UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2021

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-7665

Lydall, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 06-0865505 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | | | | |

| One Colonial Road | , | Manchester | , | Connecticut | | 06042 |

| (Address of principal executive offices) | | (zip code) |

(860) 646-1233

(Registrant’s telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | LDL | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐Accelerated filer ☒Non-accelerated filer ☐ Smaller reporting company ☐Emerging growth company☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | | | |

| Total Shares outstanding April 15, 2021 | 18,018,995 | |

LYDALL, INC.

TABLE OF CONTENTS

| | | | | | | | |

| | | Page

Number |

| | |

| |

| Part I |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Part II |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 5. | | |

| Item 6. | | |

| Signatures | | |

PART I. FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

LYDALL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts) (Unaudited)

| | | | | | | | | | | | | | | |

| | | For the Three Months Ended

|

| | | | | March 31, 2021 | | March 31, 2020 |

| Net sales | | | | | $ | 227,099 | | | $ | 200,527 | |

| Cost of sales | | | | | 178,550 | | | 161,959 | |

| Gross profit | | | | | 48,549 | | | 38,568 | |

| Selling, product development and administrative expenses | | | | | 35,633 | | | 33,027 | |

| Impairment of goodwill and other long-lived assets | | | | | 0 | | | 61,109 | |

| Restructuring expenses | | | | | 777 | | | 0 | |

| Operating income (loss) | | | | | 12,139 | | | (55,568) | |

| (Gain) loss on the sale of a business | | | | | 698 | | | 0 | |

| Employee benefit plans settlement expenses | | | | | 0 | | | 385 | |

| Interest expense | | | | | 3,448 | | | 2,857 | |

| Other (income) expense, net | | | | | 86 | | | (418) | |

| Income (loss) before income taxes | | | | | 7,907 | | | (58,392) | |

| Income tax expense (benefit) | | | | | 2,821 | | | (2,015) | |

| (Income) loss from equity method investment | | | | | (8) | | | 44 | |

| Net income (loss) | | | | | $ | 5,094 | | | $ | (56,421) | |

| Earnings (loss) per share: | | | | | | | |

| Basic | | | | | $ | 0.29 | | | $ | (3.25) | |

| Diluted | | | | | $ | 0.28 | | | $ | (3.25) | |

| Weighted average number of common shares outstanding: | | | | | | | |

| Basic | | | | | 17,545 | | | 17,336 | |

| Diluted | | | | | 17,888 | | | 17,336 | |

See accompanying notes to condensed consolidated financial statements.

LYDALL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands) (Unaudited)

| | | | | | | | | | | | | | | |

| | | For the Three Months Ended

|

| | | | | March 31, 2021 | | March 31, 2020 |

| Net income (loss) | | | | | $ | 5,094 | | | $ | (56,421) | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Foreign currency translation adjustments | | | | | (3,014) | | | (9,957) | |

| Pension liability adjustment, net of taxes of $0.1 million and $0.1 million, respectively | | | | | 365 | | | 331 | |

| Unrealized gain (loss) on hedging activities, net of taxes of $0.9 million and $0.1 million, respectively | | | | | 3,018 | | | 446 | |

| Other comprehensive income (loss) | | | | | 369 | | | (9,180) | |

| Total comprehensive income (loss) | | | | | $ | 5,463 | | | $ | (65,601) | |

See accompanying notes to condensed consolidated financial statements.

LYDALL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts) (Unaudited)

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 88,717 | | | $ | 102,176 | |

| Accounts receivable, net of allowance for doubtful accounts of $2,313 and $2,402, respectively | 135,464 | | | 116,947 | |

| Contract assets | 25,959 | | | 32,403 | |

| Inventories | 81,448 | | | 78,996 | |

| Taxes receivable | 10,031 | | | 6,652 | |

| Prepaid expenses | 4,937 | | | 4,870 | |

| Other current assets | 7,922 | | | 7,348 | |

| Total current assets | 354,478 | | | 349,392 | |

| Property, plant and equipment, at cost | 505,573 | | | 506,509 | |

| Accumulated depreciation | (295,557) | | | (291,996) | |

| Property, plant and equipment, net | 210,016 | | | 214,513 | |

| Operating lease right-of-use assets | 26,163 | | | 22,243 | |

| Goodwill | 87,195 | | | 87,595 | |

| Other intangible assets, net | 90,796 | | | 95,121 | |

| Other assets, net | 6,729 | | | 6,598 | |

| Total assets | $ | 775,377 | | | $ | 775,462 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 9,789 | | | $ | 9,789 | |

| | | |

| Accounts payable | 113,416 | | | 101,905 | |

| Accrued payroll and other compensation | 22,114 | | | 24,589 | |

| Accrued taxes | 8,339 | | | 8,214 | |

| | | |

| Derivative liabilities | 7,966 | | | 11,996 | |

| Restructuring liabilities | 2,042 | | | 9,431 | |

| Other accrued liabilities | 22,733 | | | 21,705 | |

| Total current liabilities | 186,399 | | | 187,629 | |

| Long-term debt | 251,202 | | | 260,649 | |

| Long-term operating lease liabilities | 21,220 | | | 17,947 | |

| Deferred tax liabilities | 31,411 | | | 27,174 | |

| Benefit plan liabilities | 17,930 | | | 21,691 | |

| Other long-term liabilities | 2,665 | | | 2,676 | |

| | | |

| Commitments and Contingencies (Note 15) | 0 | | 0 |

| Stockholders' equity: | | | |

| Preferred stock, $0.01 per share par value, 500 shares authorized (NaN issued or outstanding) | 0 | | | 0 | |

| Common stock, $0.01 per share par value, 30,000 shares authorized (25,741 and 25,555 shares issued, respectively) | 257 | | | 256 | |

| Capital in excess of par value | 101,361 | | | 99,770 | |

| Retained earnings | 271,998 | | | 266,904 | |

| Accumulated other comprehensive income (loss) | (17,973) | | | (18,342) | |

| Less treasury stock, 7,722 and 7,717 shares of common stock, respectively, at cost | (91,093) | | | (90,892) | |

| Total stockholders’ equity | 264,550 | | | 257,696 | |

| Total liabilities and stockholders’ equity | $ | 775,377 | | | $ | 775,462 | |

See accompanying notes to condensed consolidated financial statements.

LYDALL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited)

| | | | | | | | | | | |

| For the Three Months Ended |

| | March 31, 2021 | | March 31, 2020 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 5,094 | | | $ | (56,421) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| | | |

| Depreciation and amortization | 11,366 | | | 12,152 | |

| Amortization of debt issuance costs | 134 | | | 78 | |

| Impairment of goodwill and long-lived assets | 0 | | | 61,109 | |

| Deferred income taxes | 3,224 | | | (2,896) | |

| (Gain) loss on the sale of a business | 698 | | | 0 | |

| Employee benefit plans settlement expenses | 0 | | | 385 | |

| Stock-based compensation | 1,125 | | | 914 | |

| | | |

| (Gain) loss on disposition of property, plant and equipment | 0 | | | 20 | |

| (Gain) loss from equity method investment | (8) | | | 44 | |

| Other, net | (106) | | | 0 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (21,817) | | | (7,800) | |

| Contract assets | 6,298 | | | 1,313 | |

| Inventories | (3,127) | | | (2,026) | |

| Income taxes (receivable) payable | (3,424) | | | (546) | |

| Prepaid expenses and other assets | (1,053) | | | 526 | |

| Accounts payable | 11,456 | | | 21,127 | |

| Accrued payroll and other compensation | (2,185) | | | (68) | |

| | | |

| Deferred revenue | 21 | | | 0 | |

| Accrued taxes payable | 245 | | | (1,447) | |

| | | |

| Benefit plan liabilities | (3,517) | | | (450) | |

| Other, net | (4,204) | | | 727 | |

| Net cash provided by (used for) operating activities | 220 | | | 26,741 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (8,119) | | | (9,157) | |

| Collections of finance receivables | 1,379 | | | 1,658 | |

| Payments from divestitures | (2,715) | | | 0 | |

| | | |

| | | |

| Net cash provided by (used for) investing activities | (9,455) | | | (7,499) | |

| Cash flows from financing activities: | | | |

| Proceeds from borrowings | 0 | | | 20,000 | |

| Debt repayments | (9,499) | | | (4,500) | |

| Proceeds from servicing receivables | 4,557 | | | 2,852 | |

| Common stock issued | 642 | | | 31 | |

| Common stock repurchased | (201) | | | (8) | |

| Net cash provided by (used for) financing activities | (4,501) | | | 18,375 | |

| Effect of exchange rate changes on cash | 277 | | | (1,121) | |

| Increase (decrease) in cash and cash equivalents | (13,459) | | | 36,496 | |

| Cash and cash equivalents at beginning of period | 102,176 | | | 51,331 | |

| Cash and cash equivalents at end of period | $ | 88,717 | | | $ | 87,827 | |

See accompanying notes to condensed consolidated financial statements.

LYDALL, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. BASIS OF FINANCIAL STATEMENT PRESENTATION

Basis of Presentation

The accompanying Condensed Consolidated Financial Statements include the accounts of Lydall, Inc. and its subsidiaries (collectively, “Lydall”, "the Company”, “we”, and “our”). All financial information is unaudited for the interim periods reported. All significant intercompany transactions have been eliminated in the Condensed Consolidated Financial Statements. The Condensed Consolidated Financial Statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). The year-end Condensed Consolidated Balance Sheet amounts have been derived from the audited financial statements for the year ended December 31, 2020, but does not include all disclosures required by U.S. GAAP. In the opinion of management, the condensed consolidated financial information reflects all adjustments necessary for a fair statement of the Company’s consolidated financial position, results of operations, and cash flows for the interim periods reported, but do not include all the disclosures required by U.S. GAAP. All such adjustments are of a normal recurring nature, unless otherwise disclosed in this report. Certain amounts in prior year financial statements and notes thereto have been reclassified to conform to current year presentation. The statements should be read in conjunction with the consolidated financial statements and accompanying notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

Additional Cash Flow Information

Non-cash investing activities include non-cash capital expenditures of $1.6 million and $2.3 million that were included in Accounts payable on the Company's Condensed Consolidated Statements of Cash Flows at March 31, 2021 and 2020, respectively.

Risks and Uncertainties

Worldwide economic cycles, political changes, and the COVID-19 pandemic affect the markets that the Company’s businesses serve, affect demand for the Company's products, and could impact profitability. Among other factors, disruptions in the global credit and financial markets, including diminished liquidity and credit availability, changes in international trade agreements, swings in consumer confidence and spending, and unstable economic growth, disruptions to the global automotive supply chain, and fluctuations in unemployment rates have caused economic instability and can have a negative impact on the Company’s results of operations, financial condition, and liquidity.

Transfers of Financial Assets

The Company accounts for transfers of financial assets as sold when it has surrendered control over the related assets. Whether control has been relinquished requires, among other things, an evaluation of relevant legal considerations and an assessment of the nature and extent of the Company's continuing involvement with the assets transferred. Gains or losses and any expenditures stemming from the transfers are included in Other (income) expense, net on the Company's Condensed Consolidated Statements of Operations. Assets obtained and liabilities incurred in connection with transfers reported as sold are initially recognized on the Company's Condensed Consolidated Balance Sheets at fair value.

The Company maintains arrangements with banking institutions to sell trade accounts receivable balances for select customers. Under the programs, the Company has no risk of loss due to credit default and is charged a fee based on the nominal value of receivables sold and the time between the sale of the trade accounts receivables to banking institutions and collection from the customer. Under one of the programs, the Company services the trade receivables after the sale to the bank and receives 90.0% of the trade receivables in cash at the time of sale and the remaining 10.0% in cash, net of fees, when the customer pays. Total trade accounts receivable balances sold under both arrangements were $34.1 million and $32.7 million during the three-month periods ended March 31, 2021 and 2020, respectively. Total cash received was $31.2 million and $30.2 million during the three-month periods ended March 31, 2021 and 2020, respectively. Total fees incurred were $0.1 million and $0.1 million during the three-month periods ended March 31, 2021 and 2020, respectively.

The Company's senior secured revolving credit agreement permits the Company to sell trade accounts receivable balances to approved third parties in connection with Receivable Purchases Agreements, or other similar agreements. At any given time, outstanding trade accounts receivable balances sold cannot exceed $10.0 million for a certain approved customer and $50.0 million in aggregate for any other approved group of customers.

2. RECENT ACCOUNTING STANDARDS

Recent Accounting Standards Adopted

In December 2019, the FASB issued ASU 2019-12, "Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes". The new standard is intended to simplify accounting for income taxes by removing certain exceptions to the general principles in Topic 740, and by clarifying and amending existing guidance in other areas of the same topic. This ASU was effective for fiscal years and interim periods beginning after December 15, 2020 with early adoption permitted. The Company adopted this ASU upon issuance and there was no material impact to the Company's Consolidated Financial Statements and disclosures as of March 31, 2021.

In January 2020, the FASB issued ASU 2020-01, "Investments - Equity Securities (Topic 321), Investments - Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815)." The amendments in this update are intended to reduce diversity in practice and increase comparability of the accounting for interaction of equity securities, investments accounted for under the equity method of accounting, and the accounting for certain forward contracts and purchased options accounted for under Topic 815. This ASU was effective for fiscal years and interim periods beginning after December 15, 2020 with early adoption permitted. The Company adopted this ASU upon issuance and notes that it did not have a material impact on the Company's Consolidated Financial Statements and disclosures as of March 31, 2021.

In March 2020, the FASB issued ASU 2020-04, "Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting." The amendments in this update are elective, and provide optional expedients and exceptions in accounting for contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform. In January 2021, the FASB issued ASU 2021-01 to provide additional clarity around Topic 848. Specifically, certain provisions of Topic 848, if elected by an entity, apply to derivative instruments that use an interest rate for margining, discounting, or contract price alignment that is modified as a result of reference rate reform. The guidance in this update is effective for transactions entered into between March 12, 2020 and December 31, 2022. The Company adopted this ASU upon issuance and there was no material impact to the Company's Consolidated Financial Statements and disclosures as of March 31, 2021.

In October 2020, the FASB issued ASU 2020-10, "Codification Improvements." The amendments in this update are intended to clarify the location of certain disclosure guidance within the ASC, as well as clarify certain guidance in cases where the original guidance may have been unclear. These amendments do not change U.S. GAAP. This ASU was effective for fiscal years and interim periods beginning after December 15, 2020. The Company adopted this ASU upon issuance and notes no impact to the Company's Consolidated Financial Statements and disclosures as of March 31, 2021.

Recent Accounting Standards Not Yet Adopted

In August 2020, the FASB issued ASU 2020-06, "Debt-Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging-Contracts in Entity’s Own Equity (Subtopic 815-40)." The amendments in this update are intended to simplify the accounting for convertible debt instruments and convertible preferred stock. This ASU is effective for fiscal years and interim periods beginning after December 15, 2021 with early adoption permitted. The Company does not expect the adoption of this update to have a material impact on its Consolidated Financial Statements and disclosures.

3. REVENUE FROM CONTRACTS WITH CUSTOMERS

The Company accounts for revenue in accordance with ASC 606, "Revenue from Contracts with Customers". Revenues are generated from the design and manufacture of specialty engineered filtration media, industrial thermal insulating solutions, automotive thermal and acoustical barriers for filtration/separation and thermal/acoustical applications. The Company’s revenue recognition policies require the Company to make significant judgments and estimates. In applying the Company’s revenue recognition policy, determinations must be made as to when the control of products passes to the Company’s customers which can be either at a point in time or over time. Revenue is generally recognized at a point in time when control passes to customers upon shipment of the Company’s products and revenue is generally recognized over time when control of the Company’s products transfers to customers during the manufacturing process. The Company analyzes several factors, including, but not limited to, the nature of the products being sold and contractual terms and conditions in contracts with customers to help the Company make such judgments about revenue recognition. Unfulfilled performance obligations are generally expected to be satisfied within one year.

Contract Assets and Liabilities

The Company’s contract assets primarily include unbilled amounts typically resulting from sales under contracts when the over time method of revenue recognition is utilized and revenue recognized exceeds the amount billed to the customer. These unbilled accounts receivable in contract assets are transferred to accounts receivable upon invoicing, typically when the right to payment becomes unconditional, in which case payment is due based only upon the passage of time.

The Company’s contract liabilities primarily relate to billings and advance payments received from customers and deferred revenue. These contract liabilities represent the Company’s obligation to transfer its products to its customers for which the Company has received, or is owed, consideration from its customers. Contract liabilities are included in Other accrued liabilities in the Company's Condensed Consolidated Balance Sheets.

Contract assets and liabilities consisted of the following:

| | | | | | | | | | | | | | | | | | | | | |

| In thousands | | | At March 31, 2021 | | At December 31, 2020 | | Dollar Change |

| Contract assets | | | $ | 25,959 | | | $ | 32,403 | | | $ | (6,444) | |

| Contract liabilities | | | $ | 3,786 | | | $ | 3,686 | | | $ | 100 | |

The $6.4 million decrease in contract assets from December 31, 2020 to March 31, 2021 was primarily due to timing of tooling billings to customers and to a lesser extent, the billings on last-time buys of membrane-based filtration media initiated in December 2020 in the Company's Netherlands facility.

The $0.1 million increase in contract liabilities from December 31, 2020 to March 31, 2021 was primarily due to an increase in customer deposits, offset by $1.4 million of revenue recognized in the first three months of 2021 related to contract liabilities at December 31, 2020.

Disaggregated Revenue

The Company disaggregates revenue from customers by geographic region, as it believes this disclosure best depicts how the nature, amount, timing, and uncertainty of the Company's revenues and cash flows are affected by economic factors. Disaggregated revenue by geographical region for the three-month periods ended March 31, 2021 and 2020 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, 2021 | | For the Three Months Ended March 31, 2020 |

| In thousands | | North America | | Europe | | Asia | | Total Net Sales | | North America | | Europe | | Asia | | Total Net Sales |

| | | | | | | | | | | | | | | | |

| Performance Materials | | $ | 58,874 | | | $ | 16,924 | | | $ | 3,535 | | | $ | 79,333 | | | $ | 45,917 | | | $ | 17,275 | | | $ | 2,028 | | | $ | 65,220 | |

| Technical Nonwovens | | 35,838 | | | 16,899 | | | 8,938 | | | 61,675 | | | 35,731 | | | 16,938 | | | 4,734 | | | 57,403 | |

| Thermal Acoustical Solutions | | 60,653 | | | 26,113 | | | 4,278 | | | 91,044 | | | 57,101 | | | 23,540 | | | 3,120 | | | 83,761 | |

| Eliminations and Other | | (4,678) | | | (275) | | | 0 | | | (4,953) | | | (5,677) | | | (180) | | | 0 | | | (5,857) | |

| Total net sales | | $ | 150,687 | | | $ | 59,661 | | | $ | 16,751 | | | $ | 227,099 | | | $ | 133,072 | | | $ | 57,573 | | | $ | 9,882 | | | $ | 200,527 | |

4. INVENTORIES

Inventories as of March 31, 2021 and December 31, 2020 were as follows:

| | | | | | | | | | | | | | |

| In thousands | | At March 31, 2021 | | At December 31, 2020 |

| Raw materials | | $ | 37,116 | | | $ | 32,258 | |

| Work in process | | 16,504 | | | 17,087 | |

| Finished goods | | 27,828 | | | 29,651 | |

| | | | |

| | | | |

| Total inventories | | $ | 81,448 | | | $ | 78,996 | |

Work in process includes net tooling inventory of $3.2 million and $2.8 million at March 31, 2021 and December 31, 2020, respectively.

5. GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

The Company performs an assessment of its goodwill for impairment at least annually, in the fourth quarter, and whenever events or changes in circumstances indicate that the carrying value may exceed its fair value. There were no such events or changes in circumstances during the three-month period ended March 31, 2021.

The following table sets forth the change in carrying value of goodwill for each reportable segment and for the Company as of March 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands | | Performance Materials | | Technical Nonwovens | | Thermal Acoustical Solutions | | Total |

| Gross balance at December 31, 2020 | | $ | 143,659 | | | $ | 55,607 | | | $ | 12,160 | | | $ | 211,426 | |

| Accumulated impairment | | (111,671) | | | 0 | | | (12,160) | | | (123,831) | |

| Net balance at December 31, 2020 | | 31,988 | | | 55,607 | | | 0 | | | 87,595 | |

| | | | | | | | |

| Foreign currency translation | | (23) | | | (377) | | | 0 | | | (400) | |

| Net balance at March 31, 2021 | | $ | 31,965 | | | $ | 55,230 | | | $ | 0 | | | $ | 87,195 | |

Other Intangible Assets

The table below presents the gross carrying amount and, as applicable, the accumulated amortization of the Company’s acquired intangible assets, other than goodwill, as of March 31, 2021 and December 31, 2020. These amounts are included in Other intangible assets, net on the Company's Condensed Consolidated Balance Sheets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | At March 31, 2021 | | At December 31, 2020 |

| In thousands | | Amortization Period | | Gross Carrying Amount | | Accumulated Amortization | | Gross Carrying Amount | | Accumulated Amortization |

| Amortized intangible assets | | | | | | | | | | |

| Customer Relationships | | 10 - 14 years | | $ | 143,184 | | | $ | (53,970) | | | $ | 143,479 | | | $ | (50,076) | |

| Patents | | 28 years | | 650 | | | (619) | | | 650 | | | (616) | |

| Technology | | 15 years | | 2,500 | | | (1,185) | | | 2,500 | | | (1,144) | |

| Trade Names | | 3 - 5 years | | 7,446 | | | (7,210) | | | 7,495 | | | (7,167) | |

| License Agreements | | 10 years | | 0 | | | 0 | | | 185 | | | (185) | |

| Other | | 7 - 15 years | | 459 | | | (459) | | | 467 | | | (467) | |

| Total other intangible assets | | | | $ | 154,239 | | | $ | (63,443) | | | $ | 154,776 | | | $ | (59,655) | |

Estimated amortization expense for total intangible assets is expected to be $16.5 million, $14.5 million, $12.8 million, $11.4 million, $9.8 million and $30.1 million, for each of the years ending December 31, 2021 through 2025 and thereafter, respectively.

6. LONG-TERM DEBT AND FINANCING ARRANGEMENTS

The long-term debt payable under the Company’s amended and restated 2018 senior secured revolving credit agreement (as amended to-date, the "2018 Amended Credit Agreement") at March 31, 2021 and December 31, 2020 consisted of:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands | | Effective Rate | | Maturity | | At March 31, 2021 | | At December 31, 2020 |

| Revolver loan | | 4.25 | % | | 8/31/2023 | | $ | 127,500 | | | $ | 134,500 | |

| Term loan, net of debt issuance costs | | 4.25 | % | | 8/31/2023 | | 133,491 | | | 135,938 | |

| | | | | | | | |

| | | | | | | 260,991 | | | 270,438 | |

| Less portion due within one year | | | | | | (9,789) | | | (9,789) | |

| Total long-term debt, net of debt issuance costs | | | | | | $ | 251,202 | | | $ | 260,649 | |

The weighted average interest rate on long-term debt was 5.1% and 4.4%, for the three-month periods ending March 31, 2021 and 2020, respectively.

Total amortization expense of debt issuance costs was $0.1 million and $0.1 million for the three-month periods ending March 31, 2021 and 2020, respectively.

At March 31, 2021, the Company had amounts available for borrowing of $40.7 million under the 2018 Amended Credit Agreement, net of $127.5 million outstanding under the revolver facility and standby letters of credit outstanding of $1.8 million.

In addition to the amounts outstanding under the 2018 Amended Credit Agreement, the Company has various foreign credit facilities totaling approximately $10.8 million. At March 31, 2021 and December 31, 2020, the Company's foreign subsidiaries had $1.2 million and $1.4 million, respectively, in standby letters of credit outstanding under these foreign credit facilities.

The Company has entered into an interest rate swap to convert a portion of the Company's borrowings from a variable rate to a fixed rate. See Note 7, "Derivatives," in these Notes to Condensed Consolidated Financial Statements for additional information.

On April 26, 2021, the Company replaced its 2018 Amended Credit Agreement with a newly executed Credit Agreement by and among the Company, as borrower, and certain direct and indirect subsidiaries as guarantors, and Bank of America, N.A., as Administrative Agent, Lender, L/C Issuer and Swingline Lender, and Wells Fargo Bank, N.A., JPMorgan Chase Bank, N.A., KeyBank N.A., Santander Bank, N.A., TD Bank, N.A., and Webster Bank, N.A., as Lenders, increasing total borrowings from $314.0 million to $346.0 million. The 2021 senior secured revolving credit agreement has a revolving facility of $170.0 million, which includes a $50.0 million sublimit for the issuance of letters of credit, a $50.0 million sublimit for alternative currencies loans and a $30.0 million sublimit for swingline loans, and a term loan facility of $176.0 million (the revolving facility and the term loan facility are collectively referred to as the “2021 Credit Facility”). The 2021 Credit Facility includes an accordion feature permitting the Company to request an increase of up to $150.0 million in the aggregate. The proceeds of the 2021 Credit Facility will be used to (a) refinance indebtedness and commitments outstanding under the existing 2018 Amended Credit Agreement, (b) pay fees and expenses incurred in connection with the 2021 Credit Facility, and (c) provide ongoing working capital and for other general corporate purposes. The 2021 Credit Facility matures on April 26, 2026.

The term loan facility requires quarterly payments of principal at the rate of $2.2 million, with the remaining balance due in the final quarter of the 2021 Credit Facility’s term. The Company is permitted to prepay amounts outstanding under the 2021 Credit Facility, in whole or in part, at any time without premium or penalty, and the Company is generally permitted to irrevocably cancel unutilized portions of the revolving commitments.

The Lenders have been granted a security interest in substantially all of Lydall Inc.'s and its domestic subsidiaries’ personal property and other assets (including intellectual property), including a pledge of 65% of the Company’s equity interest in certain foreign subsidiaries and 100% of the Company’s equity interest in its domestic subsidiaries, as collateral for the Company’s obligations under the 2021 Credit Facility.

Under the 2021 Credit Facility, interest is charged on borrowings, at the Company’s option, of either: (i) LIBOR (if LIBOR is not available for an alternative currency, such other interest rate customarily used by Bank of America for such alternative currency) plus the Applicable Margin, or (ii) for U.S. denominated loans the Base Rate, which is a fluctuating rate equal to the highest of (a) the federal funds rate plus 0.50%, (b) the prime rate as set by the Administrative Agent, and (c) the one month

LIBOR (adjusted daily) plus 1.00%, plus the Applicable Margin. The Applicable Margin is 2.00% per annum in the case of LIBOR and alternative currency loans and letters of credit and 1.00% per annum in the case of Base Rate loans for the first full fiscal quarter following the closing date of the 2021 Credit Facility. Thereafter, the Applicable Margin is determined based on the Company’s Consolidated Net Leverage Ratio (as defined in the 2021 Credit Facility), which ranges from 1.25% to 2.50% per annum for LIBOR and alternative currency loans and letters of credit, and ranges from 0.25% to 1.50% per annum for Base Rate loans. The Company will pay a quarterly commitment fee of 0.275% per annum on the unused portion of the revolving facility for the first full fiscal quarter following the closing date of the 2021 Credit Facility. Thereafter, the quarterly commitment fee ranges from 0.20% to 0.30% per annum.

The 2021 Credit Facility contains customary affirmative and negative covenants, including covenants limiting the Company and its subsidiaries to, among other things, incur debt, grant liens, make certain investments, engage in a line of business substantially different from business conducted by the Company, transact with affiliates, make restricted payments, and sell assets.

The 2021 Credit Facility contains financial covenants required of the Company and its subsidiaries. The Company is required to meet certain quarterly financial covenants, including:

i.A Minimum Consolidated Fixed Charge Coverage Ratio, which requires that at the end of each fiscal quarter the ratio of (a) consolidated EBITDA to (b) the sum of consolidated interest charges, redemptions, non-financed maintenance capital expenditures, restricted payments and taxes paid, each as defined in the 2021 Credit Facility, may not be less than 1.25 to 1.00; and

ii. A Consolidated Net Leverage Ratio, which requires that at the end of each fiscal quarter the ratio of consolidated funded indebtedness minus consolidated domestic cash to consolidated EBITDA, as defined in the 2021 Credit Facility, not be greater than 4.50:1.00 through the period ended December 31, 2021, stepping down to 4.00:1.00 through the period ending June 30, 2022, and 3.50:1.00 beginning with the period starting July 1, 2022 and thereafter.

Each of the financial ratios referred to above are calculated on a consolidated trailing twelve-month basis. The 2021 Credit Facility, permits the Company to exclude certain non-cash charges and certain restructuring and other expenses, as defined by the 2021 Credit Facility, from EBITDA in the calculation of the Company's financial covenants.

The Company was in compliance with all covenants set forth in the 2018 Amended Credit Agreement as of and for the quarter ended March 31, 2021, and in the 2021 Credit Facility as of the date hereof, and the Company does not anticipate noncompliance in the foreseeable future.

7. DERIVATIVES

The Company selectively uses financial instruments to manage market risk associated with exposure to fluctuations in interest rates and foreign currency rates. These financial exposures are monitored and managed by the Company as an integral part of its risk management program.

Interest Rate Hedging

The Company’s interest rate exposure is most sensitive to fluctuations in interest rates in the United States and Europe, which impacts interest paid on its debt. The Company has debt with variable rates of interest based generally on LIBOR. From time to time, the Company enters into interest rate swap agreements to manage interest rate risk. These instruments are recorded at fair value. See Note 8, "Fair Value Measurements," in these Notes to Condensed Consolidated Financial Statements for additional information.

In November 2018, the Company entered into a five-year interest rate swap agreement with a bank to convert the interest on a notional $139.0 million of the Company's borrowings under its Amended Credit Agreement from a variable rate, plus the borrowing spread, to a fixed rate of 3.09% plus the borrowing spread. The notional amount decreases quarterly by fluctuating amounts through August 2023. Prior to May 11, 2020, the Company's interest rate swap agreements were accounted for as cash flow hedges. Effectiveness of the remaining derivative agreement was assessed quarterly, or more frequently, if necessary, by ensuring that the critical terms of the swap continued to match the critical terms of the hedged debt in order to report gains or losses on the derivative instrument in other comprehensive income. An amendment to the Company's Amended Credit Agreement on May 11, 2020 included, among other modifications, the establishment of a floor on the base and Eurocurrency rate of 1%. As a result, the Company determined that the critical terms of the swap no longer matched the critical terms of the hedged debt and performed an assessment of the effectiveness of the interest rate swap agreement. The Company concluded the interest rate swap agreement was no longer effective. The Company also concluded that the hedged forecasted transaction (the

occurrence of variable interest rate payments on the hedged debt) continues to be probable of occurring. Therefore, as of May 11, 2020, the Company discontinued hedge accounting. After May 11, 2020, any fair value gains or losses on the derivative agreement are recorded as interest expense on the Company's Condensed Consolidated Statement of Operations. The cumulative loss on the discontinued hedge relationship through May 11, 2020, which was recorded in Accumulated Other Comprehensive Income, will be amortized into earnings (loss) through August 31, 2023, the maturity date of the hedged debt. The loss included in Accumulated Other Comprehensive Income related to the discontinued hedging relationship at March 31, 2021 was $3.3 million, net of tax. The amount reclassified out of other comprehensive income into Interest expense on the Company's Condensed Consolidated Statement of Operations for the three-month period ended March 31, 2021 was $0.6 million, net of tax. The Company expects $2.0 million, net of tax, to be reclassified from Accumulated Other Comprehensive Income over the next twelve months.

Net Investment Hedges

The Company’s operations are subject to certain risks, including foreign currency exchange rate fluctuations. From time to time, the Company enters into cross-currency swaps designated as hedges, which are recorded at fair value (see Note 8, "Fair Value Measurements," in these Notes to Condensed Consolidated Financial Statements), to protect the Company's net investments in subsidiaries denominated in currencies other than the U.S. dollar.

In November 2019, the Company entered into 3 fixed-to-fixed cross-currency swaps with banking institutions with aggregate notional amounts totaling €67.8 million ($75.0 million U.S. dollar equivalent). These swaps hedge a portion of the Company's net investment in a Euro functional currency denominated subsidiary against the variability of exchange rate translation impacts between the U.S. dollar and Euro. These contracts require monthly cash interest exchanges over the life of the contracts with the Company recognizing a reduction to interest expense due to the favorable interest rate differential. Also, settlement of the notional €22.6 million ($25.0 million U.S. dollar equivalent) cross-currency swaps occur at maturity dates of August 2021, August 2022, and August 2023. The Company assesses hedge effectiveness of the cross-currency swaps quarterly by ensuring the critical terms of the swaps continue to match the critical terms of the designated net investment. The Company elected to assess effectiveness using the spot method, and as a result, records the interest rate differential monthly on the Company's Condensed Consolidated Statements of Operations.

Derivative instruments are recognized as either assets or liabilities depending on maturity. These amounts are included in Other current assets and Derivative liabilities on the Company's Condensed Consolidated Balance Sheets. For derivative instruments that are designated and qualify as a cash flow hedge, the effective portion of the gain or loss on the derivative is reported as a component of other comprehensive income and reclassified into earnings in the same period or periods in which the hedge transaction affects earnings. Any ineffective portion, or amounts related to contracts that are not designated as hedges, are recorded directly to earnings. The Company's policy for classifying cash flows from derivatives is to report the cash flows consistent with the underlying hedged item. The Company does not use derivatives for speculative or trading purposes.

The following table sets forth the fair value amounts of derivative instruments held by the Company presented on the Condensed Consolidated Balance Sheets as Derivative liabilities:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | At March 31, 2021 | | At December 31, 2020 |

| In thousands | | Asset Derivatives | | Liability Derivatives | | Asset Derivatives | | Liability Derivatives |

| Interest rate contracts | | $ | 0 | | | $ | 4,154 | | | $ | 0 | | | $ | 5,063 | |

| Cross-currency swaps | | 0 | | | 3,812 | | | 0 | | | 6,933 | |

| Total derivatives | | $ | 0 | | | $ | 7,966 | | | $ | 0 | | | $ | 11,996 | |

The following table sets forth the income (loss) recorded in accumulated other comprehensive income (loss), net of tax, for the three-month periods ended March 31, 2021 and 2020 for derivatives held by the Company and designated as hedging instruments:

| | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, | | |

| In thousands | | 2021 | | 2020 | | | | |

| Cash flow hedges: | | | | | | | | |

| Interest rate contracts | | $ | 618 | | | $ | (2,173) | | | | | |

| Cross-currency swaps | | 2,400 | | | 2,619 | | | | | |

| Total derivatives | | $ | 3,018 | | | $ | 446 | | | | | |

8. FAIR VALUE MEASUREMENTS

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date.

The Company uses a three-level fair value hierarchy that prioritizes the inputs used to measure fair value. This hierarchy requires the Company to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

•Level 1 - Quoted prices in active markets for identical assets or liabilities.

•Level 2 - Observable inputs other than quoted prices included in Level 1, such as quoted prices in markets that are not active or other inputs that are observable or can be corroborated by observable market data.

•Level 3 - Unobservable inputs that are supported by little or no market activity and are significant to the fair value of the assets or liabilities. This includes certain pricing models, discounted cash flow methodologies, and similar techniques that use significant unobservable inputs.

The following table presents the carrying value and fair value of financial instruments that are not carried at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | At March 31, 2021 | | At December 31, 2020 |

| In thousands | | Carrying Value | | Fair Value | | Carrying Value | | Fair Value |

| Debt | | $ | 261,500 | | | $ | 262,394 | | | $ | 271,000 | | | $ | 272,792 | |

The fair values of the Company’s long-term debt outstanding were computed based on discounted future cash flows (observable inputs), as applicable, which falls under Level 2 of the fair value hierarchy. Differences from carrying values are attributable to interest rate changes subsequent to when the transactions occurred.

The fair values of cash and cash equivalents, accounts receivable, net and accounts payable approximate their carrying amounts due to the short-term maturities of these instruments.

Recurring Fair Value Measures

The Company holds derivative instruments for interest rate swap contracts and cross-currency swaps that are measured using observable market inputs such as forward rates and its counterparties' credit risks. Based on these inputs, the derivative instruments are classified within Level 2 of the valuation hierarchy. At March 31, 2021 and December 31, 2020, these derivative instruments were included in Derivative liabilities on the Company's Condensed Consolidated Balance Sheets. Based on the Company's continued ability to trade and enter into interest rate swaps and cross-currency swaps, the Company considers the markets for their fair value instruments to be open.

9. STOCK REPURCHASES

During the three-month period ended March 31, 2021, the Company purchased 5,646 shares of common stock valued at $0.2 million to satisfy payroll tax withholding obligations, pursuant to provisions in agreements with recipients of restricted stock granted under the Company’s equity compensation plans, in which the Company withholds the number of shares having fair value equal to each recipient’s minimum payroll tax withholding obligation.

On April 20, 2021, the Company announced that our Board of Directors approved a Share Repurchase Program authorizing the repurchase, from time to time at the Company's discretion, of up to an aggregate of $30.0 million of common stock, par value $0.01 per share, of the Company. The ability to repurchase the Company’s common stock will continue until the Board of Directors reaches a determination to discontinue share repurchases. The timing and actual amount of shares repurchased will depend on a variety of factors including stock price, market conditions, corporate and regulatory requirements, and capital availability, among other factors.

10. EMPLOYER SPONSORED BENEFIT PLANS

The Company maintains one domestic pension plan: the Retirement Income Plan for Employees of Interface Performance Materials, Inc. ("IPM Pension Plan"). During the three-month period ended March 31, 2020, the Company settled the pension obligation of the Interface Sealing Solutions, Inc. Pension Plan ("ISS Pension Plan") through lump sum distributions to

participants or by irrevocably transferring pension liabilities to an insurance company through the purchase of a group annuity contract. This purchase, funded with pension assets, resulted in a pre-tax settlement loss of $0.4 million in the three-month period ended March 31, 2020, related to the recognition of accumulated deferred actuarial losses. The settlement loss and expenses were included as non-operating expense on the Condensed Consolidated Statements of Operations.

The IPM Pension Plan covers a portion of Interface's union and non-union employees. The plan is closed to new employees and benefits are no longer accruing for the majority of participants. The Company expects to make contributions of approximately $0.7 million to the IPM Pension Plan during 2021. Contributions of $0.2 million were made during the three-month period ended March 31, 2021. Contributions of $0.4 million were made during the three-month period ended March 31, 2020, inclusive of contributions made to the ISS Pension Plan.

The following is a summary of the components of net periodic benefit cost for the domestic defined benefit pension plans for

the three-month periods ended March 31, 2021 and 2020:

| | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, | | |

| In thousands | | 2021 | | 2020 | | | | |

| Components of employer benefit cost | | | | | | | | |

| Service cost | | $ | 29 | | | $ | 40 | | | | | |

| Interest cost | | 304 | | | 430 | | | | | |

| Expected return on assets | | (589) | | | (533) | | | | | |

| Amortization of actuarial loss | | 4 | | | 2 | | | | | |

| Net periodic benefit cost (income) | | $ | (252) | | | $ | (61) | | | | | |

| Settlement loss | | 0 | | | 385 | | | | | |

| Total employer benefit plan cost | | $ | (252) | | | $ | 324 | | | | | |

The Company reports the service cost component of net periodic benefit cost in the same line item as other compensation costs in operating expenses and the non-service cost components of net periodic benefit cost in other income.

11. RESTRUCTURING

During the third quarter of 2020, the Company’s Performance Materials segment undertook actions to discontinue production of a lower efficiency air filtration media product and, in turn, fully depreciated the supporting machinery and equipment in North America and consolidated certain product lines and began exiting underperforming facilities in Europe. These restructuring activities, which are projected to conclude in 2021, are expected to reduce operating costs, increase production efficiency, and enhance the Company’s flexibility by better aligning its manufacturing operations with the segment's customer base. Accordingly, the Company expects to record total pre-tax expenses of approximately $18.0 million, primarily related to severance and employee retention expenses in connection with these restructuring activities, of which approximately $12.3 million is expected to result in cash expenditures. The Company incurred a total of $16.7 million through March 31, 2021, of which approximately $5.7 million were non-cash expenditures, which consisted of fully depreciating and/or amortizing long-lived assets and, to a lesser extent, writing-off inventory.

The Company undertook actions to consolidate global production facilities for sealing & advanced solutions products from 5 facilities to 4, which would have resulted in the closure a facility in Germany. In the first quarter of 2021, the Company entered into an agreement to sell the German facility, which closed on March 11, 2021. The Company agreed to pay $1.8 million (€1.5 million) to the buyer and provide $2.2 million (€1.9 million) in additional funding, net of cash and certain net working capital adjustments, to cover pension and restructuring liabilities recorded in 2020. As a result of the sale of the business, the Company recorded a pre-tax loss of $0.7 million. The final consideration and loss are subject to a working capital adjustment expected to be settled in 2022.

In the first quarter of 2021, the Company recorded pre-tax restructuring charges of $0.8 million primarily consisting of severance costs and legal expenses.

The following table summarizes the total restructuring charges by cost type:

| | | | | | | | | | | | | | | | | | | | | |

| In thousands | | Severance and Related Expenses | | | Legal and Administrative Expenses | | Facility Exit and Asset Write-Off Expenses |

| Expense incurred during quarter ended: | | | | | | | |

| March 31, 2021 | | $ | 777 | | | | $ | 0 | | | $ | 0 | |

| Total pre-tax expense incurred | | $ | 777 | | | | $ | 0 | | | $ | 0 | |

The following table summarizes the change in the accrued liability balance for the restructuring actions:

| | | | | | | | |

| In thousands | | Total |

| Balance as of December 31, 2020 | | $ | 9,431 | |

| Pre-tax restructuring expenses, excluding asset write-off expenses | | 777 | |

| Cash paid | | (821) | |

| Accrued liability included with the sale of the German facility | | (7,311) | |

| Currency translation adjustments | | (34) | |

| Balance as of March 31, 2021 | | $ | 2,042 | |

The above accrued liability balances were included in Restructuring liabilities on the Company’s Condensed Consolidated Balance Sheets.

12. INCOME TAXES

For the three-month period ended March 31, 2021, the Company's effective tax rate was 35.7% compared to an effective tax rate of 3.5% for the three-month period ended March 31, 2020. For the three-month period ended March 31, 2021, the rate was negatively impacted by $0.5 million due to a change in assertion on unremitted foreign earnings, $0.4 million related to foreign earnings taxed at higher rates, and $0.2 million of valuation allowance activity. For the three-month period ended March 31, 2020, the Company had a pre-tax loss primarily resulting from an impairment charge of $61.1 million. The impairment charge significantly impacted the Company's effective tax rate as $48.7 million of the impairment charge related to non-deductible goodwill, resulting in a lower effective tax rate for the first quarter of 2020 when the Company was in a pre-tax loss position. Additionally, the effective rate, for the first quarter of 2020, was negatively impacted by valuation allowance activity of $0.3 million.

The Company and its subsidiaries file a consolidated federal income tax return, as well as returns required by various state and foreign jurisdictions. In the normal course of business, the Company is subject to examination by taxing authorities, including such major jurisdictions as the United States, Canada, China, France, Germany, Hong Kong, India, the Netherlands, and the United Kingdom. With few exceptions, the Company is no longer subject to U.S. federal examinations for years before 2017, state and local examinations for years before 2016, and non-U.S. income tax examinations for years before 2013.

The Company’s effective tax rates in future periods could be affected by an increase or decrease in earnings in countries where tax rates differ from the United States federal tax rate, the relative impact of permanent tax adjustments on earnings from domestic operations, changes in net deferred tax asset valuation allowances, including valuation allowances on loss carryforwards in which no tax benefit can be recognized, stock vesting, pension plan terminations, the completion of acquisitions or divestitures, changes in tax rates or tax laws and the completion of ongoing tax planning strategies and audits.

13. EARNINGS (LOSS) PER SHARE

For the three-month periods ended March 31, 2021 and 2020, basic earnings per share was computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Unexercised stock options and unvested restricted share awards, including awards subject to certain performance criteria, are excluded from the basic earnings per share calculation, but are included in the diluted earnings per share calculation using the treasury stock method in periods of net income, as long as their effect is not antidilutive. All potential shares of common stock from unexercised stock options and unvested restricted share awards are antidilutive in periods of net loss.

The following table provides a reconciliation of weighted-average shares used to determine basic and diluted earnings per share:

| | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, | | |

| In thousands | | 2021 | | 2020 | | | | |

| Net income (loss) | | $ | 5,094 | | | $ | (56,421) | | | | | |

| | | | | | | | |

| Basic weighted-average common shares outstanding | | 17,545 | | | 17,336 | | | | | |

| Effect of dilutive options and restricted stock awards | | 343 | | | 0 | | | | | |

| Diluted weighted-average common shares outstanding | | 17,888 | | | 17,336 | | | | | |

| | | | | | | | |

| Earnings (loss) per share: | | | | | | | | |

| Basic | | $ | 0.29 | | | $ | (3.25) | | | | | |

| Diluted | | $ | 0.28 | | | $ | (3.25) | | | | | |

For the three-month periods ended March 31, 2021 and 2020, there were 129,209 and 736,141 shares excluded from the computation of diluted earnings per share, respectively. For the three-month period ended March 31, 2021, these included antidilutive stock options, antidilutive unvested restricted share awards for which requisite service has not yet been rendered, and antidilutive unvested performance share awards with contingently issuable shares. For the three-month period ended March 31, 2020, all outstanding, unvested awards were excluded from the calculation of diluted earnings per share because the Company had net loss during the period. These included all stock options, as well as unvested restricted share awards for which requisite service has not yet been rendered, and certain unvested performance share awards with contingently issuable shares.

A description of the Company's stock options and restricted share awards is included in Note, 13, "Equity Compensation Plans", in the Notes to Consolidated Financial Statements in Part II, Item 8 - Financial Statements and Supplemental Data of the Company's Annual Report on Form 10-K for the year ended December 31, 2020.

14. SEGMENT INFORMATION

The Company is organized based on the nature of its products and is composed of 3 reportable segments each overseen by a segment manager. These segments are reflective of how the Company's Chief Executive Officer, who is its Chief Operating Decision Maker ("CODM"), reviews operating results for the purpose of allocating resources and assessing performance. The Company has not aggregated operating segments for purposes of identifying reportable segments. As of March 31, 2021, the operating segments were Performance Materials, Technical Nonwovens, and Thermal Acoustical Solutions.

Performance Materials Segment

The Performance Materials segment is a worldwide leader in delivering innovative specialty filtration, sealing, and advanced materials solutions for demanding applications. Specifically, the segment’s offerings include: (1) specialty filtration media solutions for a variety of applications in the global air and liquid filtration market such as personal protective equipment (“PPE”), indoor air quality, life sciences, transportation, and industrial applications; (2) gasket materials and parts for a broad range of applications in the global sealing market for parts in large/heavy duty equipment for commercial, industrial, agriculture, and construction end markets; and, (3) advanced materials that include highly engineered insulation solutions for cryogenic storage of liquid hydrogen/nitrogen, energy storage, and advanced composite materials for aerospace and defense applications.

Technical Nonwovens Segment

The Technical Nonwovens segment is a global leader in engineered nonwoven materials for industrial filtration applications and advanced materials products. The primary industrial filtration markets include air pollution and emissions control, power generation, and liquid filtration solutions. Advanced materials products include geotextile felts for separation, reinforcement, filtration, drainage, and protection; thermal and acoustic insulation for transportation and automotive applications, and highly customized and technical solutions for acoustic media, medical, building & construction, and safety apparel. Specifically, the segment’s offerings include needle punched nonwoven and highly engineered felts made from a variety of synthetic fibers. Automotive media is provided to Tier 1 and Tier 2 suppliers as well as the Company's Thermal Acoustical Solutions segment.

Thermal Acoustical Solutions Segment

The Thermal Acoustical Solutions segment designs, manufactures, and distributes a full range of innovative engineered products tailored for the transportation and industrial sectors. These products shield sensitive components from high temperature environments, assist in the reduction of harmful emissions and reduce noise and vibration. Within the transportation sector, the Company's products are found in the interior, underbody, and underhood of cars, trucks, SUVs, heavy duty trucks, and recreational vehicles.

Segment Results

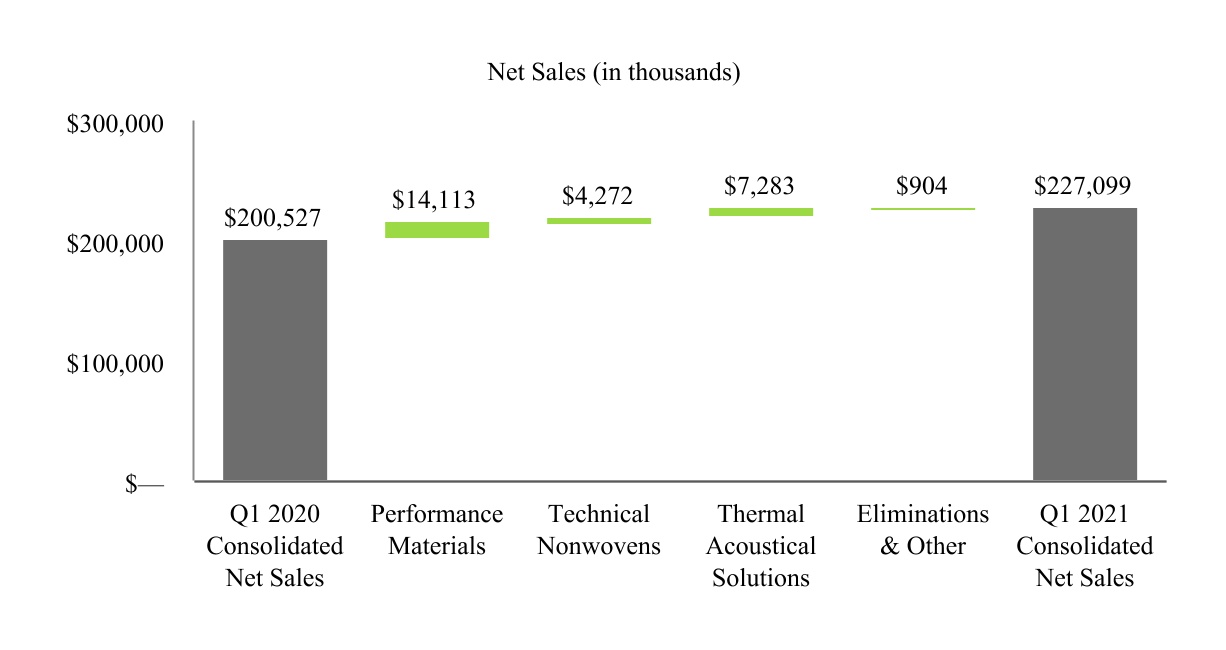

Net sales by business segment is as follows:

| | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, | | |

| In thousands | | 2021 | | 2020 | | | | |

Performance Materials Segment (1),(2): | | | | | | | | |

| Filtration Products | | $ | 34,346 | | | $ | 25,887 | | | | | |

| Sealing and Advanced Solutions Products | | 44,987 | | | 39,333 | | | | | |

| Performance Materials Segment net sales | | 79,333 | | | 65,220 | | | | | |

| | | | | | | | |

| Technical Nonwovens Segment: | | | | | | | | |

| Industrial Filtration Products | | 36,401 | | | 31,369 | | | | | |

Advanced Materials Products (2) | | 25,274 | | | 26,034 | | | | | |

| Technical Nonwovens Segment net sales | | 61,675 | | | 57,403 | | | | | |

| | | | | | | | |

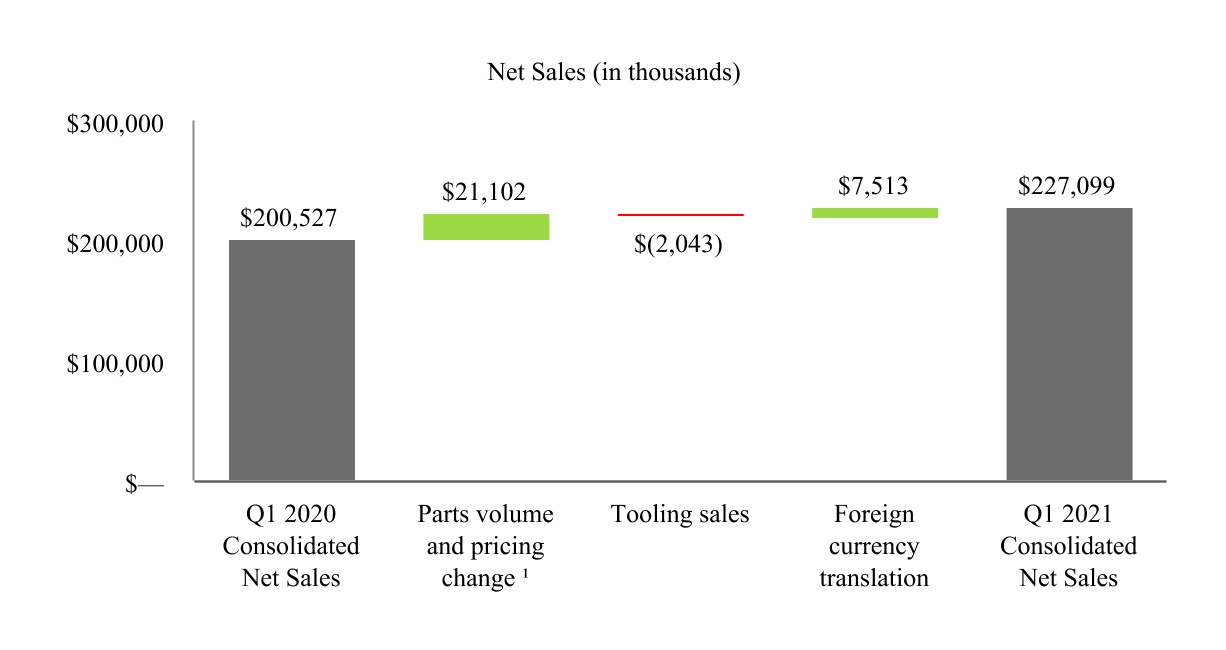

| Thermal Acoustical Solutions Segment: | | | | | | | | |

| Parts | | 86,494 | | | 77,321 | | | | | |

| Tooling | | 4,550 | | | 6,440 | | | | | |

| Thermal Acoustical Solutions Segment net sales | | 91,044 | | | 83,761 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Eliminations and Other (2) | | (4,953) | | | (5,857) | | | | | |

| Consolidated Net Sales | | $ | 227,099 | | | $ | 200,527 | | | | | |

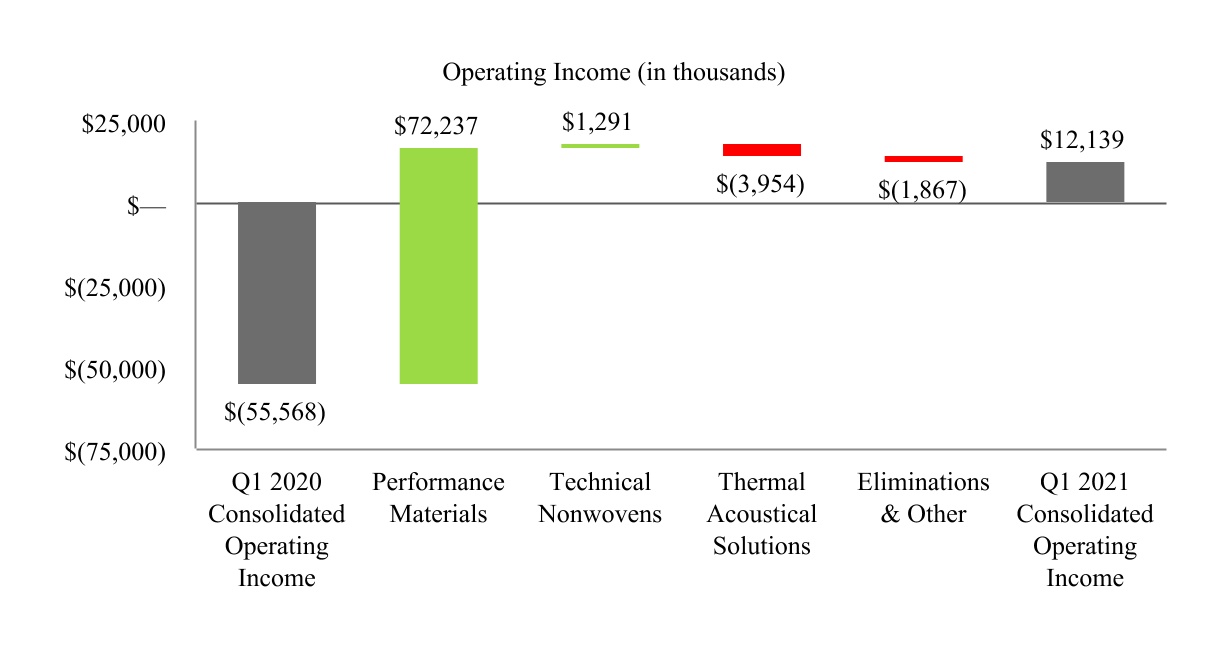

Operating income (loss) by business segment is as follows:

| | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, | | |

| In thousands | | 2021 | | 2020 | | | | |

Performance Materials (1),(3) | | $ | 15,296 | | | $ | (56,941) | | | | | |

Technical Nonwovens (4) | | 5,104 | | | 3,813 | | | | | |

| Thermal Acoustical Solutions | | 1,674 | | | 5,628 | | | | | |

| | | | | | | | |

| Corporate Office Expenses | | (9,935) | | | (8,068) | | | | | |

| Consolidated Operating Income (Loss) | | $ | 12,139 | | | $ | (55,568) | | | | | |

(1)The Performance Materials segment includes the results of the facility in German that the Company sold on March 11, 2021.

(2)Included in the Performance Materials segment, Technical Nonwovens segment, and Eliminations and Other is the following:

•Technical Nonwovens segment intercompany sales of $3.9 million and $5.0 million to the Thermal Acoustical Solutions segment for the three-month periods ended March 31, 2021 and 2020, respectively.

•Performance Materials segment intercompany sales of $1.0 million and $0.9 million to the Thermal Acoustical Solutions segment for the three-month periods ended March 31, 2021 and 2020, respectively.

(3)Included in the operating results within the Performance Materials segment are the following:

•$61.1 million of impairment charges related to goodwill and other long-lived assets for the three-month period ended March 31, 2020.

•$3.0 million and $4.0 million of intangible assets amortization for the three-month periods ended March 31, 2021 and 2020, respectively.

(4)Included in the Technical Nonwovens segment is the following:

• $1.1 million and $1.2 million of intangible assets amortization for the three-month periods ended March 31, 2021 and 2020, respectively.

15. COMMITMENTS AND CONTINGENCIES

Environmental Remediation

In the fourth quarter of 2016, as part of a groundwater discharging permitting process, water samples collected from wells and process water basins at the Company’s Rochester New Hampshire manufacturing facility, within the Performance Materials segment, showed concentrations of Per and Polyfluorinated Substances (“PFAS”) in excess of state ambient groundwater quality standards. In January 2017, the Company received a notification from the State of New Hampshire Department of Environmental Services (“NHDES”) naming Lydall Performance Materials, Inc. a responsible party with respect to the discharge of regulated contaminants and, as such, is required to take action to investigate and remediate the impacts in accordance with standards established by the NHDES. The Company conducted a site investigation, the scope of which was reviewed by the NHDES, in order to assess the extent of potential soil and groundwater contamination and develop a remedial action. Based on input received from NHDES in March 2017 with regard to the scope of the site investigation, the Company recorded $0.2 million of expense. In 2018, the Company received a response from the NHDES to the site investigation report outlining proposed remedial actions. The Company recorded an additional $0.1 million of expense in 2018 associated with the expected costs to remediate the impacts of the discharge of regulated contaminants in accordance with standards established by the NHDES. During 2018, the environmental liability was fully reduced reflecting payments made to vendors. Additionally, the Company incurred $0.2 million of capital expenditures in 2018, in relation to the lining of the Company's fresh water lagoons. During a building expansion in 2020, additional areas of concern were identified during excavation activities. An interim remedial action plan that includes additional site characterization activities was submitted to the NHDES in March 2021. No comments from the NHDES have been received. As of March 31, 2021, the Company has 0 amounts accrued for these environmental remediation activities. The Company cannot be sure that costs will not exceed the current estimates until this matter is closed with the NHDES, nor that any future corrective action at this location would not have a material effect on the Company’s financial condition, results of operations, or cash flows.

In December 2018, the New York State Department of Environmental Conservation (“NYDEC”) informed the Company that the newly acquired Interface site located at Hoosick Falls, NY will be the subject of an investigation into the possibility of it being an inactive hazardous disposable waste site. The letter specifically references PFAS that have been detected in a nearby water supply, soil and/or surface water. Notably, the PFAS contamination has been identified in the Hoosick Falls area for some time and other large manufacturers in the area have previously been identified as a source. The NYDEC approved a site characterization plan in December 2019. Additional site characterization activities were completed in the fourth quarter of 2020. Results of the site characterization will be submitted in the second quarter of 2021. As of March 31, 2021, the Company has less than $0.1 million accrued for these environmental remediation activities. The Company does not know the scope or extent of any additional future obligations, if any, that may arise from the site investigation and therefore is unable to estimate the cost of any corrective action. Accordingly, the Company cannot assure that the costs of any future corrective at this location would not have a material effect on the Company's financial condition, results of operations, or cash flows.

Provisions for such matters are charged to expense when it is probable that a liability has been incurred and reasonable estimates of the liability can be made. Estimates of environmental liabilities are based on a variety of matters, including, but not limited to, the stage of investigation, the stage of the remedial design, evaluation of existing remediation technologies, and presently enacted laws and regulations. In future periods, a number of factors could significantly impact any estimates of environmental remediation costs.

Asset Retirement Obligations

The Company accounts for asset retirement obligations by recognizing the fair value of the related liability for an asset retirement obligation in the period in which it is incurred, if a reasonable estimate of fair value can be determined. At March 31, 2021, the Company had combined asset retirement obligations of $0.8 million, which are associated with the estimated costs to remove/remediate asbestos materials from various locations. The initial measurement of the asset retirement obligations was recorded as a liability at its fair value, with an offsetting asset retirement cost recorded as an increase to the related property and equipment, which is being depreciated using a systematic and rational method similar to the approach used for the associated property and equipment. The Company also has an asset retirement obligation with an offset to goodwill as the estimated costs were derived from known required remediation obligations as of the acquisition date of Interface Performance Materials on August 31, 2018. The Company has been performing ongoing remediation activity, which offsets the liability associated with the respective asset retirement obligations.

16. STOCKHOLDERS' EQUITY AND ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Changes in stockholders' equity for the three-month periods ended March 31, 2021 and 2020 were as follows:

| | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, | | |

| In thousands | | 2021 | | 2020 | | | | |

| Beginning Balance | | $ | 257,696 | | | $ | 318,420 | | | | | |

| Comprehensive income (loss) | | 5,463 | | | (65,601) | | | | | |

| Stock repurchased | | (201) | | | (8) | | | | | |

| Stock issued under employee plans | | 642 | | | 31 | | | | | |

| Stock-based compensation expense | | 950 | | | 735 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Ending Balance | | $ | 264,550 | | | $ | 253,577 | | | | | |

The components of accumulated other comprehensive income (loss) are shown below:

| | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, | | |

| In thousands | | 2021 | | 2020 | | | | |

| Foreign currency translation: | | | | | | | | |

| Beginning balance | | $ | (3,514) | | | $ | (18,022) | | | | | |

| Net gain (loss) on foreign currency translation | | (4,048) | | | (9,957) | | | | | |

Amounts reclassified from accumulated other comprehensive income (loss) (1) | | 1,034 | | | 0 | | | | | |

| Other comprehensive income (loss), net of tax | | (3,014) | | | (9,957) | | | | | |

| Ending balance | | (6,528) | | | (27,979) | | | | | |

| | | | | | | | |

| Pension and other postretirement benefit plans: | | | | | | | | |

| Beginning balance | | (5,608) | | | (3,080) | | | | | |

Amounts reclassified from accumulated other comprehensive income (loss) (2) | | 365 | | | 331 | | | | | |

| Other comprehensive income (loss), net of tax | | 365 | | | 331 | | | | | |

| Ending balance | | (5,243) | | | (2,749) | | | | | |

| | | | | | | | |

| Unrealized loss on derivative instruments: | | | | | | | | |

| Beginning balance | | (9,220) | | | (4,877) | | | | | |

Net gain (loss) on derivative instruments (3) | | 2,400 | | | 446 | | | | | |

Amounts reclassified from accumulated other comprehensive income (loss) (4) | | 618 | | | 0 | | | | | |

| Other comprehensive income (loss), net of tax | | 3,018 | | | 446 | | | | | |

| Ending balance | | (6,202) | | | (4,431) | | | | | |

| | | | | | | | |

| Total accumulated other comprehensive income (loss) | | $ | (17,973) | | | $ | (35,159) | | | | | |

| | | | | | | | |

| | | | | | | | |

(1)For the three-month period ended March 31, 2021, the amount represents the recognition of the accumulated loss on foreign currency translation relating to the divestiture of the German Facility in the Performance Materials segment, net of tax impact of $0.2 million. This is included in (Gain) loss on the sale of a business on the Company’s Condensed Consolidated Statements of Operations.

(2)For the three-month period ended March 31, 2021, the amount primarily represents the recognition of the accumulated loss on the defined pension plan relating to the divestiture of the German Facility in the Performance Materials segment. This amount was $0.4 million, net of tax impact of $0.1 million, and is included in (Gain) loss on the sale of a business on the Company’s Condensed Consolidated Statements of Operations. For the three-month period ended March 31, 2020, the amount primarily represents the settlement of the ISS Pension Plan. This amount was $0.4 million, net of tax impact of $0.1 million. The amounts for the three-month periods ended March 31, 2021 and 2020 also include routine amortization of actuarial gains and losses in net periodic benefit cost of less than $0.1 million, net of tax impact of less than $0.1 million.

(3)Amount represents unrealized gains (losses) on the fair value of hedging activities, net of tax impact of $0.7 million and $0.1 million for the three-month periods ended March 31, 2021 and 2020, respectively.

(4)Amounts represents the impact of de-designation of the interest rate swap agreement, net of tax impact of $0.2 million, for the three-month period ended March 31, 2021.

17. SUBSEQUENT EVENTS

On April 20, 2021, the Company's Board of Directors approved a Share Repurchase Program authorizing the repurchase, from time to time at the Company's discretion, of up to an aggregate of $30.0 million of common stock, par value $0.01 per share, of the Company. See Note 9, "Stock Repurchases," in these Notes to Condensed Consolidated Financial Statements for additional information.

On April 26, 2021, the Company replaced its 2018 Amended Credit Agreement with a newly executed Credit Agreement by and among the Company, as borrower, and certain direct and indirect subsidiaries as guarantors, and Bank of America, N.A., as Administrative Agent, Lender, L/C Issuer and Swingline Lender, and Wells Fargo Bank, N.A., JPMorgan Chase Bank, N.A., KeyBank, N.A., Santander Bank, N.A., TD Bank, N.A., and Webster Bank, N.A., as Lenders. See Note 6, "Long-term Debt and Financing Arrangements," in these Notes to Condensed Consolidated Financial Statements for additional information.

| | | | | |

| Item 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-looking statements in Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) are not guarantees of future performance and involve risks and uncertainties that could cause actual results to materially differ from those projected. Refer to the "Forward-Looking Statements" section of this MD&A and Part I, Item IA - Risk Factors of the Company's Annual Report on Form 10-K for the year ended December 31, 2020 for a discussion of these risks and uncertainties.

OVERVIEW AND OUTLOOK

Business

Lydall, Inc. and its subsidiaries (collectively, “Lydall”, "the Company”, “we”, and “our”) design, manufacture, and market specialty filtration and advanced materials solutions that contribute to a cleaner, quieter, and safer world. The Company operates in a variety of attractive end markets supported by global megatrends such as the demand for indoor air quality and lower emissions, near sourcing of supply chains, and vehicle electrification redefining safety and sound. Lydall solves our customers' problems culminating in demanding applications, including: high performance air and liquid specialty filtration, molecular filtration, engineered fiber based sealing solutions, specialty insulation including high temperature and ultra-low temperature (cryogenic) insulation, needle punch nonwoven materials for industrial, geosynthetic, medical and other specialty applications; and thermal management and acoustical products and solutions to assist in the reduction of noise, vibration, and harshness. The Company principally conducts its business through three reportable segments: Performance Materials, Technical Nonwovens, and Thermal Acoustical Solutions.

The Performance Materials segment is a worldwide leader in delivering innovative specialty filtration, sealing and advanced materials solutions for demanding applications. Specifically, the segment’s offerings include: (1) specialty filtration media solutions for a variety of applications in the global air and liquid filtration market such as personal protective equipment (“PPE”), indoor air quality, life sciences, transportation, and industrial applications; (2) gasket materials and parts for a broad range of applications in the global sealing market for parts in large/heavy duty equipment for commercial, industrial, agriculture and construction end markets; and, (3) advanced materials that include highly engineered insulation solutions for cryogenic storage of liquid hydrogen/nitrogen, energy storage, and advanced composite materials for aerospace and defense applications.