- LEE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Lee Enterprises (LEE) 8-KOther Events

Filed: 1 Feb 05, 12:00am

EXHIBIT 99.1 - Presentation for Lee's January 31, 2005 conference call and webcast

[Operator reads forward-looking note, reference to the Company’s recent SEC filings and legend about the Pulitzer Proxy Statement.]

1

The Private Securities Litigation Reform Act of 1995 provides a “Safe Harbor” for forward-looking statements. This report contains information that may be deemed forward-looking and that is based largely on the Company’s current expectations and is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those anticipated. Among such risks, trends and other uncertainties are changes in advertising demand, newsprint prices, interest rates, labor costs, legislative and regulatory rulings and other results of operations or financial conditions, difficulties in integration of acquired businesses or maintaining employee and customer relationships and increased capital and other costs. The words “may,” “will,” “would,” “could,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “projects,” “considers” and similar expressions generally identify forward-looking statements. Readers are cautioned not to place undue reliance on such forward-looking statements, which are made as of the date of this report. The Company does not publicly undertake to update or revise its forward-looking statements. If you refer to our most recent 10-K, 10-K/A and 8-K Reports (including the 8-K we will file today), you will see a discussion of factors that could cause the Company’s actual results to differ materially from these projections.

The proposed transaction will be submitted to Pulitzer’s stockholders for their consideration, and Pulitzer will file with the SEC a proxy statement to be used to solicit the stockholders’ approval of the proposed transaction, as well as other relevant documents concerning the proposed transaction. STOCKHOLDERS OF PULITZER ARE URGED TO READ THE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the proxy statement, as well as other filings containing information about Pulitzer, may be obtained at the SEC’s Internet site (http://www.sec.gov). Copies of the proxy statement and the SEC filings that will be incorporated by reference in the proxy statement can also be obtained, without charge, by directing a request to James V. Maloney, Secretary, Pulitzer Inc., 900 North Tucker Boulevard, St. Louis, Missouri 63101.

Pulitzer and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Pulitzer in connection with the proposed transaction. Information regarding Pulitzer’s directors and executive officers is available in Pulitzer’s proxy statement for its 2004 annual meeting of stockholders, which was filed with the SEC on April 2, 2004. Additional information regarding the interests of such potential participants will be included in the proxy statement and the other relevant documents filed with the SEC when they become available.

2

Good morning! I’m Mary Junck and we want to thank you for joining us on this important day for Lee Enterprises and Pulitzer.

Before we begin Lee’s presentation, it’s my pleasure to turn over the microphone to the president and chief executive officer of Pulitzer, Bob Woodworth.

3

Thank you, Mary, and good morning to you all.

Today marks the beginning of a new chapter in the long and storied history of the Pulitzer company.

The Pulitzer name has been synonymous with excellence in news coverage for more than 125 years. The importance of continuing that tradition was one of the pivotal factors we considered in deciding to join with Lee.

It’s a tradition that is important to our readers, to our advertisers, to our shareholders and to our employees.

And, because preserving the best of the past as we move into the future was so important in our decision-making, I am particularly pleased to be on the call today with the leadership team from Lee Enterprises, a company that has 114 year-old distinguished history in the news business, and one of the most successful operations in the industry.

In my view, Lee is among the best newspaper operators in the industry, with an especially impressive record for revenue growth. We have admired and respected Lee and their management team for years. Mary Junck has put together a top flight group that delivers results.

We think the acquisition by Lee is a great fit for Pulitzer.

We fit well together geographically, and in an industry that’s consolidating, we think the combined company will have an impressive platform from which to compete and on which to grow.

As part of Lee, our newspapers will benefit from greater scale and resources, which are necessary to compete effectively in today’s increasingly competitive media market.

Another reason this is a great fit involves our corporate cultures. Having cultures that mesh is critical in our business. And we believe that, in Lee, we have found a company that shares our deep commitment to journalistic excellence, to supporting the communities we serve and to treating employees fairly.

I’m also pleased that a number of our key senior operational and editorial team have expressed their excitement about joining Lee. This will provide continuity to operations and will give Lee access to some of the best talent in the business.

For these reasons, we believe that Lee will be an excellent steward for the Pulitzer company and is well positioned to strengthen it as the two move forward together.

And now I'll turn the call back over to Mary. Mary...

4

Bob, thank you for your very kind words about Lee. We feel the same way about Pulitzer, which you have led so skillfully as CEO over the last six years.

Lee admires what the Pulitzer family has done for journalism in St. Louis and throughout the United States. We are committed to preserving that heritage.

Now, we are eager to tell you why this is such an attractive acquisition for Lee and our shareholders.

5

As you know, Lee has entered into a definitive agreement to acquire Pulitzer Inc. for a cash purchase price of $64 per share, implying an enterprise value totaling $1.46 billion.

It’s another terrific acquisition for Lee – and, in both order of magnitude and opportunities for revenue growth, it’s remarkably similar to our highly successful purchase of the 16 Howard newspapers in 2002. It allows us to take an exciting and logical next step into another attractive group of markets, exactly the kind where we excel.

Joining me on this call are Carl Schmidt, our chief financial officer, and Greg Schermer, who serves as a vice president, corporate counsel and a member of our board of directors.

Both Carl and Greg were extremely instrumental in the Pulitzer acquisition process, and I’m very grateful for their outstanding work.

This presentation will be available for replay on demand beginning this afternoon at lee.net.

6

Pulitzer’s 14 daily newspapers include the St. Louis Post-Dispatch and the Arizona Daily Star in Tucson.

Combined, these 14 newspapers have circulation of 575,000 daily and 799,000 on Sunday.

All these newspapers operate leading websites in their markets, and they’re fortified by more than 100 weeklies, shoppers and specialty publications, including a network of 38 weeklies in the St. Louis market with distribution of more than one million copies.

Reported revenue totaled nearly $444 million in 2004. Reported operating cash flow, including Pulitzer’s 50% share in Tucson, was $105 million.

7

Here’s the Pulitzer map.

ThePost-Dispatch in St. Louis has circulation of 286,000 daily and 450,000 on Sunday. We’ll give you more detail on St. Louis in a moment.

Tucson is an absolute standout growth market. The Arizona Daily Star is the larger paper in a joint operating agreement with Gannett, with morning circulation of 101,000 and Sunday circulation of 162,000.

Bloomington, Illinois, is another impressive growth market and The Pantagraph has circulation of 47,000 daily and 50,000 on Sunday.

More terrific markets – The Daily Herald in Provo, Utah, has circulation of 31,000 daily and 34,000 on Sunday.

In California, we have theSanta Maria Times,theLompoc Record, theNapa Valley Register andThe Sentinel in Hanford.

Rounding out the list areThe World in Coos Bay, Oregon;The Garden Island in Lihue, Hawaii; theArizona Daily Sun in Flagstaff; theDaily Journal in Park Hills, Missouri; theDaily Chronicle in DeKalb, Illinois, andThe Daily News in Rhinelander, Wisconsin.

8

Here are the Pulitzer newspapers combined with the Lee map.

Circulation at our 44 existing newspapers and 14 new ones will total 1.7 million daily and 2 million on Sunday.

9

These newspapers in 23 states will give us the fourth largest number of dailies in the country.

In terms of daily circulation, we’ll move from 12th place to 7th.

For the last 12 months through December 2004, combined reported revenue is $1.14 billion, with OCF of $295 million not adjusted for any one-time items or synergies.

With the addition of 4,000 Pulitzer people, Lee will have about 10,700 employees.

10

Pulitzer is ideal for Lee. Let me tell you why.

First, we’re gaining exceptionally fine newspapers that have strong franchises in good growth markets. AND we see upside potential.

Next, the acquisition extends Lee into a metro market that, except for size, looks surprisingly like other markets in which Lee excels.

That’s especially true because of the broad media platform in St. Louis that expands on the already-powerful reach of thePost-Dispatch.

Of course, St. Louis is a Midwestern market just downstream on the Mississippi from our corporate headquarters in Davenport, Iowa.

11

Tucson and the other Pulitzer newspapers are an obvious match to the type of markets where Lee’s track record is strong.

Tucson is on the front end of an upward curve, and it’s being led by new management that we happen to know quite well. The CEO of the JOA is a former Lee publisher, and the top advertising executive is also a highly respected Lee alum.

Other gems in the portfolio are Bloomington, Provo, Flagstaff and Napa – and we like the rest, as well.

Overall, Pulitzer’s markets rank considerably above Lee’s own locations on our market meter, an internal measure of growth potential in a market area. We believe that a better market meter translates into higher revenue growth.

12

In both order of magnitude and opportunities for revenue growth, this acquisition resembles our purchase of Howard Publications in 2002.

The Howard acquisition increased our circulation by about 75% and our revenue by about 50%. For comparison, Pulitzer will increase our daily circulation by roughly 50% and our revenue by about 60%.

By any measure, the Howard acquisition turned out to be an unqualified success.

The results are a matter of record: Our new newspapers outperformed revenue and OCF projections right out of the gate – and we aim to do it again.

We gained key talent in the acquisition, and three years later, we’ve retained a high percentage of the original publishers and other key personnel.

The Howard experience has prepared us exceedingly well, and we plan to integrate Pulitzer just as effectively.

13

As with Howard, the driver behind this acquisition is revenue growth, and we see good opportunities in each of the Pulitzer markets.

We plan to build on current strategies by providing an influx of revenue-generating programs that have worked very well for Lee – programs you’ve heard us talk about before, such as our advertising sales blitzes, frequency ad sales programs, classified employment and automotive templates, cross-selling methods, niche publications and online revenue programs.

14

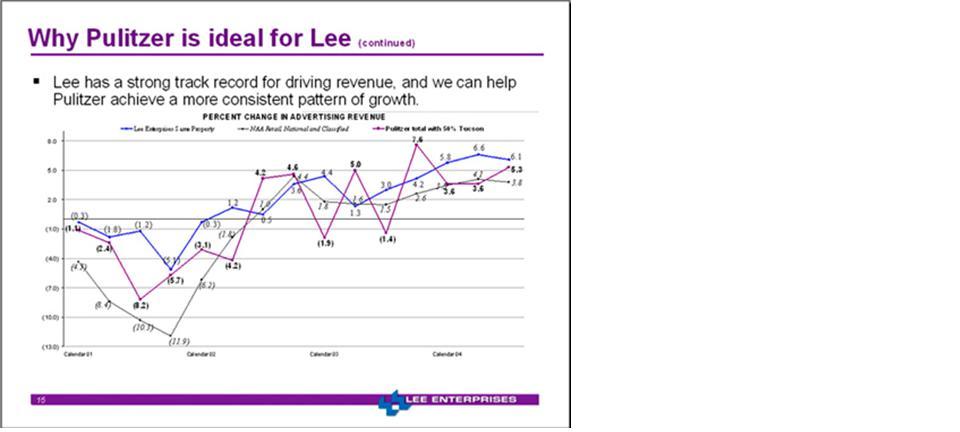

Lee has been a leader for advertising revenue growth, and you may have seen this chart in the past, comparing our performance with the industry average.

That’s Pulitzer in purple, Lee in blue and the industry in black. And we are the leader.

While Pulitzer has periodically outperformed the industry, together, we expect to achieve a more consistent pattern of even higher above-average growth.

15

Another reason we’re excited about Pulitzer is the people we’ve met. We’ve found them to be smart, receptive and enthusiastic.

Lee and Pulitzer have a lot in common.

Throughout our long histories, we’ve both been devoted to newspapers and we have strong news traditions. We view newspapers as a public trust. We’re committed to our communities and our people. We both have enjoyed a loyal base of shareholders committed to the business of quality newspapers. We both rely on strong publishers, editors and management teams.

All those things will make for a smooth transition.

16

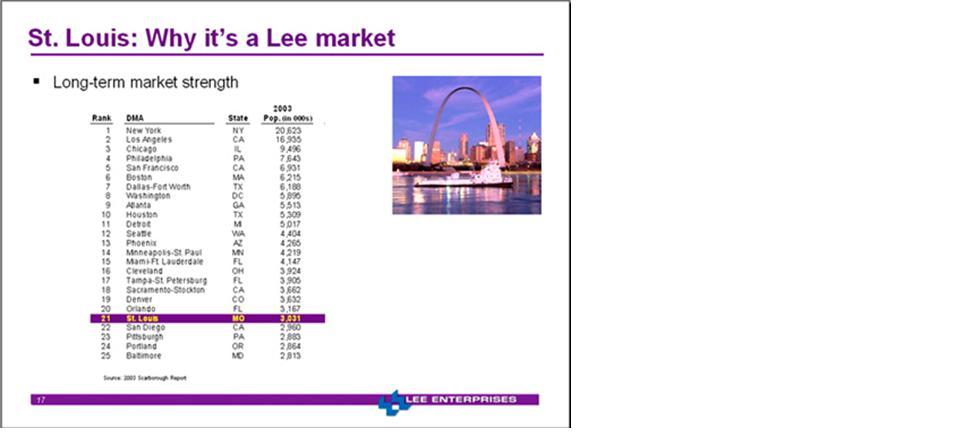

Now, let’s take a closer look at St. Louis and explain why it’s similar to other Lee markets.

St. Louis ranks as the 21st largest Designated Market Area in the country, with three million people.

As an aside, this is a market size I’m personally familiar and comfortable with, having been the publisher of the Baltimore Sun and the St. Paul Pioneer Press.

17

St. Louis is a regional hub that serves a wide area.

The suburbs are exceptionally strong, with a relatively low cost of living, low unemployment, high purchasing power and lots of growth.

At the same time, the city of St. Louis is undergoing significant change through redevelopment efforts on a broad front. Positive signs include a new $345 million baseball stadium, an $87 million Federal Reserve Bank expansion and several projects to convert old buildings into lofts and condos.

18

The dominance of the suburbs reinforces the strength of Pulitzer’s media platform and helps explain why thePost-Dispatch has remained such a powerhouse.

It reaches 32% of adults in the market daily and 51% on Sunday. You don’t see numbers like that in most metro markets, as these lists show.

For instance, the column on the right ranks the Post-Dispatch as the third best metro market newspaper for Sunday readership. That’s quite a local franchise.

19

Pulitzer has spent the last five-plus years investing in infrastructure and building its powerful media platform, and the highlights of Pulitzer’s steps are listed here.

Besides the Post-Dispatch, the media platform in St. Louis includes the 38 Suburban Journals, which reach a huge audience with distribution of more than a million copies a week.

The media platform also includes the market’s leading website, STLtoday.com, and Local Values, a direct mail program.

20

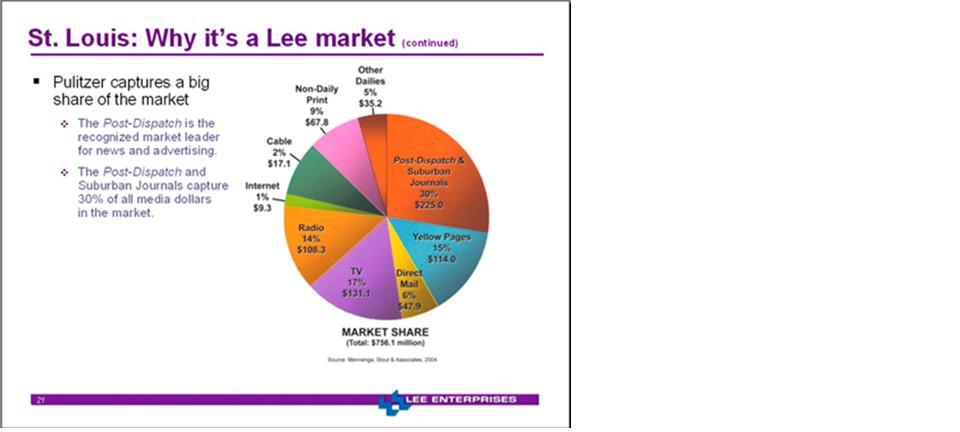

As this pie chart shows, thePost-Dispatch and theSuburban Journals capture 30% of all media dollars in the market. You can see that no competitor even comes close.

30% is an OK number for a metro market – but we and Pulitzer management are convinced we can grow market share in St. Louis.

While most U.S. daily newspapers lost ground between 2002 and 2004, the Post-Dispatch gained market share, according to the same study.

These gains in St. Louis are due to strong management there, which is already on a good course and, from what we’ve seen, is eager to join with us in driving revenue and growing ad share.

We’re convinced that Lee’s focus on revenue, circulation, strong local news and online growth will pay off in St. Louis and throughout Pulitzer, just as it has everywhere else in Lee.

Now, Carl Schmidt will discuss financial aspects of the transaction.

21

As you would expect, we took a methodical and quite painstaking approach to determining how much we should offer.

We performed extensive due diligence analysis. For example, a team of Lee executives visited seven key locations and spoke with the management of all other locations by phone. We built detailed models for revenue, expense and OCF.

We reviewed the public market value of Pulitzer and others, studied recent acquisition multiples, analyzed valuation by parts and in sum, reviewed potential price adjustments and performed discounted cash flow analysis.

The result was the purchase price of $64 per share, totaling enterprise value of $1.46 billion. As it turns out, the price was within the range of analyst expectations.

It translates into a multiple of 13.5 times operating cash flow for the 12 months ended Dec. 26, 2004 after adjusting for minority interest and making one-time adjustments to 2004 results.

For our first full fiscal year of ownership, ending Sept. 30, 2006, the multiple of OCF is estimated to be 11 to 11.5 times operating cash flow. This compares to 11.2 for Howard.

As you also saw in the news release, we’re paying cash, financed by a $1.55 billion fully committed bank facility led by Deutsche Bank and SunTrust Bank. The facility consists of a seven year, $450 million revolving credit and $1.1 billion of seven and eight year term loans at floating rates tied to the company’s leverage levels. The agreements have traditional covenants that allow the company excellent operating flexibility. Debt repayments in the early years of the agreements are modest.

We expect to close in the June quarter.

22

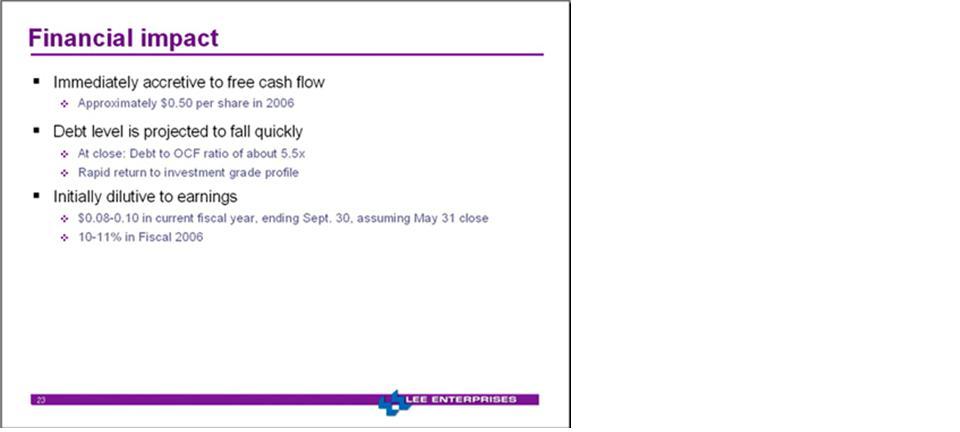

We expect the acquisition to be immediately accretive to free cash flow, and at closing we will have a debt to OCF ratio of about 5.5 times, based on the covenant formula to be used.

Because of the combined cash flow of the two companies, we expect the debt level to fall quickly, as we have clearly demonstrated that ability since the Howard acquisition. Free cash flow should increase by approximately $0.50 per diluted share in fiscal 2006.

We expect that over the next 24 months that Lee will return to a solid investment grade profile. We are comfortable with the structure given the financial attributes of the company and the attractive financing available in the current market.

Because of significant non-cash charges for amortization of intangible assets, the transaction will be initially dilutive to earnings.

We estimate dilution of 8-10 cents per diluted share for fiscal 2005, excluding one-time transition costs and assuming a May 31 close. We expect 10-11% dilution in fiscal 2006. Both of those estimates are influenced by timing of the closing and final valuation of intangible assets.

23

In summary, for all the reasons we’ve talked about, we’re excited.

The acquisition is a great fit.

It provides new markets in which we can put our successful growth strategies to work.

It provides exciting new opportunities for our employees and Pulitzer’s.

The Howard transition has prepared us for the challenge.

We’re gaining great new talent.

And, most importantly, we’re convinced that this acquisition will pay off for Lee’s shareholders.

Thanks for letting us give you the details. As the news release indicated, in order to provide additional information, we’ve posted a prepared set of questions and answers atlee.net.

For those of you who have been invited to ask questions, we’ll be glad to take them now. Please begin by identifying yourself.

24