QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Liberty Homes, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

LIBERTY HOMES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held April 29, 2004

To the Shareholders:

The Annual Meeting of Shareholders of Liberty Homes, Inc. will be held at the Ramada Inn, U.S. Highway 33 East, Goshen, Indiana, on Thursday, April 29, 2004 at 9:00 AM, Eastern Standard Time, for the following purposes:

- (1)

- To elect seven directors for the ensuing year.

- (2)

- To transact such other business as may properly come before the meeting.

All shareholders of record at the close of business on March 18, 2004 are entitled to notice of the Annual Meeting.ONLY SHAREHOLDERS OF CLASS B COMMON STOCK ARE ENTITLED TO VOTE AT THE ANNUAL MEETING IN PERSON OR BY DULY AUTHORIZED PROXY.

Accompanying this notice is a copy of the Company's annual report for the year 2003.

| | | By Order of the Board of Directors |

|

|

|

| | | Edward Joseph Hussey

Secretary |

Goshen, Indiana

March 25, 2004

|

|

|

IMPORTANT

Liberty Homes, Inc.invites each of its shareholders to attend the Annual Meeting. If you are a shareholder of Class B Common Stock and are unable to be present at the meeting, it is important that you, whether you are the owner of one or more shares of Class B Common Stock, sign and return the enclosed proxy. An envelope on which postage will be paid by the Company is enclosed for that purpose. Returning your executed proxy will make certain that you are represented at the Annual Meeting. Your cooperation will be appreciated.

LIBERTY HOMES, INC.

PO Box 35, Goshen, Indiana 46527

PROXY STATEMENT

For Annual Meeting of Shareholders

To Be Held on April 29, 2004

SOLICITATION OF PROXIES

This proxy statement is furnished to the shareholders of Liberty Homes, Inc., an Indiana corporation (the "Company"), in connection with a solicitation of proxies by the Board of Directors of the Company for the Annual Meeting of Shareholders to be held on April 29, 2004 at 9:00 AM. (Eastern Standard Time), or any adjournment thereof (the "Annual Meeting"). Proxies so given may be revoked at any time prior to the voting thereof by giving written notice to the Secretary of the Company or at the meeting by voting by ballot and thereby canceling any proxies previously returned. Proxies will be solicited by mail and proxy-soliciting material will be furnished to brokerage houses, custodians, nominees and fiduciaries upon request for forwarding to the beneficial owners of the Company's Class B Common Stock, $1.00 par value (the "Class B Common Stock"), held of record by such persons. The cost of solicitation will be borne by the Company. This proxy statement and enclosed proxy card are being sent to shareholders on or about March 25, 2004.

SHARES OUTSTANDING AND VOTING RIGHTS

The Company has authorized and outstanding two classes of Common Stock: the Class A Common Stock, $1.00 par value and the Class B Common Stock, $1.00 par value. All shares of Class A Common Stock are non-voting securities.ONLY HOLDERS OF CLASS B COMMON STOCK ARE ENTITLED TO VOTE. The Board of Directors has fixed the close of business on March 18, 2004 as the record date for the determination of shareholders entitled to notice of and/or to vote at the Annual Meeting. On that date, the Company had outstanding 2,002,045 shares of Class A Common Stock and 1,652,422 shares of Class B Common Stock. Each share of Class B Common Stock entitles its holder to one vote, executed in person or by properly executed proxy on each matter to be considered at the Annual Meeting.THE HOLDERS OF CLASS A COMMON STOCK ARE ONLY ENTITLED TO NOTICE OF THE ANNUAL MEETING AND CANNOT VOTE ON ANY OF THE MATTERS DESCRIBED HEREIN.

1

The following table sets forth the beneficial ownership of the only persons known by the Company to be the beneficial owners of more than 5% of any class of the Company's voting securities.

Title of Class

| | Name and Address of

Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percent of Class

|

|---|

| Class B Common Stock | | Hussey Investments L.P.,

an Indiana limited partnership

Edward J. Hussey(1)

Edward Joseph Hussey(2)

Michael F. Hussey(2)

John P. Hussey(2)

Nancy A. Parrish(2)

PO Box 35

Goshen, IN 46527 | | 880,881 | | 53.3% |

- (1)

- Edward J. Hussey is a limited partner in Hussey Investments L.P. and accordingly has a pecuniary interest in the shares of Class B Common Stock owned by Hussey Investments L.P. Edward J. Hussey has no voting or investment power over such shares and accordingly disclaims beneficial ownership of such shares.

- (2)

- Edward Joseph Hussey, Michael F. Hussey, John P. Hussey and Nancy A. Parrish are the general partners of Hussey Investments L.P. and accordingly share voting and investment control over the shares of Class B Common Stock owned by that limited partnership.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities and Exchange Act of 1934 requires the Company's directors and executive officers and persons who own more than 10% of a registered class of the Company's equity securities, to file reports of ownership and changes in ownership of such securities with the Securities and Exchange Commission. Directors, executive officers and greater than 10% beneficial owners are required by applicable regulations to furnish the Company with copies of all Section 16(a) forms they have filed.

Based solely upon a review of the copies of these forms furnished to the Company and representations from certain reporting persons that no Forms 5 were required, the Company believes that during 2003 all directors, executive officers and greater than 10% beneficial owners complied with all applicable filing requirements.

ELECTION OF DIRECTORS

Under the By-Laws of the Company, seven directors are to be elected at the Annual Meeting to hold office for the ensuing year or until their successors are elected and qualified. Directors will be elected by plurality of the votes cast. It is the present intention of the persons named in the accompanying proxy to vote such proxy for the election of the persons named in the following table. If, because of death or unforeseen contingencies, any of the nominees designated in the table shall be unable or unwilling to serve, the persons named in the accompanying proxy reserve the right to vote such proxy for such other person or persons as they shall determine.

2

Proxies received which contain abstentions or broker non-votes as to any matter will be included in the calculation of the presence of a quorum, but will not be counted as votes cast for or against the action to be taken on the matter. Directors are elected upon receipt of a plurality of votes cast at the meeting. Other actions are approved by the affirmative vote of the majority of the shareholders comprising a quorum. Therefore, abstentions or broker non-votes will have no effect in the election of directors, but will have the effect of being counted as a vote against any other action.

The persons named in the following table have been nominated by the Board of Directors for election at the Annual Meeting. All are presently directors of the Company. Except as otherwise indicated below, the business address of each of the directors of the Company is PO Box 35, Goshen, Indiana 46527. The following table sets forth certain other information with respect to each nominee.

Name

| | Class A Common Stock

Beneficially Owned

as of

March 18, 2004

(percent of class)(1)(2)

| | Class B Common Stock

Beneficially Owned

as of

March 18, 2004

(percent of class)(2)

|

|---|

| EDWARD J. HUSSEY, age 86, has been Chairman of the Board, a Director and Chief Executive Officer of the Company (or its predecessors) since 1960, and is the father of Edward Joseph Hussey and Michael F. Hussey.(3)(7) | | -0- | | (-0-) | | -0- | | (-0-) |

MICHAEL F. HUSSEY, age 47, has been President of the Company since 2003 and has been employed by the Company since 1980. He has been a Director of the Company since 1988. He is a son of Edward J. Hussey.(5)(6)(7)(9) |

|

1,276,054 |

|

(63.7%) |

|

945,088 |

|

(57.2%) |

EDWARD JOSEPH HUSSEY, age 56, has been Vice President—Secretary of the Company since 1985 and has been a Director of the Company since 1981. Since 1975 he has been associated with the law firm of Hodges & Davis PC, where he is currently of counsel. He is a son of Edward J. Hussey.(4)(5)(6)(7) |

|

1,276,619 |

|

(63.8%) |

|

945,653 |

|

(57.2%) |

DAVID M. HUFFINE, age 55, is self-employed. From 1997 to 2003, he was National Sales Manager of United General Mortgage Corporation, Vice President of Duneland Mortgage, President of I.M. Homes, and President of Sky View Homes, Inc. He has been a Director of the Company since 1988.(7)(9)(10) |

|

- -0- |

|

(-0-) |

|

- -0- |

|

(-0-) |

MITCHELL A. DAY, age 48, has been President of Day Equipment Corporation since 1984. Prior thereto, he was a Vice President with the same corporation. He has been a Director of the Company since 1995.(7)(9)(10) |

|

- -0- |

|

(-0-) |

|

- -0- |

|

(-0-) |

LESTER M. MOLNAR, Age 73, retired as Vice President of Purchasing for the Company in 1993 after 16 years of service. He has been a Director since 2001.(7)(10) |

|

100 |

|

(-0-) |

|

100 |

|

(-0-) |

JAMES R. EVANS, Age 43, has been Chief Financial Officer of Marque, Inc. and Pinnacle Building Systems Company since 1999. He began his service on the Board of Directors within the last year.(10) |

|

- -0- |

|

(-0-) |

|

- -0- |

|

(-0-) |

All Directors and Executive Officers as a group(8) |

|

1,299,554 |

|

(64.9%) |

|

1,009,960 |

|

(61.1%) |

- (1)

- All shares of Class A Common Stock are non-voting securities.

3

- (2)

- Except as noted in footnote (6), each individual director and officer has sole investment power with respect to the shares of Class A Common Stock and, except as noted in footnote (5), has sole voting and investment power with respect to the shares of Class B Common Stock owned by them and included in the table.

- (3)

- Edward J. Hussey is a limited partner in Hussey Investments L.P., an Indiana limited partnership which owns shares of Class B Common Stock. He also is a limited partner in Hussey Endeavors L.P., an Indiana limited partnership which owns Class A Common Stock. Edward J. Hussey disclaims beneficial ownership of all such shares.

- (4)

- The Company uses the services of the law firm of Hodges & Davis, PC in various matters related to its business. During 2003, the Company paid $4,831 for such services.

- (5)

- Includes 880,881 shares of Class B Common Stock owned by Hussey Investments L.P., an Indiana limited partnership. Edward Joseph Hussey and Michael F. Hussey are general partners of Hussey Investments L.P., and as such, share with the other general partners voting and investment control over the shares of Class B Common Stock owned by that partnership.

- (6)

- Includes 1,253,219 shares of Class A Common Stock owned by Hussey Endeavors LP, an Indiana limited partnership. Edward Joseph Hussey and Michael F. Hussey are general partners of Hussey Endeavors LP, and as such, share with the other general partners investment control over the shares of Class A Common Stock owned by that partnership.

- (7)

- During 2003, the Company paid $12,930 of consulting fees to Mr. Molnar for services he rendered in 2002. Mr. Molnar has rendered no services to the Company since then. For 2003, the Company paid $2,000 of Directors fees to Mr. Day. In exchange for his Director services, Mr. Huffine is a participant in the Company's medical benefits plan. His participation is valued at $3,865 for the year 2003. No fees were paid to the other Directors. Instead, as employees, the other Directors received compensation as shown on the summary compensation table.

- (8)

- The non-Director Executive Officers of the Company have no beneficial ownership of Common Stock of the Company.

- (9)

- Member of the Compensation Committee.

- (10)

- Member of the Audit Committee.

- (11)

- During 2003, the Company purchased $51,128 of material from TGP Distribution, Inc., a company owned by a son-in-law of Edward J. Hussey. These transactions were done at arms length and constitute less than1/10% of the Company's total purchases.

The Board of Directors of the Company held six meetings during 2003. Mr. Day, Mr. Molnar and Mr. Huffine each attended in person fewer than 75% of the aggregate of these meetings and the meetings of all committees on which they serve. However, the actions taken by the Board in their absence were reviewed with Mr. Day, Mr. Molnar and Mr. Huffine over the telephone and in all cases Mr. Day, Mr. Molnar and Mr. Huffine concurred in the actions taken.

Attendance is required of all Directors for the Annual Meeting of Shareholders and Annual Board of Directors Meeting. All members attended both Annual Meetings held in 2003.

The Board of Directors has an Audit Committee consisting during the year 2003 of Mr. Day, Mr. Huffine and Mr. Molnar. Beginning in January 2004, Mr. Evans joined this Committee. The Board of Directors has determined that Mr. Evans has the attributes of an Audit Committee Financial Expert as described in item 401(h)(2) of Regulations S-K and that he is independent as that term is used in Item 7(d)(3)(iv) of Schedule 14A of the Exchange Act. The Committee's report begins on page 9 of this Proxy Statement.

The Board of Directors has a Compensation Committee consisting during the year 2003 of Mr. Day, Mr. Huffine and Mr. Michael F. Hussey. As allowed by the "Controlled Company Exception" of the NASDAQ Corporate Governance Rules approved by the Securities and Exchange Commission, the Board of Directors has chosen a Committee that is not totally independent. The Committee's report begins on page 7 of this Proxy Statement.

As allowed by the "Controlled Company Exception" of the NASDAQ Corporate Governance Rules approved by the Securities and Exchange Commission, the Board of Directors does not have a nominating committee. The Board of Directors nominated the slate of directors set forth in this Proxy Statement.

4

EXECUTIVE COMPENSATION

Shown below is information concerning the annual compensation for services in all capacities to the Company for the fiscal years ended December 31, 2003, 2002 and 2001, of those persons who were, at anytime during the last completed fiscal year, (i) the chief executive officer and (ii) the other four most highly compensated executive officers of the Company as of December 31, 2003 (the named officers). None of the named officers received any long-term compensation pursuant to restricted stock awards, the issuance of stock options or stock appreciation rights, or through the payment of any similar stock-based compensation.

SUMMARY COMPENSATION TABLE

| | Annual Compensation

| |

|

|---|

Name & Principal Position

| | Year

| | Salary

| | Bonus(1)

| | Other

Annual

Comp.(2)

| | All

Other

Comp(3)

|

|---|

Edward J. Hussey

Chairman & CEO | | 2003

2002

2001 | | $

| 36,000

36,000

36,000 | | $

| —

—

— | | $

| 8,014

48,352

46,637 | | | —

—

— |

Michael F. Hussey

President | | 2003

2002

2001 | | $

| 145,600

145,600

145,600 | | $

| 34,100

56,400

54,400 | | | —

—

— | |

$

| —

14,023

25,957 |

Edward Joseph Hussey

Vice President & Secretary | | 2003

2002

2001 | | $

| 145,600

145,600

145,600 | | $

| 34,100

56,400

54,400 | | | —

—

— | |

$

| —

14,023

25,957 |

Nader Tomasbi

Vice President—Engineering | | 2003

2002

2001 | | $

| 83,200

81,900

79,300 | | $

| 25,800

25,475

24,825 | | | —

—

— | | | —

—

— |

Marc A. Dosmann

Vice President & Chief Financial Officer | | 2003

2002

2001 | | $

| 80,600

79,300

78,000 | | $

| 25,150

24,825

24,500 | | | —

—

— | | | —

—

— |

- (1)

- Includes amounts awarded under the Company's key employee bonus plan (described below) for the respective fiscal years, even if deferred, as well as discretionary bonuses.

- (2)

- Amount represents taxable value of personal air travel paid for by the Company.

- (3)

- Amount represents the time value calculated on the annual life insurance premiums paid by the Company for the respective trusts in accordance with the split dollar insurance plan described below. The time value was calculated using the effective interest rate method over eleven years, at a discount rate of 3.6%. This plan was terminated in 2003 and the premiums paid by the Company were repaid by the trusts to the Company upon the termination of the policies.

5

Employment Contracts

The services of Edward Joseph Hussey and Michael F. Hussey as executive officers of the Company are provided under employment agreements dated September 14, 1993. Both employment agreements are on an "at-will" basis terminable at any time by the Company or the executive. The agreements provide for a base salary determined and reviewed by the Company at least annually and the same types of benefits accorded to other executives of the Company. If termination of employment results from death, the deceased executive's legal representative will be entitled to receive the earned obligations under the employment agreements, including (i) full base salary through the end of the then current fiscal year, (ii) any incentive payments for the last fiscal year, and (iii) any previously deferred compensation (collectively, the "Accrued Obligations"). If termination of employment results from the executive's disability or retirement, the Accrued Obligations shall be paid for the benefit of the executive or the executive's legal representative or designated beneficiary. If employment is terminated for any reason other than death, disability or retirement, the executive will have no further benefits.

COMPENSATION COMMITTEE REPORT

Split Dollar Insurance Plan

The Company was a party to split dollar insurance plans effective June 11, 1993 through May 15, 2003. These plans provided additional compensation to Edward Joseph Hussey and to Michael F. Hussey in the form of cash compensation and in assisting certain trusts established by them to pay premiums on certain policies of life insurance owned by the trusts. During 2003, these plans were terminated. The premiums advanced by the Company during the plans' existence were repaid to the Company upon termination.

Compensation Principles

The foundation of the executive compensation program is based on beliefs and guiding principles designed to align compensation with business strategy, Company values and management initiatives. The program:

- •

- Integrates compensation programs with both the Company's annual and long-term strategic planning and measurement processes.

- •

- Supports a performance-oriented environment that rewards performance not only with respect to Company goals but also with respect to Company performance as compared to that of industry performance levels.

- •

- Attracts and retains key executives critical to the long-term success of the Company.

Key Employee Bonus Plan

The Company's key employee bonus plan covers all key employees, including all executive officers, of the Company. Participants are eligible to receive a bonus established as a percentage of their base salary, which percentage may depend upon the extent to which certain financial results are attained. Bonuses are determined quarterly, on a cumulative basis, for each calendar year. Each participant receives part of his bonus payment at the time the Company's earnings reports for the applicable quarter are released to the public. The balance of a participant's bonus is paid at the time the Company's annual earnings are released to the public. Payments are made only if such participant is employed by the Company on that date.

6

Amounts paid and accrued under the Key Employee Bonus Plan during 2003 are included in the compensation table above.

Compensation of the Company's Chief Executive Officer

The compensation of the Company's Chief Executive Officer, Mr. Edward J. Hussey, is based upon the Compensation Principles described above. Mr. Hussey's compensation is determined by considering the salaries of CEOs in similar sized businesses and competitor companies, relevant economic factors and the Company's performance.

Compensation of the Company's Other Executive Officers

The compensation of the Company's other executive officers is set by the Chief Executive Officer.

Compensation Committee Interlocks and Insider Participation

Michael F. Hussey served as a member of the Company's Compensation Committee and is an employee of the Company.

COMPENSATION COMMITTEE

Michael F. Hussey

David M. Huffine

Mitchell A. Day

7

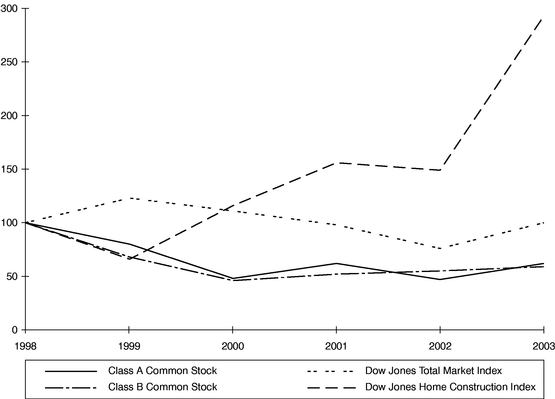

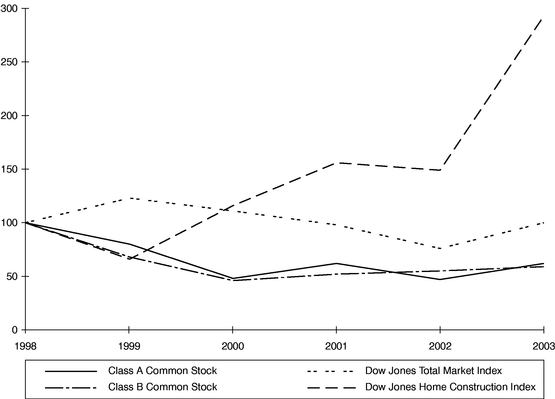

SHAREOWNER RETURN PERFORMANCE PRESENTATION

Set forth below is a line graph comparing the yearly percentage change in the cumulative total shareowner return on the Company's Class A and Class B Common Stock against the cumulative total return of the Dow Jones Total Market Index and the Dow Jones Home Construction Index for the period of five fiscal years ending December 31, 2003.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN AMONG

LIBERTY HOMES, INC., DOW JONES TOTAL MARKET INDEX

AND DOW JONES HOME CONSTRUCTION INDEX

FISCAL YEAR ENDING DECEMBER 31

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

|

|---|

| Class A Common Stock | | 100 | | 80 | | 48 | | 62 | | 47 | | 62 |

| Class B Common Stock | | 100 | | 68 | | 46 | | 52 | | 55 | | 59 |

| Dow Jones Total Market Index | | 100 | | 123 | | 111 | | 98 | | 76 | | 100 |

| Dow Jones Home Construction Index | | 100 | | 66 | | 116 | | 156 | | 149 | | 293 |

Assuming that the value of the investment in Liberty Homes, Inc. Class A and Class B Common Stock and each index was $100 on December 31, 1998 and all dividends were reinvested.

8

AUDIT COMMITTEE ISSUES

During 2003, the Audit Committee was comprised of three members of the Company's Board of Directors, David M. Huffine, Lester M. Molnar and Mitchell A. Day. In January of 2004, James R. Evans joined the Board of Directors and was appointed to the Audit Committee. Mr. Evans has the attributes of an Audit Committee Financial Expert as described in item 401(h)(2) of Regulation S-K. Throughout 2003 to the present, all members are deemed independent as that term is used in item 7(d)(3)(iv) of schedule 14A of the Exchange Act.

Furthermore, the Committee is guided by a written charter which has been adopted by the Company's Board of Directors and is reproduced on Appendix A to this Proxy Statement. The Audit Committee charter provides that the membership of the Audit Committee shall consist of at least three independent members of the Board of Directors who shall serve at the discretion of the Board of Directors. Audit Committee members and the committee chairman shall be designated by the full Board of Directors.

AUDIT COMMITTEE REPORT

The Audit Committee has reviewed and discussed with the Company's management the audited statements for the Company's fiscal year ending December 31, 2003 which are included in the Annual Report accompanying this Proxy Statement. Additionally, the Committee has reviewed and discussed with the Company's independent accountants those matters required by Statement of Auditing Standards 61. The Audit Committee has also received from the Company's independent accountants the written disclosure and the letter required by Independent Standards Board Standard No. 1 and has discussed with them the accountants' independence from the Company. Based on the review and discussion, the Committee has recommended to the Board of Directors that the audited financial statements for the Company's fiscal year ending December 31, 2003 be included in the Form 10-K filed by the Company.

AUDIT COMMITTEE

Lester M. Molnar

David M. Huffine

Mitchell Day

RELATIONSHIP WITH INDEPENDENT CERTIFIED

PUBLIC ACCOUNTANTS

The accounting firm of Crowe Chizek and Company LLC served as the Company's independent public accountants for the fiscal year ended December 31, 2003. It is presently intended that Crowe Chizek and Company LLC will serve as the Company's accountants for the fiscal year ending December 31, 2004. It is anticipated that a representative of Crowe Chizek and Company LLC will be present at the Annual Meeting and will be given the opportunity to make a statement if desired and to respond to appropriate questions.

AUDIT FEES

The aggregate fees billed for professional services rendered for the audit of the Company's annual financial statements and the reviews of the financial statements included in the Company's quarterly

9

reports and Form 10-Q for the fiscal years ended December 31, 2003 and December 31, 2002 were $50,545 and $47,055, respectively.

AUDIT-RELATED FEES

The aggregate fees billed for professional services rendered for assurance and related services to the Company and not included in the Audit Fee section above, were $6,500 in each of the years ending December 31, 2003 and 2002. These services were rendered in the audit of the Company sponsored 401K plan. The 2003 fee was pre-approved by the Audit Committee.

TAX FEES

The aggregate fees billed for professional services for the preparation of federal and state income tax returns and tax planning assistance for the years ended December 31, 2003 and 2002 were $36,300 and $54,755, respectively. All services performed after May 6, 2003 were pre-approved by the Audit Committee.

ALL OTHER FEES

The independent accountants billed the Company no fees for other services in 2003 and 2002.

SHAREHOLDER PROPOSALS

Any shareholder who intends to present a proposal for consideration at next year's Annual Meeting of Shareholders, and who desires to have the proposal considered for inclusion in the Company's proxy statement related to next year's Annual Meeting, must see that the proposal is received in the Company's offices in Goshen, Indiana no later than December 3, 2004. Submission of a proposal to the Company does not necessarily mean that it will be included in the Company's proxy statement.

In addition, if a shareholder intends to present a proposal at the next annual meeting of shareholders without including the proposal in the proxy materials for that meeting, and if the proposal is not received by the Company by February 14, 2005, then, if such proposal is properly presented, the proxies designated by the Board of Directors for that meeting may vote in their discretion on such proposal any shares for which they have been appointed proxies without mention of such matter in the Company's proxy statement or on the proxy card for that meeting.

COMMUNICATION TO THE BOARD OF DIRECTORS

Any shareholder wishing to communicate with the Board of Directors or to any member of the Board may do so at any time. Communications must be made in writing and delivered to the Company's offices in Goshen, Indiana, to the attention of the Chairman or specifically identified member.

OTHER MATTERS

The Board of Directors does not intend to present any item of business at the Annual Meeting other than as specifically set forth in the Notice of Meeting. However, it is the intention of the persons named in the enclosed proxy to vote such proxy in accordance with their judgment on any such additional matters that may properly come before the meeting.A COPY OF THE COMPANY'S ANNUAL REPORT ON

10

FORM 10-K TO THE SECURITIES AND EXCHANGE COMMISSION FOR THE YEAR ENDED DECEMBER 31, 2003 WILL BE FURNISHED WITHOUT CHARGE TO SHAREHOLDERS OF RECORD AS OF MARCH 18, 2004 UPON WRITTEN REQUEST TO MR. EDWARD JOSEPH HUSSEY, LIBERTY HOMES, INC., PO BOX 35, GOSHEN, INDIANA 46527.

| | | By Order of the Board of Directors |

|

|

|

| | | Edward Joseph Hussey

Secretary |

11

APPENDIX A

AUDIT COMMITTEE CHARTER

The Audit Committee of Liberty Homes, Inc. is a committee of the Board of Directors. Its primary function is to assist the Board in fulfilling its oversight responsibilities by reviewing the financial information which will be provided to its shareholders and others, evaluating the systems of internal controls which management and the Board of Directors have established, and reviewing the audit process.

In meeting its responsibilities, the Audit Committee shall have the following duties, authority and expectations:

- 1.

- The Committee shall provide an open avenue of communication between the independent registered public accountants and the Board of Directors.

- 2.

- It will review the Committee's charter annually and propose changes to the Board as needed.

- 3.

- The Committee will recommend to the Board of Directors the selection of the independent registered public accountants, consider their independence, approve the fees to be paid to them and establish a direct line of reporting of the accountants to the Committee.

- 4.

- On an annual basis, the Committee shall review and evaluate the performance of the accountants and all significant relationships the accountants have with the Company to determine the accountants' independence.

- 5.

- The Committee will consider and review with the independent accountants:

- a.

- The adequacy of the Company's internal controls including information system controls and security.

- b.

- Any related significant findings and recommendations of the independent accountants together with management's responses thereto.

- 6.

- With management and the independent accountants at the completion of the annual examination, the Committee will review:

- a.

- The Company's annual financial statements and related footnotes.

- b.

- The independent accountants' audit of the financial statements and their report thereon.

- c.

- Any serious difficulties or disputes with management encountered during the course of the audit.

- d.

- Other matters related to the conduct of the audit which are to be communicated to the Committee under generally accepted auditing standards.

- 7.

- The Committee shall review filings with the SEC and other published documents containing the Company's financial statements and consider whether the information contained in these documents is consistent with the information contained in the financial statements.

- 8.

- Legal and regulatory matters that may have a material impact on the financial statements, related Company compliance policies, and programs and reports received from regulators are to be reviewed.

12

- 9.

- Meetings with independent accountants and management in separate executive sessions shall be conducted by the Audit Committee to discuss any matters that the Committee or their groups believe should be discussed privately with the Committee.

- 10.

- Committee actions are to be reported to the Board of Directors with such recommendations as the Committee may deem appropriate, including whether the Committee recommends the audited financial statements be included in the Form 10-K.

- 11.

- The Committee will establish a confidential system for the receipt and treatment of complaints or notices of questionable accounting, auditing or internal control matters.

- 12.

- The Audit Committee shall have the power to conduct or authorize investigations into any matters within the Committee's scope of responsibilities, including authority to engage counsel and advisors as deemed necessary.

- 13.

- The Committee shall meet at least two times per year or more frequently as circumstances require. The Committee may ask members of management or others to attend the meeting and provide pertinent information as necessary.

- 14.

- All related party transactions are to be reviewed and approved by the Audit Committee.

- 15.

- Each member of the Committee shall be an independent member of the Board of Directors with at least one of the Audit Committee members being deemed a financial expert. All Committee members shall be able to read and understand financial statements.

- 16.

- Members of the Committee shall not receive directly or indirectly any payment from the Company for any purpose other than payments made for Board or Committee service.

- 17.

- The Committee will perform such functions as assigned by law, the Company's charter or by-laws, or the Board of Directors.

13

PROXY

Liberty Homes, Inc.

PO Box 35

Goshen, Indiana 46527

This Proxy is Solicited on Behalf of the Board of Directors

The undersigned hereby authorizes and appoints Edward J. Hussey and Lester M. Molnar, and each of them, with full power of substitution, as proxies of the undersigned, and hereby authorizes them to represent and to vote, as designated below, all the shares of Class B Common Stock of Liberty Homes, Inc. held of record by the undersigned on March 18, 2004, at the Annual Meeting of Shareholders to be held on April 29, 2004, or any adjournment thereof. PLEASE NOTE THAT ONLY HOLDERS OF CLASS B COMMON STOCK ARE ENTITLED TO VOTE ON THE MATTERS LISTED BELOW.

o FOR all nominees listed below

(except as marked to the contrary below) | | o WITHHOLD AUTHORITY

to vote for all nominees listed below |

INSTRUCTIONS:

To withhold authority to vote for any individual nominee, draw a line through the nominee's name in the list below.

Edward J. Hussey, Michael F. Hussey, Edward Joseph Hussey, David M. Huffine, Mitchell A. Day, Lester M. Molnar, James R. Evans

| 2. | | In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. |

(over)

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF ALL DIRECTOR NOMINEES.

|

Dated |

|

|

|

, 2004 |

| | | |

| | |

|

Signature |

|

Signature |

|

(Where stock is registered in joint tenancy, all tenants should sign. Persons signing as Executors, Administrators, Trustees, or the like, should so indicate.) |

|

PLEASE DATE, SIGN, AND RETURN THIS PROXY IN THE ENCLOSED ENVELOPE.

|

QuickLinks

NOTICE OF ANNUAL MEETING OF SHAREHOLDERSSHARES OUTSTANDING AND VOTING RIGHTSEXECUTIVE COMPENSATIONSUMMARY COMPENSATION TABLECOMPENSATION COMMITTEE REPORTSHAREOWNER RETURN PERFORMANCE PRESENTATIONCOMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN AMONG LIBERTY HOMES, INC., DOW JONES TOTAL MARKET INDEX AND DOW JONES HOME CONSTRUCTION INDEX FISCAL YEAR ENDING DECEMBER 31AUDIT COMMITTEE ISSUESAUDIT COMMITTEE REPORTRELATIONSHIP WITH INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTSAUDIT FEESAUDIT-RELATED FEESTAX FEESALL OTHER FEESSHAREHOLDER PROPOSALSCOMMUNICATION TO THE BOARD OF DIRECTORSOTHER MATTERSAPPENDIX A AUDIT COMMITTEE CHARTER