August 2008

2

2

Safe Harbor Statement

This presentation contains "forward-looking statements" within the

meaning of the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. Such statements involve known and unknown risks,

uncertainties and other factors that could cause the actual results of the

Company to differ materially from the results expressed or implied by such

statements, including changes from anticipated levels of sales, future

national or regional economic and competitive conditions, changes in

relationships with customers, access to capital, difficulties in developing

and marketing new products, marketing existing products, customer

acceptance of existing and new products, and other factors. Accordingly,

although the Company believes that the expectations reflected in such

forward-looking statements are reasonable, there can be no assurance that

such expectations will prove to be correct. The Company has no obligation

to update the forward-looking information contained in this presentation.

3

Mission Statement and Core Values

China Display’s mission is to become the #1 manufacturer of LED backlights to

electronics manufacturers in China and the world while entering the High Powered LED

lighting industry.

We plan to achieve this goal by diversifying and broadening our customer base,

aggressively pursuing new market opportunities, investing heavily in Research and

Development.

The Company strives for excellence in all facets of its business, seeking to deliver the

highest quality products in the industry while developing the most cost effective and

efficient production systems.

Our commitment to superior customer service is reinforced by a corporate culture that

places a high priority on training and creating a disciplined and innovative work force.

3

4

4

Company Overview

China Display Technologies Electronics established in

November 2004

Headquarter: Shenzhen, China

China Display became a publicly traded company, listed

on the OTC market, through a reverse merger in

September 2007

Fifth largest backlight unit (BLU) developer &

manufacturer in China

800 employees as of July 2008

Hi-Tech Enterprise recognized by Shenzhen Government

ISO9001:2000 Certification

China Display designs, manufactures and markets small to mid sized light emitting diode

(LED) and cold cathode fluorescent lamp (CCFL) backlights for various types of liquid

crystal displays (LCDs) and is entering the billion dollar High Powered LED lighting industry.

5

5

Equity Snapshot

*Includes 6.9 million shares of series A convertible preferred stock,

includes 3,796,700 million warrants

** Excludes $2.2 million non-cash deemed preferred stock dividend

CDYT AT A GLANCE

TICKER

CDYT

SECTOR

EMERGING

TECHNOLOGY

FISCAL YEAR

DECEMBER

MARKET CAP

36.8M

CURRENT PRICE (8/01/08)

$1.60

52-WEEK LOW

$1.10

52WEEK HIGH

$3.50

REVENUE (TTM)

$34.7M

PRICE/EARNINGS (TTM)

6.8

PRICE/SALES (TTM)

.96

NET INCOME** (2007)

5.04M

EPS* (TTM)

$0.22

SHARES OUTSTANDING*

23M

FLOAT

3M

INSIDER OWNERSHIP

56%

Capitalization Structure as of 6/30/2008

Share Type

Number of Shares

Common Shares Outstanding:

12,316,406

Common Stock issuable upon conversion of

series A preferred stock:

6,860,296

Shares issuable upon exercise of warrants

at $1.30:

3,796,700

Total:

22,973,402

6

6

Investment Highlights

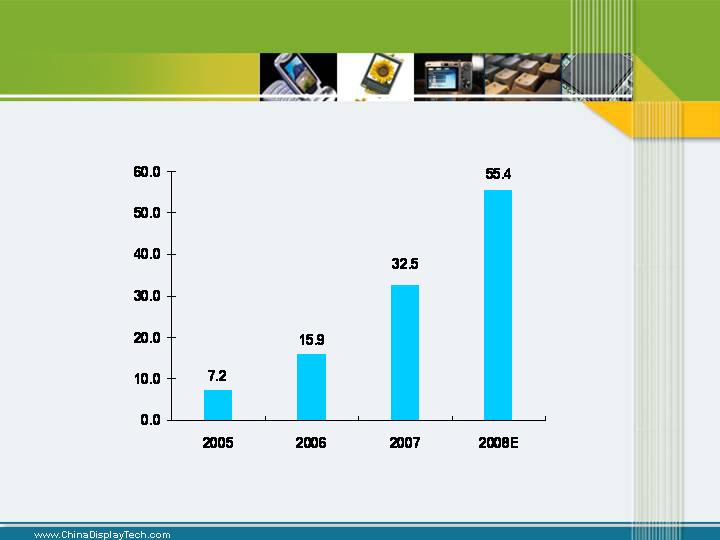

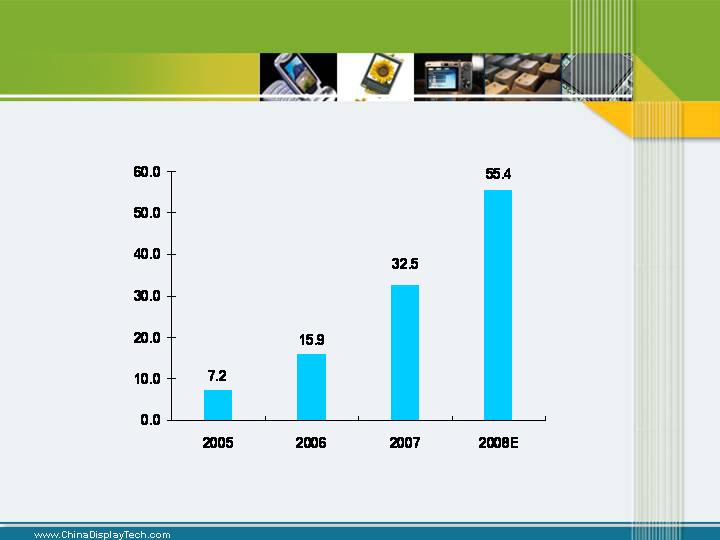

FY 2007 Revenues up 104% over FY 2006 to $32.5 million

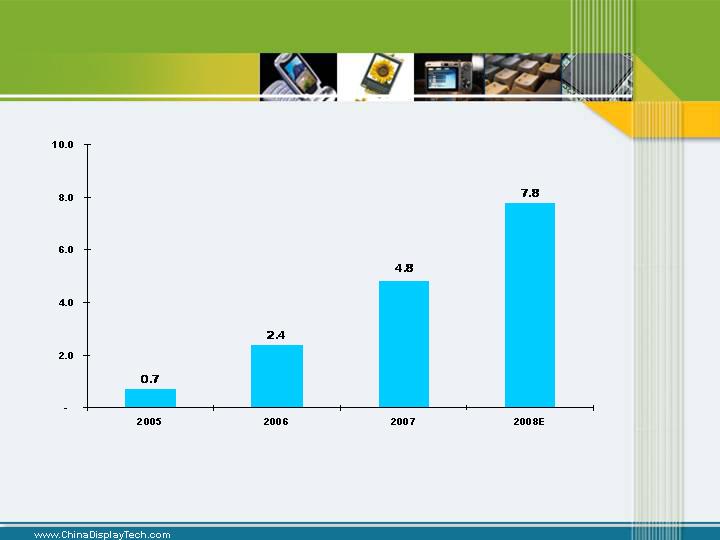

FY 2007 Earnings up 100% over FY2006 to $4.8 million

Q1 2008 Revenues up 45% over Q1 2007 ( $4.6 million, to $6.7 million)

Q1 2008 Earnings up 32.3% over Q1 2007 ($626K to $826K)

Revenue guidance FY 2008E $44M-$55.4M, 35%-70% annual growth

Earnings guidance FY 2008E: $6.16M-$7.8M, 28%-62.5% annual

growth

Substantially Undervalued among Peer Group

7

Undervalued Among Peer

Group

DGNG REV: 55.3M (ttm) EPS -0.07 (ttm) P/E N/A

Diguang International Inc.

CREE REV: $468.5M (ttm) EPS 0.36 (ttm) P/E 48.45

Cree Inc.

ASY REV: $23.4M (ttm) EPS 0.20 (ttm) P/E 34.0

Elecsys Corp.

CDYT REV: $34.6M (ttm) EPS 0.22 (ttm) P/E 6.96

China Display Technologies Inc.

8

Valuation Metrics

If CDYT Trades at Peer Group Multiples

Stock Price

At 20 P/E 08 EPS 0.30-0.34 $6.00-$6.80

At 30 P/E 08 EPS 0.30-0.34 $9.00-$10.24

Potential ROI 280%-704%

9

9

BLU Application Overview

Small backlights ( < 10.4”) for:

Cell phones

Car navigation systems

DVD, GPS, PDA & CD players

Digital cameras

Camcorders

MP3 & MP4 players

Appliance displays

Medium backlights (15”-19”) for:

Computer monitors

Large backlights (20”-47”) :

Televisions

10

What is a Backlight Unit?

Backlight units (BLU) provide the light source to LCD units.

BLUs present data and images in mobile phones, car navigation systems &

medical devices

Larger displays used in flat panel televisions and computer monitors

A BLU is one of the most expensive components used in LCD products,

accounting for 20 to 30% of the overall costs

As a light source for LCD screens, a BLU

is one of the most expensive components

of LCD products

* Data Source: “Large Area TFT LCD Backlight Market

Outlook” by Display Search

Material/Component Costs

10

Backlight, 26%

Other

Materials, 26%

Glass, 8%

Color Filter,

19%

Driver ICs, 6%

Polarizers, 15%

11

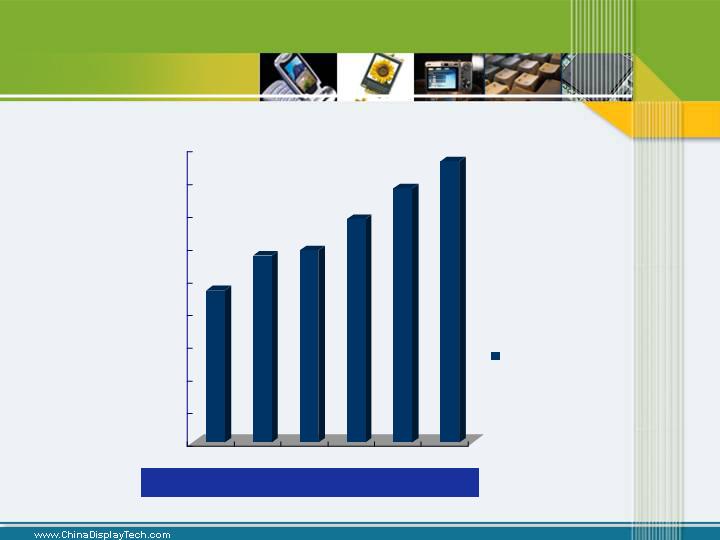

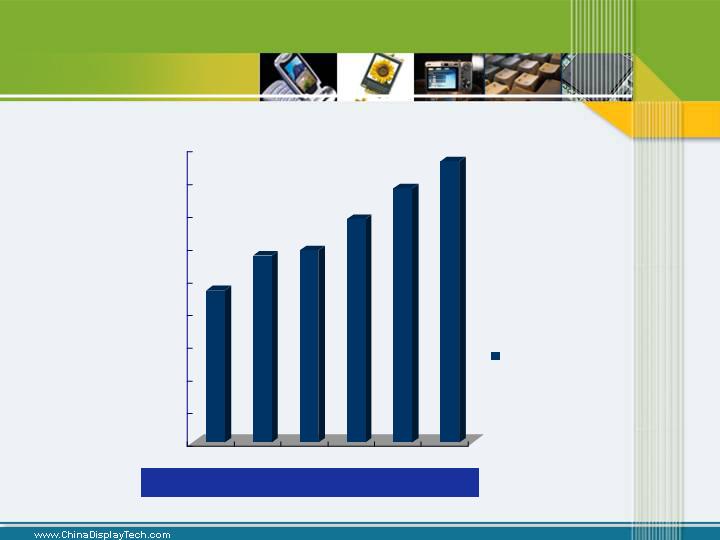

Backlight Unit Industry Growth

$90 Billion Industry Growing at 15% Annually

Unit:

$ Million

Revenues for Flat Panel Displays

(PIDA, Nov 2006)

LCD

(TFT)

46434

57158

58749

68304

77678

86004

11

0

10000

20000

30000

40000

50000

60000

70000

80000

90000

2004

2005

2006

2007

2008

2009

LCD Thin Film

Transistor (TFT)

12

The Emerging High Power LED Lighting Market

Green Technology LED (Light Emitting Diode)

LEDs use 90% less electricity than traditional incandescent light sources

LED light bulbs last 100 times longer (50,000 Hours) than traditional incandescent

light sources

LEDs contain no mercury and remain cool to the touch

Historically restricted to niche markets (flashlights, accent lighting and automobile lights)

Advances in LED technology have led to increased light output with higher efficiency,

driving costs down to dramatically broaden acceptance and applications

The high-power LED market is gaining ground in the general lighting market and steadily

driving mainland China's LED production

China is the largest producer of LED lighting products, accounting for an estimated 70%

of the industry’s global output

12

13

The Emerging High Power LED Lighting Market, cont.

According to Photonic Industry Development Association (PIDA), China's LED lighting exports

in 2007 were estimated at $1 billion and is expected to reach $2 billion in 2008, and 3.9 billion

in 2009

High power LEDs offer high brightness and energy-efficient benefits, driving their adoption by

lighting and electronics manufacturers worldwide for general illumination

Country specific mandates banning traditional incandescent lighting will drive the High

Powered LED light growth worldwide

According to Digitimes, Australia & Japan in 2012 will ban traditional incandescent light

sources

Anchorage, AK announced (August 2008) initiative calling for the retrofit of all 16,000

municipal roadway lights with high-efficiency LED fixtures

Other cities already participating in testing and deployment of High Power LED technology are

Raleigh, NC; Toronto, Ontario; Ann Arbor, MI; Austin, TX; Tianjin, China and Torraca, Italy

13

14

LED Technology Gains Widespread

Media Attention

14

July 28, 2008 New York Times article

LED lighting is showing up in more prominent

spots

Times Square New Year’s Eve Ball

Marcus Center in Milwaukee, WI

Empire State Building considering LEDs for

lighting exterior

LEDs dominated the exhibits at Lightfair, lighting

industry’s largest trade event in May 2008

Corporate Adoption

Sentry Equipment Corporation

Will save $7000 a year in energy costs

Won’t need to replace a bulb for 20 years

Will recoup its investment in less than 2

years

Source: Eric A. Taub, “Fans of L.E.D.’s Say This

Bulb’sTime Has Come”; July 28, 2008 New York Times

15

15

Competitive Advantages

Experienced Management Team

Working in conjunction with the Guangdong Flat Panel Display Association (GFPDA)

GFPDA is drafting the standards for the High Power LED lighting industry in China

Superior Product Design

Dot matrix design and optical simulation program confirms customer’s designs at

least 7 days faster than our competitors

Our software improves the light guide brightness performance by 20%-25% and

uniformity by 5%-8%

Twin screen displays are a breakthrough in mobile phone design, while also a

challenge for BLU design

16

16

Strategic R&D Initiatives

Continuous improvement of our copyrighted software

Close technology partnership with Guangdong Flat Panel Display Association

Strategic vision in 2008 to develop large-size back light unit, targeting the LCD-TV

market

OLED (Organic Light-Emitting Diodes) feasibility research – for next generation

Display Illumination Technology

17

17

2007 Revenue Breakdown

Zhujiang Delta and other

areas in China

Hong Kong

Europe

Japan

The United States

Mobile Phone (1.8’’-3.2’’)

Medical Equipment

MP3/MP4

LCD Monitor

Communication Devices and Others

By Region

By End Products

18

18

Customer Overview

42 LCM module manufacturers customers in over 17 countries

Yassy Technology (Shenzhen) Co., Ltd.

Sinopex Enterprise Company

Shenzhen Xinjiuding Optronics Technology Co., Ltd.

Viewtron Technology Ltd.

BYD Company Ltd.

China Display’s products are ultimately incorporated in NEC, General Electric,

Lenovo, and Panasonic applications

BLU

manufacturer

Design House

LCM

manufacturer

OEM Factory

Raw Material

Vendors

CDYT

End Product

Maker

19

19

Experienced Management Team

Mr. Lawrence CHAN Chairman and CEO

Founded SUNY, wholly-owed subsidiary of China Display Technologies Inc. in 2004

General manager with Wai Chi Electronics Co. from 2000 to 2002

Distinguished engineer and knowledgeable in BLU industry and factory management

Graduated from Hong Kong Polytechnic University

Mr. Jason YE CFO

Served as Finance Manager of China Display since October 2007

Acted as the financial advisor for several foreign capital corporations and Hong Kong

exchange listed banking companies

Bachelor’s degree in International Finance from South China Normal University

Mr. Jason WONG Executive VP

Joined SUNY in 2005 as head of sales and internal operation

An experienced environmental specialist

Master’s degree in Environmental Science from City University of Hong Kong

20

20

Income Statement

Year Ended December 31 Quarter Ended March 31

($ in Thousands) 2006 2007 2007Q1 2008Q1

Revenues $15,884 $32,554 $4,592 $6,723

Gross Margin 22.8% 23.8% 21.8% 22.3%

Total Operating Expenses 7.6% 7.1% 6.9% 6.6%

Operating Margin 15.2% 16.7% 14.9% 15.8%

Net income $2,412 $4,841 $626 $828

Net Profit Margin 15.2% 14.9% 13.6% 12.3%

Weighted avg. shares 11.4M 15.3M 11.4M 22.8M

EPS – diluted $0.21 $0.32 $0.05 $0.04

(Audited)

Note: 2007 results exclude $2.2 million non-cash deemed preferred stock dividend.

(Unaudited)

21

21

Balance Sheet

Ended Dec 31, 2006 Ended Dec 31, 2007 Ended Mar 31, 2008

($ in Thousands) Audited Audited Unaudited

Cash and Cash Equivalents $135 $2,949 $4,600

Accounts Receivable, net $1,656 $5,279 $6,100

Inventory $1,460 $1,693 $2,362

Total Current Assets $3,579 $17,718 $18,807

Total Assets $5,508 $21,219 $22,331

Total Current Liabilities $1,540 $8,653 $8,075

Total Liabilities $1,588 $8,653 $8,075

Total Shareholders’ Equity $3,920 $12,566 $14,256

22

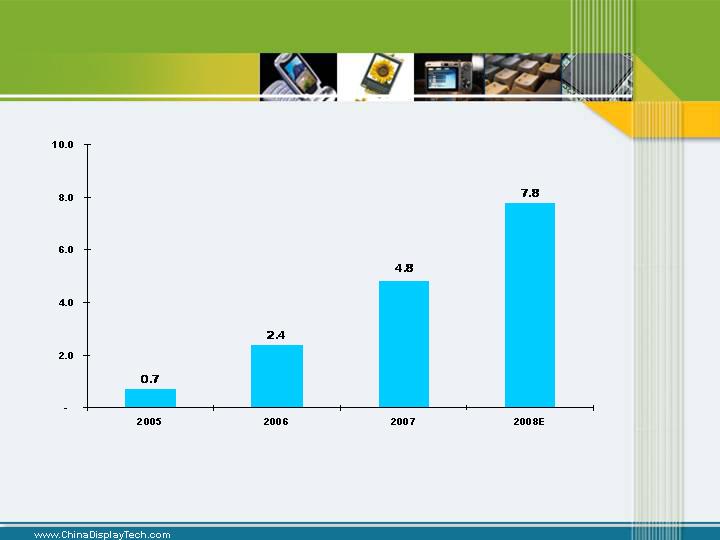

Strong Revenue Growth

(USD $ in Millions)

*The ability of the Company to achieve 55.4M in 2008 Revenue depends on its ability to obtain proceeds of not

less than $5.3 million from exercise of 1,362,187 warrants in the second quarter and 2,708,013 warrants in the

third quarter of 2008. Without the exercise of the warrants, the Company should generate Revenue of $44.0M -

45.6M.

*

22

44.0

23

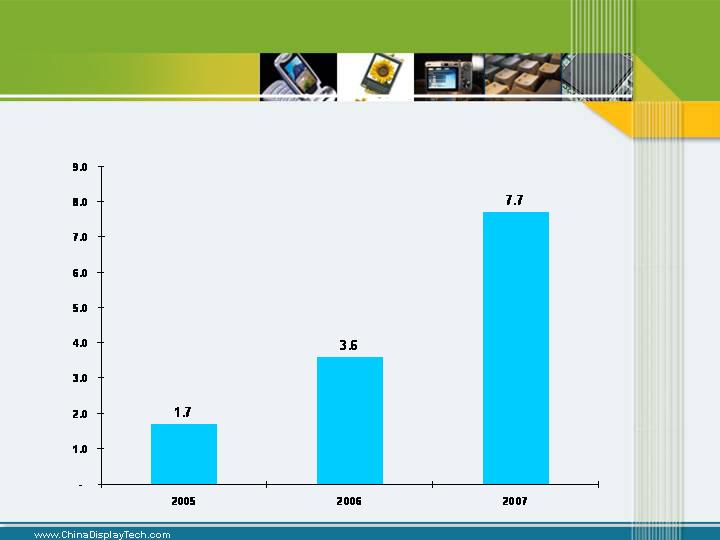

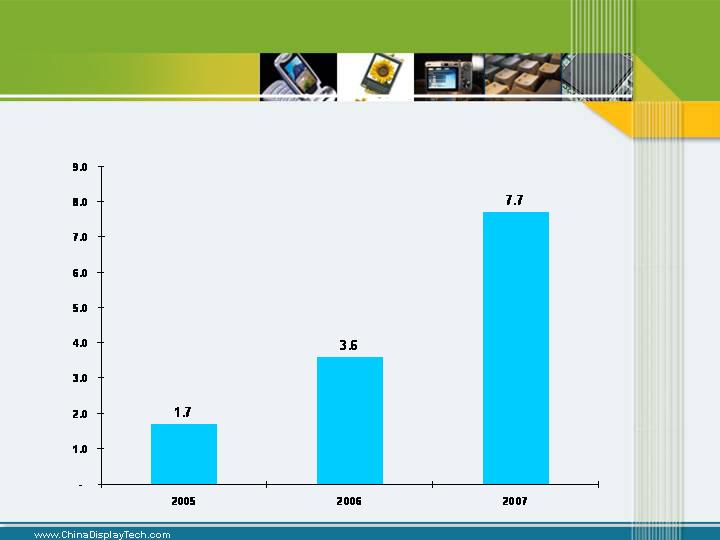

Rising Gross Profit

(USD $ in Millions)

23

24

Rising Net Income

(USD $ in Millions)

Note: 2007 results exclude $2.2 million non-cash deemed preferred stock dividend.

*The ability of the Company to generate net income of $7.8M will depend on its ability to obtain

proceeds of not less than $5.3 million from exercise of 1,362,187 warrants in the second quarter and

2,708,013 warrants in the third quarter of 2008. The Company expects to generate net income of

$6.16M - $6.39M without the exercise of the warrants.

*

24

6.16

25

Strong EPS Growth

Note: 2007 results exclude $2.2 million non-cash deemed preferred stock dividend.

*The ability of the Company to generate 0.34 EPS will depend on its ability to obtain proceeds of not

less than $5.3 million from exercise of 1,362,187 warrants in the second quarter and 2,708,013

warrants in the third quarter of 2008. The Company expects EPS of 0.30-0.31 without the exercise

of the warrants.

*

25

0.30

26

The Future of China Display

Technologies

Enter High Power LED Lighting market with new products (Indoor and Outdoor Lighting)

Develop High Power LED Market Share

Seek AMEX Listing in Q1 2009

27

Investment Summary

Q1 2008 Revenues up 45% over Q1 2007 ($4.6 million, to $6.7 million)

Q1 2008 Earnings up 32.3% over Q1 2007 ($626K to $826K)

Revenue guidance FY 2008E $44M-$55.4M, 35%-70% annual growth

Earnings guidance FY 2008E: $6.16M-$7.8M, 28%-62.5% annual growth

Substantially Undervalued among its Peer Group

At 20 P/E 08 EPS 0.30-0.34 $6.00-$6.80

At 30 P/E 08 EPS 0.30-0.34 $9.00-$10.24

Potential ROI: 280%-704%

28

28

Contact

RedChip Companies, Inc.

Jon Cunningham, Director of IR

500 Winderley Place, Suite 100

Maitland, FL 32751

Tel: 1-800-733-2447, Ext. 107

Jon@RedChip.com

US Auditor

Kempisty & Company

15 Maiden Lane, Suite 1003

New York, NY 10038

US Law Firm

Sichenzia Ross Friedman Ference LLP

61 Broadway

New York, NY 10006

China Display Technologies

Jason Wong, Executive VP

12A Block, Xinhe Road, No. 3 Xinqiao

Industrial Zone, Shajing District,

Baoan Town

Shenzhen, China 150090

Tel: 86 138 237 96598 (China mobile)

852 – 9257 8928 (HK mobile)

jason@chinadisplaytech.com