Execution Version COMMITMENT EXTENSION AGREEMENT AND AMENDMENT NO. 2 TO AMENDED AND RESTATED REVOLVING CREDIT AGREEMENT (Commitment Extension Pursuant to Section 2.08(d) of Credit Agreement and Amendments Pursuant to Section 9.05 of Existing Credit Agreement) This COMMITMENT EXTENSION AGREEMENT AND AMENDMENT NO. 2 TO AMENDED AND RESTATED REVOLVING CREDIT AGREEMENT (this “Agreement”) dated as of February 29, 2024, is entered into by and among PPL CAPITAL FUNDING, INC., a Delaware corporation (“Company”), The Narragansett Electric Company, a Rhode Island corporation (the “Designated Borrower” and together with the Company, each a “Borrower” and collectively, the “Borrowers”), PPL Corporation, a Pennsylvania corporation (“Guarantor”), the undersigned Lenders (as defined in the Credit Agreement) extending their 2027 Revolving Commitments (as defined in the Credit Agreement) (the “2027 Extending Lenders”), the Consenting Lenders (as defined below) party hereto and WELLS FARGO BANK, NATIONAL ASSOCIATION, as Administrative Agent (in such capacity, the “Administrative Agent”), Swingline Lender and Issuing Lender. Capitalized terms used and not otherwise defined herein shall have the meanings attributed to them in the Credit Agreement (as hereinafter defined). RECITALS A. Borrowers, Guarantor, the 2027 Extending Lenders, the Consenting Lenders and the Administrative Agent are parties to that certain Amended and Restated Revolving Credit Agreement dated as of December 6, 2021 (as amended by that certain Amendment No. 1 to Amended and Restated Revolving Credit Agreement, dated as March 30, 2023, and as further amended, restated, or otherwise modified from time to time prior to the date hereof, the “Existing Credit Agreement” and as amended hereby, the “Credit Agreement”). B. Pursuant to Section 2.08(d) of the Credit Agreement, the Borrowers desire to change the existing 2027 Termination Date, effective as of the Effective Date, from December 6, 2027 to December 6, 2028 and the 2027 Revolving Lenders party hereto constituting 2027 Extending Lenders and holding 2027 Revolving Commitments that aggregate at least 51% of the aggregate 2027 Revolving Commitments agree to such extension. Pursuant to Section 2.08(d) of the Credit Agreement, Borrowers have requested an extension of the 2027 Termination Date (the “2027 Commitment Extension”) of the 2027 Revolving Commitments from December 6, 2027 to December 6, 2028, effective on the Effective Date. C. Each of the undersigned 2027 Extending Lenders has agreed to extend its 2027 Revolving Commitment in accordance with Section 1 hereto. D. Pursuant to Section 9.05 of the Credit Agreement, the Borrowers desire to amend the definition of “Quarterly Date” in Section 1.01 of the Existing Credit Agreement as set forth in Section 4 of this Agreement, and the Lenders party hereto constituting all Lenders under the Existing Credit Agreement immediately prior to the Effective Date but after giving effect to the Master Assignment (as defined below) (the “Consenting Lenders”) agree to such amendment. NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows: 1. Extension of Commitments. Effective as of the Effective Date, the 2027 Termination Date of the 2027 Revolving Commitment of each 2027 Extending Lender shall be extended to December 6, 2028 which, for purposes of Section 2.08(d)(ii) of the Credit Agreement, shall be the “Current Termination Date” with respect to the 2027 Revolving Commitments. Each 2027 Extending Lender hereby waives the notice periods, notice and timing requirements set forth in Section 2.08(d) of the Credit Agreement for the extension of the 2027 Termination Date. 2. Conditions Precedent to Effectiveness of Commitment Extension and Amendments. The Commitment Extensions and the amendments to the Existing Credit Agreement as set forth in Sections 3 to 5 hereunder shall be effective on and as of the first date on which the following conditions have been satisfied (the “Effective Date”):

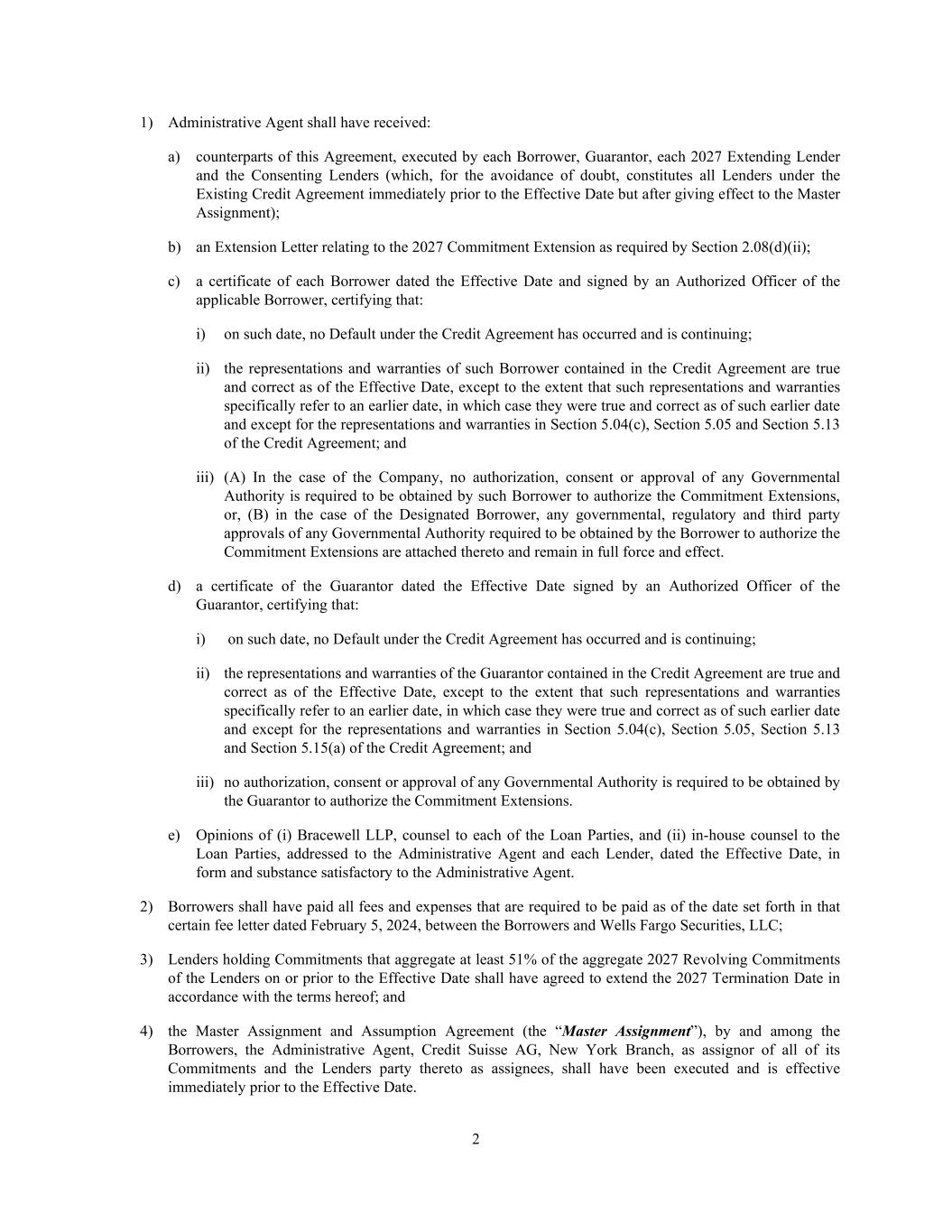

2 1) Administrative Agent shall have received: a) counterparts of this Agreement, executed by each Borrower, Guarantor, each 2027 Extending Lender and the Consenting Lenders (which, for the avoidance of doubt, constitutes all Lenders under the Existing Credit Agreement immediately prior to the Effective Date but after giving effect to the Master Assignment); b) an Extension Letter relating to the 2027 Commitment Extension as required by Section 2.08(d)(ii); c) a certificate of each Borrower dated the Effective Date and signed by an Authorized Officer of the applicable Borrower, certifying that: i) on such date, no Default under the Credit Agreement has occurred and is continuing; ii) the representations and warranties of such Borrower contained in the Credit Agreement are true and correct as of the Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they were true and correct as of such earlier date and except for the representations and warranties in Section 5.04(c), Section 5.05 and Section 5.13 of the Credit Agreement; and iii) (A) In the case of the Company, no authorization, consent or approval of any Governmental Authority is required to be obtained by such Borrower to authorize the Commitment Extensions, or, (B) in the case of the Designated Borrower, any governmental, regulatory and third party approvals of any Governmental Authority required to be obtained by the Borrower to authorize the Commitment Extensions are attached thereto and remain in full force and effect. d) a certificate of the Guarantor dated the Effective Date signed by an Authorized Officer of the Guarantor, certifying that: i) on such date, no Default under the Credit Agreement has occurred and is continuing; ii) the representations and warranties of the Guarantor contained in the Credit Agreement are true and correct as of the Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they were true and correct as of such earlier date and except for the representations and warranties in Section 5.04(c), Section 5.05, Section 5.13 and Section 5.15(a) of the Credit Agreement; and iii) no authorization, consent or approval of any Governmental Authority is required to be obtained by the Guarantor to authorize the Commitment Extensions. e) Opinions of (i) Bracewell LLP, counsel to each of the Loan Parties, and (ii) in-house counsel to the Loan Parties, addressed to the Administrative Agent and each Lender, dated the Effective Date, in form and substance satisfactory to the Administrative Agent. 2) Borrowers shall have paid all fees and expenses that are required to be paid as of the date set forth in that certain fee letter dated February 5, 2024, between the Borrowers and Wells Fargo Securities, LLC; 3) Lenders holding Commitments that aggregate at least 51% of the aggregate 2027 Revolving Commitments of the Lenders on or prior to the Effective Date shall have agreed to extend the 2027 Termination Date in accordance with the terms hereof; and 4) the Master Assignment and Assumption Agreement (the “Master Assignment”), by and among the Borrowers, the Administrative Agent, Credit Suisse AG, New York Branch, as assignor of all of its Commitments and the Lenders party thereto as assignees, shall have been executed and is effective immediately prior to the Effective Date.

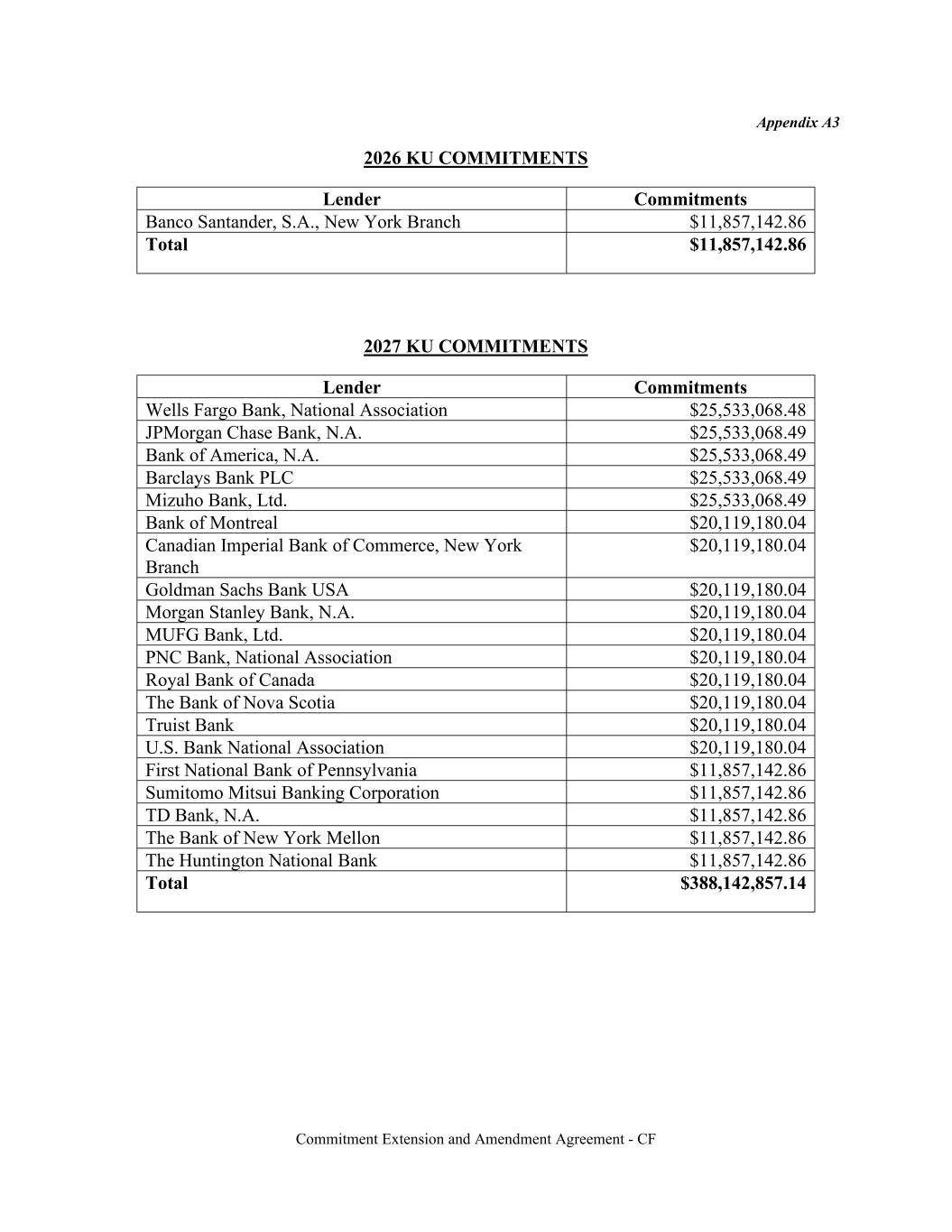

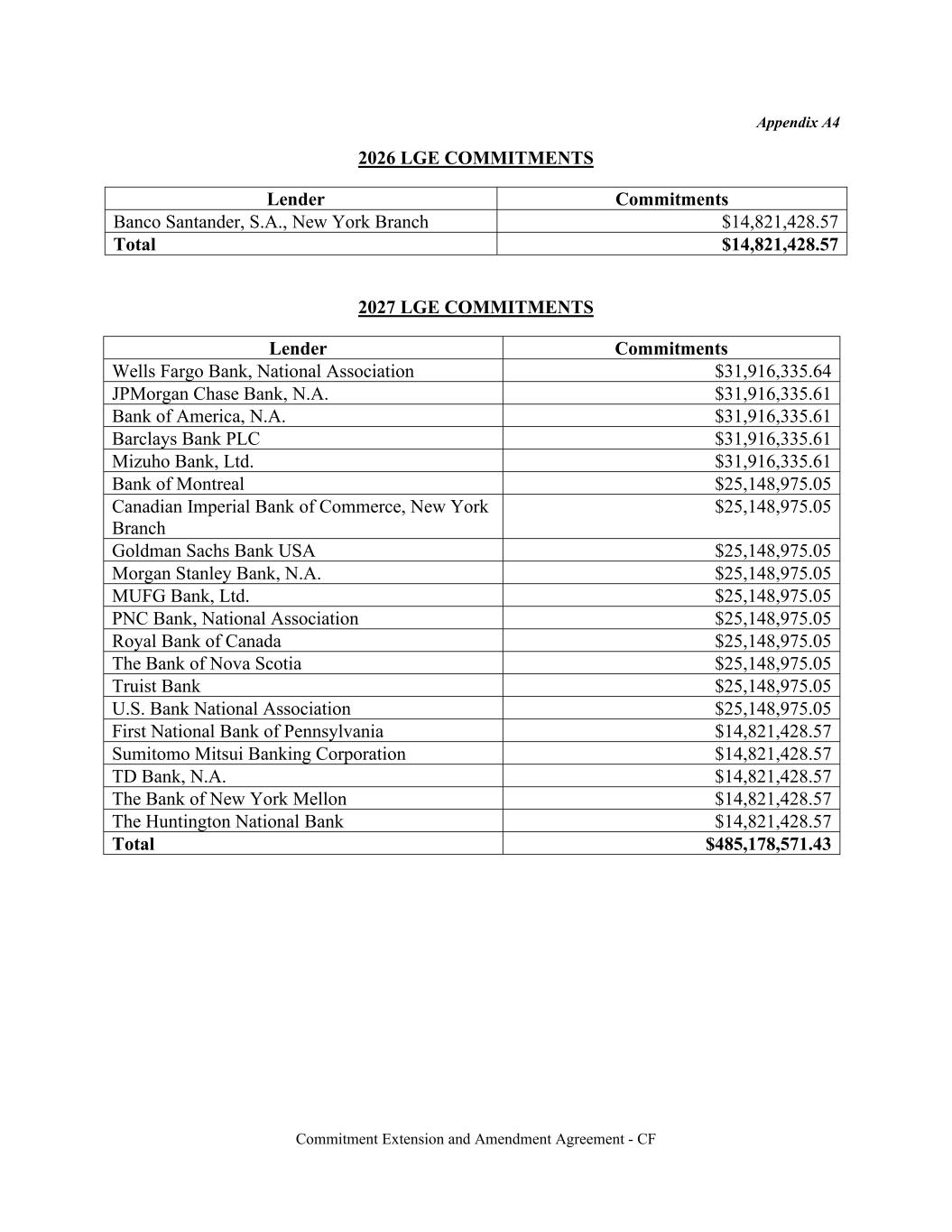

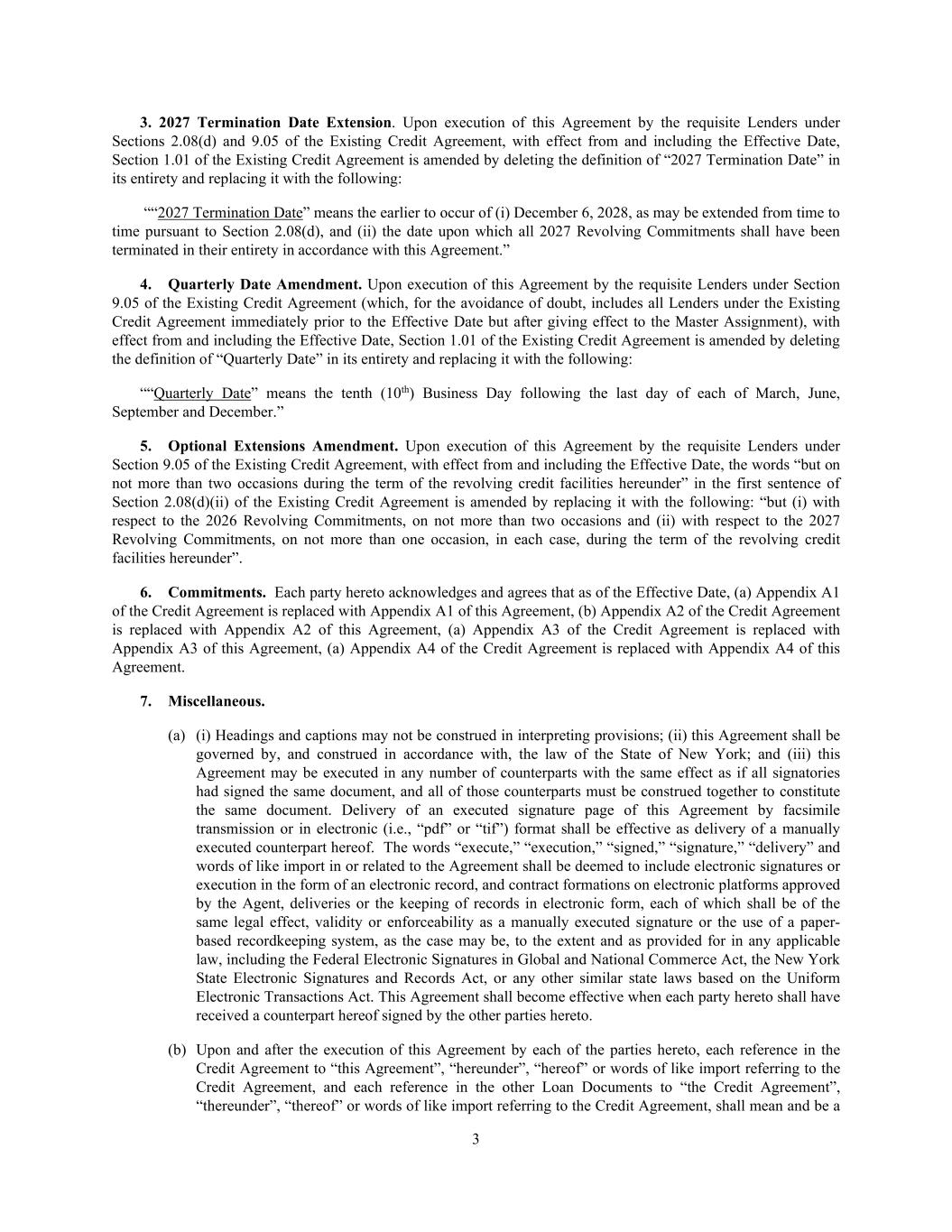

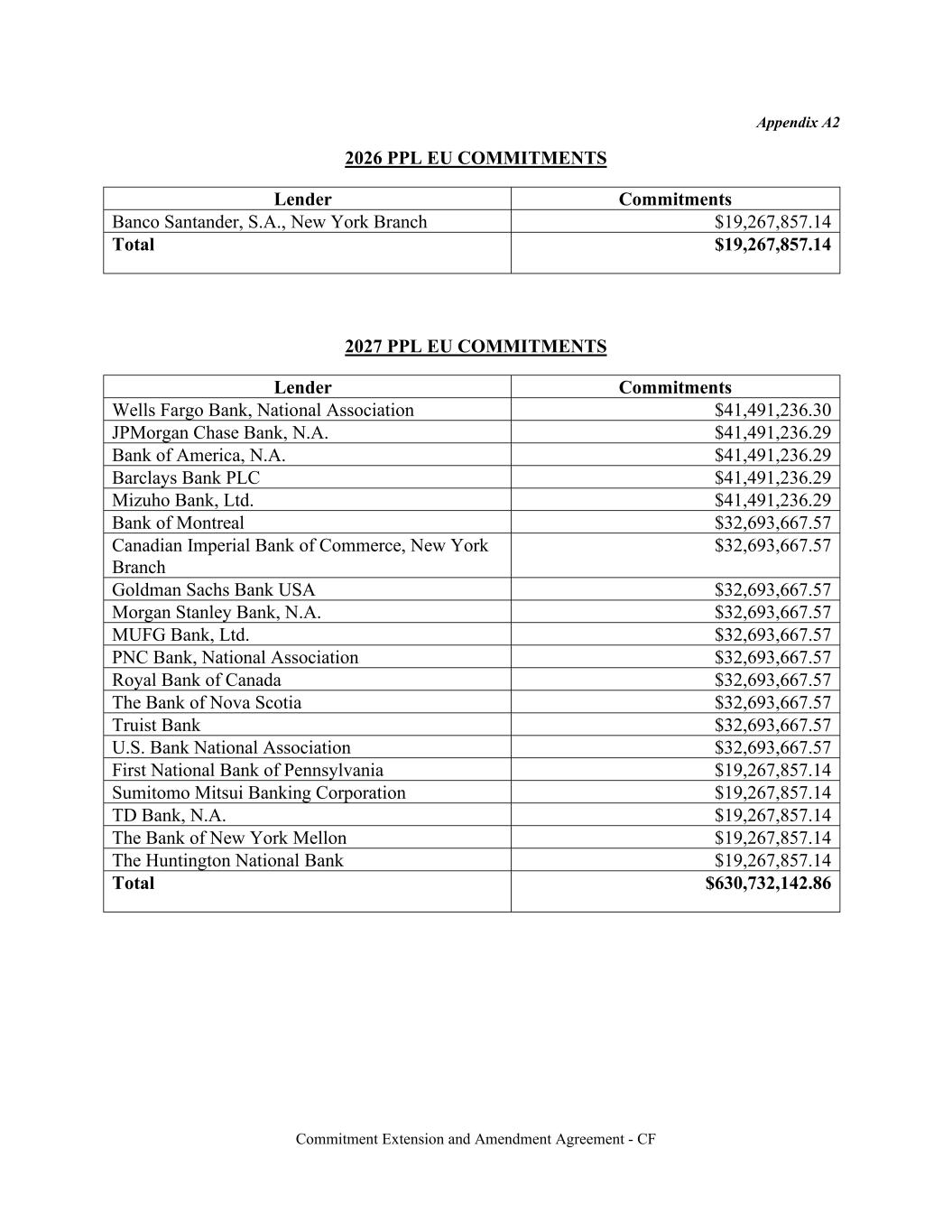

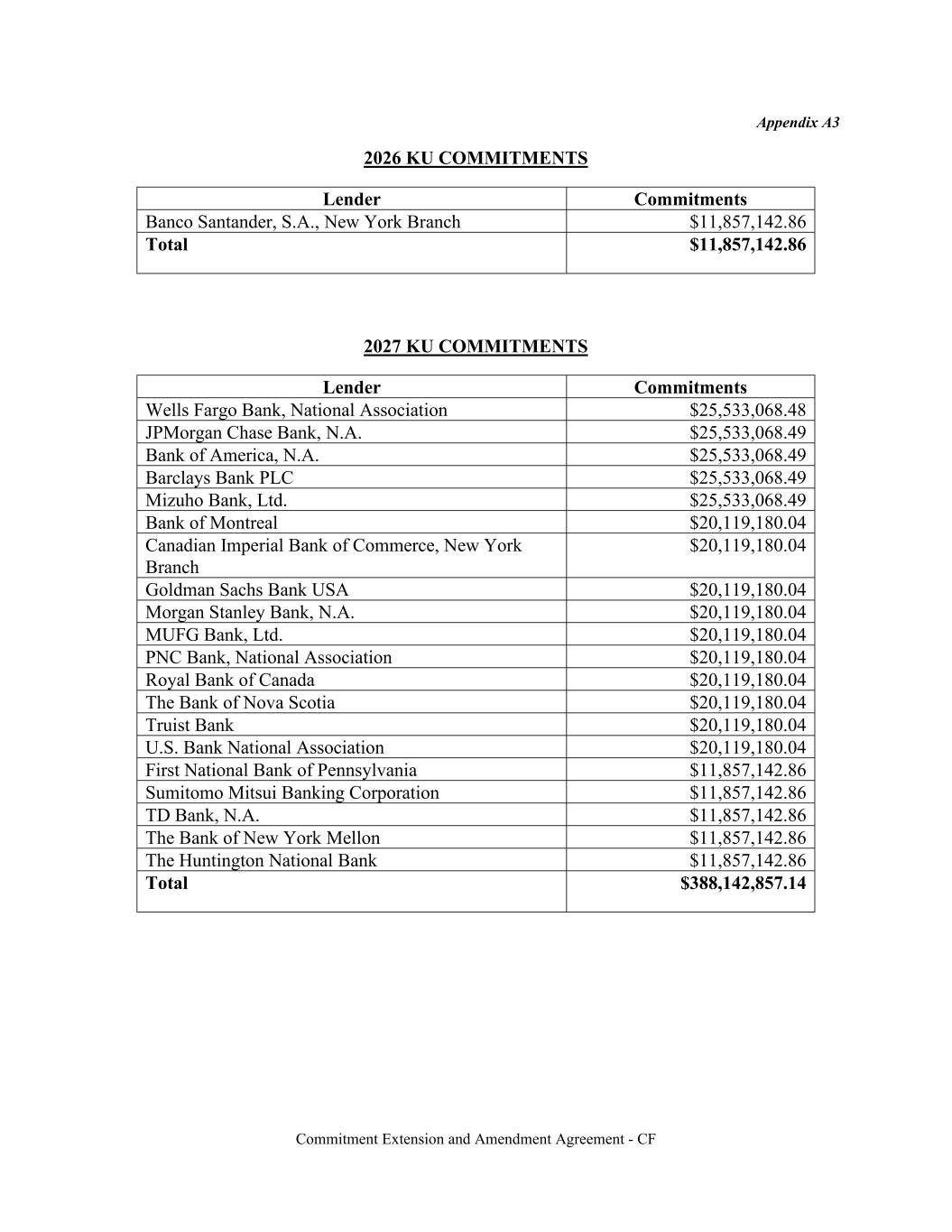

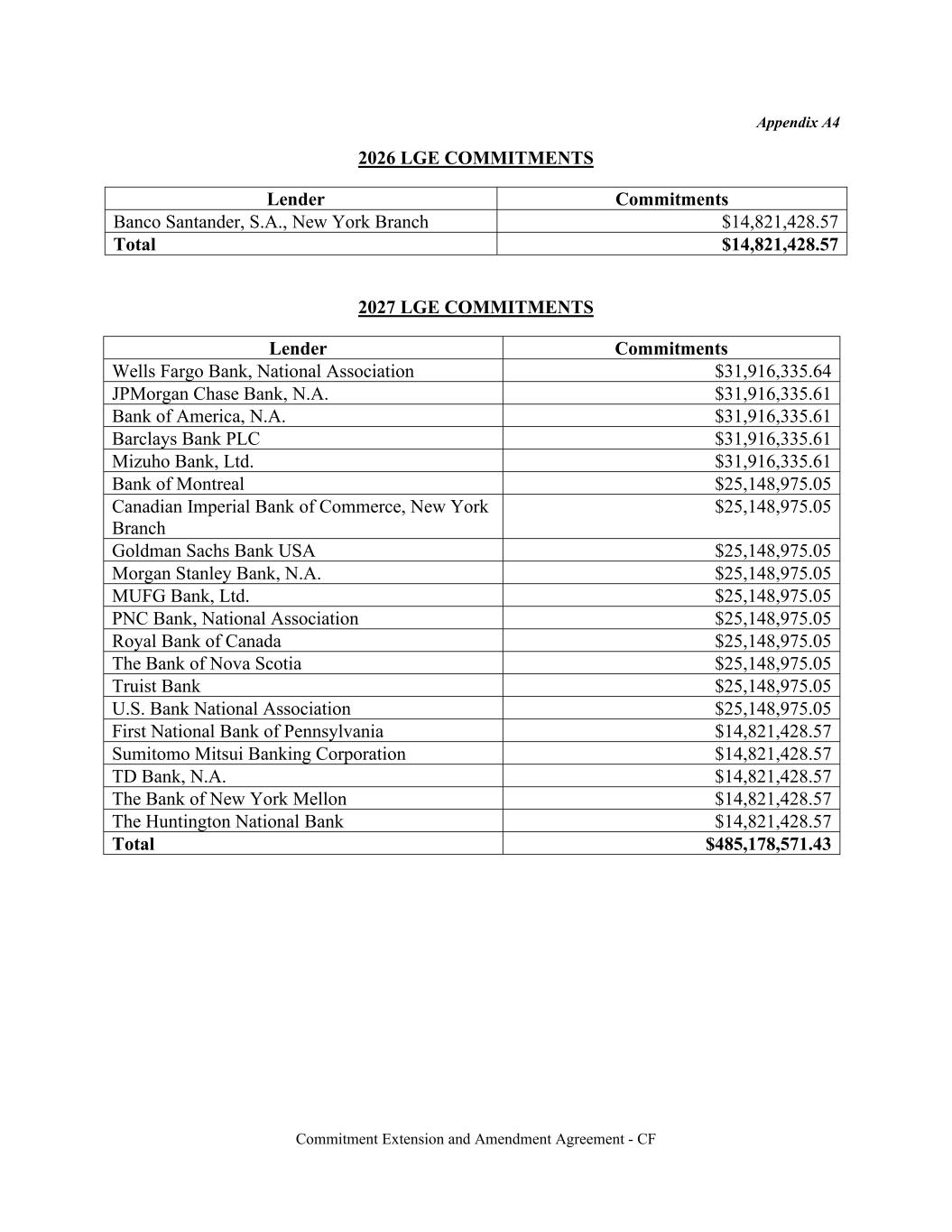

3 3. 2027 Termination Date Extension. Upon execution of this Agreement by the requisite Lenders under Sections 2.08(d) and 9.05 of the Existing Credit Agreement, with effect from and including the Effective Date, Section 1.01 of the Existing Credit Agreement is amended by deleting the definition of “2027 Termination Date” in its entirety and replacing it with the following: ““2027 Termination Date” means the earlier to occur of (i) December 6, 2028, as may be extended from time to time pursuant to Section 2.08(d), and (ii) the date upon which all 2027 Revolving Commitments shall have been terminated in their entirety in accordance with this Agreement.” 4. Quarterly Date Amendment. Upon execution of this Agreement by the requisite Lenders under Section 9.05 of the Existing Credit Agreement (which, for the avoidance of doubt, includes all Lenders under the Existing Credit Agreement immediately prior to the Effective Date but after giving effect to the Master Assignment), with effect from and including the Effective Date, Section 1.01 of the Existing Credit Agreement is amended by deleting the definition of “Quarterly Date” in its entirety and replacing it with the following: ““Quarterly Date” means the tenth (10th) Business Day following the last day of each of March, June, September and December.” 5. Optional Extensions Amendment. Upon execution of this Agreement by the requisite Lenders under Section 9.05 of the Existing Credit Agreement, with effect from and including the Effective Date, the words “but on not more than two occasions during the term of the revolving credit facilities hereunder” in the first sentence of Section 2.08(d)(ii) of the Existing Credit Agreement is amended by replacing it with the following: “but (i) with respect to the 2026 Revolving Commitments, on not more than two occasions and (ii) with respect to the 2027 Revolving Commitments, on not more than one occasion, in each case, during the term of the revolving credit facilities hereunder”. 6. Commitments. Each party hereto acknowledges and agrees that as of the Effective Date, (a) Appendix A1 of the Credit Agreement is replaced with Appendix A1 of this Agreement, (b) Appendix A2 of the Credit Agreement is replaced with Appendix A2 of this Agreement, (a) Appendix A3 of the Credit Agreement is replaced with Appendix A3 of this Agreement, (a) Appendix A4 of the Credit Agreement is replaced with Appendix A4 of this Agreement. 7. Miscellaneous. (a) (i) Headings and captions may not be construed in interpreting provisions; (ii) this Agreement shall be governed by, and construed in accordance with, the law of the State of New York; and (iii) this Agreement may be executed in any number of counterparts with the same effect as if all signatories had signed the same document, and all of those counterparts must be construed together to constitute the same document. Delivery of an executed signature page of this Agreement by facsimile transmission or in electronic (i.e., “pdf” or “tif”) format shall be effective as delivery of a manually executed counterpart hereof. The words “execute,” “execution,” “signed,” “signature,” “delivery” and words of like import in or related to the Agreement shall be deemed to include electronic signatures or execution in the form of an electronic record, and contract formations on electronic platforms approved by the Agent, deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper- based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act. This Agreement shall become effective when each party hereto shall have received a counterpart hereof signed by the other parties hereto. (b) Upon and after the execution of this Agreement by each of the parties hereto, each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof” or words of like import referring to the Credit Agreement, and each reference in the other Loan Documents to “the Credit Agreement”, “thereunder”, “thereof” or words of like import referring to the Credit Agreement, shall mean and be a

4 reference to the Credit Agreement as modified hereby. This Agreement shall constitute a Loan Document. (c) The provisions set forth in Section 9.07 and 9.11 of the Credit Agreement are incorporated herein by reference, mutatis mutandis. 8. NO NOVATION; FULL FORCE AND EFFECT; RATIFICATION; ENTIRE AGREEMENT. NOTHING HEREIN CONTAINED SHALL BE CONSTRUED AS A NOVATION (OR A SUBSTITUTION, A PAYMENT AND REBORROWING, OR A TERMINATION) OF THE OBLIGATIONS OUTSTANDING UNDER THE CREDIT AGREEMENT OR INSTRUMENTS GUARANTEEING OR SECURING THE SAME. EXCEPT AS EXPRESSLY MODIFIED HEREIN, ALL OF THE TERMS AND CONDITIONS OF THE EXISTING CREDIT AGREEMENT ARE UNCHANGED AND REMAIN IN FULL FORCE AND EFFECT, AND, AS MODIFIED HEREBY, THE BORROWERS AND THE GUARANTOR CONFIRM AND RATIFY ALL OF THE TERMS, COVENANTS AND CONDITIONS OF THE EXISTING CREDIT AGREEMENT. THIS AGREEMENT SHALL CONSTITUTE A LOAN DOCUMENT FOR ALL PURPOSES OF THE CREDIT AGREEMENT AND THE OTHER LOAN DOCUMENTS. THE EXECUTION, DELIVERY AND EFFECTIVENESS OF THIS AGREEMENT SHALL NOT, EXCEPT AS EXPRESSLY PROVIDED HEREIN, OPERATE AS A WAIVER OF ANY RIGHT, POWER OR REMEDY OF ANY LENDER OR THE ADMINISTRATIVE AGENT UNDER ANY OF THE LOAN DOCUMENTS, NOR, EXCEPT AS EXPRESSLY APPROVED HEREIN, CONSTITUTE A WAIVER OR AMENDMENT OF ANY PROVISION OF ANY OF THE LOAN DOCUMENTS. THE CREDIT AGREEMENT AND THE OTHER LOAN DOCUMENTS, TOGETHER WITH THIS AGREEMENT, REPRESENT THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES. [Signature Pages to Follow]

Commitment Extension and Amendment Agreement - CF WELLS FARGO BANK, NATIONAL ASSOCIATION as Administrative Agent, Swingline Lender and Issuing Lender By: Name: Patrick Engel Title: Managing Director

Commitment Extension and Amendment Agreement - CF WELLS FARGO BANK, NATIONAL ASSOCIATION as a 2027 Extending Lender and a Consenting Lender Name: Patrick Engel Title: Managing Director

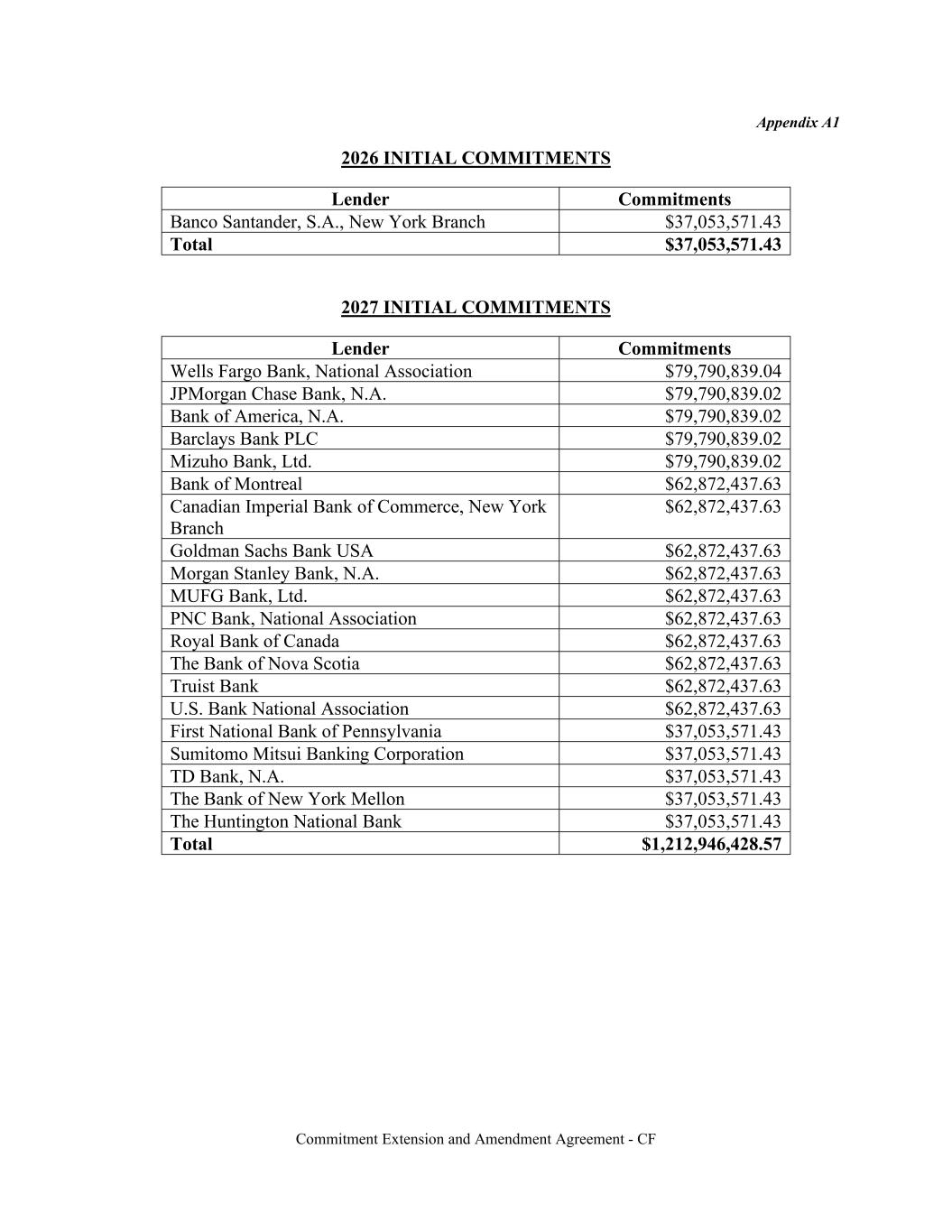

Commitment Extension and Amendment Agreement - CF BANK OF AMERICA, N.A. as a 2027 Extending Lender and a Consenting Lender Name: Dee Dee Farkas Title: Managing Director

MIZUHO BANK, LTD. as a 2027 Extending Lender and a Consenting Lender Name: Edward Sacks Title: Authorized Signatory Commitment Extension and Amendment Agreement - CF

Commitment Extension and Amendment Agreement - CF BANK OF MONTREAL as a 2027 Extending Lender and a Consenting Lender Name: Yash Gandhi Title: Vice President

Commitment Extension and Amendment Agreement - CF Canadian Imperial Bank of Commerce, New York Branch as a 2027 Extending Lender and a Consenting Lender Name: Amit Vasani Title: Managing Director

Commitment Extension and Amendment Agreement - CF GOLDMAN SACHS BANK USA as a 2027 Extending Lender and a Consenting Lender By: Name: Andrew Vernon Title: Authorized Signatory

Commitment Extension and Amendment Agreement - CF MORGAN STANLEY BANK, N.A. as a 2027 Extending Lender and a Consenting Lender By: Name: Michael King Title: Authorized Signatory

Commitment Extension and Amendment Agreement - CF ROYAL BANK OF CANADA as a 2027 Extending Lender and a Consenting Lender Name: Meg Donnelly Title: Authorized Signatory

Commitment Extension and Amendment Agreement - CF THE BANK OF NOVA SCOTIA as a 2027 Extending Lender and a Consenting Lender Name: David Dewar Title: Director

TRUIST BANK as a 2027 Extending Lender and a Consenting Lender Name: Title: Commitment Extension and Amendment Agreement - CF

U.S. BANK NATIONAL ASSOCIATION as a 2027 Extending Lender and a Consenting Lender By: _,:,-":;;;"?--i�::::::::===:::======•::::"" __ _ NGne: John Prigge Title: Senior Vice President Commitment Extension and Amendment Agreement - CF

SUMITOMO MITSUI BANKING CORPORATION as a 2027 Extending Lender and a Consenting Lender Name: Alkesh Nanavaty Title: Executive Director Commitment Extension and Amendment Agreement - CF

Commitment Extension and Amendment Agreement - CF Internal TD BANK, N.A. as a 2027 Extending Lender and a Consenting Lender Name: Bernadette Collins Title: Senior Vice President

Commitment Extension and Amendment Agreement - CF THE BANK OF NEW YORK MELLON as a 2027 Extending Lender and a Consenting Lender Name: Molly H. Ross Title: Director

Commitment Extension and Amendment Agreement - CF Confidential BANCO SANTANDER, S.A., NEW YORK BRANCH, as a Consenting Lender Name: Andres Barbosa Title: Managing Director Name Arturo Prieto Title: Managing Director

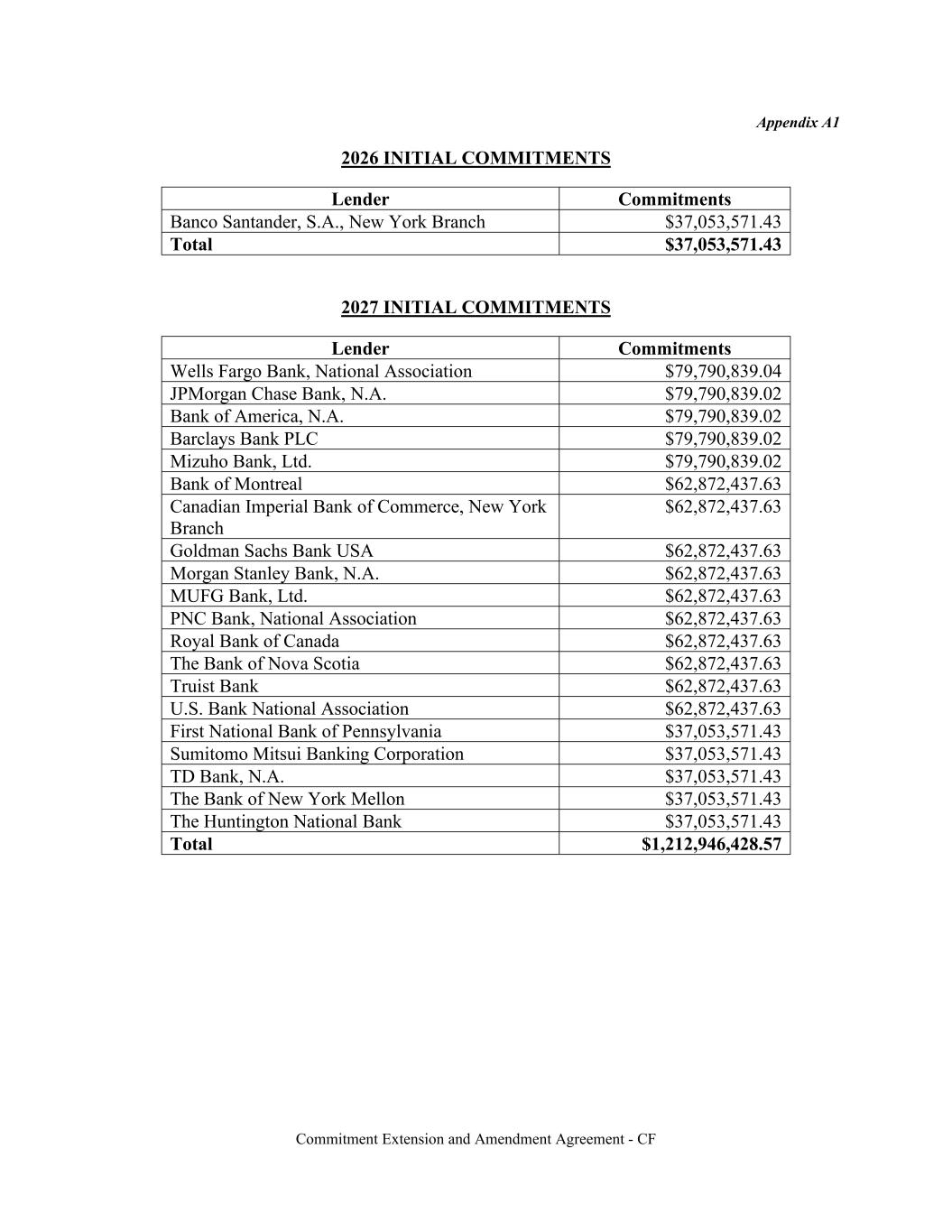

Commitment Extension and Amendment Agreement - CF Appendix A1 2026 INITIAL COMMITMENTS Lender Commitments Banco Santander, S.A., New York Branch $37,053,571.43 Total $37,053,571.43 2027 INITIAL COMMITMENTS Lender Commitments Wells Fargo Bank, National Association $79,790,839.04 JPMorgan Chase Bank, N.A. $79,790,839.02 Bank of America, N.A. $79,790,839.02 Barclays Bank PLC $79,790,839.02 Mizuho Bank, Ltd. $79,790,839.02 Bank of Montreal $62,872,437.63 Canadian Imperial Bank of Commerce, New York Branch $62,872,437.63 Goldman Sachs Bank USA $62,872,437.63 Morgan Stanley Bank, N.A. $62,872,437.63 MUFG Bank, Ltd. $62,872,437.63 PNC Bank, National Association $62,872,437.63 Royal Bank of Canada $62,872,437.63 The Bank of Nova Scotia $62,872,437.63 Truist Bank $62,872,437.63 U.S. Bank National Association $62,872,437.63 First National Bank of Pennsylvania $37,053,571.43 Sumitomo Mitsui Banking Corporation $37,053,571.43 TD Bank, N.A. $37,053,571.43 The Bank of New York Mellon $37,053,571.43 The Huntington National Bank $37,053,571.43 Total $1,212,946,428.57

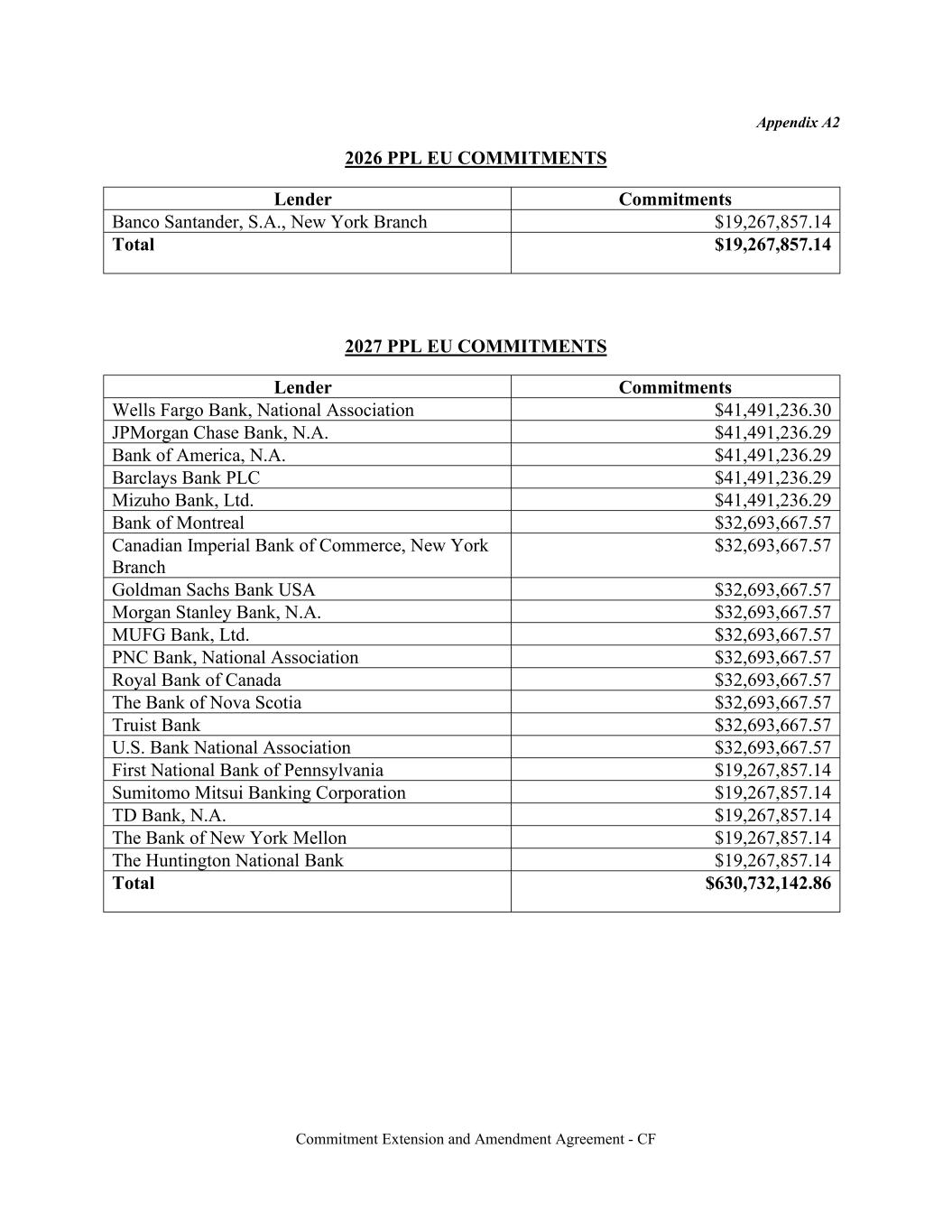

Commitment Extension and Amendment Agreement - CF Appendix A2 2026 PPL EU COMMITMENTS Lender Commitments Banco Santander, S.A., New York Branch $19,267,857.14 Total $19,267,857.14 2027 PPL EU COMMITMENTS Lender Commitments Wells Fargo Bank, National Association $41,491,236.30 JPMorgan Chase Bank, N.A. $41,491,236.29 Bank of America, N.A. $41,491,236.29 Barclays Bank PLC $41,491,236.29 Mizuho Bank, Ltd. $41,491,236.29 Bank of Montreal $32,693,667.57 Canadian Imperial Bank of Commerce, New York Branch $32,693,667.57 Goldman Sachs Bank USA $32,693,667.57 Morgan Stanley Bank, N.A. $32,693,667.57 MUFG Bank, Ltd. $32,693,667.57 PNC Bank, National Association $32,693,667.57 Royal Bank of Canada $32,693,667.57 The Bank of Nova Scotia $32,693,667.57 Truist Bank $32,693,667.57 U.S. Bank National Association $32,693,667.57 First National Bank of Pennsylvania $19,267,857.14 Sumitomo Mitsui Banking Corporation $19,267,857.14 TD Bank, N.A. $19,267,857.14 The Bank of New York Mellon $19,267,857.14 The Huntington National Bank $19,267,857.14 Total $630,732,142.86

Commitment Extension and Amendment Agreement - CF Appendix A3 2026 KU COMMITMENTS Lender Commitments Banco Santander, S.A., New York Branch $11,857,142.86 Total $11,857,142.86 2027 KU COMMITMENTS Lender Commitments Wells Fargo Bank, National Association $25,533,068.48 JPMorgan Chase Bank, N.A. $25,533,068.49 Bank of America, N.A. $25,533,068.49 Barclays Bank PLC $25,533,068.49 Mizuho Bank, Ltd. $25,533,068.49 Bank of Montreal $20,119,180.04 Canadian Imperial Bank of Commerce, New York Branch $20,119,180.04 Goldman Sachs Bank USA $20,119,180.04 Morgan Stanley Bank, N.A. $20,119,180.04 MUFG Bank, Ltd. $20,119,180.04 PNC Bank, National Association $20,119,180.04 Royal Bank of Canada $20,119,180.04 The Bank of Nova Scotia $20,119,180.04 Truist Bank $20,119,180.04 U.S. Bank National Association $20,119,180.04 First National Bank of Pennsylvania $11,857,142.86 Sumitomo Mitsui Banking Corporation $11,857,142.86 TD Bank, N.A. $11,857,142.86 The Bank of New York Mellon $11,857,142.86 The Huntington National Bank $11,857,142.86 Total $388,142,857.14

Commitment Extension and Amendment Agreement - CF Appendix A4 2026 LGE COMMITMENTS Lender Commitments Banco Santander, S.A., New York Branch $14,821,428.57 Total $14,821,428.57 2027 LGE COMMITMENTS Lender Commitments Wells Fargo Bank, National Association $31,916,335.64 JPMorgan Chase Bank, N.A. $31,916,335.61 Bank of America, N.A. $31,916,335.61 Barclays Bank PLC $31,916,335.61 Mizuho Bank, Ltd. $31,916,335.61 Bank of Montreal $25,148,975.05 Canadian Imperial Bank of Commerce, New York Branch $25,148,975.05 Goldman Sachs Bank USA $25,148,975.05 Morgan Stanley Bank, N.A. $25,148,975.05 MUFG Bank, Ltd. $25,148,975.05 PNC Bank, National Association $25,148,975.05 Royal Bank of Canada $25,148,975.05 The Bank of Nova Scotia $25,148,975.05 Truist Bank $25,148,975.05 U.S. Bank National Association $25,148,975.05 First National Bank of Pennsylvania $14,821,428.57 Sumitomo Mitsui Banking Corporation $14,821,428.57 TD Bank, N.A. $14,821,428.57 The Bank of New York Mellon $14,821,428.57 The Huntington National Bank $14,821,428.57 Total $485,178,571.43