Dennis Glass | President and Chief Executive Officer Strategic overview 2017 Conference for Analysts, Investors and Bankers Exhibit 99.1

consistently differentiating ourselves in the marketplace Proven ability to successfully respond to industry headwinds Strong, resilient, repeatable financial results driving shareholder value Powerful retail franchise that is growing today with attractive long-term opportunities Leveraging technology to meet customer expectations and fuel further growth

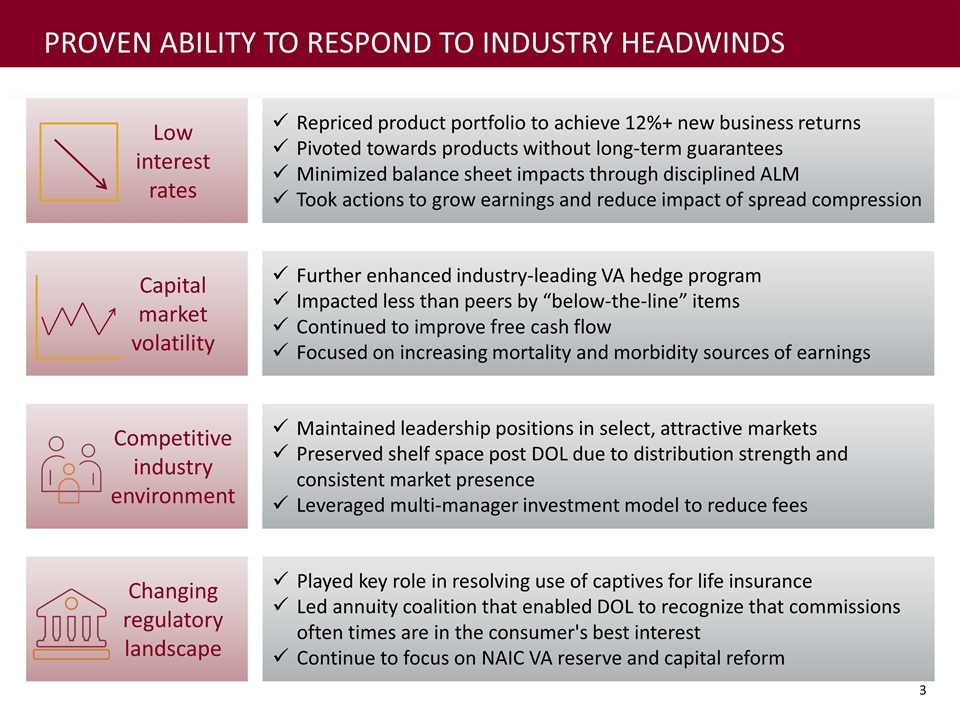

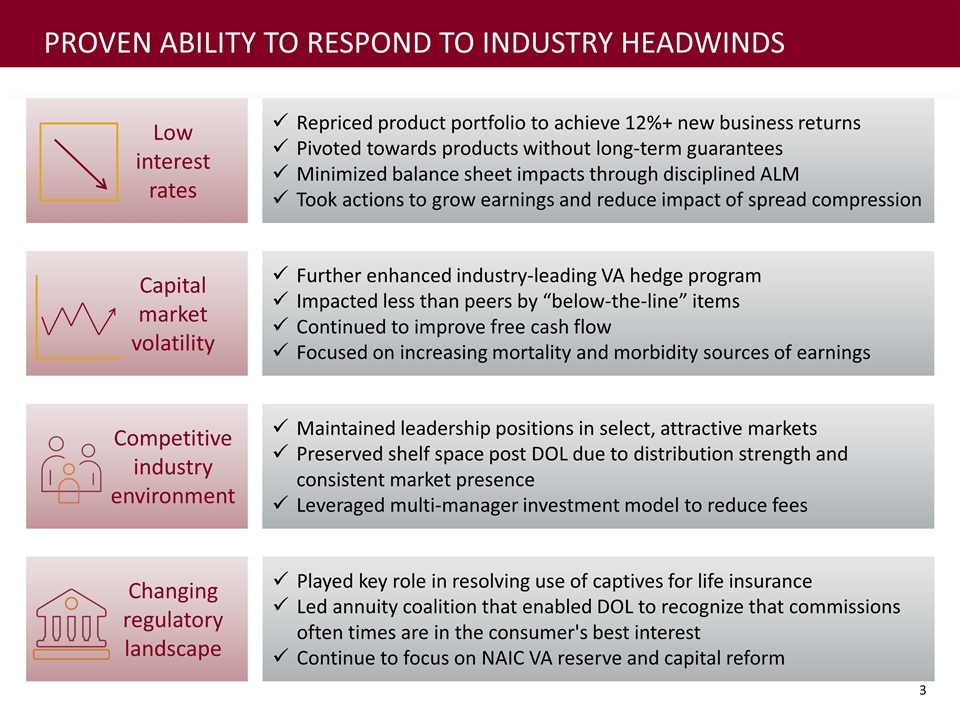

Low interest rates Capital market volatility Competitive industry environment Changing regulatory landscape Repriced product portfolio to achieve 12%+ new business returns Pivoted towards products without long-term guarantees Minimized balance sheet impacts through disciplined ALM Took actions to grow earnings and reduce impact of spread compression Further enhanced industry-leading VA hedge program Impacted less than peers by “below-the-line” items Continued to improve free cash flow Focused on increasing mortality and morbidity sources of earnings Maintained leadership positions in select, attractive markets Preserved shelf space post DOL due to distribution strength and consistent market presence Leveraged multi-manager investment model to reduce fees Played key role in resolving use of captives for life insurance Led annuity coalition that enabled DOL to recognize that commissions often times are in the consumer's best interest Continue to focus on NAIC VA reserve and capital reform Proven ability to respond to industry headwinds

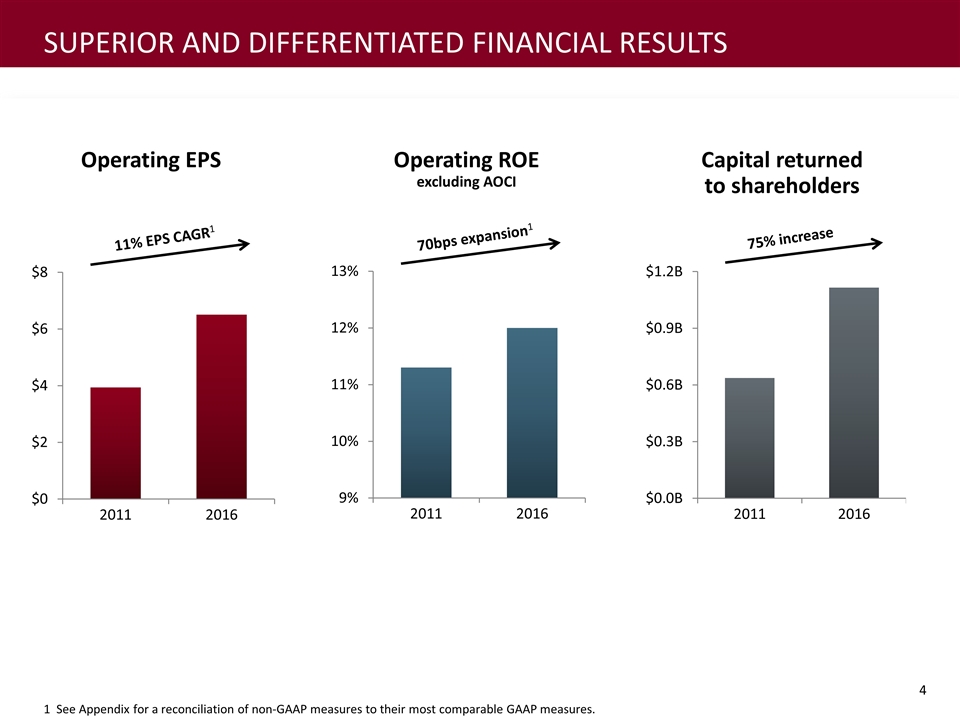

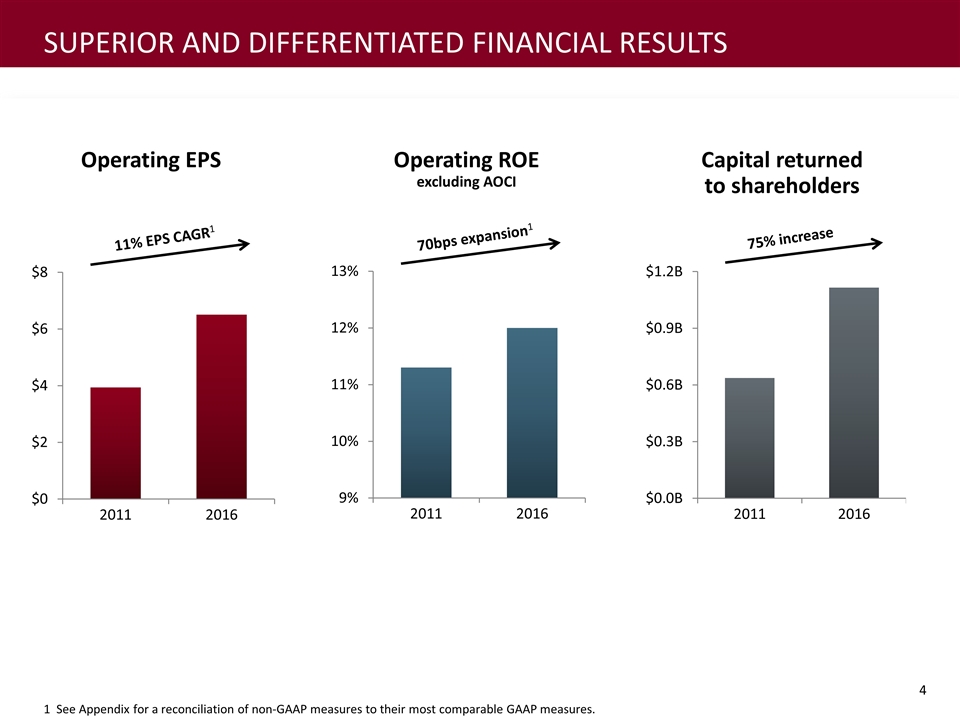

70bps expansion1 Operating EPS z Operating ROE excluding AOCI z 1 See Appendix for a reconciliation of non-GAAP measures to their most comparable GAAP measures. 11% EPS CAGR1 Capital returned to shareholders 75% increase Superior and differentiated financial results

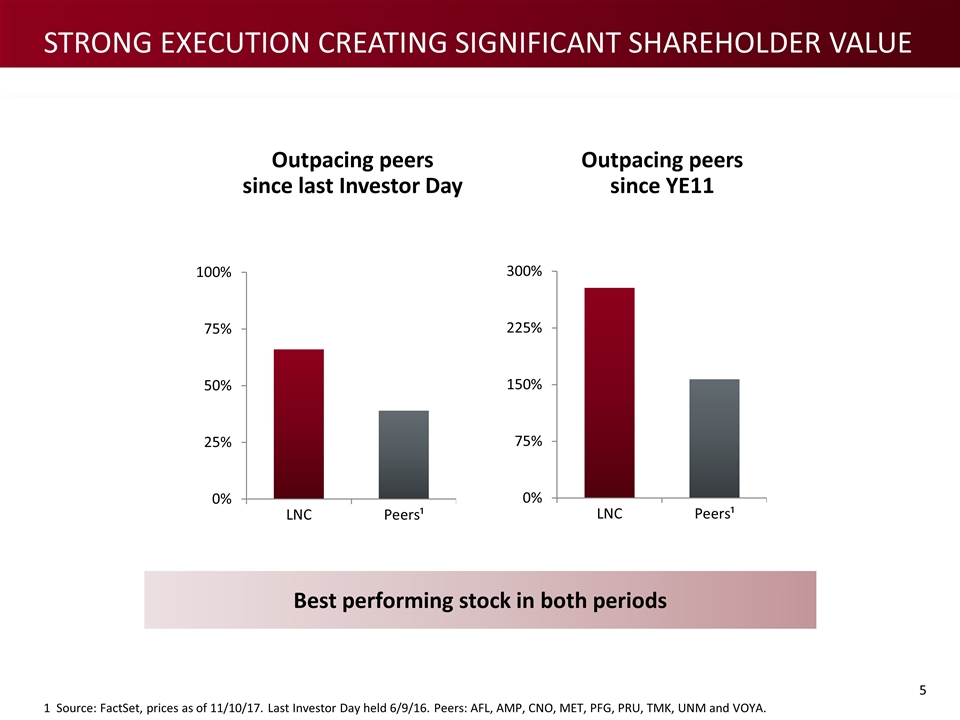

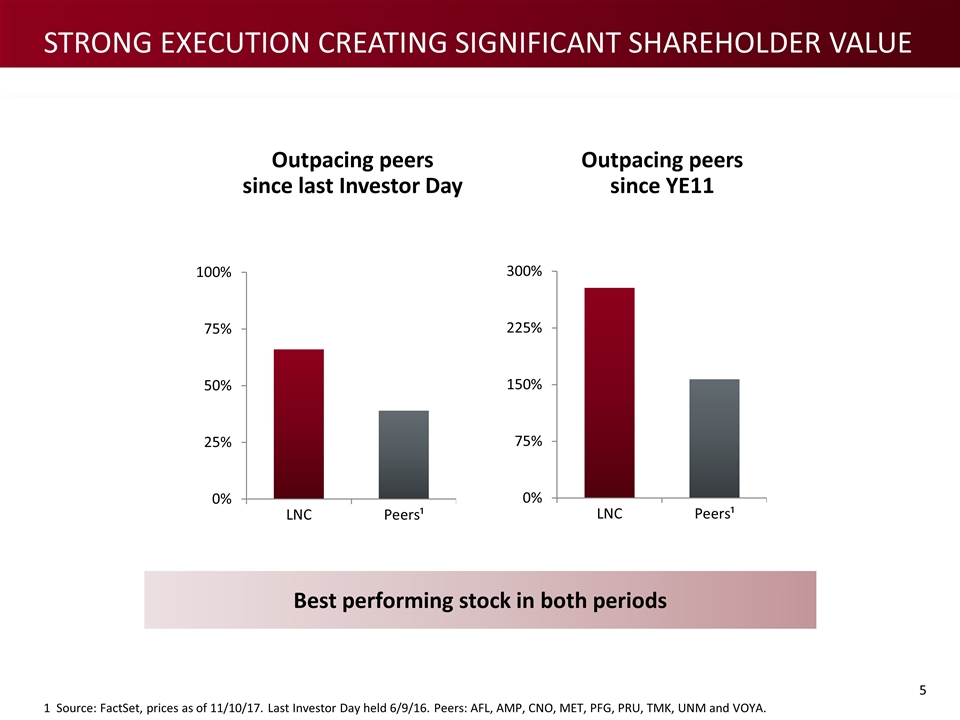

Strong execution creating significant shareholder value Outpacing peers since last Investor Day Outpacing peers since YE11 1 Source: FactSet, prices as of 11/10/17. Last Investor Day held 6/9/16. Peers: AFL, AMP, CNO, MET, PFG, PRU, TMK, UNM and VOYA. Best performing stock in both periods

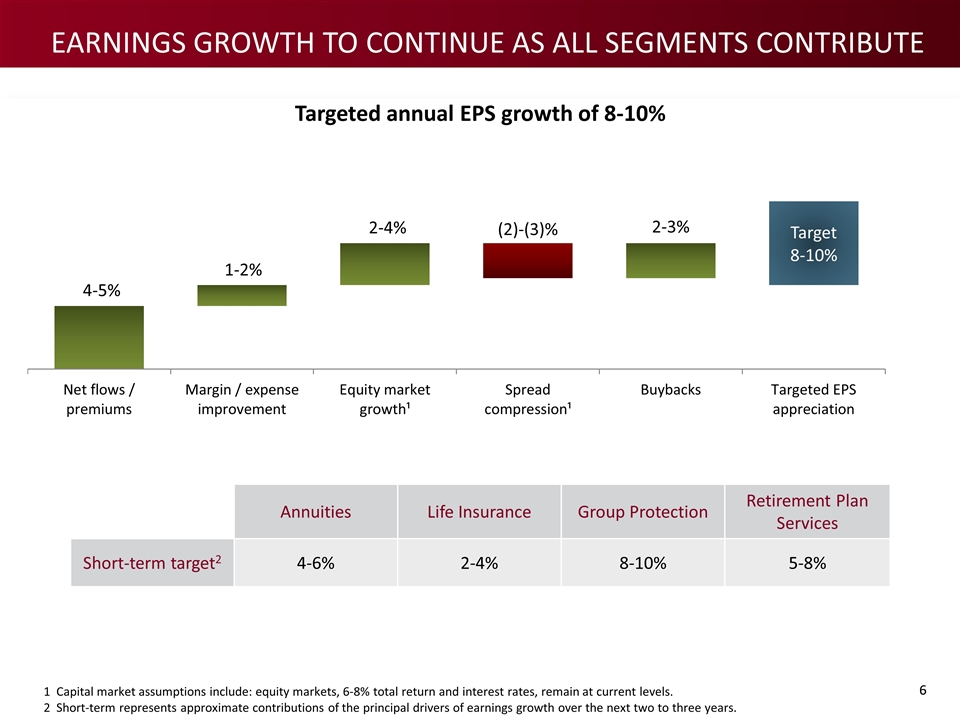

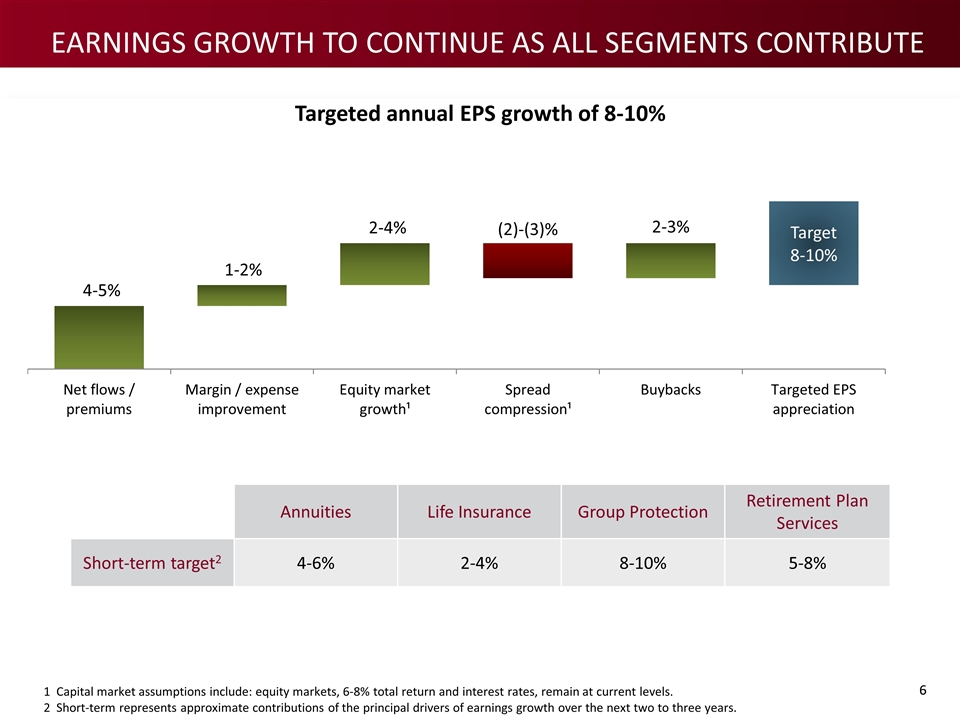

Targeted annual EPS growth of 8-10% 1 Capital market assumptions include: equity markets, 6-8% total return and interest rates, remain at current levels. 2 Short-term represents approximate contributions of the principal drivers of earnings growth over the next two to three years. earnings growth to continue as All segments contribute Annuities Life Insurance Group Protection Retirement Plan Services Short-term target2 4-6% 2-4% 8-10% 5-8%

Leading distribution capabilities 700+ wholesalers Wholesale and worksite Diversified, innovative and multiple solutions across our portfolio Annuities Life Insurance Group Protection Retirement Plan Services Comprehensive set of retail products Exclusively independent distribution Distribution strength and broad set of solutions create significant growth opportunities Broad and deep shelf space Multiple channels High net worth annuity Gen X and millennial markets Employee-paid group benefits Mid-large corporate and government Mass affluent annuity High net worth life Employer-paid group benefits Small corporate and healthcare High growth Emerging Powerful Retail franchise Targeting High-Growth Segments

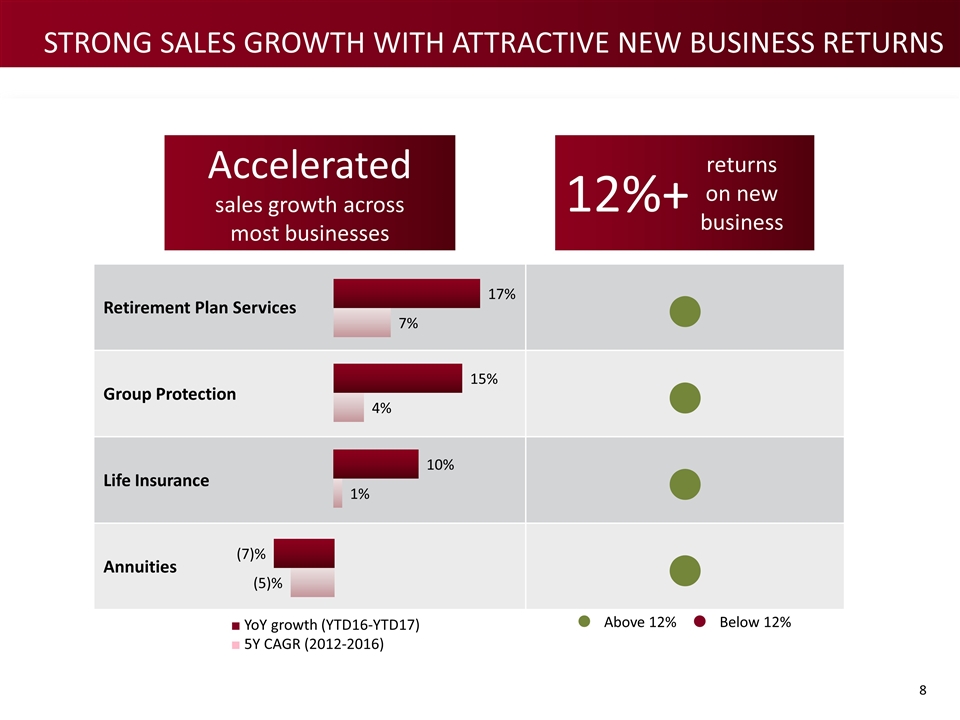

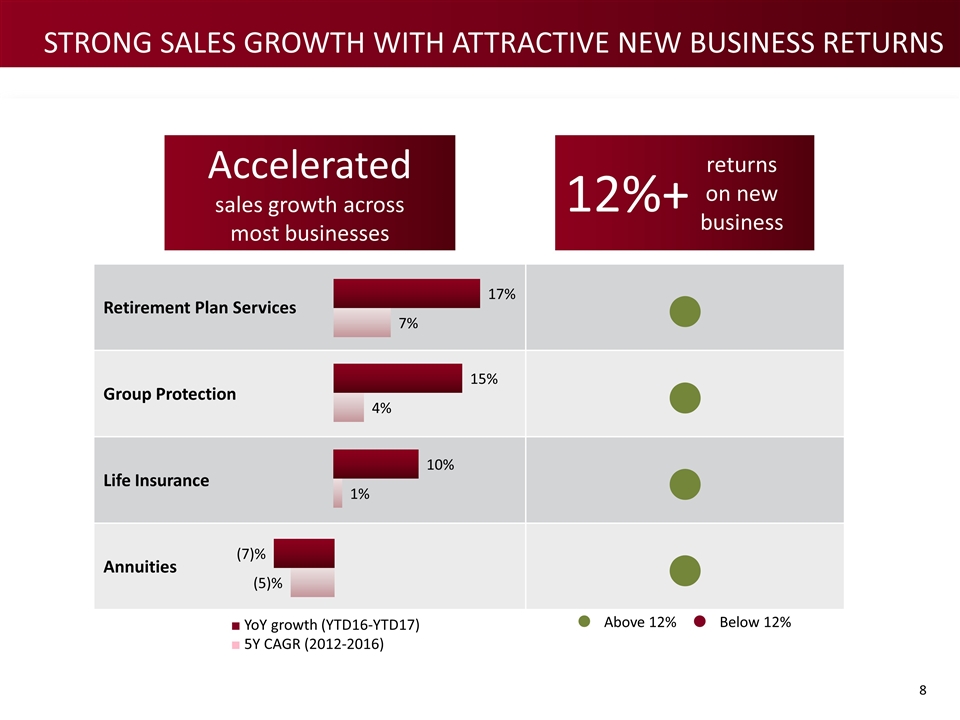

Retirement Plan Services ● Group Protection ● Life Insurance ● Annuities ● returns on new business 12%+ ˜ Above 12% ˜ Below 12% Accelerated sales growth across most businesses ■ YoY growth (YTD16-YTD17) ■ 5Y CAGR (2012-2016) Strong Sales growth with attractive new business returns

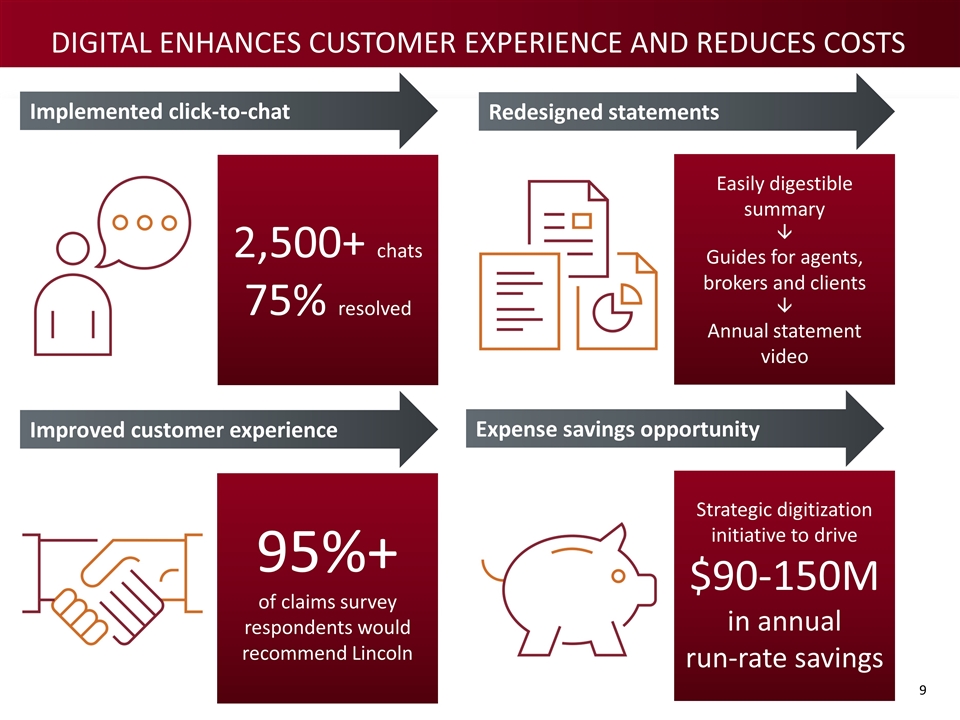

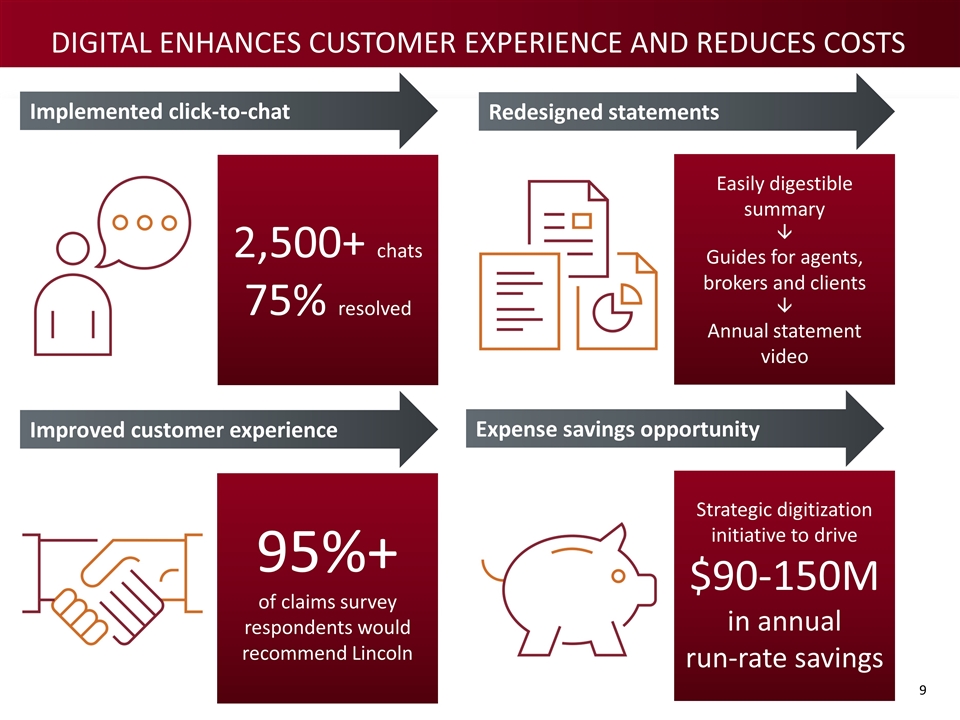

2,500+ chats 75% resolved Implemented click-to-chat 95%+ of claims survey respondents would recommend Lincoln Strategic digitization initiative to drive $90-150M in annual run-rate savings Improved customer experience Easily digestible summary â Guides for agents, brokers and clients â Annual statement video Redesigned statements Expense savings opportunity Digital Enhances Customer experience and reduces costs

Distribution 2017 Conference for Analysts, Investors and Bankers Will Fuller | President, Annuity Solutions, Lincoln Financial Distributors and Lincoln Financial Network

Distribution OUR WHOLESALE, WORKSITE AND RETAIL DISTRIBUTION FRANCHISES ARE A COMPETITIVE ADVANTAGE Consistent market presence allows us to sell through business cycles Proven ability to be a leader in our U.S. retail products supported by our strategic partner focus Leveraging best-in-class distribution to adapt to changes and win Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview

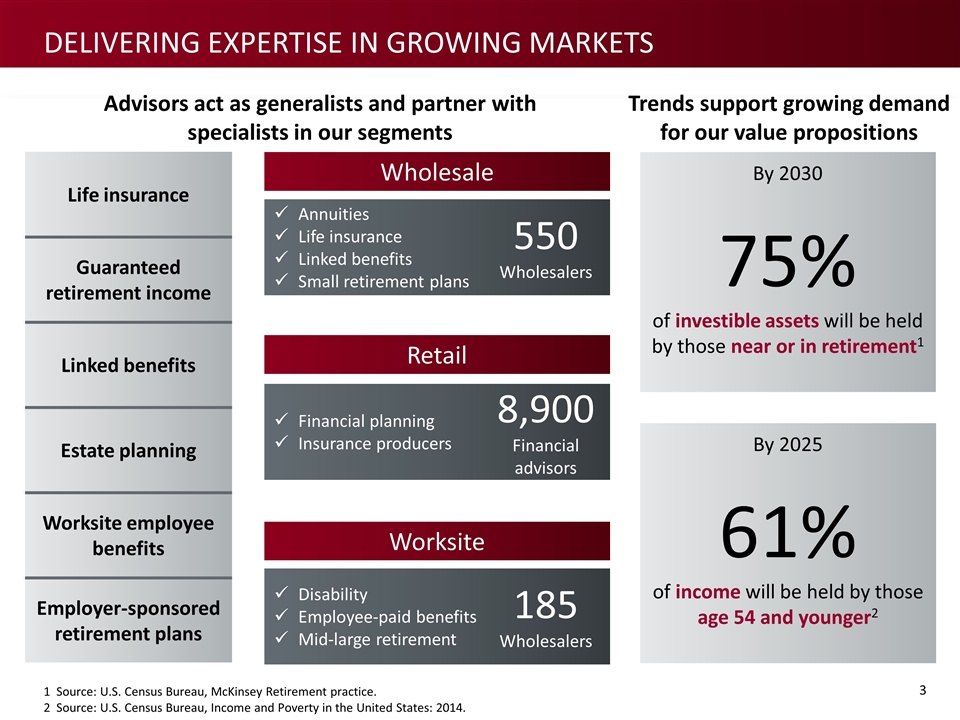

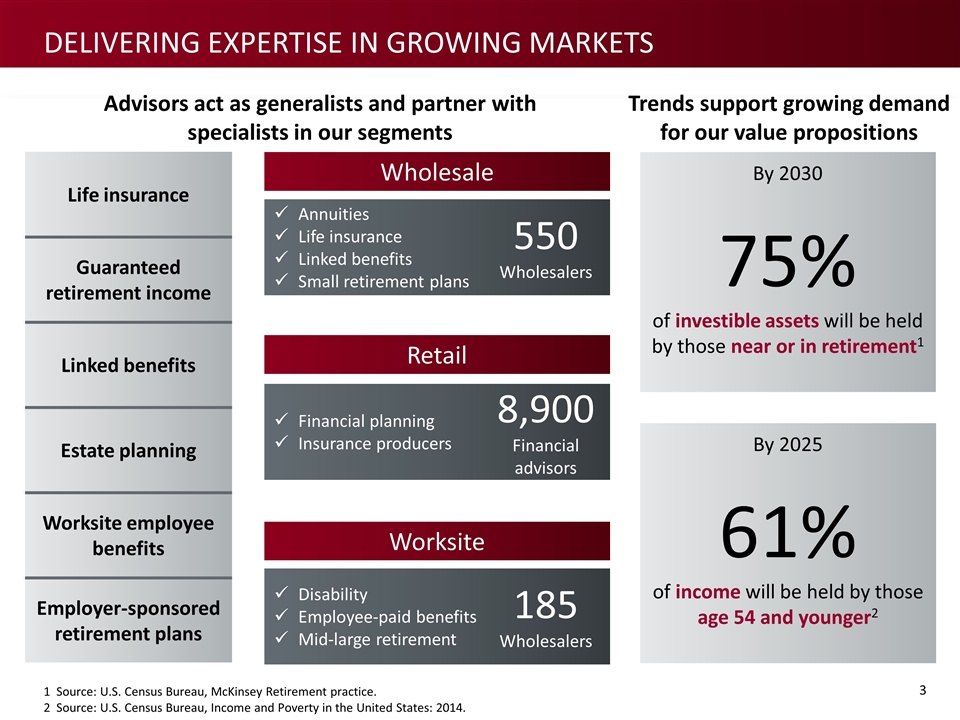

Delivering expertise in growing markets Advisors act as generalists and partner with specialists in our segments Worksite Disability Employee-paid benefits Mid-large retirement 185 Wholesalers Retail Financial planning Insurance producers 8,900 Financial advisors Wholesale Annuities Life insurance Linked benefits Small retirement plans 550 Wholesalers Trends support growing demand for our value propositions 1 Source: U.S. Census Bureau, McKinsey Retirement practice. 2 Source: U.S. Census Bureau, Income and Poverty in the United States: 2014. Life insurance Guaranteed retirement income Linked benefits Estate planning Worksite employee benefits Employer-sponsored retirement plans By 2030 75% of investible assets will be held by those near or in retirement1 By 2025 61% of income will be held by those age 54 and younger2

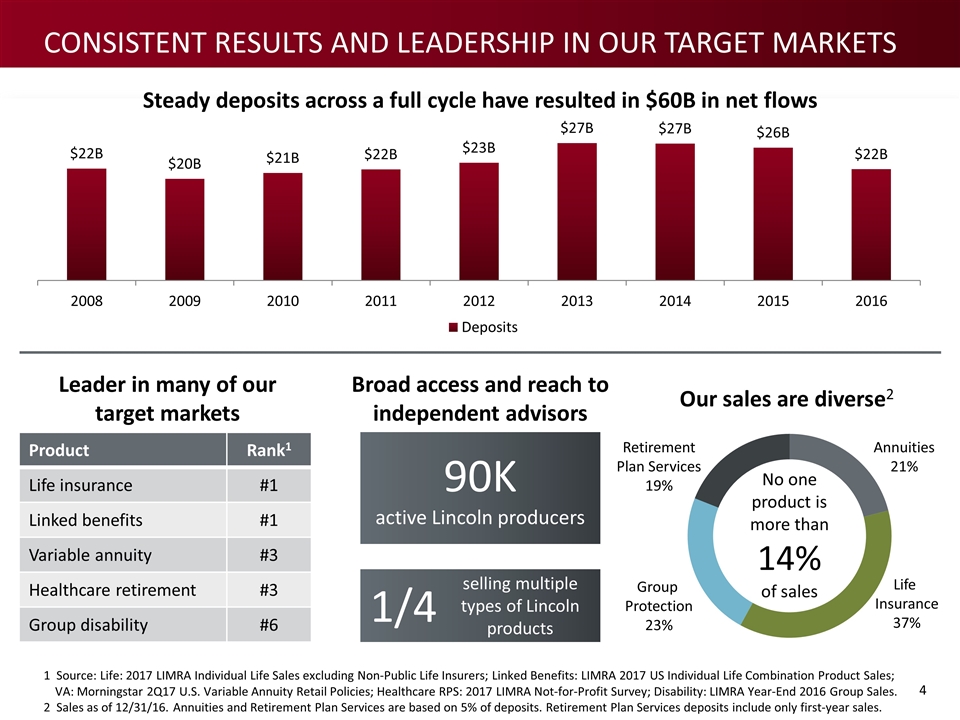

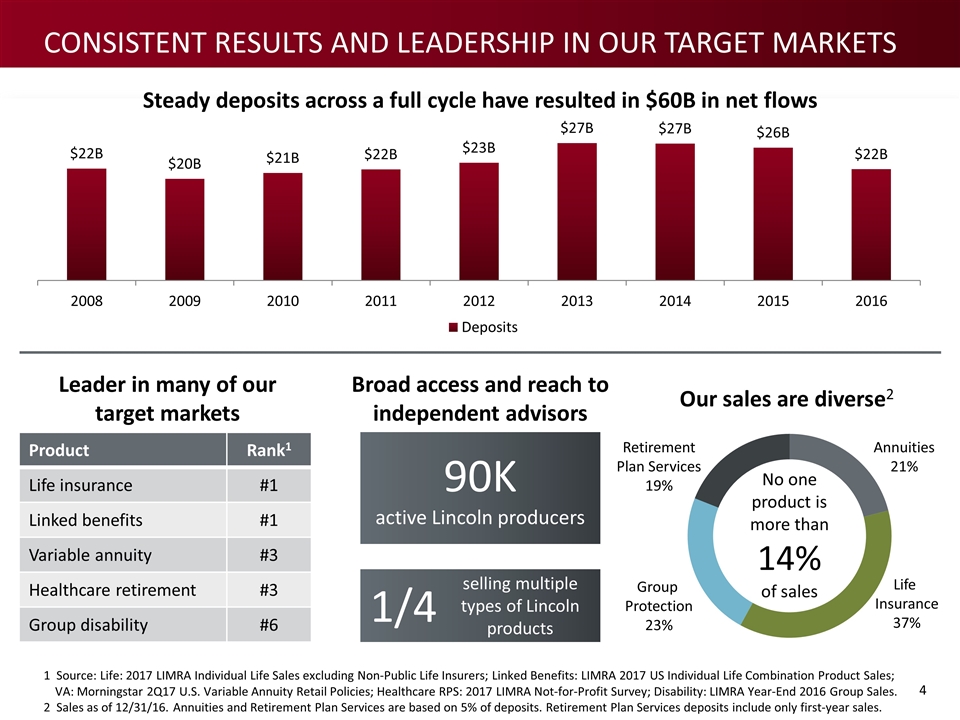

Consistent results and leadership in our target markets Product Rank1 Life insurance #1 Linked benefits #1 Variable annuity #3 Healthcare retirement #3 Group disability #6 Leader in many of our target markets Broad access and reach to independent advisors Our sales are diverse2 90K active Lincoln producers 1/4 selling multiple types of Lincoln products Life Insurance 37% Annuities 21% Group Protection 23% Retirement Plan Services 19% Steady deposits across a full cycle have resulted in $60B in net flows No one product is more than 14% of sales 1 Source: Life: 2017 LIMRA Individual Life Sales excluding Non-Public Life Insurers; Linked Benefits: LIMRA 2017 US Individual Life Combination Product Sales; VA: Morningstar 2Q17 U.S. Variable Annuity Retail Policies; Healthcare RPS: 2017 LIMRA Not-for-Profit Survey; Disability: LIMRA Year-End 2016 Group Sales. 2 Sales as of 12/31/16. Annuities and Retirement Plan Services are based on 5% of deposits. Retirement Plan Services deposits include only first-year sales.

Our strategic partner strategy drives our success Distribution is aligned to various business models to reach consumers2 LFD sales mix is diversified across multiple channels and strategic partners Focused on largest and still growing independent distribution channel1 1 Source: 2016 LIMRA Annuity Sales; 2016 LIMRA Life Insurance Sales. ■ % of industry sales from independent distribution Industry leaders Opportunity to sell full product portfolio Shelf space for product expansion Access to best producers 80% of sales come from relationships with key strategic partners 45% Insurance brokerage 21% Wirehouse and regional broker dealers 26% Independent broker dealers 8% Banks

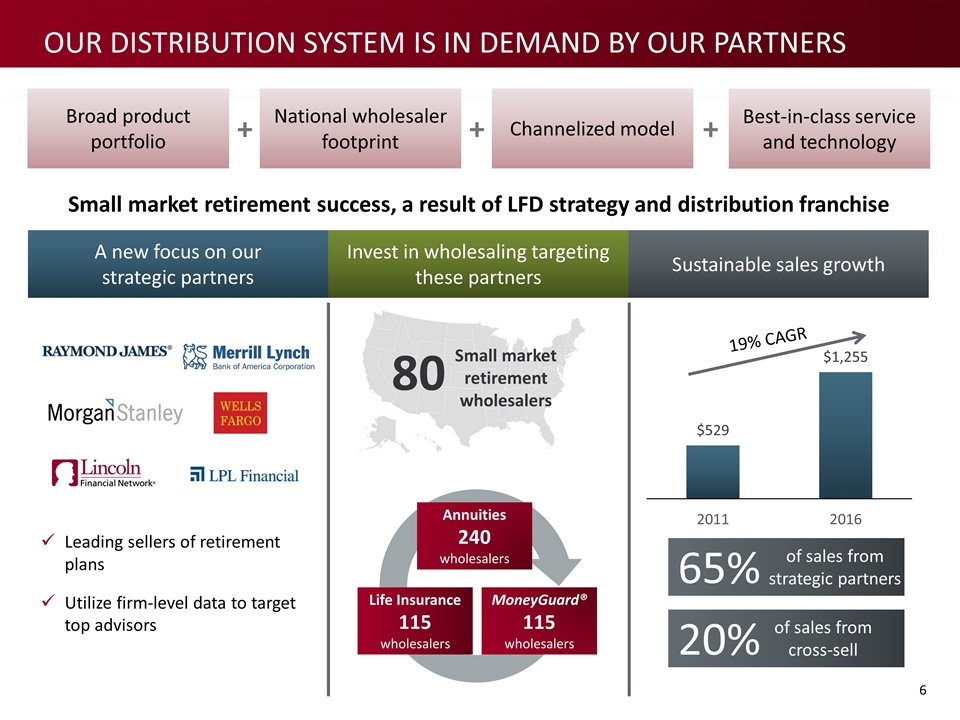

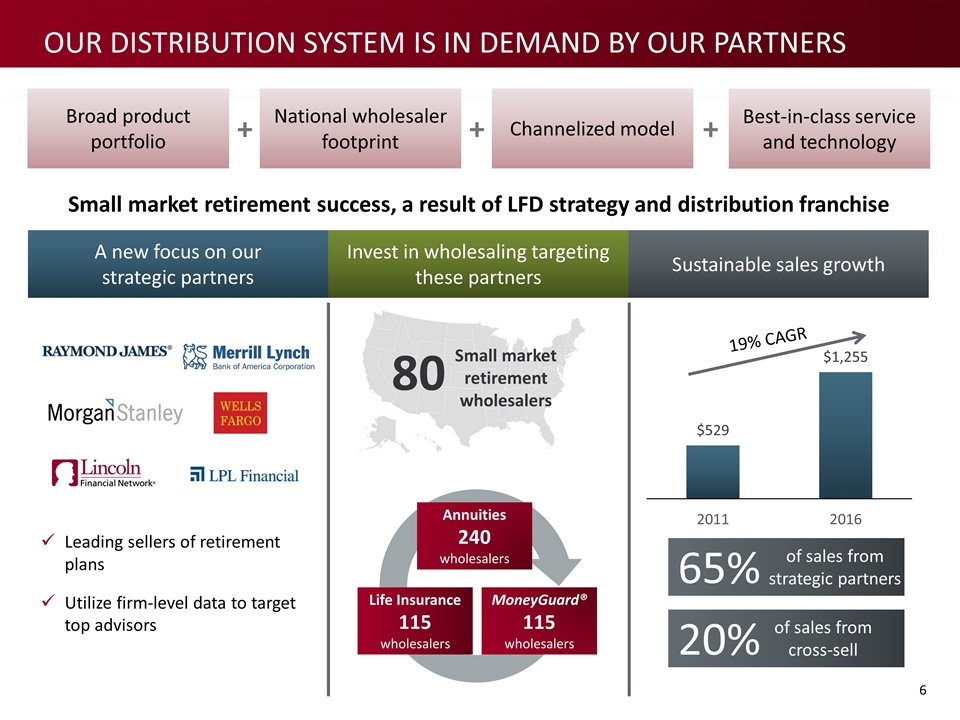

A new focus on our strategic partners Invest in wholesaling targeting these partners Sustainable sales growth Annuities 240 wholesalers Life Insurance 115 wholesalers MoneyGuard® 115 wholesalers 20% of sales from cross-sell Broad product portfolio National wholesaler footprint Channelized model Best-in-class service and technology + + + 80 Small market retirement wholesalers Leading sellers of retirement plans Utilize firm-level data to target top advisors 19% CAGR Small market retirement success, a result of LFD strategy and distribution franchise OUR distribution system IS IN DEMAND BY OUR PARTNERS 65% of sales from strategic partners

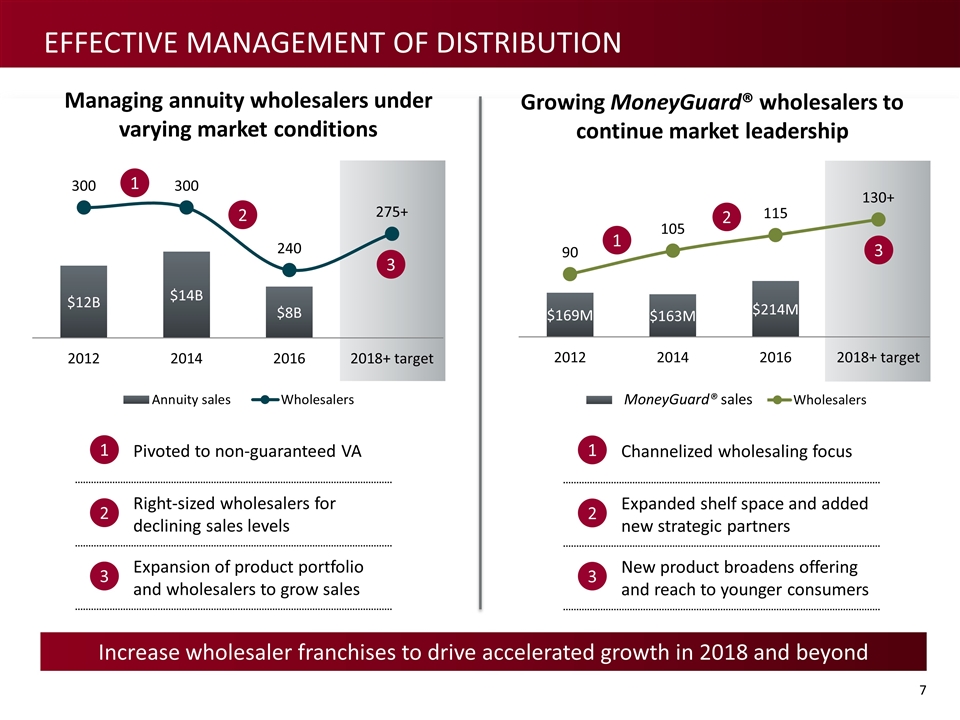

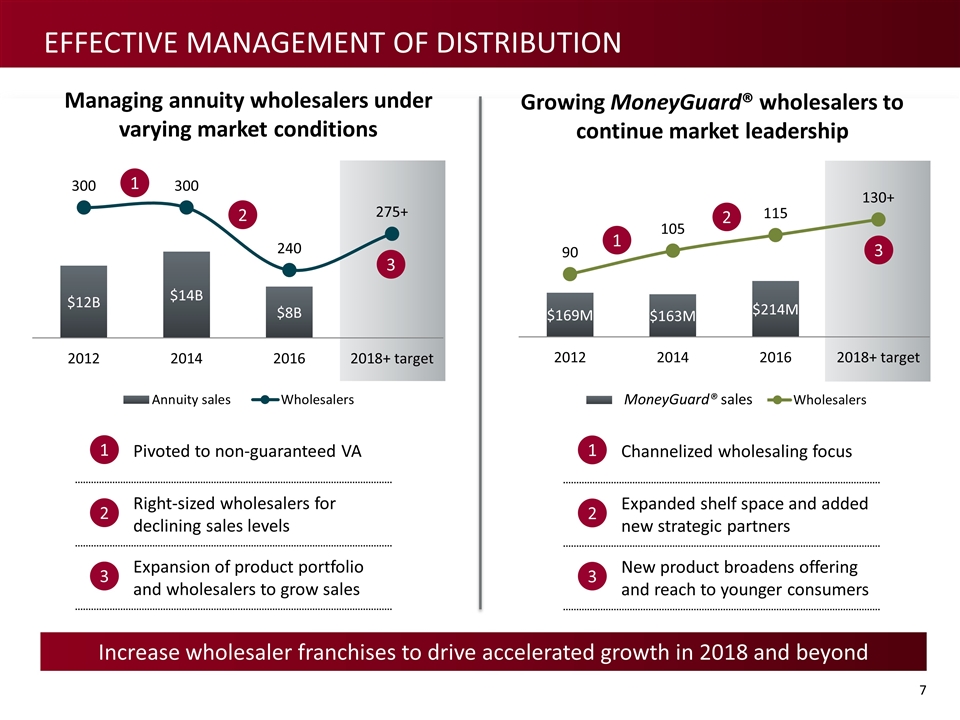

Effective management of distribution Managing annuity wholesalers under varying market conditions Growing MoneyGuard® wholesalers to continue market leadership Increase wholesaler franchises to drive accelerated growth in 2018 and beyond Pivoted to non-guaranteed VA Right-sized wholesalers for declining sales levels Expansion of product portfolio and wholesalers to grow sales 1 2 3 1 2 3 1 2 3 Channelized wholesaling focus Expanded shelf space and added new strategic partners New product broadens offering and reach to younger consumers 1 2 3 MoneyGuard® sales

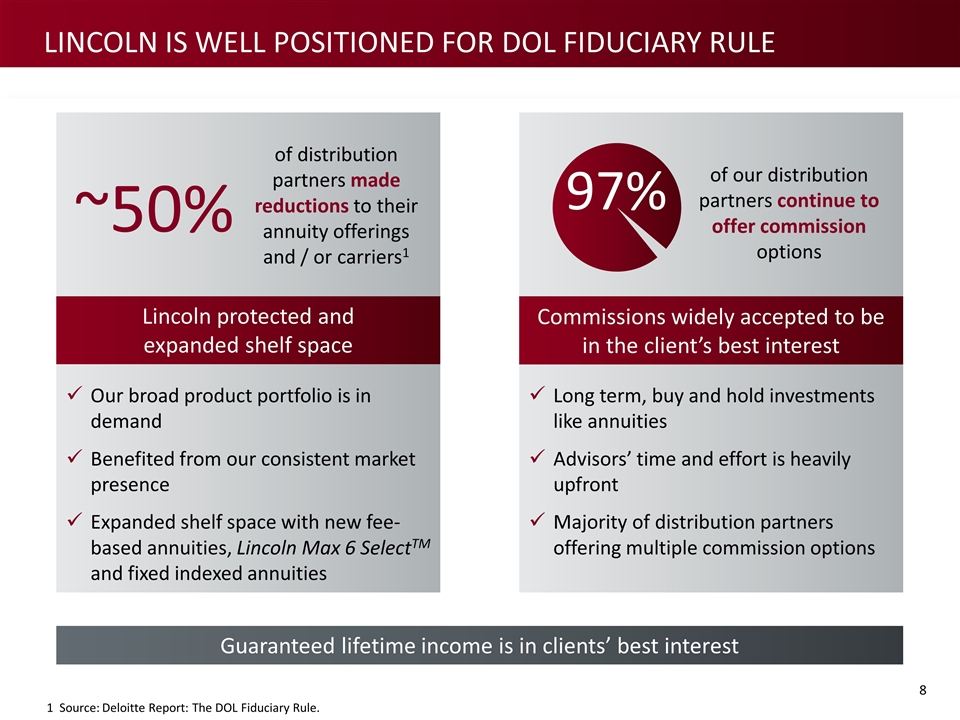

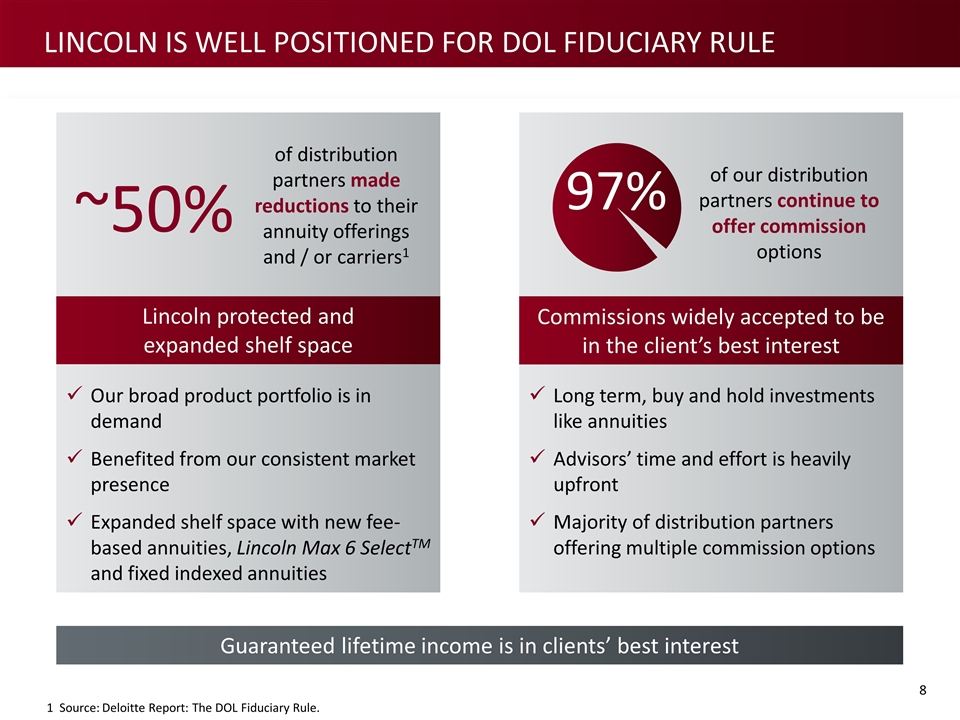

Lincoln is well positioned for dol fiduciary RULE ~50% of distribution partners made reductions to their annuity offerings and / or carriers1 of our distribution partners continue to offer commission options 97% Our broad product portfolio is in demand Benefited from our consistent market presence Expanded shelf space with new fee-based annuities, Lincoln Max 6 SelectTM and fixed indexed annuities Lincoln protected and expanded shelf space Commissions widely accepted to be in the client’s best interest Guaranteed lifetime income is in clients’ best interest Long term, buy and hold investments like annuities Advisors’ time and effort is heavily upfront Majority of distribution partners offering multiple commission options 1 Source: Deloitte Report: The DOL Fiduciary Rule.

Expand distribution to accelerate sales growth Grow best-in-class distribution to 600+ wholesalers Annuities 275+ wholesalers Life and MoneyGuard® 240+ wholesalers Small market retirement 90+ wholesalers Return annuity wholesalers to pre-2016 levels Focused expansion in bank and fixed indexed annuities Grow permanent life and MoneyGuard® wholesalers across all channels Grow wholesalers to record level, with higher levels of productivity Annuity product and rider expansion Linked benefits Term insurance Mid-size corporate retirement plans Fee-based annuities Expanding our products with strategic partners to capture sales Opportunities for adding new distribution Bank channel Aggregators and Insuretech Small market retirement partners Insurance marketing organizations RIA and fee-based channel

Distribution Consistent market presence allows us to sell through business cycles, contributing $60B in net flows since 2008 Proven ability to be a leader across annuities, life insurance, retirement plans and group benefits accessing industry-leading distribution partners Leveraging best-in-class distribution to adapt to disruption in the marketplace and drive future growth Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview

Dick Mucci | President, Group Protection Group Protection 2017 Conference for Analysts, Investors and Bankers

FOCUSED ON EARNINGS GROWTH AND 5-7% MARGIN TARGET Earnings growth and margin expansion is supported by re-emerging premium growth while sustaining favorable loss ratios Attractive target market opportunities and superior distribution will drive top-line growth Investments in new technology and process capabilities will enable an enhanced customer experience and improvements in operational efficiency Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview GROUP PROTECTION

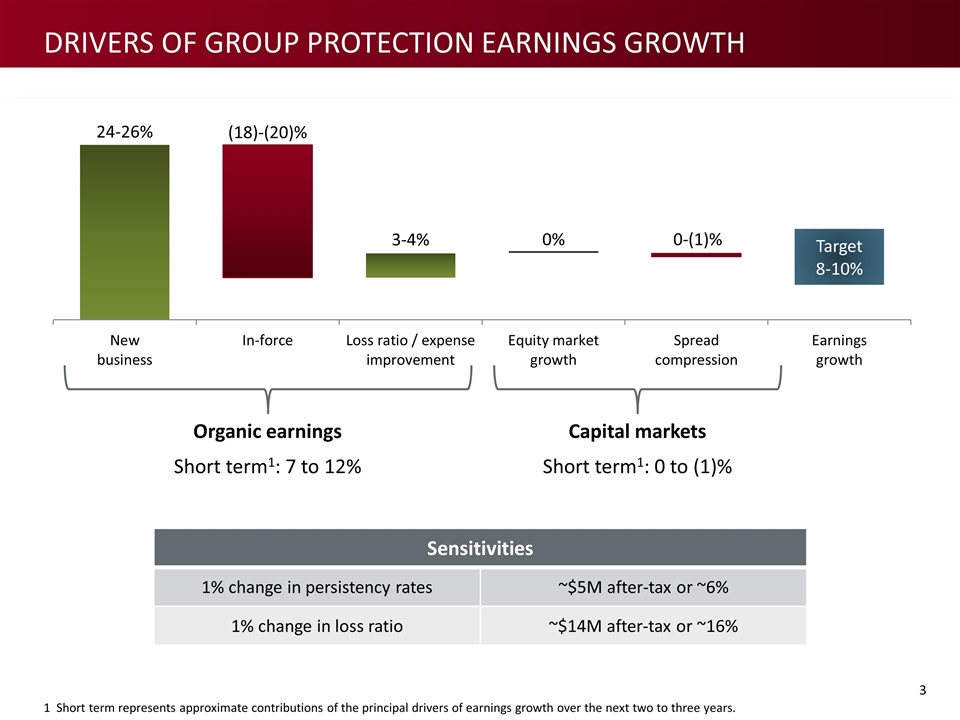

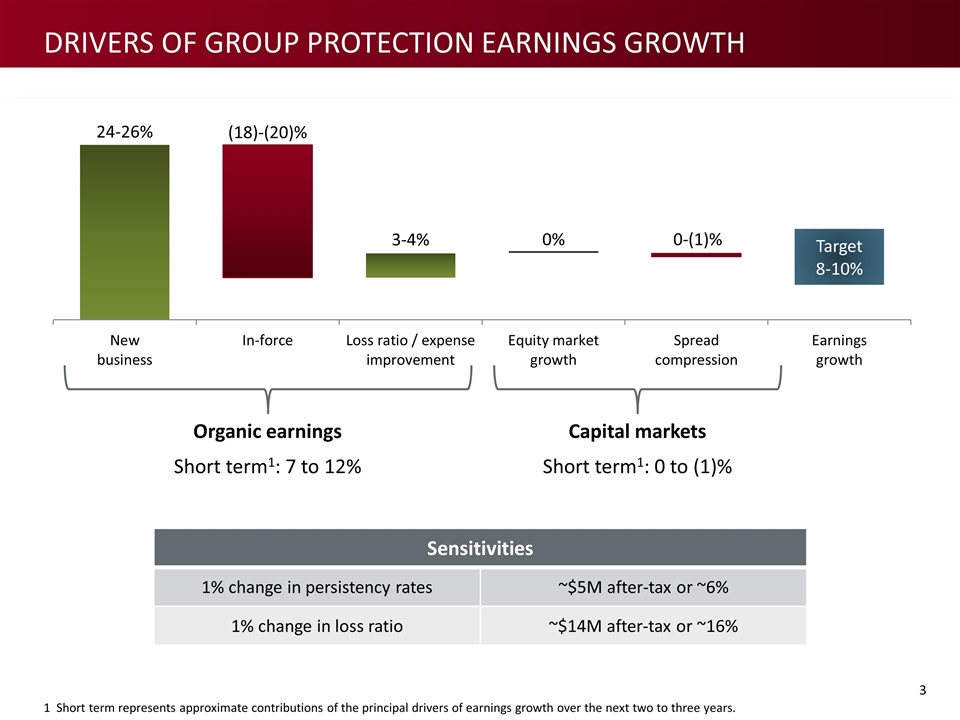

Sensitivities 1% change in persistency rates ~$5M after-tax or ~6% 1% change in loss ratio ~$14M after-tax or ~16% Organic earnings Short term1: 7 to 12% Capital markets Short term1: 0 to (1)% 1 Short term represents approximate contributions of the principal drivers of earnings growth over the next two to three years. Drivers of Group protection earnings growth

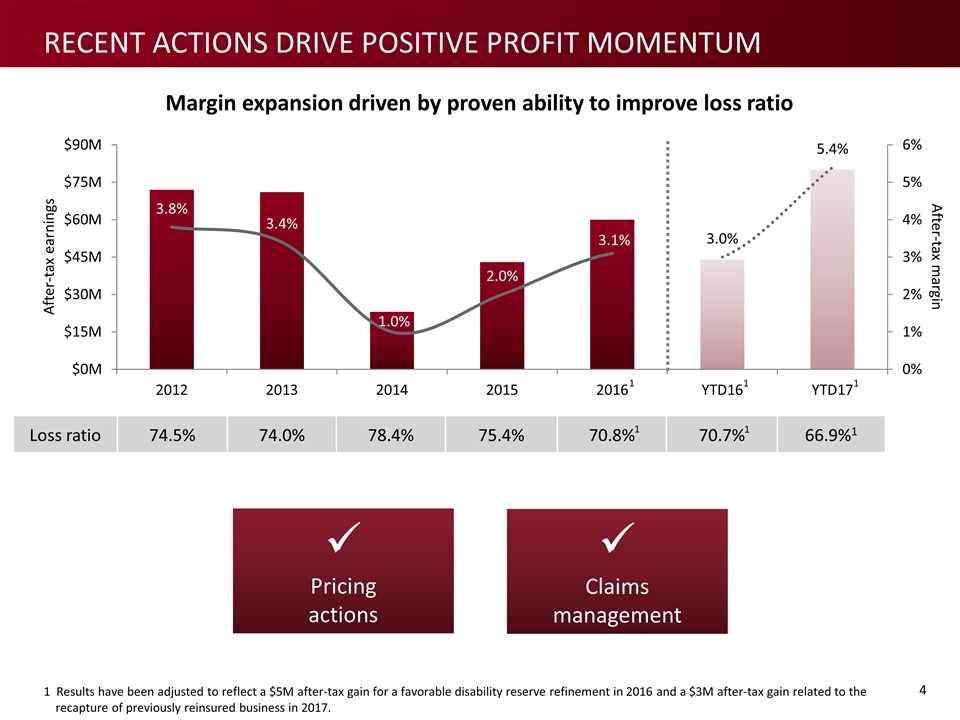

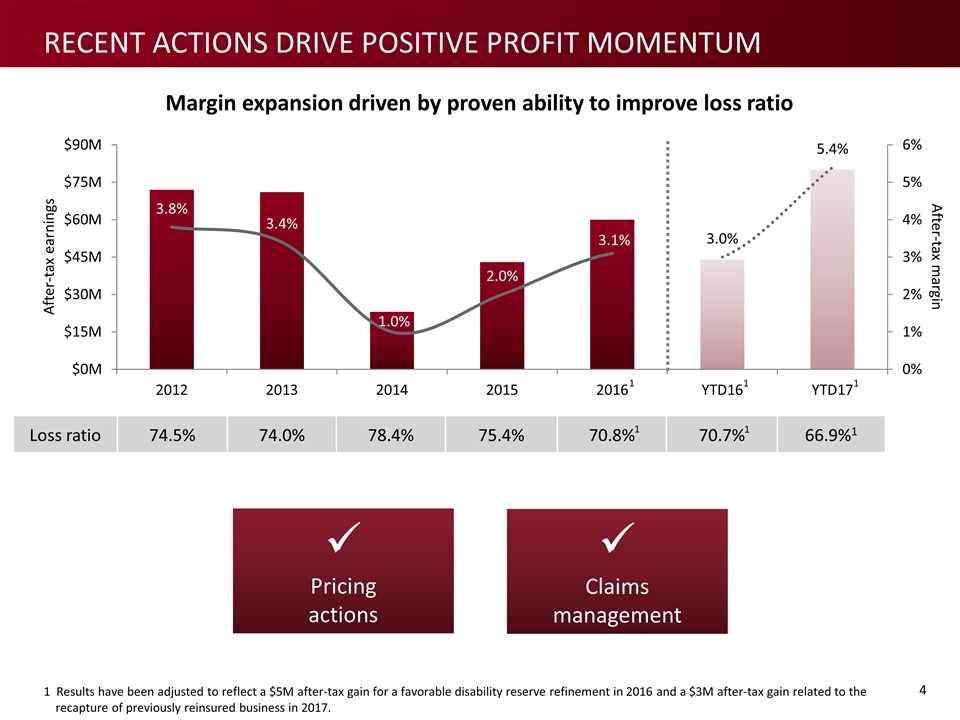

Margin expansion driven by proven ability to improve loss ratio Loss ratio 74.5% 74.0% 78.4% 75.4% 70.8% 70.7% 66.9%1 After-tax earnings After-tax margin 1 ü Pricing actions ü Claims management 1 1 Results have been adjusted to reflect a $5M after-tax gain for a favorable disability reserve refinement in 2016 and a $3M after-tax gain related to the recapture of previously reinsured business in 2017. 1 1 1 Recent Actions drive POSITIVE Profit MOMENTUM

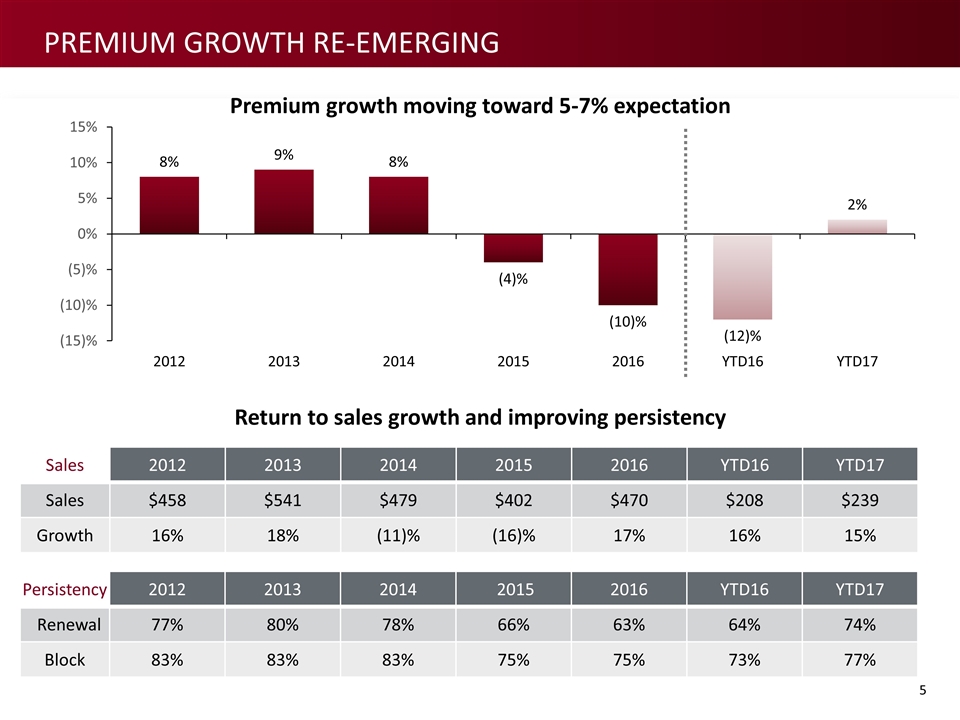

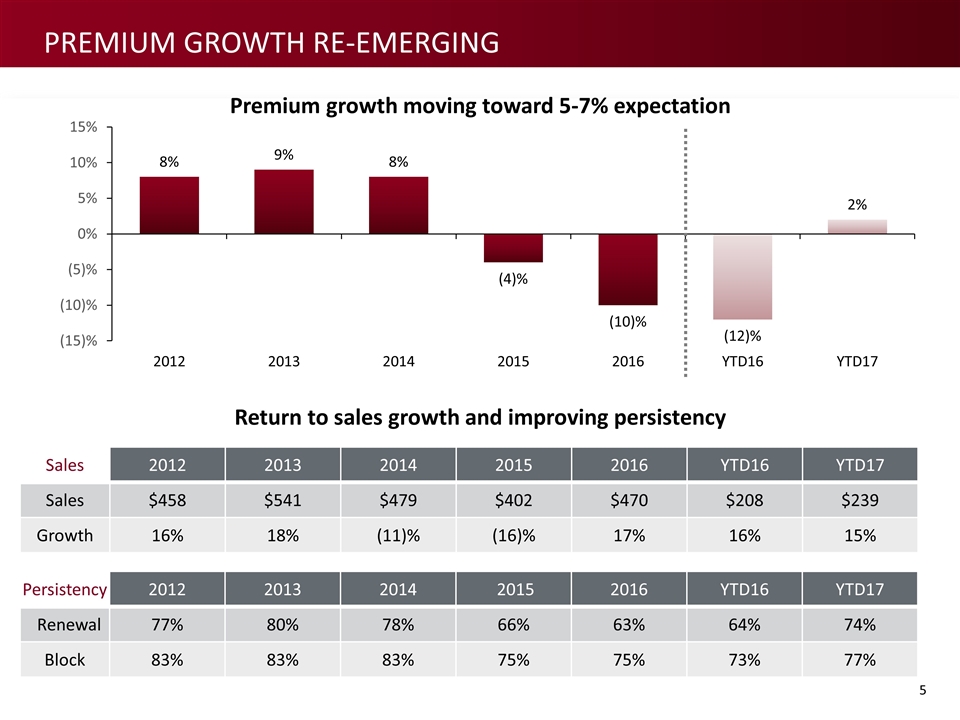

Persistency 2012 2013 2014 2015 2016 YTD16 YTD17 Renewal 77% 80% 78% 66% 63% 64% 74% Block 83% 83% 83% 75% 75% 73% 77% Sales 2012 2013 2014 2015 2016 YTD16 YTD17 Sales $458 $541 $479 $402 $470 $208 $239 Growth 16% 18% (11)% (16)% 17% 16% 15% Premium growth moving toward 5-7% expectation Return to sales growth and improving persistency Premium Growth Re-emerging

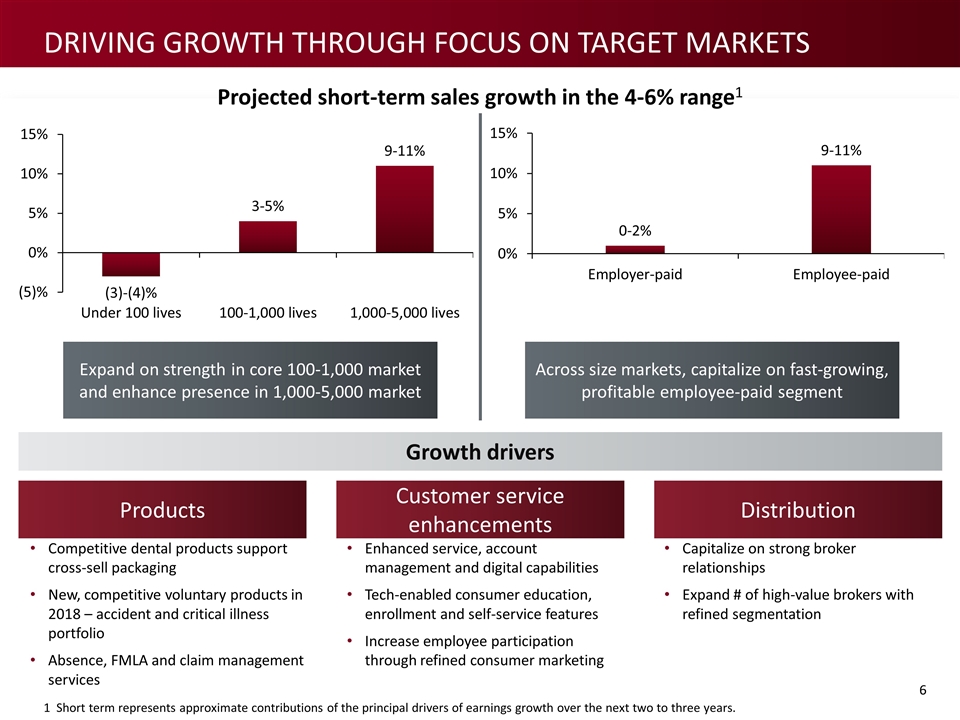

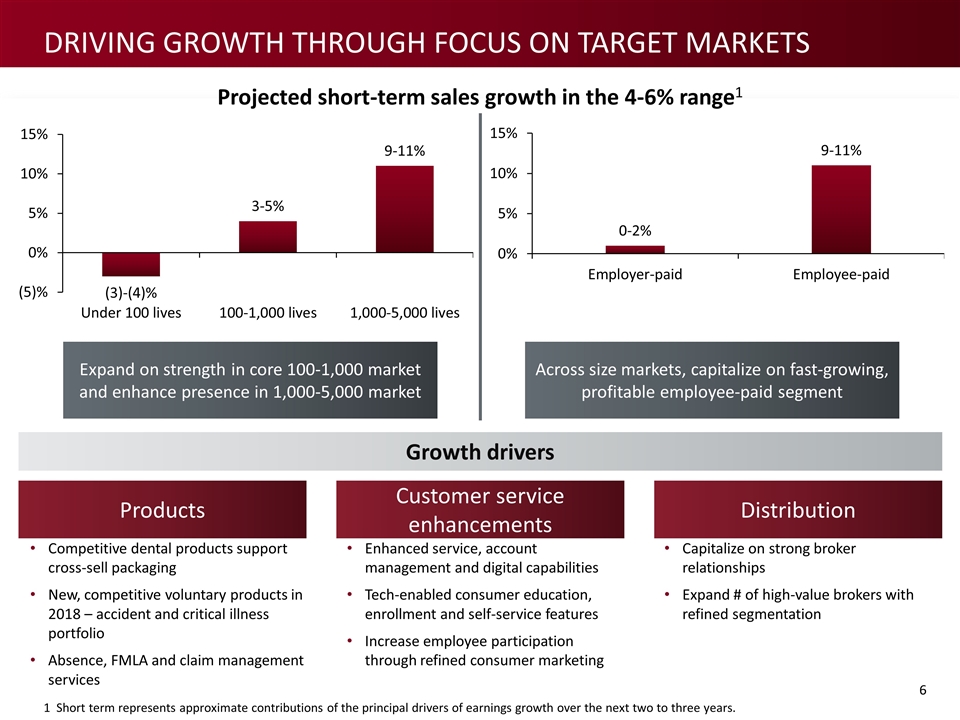

Growth drivers Competitive dental products support cross-sell packaging New, competitive voluntary products in 2018 – accident and critical illness portfolio Absence, FMLA and claim management services Projected short-term sales growth in the 4-6% range1 Expand on strength in core 100-1,000 market and enhance presence in 1,000-5,000 market Across size markets, capitalize on fast-growing, profitable employee-paid segment Products Distribution Customer service enhancements Capitalize on strong broker relationships Expand # of high-value brokers with refined segmentation Enhanced service, account management and digital capabilities Tech-enabled consumer education, enrollment and self-service features Increase employee participation through refined consumer marketing Driving growth through focus on target markets 1 Short term represents approximate contributions of the principal drivers of earnings growth over the next two to three years.

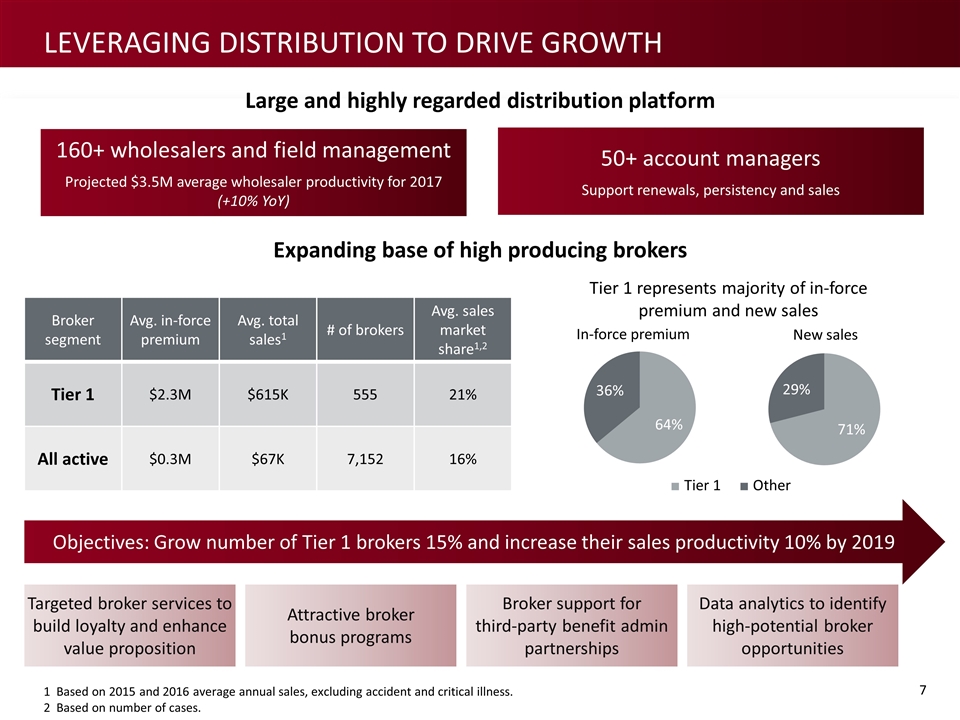

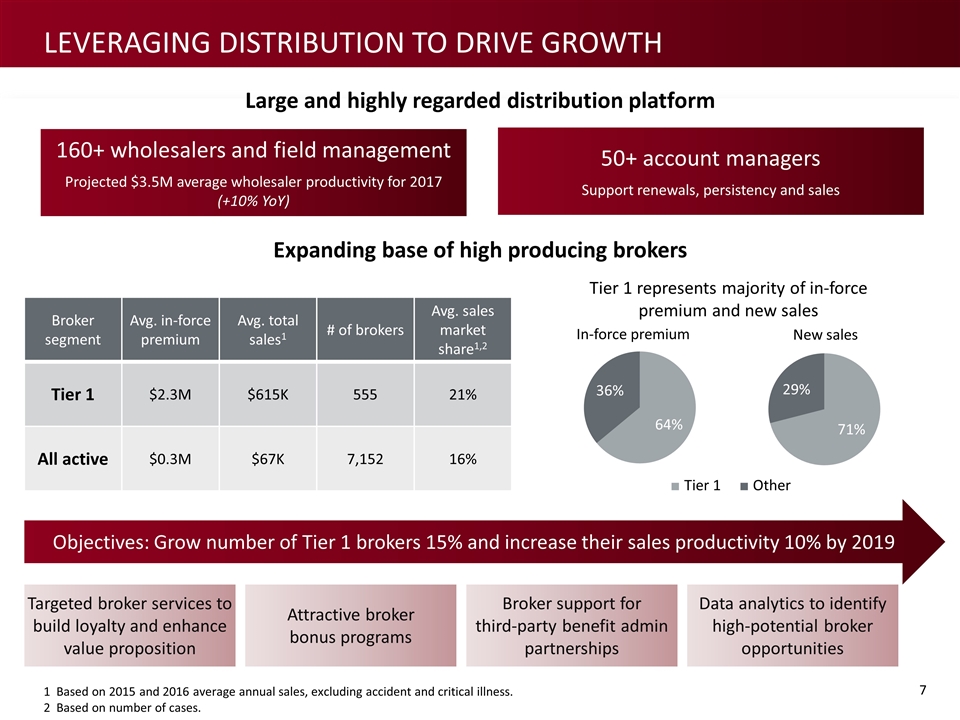

Objectives: Grow number of Tier 1 brokers 15% and increase their sales productivity 10% by 2019 Broker segment Avg. in-force premium Avg. total sales1 # of brokers Avg. sales market share1,2 Tier 1 $2.3M $615K 555 21% All active $0.3M $67K 7,152 16% Large and highly regarded distribution platform Expanding base of high producing brokers 1 Based on 2015 and 2016 average annual sales, excluding accident and critical illness. 2 Based on number of cases. Targeted broker services to build loyalty and enhance value proposition Attractive broker bonus programs Broker support for third-party benefit admin partnerships Data analytics to identify high-potential broker opportunities 50+ account managers Support renewals, persistency and sales Tier 1 represents majority of in-force premium and new sales ■ Tier 1 ■ Other 160+ wholesalers and field management Projected $3.5M average wholesaler productivity for 2017 (+10% YoY) Leveraging Distribution to drive growth

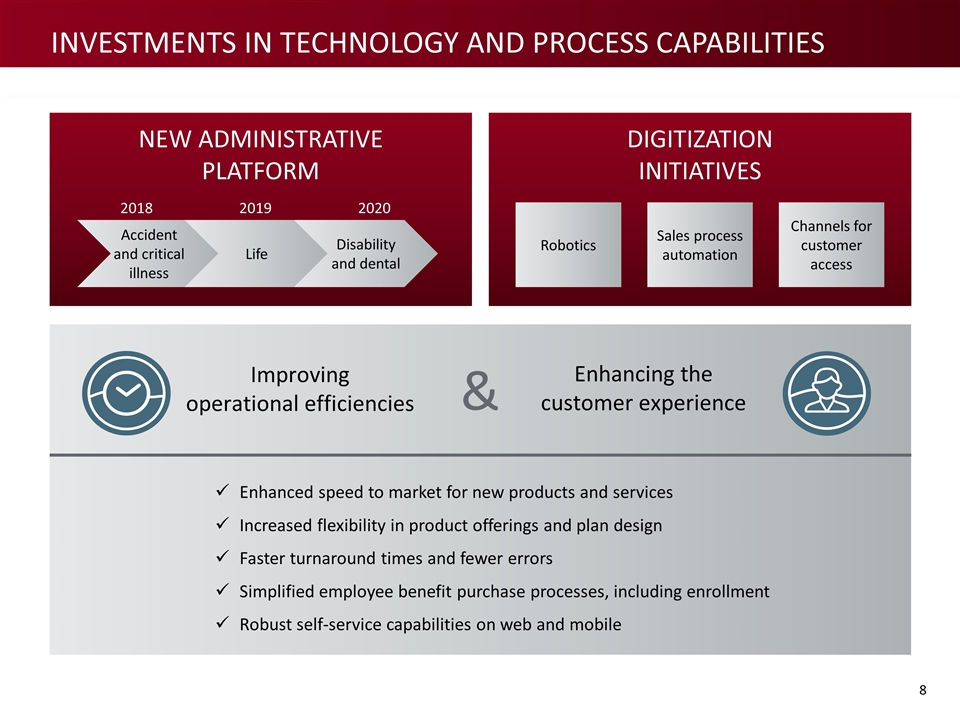

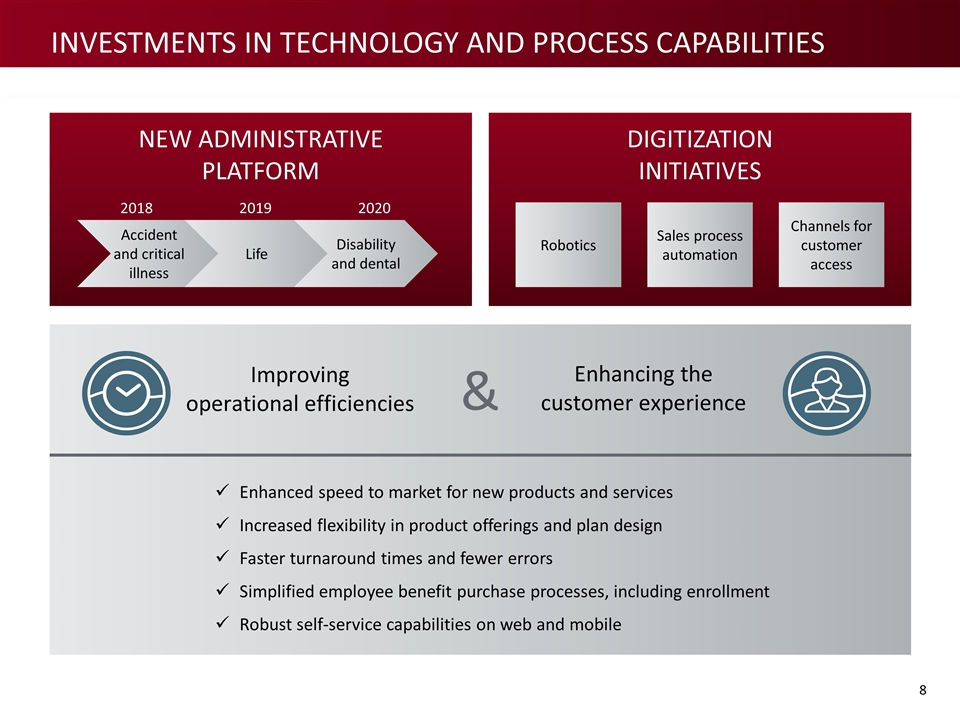

Improving operational efficiencies Enhancing the customer experience Enhanced speed to market for new products and services Increased flexibility in product offerings and plan design Faster turnaround times and fewer errors Simplified employee benefit purchase processes, including enrollment Robust self-service capabilities on web and mobile & NEW ADMINISTRATIVE PLATFORM DIGITIZATION INITIATIVES investments in technology and process CAPABILITIES Accident and critical illness Life Disability and dental 2018 2019 2020 Robotics Sales process automation Channels for customer access

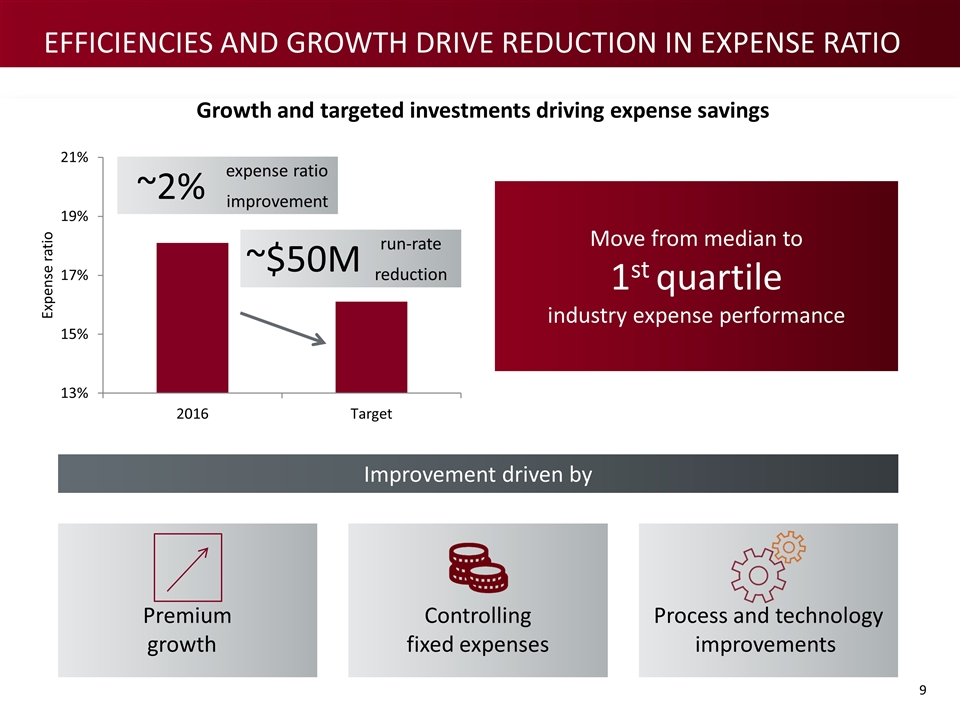

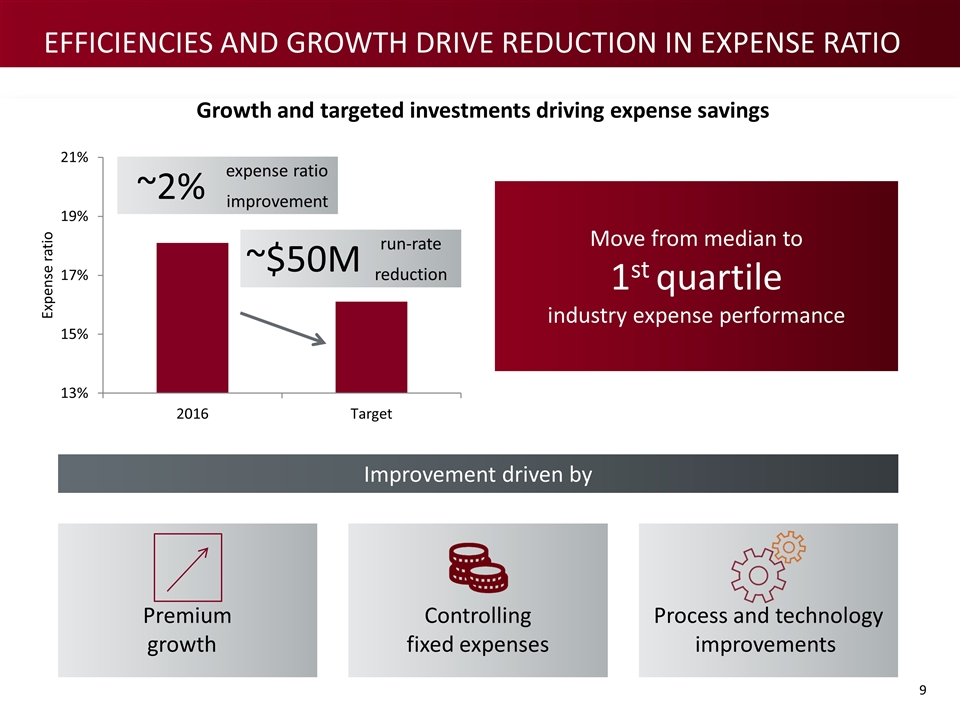

Growth and targeted investments driving expense savings expense ratio improvement Move from median to 1st quartile industry expense performance Premium growth Controlling fixed expenses Process and technology improvements Improvement driven by run-rate reduction ~2% ~$50M Efficiencies and Growth Drive Reduction in Expense Ratio

Earnings growth and margin expansion is supported by re-emerging premium growth while sustaining favorable loss ratios Attractive target market opportunities and superior distribution will drive top-line growth Investments in new technology and process capabilities will enable an enhanced customer experience and improvements in operational efficiency Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview Group Protection

| Senior Vice President, Head of Life Solutions Randy Freitag | Executive Vice President, Chief Financial Officer and Head of Individual Life Mike Burns Life Insurance 2017 Conference for Analysts, Investors and Bankers

INDUSTRY-LEADING LIFE INSURANCE FRANCHISE Broad portfolio enables scale, diversification, and a balanced risk profile Investing in solutions in select, attractive markets will drive long-term growth and capture demographic shifts Diligent financial management Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview Life insurance

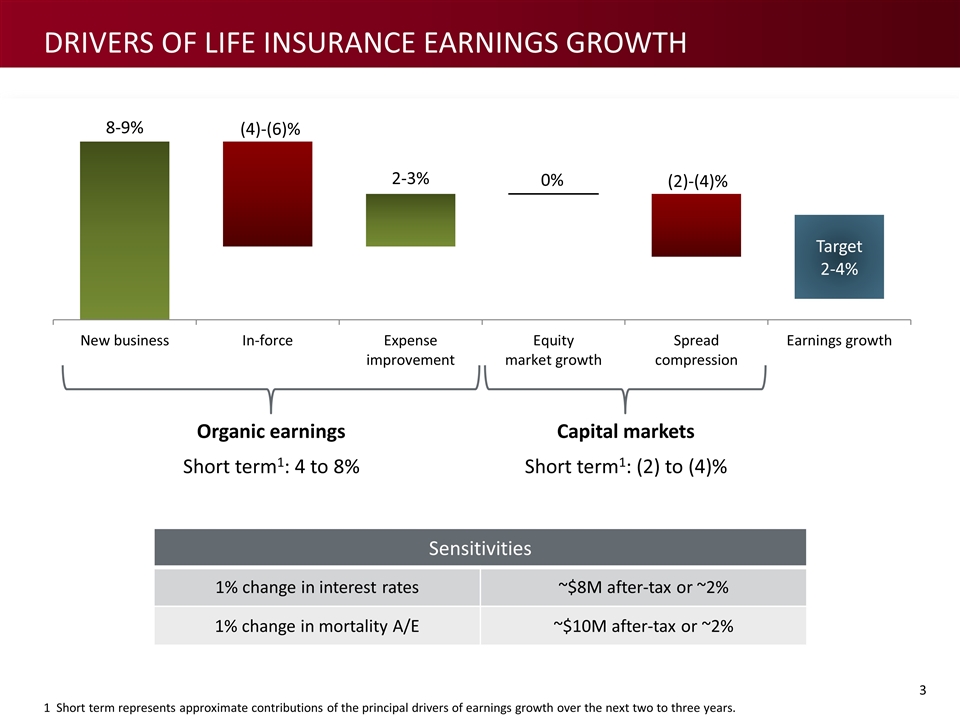

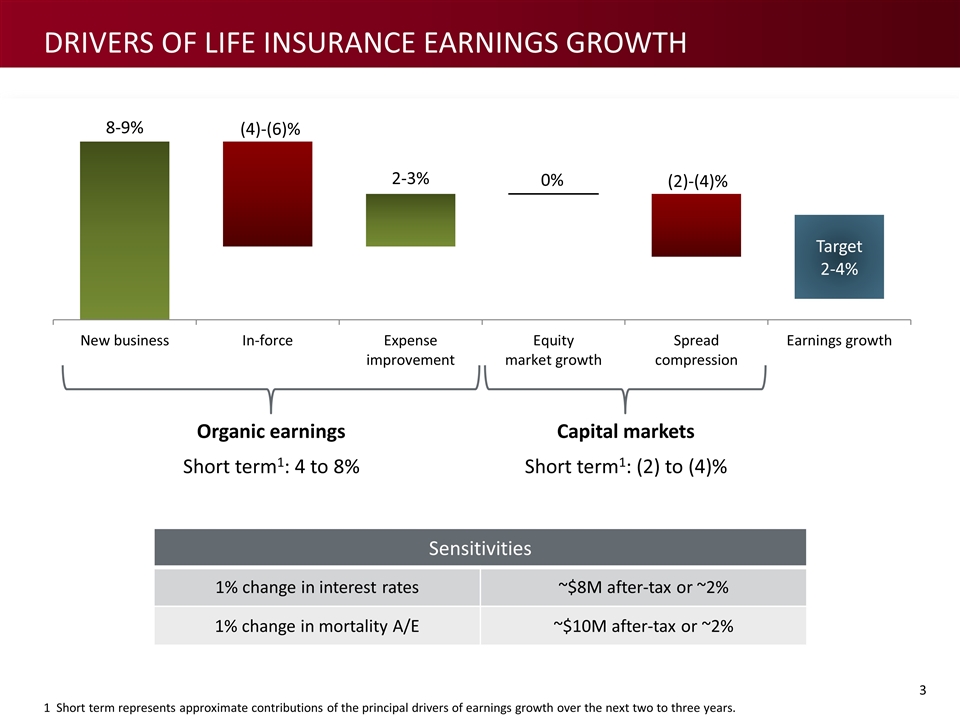

Sensitivities 1% change in interest rates ~$8M after-tax or ~2% 1% change in mortality A/E ~$10M after-tax or ~2% Organic earnings Short term1: 4 to 8% Capital markets Short term1: (2) to (4)% 1 Short term represents approximate contributions of the principal drivers of earnings growth over the next two to three years. Drivers of Life Insurance Earnings Growth

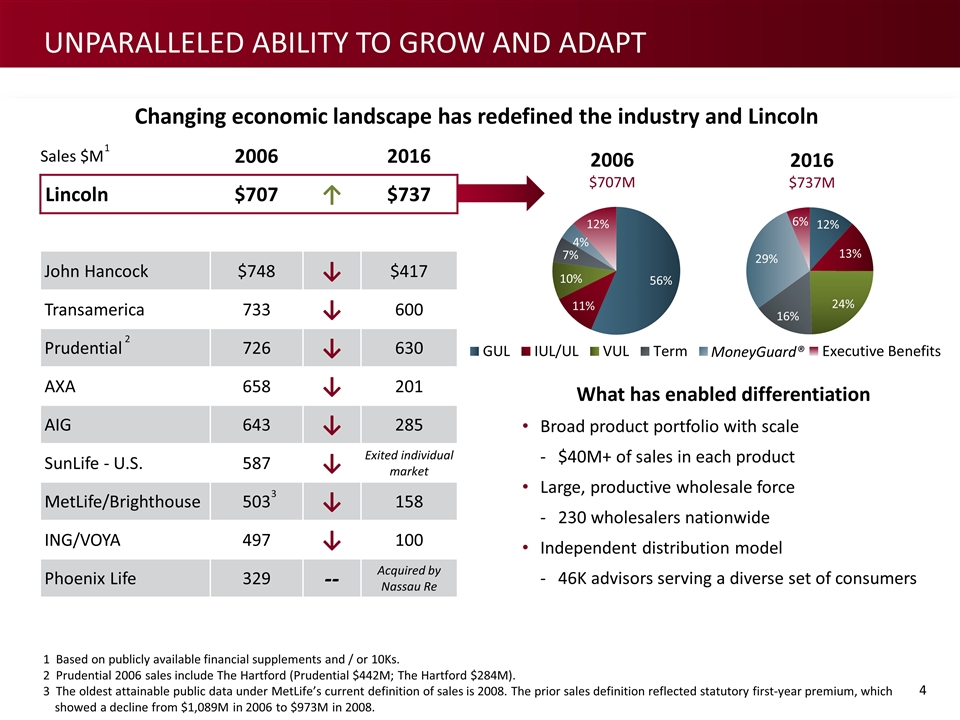

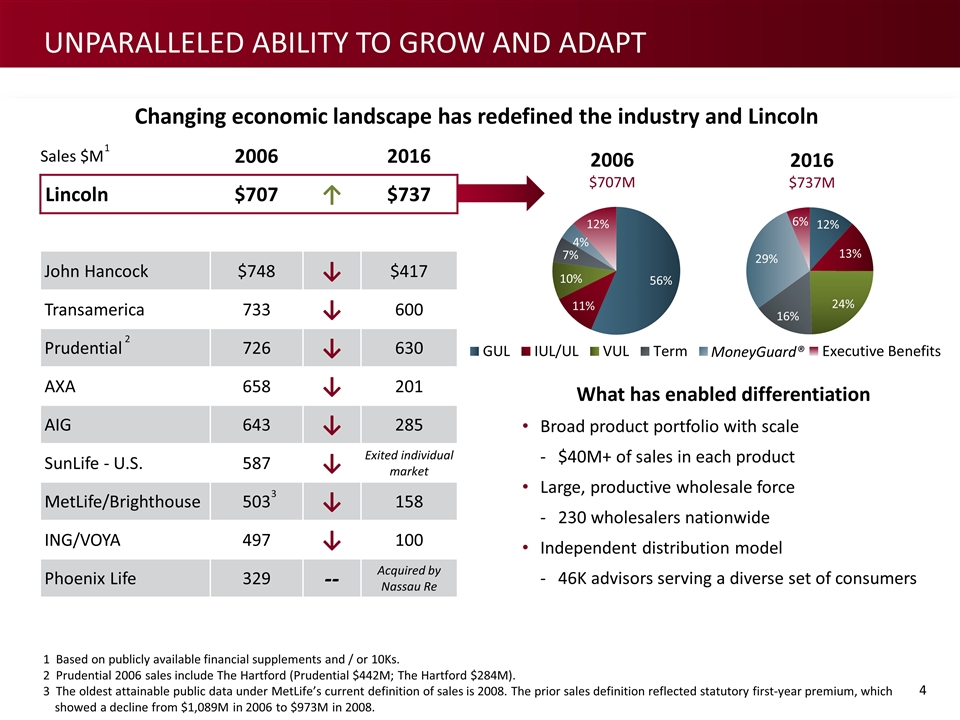

What has enabled differentiation Broad product portfolio with scale $40M+ of sales in each product Large, productive wholesale force 230 wholesalers nationwide Independent distribution model 46K advisors serving a diverse set of consumers Sales $M 2006 2016 Lincoln $707 ↑ $737 John Hancock $748 ↓ $417 Transamerica 733 ↓ 600 Prudential 726 ↓ 630 AXA 658 ↓ 201 AIG 643 ↓ 285 SunLife - U.S. 587 ↓ Exited individual market MetLife/Brighthouse 503 ↓ 158 ING/VOYA 497 ↓ 100 Phoenix Life 329 -- Acquired by Nassau Re Changing economic landscape has redefined the industry and Lincoln 1 Based on publicly available financial supplements and / or 10Ks. 2 Prudential 2006 sales include The Hartford (Prudential $442M; The Hartford $284M). 3 The oldest attainable public data under MetLife’s current definition of sales is 2008. The prior sales definition reflected statutory first-year premium, which showed a decline from $1,089M in 2006 to $973M in 2008. 2006 $707M 2016 $737M 1 2 3 Unparalleled ability to grow and adapt MoneyGuard®

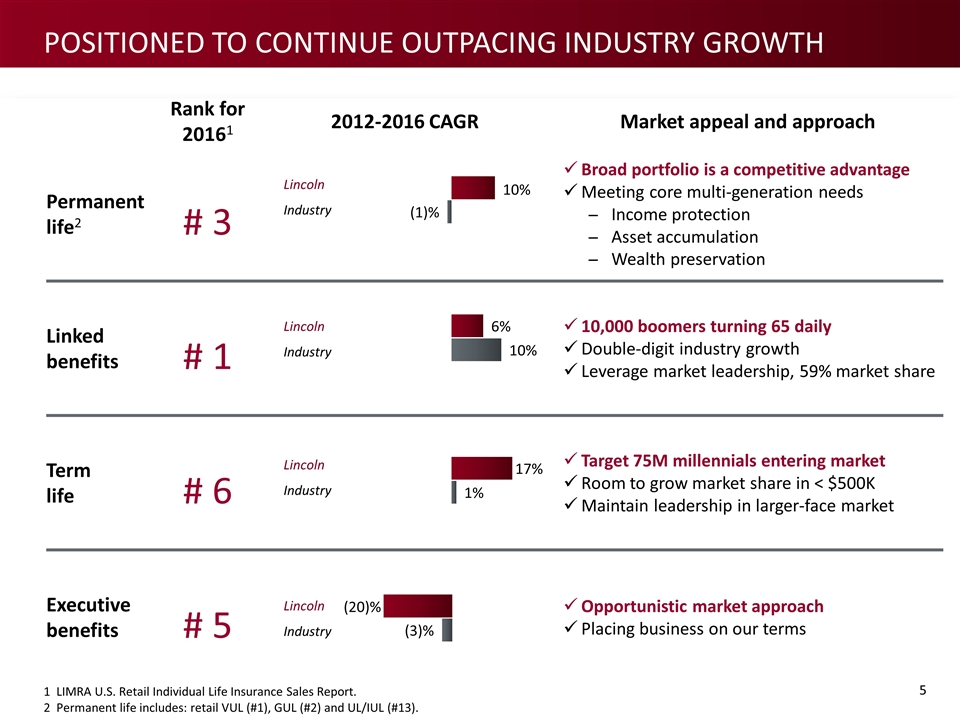

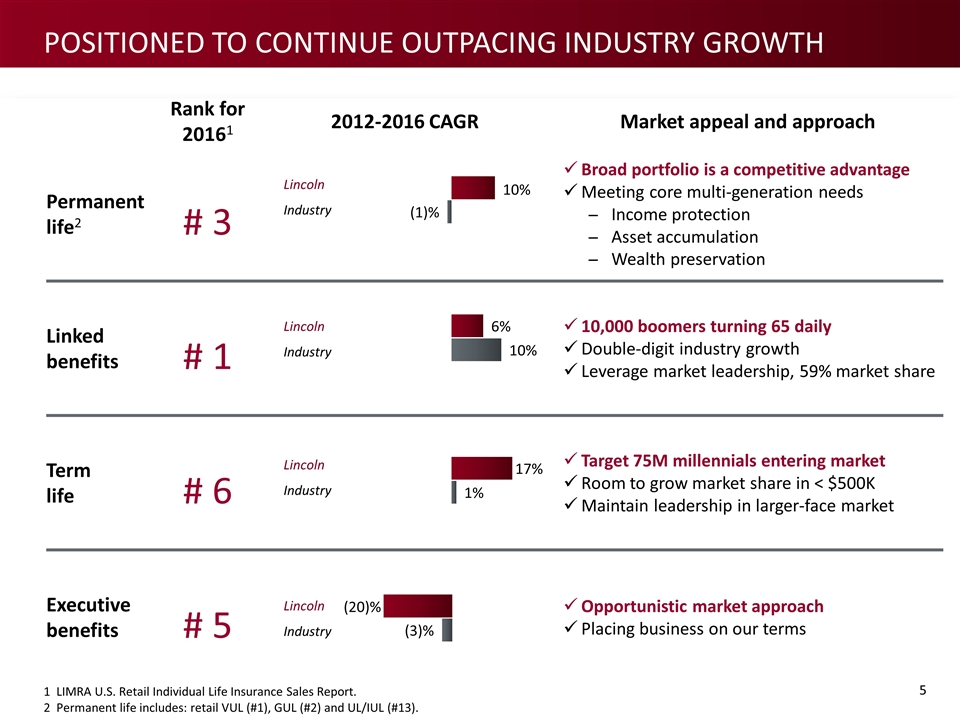

Rank for 20161 2012-2016 CAGR Market appeal and approach Permanent life2 # 3 Broad portfolio is a competitive advantage Meeting core multi-generation needs Income protection Asset accumulation Wealth preservation Linked benefits # 1 10,000 boomers turning 65 daily Double-digit industry growth Leverage market leadership, 59% market share Term life # 6 Target 75M millennials entering market Room to grow market share in < $500K Maintain leadership in larger-face market Executive benefits # 5 Opportunistic market approach Placing business on our terms 1 LIMRA U.S. Retail Individual Life Insurance Sales Report. 2 Permanent life includes: retail VUL (#1), GUL (#2) and UL/IUL (#13). Lincoln Industry Lincoln Industry Lincoln Industry Lincoln Industry (20)% Positioned to continue outpacing industry growth

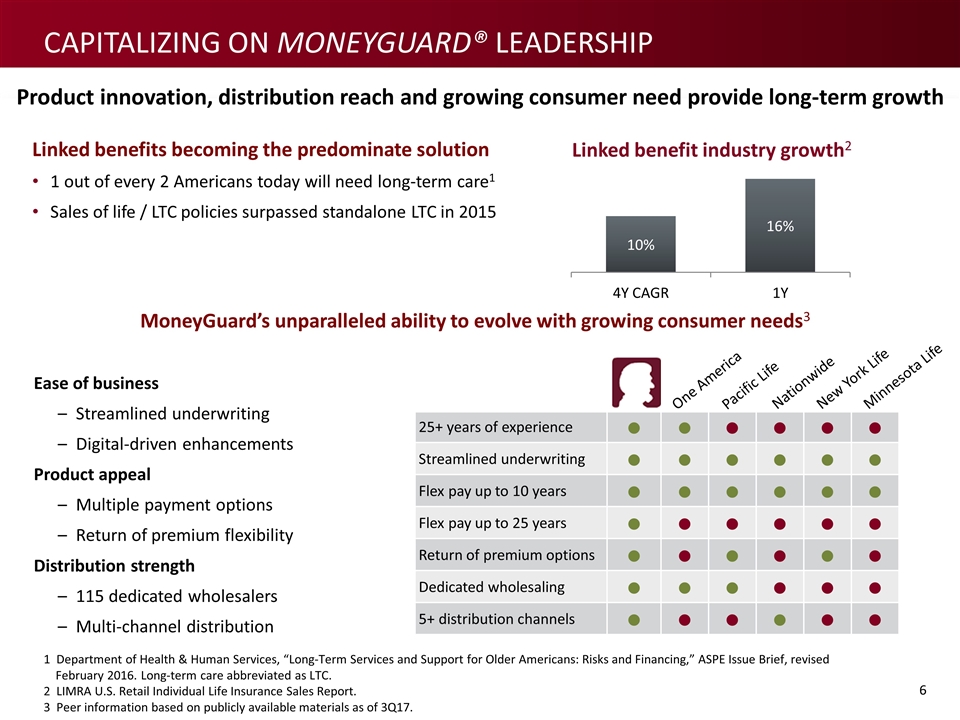

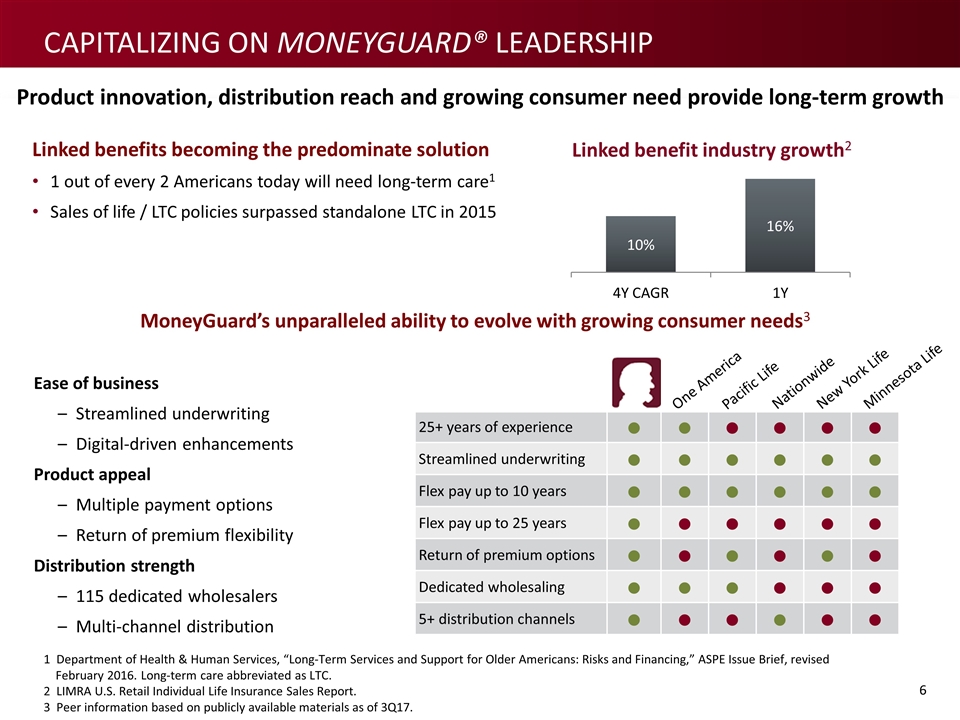

MoneyGuard’s unparalleled ability to evolve with growing consumer needs3 Ease of business Streamlined underwriting Digital-driven enhancements Product appeal Multiple payment options Return of premium flexibility Distribution strength 115 dedicated wholesalers Multi-channel distribution Linked benefits becoming the predominate solution 1 out of every 2 Americans today will need long-term care1 Sales of life / LTC policies surpassed standalone LTC in 2015 25+ years of experience ● ● ● ● ● ● Streamlined underwriting ● ● ● ● ● ● Flex pay up to 10 years ● ● ● ● ● ● Flex pay up to 25 years ● ● ● ● ● ● Return of premium options ● ● ● ● ● ● Dedicated wholesaling ● ● ● ● ● ● 5+ distribution channels ● ● ● ● ● ● Product innovation, distribution reach and growing consumer need provide long-term growth 1 Department of Health & Human Services, “Long-Term Services and Support for Older Americans: Risks and Financing,” ASPE Issue Brief, revised February 2016. Long-term care abbreviated as LTC. 2 LIMRA U.S. Retail Individual Life Insurance Sales Report. 3 Peer information based on publicly available materials as of 3Q17. One America Pacific Life Nationwide New York Life Minnesota Life Linked benefit industry growth2 Capitalizing on MoneyGuard® leadership

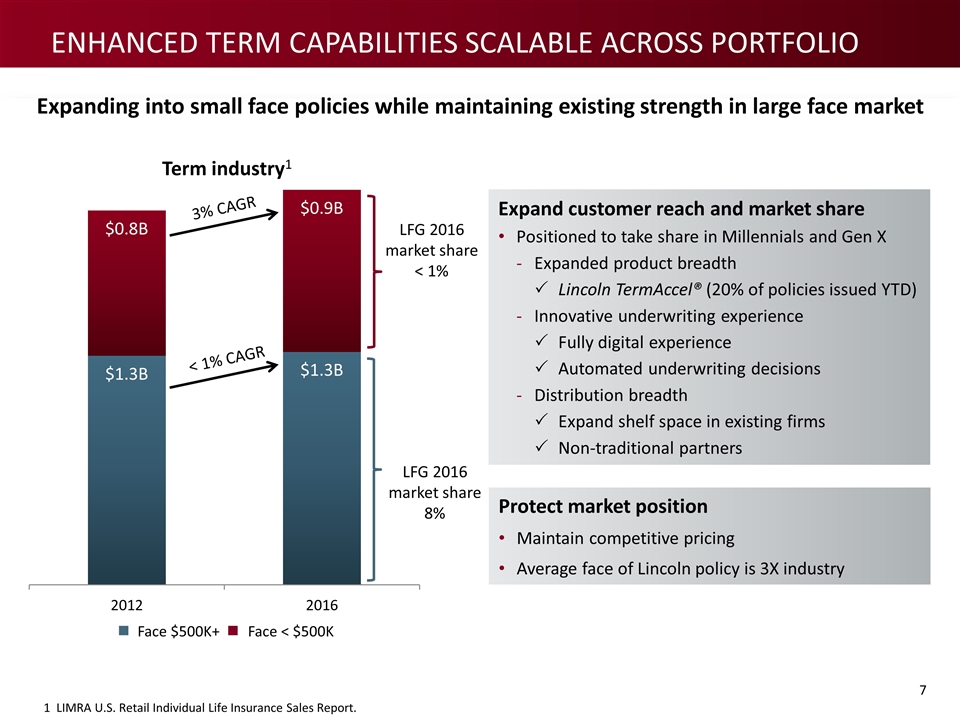

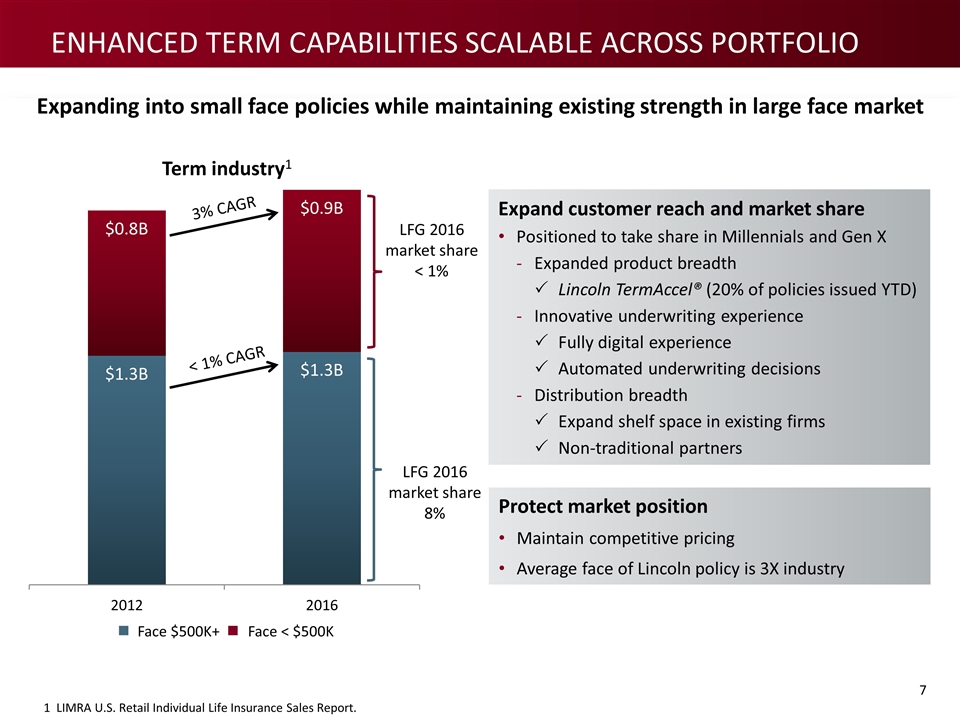

Expanding into small face policies while maintaining existing strength in large face market Protect market position Maintain competitive pricing Average face of Lincoln policy is 3X industry Expand customer reach and market share Positioned to take share in Millennials and Gen X Expanded product breadth Lincoln TermAccel® (20% of policies issued YTD) Innovative underwriting experience Fully digital experience Automated underwriting decisions Distribution breadth Expand shelf space in existing firms Non-traditional partners 1 LIMRA U.S. Retail Individual Life Insurance Sales Report. Term industry1 n Face $500K+ n Face < $500K LFG 2016 market share 8% LFG 2016 market share < 1% 3% CAGR < 1% CAGR Enhanced term capabilities scalable across portfolio

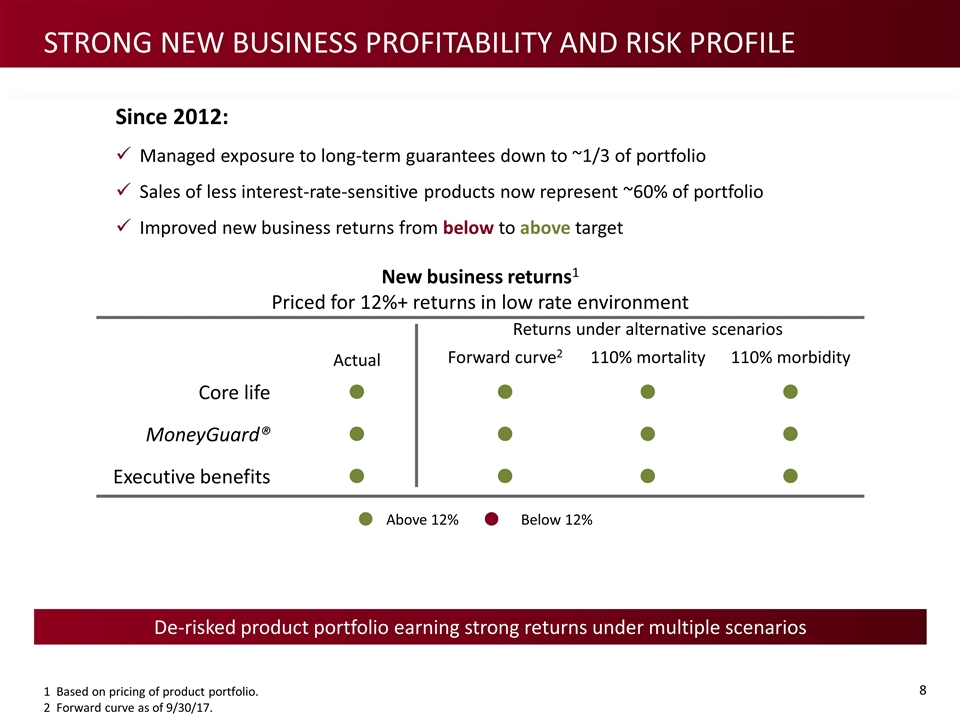

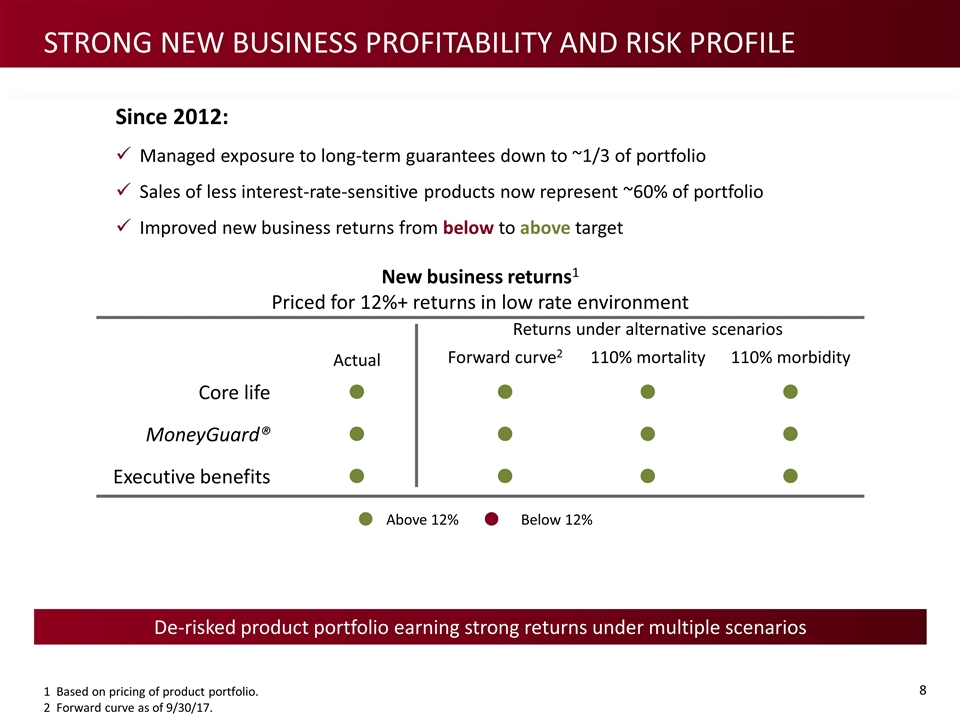

1 Based on pricing of product portfolio. 2 Forward curve as of 9/30/17. De-risked product portfolio earning strong returns under multiple scenarios Since 2012: Managed exposure to long-term guarantees down to ~1/3 of portfolio Sales of less interest-rate-sensitive products now represent ~60% of portfolio Improved new business returns from below to above target New business returns1 Priced for 12%+ returns in low rate environment Actual Returns under alternative scenarios Forward curve2 110% mortality 110% morbidity Core life ˜ ˜ ˜ ˜ MoneyGuard® ˜ ˜ ˜ ˜ Executive benefits ˜ ˜ ˜ ˜ ˜ Above 12% ˜ Below 12% Strong new business profitability and risk profile

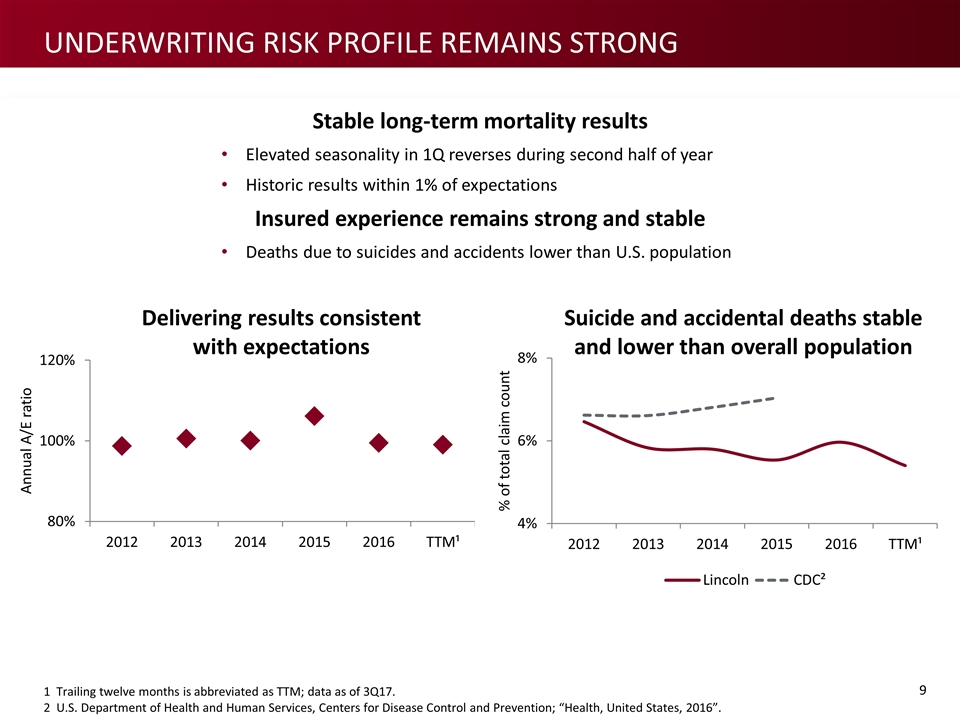

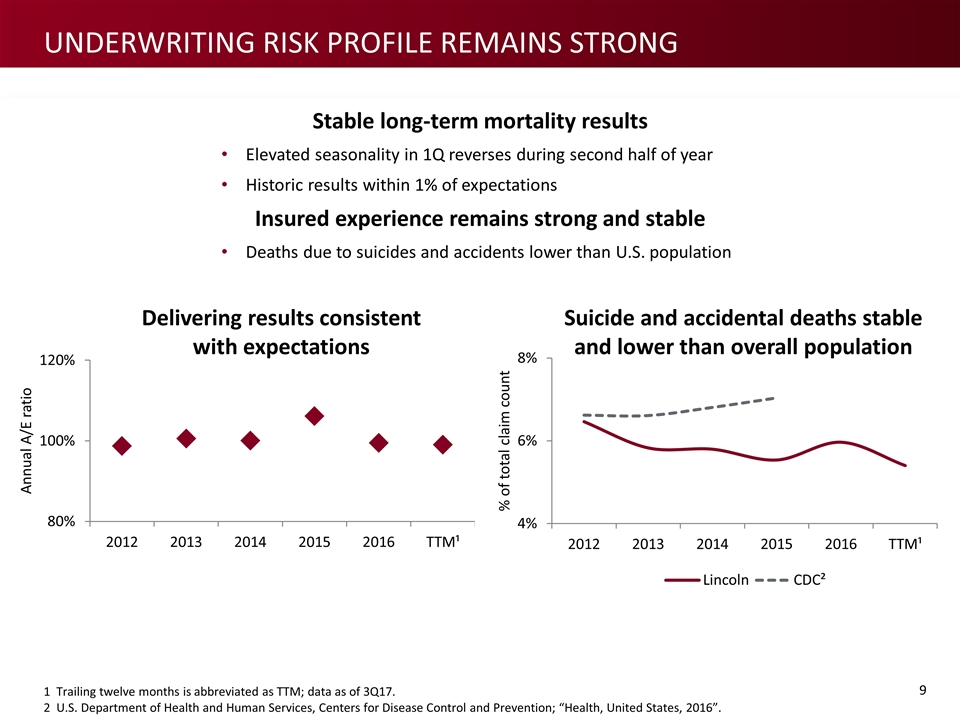

Delivering results consistent with expectations Suicide and accidental deaths stable and lower than overall population Stable long-term mortality results Elevated seasonality in 1Q reverses during second half of year Historic results within 1% of expectations Insured experience remains strong and stable Deaths due to suicides and accidents lower than U.S. population 1 Trailing twelve months is abbreviated as TTM; data as of 3Q17. 2 U.S. Department of Health and Human Services, Centers for Disease Control and Prevention; “Health, United States, 2016”. Underwriting risk profile remains strong

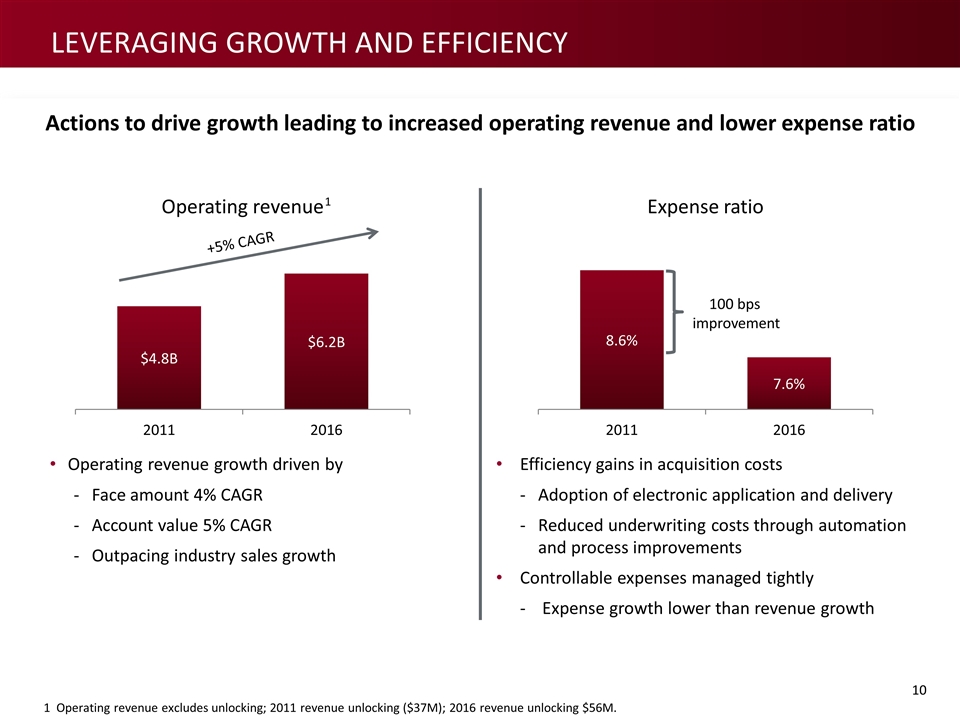

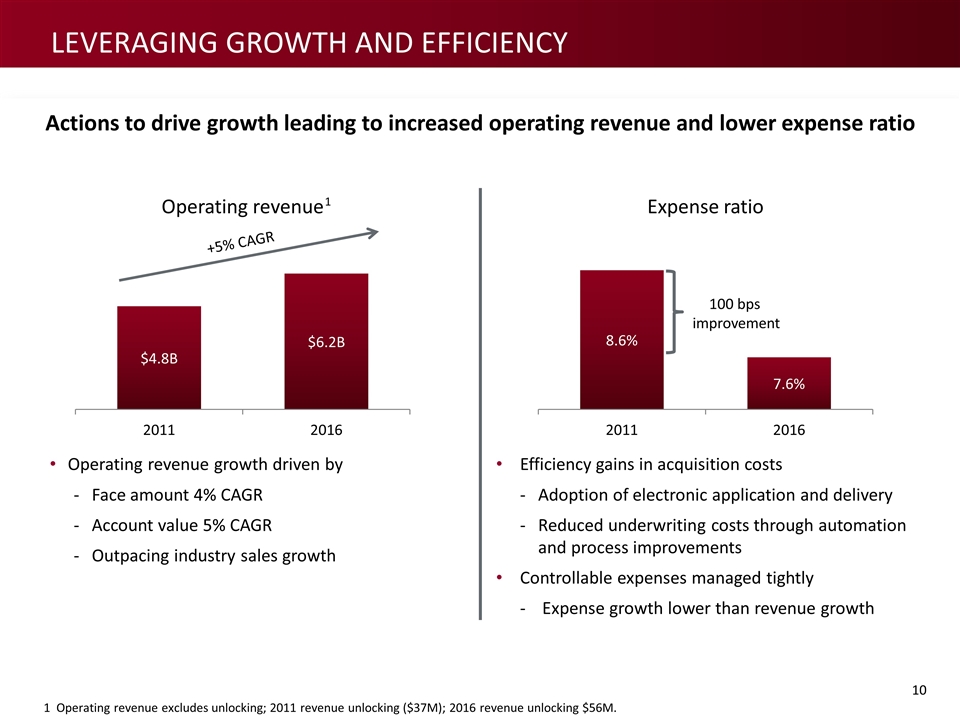

1 Operating revenue excludes unlocking; 2011 revenue unlocking ($37M); 2016 revenue unlocking $56M. Actions to drive growth leading to increased operating revenue and lower expense ratio Operating revenue growth driven by Face amount 4% CAGR Account value 5% CAGR Outpacing industry sales growth +5% CAGR 100 bps improvement Efficiency gains in acquisition costs Adoption of electronic application and delivery Reduced underwriting costs through automation and process improvements Controllable expenses managed tightly Expense growth lower than revenue growth Leveraging growth and efficiency

Unmatched product diversification and scale with balanced risk profile and unique ability to grow and adapt, combined with the depth and breadth of our distribution, distinguishes Lincoln in the market place Lincoln’s industry-leading linked benefit solution, scalability of term franchise, and longstanding leadership position in our established markets align with long-term growth opportunities Focused financial management continues to position us well for future earnings growth Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview Industry-leading LIFE insurance franchise

Jamie Ohl | President, Retirement Plan Services Retirement Plan Services 2017 Conference for Analysts, Investors and Bankers

CONSISTENT AND FOCUSED STRATEGY DRIVING GROWTH IN SALES, NET FLOWS AND EARNINGS Business model positions us to compete effectively and further accelerate growth in our target markets Strong sales, initiatives to increase recurring deposits and improving retention leading to growth in net flows and assets Expense discipline and in-force margin improvement initiatives combine to counteract impact of spread compression Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview Retirement Plan Services

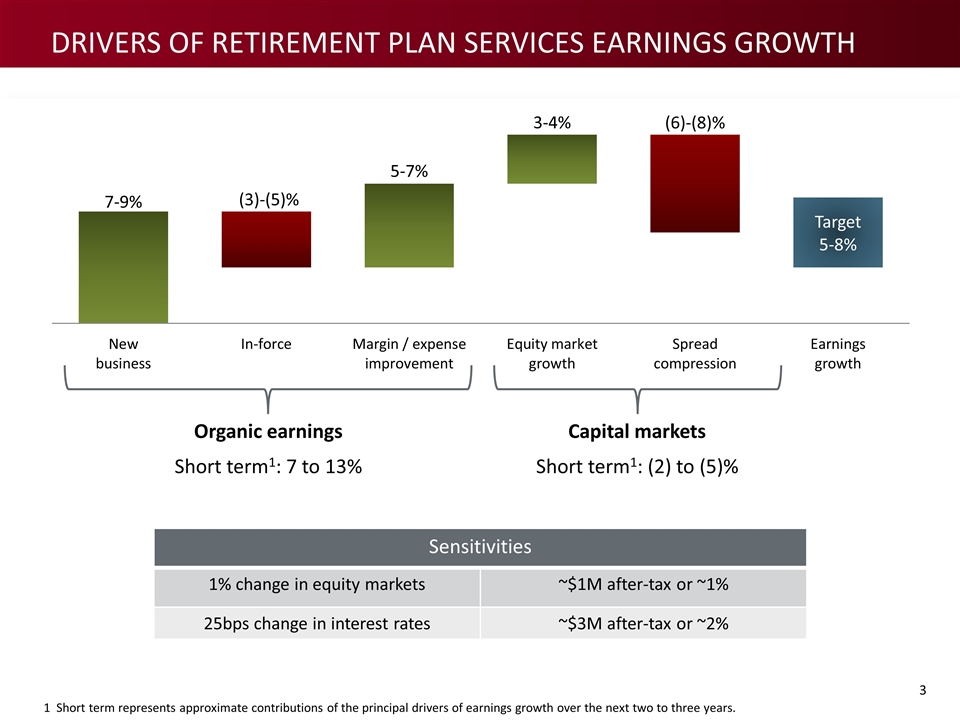

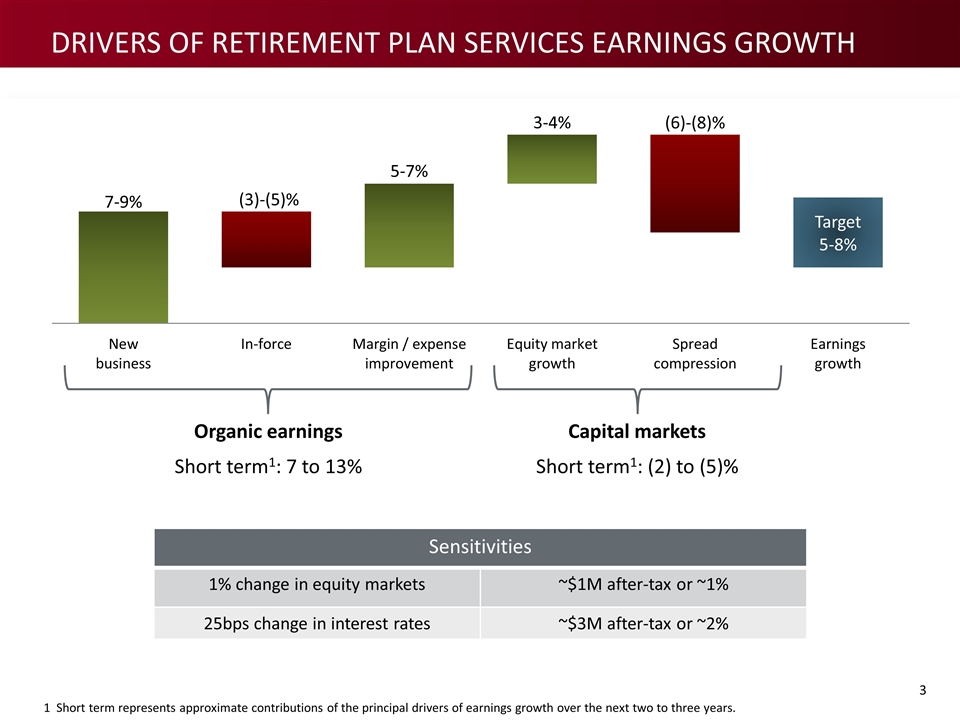

Sensitivities 1% change in equity markets ~$1M after-tax or ~1% 25bps change in interest rates ~$3M after-tax or ~2% Organic earnings Short term1: 7 to 13% Capital markets Short term1: (2) to (5)% 1 Short term represents approximate contributions of the principal drivers of earnings growth over the next two to three years. Drivers of RETIREMENT PLAN SERVICES earnings growth

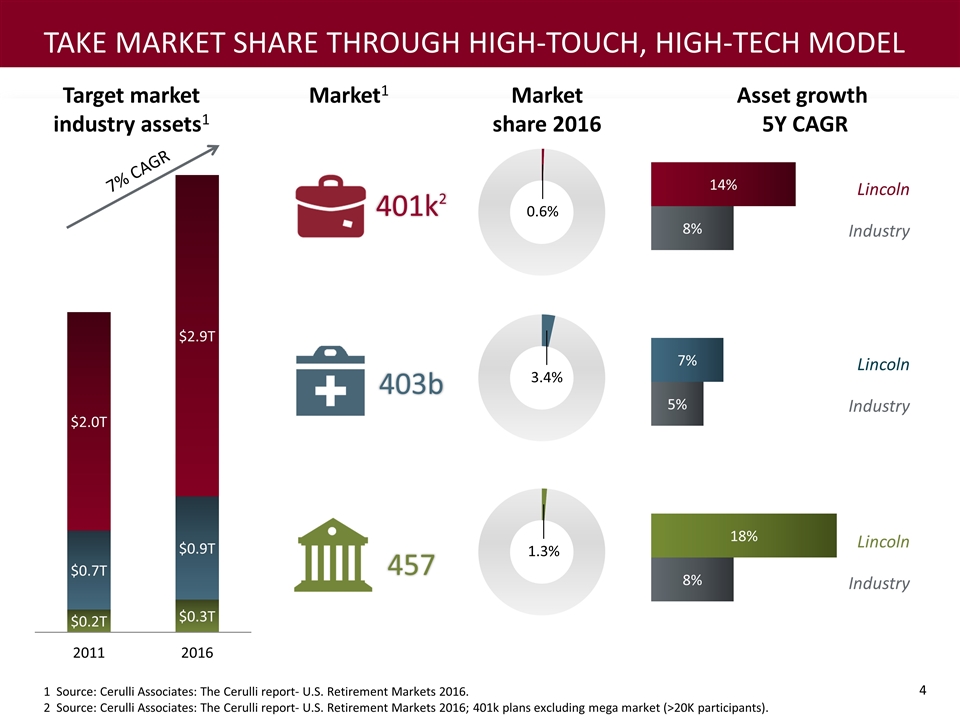

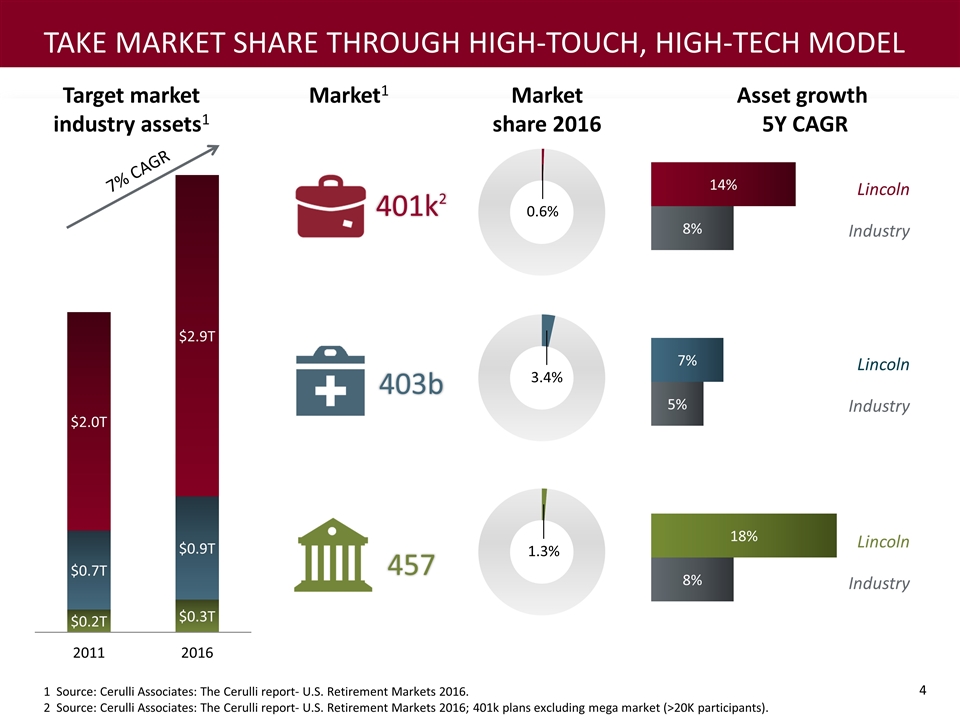

1 Source: Cerulli Associates: The Cerulli report- U.S. Retirement Markets 2016. 2 Source: Cerulli Associates: The Cerulli report- U.S. Retirement Markets 2016; 401k plans excluding mega market (>20K participants). Market1 Asset growth 5Y CAGR Target market industry assets1 Market share 2016 7% CAGR 457 403b Lincoln Industry Lincoln Industry Lincoln Industry 401k2 Take market share through high-touch, high-tech model

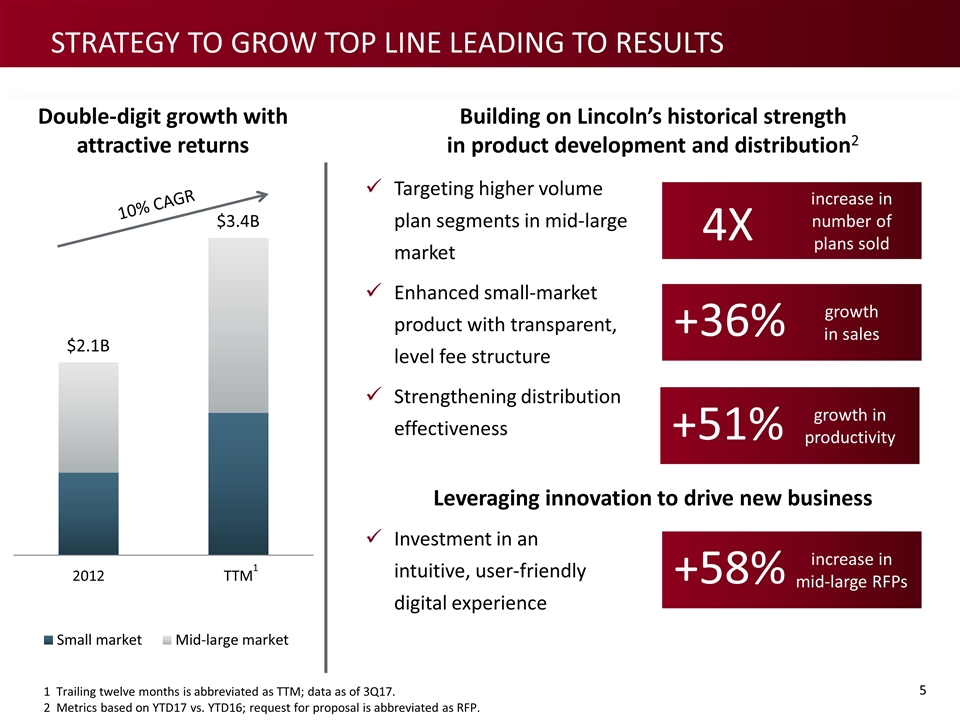

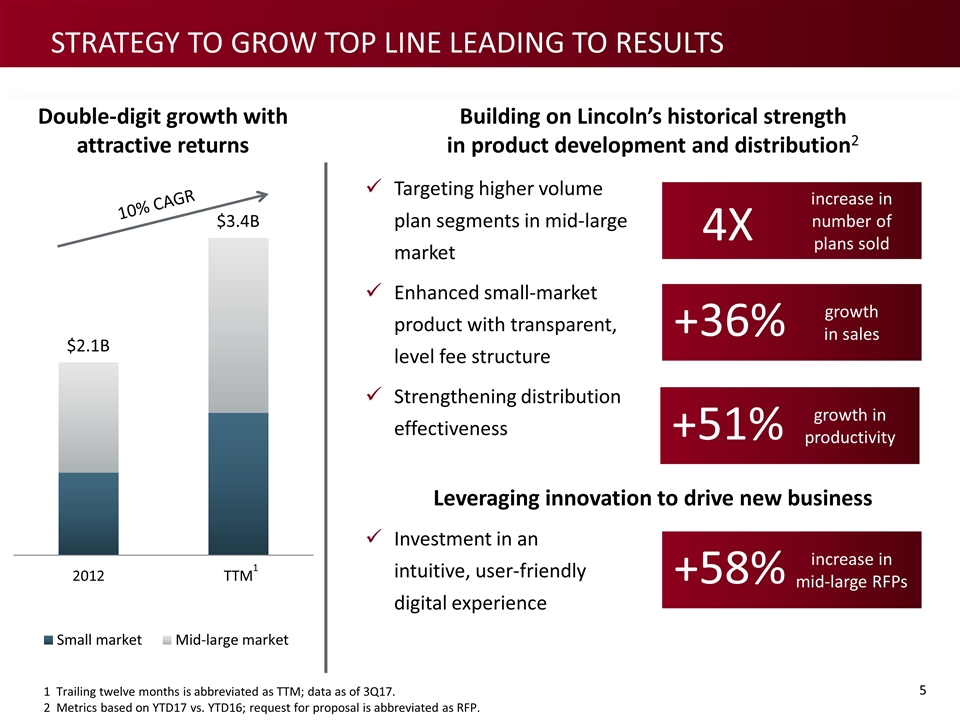

strategy to grow top line leading to results Double-digit growth with attractive returns Investment in an intuitive, user-friendly digital experience Leveraging innovation to drive new business Building on Lincoln’s historical strength in product development and distribution2 Targeting higher volume plan segments in mid-large market Enhanced small-market product with transparent, level fee structure Strengthening distribution effectiveness 10% CAGR growth in sales +36% increase in mid-large RFPs increase in number of plans sold 1 1 Trailing twelve months is abbreviated as TTM; data as of 3Q17. 2 Metrics based on YTD17 vs. YTD16; request for proposal is abbreviated as RFP. 4X +58% growth in productivity +51%

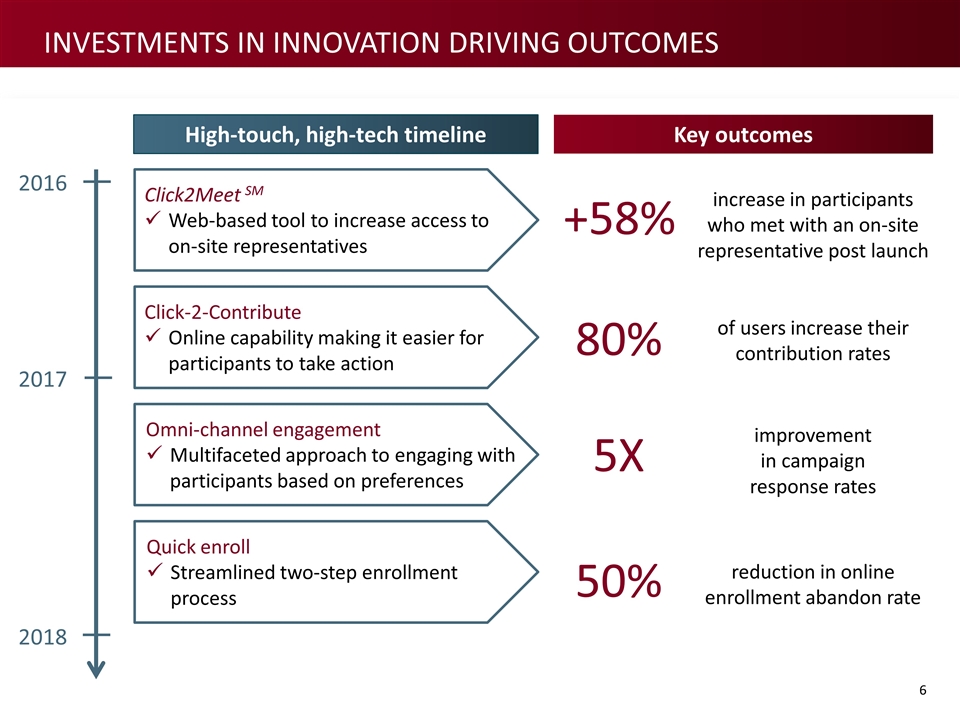

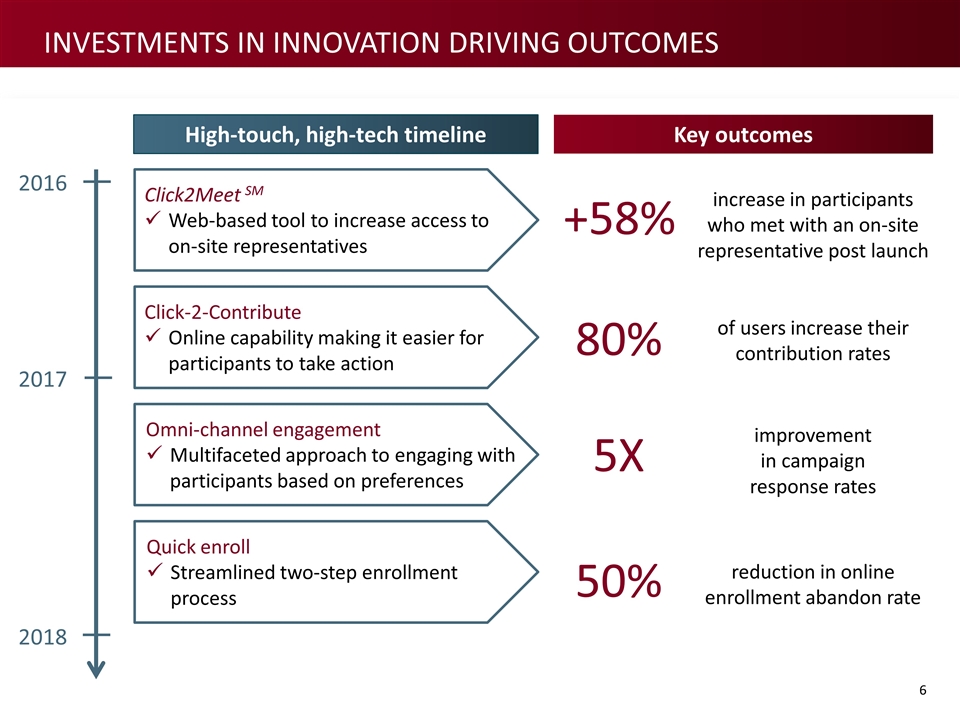

Omni-channel engagement Multifaceted approach to engaging with participants based on preferences Click2Meet SM Web-based tool to increase access to on-site representatives Click-2-Contribute Online capability making it easier for participants to take action Quick enroll Streamlined two-step enrollment process 2016 2018 2017 increase in participants who met with an on-site representative post launch +58% of users increase their contribution rates 80% improvement in campaign response rates 5X reduction in online enrollment abandon rate 50% High-touch, high-tech timeline Key outcomes Investments in innovation driving outcomes

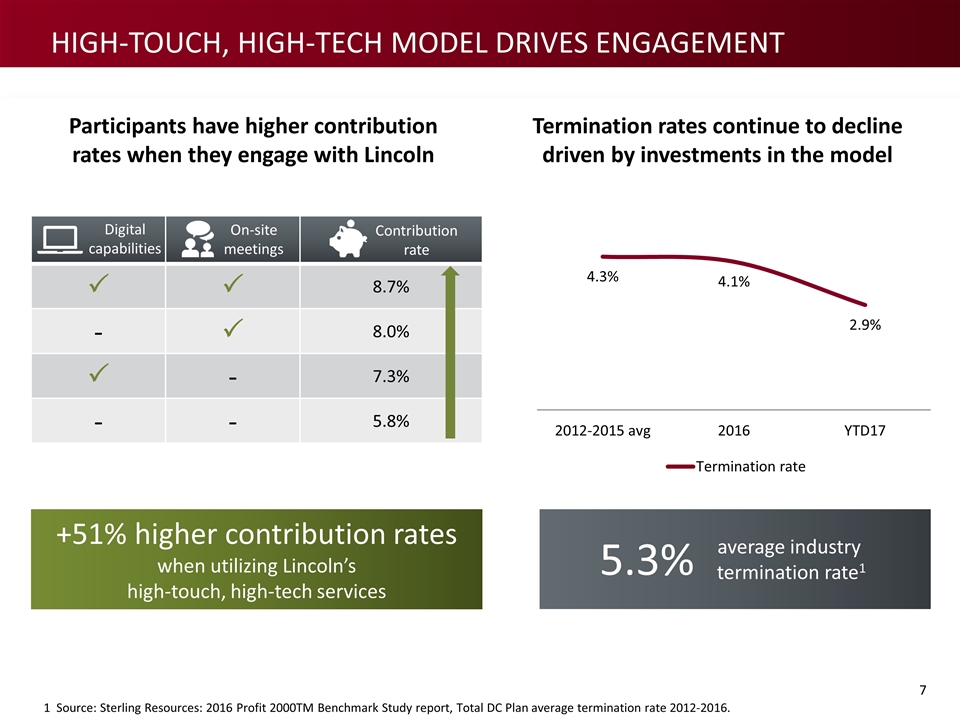

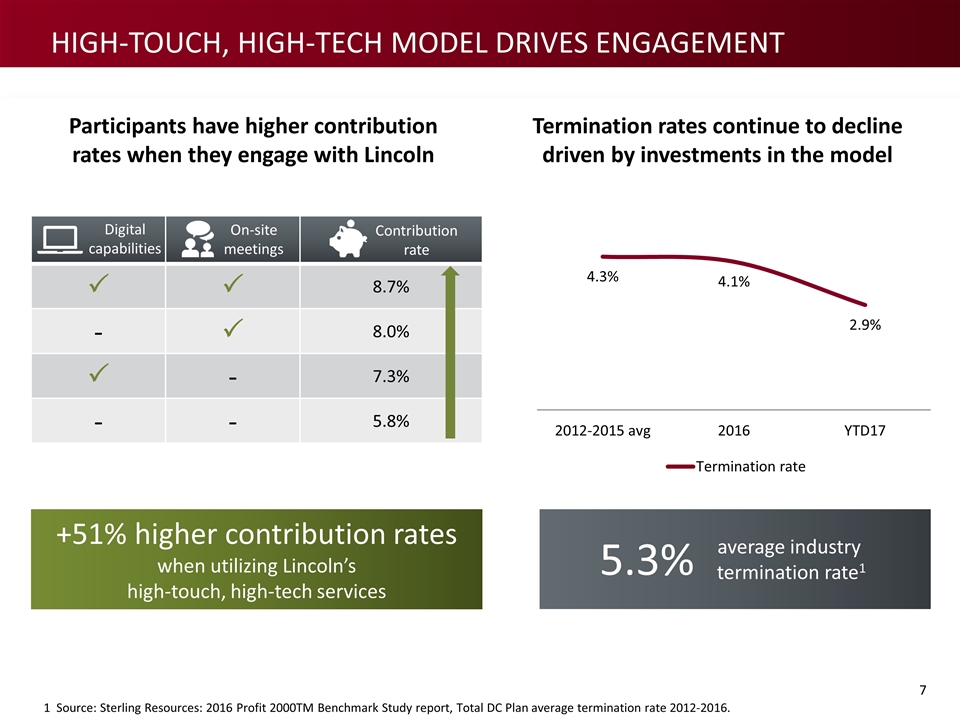

1 Source: Sterling Resources: 2016 Profit 2000TM Benchmark Study report, Total DC Plan average termination rate 2012-2016. Termination rates continue to decline driven by investments in the model Participants have higher contribution rates when they engage with Lincoln average industry termination rate1 +51% higher contribution rates when utilizing Lincoln’s high-touch, high-tech services P P 8.7% - P 8.0% P - 7.3% - - 5.8% Digital capabilities On-site meetings Contribution rate 5.3% High-touch, High-tech model drives engagement

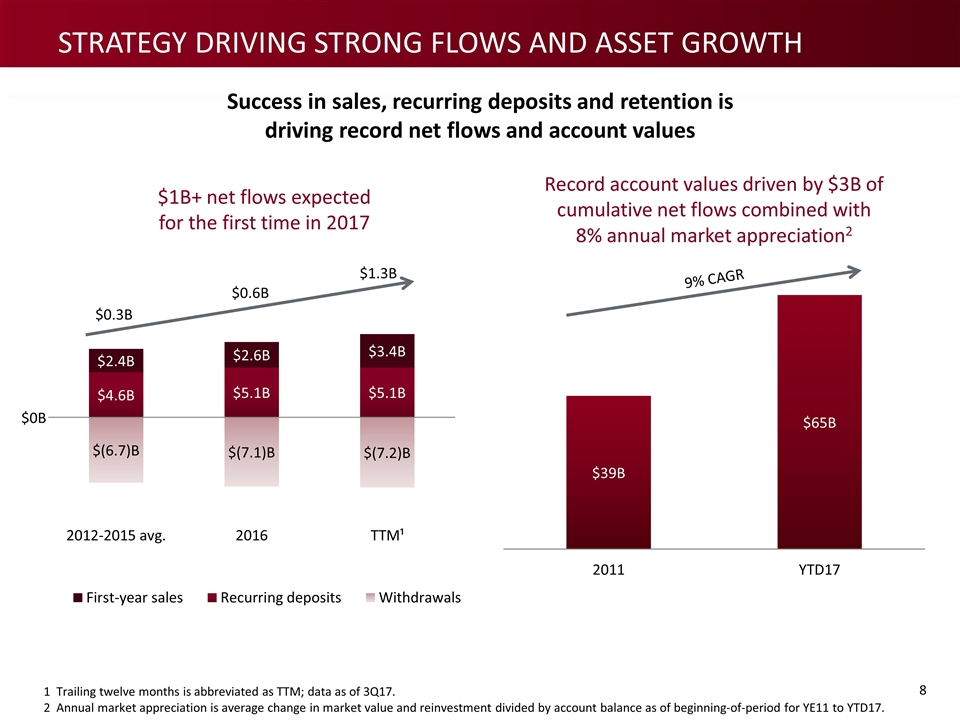

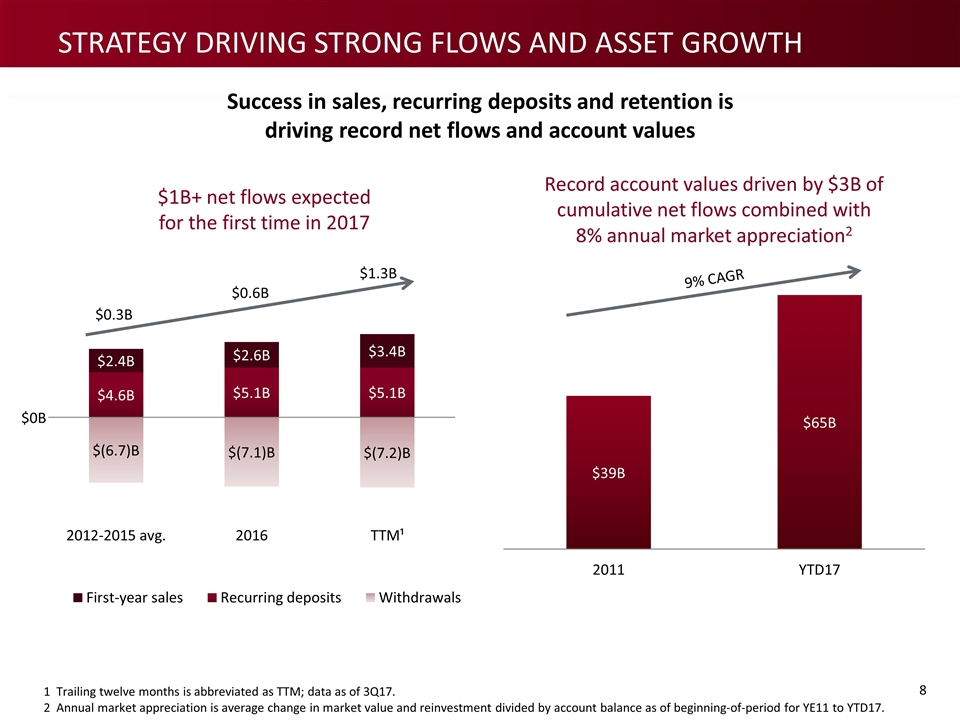

$1B+ net flows expected for the first time in 2017 Record account values driven by $3B of cumulative net flows combined with 8% annual market appreciation2 Success in sales, recurring deposits and retention is driving record net flows and account values 1 Trailing twelve months is abbreviated as TTM; data as of 3Q17. 2 Annual market appreciation is average change in market value and reinvestment divided by account balance as of beginning-of-period for YE11 to YTD17. 9% CAGR $0B $0.3B $0.6B $1.3B Strategy driving strong flows and asset growth

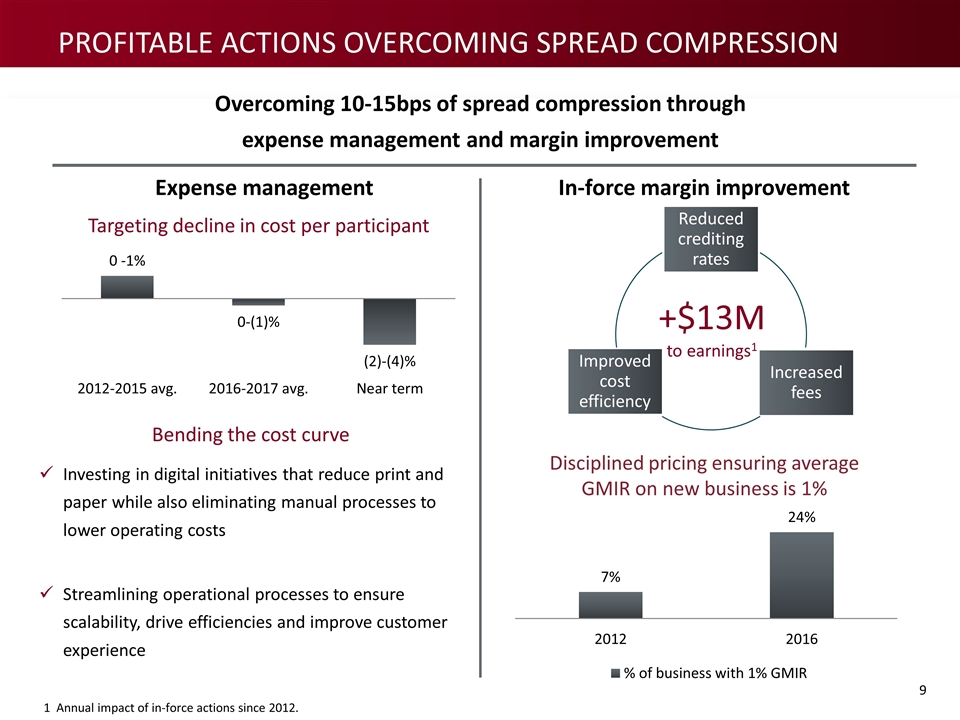

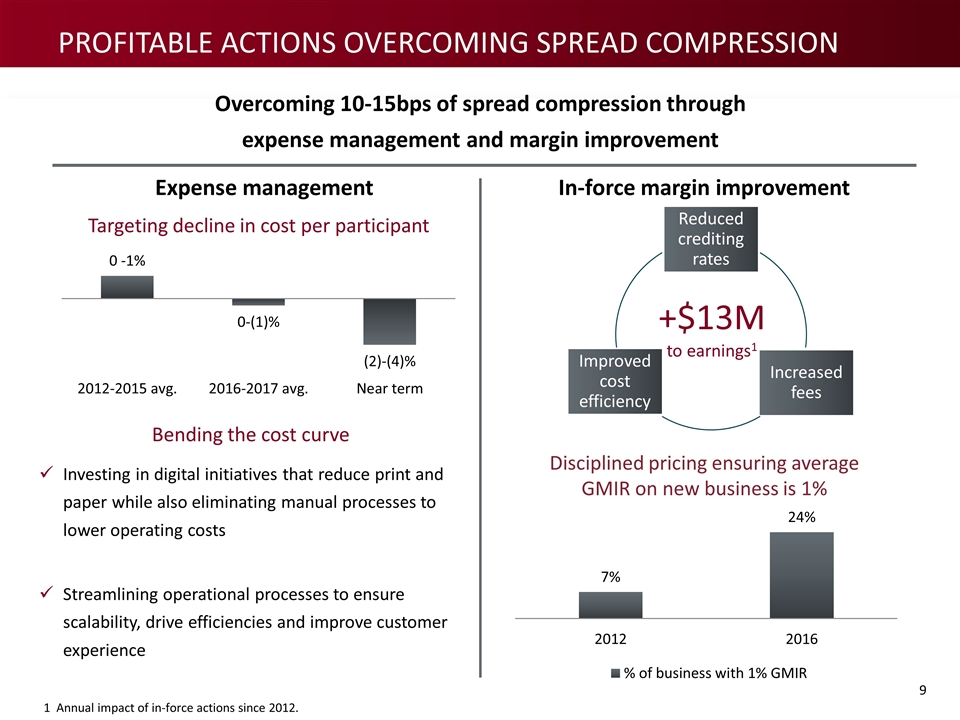

Bending the cost curve Investing in digital initiatives that reduce print and paper while also eliminating manual processes to lower operating costs Streamlining operational processes to ensure scalability, drive efficiencies and improve customer experience Expense management Targeting decline in cost per participant Overcoming 10-15bps of spread compression through expense management and margin improvement In-force margin improvement Disciplined pricing ensuring average GMIR on new business is 1% Reduced crediting rates Increased fees Improved cost efficiency +$13M to earnings1 1 Annual impact of in-force actions since 2012. Profitable actions overcoming Spread Compression

Lincoln’s high-touch, high-tech model is driving growth, outpacing the industry across key target markets Double-digit annual growth in new sales and below-industry termination rates are driving asset growth and higher net flows Overcoming 10-15bps of spread compression through targeted in-force management actions and declines in cost per participant Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview Retirement Plan Services

Will Fuller | President, Annuity Solutions, Lincoln Financial Distributors and Lincoln Financial Network Annuities 2017 Conference for Analysts, Investors and Bankers

Annuities OUR BUSINESS MODEL DELIVERS CONSISTENT AND IMPRESSIVE RESULTS THROUGH A DISCIPLINED APPROACH TO THE ANNUITY BUSINESS Quality book of business resulting from our strategy of consistency and selling on our terms Industry-leading end-to-end risk management with proven results Expand our product portfolio and leverage our best-in-class distribution to drive sales growth Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview

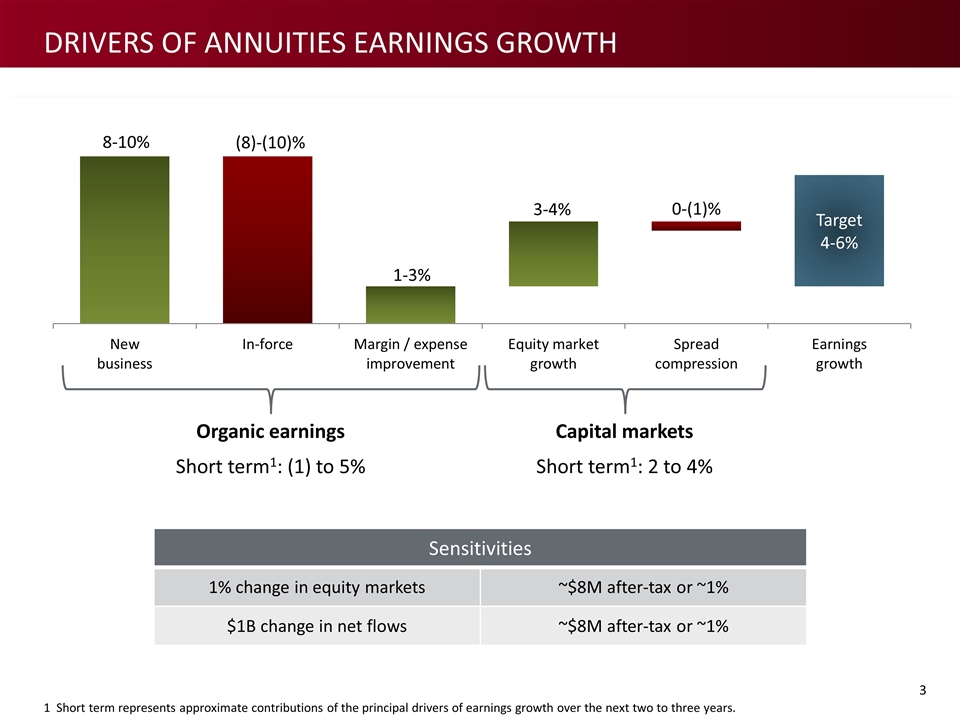

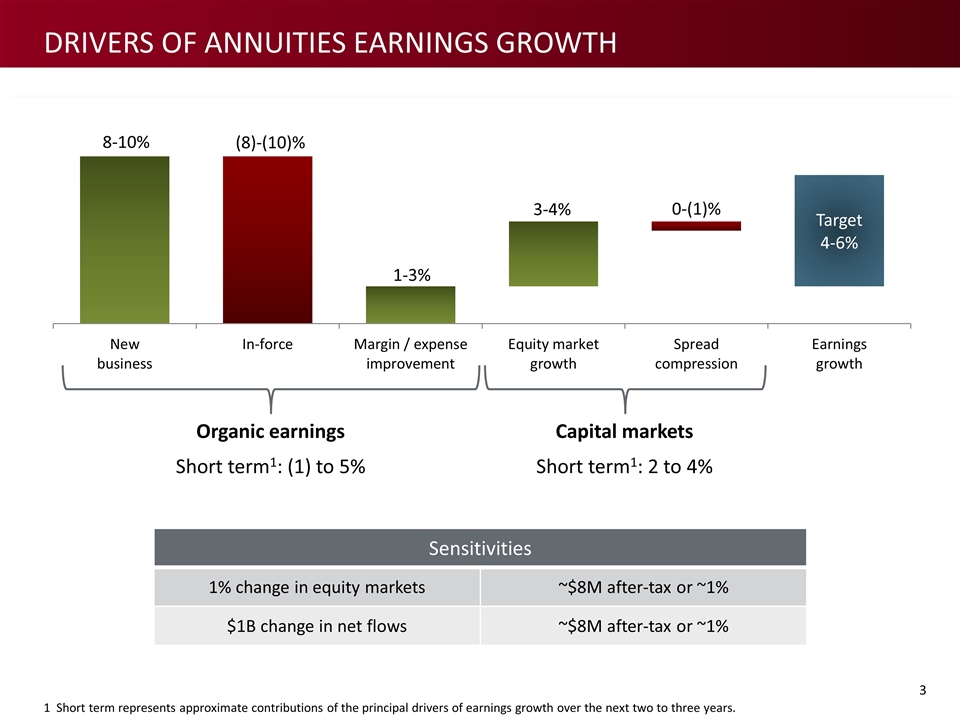

Drivers of annuities earnings growth Sensitivities 1% change in equity markets ~$8M after-tax or ~1% $1B change in net flows ~$8M after-tax or ~1% Organic earnings Short term1: (1) to 5% Capital markets Short term1: 2 to 4% 1 Short term represents approximate contributions of the principal drivers of earnings growth over the next two to three years.

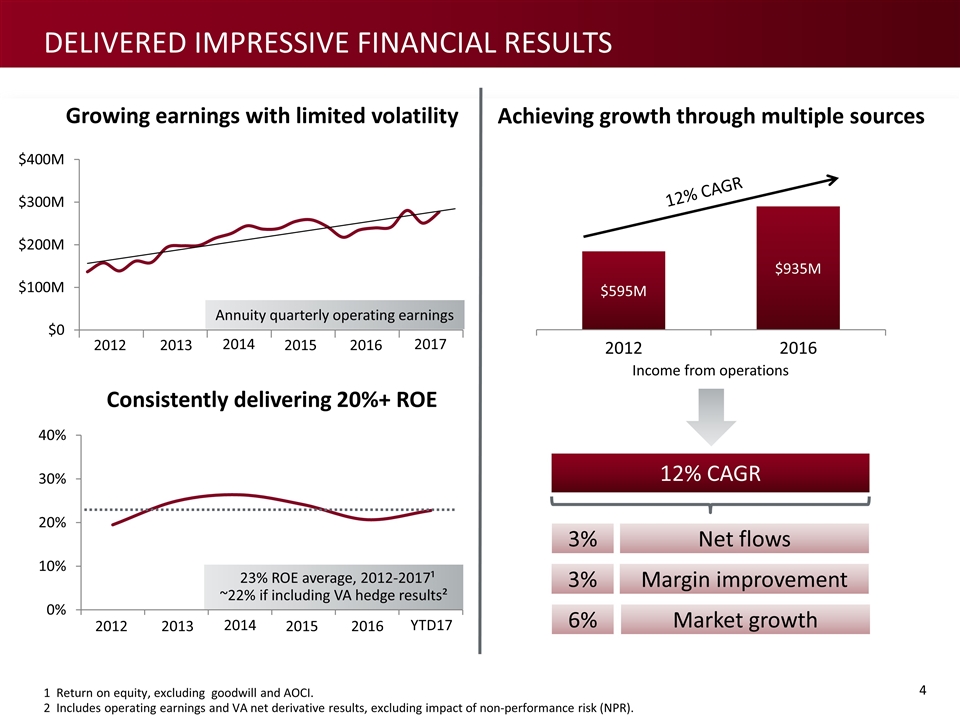

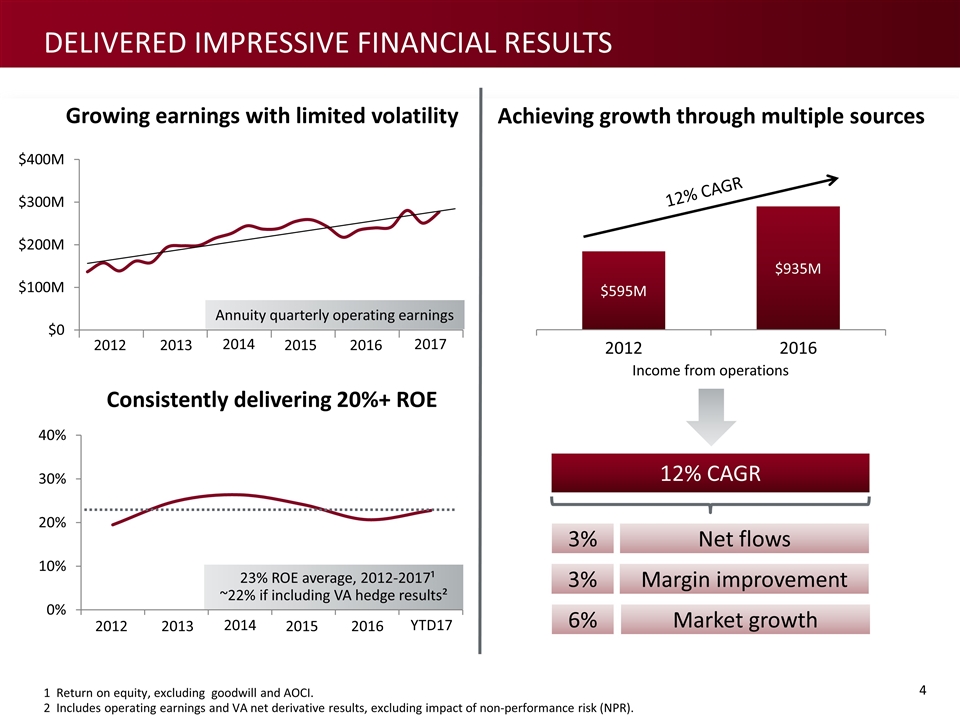

Net flows 3% Market growth 6% 12% CAGR Delivered impressive financial results Growing earnings with limited volatility Consistently delivering 20%+ ROE 1 Return on equity, excluding goodwill and AOCI. 2 Includes operating earnings and VA net derivative results, excluding impact of non-performance risk (NPR). 23% ROE average, 2012-2017¹ ~22% if including VA hedge results² Annuity quarterly operating earnings 2012 2013 2014 2015 2016 2017 2012 2013 2014 2015 2016 YTD17 Achieving growth through multiple sources 12% CAGR Income from operations Margin improvement 3%

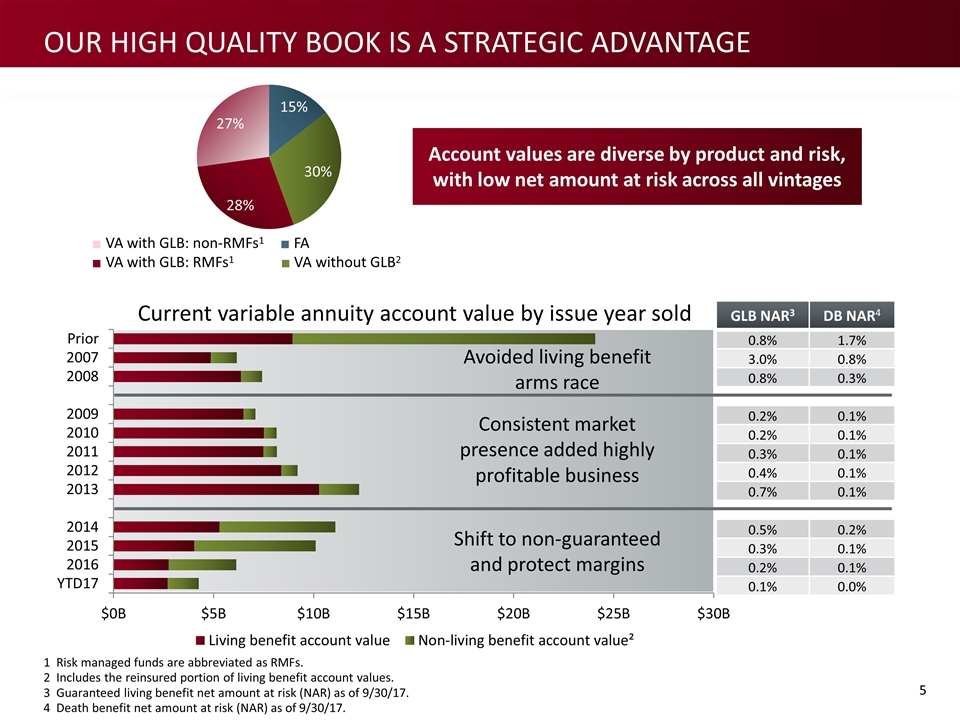

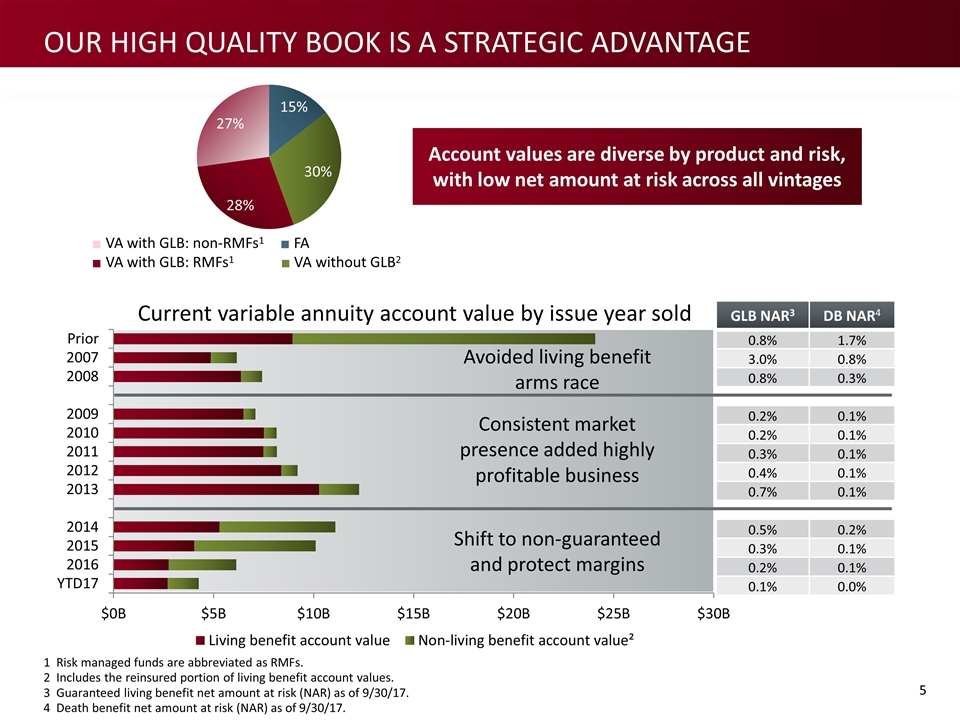

■ VA with GLB: non-RMFs1 ■ FA ■ VA with GLB: RMFs1 ■ VA without GLB2 Our high quality book is a strategic advantage GLB NAR3 DB NAR4 0.8% 1.7% 3.0% 0.8% 0.8% 0.3% 0.2% 0.1% 0.2% 0.1% 0.3% 0.1% 0.4% 0.1% 0.7% 0.1% 0.5% 0.2% 0.3% 0.1% 0.2% 0.1% 0.1% 0.0% Current variable annuity account value by issue year sold 1 Risk managed funds are abbreviated as RMFs. 2 Includes the reinsured portion of living benefit account values. 3 Guaranteed living benefit net amount at risk (NAR) as of 9/30/17. 4 Death benefit net amount at risk (NAR) as of 9/30/17. Shift to non-guaranteed and protect margins Consistent market presence added highly profitable business Avoided living benefit arms race Account values are diverse by product and risk, with low net amount at risk across all vintages

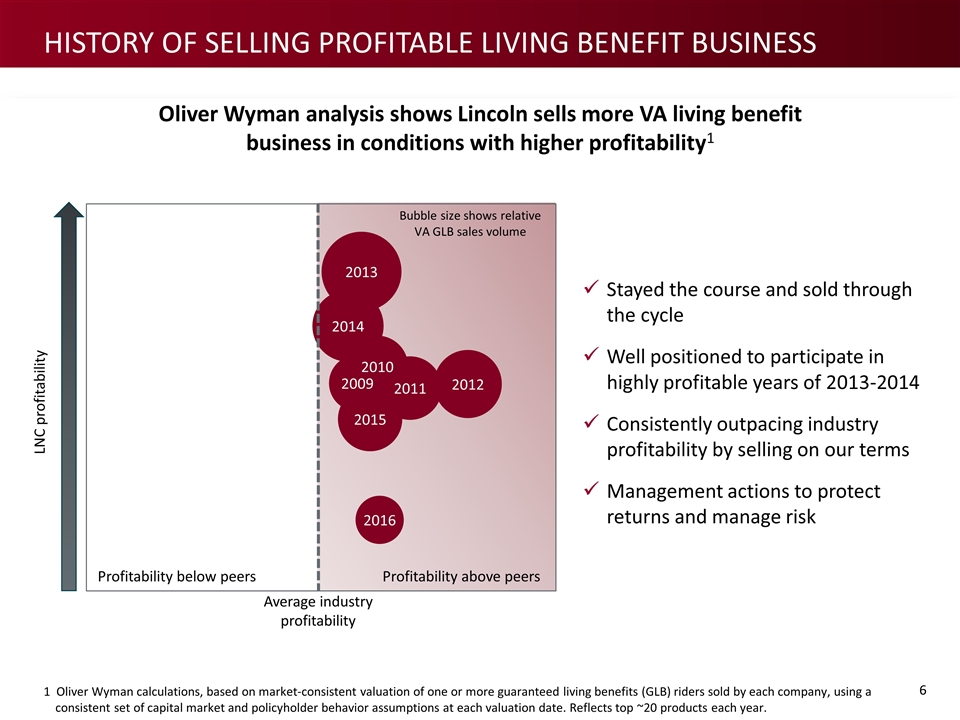

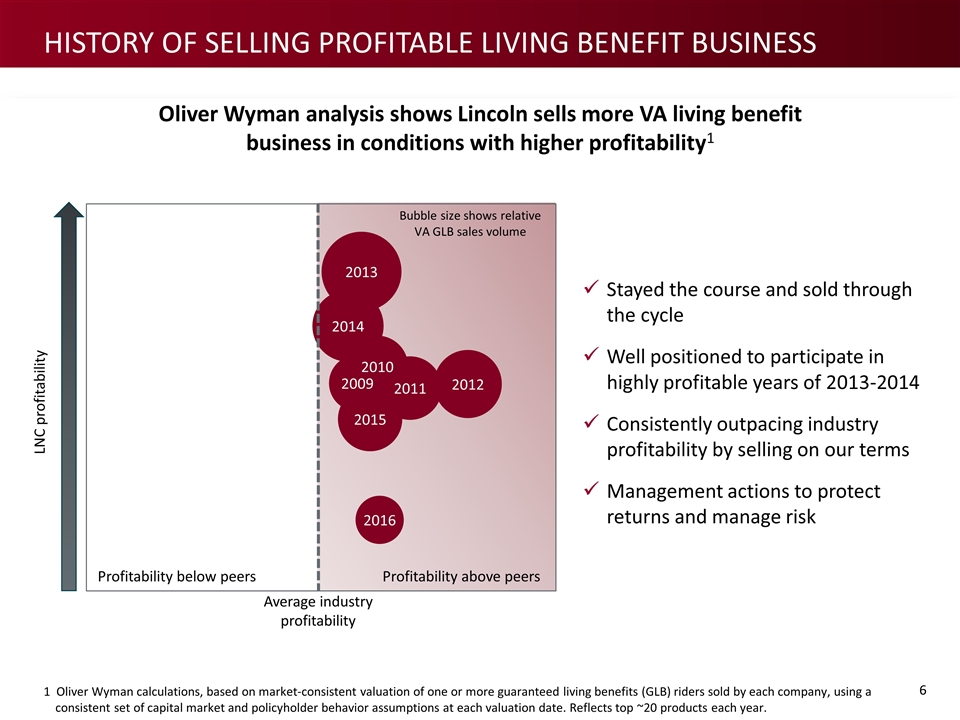

History of selling profitable living benefit business 1 Oliver Wyman calculations, based on market‐consistent valuation of one or more guaranteed living benefits (GLB) riders sold by each company, using a consistent set of capital market and policyholder behavior assumptions at each valuation date. Reflects top ~20 products each year. Oliver Wyman analysis shows Lincoln sells more VA living benefit business in conditions with higher profitability1 Profitability below peers LNC profitability Bubble size shows relative VA GLB sales volume Stayed the course and sold through the cycle Well positioned to participate in highly profitable years of 2013-2014 Consistently outpacing industry profitability by selling on our terms Management actions to protect returns and manage risk Profitability above peers Average industry profitability

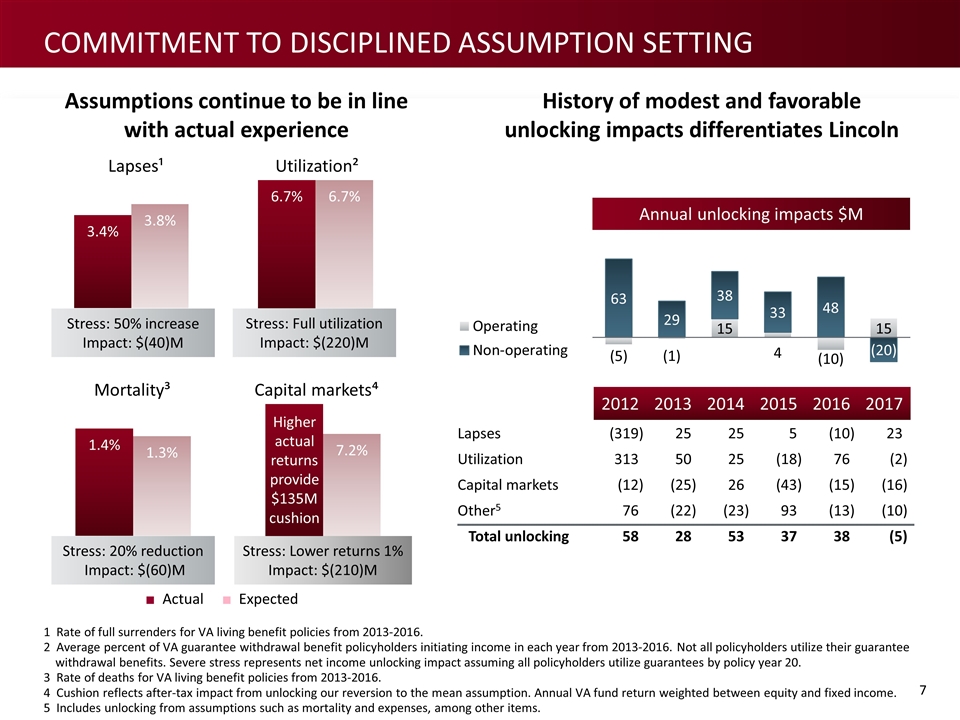

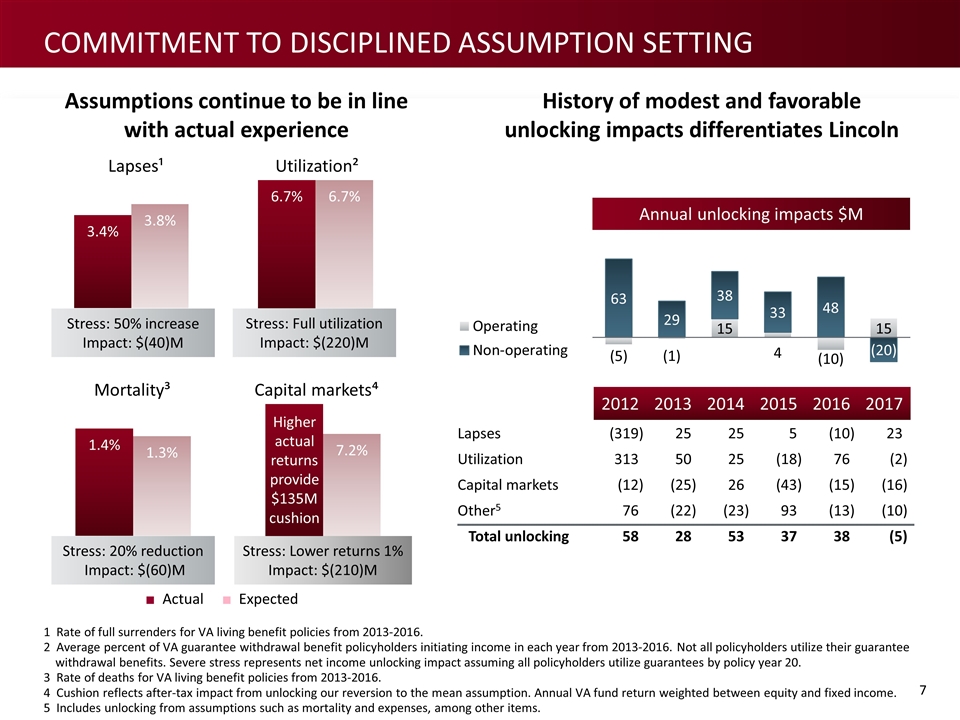

1 Rate of full surrenders for VA living benefit policies from 2013-2016. 2 Average percent of VA guarantee withdrawal benefit policyholders initiating income in each year from 2013-2016. Not all policyholders utilize their guarantee withdrawal benefits. Severe stress represents net income unlocking impact assuming all policyholders utilize guarantees by policy year 20. 3 Rate of deaths for VA living benefit policies from 2013-2016. 4 Cushion reflects after-tax impact from unlocking our reversion to the mean assumption. Annual VA fund return weighted between equity and fixed income. 5 Includes unlocking from assumptions such as mortality and expenses, among other items. 2012 2013 2014 2015 2016 2017 Lapses (319) 25) 25) 5) (10) 23) Utilization 313) 50) 25) (18) 76) (2) Capital markets (12) (25) 26) (43) (15) (16) Other5 76) (22) (23) 93) (13) (10) Total unlocking 58) 28) 53) 37) 38) (5) Mortality³ Commitment to Disciplined assumption setting ■ Actual ■ Expected Utilization² Lapses¹ Assumptions continue to be in line with actual experience Capital markets⁴ Stress: 50% increase Impact: $(40)M Stress: Full utilization Impact: $(220)M Stress: 20% reduction Impact: $(60)M Annual unlocking impacts $M History of modest and favorable unlocking impacts differentiates Lincoln Stress: Lower returns 1% Impact: $(210)M Higher actual returns provide $135M cushion

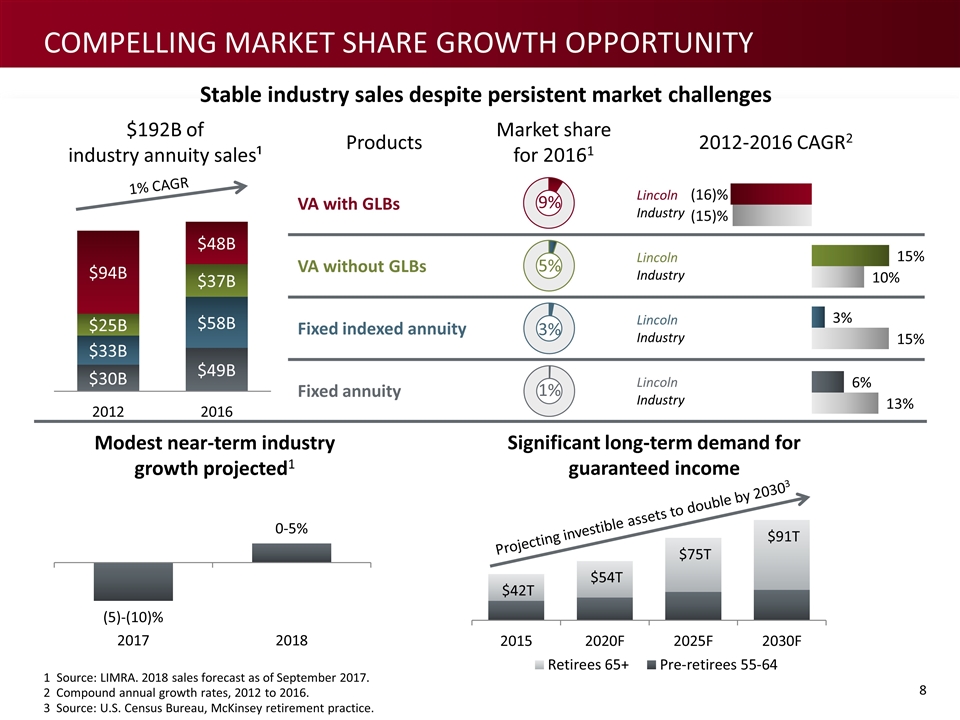

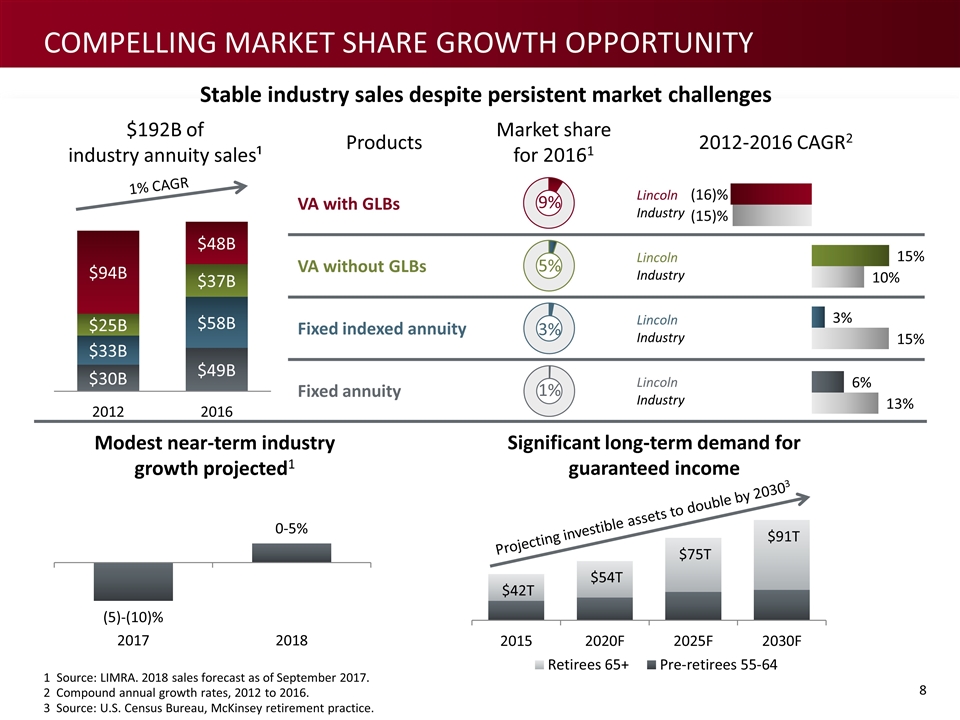

Source: LIMRA. 2018 sales forecast as of September 2017. 2 Compound annual growth rates, 2012 to 2016. 3 Source: U.S. Census Bureau, McKinsey retirement practice. Compelling market share growth opportunity Significant long-term demand for guaranteed income Modest near-term industry growth projected1 Projecting investible assets to double by 20303 Stable industry sales despite persistent market challenges Products Market share for 20161 2012-2016 CAGR2 VA with GLBs Lincoln Industry VA without GLBs Lincoln Industry Fixed indexed annuity Lincoln Industry Fixed annuity Lincoln Industry 9% 5% 3% 1% $192B of industry annuity sales¹ 1% CAGR

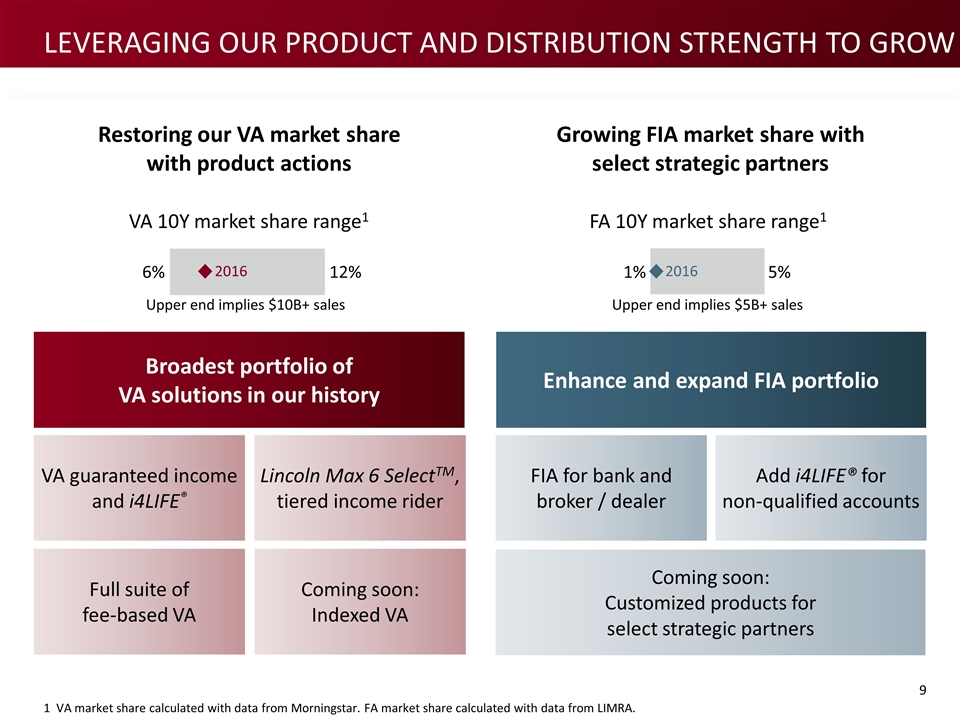

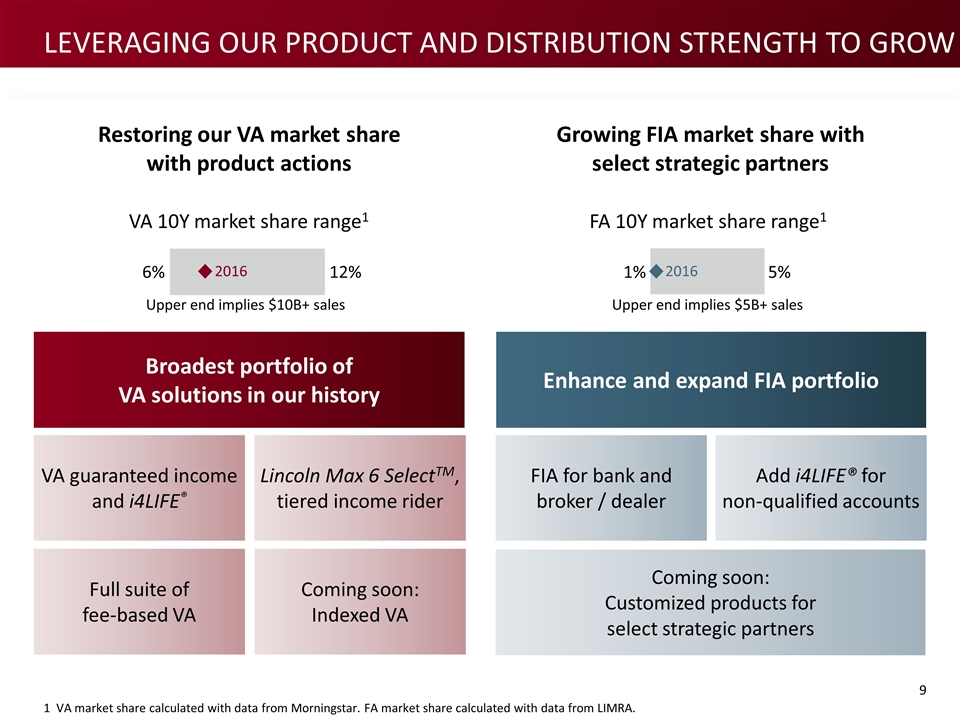

1% 2016 Leveraging our product and distribution strength to grow 1 VA market share calculated with data from Morningstar. FA market share calculated with data from LIMRA. Restoring our VA market share with product actions VA 10Y market share range1 6% 12% Upper end implies $10B+ sales Growing FIA market share with select strategic partners FA 10Y market share range1 5% Upper end implies $5B+ sales 2016 Broadest portfolio of VA solutions in our history Enhance and expand FIA portfolio VA guaranteed income and i4LIFE® Lincoln Max 6 SelectTM, tiered income rider Full suite of fee-based VA Coming soon: Indexed VA FIA for bank and broker / dealer Add i4LIFE® for non-qualified accounts Coming soon: Customized products for select strategic partners

annuities Quality book of business resulting from our strategy of consistency and selling on our terms Industry-leading end-to-end risk management with proven results Expand our product portfolio and leverage our best-in-class distribution to drive sales growth Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview

Ellen Cooper | Executive Vice President, Chief Investment Officer Investment portfolio 2017 Conference for Analysts, Investors and Bankers

OUR INVESTMENT APPROACH IS BASED ON DISCIPLINED ALM AND RISK MANAGEMENT Unique multi-manager investment framework maximizes agility, enhances risk management and lowers costs Proactive investment strategies improve investment income and moderate portfolio yield decline Diligent portfolio construction and active risk management provide greater flexibility Investment portfolio Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview

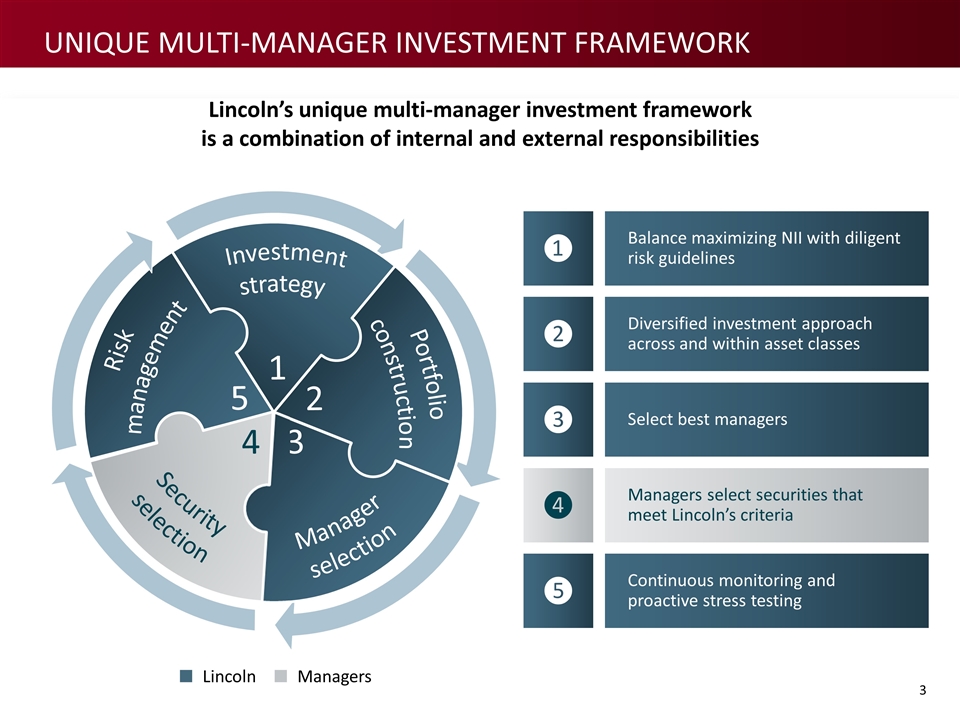

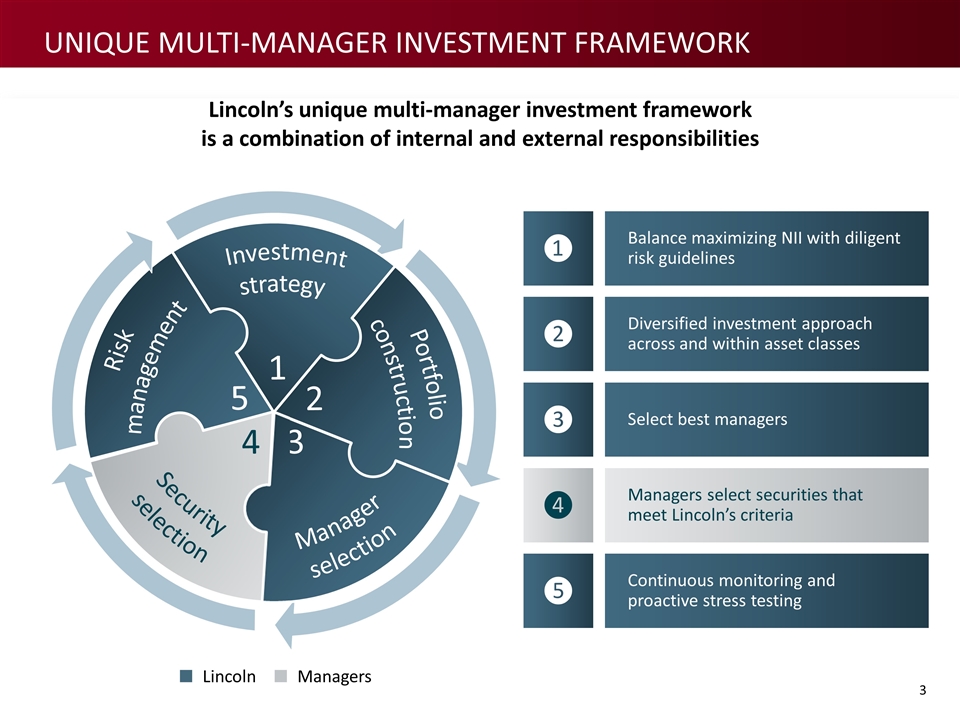

Lincoln’s unique multi-manager investment framework is a combination of internal and external responsibilities Unique multi-manager investment framework Balance maximizing NII with diligent risk guidelines ❶ Diversified investment approach across and within asset classes ❷ Managers select securities that meet Lincoln’s criteria ❹ Continuous monitoring and proactive stress testing ❺ Select best managers ❸ Investment strategy Portfolio construction Manager selection Security selection 1 2 3 5 4 Risk management ■ Lincoln ■ Managers

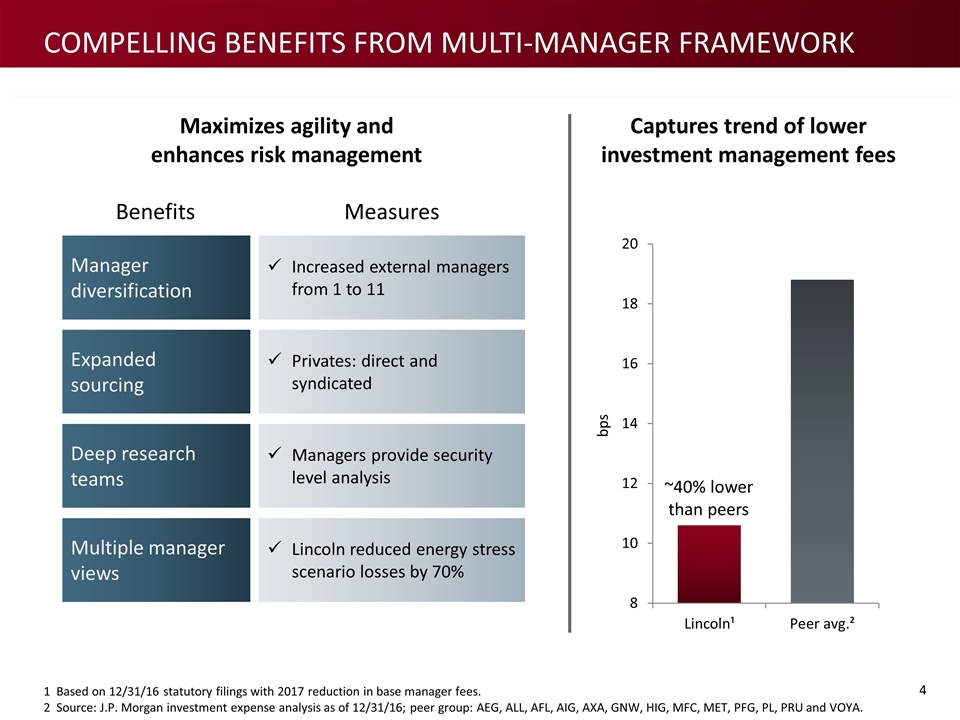

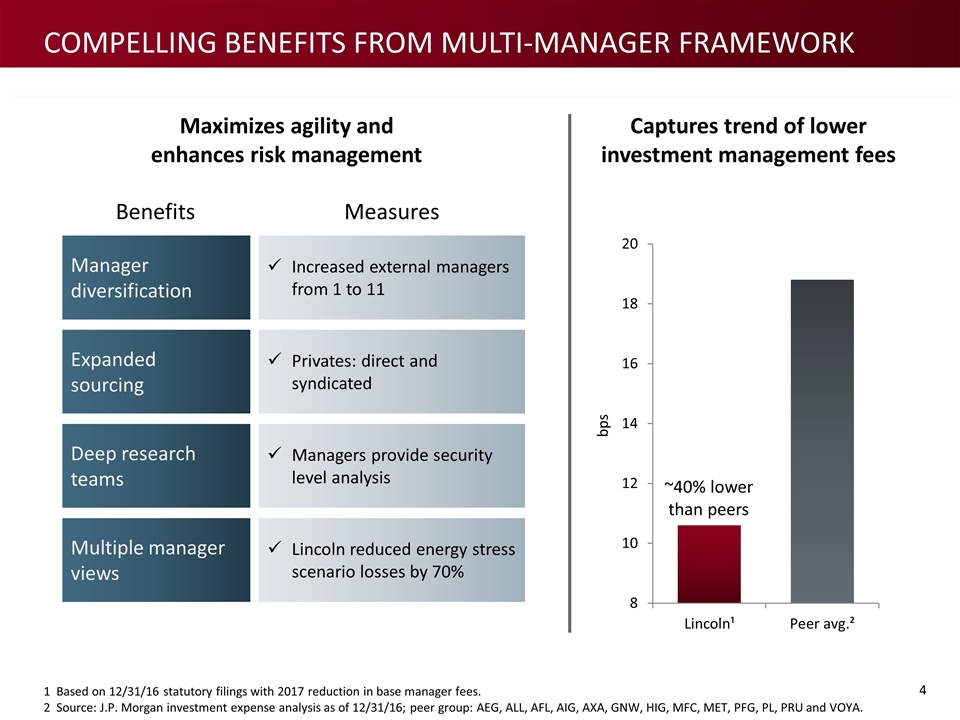

1 Based on 12/31/16 statutory filings with 2017 reduction in base manager fees. 2 Source: J.P. Morgan investment expense analysis as of 12/31/16; peer group: AEG, ALL, AFL, AIG, AXA, GNW, HIG, MFC, MET, PFG, PL, PRU and VOYA. Maximizes agility and enhances risk management Captures trend of lower investment management fees ~40% lower than peers Multiple manager views Lincoln reduced energy stress scenario losses by 70% Manager diversification Increased external managers from 1 to 11 Expanded sourcing Privates: direct and syndicated Deep research teams Managers provide security level analysis Benefits Measures bps Compelling Benefits from Multi-manager framework

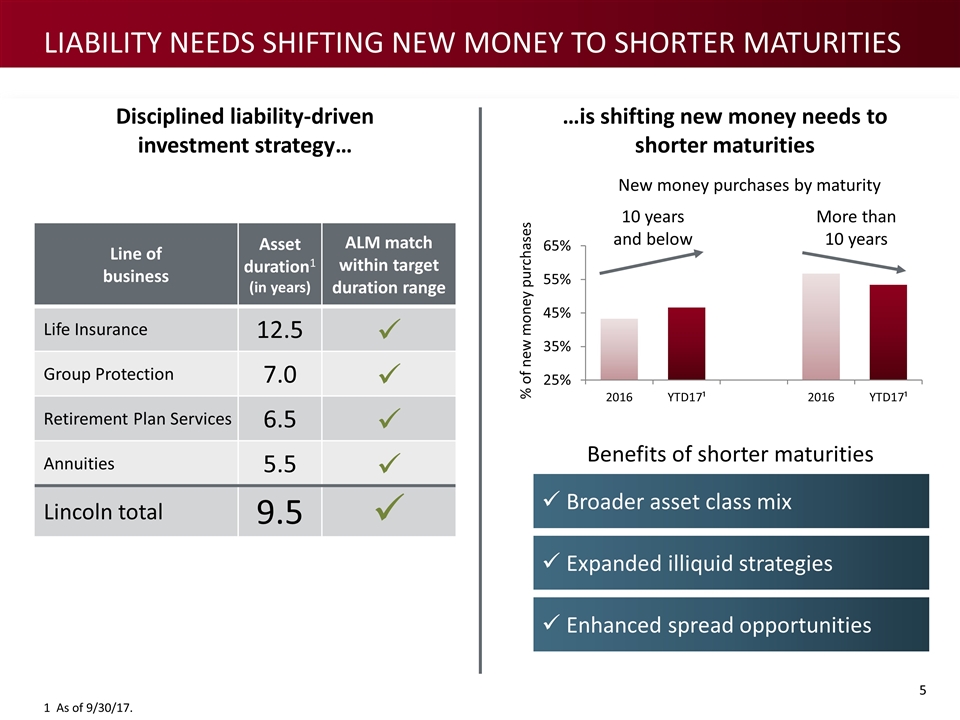

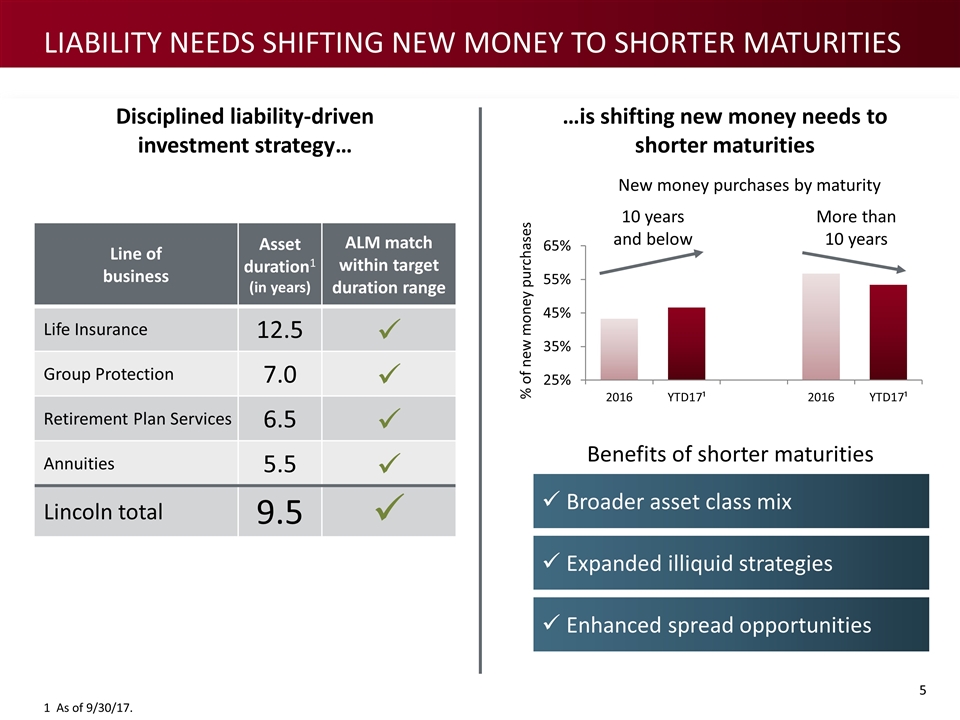

…is shifting new money needs to shorter maturities Disciplined liability-driven investment strategy… 1 As of 9/30/17. Line of business Asset duration1 (in years) ALM match within target duration range Life Insurance 12.5 ü Group Protection 7.0 ü Retirement Plan Services 6.5 ü Annuities 5.5 ü Lincoln total 9.5 ü Liability NEEDS shifting new money to shorter maturities Enhanced spread opportunities Broader asset class mix Expanded illiquid strategies Benefits of shorter maturities 10 years and below More than 10 years New money purchases by maturity

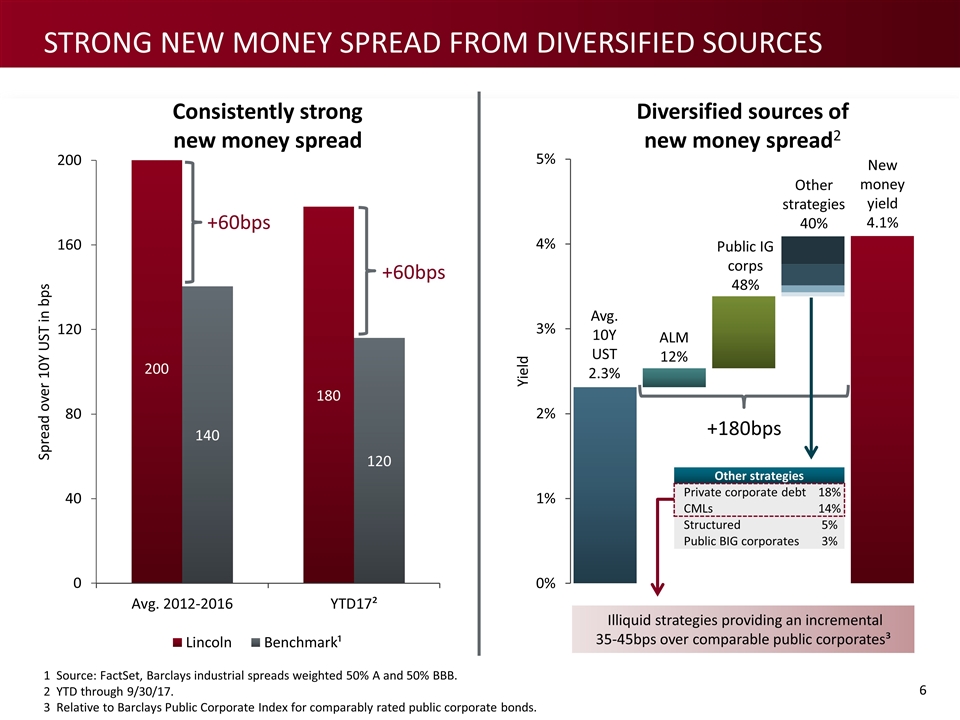

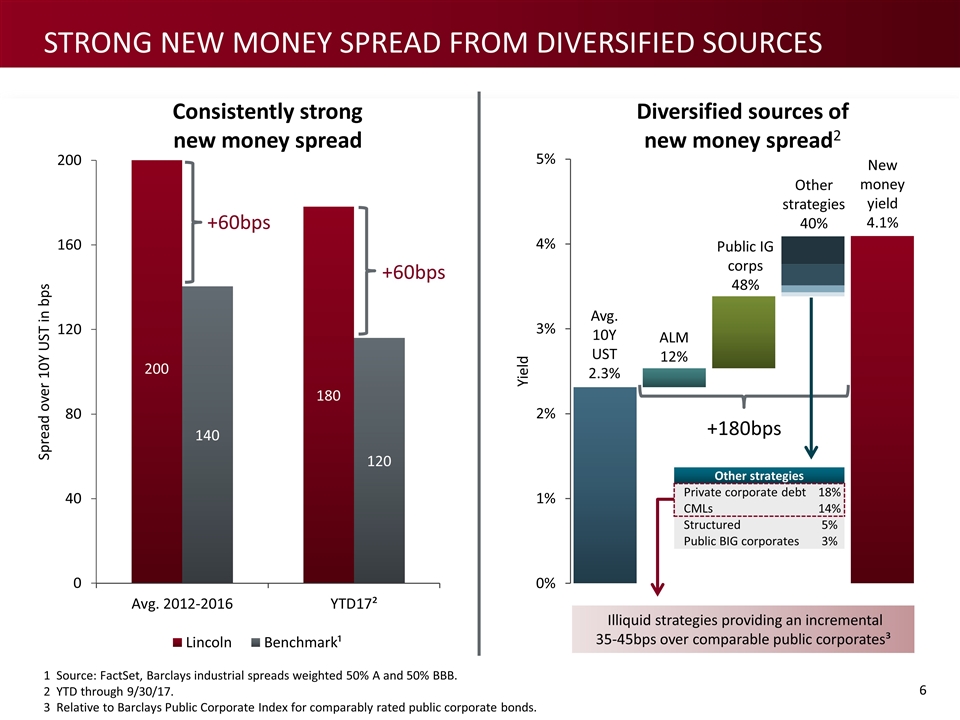

1 Source: FactSet, Barclays industrial spreads weighted 50% A and 50% BBB. 2 YTD through 9/30/17. 3 Relative to Barclays Public Corporate Index for comparably rated public corporate bonds. +60bps Other strategies 40% New money yield 4.1% ALM 12% Avg. 10Y UST 2.3% Public IG corps 48% Other strategies Private corporate debt 18% CMLs 14% Structured 5% Public BIG corporates 3% +180bps +60bps Consistently strong new money spread Diversified sources of new money spread2 Illiquid strategies providing an incremental 35-45bps over comparable public corporates³ Strong new money spread from diversified sources

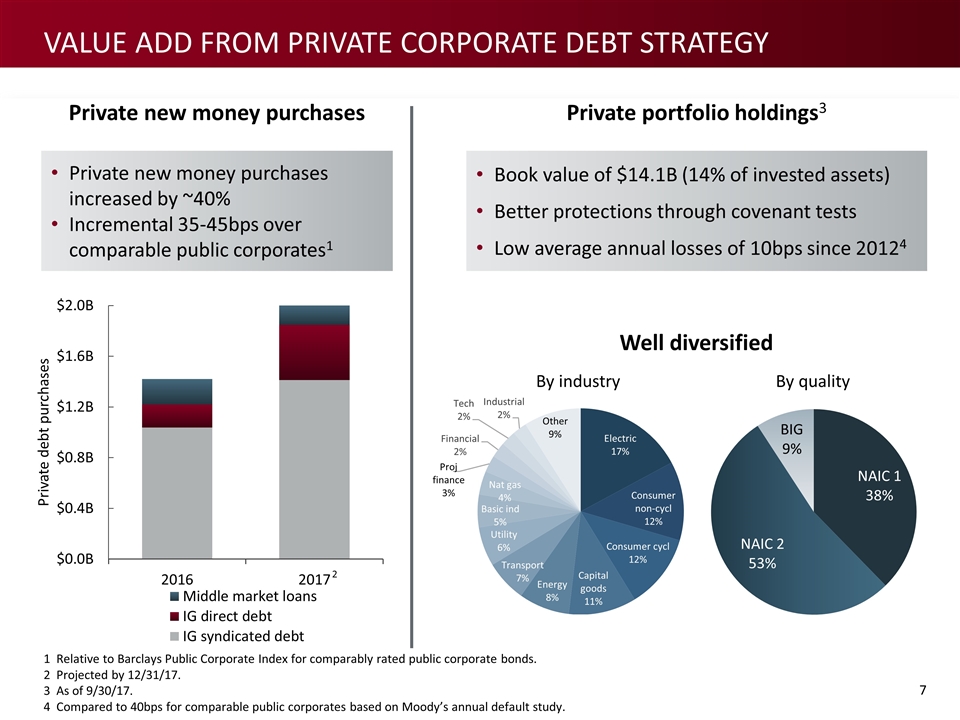

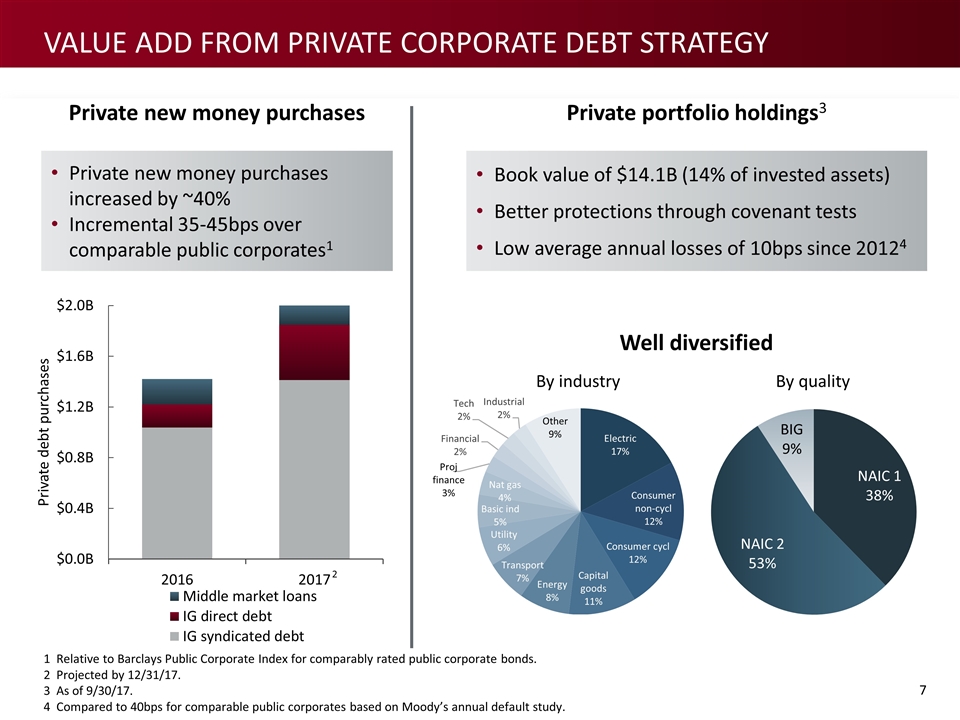

Private new money purchases By industry By quality Private portfolio holdings3 Book value of $14.1B (14% of invested assets) Better protections through covenant tests Low average annual losses of 10bps since 20124 2 1 Relative to Barclays Public Corporate Index for comparably rated public corporate bonds. 2 Projected by 12/31/17. 3 As of 9/30/17. 4 Compared to 40bps for comparable public corporates based on Moody’s annual default study. Well diversified Value ADD from Private corporate debt strategy Private new money purchases increased by ~40% Incremental 35-45bps over comparable public corporates1

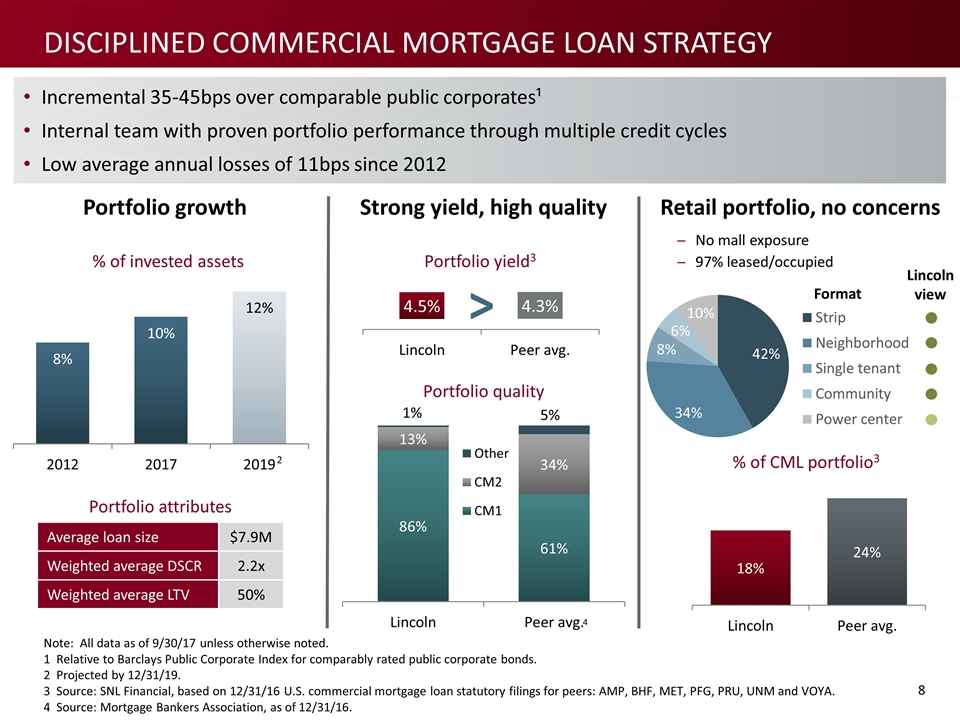

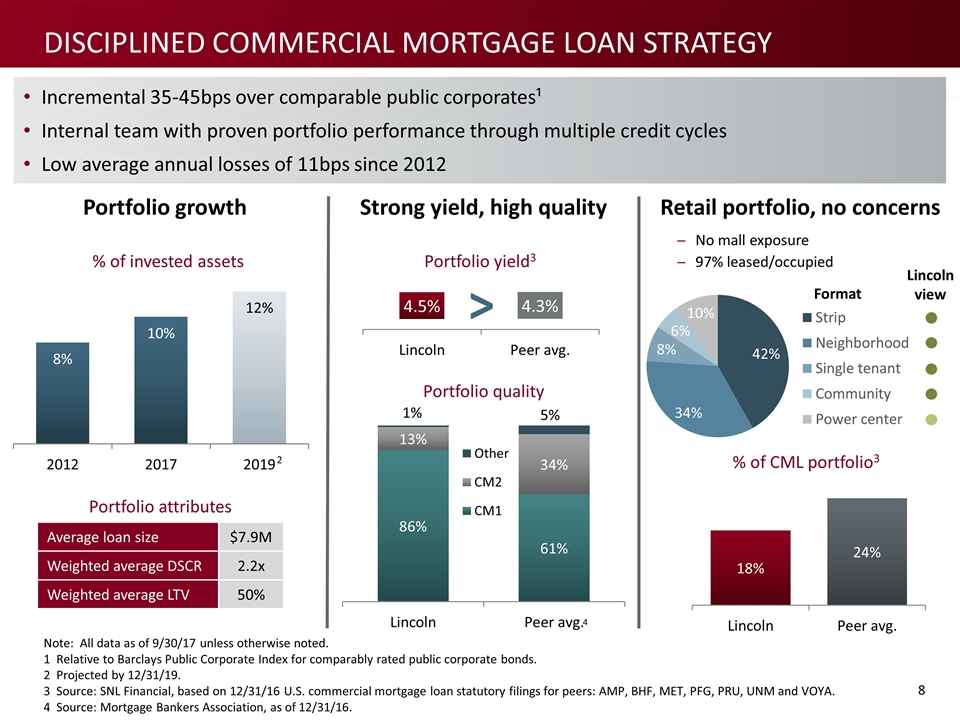

Portfolio yield3 Portfolio quality Note: All data as of 9/30/17 unless otherwise noted. 1 Relative to Barclays Public Corporate Index for comparably rated public corporate bonds. 2 Projected by 12/31/19. 3 Source: SNL Financial, based on 12/31/16 U.S. commercial mortgage loan statutory filings for peers: AMP, BHF, MET, PFG, PRU, UNM and VOYA. 4 Source: Mortgage Bankers Association, as of 12/31/16. Portfolio growth Strong yield, high quality Portfolio attributes Average loan size $7.9M Weighted average DSCR 2.2x Weighted average LTV 50% No mall exposure 97% leased/occupied % of CML portfolio3 Retail portfolio, no concerns % of invested assets Lincoln view Format Incremental 35-45bps over comparable public corporates¹ Internal team with proven portfolio performance through multiple credit cycles Low average annual losses of 11bps since 2012 > 2 4 Disciplined Commercial Mortgage Loan Strategy

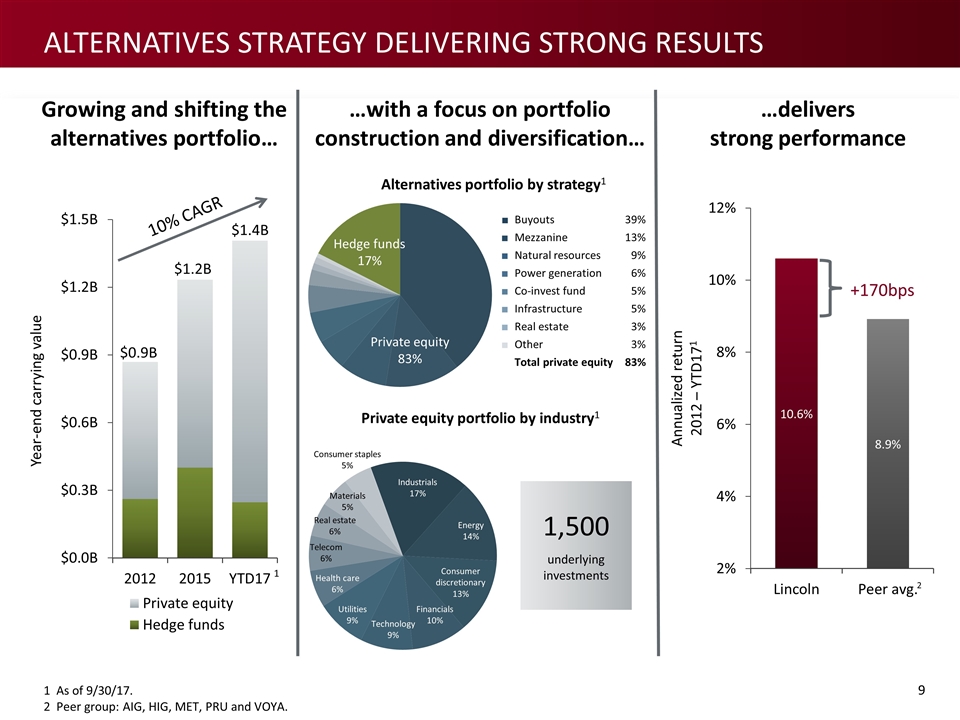

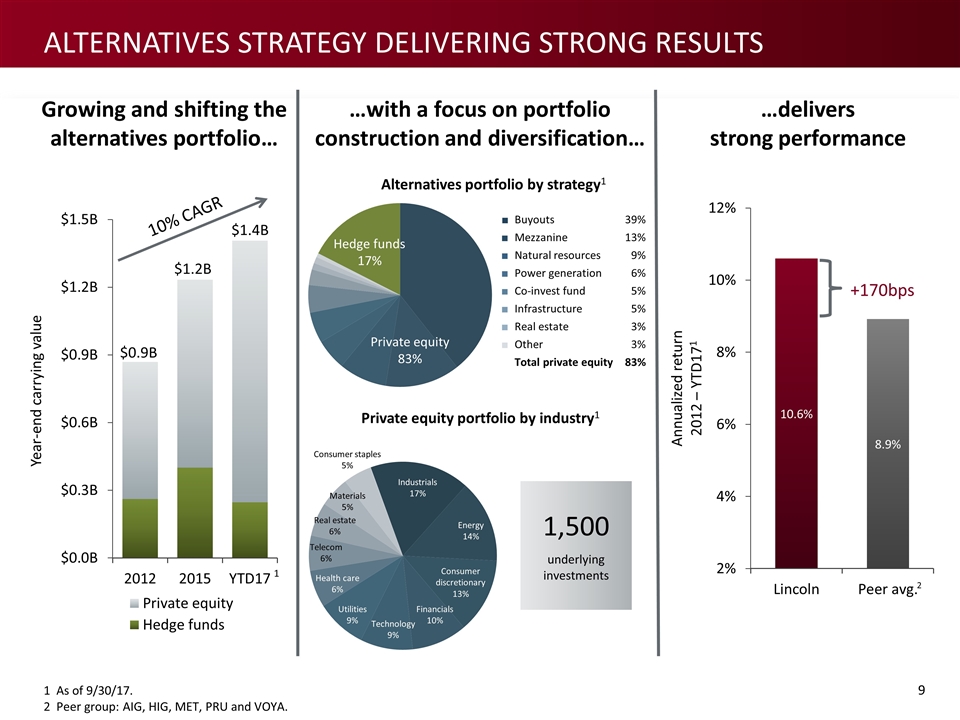

1 As of 9/30/17. 2 Peer group: AIG, HIG, MET, PRU and VOYA. Private equity portfolio by industry1 10% CAGR +170bps Hedge funds 17% Private equity 83% Growing and shifting the alternatives portfolio… …with a focus on portfolio construction and diversification… …delivers strong performance Alternatives portfolio by strategy1 1 2 $1.4B $0.9B 1,500 underlying investments Alternatives strategy delivering strong results $1.2B ■ Buyouts 39% ■ Mezzanine 13% ■ Natural resources 9% ■ Power generation 6% ■ Co-invest fund 5% ■ Infrastructure 5% ■ Real estate 3% ■ Other 3% Total private equity 83%

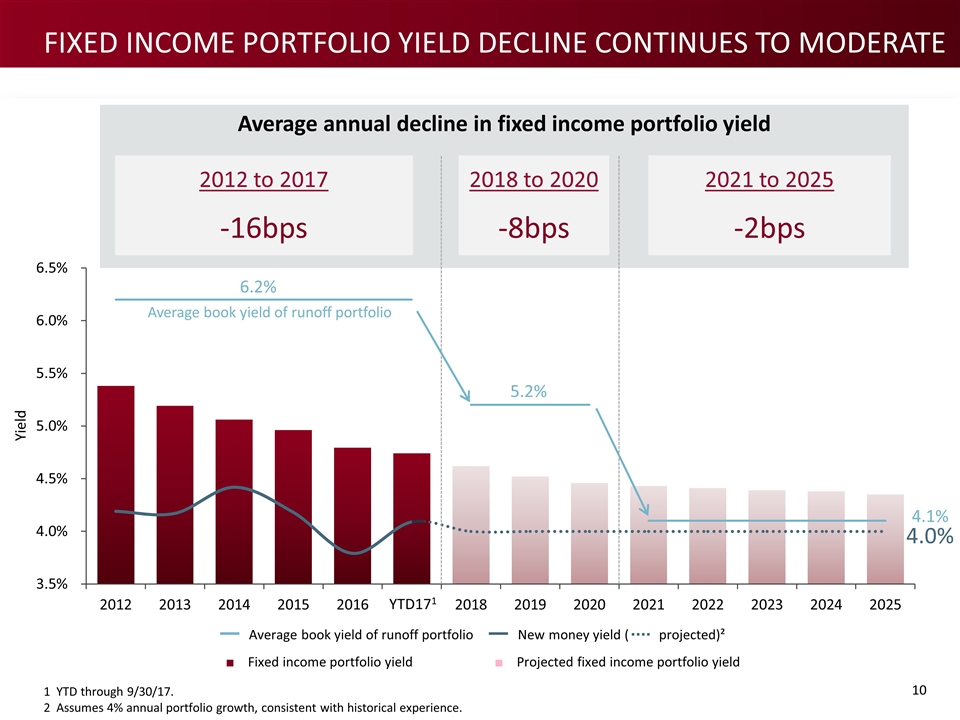

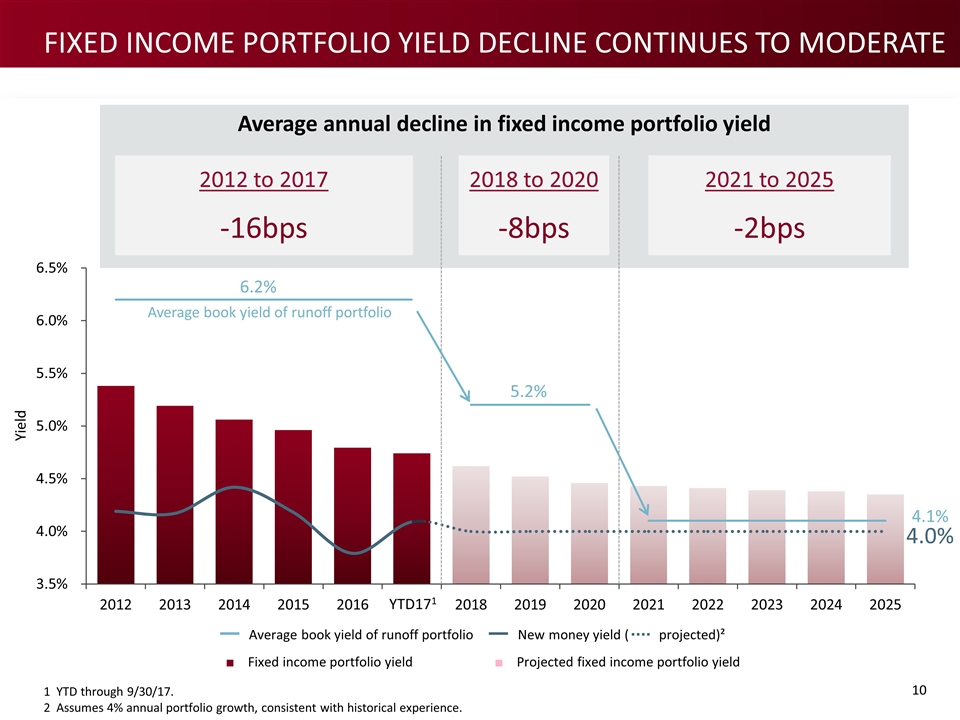

Average annual decline in fixed income portfolio yield 5.2% 4.1% 4.0% 1 YTD through 9/30/17. 2 Assumes 4% annual portfolio growth, consistent with historical experience. Average book yield of runoff portfolio YTD171 6.2% Fixed income portfolio yield decline continues to moderate 2012 to 2017 -16bps 2018 to 2020 -8bps 2021 to 2025 -2bps Yield Average book yield of runoff portfolio New money yield ( projected)² ■ Fixed income portfolio yield ■ Projected fixed income portfolio yield

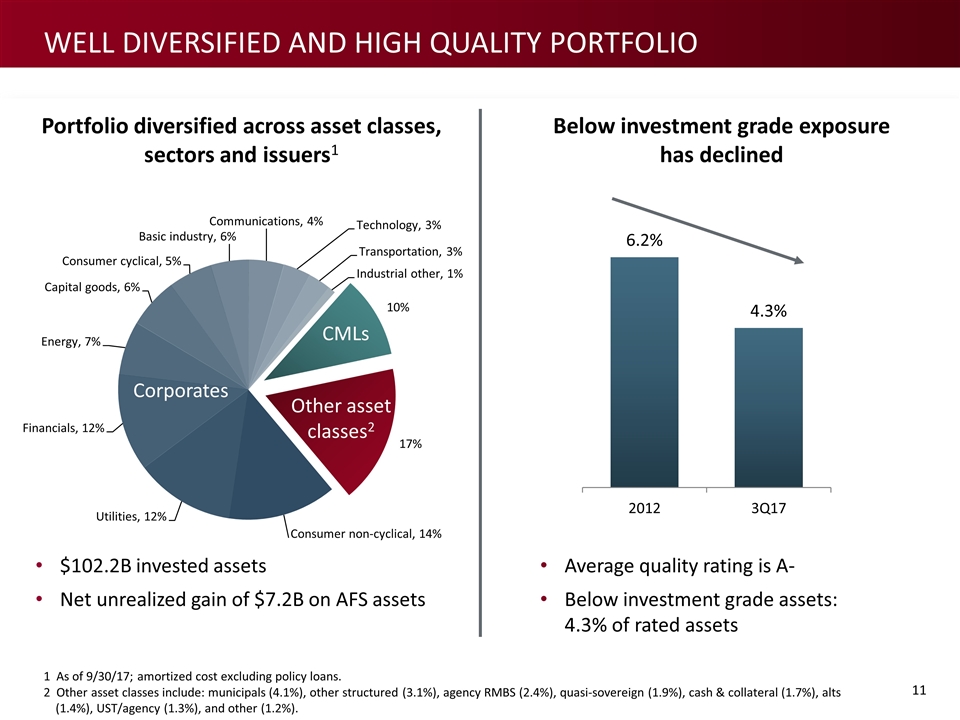

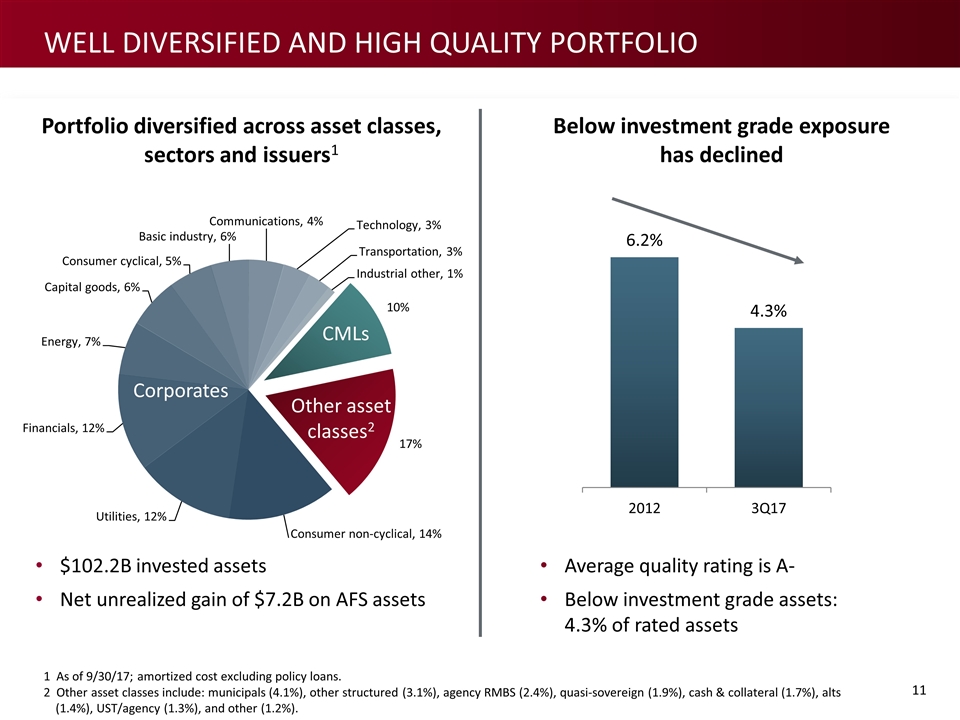

Average quality rating is A- Below investment grade assets: 4.3% of rated assets $102.2B invested assets Net unrealized gain of $7.2B on AFS assets Portfolio diversified across asset classes, sectors and issuers1 Below investment grade exposure has declined 1 As of 9/30/17; amortized cost excluding policy loans. 2 Other asset classes include: municipals (4.1%), other structured (3.1%), agency RMBS (2.4%), quasi-sovereign (1.9%), cash & collateral (1.7%), alts (1.4%), UST/agency (1.3%), and other (1.2%). Well diversified and high quality portfolio

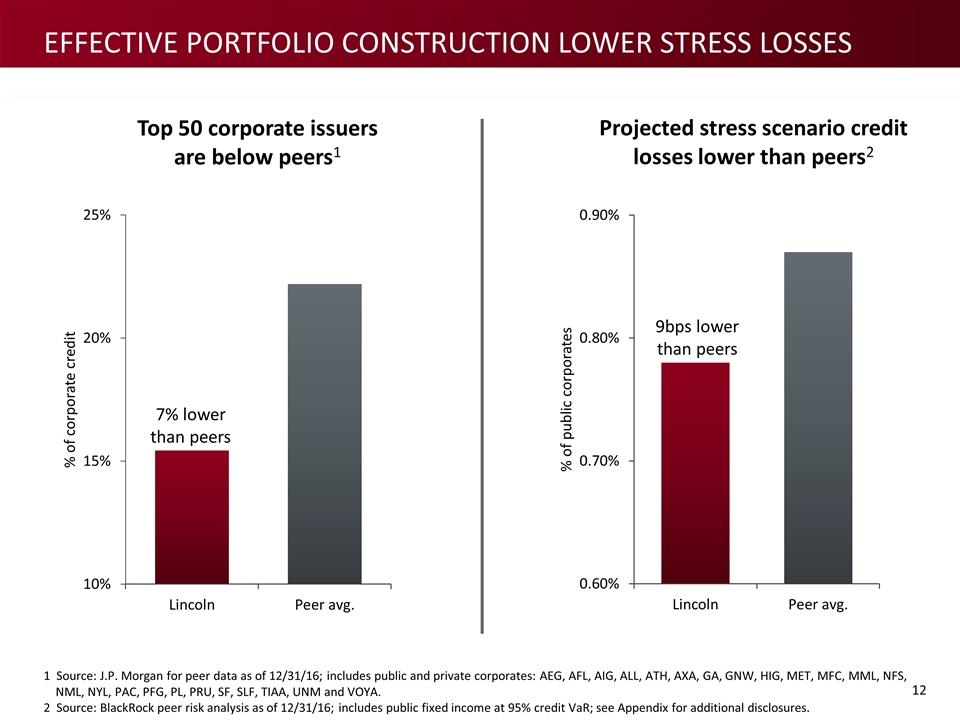

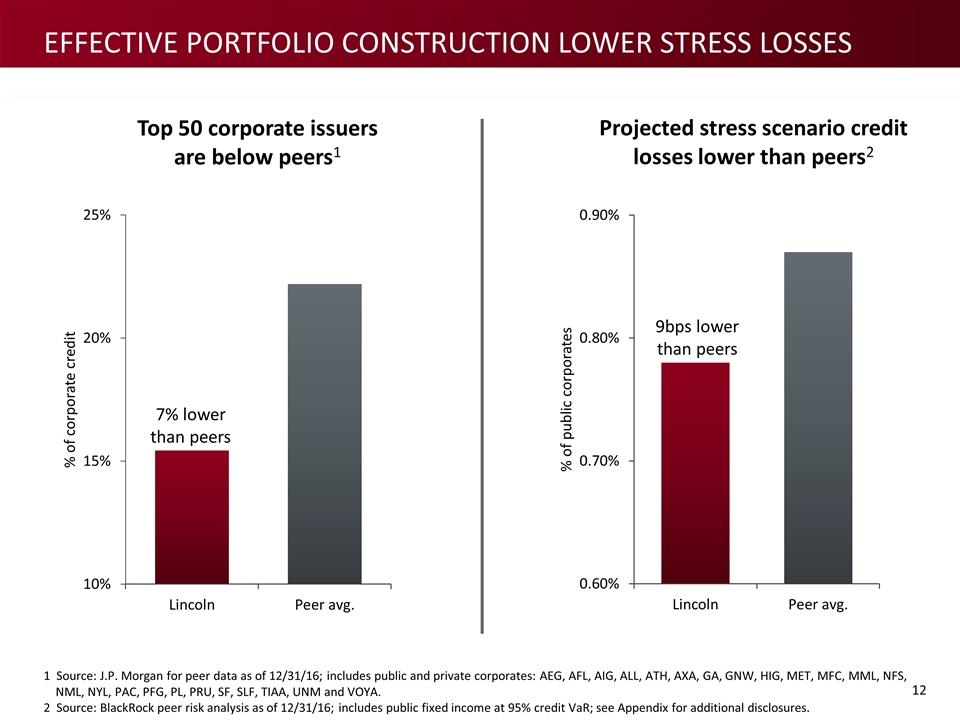

Top 50 corporate issuers are below peers1 1 Source: J.P. Morgan for peer data as of 12/31/16; includes public and private corporates: AEG, AFL, AIG, ALL, ATH, AXA, GA, GNW, HIG, MET, MFC, MML, NFS, NML, NYL, PAC, PFG, PL, PRU, SF, SLF, TIAA, UNM and VOYA. 2 Source: BlackRock peer risk analysis as of 12/31/16; includes public fixed income at 95% credit VaR; see Appendix for additional disclosures. Projected stress scenario credit losses lower than peers2 9bps lower than peers Effective portfolio construction lower stress losses 7% lower than peers

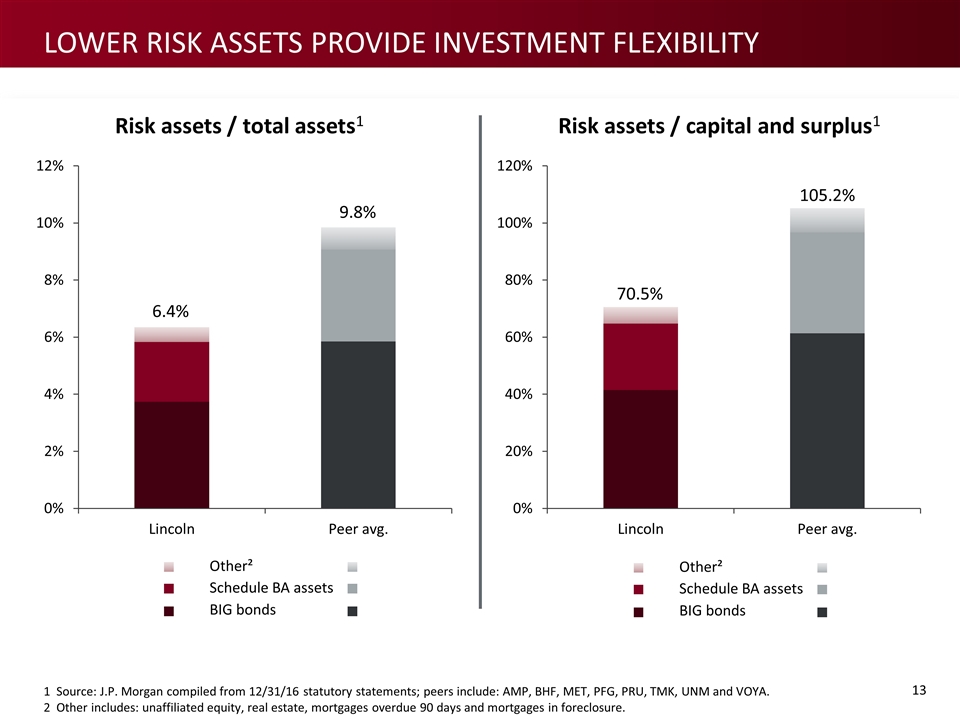

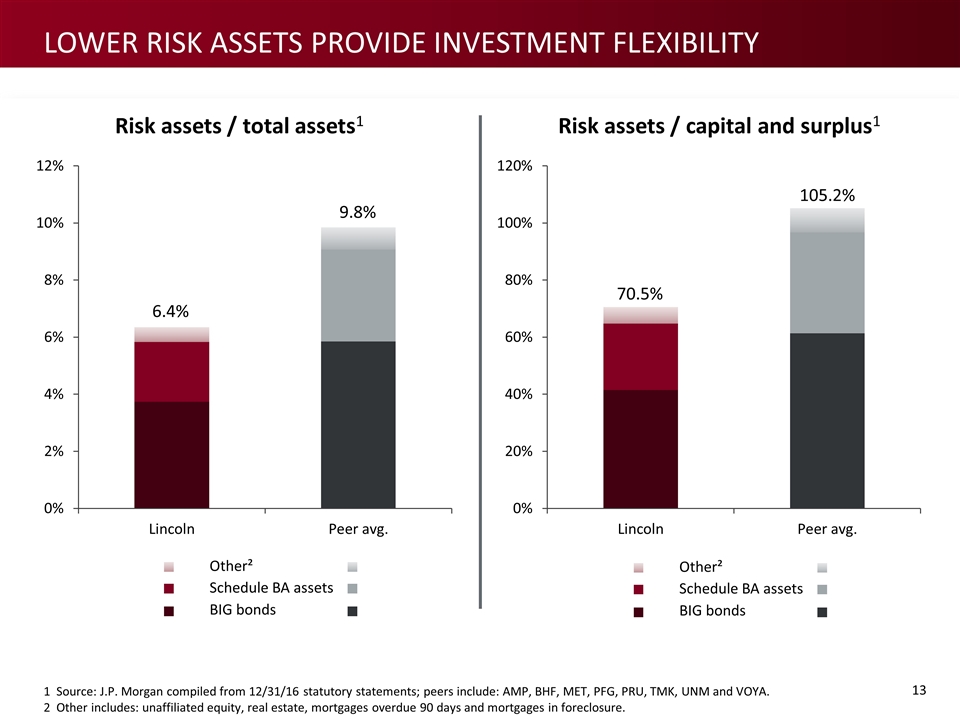

Risk assets / total assets1 Risk assets / capital and surplus1 6.4% 9.8% 70.5% 105.2% Other² Schedule BA assets BIG bonds 1 Source: J.P. Morgan compiled from 12/31/16 statutory statements; peers include: AMP, BHF, MET, PFG, PRU, TMK, UNM and VOYA. 2 Other includes: unaffiliated equity, real estate, mortgages overdue 90 days and mortgages in foreclosure. Other² Schedule BA assets BIG bonds LOWER risk assets provide investment FLEXIBILITY

Unique multi-manager investment framework maximizes agility, enhances risk management and lowers costs Proactive investment strategies improve investment income and moderate portfolio yield decline Diligent portfolio construction and active risk management provides greater flexibility Investment Portfolio Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview

Randy Freitag | Executive Vice President, Chief Financial Officer and Head of Individual Life Financial overview 2017 Conference for Analysts, Investors and Bankers

FINANCIAL RESULTS CONTINUE TO DIFFERENTIATE LINCOLN Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview Strong, stable and sustainable financial results provide catalyst to close valuation gap Appropriately balancing growth and capital management Risk management programs remain competitive advantage and have distinguished us in the marketplace Financial overview

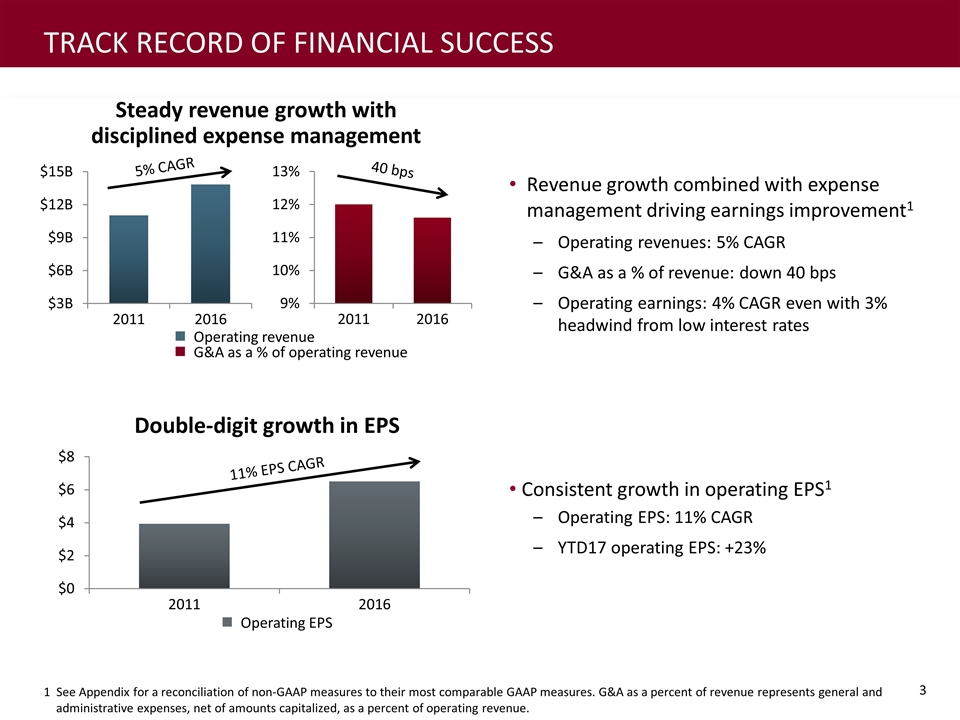

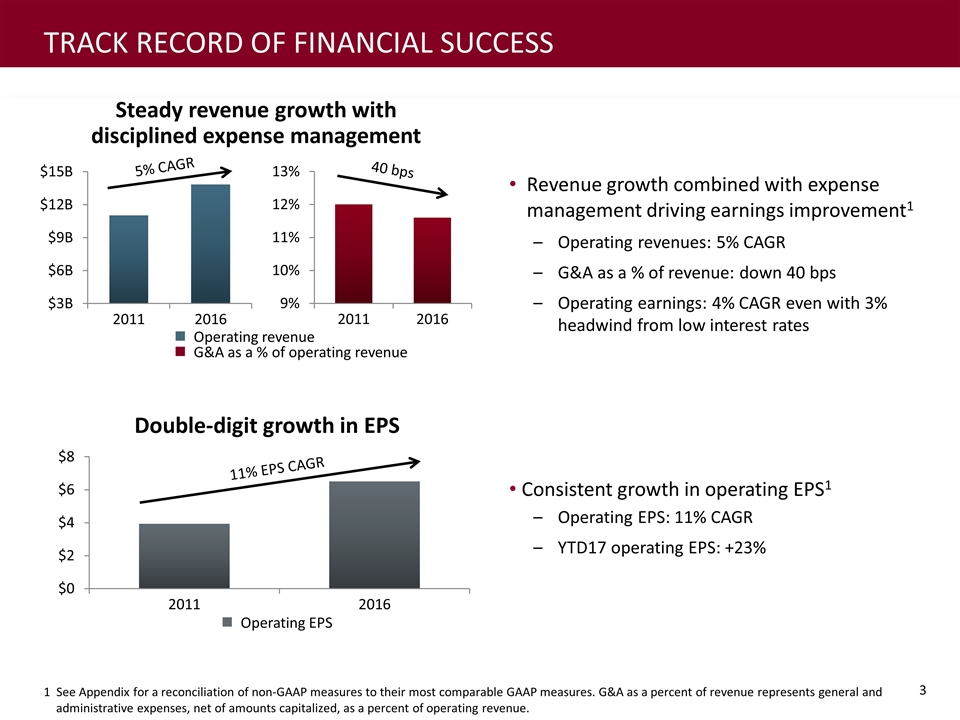

40 bps 5% CAGR n Operating EPS Double-digit growth in EPS z Steady revenue growth with disciplined expense management z 1 See Appendix for a reconciliation of non-GAAP measures to their most comparable GAAP measures. G&A as a percent of revenue represents general and administrative expenses, net of amounts capitalized, as a percent of operating revenue. Revenue growth combined with expense management driving earnings improvement1 Operating revenues: 5% CAGR G&A as a % of revenue: down 40 bps Operating earnings: 4% CAGR even with 3% headwind from low interest rates Consistent growth in operating EPS1 Operating EPS: 11% CAGR YTD17 operating EPS: +23% n Operating revenue n G&A as a % of operating revenue 11% EPS CAGR Track record of financial success

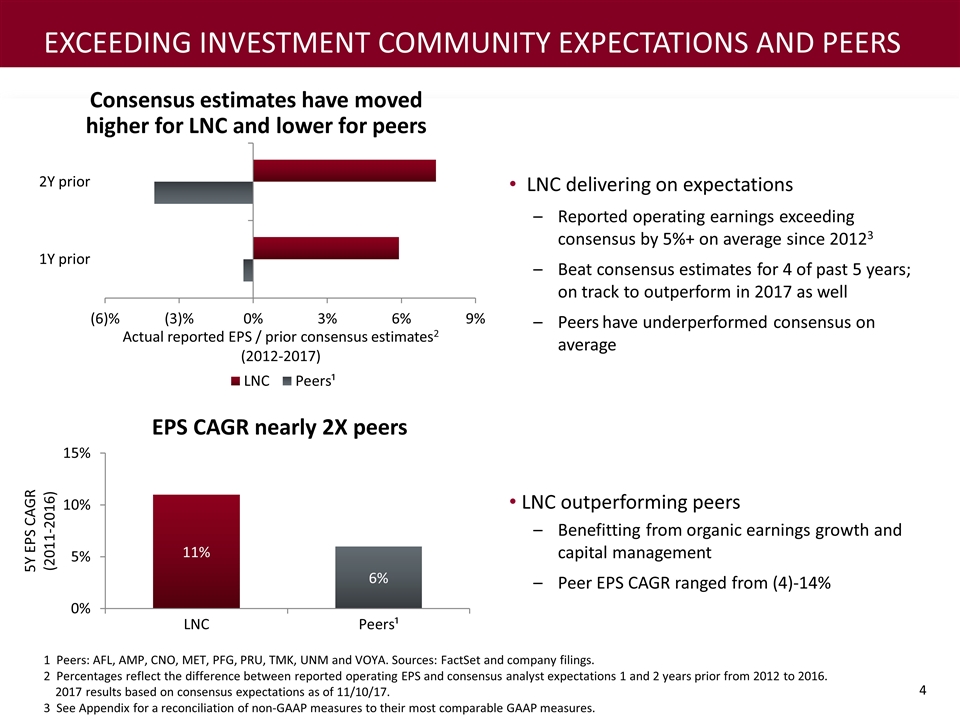

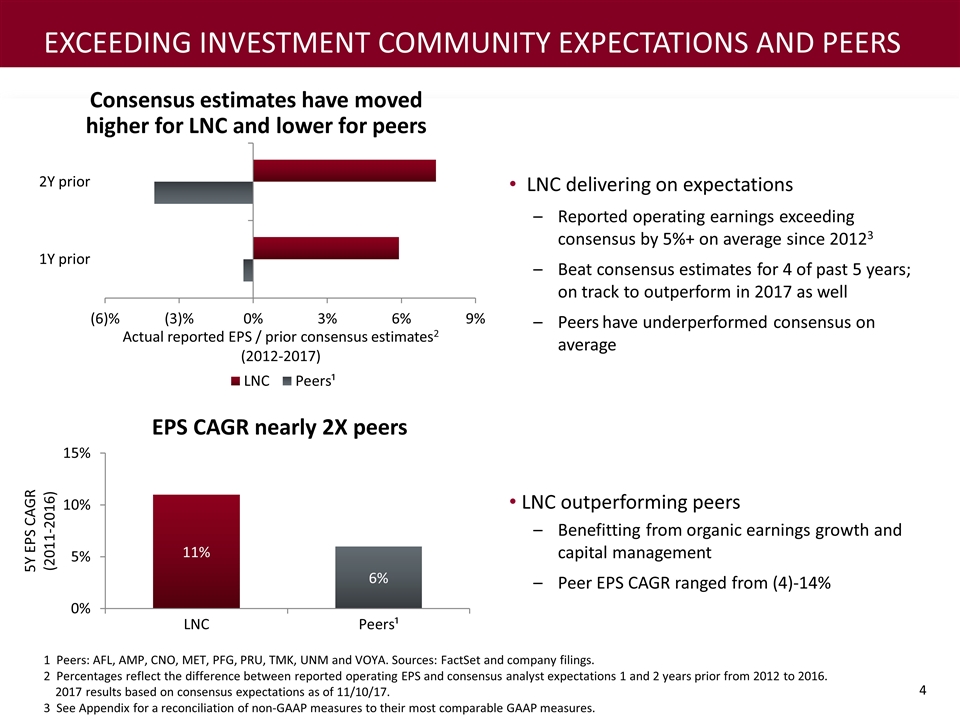

EPS CAGR nearly 2X peers z Consensus estimates have moved higher for LNC and lower for peers z LNC delivering on expectations Reported operating earnings exceeding consensus by 5%+ on average since 20123 Beat consensus estimates for 4 of past 5 years; on track to outperform in 2017 as well Peers have underperformed consensus on average LNC outperforming peers Benefitting from organic earnings growth and capital management Peer EPS CAGR ranged from (4)-14% 1 Peers: AFL, AMP, CNO, MET, PFG, PRU, TMK, UNM and VOYA. Sources: FactSet and company filings. 2 Percentages reflect the difference between reported operating EPS and consensus analyst expectations 1 and 2 years prior from 2012 to 2016. 2017 results based on consensus expectations as of 11/10/17. 3 See Appendix for a reconciliation of non-GAAP measures to their most comparable GAAP measures. Exceeding investment community expectations and peers

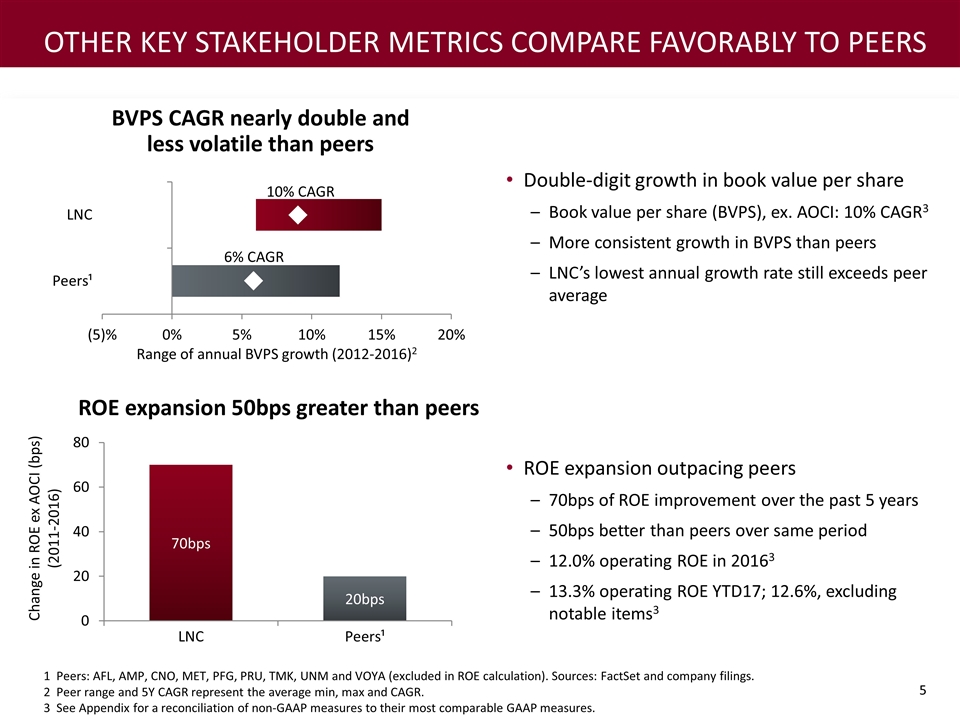

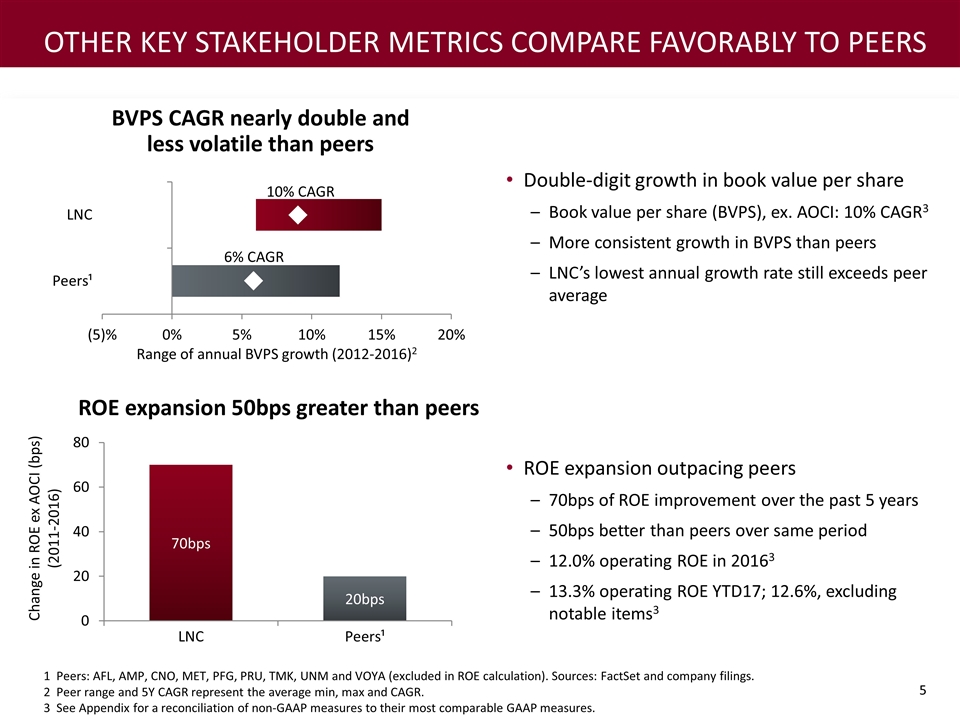

ROE expansion 50bps greater than peers BVPS CAGR nearly double and less volatile than peers Double-digit growth in book value per share Book value per share (BVPS), ex. AOCI: 10% CAGR3 More consistent growth in BVPS than peers LNC’s lowest annual growth rate still exceeds peer average ROE expansion outpacing peers 70bps of ROE improvement over the past 5 years 50bps better than peers over same period 12.0% operating ROE in 20163 13.3% operating ROE YTD17; 12.6%, excluding notable items3 1 Peers: AFL, AMP, CNO, MET, PFG, PRU, TMK, UNM and VOYA (excluded in ROE calculation). Sources: FactSet and company filings. 2 Peer range and 5Y CAGR represent the average min, max and CAGR. 3 See Appendix for a reconciliation of non-GAAP measures to their most comparable GAAP measures. 10% CAGR 6% CAGR Other key stakeholder metrics compare favorably to peers

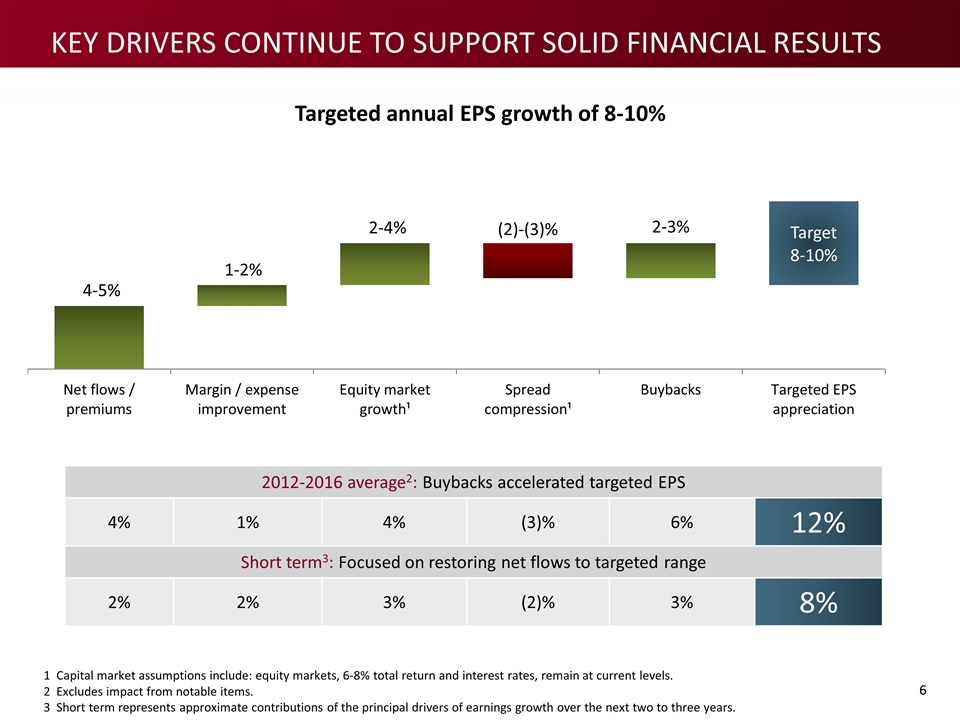

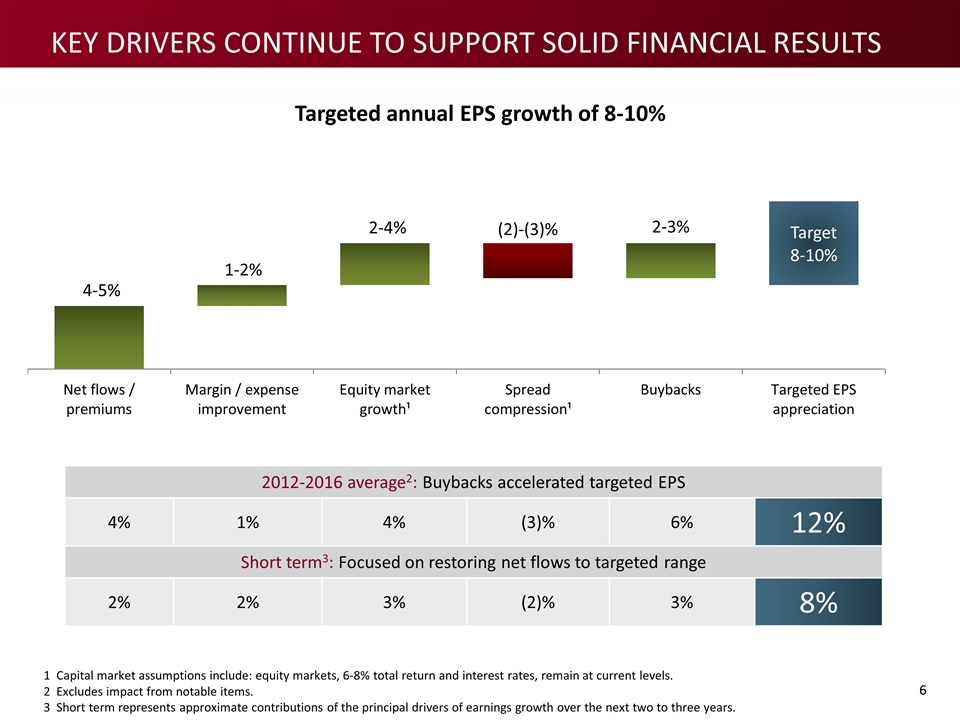

Targeted annual EPS growth of 8-10% 2012-2016 average2: Buybacks accelerated targeted EPS 4% 1% 4% (3)% 6% 12% Short term3: Focused on restoring net flows to targeted range 2% 2% 3% (2)% 3% 8% 1 Capital market assumptions include: equity markets, 6-8% total return and interest rates, remain at current levels. 2 Excludes impact from notable items. 3 Short term represents approximate contributions of the principal drivers of earnings growth over the next two to three years. Key drivers continue to support solid financial results

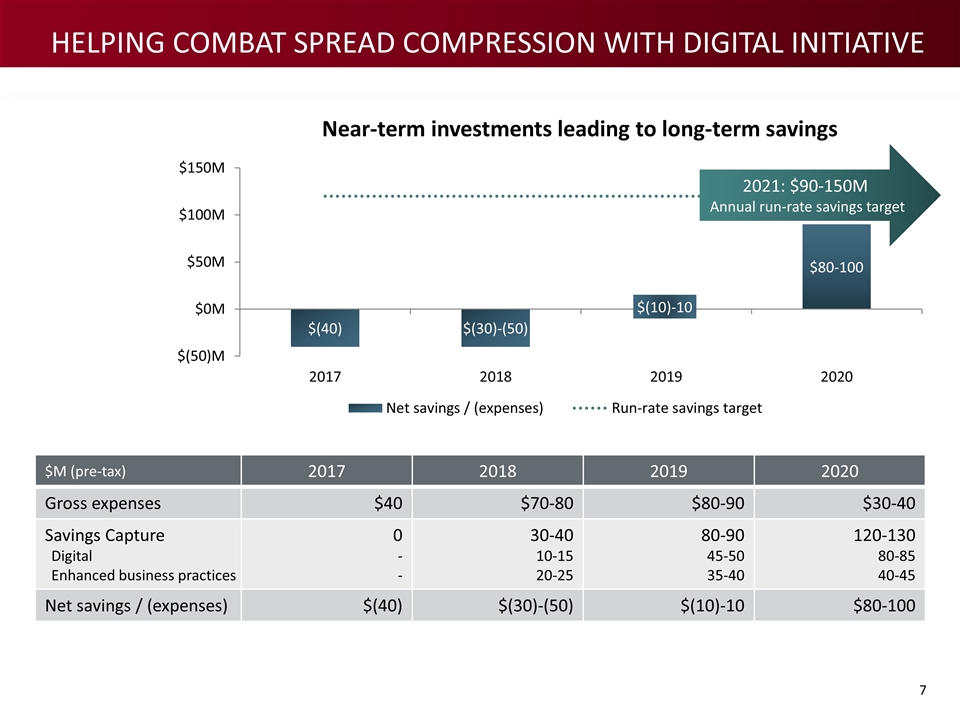

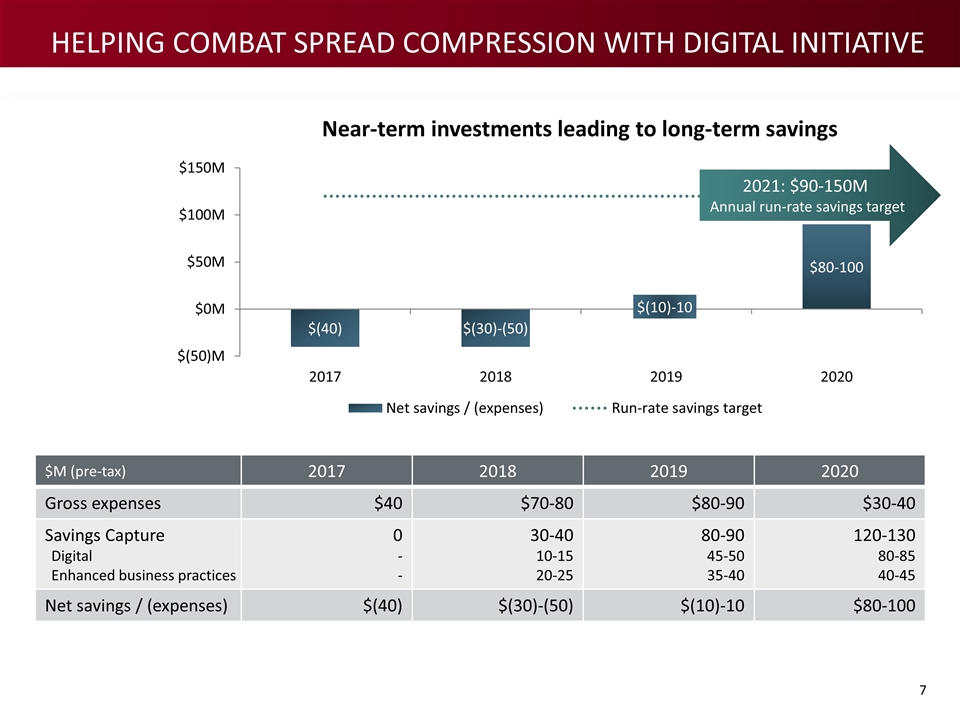

2021: $90-150M Annual run-rate savings target Near-term investments leading to long-term savings $M (pre-tax) 2017 2018 2019 2020 Gross expenses $40 $70-80 $80-90 $30-40 Savings Capture Digital Enhanced business practices 0 - - 30-40 10-15 20-25 80-90 45-50 35-40 120-130 80-85 40-45 Net savings / (expenses) $(40) $(30)-(50) $(10)-10 $80-100 Helping combat spread compression with digital initiative

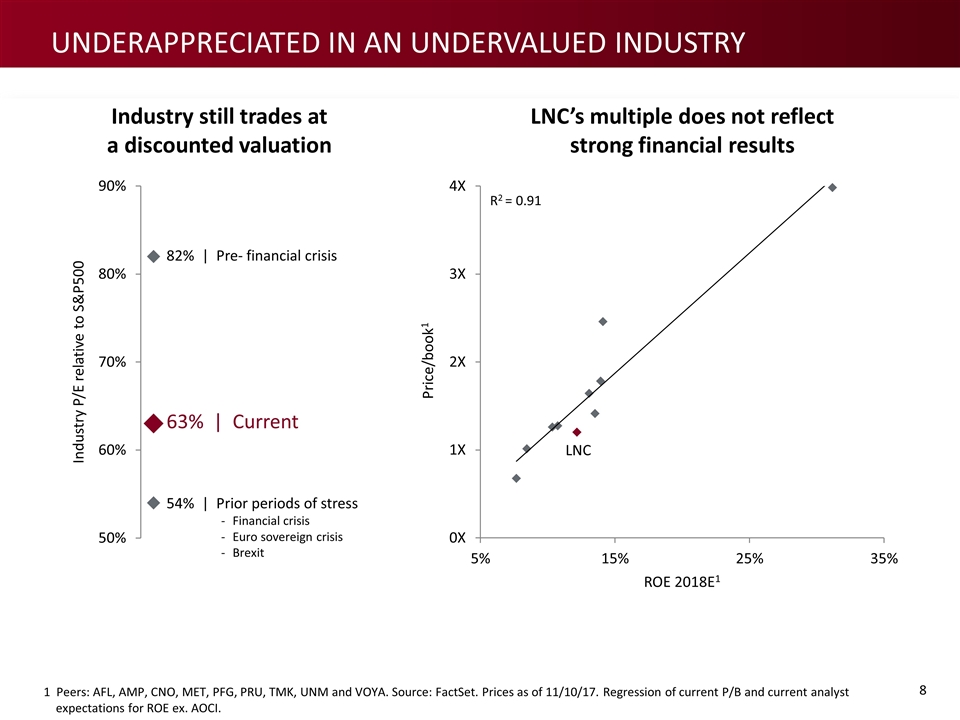

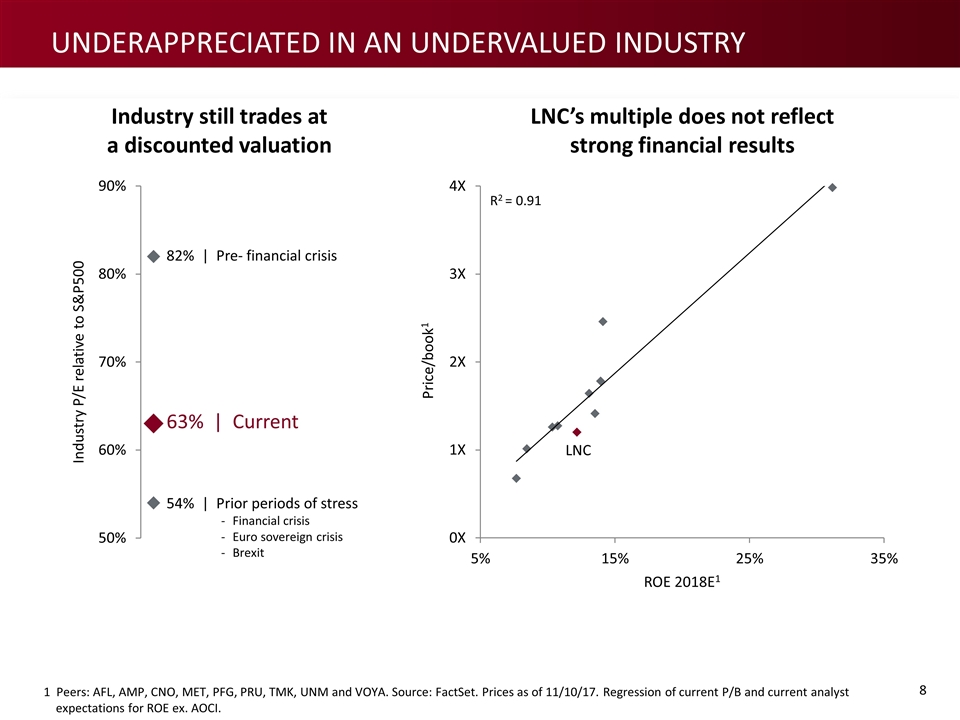

LNC’s multiple does not reflect strong financial results 82% | Pre- financial crisis 63% | Current 54% | Prior periods of stress Financial crisis Euro sovereign crisis Brexit Industry still trades at a discounted valuation 1 Peers: AFL, AMP, CNO, MET, PFG, PRU, TMK, UNM and VOYA. Source: FactSet. Prices as of 11/10/17. Regression of current P/B and current analyst expectations for ROE ex. AOCI. Underappreciated in an undervalued industry

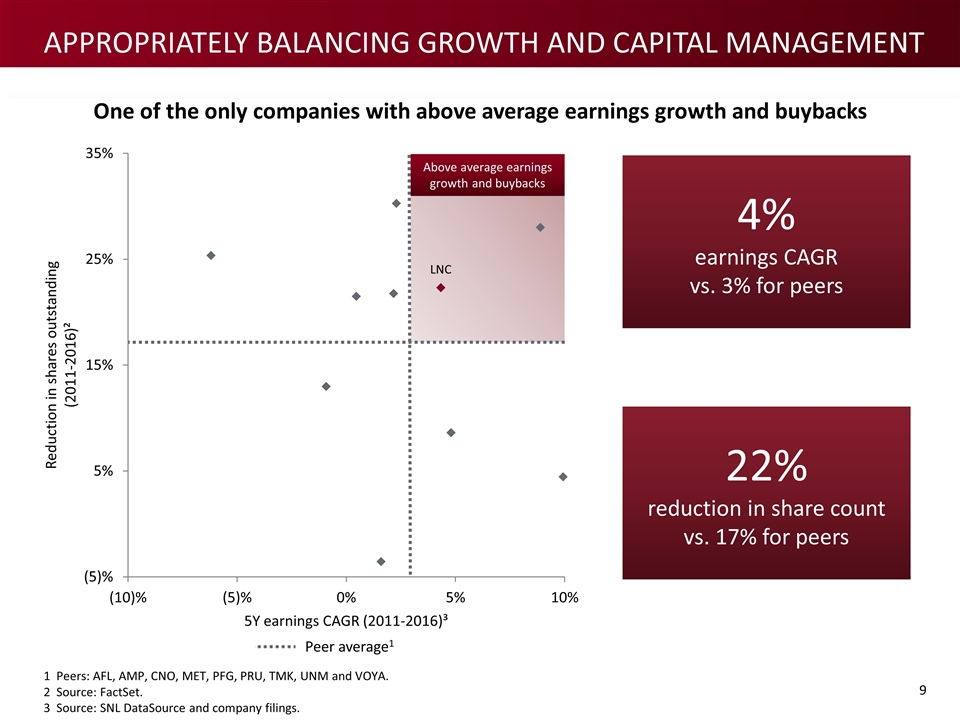

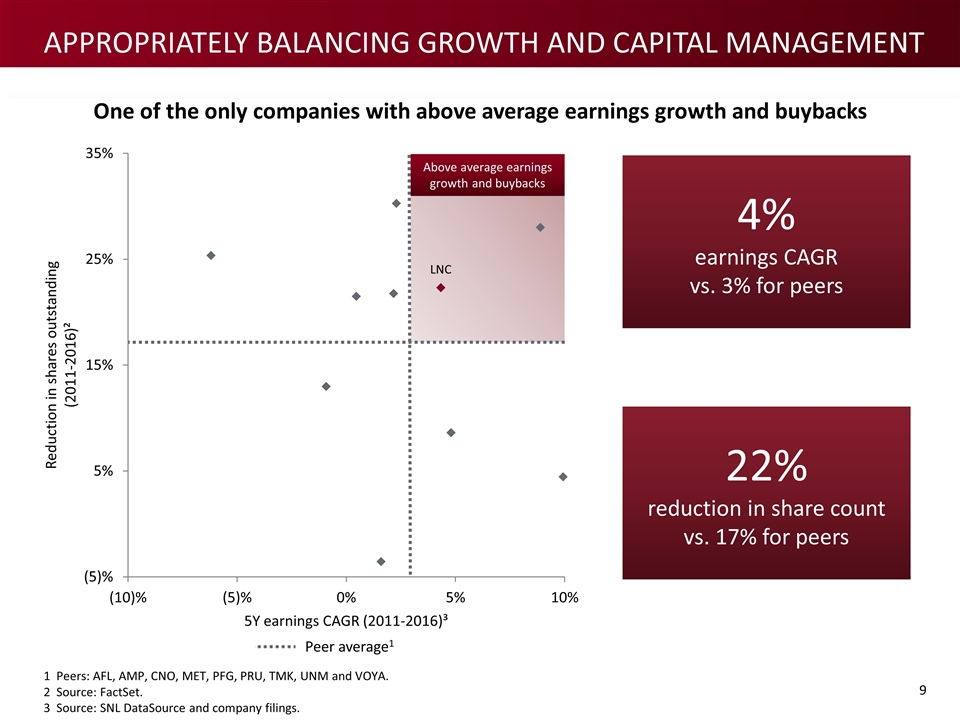

One of the only companies with above average earnings growth and buybacks 1 Peers: AFL, AMP, CNO, MET, PFG, PRU, TMK, UNM and VOYA. 2 Source: FactSet. 3 Source: SNL DataSource and company filings. Above average earnings growth and buybacks Peer average1 4% earnings CAGR vs. 3% for peers 22% reduction in share count vs. 17% for peers Appropriately balancing growth and capital management

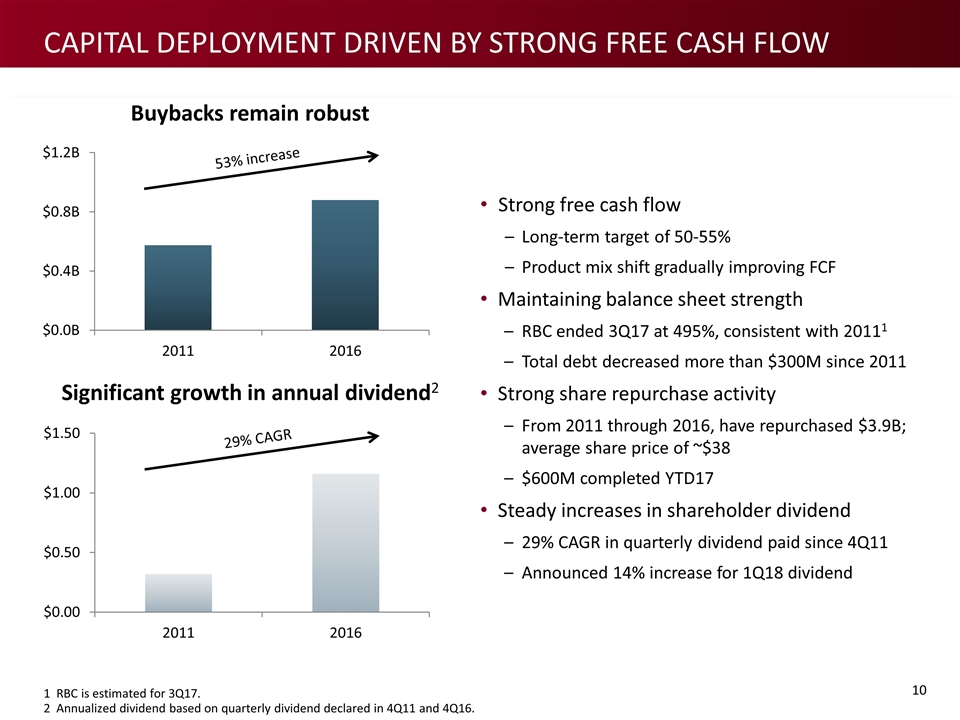

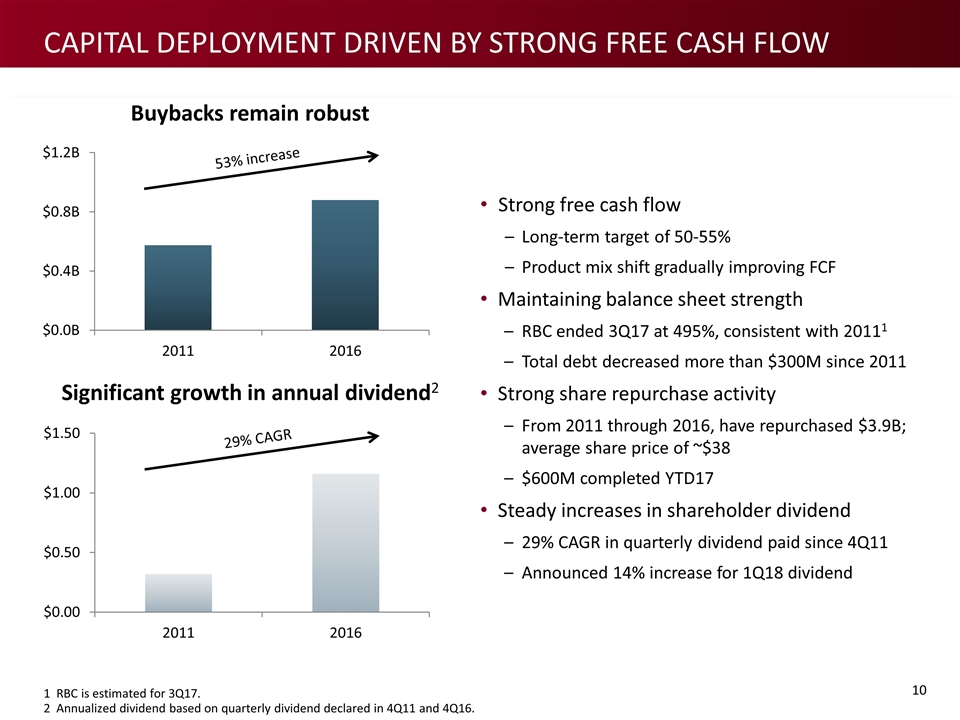

capital deployment driven by strong free cash flow 1 RBC is estimated for 3Q17. 2 Annualized dividend based on quarterly dividend declared in 4Q11 and 4Q16. Strong free cash flow Long-term target of 50-55% Product mix shift gradually improving FCF Maintaining balance sheet strength RBC ended 3Q17 at 495%, consistent with 20111 Total debt decreased more than $300M since 2011 Strong share repurchase activity From 2011 through 2016, have repurchased $3.9B; average share price of ~$38 $600M completed YTD17 Steady increases in shareholder dividend 29% CAGR in quarterly dividend paid since 4Q11 Announced 14% increase for 1Q18 dividend Buybacks remain robust 53% increase 29% CAGR Significant growth in annual dividend2

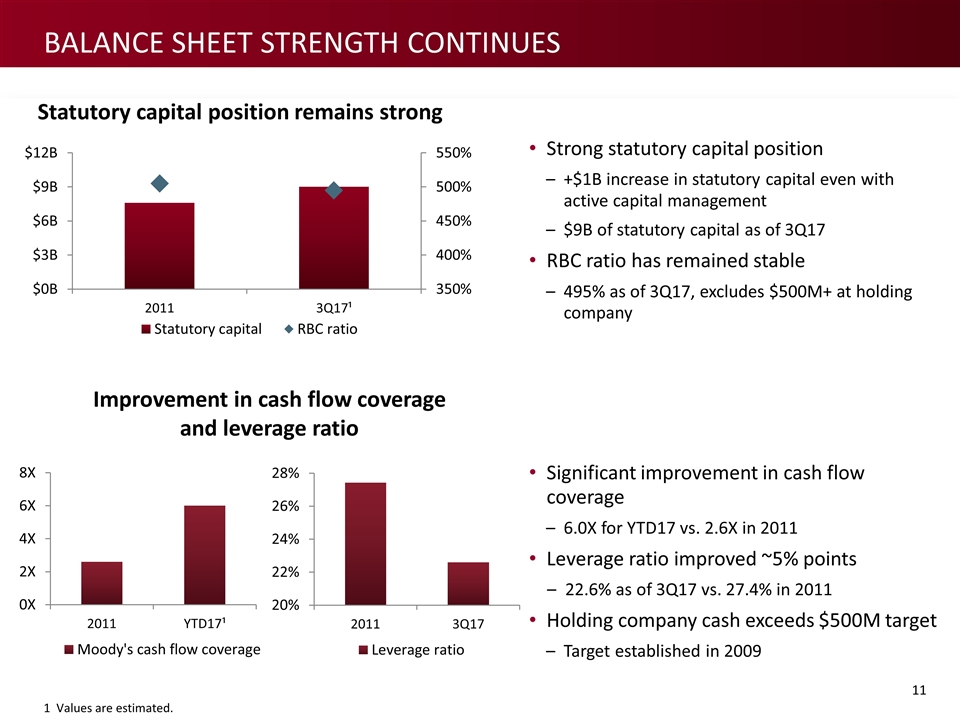

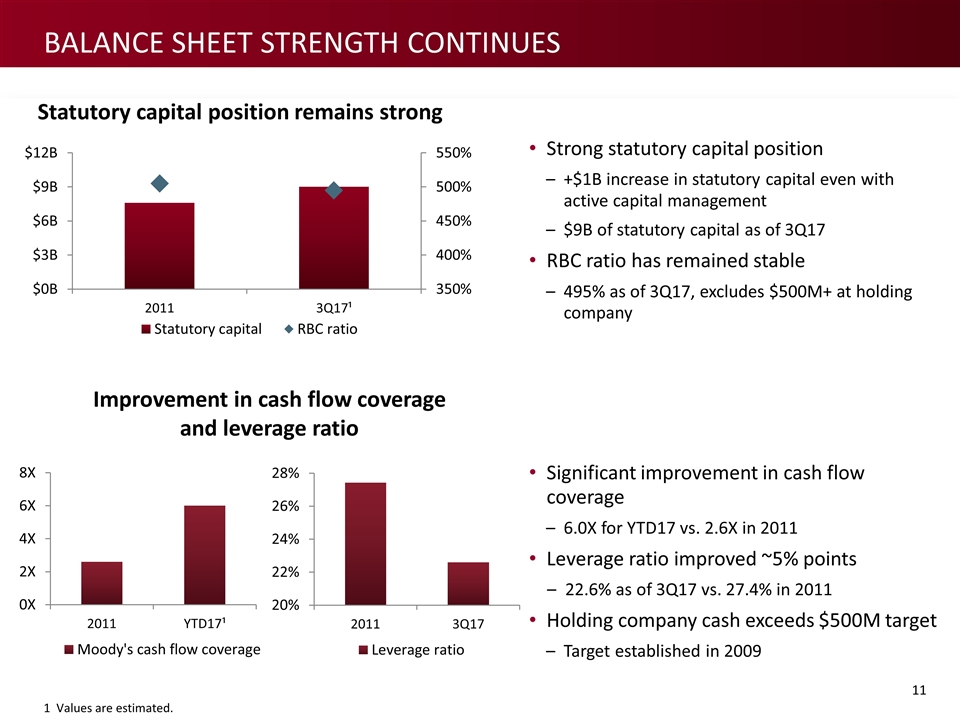

Statutory capital position remains strong 1 Values are estimated. Improvement in cash flow coverage and leverage ratio Strong statutory capital position +$1B increase in statutory capital even with active capital management $9B of statutory capital as of 3Q17 RBC ratio has remained stable 495% as of 3Q17, excludes $500M+ at holding company Significant improvement in cash flow coverage 6.0X for YTD17 vs. 2.6X in 2011 Leverage ratio improved ~5% points 22.6% as of 3Q17 vs. 27.4% in 2011 Holding company cash exceeds $500M target Target established in 2009 balance sheet strength Continues

1 Modest impacts could be seen if UST 10Y approached 1%. 2 Long-term earned rate assumption also reduced by 50bps in 2010. 3 Management actions taken include: repriced and pivoted product portfolio, investment opportunities to boost yield, expense savings, in-force management actions, and refinanced debt at lower rates. Lowered earned rate 50bps in 2012 & 20152 Financial impact in line with expectations No other unlocking impacts tied to low rates GAAP balance sheet Potential to lower long-term earned rate 50bps change is ~$125M 4% 5Y CAGR in operating earnings Management has taken actions3 2-3% earnings headwind down from 4-5% Spread compression Earnings growth can continue Actions can help offset impacts Headwinds will abate Asset adequacy up ~$1B per year $0 in reserve strengthening Statutory reserves Significant asset adequacy Modest impact in an even much lower rate environment1 What we experienced What we said Interest rate impacts consistent with guidance

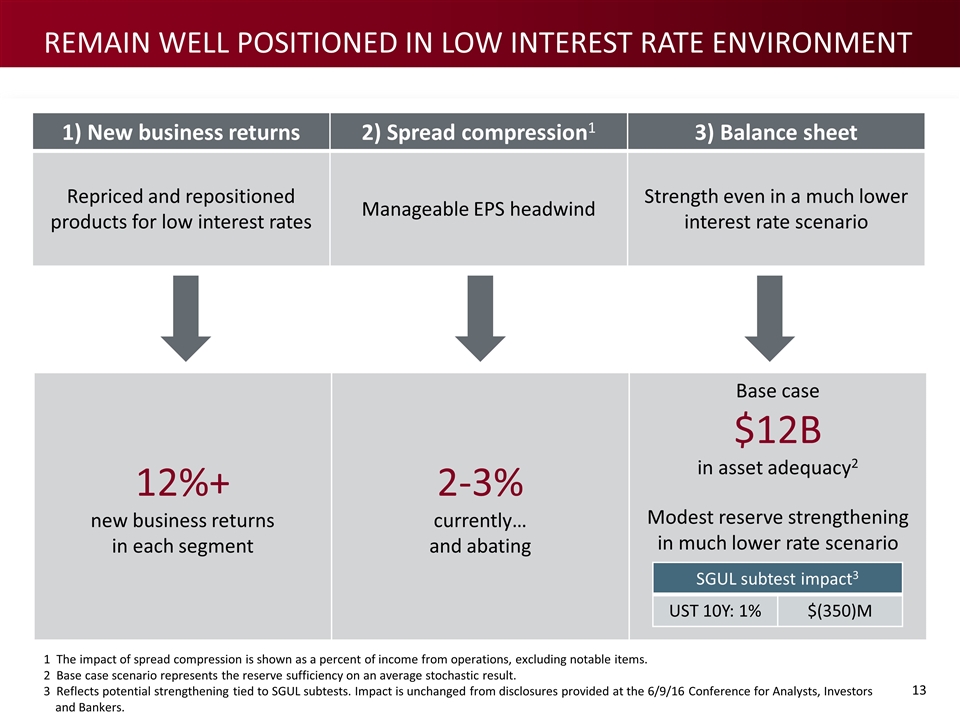

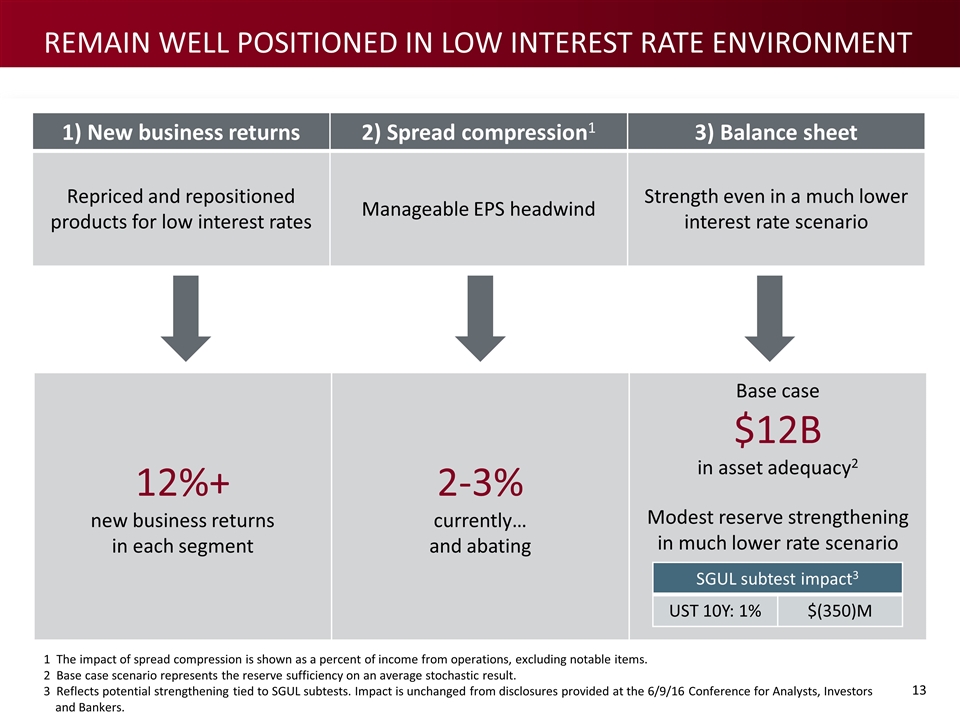

1) New business returns 2) Spread compression1 3) Balance sheet Repriced and repositioned products for low interest rates Manageable EPS headwind Strength even in a much lower interest rate scenario 1 The impact of spread compression is shown as a percent of income from operations, excluding notable items. 2 Base case scenario represents the reserve sufficiency on an average stochastic result. 3 Reflects potential strengthening tied to SGUL subtests. Impact is unchanged from disclosures provided at the 6/9/16 Conference for Analysts, Investors and Bankers. 12%+ new business returns in each segment 2-3% currently… and abating Base case $12B in asset adequacy2 Modest reserve strengthening in much lower rate scenario SGUL subtest impact3 UST 10Y: 1% $(350)M Remain Well positioned in low interest rate environment

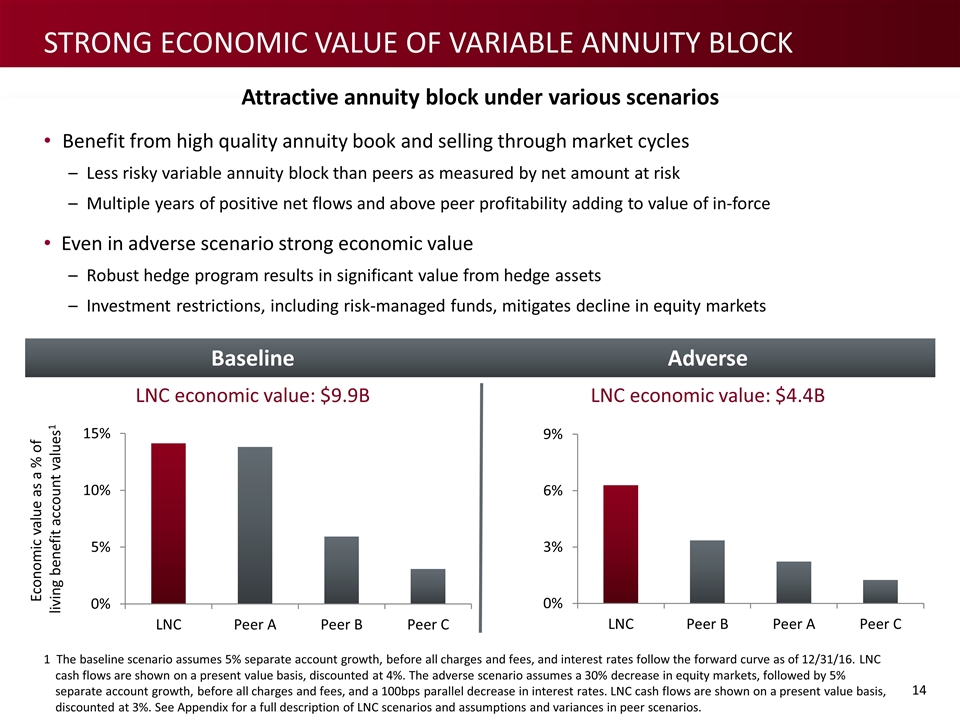

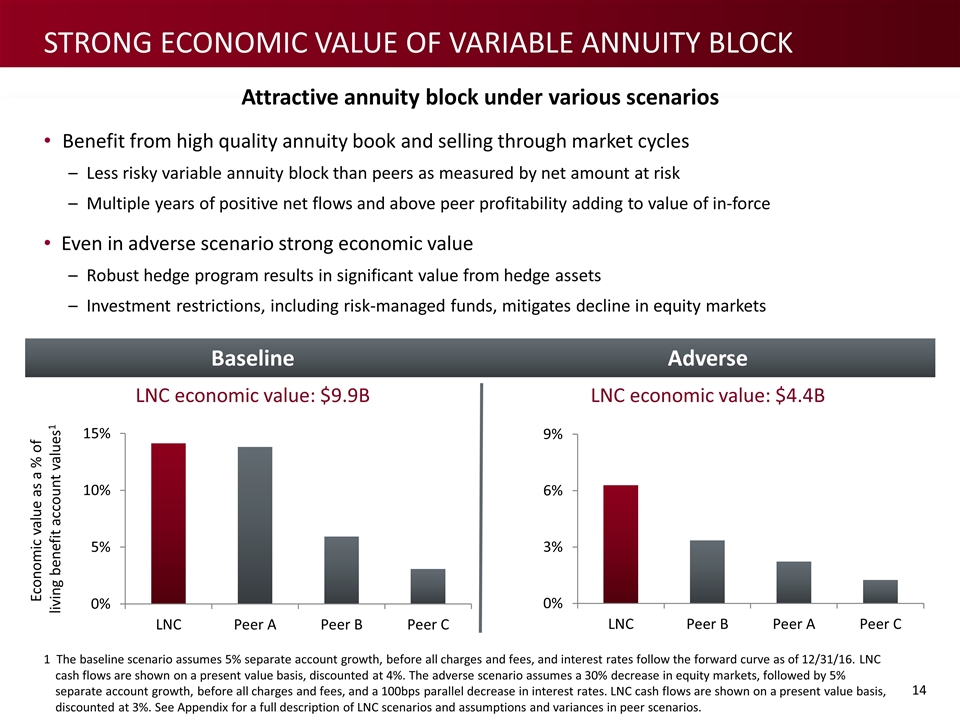

Baseline Adverse LNC economic value: $9.9B LNC economic value: $4.4B Attractive annuity block under various scenarios Economic value as a % of living benefit account values1 Strong economic value of Variable Annuity Block Benefit from high quality annuity book and selling through market cycles Less risky variable annuity block than peers as measured by net amount at risk Multiple years of positive net flows and above peer profitability adding to value of in-force Even in adverse scenario strong economic value Robust hedge program results in significant value from hedge assets Investment restrictions, including risk-managed funds, mitigates decline in equity markets 1 The baseline scenario assumes 5% separate account growth, before all charges and fees, and interest rates follow the forward curve as of 12/31/16. LNC cash flows are shown on a present value basis, discounted at 4%. The adverse scenario assumes a 30% decrease in equity markets, followed by 5% separate account growth, before all charges and fees, and a 100bps parallel decrease in interest rates. LNC cash flows are shown on a present value basis, discounted at 3%. See Appendix for a full description of LNC scenarios and assumptions and variances in peer scenarios.

Strong, stable and sustainable financial results provide catalyst to close valuation gap Appropriately balancing growth and capital management Risk management programs remain competitive advantage and have distinguished us in the marketplace Strategic overview Distribution Group Protection Life Insurance Retirement Plan Services Annuities Investment portfolio Financial overview Financial Overview

Appendix 2017 Conference for Analysts, Investors and Bankers

Forward Looking Statements – Cautionary Language Certain statements made in this presentation and in other written or oral statements made by Lincoln or on Lincoln's behalf are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words like: "believe," "anticipate," "expect," "estimate," "project," "will," "shall" and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in Lincoln's businesses, prospective services or products, future performance or financial results, and the outcome of contingencies, such as legal proceedings. Lincoln claims the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from the results contained in the forward-looking statements. Risks and uncertainties that may cause actual results to vary materially, some of which are described within the forward-looking statements, include, among others: Deterioration in general economic and business conditions that may affect account values, investment results, guaranteed benefit liabilities, premium levels, claims experience and the level of pension benefit costs, funding and investment results; Adverse global capital and credit market conditions could affect our ability to raise capital, if necessary, and may cause us to realize impairments on investments and certain intangible assets, including goodwill and the valuation allowance against deferred tax assets, which may reduce future earnings and/or affect our financial condition and ability to raise additional capital or refinance existing debt as it matures; Because of our holding company structure, the inability of our subsidiaries to pay dividends to the holding company in sufficient amounts could harm the holding company’s ability to meet its obligations; Legislative, regulatory or tax changes, both domestic and foreign, that affect: the cost of, or demand for, our subsidiaries' products; the required amount of reserves and/or surplus; our ability to conduct business and our captive reinsurance arrangements, as well as restrictions on revenue sharing and 12b-1 payments; the potential for U.S. federal tax reform; and the effect of the Department of Labor’s (“DOL”) regulation defining fiduciary; Actions taken by reinsurers to raise rates on in-force business; Declines in or sustained low interest rates causing a reduction in investment income, the interest margins of our businesses, estimated gross profits and demand for our products; Rapidly increasing interest rates causing contract holders to surrender life insurance and annuity policies, thereby causing realized investment losses, and reduced hedge performance related to variable annuities; Uncertainty about the effect of continuing promulgation and implementation of rules and regulations under the Dodd-Frank Wall Street Reform and Consumer Protection Act on us, the economy and the financial services sector in particular;

Forward Looking Statements – Cautionary Language (CONT.) The initiation of legal or regulatory proceedings against us, and the outcome of any legal or regulatory proceedings, such as: adverse actions related to present or past business practices common in businesses in which we compete; adverse decisions in significant actions including, but not limited to, actions brought by federal and state authorities and class action cases; new decisions that result in changes in law; and unexpected trial court rulings; A decline in the equity markets causing a reduction in the sales of our subsidiaries' products; a reduction of asset-based fees that our subsidiaries charge on various investment and insurance products; an acceleration of the net amortization of deferred acquisition costs ("DAC"), value of business acquired ("VOBA"), deferred sales inducements ("DSI") and deferred front-end loads ("DFEL"); and an increase in liabilities related to guaranteed benefit features of our subsidiaries' variable annuity products; Ineffectiveness of our risk management policies and procedures, including various hedging strategies used to offset the effect of changes in the value of liabilities due to changes in the level and volatility of the equity markets and interest rates; A deviation in actual experience regarding future persistency, mortality, morbidity, interest rates or equity market returns from the assumptions used in pricing our subsidiaries' products, in establishing related insurance reserves and in the net amortization of DAC, VOBA, DSI and DFEL, which may reduce future earnings; Changes in accounting principles generally accepted in the United States ("GAAP"), that may result in unanticipated changes to our net income; Lowering of one or more of our debt ratings issued by nationally recognized statistical rating organizations and the adverse effect such action may have on our ability to raise capital and on our liquidity and financial condition; Lowering of one or more of the insurer financial strength ratings of our insurance subsidiaries and the adverse effect such action may have on the premium writings, policy retention, profitability of our insurance subsidiaries and liquidity; Significant credit, accounting, fraud, corporate governance or other issues that may adversely affect the value of certain investments in our portfolios, as well as counterparties to which we are exposed to credit risk requiring that we realize losses on investments; Inability to protect our intellectual property rights or claims of infringement of the intellectual property rights of others; Interruption in telecommunication, information technology or other operational systems, or failure to safeguard the confidentiality or privacy of sensitive data on such systems from cyberattacks or other breaches of our data security systems; The effect of acquisitions and divestitures, restructurings, product withdrawals and other unusual items; The adequacy and collectability of reinsurance that we have purchased; Acts of terrorism, a pandemic, war or other man-made and natural catastrophes that may adversely affect our businesses and the cost and availability of reinsurance;

Forward Looking Statements – Cautionary Language (CONT.) Competitive conditions, including pricing pressures, new product offerings and the emergence of new competitors, that may affect the level of premiums and fees that our subsidiaries can charge for their products; The unknown effect on our subsidiaries' businesses resulting from evolving market preferences and the changing demographics of our client base; and The unanticipated loss of key management, financial planners or wholesalers. The risks included here are not exhaustive. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the Securities and Exchange Commission (“SEC”) include additional factors that could affect our businesses and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, Lincoln disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this presentation. The reporting of Risk Based Capital (“RBC”) measures is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities.

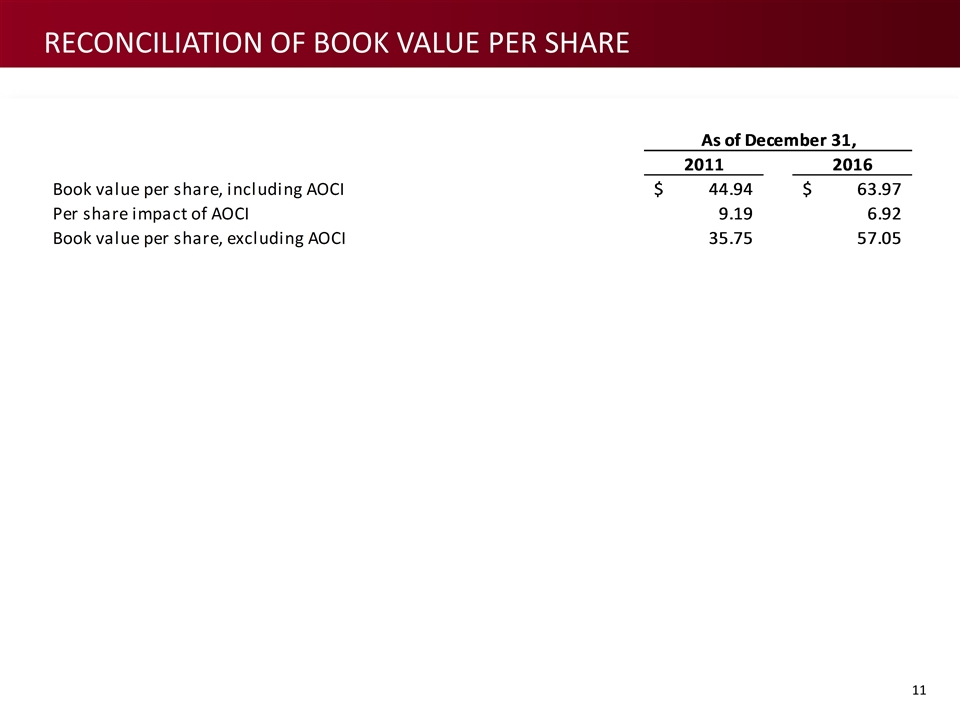

Explanatory notes on use of non-gaap measures Management believes that income from operations, operating return on equity and operating revenues better explain the results of the company’s ongoing businesses in a manner that allows for a better understanding of the underlying trends in the company’s current business because the excluded items are unpredictable and not necessarily indicative of current operating fundamentals or future performance of the business segments, and, in most instances, decisions regarding these items do not necessarily relate to the operations of the individual segments. Management also believes that using book value excluding accumulated other comprehensive income (AOCI) enables investors to analyze the amount of our net worth that is primarily attributable to our business operations. Book value per share excluding AOCI is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period, primarily based on changes in interest rates. For the historical periods, reconciliations of non-GAAP measures used in this press release to the most directly comparable GAAP measure may be included in this Appendix to the press release and/or are included in the Statistical Reports for the corresponding periods contained in the Earnings section of the Investor Relations page on our website: www.lfg.com/investor.

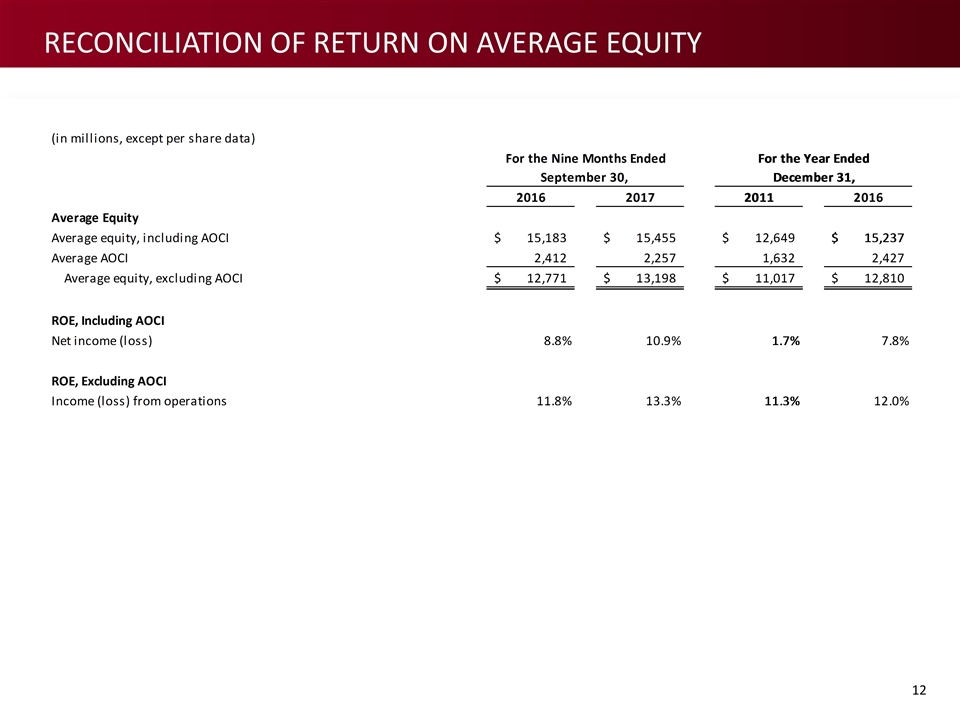

Definitions of non-gaap measures used in this presentation Income (loss) from operations, operating revenues and operating return on equity (including and excluding average goodwill within average equity), excluding AOCI, using annualized income (loss) from operations are financial measures we use to evaluate and assess our results. Income (loss) from operations, operating revenues and operating return on equity (“ROE”), as used in the earnings release, are non-GAAP financial measures and do not replace GAAP revenues, net income (loss) and ROE, the most directly comparable GAAP measures. Income (loss) from operations Income (loss) from operations, operating revenues and return on equity (ROE), as used in the presentation, are non-GAAP financial measures and do not replace GAAP revenues, net income (loss) and ROE. We exclude the after-tax effects of the following items from GAAP net income (loss) to arrive at income (loss) from operations, which we also refer to as operating earnings: realized gains and losses associated with the following (“excluded realized gain (loss)”): sale or disposal of securities; impairments of securities; change in the fair value of derivative investments, embedded derivatives within certain reinsurance arrangements and our trading securities; change in the fair value of the derivatives we own to hedge our guaranteed death benefit (GDB) riders within our variable annuities, which is referred to as “GDB derivatives results”; change in the fair value of the embedded derivatives of our guaranteed living benefit (GLB) riders within our variable annuities accounted for under the Derivatives and Hedging and the Fair Value Measurements and Disclosures Topics of the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) (“embedded derivative reserves”), net of the change in the fair value of the derivatives we own to hedge the changes in the embedded derivative reserves, the net of which is referred to as “GLB net derivative results”; and changes in the fair value of the embedded derivative liabilities related to index call options we may purchase in the future to hedge contract holder index allocations applicable to future reset periods for our indexed annuity products accounted for under the Derivatives and Hedging and the Fair Value Measurements and Disclosures Topics of the FASB ASC (“indexed annuity forward-starting option”); change in reserves accounted for under the Financial Services - Insurance - Claim Costs and Liabilities for Future Policy Benefits Subtopic of the FASB ASC resulting from benefit ratio unlocking on our GDB and GLB riders (“benefit ratio unlocking”); income (loss) from the initial adoption of new accounting standards; income (loss) from reserve changes (net of related amortization) on business sold through reinsurance; gain (loss) on early extinguishment of debt; losses from the impairment of intangible assets; and income (loss) from discontinued operations. Operating revenues Operating revenues represent GAAP revenues excluding the pre-tax effects of the following items, as applicable: excluded realized gain (loss); amortization of deferred front-end loads (DFEL) arising from changes in GDB and GLB benefit ratio unlocking; amortization of deferred gains arising from the reserve changes on business sold through reinsurance; and revenue adjustments from the initial adoption of new accounting standards. Operating return on equity Return on equity measures how efficiently we generate profits from the resources provided by our net assets. Return on equity is calculated by dividing annualized income (loss) from operations by average equity, excluding accumulated other comprehensive income (loss) (AOCI). Management evaluates return on equity by both including and excluding average goodwill within average equity.

Definitions of non-gaap measures used in this presentation (CONT.) Definition of notable items Income (loss) from operations, excluding notable items is a non-GAAP measure that excludes items which, in management’s view, do not reflect the company’s normal, ongoing operations. We believe highlighting notable items included in income (loss) from operations enables investors to better understand the fundamental trends in its results of operations and financial condition. Book value per share, excluding AOCI Book value per share excluding AOCI is calculated based upon a non-GAAP financial measure. It is calculated by dividing (a) stockholders' equity excluding AOCI by (b) common shares outstanding. We provide book value per share excluding AOCI to enable investors to analyze the amount of our net worth that is primarily attributable to our business operations. Management believes book value per share excluding AOCI is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period, primarily based on changes in interest rates. Book value per share is the most directly comparable GAAP measure.

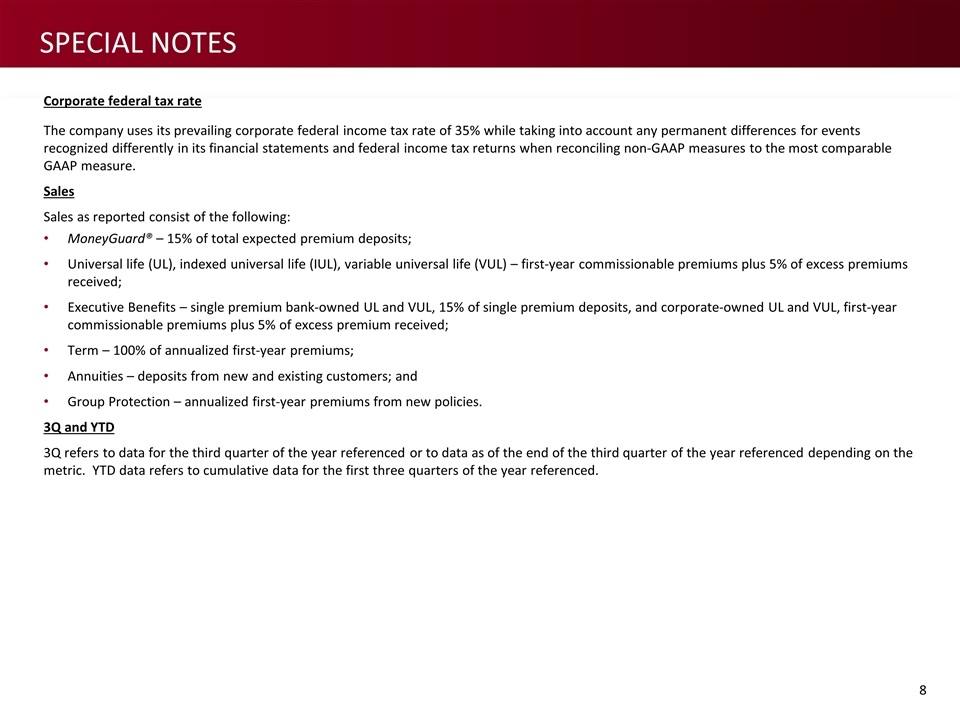

Corporate federal tax rate The company uses its prevailing corporate federal income tax rate of 35% while taking into account any permanent differences for events recognized differently in its financial statements and federal income tax returns when reconciling non-GAAP measures to the most comparable GAAP measure. Sales Sales as reported consist of the following: MoneyGuard® – 15% of total expected premium deposits; Universal life (UL), indexed universal life (IUL), variable universal life (VUL) – first-year commissionable premiums plus 5% of excess premiums received; Executive Benefits – single premium bank-owned UL and VUL, 15% of single premium deposits, and corporate-owned UL and VUL, first-year commissionable premiums plus 5% of excess premium received; Term – 100% of annualized first-year premiums; Annuities – deposits from new and existing customers; and Group Protection – annualized first-year premiums from new policies. 3Q and YTD 3Q refers to data for the third quarter of the year referenced or to data as of the end of the third quarter of the year referenced depending on the metric. YTD data refers to cumulative data for the first three quarters of the year referenced. Special Notes

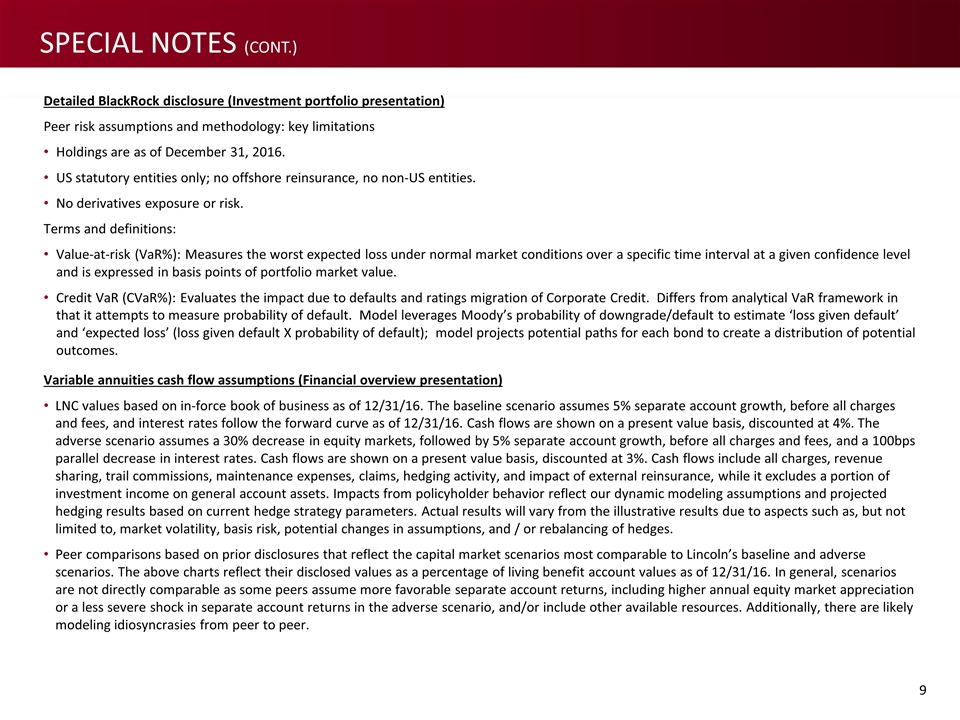

Detailed BlackRock disclosure (Investment portfolio presentation) Peer risk assumptions and methodology: key limitations Holdings are as of December 31, 2016. US statutory entities only; no offshore reinsurance, no non-US entities. No derivatives exposure or risk. Terms and definitions: Value-at-risk (VaR%): Measures the worst expected loss under normal market conditions over a specific time interval at a given confidence level and is expressed in basis points of portfolio market value. Credit VaR (CVaR%): Evaluates the impact due to defaults and ratings migration of Corporate Credit. Differs from analytical VaR framework in that it attempts to measure probability of default. Model leverages Moody’s probability of downgrade/default to estimate ‘loss given default’ and ‘expected loss’ (loss given default X probability of default); model projects potential paths for each bond to create a distribution of potential outcomes. Variable annuities cash flow assumptions (Financial overview presentation) LNC values based on in-force book of business as of 12/31/16. The baseline scenario assumes 5% separate account growth, before all charges and fees, and interest rates follow the forward curve as of 12/31/16. Cash flows are shown on a present value basis, discounted at 4%. The adverse scenario assumes a 30% decrease in equity markets, followed by 5% separate account growth, before all charges and fees, and a 100bps parallel decrease in interest rates. Cash flows are shown on a present value basis, discounted at 3%. Cash flows include all charges, revenue sharing, trail commissions, maintenance expenses, claims, hedging activity, and impact of external reinsurance, while it excludes a portion of investment income on general account assets. Impacts from policyholder behavior reflect our dynamic modeling assumptions and projected hedging results based on current hedge strategy parameters. Actual results will vary from the illustrative results due to aspects such as, but not limited to, market volatility, basis risk, potential changes in assumptions, and / or rebalancing of hedges. Peer comparisons based on prior disclosures that reflect the capital market scenarios most comparable to Lincoln’s baseline and adverse scenarios. The above charts reflect their disclosed values as a percentage of living benefit account values as of 12/31/16. In general, scenarios are not directly comparable as some peers assume more favorable separate account returns, including higher annual equity market appreciation or a less severe shock in separate account returns in the adverse scenario, and/or include other available resources. Additionally, there are likely modeling idiosyncrasies from peer to peer. Special Notes (CONT.)

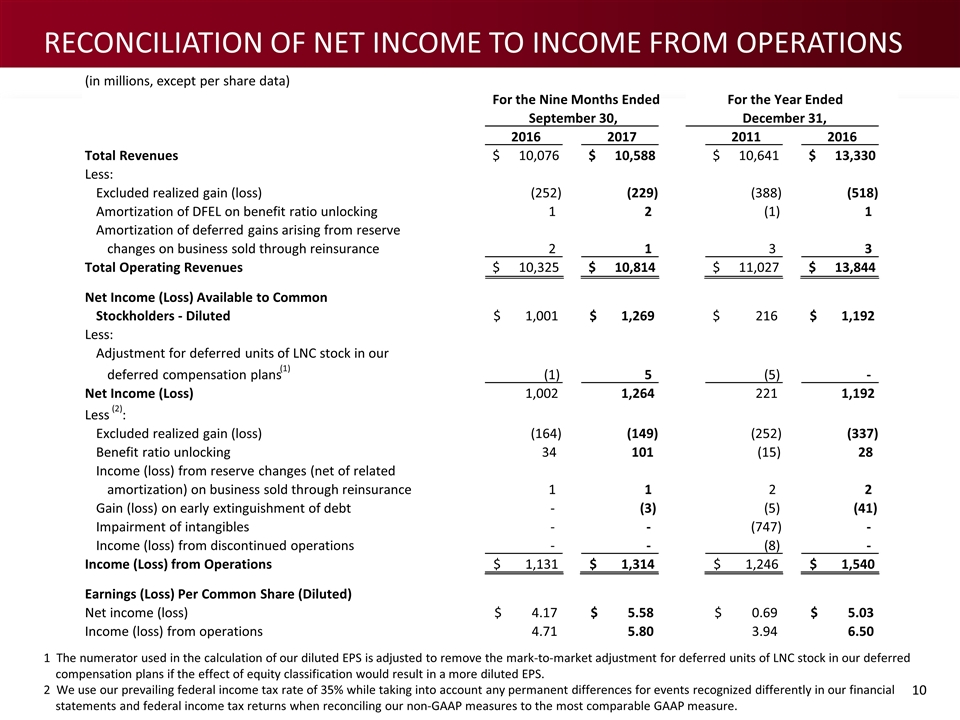

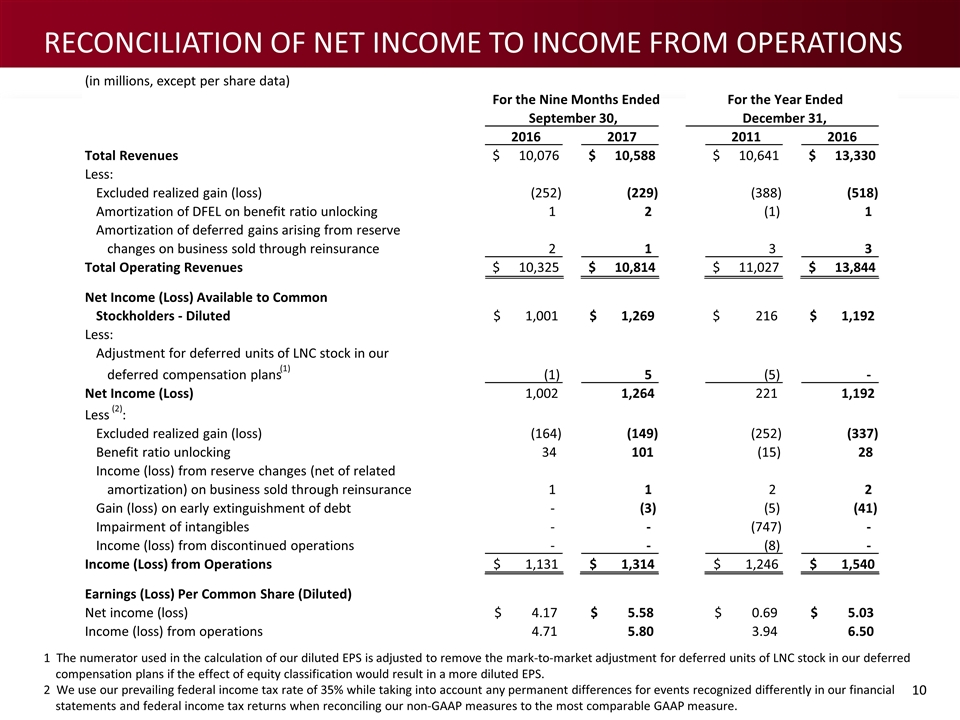

Reconciliation of net income to income from operations 1 The numerator used in the calculation of our diluted EPS is adjusted to remove the mark-to-market adjustment for deferred units of LNC stock in our deferred compensation plans if the effect of equity classification would result in a more diluted EPS. 2 We use our prevailing federal income tax rate of 35% while taking into account any permanent differences for events recognized differently in our financial statements and federal income tax returns when reconciling our non-GAAP measures to the most comparable GAAP measure. (in millions, except per share data) 2016 2017 2011 2016 Total Revenues 10,076 $ 10,588 $ 10,641 $ 13,330 $ Less: Excluded realized gain (loss) (252) (229) (388) (518) Amortization of DFEL on benefit ratio unlocking 1 2 (1) 1 Amortization of deferred gains arising from reserve changes on business sold through reinsurance 2 1 3 3 Total Operating Revenues 10,325 $ 10,814 $ 11,027 $ 13,844 $ Net Income (Loss) Available to Common Stockholders - Diluted 1,001 $ 1,269 $ 216 $ 1,192 $ Less: Adjustment for deferred units of LNC stock in our deferred compensation plans (1) (1) 5 (5) - Net Income (Loss) 1,002 1,264 221 1,192 Less (2) : Excluded realized gain (loss) (164) (149) (252) (337) Benefit ratio unlocking 34 101 (15) 28 Income (loss) from reserve changes (net of related amortization) on business sold through reinsurance 1 1 2 2 Gain (loss) on early extinguishment of debt - (3) (5) (41) Impairment of intangibles - - (747) - Income (loss) from discontinued operations - - (8) - Income (Loss) from Operations 1,131 $ 1,314 $ 1,246 $ 1,540 $ Earnings (Loss) Per Common Share (Diluted) Net income (loss) 4.17 $ 5.58 $ 0.69 $ 5.03 $ Income (loss) from operations 4.71 5.80 3.94 6.50 For the Nine Months Ended September 30, For the Year Ended December 31,

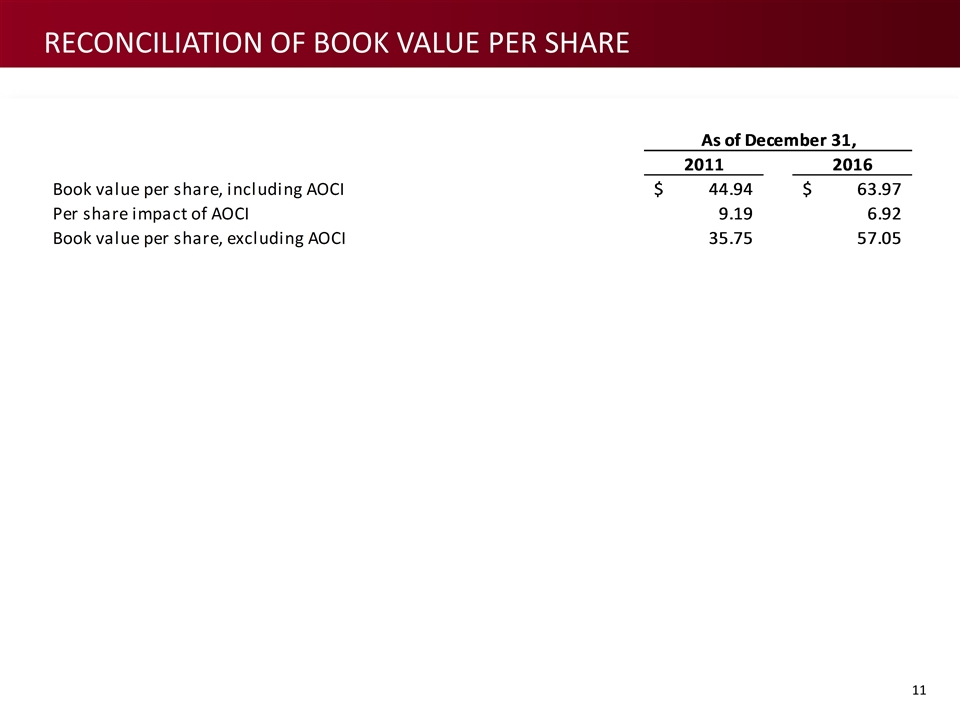

Reconciliation of book value per share

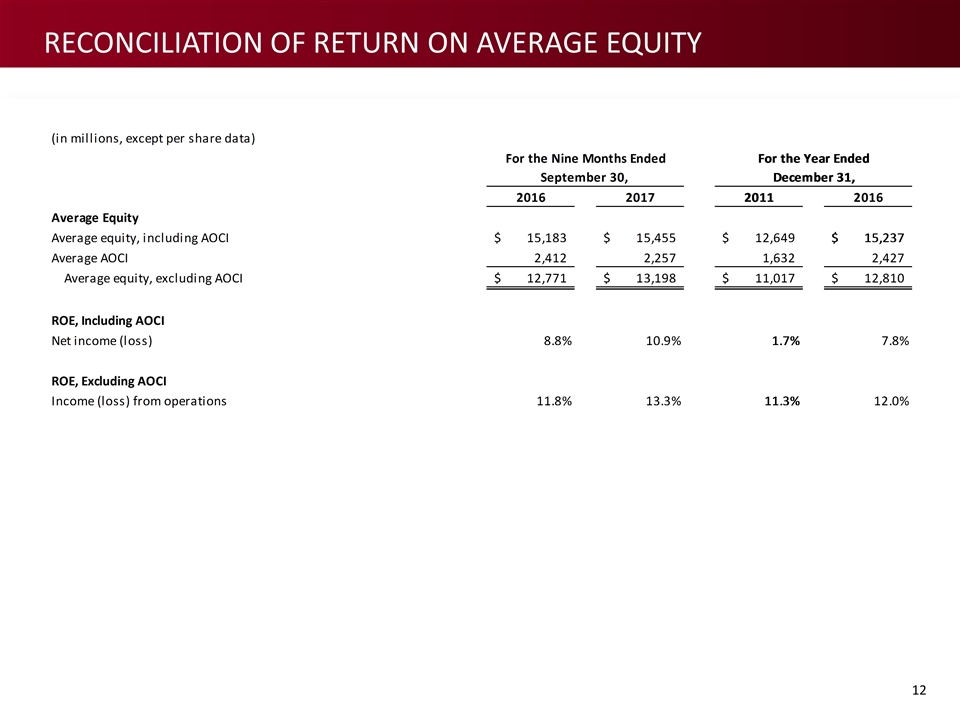

Reconciliation of return on average equity

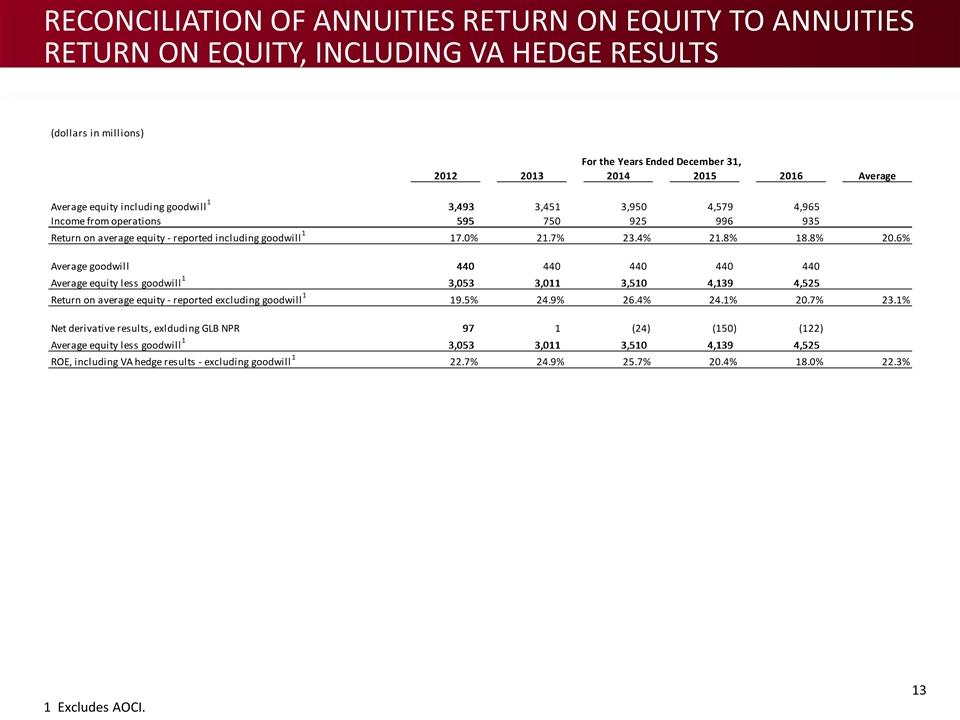

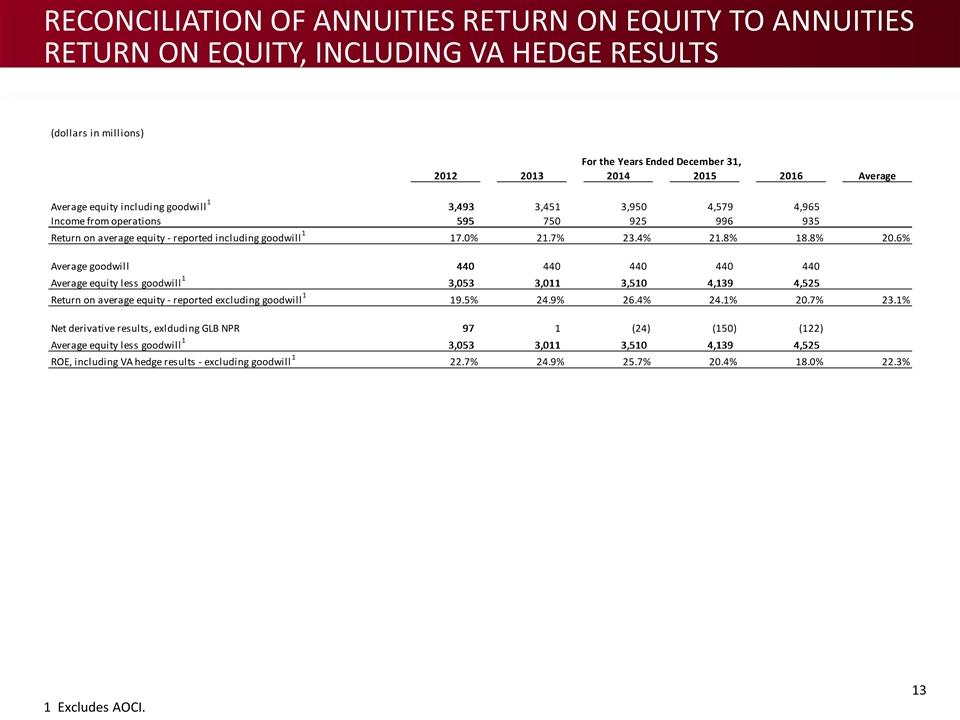

Reconciliation of annuities return on equity to annuities return on equity, including va hedge results 1 Excludes AOCI.

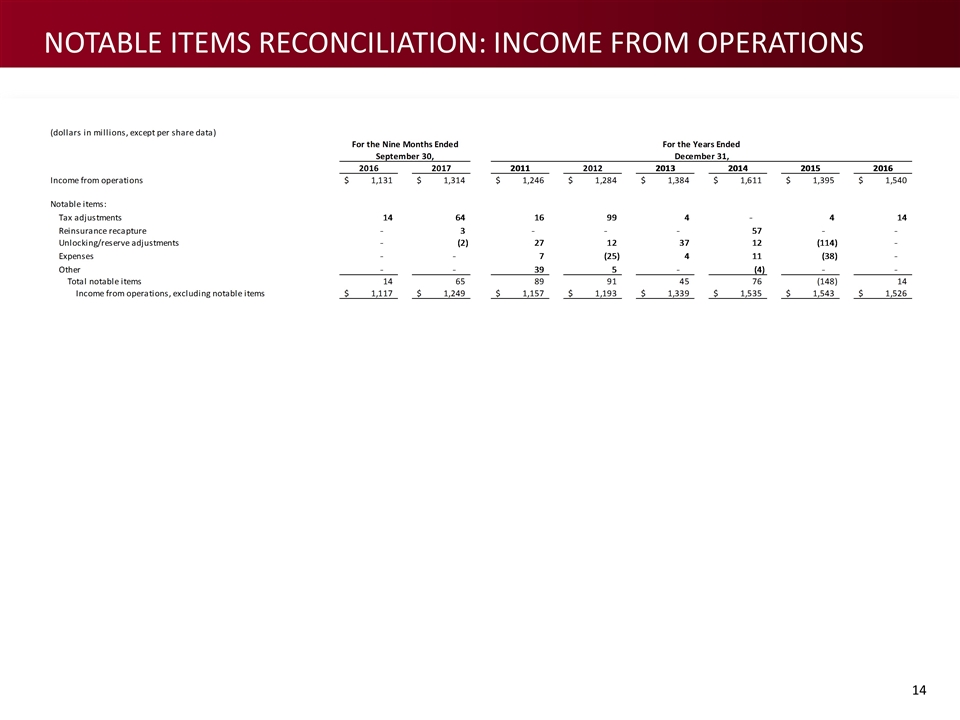

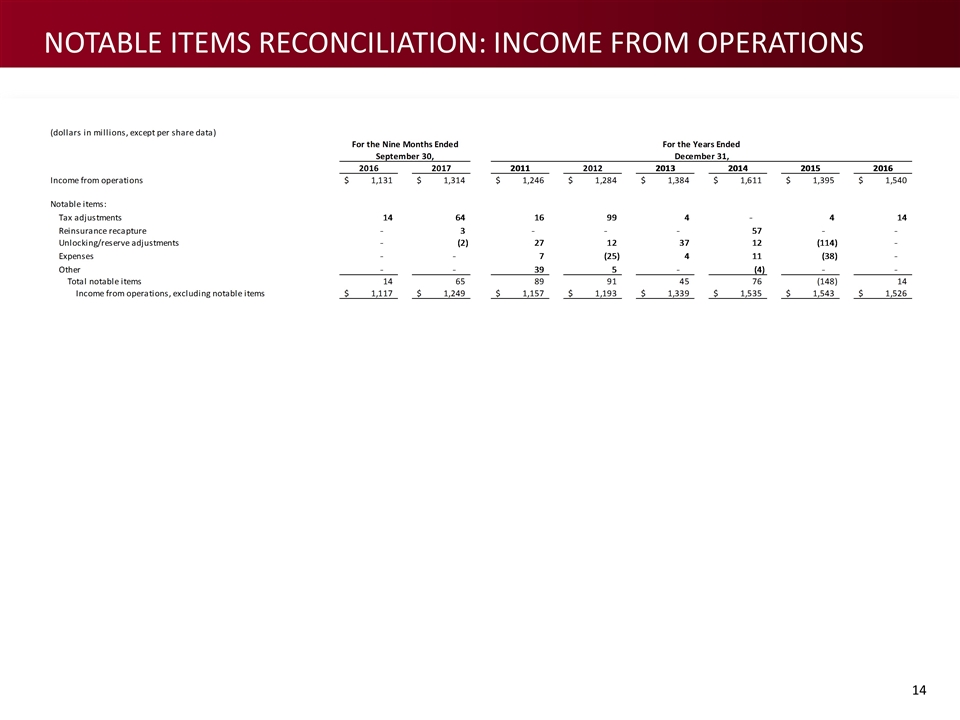

Notable Items reconciliation: Income from operations