1©2022 Lincoln National Corporation Third Quarter 2022 Investor Supplement November 2, 2022 Al Copersino Head of Investor Relations203-257-4493InvestorRelations@lfg.comThis document may not be accurate after its date, and LNC does not undertake to update or keep it accurate after such date.

1©2022 Lincoln National Corporation Third Quarter 2022 Investor Supplement November 2, 2022 Al Copersino Head of Investor Relations203-257-4493InvestorRelations@lfg.comThis document may not be accurate after its date, and LNC does not undertake to update or keep it accurate after such date.

2©2022 Lincoln National Corporation Forward-looking statements –cautionary language Certain statements made in this presentation and in other written or oral statements made by Lincoln or on Lincoln’s behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements. Forward-looking statements may contain words like: “anticipate,” “believe,” “estimate,” “expect,” “project,” “shall,” “will” and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in Lincoln’s businesses, prospective services or products, future performance or financial results and the outcome of contingencies, such as legal proceedings. Lincoln claims the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. Forward-looking statements are subject to risks and uncertainties. Actual results could differ materially from those expressed in or implied by such forward-looking statements due to a variety of factors, including:•The continuation of the COVID-19 pandemic, or future outbreaks of COVID-19, and uncertainty surrounding the length and severity of future impacts on the global economy and on our business, results of operations and financial condition;•Weak general economic and business conditions that may affect demand for our products, account values, investment results, guaranteed benefit liabilities, premium levels and claims experience;•Adverse global capital and credit market conditions that may affect our ability to raise capital, if necessary, and may cause us to realize impairments on investments and certain intangible assets, including goodwill and the valuation allowance against deferred tax assets, which may reduce future earnings and/or affect our financial condition and ability to raise additional capital or refinance existing debt as it matures;•The inability of our subsidiaries to pay dividends to the holding company in sufficient amounts, which could harm the holding company’s ability to meet its obligations;•Legislative, regulatory or tax changes, both domestic and foreign, that affect: the cost of, or demand for, our subsidiaries’ products; the required amount of reserves and/or surplus; our ability to conduct business and our captive reinsurance arrangements as well as restrictions on the payment of revenue sharing and 12b-1 distribution fees; •The impact of U.S. federal tax reform legislation on our business, earnings and capital; •The impact of Regulation Best Interest or other regulations adopted by the Securities and Exchange Commission (“SEC”), the Department of Labor or other federal or state regulators or self-regulatory organizations relating to the standard of care owed by investment advisers and/or broker-dealers that could affect our distribution model;•Actions taken by reinsurers to raise rates on in-force business;•Declines in or sustained low interest rates causing a reduction in investment income, the interest margins of our businesses, estimated gross profits and demand for our products;•Rapidly increasing interest rates causing contract holders to surrender life insurance and annuity policies, thereby causing realized investment losses, and reduced hedge performance related to variable annuities;•The impact of the implementation of the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act relating to the regulation of derivatives transactions;•The initiation of legal or regulatory proceedings against us, and the outcome of any legal or regulatory proceedings, such as: adverse actions related to present or past business practices common in businesses in which we compete; adverse decisions in significant actions including, but not limited to, actions brought by federal and state authorities and class action cases; new decisions that result in changes in law; and unexpected trial court rulings;•A decline or continued volatility in the equity markets causing a reduction in the sales of our subsidiaries’ products; a reduction of asset-based fees that our subsidiaries charge on various investment and insurance products; an acceleration of the net amortization of deferred acquisition costs (“DAC”), value of business acquired (“VOBA”), deferred sales inducements (“DSI”) and deferred front-end loads (“DFEL”); and an increase in liabilities related to guaranteed benefit features of our subsidiaries’ variable annuity products;

2©2022 Lincoln National Corporation Forward-looking statements –cautionary language Certain statements made in this presentation and in other written or oral statements made by Lincoln or on Lincoln’s behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements. Forward-looking statements may contain words like: “anticipate,” “believe,” “estimate,” “expect,” “project,” “shall,” “will” and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in Lincoln’s businesses, prospective services or products, future performance or financial results and the outcome of contingencies, such as legal proceedings. Lincoln claims the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. Forward-looking statements are subject to risks and uncertainties. Actual results could differ materially from those expressed in or implied by such forward-looking statements due to a variety of factors, including:•The continuation of the COVID-19 pandemic, or future outbreaks of COVID-19, and uncertainty surrounding the length and severity of future impacts on the global economy and on our business, results of operations and financial condition;•Weak general economic and business conditions that may affect demand for our products, account values, investment results, guaranteed benefit liabilities, premium levels and claims experience;•Adverse global capital and credit market conditions that may affect our ability to raise capital, if necessary, and may cause us to realize impairments on investments and certain intangible assets, including goodwill and the valuation allowance against deferred tax assets, which may reduce future earnings and/or affect our financial condition and ability to raise additional capital or refinance existing debt as it matures;•The inability of our subsidiaries to pay dividends to the holding company in sufficient amounts, which could harm the holding company’s ability to meet its obligations;•Legislative, regulatory or tax changes, both domestic and foreign, that affect: the cost of, or demand for, our subsidiaries’ products; the required amount of reserves and/or surplus; our ability to conduct business and our captive reinsurance arrangements as well as restrictions on the payment of revenue sharing and 12b-1 distribution fees; •The impact of U.S. federal tax reform legislation on our business, earnings and capital; •The impact of Regulation Best Interest or other regulations adopted by the Securities and Exchange Commission (“SEC”), the Department of Labor or other federal or state regulators or self-regulatory organizations relating to the standard of care owed by investment advisers and/or broker-dealers that could affect our distribution model;•Actions taken by reinsurers to raise rates on in-force business;•Declines in or sustained low interest rates causing a reduction in investment income, the interest margins of our businesses, estimated gross profits and demand for our products;•Rapidly increasing interest rates causing contract holders to surrender life insurance and annuity policies, thereby causing realized investment losses, and reduced hedge performance related to variable annuities;•The impact of the implementation of the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act relating to the regulation of derivatives transactions;•The initiation of legal or regulatory proceedings against us, and the outcome of any legal or regulatory proceedings, such as: adverse actions related to present or past business practices common in businesses in which we compete; adverse decisions in significant actions including, but not limited to, actions brought by federal and state authorities and class action cases; new decisions that result in changes in law; and unexpected trial court rulings;•A decline or continued volatility in the equity markets causing a reduction in the sales of our subsidiaries’ products; a reduction of asset-based fees that our subsidiaries charge on various investment and insurance products; an acceleration of the net amortization of deferred acquisition costs (“DAC”), value of business acquired (“VOBA”), deferred sales inducements (“DSI”) and deferred front-end loads (“DFEL”); and an increase in liabilities related to guaranteed benefit features of our subsidiaries’ variable annuity products;

3©2022 Lincoln National Corporation Forward-looking statements –cautionary language (contd.)•Ineffectiveness of our risk management policies and procedures, including various hedging strategies used to offset the effect of changes in the value of liabilities due to changes in the level and volatility of the equity markets and interest rates;•A deviation in actual experience regarding future persistency, mortality, morbidity, interest rates or equity market returns from the assumptions used in pricing our subsidiaries’ products, in establishing related insurance reserves and in the net amortization of DAC, VOBA, DSI and DFEL, which may reduce future earnings;•Changes in accounting principles that may affect our business, results of operations and financial condition, including the adoption effective January 1, 2023, of FASB ASU 2018-12, Targeted Improvements to the Accounting for Long-Duration Contracts;•Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations and the adverse effect such action may have on our ability to raise capital and on our liquidity and financial condition;•Lowering of one or more of the insurer financial strength ratings of our insurance subsidiaries and the adverse effect such action may have on the premium writings, policy retention, profitability of our insurance subsidiaries and liquidity;•Significant credit, accounting, fraud, corporate governance or other issues that may adversely affect the value of certain financial assets, as well as counterparties to which we are exposed to credit risk, requiring that we realize losses on financial assets;•Interruption in telecommunication, information technology or other operational systems or failure to safeguard the confidentiality or privacy of sensitive data on such systems, including from cyberattacks or other breaches of our data security systems;•The effect of acquisitions and divestitures, restructurings, product withdrawals and other unusual items;•The inability to realize or sustain the benefits we expect from, greater than expected investments in, and the potential impact of efforts related to, our strategic initiatives, including the Spark Initiative;•The adequacy and collectability of reinsurance that we have obtained;•Future pandemics, acts of terrorism, war or other man-made and natural catastrophes that may adversely affect our businesses and the cost and availability of reinsurance;•Competitive conditions, including pricing pressures, new product offerings and the emergence of new competitors, that may affect the level of premiums and fees that our subsidiaries can charge for their products;•The unknown effect on our subsidiaries’ businesses resulting from evolving market preferences and the changing demographics of our client base; and •The unanticipated loss of key management, financial planners or wholesalers. The risks and uncertainties included here are not exhaustive. Our most recent Form 10-K, as well as other reports that we file with the SEC, include additional factors that could affect our businesses and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, Lincoln disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this presentation. The reporting of Risk Based Capital (“RBC”) measures is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities.

3©2022 Lincoln National Corporation Forward-looking statements –cautionary language (contd.)•Ineffectiveness of our risk management policies and procedures, including various hedging strategies used to offset the effect of changes in the value of liabilities due to changes in the level and volatility of the equity markets and interest rates;•A deviation in actual experience regarding future persistency, mortality, morbidity, interest rates or equity market returns from the assumptions used in pricing our subsidiaries’ products, in establishing related insurance reserves and in the net amortization of DAC, VOBA, DSI and DFEL, which may reduce future earnings;•Changes in accounting principles that may affect our business, results of operations and financial condition, including the adoption effective January 1, 2023, of FASB ASU 2018-12, Targeted Improvements to the Accounting for Long-Duration Contracts;•Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations and the adverse effect such action may have on our ability to raise capital and on our liquidity and financial condition;•Lowering of one or more of the insurer financial strength ratings of our insurance subsidiaries and the adverse effect such action may have on the premium writings, policy retention, profitability of our insurance subsidiaries and liquidity;•Significant credit, accounting, fraud, corporate governance or other issues that may adversely affect the value of certain financial assets, as well as counterparties to which we are exposed to credit risk, requiring that we realize losses on financial assets;•Interruption in telecommunication, information technology or other operational systems or failure to safeguard the confidentiality or privacy of sensitive data on such systems, including from cyberattacks or other breaches of our data security systems;•The effect of acquisitions and divestitures, restructurings, product withdrawals and other unusual items;•The inability to realize or sustain the benefits we expect from, greater than expected investments in, and the potential impact of efforts related to, our strategic initiatives, including the Spark Initiative;•The adequacy and collectability of reinsurance that we have obtained;•Future pandemics, acts of terrorism, war or other man-made and natural catastrophes that may adversely affect our businesses and the cost and availability of reinsurance;•Competitive conditions, including pricing pressures, new product offerings and the emergence of new competitors, that may affect the level of premiums and fees that our subsidiaries can charge for their products;•The unknown effect on our subsidiaries’ businesses resulting from evolving market preferences and the changing demographics of our client base; and •The unanticipated loss of key management, financial planners or wholesalers. The risks and uncertainties included here are not exhaustive. Our most recent Form 10-K, as well as other reports that we file with the SEC, include additional factors that could affect our businesses and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, Lincoln disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this presentation. The reporting of Risk Based Capital (“RBC”) measures is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities.

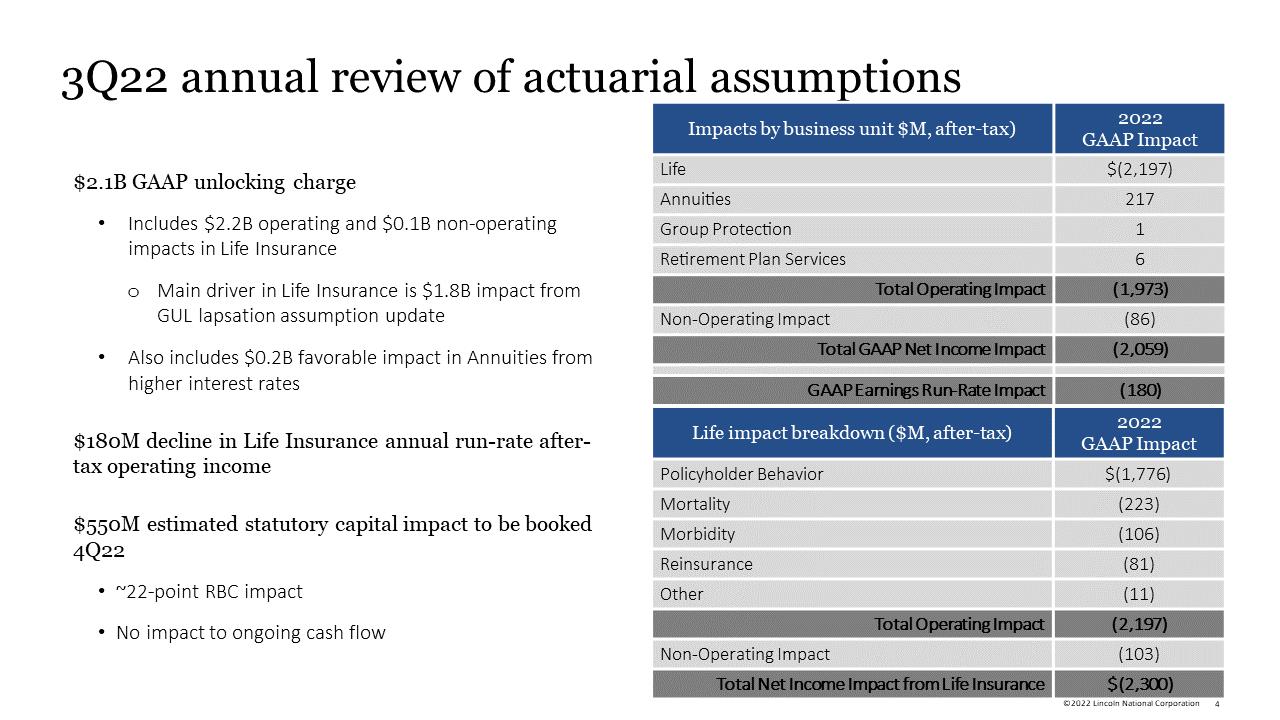

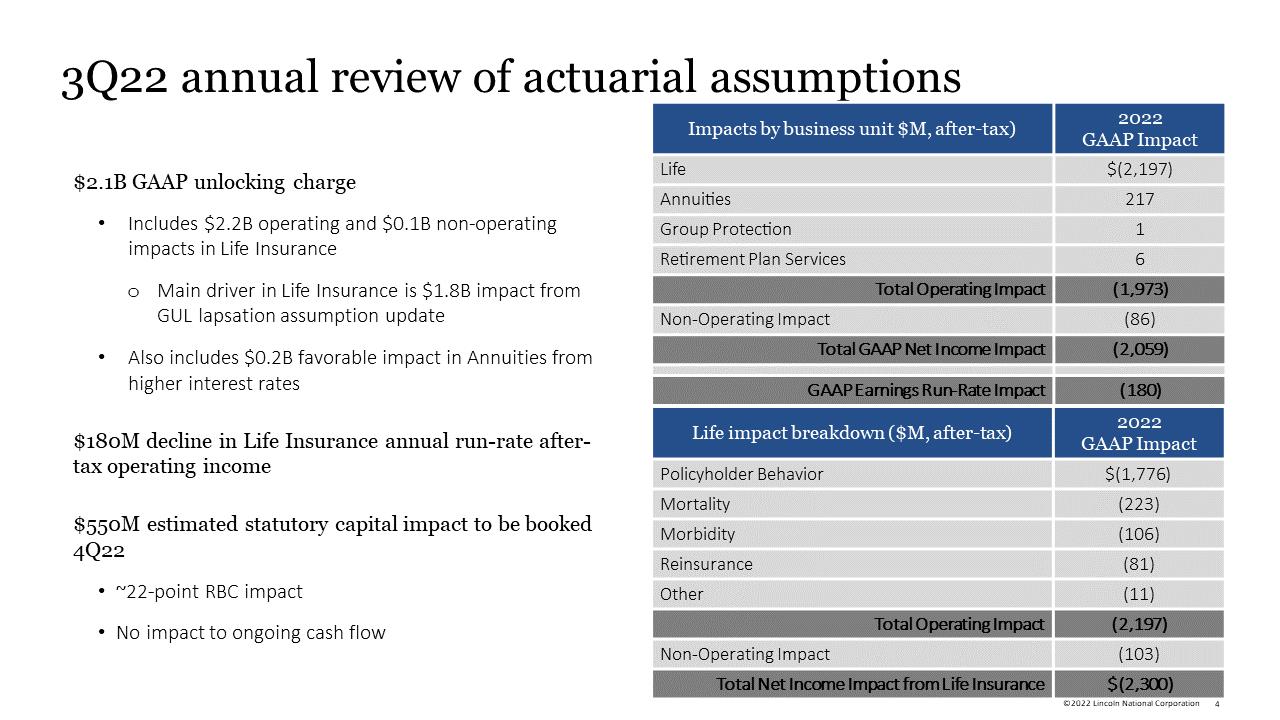

4©2022 Lincoln National Corporation3Q22 annual review of actuarial assumptions Impacts by business unit ($M, after-tax) 2022 GAAP Impact Life $(2,197) Annuities 217 Group Protection 1 Retirement Plan Services 6Total Operating Impact(1,973)Non-Operating Impact(86)Total GAAP Net Income Impact (2,059)GAAP Earnings Run-Rate Impact (180)Life impact breakdown ($M, after-tax)2022 GAAP Impact Policyholder Behavior $(1,776)Mortality (223) Morbidity (106) Reinsurance(81)Other(11)Total Operating Impact(2,197)Non-Operating Impact(103)Total Net Income Impact from Life Insurance $(2,300) $2.1B GAAP unlocking charge •Includes $2.2B operating and $0.1B non-operating impacts in Life Insurance Main driver in Life Insurance is $1.8B impact from GUL lapsation assumption update •Also includes$0.2B favorable impact in Annuities from higher interest rates$180M decline in Life Insurance annual run-rate after-tax operating income $550M estimated statutory capital impact to be booked in 4Q22•~22-point RBC impact •No impact to ongoing cash flow

4©2022 Lincoln National Corporation3Q22 annual review of actuarial assumptions Impacts by business unit ($M, after-tax) 2022 GAAP Impact Life $(2,197) Annuities 217 Group Protection 1 Retirement Plan Services 6Total Operating Impact(1,973)Non-Operating Impact(86)Total GAAP Net Income Impact (2,059)GAAP Earnings Run-Rate Impact (180)Life impact breakdown ($M, after-tax)2022 GAAP Impact Policyholder Behavior $(1,776)Mortality (223) Morbidity (106) Reinsurance(81)Other(11)Total Operating Impact(2,197)Non-Operating Impact(103)Total Net Income Impact from Life Insurance $(2,300) $2.1B GAAP unlocking charge •Includes $2.2B operating and $0.1B non-operating impacts in Life Insurance Main driver in Life Insurance is $1.8B impact from GUL lapsation assumption update •Also includes$0.2B favorable impact in Annuities from higher interest rates$180M decline in Life Insurance annual run-rate after-tax operating income $550M estimated statutory capital impact to be booked in 4Q22•~22-point RBC impact •No impact to ongoing cash flow

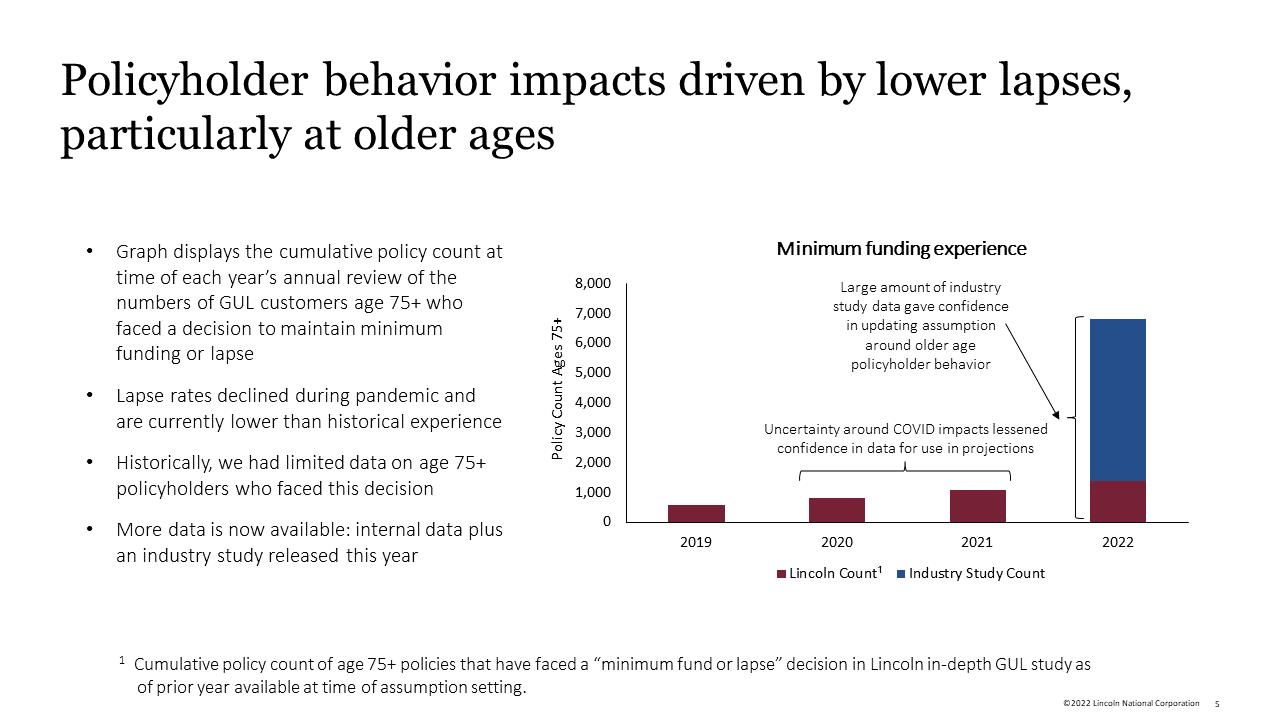

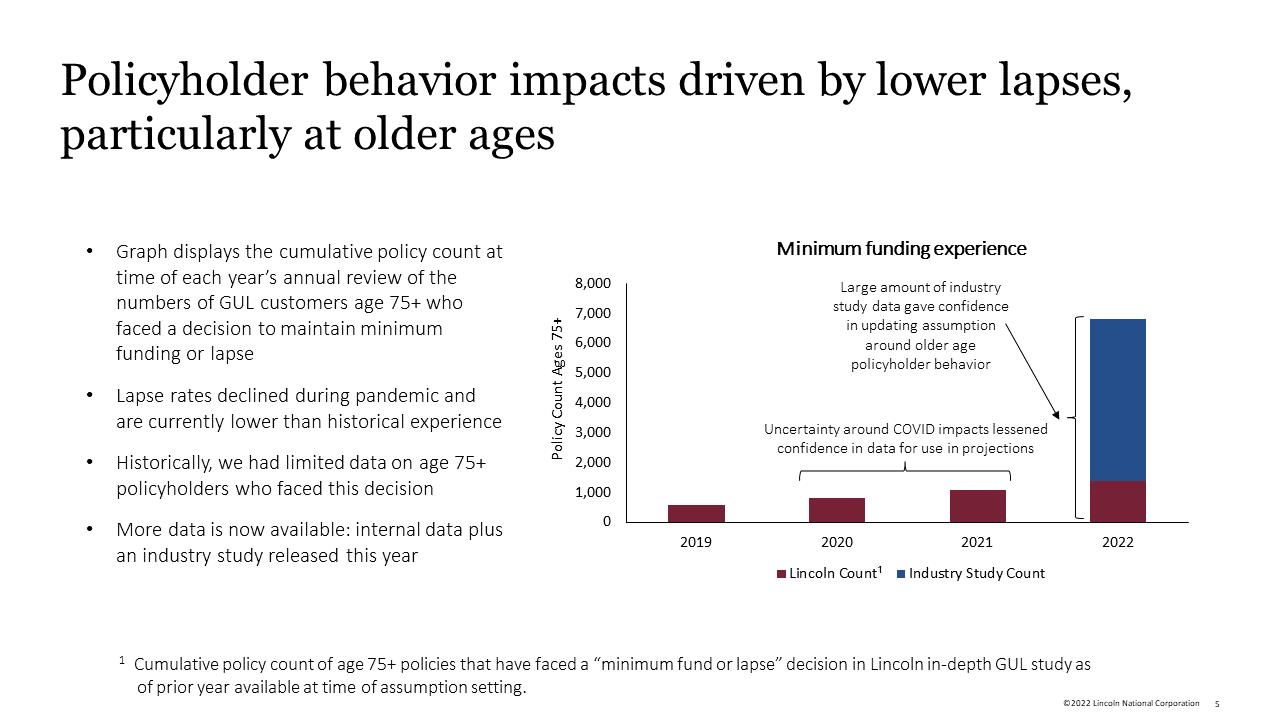

5©2022 Lincoln National Corporation Policyholder behavior impacts driven by lower lapses, particularly at older ages1Cumulative policy count of age 75+ policies that have faced a “minimum fund or lapse” decision in Lincoln in-depth GUL study as of prior year available at time of assumption setting. Uncertainty around COVID impacts lessened confidence in data for use in projections Large amount of industry study data gave confidence in updating assumption around older age policyholder behavior •Graph displays the cumulative policy count at time of each year’s annual review of the numbers of GUL customers age 75+ who faced a decision to maintain minimum funding or lapse •Lapse rates declined during pandemic and are currently lower than historical experience •Historically, we had limited data on age 75+ policyholders who faced this decision •More data is now available: internal data plus an industry study released this year Minimum funding experience

5©2022 Lincoln National Corporation Policyholder behavior impacts driven by lower lapses, particularly at older ages1Cumulative policy count of age 75+ policies that have faced a “minimum fund or lapse” decision in Lincoln in-depth GUL study as of prior year available at time of assumption setting. Uncertainty around COVID impacts lessened confidence in data for use in projections Large amount of industry study data gave confidence in updating assumption around older age policyholder behavior •Graph displays the cumulative policy count at time of each year’s annual review of the numbers of GUL customers age 75+ who faced a decision to maintain minimum funding or lapse •Lapse rates declined during pandemic and are currently lower than historical experience •Historically, we had limited data on age 75+ policyholders who faced this decision •More data is now available: internal data plus an industry study released this year Minimum funding experience

1©2022 Lincoln National Corporation Third Quarter 2022 Investor Supplement November 2, 2022 Al Copersino Head of Investor Relations203-257-4493InvestorRelations@lfg.comThis document may not be accurate after its date, and LNC does not undertake to update or keep it accurate after such date.

1©2022 Lincoln National Corporation Third Quarter 2022 Investor Supplement November 2, 2022 Al Copersino Head of Investor Relations203-257-4493InvestorRelations@lfg.comThis document may not be accurate after its date, and LNC does not undertake to update or keep it accurate after such date. 2©2022 Lincoln National Corporation Forward-looking statements –cautionary language Certain statements made in this presentation and in other written or oral statements made by Lincoln or on Lincoln’s behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements. Forward-looking statements may contain words like: “anticipate,” “believe,” “estimate,” “expect,” “project,” “shall,” “will” and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in Lincoln’s businesses, prospective services or products, future performance or financial results and the outcome of contingencies, such as legal proceedings. Lincoln claims the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. Forward-looking statements are subject to risks and uncertainties. Actual results could differ materially from those expressed in or implied by such forward-looking statements due to a variety of factors, including:•The continuation of the COVID-19 pandemic, or future outbreaks of COVID-19, and uncertainty surrounding the length and severity of future impacts on the global economy and on our business, results of operations and financial condition;•Weak general economic and business conditions that may affect demand for our products, account values, investment results, guaranteed benefit liabilities, premium levels and claims experience;•Adverse global capital and credit market conditions that may affect our ability to raise capital, if necessary, and may cause us to realize impairments on investments and certain intangible assets, including goodwill and the valuation allowance against deferred tax assets, which may reduce future earnings and/or affect our financial condition and ability to raise additional capital or refinance existing debt as it matures;•The inability of our subsidiaries to pay dividends to the holding company in sufficient amounts, which could harm the holding company’s ability to meet its obligations;•Legislative, regulatory or tax changes, both domestic and foreign, that affect: the cost of, or demand for, our subsidiaries’ products; the required amount of reserves and/or surplus; our ability to conduct business and our captive reinsurance arrangements as well as restrictions on the payment of revenue sharing and 12b-1 distribution fees; •The impact of U.S. federal tax reform legislation on our business, earnings and capital; •The impact of Regulation Best Interest or other regulations adopted by the Securities and Exchange Commission (“SEC”), the Department of Labor or other federal or state regulators or self-regulatory organizations relating to the standard of care owed by investment advisers and/or broker-dealers that could affect our distribution model;•Actions taken by reinsurers to raise rates on in-force business;•Declines in or sustained low interest rates causing a reduction in investment income, the interest margins of our businesses, estimated gross profits and demand for our products;•Rapidly increasing interest rates causing contract holders to surrender life insurance and annuity policies, thereby causing realized investment losses, and reduced hedge performance related to variable annuities;•The impact of the implementation of the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act relating to the regulation of derivatives transactions;•The initiation of legal or regulatory proceedings against us, and the outcome of any legal or regulatory proceedings, such as: adverse actions related to present or past business practices common in businesses in which we compete; adverse decisions in significant actions including, but not limited to, actions brought by federal and state authorities and class action cases; new decisions that result in changes in law; and unexpected trial court rulings;•A decline or continued volatility in the equity markets causing a reduction in the sales of our subsidiaries’ products; a reduction of asset-based fees that our subsidiaries charge on various investment and insurance products; an acceleration of the net amortization of deferred acquisition costs (“DAC”), value of business acquired (“VOBA”), deferred sales inducements (“DSI”) and deferred front-end loads (“DFEL”); and an increase in liabilities related to guaranteed benefit features of our subsidiaries’ variable annuity products;

2©2022 Lincoln National Corporation Forward-looking statements –cautionary language Certain statements made in this presentation and in other written or oral statements made by Lincoln or on Lincoln’s behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements. Forward-looking statements may contain words like: “anticipate,” “believe,” “estimate,” “expect,” “project,” “shall,” “will” and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in Lincoln’s businesses, prospective services or products, future performance or financial results and the outcome of contingencies, such as legal proceedings. Lincoln claims the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. Forward-looking statements are subject to risks and uncertainties. Actual results could differ materially from those expressed in or implied by such forward-looking statements due to a variety of factors, including:•The continuation of the COVID-19 pandemic, or future outbreaks of COVID-19, and uncertainty surrounding the length and severity of future impacts on the global economy and on our business, results of operations and financial condition;•Weak general economic and business conditions that may affect demand for our products, account values, investment results, guaranteed benefit liabilities, premium levels and claims experience;•Adverse global capital and credit market conditions that may affect our ability to raise capital, if necessary, and may cause us to realize impairments on investments and certain intangible assets, including goodwill and the valuation allowance against deferred tax assets, which may reduce future earnings and/or affect our financial condition and ability to raise additional capital or refinance existing debt as it matures;•The inability of our subsidiaries to pay dividends to the holding company in sufficient amounts, which could harm the holding company’s ability to meet its obligations;•Legislative, regulatory or tax changes, both domestic and foreign, that affect: the cost of, or demand for, our subsidiaries’ products; the required amount of reserves and/or surplus; our ability to conduct business and our captive reinsurance arrangements as well as restrictions on the payment of revenue sharing and 12b-1 distribution fees; •The impact of U.S. federal tax reform legislation on our business, earnings and capital; •The impact of Regulation Best Interest or other regulations adopted by the Securities and Exchange Commission (“SEC”), the Department of Labor or other federal or state regulators or self-regulatory organizations relating to the standard of care owed by investment advisers and/or broker-dealers that could affect our distribution model;•Actions taken by reinsurers to raise rates on in-force business;•Declines in or sustained low interest rates causing a reduction in investment income, the interest margins of our businesses, estimated gross profits and demand for our products;•Rapidly increasing interest rates causing contract holders to surrender life insurance and annuity policies, thereby causing realized investment losses, and reduced hedge performance related to variable annuities;•The impact of the implementation of the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act relating to the regulation of derivatives transactions;•The initiation of legal or regulatory proceedings against us, and the outcome of any legal or regulatory proceedings, such as: adverse actions related to present or past business practices common in businesses in which we compete; adverse decisions in significant actions including, but not limited to, actions brought by federal and state authorities and class action cases; new decisions that result in changes in law; and unexpected trial court rulings;•A decline or continued volatility in the equity markets causing a reduction in the sales of our subsidiaries’ products; a reduction of asset-based fees that our subsidiaries charge on various investment and insurance products; an acceleration of the net amortization of deferred acquisition costs (“DAC”), value of business acquired (“VOBA”), deferred sales inducements (“DSI”) and deferred front-end loads (“DFEL”); and an increase in liabilities related to guaranteed benefit features of our subsidiaries’ variable annuity products; 3©2022 Lincoln National Corporation Forward-looking statements –cautionary language (contd.)•Ineffectiveness of our risk management policies and procedures, including various hedging strategies used to offset the effect of changes in the value of liabilities due to changes in the level and volatility of the equity markets and interest rates;•A deviation in actual experience regarding future persistency, mortality, morbidity, interest rates or equity market returns from the assumptions used in pricing our subsidiaries’ products, in establishing related insurance reserves and in the net amortization of DAC, VOBA, DSI and DFEL, which may reduce future earnings;•Changes in accounting principles that may affect our business, results of operations and financial condition, including the adoption effective January 1, 2023, of FASB ASU 2018-12, Targeted Improvements to the Accounting for Long-Duration Contracts;•Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations and the adverse effect such action may have on our ability to raise capital and on our liquidity and financial condition;•Lowering of one or more of the insurer financial strength ratings of our insurance subsidiaries and the adverse effect such action may have on the premium writings, policy retention, profitability of our insurance subsidiaries and liquidity;•Significant credit, accounting, fraud, corporate governance or other issues that may adversely affect the value of certain financial assets, as well as counterparties to which we are exposed to credit risk, requiring that we realize losses on financial assets;•Interruption in telecommunication, information technology or other operational systems or failure to safeguard the confidentiality or privacy of sensitive data on such systems, including from cyberattacks or other breaches of our data security systems;•The effect of acquisitions and divestitures, restructurings, product withdrawals and other unusual items;•The inability to realize or sustain the benefits we expect from, greater than expected investments in, and the potential impact of efforts related to, our strategic initiatives, including the Spark Initiative;•The adequacy and collectability of reinsurance that we have obtained;•Future pandemics, acts of terrorism, war or other man-made and natural catastrophes that may adversely affect our businesses and the cost and availability of reinsurance;•Competitive conditions, including pricing pressures, new product offerings and the emergence of new competitors, that may affect the level of premiums and fees that our subsidiaries can charge for their products;•The unknown effect on our subsidiaries’ businesses resulting from evolving market preferences and the changing demographics of our client base; and •The unanticipated loss of key management, financial planners or wholesalers. The risks and uncertainties included here are not exhaustive. Our most recent Form 10-K, as well as other reports that we file with the SEC, include additional factors that could affect our businesses and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, Lincoln disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this presentation. The reporting of Risk Based Capital (“RBC”) measures is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities.

3©2022 Lincoln National Corporation Forward-looking statements –cautionary language (contd.)•Ineffectiveness of our risk management policies and procedures, including various hedging strategies used to offset the effect of changes in the value of liabilities due to changes in the level and volatility of the equity markets and interest rates;•A deviation in actual experience regarding future persistency, mortality, morbidity, interest rates or equity market returns from the assumptions used in pricing our subsidiaries’ products, in establishing related insurance reserves and in the net amortization of DAC, VOBA, DSI and DFEL, which may reduce future earnings;•Changes in accounting principles that may affect our business, results of operations and financial condition, including the adoption effective January 1, 2023, of FASB ASU 2018-12, Targeted Improvements to the Accounting for Long-Duration Contracts;•Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations and the adverse effect such action may have on our ability to raise capital and on our liquidity and financial condition;•Lowering of one or more of the insurer financial strength ratings of our insurance subsidiaries and the adverse effect such action may have on the premium writings, policy retention, profitability of our insurance subsidiaries and liquidity;•Significant credit, accounting, fraud, corporate governance or other issues that may adversely affect the value of certain financial assets, as well as counterparties to which we are exposed to credit risk, requiring that we realize losses on financial assets;•Interruption in telecommunication, information technology or other operational systems or failure to safeguard the confidentiality or privacy of sensitive data on such systems, including from cyberattacks or other breaches of our data security systems;•The effect of acquisitions and divestitures, restructurings, product withdrawals and other unusual items;•The inability to realize or sustain the benefits we expect from, greater than expected investments in, and the potential impact of efforts related to, our strategic initiatives, including the Spark Initiative;•The adequacy and collectability of reinsurance that we have obtained;•Future pandemics, acts of terrorism, war or other man-made and natural catastrophes that may adversely affect our businesses and the cost and availability of reinsurance;•Competitive conditions, including pricing pressures, new product offerings and the emergence of new competitors, that may affect the level of premiums and fees that our subsidiaries can charge for their products;•The unknown effect on our subsidiaries’ businesses resulting from evolving market preferences and the changing demographics of our client base; and •The unanticipated loss of key management, financial planners or wholesalers. The risks and uncertainties included here are not exhaustive. Our most recent Form 10-K, as well as other reports that we file with the SEC, include additional factors that could affect our businesses and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, Lincoln disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this presentation. The reporting of Risk Based Capital (“RBC”) measures is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities. 4©2022 Lincoln National Corporation3Q22 annual review of actuarial assumptions Impacts by business unit ($M, after-tax) 2022 GAAP Impact Life $(2,197) Annuities 217 Group Protection 1 Retirement Plan Services 6Total Operating Impact(1,973)Non-Operating Impact(86)Total GAAP Net Income Impact (2,059)GAAP Earnings Run-Rate Impact (180)Life impact breakdown ($M, after-tax)2022 GAAP Impact Policyholder Behavior $(1,776)Mortality (223) Morbidity (106) Reinsurance(81)Other(11)Total Operating Impact(2,197)Non-Operating Impact(103)Total Net Income Impact from Life Insurance $(2,300) $2.1B GAAP unlocking charge •Includes $2.2B operating and $0.1B non-operating impacts in Life Insurance Main driver in Life Insurance is $1.8B impact from GUL lapsation assumption update •Also includes$0.2B favorable impact in Annuities from higher interest rates$180M decline in Life Insurance annual run-rate after-tax operating income $550M estimated statutory capital impact to be booked in 4Q22•~22-point RBC impact •No impact to ongoing cash flow

4©2022 Lincoln National Corporation3Q22 annual review of actuarial assumptions Impacts by business unit ($M, after-tax) 2022 GAAP Impact Life $(2,197) Annuities 217 Group Protection 1 Retirement Plan Services 6Total Operating Impact(1,973)Non-Operating Impact(86)Total GAAP Net Income Impact (2,059)GAAP Earnings Run-Rate Impact (180)Life impact breakdown ($M, after-tax)2022 GAAP Impact Policyholder Behavior $(1,776)Mortality (223) Morbidity (106) Reinsurance(81)Other(11)Total Operating Impact(2,197)Non-Operating Impact(103)Total Net Income Impact from Life Insurance $(2,300) $2.1B GAAP unlocking charge •Includes $2.2B operating and $0.1B non-operating impacts in Life Insurance Main driver in Life Insurance is $1.8B impact from GUL lapsation assumption update •Also includes$0.2B favorable impact in Annuities from higher interest rates$180M decline in Life Insurance annual run-rate after-tax operating income $550M estimated statutory capital impact to be booked in 4Q22•~22-point RBC impact •No impact to ongoing cash flow 5©2022 Lincoln National Corporation Policyholder behavior impacts driven by lower lapses, particularly at older ages1Cumulative policy count of age 75+ policies that have faced a “minimum fund or lapse” decision in Lincoln in-depth GUL study as of prior year available at time of assumption setting. Uncertainty around COVID impacts lessened confidence in data for use in projections Large amount of industry study data gave confidence in updating assumption around older age policyholder behavior •Graph displays the cumulative policy count at time of each year’s annual review of the numbers of GUL customers age 75+ who faced a decision to maintain minimum funding or lapse •Lapse rates declined during pandemic and are currently lower than historical experience •Historically, we had limited data on age 75+ policyholders who faced this decision •More data is now available: internal data plus an industry study released this year Minimum funding experience

5©2022 Lincoln National Corporation Policyholder behavior impacts driven by lower lapses, particularly at older ages1Cumulative policy count of age 75+ policies that have faced a “minimum fund or lapse” decision in Lincoln in-depth GUL study as of prior year available at time of assumption setting. Uncertainty around COVID impacts lessened confidence in data for use in projections Large amount of industry study data gave confidence in updating assumption around older age policyholder behavior •Graph displays the cumulative policy count at time of each year’s annual review of the numbers of GUL customers age 75+ who faced a decision to maintain minimum funding or lapse •Lapse rates declined during pandemic and are currently lower than historical experience •Historically, we had limited data on age 75+ policyholders who faced this decision •More data is now available: internal data plus an industry study released this year Minimum funding experience