UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-07845

LEGGETT & PLATT, INCORPORATED

(Exact name of registrant as specified in its charter)

| Missouri | 44-0324630 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

No. 1 Leggett Road Carthage, Missouri | 64836 | |

| (Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code: (417) 358-8131

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Name of each exchange on which registered | |

| Common Stock, $.01 par value | New York Stock Exchange | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ý | Accelerated filer ¨ | |

| Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Emerging growth company ¨ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of the voting stock held by non-affiliates of the registrant (based on the closing price of our common stock on the New York Stock Exchange) on June 30, 2017 was $6,752,500,000.

There were 132,240,307 shares of the registrant’s common stock outstanding as of February 9, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

Part of Item 10, and all of Items 11, 12, 13 and 14 of Part III are incorporated by reference from the Company’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held on May 15, 2018.

TABLE OF CONTENTS

LEGGETT & PLATT, INCORPORATED—FORM 10-K

FOR THE YEAR ENDED December 31, 2017

Page Number | ||

| PART I | ||

| Item 1. | ||

| Item 1A. | ||

| Item 1B. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | ||

| Supp. Item. | ||

| PART II | ||

| Item 5. | ||

| Item 6. | ||

| Item 7. | ||

| Item 7A. | ||

| Item 8. | ||

| Item 9. | ||

| Item 9A. | ||

| Item 9B. | ||

| PART III | ||

| Item 10. | ||

| Item 11. | ||

| Item 12. | ||

| Item 13. | ||

| Item 14. | ||

| PART IV | ||

| Item 15. | ||

| Item 16. | ||

Forward-Looking Statements

This Annual Report on Form 10-K and our other public disclosures, whether written or oral, may contain “forward-looking” statements including, but not limited to: projections of revenue, income, earnings, capital expenditures, dividends, capital structure, cash flows, tax impacts or other financial items; possible plans, goals, objectives, prospects, strategies or trends concerning future operations; statements concerning future economic performance, possible goodwill or other asset impairment; and the underlying assumptions relating to the forward-looking statements. These statements are identified either by the context in which they appear or by use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” or the like. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described in this provision.

Any forward-looking statement reflects only the beliefs of the Company or its management at the time the statement is made. Because all forward-looking statements deal with the future, they are subject to risks, uncertainties and developments which might cause actual events or results to differ materially from those envisioned or reflected in any forward-looking statement. Moreover, we do not have, and do not undertake, any duty to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement was made. For all of these reasons, forward-looking statements should not be relied upon as a prediction of actual future events, objectives, strategies, trends or results.

Readers should review Item 1A Risk Factors in this Form 10-K for a description of important factors that could cause actual events or results to differ materially from forward-looking statements. It is not possible to anticipate and list all risks, uncertainties and developments which may affect the future operations or performance of the Company, or which otherwise may cause actual events or results to differ materially from forward-looking statements. However, the known, material risks and uncertainties include the following:

| • | factors that could affect the industries or markets in which we participate, such as growth rates and opportunities in those industries; |

| • | adverse changes in consumer confidence, housing turnover, employment levels, interest rates, trends in capital spending and the like; |

| • | factors that could impact raw materials and other costs, including the availability and pricing of steel scrap and rod and other raw materials, the availability of labor, wage rates and energy costs; |

| • | our ability to pass along raw material cost increases through increased selling prices; |

| • | price and product competition from foreign (particularly Asian and European) and domestic competitors; |

| • | our ability to maintain profit margins if our customers change the quantity and mix of our components in their finished goods; |

| • | our ability to realize 25-35% contribution margin on incremental unit volume produced utilizing spare capacity; |

| • | our ability to achieve expected levels of cash flow; |

| • | our ability to identify and consummate strategically-screened acquisitions; |

| • | our ability to maintain and grow the profitability of acquired companies; |

| • | adverse changes in foreign currency, tariffs, customs, shipping rates, political risk, and U.S. or foreign laws, regulations or legal systems (including the Tax Cuts and Jobs Act and other tax laws); |

| • | our ability to maintain the proper functioning of our internal business processes and information systems through technology failures or otherwise; |

| • | our ability to avoid modification or interruption of our information systems through cyber-security breaches; |

| • | a decline in the long-term outlook for any of our reporting units that could result in asset impairment; |

| • | the amount and timing of share repurchases; |

| • | the loss of one or more of our significant customers; and |

| • | litigation accruals related to various contingencies including vehicle-related personal injury, antitrust, intellectual property, product liability and warranty, taxation, environmental and workers’ compensation expense. |

1

PART I

PART I

Item 1. Business.

Summary

Leggett & Platt, Incorporated was founded as a partnership in Carthage, Missouri in 1883 and was incorporated in 1901. The Company, a pioneer of the steel coil bedspring, has become an international diversified manufacturer that conceives, designs and produces a wide range of engineered components and products found in many homes, offices, automobiles and aircraft. As discussed below, our operations are organized into 14 business units, which are divided into ten groups under our four segments: Residential Products; Industrial Products; Furniture Products; and Specialized Products.

Overview of Our Segments

Residential Products Segment

| BEDDING GROUP |

| U.S. Spring |

| International Spring |

| FABRIC & CARPET CUSHION GROUP |

| Fabric Converting |

| Geo Components |

| Carpet Cushion |

| MACHINERY GROUP |

| Machinery |

Our Residential Products segment began in 1883 with the manufacture of steel coil bedsprings. Today, we supply a variety of components and machinery used by bedding manufacturers in the production and assembly of their finished products. Our range of products offers our customers a single source for many of their component needs. We also produce or distribute carpet cushion, fabric, and geo components.

Innovative proprietary products and low cost have made us the largest U.S. manufacturer in many of these businesses. We strive to understand what drives consumer purchases in our markets and focus our product development activities on meeting end-consumer needs. We attain a cost advantage from efficient manufacturing methods, internal production of key raw materials, purchasing leverage, and large-scale production. Sourcing components from us allows our customers to focus on designing, merchandising and marketing their products.

PRODUCTS

Bedding Group

| • | Innersprings (sets of steel coils, bound together, that form the core of a mattress) | ||

| • | Wire forms for mattress foundations | ||

| • | Machines that we use to shape wire into various types of springs | ||

2

PART I

Fabric & Carpet Cushion Group

| • | Structural fabrics for mattresses, residential furniture and industrial uses | ||

| • | Carpet cushion (made from bonded scrap foam, fiber, rubber and prime foam) | ||

| • | Geo components (synthetic fabrics and various other products used in ground stabilization, drainage protection, erosion and weed control) | ||

Machinery Group

| • | Quilting machines for mattress covers | ||

| • | Industrial sewing/finishing machines | ||

| • | Conveyor lines | ||

| • | Mattress packaging and glue-drying equipment | ||

CUSTOMERS

| • | Manufacturers of finished bedding (mattresses and foundations) | ||

| • | Retailers and distributors of carpet cushion | ||

| • | Contractors, landscapers, road construction companies, and government agencies using geo components | ||

| • | Manufacturers of upholstered furniture, packaging, filtration and draperies | ||

Industrial Products Segment

| WIRE GROUP |

Drawn Wire1 |

| Steel Rod |

1 Drawn Wire includes our former Wire Products business unit effective January 1, 2018.

The quality of our products and service, together with low cost, have made Leggett & Platt the leading U.S. supplier of high-carbon drawn steel wire. Our Wire Group operates a steel rod mill with an annual output of approximately 500,000 tons, of which a substantial majority is used by our own wire mills. We have three wire mills that supply virtually all the wire consumed by our other domestic businesses. We also supply steel wire to trade customers that operate in a broad range of markets.

PRODUCTS

Wire Group

| • | Drawn wire | ||

| • | Steel rod | ||

CUSTOMERS

We use about 70% of our wire output to manufacture our own products, including:

| • | Bedding and furniture components | ||

| • | Automotive seat suspension systems | ||

3

PART I

The Industrial Products segment also has a diverse group of trade customers that include:

| • | Mechanical spring manufacturers | ||

| • | Wire distributors | ||

| • | Packaging and baling companies | ||

Furniture Products Segment

| HOME FURNITURE GROUP |

Home Furniture 1 |

| WORK FURNITURE GROUP |

| Work Furniture |

| CONSUMER PRODUCTS GROUP |

Consumer Products 2 |

1 Home Furniture includes our former Furniture Hardware and Seating & Distribution business units effective January 1, 2018.

2 Consumer Products includes our former Adjustable Bed and Fashion Bed business units effective January 1, 2018.

In our Furniture Products segment, we design, manufacture, and distribute a wide range of components and finished products for the residential furniture, office and commercial furniture, and specialty bedding markets. We supply components used by home and work furniture manufacturers to provide comfort, motion and style in their finished products, as well as select lines of private-label finished furniture. We are also a major supplier of adjustable beds and fashion beds, with domestic manufacturing, distribution, e-commerce fulfillment and global sourcing capabilities.

PRODUCTS

Home Furniture Group

| • | Steel mechanisms and motion hardware (enabling furniture to recline, tilt, swivel, rock and elevate) for reclining chairs, sofas, sleeper sofas and lift chairs | ||

| • | Springs and seat suspensions for chairs, sofas and love seats | ||

Work Furniture Group

| • | Select lines of private-label finished furniture | ||

| • | Bases, columns, back rests, casters and frames for office chairs, and control devices that allow chairs to tilt, swivel and elevate | ||

| • | Molded plywood components | ||

Consumer Products Group

| • | Adjustable beds | ||

| • | Fashion beds and bed frames | ||

4

PART I

CUSTOMERS

| • | Manufacturers of upholstered furniture | ||

| • | Office furniture manufacturers | ||

| • | Mattress and furniture retailers | ||

| • | Department stores and big box retailers | ||

| • | E-commerce retailers | ||

Specialized Products Segment

| AUTOMOTIVE GROUP |

| Automotive |

| AEROSPACE PRODUCTS GROUP |

| Aerospace Products |

HYDRAULIC CYLINDERS GROUP1 |

| Hydraulic Cylinders |

1 Formed January 31, 2018, with the acquisition of a manufacturer of hydraulic cylinders.

Our Specialized Products segment designs, manufactures and sells products including automotive seating components, tubing and fabricated assemblies for the aerospace industry, and hydraulic cylinders for the material handling, construction and transportation industries. Our technical capability and deep customer engagement allows us to compete on critical functionality, such as comfort, size, weight and noise. Our reliable product development and launch capability, coupled with our global footprint, makes us a trusted partner for our Tier 1 and OEM customers.

PRODUCTS

Automotive Group

| • | Mechanical and pneumatic lumbar support and massage systems for automotive seating | ||

| • | Seat suspension systems | ||

| • | Motors and actuators, used in a wide variety of vehicle power features | ||

| • | Cables | ||

Aerospace Products Group

| • | Titanium, nickel and stainless-steel tubing, formed tube and tube assemblies, primarily used in fluid conveyance systems | ||

Hydraulic Cylinders Group

| • | Engineered hydraulic cylinders | ||

5

PART I

CUSTOMERS

| • | Automobile OEMs and Tier 1 suppliers | ||

| • | Aerospace suppliers | ||

| • | Mobile equipment OEMs, primarily serving material handling and construction markets | ||

Segment Financial Information

For information about sales to trade customers, sales by product line, EBIT, and total assets of each of our segments, refer to Note E on page 82 of the Notes to Consolidated Financial Statements.

Our reportable segments are the same as our operating segments, which also correspond with our management organizational structure. In conjunction with the change in executive officers, our management organizational structure and all related internal reporting changed effective January 1, 2017. As a result, the composition of our four segments also changed to reflect the new structure. The new segment structure is largely the same as prior years except the Home Furniture Group moved from Residential Products to Furniture Products (formerly Commercial Products) and the Machinery Group moved from Specialized Products to Residential Products.

In addition, the changes in LIFO reserve are now recognized within the segments to which they relate (primarily Industrial Products). Previously segment EBIT (Earnings Before Interest and Taxes) reflected the FIFO basis of accounting for certain inventories and an adjustment to the LIFO basis for these inventories was made at the consolidated financial statement level. These changes were retrospectively applied to all periods presented. The methods and assumptions that we use in estimating our LIFO reserve did not change.

Strategic Direction

Key Financial Metric

Total Shareholder Return (TSR), relative to peer companies, is the key financial measure that we use to assess long-term performance. TSR = (Change in Stock Price + Dividends)/Beginning Stock Price. Our goal is to achieve TSR in the top third of the S&P 500 companies over rolling three-year periods through an approach that employs four TSR sources: revenue growth, margin expansion, dividends, and share repurchases.

Our incentive programs reward return generation and profitable growth. Senior executives participate in a TSR-based incentive program (based on our performance compared to a group of approximately 320 peers).

For information about our TSR targets and performance see the discussion under "Total Shareholder Return" in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations on page 28.

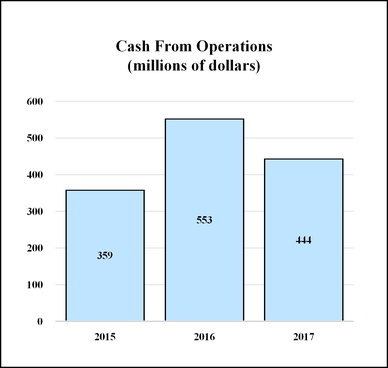

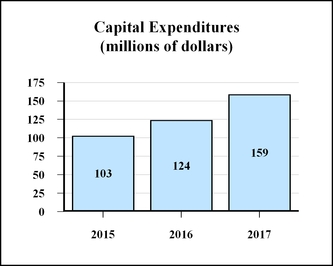

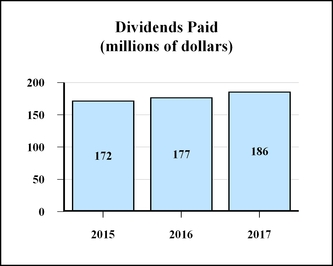

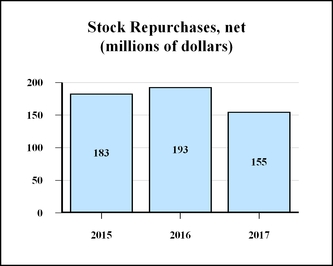

Returning Cash to Shareholders

During the past three years, we generated $1.36 billion of operating cash, and we returned much of this cash to shareholders in the form of dividends and share repurchases. Our top priorities for use of cash are organic growth (capital expenditures), dividends, and strategic acquisitions. After funding those priorities, if there is still cash available, we generally intend to repurchase stock.

For information about dividends and share repurchases see the discussion under "Pay Dividends" and "Repurchase Stock" in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations beginning on page 44.

6

PART I

Portfolio Management

We utilize a rigorous strategic planning process to help guide decisions regarding business unit roles, capital allocation priorities, and new areas in which to grow. We review the portfolio classification of each unit on an annual basis to determine its appropriate role (Grow, Core, Fix or Divest). This review includes criteria such as competitive position, market attractiveness, business unit size, and fit within our overall objectives, as well as financial indicators such as business unit return, growth of EBIT (earnings before interest and taxes), EBIT margin, EBITDA (earnings before interest, taxes, depreciation and amortization), and operating cash flows. Business units in the Grow category should provide avenues for profitable growth from competitively advantaged positions in attractive markets. Core business units are expected to enhance productivity, improve market share, and generate cash flow from operations while using minimal capital. To remain in the portfolio, business units are expected to consistently generate after-tax returns in excess of our cost of capital. Business units that fail to consistently attain minimum return goals will be moved to the Fix or Divest categories.

Disciplined Growth

We revised our TSR framework in 2016 to moderately increase the expected long-term contribution from revenue growth to 6-9% (from 4-5% previously). Over the last three years, the Company has generated combined unit volume and acquisition growth of 5% per year on average, but this growth was partially offset by divestitures, commodity deflation and currency impact.

Our long-term 6-9% annual revenue growth objective envisions periodic acquisitions. We primarily seek acquisitions within our Grow businesses, and look for opportunities to enter new, higher growth markets (carefully screened for sustainable competitive advantage). We expect all acquisitions to (a) have a clear strategic rationale, a sustainable competitive advantage, a strong fit with the Company, and be in an attractive and growing market; (b) create value by enhancing TSR; (c) for stand-alone businesses: generally possess annual revenue in excess of $50 million, strong management and future growth opportunity with a strong market position in a market growing faster than GDP; and (d) for bolt-on businesses: generally possess annual revenue in excess of $15 million, significant synergies, and a strategic fit with an existing business unit.

Acquisitions

2018

On January 31, 2018, we acquired Precision Hydraulic Cylinders (PHC), a leading global manufacturer of

engineered hydraulic cylinders primarily for the materials handling market. The purchase price was $85 million. This business has current annual revenues of $81 million and represents a new growth platform for the Company. PHC serves a market of mainly large OEM customers utilizing highly engineered, co-designed components with long product life-cycles, yet representing a small percentage of the end product’s cost. PHC will form a new business group titled Hydraulic Cylinders and report in the Specialized Products segment.

2017

We acquired three businesses and the remaining interest in a joint venture for total consideration (including cash and stock) of $56 million. The first was a Canadian geosynthetic products distributor and installer for civil engineering and construction applications. The second was a Michigan-based surface-critical bent tube manufacturer supporting our private-label seating strategy in Work Furniture. We also acquired a North Carolina manufacturer of rebond carpet cushion. Finally, we acquired the remaining 20% ownership in an Asian joint venture in our Work Furniture business.

7

PART I

2016

We acquired three businesses and the remaining interest in a joint venture for total consideration of $65 million. The first was a U.S. manufacturer of aerospace tube assemblies. This business further expands our tube forming and fabrication capabilities, and also adds precision machining to our aerospace platform. We also acquired a distributor of geosynthetic products and a South African producer of mattress innersprings. Finally, we purchased the remaining interest in an Automotive joint venture in China. This business manufactures seat comfort products and lumbar support systems.

2015

We acquired a 70% interest in a European private-label manufacturer of high-end upholstered furniture. This business is complementary to our North American private-label operation and allows us to support our Work Furniture customers as they expand globally. The initial cash outlay for the 70% interest was $12 million and, per the terms of the agreement, we will acquire the remaining 30% in two equal parts, in the second quarters of 2018 and 2020. We have recorded a liability of approximately $14 million for these future payments. The recorded liability is based upon estimates and may fluctuate significantly until the payment dates.

For more information regarding our acquisitions, please refer to Note Q on page 110 of the Notes to Consolidated Financial Statements.

Divestitures

2017

We divested our final Commercial Vehicle Products (CVP) business for total consideration of $9 million. This business unit was engaged in the manufacture of van interiors, including the racks, shelving and cabinets installed in service vans.

2016

We divested four businesses for net consideration of $72 million. We sold two wire operations, one that manufactured wire partitions, perimeter guarding and storage lockers, and another that manufactured automatic wire strapping equipment and related consumable wire products. We also sold a CVP operation that designed and assembled docking stations for mobile computing equipment in vehicles. Finally, we sold a Machinery business that assembled industrial sewing machines.

2015

We sold four operations for total consideration of $36 million. We sold our final two Store Fixtures operations and a small operation within our CVP business. We also sold our Steel Tubing business unit. This business manufactured welded steel tubing and fabricated tube components.

For further information about divestitures and discontinued operations, see Note B on page 77 of the Notes to Consolidated Financial Statements.

8

PART I

Foreign Operations

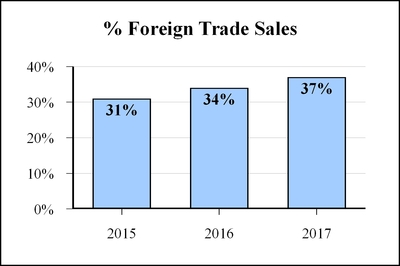

The percentages of our trade sales related to products manufactured outside the United States for the previous three years are shown below. The percentages of foreign trade sales were 31% for 2015, 34% for 2016 and 37% for 2017.

Our international operations are principally located in Europe, China, Canada and Mexico. Our products in these foreign locations primarily consist of:

Europe

| • | Innersprings for mattresses |

| • | Lumbar and seat suspension systems for automotive seating |

| • | Seamless and welded tubing and fabricated assemblies for aerospace applications |

| • | Select lines of private-label finished furniture |

| • | Machinery and equipment designed to manufacture innersprings for mattresses |

China

| • | Lumbar and seat suspension systems for automotive seating |

| • | Cables, motors, and actuators for automotive applications |

| • | Recliner mechanisms and bases for upholstered furniture |

| • | Formed wire for upholstered furniture |

| • | Innersprings for mattresses |

| • | Work furniture components, including chair bases and casters |

Canada

| • | Lumbar supports for automotive seats |

| • | Fabricated wire for the furniture and automotive industries |

| • | Work furniture chair controls, chair bases and table bases |

9

PART I

Mexico

| • | Innersprings and fabricated wire for the bedding industry |

| • | Lumbar and seat suspension systems for automotive seating |

| • | Adjustable beds |

Our international expansion strategy is to locate our operations where we believe we would possess a competitive advantage and where demand for our components is growing. We have also expanded internationally in instances where our customers move the production of their finished products overseas to supply them more efficiently.

Our international operations face the risks associated with any operation in a foreign country. These risks include:

| • | Foreign currency fluctuation |

| • | Foreign legal systems that make it difficult to protect intellectual property and enforce contract rights |

| • | Credit risks |

| • | Increased costs due to tariffs, customs and shipping rates |

| • | Potential problems obtaining raw materials, and disruptions related to the availability of electricity and transportation during times of crisis or war |

| • | Inconsistent interpretation and enforcement, at times, of foreign tax laws |

| • | Political instability in certain countries |

Our Specialized Products segment, which derives roughly 85% of its trade sales from foreign operations, is particularly subject to the above risks. These and other foreign-related risks could result in cost increases, reduced profits, the inability to carry on our foreign operations and other adverse effects on our business.

10

PART I

Geographic Areas of Operation

As of December 31, 2017, we had 121 manufacturing facilities; 73 located in the U.S. and 48 located in 17 foreign countries, as shown below. We also had various sales, warehouse and administrative facilities. However, our manufacturing plants are our most important properties.

| Residential Products | Industrial Products | Furniture Products | Specialized Products | |

| North America | ||||

| Canada | n | n | n | |

| Mexico | n | n | n | n |

| United States | n | n | n | n |

| Europe | ||||

| Austria | n | |||

| Belgium | n | |||

| Croatia | n | |||

| Denmark | n | |||

| France | n | |||

| Hungary | n | |||

| Italy | n | |||

| Poland | n | |||

| Switzerland | n | |||

| United Kingdom | n | n | ||

| South America | ||||

| Brazil | n | |||

| Asia | ||||

| China | n | n | n | |

| India | n | |||

| South Korea | n | |||

| Africa | ||||

| South Africa | n | |||

For further information concerning our trade sales related to products manufactured, and our tangible long-lived assets located outside the United States, refer to Note E on page 82 of the Notes to Consolidated Financial Statements.

11

PART I

Sales by Product Line

The following table shows our approximate percentage of trade sales by product line for the last three years:

| Product Line | 2017 | 2016 | 2015 | |||||||

| Bedding Group | 21 | % | 22 | % | 23 | % | ||||

| Automotive Group | 20 | 19 | 16 | |||||||

| Fabric & Carpet Cushion Group | 18 | 18 | 17 | |||||||

| Home Furniture Group | 10 | 11 | 11 | |||||||

| Consumer Products Group | 10 | 8 | 8 | |||||||

Wire Group1 | 7 | 8 | 9 | |||||||

| Work Furniture Group | 7 | 7 | 6 | |||||||

| Aerospace Products Group | 4 | 3 | 3 | |||||||

| Machinery Group | 2 | 2 | 2 | |||||||

Commercial Vehicle Products Group2 | 1 | 2 | 3 | |||||||

Steel Tubing Group3 | — | — | 2 | |||||||

1Certain operations in the Wire Group were sold in 2016.

2The two remaining Commercial Vehicle Products operations were sold in 2017 and 2016.

3The Steel Tubing Group was sold in 2015.

Distribution of Products

In each of our segments, we sell and distribute our products primarily through our own personnel. However, many of our businesses have relationships and agreements with outside sales representatives and distributors. We do not believe any of these agreements or relationships would, if terminated, have a material adverse effect on the consolidated financial condition, operating cash flows or results of operations of the Company.

Raw Materials

The products we manufacture require a variety of raw materials. We believe that worldwide supply sources are readily available for all the raw materials we use. Among the most important are:

| • | Various types of steel, including scrap, rod, wire, sheet, stainless and angle iron |

| • | Foam scrap |

| • | Woven and non-woven fabrics |

| • | Titanium and nickel-based alloys and other high strength metals |

We supply our own raw materials for many of the products we make. For example, we produce steel rod that we make into steel wire, which we then use to manufacture:

| • | Innersprings and foundations for mattresses |

| • | Springs and seat suspensions for chairs and sofas |

| • | Automotive seating suspension systems |

We supply a substantial majority of our domestic steel rod requirements through our own rod mill. Our wire drawing mills supply nearly all of our U.S. requirements for steel wire.

12

PART I

Customer Concentration

We serve thousands of customers worldwide, sustaining many long-term business relationships. In 2017, our largest customer accounted for approximately 5% of our consolidated revenues. Our top 10 customers accounted for approximately 33% of these consolidated revenues. The loss of one or more of these customers could have a material adverse effect on the Company as a whole, or on the respective segment in which the customer’s sales are reported, including our Residential Products, Specialized Products and Furniture Products segments.

Patents and Trademarks

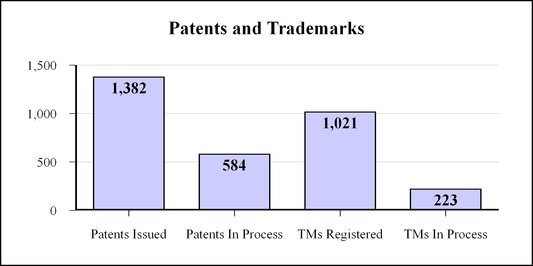

The chart below shows the approximate number of patents issued, patents in process, trademarks registered and trademarks in process held by our continuing operations as of December 31, 2017. No single patent or group of patents, or trademark or group of trademarks, is material to our operations as a whole. Substantially all of our patents relate to products manufactured by the Residential Products, Furniture Products, and Specialized Products segments, while nearly half of our trademarks relate to products manufactured by the Residential Products segment. We had 1,382 patents issued and 584 in process, and 1,021 trademarks registered and 223 in process.

Some of our most significant trademarks include:

| • | ComfortCore®, Mira-Coil®, VertiCoil®, Quantum®, Nanocoil®, Softech®, Lura-Flex®, Superlastic® and Active Support Technology® (mattress innersprings) |

| • | Semi-Flex® (box spring components and foundations) |

| • | Spuhl® (mattress innerspring manufacturing machines) |

| • | Wall Hugger® (recliner chair mechanisms) |

| • | Super Sagless® (motion and sofa sleeper mechanisms) |

| • | No-Sag® (wire forms used in seating) |

| • | LPSense® (capacitive sensing) |

| • | Hanes® (fabric materials) |

| • | Schukra®, Pullmaflex® and Flex-O-Lator® (automotive seating products) |

| • | Gribetz® and Porter® (quilting and sewing machines) |

13

PART I

Product Development

One of our strongest performing product categories across the company is ComfortCore®, our fabric-encased innerspring coils used in hybrid and other mattresses. Our ComfortCore® volume continues to grow, and represented 40% of our total innerspring units by the end of 2017. A growing number of our ComfortCore® innersprings contain a feature we call Quantum® Edge. These are narrow-diameter, fabric-encased coils that form a perimeter around a ComfortCore® innerspring set, replacing foam in a finished mattress. Over 30% of our ComfortCore® innersprings have the Quantum® Edge feature, and the volume of ComfortCore® with Quantum® Edge continues to grow. We are investing in capacity and adding machinery, supplied by our Spuhl® operation, to support the growth in ComfortCore® and Quantum® Edge.

Most of our other businesses are engaged in product development activities to protect our market position and support ongoing growth.

Research and Development

We maintain research, development and testing centers in many locations around the world. We are unable to calculate precisely the cost of research and development because the personnel involved in product and machinery development also spend portions of their time in other areas. However, we estimate our annual cost of research and development to be $25 million each year over the last three years.

Employees

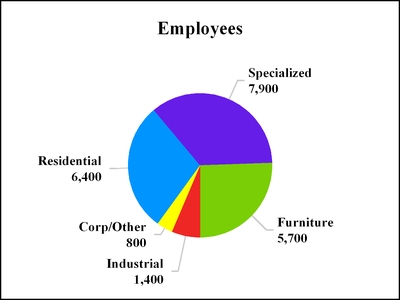

At December 31, 2017, we had approximately 22,200 employees, of which 16,300 were engaged in production. Of the 22,200, approximately 12,700 were international employees (6,400 in China). Approximately 15% of our employees are represented by labor unions that collectively bargain for work conditions, wages or other issues. We did not experience any work stoppage related to contract negotiations with labor unions during 2017. Management is not aware of any circumstances likely to result in a material work stoppage related to contract negotiations with labor unions during 2018. We had approximately 7,900 employees in Specialized Products; 6,400 in Residential Products; 5,700 in Furniture Products; and 1,400 in Industrial Products.

At December 31, 2016, we had approximately 21,300 employees.

14

PART I

Competition

Many companies offer products that compete with those we manufacture and sell. The number of competing companies varies by product line, but many of the markets for our products are highly competitive. We tend to attract and retain customers through innovation, product quality, competitive pricing and customer service. Many of our competitors try to win business primarily on price but, depending upon the particular product, we experience competition based on quality and performance as well. In general, our competitors tend to be smaller, private companies.

We believe we are the largest U.S. manufacturer, in terms of revenue, of the following:

| • | Bedding components |

| • | Automotive seat support and lumbar systems |

| • | Components for home furniture and work furniture |

| • | Carpet cushion |

| • | Adjustable beds |

| • | High-carbon drawn steel wire |

| • | Bedding industry machinery |

We continue to face pressure from foreign competitors as some of our customers source a portion of their components and finished products offshore. In addition to lower labor rates, foreign competitors benefit (at times) from lower raw material costs. They may also benefit from currency factors and more lenient regulatory climates. We typically remain price competitive, even versus many foreign manufacturers, as a result of our efficient operations, low labor content, vertical integration in steel and wire, logistics and distribution efficiencies, and large scale purchasing of raw materials and commodities. However, we have also reacted to foreign competition in certain cases by selectively adjusting prices, and by developing new proprietary products that help our customers reduce total costs.

For information about antidumping duty orders regarding innerspring and steel wire rod imports, please see "Competition" in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations on page 29.

Seasonality

As a diversified manufacturer, we generally have not experienced significant seasonality. However, unusual economic factors in any given year, along with acquisitions and divestitures, can create sales variability and obscure the underlying seasonality of our businesses. Historically, our operating cash flows are stronger in the fourth quarter primarily related to the timing of cash collections from customers and payments to vendors.

Backlog

Our customer relationships and our manufacturing and inventory practices do not create a material amount of backlog orders for any of our segments. Production and inventory levels are geared primarily to the level of incoming orders and projected demand based on customer relationships.

15

PART I

Working Capital Items

For information regarding working capital items, please see the discussion of "Cash from Operations" in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations on page 40.

Government Contracts

The Company does not have a material amount of sales derived from government contracts subject to renegotiation of profits or termination at the election of any government.

Environmental Regulation

Our operations are subject to federal, state, and local laws and regulations related to the protection of the environment. We have policies intended to ensure that our operations are conducted in compliance with applicable laws. While we cannot predict policy changes by various regulatory agencies, management expects that compliance with these laws and regulations will not have a material adverse effect on our competitive position, capital expenditures, financial condition, liquidity or results of operations.

Internet Access to Information

We routinely post information for investors under the Investor Relations section of our website (www.leggett.com). Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are made available, free of charge, on our website as soon as reasonably practicable after electronically filed with, or furnished to, the SEC. In addition to these reports, the Company’s Financial Code of Ethics, Code of Business Conduct and Ethics, and Corporate Governance Guidelines, as well as charters for the Audit, Compensation, and Nominating & Corporate Governance Committees of our Board of Directors, can be found on our website under the Corporate Governance section. Information contained on our website does not constitute part of this Annual Report on Form 10-K.

Discontinued Operations

For information on discontinued operations, please see Note B on page 77 of the Notes to Consolidated Financial Statements.

Item 1A. Risk Factors.

Investing in our securities involves risk. Set forth below and elsewhere in this report are risk factors that could cause actual results to differ materially from the results contemplated by the forward-looking statements contained in this report. We may amend or supplement these risk factors from time to time by other reports we file with the SEC.

Costs of raw materials could negatively affect our profit margins and earnings.

Raw material cost increases (and our ability to respond to cost increases through selling price increases) can significantly impact our earnings. We typically have short-term commitments from our suppliers; therefore, our raw material costs generally move with the market. When we experience significant increases in raw material costs, we typically implement price increases to recover the higher costs. Inability to recover cost increases (or a delay in the recovery time) can negatively impact our earnings. Conversely, if raw material costs decrease, we generally pass

16

PART I

through reduced selling prices to our customers. Reduced selling prices combined with higher cost inventory can reduce our segment margins and earnings.

Steel is our principal raw material. The global steel markets are cyclical in nature and have been volatile in recent years. This volatility can result in large swings in pricing and margins from year to year. Our operations can also be impacted by changes in the cost of fabrics and foam scrap. We experienced significant fluctuations in the cost of these commodities in past years.

As a producer of steel rod, we are also impacted by volatility in metal margins (the difference between the cost of steel scrap and the market price for steel rod). If market conditions cause scrap costs and rod pricing to change at different rates (both in terms of timing and amount), metal margins could be compressed and this would negatively impact our results of operations.

Higher raw material costs in past years led some of our customers to modify their product designs, changing the quantity and mix of our components in their finished goods. In some cases, higher cost components were replaced with lower cost components. This primarily impacted our Residential Products product mix and decreased profit margins. If this were to occur again it could negatively impact our results of operations.

Competition could adversely affect our market share, sales, profit margins and earnings.

We operate in markets that are highly competitive. We believe that most companies in our lines of business compete primarily on price, but, depending upon the particular product, we experience competition based on quality and performance. We face ongoing pressure from foreign competitors as some of our customers source a portion of their components and finished products from Asia and Europe. In addition to lower labor rates, foreign competitors benefit (at times) from lower raw material costs. They may also benefit from currency factors and more lenient regulatory climates. If we are unable to purchase key raw materials, such as steel, at prices competitive with those of foreign suppliers, our ability to maintain market share and profit margins could be harmed by foreign competitors.

We are exposed to litigation contingencies that, if realized, could have a material negative impact on our financial condition, results of operations and cash flows.

Although we deny liability in all currently threatened or pending litigation proceedings and believe that we have valid bases to contest all claims made against us, we have, at December 31, 2017, an aggregate litigation contingency accrual of $.4 million. Based on current facts and circumstances, aggregate reasonably possible (but not probable) losses in excess of the recorded accruals for litigation contingencies (which include Brazilian VAT and other matters) are estimated to be $22 million. If our assumptions or analysis regarding these contingencies is incorrect, or if facts and circumstances change, we could realize loss in excess of the recorded accruals (and in excess of the $22 million referenced above) which could have a material negative impact on our financial condition, results of operations and cash flows. For more information regarding our legal contingencies, please see Note S on page 115 of the Notes to Consolidated Financial Statements.

We are exposed to foreign currency risk which may negatively impact our competitiveness, profit margins and earnings.

We expect that international sales will continue to represent a significant percentage of our total sales, which exposes us to currency exchange rate fluctuations. In 2017, 37% of our sales were generated by international operations. The revenues and expenses of our foreign operations are generally denominated in local currencies; however, certain of our operations experience currency-related gains and losses where sales or purchases are denominated in currencies other than their local currency. Further, our competitive position may be affected by the relative strength of the currencies in countries where our products are sold. Foreign currency exchange risks inherent in doing business in foreign countries may have a material adverse effect on our future operations and financial results.

17

PART I

Our goodwill and other long-lived assets are subject to potential impairment which could negatively impact our earnings.

A significant portion of our assets consists of goodwill and other long-lived assets, the carrying value of which may be reduced if we determine that those assets are impaired. At December 31, 2017, goodwill and other intangible assets represented $991 million, or 28% of our total assets. In addition, net property, plant and equipment and sundry assets totaled $793 million, or 22% of total assets. If actual results differ from the assumptions and estimates used in the goodwill and long-lived asset valuation calculations, we could incur impairment charges, which would negatively impact our earnings.

We review our reporting units for potential goodwill impairment in June as part of our annual goodwill impairment testing, and more often if an event or circumstance occurs making it likely that impairment exists. In addition, we test for the recoverability of long-lived assets at year end, and more often if an event or circumstance indicates the carrying value may not be recoverable. We conduct impairment testing based on our current business strategy in light of present industry and economic conditions, as well as future expectations. If we are not able to achieve projected performance levels, future impairments could be possible, which would negatively impact our earnings.

For more information regarding potential goodwill and other long-lived asset impairment, please refer to Note C on page 79 of the Notes to Consolidated Financial Statements.

Technology failures or cyber security breaches could have a material adverse effect on our operations.

We rely on information systems to obtain, process, analyze and manage data, as well as to facilitate the manufacture and distribution of inventory to and from our facilities. We receive, process and ship orders, manage the billing of and collections from our customers, and manage the accounting for and payment to our vendors. We transitioned certain corporate-level shared service systems primarily related to our U.S. operations for general ledger, cash application, purchasing and accounts payable disbursements to a new platform during the first quarter of 2017. Technology failures or security breaches of a new or existing infrastructure could create system disruptions or unauthorized disclosure of confidential information. If this occurs, our operations could be disrupted, or we may suffer financial loss because of lost or misappropriated information. We cannot be certain that advances in criminal capabilities will not compromise our technology protecting information systems. If these systems are interrupted or damaged by these events or fail for any extended period of time, then our results of operations could be adversely affected.

We may not be able to realize deferred tax assets on our balance sheet depending upon the amount and source of future taxable income.

Our ability to realize deferred tax assets on our balance sheet is dependent upon the amount and source of future taxable income. Economic uncertainty or a reduction in the amount of taxable income or a change in the source of taxable income could impact our underlying assumptions on which valuation reserves are established and negatively affect future period earnings and balance sheets.

We have exposure to economic and other factors that affect market demand for our products which may negatively impact our sales, operating cash flows and earnings.

As a supplier of products to a variety of industries, we are adversely affected by general economic downturns. Our operating performance is heavily influenced by market demand for our components and products. Market demand for the majority of our products is most heavily influenced by consumer confidence. To a lesser extent, market demand is impacted by other broad economic factors, including disposable income levels, employment levels, housing turnover and interest rates. All of these factors influence consumer spending on durable goods, and

18

PART I

drive demand for our components and products. Some of these factors also influence business spending on facilities and equipment, which impacts approximately one quarter of our sales.

Demand weakness in our markets can lead to lower unit orders, sales and earnings in our businesses. Several factors, including a weak global economy, low consumer confidence, or a depressed housing market could contribute to conservative spending habits by consumers around the world. Short lead times in most of our markets allow for limited visibility into demand trends. If economic and market conditions deteriorate, we may experience material negative impacts on our business, financial condition, operating cash flows and results of operations.

We are exposed to political, regulatory, and legislative risks that may arise from actions by U.S. or foreign governments that could negatively impact our results of operations, financial condition and cash flows.

In 2017, 37% of our sales were generated by international operations. Further, many of our businesses obtain products, components and raw materials from global suppliers. Accordingly, our business is subject to the political, regulatory, and legislative risks inherent in operating in numerous countries. These regulations and laws are complex and may change. If the U.S. or foreign governments adopt or change regulations, this could negatively impact our results of operations, financial condition and cash flows.

Changes in tax laws or challenges to our tax positions could negatively impact our results of operations, financial condition and cash flows.

We are subject to the tax laws and reporting rules of the U.S. (federal, state and local) and several foreign jurisdictions. Current economic and political conditions make these tax rules (and governmental interpretation of these rules) in any jurisdiction, including the U.S., subject to significant change and uncertainty. There have been proposals, most notably by the Organization for Economic Cooperation and Development, the European Union, the U.S., and Canada, to reform tax laws or change interpretations of existing tax rules. Some of these proposals, if adopted, could significantly impact how multinational corporations are taxed on their earnings and transactions. Although we cannot predict whether or in what form these proposals will become law, or how they might be interpreted, such changes could have a material adverse effect on our earnings and cash flows.

On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (TCJA), resulting in significant changes to U.S. federal income tax law, including the reduction of the statutory federal income tax rate for corporations and the transition from a worldwide tax system to a territorial system. We are continuing to assess the extensive changes under this legislation and its overall impact on the Company. Based on our current understanding, we expect TCJA to reduce our tax rate in future periods. However, this expectation is based on our current knowledge of the legislation and assumptions we have made. Recognized impacts could differ materially from current estimates based on additional analysis, changes in our interpretation of certain aspects of the legislation, actual financial results for 2018, additional regulatory guidance that might be issued, and other factors, including actions the Company may take as a result of TCJA.

Business disruptions to our steel rod mill, if coupled with an inability to purchase an adequate and/or timely supply of quality steel rod from alternative sources, could have a material negative impact on our Residential Products and Industrial Products segments and Company results of operations.

We purchase steel scrap from third party suppliers. This scrap is converted into steel rod in our mill in Sterling, Illinois. Our steel rod mill has annual output of approximately 500,000 tons, a substantial majority of which is used by our three wire mills. Our wire mills convert the steel rod into drawn steel wire. This wire is used in the production of many of our products, including mattress innersprings.

19

PART I

A disruption to the operation of, or supply of steel scrap to, our steel rod mill could require us to purchase steel rod from alternative supply sources, subject to market availability. Ongoing trade action by domestic rod producers against several foreign suppliers could result in the imposition of additional duties on steel rod imports which could result in reduced market availability and/or higher cost of steel rod.

If we experience a disruption to our ability to produce steel rod in our mill, coupled with a reduction of adequate and/or timely supply from alternative market sources of quality steel rod, we could experience a material negative impact on our Residential Products and Industrial Products segments and Company results of operations.

Inability to identify and consummate acquisitions at a sufficient rate and at appropriate prices could negatively impact our annual revenue growth rate.

Our long-term 6-9% annual revenue growth objective envisions periodic acquisitions. We expect to continue our strategy of seeking acquisitions that have a clear strategic rationale, a sustainable competitive advantage, a strong fit with the Company, are in a growing market, and create value by enhancing total shareholder return. Our ability to grow revenues at 6-9% depends, in part, upon our ability to identify and successfully acquire these businesses at appropriate prices. Because of competition among prospective buyers which often leads to higher valuations, the need to satisfy applicable closing conditions or obtain antitrust and other regulatory approvals on acceptable terms, and accounting, regulatory and tax requirements, we may not be able to identify or consummate these acquisitions at a sufficient rate, which could adversely impact our annual revenue growth rate.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

The Company’s corporate office is located in Carthage, Missouri. As of December 31, 2017 we had 121 manufacturing locations, of which 73 are located across the United States and 48 are located in 17 foreign countries. We also had various sales, warehouse and administrative facilities. However, our manufacturing plants are our most important properties.

Manufacturing Locations by Segment

| Company- Wide | Subtotals by Segment | |||||||||

| Manufacturing Locations | Residential Products | Industrial Products | Furniture Products | Specialized Products | ||||||

| United States | 73 | 38 | 6 | 25 | 4 | |||||

| Europe | 15 | 7 | — | 1 | 7 | |||||

| China | 17 | 2 | — | 5 | 10 | |||||

| Canada | 6 | 1 | — | 2 | 3 | |||||

| Mexico | 6 | 2 | 1 | 1 | 2 | |||||

| Other | 4 | 2 | — | — | 2 | |||||

| Total | 121 | 52 | 7 | 34 | 28 | |||||

For more information regarding the geographic location of our manufacturing facilities refer to “Geographic Areas of Operation” under Item 1 Business on page 11.

20

PART I

Manufacturing Locations Owned or Leased by Segment

| Company- Wide | Subtotals by Segment | |||||||||

| Manufacturing Locations | Residential Products | Industrial Products | Furniture Products | Specialized Products | ||||||

| Owned | 70 | 36 | 7 | 19 | 8 | |||||

| Leased | 51 | 16 | — | 15 | 20 | |||||

| Total | 121 | 52 | 7 | 34 | 28 | |||||

In 2017, 69% of the Company's net sales were produced in these owned facilities. We also lease many of our manufacturing, warehouse and other facilities on terms that vary by lease (including purchase options, renewals and maintenance costs). For additional information regarding lease obligations, see Note J on page 92 of the Notes to Consolidated Financial Statements. Of our 121 manufacturing facilities, none are subject to liens or encumbrances that are material to the segment in which they are reported or to the Company as a whole.

None of our physical properties are, by themselves, material to the Company’s overall manufacturing processes, except for our steel rod mill in Sterling, Illinois, which is reported in Industrial Products. The rod mill consists of approximately 1 million square feet of production space, which we own, and has annual output of approximately 500,000 tons of steel rod, of which a substantial majority is used by our own wire mills. Our wire mills convert the steel rod into drawn steel wire. This wire is used in the production of many of our products, including mattress innersprings. A disruption to the operation of, or supply of steel scrap to, our steel rod mill could require us to purchase steel rod from alternative supply sources, subject to market availability. Ongoing trade action by domestic rod producers against several foreign suppliers could result in the imposition of additional duties on steel rod imports which could result in reduced market availability and/or the increase in our cost of steel rod. If we experience a disruption to our ability to produce steel rod in our mill, coupled with a reduction of adequate and/or timely supply from alternative market sources of quality steel rod, we could experience a material negative impact on our Residential Products and Industrial Products segments and Company results of operations.

In the opinion of management, the Company’s owned and leased facilities are suitable and adequate for the manufacture, assembly and distribution of our products. Our properties are located to allow quick and efficient delivery of products and services to our diverse customer base. In certain businesses, productive capacity continues to exceed current operating levels. However, utilization has increased in many of our businesses with improving market demand, and we are investing to support growth in several of our businesses, including Automotive, U.S. Spring, European Spring and Adjustable Bed.

Item 3. Legal Proceedings.

The information in Note S beginning on page 115 of the Notes to Consolidated Financial Statements is incorporated into this section by reference.

Item 4. Mine Safety Disclosures.

Not applicable.

21

PART I

Supplemental Item. Executive Officers of the Registrant.

The following information is included in accordance with the provisions of Part III, Item 10 of Form 10-K and Item 401(b) of Regulation S-K.

The table below sets forth the names, ages and positions of all executive officers of the Company. Executive officers are normally appointed annually by the Board of Directors.

| Name | Age | Position | ||

| Karl G. Glassman | 59 | President and Chief Executive Officer | ||

| Matthew C. Flanigan | 56 | Executive Vice President and Chief Financial Officer | ||

| Perry E. Davis | 58 | Executive Vice President, President - Residential Products & Industrial Products | ||

| J. Mitchell Dolloff | 52 | Executive Vice President, President - Specialized Products & Furniture Products | ||

| David M. DeSonier | 59 | Senior Vice President, Strategy & Investor Relations | ||

| Scott S. Douglas | 58 | Senior Vice President, General Counsel & Secretary | ||

| Russell J. Iorio | 48 | Senior Vice President, Corporate Development | ||

| Tammy M. Trent | 51 | Senior Vice President, Chief Accounting Officer | ||

Subject to the severance benefit agreements with Mr. Glassman, Mr. Flanigan, Mr. Davis, Mr. Dolloff and Mr. Douglas listed as exhibits to this Report (and certain other immaterial agreements with other executive officers), the executive officers generally serve at the pleasure of the Board of Directors. Please see Exhibit Index on page 120 for reference to the agreements.

Karl G. Glassman was appointed Chief Executive Officer of the Company in 2016 and President in 2013. He previously served the Company as Chief Operating Officer from 2006 to 2015. He also served as Executive Vice President from 2002 to 2013, President of Residential Furnishings from 1999 to 2006, Senior Vice President from 1999 to 2002 and in various capacities since 1982.

Matthew C. Flanigan was appointed Executive Vice President of the Company in 2013 and has served as Chief Financial Officer since 2003. He previously served as Senior Vice President from 2005 to 2013, Vice President from 2003 to 2005, Vice President and President of the Office Furniture Components Group from 1999 to 2003 and in various capacities since 1997.

Perry E. Davis was appointed Executive Vice President, President - Residential Products & Industrial Products effective January 1, 2017. He previously served as Senior Vice President and President of the Residential Furnishings segment beginning in 2012. He also served as Vice President of the Company, President—Bedding Group from 2006 to 2012, as Vice President of the Company, Executive VP of the Bedding Group and President—U.S. Spring beginning in 2005. He served as Executive VP of the Bedding Group and President—U.S. Spring from 2004 to 2005, President—Central Division Bedding Group from 2000 to 2004, and in various capacities since 1981.

J. Mitchell Dolloff was appointed Executive Vice President, President - Specialized Products & Furniture Products effective January 1, 2017. He previously served as Senior Vice President and President of the Specialized Products segment beginning in 2016. He served the Company as Vice President from 2014 to 2015. He also served as President of Automotive Asia from 2011 to 2013, Vice President of the Specialized Products segment from 2009 to 2013, and Director of Business Development for Specialized Products from 2007 to 2009. He has served the Company in various other capacities since 2000.

22

PART I

David M. DeSonier was appointed Senior Vice President—Strategy & Investor Relations in 2011. He previously served as Vice President—Strategy & Investor Relations from 2007 to 2011. He has served as Assistant Treasurer since 2002. He joined the Company as Vice President—Investor Relations in 2000.

Scott S. Douglas was appointed Senior Vice President and General Counsel in 2011. He was appointed Secretary of the Company in 2016. He previously served as Vice President and General Counsel from 2010 to 2011, as Vice President—Law and Deputy General Counsel from 2008 to 2010, as Associate General Counsel—Mergers & Acquisitions from 2001 to 2007, and as Assistant General Counsel from 1991 to 2001. He has served the Company in various legal capacities since 1987.

Russell J. Iorio was appointed Senior Vice President, Corporate Development in 2016. He previously served the Company as Senior Vice President, Mergers & Acquisitions from 2014 to 2016. He served the Company as Vice President, Mergers & Acquisitions from 2005 to 2014, and Director of Mergers, Acquisitions & Strategic Planning from 2002 to 2005.

Tammy M. Trent was appointed Senior Vice President in 2017 and has served as Chief Accounting Officer since 2015. She served as Staff Vice President, Financial Reporting from 2007 to 2015. She has served the Company in a series of progressively more responsible accounting capacities since 1998.

23

PART II

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is traded on the New York Stock Exchange (symbol LEG). The table below highlights quarterly and annual stock market information for the last two years.

| Price Range (1) | Volume of Shares Traded (1) (in Millions) | Dividend Declared | ||||||||||||

| High | Low | |||||||||||||

| 2017 | ||||||||||||||

| First Quarter | $ | 50.89 | $ | 46.24 | 61.1 | $ | 0.34 | |||||||

| Second Quarter | 54.97 | 49.92 | 59.9 | 0.36 | ||||||||||

| Third Quarter | 53.96 | 43.17 | 59.9 | 0.36 | ||||||||||

| Fourth Quarter | 51.99 | 44.76 | 58.2 | 0.36 | ||||||||||

| For the Year | $ | 54.97 | $ | 43.17 | 239.1 | $ | 1.42 | |||||||

| 2016 | ||||||||||||||

| First Quarter | $ | 48.50 | $ | 36.64 | 60.3 | $ | 0.32 | |||||||

| Second Quarter | 51.20 | 47.11 | 50.7 | 0.34 | ||||||||||

| Third Quarter | 54.63 | 45.11 | 55.6 | 0.34 | ||||||||||

| Fourth Quarter | 50.79 | 44.02 | 57.0 | 0.34 | ||||||||||

| For the Year | $ | 54.63 | $ | 36.64 | 223.6 | $ | 1.34 | |||||||

(1) Price and volume data reflect composite transactions; price range reflects intra-day prices; data source is Bloomberg.

Shareholders and Dividends

As of February 9, 2018, we had 8,497 shareholders of record.

Increasing the dividend remains a high priority. In 2017, we increased the quarterly dividend by $.02, or 6% to $.36 per share. In each year for over 25 years, we have generated operating cash in excess of our annual requirement for capital expenditures and dividends. We expect this again to be the case in 2018. We have no restrictions that materially limit our ability to pay such dividends or that we reasonably believe are likely to limit the future payment of dividends.

For more information on dividends see "Pay Dividends" in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations on page 44.

24

PART II

Issuer Purchases of Equity Securities

The table below is a listing of our purchases of the Company’s common stock during each calendar month of the fourth quarter of 2017.

| Period | Total Number of Shares Purchased (1) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (2) | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (2) | |||||||||

| October 2017 | — | $ | — | — | 7,133,023 | ||||||||

| November 2017 | 5,875 | $ | 46.45 | 3,000 | 7,130,023 | ||||||||

| December 2017 | 6,066 | $ | 48.26 | — | 7,130,023 | ||||||||

| Total | 11,941 | $ | 47.37 | 3,000 | |||||||||

| (1) | This number includes 8,941 shares which were not repurchased as part of a publicly announced plan or program, all of which were shares surrendered in transactions permitted under the Company’s benefit plans. It does not include shares withheld for taxes on option exercises and stock unit conversions, or forfeitures of stock units, all of which totaled 11,852 shares for the fourth quarter. |

| (2) | On August 4, 2004, the Board authorized management to repurchase up to 10 million shares each calendar year beginning January 1, 2005. This standing authorization was first reported in the quarterly report on Form 10-Q for the period ended June 30, 2004, filed August 5, 2004, and will remain in force until repealed by the Board of Directors. As such, effective January 1, 2018, the Company was authorized by the Board of Directors to repurchase up to 10 million shares in 2018. No specific repurchase schedule has been established. |

25

PART II

Item 6. Selected Financial Data.

| (Unaudited) | 2017 1 | 2016 2 | 2015 3 | 2014 4 | 2013 5 | ||||||||||||||

| (Dollar amounts in millions, except per share data) | |||||||||||||||||||

| Summary of Operations | |||||||||||||||||||

| Net Sales from Continuing Operations | $ | 3,944 | $ | 3,750 | $ | 3,917 | $ | 3,782 | $ | 3,477 | |||||||||

| Earnings from Continuing Operations | 294 | 367 | 328 | 225 | 186 | ||||||||||||||

| (Earnings) Attributable to Noncontrolling Interest, net of tax | — | — | (4 | ) | (3 | ) | (2 | ) | |||||||||||

| Earnings (loss) from Discontinued Operations, net of tax | (1 | ) | 19 | 1 | (124 | ) | 13 | ||||||||||||

| Net Earnings attributable to Leggett & Platt, Inc. common shareholders | 293 | 386 | 325 | 98 | 197 | ||||||||||||||

| Earnings per share from Continuing Operations | |||||||||||||||||||

| Basic | 2.16 | 2.66 | 2.30 | 1.57 | 1.27 | ||||||||||||||

| Diluted | 2.14 | 2.62 | 2.27 | 1.55 | 1.25 | ||||||||||||||

| Earnings (Loss) per share from Discontinued Operations | |||||||||||||||||||

| Basic | (.01 | ) | .14 | .01 | (.88 | ) | .09 | ||||||||||||

| Diluted | (.01 | ) | .14 | .01 | (.87 | ) | .09 | ||||||||||||

| Net Earnings (Loss) per share | |||||||||||||||||||

| Basic | 2.15 | 2.80 | 2.31 | .69 | 1.36 | ||||||||||||||

| Diluted | 2.13 | 2.76 | 2.28 | .68 | 1.34 | ||||||||||||||

| Cash Dividends declared per share | 1.42 | 1.34 | 1.26 | 1.22 | 1.18 | ||||||||||||||

| Summary of Financial Position | |||||||||||||||||||

| Total Assets | $ | 3,551 | $ | 2,984 | $ | 2,964 | $ | 3,136 | $ | 3,105 | |||||||||

| Long-term Debt, including capital leases | $ | 1,098 | $ | 956 | $ | 942 | $ | 762 | $ | 685 | |||||||||

All amounts are presented after tax.

1 | Net earnings from Continuing Operations for 2017 includes a $50 million charge associated with the TCJA; $13 million of net gains on sales of a business and real estate; an $8 million tax benefit from a divestiture; a $10 million pension settlement charge; and a $3 million charge for an impairment of a wire business. |

2 | Net earnings from Continuing Operations for 2016 includes $16 million of gains on sales of businesses; a $3 million goodwill impairment charge; and a $5 million gain on a foam litigation settlement. Discontinued operations primarily consists of a gain on a foam litigation settlement. |

3 | Net earnings from Continuing Operations for 2015 includes $4 million of impairments; $3 million associated with litigation accruals; and an $8 million pension settlement charge. |

4 | Net earnings from Continuing Operations for 2014 includes $33 million associated with litigation accruals. Discontinued Operations includes the following items: $93 million goodwill impairment; $5 million loss on the sale of the majority of our Store Fixtures unit; and $22 million associated with litigation accruals. |

5 | Net earnings from Continuing Operations for 2013 include charges of $45 million related to the Commercial Vehicle Products group ($43 million goodwill impairment charge and $2 million accelerated amortization of a customer-related intangible asset); and an $8 million bargain purchase gain related to an acquisition. |

26

PART II

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

HIGHLIGHTS

Sales increased 5% in 2017, from growth in volume, raw material-related price inflation and currency impact. Acquisitions added 2% to sales but were offset by divestitures (-2%). Sales growth came primarily from Automotive, reflecting content gains and new program awards, and Adjustable Bed. Several other businesses, including International Spring, Geo Components, Work Furniture and Aerospace, contributed to sales growth this past year.

Earnings from continuing operations decreased significantly from the effects of one-time costs associated with the recently enacted Tax Cuts and Jobs Act (TCJA). Other significant factors that reduced earnings include on going steel inflation and the timing lag associated with passing along higher steel costs. These reductions were partially offset by increased sales and lower income taxes.

We continue to optimize our portfolio by increasing investment in those businesses that possess strong competitive advantage and reducing our exposure to businesses and markets that are less attractive. We increased capital expenditures in 2017 to support product categories that are growing. In addition, we acquired three small businesses. We also divested the last remaining operation within the Commercial Vehicle Products group during the year.

Operating cash flow decreased versus 2016, primarily from higher working capital due to sales growth and inflation. However, we once again generated more than enough operating cash flow to comfortably fund dividends and capital expenditures, something we have accomplished each year for more than 25 years.

We raised the quarterly dividend by 6% in 2017 and extended our record of consecutive annual increases to 46 years. We also bought back 3.3 million shares of our stock.

During the year, we issued $500 million of 3.5% notes maturing in 2027. We also extended the term of, and expanded the borrowing capacity under, our revolving credit facility from $750 million to $800 million and correspondingly increased our commercial paper program. We ended 2017 with net debt to net capital at 33%, comfortably within our long-standing targeted range of 30-40%, as discussed on page 47.

We assess our overall performance by comparing our Total Shareholder Return (TSR) to that of peer companies on a rolling three-year basis. We target TSR in the top third of the S&P 500 over the long term. For the three years ended December 31, 2017, we generated TSR of 7% per year on average, placing us just below the midpoint of the S&P 500.

These topics are discussed in more detail in the sections that follow.

27

PART II

INTRODUCTION

Total Shareholder Return

Total Shareholder Return (TSR), relative to peer companies, is the key financial measure that we use to assess long-term performance. TSR is driven by the change in our share price and the dividends we pay: TSR = (Change in Stock Price + Dividends) / Beginning Stock Price. We seek to achieve TSR in the top third of the S&P 500 over the long term through an approach that employs four TSR drivers: revenue growth, margin expansion, dividends, and share repurchases.

We monitor our TSR performance relative to the S&P 500 on a rolling three-year basis. For the three-year measurement period that ended December 31, 2017, we generated TSR of 7% per year on average, just below the midpoint of the S&P 500.

The table below shows the components of our TSR targets. Accomplishing this level of performance over rolling three-year periods should enable us to consistently attain our top-third TSR goal.

| Current Targets | ||

| Revenue Growth | 6-9% | |

| Margin Increase | 1% | |

| Dividend Yield | 3% | |

| Stock Buyback | 1% | |

| Total Shareholder Return | 11-14% | |

Customers

We serve a broad suite of customers, with our largest customer representing approximately 5% of our sales. Many are companies whose names are widely recognized. They include producers of residential furniture and bedding, automotive and office seating manufacturers, and a variety of other companies.

Major Factors That Impact Our Business

Many factors impact our business, but those that generally have the greatest impact are market demand, raw material cost trends, and competition.

Market Demand

Market demand (including product mix) is impacted by several economic factors, with consumer confidence being most significant. Other important factors include disposable income levels, employment levels, housing turnover, and interest rates. All of these factors influence consumer spending on durable goods, and therefore affect demand for our components and products. Some of these factors also influence business spending on facilities and equipment, which impacts approximately one quarter of our sales.

Raw Material Costs