Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

Related financial report

LOW similar filings

- 5 Jun 24 Submission of Matters to a Vote of Security Holders

- 21 May 24 Lowe’s Reports First Quarter 2024 Sales and Earnings Results

- 27 Feb 24 Lowe’s Reports Fourth Quarter 2023 Sales and Earnings Results

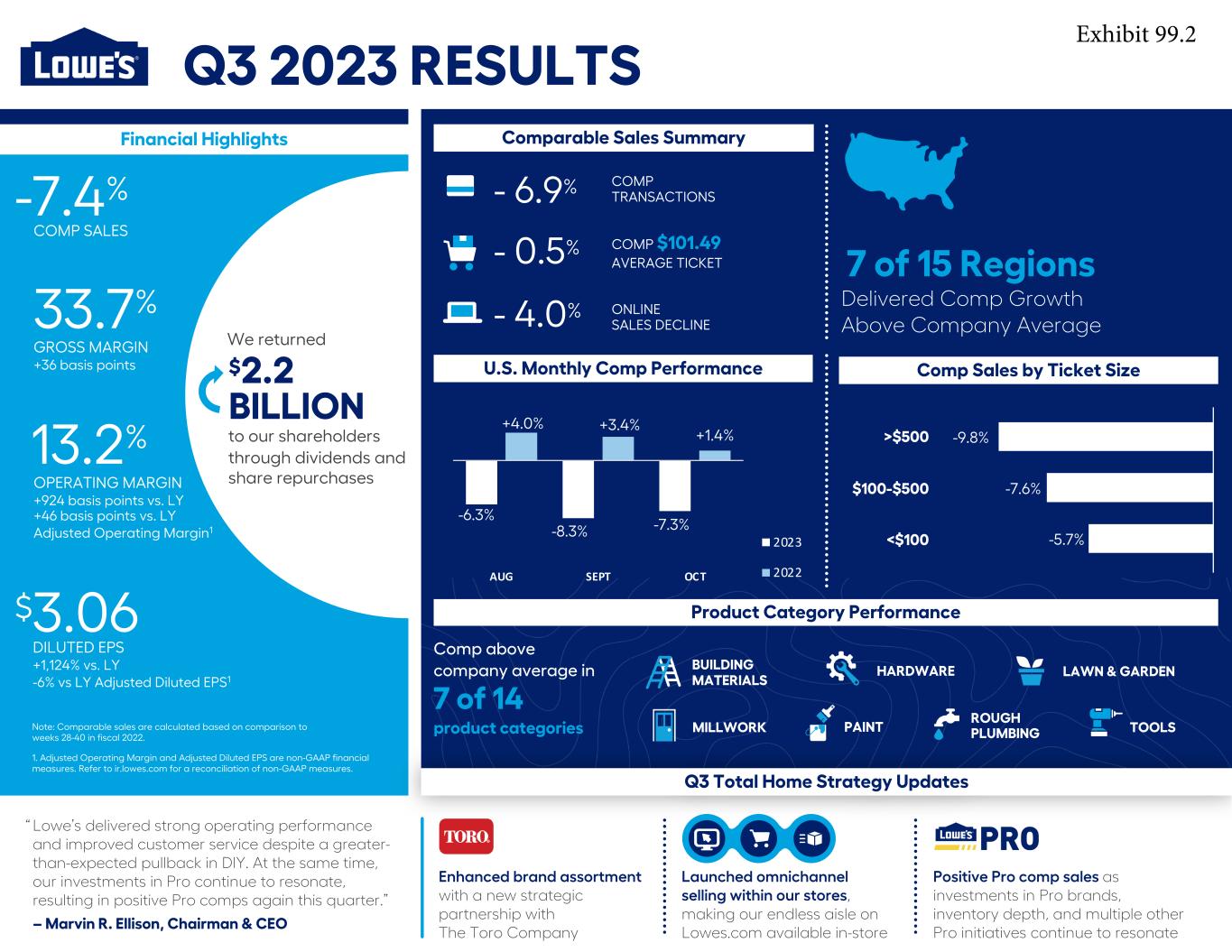

- 21 Nov 23 Lowe’s Reports Third Quarter 2023 Sales and Earnings Results

- 25 Oct 23 Departure of Directors or Certain Officers

- 7 Sep 23 Entry into a Material Definitive Agreement

- 22 Aug 23 Lowe’s Reports Second Quarter 2023 Sales and Earnings Results

Filing view

External links