INVESTOR PRESENTATION August 2019

DISCLAIMER This document and any related oral presentation does not constitute an offer or invitation to subscribe for, purchase or otherwise acquire any equity securities or debt securities instruments of Vector Group Ltd. (“Vector,” “Vector Group Ltd.” or “the Company”) and nothing contained herein or its presentation shall form the basis of any contract or commitment whatsoever. The distribution of this document and any related oral presentation in certain jurisdictions may be restricted by law and persons into whose possession this document or any related oral presentation comes should inform themselves about, and observe, any such restriction. Any failure to comply with these restrictions may constitute a violation of the laws of any such other jurisdiction. The information contained herein does not constitute investment, legal, accounting, regulatory, taxation or other advice and the information does not take into account your investment objectives or legal, accounting, regulatory, taxation or financial situation or particular needs. You are solely responsible for forming your own opinions and conclusions on such matters and the market and for making your own independent assessment of the information. You are solely responsible for seeking independent professional advice in relation to the information and any action taken on the basis of the information. The following presentation may contain "forward‐looking statements,” including any statements that may be contained in the presentation that reflect Vector’s expectations or beliefs with respect to future events and financial performance, such as the expectation that the tobacco transition payment program could yield substantial incremental free cash flow. These forward‐ looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in any forward‐looking statement made by or on behalf of the Company, including the risk that changes in Vector’s capital expenditures impact its expected free cash flow and the other risk factors described in Vector’s annual report on Form 10‐K for the year ended December 31, 2018, as filed with the SEC, and on Form 10‐Q for the quarterly period June 30, 2019, as filed with the SEC. Please also refer to Vector's Current Reports on Forms 8‐K, filed on October 2, 2015, November 15, 2016, November 24, 2017, June 14, 2018, September 28, 2018, February 28, 2019, May 3, 2019 and August 7, 2019 (Commission File Number 1‐5759) as filed with the SEC for information, including cautionary and explanatory language, relating to Non‐GAAP Financial Measures in this Presentation labeled "Adjusted". Results actually achieved may differ materially from expected results included in these forward‐looking statements as a result of these or other factors. Due to such uncertainties and risks, potential investors are cautioned not to place undue reliance on such forward‐looking statements, which speak only as of the date on which such statements are made. The Company disclaims any obligation to, and does not undertake to, update or revise and forward‐ looking statements in this presentation. 2

INVESTMENT HIGHLIGHTS & PORTFOLIO Overview . Diversified Holding Company with two unrelated, but complementary, businesses with iconic brand names: tobacco (Liggett Group) and real estate (Douglas Elliman) . History of strong earnings, and Adjusted EBITDA has increased from $178.3 million in 2011(1) to $260.6 million for the twelve months ended June 30, 2019(2) — Tobacco Adjusted EBITDA of $258.3 million for the twelve months ended June 30, 2019(3) — Douglas Elliman, which is now a wholly‐owned subsidiary, produced Revenues of $793.9 million and Adjusted EBITDA of $19.2 million for the twelve months ended June 30, 2019(4) . Diversified portfolio of consolidated and non‐consolidated real estate investments at New Valley . Maintains substantial liquidity with cash, marketable securities and long‐term investments of $590 million as of June 30, 2019(5) . Seasoned management team with average tenure of 26 years with Vector Group . Management team and directors beneficially own approximately 11% of Vector Group . Perpetual cost advantage over the largest U.S. tobacco companies – annual cost advantage ranged between $163 million and $169 million from 2012 to 2018(6) (1) Vector’s Net income for the year ended December 31, 2011 was $74.5M. Adjusted EBITDA is a Non‐GAAP Financial Measure. Please refer to Exhibit 99.2 of the Company’s Current Report on Form 8‐K, dated November 15, 2016 (Table 2) for a reconciliation of Net income to Adjusted EBITDA as well as the Disclaimer to this document on Page 2. (2) Vector’s Net income for the twelve months ended June 30, 2019 was $87.3 million. Adjusted EBITDA is a Non‐GAAP Financial Measure. Please refer to Exhibit 99.1 of the Company’s Current Report on Form 8‐K, filed on August 7, 2019 (Table 2), for a reconciliation of Net income to Adjusted EBITDA as well as the Disclaimer to this document on Page 2. (3) All “Liggett” and “Tobacco” financial information in this presentation includes the operations of Liggett Group LLC, Vector Tobacco Inc., and Liggett Vector Brands LLC unless otherwise noted. Tobacco Adjusted EBITDA is a Non‐GAAP Financial Measure and is defined in Tables 2 and 5 of Exhibit 99.1 to the Company’s Current Report on Form 8‐K, filed on August 7, 2019. (4) Douglas Elliman’s Net income was $12.1 million for the twelve months ended June 30, 2019. Adjusted EBITDA is a Non‐GAAP Financial Measure. Please refer to Exhibit 99.1 of the Company’s Current Report on Form 8‐K, filed on August 7, 2019, for a reconciliation of Adjusted EBITDA to net income (Table 7) as well as the Disclaimer to this document. (5) At June 30, 2019 the total amount ($590 million) includes cash at Douglas Elliman, a wholly‐owned subsidiary, of $79 million and cash at Liggett, a wholly‐owned subsidiary, of $69 million. Excludes real estate investments. (6) Cost advantage applies only to cigarettes sold below applicable market share exemption (approximately 1.93% of cigarettes sold in the United States). 3

TOBACCO OPERATIONS 4

LIGGETT GROUP OVERVIEW . Fourth‐largest U.S. tobacco company; founded in 1873 — Core Discount Brands – Eagle 20’s, Pyramid, Grand Prix, Liggett Select and Eve — Partner Brands – USA, Bronson and Tourney . Consistent and strong cash flow — Tobacco Adjusted EBITDA of $258.3 million for the twelve months ended June 30, 2019(1) — Low capital requirements with capital expenditures of $5.3 million related to tobacco operations for the twelve months ended June 30, 2019 . Current cost advantage of approximately $0.74 per pack(2) compared to the largest U.S. tobacco companies expected to maintain volume and drive profit in core brands — Pursuant to the MSA, Liggett has no payment obligations unless its market share exceeds a market share exemption of approximately 1.65% of total cigarettes sold in the United States, and Vector Tobacco has no payment obligations unless its market share exceeds a market share exemption of approximately 0.28% of total cigarettes sold in the United States — MSA exemption annual cost advantage ranged between $163 million and $169 million for Liggett and Vector Tobacco from 2012 to 2018 (1) Tobacco Adjusted EBITDA is a Non‐GAAP Financial Measure and is defined in the Company’s Current Report on Forms 8‐K, filed on August 7, 2019. Please also refer to the Disclaimer to this document on Page 2. 5 (2) Cost advantage only applies to cigarettes sold below applicable market share exemption (approximately 1.93% of total cigarettes sold in the United States).

LIGGETT GROUP HISTORY Signed the MSA as a Subsequent Relaunched Repositioned Liggett maintains its long‐term Participating Manufacturer, which deep discount Eagle 20’s as a focus by balancing market share established perpetual cost brand Grand national deep and profit growth, which advantageover threelargestU.S. Prix discount brand maximizes long‐term Tobacco tobacco companies Adjusted EBITDA 1998 1999 2005 2009 2013 Today Introduced deep discount brand Liggett Select taking advantage Repositioned Pyramid as a deep‐discount brand in response of the Company’s cost advantage resulting from the MSA to a large Federal Excise Tax increase $300 5.0% 4.0% 3.8% 4.0% (1) $250 Domestic Market Share 3.5% 3.5% 3.7% 4.0% 3.3% 3.4% 3.3% 3.3% $200 2.7% 2.5% 2.5% 2.5% 3.0% 2.4% 2.3% 2.4% $150 2.2% 2.2% $268 $253 ($ Millions) $243 $249 $258 1.5% 2.0% 1.3% $209 $100 1.2% $186 $198 $170 $165 $174 $144 $146 $158 $158 $121 $127 $130 1.0% Tobacco Adjusted EBITDA $50 $111 $79 $77 $46 $0 0.0% Source: MSA CRA wholesale shipment database. Note: The Liggett and Vector Tobacco businesses have been combined into a single segment for all periods since 2007. (1) Tobacco Adjusted EBITDA is a Non‐GAAP Financial Measure and is defined in Table 2 of Exhibit 99.1 of the Company’s Current Reports on Form 8‐K, filed on August 7, 2019 as well as Table 2 to Exhibit 99.2 of the Company’s Current Report son Form 8‐K, 6 dated October 2, 2015, November 15, 2016 , March 1, 2018, June 14, 2018, September 28, 2018 and February 28, 2019.

ADJUSTED U.S. TOBACCO INDUSTRY MARKET SHARE Legacy brands 15.00% 12.47% Brands acquired by ITG in 2015 12.15% Newport – acquired by RAI in 2015 10.00% 9.45% 8.49% Santa Fe tobacco – acquired by RAI in 2002 8.81% 9.26% 6.74% 5.00% 6.61% 4.04% 50.0% 48.8% 3.36% 46.7% 47.4% 46.1% 2.44% 2.36% 3.65% 2.89% 2.71% 1.88% 40.0% 0.00% 2003 2006 2014 LTM 2003 2006 2014 LTM 32.4% 32.4% 6/30/19 6/30/19 30.0% 28.9% 28.4% 12.4% 7.7% 8.8% 13.5% 0.3% 20.0% 0.4% 1.5% 2.5% 12.2% 12.5% 20.9% 9.5% 10.0% 19.2% 18.4% 8.5% 16.3% 9.3% 8.8% 6.7% 6.7% 3.4% 4.0% 2.4% 2.4% 2.9% 3.7% 2.7% 0.0% 1.9% 2003 2006 2014 LTM 2003 2006 2014 LTM 2003 2006 2014 LTM 2003 2006 2014 LTM 6/30/19 6/30/19 6/30/19 6/30/19 PHILIP MORRIS REYNOLDS USA AMERICAN ITG BRANDS LIGGETT GROUP Source: The Maxwell Report’s sales estimates for the cigarette Industry for the years ended 2003 (February 2004), 2006 (February 2007) and 2014 (March 2015) and internal estimates for LTM 6/30/2019. (1) Actual Market Share in 2003, 2006 and 2014 reported in the Maxwell Report for Reynolds American was 29.6%, 27.6% and 23.1%, respectively, and, for ITG Brands, was 2.9%, 3.7%. and 2.7%, respectively. Adjusted market share has been computed by Vector Group Ltd. by applying historical market share of each brand to the present owner of brand. Thus, the graph assumes each company owned its current brands on January 1, 2003. The legacy brands market share of Reynolds American in 2003 includes the market share of Brown & Williamson, which was acquired by Reynolds American in 2004. In 2015, Reynolds American acquired Lorillard Tobacco Company, which manufactured the Newport brand, and sold a portfolio of brands, including the Winston, Salem, Kool and Maverick brands to ITG Brands. 7 (2) Does not include smaller manufacturers, whose cumulative market shares were 9.8%, 7.9%, 8.9% and 9.0% in 2003, 2006, 2014 and LTM 6/30/2019, respectively.

TOBACCO LITIGATION AND REGULATORY UPDATES Litigation . In 2013, Liggett reached a settlement with approximately 4,900 Engle progeny plaintiffs, which represented a substantial portion of Liggett’s pending litigation — Liggett agreed to pay $60 million in a lump sum in 2014 and the balance in installments of $3.4 million in each of the following 14 years (2015 – 2028) . Liggett has resolved all but approximately 60 Engle progeny cases as of June 30, 2019 . Liggett is also a defendant in 36 non‐Engle smoking‐related individual cases and three smoking‐related actions where either a class had been certified or plaintiffs were seeking class certification . The Mississippi Attorney General has filed a motion to enforce Mississippi’s 1996 settlement agreement with Liggett and alleged that Liggett owes Mississippi at least $27 million in damages (including interest at January 2016). Regulatory . Since 1998, the MSA has restricted the advertising and marketing of tobacco products . In 2009, Family Smoking Prevention and Tobacco Control Act granted the FDA power to regulate the manufacture, sale, marketing and packaging of tobacco products — FDA is prohibited from issuing regulations that ban cigarettes — In 2018, FDA issued a Notice of Proposed Rulemaking to consider reducing nicotine in��tobacco . Federal Excise Tax is $1.01/pack (since April 1, 2009) and additional state and municipal excise taxes exist 8

REAL ESTATE OPERATIONS 9

REAL ESTATE OVERVIEW . New Valley, which now owns 100% of Douglas Elliman Realty, LLC, is a diversified real estate company that is seeking to acquire or invest in additional real estate properties or projects . New Valley has invested approximately $156 million(1), as of June 30, 2019, in a broad portfolio of real estate projects New Valley Revenues – LTM June 30, 2019 New Valley Adjusted EBITDA(2) Real Estate Brokerage Commissions Other Property Management $11M $35M $38.7M $27.9M $18.2M $799M $10.3M $753M 2016 2017 2018 LTM 6/30/19 (1) Net of cash returned. (2) New Valley’s net income was $13.5M, $37.6M, $14.8M and $26.6M for the periods presented. Adjusted EBITDA is a non‐GAAP financial measure. For a reconciliation of Net income to Adjusted EBITDA, please see Vector Group Ltd.’s Current Reports on Forms 8‐K, filed on March 1, 2017, June 14, 2018, February 28, 2019, May 3, 2019 and August 7, 2019 and Form 10‐K for the fiscal year ended December 31, 2018 and Form 10‐Q for the quarterly period ended June 30, 2019 (Commission File Number 1‐5759) as well as the Disclaimer to this document on Page 2. New Valley’s Adjusted EBITDA do not include an allocation of Vector Group Ltd.’s Corporate and Other Expenses (for purposes of computing Adjusted EBITDA) of $12.0M, $13.0M. $14.1M and $16.0M for the periods presented, 10 respectively.

DOUGLAS ELLIMAN REALTY, LLC . Largest residential real estate brokerage firm in the Douglas Elliman Closed Sales – LTM June 30, 2019 highly competitive New York metropolitan area and fourth‐largest residential brokerage firm in the U.S. Long Island, Westchester, Connecticut . Douglas Elliman has more than 7,000 affiliated agents Massachusetts and approximately 115 offices in the U.S. $7.3B . Alliance with Knight Frank provides a network with 512 New York City offices across 60 countries with approximately 19,000 Aspen Los $13.8B affiliated agents Angeles . Also offers title and settlement services, relocation services, and residential property management services South Florida through various subsidiaries $4.7B Douglas Elliman Douglas Elliman Douglas Elliman Adjusted EBITDA(1) Closed Sales Revenues – LTM June 30, 2019 Real Estate Brokerage Commissions Other Property Management $28.1B $29.2B $36.7M $24.5B$26.1B $6M $22.4B $26.1M $35M $18.2B $19.2M $14.9B $11.2M $794M 2016 2017 2018 LTM 6/30/19 2013 2014 2015 2016 2017 2018 LTM $753M 6/30/19 (1) Douglas Elliman’s net income was $21.1M, $37.6M, $14.8M and $12.1M for the periods presented. Adjusted EBITDA is a non‐GAAP financial measure. For a reconciliation of Adjusted EBITDA to net income, please see Vector Group Ltd.’s Current Reports on Forms 8‐K, filed on March 1, 2017, June 14, 2018 , February 28, 2019, May 3, 2018 and August 7, 2019, Form 10‐K for the fiscal year ended December 31, 2018 and Form 10‐Q for the quarterly period ended June 30, 2019 (Commission File Number 1‐5759) as well as the Disclaimer to this document on Page 2. 11

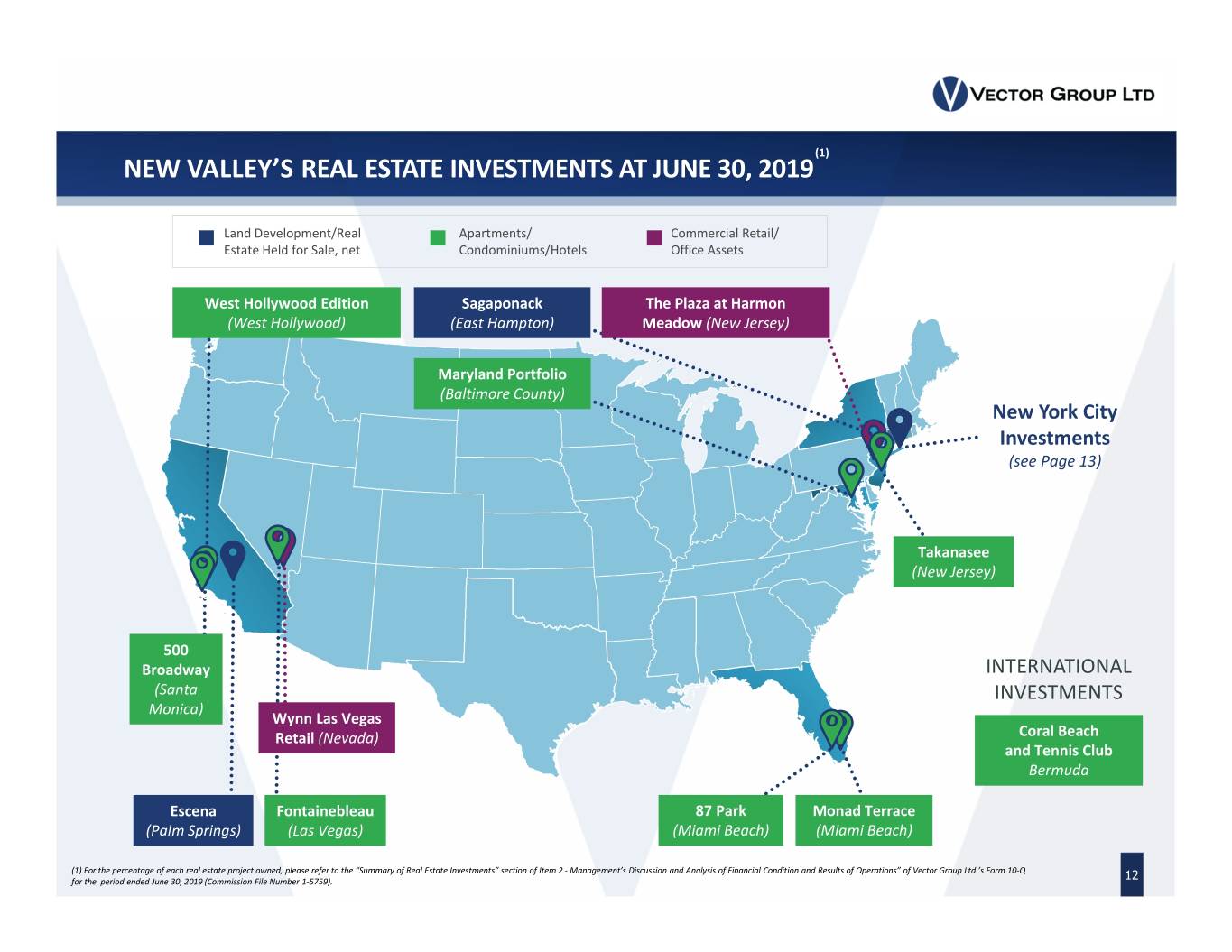

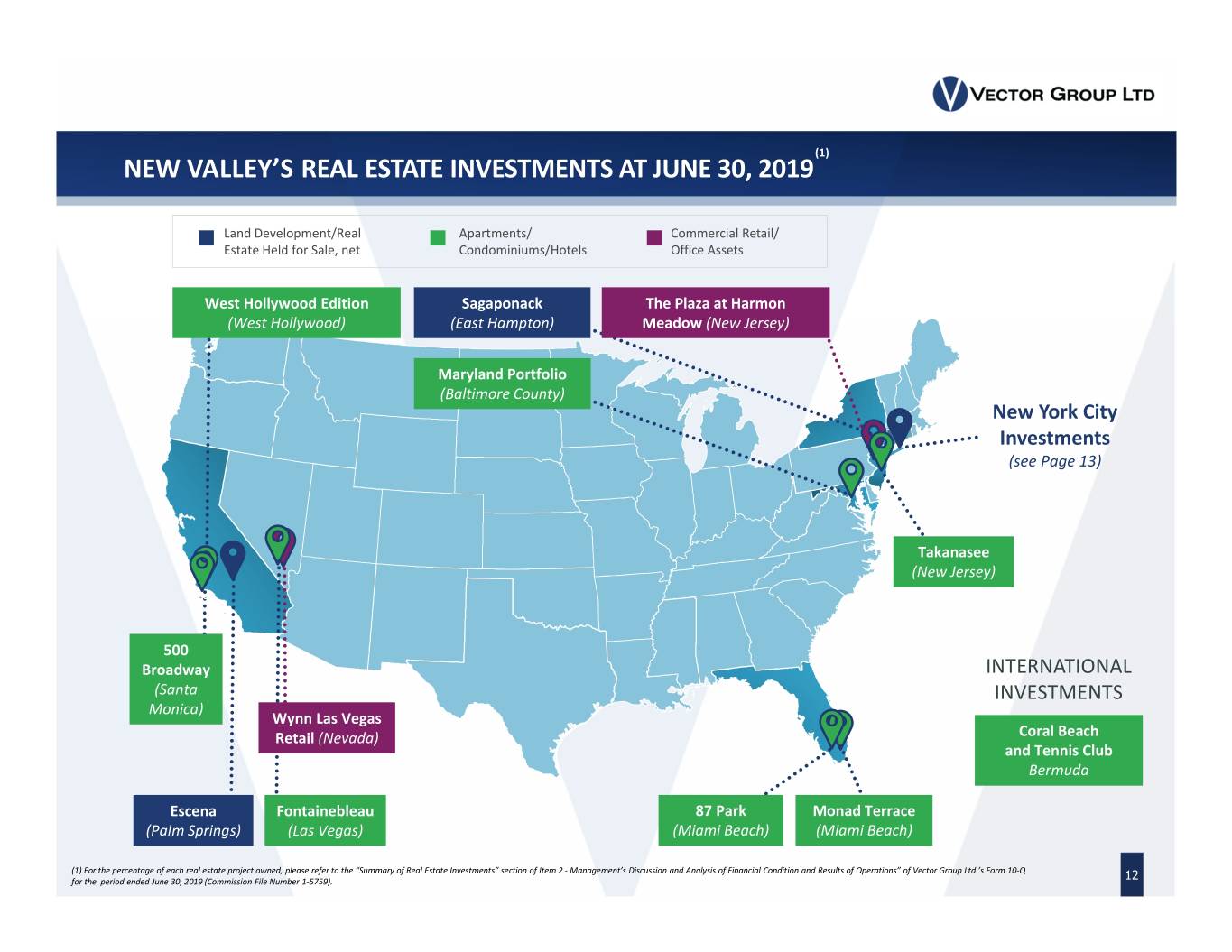

(1) NEW VALLEY’S REAL ESTATE INVESTMENTS AT JUNE 30, 2019 Land Development/Real Apartments/ Commercial Retail/ Estate Held for Sale, net Condominiums/Hotels Office Assets West Hollywood Edition Sagaponack The Plaza at Harmon (West Hollywood) (East Hampton) Meadow (New Jersey) Maryland Portfolio (Baltimore County) New York City Investments (see Page 13) Takanasee (New Jersey) 500 Broadway INTERNATIONAL (Santa INVESTMENTS Monica) Wynn Las Vegas Retail (Nevada) Coral Beach and Tennis Club Bermuda Escena Fontainebleau 87 Park Monad Terrace (Palm Springs) (Las Vegas) (Miami Beach) (Miami Beach) (1) For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 2 ‐ Management’s Discussion and Analysis of Financial Condition and Results of Operations” of Vector Group Ltd.’s Form 10‐Q 12 for the period ended June 30, 2019 (Commission File Number 1‐5759).

(1) NEW VALLEY’S REAL ESTATE INVESTMENTS IN NEW YORK CITY 1 1. The Marquand Upper East Side 10 2. 10 Madison Square West Flatiron District/NoMad (in liquidation) 9 8 3. 11 Beach Street TriBeCa 4 4. 20 Times Square Times Square (in liquidation) 5. 111 Murray Street TriBeCa 6. 160 Leroy Street Greenwich Village 7. 215 Chrystie Street Lower East Side 2 12 8. The Dutch Long Island City 17 9. 1 QPS Tower Long Island City (in liquidation) 14 10. Park Lane Hotel Central Park South 6 11. 125 Greenwich Street Financial District 7 5 3 12. The XI (formerly “The Eleventh”) West Chelsea 13. 15 East 19th Street (formerly “New Brookland”) Brooklyn 14. The Dime (Havemeyer Street) Brooklyn 11 15. 352 6th Avenue Brooklyn 13 16 15 16. 9 DeKalb Brooklyn 17. Meatpacking Plaza Meatpacking District (1) For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 7 ‐ Management’s Discussion and Analysis of Financial Condition and Results of Operations ‐ of Vector Group Ltd.’s Form 10‐Q 13 for the period ended June 30, 2019 (Commission File Number 1‐5759).

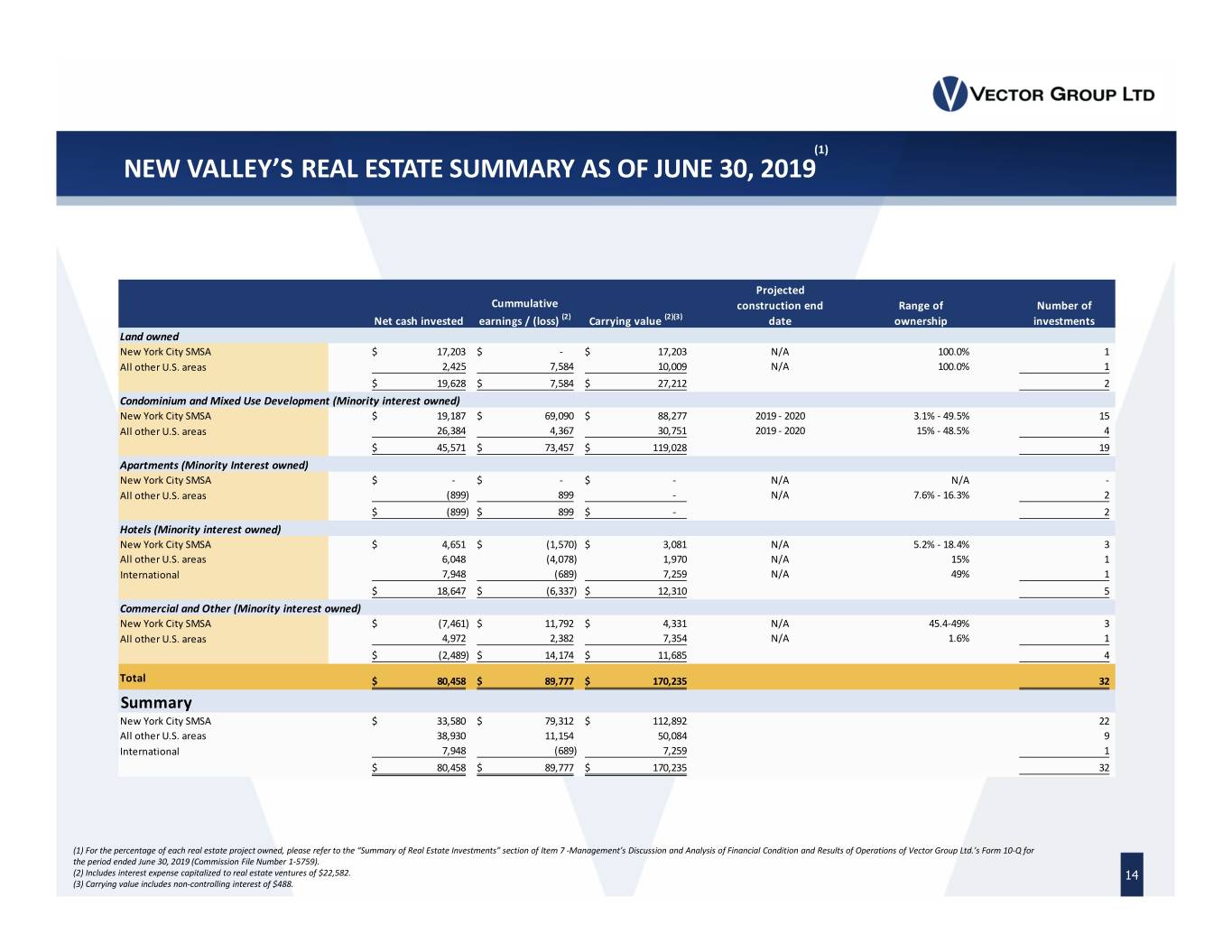

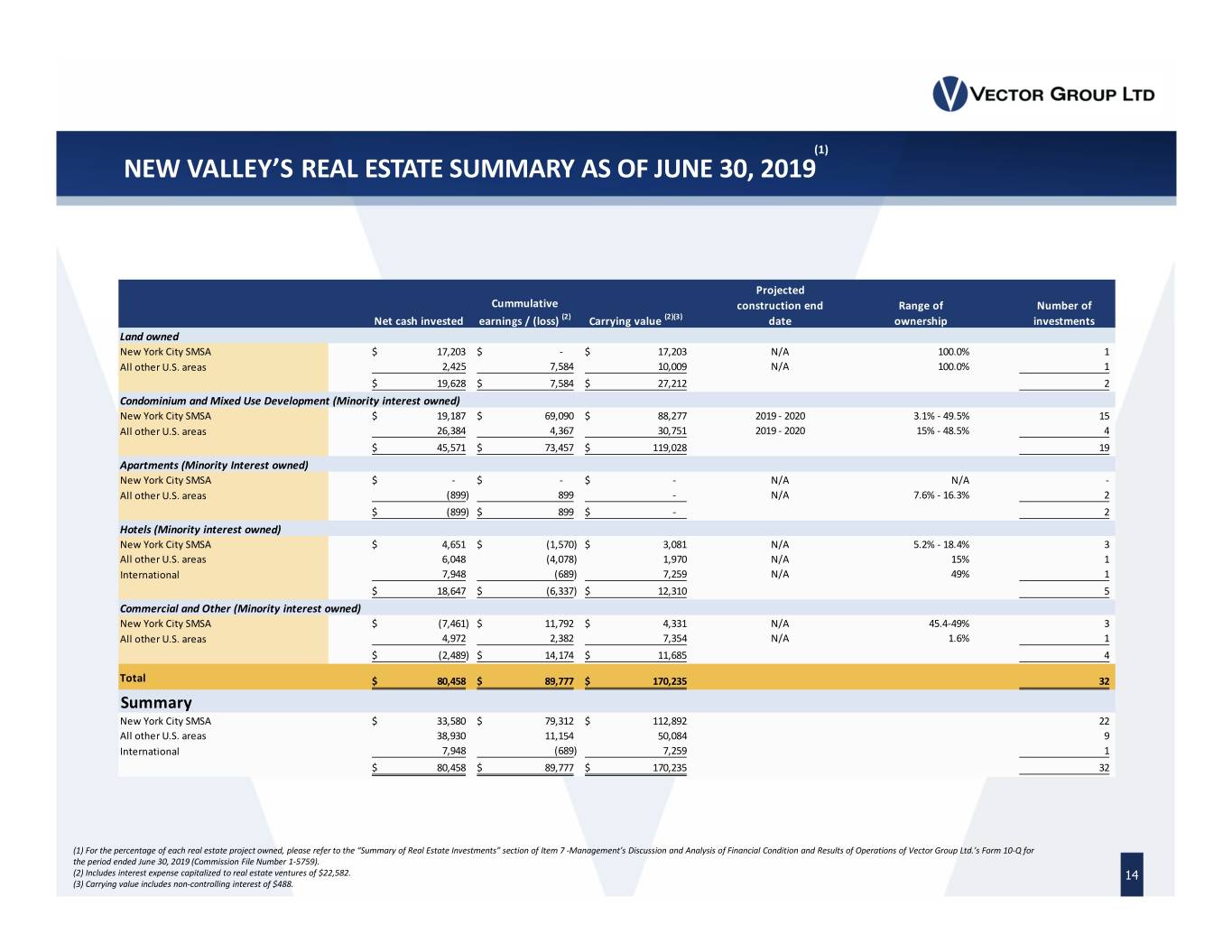

(1) NEW VALLEY’S REAL ESTATE SUMMARY AS OF JUNE 30, 2019 Projected Cummulative construction end Range of Number of Net cash invested earnings / (loss) (2) Carrying value (2)(3) date ownership investments Land owned New York City SMSA$ 17,203 $ ‐ $ 17,203 N/A 100.0% 1 All other U.S. areas 2,425 7,584 10,009 N/A 100.0% 1 $ 19,628 $ 7,584 $ 27,212 2 Condominium and Mixed Use Development (Minority interest owned) New York City SMSA$ 19,187 $ 69,090 $ 88,277 2019 ‐ 2020 3.1% ‐ 49.5% 15 All other U.S. areas 26,384 4,367 30,751 2019 ‐ 2020 15% ‐ 48.5% 4 $ 45,571 $ 73,457 $ 119,028 19 Apartments (Minority Interest owned) New York City SMSA$ ‐ $ ‐ $ ‐ N/A N/A ‐ All other U.S. areas (899) ‐ 899 N/A 7.6% ‐ 16.3% 2 $ (899) $ ‐ 899 $ 2 Hotels (Minority interest owned) New York City SMSA$ 4,651 $ (1,570) $ 3,081 N/A 5.2% ‐ 18.4% 3 All other U.S. areas 6,048 (4,078) 1,970 N/A 15% 1 International 7,948 (689) 7,259 N/A49%1 $ 18,647 $ (6,337) $ 12,310 5 Commercial and Other (Minority interest owned) New York City SMSA$ (7,461) $ 11,792 $ 4,331 N/A 45.4‐49% 3 All other U.S. areas 4,972 2,382 7,354 N/A 1.6% 1 $ (2,489) $ 14,174 $ 11,685 4 Total $ 80,458 $ 89,777 $ 170,235 32 Summary New York City SMSA$ 33,580 $ 79,312 $ 112,892 22 All other U.S. areas 38,930 11,154 50,084 9 International 7,948 (689) 7,259 1 $ 80,458 $ 89,777 $ 170,235 32 (1) For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 7 ‐Management’s Discussion and Analysis of Financial Condition and Results of Operations of Vector Group Ltd.’s Form 10‐Q for the period ended June 30, 2019 (Commission File Number 1‐5759). (2) Includes interest expense capitalized to real estate ventures of $22,582. 14 (3) Carrying value includes non‐controlling interest of $488.

FINANCIAL DATA

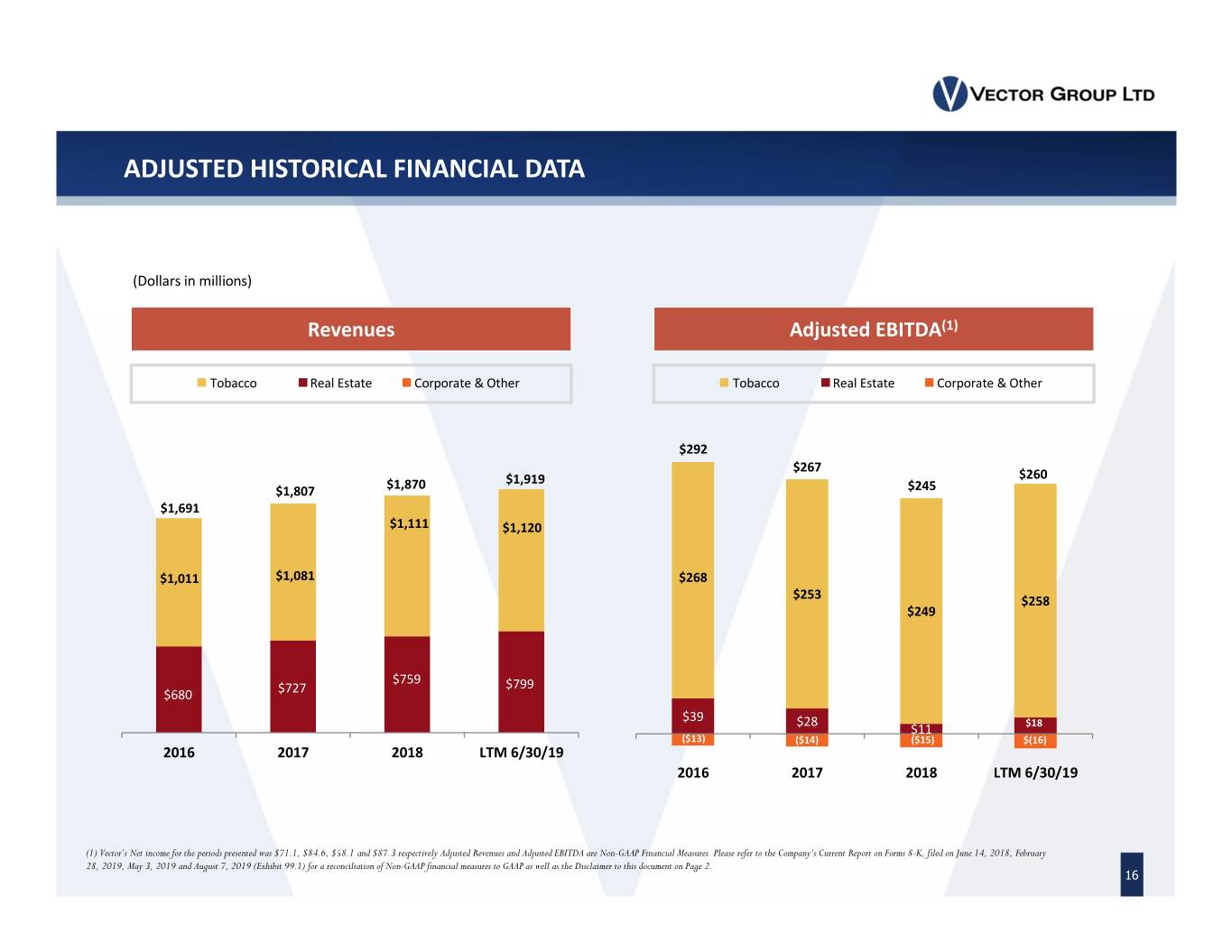

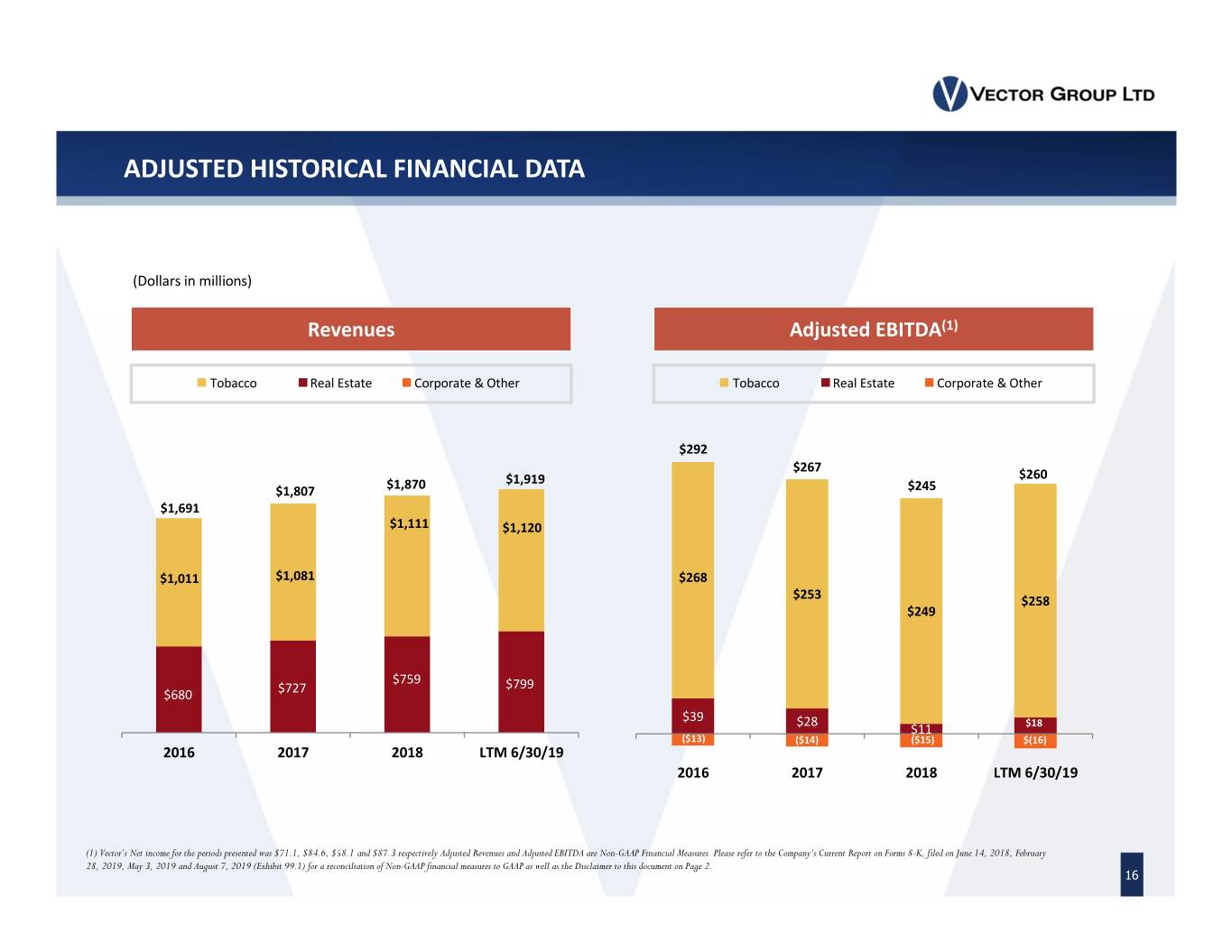

ADJUSTED HISTORICAL FINANCIAL DATA (Dollars in millions) Revenues Adjusted EBITDA(1) Tobacco Real Estate Corporate & Other Tobacco Real Estate Corporate & Other $292 $267 $1,919 $260 $1,807 $1,870 $245 $1,691 $1,111 $1,120 $1,011 $1,081 $268 $253 $258 $249 $759 $799 $680 $727 $39 $28 $18 $11 ($13) ($14) ($15) $(16) 2016 2017 2018 LTM 6/30/19 2016 2017 2018 LTM 6/30/19 (1) Vector’s Net income for the periods presented was $71.1, $84.6, $58.1 and $87.3 respectively Adjusted Revenues and Adjusted EBITDA are Non-GAAP Financial Measures. Please refer to the Company’s Current Report on Forms 8-K, filed on June 14, 2018, February 28, 2019, May 3, 2019 and August 7, 2019 (Exhibit 99.1) for a reconciliation of Non-GAAP financial measures to GAAP as well as the Disclaimer to this document on Page 2. 16

SUMMARY

SUMMARY . Vector Group, a holding . Tobacco segment . Real Estate segment company owning Tobacco — Liggett is the fourth‐ — New Valley owns a and Real Estate largest U.S. Cigarette diversified portfolio of businesses and holding company with 4.0% consolidated and non‐ consolidated cash, wholesale market share consolidated real estate investment securities and and 4.2% retail market investments totaling $170 share over LTM June 30, million at June 30, 2019. long‐term investments of 2019. $590 million at June 30, — Douglas Elliman Realty — Only major U.S. cigarette 2019 • Largest residential real manufacturer to increase estate brokerage firm in — Vector’s management both market share and New York Metropolitan team has an average unit volumes over the last area and fourth‐largest tenure of 26 years with 10 years residential brokerage the Company and, along firm in the U.S. — $258 million(1) of with directors, Adjusted EBITDA over • Closed sales volume of beneficially owns LTM June 30, 2019. $29.2 billion over LTM approximately 11% of 6/30/19 Vector’s common stock • Revenues have increased from $541 million in 2014 to $794 million over LTM 6/30/19 (1) Vector’s operating income from the tobacco segment for the twelve months ended June 30, 2019 was $249.4 million. Adjusted EBITDA is a Non-GAAP Financial Measure. Please refer to Exhibit 99.1 of the Company’s Current Report on Form 8-K, filed on August 7, 2019 (Table 5), for a reconciliation of Net income to Adjusted EBITDA as well as the Disclaimer to this document on Page 2. 18