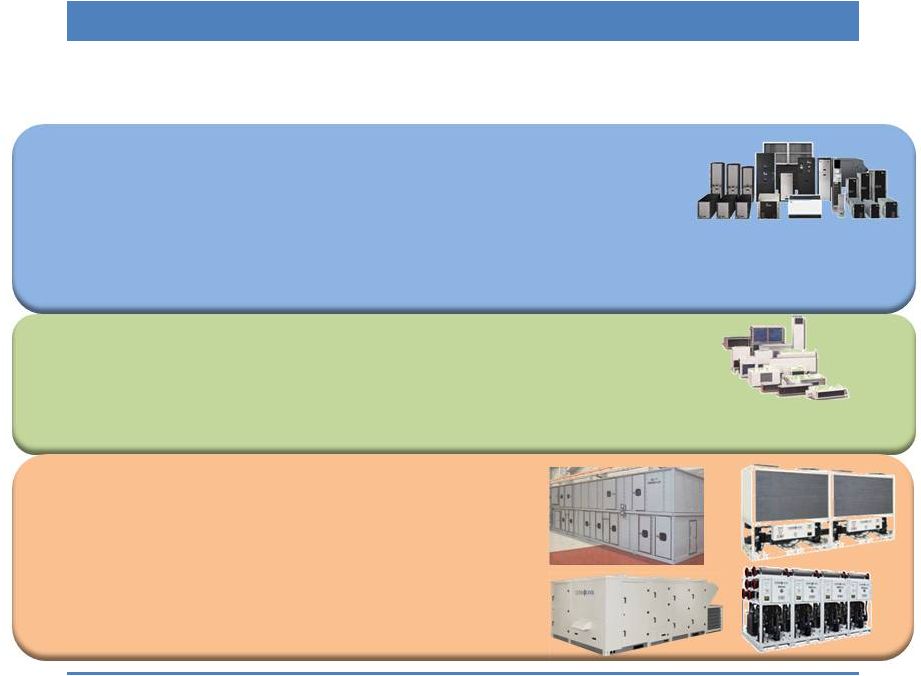

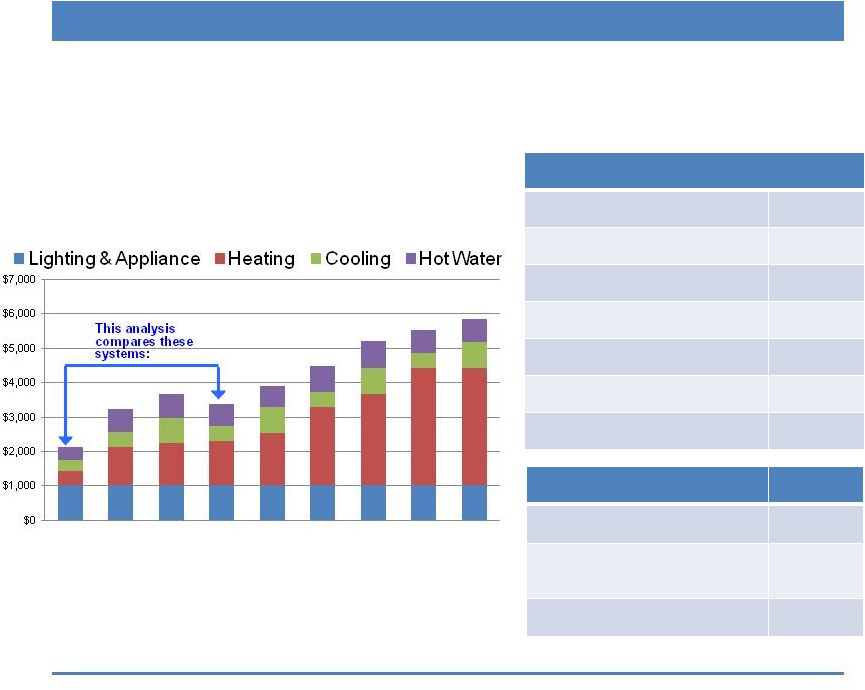

2 Safe Harbor Statement The comments today and the information contained in the presentation materials contain certain forward-looking statements. All these statements, other than statements of historical fact, are forward-looking statements. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “estimate” and similar statements of the future or of a forward-looking nature identify forward-looking statements, including but not limited to, all statements about or in references to the Architectural Building Index or any McGraw Hill forecast, any references to projected natural gas costs, ammonia costs, grain or corn demand or production, and fundamentals of the chemical or climate control business. The forward-looking statements include but are not limited to the following statements: For Chemical Business: Major investments underway to reduce costs and increase facility reliability; Positioned to benefit from strong agricultural market with favorable margins; Product balance options; Capital expansion projects reduce production costs significantly vs. purchased ammonia; Estimated completion Q4 2015/Start-up Q1 2016 for El Dorado ammonia plant; El Dorado nitric acid plant and concentrator will have a cost of $115 million to $125 million, improves operating characteristics, enhances product balance, replaces lost acid capacity and adds capacity for a total of 375,000 TPY, and estimated completion and start-up of Q2 2015; Fundamentals of the nitrogen fertilizers we produce remain positive; Gross margins remain historically strong; LSB Value Drivers; Pryor facility reliability improvements; capital projects at El Dorado; Comprehensive upgraded Chemical Business safety and plant reliability systems will improve plant up-time and reduce risks of unplanned downtime. For Climate Control Business: Market and technology leader for geothermal heat pumps, water source heat pumps, and hydronic fan coils; Poised to benefit from the economic recovery, long-term trend toward green construction, and growth of emerging products; Construction markets are poised for a recovery to pre-recession levels; Climate control’s product sales should outgrow broader markets; Leading indicators point to solid growth over the next three years in commercial and institutional construction, as well as residential housing starts; Anticipate an improvement in all the major sectors that we serve, especially lodging, multi-family housing and education; Backlog should translate into improved second half 2014; LEAN operational excellence margins. You should not rely on the forward-looking statements because actual events or results may differ materially from those indicated by these forward- looking statements as a result of a number of important factors. We incorporate the risks and uncertainties discussed under the heading Special Note Regarding Forward-looking Statements in our annual report on Form 10-K for the fiscal year ended December 31, 2013 and Form 10-Q’s for the periods ending March 31, 2014 and June 30, 2014. We undertake no duty to update the information contained in this investor presentation. The term EBITDA, as used in this presentation, is net income plus interest expense, depreciation, amortization, income taxes, and certain non-cash charges, unless otherwise described. EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to GAAP measurement. The reconciliation of GAAP and any EBITDA numbers discussed in this investor presentation are included on the Q2 2014 conference call presentation, which is posted on our website. |