February 27, 2025 Q4'24 Earnings Presentation Exhibit 99.1

Forward-Looking Statements Statements in this presentation that are not historical are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include , but are not limited to, statements regarding: our business strategy; anticipated future operating results and operating expenses, cash flows, capital resources and liquidity; trends, opportunities and risks affecting our business, industry and financial results; our ability to successfully leverage our existing business platform and portfolio of assets to produce low carbon products and execute our strategy to become a leader in the energy transition in the chemical industry; the availability of raw materials; production volumes at our production facilities; and the anticipated cost and timing of our capital projects, including turnarounds. Forward-looking statements can generally be identified by words or phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “may,” “plan,” “potential,” “should,” "will," “would,” and similar words or phrases, as well as by discussions of strategy, plans or intentions. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or actual achievements to differ materially from the results, level of activity, performance or anticipated achievements expressed or implied by the forward-looking statements. Significant risks and uncertainties may relate to, but are not limited to, business and market disruptions, market conditions and price volatility for our products and feedstocks, global and regional economic downturns, that adversely affect the demand for our end-use products; disruptions in production at our manufacturing facilities; and other financial, economic, competitive, environmental, political, legal and regulatory factors. These and other risk factors are discussed in the Company’s filings with the Securities and Exchange Commission, including but not limited to our most recent Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and uncertainties, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Unless otherwise required by applicable laws, we undertake no obligation to update or revise any forward-looking statements, whether because of new information or future developments.

Stockholder Rights Plan in Place to Preserve Substantial NOL’s Our Section 382 Stockholder Rights Plan as amended and restated (the “Rights Plan”), is intended to protect our substantial net operating losses (“NOLs”), carryforwards and other tax attributes. We can generally use our NOLs and other tax attributes to reduce federal and state income tax that would be paid in the future. Our ability to use our NOLs could be substantially limited if we experience an “ownership change,” as defined under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), and the Rights Plan has been designed to help prevent such an “ownership change.” The Rights Plan provides that if any person becomes the beneficial owner (as defined in the Code) of 4.9% or more of our common stock, stockholders other than the triggering stockholder will be entitled to acquire shares of common stock at a 50% discount or LSB may exchange each right held by such holders for one share of common stock. Under the Rights Plan, any person which currently owns 4.9% or more of LSB’s common stock may continue to own its shares of common stock but may not acquire any additional shares without triggering the Rights Plan. Our Board of Directors has the discretion to exempt any person or group from the provisions of the Rights Plan. The Rights Plan is in effect until August 22, 2026, unless terminated earlier in accordance with its terms.

Solid year-over-year increases in nitric acid and AN sales volumes UAN volumes benefitted from Q3’24 Pryor urea capacity expansion Completed injury-free turnaround of Cherokee ammonia plant Outlook for nitrogen demand and pricing remains favorable Low carbon ammonia projects progressing Q4’ 24 Overview Adjusted EBITDA is a non-GAAP financial measure. See the discussion and reconciliation in the appendix.

Industrial Market Overview(1) Sources: Federal Reserve Economic Data Industrial business stable with potentially improving outlook Steady demand for nitric acid supported by the strength of the U.S. economy and robust consumer spending levels U.S. new housing starts and auto production relatively steady for past two years; both poised to increase to the extent U.S. interest rates decrease Demand for ammonium nitrate (AN) bolstered by U.S. mining of metals, including copper for data centers and technology infrastructure, as well as quarrying/aggregate production for infrastructure upgrade and expansion Copper prices surged over the past year and currently sit above multi-year averages and exceed our estimate for cash production costs Improvement in new housing starts would drive U.S. aggregate production further strengthening AN demand

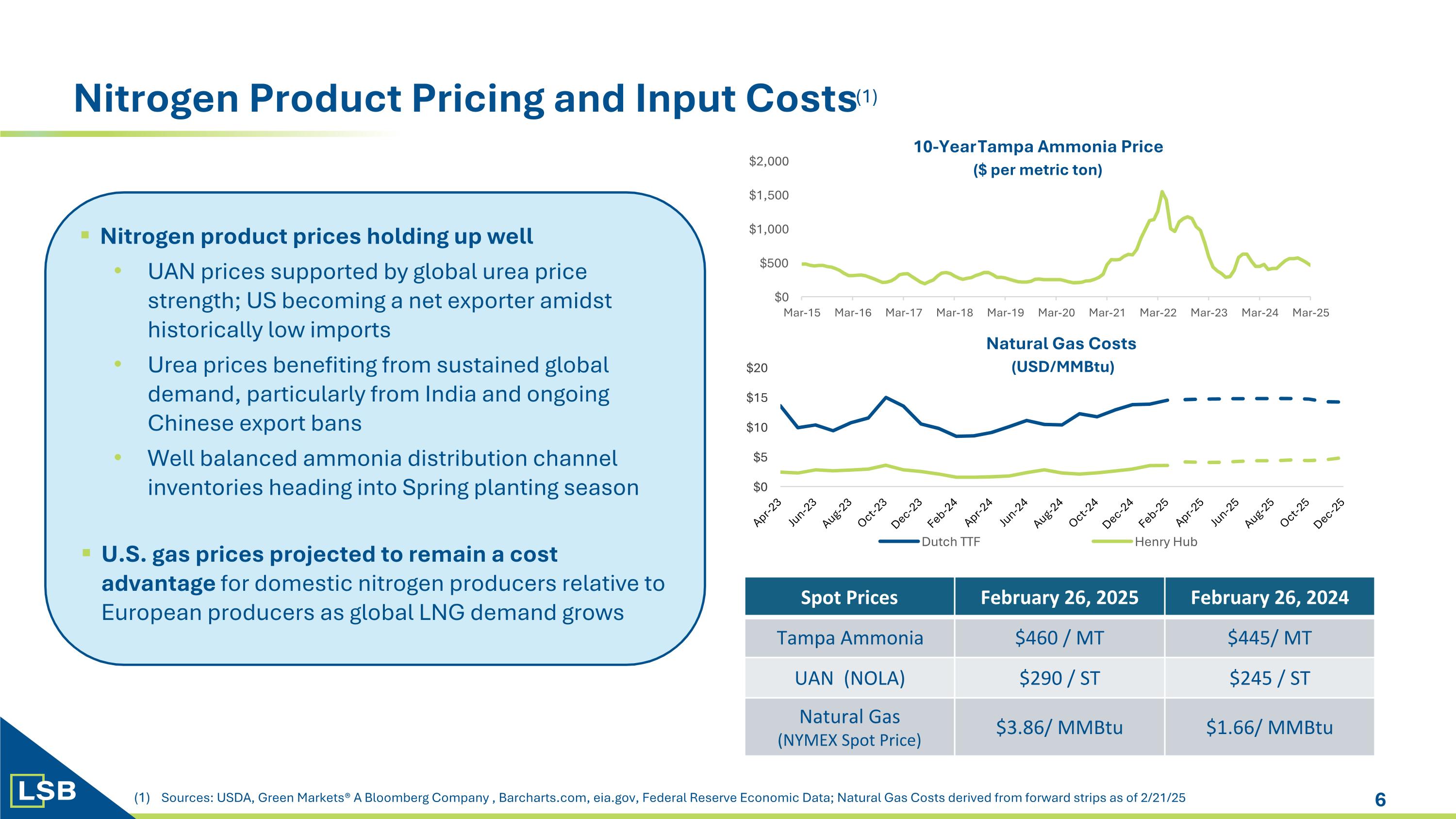

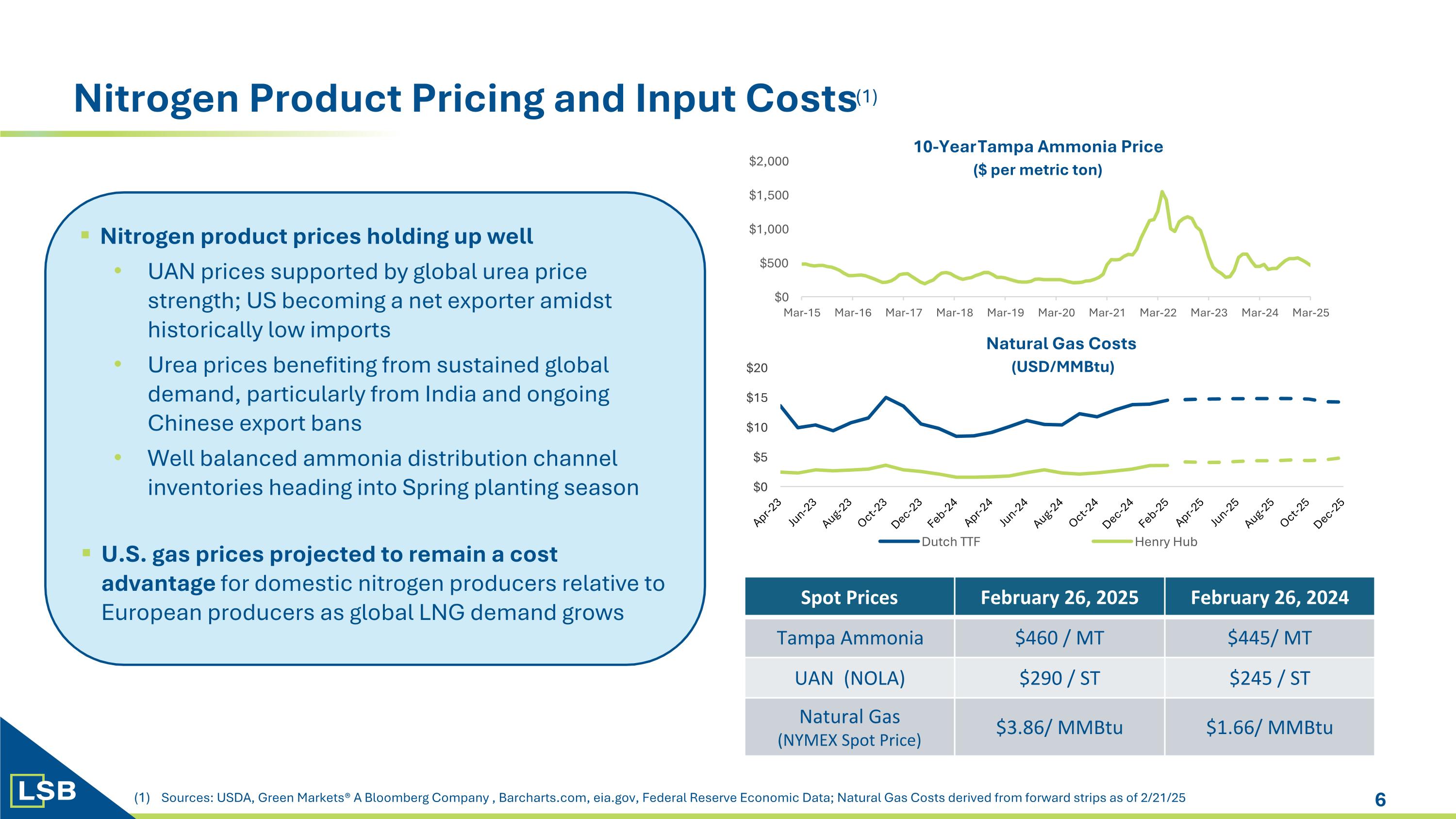

Nitrogen Product Pricing and Input Costs(1) Sources: USDA, Green Markets® A Bloomberg Company , Barcharts.com, eia.gov, Federal Reserve Economic Data; Natural Gas Costs derived from forward strips as of 2/21/25 Nitrogen product prices holding up well UAN prices supported by global urea price strength; US becoming a net exporter amidst historically low imports Urea prices benefiting from sustained global demand, particularly from India and ongoing Chinese export bans Well balanced ammonia distribution channel inventories heading into Spring planting season U.S. gas prices projected to remain a cost advantage for domestic nitrogen producers relative to European producers as global LNG demand grows Spot Prices February 26, 2025 February 26, 2024 Tampa Ammonia $460 / MT $445/ MT UAN (NOLA) $290 / ST $245 / ST Natural Gas (NYMEX Spot Price) $3.86/ MMBtu $1.66/ MMBtu

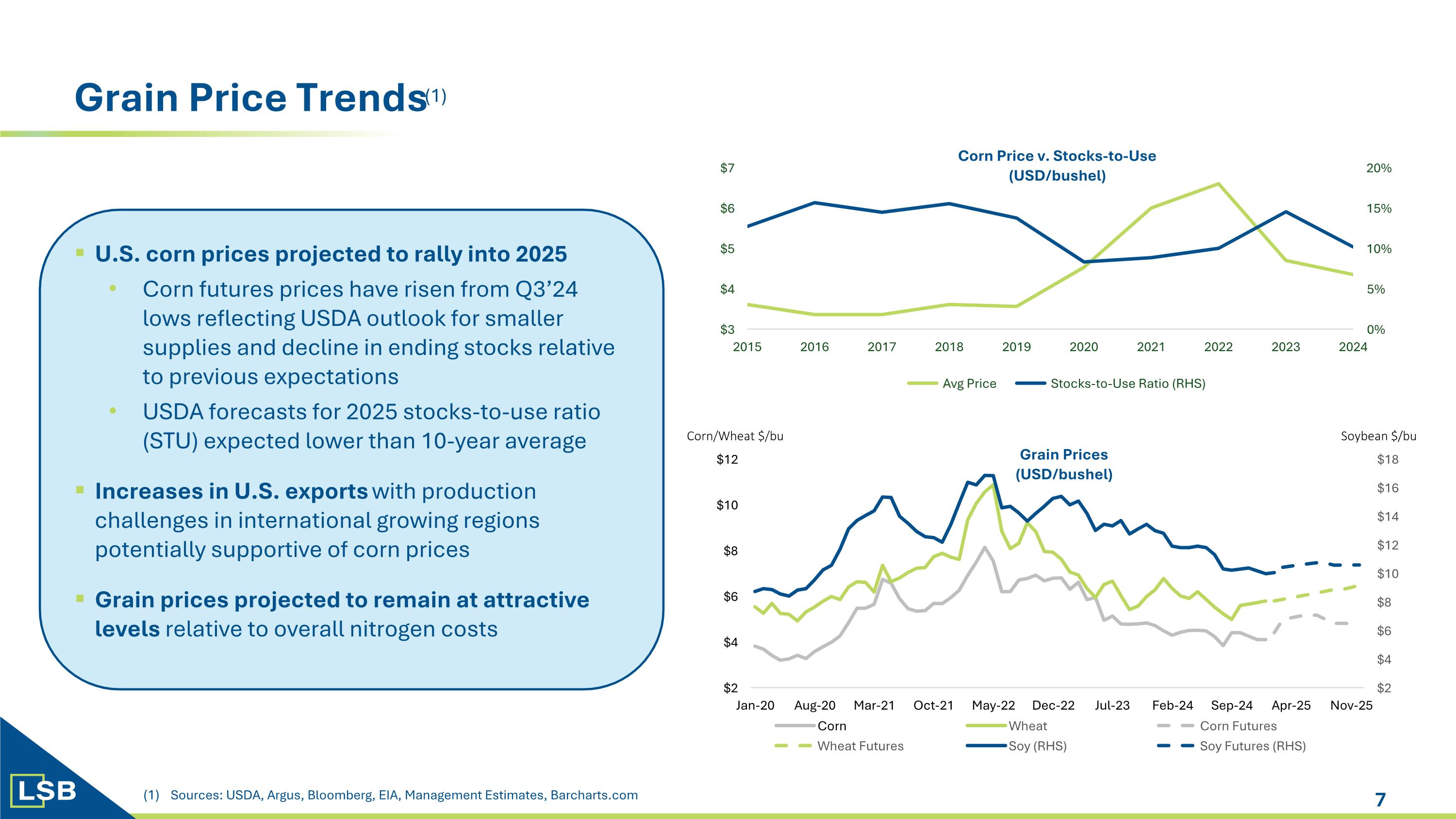

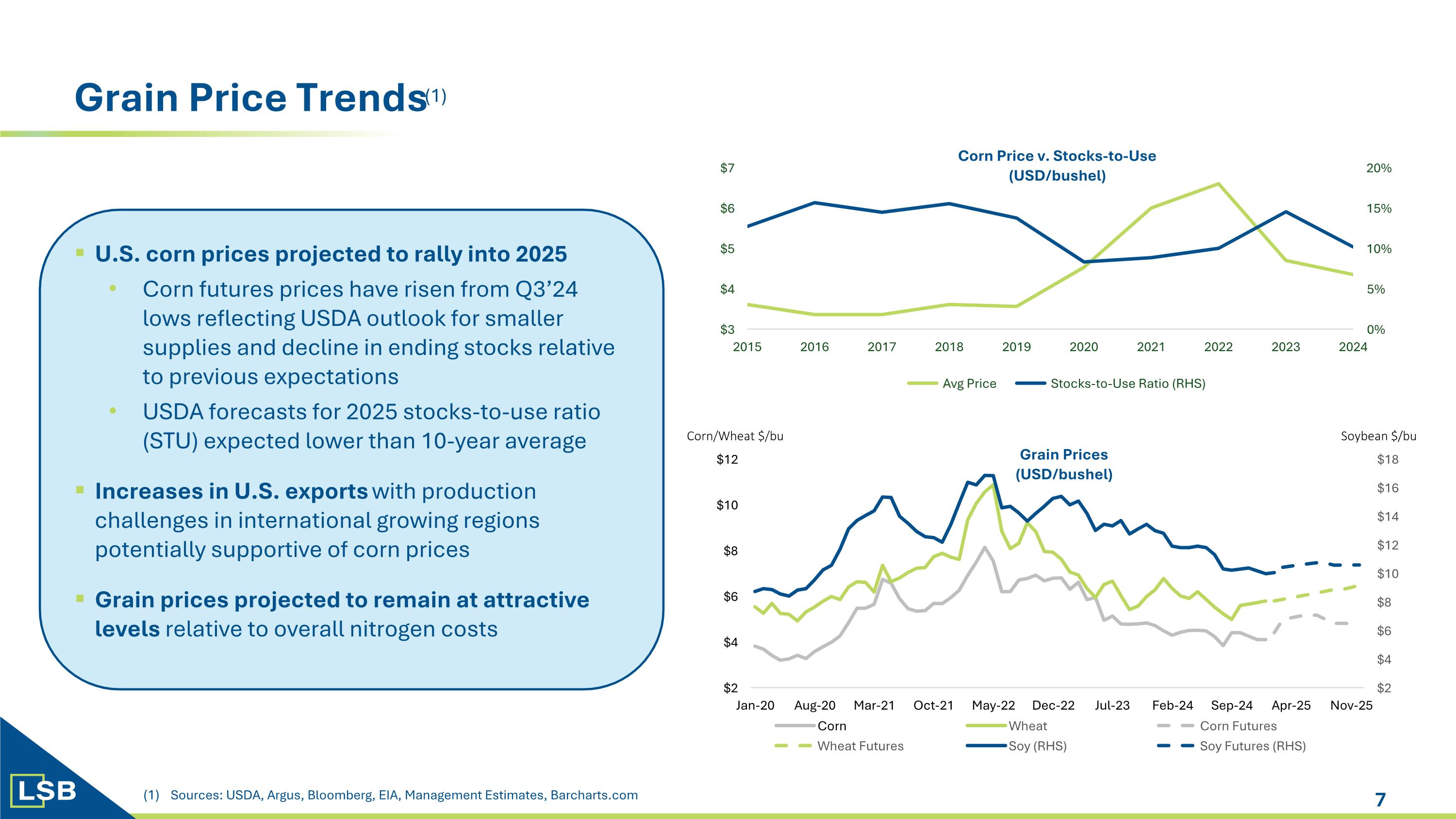

Grain Price Trends(1) U.S. corn prices projected to rally into 2025 Corn futures prices have risen from Q3’24 lows reflecting USDA outlook for smaller supplies and decline in ending stocks relative to previous expectations USDA forecasts for 2025 stocks-to-use ratio (STU) expected lower than 10-year average Increases in U.S. exports with production challenges in international growing regions potentially supportive of corn prices Grain prices projected to remain at attractive levels relative to overall nitrogen costs Sources: USDA, Argus, Bloomberg, EIA, Management Estimates, Barcharts.com Corn/Wheat $/bu Soybean $/bu

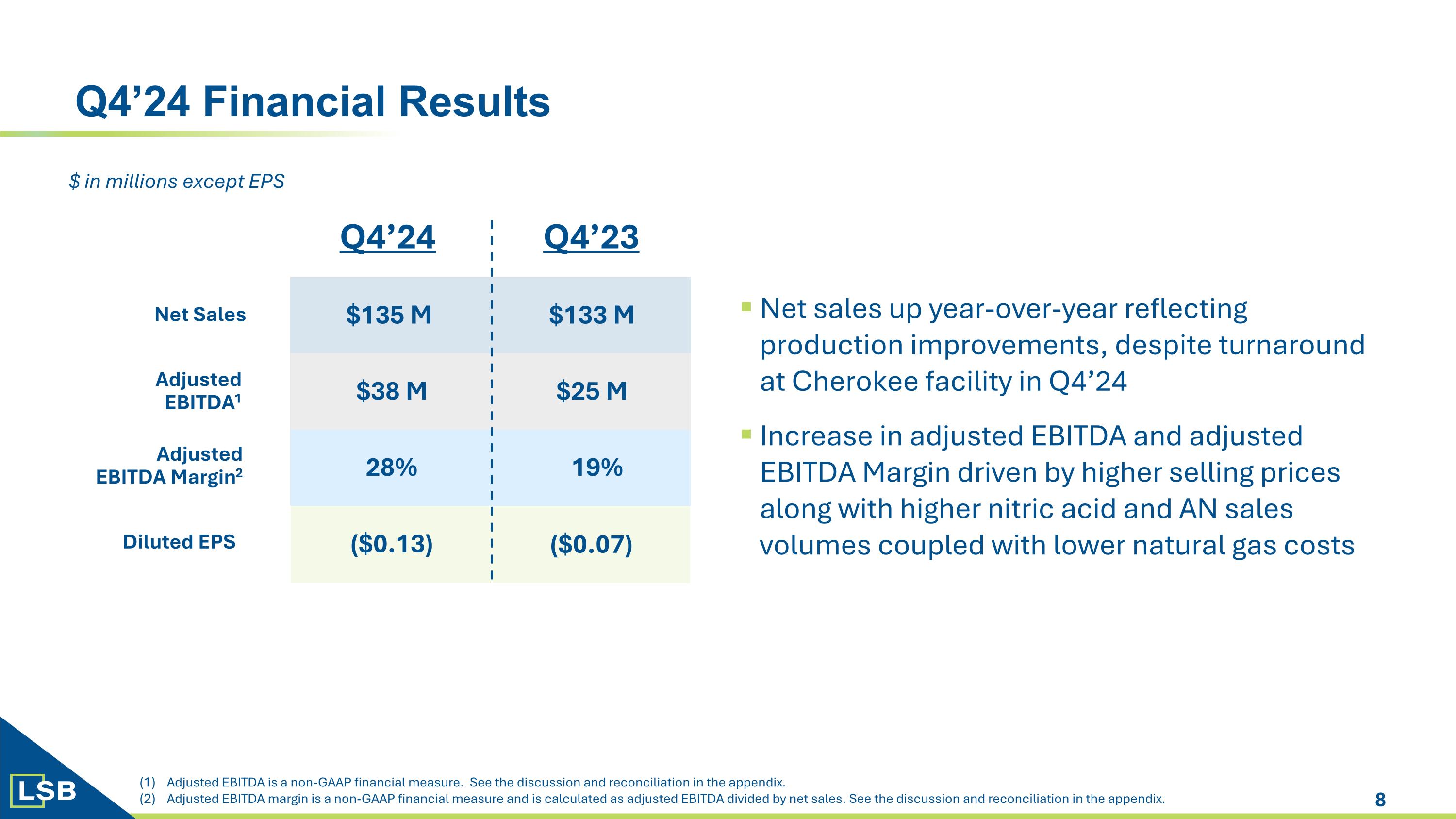

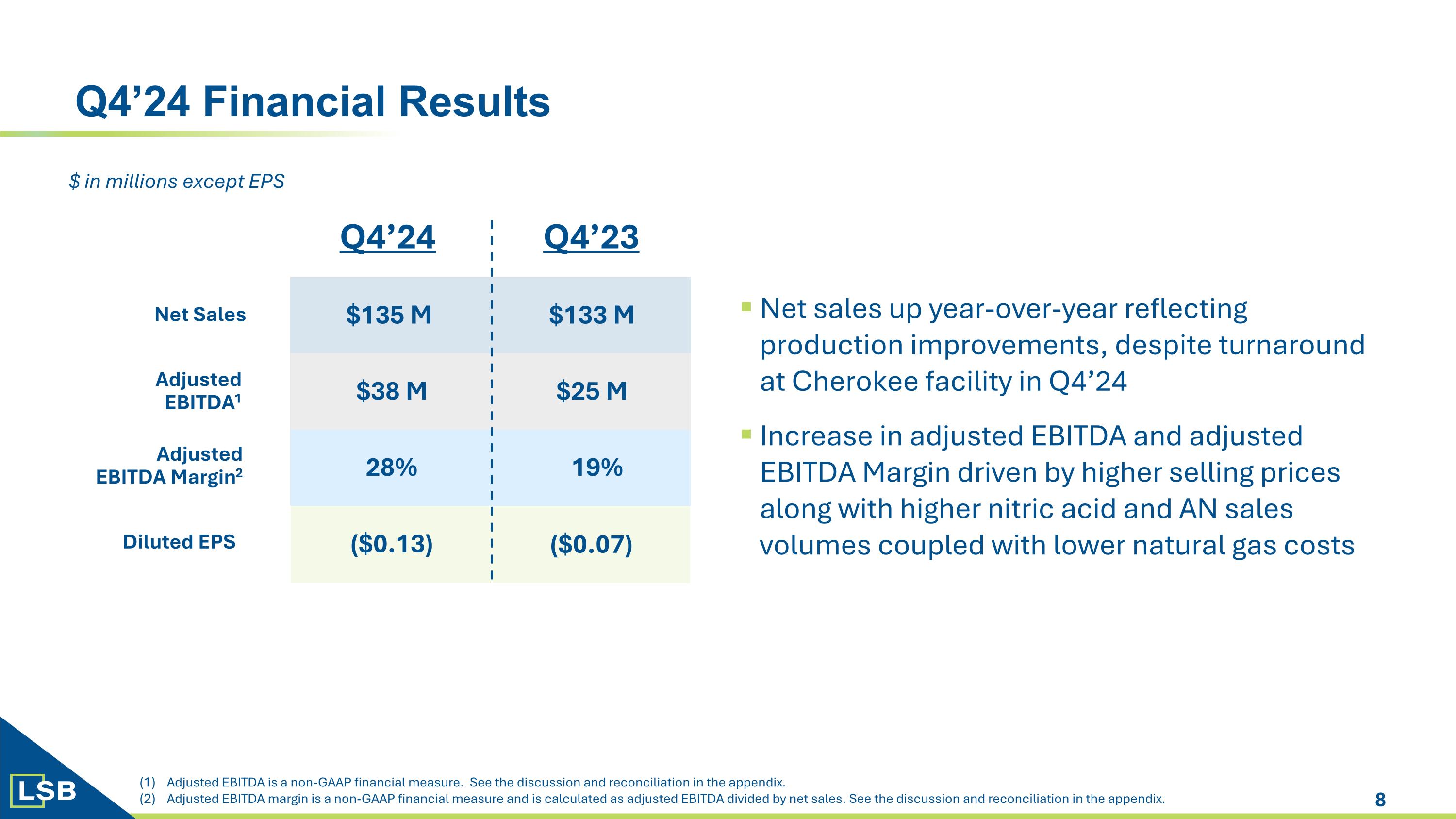

Adjusted EBITDA is a non-GAAP financial measure. See the discussion and reconciliation in the appendix. Adjusted EBITDA margin is a non-GAAP financial measure and is calculated as adjusted EBITDA divided by net sales. See the discussion and reconciliation in the appendix. Q4’24 Q4’23 Net Sales Adjusted EBITDA1 Adjusted EBITDA Margin2 $135 M $133 M $38 M $25 M 28% 19% ($0.13) ($0.07) Diluted EPS Net sales up year-over-year reflecting production improvements, despite turnaround at Cherokee facility in Q4’24 Increase in adjusted EBITDA and adjusted EBITDA Margin driven by higher selling prices along with higher nitric acid and AN sales volumes coupled with lower natural gas costs Q4’24 Financial Results $ in millions except EPS

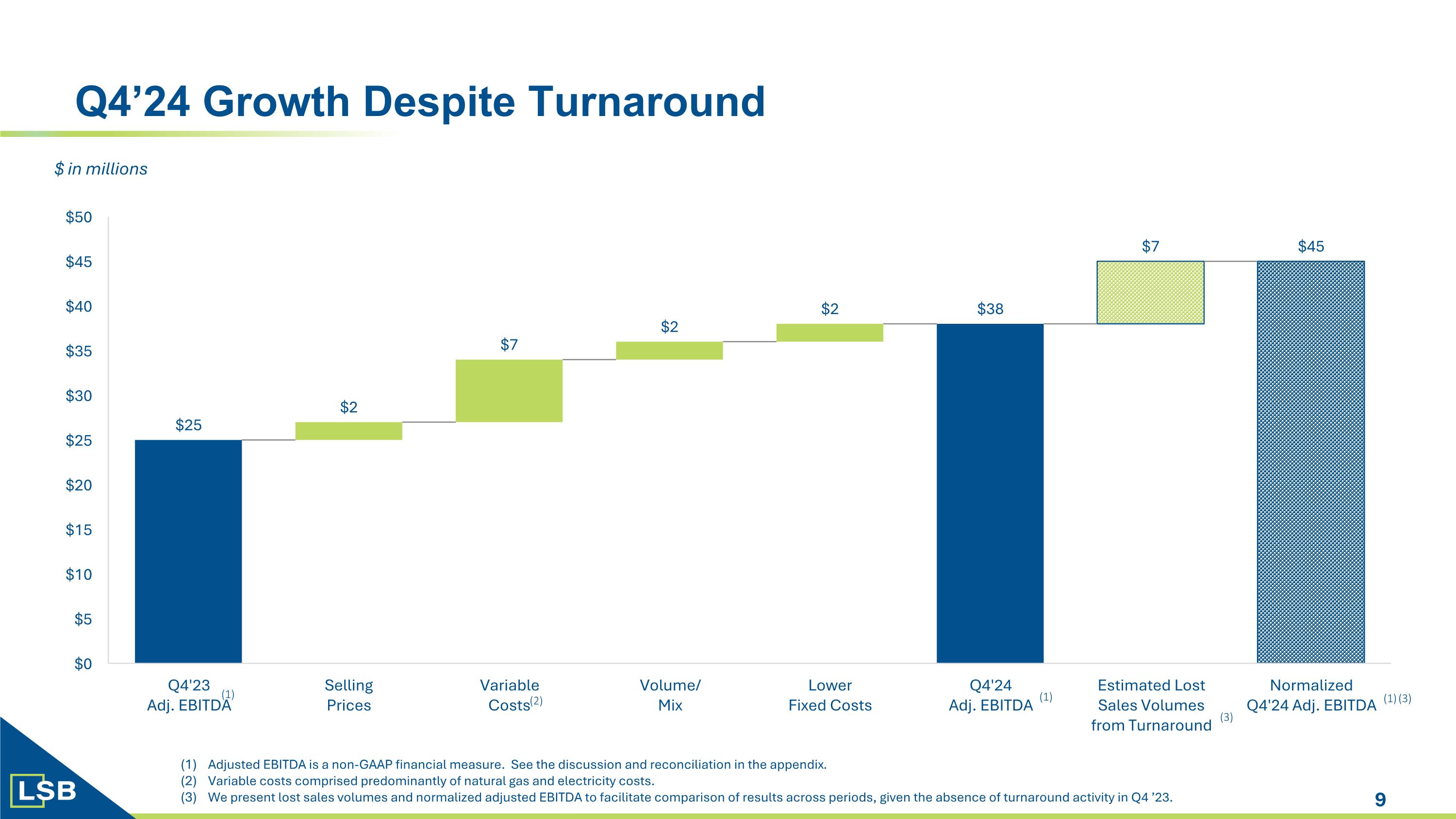

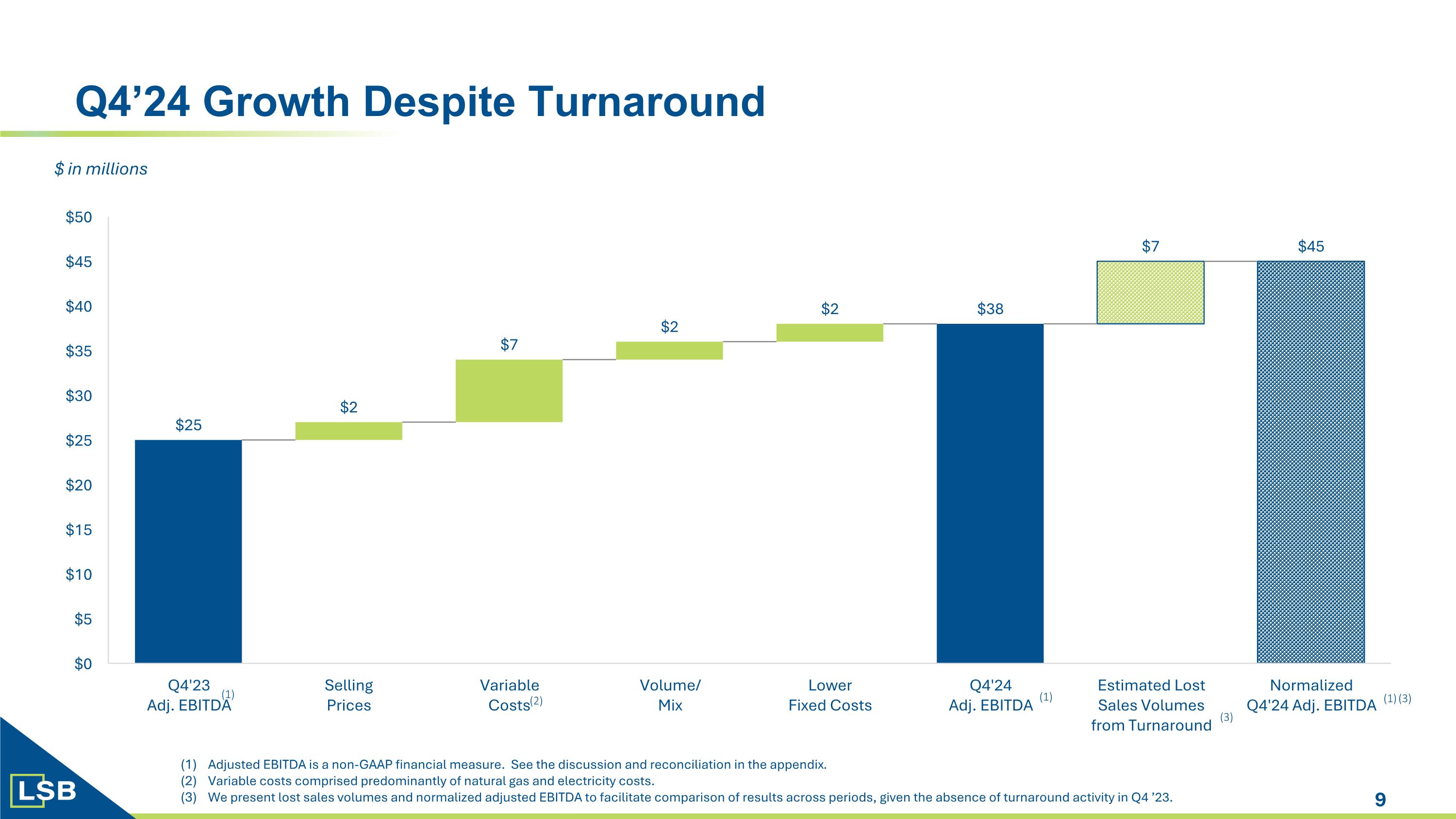

(1) Adjusted EBITDA is a non-GAAP financial measure. See the discussion and reconciliation in the appendix. Variable costs comprised predominantly of natural gas and electricity costs. We present lost sales volumes and normalized adjusted EBITDA to facilitate comparison of results across periods, given the absence of turnaround activity in Q4 ’23. Q4’24 Growth Despite Turnaround (2) $ in millions (1) (1) (1) (3) (3)

$184 M $306 M $485 M $582 M $67 M $63 M $87 M $138 M 2.3X 2.1X Solid Balance Sheet with Returns-Focused Capital Allocation Increased capex reflects investments in: Turnaround of Cherokee facility ammonia plant in Q4’24 Full turnaround of Pryor facility in Q3’24 Expansion of urea/UAN production capacity Increase in nitric acid storage Expansion of ANS loading and storage Repurchased approximately $222 million in principal amount of Senior Secured Notes and 4.6 million shares of common stock over the 24-months ended 12/31/24 Net debt/TTM Adjusted EBITDA of 2.3X Net debt calculated as total long-term debt including current minus cash and cash equivalents and short-term investments. Adjusted EBITDA is a non-GAAP financial measure. See the discussion and reconciliation in the appendix. 12/31/24 12/31/23 Cash & ST Inv. Total Debt Sustaining CAPEX TTM Op. Cash Flow Net Debt(1)/ TTM Adj. EBITDA(2) $ in millions Growth CAPEX $25 M $5 M

2025 Outlook Production & Sales Volume 2025E 2024A Ammonia Production (tons): 790,000 – 820,000 757,000 Sales Volume (tons): AN & Nitric Acid 590,000 – 620,000 554,000 UAN 620,000 – 650,000 483,000 Ammonia 250,000 – 280,000 321,000 Capital Expenditures 2025E 2024A Sustaining $60M – $65M $67M Investment/Growth $20M – $25M $25M 2025E Costs and Expenses Fixed Costs: Fixed Plant Expenses (ex-depr.) $140M – $145M Depreciation Expense $80M – $85M Logistics/Railcar Lease Expense $20M – $25M Turnaround Expense $20M – $25M Other: SG&A $35M – $40M Interest Expense $30M – $35M Non-Recurring(2) $3M – $5M Effective Tax Rate ~25% The majority of freight costs are passed through to customers and are included in gross revenue. Leidos trial 2025E Variable Plant Expenses Natural Gas Feedstock ~34 MMBtu/ton of ammonia Freight(1) 12% – 14% of sales Electricity 6% – 7% of sales Catalyst Expense 2% – 3% of sales Purchased Products/Ag. Retail 1% – 2% of sales

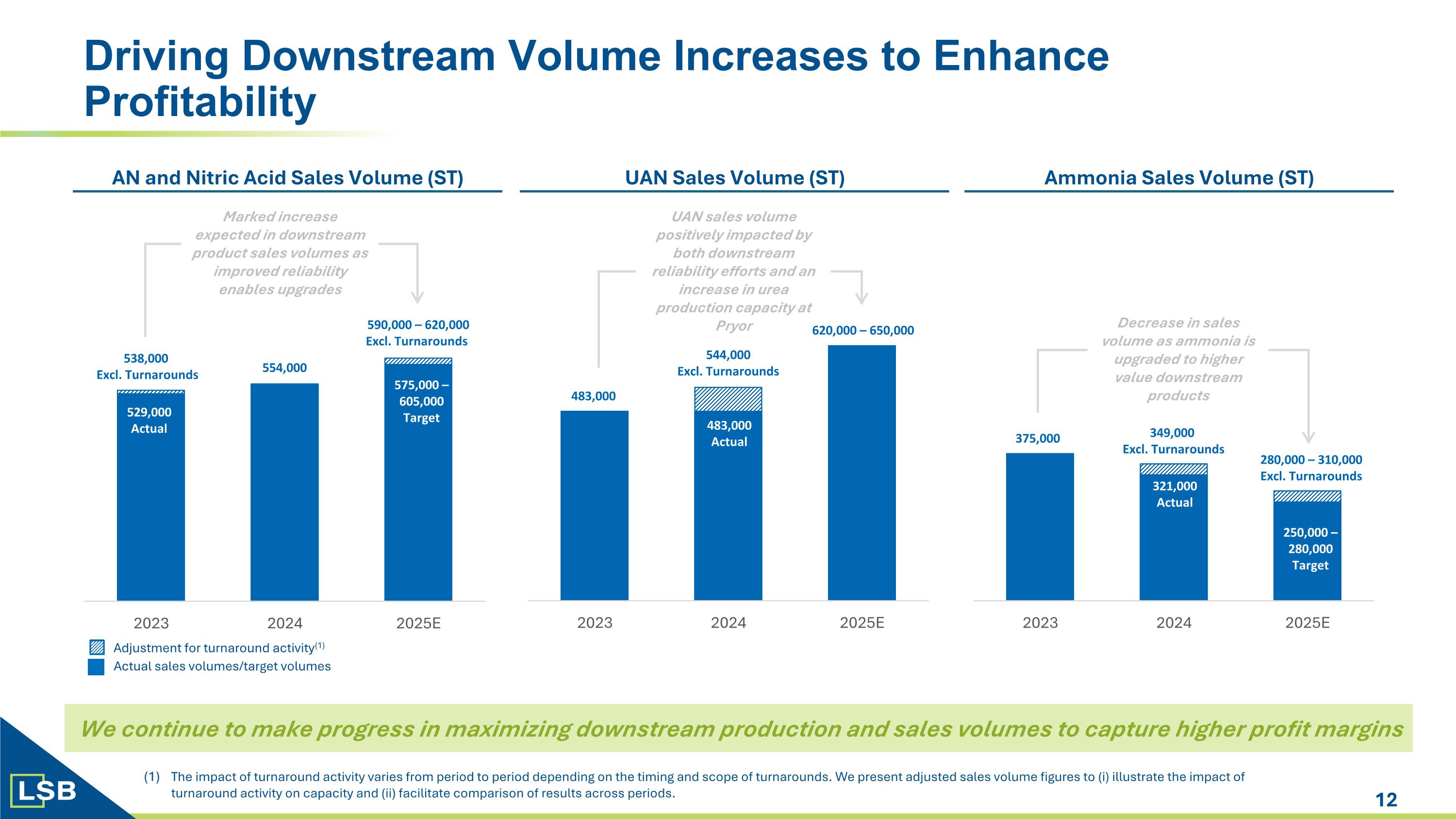

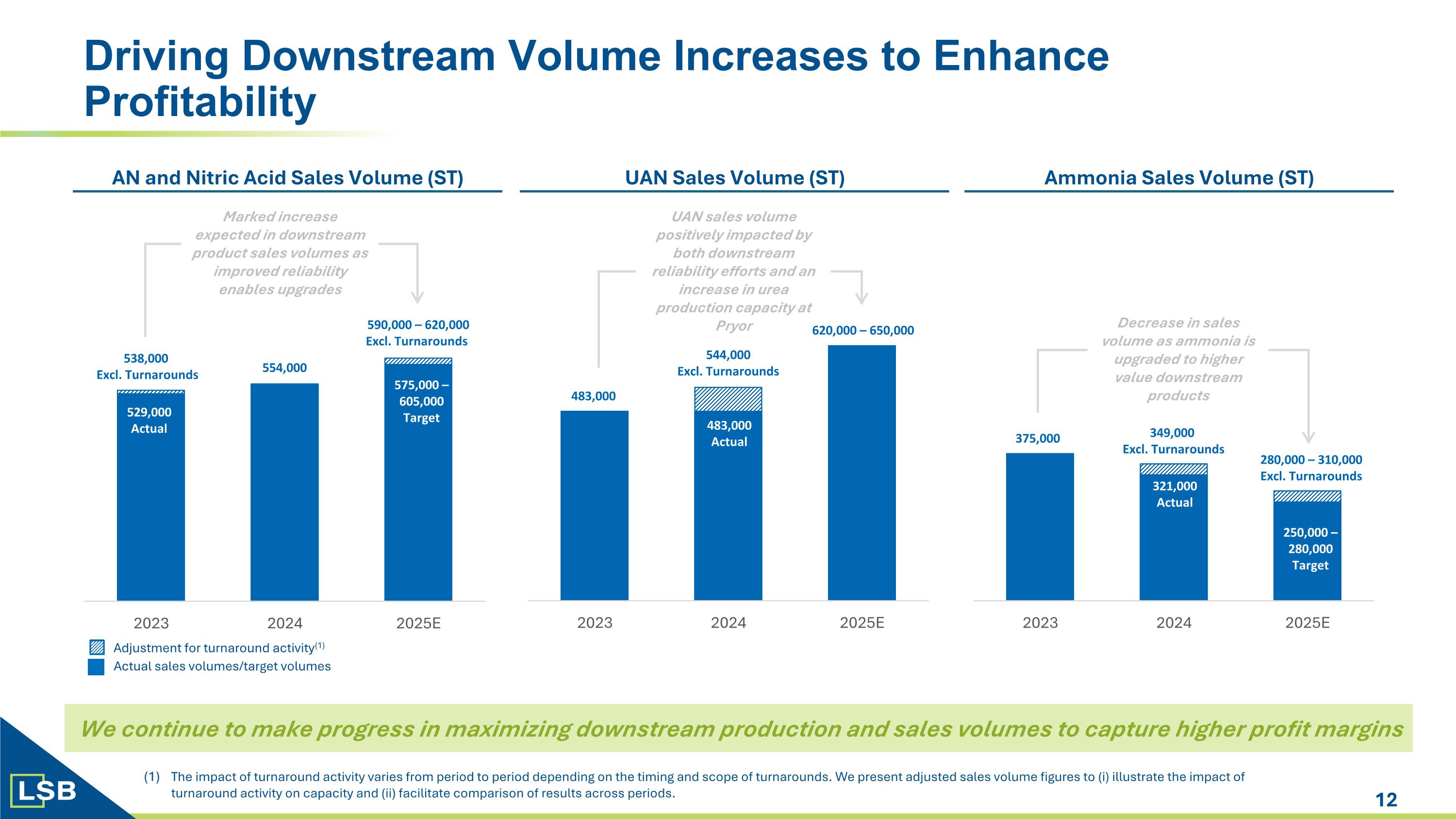

Driving Downstream Volume Increases to Enhance Profitability We continue to make progress in maximizing downstream production and sales volumes to capture higher profit margins AN and Nitric Acid Sales Volume (ST) 11 Marked increase expected in downstream product sales volumes as improved reliability enables upgrades 590,000 – 620,000 Excl. Turnarounds UAN Sales Volume (ST) UAN sales volume positively impacted by both downstream reliability efforts and an increase in urea production capacity at Pryor 620,000 – 650,000 Ammonia Sales Volume (ST) Decrease in sales volume as ammonia is upgraded to higher value downstream products 280,000 – 310,000 Excl. Turnarounds 554,000 538,000 Excl. Turnarounds 544,000 Excl. Turnarounds 483,000 375,000 349,000 Excl. Turnarounds Adjustment for turnaround activity(1) Actual sales volumes/target volumes 575,000 – 605,000 Target 529,000 Actual 483,000 Actual 321,000 Actual 250,000 – 280,000 Target The impact of turnaround activity varies from period to period depending on the timing and scope of turnarounds. We present adjusted sales volume figures to (i) illustrate the impact of turnaround activity on capacity and (ii) facilitate comparison of results across periods.

Incremental Earnings Opportunity Independent of Pricing Environment Margin Enhancement Projects Downstream Production Volume Improvement Increase in Ammonia Production Volumes EBITDA Levers Incremental EBITDA Opportunity(1) $20 to $25 Million $20 to $25 Million $5 to $10 Million Profit Optimization $15 to $20 Million Percentage of Opportunity Captured To-Date(1) Illustrative range of run-rate EBITDA based on annualized impact of production improvements made in 2024; pricing assumptions are as follows: Low end of range based on $400 Tampa Ammonia, $210 NOLA UAN, and $4.00 NYMEX Henry Hub High end of range based on $500 Tampa Ammonia, $260 NOLA UAN, and $3.00 NYMEX Henry Hub % of EBITDA opportunity captured % of opportunity remaining Key margin enhancement projects, including urea expansion at Pryor, completed in 2024, additional nitric acid storage capacity and expansion of ANS loading capability and storage capacity Recent and upcoming turnarounds driving increased ammonia production tons Implementing operational improvement measures at downstream plants to upgrade additional ammonia Profit optimization focused on more efficient operations and processes, as well as cost rationalization Key Actions

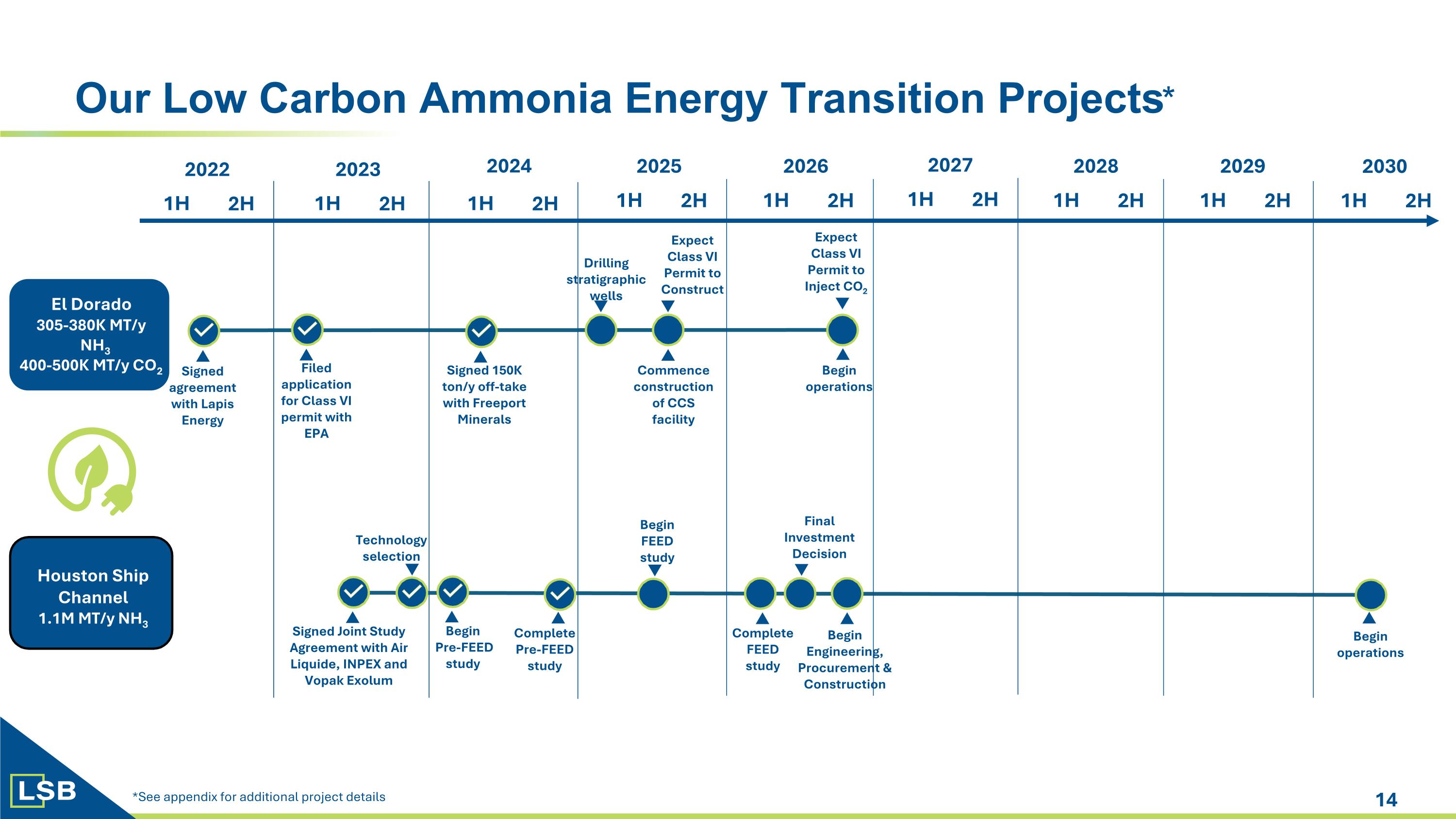

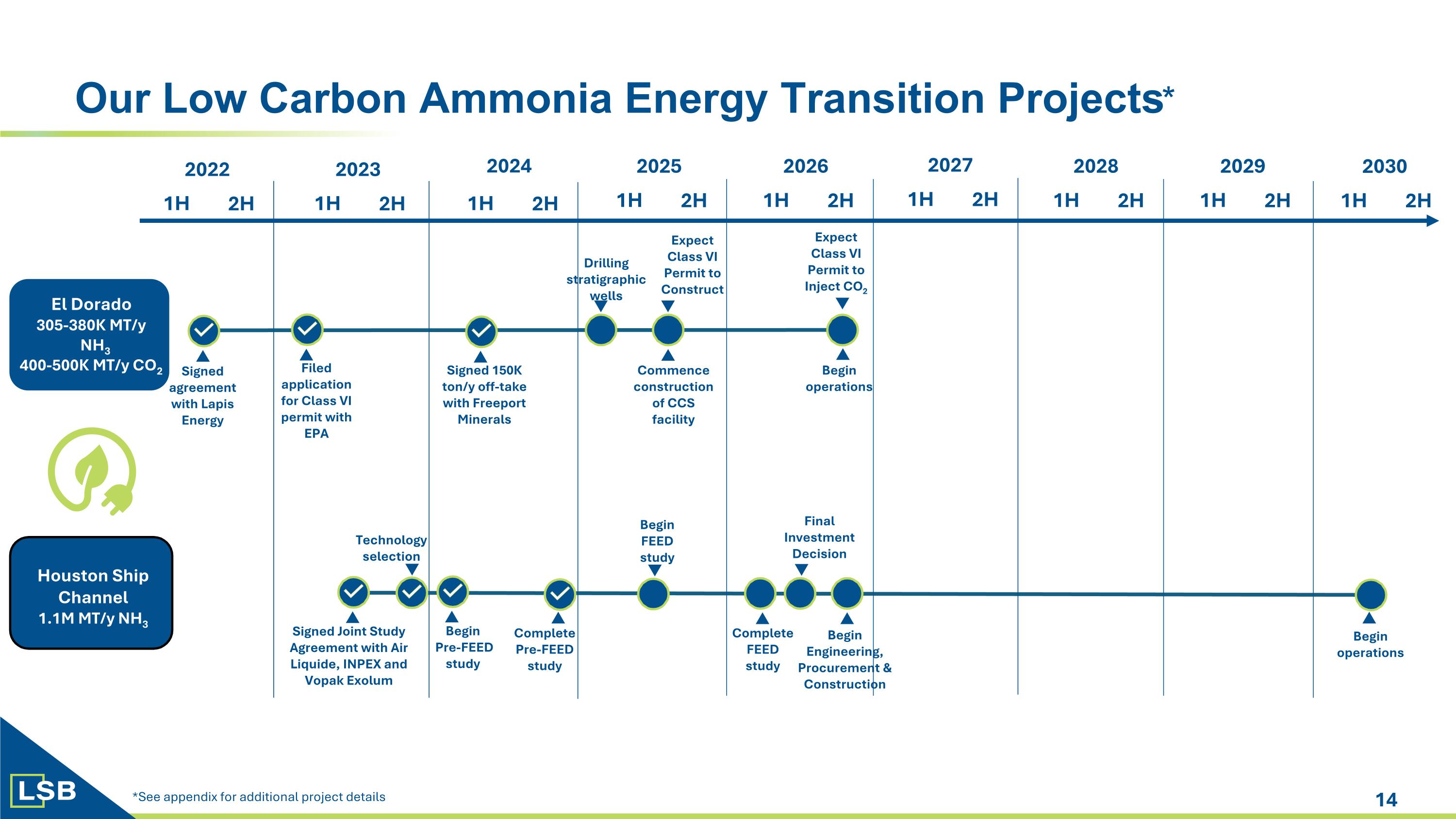

Complete FEED study Our Low Carbon Ammonia Energy Transition Projects* *See appendix for additional project details Commence construction of CCS facility Begin operations Houston Ship Channel 1.1M MT/y NH3 2022 1H 2H 2024 2025 2023 1H 2H 1H 2H 1H 2H 2026 1H 2H 2027 1H 2H 2028 1H 2H 2029 1H 2H El Dorado 305-380K MT/y NH3 400-500K MT/y CO2 Signed agreement with Lapis Energy Signed 150K ton/y off-take with Freeport Minerals Filed application for Class VI permit with EPA Expect Class VI Permit to Construct Expect Class VI Permit to Inject CO2 Signed Joint Study Agreement with Air Liquide, INPEX and Vopak Exolum Complete Pre-FEED study Begin FEED study Technology selection Begin Pre-FEED study Final Investment Decision Begin operations Begin Engineering, Procurement & Construction 2030 1H 2H Drilling stratigraphic wells

Appendix

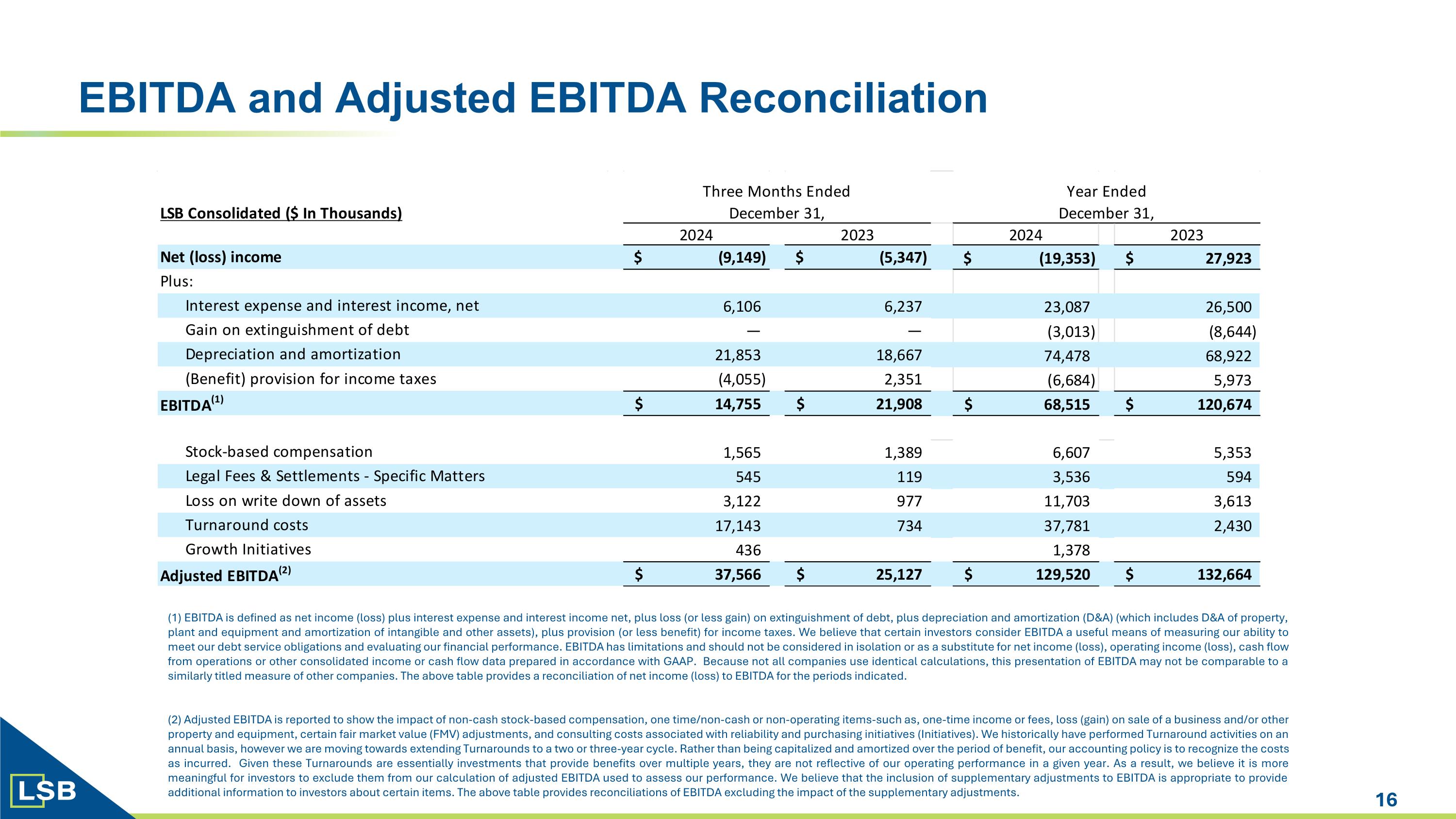

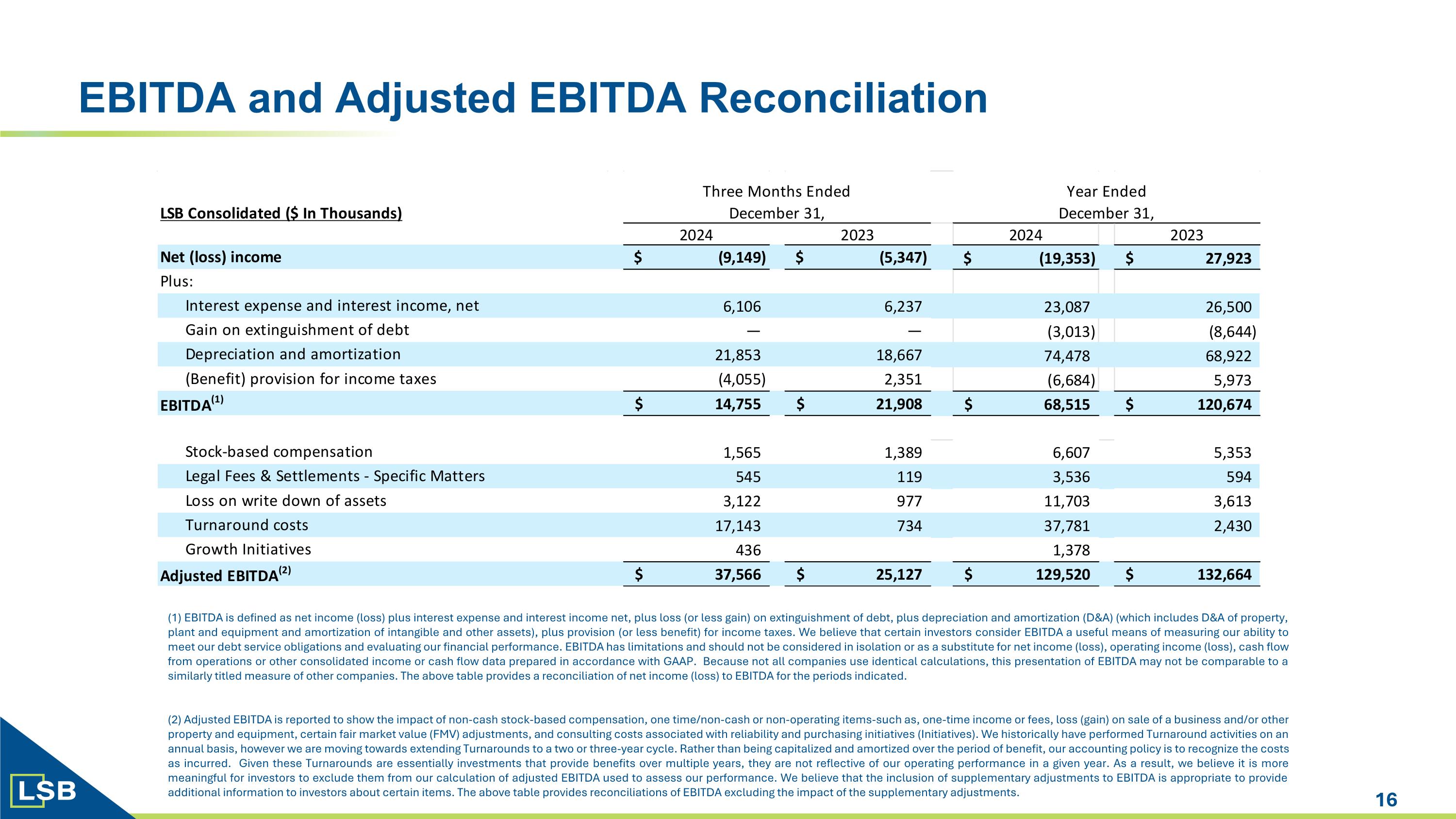

EBITDA and Adjusted EBITDA Reconciliation (1) EBITDA is defined as net income (loss) plus interest expense and interest income net, plus loss (or less gain) on extinguishment of debt, plus depreciation and amortization (D&A) (which includes D&A of property, plant and equipment and amortization of intangible and other assets), plus provision (or less benefit) for income taxes. We believe that certain investors consider EBITDA a useful means of measuring our ability to meet our debt service obligations and evaluating our financial performance. EBITDA has limitations and should not be considered in isolation or as a substitute for net income (loss), operating income (loss), cash flow from operations or other consolidated income or cash flow data prepared in accordance with GAAP. Because not all companies use identical calculations, this presentation of EBITDA may not be comparable to a similarly titled measure of other companies. The above table provides a reconciliation of net income (loss) to EBITDA for the periods indicated. (2) Adjusted EBITDA is reported to show the impact of non-cash stock-based compensation, one time/non-cash or non-operating items-such as, one-time income or fees, loss (gain) on sale of a business and/or other property and equipment, certain fair market value (FMV) adjustments, and consulting costs associated with reliability and purchasing initiatives (Initiatives). We historically have performed Turnaround activities on an annual basis, however we are moving towards extending Turnarounds to a two or three-year cycle. Rather than being capitalized and amortized over the period of benefit, our accounting policy is to recognize the costs as incurred. Given these Turnarounds are essentially investments that provide benefits over multiple years, they are not reflective of our operating performance in a given year. As a result, we believe it is more meaningful for investors to exclude them from our calculation of adjusted EBITDA used to assess our performance. We believe that the inclusion of supplementary adjustments to EBITDA is appropriate to provide additional information to investors about certain items. The above table provides reconciliations of EBITDA excluding the impact of the supplementary adjustments.

Trailing Twelve Month EBITDA and Adjusted EBITDA* (1 ) See definition of EBITDA on previous page (2) See definition of adjusted EBITDA on previous page *Columns and rows may not foot due to rounding

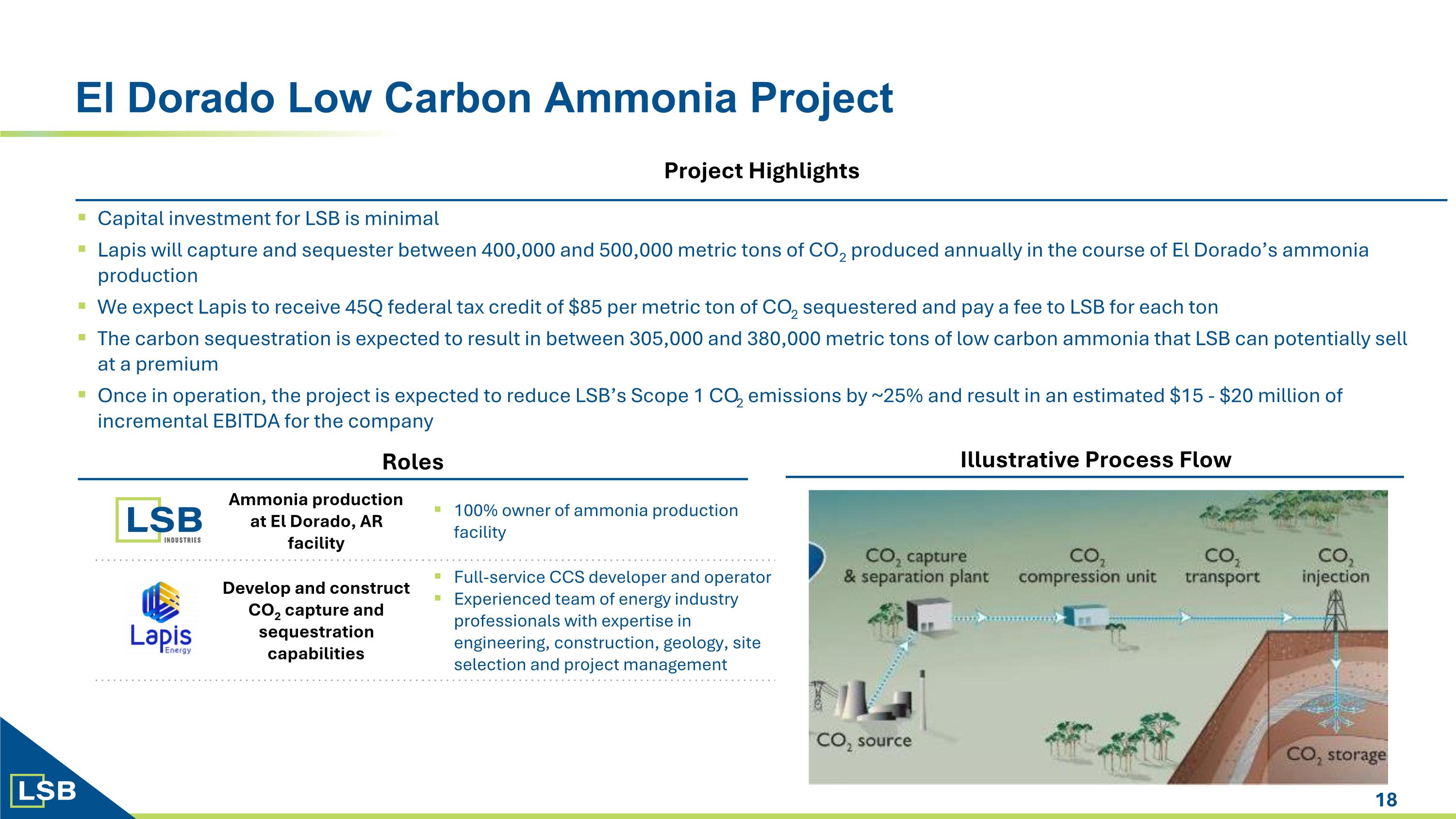

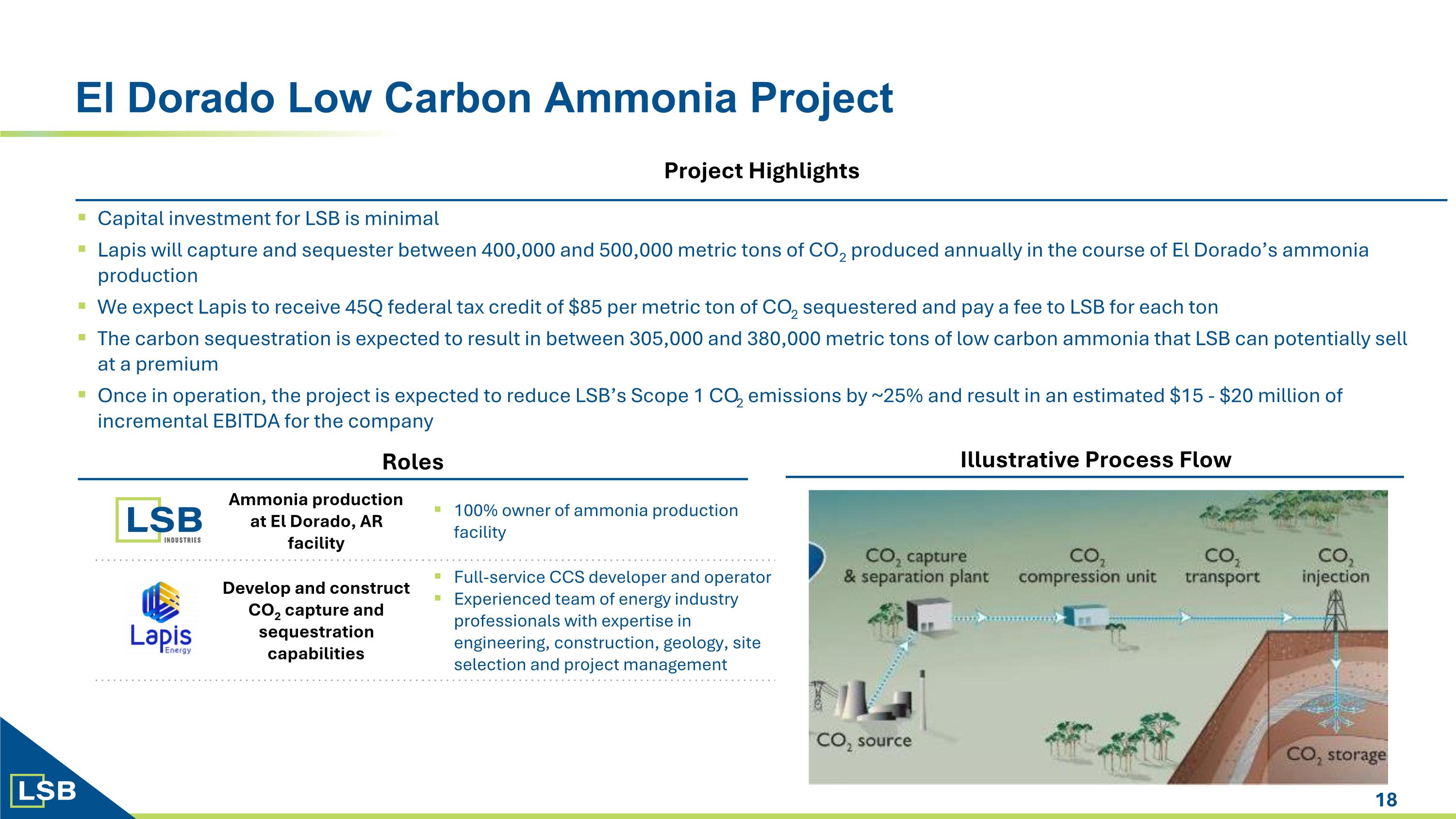

Ammonia production at El Dorado, AR facility 100% owner of ammonia production facility Develop and construct CO2 capture and sequestration capabilities Full-service CCS developer and operator Experienced team of energy industry professionals with expertise in engineering, construction, geology, site selection and project management Capital investment for LSB is minimal Lapis will capture and sequester between 400,000 and 500,000 metric tons of CO2 produced annually in the course of El Dorado’s ammonia production We expect Lapis to receive 45Q federal tax credit of $85 per metric ton of CO2 sequestered and pay a fee to LSB for each ton The carbon sequestration is expected to result in between 305,000 and 380,000 metric tons of low carbon ammonia that LSB can potentially sell�at a premium Once in operation, the project is expected to reduce LSB’s Scope 1 CO2 emissions by ~25% and result in an estimated $15 - $20 million of incremental EBITDA for the company El Dorado Low Carbon Ammonia Project Roles FEED Study Feasibility Study Pre-FEED Study Feasibility Study Illustrative Process Flow Project Highlights

Location Terminal Project Site Project Site Ammonia loop equity partner and operator Experienced North American ammonia producer To own (~ 50%) and operate the ammonia loop Hydrogen and nitrogen feedstock supplier #2 supplier of industrial gases with $100 billion of EV To build and operate ASU and ATR for project Equity partner and developer delivering Asian offtakers #1 E&P company in Japan with $25 billion of EV Equity partner to Air Liquide for ASU and ATR; equity partner to LSB for the ammonia loop Terminaling and logistics services JV between major terminaling and storage firms To provide site and services to the project New 1.1 million TPA low carbon ammonia plant at an attractive site in Deer Park, on the Houston Ship Channel – access to low-cost natural gas, key pipelines, and deepwater logistics Focused on the domestic and export markets, particularly power generation demand from Japan and Korea and low carbon ammonia demand from the U.S. and Europe – seizing government incentives at both production and consumption INPEX relationship with Japanese utilities provides potential to be highly-contracted with creditworthy counterparties, enabling predictable cash flows and non-recourse project financing Houston Ship Channel Ammonia Project Project Highlights Roles