Earnings Supplement Third Quarter 2024 Insurance products issued by: The Lincoln National Life Insurance Company Lincoln Life & Annuity Company of New York October 31, 2024

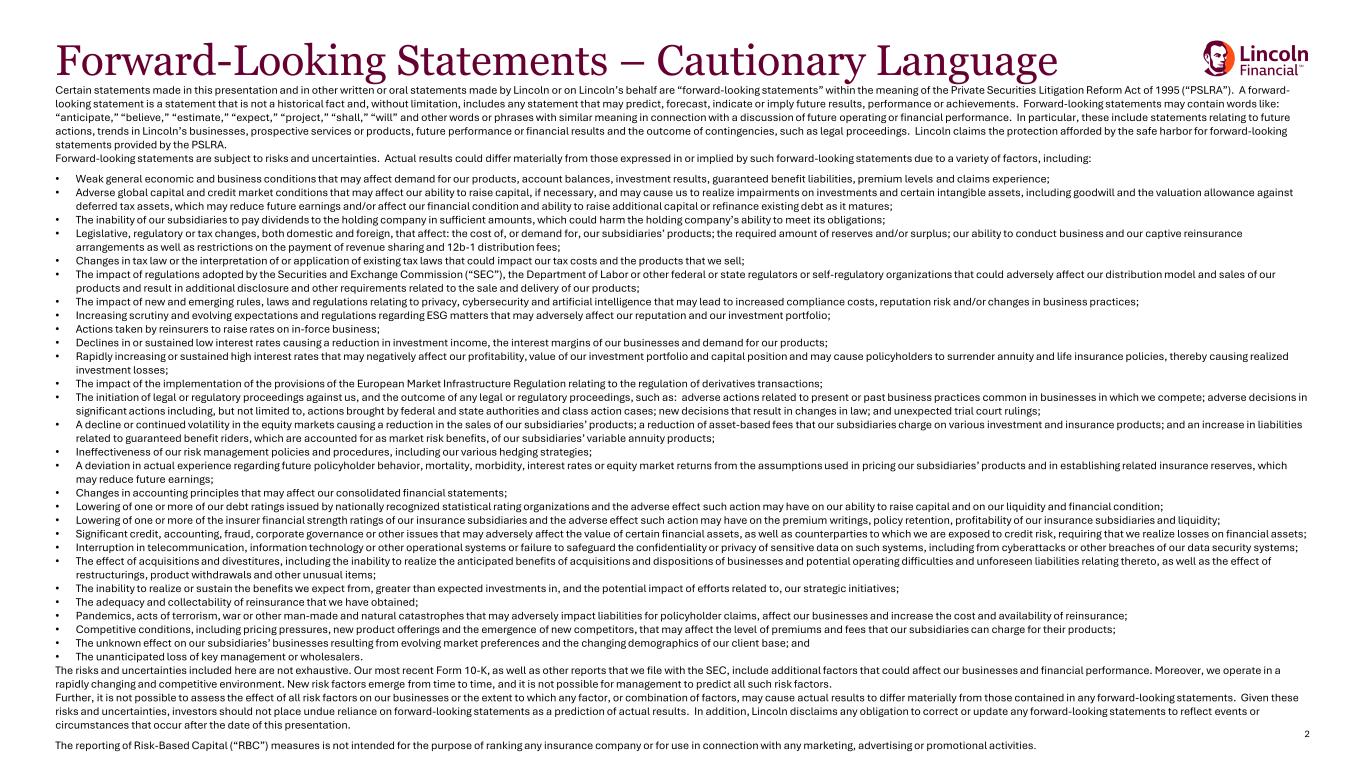

2 Forward-Looking Statements – Cautionary Language Certain statements made in this presentation and in other written or oral statements made by Lincoln or on Lincoln’s behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward- looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements. Forward-looking statements may contain words like: “anticipate,” “believe,” “estimate,” “expect,” “project,” “shall,” “will” and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in Lincoln’s businesses, prospective services or products, future performance or financial results and the outcome of contingencies, such as legal proceedings. Lincoln claims the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. Forward-looking statements are subject to risks and uncertainties. Actual results could differ materially from those expressed in or implied by such forward-looking statements due to a variety of factors, including: • Weak general economic and business conditions that may affect demand for our products, account balances, investment results, guaranteed benefit liabilities, premium levels and claims experience; • Adverse global capital and credit market conditions that may affect our ability to raise capital, if necessary, and may cause us to realize impairments on investments and certain intangible assets, including goodwill and the valuation allowance against deferred tax assets, which may reduce future earnings and/or affect our financial condition and ability to raise additional capital or refinance existing debt as it matures; • The inability of our subsidiaries to pay dividends to the holding company in sufficient amounts, which could harm the holding company’s ability to meet its obligations; • Legislative, regulatory or tax changes, both domestic and foreign, that affect: the cost of, or demand for, our subsidiaries’ products; the required amount of reserves and/or surplus; our ability to conduct business and our captive reinsurance arrangements as well as restrictions on the payment of revenue sharing and 12b-1 distribution fees; • Changes in tax law or the interpretation of or application of existing tax laws that could impact our tax costs and the products that we sell; • The impact of regulations adopted by the Securities and Exchange Commission (“SEC”), the Department of Labor or other federal or state regulators or self-regulatory organizations that could adversely affect our distribution model and sales of our products and result in additional disclosure and other requirements related to the sale and delivery of our products; • The impact of new and emerging rules, laws and regulations relating to privacy, cybersecurity and artificial intelligence that may lead to increased compliance costs, reputation risk and/or changes in business practices; • Increasing scrutiny and evolving expectations and regulations regarding ESG matters that may adversely affect our reputation and our investment portfolio; • Actions taken by reinsurers to raise rates on in-force business; • Declines in or sustained low interest rates causing a reduction in investment income, the interest margins of our businesses and demand for our products; • Rapidly increasing or sustained high interest rates that may negatively affect our profitability, value of our investment portfolio and capital position and may cause policyholders to surrender annuity and life insurance policies, thereby causing realized investment losses; • The impact of the implementation of the provisions of the European Market Infrastructure Regulation relating to the regulation of derivatives transactions; • The initiation of legal or regulatory proceedings against us, and the outcome of any legal or regulatory proceedings, such as: adverse actions related to present or past business practices common in businesses in which we compete; adverse decisions in significant actions including, but not limited to, actions brought by federal and state authorities and class action cases; new decisions that result in changes in law; and unexpected trial court rulings; • A decline or continued volatility in the equity markets causing a reduction in the sales of our subsidiaries’ products; a reduction of asset-based fees that our subsidiaries charge on various investment and insurance products; and an increase in liabilities related to guaranteed benefit riders, which are accounted for as market risk benefits, of our subsidiaries’ variable annuity products; • Ineffectiveness of our risk management policies and procedures, including our various hedging strategies; • A deviation in actual experience regarding future policyholder behavior, mortality, morbidity, interest rates or equity market returns from the assumptions used in pricing our subsidiaries’ products and in establishing related insurance reserves, which may reduce future earnings; • Changes in accounting principles that may affect our consolidated financial statements; • Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations and the adverse effect such action may have on our ability to raise capital and on our liquidity and financial condition; • Lowering of one or more of the insurer financial strength ratings of our insurance subsidiaries and the adverse effect such action may have on the premium writings, policy retention, profitability of our insurance subsidiaries and liquidity; • Significant credit, accounting, fraud, corporate governance or other issues that may adversely affect the value of certain financial assets, as well as counterparties to which we are exposed to credit risk, requiring that we realize losses on financial assets; • Interruption in telecommunication, information technology or other operational systems or failure to safeguard the confidentiality or privacy of sensitive data on such systems, including from cyberattacks or other breaches of our data security systems; • The effect of acquisitions and divestitures, including the inability to realize the anticipated benefits of acquisitions and dispositions of businesses and potential operating difficulties and unforeseen liabilities relating thereto, as well as the effect of restructurings, product withdrawals and other unusual items; • The inability to realize or sustain the benefits we expect from, greater than expected investments in, and the potential impact of efforts related to, our strategic initiatives; • The adequacy and collectability of reinsurance that we have obtained; • Pandemics, acts of terrorism, war or other man-made and natural catastrophes that may adversely impact liabilities for policyholder claims, affect our businesses and increase the cost and availability of reinsurance; • Competitive conditions, including pricing pressures, new product offerings and the emergence of new competitors, that may affect the level of premiums and fees that our subsidiaries can charge for their products; • The unknown effect on our subsidiaries’ businesses resulting from evolving market preferences and the changing demographics of our client base; and • The unanticipated loss of key management or wholesalers. The risks and uncertainties included here are not exhaustive. Our most recent Form 10-K, as well as other reports that we file with the SEC, include additional factors that could affect our businesses and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, Lincoln disclaims any obligation to correct or update any forward-looking statements to reflect events or circumstances that occur after the date of this presentation. The reporting of Risk-Based Capital (“RBC”) measures is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities.

3 3Q24 Key Messages Highest earnings quarter in over two years; achieving targeted outcomes through strong execution • Sustained momentum in every business supported by strong underlying fundamentals and continued progress toward strategic objectives. • Group Protection earnings more than doubled YOY and Annuities earnings grew 15%2. • Annual assumption review resulted in a modest benefit to operating earnings for the quarter. Accelerating sales trajectory as product and segment strategies gain traction • Annuities sales increased nearly 25% YOY, with spread-based products representing two-thirds of total Annuities sales. • RPS YTD first-year sales increased nearly 80% YOY, driven by strong execution against segment strategy. • Life Insurance generated sequential sales growth for the second quarter in a row. Capital position continued to strengthen, supported by improving free cash flow generation • RBC ratio remained above 420% as capital position continues to strengthen. • Leverage ratio continued to decline, driven by organic equity growth. • Expense discipline and operational efficiencies are driving operating leverage. After- tax Per share Adjusted Operating Income, ex. significant and normalizing items $343M $1.97 Significant items Assumption review benefit $8M $0.05 Normalizing items Alternative investment income compared to our 10% long-term return target $7M $0.04 Total items impact $15M $0.09 Adjusted Operating Income1 $358M $2.06 1 Represents Adjusted Operating Income Available to Common Stockholders. See Non-GAAP Financial Measures Appendix for definition and reconciliation. 2 Not including the impact of the annual assumption review.

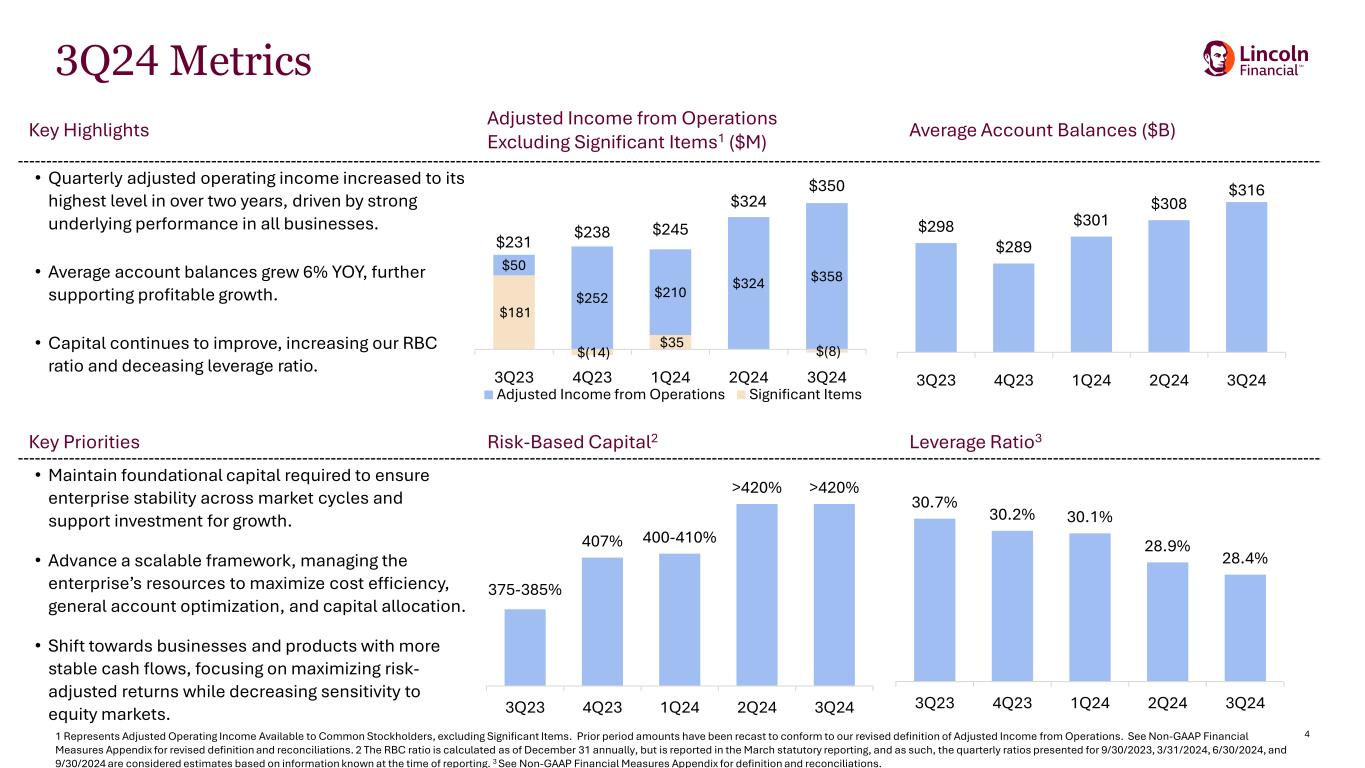

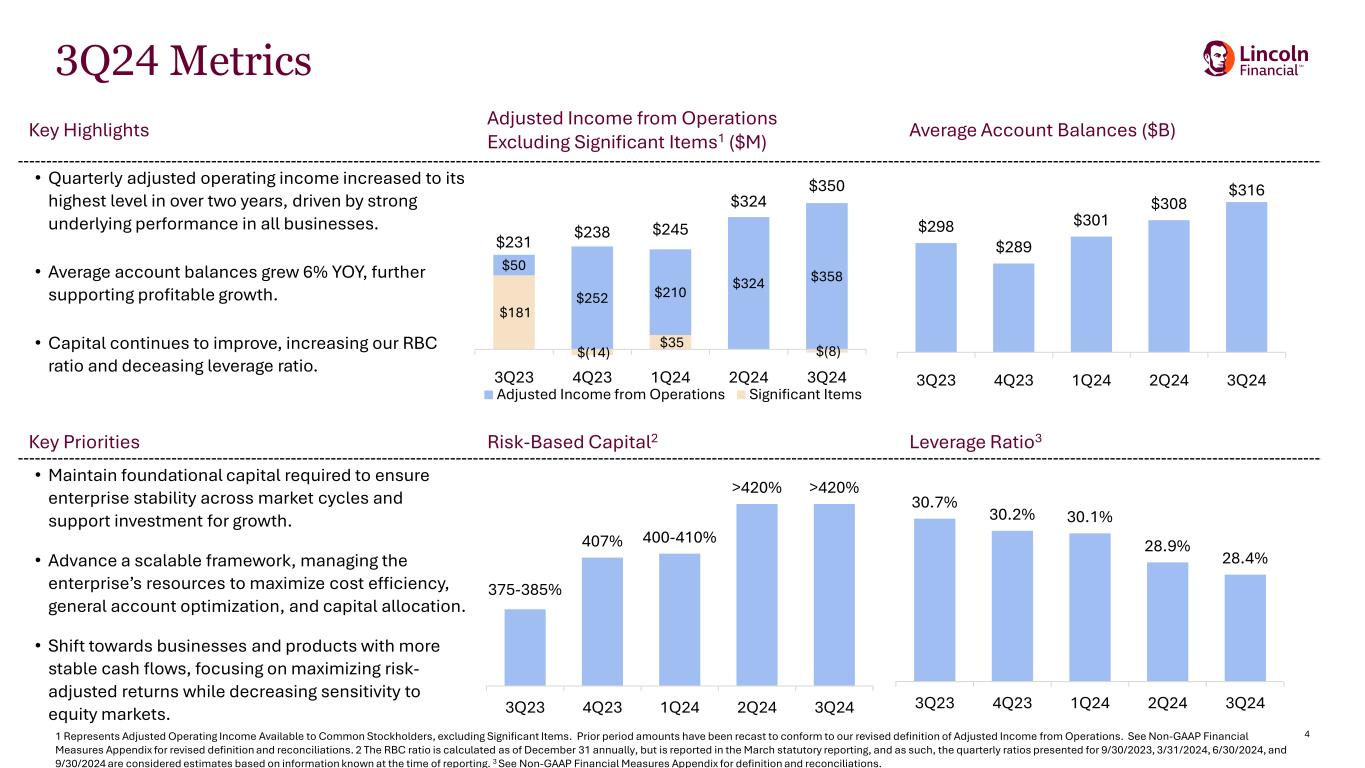

4 3Q24 Metrics Key Highlights Adjusted Income from Operations Excluding Significant Items1 ($M) Average Account Balances ($B) • Quarterly adjusted operating income increased to its highest level in over two years, driven by strong underlying performance in all businesses. • Average account balances grew 6% YOY, further supporting profitable growth. • Capital continues to improve, increasing our RBC ratio and deceasing leverage ratio. Key Priorities Risk-Based Capital2 Leverage Ratio3 • Maintain foundational capital required to ensure enterprise stability across market cycles and support investment for growth. • Advance a scalable framework, managing the enterprise’s resources to maximize cost efficiency, general account optimization, and capital allocation. • Shift towards businesses and products with more stable cash flows, focusing on maximizing risk- adjusted returns while decreasing sensitivity to equity markets. 1 Represents Adjusted Operating Income Available to Common Stockholders, excluding Significant Items. Prior period amounts have been recast to conform to our revised definition of Adjusted Income from Operations. See Non-GAAP Financial Measures Appendix for revised definition and reconciliations. 2 The RBC ratio is calculated as of December 31 annually, but is reported in the March statutory reporting, and as such, the quarterly ratios presented for 9/30/2023, 3/31/2024, 6/30/2024, and 9/30/2024 are considered estimates based on information known at the time of reporting. 3 See Non-GAAP Financial Measures Appendix for definition and reconciliations. $181 $(14) $35 $(8) $50 $252 $210 $324 $358 $231 $238 $245 $324 $350 3Q23 4Q23 1Q24 2Q24 3Q24 Adjusted Income from Operations Significant Items 375-385% 407% 400-410% >420% >420% 3Q23 4Q23 1Q24 2Q24 3Q24 $298 $289 $301 $308 $316 3Q23 4Q23 1Q24 2Q24 3Q24 30.7% 30.2% 30.1% 28.9% 28.4% 3Q23 4Q23 1Q24 2Q24 3Q24

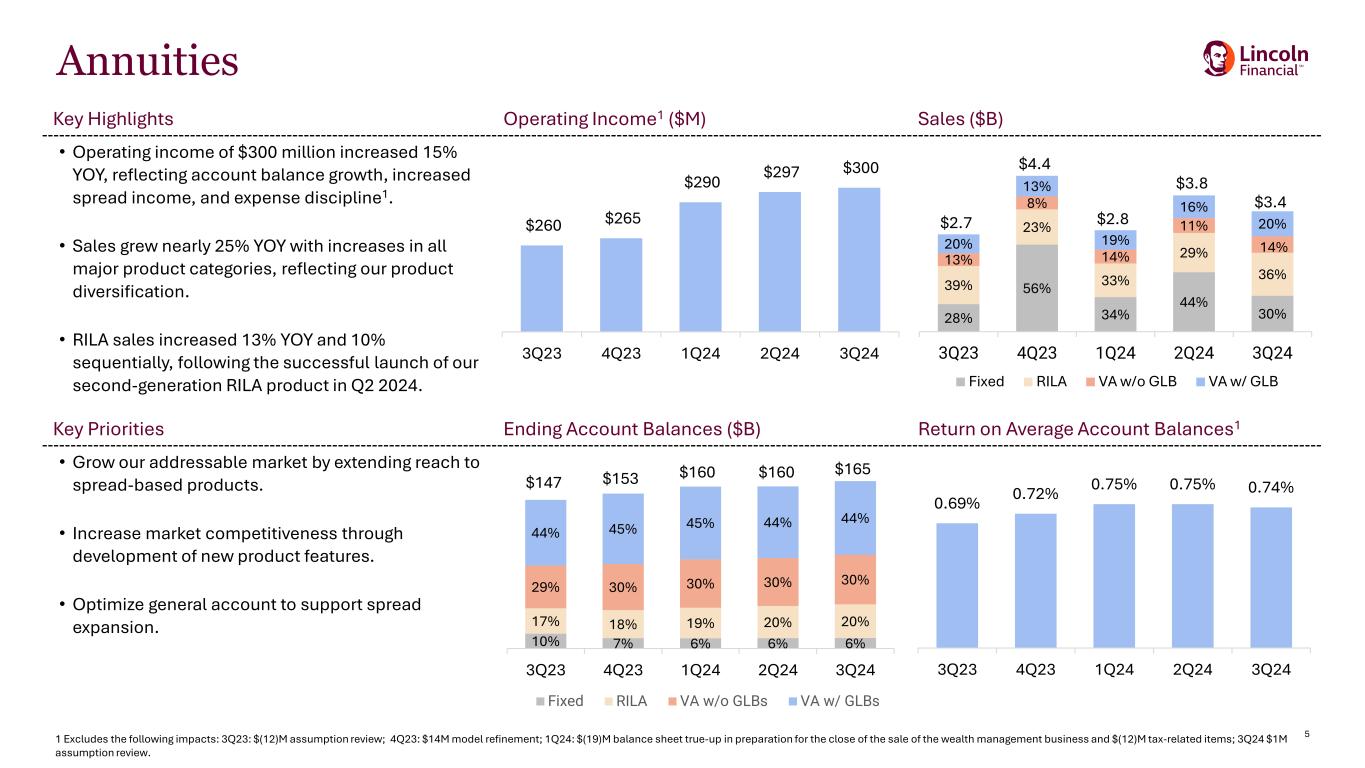

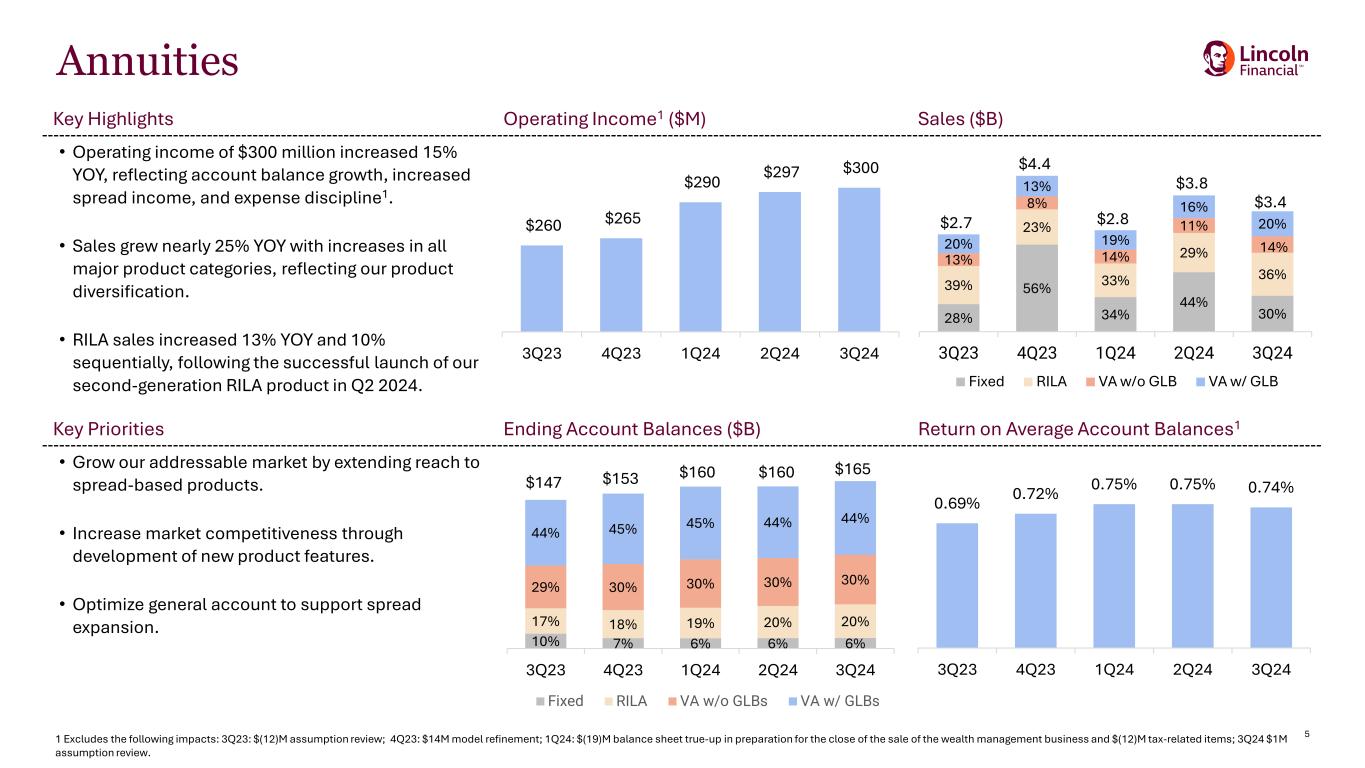

5 Annuities Key Highlights Operating Income1 ($M) Sales ($B) • Operating income of $300 million increased 15% YOY, reflecting account balance growth, increased spread income, and expense discipline1. • Sales grew nearly 25% YOY with increases in all major product categories, reflecting our product diversification. • RILA sales increased 13% YOY and 10% sequentially, following the successful launch of our second-generation RILA product in Q2 2024. Key Priorities Ending Account Balances ($B) Return on Average Account Balances1 • Grow our addressable market by extending reach to spread-based products. • Increase market competitiveness through development of new product features. • Optimize general account to support spread expansion. 1 Excludes the following impacts: 3Q23: $(12)M assumption review; 4Q23: $14M model refinement; 1Q24: $(19)M balance sheet true-up in preparation for the close of the sale of the wealth management business and $(12)M tax-related items; 3Q24 $1M assumption review. 10% 7% 6% 6% 6% 17% 18% 19% 20% 20% 29% 30% 30% 30% 30% 44% 45% 45% 44% 44% 3Q23 4Q23 1Q24 2Q24 3Q24 Fixed RILA VA w/o GLBs VA w/ GLBs 0.69% 0.72% 0.75% 0.75% 0.74% 3Q23 4Q23 1Q24 2Q24 3Q24 $260 $265 $290 $297 $300 3Q23 4Q23 1Q24 2Q24 3Q24 $147 $153 $160 $160 28% 56% 34% 44% 30% 39% 23% 33% 29% 36% 13% 8% 14% 11% 14%20% 13% 19% 16% 20% 3Q23 4Q23 1Q24 2Q24 3Q24 Fixed RILA VA w/o GLB VA w/ GLB $2.7 $4.4 $2.8 $3.8 $3.4 $165

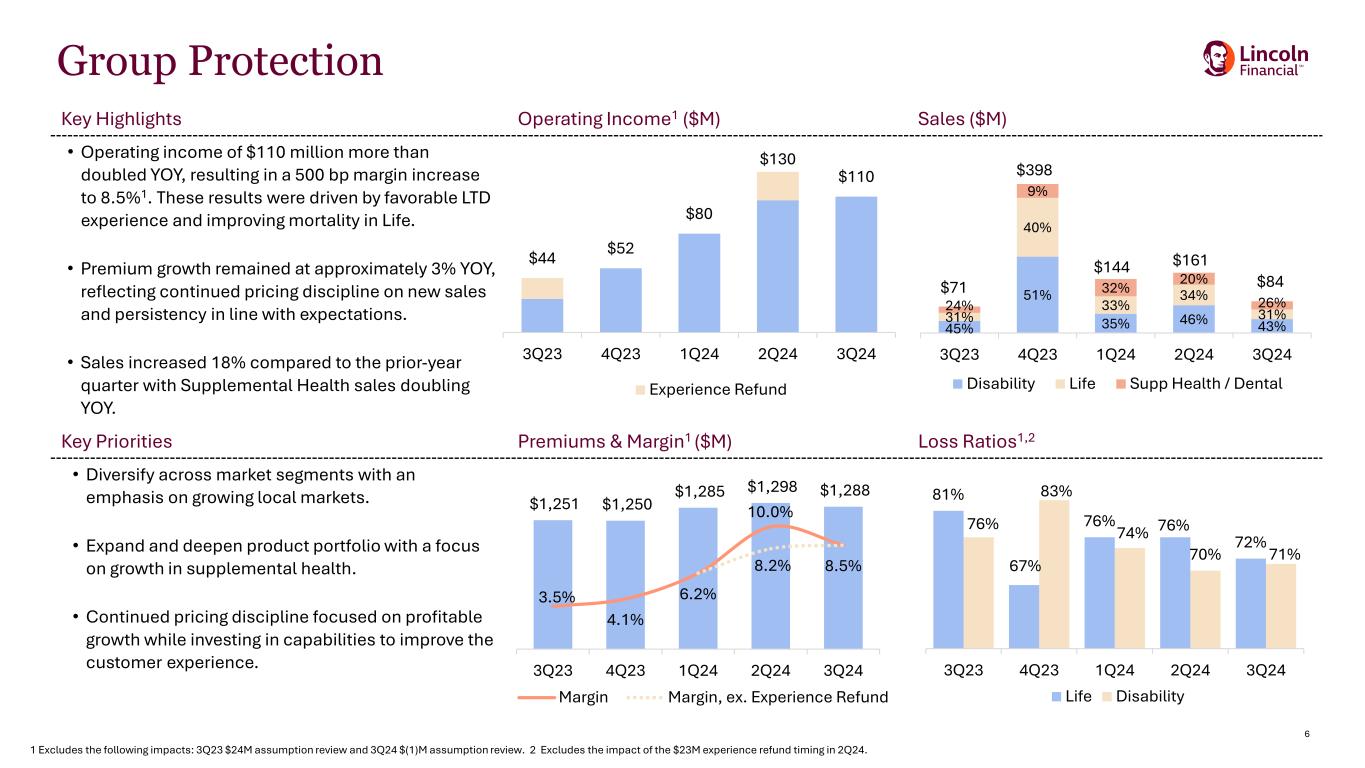

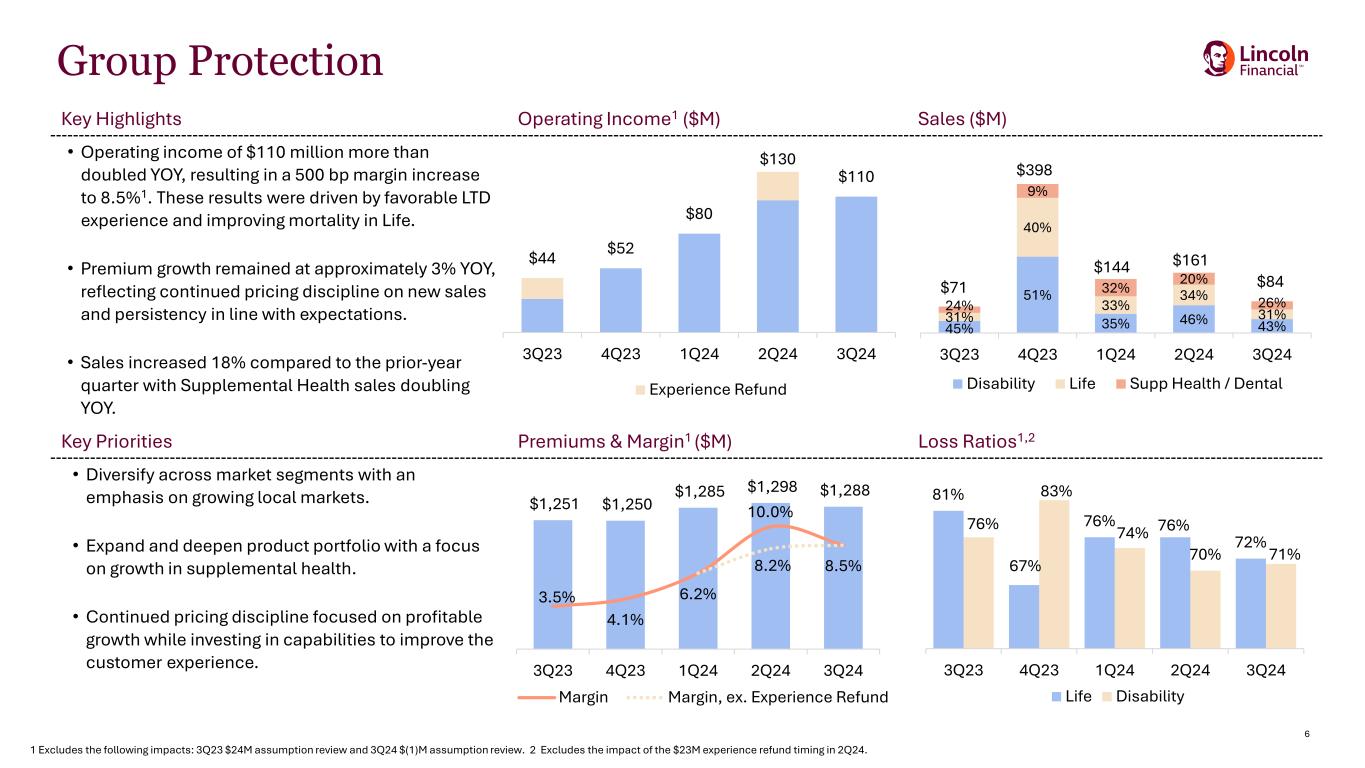

6 Group Protection Key Highlights Operating Income1 ($M) Sales ($M) • Operating income of $110 million more than doubled YOY, resulting in a 500 bp margin increase to 8.5%1. These results were driven by favorable LTD experience and improving mortality in Life. • Premium growth remained at approximately 3% YOY, reflecting continued pricing discipline on new sales and persistency in line with expectations. • Sales increased 18% compared to the prior-year quarter with Supplemental Health sales doubling YOY. Key Priorities Premiums & Margin1 ($M) Loss Ratios1,2 • Diversify across market segments with an emphasis on growing local markets. • Expand and deepen product portfolio with a focus on growth in supplemental health. • Continued pricing discipline focused on profitable growth while investing in capabilities to improve the customer experience. 45% 51% 35% 46% 43%31% 40% 33% 34% 31%24% 9% 32% 20% 26% 3Q23 4Q23 1Q24 2Q24 3Q24 Disability Life Supp Health / Dental 81% 67% 76% 76% 72% 76% 83% 74% 70% 71% 3Q23 4Q23 1Q24 2Q24 3Q24 Life Disability $44 $52 $80 $130 $110 3Q23 4Q23 1Q24 2Q24 3Q24 Experience Refund $1,251 $1,250 $1,285 $1,298 $1,288 3.5% 4.1% 6.2% 10.0% 8.2% 8.5% 3Q23 4Q23 1Q24 2Q24 3Q24 Margin Margin, ex. Experience Refund $71 $398 $144 $161 1 Excludes the following impacts: 3Q23 $24M assumption review and 3Q24 $(1)M assumption review. 2 Excludes the impact of the $23M experience refund timing in 2Q24. $84

7 Retirement Plan Services Key Highlights Operating Income ($M) Sales ($B) • Operating income of $44 million increased 10% sequentially, reflecting higher account balances. • First-year sales more than tripled YOY, driven in part by increased sales growth in RPS’s full-service segments. • Ending account balances increased 21% YOY reflecting favorable market conditions and positive net flows. Key Priorities Ending Account Balances ($B) Net G&A Expenses ($M) • Growth in core recordkeeping and institutional market segments through our differentiated service model. • Expand access to retirement solutions by leveraging distribution relationships and product innovation. • Increase operational and expense efficiencies to drive down our cost per participant and improve profitability. 26% 24% 22% 22% 21% 74% 76% 78% 78% 79% $94 $101 $107 $108 $114 3Q23 4Q23 1Q24 2Q24 3Q24 General Account Separate Account and Mutual Funds $43 $38 $36 $40 $44 3Q23 4Q23 1Q24 2Q24 3Q24 $81 $84 $81 $80 $81 3Q23 4Q23 1Q24 2Q24 3Q24 61% 56% 34% 49% 27% 21% 23% 48% 23% 62% 18% 21% 18% 28% 11% 3Q23 4Q23 1Q24 2Q24 3Q24 Sm. Market Mid-Large Market Stable Value/Other $1.7 $0.5 $0.9 $1.1 $0.8

8 Life Insurance Key Highlights Operating Income1 ($M) Sales ($M) • Operating income of $14 million decreased YOY, reflecting a lower run-rate post the Fortitude Re transaction1. • Sales grew 16% sequentially as our ongoing strategic realignment gains traction. • Continued expense discipline resulting in a 9% reduction in net G&A YOY. Key Priorities Net Death Benefits ($M) Net G&A Expenses ($M) • Optimize product portfolio to support pivot toward products with more stable cash flows and higher risk-adjusted returns. • Continue efforts to reduce expense base to drive cost efficiency and earnings growth. • Maintain focus on optimizing the legacy in force and increase earnings. $138 $143 $130 $125 $126 3Q23 4Q23 1Q24 2Q24 3Q24 $43 $11 $(29) $4 $8 $(20) $(17) $(5) $(39) $6 3Q23 4Q23 1Q24 2Q24 3Q24 Above/Below-Target Alt. Inv. Impact Underlying Earnings $653 $668 $664 $644 $638 $500 $493 $758 $608 $663 3Q23 4Q23 1Q24 2Q24 3Q24 Net death benefits Death claims ceded 71% 83% 92% 91% 85% 29% 17% 8% 9% 15% $144 $144 $91 $105 $122 3Q23 4Q23 1Q24 2Q24 3Q24 Core Life Executive Benefits 1 Excludes the following impacts: 3Q23: $(156)M assumption review, $(25)M unclaimed property, and $(15)M surrender benefit program, 1Q24: $(1) related to Dividend Received Deduction true-up, and 3Q24: $8M assumption review. $23 $(6) $(34) $(35) $14

9 Key Highlights Operating Loss1,2 and Preferred Dividend ($M) Interest Expense ($M) • Operating loss was $(84) million, a 20% improvement year over year. 1 • Non-Spark G&A expenses increased by $3 million YOY driven by project spend. • Spark G&A expenses declined by 25% YOY, reflecting the planned reduction of program expense. Key Priorities Non-Spark G&A Expenses2,3 ($M) Spark Initiative Expenses ($M) • Reduce leverage ratio through continued growth in capital and opportunistic deleveraging. • Continued focus on operational efficiency, including the conclusion of Spark Initiative- related projects in 2025. Other Operations $(105) $(100) $(93) $(97) $(84) $(34) $(11) $(34) $(11) $(34) 3Q23 4Q23 1Q24 2Q24 3Q24 Operating Loss Preferred Dividend $84 $81 $81 $86 $86 3Q23 4Q23 1Q24 2Q24 3Q24 $36 $52 $27 $30 $27 3Q23 4Q23 1Q24 2Q24 3Q24 1 Excludes the following impacts: 3Q23: $3M in unclaimed property; 1Q24: Excess tax true-up impact of $(3)M. 2 Prior period amounts have been recast to conform to our revised definition of income (loss) from operations. 3 2Q24 and 3Q24 excludes the impact of expenses related to Other Operations associated with the sale of the wealth management business. These expenses are directly offset in Other Revenues. $32 $27 $30 $32 $35 3Q23 4Q23 1Q24 2Q24 3Q24

10 Investment Portfolio Key Highlights General Account ($B) Portfolio Quality • Well-diversified portfolio with 97% investment grade securities. • New money yield pick-up of 1.6% increased 70 bps YOY. • Our diversified alternatives portfolio delivered a 2.7% quarterly return, above our long-term expectation of 2.5%. Key Priorities New Money Alternative Investment Income ($M), Pre-Tax • Optimize new money strategies by leveraging the sourcing capabilities of our multi-manager platform. • New money strategy focused on maintaining diversification and high quality while capitalizing on less liquid assets and structured asset class premiums. • Achieve attractive risk-adjusted alternative returns. 5.3% 5.4% 5.0% 5.3% 4.8% 0.9% 1.0% 1.1% 1.6% 1.6% 6.2% 6.4% 6.1% 6.9% 6.4% 4.33% 4.37% 4.39% 4.50% 4.53% 3Q23 4Q23 1Q24 2Q24 3Q24 Yield Pick-up Average Market Yield New Money Yield Fixed Income Portfolio Yield $52 $58 $78 $36 $100 1.6% 1.7% 2.3% 1.0% 2.7% 3Q23 4Q23 1Q24 2Q24 3Q24 % Returns, Unannualized 61% 61% 62% 62% 62% 36% 36% 35% 35% 35% 3% 3% 3% 3% 3% 3Q23 4Q23 1Q24 2Q24 3Q24 NAIC 1/CM1 NAIC 2/CM2 NAIC 3-6/CM3-7 50% 50% 41% 40% 38% 15% 15% 18% 18% 18% 12% 13% 14% 14% 14% 13% 13% 17% 17% 17% 2% 2% 3% 3% 3% 8% 7% 7% 8% 10% 3Q23 4Q23 1Q24 2Q24 3Q24 Public Corps Private Corps Structured Mortgage Loans Alts Other $138 $113 $115 $119 1 Mortgage Loans include CMLs and RMLs. 2 Other includes cash, COLI, common and preferred stock, municipals, sovereign government and UST/agency. 3 Defined as the yield on the 7-year US Treasury note plus the Barclay’s Public Corp Industrial Spreads Weighted 50% A and 50% BBB. $118

11 Appendix

12 Investment portfolio High quality and well-diversified portfolio1 Industrial Other 2% Energy 2% Municipal 2% Communications 2% Basic Industry 2% Transportation 3% Alts 3% Technology 3% Consumer Cyclical 5% Capital Goods 5% Other2 7% Utilities 10% Consumer Non-Cyclical 11% Financials 7% Banking 4% Structured 14% CMLs 15% Resi 3% The portfolio is well-positioned • Long-term investment strategy is tightly aligned with our liability profile and positioned for various economic cycles. • 97% investment grade, the portfolio is up in quality providing flexibility to further add incremental yield. • Well positioned to further optimize the portfolio given high-quality asset mix and shift toward shorter duration liabilities. $119B Average A Rated Portfolio allocation by asset class 1 Data on slide is as of September 30, 2024. 2 Other asset classes primarily include quasi-sovereign, cash/collateral, and UST/agency. Note: All information regarding LNC’s investment portfolio in this earnings supplement excludes assets related to certain modified coinsurance and coinsurance with funds withheld transactions. The modified coinsurance and funds withheld reinsurance agreements investment portfolio has counterparty protections in place including investment guidelines, as well as additional support including trusts and letters of credit that were established to meet LNC’s risk management objectives.

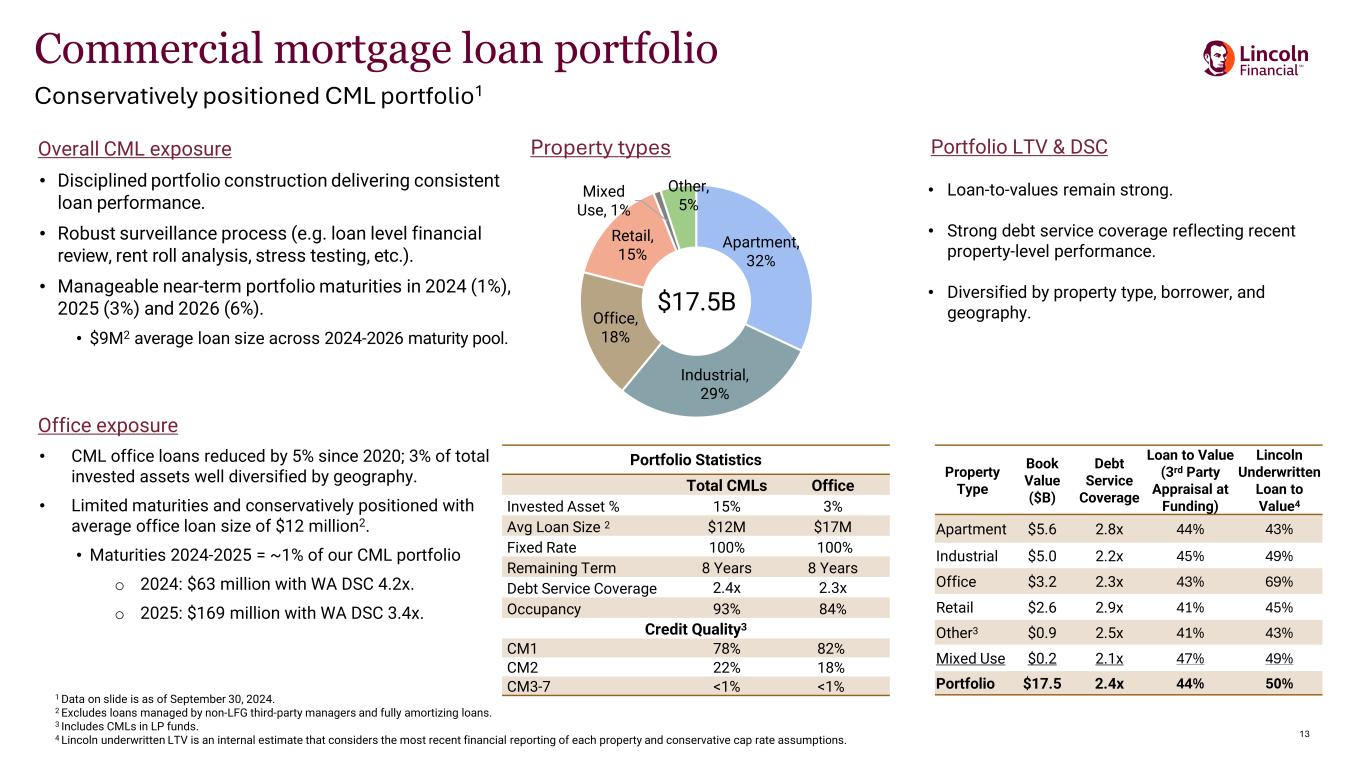

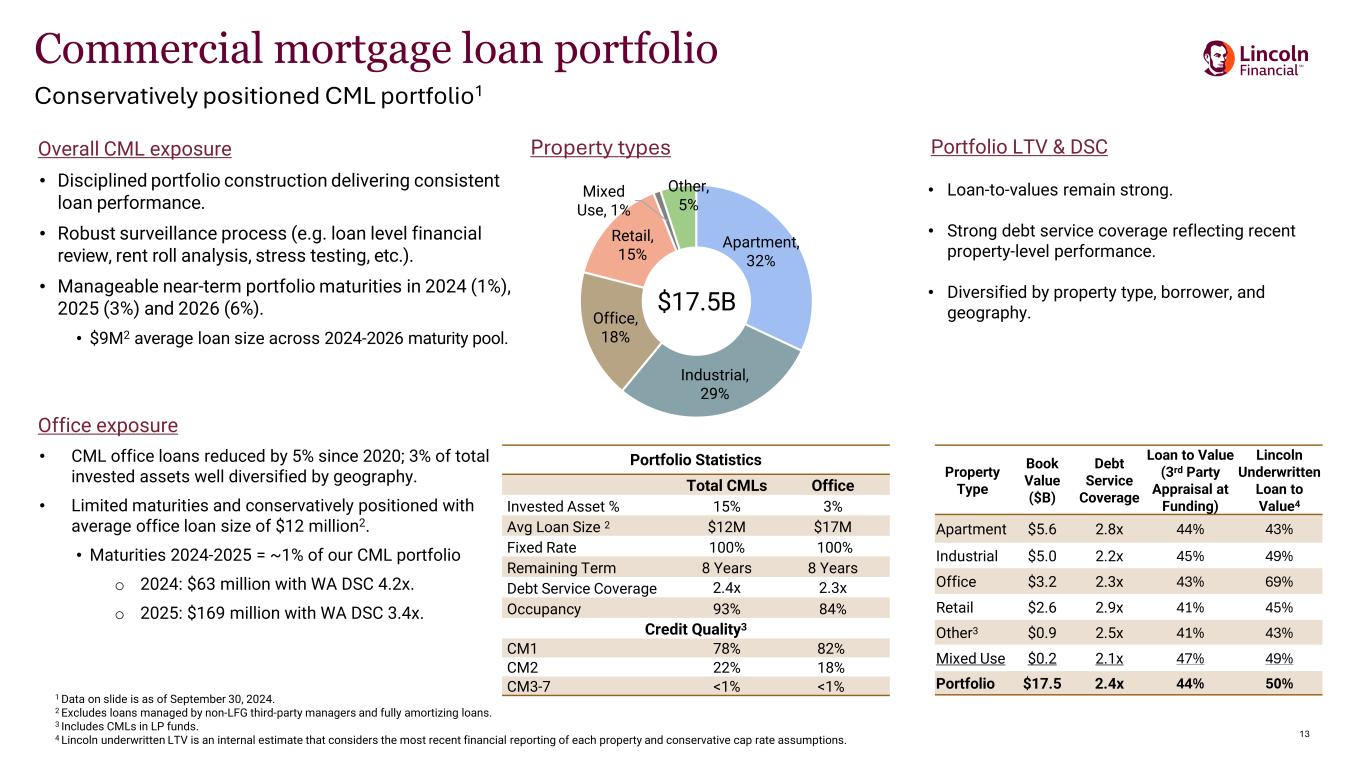

13 Commercial mortgage loan portfolio Conservatively positioned CML portfolio1 Overall CML exposure • Disciplined portfolio construction delivering consistent loan performance. • Robust surveillance process (e.g. loan level financial review, rent roll analysis, stress testing, etc.). • Manageable near-term portfolio maturities in 2024 (1%), 2025 (3%) and 2026 (6%). • $9M2 average loan size across 2024-2026 maturity pool. Office exposure • CML office loans reduced by 5% since 2020; 3% of total invested assets well diversified by geography. • Limited maturities and conservatively positioned with average office loan size of $12 million2. • Maturities 2024-2025 = ~1% of our CML portfolio o 2024: $63 million with WA DSC 4.2x. o 2025: $169 million with WA DSC 3.4x. $17.5B Property types Apartment, 32% Industrial, 29% Office, 18% Retail, 15% Mixed Use, 1% Other, 5% 1 Data on slide is as of September 30, 2024. 2 Excludes loans managed by non-LFG third-party managers and fully amortizing loans. 3 Includes CMLs in LP funds. 4 Lincoln underwritten LTV is an internal estimate that considers the most recent financial reporting of each property and conservative cap rate assumptions. Portfolio LTV & DSC • Loan-to-values remain strong. • Strong debt service coverage reflecting recent property-level performance. • Diversified by property type, borrower, and geography. Portfolio Statistics Total CMLs Office Invested Asset % 15% 3% Avg Loan Size 2 $12M $17M Fixed Rate 100% 100% Remaining Term 8 Years 8 Years Debt Service Coverage 2.4x 2.3x Occupancy 93% 84% Credit Quality3 CM1 78% 82% CM2 22% 18% CM3-7 <1% <1% Property Type Book Value ($B) Debt Service Coverage Loan to Value (3rd Party Appraisal at Funding) Lincoln Underwritten Loan to Value4 Apartment $5.6 2.8x 44% 43% Industrial $5.0 2.2x 45% 49% Office $3.2 2.3x 43% 69% Retail $2.6 2.9x 41% 45% Other3 $0.9 2.5x 41% 43% Mixed Use $0.2 2.1x 47% 49% Portfolio $17.5 2.4x 44% 50%

14 Non-GAAP Financial Measures Appendix

15 Non-GAAP Financial Measures

16 Non-GAAP Financial Measures, Cont’d

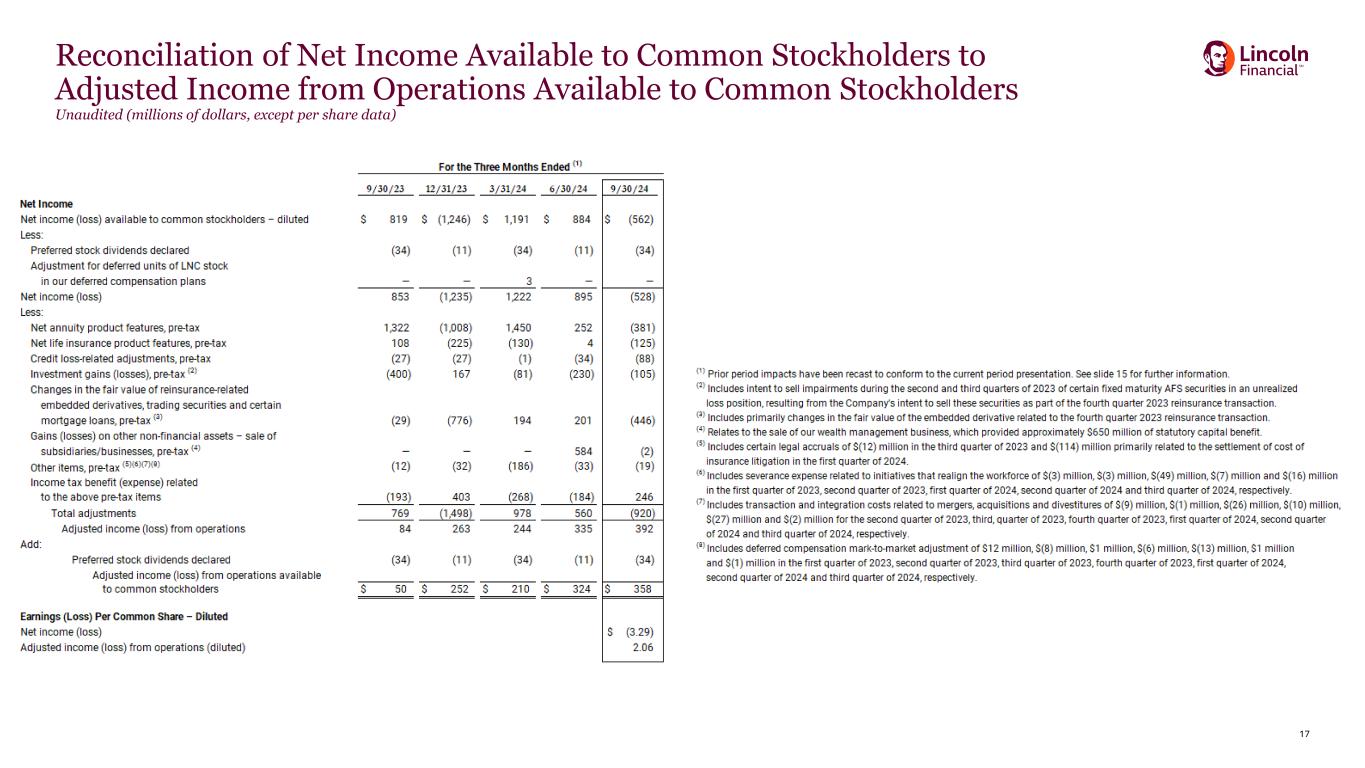

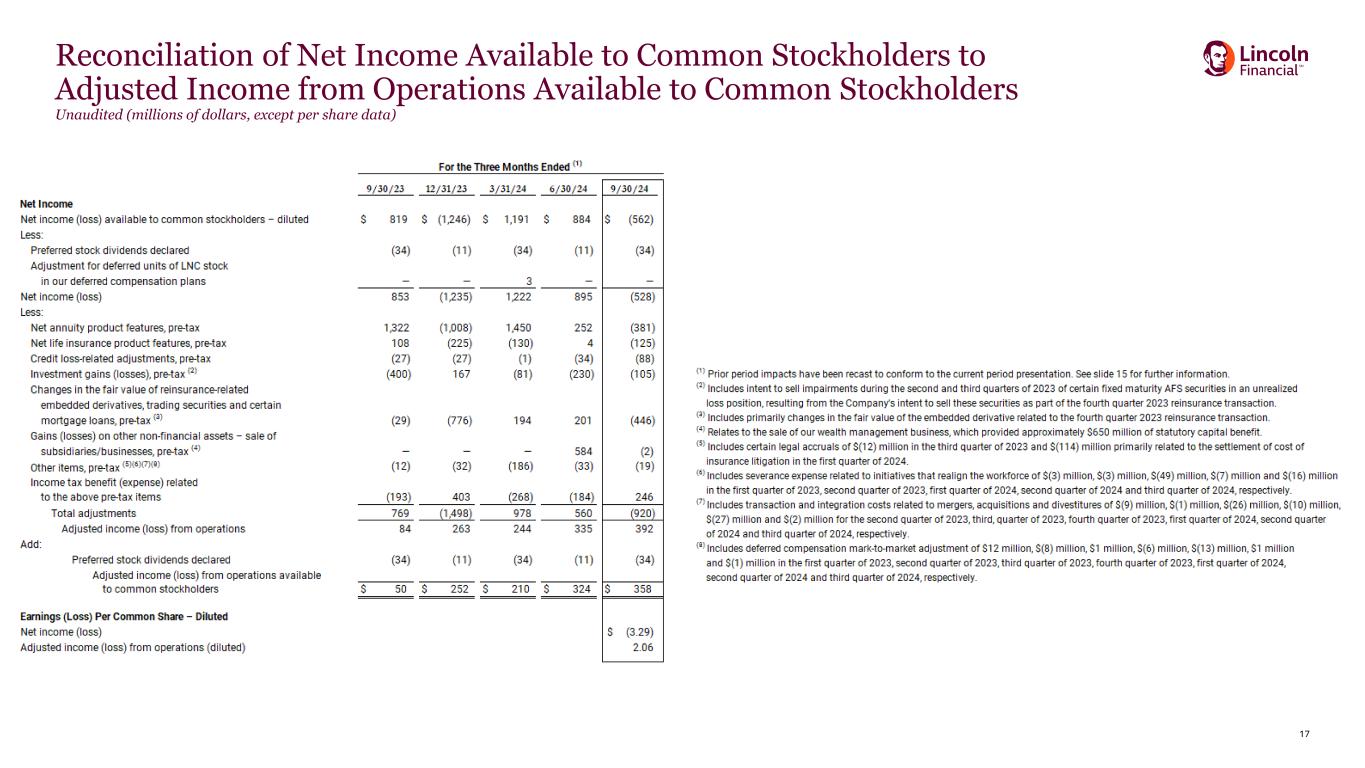

17 Reconciliation of Net Income Available to Common Stockholders to Adjusted Income from Operations Available to Common Stockholders Unaudited (millions of dollars, except per share data)

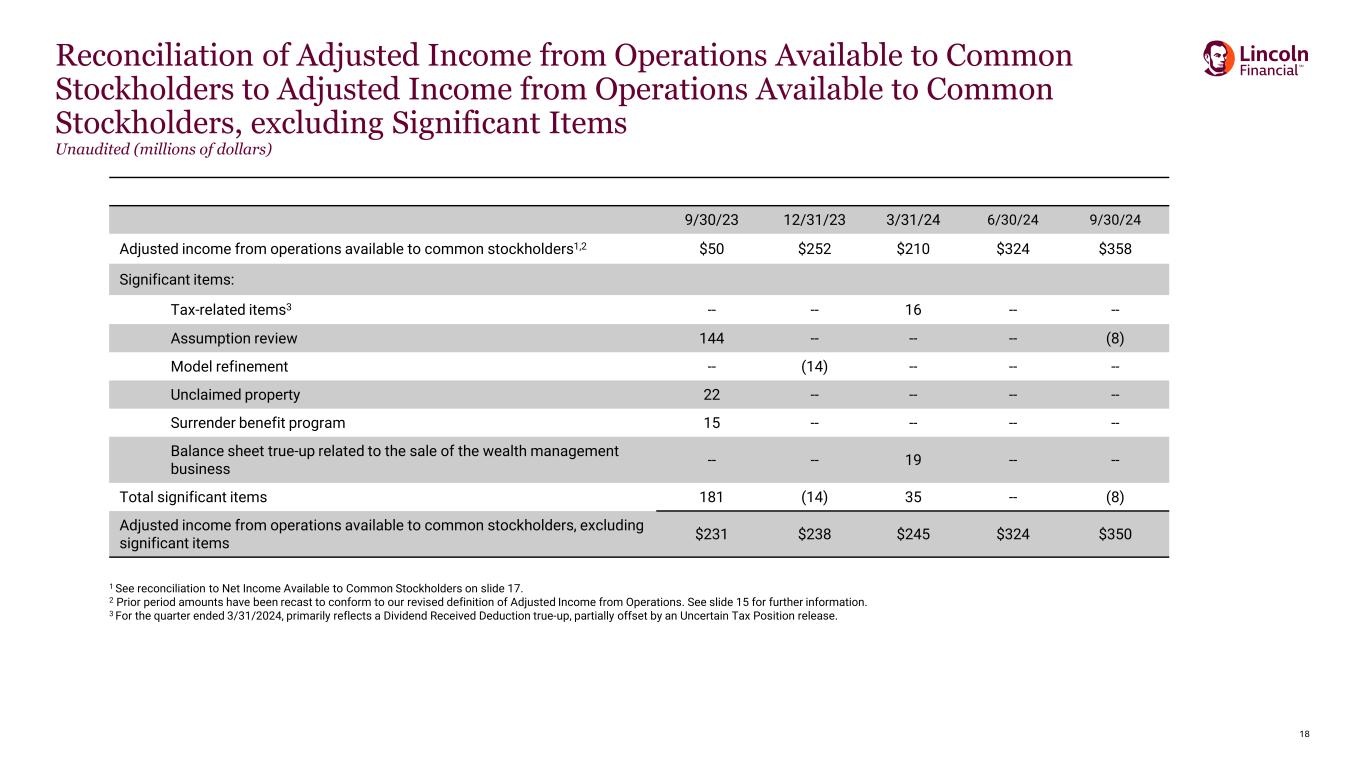

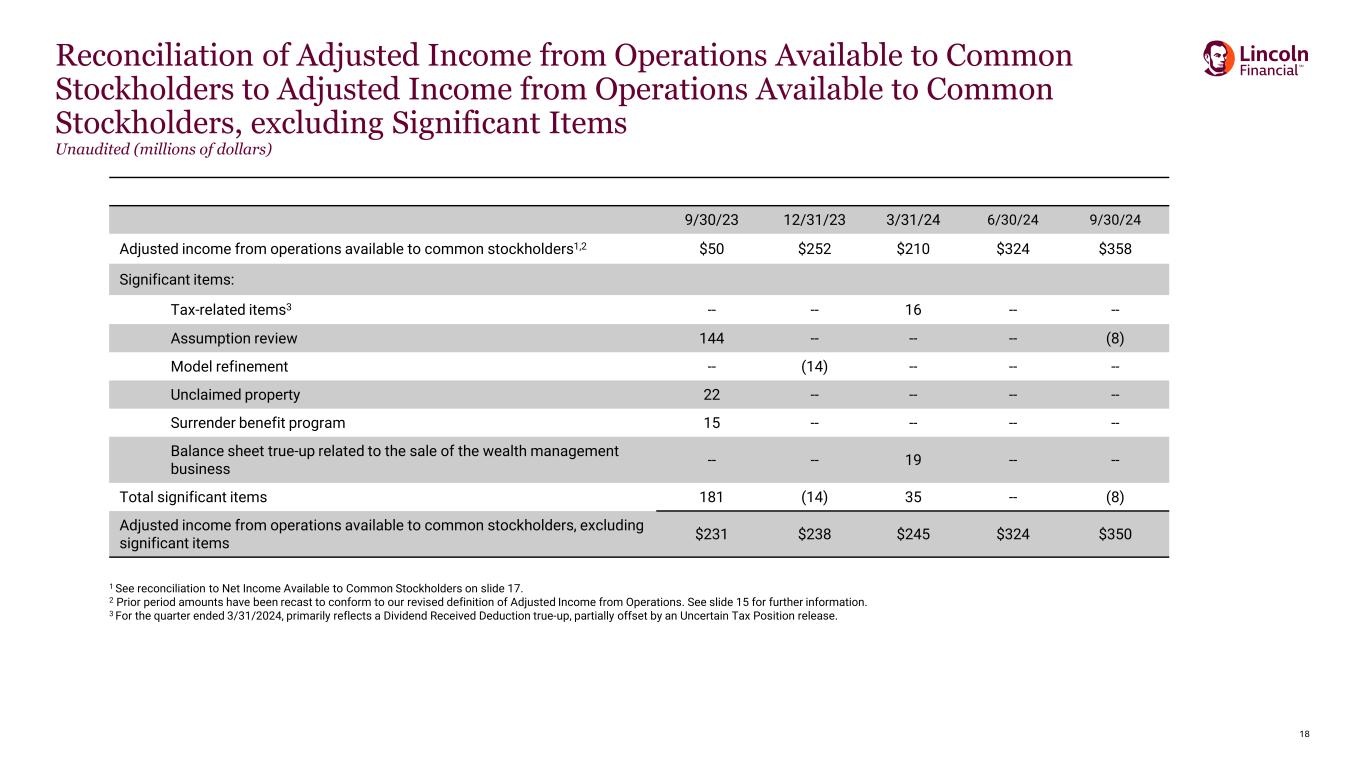

18 Reconciliation of Adjusted Income from Operations Available to Common Stockholders to Adjusted Income from Operations Available to Common Stockholders, excluding Significant Items Unaudited (millions of dollars) 9/30/23 12/31/23 3/31/24 6/30/24 9/30/24 Adjusted income from operations available to common stockholders1,2 $50 $252 $210 $324 $358 Significant items: Tax-related items3 -- -- 16 -- -- Assumption review 144 -- -- -- (8) Model refinement -- (14) -- -- -- Unclaimed property 22 -- -- -- -- Surrender benefit program 15 -- -- -- -- Balance sheet true-up related to the sale of the wealth management business -- -- 19 -- -- Total significant items 181 (14) 35 -- (8) Adjusted income from operations available to common stockholders, excluding significant items $231 $238 $245 $324 $350 1 See reconciliation to Net Income Available to Common Stockholders on slide 17. 2 Prior period amounts have been recast to conform to our revised definition of Adjusted Income from Operations. See slide 15 for further information. 3 For the quarter ended 3/31/2024, primarily reflects a Dividend Received Deduction true-up, partially offset by an Uncertain Tax Position release.

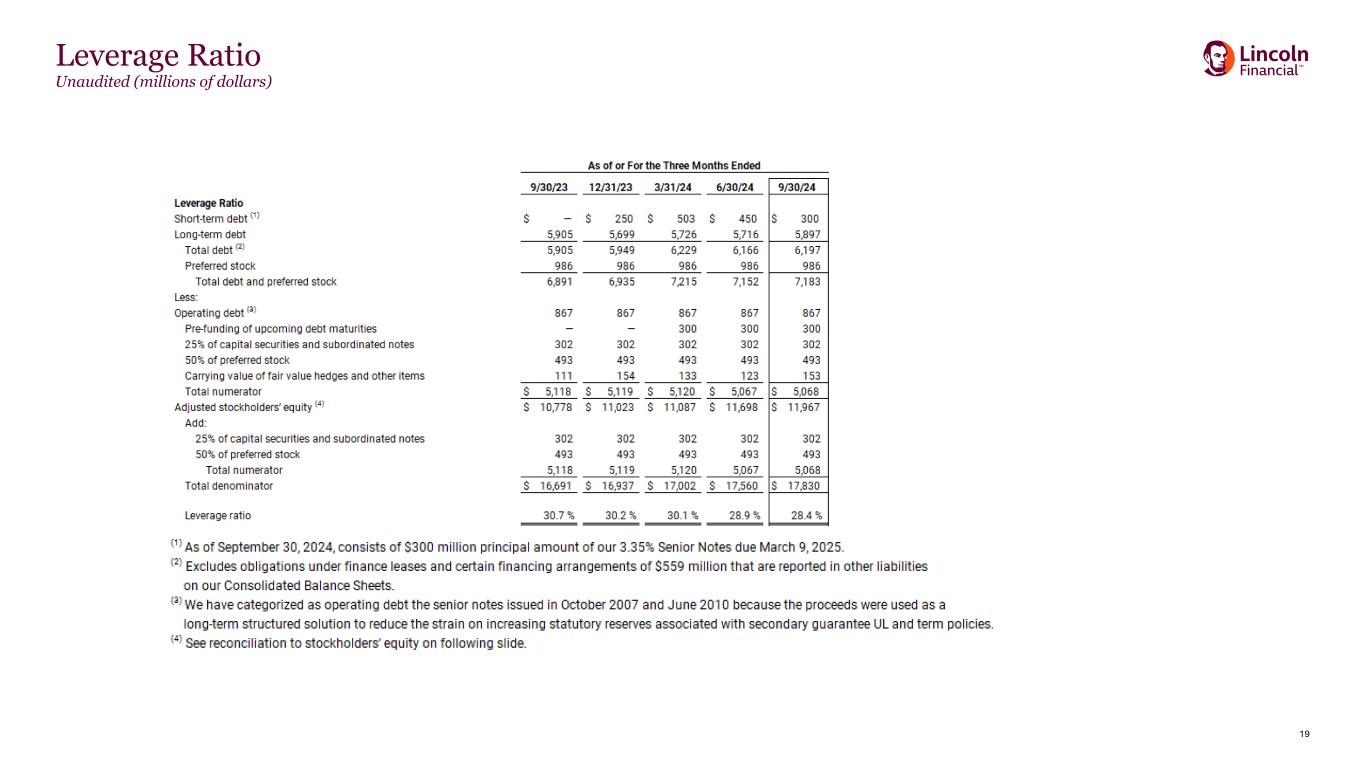

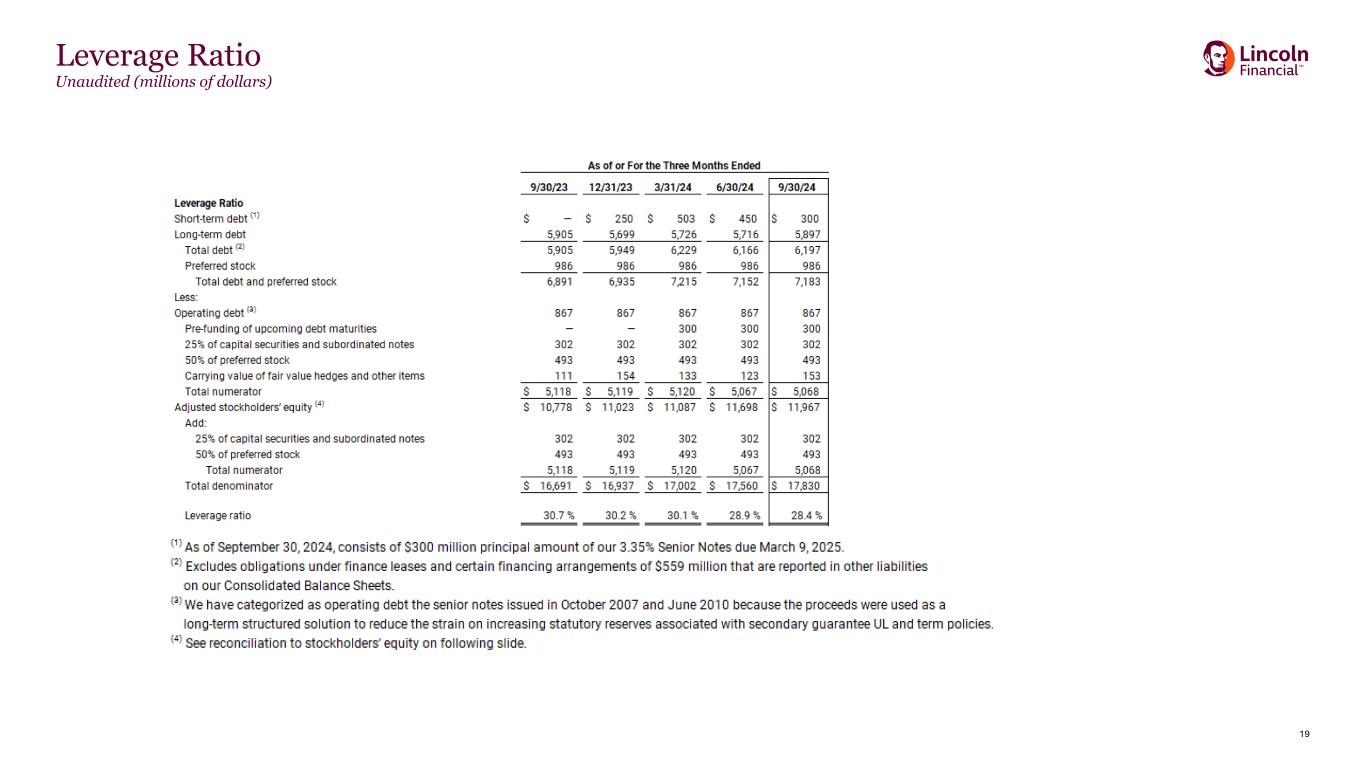

19 Leverage Ratio Unaudited (millions of dollars)

20 Reconciliation of Stockholders’ Equity to Adjusted Stockholders’ Equity Unaudited (millions of dollars)