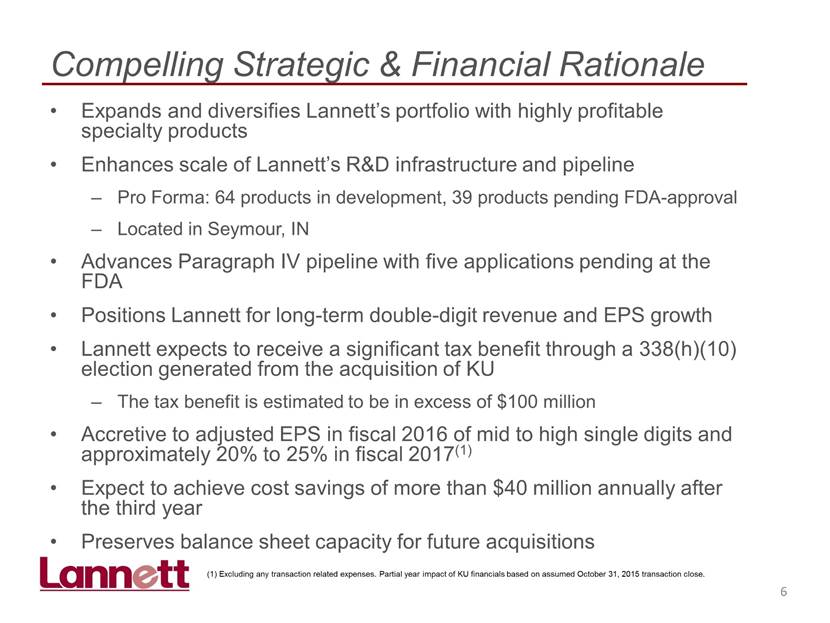

| Use of Non-GAAP Financial Measures 3 This presentation contains references to non-GAAP financial measures, including adjusted EPS and adjusted EBITDA, which are financial measures that are not prepared in conformity with accounting principles generally accepted in the United States (GAAP). Adjusted EPS is adjusted to exclude, among other things, the impact of amortization from acquired intangible assets and other purchase accounting entries, acquisition-related costs including integration and restructuring, non-cash interest expense, as well as other non-recurring items. We define adjusted EBITDA as net income or loss from the consolidated statements of operations before interest, income taxes, depreciation and amortization, and other non-operating items, as well as certain other items considered unusual or non-recurring in nature. We believe that our presentation of non-GAAP financial measures provides useful supplementary information regarding operational performance, because it enhances an investor's overall understanding of the financial results for the Company’s core business. Additionally, it provides a basis for the comparison of the financial results for the Company’s core business between current, past and future periods. A reconciliation of non-GAAP financial measures to the nearest comparable GAAP amounts have been provided in footnotes within this presentation. Non-GAAP financial measures, including adjusted EPS and adjusted EBITDA, should be considered only as a supplement to, and not as a substitute for or as a superior measure to, financial measures prepared in accordance with U.S. GAAP. |