UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the Fiscal Year Ended December 31, 2011

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-7665

Lydall, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 06-0865505 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | |

| One Colonial Road, Manchester, Connecticut | 06042 |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (860) 646-1233

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

| Common Stock, $.10 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer¨ | Accelerated filerx |

| | | |

| | Non-accelerated filer¨ | Smaller reporting company¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox

On June 30, 2011, the aggregate market value of the Registrant’s voting stock held by nonaffiliates was $198,243,745 based on the New York Stock Exchange closing price on that date. For purposes of this calculation, the Registrant has assumed that its directors and executive officers are affiliates.

On February 15, 2012, there were 17,147,953 shares of Common Stock outstanding, exclusive of treasury shares.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference to the definitive Proxy Statement to be distributed in connection with the Registrant’s Annual Meeting of Stockholders to be held on April 27, 2012.

The exhibit index is located on pages 39-41.

INDEX TO ANNUAL REPORT ON FORM 10-K

Year Ended December 31, 2011

| | | Page

Number |

| Cautionary Note Concerning Factors That May Affect Future Results | 3 |

| | | |

| PART I | | |

| Item 1. | Business | 4 |

| Item 1A. | Risk Factors | 7 |

| Item 1B. | Unresolved Staff Comments | 11 |

| Item 2. | Properties | 11 |

| Item 3. | Legal Proceedings | 11 |

| Item 4. | Mine Safety Disclosures | 11 |

| | Executive Officers of the Registrant | 12 |

| | | |

| PART II | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 13 |

| Item 6. | Selected Financial Data | 16 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 35 |

| Item 8. | Financial Statements and Supplementary Data | 35 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 35 |

| Item 9A. | Controls and Procedures | 36 |

| Item 9B. | Other Information | 37 |

| | | |

| PART III | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 38 |

| Item 11. | Executive Compensation | 38 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 38 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 38 |

| Item 14. | Principal Accounting Fees and Services | 38 |

| | | |

| PART IV | | |

| Item 15. | Exhibits, Financial Statement Schedules | 39 |

| | Signatures | 42 |

The information called for by Items 10, 11, 12, 13 and 14, to the extent not included in this document, is incorporated herein by reference to such information included in the Company’s definitive Proxy Statement to be filed with the Securities and Exchange Commission and distributed in connection with Lydall, Inc.’s 2012 Annual Meeting of Stockholders to be held on April 27, 2012.

CAUTIONARY NOTE CONCERNING FACTORS THAT MAY AFFECT FUTURE RESULTS

Lydall, Inc. and its subsidiaries are hereafter collectively referred to as “Lydall,” the “Company” or the “Registrant.”

This report contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In general, any statements contained in this report that are not statements of historical fact may be deemed to be forward-looking statements within the meaning of Section 21E. All such forward-looking statements are intended to provide management’s current expectations for the future operating and financial performance of the Company based on current expectations and assumptions relating to the Company’s business, the economy and other future conditions. Forward-looking statements generally can be identified through the use of the words “believes,” “anticipates,” “may,” “plans,” “projects,” “expects,” “estimates,” “forecasts,” “predicts,” “targets,” and other similar expressions in connection with the discussion of future operating or financial performance. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Accordingly, the Company’s actual results may differ materially from those contemplated by the forward-looking statements. Investors, therefore, are cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Forward-looking statements in this Annual Report on Form 10-K includes, among others, statements relating to:

| · | Overall economic and business conditions and the effects on the Company’s markets; |

| · | The ability of the Company to continue to improve operating results of fiber based products at its North American automotive facility; |

| · | Expected automobile production in the North American or European automotive markets; |

| · | Growth opportunities in markets served by the Company’s Performance Materials segment; |

| · | Product development and new business opportunities; |

| · | Future strategic transactions, included but not limited to: acquisitions, joint ventures, alliances, licensing agreements and divestitures; |

| · | The cost and availability of raw materials and energy and ability to pass through to customers increases in such costs; |

| · | Benefits realized from operating efficiency improvements as a result of Lean Six Sigma and other operational excellence initiatives; |

| · | The Company’s ability to remediate identified control deficiencies over financial reporting (including a material weakness with respect to accounting for income taxes); |

| · | Pension plan assumptions and future expense and funding requirements; |

| · | Future cash flow and uses of cash; |

| · | Future dividends on, or repurchases of, the Company’s Common Stock; |

| · | Future amounts of stock-based compensation expense; |

| · | Future earnings and other measurements of financial performance; |

| · | Future levels of indebtedness and capital spending; |

| · | Benefits expected to be realized from capital equipment investments in businesses, including expected realization of sales growth of Solutech membrane products and Life Sciences Vital Fluids bioprocessing products; |

| · | The Company’s ability to meet cash operating requirements; |

| · | The Company’s ability to meet financial covenants in its Domestic Credit Facility; |

| · | The expected future impact of recently issued accounting pronouncements upon adoption; |

| · | Future effective income tax rates and realization of deferred tax assets; |

| · | Estimates of fair values of reporting units and long-lived assets used in assessing goodwill and long-lived assets for possible impairment; |

| · | The expected outcomes of contingencies; |

| · | The Company’s ability to earn fees for services to be rendered under a process technology license agreement; and |

| · | Competitive factors in the industries and geographic markets in which the Company competes or may compete. |

All forward-looking statements are inherently subject to a number of risks and uncertainties that could cause the actual results of the Company to differ materially from those reflected in such forward-looking statements. See Item 1A. Risk Factors for a description of identified risks. The occurrence of one or more of these risks, or other unidentified risks, could cause the Company’s actual results to vary materially from recent results or from the anticipated future results.

The Company does not undertake to update any forward-looking statement made in this report or that may from time to time be made by or on behalf of the Company.

PART I

Item 1. BUSINESS

Lydall, Inc. has been incorporated in Delaware since 1987 after originally being incorporated in Connecticut in 1969. The principal executive offices are located in Manchester, Connecticut. The Company’s subsidiaries design and manufacture specialty engineered filtration media, industrial thermal insulating solutions, automotive thermal and acoustical barriers, medical filtration media and devices and biopharmaceutical processing components for thermal/acoustical, filtration/separation and bio/medical applications.

Lydall serves a number of markets. The Company’s products are primarily sold directly to customers through an internal sales force and external sales representatives and distributed via common carrier. The majority of products are sold to original equipment manufacturers and tier-one suppliers. The Company competes through high-quality, specialty engineered innovative products and exceptional customer service. Lydall has a number of domestic and foreign competitors for its products, most of whom are either privately owned or divisions of larger companies, making it difficult to determine the Company’s share of the markets served.

Foreign and export sales were 49.9% of net sales in 2011, 50.7% in 2010, and 50.8% in 2009. Foreign sales were $144.5 million, $119.5 million, and $94.8 million for the years ended December 31, 2011, 2010 and 2009, respectively. Export sales primarily to Europe, Asia, Mexico and Canada were $47.0 million, $40.7 million, and $27.1 million in 2011, 2010 and 2009, respectively. The increase in foreign sales during 2011 was primarily from sales at the Company’s automotive facility in Germany, which is included in the Thermal/Acoustical segment. The increase in export sales during 2011 was primarily related to higher export sales to Asia in the Performance Materials and Thermal/Acoustical segments.

Foreign operations generated operating income of $11.9 million, $9.8 million, and $1.1 million for the years ended December 31, 2011, 2010 and 2009, respectively. Total foreign assets were $88.9 million at December 31, 2011 compared with $94.1 million at December 31, 2010.

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and Proxy Statements are made available free of charge through the Investor Relations section of the Company’s Internet website at www.lydall.com after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (the “Commission”) and are also available on the Commission’s website at www.sec.gov. Information found on these websites is not part of this Form 10-K. Additionally, the public may read and copy any materials the Company files with the Commission at the Commission’s Public Reference room located at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

SEGMENTS

The Company’s reportable segments are Performance Materials and Thermal/Acoustical. The Performance Materials segment reports the results of the Industrial Filtration, Industrial Thermal Insulation and Life Sciences Filtration businesses. The Thermal/Acoustical segment reports the results of Lydall’s automotive business, which includes Metal parts, Fiber parts and related Tooling. Other Products and Services (“OPS”) include Life Sciences Vital Fluids. For additional information regarding the Company’s reportable segments, please refer to Note 12 in the Consolidated Financial Statements included in this Annual Report.

Performance Materials Segment

The Performance Materials segment includes filtration media solutions for air, fluid power, and industrial applications (“Industrial Filtration”), air and liquid life science applications (“Life Sciences Filtration”), and industrial thermal insulation solutions for building products, appliances, and energy and industrial markets (“Industrial Thermal Insulation”).

Industrial Filtration products include LydAir® MG (Micro-Glass) Air Filtration Media, LydAir® MB (Melt Blown) Air Filtration Media, LydAir® SC (Synthetic Composite) Air Filtration Media, and Arioso™ Membrane Composite Media. These products constitute the critical media component of clean-air systems for applications in clean-space, commercial, industrial and residential HVAC, power generation, and industrial processes. Lydall has leveraged its extensive technical expertise and applications knowledge into a suite of media products covering the vast liquid filtration landscape across the engine and industrial fields. The LyPore® Liquid Filtration Media and activated carbon containing ActiPure® Filtration Media series address a variety of application needs in fluid power including hydraulic filters, air-water and air-oil coalescing, industrial fluid processes, diesel filtration and fuel filtration.

Industrial Thermal Insulation products are high performance nonwoven veils, papers, mats and specialty composites for the cryogenic, building products, appliance, and high temperature insulation markets. The Manniglas® Thermal Insulation brand is diverse in its product application ranging from high temperature seals and gaskets in ovens and ranges to specialty veils for HVAC and cavity wall insulation. appLY® Mat Needled Glass Mats have been developed to expand Lydall’s high temperature technology portfolio for broad application into the appliance market and supplements the Lytherm® Insulation Media product brand, traditionally utilized in the industrial market for kilns and furnaces used in metal processing. Lydall’s Cryotherm® Super-Insulating Media, CRS-Wrap® Super-Insulating Media and Cryo-Lite™ Cryogenic Insulation products are industry standards for state-of-the-art cryogenic insulation designs used by manufacturers of cryogenic equipment for liquid gas storage, piping, and transportation.

Life Sciences Filtration products include the LyPore® and ActiPure® Filtration Media developed to meet the requirements of life science applications including biopharmaceutical pre-filtration and clarification, diagnostic and analytical testing, respiratory protection, life protection, medical air filtration, drinking water filtration and high purity process filtration such as that found in food and beverage and medical applications. Lydall also offers Solupor® Membrane specialty microporous membranes that are utilized in various markets and applications including air and liquid filtration and transdermal drug delivery. Solupor® membranes are based on ultra-high molecular weight polyethylene and incorporate a unique combination of mechanical strength, chemical inertness, and high porosity in a unique open structure.

Net sales from the Performance Materials segment represented 34.9% of Lydall’s net sales in 2011 compared with 39.0% in 2010 and 40.9% in 2009. Net sales generated by the international operations of the Performance Materials segment accounted for 29.8% of segment net sales in 2011, 2010 and 2009.

Thermal/Acoustical Segment

The Thermal/Acoustical segment offers a full line of innovative engineered products to assist in noise and heat abatement within the transportation sector. Lydall products are found in the interior (dash insulators), underbody (wheel well, fuel tank, exhaust) and under hood (engine compartment) of cars, trucks, SUV’s, heavy duty trucks and recreational vehicles. Lydall’s patented products include ZeroClearance®, AMS®, Flexshield® and dBCore® comprised of organic and inorganic fiber composites (fiber parts) as well as metal combinations (metal parts).

Thermal/Acoustical segment net sales represented 61.7% of the Company’s net sales in 2011, 56.6% in 2010 and 53.3% in 2009. Net sales generated by international operations of the Thermal/Acoustical segment accounted for 44.2%, 46.2% and 51.4% of segment net sales in 2011, 2010 and 2009, respectively.

Other Products and Services

The Life Sciences Vital Fluids business offers specialty products for blood filtration devices, blood transfusion single-use containers and bioprocessing single-use containers and products for containment of media, buffers and bulk intermediates used in biotech, pharmaceutical and diagnostic reagent manufacturing processes.

OPS net sales were 3.8% of the Company’s net sales in 2011 compared with 4.9% in 2010 and 6.1% in 2009.

GENERAL BUSINESS INFORMATION

Lydall holds a number of patents, trademarks and licenses. While no single patent, trademark or license is critical to the success of Lydall, together these intangible assets are of considerable value to the Company.

The Company’s business is generally not seasonal; however, results of operations are impacted by shutdowns at its domestic operations and European operations as a result of customer shutdowns in North America and Europe that typically occur in the third and fourth quarters of each year. Lydall maintains levels of inventory and grants credit terms that are normal within the industries it serves. The Company uses a wide range of raw materials in the manufacturing of its products, including aluminum and other metals to manufacture most of its automotive heat shields and various fibers in its Performance Materials and Thermal/Acoustical segments. The majority of raw materials used are generally available from a variety of suppliers.

Sales to Ford Motor Company accounted for 16.2%, 11.1% and 10.0% of Lydall’s net sales in the years ended December 31, 2011, 2010 and 2009, respectively. No other customer accounted for more than 10% of Lydall’s net sales in such years.

The Company invested $8.1 million in 2011, $8.5 million in 2010 and $7.9 million in 2009, or approximately 2% in 2011 and 3% in 2010 and 2009, of net sales, in research and development to develop new products and to improve existing products. All amounts were expensed as incurred. Most of the investment in research and development is application specific. There were no significant customer-sponsored research and development activities during the past three years.

Backlog at January 31, 2012 was $52.9 million. Lydall’s backlog was $48.3 million at December 31, 2011, $47.4 million at December 31, 2010 and $22.6 million at December 31, 2009. Thermal/Acoustical segment backlog, comprising the global automotive business,was $38.0 million, $35.4 million and $12.2 million at December 31, 2011, 2010 and 2009, respectively. Thermal/Acoustical segment backlog may be impacted by various assumptions, including future automotive production volume estimates, changes in program launch timing and changes in customer development plans. The Company believes that global automotive orders for a two month period represent a reasonable timeframe to be deemed as firm orders and included as Thermal/Acoustical segment backlog.There are minimal seasonal aspects to Lydall’s backlog.

No material portion of Lydall’s business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of any governmental body.

Lydall believes that its plants and equipment are in substantial compliance with applicable federal, state and local provisions that have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment.

As of December 31, 2011, Lydall employed approximately 1,600 people. Four unions with contracts expiring on March 31, 2012 represent approximately 70 employees in the United States. All employees at the facilities in France and the Netherlands are covered under a National Collective Bargaining Agreement. Certain salaried and all hourly employees in Germany are also covered under a National Collective Bargaining Agreement. Lydall considers its employee relationships to be satisfactory and did not have any actual or threatened work stoppages due to union-related activities in 2011.

There are no significant anticipated operating risks related to foreign investment law, expropriation, or availability of material, labor or energy. The foreign and domestic operations limit foreign currency exchange transaction risk by completing transactions in functional currencies whenever practical or through the use of foreign currency forward exchange contracts when deemed appropriate.

Item 1A. RISK FACTORS

The reader should carefully review and consider the risk factors discussed below. Any and all of these risk factors could materially affect the Company’s business, financial condition, future results of operations or cash flows and possibly lead to a decline in Lydall’s stock price. The risks, uncertainties and other factors described below constitute all material risk factors known to management as of the date of this report.

Uncertainty in the global economy may continue to negatively impact Lydall’s business – Uncertainty in the global economy has, and could continue to adversely affect demand for the Company’s products and impact profitability. Among other factors, disruptions in the global credit and financial markets, including diminished liquidity and credit availability, swings in consumer confidence and spending, unstable economic growth and fluctuations in unemployment rates has caused economic instability that had, and could continue to have a negative impact on the Company’s results of operations, financial condition and liquidity and make it difficult to accurately forecast and plan future business activities.

The global economy is volatile, affected in part by the risk of debt default by certain European countries. The Company’s foreign and export sales were 49.9% of net sales in 2011, 50.7% in 2010 and 50.8% in 2009. If the global economy were to take a significant downturn, depending on the length, duration and severity of such downturn, the Company’s business and financial statements could be adversely affected.

The Company’s Thermal/Acoustical segment is tied to general economic and automotive industry conditions– The Company’s Thermal/Acoustical segment, a supplier in the automotive market, accounted for approximately 62% of consolidated net sales in 2011. Approximately 56% of segment net sales were from products manufactured in North America and 44% were manufactured in Europe. This segment is tied to general economic and automotive industry conditions as demand for vehicles depends largely on the strength of the economy, employment levels, consumer confidence levels, the availability and cost of credit and the cost of fuel. These factors have had and could continue to have a substantial impact on the business. Adverse developments could reduce demand for new vehicles, causing Lydall’s customers to reduce their vehicle production in North America and Europe and, as a result, demand for Company products would be adversely affected.

The Company’s quarterly operating results may fluctuate. As a result, the Company may fail to meet or exceed the expectations of research analysts or investors, which could cause our stock price to decline– The Company’s quarterly results are subject to significant fluctuations. Operating results have fluctuated as a result of many factors, including size and timing of orders and shipments, loss of significant customers, product mix, technological change, operational efficiencies and inefficiencies, competition, changes in deferred tax asset valuation allowances and general economic conditions. In addition, lower revenues may cause asset utilization to decrease, resulting in the under absorption of the Company’s fixed costs, which could negatively impact gross margins. Additionally, the Company’s gross margins vary among its product groups and have fluctuated from quarter to quarter as a result of shifts in product mix. Any and all of these factors could affect the Company’s business, financial condition, future results of operations or cash flows and possibly lead to a decline in Lydall’s stock price.

Implementation of our strategic initiatives may not be successful – As part of Lydall’s business strategy, the Company continues to review various strategic and business opportunities to grow the business and to assess the profitability and growth potential for each of its existing businesses. The Company cannot predict with certainty whether any recent or future strategic transactions will be beneficial to the Company. Future performance could be impacted by the Company’s ability to:

| · | Identify and effectively complete strategic transactions; |

| · | Obtain adequate financing to fund strategic initiatives, which could be difficult to obtain; and |

| · | Successfully integrate and manage acquired businesses that involve numerous operational and financial risks, including difficulties in the integration of acquired operations, diversion of management's attention from other business concerns, managing assets in multiple geographic regions and potential loss of key employees and key customers of acquired operations. |

Future performance may also be impacted by the Company’s ability to improve operating margins under its Lean Six Sigma initiatives. The Lean Six Sigma program is intended to improve processes and work flow, improve customer service, reduce costs and leverage synergies across the Company to improve operating margins.

In order to meet its strategic objectives, the Company may also divest assets and/or businesses. Successfully executing such a strategy depends on various factors, including effectively transferring assets, liabilities, contracts, facilities and employees to any purchaser, identifying and separating the intellectual property to be divested from the intellectual property that the Company wishes to retain, reducing or eliminating fixed costs previously associated with the divested assets or business, and collecting the proceeds from any divestitures.

Raw material pricing and supply issues could affect all of the Company’s businesses–The Thermal/Acoustical segment uses aluminum and other metals to manufacture most of its automotive heat shields. The Thermal/Acoustical and Performance Materials segments use various fibers in manufacturing products. If the prices of these raw materials, or any other raw materials, increase, the Company may not have the ability to pass incremental cost increases on to its customers. In addition, an interruption in the ability of the Company to source materials could negatively impact operations and sales.

If the Company’s goodwill or other intangible assets become impaired, it may be required to record a significant charge to earnings –The Company reviews its intangible assets, including goodwill, for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is also tested by the Company for impairment during the fourth quarter of each year. Factors that may be considered a change in circumstances, indicating that the carrying value of goodwill or amortizable intangible assets may not be recoverable, include, but are not limited to, a decline in the Company’s stock price and market capitalization, reduced future cash flow estimates, and slower growth rates. The Company’s most recent review of goodwill for potential impairment determined that the Life Sciences Vital Fluids reporting unit, with $4.7 million of goodwill, had excess fair value over its carrying value of approximately 4%. Lydall’s results of operations could be adversely affected if the Company is required to record a charge to earnings in its Consolidated Financial Statements because of impairment of its goodwill or other intangible assets.

The Company’s ability to accurately report its financial results may be adversely affected by the lack of effective internal controls and procedures – At December 31, 2011, the Company had a material weakness in internal control over financial reporting. In connection with the preparation and filing of the third quarter 2011 Form 10-Q, the Company’s Chief Executive Officer and Chief Financial Officer concluded thatthe disclosure controls and procedures were not effective as of September 30, 2011 because of a material weakness in its internal control over financial reporting related to the accounting for income taxes associated with a foreign subsidiary. This matter is more fully described in Item 4 of the Form 10-Q filed on November 8, 2011. As described in Item 9A of this Annual Report on Form 10-K, management believes that at December 31, 2011, enhancements have been made to strengthen the disclosure controls and procedures.Because the reliability of the internal control process requires repeatable execution, the successful remediation of this material weakness will require review and evidence of effectiveness prior to management concluding that the controls are now effective. Some of the enhancements that have been implemented by management in the fourth quarter of 2011 have not been in place for a sufficient period of time to demonstrate that their effectiveness is sustainable. Until management is able to ensure the effectiveness of the Company’s disclosure controls and procedures, the material weakness may materially adversely affect the Company’s ability to report accurately its financial information in a timely and reliable manner.

Volatility in the securities markets, interest rates, and other factors could substantially increase Lydall’s costs and funding for its domestic defined benefit pension plan –The Company’s domestic defined benefit pension plan is funded with trust assets invested in a diversified portfolio of securities. Changes in interest rates, mortality rates, investment returns, and the market value of plan assets may affect the funded status and cause volatility in the net periodic benefit cost and future funding requirements. A significant increase in benefit plan liabilities or future funding requirements could have a negative impact on the Company’s financial statements.

The Company is involved with certain legal proceedings and may become involved in future legal proceedings all of which could give rise to liability–The Company is involved in legal proceedings that, from time to time, may be material. These proceedings may include, without limitation, commercial or contractual disputes, intellectual property matters, personal injury claims, shareholder claims, and employment matters. No assurances can be given that such proceedings and claims will not have a material adverse impact on the Company’s financial statements.

Changes in tax rates and exposure to additional income tax liabilities– The Company is subject to risks with respect to changes in tax law and rates, changes in rules related to accounting for income taxes, or adverse outcomes from tax audits that may be in process in any of the jurisdictions in which the Company operates. In addition, certain jurisdictions have statutory rates greater than or less than the United States statutory rate. Changes in the mix and source of earnings between jurisdictions could have a significant impact on Lydall’s overall effective tax rate.

Realization of deferred tax assets is not assured–The Company maintains valuation allowances against certain deferred tax assets where realization is not reasonably assured. The Company evaluates the likelihood of the realization of all deferred tax assets and reduces the carrying amount to the extent it believes a portion will not be realized. Changes in these assessments can result in an increase or reduction to valuation allowances on deferred tax assets and could have a significant impact on the Company’s overall effective tax rate.

The Company’s future success depends upon its ability to continue to innovate, improve its products, develop and market new products, and identify and enter new markets– Improved performance and growth are partially dependent on new product introductions planned for the future. Delays in developing products and long customer qualification cycles may impact the success of new product programs. The degree of success of new product programs could impact the Company’s future results.

The Company’s international operations expose it to business, economic, political, legal and other risks– The Company believes that in order to be competitive and grow its businesses, it needs to maintain significant international operations. Foreign sales were $144.5 million, $119.5 million and $94.8 million in 2011, 2010 and 2009, respectively. International operations are subject to inherent risks including political and economic conditions in various countries, unexpected changes in regulatory requirements, longer accounts receivable collection cycles and potentially adverse tax consequences.

Foreign currency exchange rate fluctuations may affect the Company’s results of operations – The Company’s primary currency exposure is to the Euro. The Company’s foreign and domestic operations seek to limit foreign currency exchange transaction risk by completing transactions in functional currencies whenever practical or through the use of foreign currency forward exchange contracts when deemed appropriate. If the Company does not successfully hedge its currency exposure, changes in the rate of exchange between these currencies and the U.S. dollar may negatively impact the Company. Additionally, translation of the results of operations and financial condition of its foreign operations into U.S. dollars may be affected by exchange rate fluctuations. The Company receives a material portion of its revenue from foreign operations.

The Company’s manufacturing processes are subject to inherent risk–The Company operates a number of manufacturing facilities and relies upon an effective workforce and properly performing machinery and equipment. The workforce may experience a relatively high turnover rate, causing inefficiencies associated with retraining and rehiring. The equipment and systems necessary for such operations may break down, perform poorly or fail, possibly causing higher manufacturing costs. Manufacturing processes affect the Company’s ability to deliver quality products on a timely basis, and delays in delivering products to customers could result in the Company incurring penalties from customers.

Increases in energy pricing can affect all of the Company’s businesses –Higher energy costs at the Company’s manufacturing plants or higher energy costs passed on from the Company’s vendors could impact the Company’s profitability.

The Company’s resources are limited and may impair its ability to capitalize on changes in technology, competition and pricing– The industries in which Lydall sells its products are highly competitive and many of the competitors are affiliated with entities that are substantially larger and that have greater financial, technical and marketing resources. The Company’s more limited resources and relatively diverse product mix may limit or impair its ability to capitalize on changes in technology, competition and pricing.

The Company’s products may fail to perform as expected, subjecting it to warranty or other claims from its customers–If such failure results in, or is alleged to result in, bodily injury and/or property damage or other losses, the Company may be subject to product liability lawsuits, FDA product recalls and other claims, any of which could have a material adverse impact on results of operations and cash flows.

If Lydall does not retain its key employees, the Company’s ability to execute its business strategy could be adversely affected– The Company’s success, in part, depends on key managerial, engineering, sales and marketing and technical personnel and its ability to continue to attract and retain additional personnel. The loss of certain key personnel could have a material, adverse effect upon the Company's business and results of operations. There is no assurance that Lydall can retain its key employees or that it can attract competent and effective new or replacement personnel in the future.

The Company’s current reserve levels may not be adequate to cover potential exposures–Estimates and assumptions may affect the reserves that the Company has established to cover uncollectible accounts receivable, excess or obsolete inventory, income tax valuation and fair market value write downs of certain assets and various liabilities. Actual results could differ from those estimates.

The Company is subject to environmental laws and regulations, that could increase its expense and affect operating results– The Company is subject to federal, state, local, and foreign environmental, health and safety laws and regulations that affect operations. New and changing environmental laws and regulations may impact the products manufactured by Lydall and sold to customers. In order to maintain compliance with such laws and regulations, Lydall must devote significant resources and maintain and administer adequate policies, procedures and oversight. Should the Company fail to do these things, it could be negatively impacted by lower net sales, fines, legal costs, and clean-up requirements.

The Company may be unable to adequately protect its intellectual property, which may limit its ability to compete effectively–Lydall owns intellectual property, including patents and trademarks, which play an important role in helping the Company to maintain its competitive position in a number of markets. The Company is subject to risks with respect to (i) changes in the intellectual property landscape of markets in which it competes; (ii) the potential assertion of intellectual property-related claims against Lydall; (iii) the failure to maximize or successfully assert its intellectual property rights; and (iv) significant technological developments by others.

Disruptions may occur to the Company’s operations relating to information technology – The capacity, reliability and security of the Company’s information technology hardware and software infrastructure and the ability to expand and update this infrastructure in response to the Company’s changing needs are important to the operation of the businesses.In response to a review of its IT infrastructure, the Company has undertaken a project to upgrade its ERP system. The deployment, implementation and integration to a new version of its ERP system may not be managed in an efficient, timely and cost effective manner resulting in greater than anticipated costs and other operating difficulties. Also, any inadequacy, interruption, loss of data, integration failure or security failure of the Company’s technology could harm Lydall’s ability to effectively operate its business, which could adversely impact the Company’s results of operations and cash flows.

The Company could be subject to work stoppages or other business interruptions as a result of its unionized work force –A portion of the Company’s hourly employees are represented by various union locals and covered by collective bargaining agreements. These agreements contain various expiration dates and must be renegotiated upon expiration. Specifically, four union contracts expiring on March 31, 2012 represent approximately 70 employees in the United States. If the Company is unable to negotiate any of its collective bargaining agreements on satisfactory terms prior to expiration, the Company could experience disruptions in its operations which could have a material adverse effect on operations.

The Company may not have adequate cash to fund its operating requirements – The principal source of the Company’s liquidity is operating cash flows. In addition to operating cash flows, other significant factors that affect the overall management of liquidity include capital expenditures, investments in businesses, acquisitions, income tax payments, pension funding, outcomes of contingencies and availability of lines of credit and long-term financing. The Company’s liquidity can be impacted by the Company’s ability to:

| · | Manage working capital and the level of future profitability. The consolidated cash balance is impacted by capital equipment and inventory investments that may be made in response to changing market conditions; |

| · | Satisfy covenants and other obligations under its Domestic Credit Facility, which could limit or prohibit Lydall’s ability to borrow funds. Additionally, these debt covenants and other obligations could limit the Company’s ability to make acquisitions, incur additional debt, make investments, or consummate asset sales; and |

| · | Obtain additional financing from other sources. |

Item 1B. UNRESOLVED STAFF COMMENTS

None

Item 2. PROPERTIES

The principal properties of the Company as of December 31, 2011 are situated at the following locations and have the following characteristics:

| Location | | Primary Business Segment/General Description | | Type of Interest |

| Hamptonville, North Carolina | | Thermal/Acoustical – Product Manufacturing | | Owned |

| Yadkinville, North Carolina | | Thermal/Acoustical – Product Manufacturing | | Leased |

| Meinerzhagen, Germany | | Thermal/Acoustical – Product Manufacturing | | Owned |

| Saint-Nazaire, France | | Thermal/Acoustical – Product Manufacturing | | Leased |

| Green Island, New York | | Performance Materials – Specialty Media Manufacturing | | Owned |

| Rochester, New Hampshire | | Performance Materials – Specialty Media Manufacturing | | Owned |

| Saint-Rivalain, France | | Performance Materials – Specialty Media Manufacturing | | Owned |

| Geleen, the Netherlands | | Performance Materials – Specialty Media Manufacturing | | Leased |

| Heerlen, the Netherlands | | Performance Materials – Specialty Media Manufacturing | | Leased |

Winston-Salem, North Carolina | | Other Products and Services – Biomedical Products Manufacturing | | Leased |

| Manchester, Connecticut | | Corporate Office | | Owned |

For additional information regarding lease obligations, see Note 15 to the Consolidated Financial Statements. Lydall considers its properties to be in good operating condition and suitable and adequate for its present needs. In addition to the properties listed above, the Company has several leases for sales offices and warehouses in the United States, Europe and Asia. During 2011, the Company sold its Affinity business which included a facility owned in Ossipee, New Hampshire. The Company’s leased manufacturing facility in Yadkinville, North Carolina expires in March 2013.

Item 3. LEGAL PROCEEDINGS

The Company is, from time to time, subject to governmental audits, proceedings and various litigation relating to matters incidental to its business, including product liability and environmental claims. While the outcome of current matters cannot be predicted with certainty, management, after reviewing such matters and consulting with the Company’s internal and external counsel and considering any applicable insurance or indemnification, does not expect any liability that may ultimately be incurred will materially affect the consolidated financial position, results of operations or cash flows of the Company.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

The executive officers of Lydall, Inc. or its subsidiaries, together with the offices presently held by them, their business experience since January 1, 2007, and their age as of March 1, 2012, the record date of the Company’s 2012 Annual Meeting, are as follows:

| Name | | Age | | Position and Date of Initial

Employment | | Other Business Experience Since 2007 |

| Dale G. Barnhart | | 59 | | President, Chief Executive Officer (August 27, 2007) | | Chief Executive Officer, Synventive Molding Solutions (March 2005 - August 2007), a provider of hot runner systems, machine nozzles, temperature controllers and sprue bushings for the injection molding industry. |

| | | | | | | |

| Erika H. Steiner (formerly Turner) | | 56 | | Vice President, Chief Financial Officer and Treasurer (November 4, 2009) | | Chief Financial Officer, Superior Industries International (February 2008 – November 2009), a manufacturer of aluminum road wheels for sale to original equipment manufacturers; Chief Financial Officer and Vice President of Finance, Monogram Systems (July 2004 - February 2008), a supplier of cabin systems and equipment to the global aerospace industry. |

| | | | | | | |

| Mona G. Estey | | 57 | | Vice President, Human Resources (July 1, 2000); formerly Director, Human Resources (September 1, 1986) | | Not applicable |

| | | | | | | |

| Paul G. Igoe | | 49 | | Vice President, General Counsel and Secretary (October 14, 2009) | | Associate General Counsel and Assistant Corporate Secretary, Teradyne, Inc. (June 2001 - September 2009), a supplier of automatic test equipment for the semiconductor industry. |

| | | | | | | |

| James V. Laughlan | | 39 | | Chief Accounting Officer and Controller (March 29, 2010); formerly Principal Accounting Officer and Controller (December 4, 2007); formerly Controller (October 17, 2005) | | Not applicable |

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

PRICE RANGE OF COMMON STOCK AND DIVIDEND HISTORY

The Company’s Common Stock is traded on the New York Stock Exchange (“NYSE”) under the symbol LDL. The table below shows the range of reported sale prices on the NYSE Composite Tape for the Company’s Common Stock for the periods indicated. As of December 31, 2011, 5,113 stockholders of record held 17,147,629 shares of Lydall’s Common Stock, $.10 par value.

| | | High | | | Low | | | Close | |

| 2011 | | | | | | | | | | | | |

| First Quarter | | $ | 9.36 | | | $ | 7.28 | | | $ | 8.89 | |

| Second Quarter | | | 12.04 | | | | 8.55 | | | | 11.96 | |

| Third Quarter | | | 12.50 | | | | 7.51 | | | | 8.90 | |

| Fourth Quarter | | | 11.70 | | | | 7.75 | | | | 9.49 | |

| | | | | | | | | | | | | |

| 2010 | | | | | | | | | | | | |

| First Quarter | | $ | 8.56 | | | $ | 5.21 | | | $ | 7.85 | |

| Second Quarter | | | 9.36 | | | | 7.22 | | | | 7.64 | |

| Third Quarter | | | 8.21 | | | | 6.51 | | | | 7.36 | |

| Fourth Quarter | | | 9.04 | | | | 6.91 | | | | 8.05 | |

The Company does not pay a cash dividend on its Common Stock. The Company’s Domestic Credit Facility, entered into on June 16, 2011, does not place any restrictions on cash dividend payments, so long as the payments do not place the Company in default.

The following table provides information about the Company’s Common Stock that may be issued upon exercise of options and rights under all of the Company’s existing equity compensation plans at December 31, 2011. The number of securities remaining available for issuance at December 31, 2011 was 397,723 and includes 352,812 shares that may be issued as restricted stock, performance shares and other stock awards.

| Plan Category | | Number of

securities to be

issued upon

exercise of

outstanding

options,

warrants and

rights

(a) | | | Weighted

average exercise

price of

outstanding

options,

warrants and

rights

(b) | | | Number of securities

remaining available

for issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

(c) | |

| Equity compensation plans approved by security holders | | | 1,281,888 | | | $ | 6.51 | | | | 397,723 | |

| Equity compensation plans not approved by security holders | | | - | | | | - | | | | - | |

| Total | | | 1,281,888 | | | $ | 6.51 | | | | 397,723 | |

ISSUER PURCHASES OF EQUITY SECURITIES

In August 2003, the Company’s Board of Directors approved a Stock Repurchase Program (“Repurchase Program”) to mitigate the potentially dilutive effects of stock options and shares of restricted and unrestricted stock granted by the Company. Under the Repurchase Program, shares may be purchased by the Company up to the quantity of shares underlying options and other equity-based awards granted under shareholder approved plans.

As of December 31, 2011, there were 2,501,830 shares remaining available for purchase under the Repurchase Program. There was no repurchase activity under the Repurchase Program during 2011. The 22,371 shares acquired by the Company during the quarter ended December 31, 2011 represent shares withheld by the Company pursuant to provisions in agreements with recipients of restricted stock granted under the Company’s equity compensation plans allowing the Company to withhold the number of shares having fair value equal to each recipient’s tax withholding due. The following table details the activity for the fourth quarter ended December 31, 2011.

| Period | | Total Number

of Shares

Purchased | | | Average Price

per Share | | | Total Number

of Shares

Purchased as

Part of a

Publicly

Announced

Program | | | Maximum

Number of

Shares Remaining

Available for

Purchase Under the

Plans or Programs | |

| Activity October 1, 2011 - October 31, 2011 | | | 1,658 | | | $ | 10.99 | | | | — | | | | 2,311,051 | |

| Activity November 1, 2011 - November 30, 2011 | | | 830 | | | $ | 11.46 | | | | — | | | | 2,311,051 | |

| Activity December 1, 2011 - December 31, 2011 | | | 19,883 | | | $ | 8.69 | | | | — | | | | 2,501,830 | |

| Total | | | 22,371 | | | $ | 8.96 | | | | — | | | | 2,501,830 | |

Unregistered Sales of Equity Securities

Lydall sponsored an Employee Stock Purchase Plan (the “Plan”) that provided a method by which participating employees used voluntary, systematic payroll deductions to purchase shares of Lydall Common Stock in open-market purchase transactions effectuated by a broker. The Plan was suspended by the Company on February 25, 2010 and no shares have been purchased for participants since February 1, 2010. The Plan included a Company matching contribution feature, pursuant to which the Company contributed an amount equal to 33 and 1/3 cents for each dollar contributed by a participating employee, up to a maximum of $150 per month. The broker accumulated the contributions and purchased shares of Company stock for participants in open market transactions on a monthly basis. The Company received no proceeds from the transactions. Nevertheless, because the Plan included a matching contribution feature, the Company may have been required to register the transactions under the Securities Act of 1933, and for many years, the Company prepared and filed appropriate registration statements on Form S-8. In connection with the preparation and filing of the Company’s 2009 Annual Report on Form 10-K, the Company concluded that a new registration statement should have been filed with respect to the Plan a number of years ago. During 2010 and 2009, an aggregate of approximately 89,000 shares of Company stock were acquired by participating employees pursuant to the Plan without having been registered. Because the transactions were not registered, certain Plan participants may have a right to rescind their transactions. Based on Lydall’s current stock price, the Company does not believe that any liability for rescission would be material to the Company’s consolidated financial position, results of operations or cash flows.

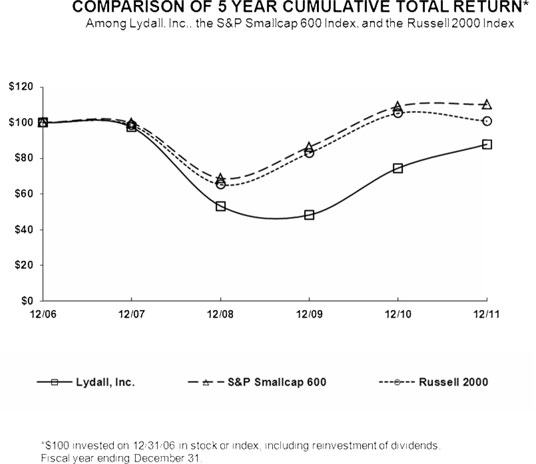

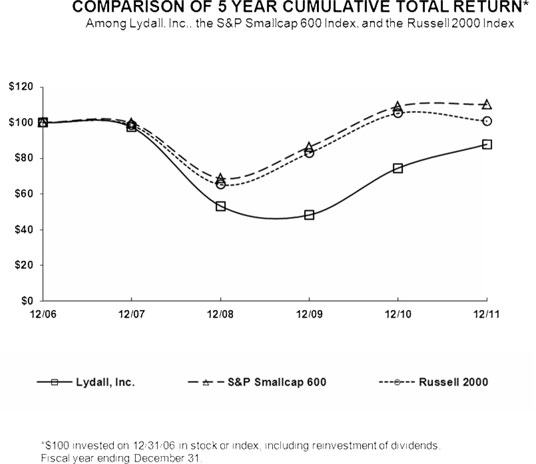

PERFORMANCE GRAPH

The following graph compares the cumulative total return on Lydall’s shares over the past five years with the cumulative total return on shares of companies comprising the Standard & Poor’s Smallcap 600 Index and the Russell 2000 Index. Cumulative total return is measured assuming an initial investment of $100 on December 31, 2006, including reinvestment of dividends. Due to the diversity of niche businesses that the Company participates in, it is difficult to identify a reasonable peer group or one industry or line-of-business index for comparison purposes. Thus, Lydall has chosen to compare its performance to the Standard & Poor’s Smallcap 600 Index and to the Russell 2000 Index, which are comprised of issuers with generally similar market capitalizations to that of the Company.

| | | 12/06 | | | 12/07 | | | 12/08 | | | 12/09 | | | 12/10 | | | 12/11 | |

| | | | | | | | | | | | | | | | | | | |

| Lydall, Inc. | | $ | 100.00 | | | $ | 97.32 | | | $ | 53.19 | | | $ | 48.20 | | | $ | 74.47 | | | $ | 87.79 | |

| S&P Smallcap 600 | | $ | 100.00 | | | $ | 99.70 | | | $ | 68.72 | | | $ | 86.29 | | | $ | 108.99 | | | $ | 110.10 | |

| Russell 2000 | | $ | 100.00 | | | $ | 98.43 | | | $ | 65.18 | | | $ | 82.89 | | | $ | 105.14 | | | $ | 100.75 | |

Item 6. SELECTED FINANCIAL DATA

FIVE-YEAR SUMMARY

| | | | | | Revised | | | Revised | | | Revised | | | Revised | |

| In thousands except per share amounts and ratio data | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Financial results from continuing operations | | | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 383,588 | | | $ | 316,113 | | | $ | 239,732 | | | $ | 290,612 | | | $ | 299,014 | |

| Income (loss) from continuing operations | | $ | 9,047 | | | $ | 1,899 | | | $ | (13,165 | ) | | $ | (1,581 | ) | | $ | 8,611 | |

| Common stock per share data | | | | | | | | | | | | | | | | | | | | |

| Diluted income (loss) from continuing operations | | $ | 0.54 | | | $ | 0.11 | | | $ | (0.79 | ) | | $ | (0.10 | ) | | $ | 0.52 | |

| Diluted income (loss) from discontinued operations | | $ | 0.28 | | | $ | 0.04 | | | $ | (0.10 | ) | | $ | (0.23 | ) | | $ | (0.01 | ) |

| Diluted net income (loss) | | $ | 0.82 | | | $ | 0.16 | | | $ | (0.89 | ) | | $ | (0.32 | ) | | $ | 0.51 | |

| Financial position | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 235,185 | | | $ | 230,738 | | | $ | 223,083 | | | $ | 234,944 | | | $ | 258,159 | |

| Long-term debt, net of current maturities | | $ | 2,261 | | | $ | 3,392 | | | $ | 5,220 | | | $ | 6,699 | | | $ | 8,377 | |

| Total stockholders’ equity | | $ | 160,852 | | | $ | 154,145 | | | $ | 155,179 | | | $ | 165,173 | | | $ | 179,760 | |

| Property, plant and equipment | | | | | | | | | | | | | | | | | | | | |

| Net property, plant and equipment | | $ | 78,939 | | | $ | 88,236 | | | $ | 93,419 | | | $ | 101,592 | | | $ | 107,231 | |

| Capital expenditures | | $ | 8,884 | | | $ | 12,001 | | | $ | 5,921 | | | $ | 12,037 | | | $ | 14,610 | |

| Depreciation | | $ | 13,625 | | | $ | 13,650 | | | $ | 14,923 | | | $ | 15,867 | | | $ | 15,171 | |

| Performance and other ratios | | | | | | | | | | | | | | | | | | | | |

| Gross margin | | | 17.6 | % | | | 17.0 | % | | | 13.8 | % | | | 21.4 | % | | | 23.6 | % |

| Operating margin | | | 4.2 | % | | | 1.1 | % | | | (6.4 | )% | | | (0.8 | )% | | | 5.4 | % |

| Total debt to total capitalization | | | 2.0 | % | | | 3.1 | % | | | 4.2 | % | | | 4.7 | % | | | 5.2 | % |

Please read Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operations) and the Notes to the Consolidated Financial Statements for specific changes in the Company and its markets that provide context to the above data for the years 2009 through 2011, including without limitation discussions concerning (i) how global economic uncertainties have affected the Company’s results; (ii) business combinations and dispositions of business operations; and (iii) restructuring related charges. In 2008, changes in the Company that provide context to the above data include the recording of pretax impairment charges related to goodwill and long-lived assets of $17.4 million, or $0.66 per diluted share, and pretax restructuring related charges associated with the North American automotive consolidation of $1.6 million, or $0.06 per diluted share.

On June 29, 2011, the Company sold its Affinity business for $15.2 million in cash. Affinity designed and manufactured high precision, specialty engineered temperature-control equipment for semiconductor, pharmaceutical, life sciences and industrial applications. The Company recorded a gain on sale, net of transaction costs and income taxes, of $3.9 million. The Consolidated Financial Statements have been retroactively restated to reflect Affinity as a discontinued operation for all periods presented.

As disclosed in the Company’s Form 10-Q for the period ended September 30, 2011 and Note 2 to the Consolidated Financial Statements in this Form 10-K, the Company has revised prior period results for the years ended 2010, 2009, 2008, and 2007 to correct errors in accounting for income taxes associated with dividends from a foreign subsidiary. Please read Note 2 to the Consolidated Financial Statements for the impact to 2010 and 2009. The revision resulted in a decrease to retained earnings of $1.0 million and $0.6 million as of December 31, 2008 and December 31, 2007, respectively.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview and Outlook

Lydall, Inc. and its subsidiaries (collectively, the “Company” or “Lydall”) design and manufacture specialty engineered filtration media, industrial thermal insulating solutions, automotive thermal and acoustical barriers, medical filtration media and devices and biopharmaceutical processing components for filtration/separation, thermal/acoustical, and bio/medical applications. Lydall principally conducts its business through two reportable segments: Performance Materials and Thermal/Acoustical, with sales globally.

The Performance Materials segment includes filtration media solutions for air, fluid power, and industrial applications (“Industrial Filtration”), air and liquid life science applications (“Life Sciences Filtration”), and industrial thermal insulation solutions for building products, appliances, and energy and industrial markets (“Industrial Thermal Insulation”).

The Thermal/Acoustical segment offers a full line of innovative engineered products to assist in noise and heat abatement within the transportation sector. Lydall products are found in the interior (dash insulators), underbody (wheel well, fuel tank, exhaust) and under hood (engine compartment) of cars, trucks, SUV’s, heavy duty trucks and recreational vehicles. Lydall’s patented products include organic and inorganic fiber composites (fiber parts) as well as metal combinations (metal parts).

Included in OPS is the Life Sciences Vital Fluids business. Life Sciences Vital Fluids offers specialty products for blood filtration devices, blood transfusion single-use containers and bioprocessing single-use containers and products for containment of media, buffers and bulk intermediates used in biotech, pharmaceutical and diagnostic reagent manufacturing processes.

On June 29, 2011, the Company sold its Affinity business. Affinity designed and manufactured high precision, specialty engineered temperature-control equipment for semiconductor, pharmaceutical, life sciences and industrial applications. The Consolidated Financial Statements have been retroactively restated to reflect Affinity as a discontinued operation for all periods presented.

Highlights

Below are financial highlights comparing Lydall’s 2011 results to its 2010 results:

| · | Consolidated net sales increased by $67.5 million, or 21.3%, to a record annual amount of $383.6 million; |

| · | Gross margin increased to 17.6% compared to 17.0%; |

| · | Selling, product development and administrative expenses as a percentage of net sales decreased from 16.7% to 13.8%, or 290 basis points; |

| · | Consolidated operating income from continuing operations was $16.2 million, or 4.2% of net sales, compared to $3.5 million, or 1.1% of net sales; |

| · | Income from discontinued operations, net of tax, was $4.7 million (including gain on sale of $3.9 million) compared to $0.7 million; |

| · | Net income was $13.8 million (including gain on sale of $3.9 million), or $0.82 per diluted share, compared to $2.6 million, or $0.16 per diluted share; |

| · | Cash and short-term term investments were $42.9 million at December 31, 2011 compared to $25.0 million at December 31, 2010. |

Operational and Financial Overview

Lydall reported record net sales in 2011 of $383.6 million and its highest operating income from continuing operations since 2007. Sales growth was reported in both the Performance Materials and Thermal/Acoustical segments. The improvement in operating income was primarily attributable to the Thermal/Acoustical segment due to an increase in net sales of $57.7 million, or 32.2%, and operating income improvement of $12.4 million. Contributing to this increase was the implementation ofacomprehensive plan which began to improve the financial results for fiber automotive parts in the Thermal/Acoustical segment.

The Company closely managed its selling, product development and administrative expenses in 2011, reporting 13.8% as a percentage of net sales compared to 16.7% in 2010. Expenses were essentially flat in 2011 compared to 2010 as increased selling costs as a result of higher net sales were offset by lower administrative expenses.

During 2011, the Company continued to evaluate the fit and growth potential of its existing businesses. During the second quarter of 2011, the Company divested of its Affinity business, previously included in OPS, and recorded a gain on sale of $3.9 million, net of tax. In 2012, the Company will continue to evaluate each of its businesses for growth potential and its ability to maximize shareholder value.

Lydall ended 2011 with cash and cash equivalents and short-term investments of $42.9 million compared to $25.0 million at December 31, 2010. Other than capital lease obligations, the Company does not have any significant debt outstanding. The Company is selective in making capital investments and invests in equipment to support strategic growth markets as well as improving the Company’s manufacturing efficiency.

Performance Materials Segment

The Performance Materials segment reported record net sales of $134.1 million in 2011, which represented an increase of 8.9% from 2010, and operating income of $18.2 million, or 13.6% of net sales, compared to operating income of $17.2 million, or 14.0% of net sales in 2010. Included in 2011 and 2010 operating income was $1.6 million and $2.5 million, respectively, of gain recognized from the 2010 sale of the electrical papers product line and services provided by the Company under a license agreement associated with that sale. Excluding this gain in both periods, operating margin in 2011 was 12.4% compared to 11.9% in 2010.This increase was primarily a result of a reduction in selling, product development and administrative expenses as a percentage of net sales as gross margin in 2011 remained essentially flat compared to 2010.

This segment is comprised of the industrial filtration, industrial thermal insulation and life sciences filtration businesses which all reported increased net sales in 2011 compared to 2010. These businesses are in markets that the Company believes present long-term growth opportunities through expansion of existing products and through strategic transactions. Although the segment reported record net sales in 2011, backlog at December 31, 2011 was at levels below December 31, 2010 due to a general leveling off of demand, following peak net sales in the first half of 2011. In Europe and Asia, beginning in September 2011, demand for the Company’s filtration media from filtration OEMs was lower as OEMs cautiously manage inventory levels as they evaluate their markets and demand for their products. The Company is cautiously managing its spending, but at the same time remains committed to new product development and growth opportunities.

Thermal/Acoustical Segment

The Thermal/Acoustical segment reported record net sales of $236.8 million in 2011, an increase of 32.2% from 2010. Segment net sales were 61.7% of the Company’s consolidated net sales in 2011, compared to 56.6% of net sales in 2010. According to a published automotive market forecasting service, production of cars and light trucks in North America and Europe in 2011 increased by 8.9%, or 2.7 million vehicles, compared to 2010, indicating that the Thermal/Acoustical segment increased market share through the introduction of new products and growth of the automotive platforms served. The same service predicts that production of cars and light trucks in North America and Europe in 2012 will be essentially flat with 2011. While uncertain global economic conditions could impact consumer spending on automobiles, backlog for the Thermal/Acoustical segment as of December 31, 2011 was higher than December 31, 2010.

The segment reported operating income in 2011 of $12.9 million compared with operating income of $0.4 million in 2010. Contributing to this improvement was higher net sales and improved gross margin realized from manufacturing efficiency improvements associated with fiber parts of the North American automotive facility (“NA Auto Facility”) in 2011. Segment gross margin increased by 270 basis points in 2011 compared to 2010. While the operating results of fiber parts began to improve in the second half of 2011, the Company continues to be focused on its comprehensive improvement plan for fiber parts.

In the first quarter of 2012, the Thermal/Acoustical segment continues to implement a comprehensive improvement plan in its fibers business. Internal organizational changes were made in the Company’s Thermal/Acoustical segment to better align the Company’s structure with its strategic direction. As a result, the Company is evaluating the impact of these changes on its reportable segments.

Outlook

The Company is focused on increasing revenues and margins in all operations through additional efficiencies, Lean Six Sigma initiatives, new product development and improving plant capabilities. Priorities for 2012 include:

| · | Realizing expected sales growth of Solutech membrane products in the Performance Materials segment and Life Sciences Vital Fluids’ bioprocessing products; |

| · | Launching market driven, value enhancing new products; |

| · | Further improvements in operating results of automotive fiber parts; |

| · | Efficient use of working capital and deployment of cash; |

| · | Assessing Lydall’s portfolio of businesses in order to focus on core competencies and maximizing shareholder value; and |

| · | Acquisitions in the Company’s strategic growth markets. |

The volatility of the global economy and turmoil in world financial markets provide an element of risk and uncertainty which the Company is carefully monitoring. Spending will be managed cautiously, without sacrificing future growth and new product development.

Prior Period Amounts

During the third quarter of 2011, the Company revised prior period financial statements for the years ended 2010, 2009, 2008 and 2007 to correct accounting errors for income taxes associated with dividends from a foreign subsidiary. None of the revisions were considered material to the periods impacted, as disclosed in Note 2 to Notes to the Consolidated Financial Statements. All figures in Item 7 of this filing are provided as revised.

The Consolidated Financial Statements have been retroactively restated to reflect Affinity as a discontinued operation for all periods presented (See Note 8 to the Consolidated Financial Statements).

CONSOLIDATED RESULTS OF OPERATIONS

Net Sales

| In thousands of dollars | | 2011 | | | Percent

Change | | | 2010 | | | Percent

Change | | | 2009 | |

| Net sales | | $ | 383,588 | | | | 21.3 | % | | $ | 316,113 | | | | 31.9 | % | | $ | 239,732 | |

The increase in 2011 net sales of $67.5 million, or 21.3%, compared with 2010, was primarily attributable to higher sales volumes from the Thermal/Acoustical segment of $57.7 million, or 32.2%. In addition, 2011 Performance Materials segment net sales increased by $10.9 million, or 8.9%, compared with 2010. Net sales of OPS decreased by $0.9 million, or 5.7%. Included in these figures is foreign currency translation, which increased net sales by $6.6 million, or 2.1%, for the current year, compared with 2010, impacting the Thermal/Acoustical segment by $4.6 million and the Performance Materials segment by $2.0 million.

The increase in 2010 net sales of $76.4 million, or 31.9%, compared with 2009, was primarily attributable to higher sales volumes from the Thermal/Acoustical segment of $51.3 million, or 40.1%, and the Performance Materials segment of $25.1 million, or 25.6%. Net Sales of OPS increased by $1.0 million or 6.6%. Included in these figures is foreign currency translation, which decreased net sales by $6.6 million, or 2.8%, in 2010 compared to 2009, impacting the Thermal/Acoustical segment by $4.5 million and the Performance Materials segment by $2.1 million.

Gross Profit

| In thousands of dollars | | 2011 | | | 2010 | | | 2009 | |

| Gross profit | | $ | 67,506 | | | $ | 53,863 | | | $ | 33,183 | |

| Gross margin | | | 17.6 | % | | | 17.0 | % | | | 13.8 | % |

The increase in gross margin in 2011 compared to 2010 was attributable to the Thermal/Acoustical segment. Improved absorption of fixed costs due to higher net sales of $57.7 million and realized manufacturing efficiency improvements and other cost savings associated with fiber parts of the NA Auto Facility contributed to increased gross margin for the Thermal/Acoustical segment. The Performance Materials segment reported essentially flat gross margin in 2011 compared to 2010, while gross margin for OPS was lower in 2011 compared to 2010 due to a reduction in net sales resulting in lower absorption of fixed costs.

The increase in gross margin in 2010 compared to 2009 was attributable to improved gross margin from both the Performance Materials and Thermal/Acoustical segments. The Performance Materials segment reported improved gross margin primarily due to significantly higher net sales and the resulting improved absorption of fixed costs. The 2009 gross margin was negatively impacted by restructuring related charges of $5.7 million, or 230 basis points, associated with the NA Auto consolidation, included in the Thermal/Acoustical segment. Excluding these restructuring charges in 2009, the Thermal/Acoustical segment gross margin percentage increased marginally in 2010 compared to 2009 due to improvements in gross margin for worldwide non-fiber based products from higher sales partially offset by higher per unit costs for fiber-based products at its NA Auto Facility.

Selling, Product Development and Administrative Expenses

| In thousands of dollars | | 2011 | | | 2010 | | | 2009 | |

| Selling, product development and administrative expenses | | $ | 52,937 | | | $ | 52,890 | | | $ | 48,470 | |

| Percentage of net sales | | | 13.8 | % | | | 16.7 | % | | | 20.2 | % |

Selling, product development and administrative expenses in 2011 were essentially flat with 2010. Reductions in legal expenses of $0.9 million and severance related charges of $1.0 million were offset by increases in sales commission expense of $0.8 million, workers compensation charges of $0.5 million and salaries and wages expense of $0.3 million, as well as increases in other discretionary spending. Higher legal expenses in 2010 were primarily related to litigation and settlement costs with a former employee. The increase in net sales in 2011, compared to 2010, caused the increase in sales commission expense in 2011. Higher salaries and wages expense were primarily caused by annual rate increases.

Selling, product development and administrative expenses increased in 2010 by $4.4 million, or 9.1%, compared to 2009. However, as a percentage of net sales, selling, product development and administrative expenses decreased by 350 basis points in 2010 compared to 2009. The increase in 2010 expenses was primarily due to higher incentive compensation expense of $1.6 million, sales commission expense of $0.8 million, legal expenses of $0.8 million, primarily associated with a matter with a former employee, salaries and wages expense of $0.4 million, severance-related expenses of $0.4 million and research and development trial expenses of $0.4 million. Because certain businesses met 2010 bonus plan targets, the Company recorded incentive compensation in 2010, while in 2009 the Company did not record any incentive compensation expense. A significant increase in net sales in 2010, compared to 2009, caused the increase in sales commission expense in 2010. Higher salaries and wages expense was primarily caused by higher headcount in 2010 compared to 2009 to support the increase in net sales in 2010 and strategic initiatives for the Company, and, to a lesser extent, the reinstatement of the matching contribution to its sponsored 401(k) plan in July 2010, for all non-union domestic employees.

Gain on Sale of Product Line, net

| In thousands of dollars | | 2011 | | | 2010 | | | 2009 | |

| Gain on sale of product line, net | | $ | 1,619 | | | $ | 2,542 | | | $ | - | |

On June 30, 2010, the Company divested its electrical papers product line business for total consideration of $5.8 million, of which $4.8 million was paid on June 30, 2010. This transaction contained multiple deliverables, some of which were delivered on June 30, 2010, while others have been, and will continue to be, delivered in subsequent periods. The Company deferred $3.2 million of the gain from this sale related to undelivered elements of the transaction at June 30, 2010. As part of the sale transaction, the Company entered into a Manufacturing Agreement and a License Agreement with the buyer. Under the Manufacturing Agreement, the Company is obligated to manufacture and sell electrical paper products to the buyer for a two-year period. Pursuant to the License Agreement, treated as a separate unit of accounting, the Company granted the buyer the right to use certain process technology and agreed to provide certain services to the buyer to facilitate the transfer of know-how for the manufacture of electrical paper products. Under the License Agreement, the buyer is obligated to pay the Company the additional $1.0 million on the earlier of June 30, 2012 or completion by Lydall of its obligations to provide services to the buyer.

For the year ended December 31, 2010, the Company recorded a $2.5 million gain related to this transaction. This gain comprised of the gain on sale of $1.7 million recognized in the second quarter of 2010, net of a write-off of $0.8 million of goodwill that was allocated to the electrical papers product line, and income of $0.8 million recognized during the six months ended December 31, 2010 as the Company provided services to the buyer in accordance with the terms of the License Agreement. The deferred gain amount is being recognized as income as services under the License Agreement are delivered in periods subsequent to the sale, including $1.6 million recognized in 2011. As of December 31, 2011, the remainder of the gain, approximately $0.8 million, will be recognized on a straight-line basis over the period that the Company satisfies its obligations under the License Agreement, which is expected to be completed as of June 2012.

Discontinued Operations, net of tax

On June 29, 2011, the Company sold its Affinity business for $15.2 million in cash. Affinity designed and manufactured high precision, specialty engineered temperature-control equipment for semiconductor, pharmaceutical, life sciences and industrial applications. The Company recorded a gain on sale, net of transaction costs and income taxes of $3.9 million for the year ended December 31, 2011.

| In thousands of dollars | | 2011 | | | 2010 | | | 2009 | |