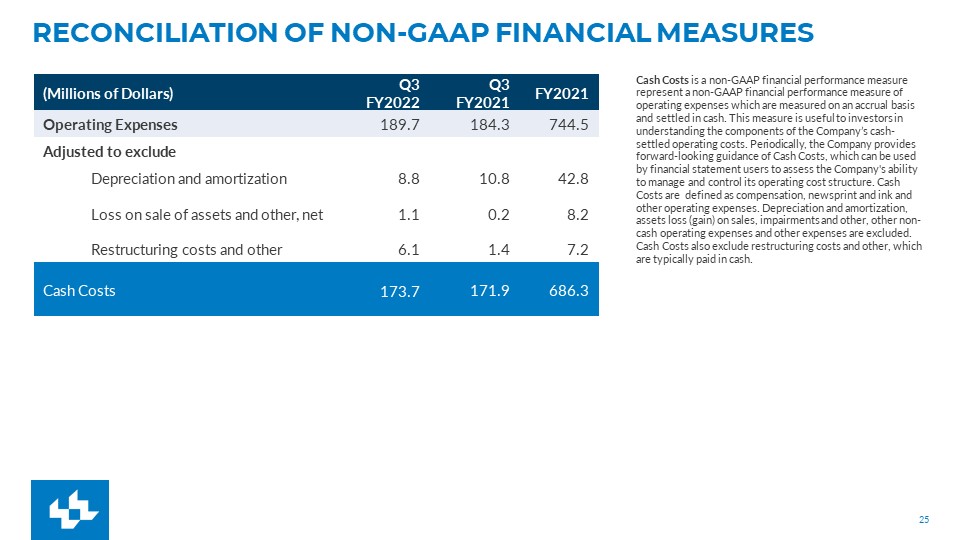

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Adjusted EBITDA is a non-GAAP financial performance measure that enhances financial statement users overall understanding of the operating performance of the Company. The measure isolates unusual, infrequent or non-cash transactions from the operating performance of the business. This allows users to easily compare operating performance among various fiscal periods and how management measures the performance of the business. This measure also provides users with a benchmark that can be used when forecasting future operating performance of the Company that excludes unusual, nonrecurring or one time transactions. Adjusted EBITDA is a component of the calculation used by stockholders and analysts to determine the value of our business when using the market approach, which applies a market multiple to financial metrics. It is also a measure used to calculate the leverage ratio of the Company, which is a key financial ratio monitored and used by the Company and its investors. Adjusted EBITDA is defined as net income (loss), plus non-operating expenses, income tax expense, depreciation and amortization, assets loss (gain) on sales, impairments and other, restructuring costs and other, stock compensation and our 50% share of EBITDA from TNI and MNI, minus equity in earnings of TNI and MNI. (Millions of Dollars) Q3 FY2022 Net Income 0.2 Adjusted to exclude Income tax expense 0.2 Non-operating expenses, net 6.1 Equity in earnings of TNI and MNI (1) (1.1) Loss on sale of assets and other, net 1.1 Depreciation and amortization 8.8 Restructuring costs and other 6.1 Stock compensation 0.3 Add Ownership share of TNI and MNI EBITDA (50%) 1.3 Adjusted EBITDA 23.0 (1) TNI refers to TNI Partners publishing operations in Tucson, AZ. MNI refers to Madison Newspapers, Inc. publishing operations in Madison, WI.