AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 16, 2009

REGISTRATION NO. 333-156125

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

x Pre-Effective Amendment No. 1

¨ Post-Effective Amendment No.

(Check appropriate box or boxes)

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST

(Exact Name of Registrant as Specified in Charter)

1300 South Clinton Street

Fort Wayne, IN 46801

(Address of Principal Executive Offices)

Registrant’s Telephone Number, Including Area Code: (260) 455-2000

Dennis L. Schoff, Esq.

The Lincoln National Life Insurance Company

1300 South Clinton Street

Post Office Box 1110

Fort Wayne, IN 46801

(Name and Address of Agent for Service)

Copies of all communications to:

Robert A. Robertson, Esq.

Dechert LLP

4675 MacArthur Court, Suite 1400

Newport Beach, CA 92660

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

It is proposed that this registration statement shall hereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

No filing fee is due because an indefinite number of shares have been deemed to be registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

LINCOLN NATIONAL VARIABLE ANNUITY FUND A

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

March 16, 2009

Dear Contract Owner or Participant:

Enclosed you will find a Notice and Proxy Statement/Prospectus for a special meeting of contract owners of Lincoln National Variable Annuity Fund A (“Fund A”) to be held on June 11, 2009. The special meeting will be held at 9:00 a.m., local time, at 1300 South Clinton Street, Fort Wayne, IN 46802. The following proposals will be considered and acted upon at the meeting:

| | |

| Proposal 1: | | To approve an Agreement and Plan of Reorganization and related transactions to transfer the assets of Fund A to the LVIP Delaware Growth and Income Fund, a series of the Lincoln Variable Insurance Products Trust, in exchange for Standard Class shares of LVIP Delaware Growth and Income Fund, and to restructure Fund A into a unit investment trust. |

| |

| Proposal 2: | | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

After reviewing this matter carefully, the Board of Managers of Fund A unanimously recommends that you vote “FOR” the proposals. Your vote is extremely important regardless of the number of votes that you hold. Please take a few minutes to review this material, cast your vote on the enclosed proxy and return it in the enclosed postage-paid envelope. Your prompt response is needed so that the necessary quorum and vote can be obtained. It is important that your vote be received prior to the special meeting.

We appreciate your participation and prompt response in this matter, and thank you for your continued support.

|

| By Order of the Fund’s Board of Managers |

|

|

| Cynthia A. Rose |

| Secretary |

LINCOLN NATIONAL VARIABLE ANNUITY FUND A

PROXY STATEMENT/PROSPECTUS

This Proxy Statement/Prospectus is being furnished to you in connection with the solicitation of proxies relating to the special meeting of contract owners of Lincoln National Variable Annuity Fund A. The special meeting will be held on June 11, 2009 at 9:00 a.m., local time, at 1300 South Clinton Street, Fort Wayne, IN 46802.

The special meeting is for the purpose of considering and acting on the following matters:

| | 1. | To approve an Agreement and Plan of Reorganization and related transactions to transfer the assets of Fund A to the LVIP Delaware Growth and Income Fund (“LVIP G&I Fund”), a series of Lincoln Variable Insurance Products Trust, a mutual fund registered under the 1940 Act, in exchange for Standard Class shares of the LVIP G&I Fund, and to restructure Fund A as a unit investment trust. |

| | 2. | To consider and act upon such other business as may properly come before the special meeting or any adjournment(s) or postponement(s) thereof. |

After careful consideration, the Board of Managers of Fund A unanimously approved the proposals and recommends that contract owners vote “FOR” the proposals. The matters referred to above are discussed in detail in this Proxy Statement/Prospectus. The Board of Managers of Fund A has fixed the close of business on February 17, 2009 as the record date for determining contract owners entitled to notice of and to vote at the special meeting, and any adjournment thereof.

Whether or not you plan to attend the special meeting, please complete, sign, and return the enclosed proxy promptly so that you will be represented at the special meeting. If you have returned a proxy and are present at the special meeting, you may change the vote specified in the proxy at that time. However, attendance at the special meeting, by itself, will not revoke a previously tendered proxy.

The date of the first mailing of the proxy cards and this Proxy Statement/Prospectus by us will be on or about March 23, 2009. If you have any questions about the meeting, please feel free to call us at (800) 4LINCOLN 9454-6265).

This Proxy Statement/Prospectus, which should be retained for future reference, sets forth concisely the information about the LVIP G&I Fund that a prospective investor should know before investing. We recommend that you read this Proxy Statement/Prospectus in its entirety as the explanations will help you to decide how to vote on the Proposals. A Statement of Additional Information dated March 16, 2009, relating to this Proxy Statement/Prospectus and the reorganization is incorporated hereby by reference. If you would like a copy of this Statement of Additional Information, call (800) 4LINCOLN (454-6265), or write the LVIP Trust at P.O. Box 2340, Fort Wayne, Indiana 46801 and you will be mailed one promptly, free of charge.

Mutual fund shares are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

ii

QUESTIONS AND ANSWERS

Q. Why am I receiving this Proxy Statement/Prospectus?

You are receiving this Proxy Statement/prospectus because you own a contract or certificate issued by The Lincoln National Life Insurance Company (“Lincoln Life”) and such contract or certificate was issued through Lincoln National Variable Annuity Fund A (“Fund A”), a separate account of Lincoln Life. Lincoln Life is a wholly-owned subsidiary of Lincoln National Corporation (“LNC”).

Because the contracts are no longer being sold, the asset base of Fund A has been declining over the years and will not increase substantially in the foreseeable future. Accordingly, the administration costs for Fund A cannot benefit from economies of scale. Further, Lincoln Life has been operating the LVIP G&I Fund, which has investment objectives and strategies substantially similar to those of Fund A, since June 15, 1981. The officers of Fund A (“Fund A Management”) have determined that, rather than continuing to operate Fund A as an actively managed portfolio, it would be more efficient to restructure Fund A into unit investment trust (“New UIT”), which will invest in shares of the LVIP G&I Fund, a registered investment company. The contracts and certificates issued through the Lincoln Life separate account, currently Fund A, will remain in this separate account. What will change is the structure of the separate account as a New UIT.

The reorganization is intended to eliminate duplication of costs and other inefficiencies to Lincoln Life arising from having two comparable investment vehicles operated by Lincoln Life. Also, the contract owners and participants are expected to benefit from the larger asset base in the LVIP G&I Fund that will result from the Reorganization. The larger asset base of the LVIP G&I Fund should increase investment opportunities and broaden diversification of the funding medium for the contracts.

Further, the end result of the reorganization will be an organizational structure for the contract owners and participants that is more common in the variable annuity industry than the current organization structure. All of Lincoln Life’s other individual variable annuity products are structured with two tiers or levels; namely, the insurance company separate account purchases shares of mutual funds and those mutual funds hold diverse portfolios of investments. Currently, Fund A is a one-tier structure consisting of an insurance company separate account that invests directly in a diverse portfolio of investments. The Reorganization will move Fund A from a one-tier structure to the more common two-tiered structure.

This Proxy Statement/Prospectus is soliciting the contract owners and participants of Fund A to approve the Agreement and Plan of Reorganization, which contemplates the transfer of all of the asset and liabilities of Fund A (other than insurance obligations such as death benefits, surrender benefits and annuity payments) to the LVIP G&I Fund in exchange for Standard Class shares of the LVIP G&I Fund having an aggregate value equal to the net asset value of Fund A, and the restructuring of Fund A into a unit investment trust under the Investment Company Act of 1940, as amended (“1940 Act”), that will invest in Standard Class shares of the LVIP G&I Fund (the “Reorganization”). No sales charge will be imposed on the shares of the LVIP G&I Fund received by Fund A, the New UIT.

You are being asked to approve the Reorganization Agreement and the related transactions. Because contract owners and participants of Fund A are being asked to approve a Reorganization that will result in their having an interest in shares of the LVIP G&I Fund, this document also serves as a Prospectus for the LVIP G&I Fund.

Accompanying this Proxy Statement/Prospectus as Exhibit A is a copy of the Agreement and Plan of Reorganization pertaining to the transaction.

iii

Q. How do the Funds differ?

Fund A’s investment objective is long-term growth of capital in relation to the changing value of the dollar. A secondary investment objective of Fund A is the production of current income. The LVIP G&I Fund’s investment objective is to maximize long-term capital appreciation. The investment strategy of the LVIP G&I Fund also includes an income component. The LVIP G&I Fund typically invests in companies that have a long history of profit growth and dividend payment, which provide current income. Both Fund A and the LVIP G&I Fund are managed by the same sub-adviser, Delaware Management Company, a series of Delaware Management Business Trust, and the same portfolio management team. Fund A and the LVIP G&I Fund are managed using the same investment process, research, and proprietary technical models. As a result, the two Funds hold investments that are substantially the same. The primary difference in Fund A and the LVIP G&I Fund is that due to smaller asset flows into Fund A and Fund A’s smaller size, its investments and the amounts of those investments may differ slightly from those that are held by the LVIP G&I Fund.

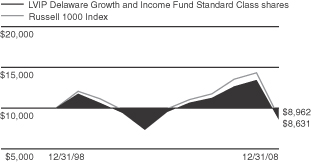

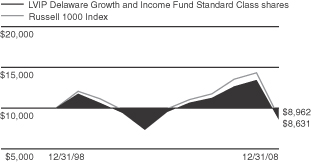

Both Fund A and the LVIP G&I Fund are equity funds with a diversified portfolio. They primarily invest in stocks of large-sized U.S. companies. Both Funds benchmark their investment performance against the Russell 1000® Index, which consists of the 1,000 largest U.S. companies, based on total market capitalization, in the Russell 3000® Index. The Russell 3000® Index is a capitalization-weighted total return index, which is comprised of 3000 of the largest capitalized U.S. domiciled companies.

Please see the section entitled “Principal Investment Strategies and Risks of Each Fund” in this Proxy Statement/Prospectus for a more detailed discussion of the similarities and difference in the investment objectives, policies and principal risks of Fund A and the LVIP G&I Fund.

Q. Will there be any tax consequences as a result of the merger?

The Reorganization is being structured as a tax-free reorganization. See “Information About the Reorganization—Federal Income Tax Consequences.”

Q. Will my vote make a difference?

Your vote is important regardless of the number of shares attributable to your contract and/or qualified plan. To avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the proxy statement/prospectus and provide your vote. It is important that your vote be received before the special meeting.

Q. Who will pay for the costs of the preparation, printing and mailing of this Proxy Statement/Prospectus?

The Lincoln National Life Insurance Company, the issuer of the Contracts, has agreed to pay the costs of the Reorganization, which includes preparation of the Proxy Statement/Prospectus, printing and distributing proxy materials, legal fees, accounting fees, and expenses of holding the shareholder meeting. We do not anticipate any brokerage costs associated with repositioning Fund A’s portfolio holdings as a result of the Reorganization.

Q. How does the Board recommend that I vote?

The Board of Managers of the Fund recommends that you vote to APPROVE the Reorganization on behalf of the Fund.

iv

Q. How do I give my voting instructions?

|

| |

| VOTING PROCEDURES |

Contract Owners /Participants are urged to designate their choice on the matter to be acted upon by using one of the following three methods: 1. BY INTERNET • Read the Proxy Statement/Prospectus. • Go to the voting link found on your proxy card. • Follow the instructions using your proxy card as a guide. • (Do not mail the proxy card if you provide voting instructions by Internet.) 2. BY MAIL • Read the Proxy Statement/Prospectus. • Date, sign, and return the enclosed proxy card in the envelope provided, which requires no postage if mailed in the United States. 3. BY TELEPHONE • Read the Proxy Statement/Prospectus. • Call the toll-free number found on your proxy card. • Follow the recorded instructions using your proxy card as a guide. (Do not mail the proxy card if you provide voting instructions by telephone.) |

Q. Who do I call if I have questions?

If you have any questions about the meeting or anything in this Proxy Statement/Prospectus, please feel free to call us toll free at (800) 4LINCOLN (454-6265).

Q. Is there any other information available to me?

Fund A. The following documents have been filed with the Securities and Exchange Commission (“SEC”) File Nos. 002-25618 and 002-26342): (i) the Prospectus of Fund A (Individual), dated April 30, 2008, which is incorporated herein by reference into this Proxy Statement/Prospectus; (ii) the Prospectus of Fund A (Group), dated April 30, 2008, which is incorporated herein by reference into this Proxy Statement/Prospectus; (iii) the Statement of Additional Information for Fund A (Individual), dated April 30, 2008, which is incorporated herein by reference into this Proxy Statement/Prospectus; (iv) the Statement of Additional Information for Fund A (Group), dated April 30, 2008, which is incorporated herein by reference into this Proxy Statement/Prospectus; (v) the Annual Report for Fund A dated December 31, 2008; and (vi) the Semi-Annual Report for Fund A dated June 30, 2008.

LVIP G&I Fund. The following documents have been filed with the SEC (SEC File Nos. 811-08090); (i) the Prospectus of the LVIP G&I Fund (Standard Class Shares), dated April 30, 2008, which is incorporated herein by reference into this Proxy Statement/Prospectus; (ii) the Statement of Additional Information for the LVIP G&I Fund, dated April 30, 2008, which is incorporated herein by reference into this Proxy Statement/Prospectus; (iii) the Annual Report for the LVIP G&I Fund, dated December 31, 2008; and (iv) the Semi-Annual Report for the LVIP G&I Fund, dated June 30, 2008.

v

Copies of each of these documents, the Statement of Additional Information related to this Proxy Statement /Prospectus and any subsequently released shareholder reports are available upon request by calling (800) 4LINCOLN (454-6265) or by writing to P.O. Box 2340, Fort Wayne, Indiana 46801 and you will be mailed one free of charge. You can also access the Annual/Reports and Semi-Annual Reports and any subsequently released shareholder reports at:

http://www.annuitycontent.lnc.com/LLsup/PDFLibrary/19875A.pdf

http://www.annuitycontent.lnc.com/llsup/PDFLibrary/SAR-A-MF5.pdf

Fund A and the LVIP G&I Fund are each subject to informational requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940 (the “1940 Act”), and in accordance therewith, file reports and other information with the SEC. Accordingly, they must file proxy material, reports, and other information with the SEC. Such proxy material, reports, and other information filed by Fund A and the LVIP G&I Fund can be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.W., Washington, DC 20549. To learn more about this service, call the SEC at (202) 551-8090. Copies of such materials can also be obtained at prescribed rates by electronic request at the following email address: publicinfo@sec.gov, or by writing the Public Reference Branch, Office of Consumer Affairs and Information Services, U.S. Securities and Exchange Commission, Washington, DC 20549-0102. Contract owners and participants may also obtain such information from the SEC’s website at http://www.sec.gov.

vi

TABLE OF CONTENTS

vii

viii

INTRODUCTION

PROPOSAL 1

To Approve an Agreement and Plan of Reorganization

SUMMARY

This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Proxy Statement/Prospectus and the Agreement and Plan of Reorganization, which is attached hereto as Exhibit A.

How will the Reorganization affect me?

This Proxy Statement/Prospectus is soliciting contract owners and participants of Fund A, to approve a proposed reorganization of Fund A whereby (1) the assets and liabilities of Fund A (other than liabilities associated with insurance obligations) will be transferred to the LVIP G&I Fund, a series of Lincoln Variable Insurance Products Trust, an open-end management investment company registered under the 1940 Act, in exchange for Standard Class shares of the LVIP G&I Fund and (2) Fund A will be restructured as a unit investment trust (“New UIT”) under the Investment Company Act of 1940, as amended (“1940 Act”) (“Reorganization”). If contract owners and participants approve the Reorganization, then immediately following the consummation of the Reorganization, each contract owner and participant will have an interest in the New UIT equal in value to that contract owner’s or participant’s interest in Fund A immediately prior to the Reorganization.

The contract owners and participants are being asked to approve the Reorganization Agreement and the related transactions pursuant to which the Reorganization transaction would be accomplished. Because the contract owners and participants of Fund A are being asked to approve a Reorganization transaction that will result in them holding an interest in shares of the LVIP G&I Fund through their ownership of a Lincoln Life contract or certificate issued through Fund A, this document also serves as a Prospectus for the LVIP G&I Fund.

Fund A is a separate account under Indiana insurance law that is registered as a management investment company under the Investment Company Act of 1940. The LVIP G&I Fund is a separate diversified series of the Lincoln Variable Insurance Products Trust, a Delaware statutory trust, which is registered as an open-end management investment company under the Investment Company Act of 1940 (“1940”) Act. The investment objectives and strategies for Fund A are substantially similar to the investment objectives and strategies of the LVIP G&I Fund. Fund A and the LVIP G&I Fund have the same sub-adviser, Delaware Management Company (“DMC”), a series of Delaware Management Business Trust, the same portfolio management team, and are managed in the same manner. The investment objectives of Fund A and the LVIP G&I Fund are fundamental and may not be changed without shareholder approval.

The Reorganization is intended to eliminate duplication of costs and other inefficiencies to Lincoln Life from operating two comparable investment vehicles. Also, the contract owners and participants are expected to benefit from the larger asset base in the LVIP G&I Fund that will result from the Reorganization. The larger asset base of the LVIP G&I Fund should increase investment opportunities and broaden diversification of the investments for the contract owners and participants who select to have their contract value in the LVIP G&I Fund.

Immediately after the Reorganization, each contract owner’s interest in the New UIT will have a value identical to the value of the contract owners’ interest in Fund A immediately before the Reorganization. Immediately after the Reorganization, each participant’s interest in the New UIT will have a value identical to the value of the participant’s interest in Fund A immediately before the Reorganization. The value of your

1

variable annuity contract (“contract”) or certificate will remain in the same Lincoln Life separate account, but that separate account, which has been reorganized into the New UIT, will invest in the LVIP G&I Fund following the Reorganization.

There will be no change in the contracts or in the rights of contract owners under those contracts after the Reorganization. There will be no change in the certificates or in the rights of participants under those certificates after the Reorganization. Also, there will be no change in purchase or transfer privileges or surrender or withdrawal procedures. Insurance obligations under contracts or certificates issued by Lincoln Life (e.g., death benefits, surrender benefit, and annuity payments) and currently supported by the assets of Fund A will be supported by the assets of the New UIT after the reorganization. The total value of the accumulation or annuity units a contract owner or participant has in Fund A immediately prior to the Reorganization will be the same as the total value of the accumulation or annuity units the contract owner or participant will have in the New UIT immediately after the Reorganization.

The current level of operating expenses for the LVIP G&I Fund are higher than the operating expenses of Fund A. However, if the Reorganization is approved, Lincoln Life will waive certain New UIT expenses (separate account expenses) to ensure that contract owners and participants do not incur aggregate contract or certificate expenses after the Reorganization that are higher than their pre-Reorganization aggregate contract or certificate expenses. Lincoln Life will effect this expense waiver by making adjustments, on a daily basis, in the New UIT expenses (separate account expenses) such that the sum of (a) the LVIP G&I Fund’s net fund operating expense ratio (taking into account any expense waivers or reimbursements), calculated as of the end of the most recently ended semi-annual period, and (b) the New UIT’s separate account expense ratio (i.e., asset-based fees and charges deducted on a daily basis from the New UIT assets and reflected in the calculations of the New UIT’s unit value) will not exceed, on an annualized basis, the aggregate annual expense ratio for Fund A (i.e., total separate account expenses and annual fund operating expenses as a % of average daily net assets in Fund A) for fiscal year 2008. In the event that the sum of the LVIP G&I Fund’s actual net fund operating expense ratio and the New UIT’s separate account expense ratio for any semi-annual period, including the expense waiver, exceeds, on an annual basis, the aggregate annual expense ratio for Fund A for fiscal year 2008, Lincoln Life will, in the following semi-annual period, reimburse the New UIT an additional amount that is equal to the excess of the adjusted expenses previously paid by contract owners and participants during that most recently completed semi-annual period over those expenses that would have been paid assuming the aggregate annual expense ratio for Fund A for the year ended December 31, 2008.

Lincoln Life’s waiver obligation will continue for as long as there is any contract or certificate is in effect. The fee waiver will apply to all Fund A contract owners and participants, whether they had an interest in Fund A at the time of the Reorganization. Accordingly, officers of Fund A (“Fund A Management”) is of the opinion that contract owners and participants will not be harmed by the Reorganization. See “Comparison of Fees and Expenses” and “Supplementary Financial Information” below.

Will the Reorganization result in a change in Voting Procedures?

Voting procedures will change after the Reorganization. Currently, the contract owners vote directly with respect to items affecting Fund A; in other words, contract owners are not required to instruct another party who votes on their behalf. After Fund A is restructured as a UIT, it will no longer have a Board of Managers. However, the LVIP G&I Fund has a Board of Trustees.

If the Reorganization is approved, contract owners will vote indirectly by instructing Lincoln Life as to how to vote shares of the LVIP G&I Fund held by the New UIT. Contract owners will complete voting instruction cards as opposed to proxy cards. Lincoln Life will vote the shares in accordance with the shareholder instructions pursuant to the requirements of the Investment Company Act of 1940. Lincoln Life will vote the shares of the LVIP G&I Fund held by the New UIT for which instructions are not provided in proportion to the instructions received from contract owners. If the Reorganization is approved, participants will continue to vote indirectly by providing voting instructions to the contract owner.

2

Fund A shares and shares of the LVIP G&I Fund have non-cumulative voting rights, which is typical. If you have cumulative voting rights for the election of Board members, you may vote all of your shares cumulatively. This means that you would have the right to give each Board nominee an equal number of votes or divide the votes among the nominees as you wish.

See “Voting Information” and “Quorum Requirements/Votes Necessary to Approve Proposals.”

Why is the Reorganization being proposed?

The Reorganization is intended to eliminate duplication of costs and other inefficiencies to Lincoln Life arising from having two comparable investment vehicles offered by the LFG organization, as well as to assist in achieving economies of scale and increased investment opportunities for contract owners. Contract owners are also expected to benefit from the larger asset base that will result from the Reorganization. Further, the end result will be an organizational structure that is more common in the variable annuity industry than the current organization structure.

What are the key features of the Reorganization?

The Reorganization Agreement sets forth the key features of the Reorganization. For a complete description of the Reorganization, see Exhibit A. The Reorganization Agreement generally provides for the following:

| | • | | Fund A will transfer all of its assets to the LVIP G&I Fund. LVIP G&I Fund will assume Fund A’s stated liabilities other than liabilities associated with insurance obligations that will be assumed by the New UIT. |

| | • | | Fund A will be restructured as the New UIT. The New UIT will assume Fund A’s stated liabilities associated with insurance obligations. |

| | • | | The LVIP G&I Fund will issue Standard Class shares to be held by the New UIT in an amount equal to the value of the assets that the LVIP G&I Fund received from Fund A, less the liabilities LVIP G&I Fund assumes. Immediately after the Reorganization, your indirect interest in the LVIP G&I Fund will equal your previous direct interest in Fund A. |

| | • | | Contract owners will retain their same Lincoln Life contract and participants will retain their same certificate issued by Lincoln Life. The aggregate contract charges will not change for contract owners and participants. There will be no change in the value of your contract or certificate and no change in your benefits under your contract or certificate as a result of the Reorganization. The Reorganization also will not affect the features of the contracts; and |

| | • | | The Reorganization should not result in adverse tax consequences to contract owners or participants. |

Will I have to pay any sales load, commission or other transaction fee in connection with the Reorganization?

Neither Fund A nor the contract owners of Fund A will pay any fees or charges in connection with the Reorganization. Lincoln Life will pay all costs and expenses associated with effecting the Reorganization.

How does the Board of Managers recommend that I vote?

After careful consideration, the Board of Managers unanimously approved the proposed reorganization. The Board of Managers recommends that you vote “FOR” the proposed reorganization.

What happens if the contract owners do not approve the Reorganization?

In the event that Contract Owners do not approve the Reorganization, Fund A will continue to operate as it is currently, and its Board of Managers will determine what further action, if any, to take.

3

How do the Funds’ investment objectives, principal investment strategies and risks compare?

Fund A’s investment objective is long-term growth of capital in relation to the changing value of the dollar. A secondary investment objective of Fund A is the production of current income. The LVIP G&I Fund’s investment objective is to maximize long-term capital appreciation. The investment strategy of the LVIP G&I Fund also includes an income component. The LVIP G&I Fund typically invests in companies that have a long history of profit growth and dividend payment, which provide current income. Accordingly, Fund A and the LVIP G&I Fund have substantially similar investment objectives.

Fund A and the LVIP G&I Fund are each equity funds with diversified portfolios. They primarily invest in stocks of large-sized U.S. companies. Both funds benchmark their investment performance against the Russell 1000® Index, which consists of the 1,000 largest U.S. companies based on total market capitalization. Fund A and the LVIP G&I Fund have the same investment sub-adviser, Delaware Management Company (“DMC”), a series of Delaware Management Business Trust, and the same portfolio management team. DMC manages Fund A and the LVIP G&I Fund using the same investment process, research and proprietary technical models. As a result, Fund A and the LVIP G&I Fund hold investments that are substantially similar.

Because Fund A and the LVIP G&I Fund have substantially similar investment objectives and strategies and are managed by the same sub-adviser and portfolio management team in the same manner, these funds have substantially similar risks. Fund A and the LVIP G&I Fund are subject to market, industry and company risks. Also, Fund A and the LVIP G&I Fund are subject to the risk associated with medium-sized companies.

How do the Funds’ fees and expenses compare?

Fund A offers only one class of shares, while the LVIP G&I Fund offers two classes of shares, Standard Class and Service Class shares. After the Reorganization, the New UIT will be invested in the Standard Class shares of the LVIP G&I Fund. While contract owners and participants will not own the shares directly, contract owners and participants will have an indirect interest through their ownership of contracts or certificates, respectively, which are held in the New UIT. Contract owners and participants will not pay any initial or deferred sales charge in connection with the Reorganization.

4

The following tables allow you to compare the various fees and expenses that you may pay for buying and holding shares of each of the Funds. The column entitled “New UIT and LVIP G&I Fund Standard Class (Pro-Forma)” shows what fees and expenses are estimated to be assuming the Reorganization takes place. The fees and expenses shown for the shares of Fund A and the LVIP G&I Fund as set forth in the following tables in the in examples are based on the expenses for the Fund A and the LVIP G&I Fund for the year ended December 31, 2008. The amounts for the “New UIT and LVIP G&I Fund Standard Class (Pro Forma)” set forth in the following table and in the examples are based on what the estimated expenses of the New UIT and LVIP G&I Fund would have been for the year ended December 31, 2008, after giving effect to the proposed Reorganization.

| | | | | | | | | | | | | | | | | |

| | | Fund A (Individual and

Group) | | | LVIP G&I

Fund3 | | | New UIT and LVIP

G&I Fund

Standard Class

(Pro Forma) | |

| | | Single

Premium | | | Periodic

Premium | | | Standard

Class | | | Single

Premium | | | Periodic

Premium | |

Contract Owner Fees | |

Sales Charge (Load) Imposed on Purchases (as a % of purchase payments, as applicable) | | | 2% + $50 | 1 | | 4.25 | % | | N/A | | | | 2% + $50 | 1 | | 4.25 | % |

Administrative Expenses (as a % of purchase payments, as applicable) | | $ | 65 | 1 | | 1.00 | % | | N/A | | | $ | 65 | 1 | | 1.00 | % |

Minimum Death Benefit Rider, if elected (as a % of purchase payments) | | | .75 | %2 | | .75 | %2 | | N/A | | | | .75 | %2 | | .75 | %2 |

Separate Account Expenses (as a % of average daily net assets in the separate account) | | | | | | | | | | | | | | | | | |

Mortality and Expense Risk Charge | | | 1.002 | % | | 1.002 | % | | N/A | | | | 1.002 | % | | 1.002 | % |

Annual Fund Operating Expenses (as a % of average daily net assets in the separate account or fund, as applicable) | | | | | | | | | | | | | | |

Management Fees | | | .323 | % | | .323 | % | | .34 | % | | | .34 | % | | .34 | % |

Other Expenses | | | N/A | | | N/A | | | .07 | % | | | .07 | % | | .07 | % |

| | | | | | | | | | | | | | | | | |

Total Annual Fund Operating Expenses | | | .323 | % | | .323 | % | | .41 | % | | | .41 | % | | .41 | % |

| | | | | | | | | | | | | | | | | |

Total Separate Account Expenses and Annual Fund Operating Expenses (as a % of average daily net assets in the separate account or fund, as applicable) | | | 1.325 | % | | 1.325 | % | | .41 | % | | | 1.412 | % | | 1.412 | % |

Less Expense Waiver (as a % of average daily net assets in the separate account) | | | N/A | | | N/A | | | N/A | | | | (.087 | %)4 | | (.087 | %)4 |

| | | | | | | | | | | | | | | | | |

Net Separate Account Expenses and Annual Fund Operating Expenses | | | 1.325 | % | | 1.325 | % | | .41 | % | | | 1.325 | % | | 1.325 | % |

| | | | | | | | | | | | | | | | | |

1 | This charge is deducted at the time of purchase of the contract and is a one-time charge. |

2 | The minimum death benefit rider is no longer available for sale. |

3 | This column does not reflect any fees, expenses and withdrawal charges imposed by the variable annuity contracts for which the fund serves as an investment vehicle. If those fees and expenses had been included, your costs would be higher. |

4 | Lincoln Life has contractually agreed to waive certain New UIT expenses (separate account expenses) to the extent needed to ensure that the contract owners and participants do not incur aggregate contract or certificate expenses that are higher than their pre-Reorganization aggregate contract or certificate expenses. In this instance, the amount of the waiver would be (.087%). Lincoln Life may, in its discretion, waive additional amounts of the separate account expenses to account for fluctuations in the total annual fund operating expenses of the LVIP G&I Fund. |

5

Lincoln Life has contractually agreed to waive a portion of the New UIT’s expenses (separate account expenses) to ensure that the contract owners and participants do not incur aggregate contract or certificate expenses after the Reorganization that are higher than their pre-Reorganization aggregate contract or certificate expenses. Lincoln Life will effect this expense waiver by making adjustments, on a daily basis, in the New UIT expenses (separate account expenses) such that the sum of (a) the LVIP G&I Fund’s net fund operating expense ratio (taking into account any expense waivers or reimbursements), calculated as of the end of the most recently ended semi-annual period, and (b) the New UIT’s separate account expense ratio (i.e., asset-based fees and charges deducted on a daily basis from the New UIT assets and reflected in the calculations of the New UIT’s unit value) will not exceed, on an annualized basis, the aggregate annual expense ratio for Fund A (i.e., total separate account expenses and annual fund operating expenses as a % of average daily net assets in Fund A) for fiscal year 2008. In the event that the sum of the LVIP G&I Fund’s actual net fund operating expense ratio and the New UIT’s separate account expense ratio for any semi-annual period, including the expense waiver, exceeds, on an annual basis, the aggregate annual expense ratio for Fund A for fiscal year 2008, Lincoln Life will, in the following semi-annual period, reimburse the New UIT an additional amount that is equal to the excess of the adjusted expenses previously paid by contract owners and participants during that most recently completed semi-annual period over those expenses that would have been paid assuming the aggregate annual expense ratio for Fund A for the year ended December 31, 2008.

Lincoln’s Life waiver obligation will continue for as long as there is any contract or certificate in effect. The fee waiver will apply to all Fund A contract owners and participants, whether or not they had an interest in Fund A at the time of the Reorganization.

EXAMPLES

The examples are intended to show you the cost of investing in Fund A, the LVIP G&I Fund, and the New UIT and the LVIP G&I Fund (Pro Forma), assuming the Reorganization takes place. The examples assume that you redeem all of your interest or shares at the end of each time period and that you reinvest all of your dividends. The following tables also assume that total annual operating expenses remain the same. The examples are for illustration purposes only, and your actual expenses may be greater or less than those shown.

Whether or not a contract is annuitized or surrendered at the end of the applicable time period, an investor would pay the following expenses on a $10,000 investment, assuming a 5% annual return on assets:

| | | | | | | | | | | | |

| | | Lincoln National Variable Annuity Fund A* |

| | | One Year | | Three Years | | Five Years | | Ten Years |

Single Premium | | $ | 521 | | $ | 796 | | $ | 1,092 | | $ | 1,931 |

Periodic Premium | | $ | 728 | | $ | 997 | | $ | 1,287 | | $ | 2,108 |

| * | These examples assume that the minimum death benefit is in effect. Without this benefit, expenses would be lower. Premium taxes may also apply, although they do not appear in the examples. |

| | | | | | | | | | | | |

| | | LVIP G&I Fund* |

| | | One Year | | Three Years | | Five Years | | Ten Years |

Standard Class | | $ | 42 | | $ | 132 | | $ | 230 | | $ | 518 |

| * | The examples do not reflect any fees, expenses or withdrawal charges imposed by the variable annuity contracts for which the LVIP G&I Fund serves as an investment vehicle. If those fees and expenses had been included, your costs would be higher. |

6

| | | | | | | | | | | | |

| | | New UIT and LVIP G&I Fund Standard Class

(Pro Forma)* |

| | | One Year | | Three Years | | Five Years | | Ten Years |

Single Premium | | $ | 521 | | $ | 796 | | $ | 1,092 | | $ | 1,931 |

Periodic Premium | | $ | 728 | | $ | 997 | | $ | 1,287 | | $ | 2,108 |

| * | These examples reflect the separate account expenses (New UIT charges) with expense waivers for years one through ten. |

Who will be the investment adviser/sub-adviser of my Fund after the Reorganization? What will the advisory and sub-advisory fees be after the Reorganization?

Lincoln National Life Insurance Company (“Lincoln Life”), an SEC-registered investment adviser, serves as the investment adviser of Fund A. Lincoln Life is a direct subsidiary of Lincoln National Corporation and has its principal place of business at 1300 South Clinton Street, Fort Wayne, Indiana. Lincoln Life has engaged Delaware Management Company (“DMC”), a series of Delaware Management Business Trust (“DMBT”), to serve as sub-adviser and make the day-to-day investment decisions for Fund A. DMBT is registered with the SEC as an investment adviser and is located at 2005 Market Street, Philadelphia, Pennsylvania 19103. DMBT is a subsidiary of Delaware Management Holdings, Inc. (“DMHI”). DMHI is an indirect subsidiary, and subject to the ultimate control, of Lincoln National Corporation.

Lincoln Investment Advisors Corporation (“LIAC”), a direct subsidiary of Lincoln National Corporation, serves as the investment adviser for the LVIP G&I Fund. LIAC is registered with the SEC as an investment adviser and has its principal place of business at 1300 South Clinton Street, Fort Wayne, Indiana. LIAC has retained DMC to serve as LVIP G&I Fund’s sub-adviser and to make the day-to-day investment decisions for the LVIP G&I Fund.

The table shows the effective fee rate that Fund A and the LVIP G&I Fund paid to their respective advisers for calendar year 2008, and the fee that each adviser paid to DMC as the sub-adviser for calendar year 2008:

| | | | | | | | | | |

Fund | | Adviser | | Effective Fee Rate for

Adviser

(annual rate as a % of

average daily net assets) | | | Sub-Adviser | | Effective Fee Rate for

Sub-Adviser (annual

rate as a % of average

daily net assets) | |

Fund A | | Lincoln Life | | 0.323 | % | | DMC | | 0.20 | % |

LVIP G&I Fund | | LIAC | | 0.34 | %1 | | DMC | | 0.20 | % |

1 | The management fee for the LVIP G&I Fund is calculated using the following percentages of average daily net assets of the fund: .48% of the first $200 million; .40% of the next $200 million; and .30% of the excess over $400 million. |

What will be the primary federal tax consequences of the Reorganization?

The transaction is intended to qualify as a tax-free reorganization for federal income tax purposes. Assuming the Reorganization qualifies for such treatment and each contract owners’ variable annuity contract is treated as a variable annuity for federal income tax purposes, each contract owner will not recognize taxable income as a result of the Reorganization. As a condition to the closing of the Reorganization, Fund A will receive an opinion of counsel to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. You should separately consider any state, local and other tax consequences in consultation with your tax advisor. Opinions of counsel are not binding on the Internal Revenue Service or the courts.

7

Dividends and Distributions

Fund A and the LVIP G&I Fund both declare and pay dividends from net investment income and net realized capital gains each year to their shareholders. A fund may distribute net realized capital gains only once a year. As described in more detail in “More Information About the Funds—Distributions” below, all dividends and distributions are reinvested automatically in additional shares of the same class of the respective fund at net asset value.

Shareholder Voting Rights

Fund A does not generally hold annual meetings of its contract owners. Neither does the LVIP G&I Fund hold annual shareholder meetings. The 1940 Act requires that a shareholder meeting be called for the purpose of electing Managers/Trustees at such time as less than a majority of Managers/Trustees holding office have been elected by shareholders. Meetings of the shareholders may be called at any time by the Board of Managers/Trustees or by the chairperson of the Board or by the President of the Trust/Fund. To the extent required by the 1940 Act, meetings of the shareholders for the purpose of voting on the removal of any Trustees shall be called promptly by the Trustees upon the written request of shareholders holding at least 10% of the outstanding shares of the Trust entitled to vote.

Appraisal Rights

Under the laws of the State of Indiana, the contract owners of Fund A do not have appraisal rights in connection with a combination or acquisition of the assets of another fund. Under the laws of the State of Delaware, shareholders of the LVIP G&I Fund do not have appraisal rights in connection with a combination of acquisition of the assets of another fund.

DESCRIPTION OF CONTRACT FEATURES

The following presents a brief description of contract features. These features will not change as a result of the reorganization. Greater detail regarding the contracts is provided in the prospectuses for Fund A, which are incorporated by reference into this Proxy Statement/Prospectus.

General

Fund A Individual contracts are individual variable annuity contracts for use primarily with certain nonqualified plans and qualified retirement plans. Fund A Group contracts are group variable annuity contracts for use primarily with certain nonqualified plans and qualified retirement plans. The contracts are no longer being offered for sale, but additional payments may be made on certain outstanding contracts. The contracts are either single payment contracts under which no additional payments may be made or deferred contracts under which additional payments may be made.

| | • | | Fund A Individual contracts and Fund A Group contracts were available as single payment immediate annuities. |

| | • | | Fund A Individual contracts and Fund A Group contracts were also available as deferred annuities that could be purchased with either a single payment or periodic payments. Periodic purchase payments are payable to Lincoln Life at a frequency and in an amount the contract owner or participant selected in the application. Subject to these restrictions, periodic payments are completely flexible. |

| | • | | Fund A Group contracts were available as group annuities under which payments were allocated to the accounts of individual participants who each received a certificate which summarized the provisions of the group contracts. Fund A Group contracts were also available as group variable annuity deposit administration contracts, designed for use with defined benefit plans and defined benefit H.R.-10 plans. |

8

Transfers between Accounts

Both Fund A Individual contracts and Fund A Group contracts provide that the contract owner can transfer all or any part of the contract value from Fund A to the fixed side of the contract, subject to certain restrictions. The contract owner may also transfer all or any part of the contract value from the fixed side of the contract to Fund A, subject to certain restrictions. When the participant is not the contract owner, the ability to transfer between accounts is subject to the restrictions established by the contract owner.

Valuing the Contracts

Lincoln Life measures the value of the contracts or certificates by valuing accumulation units before annuity payouts begin and valuing annuity units after annuity payouts begin. Currently Lincoln Life values these units each business day at the close of trading on the New York Stock Exchange. On any date other than a valuation date, the accumulation unit value and the annuity unit value will not change.

Annuity Payouts

Under both Fund A Individual contracts and Fund A Group contracts and certificates, contract owners and participants can elect annuity payouts in monthly, quarterly, semiannual or annual installments. Depending upon the terms of the contract or certificate or plan, a contract owner or participant may select from various annuity payout options, which include:

| | • | | Payouts Guaranteed for Designated Period: payouts are made for a guaranteed period of usually ten or twenty years (certain restrictions apply to contracts issued in connection with a 403(b) plan); |

| | • | | Life Annuity with Payouts Guaranteed for Designated Period: payouts are made for a guaranteed period of usually ten, fifteen or twenty years and then continued throughout the lifetime of the annuitant; |

| | • | | Unit Refund Life Annuity: payouts are made during the lifetime of the annuitant with the guarantee that a payout based on the value of annuity units will be made upon death (not available as a fixed payout); |

| | • | | Payouts Guaranteed for Designated Amount: periodic payouts of a designated amount until the proceeds are exhausted (not available to contracts issued in connection with a 403(b) plan) (not available as a fixed payout); |

| | • | | Interest Income: payouts are left on deposit with Lincoln Life, subject to withdrawal upon demand, with the interest being paid out at a frequency chosen by the contract owner (not available for Fund A Group contracts) (not available to contracts issued in connection with a 403(b) plan) (not available as a variable payout); |

| | • | | Annuity Settlement: payouts are made in the form provided by any single payment immediate annuity contract on the date the proceeds become payable; |

| | • | | Life Annuity: periodic payouts are made during the lifetime of the annuitant and end with the last payout before the death of the annuitant; |

| | • | | Joint Life Annuity: periodic payouts are made during the joint lifetime of the annuitant and a designated joint annuitant, with payouts continuing throughout the life of the survivor; |

| | • | | Joint Life and Two Thirds Survivor: periodic payouts are made during the joint lifetime of the annuitant and a designated joint annuitant, with the survivor receiving two-thirds of the periodic payout made when both were alive. |

The annuity payout may be used to provide fixed dollar or variable payments, unless otherwise noted in the contract, certificate or plan.

9

Death Benefit

Under Fund A Individual contracts and Fund A Group contracts and certificates, a death benefit will be paid if the contract owner (or joint owner), participant or annuitant dies prior to the date that annuity payments begin. The death benefit will be equal to the contract value.

Contract owners could elect a minimum death benefit. Participants who are not contract owners may elect a minimum death benefit if permitted by the contract owner. If the election has been made, the death benefit for a contract owner or participant shall be equal to the greater of the contract or account value or the minimum death benefit. The minimum death benefit is equal to the total purchase payments minus any withdrawals, partial annuitizations, premium taxes incurred and rider premiums.

Surrendering the Contract

A Fund A Individual contract owner or Fund A Group contract owner may surrender all or part of his or her contract or certificate any time before the annuity payout starting date. Contracts or certificates issued in connection with qualified plans, including H.R.-10 plans and tax-deferred annuity plans may have certain limitations on surrenders imposed by the plan. There is no surrender charge for either partial or full surrenders.

Making Withdrawals from the Contract

A Fund A Individual contract owner or Fund A Group contract owner may withdraw a portion of the contract value upon written request. The amount available for withdrawal is the contract value at the end of the valuation period during which the written request for withdrawal is received by Lincoln Life. Contracts or certificates issued in connection with qualified plans, including H.R.-10 plans and tax-deferred annuity plans may have certain early withdrawal limitations imposed by the plan.

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

The Reorganization is being proposed due to a declining asset base in Fund A and, with no new contracts being sold, the inability of contract owners to benefit from economies of scale. The Reorganization is intended to eliminate duplication of costs and other inefficiencies to Lincoln Life from operating two comparable investment vehicles—namely, Fund A and the LVIP G&I Fund.

Contract owners of Fund A are expected to benefit from the larger asset base in the LVIP G&I Fund that will result from the Reorganization. As of December 31, 2008, the net assets of Fund A were $40,221,697. By comparison, the net assets of the LVIP G&I Fund as of that date were $1,038,493,544. Management of Fund A anticipates that the larger asset base of the LVIP G&I Fund will increase investment opportunities and broaden diversification of the investments for the contract owners and participants who select to have their contract value in the LVIP G&I Fund.

Board Considerations

At the December 9, 2008 meeting of the Board of Managers of Fund A, Fund A Management presented the Reorganization to the Board of Managers, with supporting materials prepared by Fund A Management regarding the reasons for the proposal and details regarding the Reorganization. Fund A Management stated that the Reorganization was being proposed due to the declining assets of Fund A and that the Lincoln National Life Insurance Company (“Lincoln Life”) had not issued new contracts under Fund A for more than ten years. Therefore, the asset base of Fund A will not increase substantially in the foreseeable future, and Fund A cannot benefit from economies of scale. Fund A Management explained that the LVIP G&I Fund was proposed as the acquiring fund, because of its similarity to Fund A in terms of investment objective, strategy and policies, and

10

because it was currently managed by the same sub-adviser with the same portfolio management team as Fund A. Fund A Management believes that the larger asset base of the LVIP G&I Fund should increase investment opportunities and broaden diversification of the funding medium for the contracts and would provide the potential for shareholders to benefit from economies of scale in a larger fund. Lincoln Life also expects to experience savings of approximately $90,000 per year as a result of the Reorganization, due to elimination of duplicate costs to Lincoln Life for printing expenses, audit fees, fidelity bond premiums, Board of Manager fees and bank fees.

All of the Managers who are not “interested persons” (as such term is defined in the 1940 Act) (the “Independent Managers”) met separately with their independent legal counsel to review and consider the proposal, information about Fund A and the LVIP G&I Fund, and the proposed Reorganization and the supporting materials provided. Among other matters, independent legal counsel advised the Independent Managers of the findings that would need to be made by the Board under Rule 17a-8 under the 1940 Act to approve the merger of affiliated funds. The Independent Managers noted the representation by Fund A Management that the interests of the contract owners and participants of Fund A would not be diluted as a result of the Reorganization.

The Independent Managers reported their findings to the Board of Managers of Fund A, and the other Manager, who is an “interested person” (as such term is defined in the 1940 Act) adopted the considerations and conclusions of the Independent Managers. In reviewing the Reorganization, based on information provided to them by Fund A Management, the Board considered a number of factors, including:

| | • | | that the interests of the contract owners and participants following the Reorganization would not materially differ from their interests prior to the Reorganization. Immediately after the Reorganization, the value of each contract and certificate would be allocated to the same separate account and that separate account would invest in the LVIP G&I Fund; |

| | • | | Fund A Management’s representation that the larger asset base of the LVIP G&I Fund should increase investment opportunities and broaden diversification of the funding medium for the contracts and certificates; |

| | • | | the similarity of the LVIP G&I Fund’s investment objective, strategy and policies, and past performance to Fund A’s investment objective, strategy and policies, and past performance; |

| | • | | that Fund A and the LVIP G&I Fund were both sub-advised by Delaware Management Company and had the same portfolio management team; |

| | • | | that the Reorganization would result in significant cost savings to Lincoln Life, as described above, with no increase in total expenses to the contract owners or participants anticipated; |

| | • | | that Lincoln Life has agreed to pay all costs and expenses associated with effecting the Reorganization; |

| | • | | that Lincoln Life has agreed to limit the New UIT’s expenses to ensure that the contract owners and participants do not incur aggregate contract or certificate expenses that are higher than their pre-Reorganization aggregate contract or certificate expenses; and |

| | • | | that the Reorganization has been structured as a tax free transaction for federal income tax purposes. |

Based on all of the foregoing, the Board of Managers determined on December 9 that: (1) participation in the Reorganization was in the best interests of Fund A; and (2) the interests of existing contract owners and participants of the Fund A would not be diluted as a result of the Reorganization. On that date, the Board approved the Reorganization with respect to the Fund A.

Agreement and Plan of Reorganization

To effect the Reorganization, the assets and liabilities of Fund A (other than liabilities relating to insurance obligations such as death benefits, surrender benefits and annuity payments) will be used to purchase Standard

11

Class shares of the LVIP G&I Fund. The date that the assets and liabilities of Fund A will be valued for purposes of the Reorganization will be after the close of business on the closing date, which is a date to be mutually agreed upon by all of the parties to the Reorganization Agreement. If the Reorganization is approved, the closing is expected to occur in the second quarter of 2009. After the Reorganization, Fund A will no longer hold securities and other instruments directly; instead, Fund A, which will be restructured as a unit investment trust (“New UIT”), will hold similar investments indirectly through the intermediate vehicle of the LVIP G&I Fund. When Fund A is restructured as a unit investment trust, it will no longer be registered as a management investment company under the 1940 Act.

The LVIP G&I Fund will issue Standard Class shares to the New UIT in an amount equal to the value of the assets that the LVIP G&I Fund receives from Fund A, less Fund A’s liabilities (other that liabilities relating to insurance obligations that will be assumed by the New UIT) assumed by the LVIP G&I Fund in the transaction. As a result, the New UIT will become a shareholder of the LVIP G&I Fund. Accumulation or annuity units a contract owner or participant had in Fund A prior to the Reorganization, will, as part of the Reorganization, be allocated to the New UIT investing in the LVIP G&I Fund. The total value of the accumulation or annuity units a contract owner has in Fund A immediately prior to the Reorganization will be the same as the total value of the accumulation or annuity units the same contract owner will have in the New UIT immediately after the Reorganization. The total value of the accumulation or annuity units a participant has in Fund A immediately prior to the Reorganization will be the same as the total value of the accumulation or annuity units the same participant will have in the New UIT immediately after the Reorganization.

More information on the Reorganization is contained in the Reorganization Plan attached to this Proxy Statement/Prospectus as Exhibit A. Approval of the Reorganization by contract owners and participants is a prerequisite to the implementation of the Reorganization. The Reorganization may be postponed or canceled for any reason with the consent of the parties to the Reorganization Plan.

THE BOARD, INCLUDING ALL OF THE INDEPENDENT MANAGERS, HAS

UNANIMOUSLY RECOMMENDED APPROVAL OF THE REORGANIZATION PLAN.

Description of the LVIP G&I Fund’s Shares

The New UIT will receive shares of the LVIP G&I Fund in accordance with the procedures provided for in the Reorganization Agreement. Each such share will be fully paid and non-assessable when issued, which means that the consideration for the shares has been paid in full and the issuing fund may not impose levies on shareholders for more money, respectively. Full and fractional Standard Class shares of the LVIP G&I Fund will be issued to the New UIT in accordance with the procedures detailed in the Reorganization Agreement. The LVIP G&I Fund will not issue share certificates; rather, the ownership of the shares will be recorded on the books of the LVIP G&I Fund. The shares of the LVIP G&I Fund issued to the New UIT will have no pre-emptive or conversion rights.

Federal Income Tax Consequences

Lincoln Life does not believe that the Reorganization will result in the realization of taxable income or loss to Lincoln Life, Fund A, or Lincoln Variable Insurance Products Trust. Lincoln Life also does not believe that the Reorganization will result in tax consequences to contract owners or participants. The Reorganization itself will not result in a distribution from contracts currently supported by Fund A that would give rise to taxable income to contract owners or participants.

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under section 368(a) of the Internal Revenue Code of 1984 (the “Code”). As a condition to the closing of the Reorganization, Lincoln Life, Fund A, and LVIP G&I Fund will receive an opinion from the law firm of Dechert LLP to the effect that, on the basis of the existing provisions of the Code., U.S. Treasury regulations issued

12

thereunder, current administrative rules, pronouncements and court decisions, and certain representations made by the Funds, for federal income tax purposes, upon consummation of the Reorganization:

| | (1) | Lincoln Life (including Fund A) will not recognize any gain or loss as a result of the restructuring of Fund A as a New UIT; |

| | (2) | Lincoln Life (including Fund A) will not recognize any gain or loss as a result of the transfer of Fund A’s assets to LVIP G&I Fund in exchange for shares of the LVIP G&I Fund and the assumption by the LVIP G&I Fund of Fund A’s liabilities (other than liabilities associated with insurance obligations that will be assumed by the New UIT); |

| | (3) | The LVIP G&I Fund’s basis in Fund A’s assets received will be the same as Lincoln Life’s basis in those assets immediately prior to the Reorganization; |

| | (4) | The LVIP G&I Fund’s holding period for the transferred assets will include Lincoln Life’s holding period therefore; |

| | (5) | No gain or loss will be recognized by the LVIP G&I Fund upon the receipt of Fund A’s assets solely in exchange for the issuance of LVIP G&I Fund’s shares and the assumption of Fund A’s liabilities (other than liabilities associated with insurance obligations that will be assumed by the New UITs); |

| | (6) | No gain or loss will be recognized by the contract owners or participants as a result of the Reorganization; |

| | (7) | Lincoln Life’s aggregate basis in the shares of the LVIP G&I Fund received in the Reorganization will be the same as the aggregate adjusted basis of the assets surrendered in exchange there for reduced by the amount of any liabilities of Fund A assumed by the LVIP G&I Fund; and |

| | (8) | Lincoln Life’s holding period in the shares of the LVIP G&I Fund received in the Reorganization will include its holding period for the assets surrendered in exchange therefore, provided that at the time of the exchange, such assets were held as capital assets. |

The LVIP G&I Fund’s utilization after the Reorganization of any pre-Reorganization losses realized by Fund A to offset gains realized by the LVIP G&I Fund could be subject to limitation in future years.

13

Pro-Forma Capitalization

The following table sets forth the capitalization of the of Fund A and the LVIP G&I Fund as of December 31, 2008 and the capitalization of the LVIP G&I Fund on a pro-forma basis as of that date, giving effect to the proposed acquisition of assets at net asset value.

Capitalization of Fund A,

LVIP G&I Fund and

LVIP G&I Fund ( Pro Forma)

(as of December 31, 2008) (Unaudited)

| | | | | | | | | | | | | | |

| | | Fund A | | | LVIP G&I

Fund | | Adjustments | | | LVIP G&I Fund

(Pro Forma) |

Net Assets | | | | | | | | | | | | | | |

Standard Class | | $ | 40,221,697 | | | $ | 993,796,589 | | $ | — | | | $ | 1,034,018,286 |

Service Class | | | — | | | | 44,696,995 | | | — | | | | 44,696,995 |

| | | | | | | | | | | | | | |

Total Net Assets | | $ | 40,221,697 | | | $ | 1,038,493,584 | | $ | — | | | $ | 1,078,715,281 |

| | | | | | | | | | | | | | |

Net Asset Value Per Unit or Share | | | | | | | | | | | | | | |

Standard Class | | $ | 14.485 | 1 | | $ | 20.972 | | | | | | $ | 20.972 |

Service Class | | | | | | $ | 20.963 | | | | | | $ | 20.963 |

| | | | |

Units/Shares Outstanding | | | | | | | | | | | | | | |

Standard Class | | | 2,776,797 | 2 | | | 47,386,242 | | | (858,945 | )3 | | | 49,304,094 |

Service Class | | | | | | | 2,132,135 | | | — | | | | 2,132,135 |

| | | | | | | | | | | | | | |

Total Shares Outstanding | | | 2,776,797 | 2 | | | 49,518,377 | | | (858,945 | ) | | | 51,436,229 |

| | | | | | | | | | | | | | |

1 | Unit Value. Fund A has only one class of shares. |

2 | Units outstanding. Fund A has only one class of shares. |

3 | Reflects change in shares outstanding due to issuance of Standard Class shares of the LVIP G&I Fund in exchange for units of Fund A based upon the net asset value of the LVIP G&I Fund’s Standard Class shares on December 31, 2008. |

The table set forth above should not be relied upon to reflect the number of shares to be received in the Reorganization; the actual number of shares to be received will depend upon the net asset value and number of shares outstanding of each Fund at the time of the Reorganization.

14

COMPARISON OF INVESTMENT OBJECTIVES AND POLICIES

The following discussion comparing investment objectives, policies and restrictions of the Fund A and the LVIP G&I Fund is based upon and qualified in its entirety by the respective investment objectives, policies and restrictions set forth in each of the prospectuses of the Fund A and the LVIP G&I Fund, dated April 30, 2008.

Investment Objectives of each Fund

The Fund A’s investment objective is long-term growth of capital in relation to the changing value of the dollar. A secondary investment objective of Fund A is the production of current income. The LVIP G&I Fund’s investment objective is to maximize long-term capital appreciation. The investment strategy of the LVIP G&I Fund also includes an income component. The LVIP G&I Fund typically invests in companies that have a long history of profit growth and dividend payment, which provide current income. Accordingly, Fund A and the LVIP G&I Fund have substantially similar investment objectives.

Principal Investment Strategies and Risks of each Fund

Principal Strategies

Fund A and the LVIP G&I Fund have substantially similar investment objectives and investment strategies. Fund A and the LVIP G&I Fund have the same sub-adviser, Delaware Management Company, and the same portfolio management team. DMC manages Fund A and the LVIP G&I Fund in the same manner, using the same investment process, research, and proprietary technical models. As a result, the Funds hold investments that are substantially the same. Due to smaller asset flows into Fund A and Fund A’s smaller size, Fund A’s investments and the amounts of those investments may differ slightly from those that are held by the LVIP G&I Fund.

Both Fund A and the LVIP G&I Fund pursue their objectives by investing in a diversified portfolio of stocks primarily of large-sized U.S. companies with market capitalizations, at the time of purchase, similar to the market capitalizations of the companies in the Russell 1000® Index. The Russell 1000® Index represents the largest 1000 companies in the Russell 3000® Index. The Russell 3000® Index is a capitalization-weighted total return index, which is comprised of 3000 of the largest capitalized U.S. domiciled companies.

For both Fund A and the LVIP G&I Fund, DMC places some emphasis on medium-sized companies, which are companies that have capitalizations similar to the market capitalizations of the companies in the Russell Mid-Cap® Index. As of December 31, 2008, the cap range for the companies in the Russell Mid-Cap® index is $3.06 billion to $9.96 billion.

Fund A’s and the LVIP G&I Fund’s management style focuses on seeking growth companies at a reasonable price by blending:

| | • | | A growth oriented management style, which seeks companies with earnings and/or revenues that are growing equal to or faster than the industry average; and |

| | • | | A value oriented management style, which seeks companies within an industry with current stock prices that do not reflect the stocks’ perceived true worth. |

More specifically, Fund A and the LVIP G&I Fund seek to invest in companies believed to:

| | • | | Show earnings growth equal to or greater than the average expected growth rate of the companies in the same industry; and |

| | • | | Be undervalued in the market relative to the companies’ industry peers. |

15

The companies sought typically have:

| | • | | A long history of profit growth and dividend payment; and |

| | • | | A reputation for quality management, products and service. |

DMC, the sub-adviser, has access to research and proprietary technical models and will apply quantitative and qualitative analysis in determining the appropriate allocations among categories of issuers and types of securities. Fund A’s and the LVIP G&I Fund’s investments are selected using both a variety of quantitative techniques and fundamental research in seeking to maximize each Fund’s expected return while maintaining risk, style and capitalization characteristics similar to those of securities in the Russell 1000® Index.

Principal Risks

As stated above, Fund A and the LVIP G&I Fund have substantially similar investment objectives and strategies. Fund A and the LVIP G&I Fund are each managed by the same sub-adviser, DMC, and the same portfolio management team, who manages Fund A and the LVIP G&I Fund in the same manner. DMC uses the same investment process, research and proprietary technical models to manage Fund A and the LVIP G&I Fund. As a result, Fund A and the LVIP G&I Fund hold investments that are substantially the same, and accordingly, Fund A and the LVIP G&I Fund are subject to substantially similar risks.

A principal risk of investing in Fund A and the LVIP G&I Fund involves the risk that the value of the stocks purchased will fluctuate. These fluctuations could cause the value of a Fund’s stock investments and, therefore, the value of the Fund’s shares held under your contract to fluctuate, and you could lose money.

Fund A and the LVIP G&I Fund are also subject to market, industry and company risk. Market risk is the risk that all or a majority of the securities in a certain market—like the stock or bond market—will decline in value because of economic conditions, future expectations, or investor confidence. Industry risk is the risk that the value of securities in a particular industry will decline because of changing expectations for the performance of that industry. Company risk is the risk that the value of an individual stock will decline because of changing expectations for the performance of the individual company issuing the stock.

Another principal risk of investing in Fund A and the LVIP G&I Fund is the risk associated with medium-sized companies. Medium-sized companies, which are not as well-established as large-sized companies, may react more severely to market conditions and suffer more from economic, political and regulatory developments. The value of securities of medium sized, less well-know companies, can be more volatile than that of relatively larger companies.

Other Investment Strategies and Risks of Each Fund

(other than Principal Strategies and Risks)

Fund A and the LVIP G&I Fund may also use other investment strategies, to a lesser degree, to pursue their investment objectives. Each Fund’s Statement of Additional Information (“SAI”) describes these other investment strategies and the risks involved.

In response to market, economic, political or other conditions, Fund A and the LVIP G&I Fund may use temporarily different investment strategies for defensive purposes. If either Fund does so, different factors could affect the Fund’s performance and the Fund may not achieve its investment objective.

16

PURCHASE AND REDEMPTION OF FUND SHARES

Net Asset Value

Each Fund determines its net asset value per share (“NAV”) as of close of regular trading (normally 4:00 p.m., Eastern time) on the New York Stock Exchange (“NYSE”) on each day the NYSE is open for trading. Each Fund determines its NAV by:

| | • | | Adding the values of all securities investments and other assets; |

| | • | | Subtracting liabilities (including dividends payable); and |

| | • | | Dividing by the number of shares outstanding. |

A Fund’s securities may be traded in other markets on days when the NYSE is closed. Therefore, the Fund’s NAV may fluctuate on days when you do not have access to the Fund to purchase or redeem shares.

Each Fund typically values its securities investments as follows:

| | • | | Equity securities, at their last sale prices on national securities exchanges or over-the-counter, or, in the absence of recorded sales, at the average of readily available closing bid and asked prices on exchanges or over-the-counter; |

| | • | | Debt securities, at the price established by an independent pricing service, which is believed to reflect the fair value of these securities; and |

| | • | | Fixed income securities with a maturity of less than sixty days are priced at amortized cost. |

In certain circumstances, a Fund may value its portfolio securities at fair value as estimated in good faith under procedures established by the Funds’ Board of Trustees. When a Fund uses fair value pricing, it may take into account any factors it deems appropriate. A Fund may determine fair value based upon developments related to a specific security, current valuations of foreign stock indices (as reflected in U.S. futures markets) and/or U.S. sector or broader stock market indices. The price of securities used by a Fund to calculate its NAV may differ from quoted or published prices for the same securities. Fair value pricing may involve subjective judgments, and it is possible that the fair value determined for a security is materially different than the value that could be realized upon the sale of that security.

The Funds anticipate using fair value pricing for securities primarily traded on U.S. exchanges only under very limited circumstances, such as the unexpected early closing of the exchange on which a security is traded or suspension of trading in the security. A Fund may use fair value pricing more frequently for securities primarily traded in non-U.S. markets because, among other things, most foreign markets close well before the Fund values its securities, normally at 4:00 p.m. Eastern time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim. To account for this, a Fund may frequently value many foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available.

Share Classes

The LVIP G&I Fund offers two classes of shares: the Standard Class and the Service Class. The two classes of shares are identical, except that Service Class shares are subject to a distribution (Rule 12b-1) fee, which has been adopted pursuant to a distribution and service plan.

As part of the Reorganization, the LVIP G&I Fund will issue Standard Class shares to be held by the New UIT in an amount equal to the value of the assets that the LVIP G&I Fund received from Fund A, less the liabilities the LVIP G&I Fund assumes. Following the Reorganization, Contract Owners will have an indirect interest in LVIP G&I Fund Standard Class shares.

17

MORE INFORMATION ABOUT THE FUNDS

Management of the Funds

Fund A’s and the LVIP G&I Fund’s business and affairs are managed under the direction of their Board of Managers and Board of Trustees, respectively. The Board of Managers and the Board of Trustees have the power to amend their Funds’ bylaws, to declare and pay dividends, and to exercise all the powers of the Funds, except those granted to the contractholders/shareholders.

Manager of Managers.