- LECO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Lincoln Electric (LECO) DEF 14ADefinitive proxy

Filed: 20 Mar 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

LINCOLN ELECTRIC HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

DEAR SHAREHOLDER:

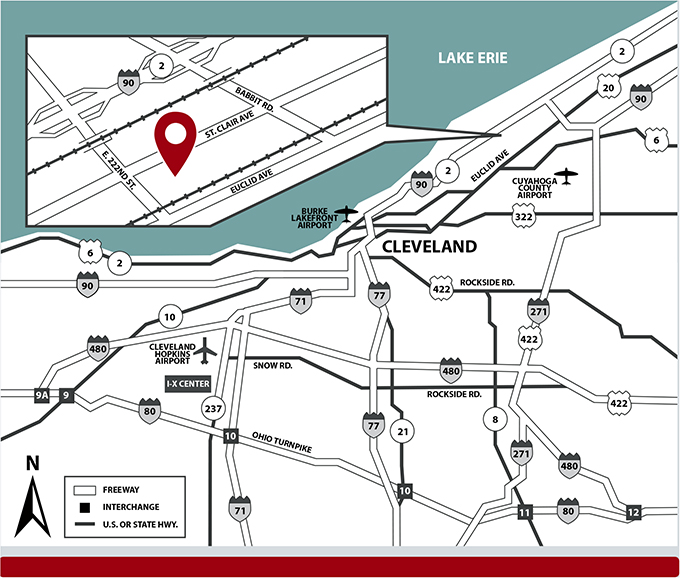

You are cordially invited to attend the Annual Meeting of Shareholders of Lincoln Electric Holdings, Inc., which will be held at 11:00am ET on Thursday, April 19, 2018 at Lincoln Electric’s Welding Technology & Training Center, 22800 St. Clair Avenue, Cleveland, Ohio. A map of the location is printed on the inside back cover of this proxy statement.

| At the meeting, you will be asked to:

• Elect ten Director nominees named in the proxy statement for aone-year term;

• Ratify the appointment of our independent auditors for the year ending December 31, 2018;

• Approve, on an advisory basis, the compensation of our named executive officers; and

• Address any other business that properly comes before the meeting.

Shareholders of record on the close of business on March 1, 2018, the record date, are entitled to vote at the Annual Meeting. Your vote is very important! Please vote your shares promptly in one of the four ways noted on page 4. We appreciate your continued | confidence in Lincoln Electric and we look forward to seeing you at the Annual Meeting!

Sincerely,

Christopher L. Mapes Chairman, President and Chief Executive Officer | ||||||||

Jennifer I. Ansberry Executive Vice President, General Counsel and Secretary

| ||||||||||

WE WILL BEGIN MAILING THIS PROXY STATEMENT ON OR ABOUT MARCH 20, 2018.

| ||||||||||

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on April 19, 2018: This proxy statement and the related form of proxy, along with our 2017 Annual Report and Form10-K, are available free of charge at www.lincolnelectric.com/proxymaterials.

|

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 0 1 | |

|

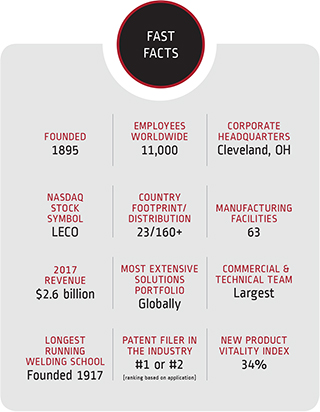

BUSINESS OVERVIEW //

Lincoln Electric is the world leader in the design, development and manufacture of arc welding products, robotic arc welding systems, plasma and oxyfuel cutting equipment and has a leading global position in the brazing and soldering alloys market. Headquartered in Cleveland, Ohio, U.S., we operate 63 manufacturing locations in 23 countries and distribute to over 160 countries. In 2017, we generated $2.6 billion in sales.

As an innovation leader with the broadest portfolio of solutions and the industry’s largest team of technical sales representatives and application experts, we are known as the Welding Experts®. Our portfolio of welding and cutting solutions are designed to help customers achieve greater productivity and quality in their manufacturing and fabrication processes. We leverage our global presence and broad distribution network to serve an array of customers across various end markets including: general metal fabrication, power generation and process industries, structural steel construction (buildings and bridges), heavy equipment fabrication (agricultural, mining, construction and rail), shipbuilding, automotive, pipe mills and pipelines, and oil and gas. |

OUR GLOBAL FOOTPRINT

/ 0 2 | ||

For over 120 years, we have achieved success through a balanced approach and our focus in providing:

| ||

• Customers with a market leading product offering and superior technical application capability, | • Employees with an incentive and results driven culture, and

• Shareholders with above market returns. | |

In 2010, we mobilized the organization around a ten year “2020 Vision and Strategy” that focuses on expanding Lincoln Electric’s position as a valued, technical solutions-provider in our industry by accelerating innovation, operational excellence, and achievingbest-in-class financial results through an economic cycle. The strategy is founded on Lincoln Electric’s values and organizes commercial and operational initiatives around six core capabilities and competitive advantages to drive growth and improved margin and return performance: welding process expertise, commercial excellence, product development, global network and reach, operational excellence and financial discipline. |

| In executing our “2020 Vision and Strategy,” we have pursued an aggressive acquisition strategy, accelerated our investments in R&D to enhance the value proposition and positioning of our solutions, and have emphasized engineered solutions for mission-critical applications. Additionally, we have focused on expanding our brand’s geographic and channel reach into attractive areas such as automation. Our efforts have been successful. Contributions from acquisitions, a strong vitality index of new products, and expanded market presence have improved margin performance and returns. Continuous improvement initiatives have also structurally improved our business profile. Our focus on operational excellence and safety have contributed to improved margins, cash flow generation and returns. We are well positioned for improved long-term operating performance of the business through the economic cycle. | |

As we navigate through the 2020 strategy, we continue to review our progress and remain confident in our program, our ability to execute to plan and achieve our goals. | ||

| Key Financial Metrics | 2020 Goal | 2009–2017 Achievement1 | Key Initiatives and Focus | |||

| Sales Growth CAGR | 10% CAGR through the cycle | 5% Reported Sales CAGR

7% CAGR [Excludes FX and Venezuela results] | • Increased investment in R&D, increasing our new product vitality index • Active acquisition program | |||

| Operating Income Margin | 15% Average through the cycle | 11.1% Average Reported

12.6% Average Adjusted [Achieved a5-year average 14.6% adjusted margin] | • Targeted growth opportunities • Richening the portfolio mix through differentiated technologies and applications • Operational excellence | |||

Return on Invested Capital [ROIC] | 15% Average through the cycle | 16.6% Average | • Disciplined acquisition program with stringent ROIC and IRR goals • Margin expansion • Cash management | |||

Average Operating Working Capital Ratio | 15% at 2020 | 15.9% at 2017; 14.2% excluding ALW acquisition | • Effective cash cycle management • Inventory management | |||

[1] See Appendix A for definitions and/or reconciliations of these metrics to results reported in accordance with generally accepted accounting principles.

|

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 0 3 | |

ANNUAL MEETING INFORMATION

ANNUAL MEETING OF SHAREHOLDERS

|

| DATE & TIME | LOCATION | RECORD DATE | ||||

| Thursday, April 19, 2018 | Lincoln Electric’s Welding | March 1, 2018 | ||||

| 11:00 ET | Technology & Training Center | |||||

| 22800 St. Clair Avenue | ||||||

| Cleveland, Ohio |

HOW TO CAST YOUR VOTE//

Your vote is important! Please vote your shares promptly in one of the following ways: |

|

|

|

| |||

BY INTERNET Visit www.proxyvote.com until April 18, 2018 | BY PHONE Please call 1-800-690-6903 by April 18, 2018 | BY MAIL Sign, date and return your proxy card or voting instruction form, must be received by April 18, 2018 | IN PERSON You can vote in person at the meeting in Cleveland, Ohio on April 19, 2018 |

| MEETING AGENDA VOTING MATTERS// |

| PROPOSAL 1 To elect ten Director nominees named in this Proxy Statement to hold office until the 2019 Annual Meeting |  | FOR each nominee | PAGE 12 | ||||||||

| PROPOSAL 2 To ratify the appointment of Ernst & Young LLP as independent auditor for the 2018 fiscal year |  | FOR | PAGE71 | ||||||||

| PROPOSAL 3 To approve, on an advisory basis, the compensation of our named executive officers (NEOs) |  | FOR | PAGE73 | ||||||||

/ 0 4 | ||

PROXY SUMMARY //

This section provides an overview of important items related to this proxy statement and the Annual Meeting.

We encourage you to read the entire proxy statement for more information before voting.

2017 PERFORMANCE HIGHLIGHTS //

We achieved solid performance in 2017 despite a slow recovery in industrial end markets. Sales increased 15% to $2.6 billion on 7% organic sales growth and 8% from acquisitions, substantially from the Air Liquide Welding (ALW) acquisition. We generated solid profit growth in our core business (excluding acquisitions) as we continued to focus on improving mix, disciplined cost management and operational excellence. Successful execution of a number of commercial and operational initiatives resulted in strong cash flows, solid return performance, as well as record-level working capital efficiency in our core business. We also reached record performance across safety and environmental metrics, including safety, energy intensity and ourre-use and recycling rates. These results demonstrate the structural improvements achieved in the business through our “2020 Vision and Strategy” and how the organization continues to advance towardsbest-in-class results.

| OPERATING INCOME MARGIN | ||

| Reported | Adjusted | |

| 14.4% | 13.8% | |

| DILUTED EPS | ||

| Reported | Adjusted | |

| $3.71 | $3.79 | |

CASH FLOW FROM OPERATIONS OF

$335M

[108% cash conversion of adjusted net income]

|

AVERAGE OPERATING WORKING CAPITAL TO NET SALES RATIO OF

15.9%

[14.2% record performance excluding ALW acquisition]

|

RETURN ON INVESTED CAPITAL [ROIC] OF

16.2%

|

See Appendix A for definitions and/or reconciliation of these metrics to results reported in accordance with generally accepted accounting principles. Performance measures used in the design of the executive compensation program are presented within the Compensation Discussion and Analysis section.

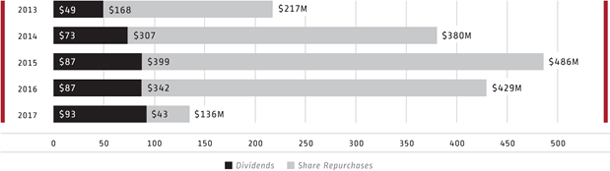

In addition, we continued to focus on generating long-term value for our shareholders. In 2017, 50% of cash was invested in growth (capital expenditures and acquisitions) and 50% was returned to shareholders through our dividend program and share repurchases. In the last five years, we have repurchased an aggregate amount of $1.3 billion in shares and have increased the dividend payout rate by 70%. Our Board of Directors increased the dividend payout rate by 11.4% in 2018, marking 22 years of dividend increases.

Cumulative Capital Returned to Shareholders[$ millions, based on capital allocation]

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 05 | |

PROXY SUMMARY

| CORPORATE GOVERNANCE HIGHLIGHTS // | ||||||

Lincoln Electric has a solid track record of integrity and corporate governance practices that promote thoughtful management by its officers and Board of Directors facilitating profitable growth while strategically balancing risk to maximize shareholder value. Below is a summary of certain Board of Director and governance information with respect to 2017:

| ||||||

Board & Governance Information

| ||||||

Size of Board

| 11* | Number of fully independent Board committees

| 4 | |||

Number of independent Directors

| 10 | Independent Directors meet without management

| Yes | |||

Average age of Directors

| 66 | Director attendance at Board & committee meetings

| 100% | |||

Percent diverse

| 27% | Mandatory retirement age [75]

| Yes | |||

Board meetings held in 2017

| 5 | Stock ownership requirements for Directors

| Yes | |||

New Directors in the last 5 years

| 2 | Annual Board and committee self-assessments

| Yes | |||

Annual election of Directors

| Yes | Code of Ethics for Directors, officers & employees

| Yes | |||

Majority voting policy for Directors

| Yes | Succession planning and implementation process

| Yes | |||

Lead Independent Director

| Yes | Environmental & risk management review

| Yes | |||

*There were 11 Directors [10 were independent] during the 2017 calendar year. There are currently 12 Directors [11 are independent] following Dr. Patel’s election to the Board on February 21, 2018.

SIZE OF BOARD

11

AVERAGE AGE OF

DIRECTORS

66

BOARD MEETINGS

HELD IN 2017

5

NUMBER OF

INDEPENDENT

DIRECTORS

10

PERCENT

DIVERSE

27%

NEW DIRECTORS

IN THE

LAST 5 YEARS

2

/ 0 6 | ||

DIRECTOR NOMINEES AND BOARD SUMMARY //

You are being asked to vote on the election of ten Director nominees. Summary biographical information and the committee membership and leadership of each Director, including Director nominees, is listed below. Additional information can be found in the Director biographies under Proposal 1.

|

| Director Nominees |

| Name | Age | Director Since | Independent | Audit | Compensation & Executive Development | Nominating & Corporate Governance | Finance | Other Public Boards | ||||||||

Curtis E. Espeland Executive Vice President and CFO, Eastman Chemical Company | 53 | 2012 | ✓ | ∎ | ● | — | ||||||||||

Stephen G. Hanks Retired President and CEO, Washington Group International | 67 | 2006 | ✓ | ● | ∎ | 2 | ||||||||||

Michael F. Hilton President and CEO, Nordson Corporation | 63 | 2015 | ✓ | ● | ● | 2 | ||||||||||

G. Russell Lincoln President, N.A.S.T. Inc. [personal investment firm] | 71 | 1989 | ✓ | ● | ● | — | ||||||||||

Kathryn Jo Lincoln Chair and CIO, Lincoln Institute of Land Policy | 63 | 1995 | ✓ | ● | ∎ | — | ||||||||||

William E. MacDonald, III Retired Vice Chairman, National City Corporation | 71 | 2007 | ✓ | ∎ | ● | — | ||||||||||

Christopher L. Mapes [Chairman] President and CEO, Lincoln Electric | 56 | 2010 | 1 | |||||||||||||

Phillip J. Mason Retired President, EMEA Sector of Ecolab, Inc. | 67 | 2013 | ✓ | ● | ● | 1 | ||||||||||

Ben P. Patel Vice President and Chief Technology Officer, Tenneco, Inc. | 50 | 2018 | ✓ | ● | ● | — | ||||||||||

Hellene S. Runtagh Retired President and CEO, Berwind Group | 69 | 2001 | ✓ | ● | ● | — | ||||||||||

∎ Chair ● Member

|

Retiring Directors

|

| Name | Age | Director Since | Independent | Audit | Compensation & Executive Development | Nominating & Corporate Governance | Finance | Other Public Boards | ||||||||

David H. Gunning [Lead Director] Retired Vice Chairman, Cliffs Natural Resources, Inc. | 75 | 1987 | ✓ | ● | ● | — | ||||||||||

George H. Walls, Jr. Retired Chief Deputy Auditor, State of North Carolina | 75 | 2003 | ✓ | ● | ● | — | ||||||||||

| ∎ Chair ● Member |

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 0 7 | |

PROXY SUMMARY

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS II

Our “2020 Vision and Strategy” is focused on key actions and initiatives that generate long-term profitable growth within our targeted markets through value-added solutions and operational excellence. We have established targets in our programs to achieve a long-term 10% compounded annual growth rate (CAGR) in sales, a 15% average Adjusted Operating Income Margin and Return on Invested Capital (ROIC) through an economic cycle, as well as a 15% Average Operating Working Capital to Net Sales ratio by 2020. We believe this framework engages our business team in creating a long-term value proposition for shareholders that generates above-market returns through economic cycles and maintains a short-term focus on aggressive profit and working capital targets that incentivizes management to improve profitability and operating excellence. Our executive compensation designs are structured to align our incentives with the “2020 Vision and Strategy.”

We have a long history of driving an incentive management culture, emphasizingpay for performanceto align compensation with the achievement of enterprise, segment and individual goals.

We believe our compensation program and practices provide an appropriatebalancebetween profitability, cash flow and returns, on the one hand, and suitable levels of risk-taking, on the other. This balance, in turn, aligns compensation strategies withshareholder interests, as reflected by the consistent high level of shareholders voting for the compensation of our named executive officers (NEOs).

ACTIONS TO FURTHER ALIGN EXECUTIVE COMPENSATION WITH SHAREHOLDER INTERESTS

The Compensation and Executive Development Committee of the Board reviews the framework of our executive compensation program to ensure executive pay aligns with our pay for performance philosophy. Our Compensation and Executive Development Committee has made a number of changes over the last few years to ensure our executive compensation program is well aligned with corporate performance and shareholder interests, which has been reflected in the strong results on our“say-on-pay” proposals on the compensation of our NEOs. In 2017, the overall design of our executive compensation program was held consistent with policies developed in prior years, with the following actions taken to further align our executive compensation with shareholder interests: |

• As a result of freezing the Retirement Annuity Program (RAP) at the end of 2016, implemented a Restoration Plan to allow NEOs to participate in a standard retirement design subject to IRS limitations. | • Amended our Change in Control Severance Agreements to align with market practices. |

2017 Executive Compensation Practices

| ||||||

What We Do

|

What We Don’t Do

| |||||

We have long-term compensation programs focused on profitability, net income growth, ROIC and total shareholder returns

| ✔ | We do not allow hedging or pledging of our shares | x | |||

We use targeted performance metrics to align pay with performance

| ✔ | We do not reprice stock options and do not issue discounted stock options | x | |||

We maintain stock ownership requirements[5x base salary for CEO; 3x base salary for other NEOs]

| ✔ | We do not provide excessive perquisites | x | |||

We have shareholder-approved incentive plans

| ✔ | We do not have multi-year guarantees for compensation increases | x | |||

We have a broad clawback policy

| ✔ | |||||

We have a double-trigger change in control policy

| ✔ | |||||

/ 08 | ||

COMPENSATION FRAMEWORK & PHILOSOPHY

Our compensation program is designed to attract and retain exceptional employees. As indicated below, we design our compensation system to reflect current best practices, including setting base pay below the competitive market for each position, targeting incentive-based compensation above the competitive market and promoting quality corporate governance in compensation decisions. We believe these practices result in sustained, long-term shareholder value and reflect our philosophy that the best performers should receive the greatest rewards.

Our executive compensation program is structured as follows:

• Base salary is targeted to be the smallest component of total direct compensation

• Short-term incentive compensation is based on annual consolidated and, if applicable, segment performance | • Long-term incentive compensation is based on our financial performance over a three-year cycle

• Variable, “at risk,” pay is a significant percentage of total compensation |

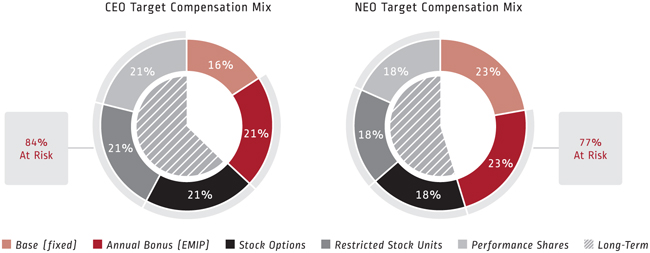

AVERAGE MIX OF KEY COMPENSATION COMPONENTS AND KEY COMPENSATION METRICS

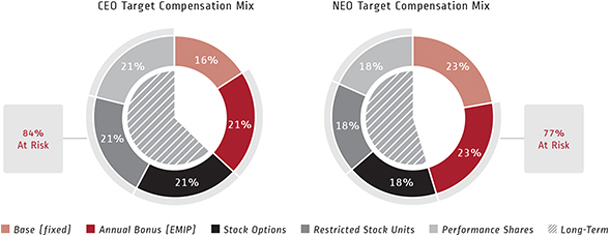

The following charts present the mix of 2017 target direct compensation for our Chief Executive Officer and all NEOs. As shown below, 84% of our CEO’s compensation value and, on average, 77% of our NEOs’ compensation value was “at risk,” with the actual amounts realized based on annual and long-term performance as well as our stock price.

|

|

|

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 0 9 | |

PROXY SUMMARY

We use the following six key financial performance measures to evaluate results across short-term and long-term periods. These metrics are also closely tied to our “2020 Vision and Strategy” program.

|

Key Performance Metrics Tied to Executive Compensation

|

| Metric | Annual Compensation | Long-Term Incentive Programs [3-yr Performance Cycle] | ||

EBITB1,2 [Earnings before interest, taxes and bonus] | ✓ | |||

Average Operating Working Capital to Sales2 ratio | ✓ | |||

Consolidated, segment and individual performance | ✓ | |||

Adjusted Net Income2 growth | ✓ | |||

Return on Invested Capital [ROIC]2 | ✓ | |||

Total Shareholder Return [TSR]2 | ✓ | |||

[1] EBITB is an internal measure which tracks our adjusted operating income.

[2] Performance measures used in the design of the executive compensation program are defined in Appendix A.

|

AUDITOR //

We ask our shareholders to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2018. Below is summary information about fees paid to Ernst & Young LLP for services provided during fiscal 2017 and 2016.

|

| 2017 | 2016 | |||

Audit Fees | $3,474,000 | $3,079,000 | ||

Audit-Related Fees | 14,000 | 10,000 | ||

Tax Fees | 235,000 | 178,000 | ||

All Other Fees | 0 | 0 | ||

Total Fees | $3,723,000 | $3,267,000 | ||

/ 10 | ||

PROPOSAL 1—ELECTION OF DIRECTORS

|

| PROPOSAL 1–ELECTION OF DIRECTORS //

ELECTION OF TEN DIRECTORS TO SERVE UNTIL 2019

The term of office of each of our Directors expires at this year’s Annual Meeting. Mr. Gunning and Mr. Walls will retire as Directors effective as of the expiration of their terms at the time of this year’s Annual Meeting. Upon their retirement, the authorized number of Directors will be reduced from its current size of twelve and fixed at ten. | |

Our shareholders are being asked to elect ten Directors to serve for aone-year term until the 2019 Annual Meeting and until their successors are duly elected and qualified. Unless otherwise directed, shares represented by proxy will be votedFORthe following nominees:

| Curtis E. Espeland | Kathryn Jo Lincoln | Ben P. Patel | ||

| Stephen G. Hanks | William E. MacDonald, III | Hellene S. Runtagh | ||

| Michael F. Hilton | Christopher L. Mapes | |||

| G. Russell Lincoln | Phillip J. Mason | |||

All of the Director nominees, other than Dr. Patel, who was elected to the Board on February 21, 2018, have been previously elected by our shareholders.

Each of the nominees has agreed to stand for election. The biographies of all of our Director nominees can be found later in this section.

If any of the nominees is unable to stand for election, the Board may provide for a lesser number of nominees or designate a substitute. In the latter event, shares represented by proxies solicited by the Directors may be voted for the substitute. We have no reason to believe that any of the nominees will be unable to stand for election.

MAJORITY VOTING POLICY

The Director nominees receiving the greatest number of votes will be elected (plurality standard). However, our majority voting policy states that any Director who fails to receive a majority of the votes cast in his/her favor is required to submit his/her resignation to the Board. The Nominating and Corporate Governance Committee of the Board would then consider each resignation and determine whether to accept or reject it. Abstentions and brokernon-votes will have no effect on the election of a Director and are not counted under our majority voting policy. Holders of common stock do not have cumulative voting rights with respect to the election of a Director.

OUR BOARD RECOMMENDS A VOTEFOR EACH DIRECTOR NOMINEE LISTED ABOVE

ANNUAL MEETING ATTENDANCE; NO SPECIAL ARRANGEMENTS

Directors are expected to attend each annual meeting. The Director nominees plan to attend this year’s Annual Meeting. At the 2017 Annual Meeting, all of our Directors were in attendance.

None of the Director nominees has any special arrangement or understanding with any other person pursuant to which the Director nominee was or is to be selected as a Director or nominee. There are no family relationships, as defined by SEC rules, among any of our Directors or executive officers. SEC rules define the term “family relationship” to mean any relationship by blood, marriage or adoption, not more remote than first cousin.

/ 12 |

|

CURTIS E. ESPELAND

AGE: 53

Director since 2012

| Recent Business Experience: Executive Vice President and Chief Financial Officer of Eastman Chemical

Qualifications: Mr. Espeland has extensive experience in corporate finance and accounting, | |||

STEPHEN G. HANKS

AGE: 67

Director since 2006

| Recent Business Experience: Mr. Hanks spent 30 years with global engineering and construction company

Directorships: McDermott International, Inc. (NYSE: MDR) since 2009, Babcock & Wilcox

Qualifications: Mr. Hanks’ executive leadership of a U.S. publicly-held company with | |||

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 13 |

PROPOSAL 1—ELECTION OF DIRECTORS

|

DIRECTOR NOMINEES

MICHAEL F. HILTON

AGE: 63

Director since 2015

| Recent Business Experience: President and Chief Executive Officer of Nordson Corporation (a company

Directorships: Ryder System, Inc. (NYSE: R) since 2012, Nordson Corporation (Nasdaq:

Qualifications: With over 30 years of global manufacturing experience, Mr. Hilton brings to | |||

G. RUSSELL LINCOLN

AGE: 71

Director since 1989

| Recent Business Experience: President of N.A.S.T. Inc. (a personal investment firm), since 1996. Prior to

Qualifications: As an entrepreneurial businessman with experience, including 25 years |

/ 14 |

|

DIRECTOR NOMINEES

KATHRYN JO LINCOLN

AGE: 63

Director since 1995

| Recent Business Experience: Chair and Chief Investment Officer of the Lincoln Institute of Land Policy

Directorships: Advisory Board Member for several of the private equity placements utilized

Qualifications: Ms. Lincoln’s leadership experience with the Lincoln Institute, where she | |||

WILLIAM E. MACDONALD, III

AGE: 71

Director since 2007

| Recent Business Experience: Former Vice Chairman of National City Corporation (a diversified financial positions, including Senior Executive Vice President of National

Directorships: American Greetings Corporation from 2007 to September 2013 (when

Qualifications: Mr. MacDonald brings experience in leading a large corporate organization | |||

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 15 |

PROPOSAL 1—ELECTION OF DIRECTORS

|

DIRECTOR NOMINEES

CHRISTOPHER L. MAPES

AGE: 56

Director since 2010

| Recent Business Experience: Chairman, President and CEO of Lincoln Electric. Mr. Mapes has served Mr. Mapes was appointed as Chairman of the Board in addition to his other Smith Corporation (a global manufacturer with a water heating and water

Directorships: The Timken Company (NYSE: TKR), since 2014.

Qualifications: As an experienced executive officer of Lincoln Electric as well as other Mr. Mapes has an MBA and a law degree. | |||

PHILLIP J. MASON

AGE: 66

Director since 2013

| Recent Business Experience: Former President of the Europe, Middle East & Africa Sector (EMEA Sector)

Directorships: GCP Applied Technologies (NYSE: GCP). GCP Applied Technologies was

Qualifications: Mr. Mason has over 35 years of international business experience with | |||

/ 16 |

|

DIRECTOR NOMINEES

BEN P. PATEL

AGE: 50

Director since 2018

| Recent Business Experience: Vice President and Chief Technology Officer of Tenneco, Inc. (a manufacturer

Qualifications: Dr. Patel brings to the Board extensive experience leading global product and technology initiatives, including advanced technology development | |||

HELLENE S. RUNTAGH

AGE: 69

Director since 2001

| Recent Business Experience: Former President and CEO of the Berwind Group (a diversified pharmaceutical

Directorships: Harman International Industries, Inc. from 2008 to 2017, NeuStar, Inc.

Qualifications: Ms. Runtagh has over 30 years of experience in management positions | |||

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 17 |

PROPOSAL 1—ELECTION OF DIRECTORS

|

DAVID H. GUNNING

AGE: 75

Director since 1987 Lead Director since 2013

| Recent Business Experience: Former Vice Chairman of Cliffs Natural Resources, Inc. (an iron ore and

Directorships: MFS Funds from 2004 to 2017 (Chair of the Board), Cliffs Natural Resources,

Qualifications: Mr. Gunning brought to the Board CEO and senior management experience | |||

GEORGE H. WALLS, JR.

AGE: 75

Director since 2003

| Recent Business Experience: General Walls is the former Chief Deputy Auditor of the State of North

Directorships: The PNC Financial Services Group, Inc. from 2006 to 2015 and Thomas

Qualifications: General Walls brought to the Board substantial financial acumen and | |||

/ 18 |

|

Governance Framework

At Lincoln Electric, we are committed to effective corporate governance and high ethical standards. We adhere to our ethical commitments in every aspect of our business, including our commitments to each other, in the marketplace and in the global, governmental and political arenas. These commitments are spelled out in our Code of Corporate Conduct and Ethics, which applies to all of our employees (including our principal executive and senior financial officers) and Board of Directors.

We encourage you to visit our website where you can find detailed information about our corporate governance programs/policies including:

| • | Code of Corporate Conduct and Ethics |

| • | Guidelines on Significant Corporate Governance Issues |

| • | Charters for our Board Committees |

| • | Director Independence Standards |

Corporate Governance Highlights

Board of Directors

| • | Our Board held five meetings in 2017 |

| • | During 2017, each of our Directors attended at least 75% of the total full Board meetings and meetings of committees on which he or she served during the time he or she served as a Director |

| • | Size of Board—11 in 2017 |

| • | Plurality vote with director resignation policy for failures to receive a majority vote in uncontested director elections |

| • | Combined Chairman and CEO |

| • | Lead Independent Director |

| • | All Directors are expected to attend the Annual Meeting |

Board Composition

| • | Number of independent Directors—10 in 2017 |

| • | Diverse Board including different backgrounds, experiences and expertise, as well as balanced mix of ages and tenure of service |

| • | Several current and former CEOs |

| • | Audit Committee has multiple financial experts |

Board Processes

| • | Independent Directors meet without management present |

| • | Annual Board and Committee self-assessments |

| • | Board orientation/evaluation program |

| • | Governance Guidelines approved by Board |

| • | Board plays active role in risk oversight |

| • | Full Board review of succession planning |

Board Alignment with Shareholders

| • | Annual equity grants align interests of Directors and officers with shareholders |

| • | Annual advisory approval of executive compensation |

| • | No poison pill |

| • | Stock ownership requirements for officers and Directors |

Compensation

| • | No employment agreements |

| • | Executive compensation is tied to performance—84% of CEO target pay and 77% of all NEO target pay is performance-based (at risk) |

| • | Anti-hedging and anti-pledging policies for Directors and officers |

| • | Recoupment/clawback policy |

Integrity and Compliance

| • | Code of Conduct for employees, officers and Directors |

| • | Environmental, health and safety guidelines and goals, including long-term sustainability goals |

| • | Annual training on ethical behavior |

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 19 |

PROPOSAL 1—ELECTION OF DIRECTORS

|

Our Board of Directors

Our Board oversees management in the long-term interest of Lincoln Electric and our shareholders. The Board’s major responsibilities include:

| • | Overseeing the conduct of our business |

| • | Reviewing and approving key financial objectives, strategic and operating plans and other significant actions |

| • | Evaluating CEO and senior management performance and determining executive compensation |

| • | Planning for CEO succession and monitoring management’s succession planning for other key executives |

| • | Establishing an appropriate governance structure, including appropriate board composition and succession planning |

How We Select Director Nominees

In evaluating Director candidates, including persons nominated by shareholders, the Nominating and Corporate Governance Committee expects that any candidate must have these minimum qualifications:

| • | Demonstrated character, integrity and judgment |

| • | High-level managerial experience or experience dealing with complex problems |

| • | Ability to work effectively with others |

| • | Sufficient time to devote to the affairs of Lincoln Electric and these specific qualifications |

| • | Specialized experience and background that will add to the depth and breadth of the Board |

| • | Independence as defined by the Nasdaq listing standards |

| • | Financial literacy |

In evaluating candidates to recommend to the Board, including the Director nominees, the Nominating and Corporate Governance Committee also considers whether the candidate enhances the diversity of the Board. Such diversity includes professional background and capabilities, knowledge of specific industries and geographic experience, as well as race, gender and national origin.

Lincoln Electric is also committed to having director candidates that can provide perspective on the industry challenges that Lincoln Electric faces and Lincoln Electric’s long-term commitment to a pay for performance culture.

During 2017, in recruiting the new Director nominee, Dr. Patel, the Nominating and Corporate Governance Committee retained the search firm of Korn Ferry to help identify director prospects, perform candidate outreach, assist in reference and background checks and provide other related services. The recruiting process typically involves either the search firm, the CEO or a member of the Nominating and Corporate Governance Committee (usually, the Chair) contacting a prospect to gauge his or her interest and availability. The candidate will then meet with several members of the Board, including our Lead Director. At the same time, the search firm will contact references for the prospect. A background check is completed before a final recommendation is made to the Board to appoint a candidate to the Board.

For the director search conducted during 2017, the Board targeted senior executives who had experience in managing global business where the ability to drive collaborative technologies to various markets and global customers is a critical portion of the strategy. Experience in leadership and management of technologies, whether through exposure to automation capabilities, “internet of things” (IoT), internet-based marketing or data analytics was a key focus for the search. The Board determined that Dr. Patel possesses the capability and desired management experience and was elected to the Board on February 21, 2018.

Shareholders may nominate one or more persons for election as Director of Lincoln Electric. The process for doing so is set forth in the FAQ section of this proxy statement.

Director Independence

Each of our non-employee Directors meets the independence standards set forth in the Nasdaq listing standards, which are reflected in our Director Independence Standards. To be considered independent, the Board must affirmatively determine that the director has no material relationship with Lincoln Electric.

/ 20 |

|

During 2017, the independent Directors met in regularly scheduled Executive Sessions in conjunction with each of the Board meetings. The Lead Director presided over these sessions.

Board Leadership

Our Chairman, President and CEO is responsible for planning, formulating and coordinating the development and execution of our corporate strategy, policies, goals and objectives. He is accountable for Lincoln Electric’s performance and:

| • | reports directly to our Board; |

| • | works closely with our management to develop our strategic plan; |

| • | works with our management on transactional matters by networking with strategic relationships; |

| • | promotes and monitors the Board’s fulfillment of its oversight and governance responsibilities; |

| • | encourages the Board to set and implement our goals and strategies; |

| • | establishes procedures to govern our Board’s work; |

| • | oversees the execution of the financial and other decisions of our Board; |

| • | makes available to all members of our Board opportunities to acquire sufficient knowledge and understanding of our business to enable them to make informed judgments; |

| • | presides over meetings of our shareholders; and |

| • | sets the agenda for, and presides over, Board meetings. |

Mr. Mapes, our President and CEO, serves as Chairman in addition to his other responsibilities. Our Board believes having one individual serve as Chairman and CEO is beneficial to us because the dual role enhances Mr. Mapes’ ability to provide direction and insight on strategic initiatives impacting us and our shareholders. The Board also believes the dual role is consistent with good corporate governance practices because it is complemented by a Lead Director.

Lead Director

Our Lead Director is appointed each year by the independent Directors. The Lead Director serves as a liaison between the Chairman of the Board and the independent Directors, presides as Chairman of the Board for all meetings at which the Chairman is not present and presides over executive sessions attended only by independent Directors. The Lead Director consults with the Chairman on the format and adequacy of information the Directors receive and the effectiveness of the Board meeting process and has independent authority to review and approve Board meeting agendas and schedules, as well as the authority to request from our officers any company information deemed desirable by the independent Directors. The Lead Director may call meetings of the independent Directors should he or she see fit—during 2017, the independent Directors met in conjunction with each of the Board meetings. The Lead Director may also speak on behalf of Lincoln Electric, from time to time, as the Board may decide.

David H. Gunning currently serves as our Lead Director, a position he has held since 2013. Mr. Gunning will continue to serve as Lead Director until his retirement from the Board at this year’s Annual Meeting, at which time we anticipate that Mr. Espeland will be elected as Lead Director.

Board Role in Risk Oversight & Assessment

In the ordinary course of business, we face various strategic, operating, compliance and financial risks. Our risk management processes seek to identify and address significant risks. Our Board oversees this enterprise-wide approach, and the Lead Director promotes our Board’s engagement in enterprise risk management. Additionally, the Audit Committee reviews major financial risk exposure and the steps management has taken to monitor and control risk. Our Board has integrated its enterprise risk management process with its strategic planning process, refining the distinction between strategic risks and operational risks. Our Board reviews both regularly.

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 21 |

PROPOSAL 1—ELECTION OF DIRECTORS

|

We regularly assess risks related to our compensation and benefit programs, including our executive programs, and our Compensation and Executive Development Committee is actively involved in those assessments. In addition, Willis Towers Watson, a compensation consultant engaged by management, has provided a risk assessment of our executive programs in the past. Although we have a long history of pay for performance and incentive-based compensation, we believe our compensation programs contain many mitigating factors to ensure that our employees are not encouraged to take unnecessary risks.

As a result of all these efforts, we do not believe the risks arising from our executive compensation policies and practices are reasonably likely to have a material adverse effect on Lincoln Electric.

Any related party transactions concerning Lincoln Electric and any of its Directors, officers or other employees (or any of their immediate family members) are to be disclosed to and approved by the Chief Compliance Officer and the Audit Committee of the Board. We define “related party transactions” generally as transactions in which the self-interest of the employee, officer or Director may be at odds or conflict with the interests of Lincoln Electric, such as doing business with entities that are or may be controlled or significantly influenced by such persons or their immediate family members. Our related party transaction policies can be found in our Code of Corporate Conduct and Ethics, as well as the Audit Committee Charter, both of which are available on our website at www.lincolnelectric.com in the Investor Relations section.

In February 2018, the Audit Committee considered and approved a related party transaction involving P&R Specialty, Inc., a supplier to Lincoln Electric. Greg D. Blankenship, the brother of George D. Blankenship, is the sole stockholder and President of P&R Specialty, Inc. During 2017, we purchased approximately $2.4 million worth of products from P&R Specialty in ordinary course of business transactions. George D. Blankenship has no ownership interest in or any involvement with P&R Specialty. We believe that the transactions with P&R Specialty were, and are, on terms no less favorable to us than those that could have been obtained from unaffiliated parties.

We have separately designated standing Audit, Compensation and Executive Development and Nominating and Corporate Governance Committees established in accordance with applicable provisions of the Securities Exchange Act of 1934 (the “Exchange Act”) and Securities and Exchange Commission (“SEC”) and Nasdaq rules. The Board also has designated a standing Finance Committee. The number of meetings held by each committee during 2017 is set forth below.

Audit

|

Compensation

| Nominating

| Finance

| |||||

Number of Committee Meetings | 6 | 6 | 5 | 5 | ||||

/ 22 |

|

The following summaries set forth the principal responsibilities of each of the Board’s separately designated standing committees, as well as other information regarding their makeup and operations. A copy of each committee’s charter may be found on our website at www.lincolnelectric.com.

Audit Committee

Members

Messrs. Espeland (Chair),

Hilton, Lincoln, Mason, Patel (appointed February 21, 2018) and Walls

• Appoints and determines whether to retain or terminate the independent auditors

• Approves all audit engagement fees, terms and services

• Approves anynon-audit engagements

• Reviews and discusses the independent auditors’ quality control

• Reviews and discusses the independence of the auditors, the audit plan, the conduct of the audit and the results of the audit

• Reviews and discusses with management Lincoln Electric’s financial statements and disclosures, its interim financial reports and its earnings press releases | • Reviews with Lincoln Electric’s General Counsel legal matters that might have a significant impact on our financial statements

• Oversees compliance with our Code of Corporate Conduct and Ethics, including annual reports from compliance officers

• Reviews with management the appointment, replacement, reassignment or dismissal of the Senior Vice President, Internal Audit, the internal audit charter, internal audit plans and reports

• Reviews with management the adequacy of internal control over financial reporting

• Discusses and oversees management policies relating to risk management |

Each of the members of our Audit Committee meets the independence standards set forth in the Nasdaq listing standards and have likewise been determined by the Board to have the financial competency required by the listing standards. In addition, because of the professional training and past employment experience of Messrs. Espeland and Hilton, the Board has determined that they are financially sophisticated Audit Committee Members under the Nasdaq listing standards and qualify as “audit committee financial experts” in accordance with SEC rules. Shareholders should understand that the designation of Messrs. Espeland and Hilton as “audit committee financial experts” is a disclosure requirement and that it does not impose upon them any duties, obligations or liabilities that are greater than those generally imposed on them as members of the Audit Committee and the Board.

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 23 |

PROPOSAL 1—ELECTION OF DIRECTORS

|

Compensation and Executive Development Committee

Members

Messrs. MacDonald, III (Chair),

Gunning, Hanks, Ms. Lincoln and Ms. Runtagh

• Reviews and recommends to the Board total compensation of our CEO and reviews and establishes total compensation of our other executive officers

• Annually assesses the performance of our CEO and other executive officers

• Monitors our key management resources, structure, succession planning, development and selection processes and the performance of key executives

• Reviews and recommends to the Board, in conjunction with the Nominating and Corporate Governance Committee, the appointment and removal of our elected officers | • Has oversight for our employee stock and incentive plans and reviews, approves or otherwise makes recommendations to the Board concerning our employee benefit plans

• Reviews and recommends to the Board new or amended executive compensation plans with our executive officers |

Each of the members of our Compensation and Executive Development Committee meets the independence standards set forth in the Nasdaq listing standards and each of whom is deemed to be (1) an outside Director within the meaning of Section 162(m) of the U.S. Internal Revenue Code (“Section 162(m)”), and (2) a “non-employee director” within the meaning of Rule 16b-3 of the Exchange Act. As part of the independence evaluation, the Board must consider all factors relevant to whether the Director has a relationship to the Company that is material to his or her ability to be independent, including the Director’s source of compensation and whether the Director is affiliated with the Company. None of the members of the Compensation and Executive Development Committee were determined to have an affiliation or source of income that was material to his or her ability to be independent.

/ 24 |

|

Nominating and Corporate Governance Committee

Members

Ms. Lincoln (Chair),

Messrs. Hilton, Gunning, Patel (appointed February 21, 2018), Walls and Ms. Runtagh

• Reviews external developments in corporate governance matters, and develops and recommends to the Board corporate governance principles for Lincoln Electric

• Identifies and evaluates Board member candidates and is responsible for director succession planning

• Reviews director compensation, benefits and expense reimbursement programs | • Reviews periodically the quality, sufficiency and currency of governance information furnished to the Board by management

• Reviews and advises on shareholder proposals and engagement

• Leads our Board and Committees in annual reviews of their performance |

Each of the members of our Nominating and Corporate Governance Committee meets the independence standards set forth in the Nasdaq listing standards.

Finance Committee

Members

Messrs. Hanks (Chair),

Espeland, Lincoln, MacDonald, III and Mason

• Reviews financial performance, including comparing our financial performance to budgets and goals

• Reviews capital structure issues, including dividend and share repurchasing policies

• Reviews our financial operations | • Reviews our capital expenditures

• Oversees strategic planning and financial policy matters

• Reviews pension plan funding and plan investment management performance |

Each of the members of our Finance Committee meets the independence standards set forth in the Nasdaq listing standards. All of our Directors typically attend the Finance Committee meetings, a practice that has been in place for the past several years.

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 25 |

PROPOSAL 1—ELECTION OF DIRECTORS

|

OUR BOARD COMPENSATION PROGRAM

Based upon the recommendations of the Nominating and Corporate Governance Committee, the Board determines our non-employee Director compensation. The Nominating and Corporate Governance Committee periodically reviews the status of Board compensation in relation to other comparable companies, trends in Board compensation and other factors it deems appropriate. In connection with its review in 2017, with Korn Ferry as an independent advisor, the Nominating and Corporate Governance Committee made certain adjustments to Board compensation to better align with our peer group. As a result of that review, in December 2017 the approximate value of annual stock-based awards was increased from $107,000 per year to $125,000 per year and the retainer for the Audit Committee Chair was increased from $16,000 to $18,000. The objectives of our non-employee Director compensation programs are to attract highly qualified and diverse individuals to serve on our Board and to align their interests with those of our shareholders. An employee of Lincoln Electric who also serves as a Director does not receive any additional compensation for serving as a Director, or as a member or chair of a Board committee.

All non-employee Directors receive cash retainers and an annual stock-based award for serving on our Board. Stock-based compensation is provided under our 2015 Stock Plan for Non-Employee Directors. Below is a summary of our Director compensation program:

| Board Level | Lead Director | Committee Chairs | ||||||

| Retainer | $ 80,000 | Additional $25,000 | Additional

| ||||

Meeting Fees1 |

– |

– |

– | |||||

| Annual Restricted Stock Award “approx. value”2 | $125,000 | – | – | ||||

Initial Restricted | $125,000 | – | – | |||||

| [1] | We do not have separate meeting fees, except if there are more than eight full Board or Committee meetings in any given year, Directors will receive $1,500 for each full Board meeting in excess of eight meetings and Committee members will receive $1,000 for each Committee meeting in excess of eight meetings in total. |

| [2] | The restricted stock agreements contain pro-rata vesting of the award upon retirement. Accordingly, if a Director retires before the restricted stock award vests in full [1 year from the date of the grant], the Director will receive unrestricted shares equal to a portion of the original award calculated based on the Director’s length of service during the 1-year term. |

| [3] | The initial award will be pro-rated based on the Director’s length of service during the twelve-month period preceding the next regularly scheduled annual equity grant [which normally occurs in the fourth quarter of each year]. |

/ 26 |

|

Director Compensation Table

Director

|

Fees Earned or Paid in Cash

| Stock Awards1

| All Other Compensation

| Total

| ||||

Curtis E. Espeland | $ 96,0002 | $124,940 | – | $220,940 | ||||

David H. Gunning | 105,000 | 124,940 | – | 229,940 | ||||

Stephen G. Hanks | 90,000 | 124,940 | – | 214,940 | ||||

Michael Hilton | 80,000 | 124,940 | – | 204,940 | ||||

G. Russell Lincoln | 80,000 | 124,940 | – | 204,940 | ||||

Kathryn Jo Lincoln | 90,000 | 124,940 | – | 214,940 | ||||

William E. MacDonald, III | 93,000 | 124,940 | – | 217,940 | ||||

Phillip J. Mason | 80,000 | 124,940 | – | 204,940 | ||||

Hellene S. Runtagh | 80,000 | 124,940 | – | 204,940 | ||||

George H. Walls, Jr. | 80,0002 | 124,940 | – | 204,940 | ||||

| [1] | On December 14, 2017, 1,391 shares of restricted stock were granted to each non-employee Director under our 2015 Stock Plan for Non-Employee Directors. The Stock Awards column represents the grant date fair value under Accounting Standards Codification [ASC] Topic No. 718 based on a closing price of $89.82 per share on December 14, 2017. Assumptions used in the calculation of these amounts are included in footnote 9 to our audited financial statements for the fiscal year ended December 31, 2017 included in our Annual Report on Form 10-K filed with the SEC on February 27, 2018. As of December 31, 2017, the aggregate number of shares of restricted stock held by each non-employee Director was 4,727 shares, except for Mr. Hilton, who held 5,313 shares of restricted stock. |

| [2] | All of Messrs. Espeland’s and Walls’ board fees were deferred under our Non-Employee Director’s Deferred Compensation Plan. |

Other Arrangements

We reimburse Directors for reasonable out-of-pocket expenses incurred in connection with attendance at Board meetings, or when traveling in connection with the performance of their services for Lincoln Electric.

Continuing Education

Directors are reimbursed ($5,000 is used as a guideline) for continuing education expenses (inclusive of travel expenses) for programs each Director may elect.

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 27 |

PROPOSAL 1—ELECTION OF DIRECTORS

|

Stock Ownership Guidelines

In keeping with the philosophy that Directors’ interests should be aligned with the shareholders’ and as part of the Board’s continued focus on corporate governance, all of our non-employee Directors must adhere to our stock ownership guidelines. Restricted stock awards count toward the stock ownership guidelines; common shares underlying stock options and shares held in another person’s name (including a relative) do not. The stock ownership guidelines can be met by satisfying one of the two thresholds noted in the chart below. As of December 31, 2017, all of our non-employee Directors had satisfied the stock ownership guidelines. Directors have five years from the date of election to the Board to satisfy the stock ownership guidelines. The Nominating and Corporate Governance Committee reviews the guidelines at least every two-and-a-half years to ensure that the components and values are appropriate—a review was conducted during 2017, with the assistance of Korn Ferry as an independent advisor, and it was determined that the guidelines should be adjusted to better align with our peer group. The next review is anticipated to occur in 2019.

Retainer Multiple

| Number of Shares | |||

Shares valued at 5 x annual Board retainer [$400,000] | OR | 4,368* | ||

| * | Represents shares equal to $400,000 based on the closing price of Lincoln Electric stock as of December 29, 2017 [the last trading day of the calendar year] of $91.58. |

Equity Awards

The 2015 Stock Plan for Non-Employee Directors is the vehicle for the annual and initial grants of stock-based awards.

Under the terms of the awards, shares of restricted stock vest in full one year after the date of grant, with accelerated vesting in the event of a change in control of Lincoln Electric if the Director’s service is terminated or if the award is not assumed upon the change in control, or upon the death or disability of the Director, as well as accelerated vesting of a pro-rata portion of the award upon retirement based on the Director’s length of service during the 1-year term. During the period in which the shares remain forfeitable, dividends are paid to the Directors in cash.

Deferred Compensation Plan

Adopted in 1995, this plan allows the non-employee Directors to defer payment of all or a portion of their annual cash compensation. This plan allows each participating non-employee Director to elect to begin payment of the deferred amounts as of the earlier of termination of services as a Director, death or a date not less than one full calendar year after the year the fees are initially deferred.

The investment elections available under the plan are the same as those available to executives under our Top Hat Plan, which is discussed below in the narrative of the Nonqualified Deferred Compensation Table.

/ 28 |

EXECUTIVE COMPENSATION

|

Our “2020 Vision and Strategy” is focused on key actions and initiatives that generate long-term profitable growth within our targeted markets through value-added solutions and operational excellence. We have established targets in our programs to achieve a long-term 10% compounded annual growth rate (CAGR) in sales, a 15% average Adjusted Operating Income Margin and Return on Invested Capital (ROIC) through an economic cycle, as well as a 15% Average Operating Working Capital to Net Sales (AOWC/Sales) ratio by 2020. We believe this framework engages our business team in creating a long-term value proposition for shareholders that generates above-market returns through an economic cycle while maintaining a short-term focus on improving profitability and driving operating excellence. Our executive compensation designs are structured to align our incentives with this “2020 Vision and Strategy.” More information on our business and “2020 Vision and Strategy” can be found in the “Business Overview” section at the beginning of this proxy statement.

The Compensation Discussion and Analysis (CD&A) describes our executive compensation programs and how they apply to our NEOs.

2017 Named Executive Officers [NEOs]

| Name | Title | |

Christopher L. Mapes | Chairman, President and Chief Executive Officer | |

Vincent K. Petrella | Executive Vice President, Chief Financial Officer and Treasurer | |

George D. Blankenship | Executive Vice President, President, Americas Welding | |

Steven B. Hedlund | Executive Vice President, President, International Welding | |

Jennifer I. Ansberry | Executive Vice President, General Counsel and Secretary | |

The CD&A contains statements regarding future performance targets and goals. These targets and goals are disclosed in the context of our compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We caution investors not to apply these statements in other contexts.

Executive Compensation Table of Contents

| Compensation Discussion & Analysis | Executive Compensation Tables | |||||

Executive Summary | p. 30 | Summary of 2017 Compensation Elements | p. 52 | |||

Our Compensation Philosophy | p. 36 | 2017 Summary Compensation Table | p. 53 | |||

Elements of Executive Compensation | p. 39 | 2017 Grants of Plan-Based Awards | p. 55 | |||

Other Arrangements, Policies and Practices | p. 48 | Holdings of Equity-Related Interests | p. 57 | |||

| 2017 Pension Benefits | p. 58 | |||||

| Termination and Change in Control Arrangements | p. 62 | |||||

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 29 |

EXECUTIVE COMPENSATION

|

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

Our approach to executive compensation is generally the same as our approach to employee-wide compensation, with a strong belief in pay for performance and a long-standing commitment to incentive-based compensation.

While maintaining our performance-driven culture, our executive compensation program is designed to achieve the following objectives:

| • | Incent our executives to deliver above-market financial results; |

| • | Align management interests with the long-term interests of our shareholders; |

| • | Define performance drivers which support key financial and strategic business objectives; |

| • | Address specific business challenges; and |

| • | Maintain good governance practices in the design and operation of our executive compensation programs, including consideration of the risks associated with those practices. |

OVERVIEW

• We maintain a performance-driven culture, withpay for performancecompensation programs

• 84% of CEO target pay was “at risk” and, on average, 77% of all NEO target pay was “at risk”

• Of the shareholders who voted on “say-on-pay,” 95%voted forthe compensation of our NEOs at last year’s Annual Meeting

• Mindful of our shareholders’ strong support, we have retained our general approach andemphasis on incentive compensation

Key Financial Performance

We have a strong track record of delivering increased value to our shareholders and we have typically delivered above-market performance across various financial metrics over many economic cycles. Our long-term “2020 Vision and Strategy” seeks to achieve profitable sales growth both organically and through acquisitions by emphasizing value-added solutions and differentiated technologies to our mix. We anticipate this strategy will yield improved profit margins and returns, and will generate best-in-class financial performance measured against our peer group.

In 2017, sales increased approximately 15% to $2.6 billion from 7% organic growth and 8% primarily from our acquisition of Air Liquide Welding, which substantially increased our European business. Our strategic emphasis on improving our mix, achieving operational excellence and diligent cost management resulted in operating income growth, double digit percent earnings per share growth, record working capital performance in our core business, strong cash flows and solid return on invested capital. Highlights include:

| • | Reported operating income margin was 14.4%. Excluding special items, Adjusted operating income margin was 13.8% reflecting the unfavorable impact of the acquisition. Excluding the acquisition and special items, adjusted operating margin would have been 14.7%, a 50 basis point increase versus the prior year; |

| • | Cash flow from operations increased 7% to $335 million, representing 108% free cash flow conversion of adjusted net income; |

| • | Average operating working capital (AOWC) to net sales ratio of 15.9%. Excluding the acquisition, record 14.2% AOWC ratio; |

| • | ROIC of 16.2%; and |

| • | Cash returned to shareholders of $136 million—through a 9.4% increase in the dividend payout rate and $43 million in share repurchases. |

/ 30 |

|

2017 diluted earnings per common share (EPS) was $3.71, including special item after-tax net charges of $0.08 per diluted share. On an adjusted basis, 2017 EPS increased 15% to $3.79, as compared with $3.29 in 2016.

We continued to pursue our “2020 Vision and Strategy” through the development of innovative solutions and acquisitions. In 2017, we increased R&D spend by 7%, which represents approximately 1.8% of revenue. Our investments in innovation generated a sales vitality index from new products launched in the last five years of 34%, and we achieved a 39% vitality index in equipment systems.

Financial Measures Used For Compensation Purposes

We consider various types of widely reported financial metrics, each of which is related to our executive compensation programs in some way. Some of these financial metrics directly impact our executive compensation programs, while others are the closest approximation to the metrics that we use in our programs. We believe that all of these financial metrics are critical to the short-term and long-term growth and performance of our organization.

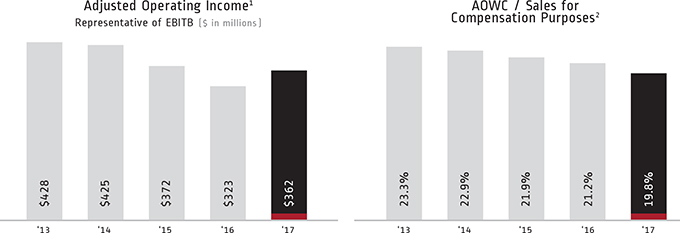

Short-term financial metrics used to evaluate operational performance and used in our annual bonus design are:

| • | Adjusted earnings before interest, taxes and bonus (EBITB), and |

| • | Average operating working capital to net sales ratio (AOWC/Sales) for compensation purposes. |

The following charts illustrate our performance in these or comparable metrics.

| [1] | Excluding special items where applicable. Definitions and a reconciliation of non-GAAP results to our most closely comparable GAAP results are included in Appendix A. |

| [2] | See Appendix A for definitions of AOWC/Sales for Compensation Purposes. |

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 31 |

EXECUTIVE COMPENSATION

|

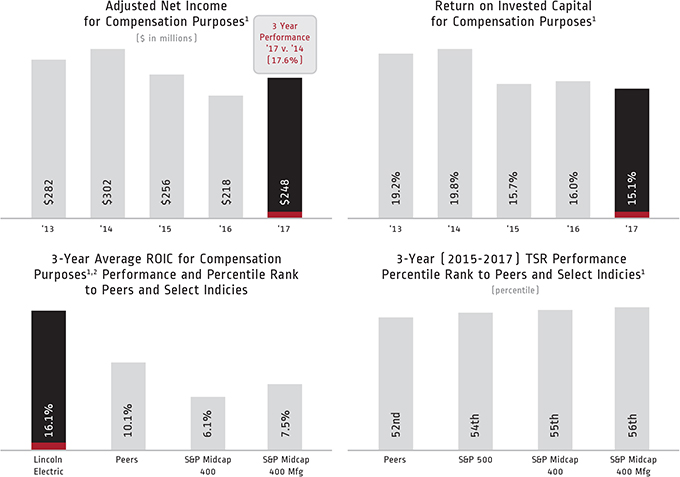

Financial metrics considered in long-term compensation programs include:

| • | Adjusted net income for compensation purposes growth (over a three-year cycle), |

| • | Three-year average ROIC for compensation purposes indexed to peer performance, and |

| • | Share price appreciation, including dividends (TSR), versus various indices over a three-year period. |

The following tables illustrate Lincoln Electric’s Adjusted Net Income for Compensation Purposes, ROIC for Compensation Purposes and TSR performance. ROIC for Compensation Purposes and TSR results are compared to our peer group, S&P 400 Midcap Index (in which we participate), S&P 400 Midcap Manufacturing Index and the S&P 500 Index. The ROIC for Compensation Purposes and TSR percentile rankings show the position of Lincoln Electric’s financial results compared to the particular group, with a 50th percentile ranking indicating median (or market) performance. Percentiles below 50 indicate below-market performance, while percentiles above 50 indicate above-market performance. Information is based on the most recently available public information (as accumulated by an independent third party), as of January 2018 when the analysis was performed.

3-Year [2015-2017] Average ROIC1,2 Performance Percentile Rank to Peers and Select Indices | ||||

| Peers | S&P Midcap 400 | S&P Midcap 400 Mfg | ||

| 71st | 86th | 82nd | ||

| [1] | Excludes certain items as approved by the Committee where applicable. See discussion and definitions on page 45 in the “Long-Term Incentive Plan (LTIP)” section in Performance Measures and in Appendix A. |

| [2] | As of September 30, 2017. |

/ 32 |

|

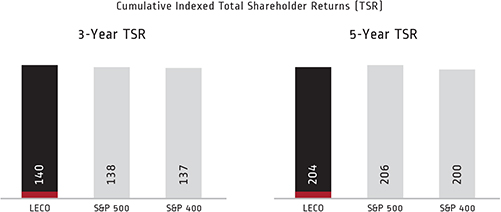

3- and 5-Year Total Shareholder Return

The following charts compare the change in the cumulative total shareholder return on our common stock against the cumulative total shareholder return of the S&P Composite 500 Stock Index (S&P 500) and the S&P 400 Midcap Index (S&P 400) for the three-year and five-year periods ending December��31, 2017. The charts assume that $100 was invested at the beginning of each period in each of Lincoln Electric common stock, the S&P 500 and the S&P 400.

Pay for Performance, Objectives and Process

In designing our executive compensation programs, a core philosophy is that our executives should be rewarded when they deliver financial results that provide value to our shareholders. Therefore, we have established a program that ties executive compensation to superior financial performance.

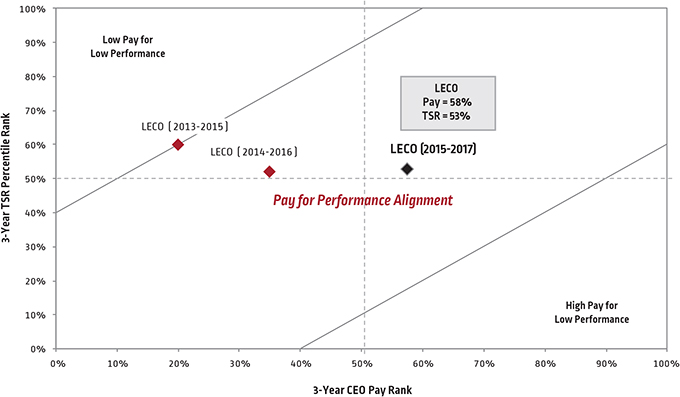

To assess pay for performance, we evaluate the relationship between CEO pay and TSR performance considering the ISS methodology. This allows us to understand the relative degree of alignment over a three-year period between the pay opportunity delivered to the CEO and the performance achieved by shareholders relative to the ISS peer group. The ISS peer group for this analysis is comprised of 24 companies of which 11 companies overlap with the Lincoln Electric peer group. In conjunction with ISS resources, this analysis is performed by management’s compensation consultant, Willis Towers Watson, which is reviewed by the Compensation and Executive Development Committee (the “Committee”) and by its independent consultant, Korn Ferry.

In evaluating pay and performance alignment, the analysis focuses on CEO pay primarily as reflected in the Summary Compensation Table, with the exception of valuing equity-based awards. All stock-based awards (both time- and performance-vesting) are calculated by multiplying the number of underlying shares by the closing stock price on the grant date, and option awards are calculated using the ISS Black-Scholes option pricing model. This means that for Lincoln Electric, the CEO is evaluated based on the following compensation elements for the applicable three-year period:

| • | Base pay; |

| • | Annual EMIP bonus; |

| • | Cash long-term incentive program (“Cash LTIP”) with the 2015–2017 LTIP being the final cash cycle; |

| • | The value of restricted stock units (“RSUs”) granted (based on the closing price of Lincoln Electric common stock as of the grant date); |

| • | The value of performance shares (“PSUs”) granted (based on the closing price of Lincoln Electric common stock as of the grant date); |

| • | The value of stock options granted (based on the ISS Black-Scholes pricing model as of the grant date); |

| • | Actual nonqualified deferred compensation earnings; and |

| • | All other compensation for the applicable three-year period. |

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 33 |

EXECUTIVE COMPENSATION

|

As the chart below demonstrates, our TSR performance was slightly above the median of the ISS peer group for the most recent three-year period. For the same period, CEO pay was also slightly above the median. Comparing TSR performance with CEO pay resulted in a -5% relative degree of alignment. A medium concern level would be triggered using the 2018 ISS methodology with a relative degree of alignment greater than -40%.

Lincoln Electric Holdings, Inc.: Pay for Performance

3-Year CEO Pay Rank vs. 3-Year TSR Percentile Rank

While we consider the ISS methodology in assessing pay for performance, we view it as one of the variables for evaluating pay for performance alignment. We have provided the ISS analysis in assessing pay for performance for investors that might be utilizing it in evaluating pay for performance.

/ 34 |

|

2017 Executive Compensation Actions

During 2017, the Committee reviewed the design of our executive compensation programs to ensure consistency with our pay for performance philosophy. The Committee has taken a number of actions over the last few years to better align executive compensation to value drivers in line with our financial performance and shareholder interests. In 2017, the overall design of our executive compensation program was held consistent with the policies developed in prior years. In consultation with its independent adviser, the Committee instituted certain actions to further align executive compensation with our pay for performance philosophy. Key actions approved by the Committee include:

| • | As a result of freezing the Retirement Annuity Program (RAP) at the end of 2016, implemented a Restoration Plan to allow NEOs to participate in a standard retirement design subject to IRS limitations. |

| • | Amended our Change in Control Severance Agreements to align with market practices. |

Good Governance Practices

In addition to our emphasis on above-market financial performance and pay for performance, we design our executive compensation programs to be current with best practices and good corporate governance. We also consider the risks associated with any particular program, design or compensation decision. We believe these assessments result in sustained, long-term shareholder value. Some of those governance practices are described in the Compensation-Related Risk portion of the Corporate Governance section above. Other such practices include:

| What We Do | What We Don’t Do | |||||||

Pay for Performance Focus [Compensation programs weighted heavily toward variable, “at risk,” compensation; perform annual reviews of market competitiveness and the relationship of compensation to financial performance]. | ✔ | No Guaranteed Pay [No multi-year guarantees for compensation increases, including base pay, and no guaranteed bonuses]. | x | |||||

Balanced Compensation [Compensation opportunities linked to both short-term and long-term periods of time, while aligning compensation with several financial performance metrics that are critical to achievement of sustained growth and shareholder value creation]. | ✔ | No Repricing or Replacement of Underwater Stock Options without Prior Shareholder Approval | x | |||||

| Double Trigger Provisions for Change in Control | ✔ | No Payment of Dividends on Unvested Equity | x | |||||

| Stock Ownership Policy | ✔ | No Excessive Perks | x | |||||

Clawback Policy [Applies to all recent incentive awards for officers]. | ✔ | No Excise Tax Gross-Ups or Tax Reimbursements | x | |||||

| Independent Compensation Committee and Consultants | ✔ | No Hedging or Pledging of Lincoln Electric Stock | x | |||||

L I N C O L N E L E C T R I C : 2 0 1 8 P R O X Y S T A T E M E N T | / 35 |

EXECUTIVE COMPENSATION

|

Our Compensation Philosophy

Core Principles

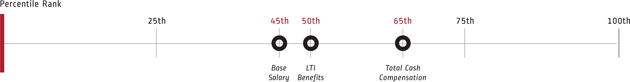

Our executive compensation programs consist of four main components: (1) base pay, (2) annual bonus (EMIP), (3) long-term incentives and (4) benefits/perquisites, all of which are discussed in more detail below. Base pay is targeted at the 45th percentile of the competitive market (below market), while target total cash compensation (which includes an annual bonus that incorporates financial targets) is set at the 65th percentile of the market (above market). Long-term incentive compensation is set at the 50th percentile (at market), and is divided equally among three programs: (1) stock options, (2) restricted stock units (RSUs), and (3) a Performance Share LTIP. Although not targeted to a specific competitive level, we believe our benefits and perquisites, taken as a whole, are at the market median.

We use base pay and benefits to deliver a level of fixed compensation since our compensation programs are heavily weighted toward variable compensation. Therefore, fixed components, such as base pay, are generally below the competitive market for each position, while incentive-based compensation, such as annual bonuses, are set above the competitive market and require above market financial performance. However, because annual bonuses (EMIP) reward short-term operating performance and are paid in cash, our long-term incentive compensation programs are weighted more heavily toward rewards for share price appreciation and long-term profitability. To further align our realizable compensation with share price appreciation or depreciation, beginning in 2016, the cash portion of the long-term incentive plan was replaced with performance shares (PSUs). Individual performance also plays a key role in determining the amount of compensation delivered to an individual in many of our programs, with our philosophy being that the best performers should receive the greatest rewards. In addition, for 2017, as the charts below demonstrate, 84% of the CEO’s compensation mix was “at risk” and 77% of the NEOs’ compensation mix was “at risk.”

The following is a summary of our 2017 executive compensation and how each component fits within our core principles:

/ 36 |

|

The Roles of the Committee, External Advisors and Management