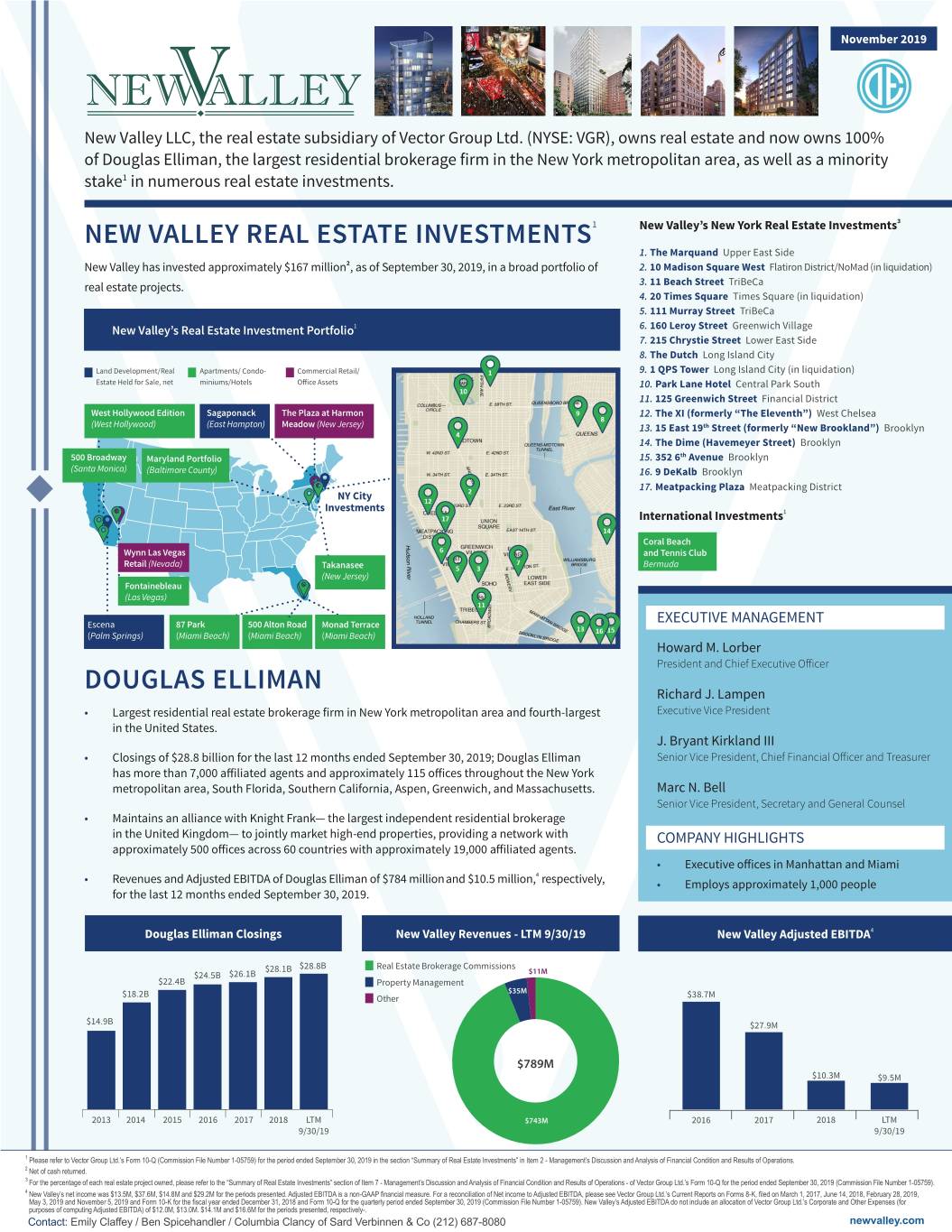

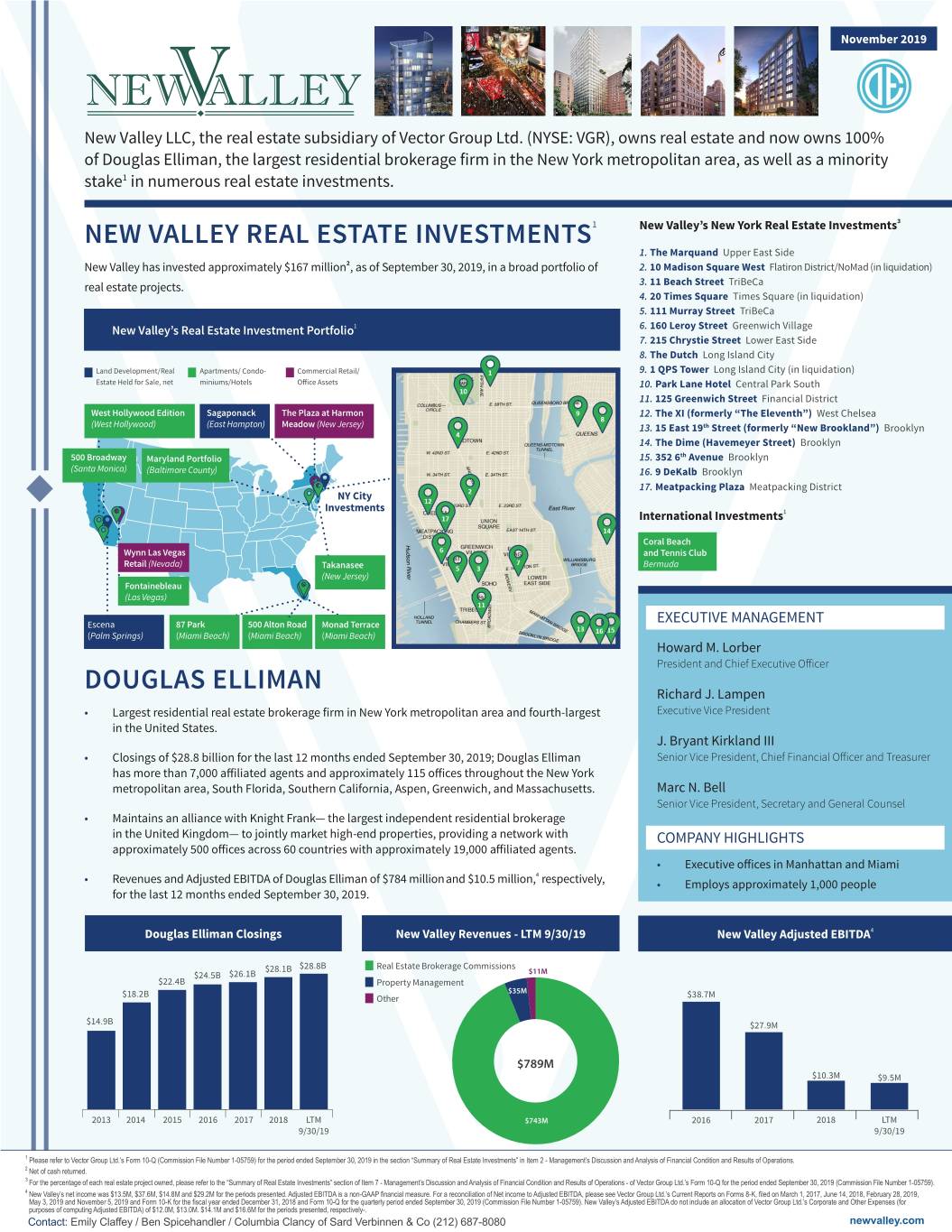

November 2019 New Valley LLC, the real estate subsidiary of Vector Group Ltd. (NYSE: VGR), owns real estate and now owns 100% of Douglas Elliman, the largest residential brokerage firm in the New York metropolitan area, as well as a minority stake1 in numerous real estate investments. 3 NEW VALLEY REAL ESTATE INVESTMENTS1 New Valley’s New York Real Estate Investments 1. The Marquand Upper East Side 2 New Valley has invested approximately $167 million , as of September 30, 2019, in a broad portfolio of 2. 10 Madison Square West Flatiron District/NoMad (in liquidation) real estate projects. 3. 11 Beach Street TriBeCa 4. 20 Times Square Times Square (in liquidation) 5. 111 Murray Street TriBeCa New Valley’s Real Estate Investment Portfolio1 6. 160 Leroy Street Greenwich Village 7. 215 Chrystie Street Lower East Side 8. The Dutch Long Island City Land Development/Real Apartments/ Condo- Commercial Retail/ 9. 1 QPS Tower Long Island City (in liquidation) Estate Held for Sale, net miniums/Hotels Office Assets 10. Park Lane Hotel Central Park South 11. 125 Greenwich Street Financial District West Hollywood Edition Sagaponack The Plaza at Harmon 12. The XI (formerly “The Eleventh”) West Chelsea (West Hollywood) (East Hampton) Meadow (New Jersey) 13. 15 East 19th Street (formerly “New Brookland”) Brooklyn 14. The Dime (Havemeyer Street) Brooklyn 500 Broadway Maryland Portfolio 15. 352 6th Avenue Brooklyn (Santa Monica) (Baltimore County) 16. 9 DeKalb Brooklyn 17. Meatpacking Plaza Meatpacking District NY City Investments International Investments1 Coral Beach Wynn Las Vegas and Tennis Club Retail (Nevada) Takanasee Bermuda (New Jersey) Fontainebleau (Las Vegas) Escena 87 Park 500 Alton Road Monad Terrace EXECUTIVE MANAGEMENT (Palm Springs) (Miami Beach) (Miami Beach) (Miami Beach) Howard M. Lorber President and Chief Executive Officer DOUGLAS ELLIMAN Richard J. Lampen • Largest residential real estate brokerage firm in New York metropolitan area and fourth-largest Executive Vice President in the United States. J. Bryant Kirkland III • Closings of $28.8 billion for the last 12 months ended September 30, 2019; Douglas Elliman Senior Vice President, Chief Financial Officer and Treasurer has more than 7,000 affiliated agents and approximately 115 offices throughout the New York metropolitan area, South Florida, Southern California, Aspen, Greenwich, and Massachusetts. Marc N. Bell Senior Vice President, Secretary and General Counsel • Maintains an alliance with Knight Frank— the largest independent residential brokerage in the United Kingdom— to jointly market high-end properties, providing a network with COMPANY HIGHLIGHTS approximately 500 offices across 60 countries with approximately 19,000 affiliated agents. • Executive offices in Manhattan and Miami 4 • Revenues and Adjusted EBITDA of Douglas Elliman of $784 millionand $10.5 million, respectively, • Employs approximately 1,000 people for the last 12 months ended September 30, 2019. Douglas Elliman Closings New Valley Revenues - LTM 9/30/19 New Valley Adjusted EBITDA4 $28.8B $28.1B Real Estate Brokerage Commissions $11M $24.5B $26.1B $22.4B Property Management $18.2B $35M Other $38.7M $14.9B $27.9M $789M $10.3M $9.5M 2013 2014 2015 2016 2017 2018 LTM $743M 2016 2017 2018 LTM 9/30/19 9/30/19 1 Please refer to Vector Group Ltd.’s Form 10-Q (Commission File Number 1-05759) for the period ended September 30, 2019 in the section “Summary of Real Estate Investments” in Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations. 2 Net of cash returned. 3 For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations - of Vector Group Ltd.’s Form 10-Q for the period ended September 30, 2019 (Commission File Number 1-05759). 4 New Valley’s net income was $13.5M, $37.6M, $14.8M and $29.2M for the periods presented. Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Net income to Adjusted EBITDA, please see Vector Group Ltd.’s Current Reports on Forms 8-K, filed on March 1, 2017, June 14, 2018, February 28, 2019, May 3, 2019 and November 5, 2019 and Form 10-K for the fiscal year ended December 31, 2018 and Form 10-Q for the quarterly period ended September 30, 2019 (Commission File Number 1-05759). New Valley’s Adjusted EBITDA do not include an allocation of Vector Group Ltd.’s Corporate and Other Expenses (for purposes of computing Adjusted EBITDA) of $12.0M, $13.0M. $14.1M and $16.6M for the periods presented, respectively-. Contact: Emily Claffey / Ben Spicehandler / Columbia Clancy of Sard Verbinnen & Co (212) 687-8080 newvalley.com