Item 1. Business.

Summary

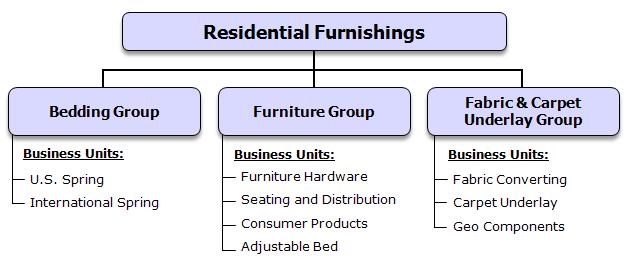

Leggett & Platt, Incorporated was founded as a partnership in Carthage, Missouri in 1883 and was incorporated in 1901. The Company, a pioneer of the steel coil bedspring, has become an international diversified manufacturer that conceives, designs and produces a wide range of engineered components and products found in many homes, offices, automobiles and commercial aircraft. As discussed below, our continuing operations are organized into 19 business units, which are divided into 9 groups under our four segments: Residential Furnishings; Commercial Fixturing & Components; Industrial Materials; and Specialized Products.

Overview of Our Segments

Residential Furnishings Segment

Our Residential Furnishings segment began in 1883 with the manufacture of steel coiled bedsprings. Today, we supply a variety of components used by bedding and upholstered furniture manufacturers in the assembly of their finished products. Our range of products offers our customers a single source for many of their component needs.

Efficient manufacturing methods, internal production of key raw materials and machinery, and numerous manufacturing and assembly locations allow us to supply many customers with components at a lower cost than they can produce themselves. In addition to cost savings, sourcing components from us allows our customers to focus on designing, merchandising and marketing their products.

Products

Products manufactured or distributed by our Residential Furnishings groups include:

Bedding Group

| |

| • | Innersprings (sets of steel coils, bound together, that form the core of a mattress) |

| |

| • | Wire forms for mattress foundations |

Furniture Group

| |

| • | Steel mechanisms and hardware (enabling furniture to recline, tilt, swivel, rock and elevate) for reclining chairs and sleeper sofas |

| |

| • | Springs and seat suspensions for chairs, sofas and love seats |

| |

| • | Steel tubular seat frames |

| |

| • | Bed frames, ornamental beds, and “top-of-bed” accessories |

Fabric & Carpet Underlay Group

| |

| • | Structural fabrics for mattresses, residential furniture and industrial uses |

| |

| • | Carpet underlay materials (bonded scrap foam, felt, rubber and prime foam) |

| |

| • | Geo components (synthetic fabrics and various other products used in ground stabilization, drainage protection, erosion and weed control, as well as silt fencing) |

Customers

| |

| • | Manufacturers of finished bedding (mattresses and foundations) and upholstered furniture |

| |

| • | Retailers and distributors of adjustable and ornamental beds, bed frames and carpet underlay |

| |

| • | Contractors, landscapers, road construction companies and government agencies using geo components |

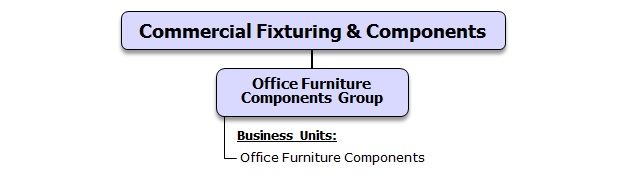

Commercial Fixturing & Components Segment

Our Office Furniture Components group designs, manufactures, and distributes a wide range of engineered components and products primarily for the office seating market.

Products

Products manufactured or distributed by our Commercial Fixturing & Components groups include:

Office Furniture Components Group

| |

| • | Bases, columns, back rests, casters and frames for office chairs, and control devices that allow office chairs to tilt, swivel and elevate |

| |

| • | Select lines of private label finished furniture |

Customers

Customers of the Commercial Fixturing & Components segment include:

| |

| • | Office, institutional and commercial furniture manufacturers |

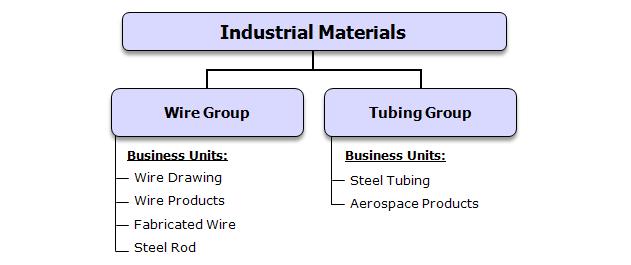

Industrial Materials Segment

We believe that the quality of our products and services, together with low cost, have made us the leading U.S. supplier of drawn steel wire. Our Wire group operates a steel rod mill with an annual output of approximately 500,000 tons, of which a substantial majority is used by our own wire mills. We have four wire mills that supply virtually all the wire consumed by our other domestic businesses. Our Steel Tubing business unit also supplies a portion of our internal needs for welded steel tubing. In addition to supporting our internal requirements, we supply many external customers with wire and steel tubing products.

In 2012, we completed the acquisition of Western Pneumatic Tube (Western). Western is a leading provider of integral components for critical aircraft systems, and formed the Aerospace Products business unit within the Tubing Group. Western specializes in fabricating thin-walled, large diameter, welded tubing and specialty formed products from titanium, nickel and other specialty materials for leading aerospace suppliers and OEMs. In 2013, we expanded our Aerospace Products business unit with the acquisition of two companies. The first was a UK-based business that extended our capability in aerospace tube fabrication. The second was a French-based company that added small-diameter, high-pressure seamless tubing to our product portfolio. For further information about acquisitions, see Note R on page 44 of the Notes to Consolidated Financial Statements in Exhibit 99.4 attached to this Form 8-K.

Products

Products manufactured or distributed by our Industrial Materials groups include:

Wire Group

| |

| • | Fabricated wire products |

Tubing Group

| |

| • | Fabricated tube components |

| |

| • | Titanium and nickel tubing for the aerospace industry |

Customers

We use about half of our wire output and roughly 15-20% of our steel tubing output to manufacture our own products. For example, we use our wire and steel tubing to make:

| |

| • | Bedding and furniture components |

| |

| • | Motion furniture mechanisms |

| |

| • | Automotive seat components |

The Industrial Materials segment also has a diverse group of external customers, including:

| |

| • | Bedding and furniture makers |

| |

| • | Automotive seating manufacturers |

| |

| • | Aerospace suppliers and OEMs |

| |

| • | Mechanical spring makers |

| |

| • | Waste recyclers and waste removal businesses |

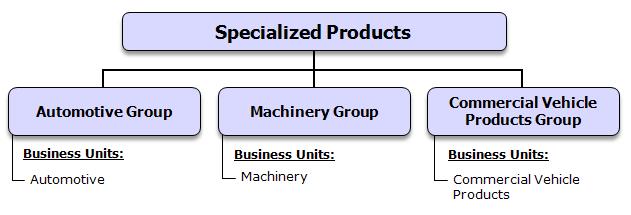

Specialized Products Segment

Our Specialized Products segment designs, produces and sells components for automotive seating, specialized machinery and equipment, and service van interiors. Our established design capability and focus on product development have made us a leader in innovation. We also benefit from our broad geographic presence and our internal production of key raw materials and components.

Products

Products manufactured or distributed by our Specialized Products groups include:

Automotive Group

| |

| • | Manual and power lumbar support and massage systems for automotive seating |

| |

| • | Automotive control cables |

| |

| • | Low voltage motors and motion assemblies |

| |

| • | Formed metal and wire components for seat frames |

Machinery Group

| |

| • | Full range of quilting machines for mattress covers |

| |

| • | Machines used to shape wire into various types of springs |

| |

| • | Industrial sewing/finishing machines |

Commercial Vehicle Products Group

| |

| • | Van interiors (the racks, shelving and cabinets installed in service vans) |

Customers

Our primary customers for the Specialized Products segment include:

| |

| • | Automobile seating manufacturers |

| |

| • | Telecommunication, cable, home service and delivery companies |

Strategic Direction

Key Financial Metric

Total Shareholder Return (TSR), relative to peer companies, is the key financial measure that we use to assess long-term performance. TSR = (Change in Stock Price + Dividends)/Beginning Stock Price). Our goal is to achieve TSR in the top 1/3 of the S&P 500 companies over rolling three-year periods through a balanced approach that employs all four TSR sources: revenue growth, margin expansion, dividends, and share repurchases. For the three-year measurement period that ended December 31, 2013 we generated TSR of 56% (16% per year on average), which placed us in the top one half of the S&P 500.

Our incentive programs reward return generation and profitable growth. Senior executives participate in a TSR-based incentive program (based on our performance compared to a group of approximately 320 peers). Business unit bonuses emphasize the achievement of higher returns on the assets under the unit’s direct control.

Returning Cash to Shareholders

During the past three years, we generated $1.2 billion of operating cash, and we returned much of this cash to shareholders in the form of dividends and share repurchases. Dividends and share repurchases are expected to remain significant contributors to long-term TSR.

We currently pay a quarterly dividend of $.30 per share. Our dividend payout target is 50-60% of earnings; however we have been above that target in recent years. Our dividend payout ratio (dividends declared per share/earnings per share) was 106%, 67% and 88% in 2011, 2012 and 2013, respectively. As our markets recover, we expect to move into our target payout range. In the meantime, we expect to generate enough cash to continue to pay and modestly grow the dividend. The Company has consistently (for over 20 years) generated operating cash in excess of our annual requirement for capital expenditures and dividends.

We expect to use cash (after repayment of debt and funding capital expenditures, dividends, and growth opportunities) for share repurchases. During the past three years, we have repurchased 18 million shares of our stock (and issued 11 million shares through employee benefit plans), which reduced the net outstanding shares by approximately 5%. In 2013, we repurchased 6 million shares at an average per share price of $30.81 (and issued 3 million shares through employee benefit plans). In 2013, our shares outstanding was reduced by approximately 2% to 139.4 million at year-end.

Portfolio Management

We utilize a rigorous strategic planning process to help guide future decisions regarding business unit roles, capital allocation priorities, and new areas in which to grow. We review the portfolio classification of each unit on

an annual basis to determine its appropriate role (Grow, Core, Fix, or Divest). This review includes criteria such as competitive position, market attractiveness, business unit size, and fit within our overall objectives, as well as financial indicators such as growth of EBIT (earnings before interest and taxes) and EBITDA (earnings before interest, taxes, depreciation and amortization), operating cash flows, and return on assets. Business units in the Grow category should provide avenues for profitable growth from competitively advantaged positions in attractive markets. Core business units are expected to enhance productivity, maintain market share, and generate cash flow from operations while using minimal capital. To remain in the portfolio, business units are expected to consistently generate after-tax returns in excess of our cost of capital. Business units that fail to consistently attain minimum return goals will be moved to the Fix or Divest categories.

Disciplined Growth

Long-term, we aim to achieve consistent, profitable growth of 4-5% annually. To attain this goal, we will need to supplement the approximate 2-3% growth that our markets typically produce (in normal economic times) with two additional areas of opportunity. First, we must enhance our success rate at developing and commercializing innovative new products within markets in which we already enjoy strong competitive positions. Second, we need to uncover new growth platforms: opportunities in markets new to us containing margins and growth higher than the Company's average, and in which we would possess a competitive advantage.

Our long-term, 4-5% annual growth objective envisions periodic acquisitions. We seek acquisitions within our Grow businesses, and look for opportunities to enter new, higher growth markets (carefully screened for sustainable competitive advantage). We expect all acquisitions to (a) have a clear strategic rationale, a sustainable competitive advantage, a strong fit with the Company, and be in an attractive and growing market; (b) create value by enhancing Total Shareholder Return; (c) for stand-alone companies: generally, revenue in excess of $50 million, strong management and future growth opportunity with a strong market position in a market growing faster than GDP; and (d) for add-on companies: generally, revenue in excess of $15 million, significant synergies, and a strategic fit with an existing business unit.

Acquisitions

In 2013, we expanded our Aerospace Products business unit with the acquisition of two companies. The first was a UK-based business acquired in May that extended our capability in aerospace tube fabrication. The second was a French-based company acquired in July that added small-diameter, high-pressure seamless tubing to our product portfolio. With these acquisitions, our Aerospace Products business unit, which is part of the Industrial Materials segment, has an annual revenue run rate in excess of $120 million.

In 2012, we acquired for a cash purchase price of $188 million, Western Pneumatic Tube, which produces thin-walled, large diameter, welded tubing and specialty formed products for aerospace applications. Western fabricates products from specialty materials, such as titanium, nickel, stainless steel, and other high strength metals for use in aircraft systems, including fuel, hydraulic, pneumatic, environmental, life support, stability, and cooling systems. Western operates two facilities, one in Kirkland, Washington, and another in Poway, California, and is part of the Aerospace Products business unit.

We had no significant acquisitions in 2011.

For further information about acquisitions, see Note R on page 44 of the Notes to Consolidated Financial Statements in Exhibit 99.4 attached to this Form 8-K.

Divestitures

There were no significant divestitures in 2011, 2012 or 2013.

For further information about divestitures and discontinued operations, see Note B on page 12 of the Notes to Consolidated Financial Statements in Exhibit 99.4 attached to this Form 8-K.

Segment Financial Information

For information about sales to external customers, sales by product line, EBIT, and total assets of each of our segments, refer to Note F on page 19 of the Notes to Consolidated Financial Statements in Exhibit 99.4 attached to this Form 8-K.

Foreign Operations

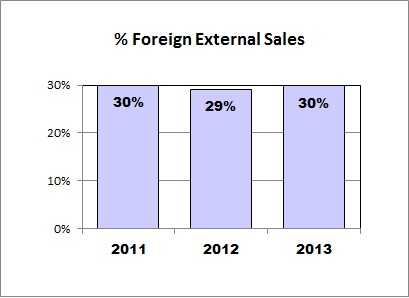

The percentages of our external sales in continuing operations related to products manufactured outside the United States for the previous three years are shown below.

Our international continuing operations are principally located in China, Europe, Canada and Mexico. The products we make in these countries primarily consist of:

China

| |

| • | Innersprings for mattresses |

| |

| • | Recliner mechanisms and bases for upholstered furniture |

| |

| • | Formed wire for upholstered furniture |

| |

| • | Office furniture components, including chair bases and casters |

| |

| • | Formed metal products, lumbar and seat suspension systems for automotive seating |

| |

| • | Cables and small electric motors used in lumbar systems for automotive seating |

| |

| • | Machinery and replacement parts for machines used in the bedding industry |

Europe

| |

| • | Innersprings for mattresses |

| |

| • | Seamless tubing and specialty formed products for aerospace applications |

| |

| • | Lumbar and seat suspension systems for automotive seating |

| |

| • | Machinery and equipment designed to manufacture innersprings for mattresses and other bedding-related components |

Canada

| |

| • | Fabricated wire for the furniture and automotive industries |

| |

| • | Chair bases, table bases and office chair controls |

| |

| • | Lumbar supports for automotive seats |

| |

| • | Wire and steel storage systems and racks for service vans and utility vehicles |

Mexico

| |

| • | Innersprings and fabricated wire for the bedding industry |

| |

| • | Retail point-of-purchase displays |

| |

| • | Automotive control cable systems and seating components |

| |

| • | Shafts for the appliance industry |

Our international expansion strategy is to locate our operations where we believe we would possess a competitive advantage and where demand for components is growing. Also, in instances where our customers move the production of their finished products overseas, we have located facilities nearby to supply them more efficiently.

Our international operations face the risks associated with any operation in a foreign country. These risks include:

| |

| • | Foreign currency fluctuation |

| |

| • | Foreign legal systems that make it difficult to protect intellectual property and enforce contract rights |

| |

| • | Increased costs due to tariffs, customs and shipping rates |

| |

| • | Potential problems obtaining raw materials, and disruptions related to the availability of electricity and transportation during times of crisis or war |

| |

| • | Inconsistent interpretation and enforcement, at times, of foreign tax laws |

| |

| • | Political instability in certain countries |

Our Specialized Products segment, which derives roughly 76% of its trade sales from foreign operations, is particularly subject to the above risks. These and other foreign-related risks could result in cost increases, reduced profits, the inability to carry on our foreign operations and other adverse effects on our business.

Geographic Areas of Operation

We have continuing operations manufacturing facilities in countries around the world, as shown below.

|

| | | | | | | |

| | | | | | | | |

| | Residential Furnishings | | Commercial Fixturing & Components | | Industrial Materials | | Specialized Products |

| North America | | | | | | | |

| Canada | n | | n | | | | n |

| Mexico | n | | | | n | | n |

| United States | n | | n | | n | | n |

| Europe | | | | | | | |

| Austria | | | | | | | n |

| Belgium | | | | | | | n |

| Croatia | n | | | | | | n |

| Denmark | n | | | | | | |

| France | | | | | n | | |

| Germany | | | | | | | n |

| Hungary | | | | | | | n |

| Italy | | | n | | | | n |

| Switzerland | | | | | | | n |

| United Kingdom | n | | | | n | | n |

| South America | | | | | | | |

| Brazil | n | | | | | | |

| Asia | | | | | | | |

| China | n | | n | | | | n |

| India | | | | | | | n |

| South Korea | | | | | | | n |

| Africa | | | | | | | |

| South Africa | n | | | | | | |

For further information concerning our continuing operations external sales related to products manufactured outside the United States and our tangible long-lived assets outside the United States, refer to Note F on page 19 of the Notes to Consolidated Financial Statements in Exhibit 99.4 attached to this Form 8-K.

Sales by Product Line

The following table shows our approximate percentage of continuing operations external sales by classes of similar products for the last three years:

|

| | | | | | | | | | |

| Product Line | 2013 | | 2012 | | 2011 |

| Furniture Group | 19 | % | | 20 |

| % | | 19 |

| % |

| Bedding Group | 19 | | | 19 |

| | | 20 |

| |

| Fabric & Carpet Underlay Group | 18 | | | 17 |

| | | 16 |

| |

| Automotive Group | 15 | | | 14 |

| | | 13 |

| |

| Wire Group | 12 | | | 13 |

| | | 16 |

| |

| Tubing Group | 5 | | | 5 |

| | | 3 |

| |

| Office Furniture Components Group | 5 | | | 5 |

| | | 6 |

| |

| Machinery Group | 4 | | | 3 |

| | | 3 |

| |

| Commercial Vehicle Products Group | 3 | | | 4 |

| | | 4 |

| |

Distribution of Products

In each of our segments, we sell and distribute our products primarily through our own personnel. However, many of our businesses have relationships and agreements with outside sales representatives and distributors. We do not believe any of these agreements or relationships would, if terminated, have a material adverse effect on the consolidated financial condition, operating cash flows or results of operations of the Company.

Raw Materials

The products we manufacture require a variety of raw materials. We believe that worldwide supply sources are readily available for all the raw materials we use. Among the most important are:

| |

| • | Various types of steel, including scrap, rod, wire, coil, sheet, stainless and angle iron |

| |

| • | Woven and non-woven fabrics |

| |

| • | Titanium and nickel-based alloys and other high strength metals |

We supply our own raw materials for many of the products we make. For example, we produce steel rod that we make into steel wire, which we then use to manufacture:

| |

| • | Innersprings and foundations for mattresses |

| |

| • | Springs and seat suspensions for chairs and sofas |

| |

| • | Automotive seating components |

We supply a substantial majority of our domestic steel rod requirements through our own rod mill. Our wire drawing mills supply nearly all of our U.S. requirements for steel wire. We also produce welded steel tubing, both for our own consumption and for sale to external customers.

Customer Concentration

We serve thousands of customers worldwide, sustaining many long-term business relationships. In 2013, our largest customer accounted for approximately 7% of our consolidated continuing operations revenues. Our top 10 customers accounted for approximately 25% of these consolidated continuing operations revenues. The loss of one or more of these customers could have a material adverse effect on the Company, as a whole, or on the respective segment in which the customer’s sales are reported, including our Residential Furnishings, Commercial Fixturing & Components and Specialized Products segments.

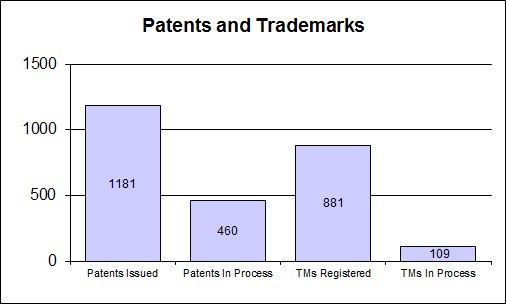

Patents and Trademarks

The chart below shows the approximate number of patents issued, patents in process, trademarks registered and trademarks in process held by our continuing operations as of December 31, 2013. No single patent or group of patents, or trademark or group of trademarks, is material to our operations, as a whole. Most of our patents relate to products sold in the Specialized Products segment, while a substantial majority of our trademarks relate to products sold in the Residential Furnishings and Specialized Products segments.

Some of our most significant trademarks include:

| |

| • | Semi-Flex® (box spring components and foundations) |

| |

| • | Mira-Coil®, VertiCoil®, Lura-Flex®, Superlastic® and Comfort Core® (mattress innersprings) |

| |

| • | Active Support Technology® (mattress innersprings) |

| |

| • | Wall Hugger® (recliner chair mechanisms) |

| |

| • | Super Sagless® (motion and sofa sleeper mechanisms) |

| |

| • | No-Sag® (wire forms used in seating) |

| |

| • | Tack & Jump® and Pattern Link® (quilting machines) |

| |

| • | Hanes® (fiber materials) |

| |

| • | Schukra®, Pullmaflex® and Flex-O-Lator® (automotive seating products) |

| |

| • | Spuhl® (mattress innerspring manufacturing machines) |

| |

| • | Gribetz® and Porter® (quilting and sewing machines) |

| |

| • | Quietflex® and Masterack® (equipment and accessories for vans and trucks) |

Research and Development

We maintain research, development and testing centers in Carthage, Missouri and at many of our other facilities. We are unable to calculate precisely the cost of research and development because the personnel involved in product and machinery development also spend portions of their time in other areas. However, we estimate the cost of research and development was $20 million in 2011, $22 million in 2012 and $24 million in 2013.

Employees

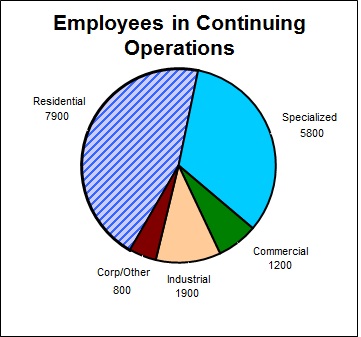

As of December 31, 2013, we had approximately 17,600 employees in continuing operations, of which roughly 12,400 were engaged in production. Of the 17,600, approximately 8,700 were international employees (4,700 in China). Roughly 15% of our employees in continuing operations are represented by labor unions that collectively bargain for work conditions, wages or other issues. We did not experience any material work stoppage related to contract negotiations with labor unions during 2013. Management is not aware of any circumstances likely to result in a material work stoppage related to contract negotiations with labor unions during 2014. The chart below shows the approximate number of continuing operations employees by segment.

As of December 31, 2012, we had approximately 16,900 employees in continuing operations.

Competition

Many companies offer products that compete with those we manufacture and sell. The number of competing companies varies by product line, but many of the markets for our products are highly competitive. We tend to attract and retain customers through product quality, innovation, competitive pricing and customer service. Many of our competitors try to win business primarily on price but, depending upon the particular product, we experience competition based on quality, performance and availability as well. In general, our competitors tend to be smaller, private companies.

We believe we are the largest U.S. manufacturer, in terms of revenue, of the following:

| |

| • | Components for residential furniture and bedding |

| |

| • | Components for office furniture |

| |

| • | Automotive seat support and lumbar systems |

| |

| • | Bedding industry machinery for wire forming, sewing and quilting |

| |

| • | Thin-walled, titanium, nickel and other specialty tubing for the aerospace industry |

We continue to face pressure from foreign competitors as some of our customers source a portion of their components and finished products offshore. In addition to lower labor rates, foreign competitors benefit (at times) from lower raw material costs. They may also benefit from currency factors and more lenient regulatory climates. We typically remain price competitive, even versus many foreign manufacturers, as a result of our efficient operations, low labor content, vertical integration in steel and wire, logistics and distribution efficiencies, and large scale purchasing of raw materials and commodities. However, we have also reacted to foreign competition in

certain cases, by selectively adjusting prices, and by developing new proprietary products that help our customers reduce total costs.

Premium non-innerspring mattresses (those that have either a foam or air core) experienced rapid growth in the U.S. bedding market in recent years. These products represent a relatively small portion of the bedding market in units (approximately 10%-12%), but comprise a larger portion of the market in dollars (approximately 25%-30%) due to their higher average selling prices. In 2013, non-innerspring mattress sales declined and the proportion of the total bedding market that they represent also decreased. Most traditional bedding manufacturers (who are our customers) now offer mattresses that combine an innerspring core with top layers comprised of specialty foam and gel. These hybrid products, which allow our customers to address a consumer preference for the feel of a specialty mattress and the characteristics of an innerspring, have been well received by consumers.

For the past five years, there have been antidumping duty orders on innerspring imports from China, South Africa and Vietnam, ranging from 116% to 234%. The orders remain in effect while the Department of Commerce (DOC) and the International Trade Commission (ITC) conduct separate reviews to determine whether to extend the duties through February 2019 (for China) and December 2018 (for South Africa and Vietnam). If it is determined that the revocation of the duties would likely lead to the continuation or recurrence of dumping of innersprings (determined by the DOC) and material injury to the U.S. innerspring industry (determined by the ITC), the duties will be extended. We believe that, without the extension, it is likely that dumping will recur and the U.S. innerspring industry will be materially injured. As a result, we are actively participating in the DOC and ITC reviews. We expect the DOC and ITC to issue their respective determinations in March 2014. If the duties are not extended, they will be retroactively revoked to February 2014 (for China) and December 2013 (for South Africa and Vietnam).

In addition, because of the documented evasion of antidumping orders by shipping of goods through third countries and falsely identifying the countries of origin, Leggett, along with several U.S. manufacturers have formed a coalition and are working with members of Congress, the DOC, and U.S. Customs and Border Protection to seek stronger enforcement of existing antidumping and/or countervailing duty orders.

Seasonality

As a diversified manufacturer, we generally have not experienced significant seasonality. The timing of acquisitions, dispositions, and economic factors in any year can distort the underlying seasonality in certain of our businesses. Historically, for the Company as a whole, the second and third quarters typically have proportionately greater sales, while the first and fourth quarters are generally lower.

| |

| • | Residential Furnishings: typically does not exhibit any significant seasonality, except for a reduction in fourth quarter sales. |

| |

| • | Commercial Fixturing & Components: typically does not exhibit any significant seasonality. |

| |

| • | Industrial Materials: minimal variation in sales throughout the year. |

| |

| • | Specialized Products: relatively little quarter-to-quarter variation in sales, although the automotive business is typically somewhat heavier in the second and fourth quarters of the year and lower in the third quarter due to model changeovers and plant shutdowns in the automobile industry during the summer. |

Backlog

Our customer relationships and our manufacturing and inventory practices do not create a material amount of backlog orders for any of our segments. Production and inventory levels are geared primarily to the level of incoming orders and projected demand based on customer relationships.

Working Capital Items

For information regarding working capital items, see the discussion of “Cash from Operations” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations on page 14 in Exhibit 99.3 attached to this Form 8-K.

Government Contracts

The Company does not have a material amount of sales derived from Government contracts subject to renegotiation of profits or termination at the election of any Government.

Environmental Regulation

Our operations are subject to federal, state, and local laws and regulations related to the protection of the environment. We have policies intended to ensure that our operations are conducted in compliance with applicable laws. While we cannot predict policy changes by various regulatory agencies, management expects that compliance with these laws and regulations will not have a material adverse effect on our competitive position, capital expenditures, financial condition, liquidity or results of operations.

Internet Access to Information

We routinely post information for investors to our website (www.leggett.com) under the Investor Relations section. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are made available, free of charge, on our website as soon as reasonably practicable after electronically filed with, or furnished to, the SEC. In addition to these reports, the Company’s Financial Code of Ethics, Code of Business Conduct and Ethics, and Corporate Governance Guidelines, as well as charters for the Audit, Compensation, and Nominating & Corporate Governance Committees of our Board of Directors, can be found on our website under the Corporate Governance section. Information contained on our website does not constitute part of this Annual Report on Form 10-K.

Discontinued Operations

Some of our prior businesses are disclosed in our annual financial statements as discontinued operations since (i) the operations and cash flows of the businesses were clearly distinguished and have been or will be eliminated from our ongoing operations; (ii) the businesses have either been disposed of or are classified as held for sale; and (iii) we will not have any significant continuing involvement in the operations of the businesses after the disposal transactions.

Our Store Fixtures business is classified as a discontinued operation. This business designs, produces, installs and manages customers' store fixture projects. It manufactures custom-designed, full store fixture packages for retailers, including shelving, counters, showcases and garment racks. It also produces standard shelving used by large retailers, grocery stores and discount chains. For more information on discontinued operations, see Note B on page 12 of the Notes to Consolidated Financial Statements in Exhibit 99.4 attached to this Form 8-K.