Exhibit 99.2

| THE NEW LINCOLN FACT SHEET |

Lincoln Financial Group (NYSE: LNC) Lincoln Financial Group is the marketing name for Lincoln National Corporation (NYSE:LNC) and its affiliates. With headquarters in Philadelphia, Lincoln Financial Group has consolidated assets of $125 billion as of December 31, 2005, and had annual consolidated revenues of $5.5 billion in 2005. Beginning the second quarter of 2006, the company will offer: annuities; life, group life and disability insurance; 401(k) and 403(b) plans; savings plans; mutual funds; managed accounts; institutional investments; and comprehensive financial planning and advisory services. Individual products and services are distributed primarily through brokers, planners, agents and other intermediaries with wholesaling and marketing support | provided by Lincoln Financial Distributors. Group products and services are distributed primarily through financial advisors, employee benefit brokers, third party administrators and other employee benefit firms. Lincoln Financial Advisors offers Lincoln and non-proprietary products and advisory services through a national network of financial planners agents, and registered representatives. Other affiliates include: Delaware Investments, the marketing name for Delaware Management Holdings, Inc. and its subsidiaries; Lincoln Financial Media, which owns and operates three television stations, 18 radio stations, and the Lincoln Financial Sports production and syndication business; and Lincoln UK. For more information please visit www.LFG.com. |

Strategic Rationale

The combined organization has:

| v | A broader, more balanced product portfolio, with leadership positions in the U.S. life and annuity market: |

#2 in total life salesi #1 in UL salesi #5 in VUL salesi #5 in VA salesii | #9 in equity indexed annuity salesiii #5 in group disability salesiii #12 in group life salesiv #7 in employer sponsored (DC/retirement plan assets)v |

| v | Powerful distribution organization with greater penetration. |

| § | Lincoln has a multi-channel platform comprised of financial planning, general agency and wholesale distribution organizations. |

| § | Complementary distribution networks with little overlap, creating a unique franchise. |

| § | Strengthened relationships with key distributors and strategic partners. |

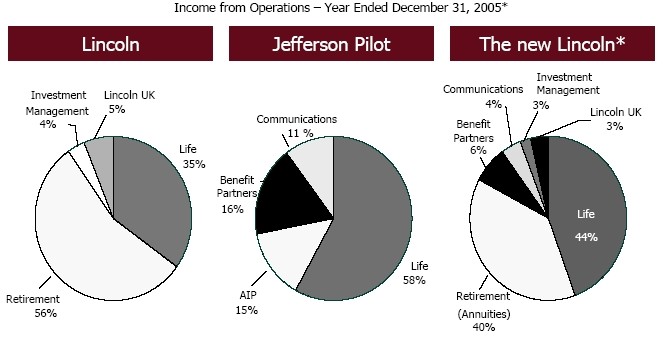

| v | Improved earnings diversification and strong financial flexibility. |

| § | Complementary product lines include Lincoln’s strength in life and annuities and its leading 401(k) and 403(b) offerings and Jefferson Pilot’s strength in life and fixed annuities, including equity indexed annuities, group life and disability, providing a more balanced business mix; Jefferson Pilot’s successful communications business (now Lincoln Financial Media) adds further earnings diversification. |

| § | The New Lincoln has greater scale, strong capital flexibility, an attractive risk profile and anticipated continued ratings as a strong AA company. |

| v | Significant value creation opportunities. Lincoln expects: |

| § | Annualized cost synergies of approximately $180 million, pre-tax, by the third anniversary of the merger. |

| § | The merger to be accretive to the combined company’s income from operations per share in the first year and building thereafter, excluding one-time costs. |

| § | To benefit from revenue enhancement opportunities across business units. |

| § | Its combined management team’s proven integration track record to provide additional results. |

Transaction Summary |

Company Name | Will operate under the brand name Lincoln Financial Group and will be NYSE-listed as “LNC” |

Locations | Lincoln will be headquartered in Philadelphia, PA. Greensboro, NC, and Fort Wayne, IN, will be centers of operations for the life and annuity businesses, respectively. Other significant operations will be located in Hartford, CT; Concord, NH; Charlotte, NC; and Omaha, NE. |

Exchange Ratio | 1.0906 Lincoln shares for each Jefferson Pilot share or $55.96 in cash, subject to proration |

Closing Date | April 3, 2006 |

Required Approvals | Shareholder, regulatory, antitrust, and customary closing conditions have all been met |

Board of Directors | 15 member Board of Directors, consisting of 8 Lincoln and 7 Jefferson Pilot (including lead director) representatives |

Key Financial Metrics |

| | Lincoln | Jefferson Pilot | Combinedvi |

2005 Income from Operationsvii | $852 million | $572 million | $1,424 million |

Market Cap at 3/01/06 | $9.9 billion | $8.1 billion | $16.2 billionviii |

Book Value as of 12/31/05 (excludes AOCI) | $5.9 billion | $3.5 billion | $11.5 billionix |

2005 Statutory Capital, Surplus + AVR | $3.7 billion | $2.1 billion | $5.8 billion |

2005 Revenue | $5.5 billion | $4.2 billion | $9.7 billion |

Assets at 12/31/05 | $125 billion | $36 billion | $161 billion |

Agency Ratings (S&P/Fitch/A.M. Best) | AA-/AA/A+ | AAA/AA+/A++ | AA/AA/A+x |

The Companies At-A-Glance

* Based on combined income from operations; Excludes Corporate and Other

Key Products | Life | Annuities | Communications |

| | - Universal Life - Variable Universal Life - Term Life | - Individual Variable Annuities - Individual Fixed Annuities - Equity Indexed Annuities | - Broadcasting |

| | Investments | Group | |

| | - Mutual Funds - Institutional Investments - Asset Management/ Individual Managed Accounts | - Group Variable Annuities - Group Life - Group Disability - Group Dental - COLI/BOLI - 401(k)/403(b) | |

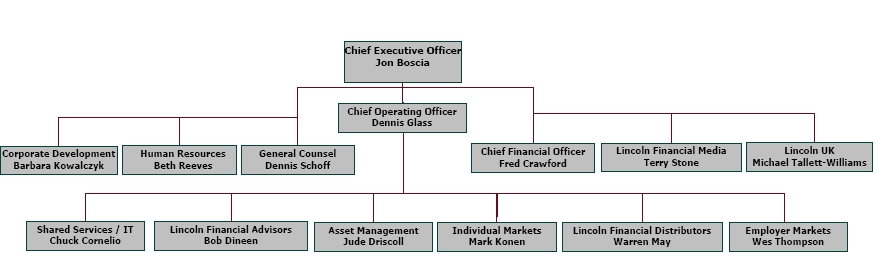

The New Lincoln’s Organization Chart |

For additional information, please access our joint merger website at www.lfgjpmerger.com or go to www.lfg.com

Forward-Looking Statements—Cautionary Language

This document may contain information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends in operations and financial results.

Any or all forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining our actual future results. These statements are based on current expectations and the current economic environment. They involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance. Actual results could differ materially from those expressed or implied in the forward-looking statements. Among factors that could cause actual results to differ materially are:

| · | Problems arising with the ability to successfully integrate our and Jefferson-Pilot Corporation’s (“Jefferson-Pilot”) businesses, which may affect our ability to operate as effectively and efficiently as expected or to achieve the expected synergies from the merger or to achieve such synergies within our expected timeframe; |

| · | Legislative, regulatory or tax changes, both domestic and foreign, that affect the cost of, or demand for, our products, the required amount of reserves and/or surplus, or otherwise affect our ability to conduct business, including changes to statutory reserves and/or risk-based capital requirements related to secondary guarantees under universal life and variable annuity products such as Actuarial Guideline 38; restrictions on revenue sharing and 12b-1 payments; and the potential for U.S. Federal tax reform; |

| · | The initiation of legal or regulatory proceedings against LNC or its subsidiaries and the outcome of any legal or regulatory proceedings, such as: (a) adverse actions related to present or past business practices common in businesses in which LNC and its subsidiaries compete; (b) adverse decisions in significant actions including, but not limited to, actions brought by federal and state authorities, and extra-contractual and class action damage cases; (c) new decisions that result in changes in law; and (d) unexpected trial court rulings; |

| · | Changes in interest rates causing a reduction of investment income, the margins of our fixed annuity and life insurance businesses and demand for our products; |

| · | A decline in the equity markets causing a reduction in the sales of our products, a reduction of asset fees that LNC charges on various investment and insurance products, an acceleration of amortization of deferred acquisition costs (“DAC”), the value of business acquired (“VOBA”), deferred sales inducements (“DSI”) and deferred front-end loads (“DFEL”) and an increase in liabilities related to guaranteed benefit features of our variable annuity products; |

| · | Ineffectiveness of our various hedging strategies used to offset the impact of declines in the equity markets; |

| · | A deviation in actual experience regarding future persistency, mortality, morbidity, interest rates or equity market returns from our assumptions used in pricing our products, in establishing related insurance reserves, and in the amortization of intangibles that may result in an increase in reserves and a decrease in net income; |

| · | Changes in accounting principles generally accepted in the U.S. (“GAAP”) that may result in unanticipated changes to our net income; |

| · | Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations, and the adverse impact such action may have on our ability to raise capital and on our liquidity and financial condition; |

| · | Lowering of one or more of the insurer financial strength ratings of our insurance subsidiaries, and the adverse impact such action may have on the premium writings, policy retention, and profitability of our insurance subsidiaries; |

| · | Significant credit, accounting, fraud or corporate governance issues that may adversely affect the value of certain investments in the portfolios of our companies requiring that LNC realize losses on such investments; |

| · | The impact of acquisitions and divestitures, restructurings, product withdrawals and other unusual items, including our ability to integrate acquisitions and to obtain the anticipated results and synergies from acquisitions; |

| · | The adequacy and collectibility of reinsurance that we have purchased; |

| · | Acts of terrorism or war that may adversely affect our businesses and the cost and availability of reinsurance; |

| · | Competitive conditions, including pricing pressures, new product offerings and the emergence of new competitors, that may affect the level of premiums and fees that we can charge for our products; |

| · | The unknown impact on our business resulting from changes in the demographics of our client base, as aging baby-boomers move from the asset-accumulation stage to the asset-distribution stage of life; |

| · | Loss of key management, portfolio managers in the Investment Management segment, financial planners or wholesalers; and |

| · | Changes in general economic or business conditions, both domestic and foreign, that may be less favorable than expected and may affect foreign exchange rates, premium levels, claims experience, the level of pension benefit costs and funding, and investment results. |

The risks included here are not exhaustive. We describe these risks and uncertainties in greater detail under the caption “Risk Factors” below and in our recent Forms 10-K and 8-K and other documents filed with the Securities and Exchange Commission (the “SEC”). Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors.

Further, it is not possible to assess the impact of all risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, we disclaim any current intention to update any forward-looking statements to reflect events or circumstances that occur after the date of this document.

___________________

| i | LIMRA - ranked by annualized YTD 4Q05 premium dollars |

| ii | VARDS - ranked by 2005 new sales |

| iii | LIMRA - ranked by 2005 new sales |

| iv | LIMRA - ranked by YTD 3Q05 new sales |

| v | Pension and Investments, November 2005 - Public life insurers ranked by assets |

| vi | Combined financial data are estimates and have been calculated by adding similar category information from the companies’ separate filings with the SEC. |

| vii | Income from operations calculated before accounting change, discontinued operations, restructuring charges and realized gains/(losses). |

| viii | Market cap reflects estimated post-merger LNC market cap, including issuance of additional shares resulting from completion of the merger. |

| ix | The combined book value is based on management’s estimate of implied consideration and transaction structure. |

| x | Anticipated ratings |