Exhibit 5.2

D:+1212-225-2414ngrabar@cgsh.com

March 26, 2020

BOFA SECURITIES, INC.

CITIGROUP GLOBAL MARKETS INC.

J.P. MORGAN SECURITIES LLC

RBC CAPITAL MARKETS, LLC

as Representatives of the several Underwriters c/o

BOFA SECURITIES, INC.

One Bryant Park

New York, New York 10036

c/o CITIGROUP GLOBAL MARKETS INC.

388 Greenwich Street

New York, New York 10013

c/o J.P. MORGAN SECURITIES LLC

383 Madison Avenue

New York, New York 10179

c/o RBC CAPITAL MARKETS, LLC

200 Vesey Street, 8th Floor

New York, New York 10281

Ladies and Gentlemen:

We haveactedas specialcounsel toLowe’sCompanies,Inc., a NorthCarolinacorporation(the“Company”), inconnection with theCompany’soffering pursuant to aregistration statement onFormS-3(No. 333-226983) of $750,000,000aggregate principal amount of its 4.000% Notes due 2025(the“2025 Notes”), $1,250,000,000aggregate principal amount of its 4.500% Notes due 2030(the“2030 Notes”), $750,000,000aggregateprincipal

BofA Securities, Inc. et. al, p.2

amount of its 5.000% Notes due 2040(the“2040 Notes”)and, $750,000,000aggregate principalamount of its 5.125% Notes due 2050(the“2050 Notes”),and together with the 2025 Notes, the 2030 Notesand the 2040 Notes, the“Securities”)to be issued underan indenture datedas of December 1, 1995(the“BaseIndenture”)between theCompanyand U.S.BankNational Association,as successor trustee(the“Trustee”),as supplementedby theSixteenthSupplementalIndenturedatedas ofMarch 26, 2020(the“SupplementalIndenture”and theBaseIndentureassupplementedby theSupplementalIndenture, the“Indenture”)between theCompanyand the Trustee.Suchregistration statement,asamendedas of its mostrecenteffective date(March 24, 2020), insofaras itrelates to theSecurities(as determinedfor purposes ofRule 430B(f)(2) under theSecurities Act of 1933,asamended(the“Securities Act”)), including the documents incorporatedbyreference therein butexcludingExhibit 25.1, is hereincalled the“RegistrationStatement;” therelatedprospectus dated August 23, 2018, included in theRegistrationStatementfiled with theSecuritiesand ExchangeCommission(the“Commission”) under theSecurities Act, including the documents incorporatedbyreference therein, is hereincalled the“BaseProspectus;” the preliminary prospectus supplement dated March 24, 2020,asfiled with theCommission pursuant toRule 424(b) under theSecurities Act, including the documents incorporatedbyreferencetherein, is hereincalled the“PreliminaryProspectusSupplement;”and therelatedprospectus supplement dated March24, 2020,asfiled with theCommission pursuant toRule 424(b) under theSecurities Act, including the documents incorporatedbyreference therein, is hereincalledthe“FinalProspectusSupplement.” TheBaseProspectusand thePreliminaryProspectusSupplement togetherarehereincalled the“PricingProspectus,”and theBaseProspectusand theFinalProspectusSupplement togetherare hereincalled the“FinalProspectus.”

This opinion letter isfurnished toyou pursuant toSection 5(b) of the underwritingagreement dated March24, 2020(the“UnderwritingAgreement”) between theCompanyand the several underwriters named inSchedule A thereto(the“Underwriters”).

Inarrivingat the opinionsexpressed below, wehavereviewed thefollowing documents:

(a)anexecutedcopy ofthe UnderwritingAgreement;(b) theRegistrationStatement;

(c) thePricingProspectusand the document listed inSchedule I hereto;(d) theFinalProspectus;

(e) afacsimilecopyof theSecurities inglobalformasexecutedby theCompanyandauthenticatedby the Trustee;

(e)anexecutedcopy ofeach of theBaseIndentureand theSupplementalIndenture; and

(f) the documents delivered toyouby theCompanyat theclosing pursuant to the UnderwritingAgreement.

BofA Securities, Inc. et. al, p.3

Inaddition, we havereviewed the originals orcopiescertifiedor otherwise identified to our satisfaction of such other documents,and wehave made such investigationsof law,aswehave deemedappropriateas a basisfor the opinionsexpressed below.

Inrendering the opinionsexpressed below, wehaveassumed theauthenticity ofall documents submitted to usas originalsand theconformity to theoriginals ofall documents submitted to usascopies.Inaddition, we haveassumedand have notverified theaccuracyas tofactual mattersofeachdocument wehavereviewed(including, without limitation, theaccuracy of therepresentationsand warranties of theCompany in the Underwriting Agreement).

Based on theforegoing,and subject to thefurtherassumptionsand qualifications setforth below, it is our opinion that:

1. Each of theBaseIndentureand theSupplementalIndenturehas been dulyexecutedand deliveredby theCompany under the law of theState ofNew Yorkand theIndenturehas been qualified under the TrustIndenture Act of 1939,asamended(the“TrustIndentureAct”),and is a valid, bindingandenforceableagreement of theCompany

2. TheSecuritieshavebeendulyexecutedanddeliveredby theCompany under the lawof theState of New Yorkandare the valid, bindingandenforceable obligations of theCompany,entitled to the benefits of theIndenture.

3. The statementsunder theheadings“Descriptionof Our DebtSecurities”and“Description of Notes” in thePricingProspectus,considered togetherwith the document listed inSchedule Ihereto,and theFinalProspectus, insofaras such statements purport to summarizecertain provisions of theSecuritiesand theIndentureprovide afair summary of such provisions.

4. Thestatementsundertheheading“Taxation”in thePricingProspectus,considered together with the document listed inSchedule I hereto,andtheFinalProspectus,insofarassuchstatementspurporttosummarizecertainfederalincometaxlawsoftheUnitedStates,constitute afairsummaryoftheprincipalU.S.federalincometaxconsequencesofaninvestmentintheSecurities.

5. The UnderwritingAgreement has been dulyexecutedand deliveredby theCompany under the law of theState of New York.

6. The issuanceand saleof theSecurities to the Underwriterspursuant to theUnderwritingAgreement do not,and the performanceby theCompany of its obligations in the UnderwritingAgreement, theIndentureand theSecurities will not,(a)requireanyconsent,approval,authorization,registration or qualification of or withanygovernmentalauthorityof the UnitedStates or theState of New York that in ourexperience normally would beapplicable togeneralbusinessentities withrespect to such issuance, saleorperformance,except suchashave beenobtainedoreffectedunder theSecuritiesActand the TrustIndenture Act(butweexpressnoopinionrelatingtoanystatesecuritiesorBlueSky laws), or(b)result in a breach ofany of the terms and provisions of, or constitute a default under, any of the agreements of the Company

BofA Securities, Inc. et. al, p.4

identified in Exhibit A hereto(but weexpress no opinionas tocompliance withanyfinancial oraccounting test, orany limitation orrestrictionexpressedas a dollar(or othercurrency)amount,ratio or percentage) or(c)resultin aviolationofanyUnitedStatesfederalorNewYorkStatelaworpublishedruleorregulationthatinourexperiencenormallywouldbeapplicabletogeneralbusinessentities withrespect to such issuance,sale or performance(butweexpressnoopinionrelatingtotheUnitedStatesfederalsecuritieslawsoranystatesecuritiesorBlueSkylaws).

7. NoregistrationoftheCompanyundertheU.S.InvestmentCompanyActof

1940,asamended,isrequiredfortheofferandsaleoftheSecurities bytheCompanyinthemanner contemplated bytheUnderwritingAgreementandtheProspectus.

Insofaras theforegoing opinionsrelate to the validity, bindingeffect orenforceabilityofanyagreement or obligation oftheCompany,(a) we haveassumedthat theCompanyandeach other party to suchagreement or obligation has satisfied those legalrequirements thatareapplicable to it to theextent necessary to make suchagreement or obligationenforceableagainst it(except that no suchassumption is madeas to theCompanyregarding matters of thefederal law of the UnitedStates of Americaor the law of theState of New York that in ourexperience normally would beapplicable to general businessentities withrespect to suchagreement or obligation),and(b)such opinionsare subjecttoapplicable bankruptcy, insolvencyand similar lawsaffectingcreditors’rightsgenerallyand togeneralprinciples ofequity.Inrendering the opinion in numbered paragraph 6, we haveassumed that to theextentany documentreferred to inclause(b)of numberedparagraph 6isgovernedby the law of a jurisdiction other than thosereferred to in thefollowing paragraph, such document would be interpreted inaccordance with its plain meaning.

Theforegoing opinionsare limited to thefederal law of the UnitedStatesof

Americaand the lawof theState of New York.

Wearefurnishing this opinion letter toyou,asRepresentatives of the Underwriters, solelyforthe benefit of the Underwriters in theircapacityas such inconnection with the offering of theSecurities. This opinion letter is not to berelied onby orfurnished toany other person or used,circulated, quotedor otherwisereferred toforany other purpose,except that this opinionletteras to numbered paragraphs 1and 2 mayberelied uponby the Trustee in itscapacityas such.Weassume no obligation toadviseyouorany other person, or to makeany investigations,as toanylegal developments orfactual mattersarising subsequent to the date hereof that mightaffect the opinionsexpressed herein.

| | Very trulyyours, |

| | | | |

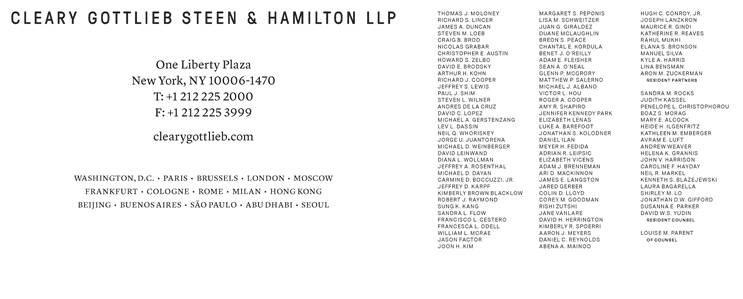

| | CLEARY GOTTLIEBSTEEN & HAMILTON LLP |

| | | | |

| | | | |

| | By: | /s/ Nicolas Grabar |

| | | Nicolas Grabar, a Partner |

BofA Securities, Inc. et. al, p.5

Schedule I

Final TermSheet, dated March 24, 2020 in theformfiled with theCommission pursuant toRule

433 under theSecurities Act on March 24, 2020.