for shares of our common stock based on an exchange price of $6.16, which is equal to the 30-day volume weighted average price of our shares as of July 16, 2021, subject to, among other things, the receipt of stockholder approval from our stockholders, other than Eldridge and its affiliates.

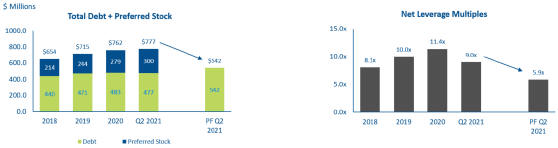

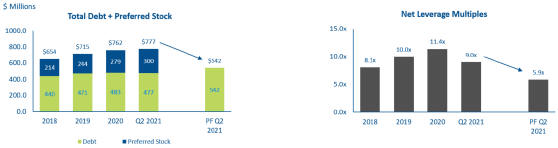

The following tables show our total debt and preferred stock balance and net leverage multiples over the periods presented:

Total debt is calculated as long-term debt, including current portion and excluding OID and debt issuance costs. Preferred Stock balance represents liquidation preference and includes approximately $2.0 million as of June 30, 2021 of participation rights value based on the 30-day volume weighted average price of $6.16 as of July 16, 2021, and excludes the Company’s Series B 12% Cumulative Convertible Preferred Stock and Series D 6% Cumulative Convertible Preferred Stock of $3.0mm.

Net Leverage is defined as Total Debt plus Preferred Stock net of Cash divided by Adjusted EBITDA on a trailing twelve month basis.

At a special meeting of the stockholders of the Company held on September 22, 2021, the stockholders of the Company approved certain proposals necessary to effectuate the exchange with the Holder and related transactions (as described below). We expect to consummate the exchange on September 27, 2021, and issue 49,066,005 shares of our common stock to the Holder. In addition, in connection with the foregoing exchange, our existing common stockholders, and holders of the Series B 12% Cumulative Convertible Preferred Stock and the Series D 6% Cumulative Convertible Preferred Stock, in each case, on an as converted basis, became entitled to receive a special dividend of 0.30 shares of our common stock for every 1 share of common stock owned (or owned on an as converted basis, as applicable), with any shares of common stock payable to the Holder or its affiliates on account of the above-mentioned dividend reducing, on a share for share basis, the consideration payable to the Holder on account of the exchange. The dividend is expected to be paid on October 8, 2021.

The Refinancing Transactions

Concurrently with the pricing of this offering, we expect to deliver a conditional notice of optional redemption through Wilmington Trust, National Association, as trustee under the indenture (the “Existing Notes Indenture”) governing our 9.625% Senior Secured Notes due 2023 (the “Existing Notes”), to the holders of the Existing Notes of our election to redeem all of the Existing Notes, conditional on the consummation of this offering, and to effect a satisfaction and discharge of the Existing Notes Indenture concurrently with the consummation of this offering. The Existing Notes are currently redeemable at a price equal to 103.609% of the principal amount thereof, together with accrued and unpaid interest to but excluding the redemption date, or an aggregate of $471.3 million. While the Existing Notes will remain outstanding during the 30-day notice period following the delivery of the notice of redemption, the Existing Notes Indenture will be satisfied and discharged, and the guarantees of the Existing Notes and liens securing the Existing Notes will be released, following delivery of such notice and the deposit of necessary funds, which we currently expect to effect concurrently with the consummation of this offering. We intend to fund the redemption with the net proceeds from this offering.