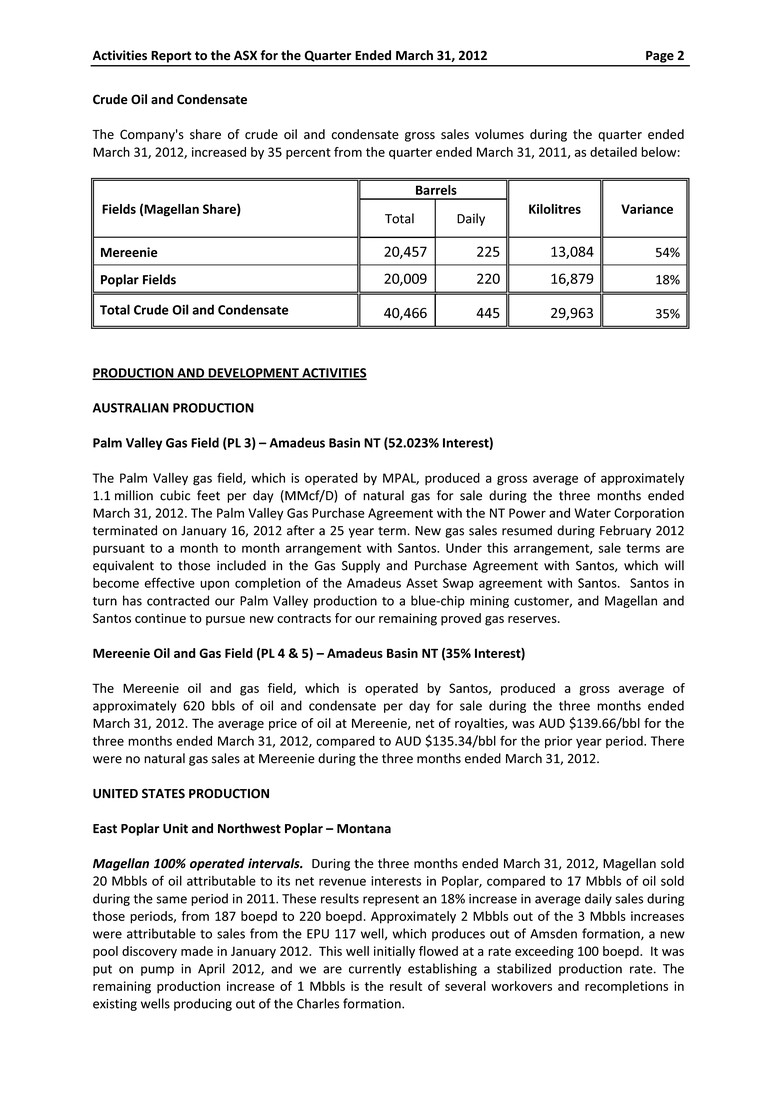

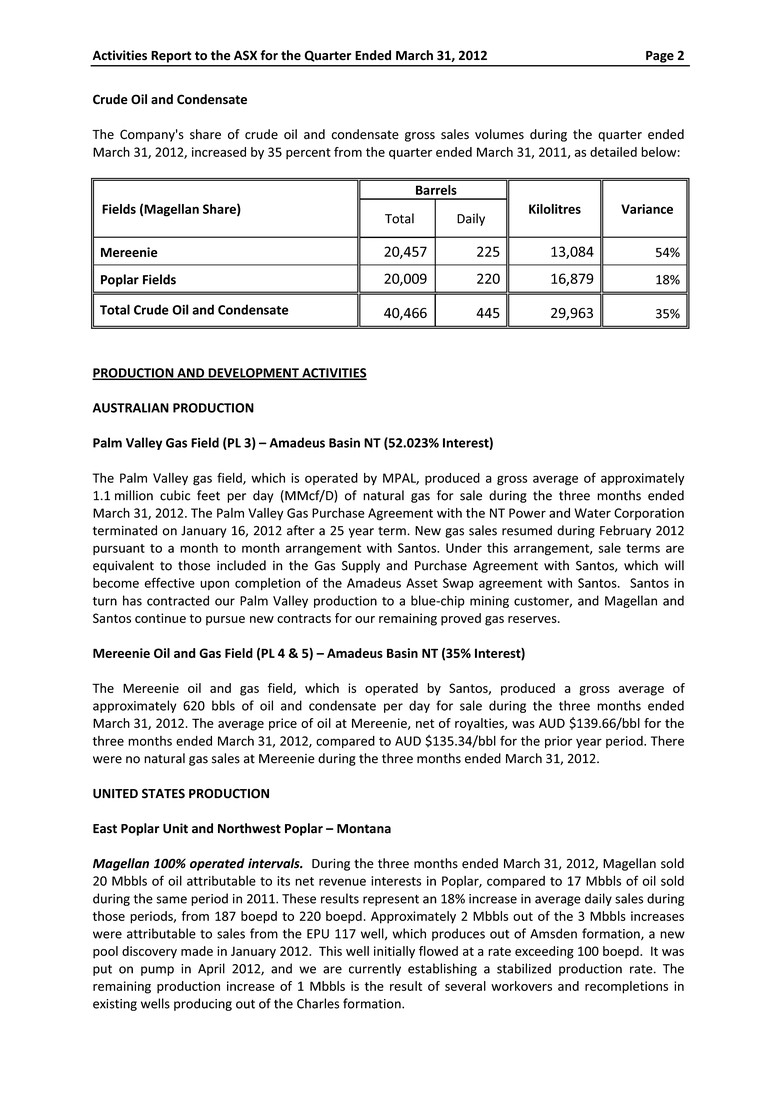

EXECUTIVE OFFICE 700 East Ninth Avenue, Ste. 200F DENVER, CO 80203, USA Telephone: (+1) 720 570 3858 Website: www.magellanpetroleum.com ARBN 117 452 454 AUSTRALIAN OFFICE Level 10, 145 Eagle Street BRISBANE QLD 4000, AUSTRALIA (GPO Box 2766, Brisbane Q 4001) Telephone: (+61) 7 3224 1600 Facsimile: (+61) 7 3224 1699 Email: magadmin@magpet.com.au April 30, 2012 Company Announcements Office Australian Securities Exchange Level 10, 20 Bond Street SYDNEY, NSW 2000 The Manager ACTIVITIES REPORT FOR THE QUARTER ENDED MARCH 31, 2012 This report is submitted by Magellan Petroleum Corporation (NASDAQ:MPET) (ASX Code MGN) (“Magellan” or “the Company”) in compliance with the Australian Stock Exchange Listing Rule 5.2, and covers the quarter January 1 to March 31, 2012. This report is based upon, and accurately reflects, information compiled by a person who is a practicing geologist, who holds a Bachelor of Science Degree in Geology, who has had a minimum of five years experience in the practice of geology, and who is a full time employee in Magellan Petroleum Corporation’s group of companies. OIL & GAS SALES Natural Gas The Company's share of natural gas sales volumes during the quarter ended March 31, 2012, decreased by 75 percent from the quarter ended March 31, 2011, as detailed below: Field (Magellan Share) Million Cubic Feet Terajoules Variance Total Daily Mereenie* — — — 0% Palm Valley 43 0.47 45 (75)% Total Gas 43 0.47 45 (75)% * Gas sales from Mereenie Field ceased in February 2010.

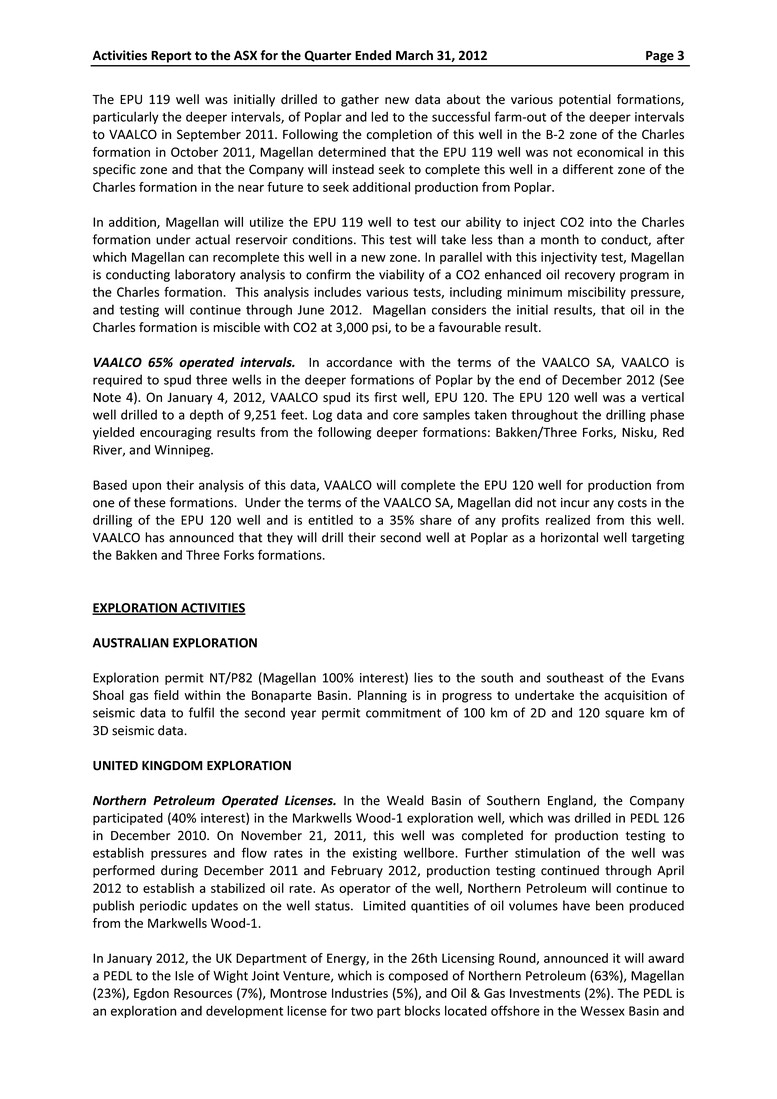

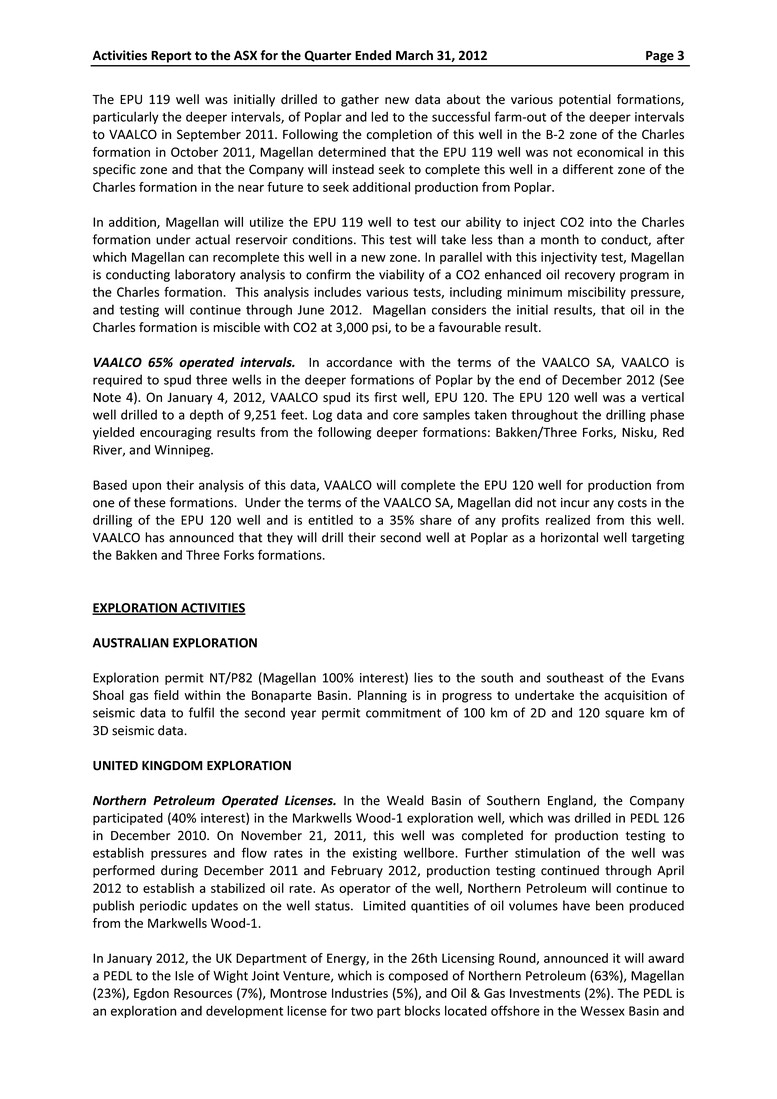

Activities Report to the ASX for the Quarter Ended March 31, 2012 Page 2 Crude Oil and Condensate The Company's share of crude oil and condensate gross sales volumes during the quarter ended March 31, 2012, increased by 35 percent from the quarter ended March 31, 2011, as detailed below: Fields (Magellan Share) Barrels Kilolitres Variance Total Daily Mereenie 20,457 225 13,084 54% Poplar Fields 20,009 220 16,879 18% Total Crude Oil and Condensate 40,466 445 29,963 35% PRODUCTION AND DEVELOPMENT ACTIVITIES AUSTRALIAN PRODUCTION Palm Valley Gas Field (PL 3) – Amadeus Basin NT (52.023% Interest) The Palm Valley gas field, which is operated by MPAL, produced a gross average of approximately 1.1 million cubic feet per day (MMcf/D) of natural gas for sale during the three months ended March 31, 2012. The Palm Valley Gas Purchase Agreement with the NT Power and Water Corporation terminated on January 16, 2012 after a 25 year term. New gas sales resumed during February 2012 pursuant to a month to month arrangement with Santos. Under this arrangement, sale terms are equivalent to those included in the Gas Supply and Purchase Agreement with Santos, which will become effective upon completion of the Amadeus Asset Swap agreement with Santos. Santos in turn has contracted our Palm Valley production to a blue‐chip mining customer, and Magellan and Santos continue to pursue new contracts for our remaining proved gas reserves. Mereenie Oil and Gas Field (PL 4 & 5) – Amadeus Basin NT (35% Interest) The Mereenie oil and gas field, which is operated by Santos, produced a gross average of approximately 620 bbls of oil and condensate per day for sale during the three months ended March 31, 2012. The average price of oil at Mereenie, net of royalties, was AUD $139.66/bbl for the three months ended March 31, 2012, compared to AUD $135.34/bbl for the prior year period. There were no natural gas sales at Mereenie during the three months ended March 31, 2012. UNITED STATES PRODUCTION East Poplar Unit and Northwest Poplar – Montana Magellan 100% operated intervals. During the three months ended March 31, 2012, Magellan sold 20 Mbbls of oil attributable to its net revenue interests in Poplar, compared to 17 Mbbls of oil sold during the same period in 2011. These results represent an 18% increase in average daily sales during those periods, from 187 boepd to 220 boepd. Approximately 2 Mbbls out of the 3 Mbbls increases were attributable to sales from the EPU 117 well, which produces out of Amsden formation, a new pool discovery made in January 2012. This well initially flowed at a rate exceeding 100 boepd. It was put on pump in April 2012, and we are currently establishing a stabilized production rate. The remaining production increase of 1 Mbbls is the result of several workovers and recompletions in existing wells producing out of the Charles formation.

Activities Report to the ASX for the Quarter Ended March 31, 2012 Page 3 The EPU 119 well was initially drilled to gather new data about the various potential formations, particularly the deeper intervals, of Poplar and led to the successful farm‐out of the deeper intervals to VAALCO in September 2011. Following the completion of this well in the B‐2 zone of the Charles formation in October 2011, Magellan determined that the EPU 119 well was not economical in this specific zone and that the Company will instead seek to complete this well in a different zone of the Charles formation in the near future to seek additional production from Poplar. In addition, Magellan will utilize the EPU 119 well to test our ability to inject CO2 into the Charles formation under actual reservoir conditions. This test will take less than a month to conduct, after which Magellan can recomplete this well in a new zone. In parallel with this injectivity test, Magellan is conducting laboratory analysis to confirm the viability of a CO2 enhanced oil recovery program in the Charles formation. This analysis includes various tests, including minimum miscibility pressure, and testing will continue through June 2012. Magellan considers the initial results, that oil in the Charles formation is miscible with CO2 at 3,000 psi, to be a favourable result. VAALCO 65% operated intervals. In accordance with the terms of the VAALCO SA, VAALCO is required to spud three wells in the deeper formations of Poplar by the end of December 2012 (See Note 4). On January 4, 2012, VAALCO spud its first well, EPU 120. The EPU 120 well was a vertical well drilled to a depth of 9,251 feet. Log data and core samples taken throughout the drilling phase yielded encouraging results from the following deeper formations: Bakken/Three Forks, Nisku, Red River, and Winnipeg. Based upon their analysis of this data, VAALCO will complete the EPU 120 well for production from one of these formations. Under the terms of the VAALCO SA, Magellan did not incur any costs in the drilling of the EPU 120 well and is entitled to a 35% share of any profits realized from this well. VAALCO has announced that they will drill their second well at Poplar as a horizontal well targeting the Bakken and Three Forks formations. EXPLORATION ACTIVITIES AUSTRALIAN EXPLORATION Exploration permit NT/P82 (Magellan 100% interest) lies to the south and southeast of the Evans Shoal gas field within the Bonaparte Basin. Planning is in progress to undertake the acquisition of seismic data to fulfil the second year permit commitment of 100 km of 2D and 120 square km of 3D seismic data. UNITED KINGDOM EXPLORATION Northern Petroleum Operated Licenses. In the Weald Basin of Southern England, the Company participated (40% interest) in the Markwells Wood‐1 exploration well, which was drilled in PEDL 126 in December 2010. On November 21, 2011, this well was completed for production testing to establish pressures and flow rates in the existing wellbore. Further stimulation of the well was performed during December 2011 and February 2012, production testing continued through April 2012 to establish a stabilized oil rate. As operator of the well, Northern Petroleum will continue to publish periodic updates on the well status. Limited quantities of oil volumes have been produced from the Markwells Wood‐1. In January 2012, the UK Department of Energy, in the 26th Licensing Round, announced it will award a PEDL to the Isle of Wight Joint Venture, which is composed of Northern Petroleum (63%), Magellan (23%), Egdon Resources (7%), Montrose Industries (5%), and Oil & Gas Investments (2%). The PEDL is an exploration and development license for two part blocks located offshore in the Wessex Basin and

Activities Report to the ASX for the Quarter Ended March 31, 2012 Page 4 contains a potential Wytch Farm type play. Northern Petroleum is the operator. Commitments to the PEDL consist of a contingent “Drill or Drop” well with a decision on drilling to be made before the end of Permit Year 2. Celtique Energie Operated Licenses. In the Weald Basin, Magellan and Celtique Energie each own a 50% working interest in four licenses (PEDL 231, 232, 234, and 243) covering a gross total of approximately 270,000 acres, all expiring on June 30, 2014, unless extended. Celtique Energie continues to gather data to assess the prospect for unconventional and conventional hydrocarbon deposits in these licenses. In September 2011, Celtique completed the acquisition of approximately 200 km of 2D seismic. This seismic acquisition fulfilled our current work commitment under the licenses. This seismic data revealed several prospects and an exploratory drilling program is under development. These four licenses remain subject to contingent “Drill or Drop” requirements. UNITED STATES EXPLORATION At Poplar, the EPU 117 well, spud in October 2011, was completed in January 2012 as a new pool producer in the Amsden formation at a depth of approximately 4800 feet. The well initially flowed at a rate of approximately 106 barrels of oil per day with no appreciable water. This was the first production from this formation within the Unit. In April 2012, the EPU 117 well was placed on pump and is currently producing at an average rate of approximately 90 barrels of oil per day. EXPENDITURES Expenditures incurred on exploration, appraisal, development, and production activities during the quarter ended March 31, 2012, totalled US $ 1.6 million. All figures are unaudited. FORWARD LOOKING STATEMENTS Statements in this release which are not historical in nature are intended to be, and are hereby identified as, forward‐looking statements for purposes of the United States Private Securities Litigation Reform Act of 1995. These statements about the Company may relate to its businesses and prospects, revenues, expenses, operating cash flows, and other matters that involve a number of uncertainties that may cause actual results to differ materially from expectations. Among these risks and uncertainties are pricing and production levels from the properties in which the Company has interests, the extent of the recoverable reserves at those properties and the future outcome of the negotiations for gas sales contracts for the remaining uncontracted reserves at both the Mereenie and Palm Valley gas fields in the Amadeus Basin. In addition, the Company has a large number of exploration permits and faces the risk that any wells drilled may fail to encounter hydrocarbons in commercially recoverable quantities. For a more complete disclosure of the risk factors pertaining to the Company’s forward looking statements, please see Item 1A. Risk Factors, in the Company’s 10‐K filed with the United States Securities and Exchange Commission. Any forward‐looking information provided in this release should be considered with these factors in mind. The Company assumes no obligation to update any forward‐looking statements contained in this release, whether as a result of new information, future events, or otherwise. Yours sincerely