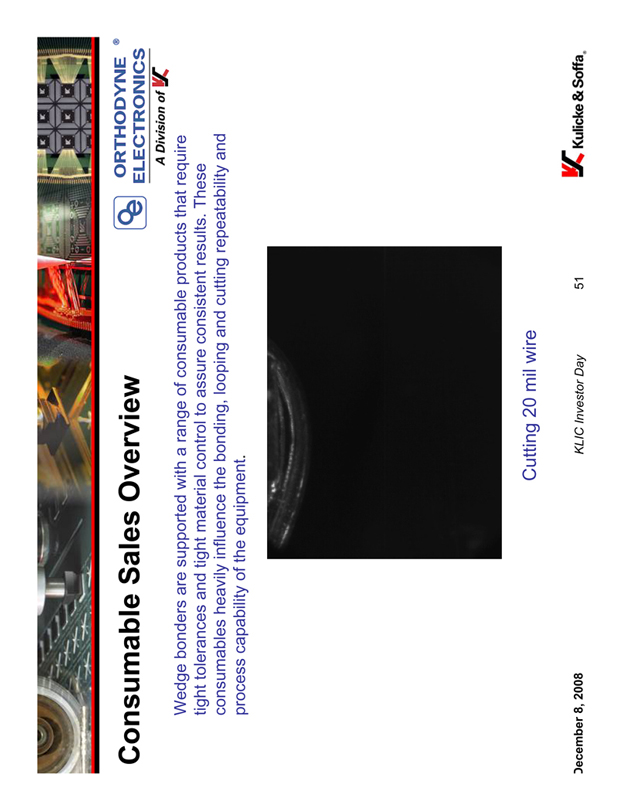

Consumable Sales Overview

ORTHODYNE ®

ELECTRONICS

A Division of

Wedge bonders are supported with a range of consumable products that require tight tolerances and tight material control to assure consistent results. These consumables heavily influence the bonding, looping and cutting repeatability and process capability of the equipment.

Cutting 20 mil wire

December 8, 2008 KLIC Investor Day 51 Kulicke & Soffa®

Highlights

ORTHODYNE ®

ELECTRONICS

A Division of

Strong Products & Brand Recognition

High Market Share

Market Acceptance of Newly Introduced Equipment VLSI Customer Recognition

Diverse Revenue Stream

Semiconductor Equipment Market

Hybrid Equipment Market

Consumables & Spares

Good Market Drivers

Energy Efficiency

Clean Reliable Interconnect

Strong Investment into Emerging Markets

Ribbon as an Interconnect

Solar

Power LED

December 8, 2008 KLIC Investor Day 52 Kulicke & Soffa®

Visit us at

www.kns.com

Financial Overview

Confidential Name Kulicke & Soffa®

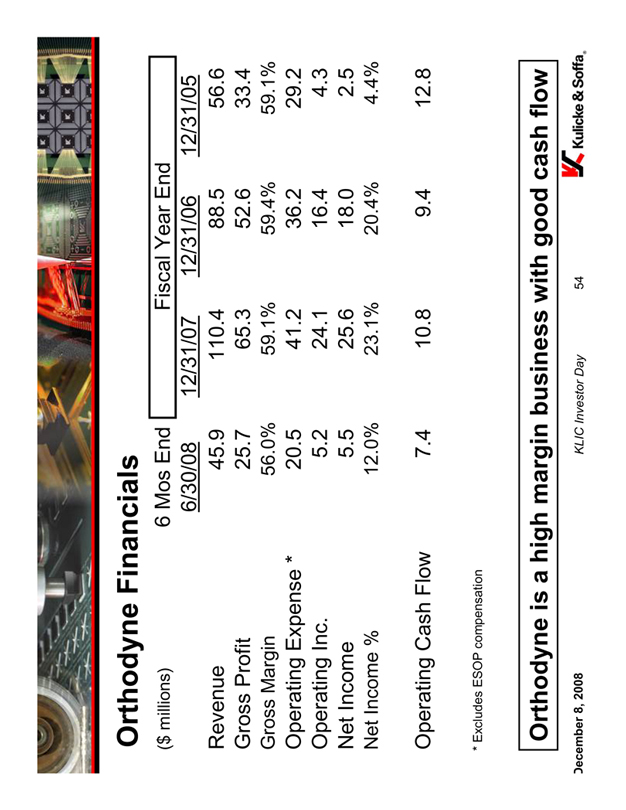

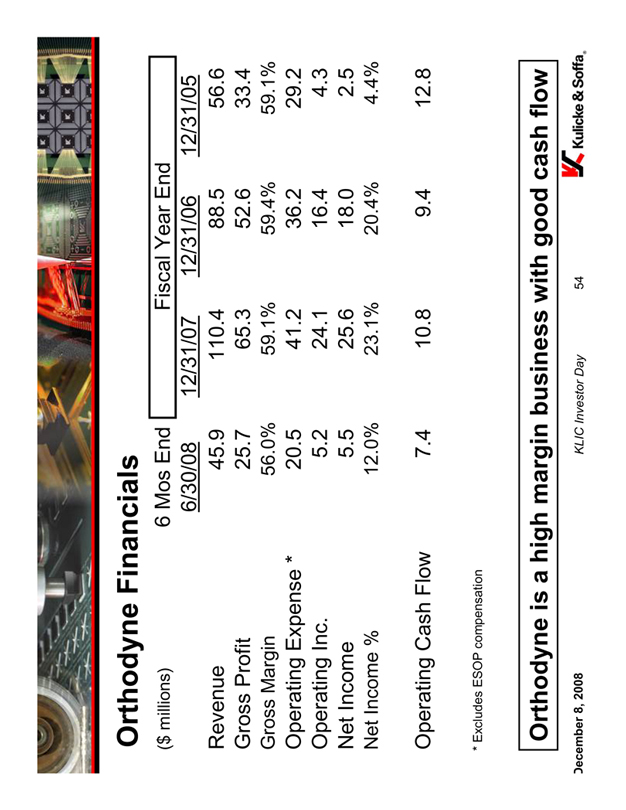

Orthodyne Financials

($ millions) 6 Mos End Fiscal Year End

6/30/08 12/31/07 12/31/06 12/31/05

Revenue 45.9 110.4 88.5 56.6

Gross Profit 25.7 65.3 52.6 33.4

Gross Margin 56.0% 59.1% 59.4% 59.1%

Operating Expense * 20.5 41.2 36.2 29.2

Operating Inc. 5.2 24.1 16.4 4.3

Net Income 5.5 25.6 18.0 2.5

Net Income % 12.0% 23.1% 20.4% 4.4%

Operating Cash Flow 7.4 10.8 9.4 12.8

* Excludes ESOP compensation

Orthodyne is a high margin business with good cash flow

December 8, 2008 KLIC Investor Day 54 Kulicke & Soffa®

K&S Before & After

K&S with Wire K&S less Wire plus OE **

($ millions) 9 Mos End FY 9 Mos End FY

6/28/08 9/29/07 6/28/08 9/29/07

Revenue * 582.7 700.4 343.6 480.9

Gross Profit 131.2 181.2 152.6 220.9

Gross Margin 22.5% 25.9% 44.4% 45.9%

Operating Exp. 112.0 139.1 139.8 173.1

Operating Inc. 19.0 42.1 12.5 47.9

Net Income 17.6 40.1 12.6 42.6

Net Income % 3.0% 5.7% 3.7% 8.9%

Working Capital 163.3 119.7

* Includes $283 million and $292 gold pass through in 2008 and 2007, respectively

** Excludes Orthodyne pro forma adjustments

*** Accounts Receivable plus inventory minus accounts payable

All K&S amounts adjusted for non-GAAP items

December 8, 2008 KLIC Investor Day 55 Kulicke & Soffa®

Liquidity Analysis

$(000,000)

2008 Ending Cash Balance 184

Net cash from transactions 70

.5% Notes (paid in November) (72)

2009 Cash from operations (64)

2009 CapX (5)

2009 Misc 1 Time Cash payments (20)

2009 Working Capital Change 42

2009 End of Year Cash 135

Table includes management’s estimates for expenses, cash flows, and cash balances in the event that revenue levels for the last 3 quarters of FY2009 stay approximately the same as the revenue forecast for the current quarter. FY 2009 revenue levels included in the table are only a “what if” scenario for management’s planning purposes and are not management’s expectations for FY 2009 revenue. Due to limited visibility for bonder demand, we can not offer revenue projections beyond the current fiscal quarter.

December 8, 2008 KLIC Investor Day 56 Kulicke & Soffa®

Liquidity Analysis

$(000,000)

2008 Ending Cash Balance 184

Net cash from transactions 70

.5% Notes (paid in November) (72)

2009 Cash from operations (64)

2009 CapX (5)

2009 Misc 1 Time Cash payments (20)

2009 Working Capital Change 42

2009 End of Year Cash 135

These first three items are complete, both transactions closed in early October and the .5% notes were repaid during the quarter

Table includes management’s estimates for expenses, cash flows, and cash balances in the event that revenue levels for the last 3 quarters of FY2009 stay approximately the same as the revenue forecast for the current quarter. FY 2009 revenue levels included in the table are only a “what if” scenario for management’s planning purposes and are not management’s expectations for FY 2009 revenue. Due to limited visibility for bonder demand, we can not offer revenue projections beyond the current fiscal quarter.

December 8, 2008 KLIC Investor Day 57 Kulicke & Soffa®

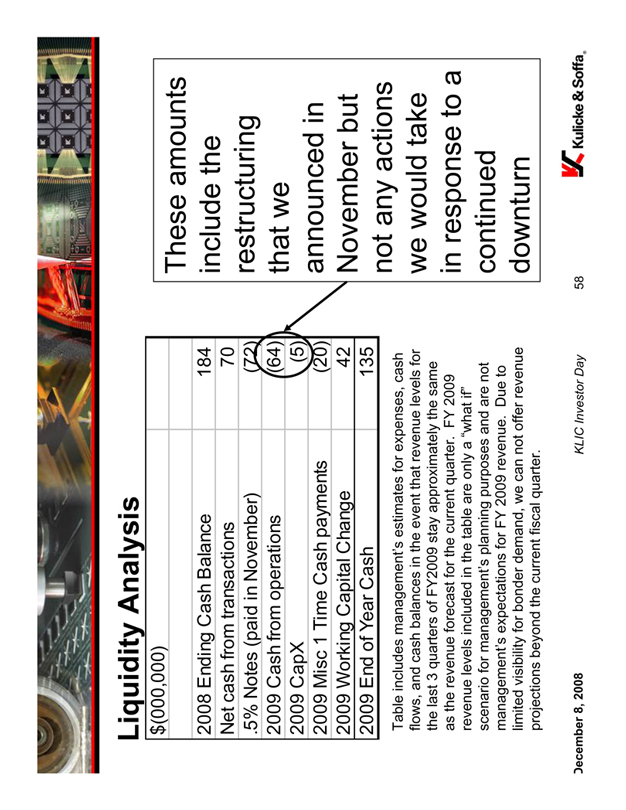

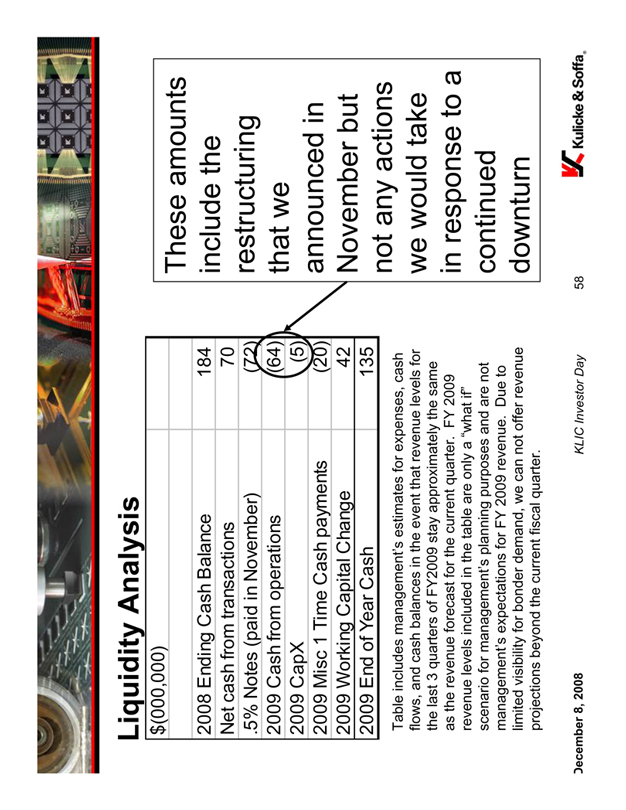

Liquidity Analysis

$(000,000)

2008 Ending Cash Balance 184

Net cash from transactions 70

.5% Notes (paid in November) (72)

2009 Cash from operations (64)

2009 CapX (5)

2009 Misc 1 Time Cash payments (20)

2009 Working Capital Change 42

2009 End of Year Cash 135

These amounts include the restructuring that we announced in November but not any actions we would take in response to a continued downturn

Table includes management’s estimates for expenses, cash flows, and cash balances in the event that revenue levels for the last 3 quarters of FY2009 stay approximately the same as the revenue forecast for the current quarter. FY 2009 revenue levels included in the table are only a “what if” scenario for management’s planning purposes and are not management’s expectations for FY 2009 revenue. Due to limited visibility for bonder demand, we can not offer revenue projections beyond the current fiscal quarter.

December 8, 2008 KLIC Investor Day 58 Kulicke & Soffa®

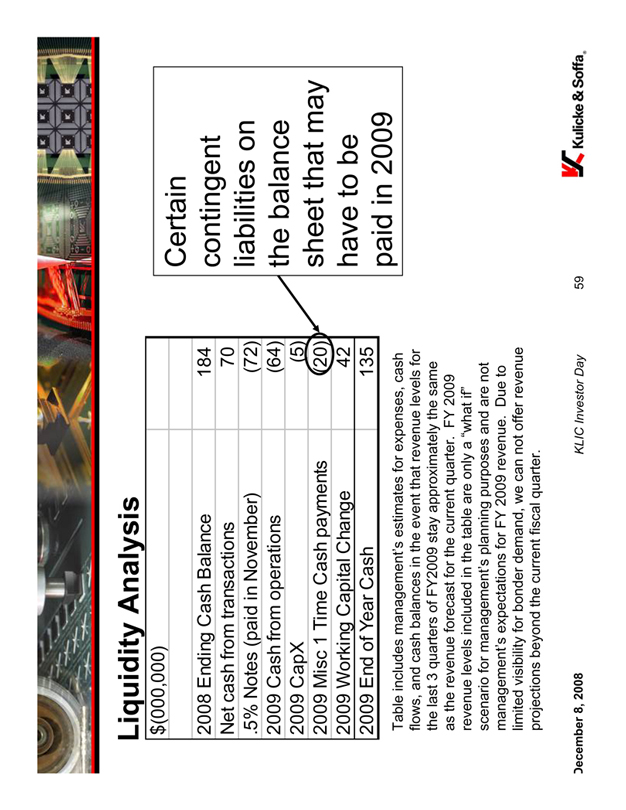

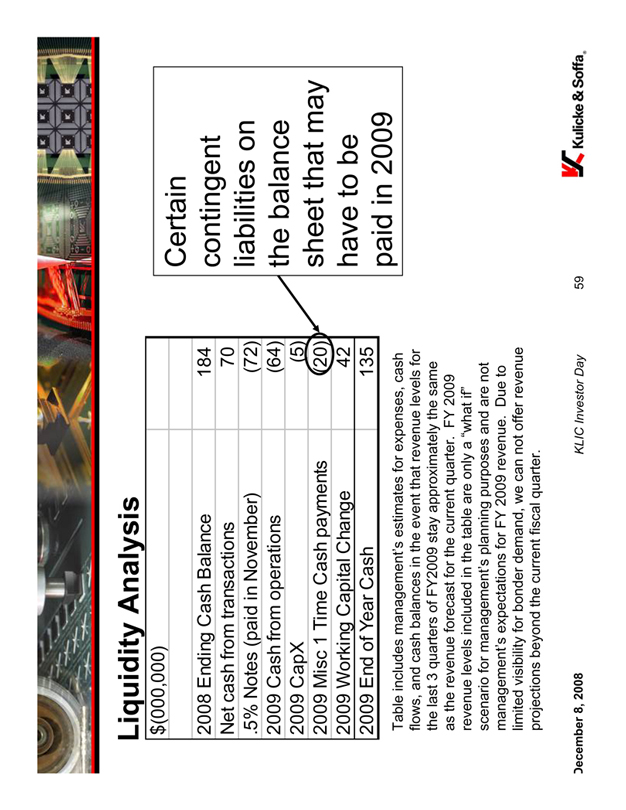

Liquidity Analysis

$(000,000)

2008 Ending Cash Balance 184

Net cash from transactions 70

.5% Notes (paid in November) (72)

2009 Cash from operations (64)

2009 CapX (5)

2009 Misc 1 Time Cash payments (20)

2009 Working Capital Change 42

2009 End of Year Cash 135

Certain contingent liabilities on the balance sheet that may have to be paid in 2009

Table includes management’s estimates for expenses, cash flows, and cash balances in the event that revenue levels for the last 3 quarters of FY2009 stay approximately the same as the revenue forecast for the current quarter. FY 2009 revenue levels included in the table are only a “what if” scenario for management’s planning purposes and are not management’s expectations for FY 2009 revenue. Due to limited visibility for bonder demand, we can not offer revenue projections beyond the current fiscal quarter.

December 8, 2008 KLIC Investor Day 59 Kulicke & Soffa®

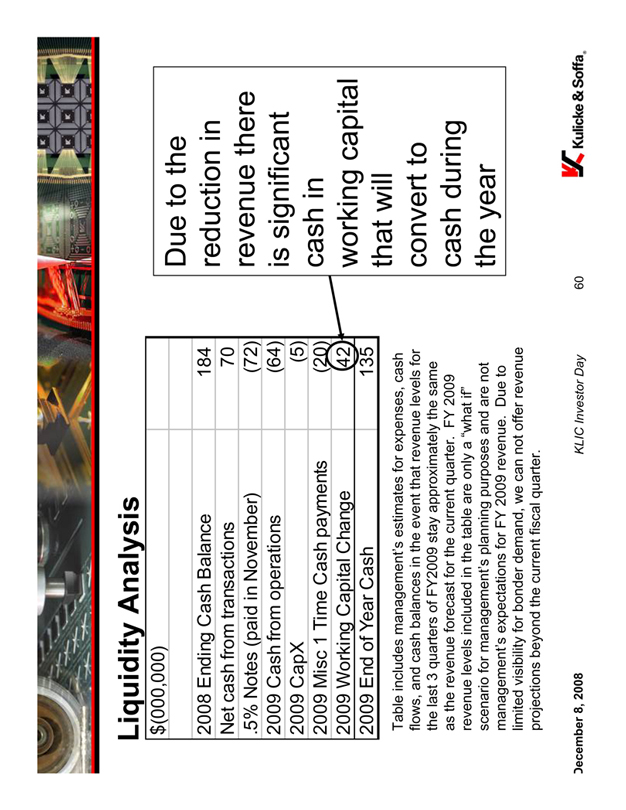

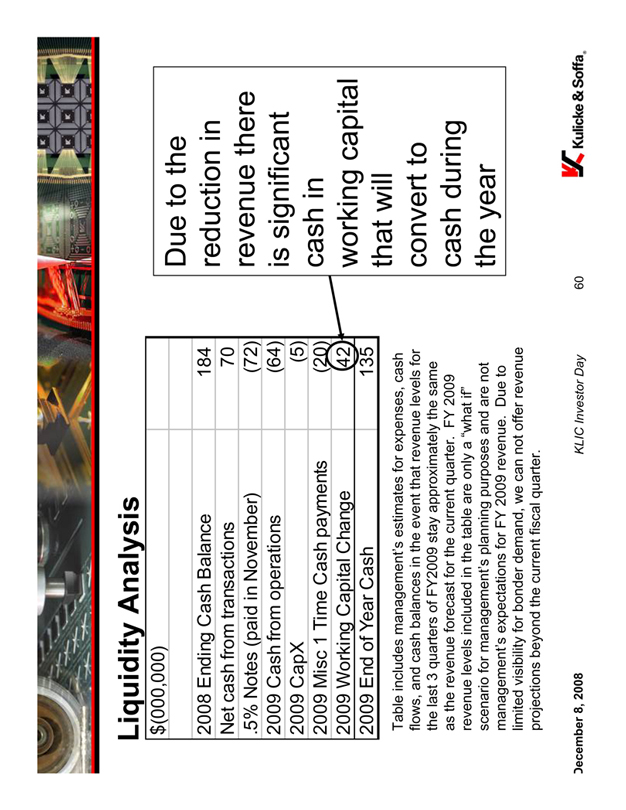

Liquidity Analysis

$(000,000)

2008 Ending Cash Balance 184

Net cash from transactions 70

.5% Notes (paid in November) (72)

2009 Cash from operations (64)

2009 CapX (5)

2009 Misc 1 Time Cash payments (20)

2009 Working Capital Change 42

2009 End of Year Cash 135

Due to the reduction in revenue there is significant cash in working capital that will convert to cash during the year

Table includes management’s estimates for expenses, cash flows, and cash balances in the event that revenue levels for the last 3 quarters of FY2009 stay approximately the same as the revenue forecast for the current quarter. FY 2009 revenue levels included in the table are only a “what if” scenario for management’s planning purposes and are not management’s expectations for FY 2009 revenue. Due to limited visibility for bonder demand, we can not offer revenue projections beyond the current fiscal quarter.

December 8, 2008 KLIC Investor Day 60 Kulicke & Soffa®

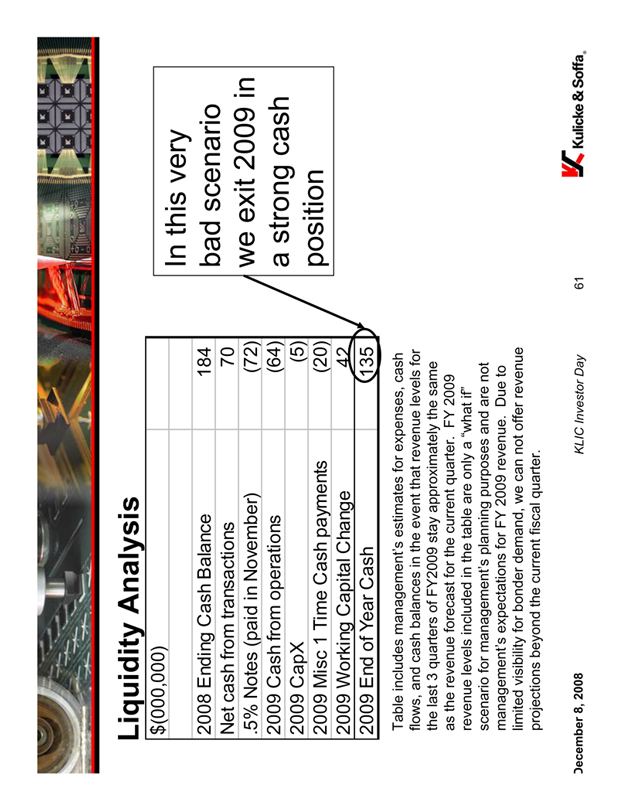

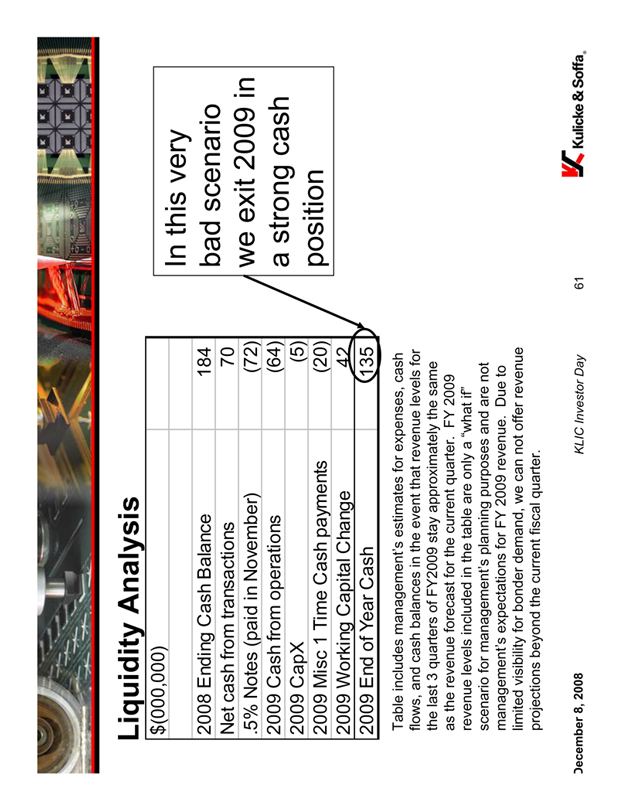

Liquidity Analysis

$(000,000)

2008 Ending Cash Balance 184

Net cash from transactions 70

.5% | | Notes (paid in November) (72) |

2009 Cash from operations (64)

2009 CapX (5)

2009 Misc 1 Time Cash payments (20)

2009 Working Capital Change 42

2009 End of Year Cash 135

In this very bad scenario we exit 2009 in a strong cash position

Table includes management’s estimates for expenses, cash flows, and cash balances in the event that revenue levels for the last 3 quarters of FY2009 stay approximately the same as the revenue forecast for the current quarter. FY 2009 revenue levels included in the table are only a “what if” scenario for management’s planning purposes and are not management’s expectations for FY 2009 revenue. Due to limited visibility for bonder demand, we can not offer revenue projections beyond the current fiscal quarter.

December 8, 2008 KLIC Investor Day 61 Kulicke & Soffa®

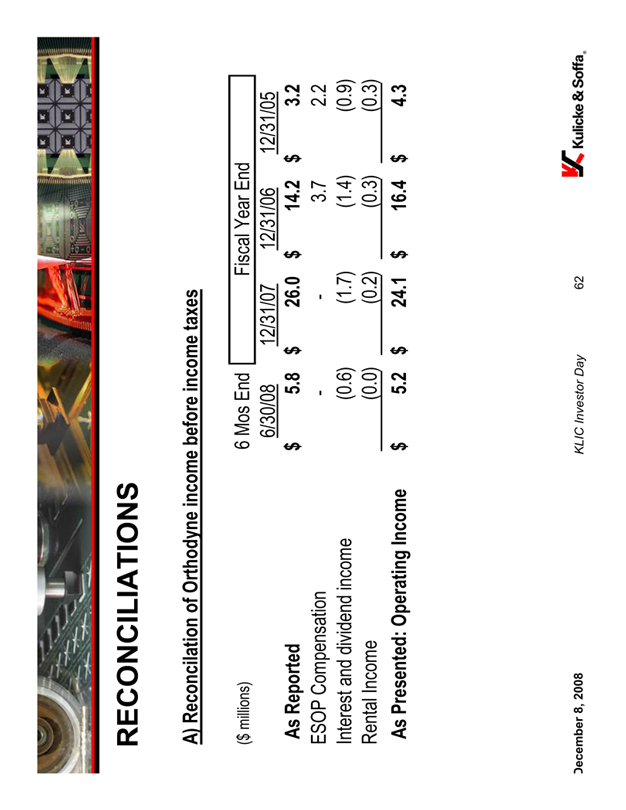

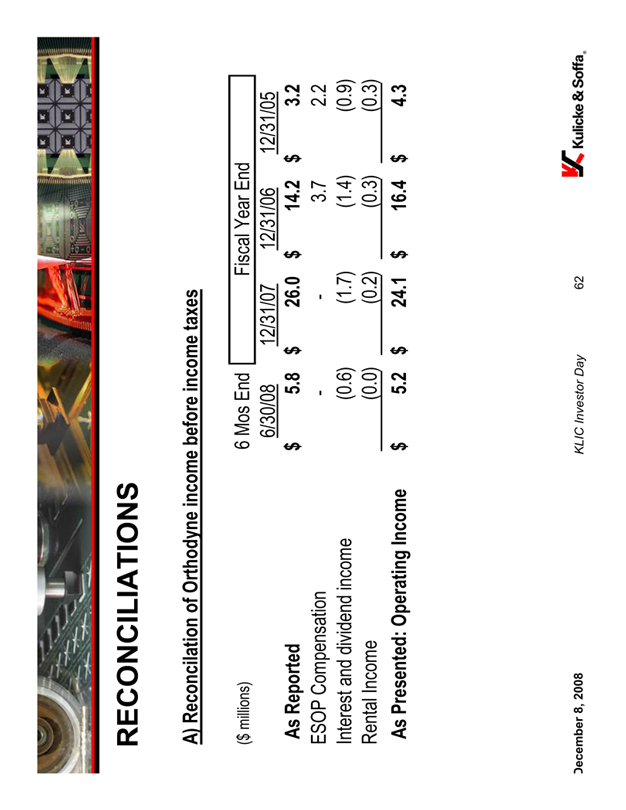

RECONCILIATIONS

A) Reconcilation of Orthodyne income before income taxes

($ millions) 6 Mos End Fiscal Year End

6/30/08 12/31/07 12/31/06 12/31/05

As Reported $5.8 $26.0 $14.2 $3.2

ESOP Compensation - - 3.7 2.2

Interest and dividend income (0.6) (1.7) (1.4) (0.9)

Rental Income (0.0) (0.2) (0.3) (0.3)

As Presented: Operating Income $5.2 $24.1 $16.4 $4.3

December 8, 2008 KLIC Investor Day 62 Kulicke & Soffa®

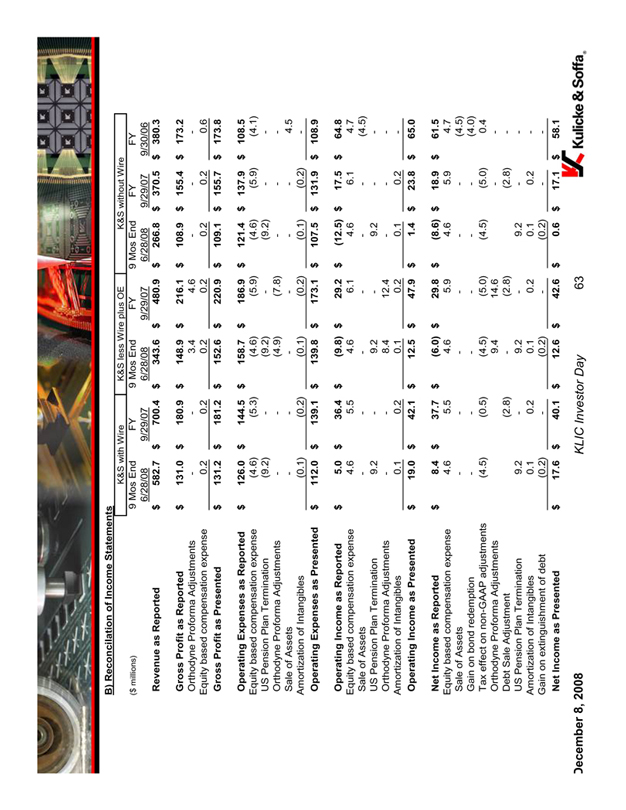

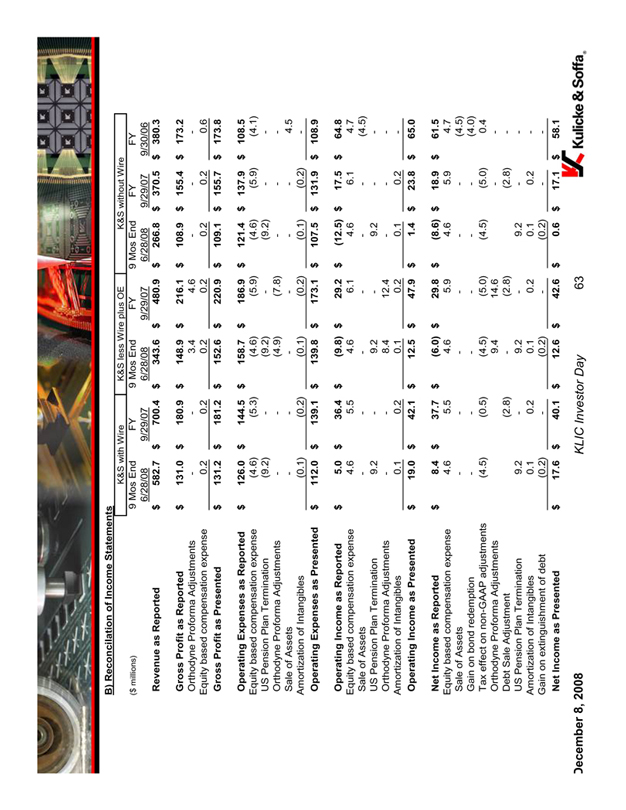

B) Reconcilation of Income Statements

K&S with Wire K&S less Wire plus OE K&S without Wire

($ millions) 9 Mos End FY 9 Mos End FY 9 Mos End FY FY

6/28/08 9/29/07 6/28/08 9/29/07 6/28/08 9/29/07 9/30/06

Revenue as Reported $582.7 $700.4 $343.6 $480.9 $266.8 $370.5 $380.3

Gross Profit as Reported $131.0 $180.9 $148.9 $216.1 $108.9 $155.4 $173.2

Orthodyne Proforma Adjustments - - 3.4 4.6 - -

Equity based compensation expense 0.2 0.2 0.2 0.2 0.2 0.2 0.6

Gross Profit as Presented $131.2 $181.2 $152.6 $220.9 $109.1 $155.7 $173.8

Operating Expenses as Reported $126.0 $144.5 $158.7 $186.9 $121.4 $137.9 $108.5

Equity based compensation expense (4.6) (5.3) (4.6) (5.9) (4.6) (5.9) (4.1)

US Pension Plan Termination (9.2) - (9.2) - (9.2) - -

Orthodyne Proforma Adjustments - - (4.9) (7.8) - - -

Sale of Assets - - - - - - - 4.5

Amortization of Intangibles (0.1) (0.2) (0.1) (0.2) (0.1) (0.2) -

Operating Expenses as Presented $112.0 $139.1 $139.8 $173.1 $107.5 $131.9 $108.9

Operating Income as Reported $5.0 $36.4 $(9.8) $29.2 $(12.5) $17.5 $64.8

Equity based compensation expense 4.6 5.5 4.6 6.1 4.6 6.1 4.7

Sale of Assets - - - - - - (4.5)

US Pension Plan Termination 9.2 - 9.2 - 9.2 - -

Orthodyne Proforma Adjustments - - 8.4 12.4 - - -

Amortization of Intangibles 0.1 0.2 0.1 0.2 0.1 0.2 -

Operating Income as Presented $19.0 $42.1 $12.5 $47.9 $1.4 $23.8 $65.0

Net Income as Reported $8.4 $37.7 $(6.0) $29.8 $(8.6) $18.9 $61.5

Equity based compensation expense 4.6 5.5 4.6 5.9 4.6 5.9 4.7

Sale of Assets - - - - - - (4.5)

Gain on bond redemption - - - - - - (4.0)

Tax effect on non-GAAP adjustments (4.5) (0.5) (4.5) (5.0) (4.5) (5.0) 0.4

Orthodyne Proforma Adjustments 9.4 14.6 - -

Debt Sale Adjustment (2.8) - (2.8) (2.8) -

US Pension Plan Termination 9.2 - 9.2 - 9.2 - -

Amortization of Intangibles 0.1 0.2 0.1 0.2 0.1 0.2 -

Gain on extinguishment of debt (0.2) - (0.2) - (0.2) - -

Net Income as Presented $17.6 $40.1 $12.6 $42.6 $0.6 $17.1 $58.1

December 8, 2008 KLIC Investor Day 63 Kulicke & Soffa®

Final Thoughts

KLIC is growth story

Technology leadership in core areas

Acquisition of Orthodyne adds:

Penetration into new growth markets

Technology leadership in wedge bonding

Experience Management Team

Successfully managed downturns before

December 8, 2008 KLIC Investor Day 64 Kulicke & Soffa®

Company Copyright

This PowerPoint presentation and all of its contents are protected under International and United States Copyright laws. Any reproduction or use of all or any part of this presentation without the express written consent of K&S is prohibited.

December 8, 2008 KLIC Investor Day 65 Kulicke & Soffa®

Schedule

Schedule