Exhibit 10.1 CONFIDENTIAL TREATMENT REQUESTED. INFORMATION FOR WHICH CONFIDENTIAL TREATMENT HAS BEEN REQUESTED IS OMITTED AND MARKED WITH “[***]”. AN UNREDACTED VERSION OF THE DOCUMENT HAS ALSO BEEN FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION. Magellan Petroleum (NT) Pty Ltd Power and Water Corporation Gas Supply and Purchase Agreement Dingo Gas Field

page i Contents 1 Definitions and interpretation 1 1.1 Definitions 1 1.2 Interpretation 11 2 Measurement 12 2.1 Units of Measurement 12 2.2 Rounding of Dollars 12 2.3 Rounding of Gas Quantities 12 2.4 Contract Years of less than 365 Days 12 3 Conditions Precedent 13 3.1 Conditions 13 3.2 Board Approval 13 3.3 Seller Conditions 13 3.4 Satisfaction date 14 3.5 Extension of CP Date 14 3.6 Termination 14 4 Warranties 14 4.1 Warranties by Seller 14 4.2 Implied warranties 15 4.3 Warranties by Buyer 15 5 Construction and Commencement of Supply 15 5.1 Construction of Upstream Facilities 15 5.2 Supply Commencement Date 15 5.3 Determination of Commencement Date 15 5.4 Delays in Commencement Date 16 6 Supply Period 16 6.1 Supply Period 16 6.2 Expiry Date 16 7 Sale and purchase of Gas 16 7.1 Sale and purchase of Gas 16 7.2 Reserves Report 17 7.3 Annual Contract Quantity 17 7.4 Obligation to pay 19 7.5 Reduction in Annual take or pay quantity 19 7.6 Maximum Hourly Quantity 19 7.7 Increase in MDQ 20 7.8 Right of first refusal 20 7.9 Reduction in basic obligation 20 8 Make-up Gas 21 8.1 Make-up Gas 21

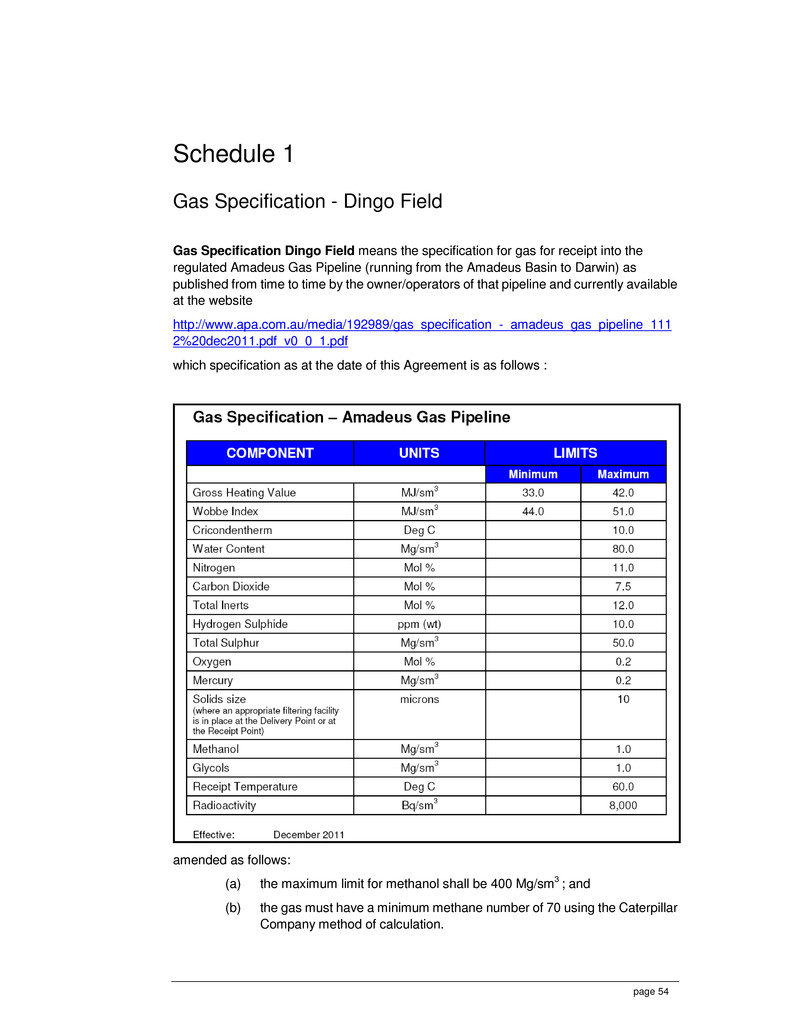

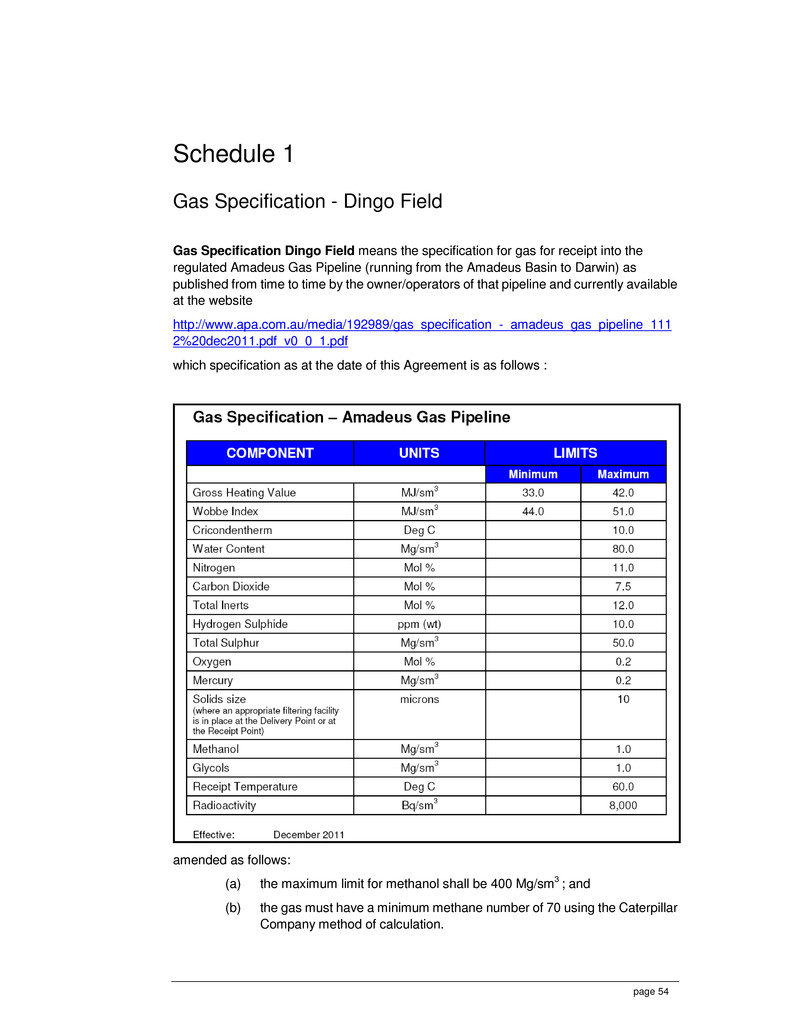

page ii 9 Nomination of quantities 22 9.1 Annual Forecast 22 9.2 Quarterly and Monthly Forecasts 22 9.3 Change in Forecasts 22 9.4 Daily Nomination 22 9.5 Form of nomination 23 10 Continuity of Supply 23 10.1 Planned Maintenance 23 10.2 Permitted interruptions – Seller 23 10.3 Permitted interruptions – Buyer 24 10.4 Reserves Shortfall 24 10.5 Priority 24 10.6 Source 24 11 Gas Quality 24 11.1 Specification 24 11.2 Delivery pressure 25 11.3 Notice of Off-Specification Gas 25 11.4 Return to Specification 25 11.5 Undelivered Off-Specification Gas 25 11.6 Dispute to be referred to expert 25 11.7 Limitation of liability for Off-Specification Gas 26 11.8 Odourisation 26 11.9 Removal of Certain Elements 26 12 Title and measurement 26 12.1 Title and risk 26 12.2 Provision of Metering Equipment 26 12.3 Check Measuring Equipment 27 12.4 Calibration 27 12.5 Correction 27 12.6 Inspection of Equipment and Records 27 12.7 Seller's Agent 27 12.8 Method of Measurement 28 12.9 Unit of Measurement 28 12.10 Atmospheric Pressure 28 12.11 Flowing Temperature 28 12.12 Determination of Gas Characteristics 28 12.13 Exchange of Metering Information 28 12.14 Preservation of Measurement Records 29 13 Price 29 13.1 Contract Price 29 13.2 Variation of Contract Price 29 14 Carbon 29 14.1 General 29

page iii 14.2 Definitions 29 14.3 Embodied Emissions Charges 31 14.4 Exclusive Application 31 14.5 Quotation of OTN 31 14.6 Survival 32 15 Change in Law 32 15.1 Change Events 32 15.2 Notification of Increased Costs Event 32 15.3 Increased Costs 32 15.4 Parties to meet and talk 33 15.5 Pass on of Financial Adjustment 33 16 Imposts 33 16.1 Seller liability 33 16.2 Buyer liability 33 17 Goods and Services Tax 34 17.1 GST 34 17.2 Invoices and statements 34 18 Billing and payment 35 18.1 Unit of billing 35 18.2 Monthly statements 35 18.3 Annual reconciliation 35 18.4 Time for payment 36 18.5 Interest 36 18.6 Disputed statements 36 18.7 Audit 36 18.8 Error in statements 37 19 Force majeure 37 19.1 Definition 37 19.2 Performance suspended by Event of Force Majeure 38 19.3 Mitigation 39 19.4 Notification and diligence 39 19.5 Consultation 40 19.6 End of Event of Force Majeure 40 19.7 Termination for prolonged Event of Force Majeure 40 20 Failure to supply 40 20.1 Failure to Supply 40 20.2 Exclusive Remedy 41 20.3 Audit 41 21 Default by Seller 42 21.1 Events of Default and Termination 42 21.2 Liability for failure to deliver 42 21.3 Effect of Termination 42

page iv 22 Default by Buyer 42 22.1 Default 42 22.2 Effect of Termination 43 23 Disputes and Independent Expert 43 23.1 Separate Agreement 43 23.2 Method 43 23.3 Senior Officer Resolution 43 23.4 Expert 44 23.5 Decision of Independent Expert 46 23.6 Costs 46 23.7 Information and Representation 46 23.8 Arbitration 46 23.9 Arbitration Procedure 46 23.10 Confidentiality of Arbitration Proceedings 47 23.11 Interlocutory or urgent relief 47 24 Seller’s and Buyer’s limitation of liability 47 24.1 General Limitation of Liability 47 24.2 Survival 47 25 Assignment 48 25.1 Assignment by Seller 48 25.2 Assignment by Buyer 48 25.3 Assignment to Related Corporation 48 25.4 Change of control 49 25.5 Right to Charge 49 26 Notices 49 26.1 Method of notice 49 26.2 Change of address 51 27 Confidentiality 51 27.1 Duty of confidentiality 51 27.2 Public Announcements 52 28 Miscellaneous 52 28.1 Governing law 52 28.2 Costs and stamp duty 52 28.3 Entire agreement 52 28.4 Severability 53 28.5 Amendment 53 28.6 Further assurances 53 28.7 No waiver 53 28.8 Partnership 53 28.9 Counterparts 53

page v Schedule 1 - Specification 54 Schedule 2 - Contract Price 55

page 1 Date Parties Magellan Petroleum (NT) Pty Ltd ABN 95 009 718 183 of Level 1, 167 Eagle street, Brisbane, Queensland (Seller) Power and Water Corporation ABN 15 947 352 360 of Level 2, Mitchell Centre, 55-59 Mitchell Street, Darwin, Northern Territory (Buyer) Background A The Seller has agreed to sell and deliver Gas to the Buyer on the terms and conditions contained in this Gas Supply Agreement. B The Buyer has agreed to purchase and take delivery of Gas from the Seller on the terms and conditions contained in this Gas Supply Agreement. Agreed terms 1 Definitions and interpretation 1.1 Definitions In this Agreement unless the contrary intention appears: 1P Reserves means Proved Reserves including developed reserves and undeveloped reserves as defined and assessed in accordance with the SPE Code. Aboriginal Lands Act means the Aboriginal Land Rights (Northern Territory) Act 1976 (Cth). Accumulated Make-up Gas means at the commencement of any Contract Year the aggregate quantity of Make-up Gas less all quantities of Make-up Gas which the Buyer has recovered over preceding Contract Years. Act means the Petroleum Act of the Northern Territory. Affected Party means a Party whose ability to perform its obligations under this Agreement is prevented or deemed to be prevented, wholly or in part, by an Event of Force Majeure. Agreement means this agreement including its recitals and schedules.

page 2 Aggregate Delivery Quantity or ADQ has the meaning under clause 18.3(c). Annual Contract Quantity or ACQ means the maximum quantity of Gas the Seller may be required to deliver over a Contract Year as determined under clause 7.3. Annual Take or Pay Quantity or ATPQ means 100% of the ACQ. Applicable Carbon Scheme means each of the Clean Energy Scheme and New Emissions Scheme as applicable. Authorisation includes: (a) any consent, authorisation, registration, filing, recording, agreement, notarisation, certificate, permission, licence, approval, permit, authority or exemption, including a pipeline licence under the Pipelines Act and a production licence under the Act; or (b) in relation to any act, matter or thing which may be proscribed or restricted in whole or in part by law or otherwise if a Government Body intervenes or acts in any way within a specified period after lodgement, registration or other notification of such act, matter or thing, the expiration of such period without such intervention or action. Bank Bill Rate means the Australia & New Zealand Banking Group Limited Reference Rate from time to time provided that if the said bank ceases to publish or use such rate then the “Bank Bill Rate” will be such rate as charged from time to time by Australia & New Zealand Banking Group Limited on overdraft accounts for amounts in excess of $100,000.00 as advised to the Seller by that bank. Board of Directors means the directors of a Party or sufficient of them to make a decision which binds the Party in accordance with its constituent documents. Business Day means a day on which banks are open for business in Darwin, excluding a Saturday, Sunday or a public holiday. Buyer Permitted Interruption means any discontinuance or cessation or reduction by the Buyer in taking Gas due to the shutdown or reduction in operation of the Buyer’s Plant because of any of the following: (a) any planned interruption of the Buyer’s Plant required by the Buyer having regard to Good Engineering and Operating Practices including any suspension of operations required to allow interconnection of processing and transportation facilities and infrastructure for gas, for a maximum of 10 days in each Contract Year; and (b) any unplanned interruption of the Buyer's Plant for a maximum of 5 days in each Contract Year. Buyer’s Plant means Owen Springs Power Station at Brewer Estate near Alice Springs and any part of that facility. Carbon Cost means any liabilities, charges, expenses, duties, or taxes or Imposts that: (a) are imposed upon or incurred by:

page 3 (i) the Seller; or (ii) any supplier, transporter (including a pipeline operator), wholesaler, distributor, retailer or other person and passed on to the Seller, in respect of the production, recovery, processing, transportation, handling or supply of Gas under this Agreement up to the Delivery Point; and (b) directly arise out of or result from implementation of a Carbon Scheme and include, without limitation: (i) import or excise costs or sales tax; (ii) energy or fuel costs being higher than they would otherwise be in the absence of the Carbon Scheme; and (iii) the amount of any Impost or charge imposed under the Carbon Scheme (except where arising as a result of non-compliance by the Seller or any person with the Carbon Scheme); but excluding any Embodied Emissions Charges. Carbon Scheme means any law or regulation with respect to the production, or emission of, or to reduce, limit, cease, prevent, offset, manage, remove or sequester, greenhouse gas emissions, including without limitation the Clean Energy Scheme and any other mandatory emissions trading scheme or carbon tax for the reduction or management of greenhouse gas emissions or concentrations. Carbon Scheme Change means the introduction of a new Carbon Scheme or amendment to an existing Carbon Scheme. Clean Energy Scheme means the clean energy future scheme of the Commonwealth of Australia established under the Clean Energy Act 2011 (Cth) and its associated Acts, regulations, determinations and guidelines as amended from time to time provided that the scheme continues to include a Transfer Mechanism. Commencement Date means the date for commencement of supply of Gas determined under clause 5.3. Conditions means the conditions precedent to this Agreement set out in clause 3.1. Connection Pipeline means the pipeline for the transmission of gas from the Gas Production Area to the Treatment Plant, which will be approximately 43kms in length. Contract Day means any Day in the Supply Period. Contract Month means each Month during a Contract Year. Contract Year means each period of 12 consecutive Months during the Supply Period commencing at 8.00 am on 1 January and ending at 8.00 am on 1 January in the following calendar year except that: (a) the first Contract Year will commence at 8.00 am on the Commencement Date and end at 8.00 am on the immediately following 1 January; and

page 4 (b) the final Contract Year shall end at 8.00 am on the last day of the Supply Period. Contract Price means the GST exclusive price for the Gas as calculated in accordance with Schedule 2. CP Date is defined in clause 3.4. CPI means the Consumer Price Index Weighted Average of 8 Capital Cities (All Groups) as determined by the Australian Bureau of Statistics, and if that index is discontinued or if its basis of assessment is changed so that it no longer accurately reflects changes in the prevailing levels of prices substantially in the same manner as it did prior to the change in basis, then such other index in substitution for that index: (a) as may be provided by the Australian Bureau of Statistics; or (b) if no index is provided by the Australian Bureau of Statistics, as may be agreed by the Seller and the Buyer; or (c) if no index is provided by the Australian Bureau of Statistics and the Seller and the Buyer are unable to agree within 30 days, as may be provided, at the request of either the Buyer or the Seller, by the President for the time being of the Institute of Actuaries of Australia, or by that person’s nominee, which will provide a basis for comparison equivalent to the Consumer Price Index Weighted Average of 8 Capital Cities (All Groups). Daily Contract Quantity or DCQ means for any Day in a Contract Year the ACQ for that Contract Year divided by the number of days in the relevant Contract Year. Day means a period of 24 consecutive hours beginning at 8.00 a.m. on a day and ending at 8.00 a.m. on the following day. Default means a breach of this Agreement by a Party. Default Quantity has the meaning under clause 20.1. Default Rate means the Bank Bill Rate plus 2% per annum. Defaulting Party means, in the case of a Default by or in respect of: (a) the Seller, the Seller; and (b) the Buyer, the Buyer. Delivery Point means the flange on the spurline of the Palm Valley – Alice Springs Pipeline, in the immediate vicinity of the Buyer’s Plant at the location to be determined in accordance with clause 5.1(b). Delivery Shortfall has the meaning under clause 20.1. Dispute has the meaning given to that term in clause 23.2. Dispute Notice has the meaning given to that term in clause 23.2. Economically Deliverable Reserves means the level of 1P Reserves within the Gas Production Area identified as deliverable during each Contract Year in

page 5 the Reserves Report, with the criteria for the Independent Certifier to conclude that reserves are economically deliverable during a Contract Year to be in accordance with the SPE Code and by reference to each of the following: (a) the only available market for gas from the Gas Production Area is constituted by the terms of this Agreement, including Contract Price; (b) the costs of processing and transporting the Gas to the Delivery Point are the actual costs to the Seller of operating and maintaining the Upstream Facilities either directly or through tolling and use charges payable to third parties; (c) the Seller is not required to incur any additional capital expenditure in respect of production, processing and transportation from the Gas Production Area which would not be economic under then current economic conditions as those terms are defined in the SPE Code; and (d) the Seller must derive a minimum acceptable rate of return on the capital investment involved in the production, processing and transporting of the Gas which rate of return reasonably reflects the weighted average cost of capital or the minimum acceptable rate of return of the Seller but must be consistent with Australian petroleum industry norms for a company the size of the Seller as at the relevant date. Eligible Emissions Unit has the same meaning as in the Clean Energy Act 2011 (Cth). Embodied Emissions Charges means any liability, cost or expense (whether by way of Impost, levy, fee, tax, charge or otherwise), directly imposed on or incurred by the Seller pursuant to: (a) the Clean Energy Scheme (including the cost of paying an Acceptable Shortfall Charge or the cost of acquiring Eligible Emissions Units for the purposes of discharging its compliance liability or avoiding a liability under the Clean Energy Scheme); or (b) a New Emissions Scheme, in each case, in respect of the number of tonnes of potential greenhouse gas emissions (measured in the Relevant Substance) embodied in an amount of Gas supplied at the Delivery Point under this Agreement calculated in accordance with the requirements of the Clean Energy Scheme (or a New Emissions Scheme). Environmental Authorities means all permits, consents, licences, authorities and approvals under the laws of the Northern Territory and/or the Commonwealth relating to the environment required in respect of the construction and operation of the Upstream Facilities and the Production Licence. Event of Force Majeure has the meaning given to that term in clause 19.1. Expiry Date means the date the Supply Period ends as determined under clause 6.2.

page 6 Export Pipeline means any necessary compressors and the pipeline running from the Treatment Plant to the Delivery Point, including all metering and testing equipment upstream of the Delivery Point. Financial Adjustment means an adjustment in the amounts payable under this Agreement (whether in the form of a lump sum or recurrent payment or increase in the Contract Price or otherwise) pursuant to clause 15. gas means a mixture of one or more hydrocarbons and other gases which, at atmospheric pressure and 15oC, is in a gaseous state. Gas means gas which meets the Specification and includes any Off-Specification Gas delivered to the Buyer in accordance with clause 11.5(b). Gas Production Area means the natural gas reservoir or series of reservoirs within the Arumbera Sandstone and Julie Formation within the Retention Licence or within any Production Licence succeeding to the Retention License and referred to as the “Dingo Field”. GJ means one gigajoule which is equal to 109 joules. Good Engineering and Operating Practices means recognised practices, methods and acts, together with the exercise of that degree of skill, diligence, prudence and foresight that reasonably would be expected from Australian and internationally recognised operators under conditions comparable to those applicable to the relevant facility in the light of known facts or facts which should reasonably have been known at the time and consistent with applicable law, regulations, Authorisations, consents and licences and having regard to the need for: (a) adequate materials; (b) suitable personnel; (c) appropriate maintenance procedures; (d) ongoing monitoring and testing of plant and equipment performance; and (e) safe operating procedures. goods means goods as defined in the GST Law. Government Body means any government, governmental or semi-government or judicial entity, any ministry and any public, statutory or administrative entity, whether domestic, federal, state or local. Gross Heating Value means the gross number of joules produced by the complete combustion of 1 cubic metre of gas at a temperature of 15°C and under an absolute pressure of 101.325 kPa with air of the same temperature and pressure as the gas, when the products of combustion are cooled to the initial temperature of the gas and air, and when the water formed by combustion is condensed to the liquid state, corrected to a water vapour free basis and expressed at a pressure base of 101.325 kPa. GST means any tax on goods, services or goods and services, including any value-added tax, broad-based consumption tax or other similar tax.

page 7 GST Law means A New Tax System (Goods and Services Tax) Act 1999 (Cth) (as amended from time to time) or any replacement or other relevant legislation and regulations, and includes any other legislation enacted to validate, recapture or recoup tax collected as GST. Impost means any royalty (whether based on value, profit or otherwise), tax (other than GST and tax on income or tax on gains of a capital nature), including petroleum resource rent tax, environmental tax, excise, levy, fee, rate, or other charge imposed by any Government Body (Federal, State or local in Australia) (other than a Carbon Cost or Embodied Emissions Charge) which is or may become payable in respect of the recovery, production, transportation, processing, export, import, supply, sale or use of Gas delivered under this Agreement. Increased Costs Event means where: (a) an Impost which was not in force as at the date of this Agreement is imposed or the basis for imposing or calculating any Impost changes; or (b) any liability, cost or reduction in benefit is incurred in connection with the production, recovery, processing, transportation, handling or sale of the Gas to be supplied under this Agreement due to or arising from the introduction of, or a change in a Law or a change to the interpretation or effect of a Law (other than a Carbon Scheme Change) which occurs after the date of this Agreement; (c) Carbon Costs increase as the result of a Carbon Scheme Change which occurs after the date of this Agreement; but does not include an Embodied Emissions Charge. Increased Costs Event Notice has the meaning given in clause 15.2. Independent Certifier means an internationally recognised firm or company which carries out certification of gas reserves, or a member of such a firm or company, selected by the Seller with the consent of the Buyer, such consent not to be unreasonably withheld. Independent Expert means an expert appointed under and for the purposes of clauses 23.3 and 23.4. Input Tax Credit has the meaning given to that term in the GST Law. Invoice includes a document deemed to constitute a Tax Invoice under the GST Law. kPa means kilopascal. Law means common law, equity, any statute, regulation, order, rule, subordinate legislation or other document enforceable under any statute, regulation, order, rule or subordinate legislation and includes the amendment, modification, consolidation, re-enactment or replacement of any of them. Loss includes loss, costs, damages, liabilities and expenses. Make-up Gas or MUG means the quantity of Gas which is paid for but not taken by the Buyer in any Contract Year.

page 8 Material Default means a Default which causes or is likely to cause to the Non-Defaulting Party damages, costs or expenses either directly or if it is not rectified, of at least $500,000 or which would otherwise remove or substantially vitiate for the Non-Defaulting Party a benefit or consideration under this Agreement. Maximum Daily Quantity or MDQ means the maximum quantity of Gas which the Seller can be required to deliver on any Day during a Contract Year being 120% of DCQ for the relevant Day. Maximum Hourly Quantity or MHQ means the maximum quantity of Gas which the Seller can be required to deliver over any hour of any Day during a Contract Year being the MDQ for the Day divided by 24. Metering Equipment means suitable equipment of a standard of manufacture approved for use in the Northern Territory for measuring the rate and quantity of gas delivered to the Delivery Point and to be located on the Export Pipeline in the vicinity of the Delivery Point. MJ means one megajoule which is equal to 106 joules. Month means a period commencing at 8.00 a.m. on the first day of a calendar month and ending at 8.00 a.m. on the first day of the next calendar month. MUG Reserve Amount means the lesser of; (a) Accumulated Make-up Gas; and (b) 0.315 PJ (i.e., 60 x MDQ). Native Title Act means the Native Title Act 1993 (Cth). Net Financial Effect means the net effect in financial terms of an Increased Costs Event on the costs incurred by the Seller in producing, processing, transporting or selling the Gas to be supplied under this Agreement, taking into account any offsetting benefit available to the Seller which is related to the Increased Costs Event. New Emissions Scheme means the introduction of a new Carbon Scheme that directly imposes a liability, cost or expense on the Seller in respect of the number of tonnes of potential greenhouse gas emissions (measured in the Relevant Substance) embodied in an amount of Gas supplied at the Delivery Point under this Agreement. NDQ or Nominated Daily Quantity means the quantity of Gas which the Buyer nominates in accordance with clause 9 for delivery to the Delivery Point on any Day but which cannot exceed on any Day the MDQ for that Day. Non-Defaulting Party means the Party which is not the Defaulting Party in respect of a Default. Nominations means nominations for the quantity of Gas to be delivered on any Day as given by the Buyer in accordance with clause 9. Notice has the meaning given in clause 26.1. Off-Specification Gas means gas which does not meet the Specification.

page 9 Palm Valley – Alice Springs Pipeline means the pipeline from the Palm Valley gas field to Alice Springs including the spurline to the Buyer’s Plant. Party means a party to this Agreement and are collectively referred to as the Parties. Permitted Interruptions means each and both of Buyer Permitted Interruption and Seller Permitted Interruption. Pipelines Act means Energy Pipelines Act of the Northern Territory. Pipeline Licence means a pipeline licence under the Pipelines Act granted in respect of the Connection Pipeline. Planning Approval means the permit, approval or consent required under Northern Territory planning and development laws to permit the lawful construction and operation of the Treatment Plant. PJ means one petajoule which is equal to 1015 joules. Production Plant means a gas gathering system and plant located at the Gas Production Area intended to produce, gather and process gas for transport in the Connection Pipeline. Production Licence means a production licence under the Act granted to the Seller in respect of the Gas Production Area. Proposed Financial Adjustment has the meaning given in clause 15.3(d). Quarter means a period of 3 calendar months commencing on the first day of July, October, January or April and Quarterly has a corresponding meaning. Reasonable and Prudent Operator means a person who exercises that degree of diligence, prudence and foresight reasonably and ordinarily exercised by skilled and experienced operators under similar circumstances and conditions and in accordance with applicable laws, regulations and standards. Reckless means where the Party did not actually intend or foresee the relevant consequence/s of its action or omission but there was a reasonably apparent risk that such consequences would occur, and the Party took the action or made the omission as a result of a mental attitude of indifference to the existence of the risk or deliberate failure to investigate the existence of the risk, where that attitude or failure was caused by or constitutes more than negligence, or a failure to take reasonable care or an error of judgement, but was rather so wanton and reckless that a reasonable person considering the results of the Party’s acts or omissions on an objective basis would be justified acting reasonably in concluding that the Party actually foresaw and intended the consequences or had an utter disregard for the obvious and foreseeable consequences. Reduction has the meaning given in clause 7.5 Related Corporation means, in relation to: (a) the Seller, a body corporate that is a related body corporate of the Seller within the meaning of section 50 of the Corporations Act 2001; and

page 10 (b) the Buyer, a body corporate that is a related body corporate of the Buyer within the meaning of section 50 of the Corporations Act 2001. Relevant Substance means CO2-e or such other substance stipulated under the Applicable Carbon Scheme from time to time by which potential greenhouse gas emissions embodied in the Gas delivered under this Agreement must be measured. Requested Commencement Date means the date which is 18 months from the date of this Agreement, as extended under clause 3.5(c). Retention Licence means retention licence 2 granted under the Act. Reserves has the meaning ascribed to that term under the SPE Code. Reserves Report is defined in clause 7.2. Reserves Shortfall has the meaning under clause 10.4. Seller Conditions has the meaning under clause 3.3(a). Seller Permitted Interruption means any discontinuance or cessation or reduction by the Seller in the supply or delivery of Gas against the NDQ due to the shutdown or reduction in operation of the Seller’s Facilities because of any of the following: (a) any planned interruption of the Seller’s Facilities, required by the Seller or the operators of those facilities having regard to Good Engineering and Operating Practices including any suspension of operations required to allow interconnection of processing and transportation facilities and infrastructure for gas, for a maximum period of 10 Days in each Contract Year; (b) any unplanned interruption of the Seller’s Facilities (other than under subclause (c)), required by the Seller or the operators of those facilities for a maximum period of 5 Days in each Contract Year; and (c) any unexpected or unplanned problem or event which arises within the first 30 days on and from the Commencement Date , for a maximum period of 72 hours. Seller’s Facilities means the wells, pipelines, plant and equipment for the production, transportation, processing, measuring and testing of gas upstream of the Delivery Point which are necessary to produce or deliver Gas to the Buyer at the Delivery Point, including the Upstream Facilities (whether or not owned by or operated for the Seller) and any one or more of them and any part of them. Senior Officer means a person having authority, without recourse to the Party that designated him or her for further authority or instructions, to settle the matter requiring resolution. Specification means the Gas Specification Dingo Field set out in schedule 1. SPE Code means the document called “Petroleum Resources Management System” published in 2007 and the document called “Guidelines for the Application of the Petroleum Resources Management System” published in November 2011, each by the Society of Petroleum Engineers.

page 11 Supply has the meaning given to that term in the GST Law. Supply Period has the meaning given to that term in clause 6.1. Tax Invoice has the meaning given to that term in the GST Law. Term Sheet means the document entitled “Dingo Gas Supply Terms Sheet – 11 April 2013” between the Parties relating to the subject matter of this Agreement. TJ means one terajoule which is equal to 1012 joules. Transfer Mechanism means a statutory mechanism under a Carbon Scheme for transferring from the Seller to the Buyer the Seller’s direct liability under that scheme for the potential greenhouse gas emissions embodied in the Gas supplied under this Agreement. Treatment Plant means a gas processing plant intended to process gas from the Gas Production Area to meet the Specification, which plant is to be located within Brewer Estate near Alice Springs at a place determined by the Seller. Upstream Facilities means each of the Production Plant, Connection Pipeline, Treatment Plant and Export Pipeline. Wilful Misconduct means a deliberate or Reckless refusal to comply with the terms of this Agreement by a Party where that Party otherwise has the ability to comply. For the avoidance of doubt, Wilful Misconduct does not include a Party's negligence (as defined by common law and/or statute from time to time). 1.2 Interpretation In this Agreement: (a) headings are for convenience only and do not affect interpretation; (b) unless the context indicates a contrary intention: (i) "person" includes an individual, the estate of an individual, a corporation, an authority, an association or a joint venture (whether incorporated or unincorporated), a partnership, a trust, state or government; (ii) a reference to a party includes that party's executors, administrators, successors and permitted assigns, including persons taking by way of novation; (iii) a reference to a document (including this Agreement) is to that document as varied, novated, ratified or replaced from time to time; (iv) a reference to a statute includes its delegated legislation and a reference to a statute or delegated legislation or a provision of either includes consolidations, amendments, re-enactments and replacements; (v) a reference to any authority, association or body whether statutory or otherwise shall, in the event of any such authority, association or body ceasing to exist or being re-constituted, re-named or replaced or the powers or functions thereof being transferred to any other

page 12 authority, association or body, be deemed to refer respectively to the authority, association or body established or constituted in lieu thereof or as nearly as may be succeeding to the powers or functions thereof; (vi) a word importing the singular includes the plural (and vice versa), and a word indicating a gender includes the other gender; (vii) a reference to this Agreement includes all schedules, exhibits, attachments and annexures to it; (viii) if a word or phrase is given a defined meaning, any other part of speech or grammatical form of that word or phrase has a corresponding meaning; (ix) "includes" in any form is not a word of limitation; (x) a reference to "$" or "dollar" is to Australian currency; and (xi) references to time are references to time in Darwin, Northern Territory and “month” is a reference to “calendar month”. 2 Measurement 2.1 Units of Measurement Terminology used to describe units will be, unless otherwise stated, in accordance with Australian Standard AS1000-1998 “The International System of Units (SI) and its Application”, the National Measurement Act 1960 of the Commonwealth of Australia and Regulations thereunder and Australian Standard AS/NZS1376-1996 “Conversion Factors”. 2.2 Rounding of Dollars For the purpose of this Agreement any fractional part of a dollar must be rounded to four places after the decimal point with the fourth decimal being rounded up if the fifth decimal is “5” or a greater number and rounded down if the fifth decimal is less than “5”. 2.3 Rounding of Gas Quantities (a) For billing purposes under this Agreement all quantities of Gas must be rounded to the nearest GJ. (b) Unless otherwise specified, gas and Gas measured and stated for the purposes of this Agreement are to be measured and stated by reference to the Gross Heating Value. 2.4 Contract Years of less than 365 Days Any quantity expressed in this Agreement which is applied to or by reference to a Contract Year will, in the case of a Contract Year comprising less than 365 days, be reduced on a pro rata basis based on the number of days in that Contract Year.

page 13 3 Conditions Precedent 3.1 Conditions This Agreement (other than this clause and clauses 1,19, 23,24, 25, 26, 27 and 28) is subject to and conditional upon the following: (a) the Board of Directors of each of the Seller and Buyer approving this Agreement; (b) the acquisition by the Seller of land within Brewer Estate for the location of the Treatment Plant; (c) the Seller obtaining the Planning Approval; (d) the Seller obtaining the Pipeline Licence; (e) the Seller obtaining the Production Licence; (f) the Seller entering into agreements with all relevant native title parties and Aboriginal people representative bodies or groups as may be required under the Native Title Act and the Aboriginal Lands Act to: (i) allow the grant of the Pipeline Licence and the Production Licence; and (ii) secure access to and use of the pipeline corridor for the Connection Pipeline and the Export Pipeline; (g) the Seller obtaining the Environmental Authorities; and (h) the Seller obtaining financing for the construction of the Upstream Facilities in an amount and on terms acceptable to the Seller. 3.2 Board Approval (a) Each Party must seek the approval of its Board of Directors to this Agreement either prior to or as soon as practicable after its execution. (b) If that approval is not obtained by a Party within 45 days of the date of this Agreement then that Party may terminate this Agreement by notice in writing to the other Party without liability and thereupon the Parties shall be released from all and any obligations and liabilities under this Agreement. (c) Each Party must notify the other of receipt of approval of its Board of Directors within one Business Day of that approval being given. (d) If a Party has not provided a notification under clause 3.2(c) by no later than one Business Day after the expiration of the 45 days of the date of this Agreement, then it will be deemed not to have obtained approval of its Board of Directors within the said 45 days. 3.3 Seller Conditions (a) The Seller shall be responsible for satisfying the Conditions at clauses 3.1(b) to (h)inclusive (Seller Conditions) and must use its reasonable endeavours to do so provided that the Seller will not be required to act to

page 14 its financial detriment (as reasonably determined by the Seller) in satisfying any of those Conditions. (b) The Seller must keep the Buyer informed on a monthly basis as to progress in satisfaction of the Seller Conditions. (c) The Buyer must give, at the Seller’s cost, any reasonable assistance which the Seller requests of the Buyer in satisfying any of the Seller Conditions, including, accepting gas at the Delivery Point to enable commissioning of any of the Upstream Facilities. 3.4 Satisfaction date (a) Each of the Seller Conditions must be satisfied or waived by the date that is the first anniversary of the date of this Agreement (CP Date). The Seller Conditions are for the sole benefit of the Seller and may be waived by the Seller in its absolute discretion. 3.5 Extension of CP Date (a) Provided the Seller has complied with clause 3.3(a) and has used reasonable endeavours to overcome or minimise the extent of the delay, the Seller may extend the CP Date for the period of the estimated delay on one or more occasions, but in any event by no more than six months in aggregate from the original CP Date, by written notice to the Buyer given not later than 28 days prior to the then current CP Date if it considers that the Seller Conditions will not be satisfied prior to the then current CP Date. (b) Each notice under clause 3.5(a) will set out the causes of the delay and the steps which the Seller has taken to overcome or minimise the extent of the delay. (c) Each time the CP Date is extended under this clause 3.5, the Requested Commencement Date will be extended by an equivalent period of time. 3.6 Termination If any of the Seller Conditions are not satisfied or waived by the CP Date (including as extended under clause 3.5), then either Party may by notice in writing to the other terminate this Agreement whereupon the Parties shall be released from all or any further obligation or liability under this Agreement. Prior to the CP Date neither Party may terminate this Agreement except pursuant to clause 3.2(b) or clause 19. 4 Warranties 4.1 Warranties by Seller The Seller represents and warrants to and for the benefit of the Buyer that: (a) it will have good title to all Gas delivered to the Buyer under this Agreement and that at the Delivery Point such Gas will be free from all mortgages, charges, liens and other encumbrances and adverse claims;

page 15 (b) it is a body corporate duly incorporated in its place of incorporation and validly existing; and (c) it has full power, authority and legal right to execute and deliver and perform its obligations under this Agreement. 4.2 Implied warranties To the full extent permitted by law, any warranties regarding the quality of the Gas, its fitness for any particular purpose and its merchantability, other than those expressly stated in this Agreement, are excluded from and shall form no part of the agreement between the Parties. 4.3 Warranties by Buyer The Buyer represents and warrants to and for the benefit of the Seller that: (a) it is a body corporate duly incorporated in its place of incorporation and validly existing; and (b) it has full power, authority and legal right to execute and deliver and perform its obligations under this Agreement. 5 Construction and Commencement of Supply 5.1 Construction of Upstream Facilities (a) The Seller will commence the work required to construct and commission the Upstream Facilities and use its reasonable endeavours to complete construction and commissioning to be in a position to commence the supply of gas by the Requested Commencement Date. (b) The Buyer must at its cost cause the Delivery Point to be constructed through its arrangements with the owner/operator of the Palm Valley-Alice Springs Pipeline. The Buyer must ensure the Delivery Point is available for tie-in or connection with the Export Pipeline in sufficient time to allow the supply of gas by the Requested Commencement Date. Each Party must give reasonable assistance to the other Party, as requested by it, and consult with the other Party concerning construction of the Delivery Point. Further the exact location of the Delivery Point must be agreed by both Parties. 5.2 Supply Commencement Date The supply of Gas in accordance with this Agreement shall commence on and from the Commencement Date. 5.3 Determination of Commencement Date The Seller shall provide notice of the Commencement Date to the Buyer within 14 days after the completion of construction and commissioning of the Upstream Facilities (including the obtaining of all approvals and licences required to operate the Upstream Facilities) and the Delivery Point. The Commencement Date must be no later than the first day of that Month which first commences on or after 14 days after the date of the notice.

page 16 5.4 Delays in Commencement Date Where, other than due to any of: (a) a delay in completion of construction or commissioning of the Upstream Facilities because of an Event of Force Majeure; or (b) termination of this Agreement under clause 3.6 or (c) a delay in the construction and commissioning of the Delivery Point, the Commencement Date has not occurred within 90 days of the Requested Commencement Date, then the Commencement Date will be deemed to be the date which is 90 days after the Requested Commencement Date. 6 Supply Period 6.1 Supply Period The Supply Period will start on the Commencement Date and end on the earlier to occur of: (a) 8.00 a.m. on the Expiry Date; and (b) the date upon which this Agreement is terminated in accordance with the provisions of this Agreement. 6.2 Expiry Date The Expiry Date is the first to occur of: (a) the day which is the 20th anniversary of the Commencement Date; and (b) the day by when the aggregate quantity of Gas delivered to the Buyer under this Agreement since the Commencement Date is 31 PJ; and (c) the expiration of the last Contract Year as determined under clause 7.3(e). 7 Sale and purchase of Gas 7.1 Sale and purchase of Gas During the Supply Period, subject to the terms and conditions of this Agreement: (a) the Seller agrees to sell and make available for delivery to the Buyer at the Delivery Point, Gas at a rate equal to the NDQ; (b) the Seller is not required to deliver more than MDQ on any Day; (c) subject to clause 8.1(b), the Seller is not required to deliver more than ACQ in any Contract Year, but the Seller will use its reasonable endeavours to supply more than ACQ in any Contract Year where requested by the Buyer; and

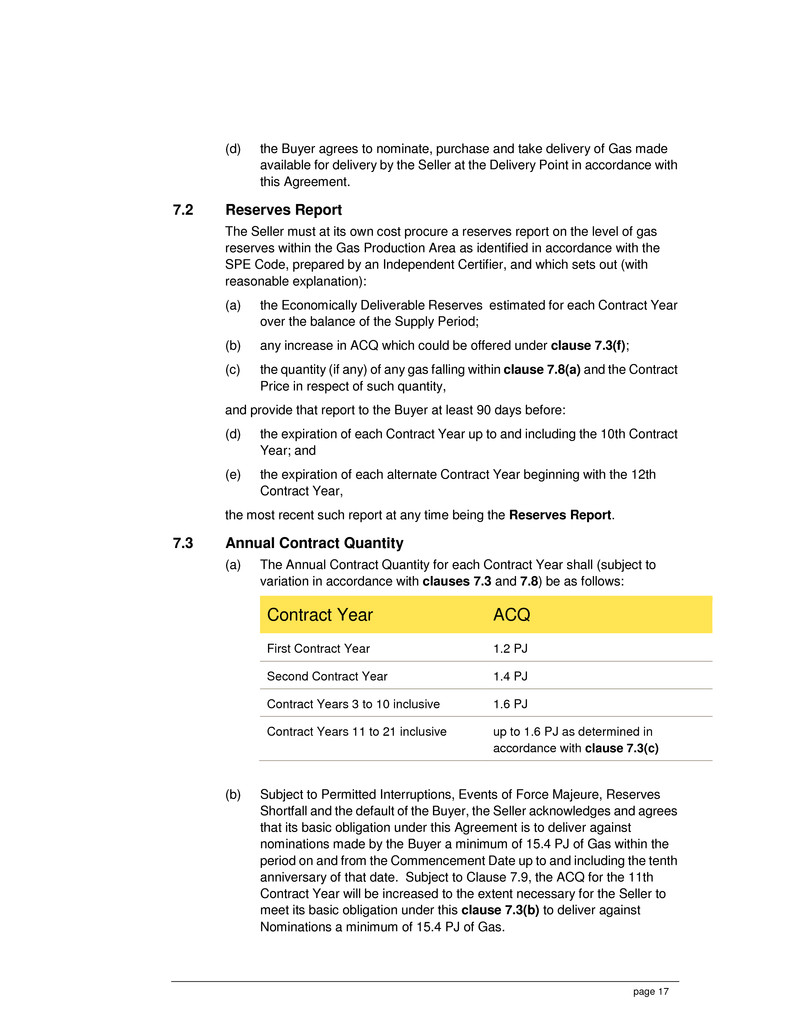

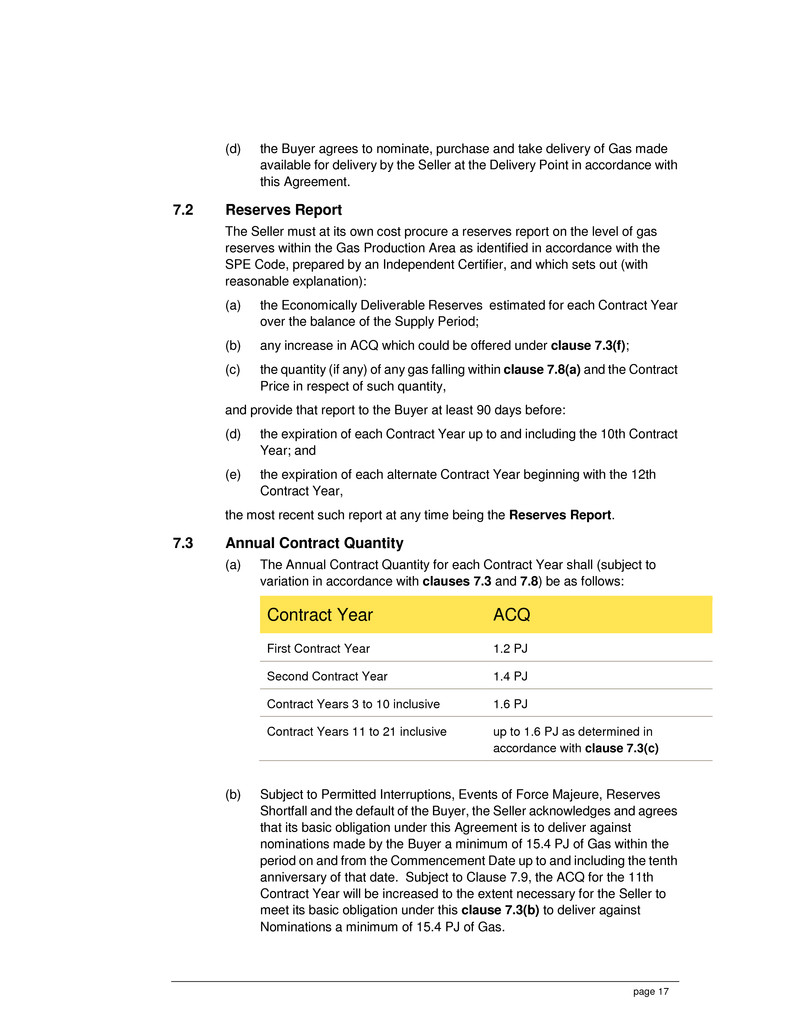

page 17 (d) the Buyer agrees to nominate, purchase and take delivery of Gas made available for delivery by the Seller at the Delivery Point in accordance with this Agreement. 7.2 Reserves Report The Seller must at its own cost procure a reserves report on the level of gas reserves within the Gas Production Area as identified in accordance with the SPE Code, prepared by an Independent Certifier, and which sets out (with reasonable explanation): (a) the Economically Deliverable Reserves estimated for each Contract Year over the balance of the Supply Period; (b) any increase in ACQ which could be offered under clause 7.3(f); (c) the quantity (if any) of any gas falling within clause 7.8(a) and the Contract Price in respect of such quantity, and provide that report to the Buyer at least 90 days before: (d) the expiration of each Contract Year up to and including the 10th Contract Year; and (e) the expiration of each alternate Contract Year beginning with the 12th Contract Year, the most recent such report at any time being the Reserves Report. 7.3 Annual Contract Quantity (a) The Annual Contract Quantity for each Contract Year shall (subject to variation in accordance with clauses 7.3 and 7.8) be as follows: Contract Year ACQ First Contract Year 1.2 PJ Second Contract Year 1.4 PJ Contract Years 3 to 10 inclusive 1.6 PJ Contract Years 11 to 21 inclusive up to 1.6 PJ as determined in accordance with clause 7.3(c) (b) Subject to Permitted Interruptions, Events of Force Majeure, Reserves Shortfall and the default of the Buyer, the Seller acknowledges and agrees that its basic obligation under this Agreement is to deliver against nominations made by the Buyer a minimum of 15.4 PJ of Gas within the period on and from the Commencement Date up to and including the tenth anniversary of that date. Subject to Clause 7.9, the ACQ for the 11th Contract Year will be increased to the extent necessary for the Seller to meet its basic obligation under this clause 7.3(b) to deliver against Nominations a minimum of 15.4 PJ of Gas.

page 18 (c) For the 11th to 21st Contract Years inclusive (and subject to clause 7.3(b)) the ACQ shall be the Economically Deliverable Reserves for the relevant Contract Year as indicated in the last Reserves Report as of the date of commencement of the relevant Contract Year but up to and not exceeding 1.6 PJ, provided that and subject to clause 7.3(e), for the 21st Contract Year ACQ shall be the Economically Deliverable Reserves (up to 1.6 PJ pro-rated) for that Contract Year less the MUG Reserve Amount. The 21st Contract Year means the Contract Year ending on the 20th anniversary of the Commencement Date. (d) For each of the 11th to 21st Contract Years, Economically Deliverable Reserves shall be determined by reference to the Reserves Report. (e) Where in respect of a Contract Year after Contract Year 10, the Economically Deliverable Reserves are zero, subject to clause 7.3(b), unless the Parties otherwise agree or the Buyer agrees to take an amount of gas under clause 7.8, then the preceding Contract Year shall be the last Contract Year of the Supply Period and the ACQ for that last Contract Year shall be the Economically Deliverable Reserves for that Contract Year less the MUG Reserve Amount, and the MUG may be taken by the Buyer in accordance with clause 8.1 during that last Contract Year. (f) This subclause applies only in respect of Contract Years in respect of which the ACQ is 1.6 PJ. Where at any time the Seller (acting as a Reasonable and Prudent Operator and having regard to the Reserves Report) considers that the deliverability and capacity of Reserves from the Gas Production Area is such as to permit an increase in the ACQ above 1.6 PJ for certain Contract Years: (i) it may (but is not obliged to) notify the Buyer of what the Seller considers to be that increase for one or more Contract Years; (ii) within 30 Business Days of receiving that notification, the Buyer must indicate whether it is prepared to accept the increased quantity or part of it as ACQ for the relevant Contract Years; (iii) if the Buyer so notifies the Seller, the increased quantity will become ACQ for the relevant Contract Years for the purposes of this Agreement; and (iv) if the Buyer does not respond within the said 30 Business Days there shall be no adjustment to the ACQ. (g) If the Seller in respect of any or all of the first and second Contract Years offers (in writing prior to the commencement of that Contract Year) to increase ACQ to 1.6 PJ then the Buyer must accept that offer and the ACQ for the relevant Contract Years will be increased to 1.6 PJ. (h) At the beginning of each Contract Year, the Seller will provide the Buyer with a table showing the ACQ (adjusted in accordance with this clause 7) for each Contract Year.

page 19 7.4 Obligation to pay In respect of each Contract Year of the Supply Period the Buyer must pay for the greater of ATPQR (ATPQ as reduced in accordance with clause 7.5) or the quantity of Gas nominated by the Buyer and made available for delivery at the Delivery Point by the Seller in accordance with this Agreement over that Contract Year, at the Contract Price. 7.5 Reduction in Annual take or pay quantity (a) The ATPQ for a Contract Year will be reduced in accordance with the following formula: ATPQR = ATPQ - Reduction Where ATPQR = the ATPQ which is reduced to take account of any Reduction; Reduction = the sum during the Contract Year of the reductions, being the aggregate quantity of Gas which the Seller did not make available for delivery or the Buyer did not take on any Day during the Contract Year as a result of any of the following: (i) an Event of Force Majeure entitling the Buyer or Seller to suspend performance of its obligations under this Agreement; (ii) any Buyer or Seller Permitted Interruptions; (iii) Off-Specification Gas delivered without the Buyer’s consent or any interruption to supply associated with Off-Specification Gas; (iv) Reserves Shortfall; and (v) any Delivery Shortfall. (b) In the absence of a nomination by the Buyer because of any of the events within subparagraphs (i) to (iv) above, then the reductions shall be calculated against the lesser of DCQ and the quantities of Gas last nominated by the Buyer under clause 9 in relation to the relevant period. 7.6 Maximum Hourly Quantity The hourly rate of delivery of the Gas on any Day shall not exceed MHQ.

page 20 7.7 Increase in MDQ If requested by the Buyer in respect of any Day the Seller will use reasonable endeavours to supply a quantity of Gas in excess of the MDQ, but the Seller shall have no liability to the Buyer for any failure to supply in excess of the MDQ. The Buyer cannot make requests for deliveries in excess of the MDQ throughout a Contract Year in such a way as would cause the ACQ for that Contract Year to be exceeded unless the Seller otherwise agrees in its absolute discretion. 7.8 Right of first refusal (a) This clause only applies for a Contract Year or Years on and from Contract Year 11 where in respect of that Contract Year (and before the application of this clause) the ACQ is less than 1.6 PJ. (b) From Contract Year 11 onwards, if based on a Reserves Report, the Seller reasonably determines that any gas, up to a maximum quantity which when added to the then existing ACQs for each of the relevant remaining Contract Years would not exceed 1.6 PJ per Contract Year (Additional Quantity), that was not considered as Economically Deliverable Reserves, however, would become Economically Deliverable Reserves if the Contract Price were increased to offset increases in capital and operating expenditure to produce, process and transport such Additional Quantities of gas, then the Seller must offer to the Buyer to increase the ACQ for each remaining Contract Year by the Additional Quantity at the increased Contract Price, on a first right of refusal basis. (c) The Buyer shall have 60 days after receipt of that offer to accept that offer. (d) If the Buyer accepts an offer made under paragraph (b) within the time referenced above in paragraph (c), then the ACQ for each remaining Contract Year of the Supply Period shall be increased by the Additional Quantity and the Contract Price shall be adjusted to be the price contained in the offer and the terms of this Agreement with all necessary changes including provisions concerning the adjustment of the Contract Price in Schedule 2, shall apply to the Seller’s obligation to sell and the Buyer’s obligation to buy those increased ACQs at the increased Contract Price on and from the Contract Years indicated in the Seller’s offer. (e) If the Buyer does not accept the offer or makes no response within the 60 days then the Seller is free to sell or otherwise dispose of the additional quantities of gas on such terms, as it sees fit but at no lesser price than that offered to the Buyer. (f) Subject to clause 7.3(f)(iii), during any Contract Year the Seller is not restricted from selling or disposing of quantities of Gas from the Gas Production Area which are over and above the maximum ACQ of 1.6 PJ allocated to this Agreement. 7.9 Reduction in basic obligation (a) Pursuant to clause 7.3(b), the basic obligation to deliver against Nominations made by the Buyer a minimum quantity of 15.4 PJ of Gas (Basic Obligation Quantity) within the period on and from the

page 21 Commencement Date up to and including the tenth anniversary of that date, may be reduced by the effects of Permitted Interruptions, Events of Force Majeure, Reserves Shortfall and the default of the Buyer (Reduction Events). (b) Subject to clause 7.7, where deliveries of Gas against Nominations are in excess of the ACQ in a Contract Year there shall be no reduction in the Basic Obligation Quantity due to Reduction Events which may have occurred during that Contract Year. (c) If during a Contract Year during which Reduction Events occur, deliveries of Gas against Nominations are less than the ACQ, then the Basic Obligation Quantity shall be reduced by the lesser of: (i) the difference between the ACQ and the actual quantity of Gas delivered against Nominations during that Contract Year; and (ii) the quantity equal to the DCQ for each day of each period of each Reduction Event during that Contract Year (Basic Obligation Quantity Reduction Amount). 8 Make-up Gas 8.1 Make-up Gas (a) During the Supply Period, the Buyer will be entitled to the delivery of quantities of Gas paid for under clause 18 but not required to be delivered or not taken by the Buyer during the previous periods (Make-up Gas or MUG) provided deliveries of MUG and NDQ in aggregate on any Day cannot exceed MDQ for that Day and provided that during the Supply Period no Make-up Gas may be taken by the Buyer unless and until ACQ has been taken for that Contract Year. (b) During the Supply Period, the Seller will use reasonable endeavours to deliver quantities of MUG over and above the ACQ where so nominated by the Buyer. (c) Gas paid for but not taken by the expiration of the Supply Period shall be forfeited by the Buyer and no compensation is payable to the Buyer. (d) The Buyer must pay for the MUG at the Contract Price prevailing at the time the quantity of MUG is taken less the Contract Price paid for the relevant quantity as part of the ATPQ. The prevailing Contract Price shall be determined as if Schedule 2 continued to apply for that period. (e) MUG will be deemed to be taken on a “first banked, first taken” basis. (f) The Buyer must use reasonable endeavours to take delivery of MUG continuously and as quickly as reasonably possible but at a rate that does not exceed MDQ for any Day unless the Seller otherwise agrees.

page 22 (g) The Seller is not required to incur any capital costs to establish or maintain facilities to enable the MUG Reserve Amount to be available or to be delivered during the last Contract Year. 9 Nomination of quantities 9.1 Annual Forecast At least 60 Days prior to the commencement of each Contract Year, the Buyer must give notice to the Seller of: (a) its forecast annual requirements of Gas under this Agreement for the next 5 Contract Years or the number of Contract Years remaining if less than 5; and (b) its forecast monthly requirements of Gas under this Agreement for each Month for the forthcoming Contract Year specifying for each Month its forecast peak and average demands. 9.2 Quarterly and Monthly Forecasts At least 7 Days prior to the commencement of each Quarter, the Buyer must give notice to the Seller of its forecast requirements of Gas under this Agreement for each of the following 12 Months specifying for each Month its forecast peak and average demands. At least 7 Days prior to the commencement of each Month, the Buyer must give notice to the Seller of its forecast requirements of Gas under this Agreement for each Day of that Month. 9.3 Change in Forecasts The Buyer must give to the Seller as much notice as is reasonably possible of any substantial changes in the forecast provided for in clauses 9.1 and 9.2 and of any likely departures from such forecasts in the Buyer's actual requirements of Gas. 9.4 Daily Nomination The Seller and the Buyer agree as follows: (a) By 10.00 am on each Day, the Buyer must nominate to the Seller, the Buyer’s requirements for Gas for the next Day. (b) The Buyer may amend its nomination given in accordance with paragraph (a) of this clause 9.4 provided that notice of such amended nomination is given not later than 2.00 pm on the day prior to the Day for which the amended nomination is given. (c) The Buyer may not give a Nomination which requires delivery of a quantity of Gas in excess of the ACQ in any Contract Year or at a rate which would cause the MDQ on any Day in any Contract Year to be exceeded unless otherwise agreed by the Seller pursuant to clause 7.7.

page 23 (d) If the Buyer fails to notify the Seller of its requirements in accordance with this clause 9.4, the Seller will continue to make Gas available for delivery at the Delivery Point in accordance with the last nomination properly made by the Buyer pursuant to clause 9.2. The Buyer must use its reasonable endeavours to minimise the rate at which it varies its requirements for Gas under this Agreement. 9.5 Form of nomination (a) Nominations pursuant to this clause 9 may be made by facsimile or email or another system as mutually agreed between the Parties. (b) The Nomination is taken to be received when the Seller sends a Notice to the Buyer acknowledging receipt and confirmation of the Nomination but the Seller must acknowledge such receipt as soon as possible after receiving the Nomination. 10 Continuity of Supply 10.1 Planned Maintenance (a) In the third Month prior to the end of each Contract Year, the Parties must meet and discuss maintenance requirements for the following Contract Year and attempt to coordinate planned maintenance between the Parties to minimise shortfalls in deliveries of Gas. The Buyer will at this time provide to the Seller a schedule of the time during which it is anticipated that planned maintenance will be undertaken by the Buyer on the Buyer’s Plant. (b) All planned maintenance requirements which may interrupt deliveries or receipt of Gas must be advised to the other Party in advance upon reasonable notice but at least 20 Business Days which notice must advise of the anticipated period of interruption. (c) Each Party must keep the other Party advised of progress during any planned maintenance period. 10.2 Permitted interruptions – Seller (a) The Seller may interrupt or curtail the delivery of Gas to the Buyer for a Seller Permitted Interruption. (b) In the case of a Seller Permitted Interruption for planned maintenance to the Seller’s Facilities (as contained at paragraph (a) of the definition of Seller Permitted Interruption) the Seller shall give not less than 20 Business Days’ notice to the Buyer of the Seller Permitted Interruption. (c) In the case of a Seller Permitted Interruption as defined at paragraphs (b) and (c) of the definition of that term the Seller shall give as much notice of the Seller Permitted Interruption to the Buyer as is reasonably practicable in the circumstances.

page 24 10.3 Permitted interruptions – Buyer (a) The Buyer may discontinue or cease or reduce taking Gas from the Seller for a Buyer Permitted Interruption. (b) In the case of a Buyer Permitted Interruption for planned maintenance to the Buyer’s Plant (as contained at paragraph (a) of the definition of Buyer Permitted Interruption) the Buyer shall give not less than 20 Business Days’ notice to the Seller of the Buyer Permitted Interruption. (c) In the case of a Buyer Permitted Interruption as defined at paragraph (b) of the definition of that term the Buyer shall give as much notice of the Buyer Permitted Interruption to the Seller as is reasonably practicable in the circumstances. 10.4 Reserves Shortfall (a) The Seller will not be liable for a failure to deliver Gas to the extent that such failure is due to a restriction on or impediment to the quantity or rate of production of Gas from the Gas Production Area due to any natural or geological cause, including the effective exhaustion of Reserves (Reserves Shortfall), and subject to the Seller having: (i) provided as much notice to PWC as is reasonably practicable of the likelihood, extent and timing of the Reserves Shortfall; and (ii) taken steps in accordance with Good Engineering and Operating Practices to develop any undeveloped 1P Reserves within the Gas Production Area, to meet its obligations to supply Gas under this Agreement. (b) Any Dispute in relation to the matters set out in clause 10.4(a) will be determined by an Independent Expert as a technical matter. 10.5 Priority On each Contract Day the Buyer has priority of gas supply from the Gas Production Area for NDQ for that Contract Day. 10.6 Source The Seller may at any time perform its obligation to deliver Gas under this Agreement by delivering Gas to the Delivery Point from a source other than the Gas Production Area, but the Seller is not obliged to do so. 11 Gas Quality 11.1 Specification The gas to be delivered by the Seller under this Agreement must be in accordance with the Specification at the Delivery Point.

page 25 11.2 Delivery pressure The Seller must make Gas available for delivery to the Buyer at the Delivery Point in accordance with this Agreement at a pressure not in excess of 6,800 kPa and at a pressure not below 6,500 kPa. 11.3 Notice of Off-Specification Gas (a) Without derogating from the Seller’s obligation under clause 11.1 to deliver Gas in accordance with the Specification, the Seller must notify the Buyer as soon as practicable after the Seller becomes aware that gas delivered or available to be delivered at the Delivery Point fails, or is expected to fail, to meet the Specification and of the anticipated duration of such failure, if known. (b) The notification must include the details of the failure or expected failure to meet the Specification. (c) The Seller must advise the Buyer as soon as practicable of when it can resume delivery of gas which meets the Specification. 11.4 Return to Specification The Seller must, in accordance with Good Engineering and Operating Practices, take all steps as are reasonably practicable and in a timely manner to ensure all gas subsequently tendered for delivery complies with the Specification. 11.5 Undelivered Off-Specification Gas Upon receipt of a notice under clause 11.3(a), the Buyer may: (a) refuse to accept all or part of such Off-Specification Gas until the non-conformity has been remedied (and to avoid doubt, gas not delivered as a result of that refusal shall be taken into accounting in determining Delivery Shortfalls) provided that the Buyer must use reasonable endeavours to accept Off-Specification Gas; or (b) consent in writing to take delivery of all or part of the Off Specification Gas, in which case it will be deemed to be Gas and must be paid for at the Contract Price, and the Seller shall have no liability arising out of the gas not meeting the Specification (including liability under clause 11.7) provided the Buyer will not be taken to have accepted gas which has been incorrectly described by the Seller in a material way with respect to its variance from the Specification. The Buyer must notify the Seller of its election under this clause as soon as practicable after receiving the Seller’s notification under clause 11.3. 11.6 Dispute to be referred to expert Any dispute as to whether gas delivered to the Buyer complies with the Specification will be referred to an Independent Expert for determination in accordance with clause 23.4 but only in relation to technical matters.

page 26 11.7 Limitation of liability for Off-Specification Gas If Off-Specification Gas is delivered to the Buyer without its written consent and that Off-Specification Gas causes physical damage to, or interferes with the proper operation of the Buyer’s Plant, then the Buyer may, at the Buyer’s sole discretion, take all necessary steps to clear, clean, repair or replace that plant, equipment or pipelines to the extent necessary to remedy the damage or interference caused by the Off-Specification Gas. The Seller must pay or reimburse the Buyer on demand for the reasonable direct costs and expenses incurred in doing so. Except to the extent that the delivery of the Off-Specification Gas arises as a result of the Seller's Wilful Misconduct, the Seller shall have no other liability to the Buyer for the delivery, without consent, of Off-Specification Gas. 11.8 Odourisation The Gas supplied under this Agreement will be odorised. 11.9 Removal of Certain Elements Provided that Gas delivered under this Agreement remains in accordance with the Specification, the Seller may, prior to delivery, submit natural gas from the Gas Field to any process for the removal of constituents or elements therein other than for the removal of methane (except where the removal of methane is an unavoidable consequence of the removal of other constituents). Any constituents or elements removed from that natural gas will be and remain the property of the Seller. 12 Title and measurement 12.1 Title and risk The title to, custody of and risk in the Gas sold and purchased under this Agreement will pass from the Seller to the Buyer at the Delivery Point. 12.2 Provision of Metering Equipment (a) The Metering Equipment will be used to measure: (i) the quantity of Gas delivered under this Agreement; and (ii) the composition of Gas delivered under this Agreement, for the purpose of determining whether gas supplied meets the Specification. (b) The Seller will provide or cause to be provided the Metering Equipment and necessary measurement and flow control equipment upstream of the Delivery Point for operation of this Agreement. (c) The Seller must install, operate and maintain the Metering Equipment in accordance with Good Engineering and Operating Practices.

page 27 12.3 Check Measuring Equipment The Buyer may install and operate check measuring equipment as near as practicable to the Delivery Point provided it does not interfere with the operation of the Export Pipeline or the Metering Equipment. 12.4 Calibration (a) The accuracy of the Metering Equipment must be tested and verified by the Seller once each Month or at such other intervals as may be required by the type of equipment, but at least Quarterly. (b) Reasonable notice of the time and nature of each test must be given to the Buyer to permit it to arrange for a representative to observe the test and any adjustments resulting from such test. If, after notice, the Buyer fails to have a representative present, the results of the test will nevertheless be considered accurate. 12.5 Correction If at any time, any of the Metering Equipment is found to be out of service or registering inaccurately, it must be adjusted at once to read as accurately as possible and the readings of that equipment must be adjusted to zero error for a period definitely known or agreed upon, or if not known or agreed upon, for a period of sixteen (16) days or one-half (½) of the elapsed time since the last test, whichever is shorter. Measurement during the appropriate period shall be determined on the basis of the best data available using the first of the following methods which is feasible or such other method as the Buyer and Seller may agree: (a) by using data recorded by any check measuring equipment if installed and accurately registering; or (b) by making the appropriate correction if the deviation from the accurate reading is ascertainable by calibration test or mathematical calculation; or (c) by estimating based upon receipts or deliveries under similar conditions during a period when the equipment was registering accurately. 12.6 Inspection of Equipment and Records (a) The Buyer will have the right at all times to have access to and to inspect the Metering Equipment but will be subject to all reasonable requirements of the Seller with regard to the security of the equipment. (b) The reading, calibration and adjustment of that equipment must be done by the Seller and a representative of the Buyer will be entitled to be present at that time. 12.7 Seller's Agent For the purpose of this clause 12 the Seller may appoint any person as its agent to perform or act in its stead.

page 28 12.8 Method of Measurement All measurements, calculations and procedures used in determining volume, except for the correction for deviation from Boyle's Law, must be made in accordance with the instructions Measurement of Delivered Gas contained in the Gas Measurement Committee Report Number 3 of the American Gas Association, dated April 1955, together with all presently existing supplements, amendments and appendices to that Report. Those instructions will be converted where necessary for compliance with Australia Standard AS1000-1979 “The International System of Units (SI) and Its Application”, the National Measurement Act 1960 and Regulations under that Act and the Australian Gas Association publication “Metric Units and Conversion Factors for Use in the Australian Gas Industry”. The correction for deviation from Boyle's Law shall be determined from the data contained in “PAR Research Project NX-19” as published by the American Gas Association in 1962, or any revision of it acceptable to the Buyer and the Seller jointly. 12.9 Unit of Measurement The unit of volume for purposes of measurement under this Agreement will be one cubic metre (m3) of Gas and be expressed to the nearest m3 or another unit of volume agreed to by the Buyer and the Seller jointly. 12.10 Atmospheric Pressure For the purposes of measurement, atmospheric pressure will be determined by a recognised formula applied to the nearest one hundredth of a kilopascal absolute (.01 kPa) and deemed to be a constant. 12.11 Flowing Temperature The flowing temperature of Gas will be determined by means of an approved recording thermometer of standard make. The arithmetic mean of all readings each Day will be deemed to be the Gas temperature and will be used in computing volume. 12.12 Determination of Gas Characteristics The gas characteristics including, Gross Heating Value, relative density, nitrogen and carbon dioxide content of gas will be determined by continuous recording equipment or by laboratory equipment. If continuous recording equipment is used the arithmetic mean of all recordings for each Day will be used to determine gas characteristics. If spot samples are taken or a spot sampler is used, gas characteristics will be determined from the analysis of the samples using laboratory equipment and recognised analytical methods. 12.13 Exchange of Metering Information (a) The Seller must send to the Buyer copies of all measuring and testing data and measuring information promptly after receiving them. (b) Without limiting paragraph (a), the Seller must make available to the Buyer on a daily basis the information recorded by the Metering Equipment in

page 29 relation to the quality and composition of Gas delivered at the Delivery Point for the previous Day. (c) The Buyer will cause to be sent to the Seller promptly upon request, copies of the information kept or obtained by it with respect to measurement of the Gas at the Delivery Point where that information is not derived from the Metering Equipment. 12.14 Preservation of Measurement Records The Parties must preserve all measurement test data, measurement charts and other similar records for the greater of a period of seven (7) years or the minimum period required by record retention rules of any Government Body having jurisdiction or the currency of this Agreement. 13 Price 13.1 Contract Price The Buyer must pay to the Seller the Contract Price for all Gas delivered by the Seller under this Agreement. 13.2 Variation of Contract Price The Contract Price will be varied Quarterly on the first day of January, April, July and October in each year commencing on 1 April 2013 in accordance with Schedule 2. 14 Carbon 14.1 General The Parties acknowledge that under the Clean Energy Scheme the Seller incurs: (a) Embodied Emissions Charges in respect to its liability under section 33 of the Clean Energy Act 2011 (Cth) for the potential greenhouse gas emissions (measured in the Relevant Substance) embodied in an amount of Gas supplied at the Delivery Point under this Agreement (which is addressed in this clause 14); and (b) Carbon Costs in respect to its production, recovery, processing, transportation, handling or supply of Gas under this Agreement up to the Delivery Point (which are addressed in clauses 15 and 16). 14.2 Definitions In this clause 14 the following words have the following meanings. Acceptable Shortfall Charge means the proportion of: (a) any unit shortfall charge (as defined under the Clean Energy Scheme) that is imposed on the Seller or a Related Corporation under the Clean Energy Scheme; or

page 30 (b) a charge under a New Emissions Scheme that is equivalent to the charge in (a) and imposed because the Seller or its Related Corporations did not surrender the required number of relevant units in respect of an amount of Gas delivered at the Delivery Point under this Agreement by the due date under the New Emissions Scheme; and that was incurred because the cost of acquiring Eligible Emissions Units or equivalent units under a New Emissions Scheme would have been greater than incurring the charge. OTN means an Obligation Transfer Number within the meaning of that term in the Clean Energy Act 2011 (Cth). Preliminary Embodied Emissions means the number of tonnes of potential greenhouse gas emissions (measured in the Relevant Substance) embodied in an amount of Gas supplied at the Delivery Point under this Agreement in a Contract Month calculated in accordance with the requirements of the Clean Energy Scheme (or a New Emissions Scheme) based on the latest measurement available to the Seller of the relevant amount of Gas supplied at the Delivery Point under this Agreement. Unit Price means: (a) in relation to an Eligible Emissions Unit: (i) during the fixed price period (as defined in the Clean Energy Scheme) the price at which Eligible Emissions Units can be purchased from the Clean Energy Regulator (as defined under the Clean Energy Scheme); or (ii) during the flexible price period (as defined in the Clean Energy Scheme), the carbon reference price (in Australian dollars/tonne of Relevant Substance) for a Contract Month, determined in accordance with the methodology for determination of the Carbon Reference Price (CRP) referred to in clause 3 of the August 2010 Australian Carbon Benchmark Addendum published by the Australian Financial Markets Association (Carbon Addendum) and references in the Carbon Addendum to: (A) a "Calculation Period" or "Billing Period" are taken to be references to the Contract Month in which the Unit Price is being determined, (B) the "parties" are to the Parties to this Agreement; and (C) "Carbon Scheme" are taken to refer to the Applicable Carbon Scheme. (b) In relation to a unit that is eligible for use, surrender, acquittal or relinquishment pursuant to a New Emissions Scheme: (i) for the relevant Contract Month the arithmetic average of the market price (published at or after the close of business for a Business Day) for the purchase of those units for each Business

page 31 Day occurring during that Contract Month, where agreed by the Parties; or (ii) failing agreement between the Parties under paragraph (b)(i) within 5 Business Days of the end of that Contract Month, the price determined as a financial matter by an Independent Expert pursuant to clause 23.4. 14.3 Embodied Emissions Charges (a) If the Seller or its Related Corporation has incurred Embodied Emissions Charges during a Contract Month or any prior Contract Month, the Seller may include in statements to the Buyer in accordance with clause 18.2 or clause 18.3 the amount of the Embodied Emissions Charges that it has incurred with respect to the Gas delivered to the Delivery Point in the relevant Contract Month or prior Contract Month including in aggregate over a number of Contract Months (provided that it has not previously included the relevant Embodied Emissions Charges in a prior statement to the Buyer in accordance with clause 18.2). (b) The amount of the Embodied Emissions Charges for the relevant Contract Month or relevant prior Contract Months will be calculated by multiplying the Unit Price for the relevant Contract Month by the Preliminary Embodied Emissions for the relevant Contract Month and adding any Acceptable Shortfall Charges incurred by the Seller or its Related Corporations. The Buyer must pay the Seller the amount claimed on account of such Embodied Emissions Charges. (c) If the Buyer validly quotes an OTN (or equivalent notification or consent for the transfer of liability in respect to the Preliminary Emissions Number under a New Emissions Scheme) to the Seller in relation to the supply of any particular delivery of Gas under this Agreement, the Buyer will not be required to pay the Seller any amount on account of Embodied Emissions Charges with respect to that delivery of Gas to the extent that the consequence of the quotation of the OTN (or equivalent notification) is that responsibility for liability under the Clean Energy Scheme or New Emissions Scheme for the potential greenhouse gas emissions embodied in that Gas is effectively transferred to the Buyer. 14.4 Exclusive Application (a) No claim or adjustment for Embodied Emissions Charges may be made as between the Parties other than in accordance with clause 14.3 .Nothing in this clause limits the operation or effect of clause14.5. (b) To the extent of any conflict between this clause 14 and any other provision of this Agreement that may allow for pass through of Embodied Emissions Charges, this clause 14 prevails. 14.5 Quotation of OTN (a) If the Buyer is permitted or required to obtain an OTN under the Clean Energy Scheme in relation to Gas to be delivered to the Buyer at the