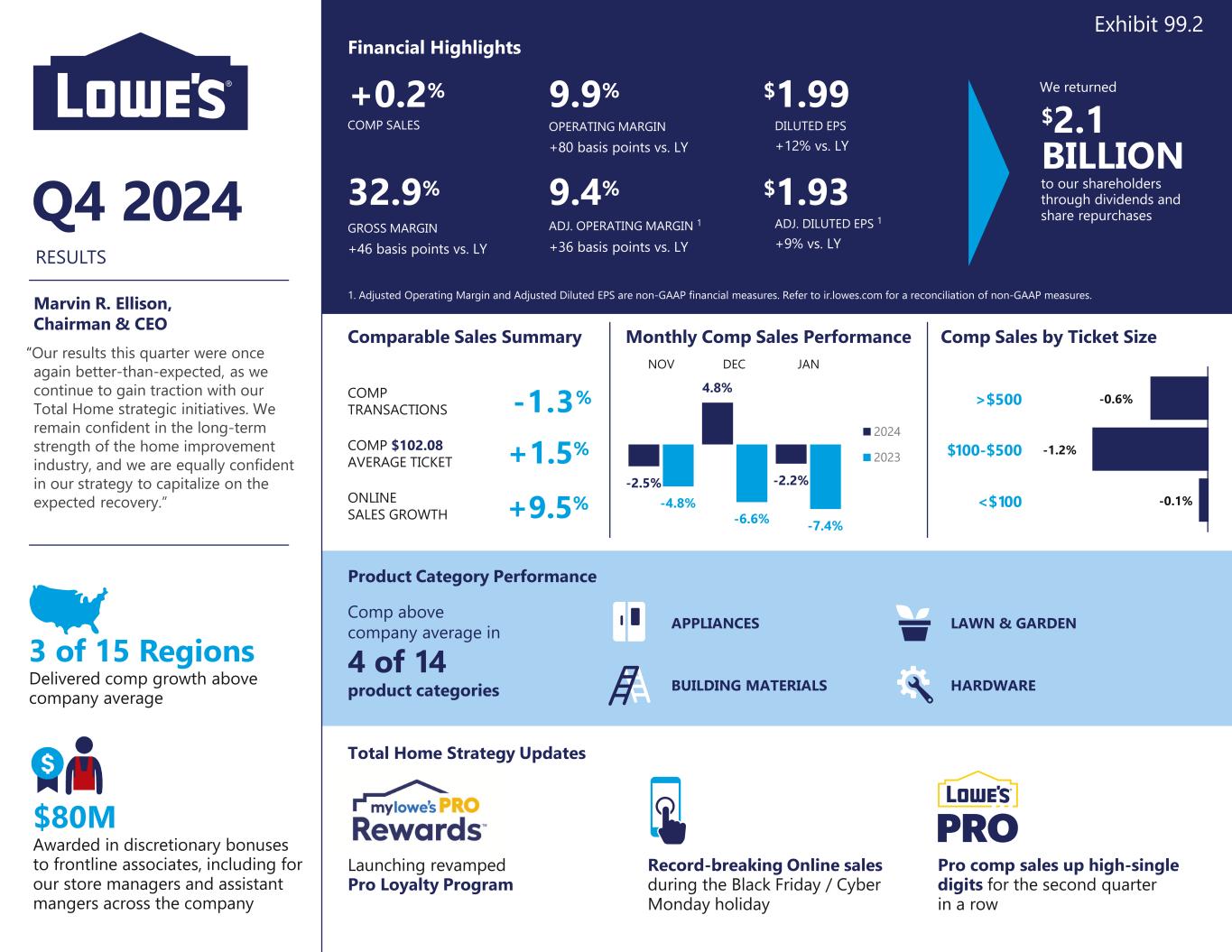

Q4 and Fiscal 2024 Reconciliation of Non-GAAP Measures Management of Lowe's Companies, Inc. (the Company) uses certain non-GAAP financial measures to provide additional insight for analysts and investors in evaluating the Company's financial and operating performance. These non-GAAP financial measures should not be considered alternatives to, or more meaningful indicators of, the Company's financial measures as prepared in accordance with GAAP. The Company's methods of determining these non-GAAP financial measures may differ from the methods used by other companies and may not be comparable. The Company has provided the following non-GAAP financial measures to assist in comparing its operating performance for the three months ended January 31, 2025, and years ended January 31, 2025 and February 2, 2024, respectively: adjusted operating income, adjusted operating margin, and adjusted diluted earnings per share. These measures exclude the impacts of a certain item, further described below, not contemplated in Lowe's Business Outlook. Fiscal 2024 Impacts The Company recognized financial impacts from the following: • In the fourth quarter of fiscal 2024, the Company recognized pre-tax income of $80 million consisting of a realized gain on the contingent consideration associated with the fiscal 2022 sale of the Canadian retail business (Canadian retail business transaction). • In the third quarter of fiscal 2024, the Company recognized pre-tax income of $54 million consisting of a realized gain on the contingent consideration associated with the fiscal 2022 sale of the Canadian retail business (Canadian retail business transaction). • In the second quarter of fiscal 2024, the Company recognized pre-tax income of $43 million consisting of a realized gain on the contingent consideration associated with the fiscal 2022 sale of the Canadian retail business (Canadian retail business transaction). Fiscal 2023 Impacts The Company recognized financial impacts from the following: • In the first quarter of fiscal 2023, the Company recognized pre-tax income of $63 million consisting of a realized gain on the contingent consideration and estimated adjustments to the selling price associated with the fiscal 2022 sale of the Canadian retail business (Canadian retail business transaction). The following provides a reconciliation of the Company's non-GAAP financial measures to the most directly comparable GAAP financial measures: Three Months Ended Years Ended Adjusted Operating Income (in millions, except percentage data) January 31, 2025 January 31, 2025 February 2, 2024 Operating Income, As Reported $ 1,830 $ 10,466 $ 11,557 Canadian retail business transaction (80) (177) (63) Adjusted Operating Income $ 1,750 $ 10,289 $ 11,494 Operating Margin, % of Sales, As Reported 9.87 % 12.51 % 13.38 % Adjusted Operating Margin, % of Sales 9.43 % 12.30 % 13.31 %

Three Months Ended January 31, 2025 Adjusted Diluted Earnings Per Share Pre-Tax Earnings Tax 1 Net Earnings Diluted Earnings Per Share, As Reported $ 1.99 Canadian retail business transaction (0.14) 0.08 (0.06) Adjusted Diluted Earnings Per Share $ 1.93 1 Represents the tax benefit or expense related to the item excluded from adjusted diluted earnings per share. Years Ended January 31, 2025 February 2, 2024 Adjusted Diluted Earnings Per Share Pre-Tax Earnings Tax 1 Net Earnings Pre-Tax Earnings Tax 1 Net Earnings Diluted Earnings Per Share, As Reported $ 12.23 $ 13.20 Canadian retail business transaction (0.31) 0.07 (0.24) (0.11) — (0.11) Adjusted Diluted Earnings Per Share $ 11.99 $ 13.09 1 Represents the tax benefit or expense related to the item excluded from adjusted diluted earnings per share. 1

Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as “believe”, “expect”, “anticipate”, “plan”, “desire”, “project”, “estimate”, “intend”, “will”, “should”, “could”, “would”, “may”, “strategy”, “potential”, “opportunity”, “outlook”, “scenario”, “guidance”, and similar expressions are forward-looking statements. Forward-looking statements involve, among other things, expectations, projections, and assumptions about future financial and operating results, objectives (including objectives related to environmental and social matters), business outlook, priorities, sales growth, shareholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for products and services including customer acceptance of new offerings and initiatives, macroeconomic conditions and consumer spending, share repurchases, and Lowe’s strategic initiatives, including those relating to acquisitions and dispositions and the impact of such transactions on our strategic and operational plans and financial results. Such statements involve risks and uncertainties, and we can give no assurance that they will prove to be correct. Actual results may differ materially from those expressed or implied in such statements. A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by these forward-looking statements including, but not limited to, changes in general economic conditions, such as volatility and/or lack of liquidity from time to time in U.S. and world financial markets and the consequent reduced availability and/or higher cost of borrowing to Lowe’s and its customers, slower rates of growth in real disposable personal income that could affect the rate of growth in consumer spending, inflation and its impacts on discretionary spending and on our costs, shortages, and other disruptions in the labor supply, interest rate and currency fluctuations, home price appreciation or decreasing housing turnover, age of housing stock, the availability of consumer credit and of mortgage financing, trade policy changes or additional tariffs, outbreaks of pandemics, fluctuations in fuel and energy costs, inflation or deflation of commodity prices, natural disasters, geopolitical or armed conflicts, acts of both domestic and international terrorism, and other factors that can negatively affect our customers. Investors and others should carefully consider the foregoing factors and other uncertainties, risks and potential events including, but not limited to, those described in “Item 1A - Risk Factors” in our most recent Annual Report on Form 10-K and as may be updated from time to time in Item 1A in our quarterly reports on Form 10-Q or other subsequent filings with the SEC. All such forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update these statements other than as required by law.