Ref: JK/PC #C# © Corrs Chambers Westgarth Magellan Petroleum Australia Pty Ltd Magellan Petroleum (N.T) Pty. Ltd. Magellan Petroleum Corporation Jarl Pty. Ltd. Central Petroleum PVD Pty. Ltd Central Petroleum Limited Share Sale and Purchase Deed

Corrs Chambers Westgarth H:\LEGAL\da Gama\SPA\FINAL SPA and anciallary docs\CORRSDMS-#10419258-v1-SPA 14 Feb 14 FINAL.docpage i Share Sale and Purchase Deed Contents 1 Definitions 1 1.1 Terms defined in this Deed 1 1.2 Additional definitions in schedules 22 2 Sale and purchase 22 2.1 Sale and purchase of Sale Shares 22 2.2 Transfer of rights of Sale Shares 22 2.3 Transfer of Seller Assets 22 2.4 Title and Property of Seller Assets 22 2.5 Apportionment of Total Purchase Price 23 3 Purchase Price 23 3.1 The Total Purchase Price 23 3.2 The Base Purchase Price 23 3.3 Additions to Base Purchase Price 23 3.4 Deposit Banker's Undertaking 23 3.5 Adjustment Amount 24 3.6 Payment of Second Instalment 25 4 Appointment of the Seller Director 25 4.1 Right to nominate the Seller Director 25 4.2 Appointment of the Seller Director 25 4.3 Appointment of Replacement Seller Director 26 4.4 Terms of appointment 26 4.5 Cessation of Seller Director 26 5 Consideration Shares 27 5.1 Issue 27 5.2 Constitution 27 5.3 Subscription Completion 27 5.4 Quotation of Shares 27 5.5 Cleansing notice 28 6 Apportionment of Expenditure and Costs 28 6.1 The Basic Principle 28 6.2 Related Party Debts and Receivables 28 6.3 Payment of the Dingo Field Costs 29 6.4 Outgoings and Income Reconciliation 29 6.5 Unreconciled Outgoings or Income 30 7 Conditions to Completion 30 7.1 Conditions 30 7.2 Obligations of parties in relation to Conditions 32 7.3 Notice 33 7.4 Waiver 33

Corrs Chambers Westgarth page ii Share Sale and Purchase Deed 8 Conduct of the Business until Completion 33 8.1 Conduct 33 8.2 Permitted acts 35 9 Dingo Contracts 35 9.1 Dingo Contracts 35 10 Guarantees 35 10.1 Bank Guarantees 35 11 Notifications before Completion 36 11.1 Notifications by the Buyer 36 11.2 Notifications by the Seller 36 12 Business Equipment Leases and Business Property Leases 37 12.1 Consents 37 12.2 Right of use or occupation pending assignment 37 13 Employees 38 13.1 Further assistance 38 14 Seller Contracts 39 14.1 Buyer Guarantor entitled to benefit of Seller Contracts 39 14.2 Novation or assignment of the Contracts 39 14.3 Contracts that are not novated or assigned 39 14.4 Assumption of responsibility for Retained Seller Contracts and assigned Seller Contracts 39 14.5 Buyer Guarantor's indemnity 39 14.6 Seller or Seller Affiliate's indemnity 40 15 Alice Springs land 40 15.1 Agreement to sell 40 16 Santos Bonus Payment Rights 40 16.1 Assignment 40 17 Santos Bonus Payment and Gas Price Bonus Tax Indemnity and Payment41 17.1 Risk, indemnity and payment 41 17.2 Set-off 42 17.3 Tax Relief 43 17.4 Buyer and Seller’s intent as to the Santos Bonus Payment 43 18 Completion 43 18.1 Date, time and place 43 18.2 Obligations at Completion 43 18.3 Interdependence of obligations 43 18.4 Title and risk 44 19 Power of attorney 44 19.1 Appointment 44

Corrs Chambers Westgarth page iii Share Sale and Purchase Deed 19.2 Powers 44 19.3 Ratification 44 19.4 Consideration 44 20 Obligations after Completion 44 20.1 Access to the Business Records by the Seller 44 20.2 Access to records by the Buyer, the Company and Jarl 45 20.3 Wrong Pockets 45 21 Seller Group names 46 21.1 Change of Company Names 46 22 Warranties 46 22.1 Seller Warranties 46 22.2 Buyer Warranties 47 22.3 Buyer Guarantor Warranties 48 22.4 Buyer Guarantor and Buyer Warranties Limits 48 23 Tax 49 23.1 Sharing of information 49 23.2 Pre Completion Tax Events 49 23.3 Exit from Seller Consolidated Group 50 23.4 Release and covenant not to sue Buyer Group Company, Company and Jarl 51 23.5 Petroleum Resource Rent Tax 51 24 Payments and default interest 52 24.1 Payment directions 52 24.2 Method of payment 53 24.3 Time for notices 53 24.4 Default interest 53 24.5 Effect of payments 53 24.6 Tax effects 53 25 Confidentiality 54 25.1 Agreed announcement 54 25.2 Confidentiality 54 26 Termination 56 26.1 Termination by the Seller 56 26.2 Termination by the Buyer 56 26.3 Termination by the Buyer or Seller 56 26.4 Termination due to failure of Completion 57 26.5 Effect of termination 57 27 Notices 57 27.1 General 57 27.2 How to give a communication 57 27.3 Particulars for delivery of notices 57

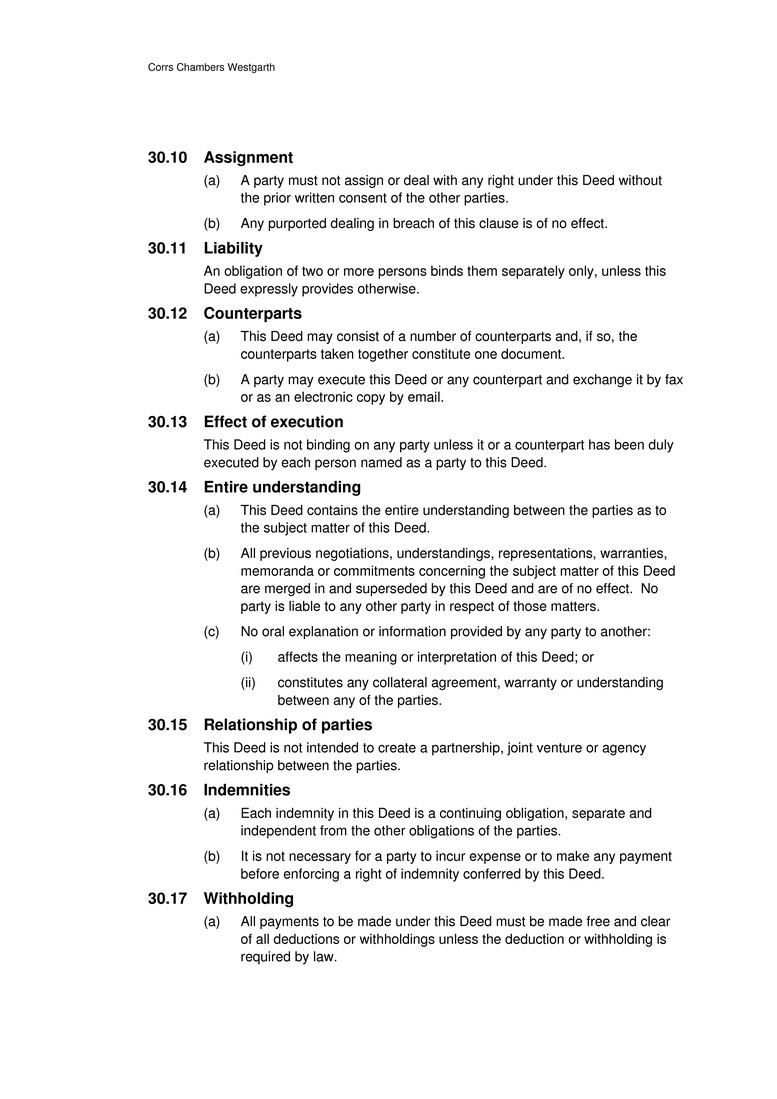

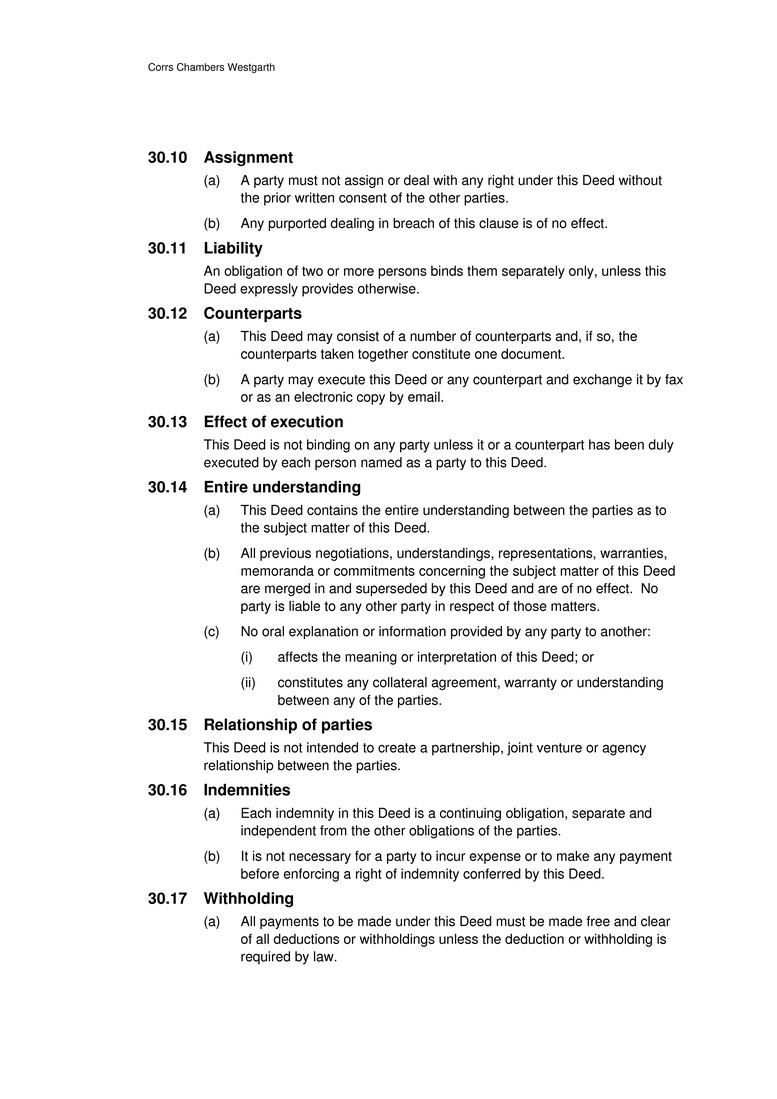

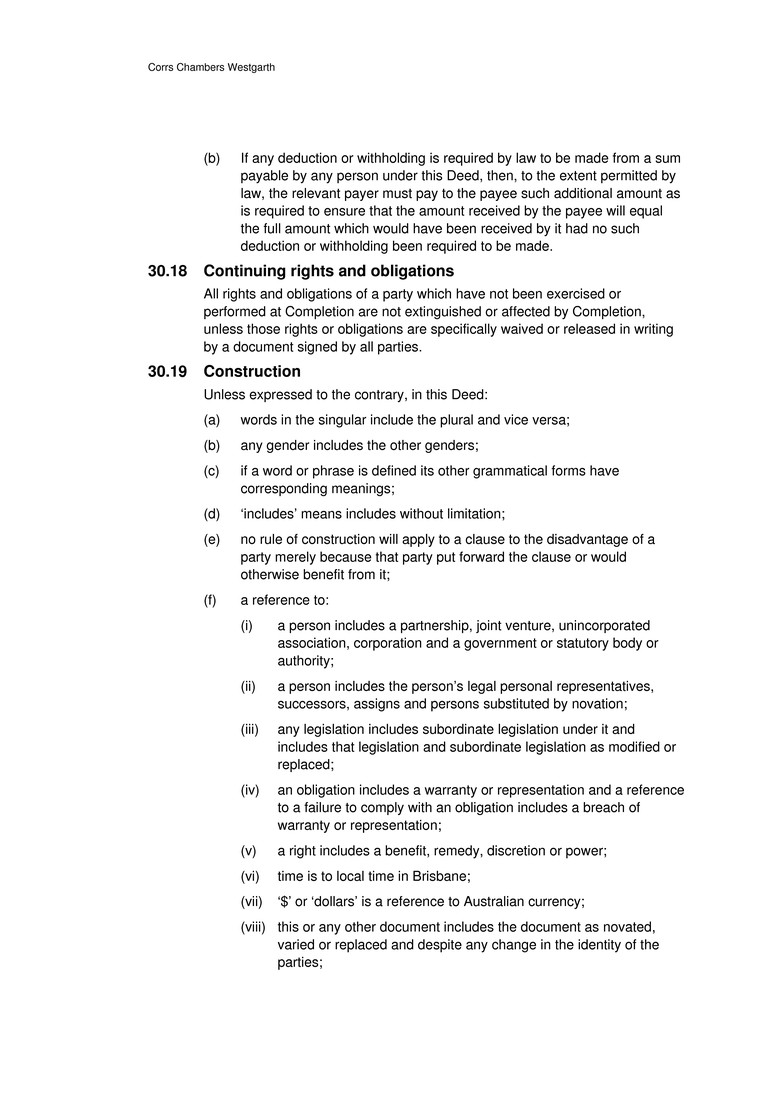

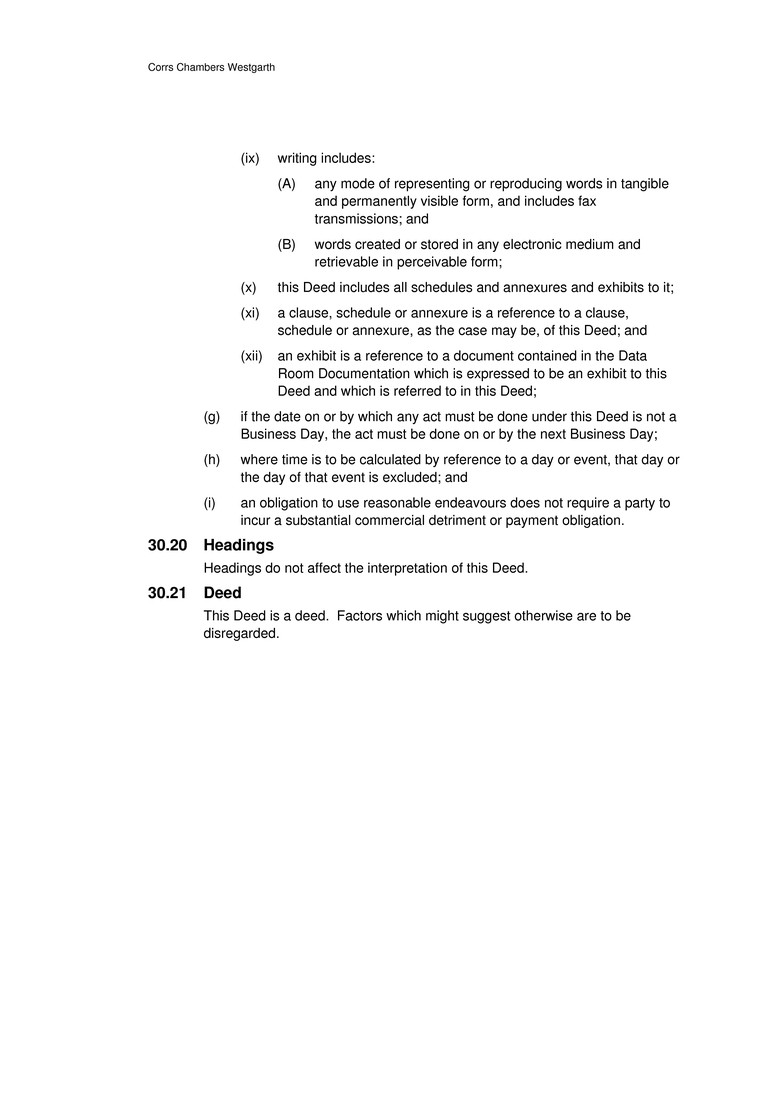

Corrs Chambers Westgarth page iv Share Sale and Purchase Deed 27.4 Communications by post 59 27.5 Communications by fax 59 27.6 After hours communications 59 27.7 Process service 60 28 GST 60 28.1 Construction 60 28.2 Consideration GST exclusive 60 28.3 Payment of GST 60 28.4 Timing of GST payment 60 28.5 Tax invoice 60 28.6 Adjustment event 60 28.7 Reimbursements 61 29 Guarantee 61 29.1 Guarantee 61 29.2 Liability unaffected by other events 61 29.3 Principal obligations 61 29.4 Continuing guarantee and indemnity 61 30 General 62 30.1 Duty 62 30.2 Disputes 62 30.3 Legal costs 63 30.4 Amendment 63 30.5 Waiver and exercise of rights 63 30.6 Rights cumulative 63 30.7 Consents 63 30.8 Further steps 63 30.9 Governing law and jurisdiction 63 30.10 Assignment 64 30.11 Liability 64 30.12 Counterparts 64 30.13 Effect of execution 64 30.14 Entire understanding 64 30.15 Relationship of parties 64 30.16 Indemnities 64 30.17 Withholding 64 30.18 Continuing rights and obligations 65 30.19 Construction 65 30.20 Headings 66 30.21 Deed 66

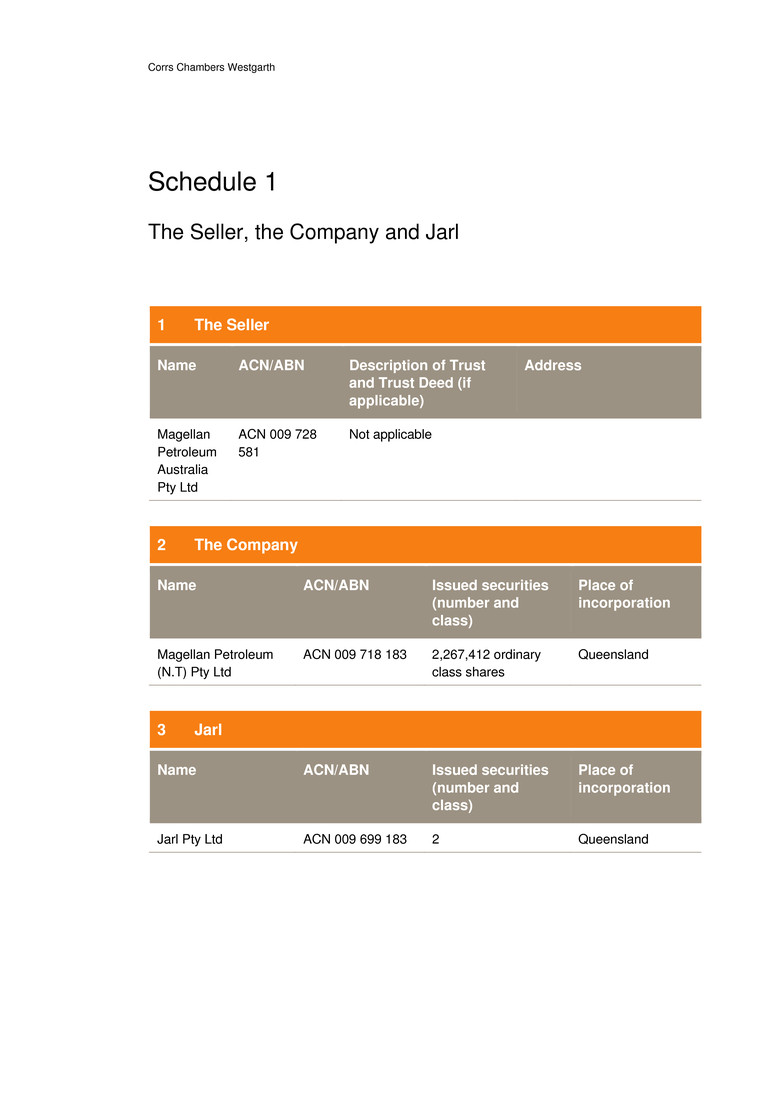

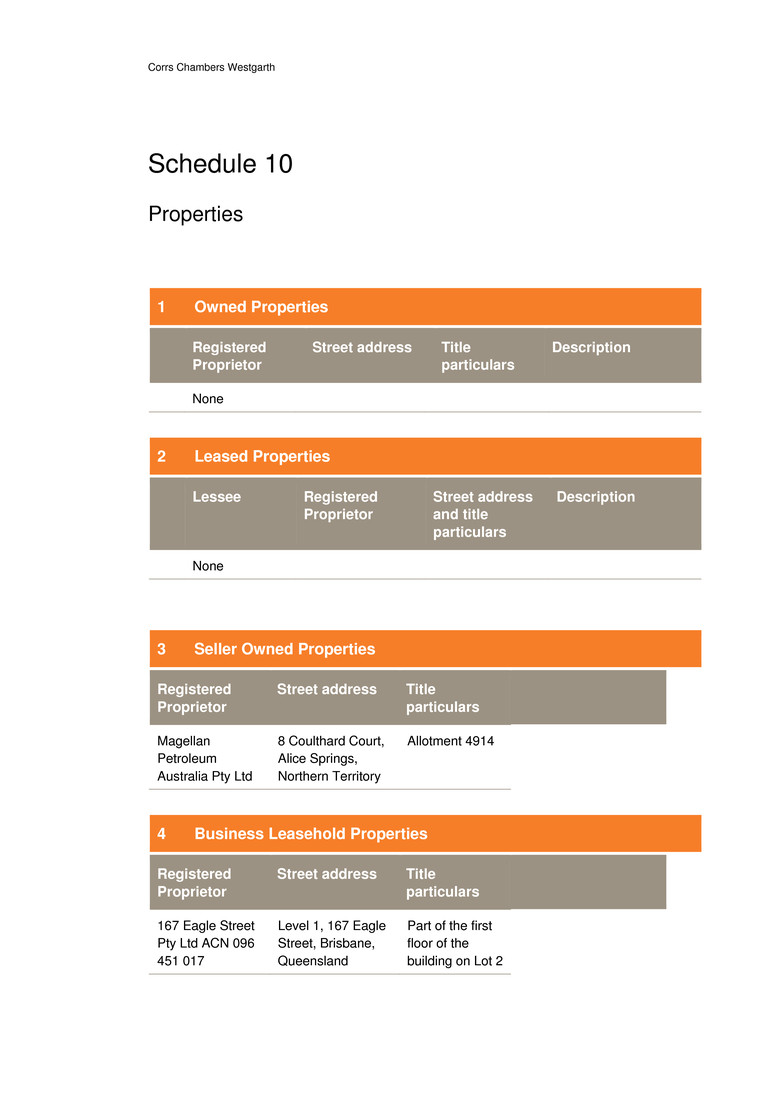

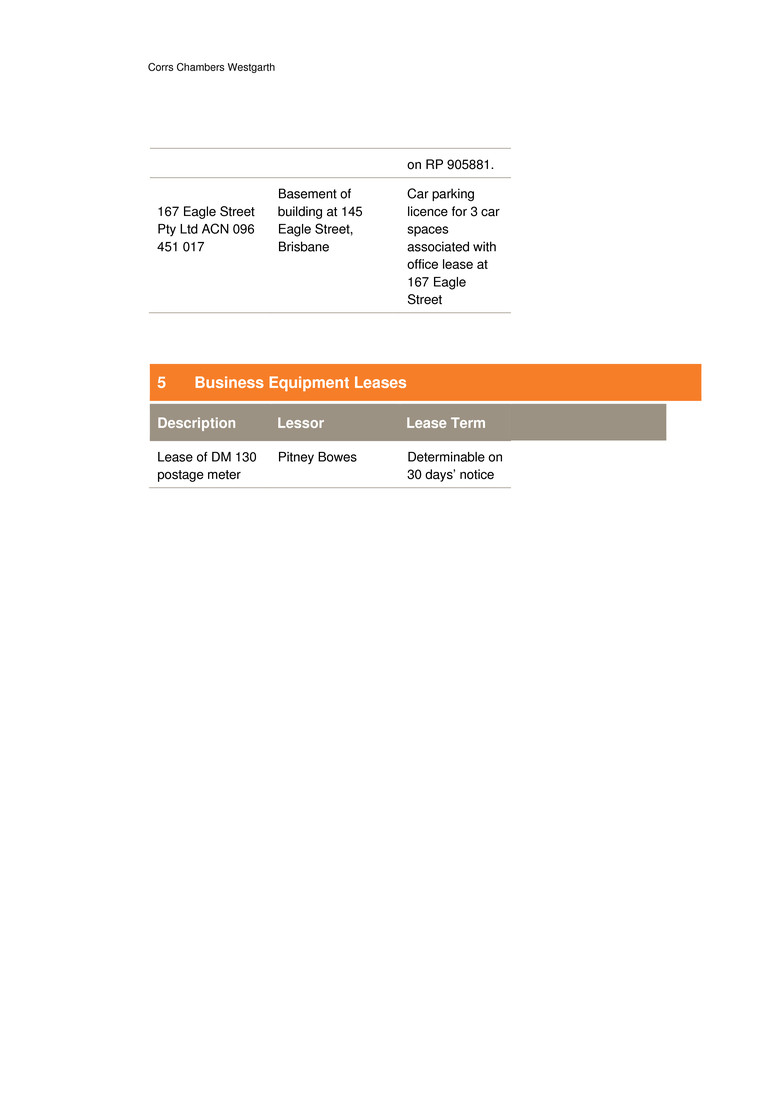

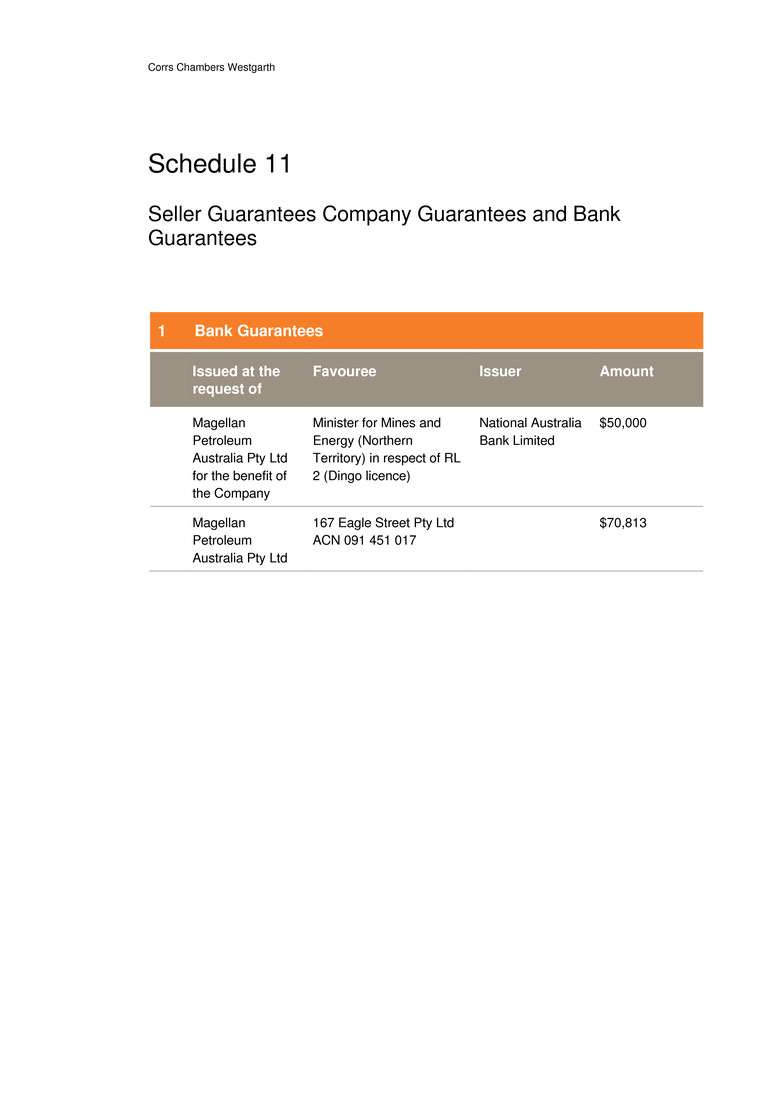

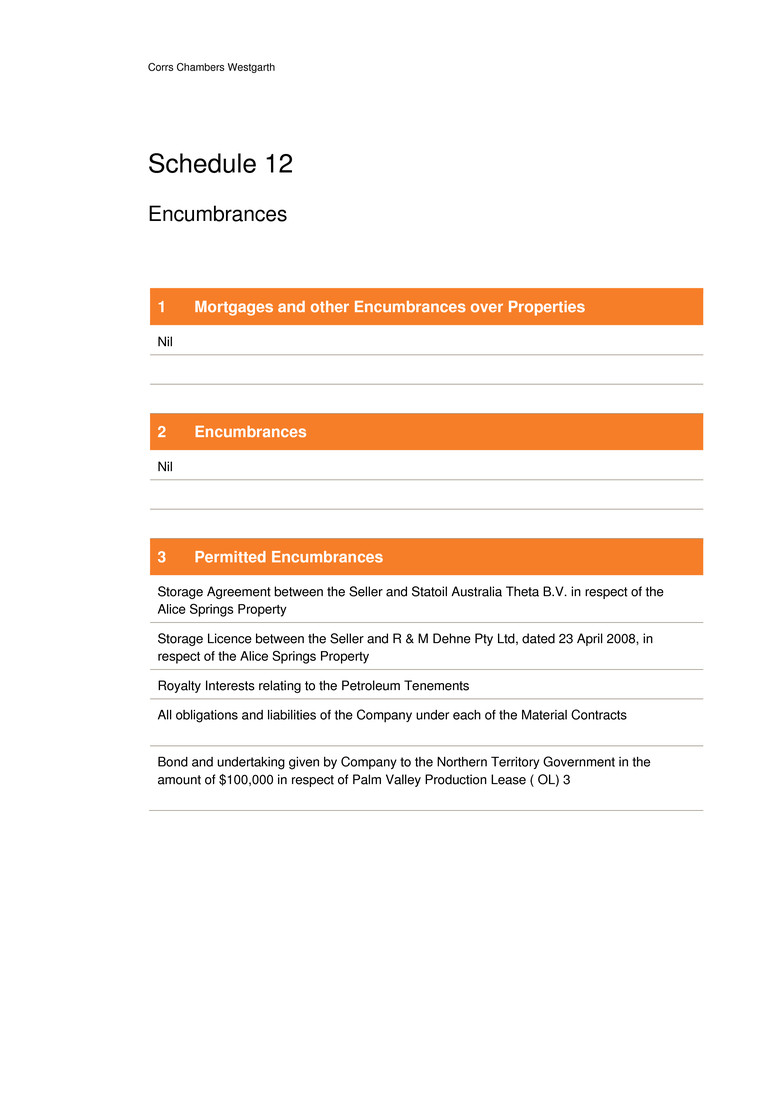

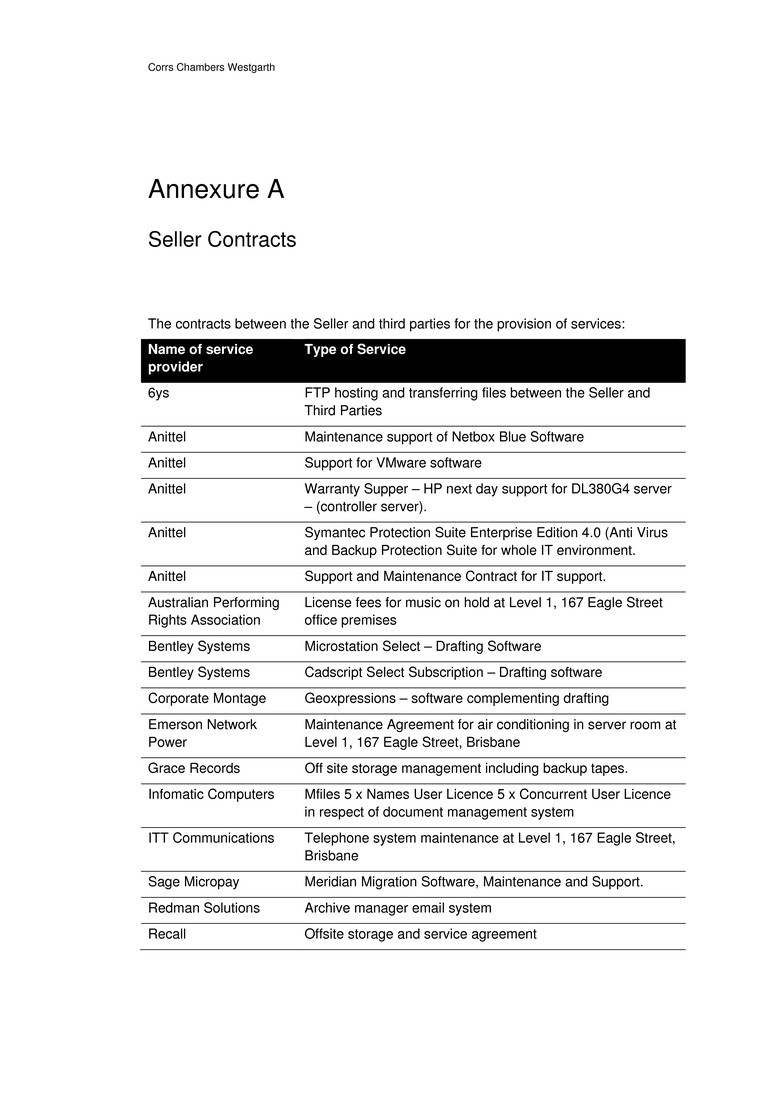

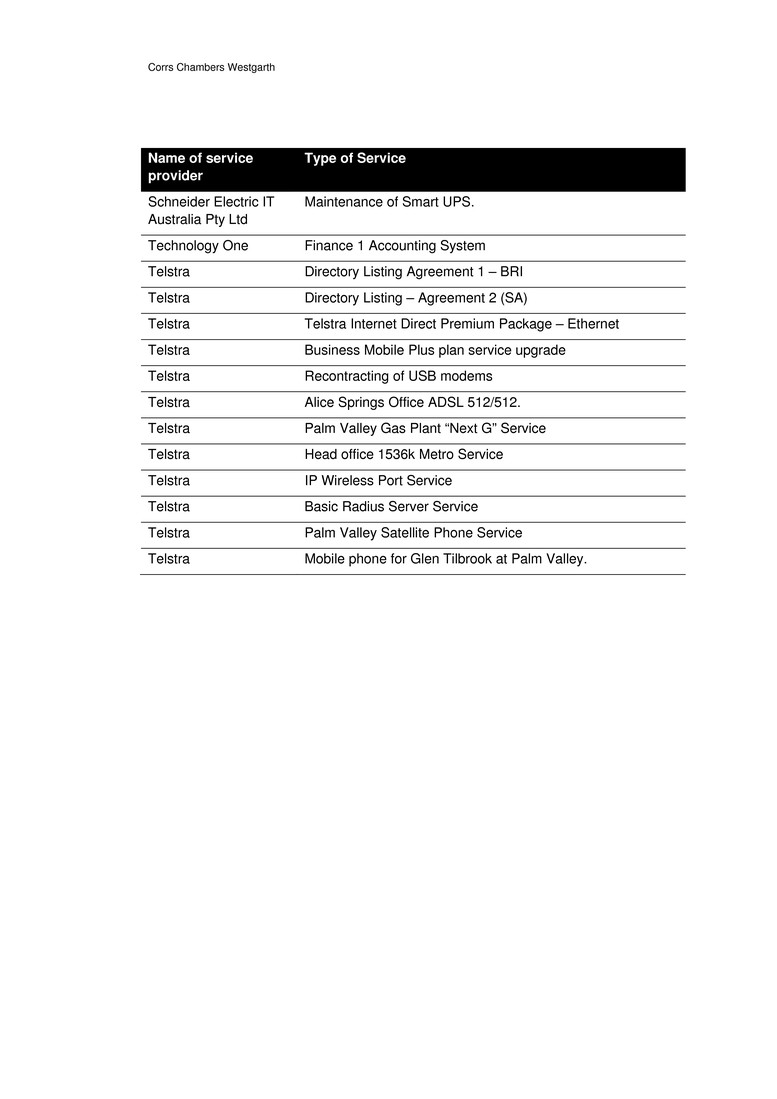

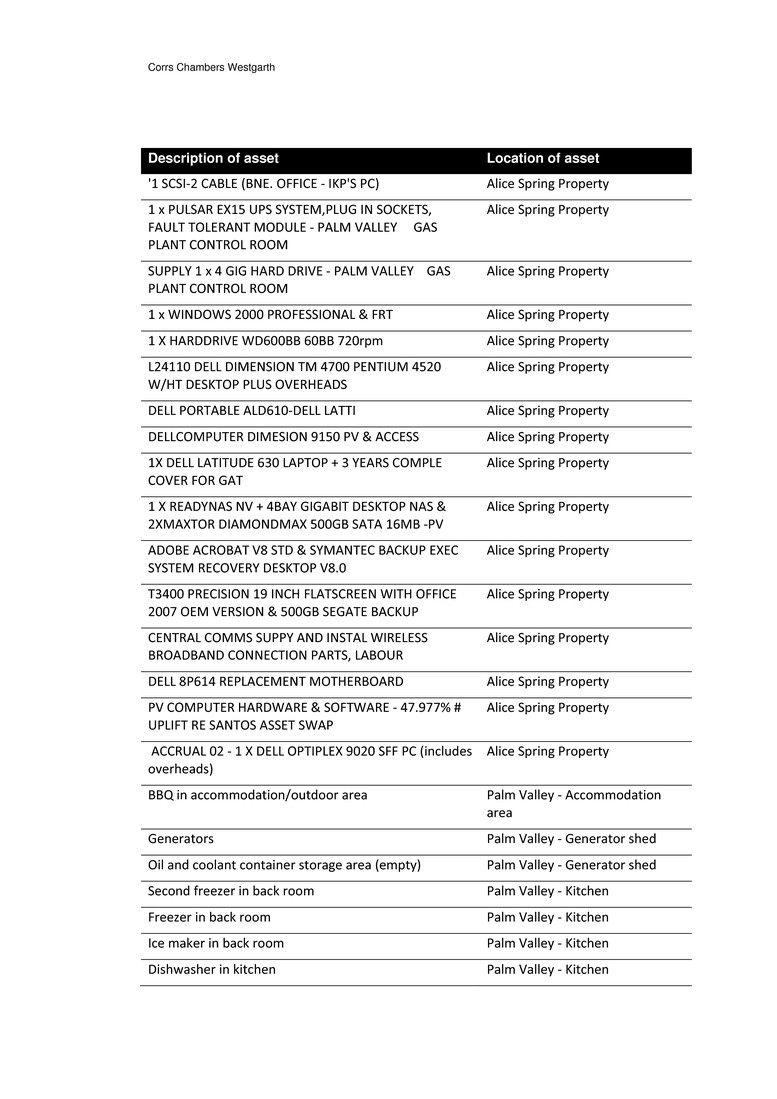

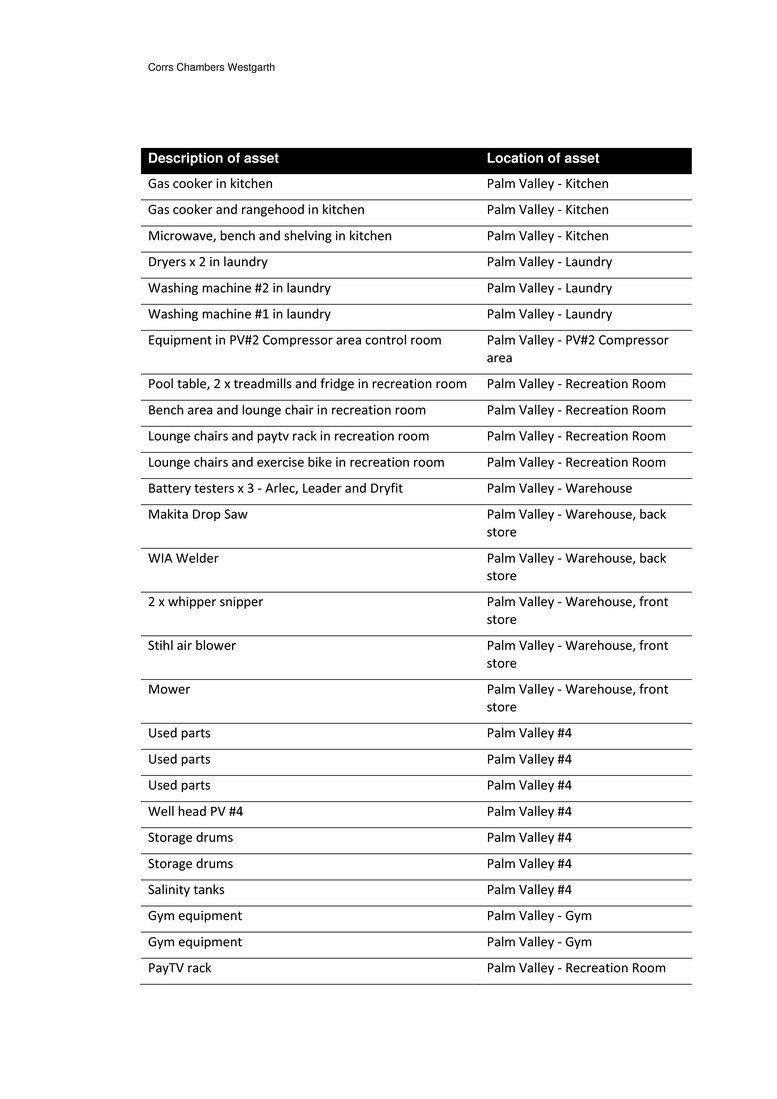

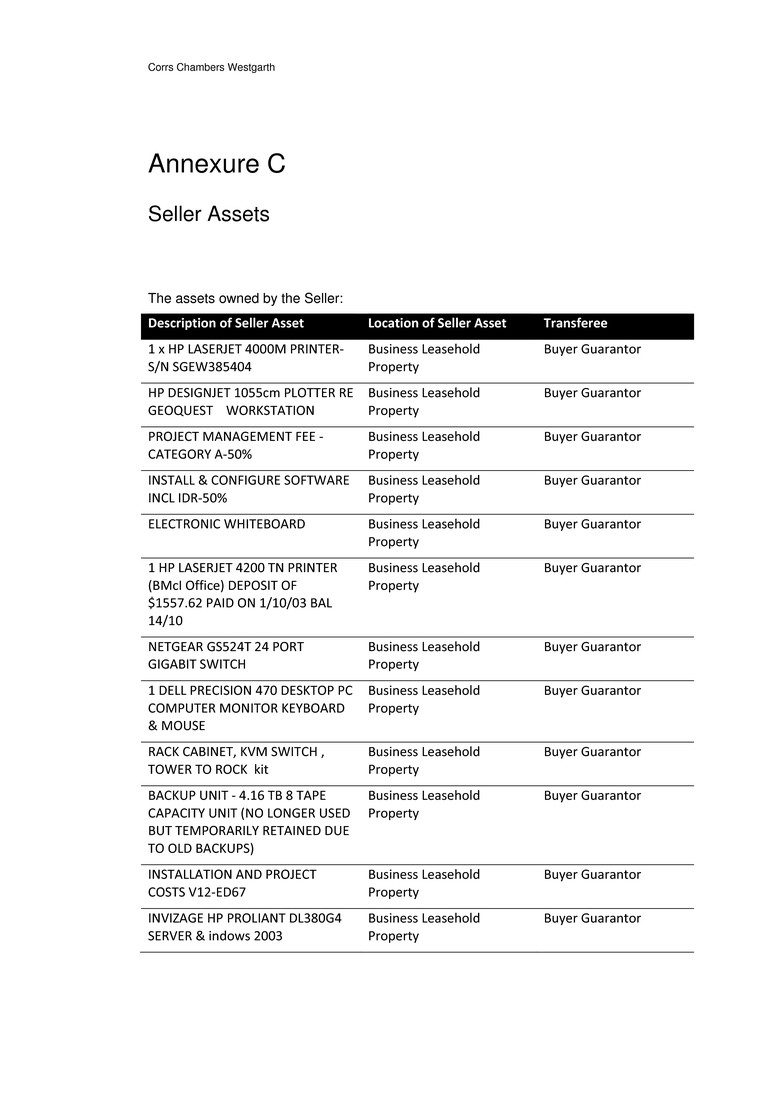

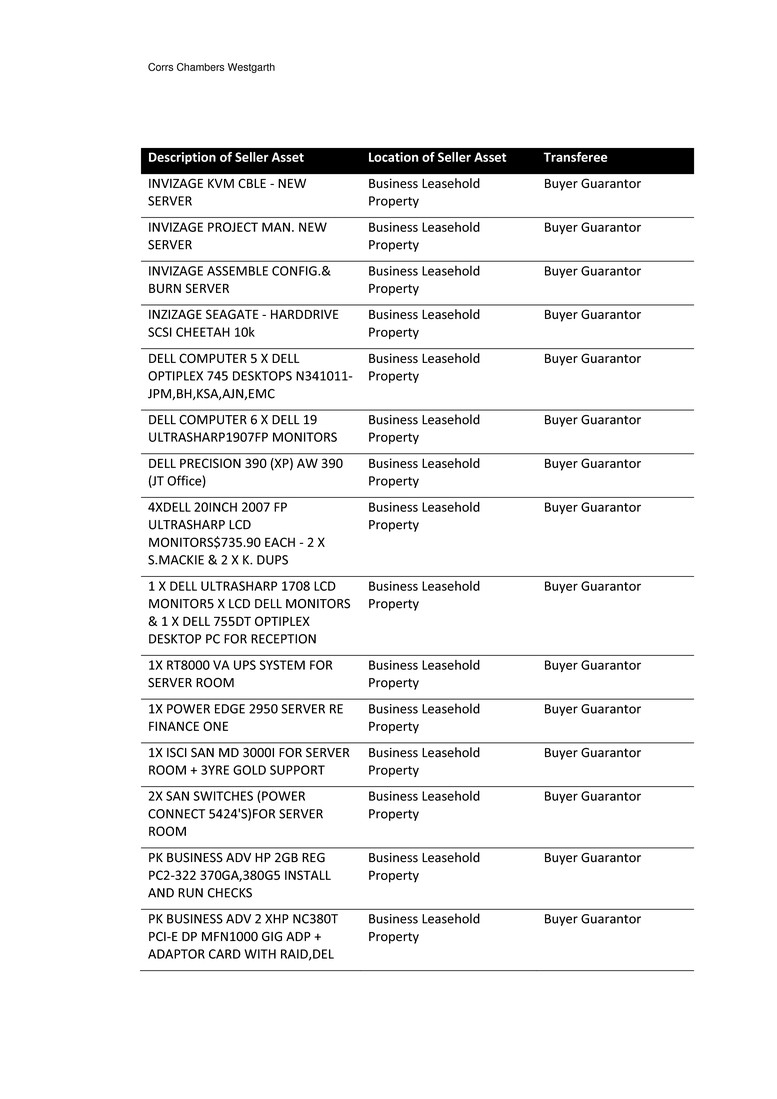

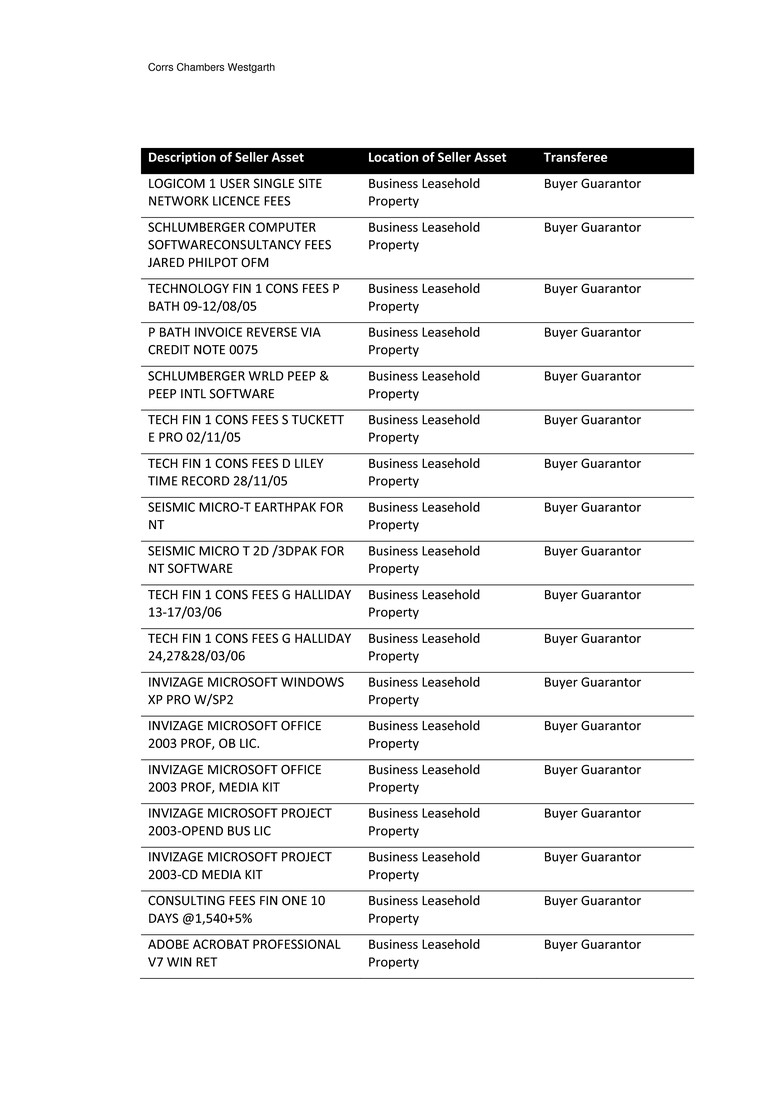

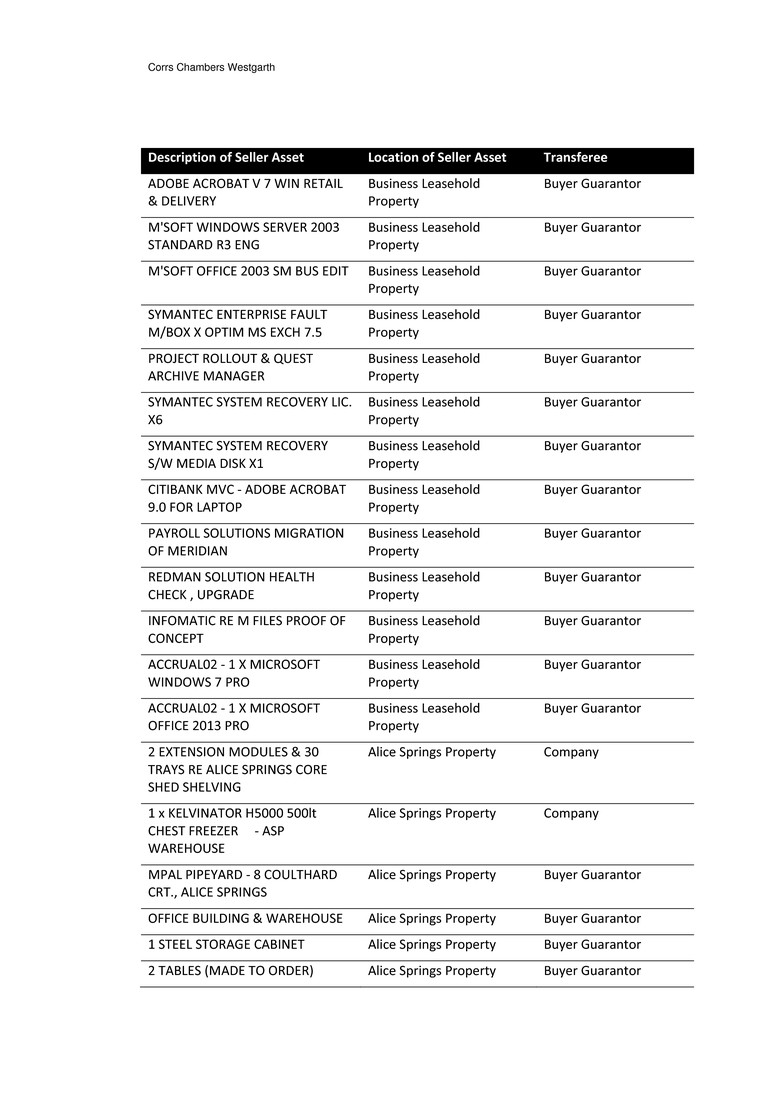

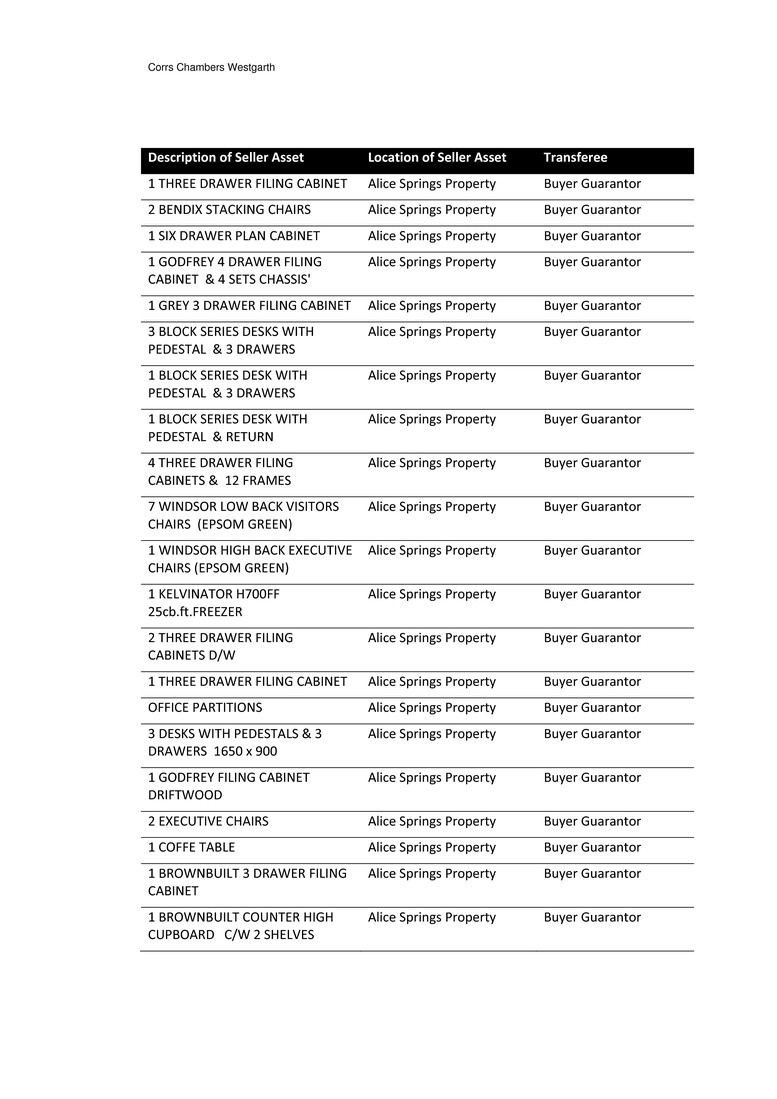

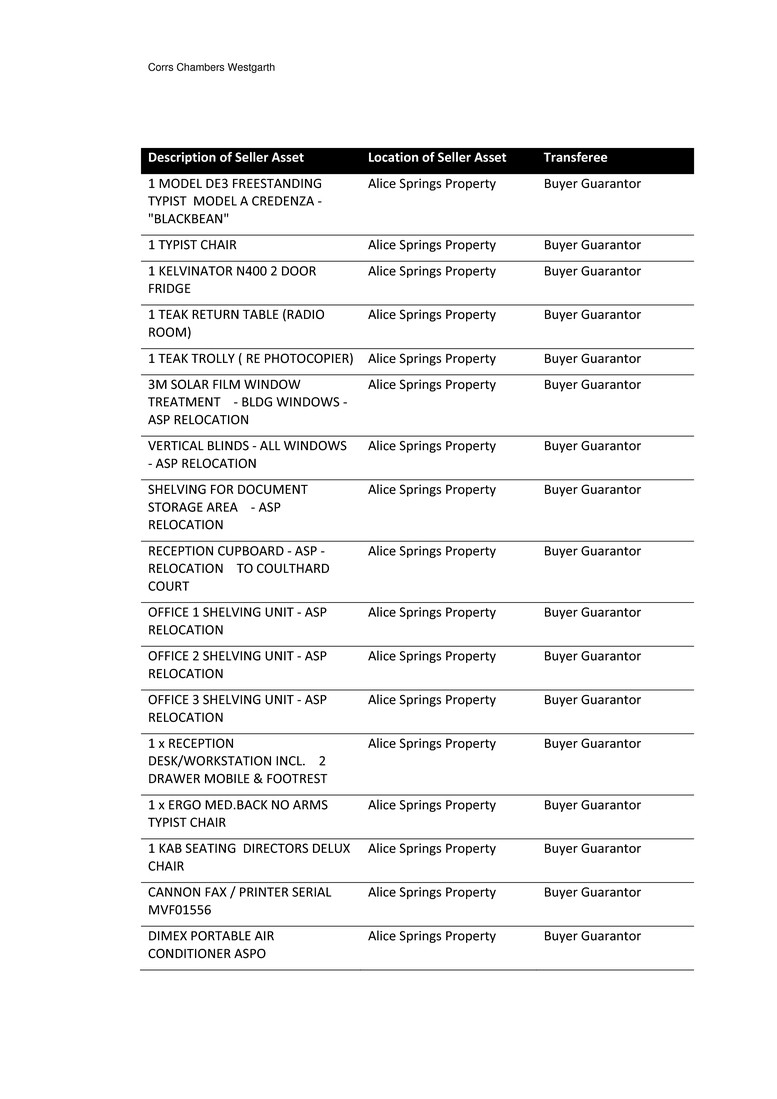

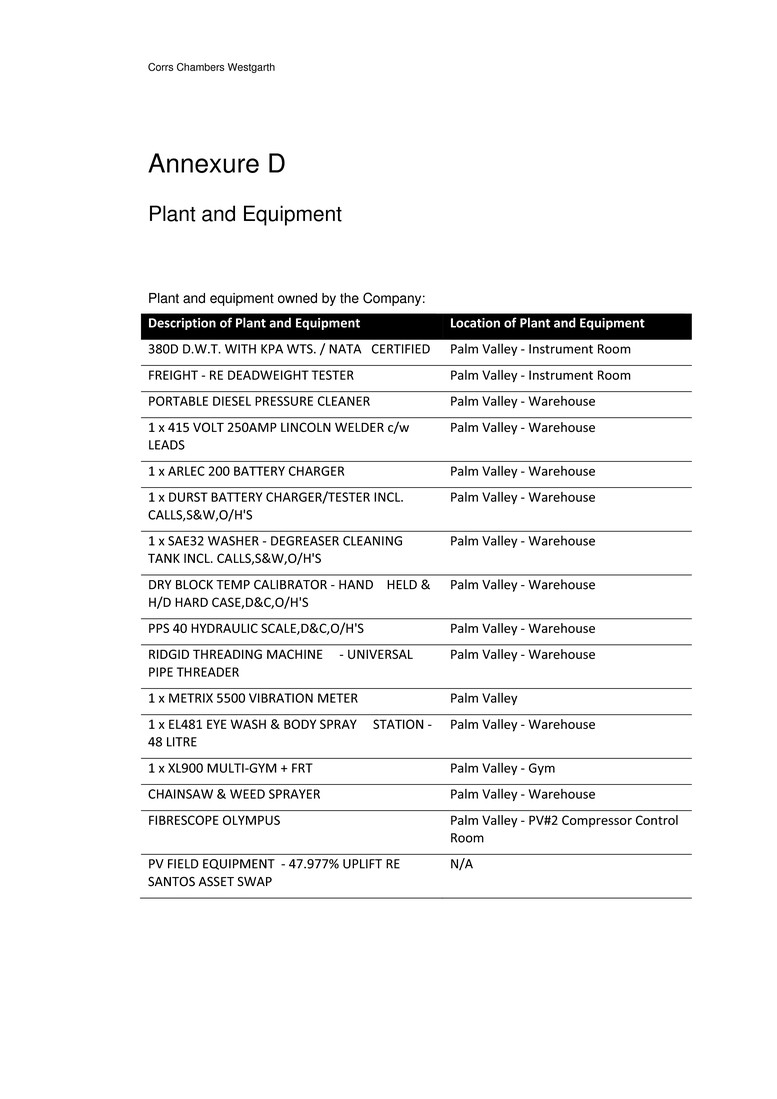

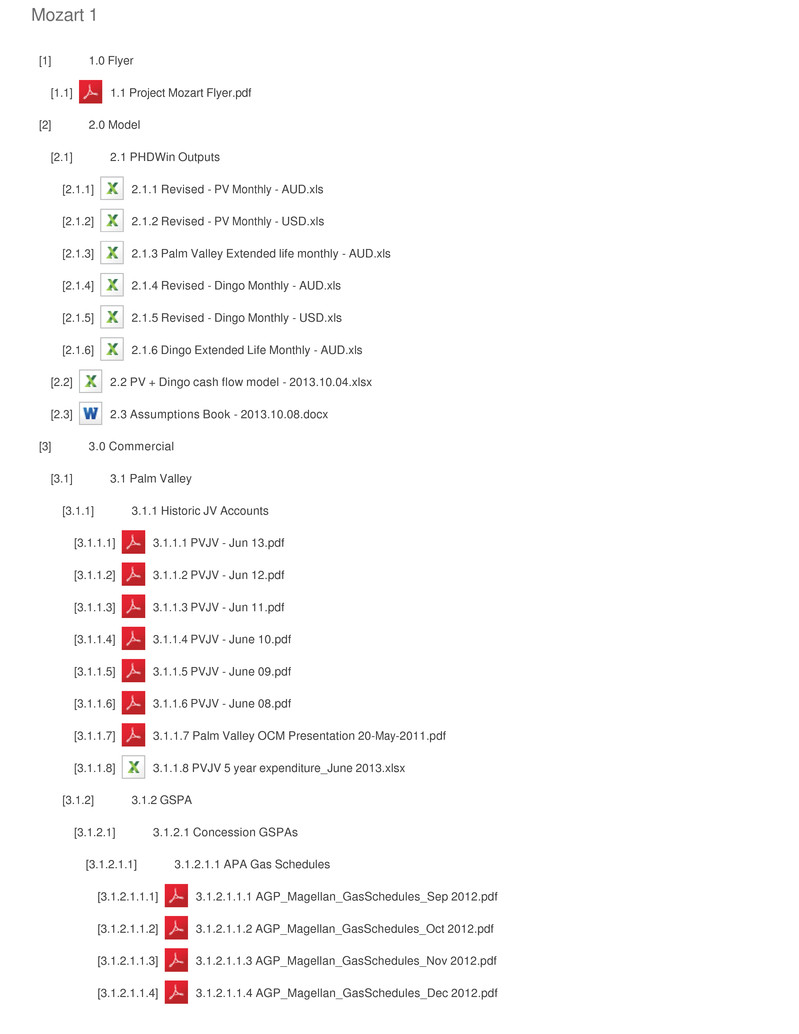

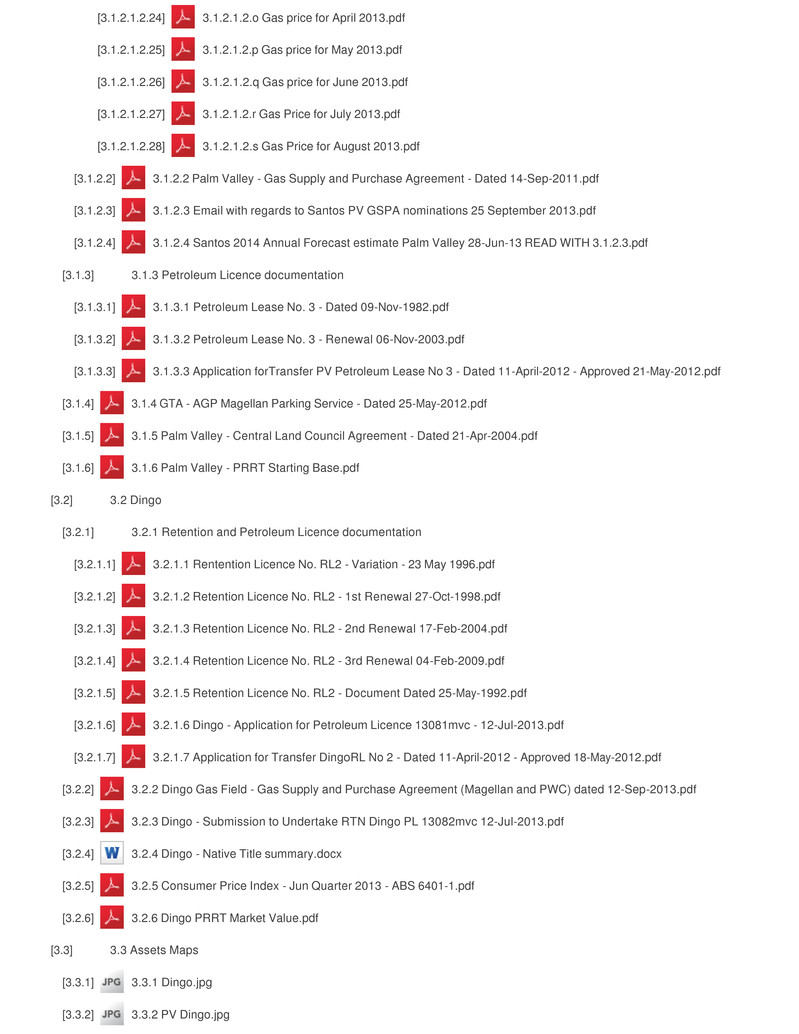

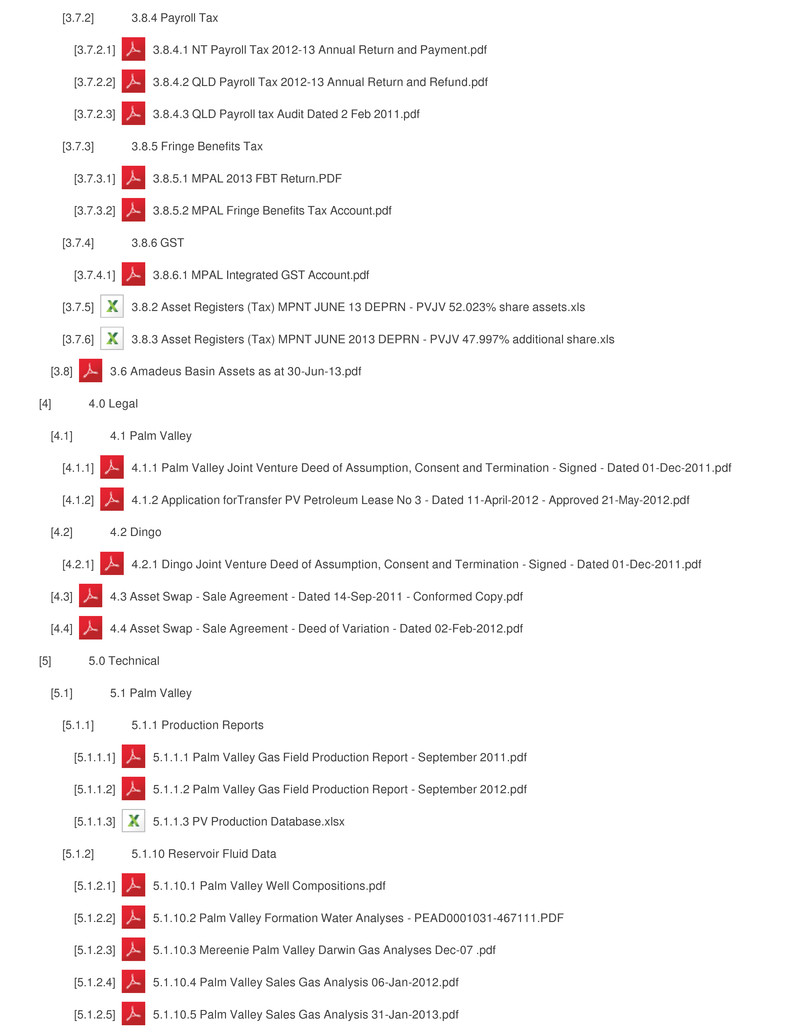

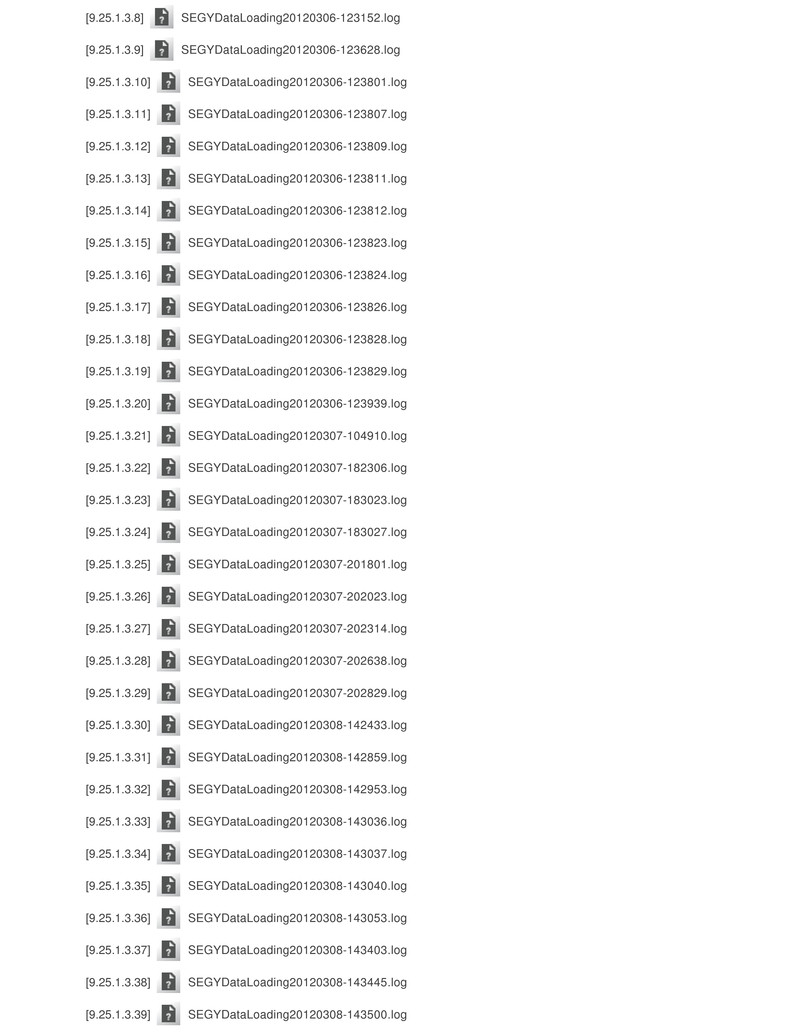

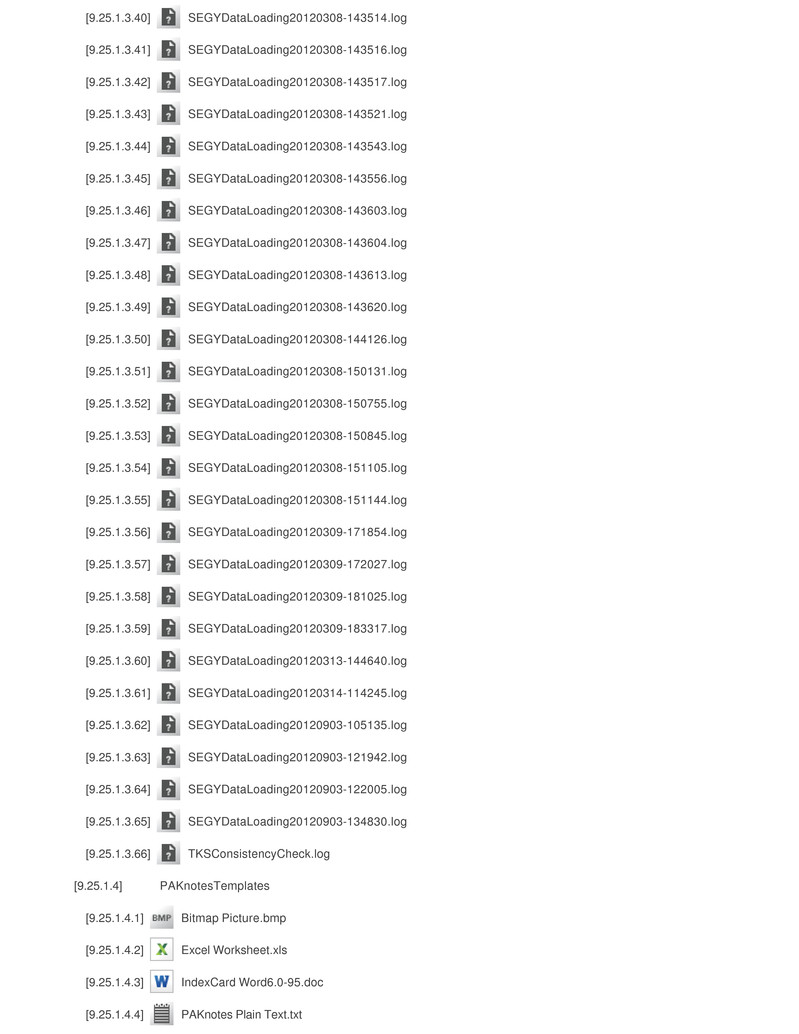

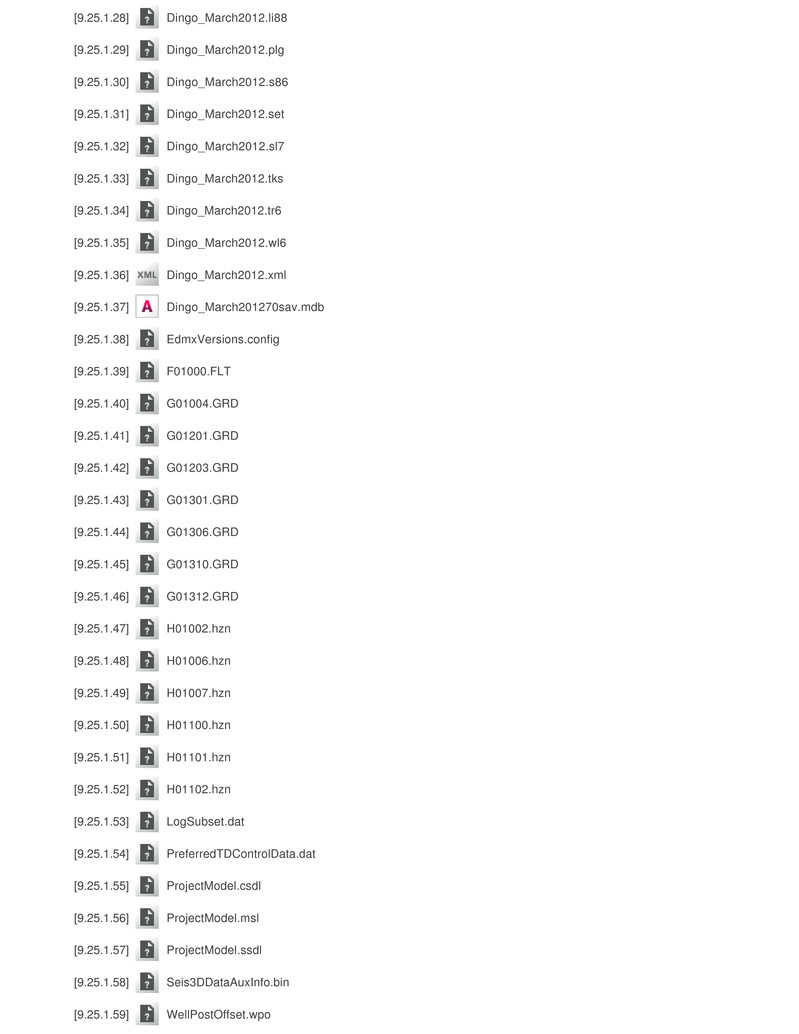

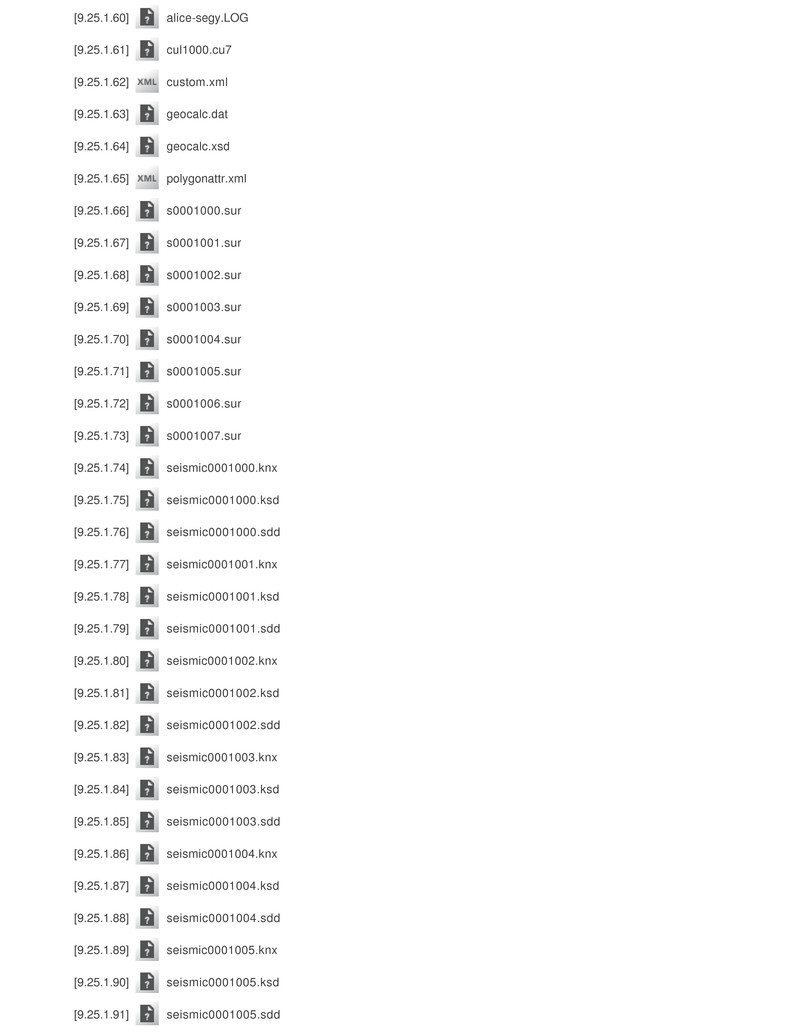

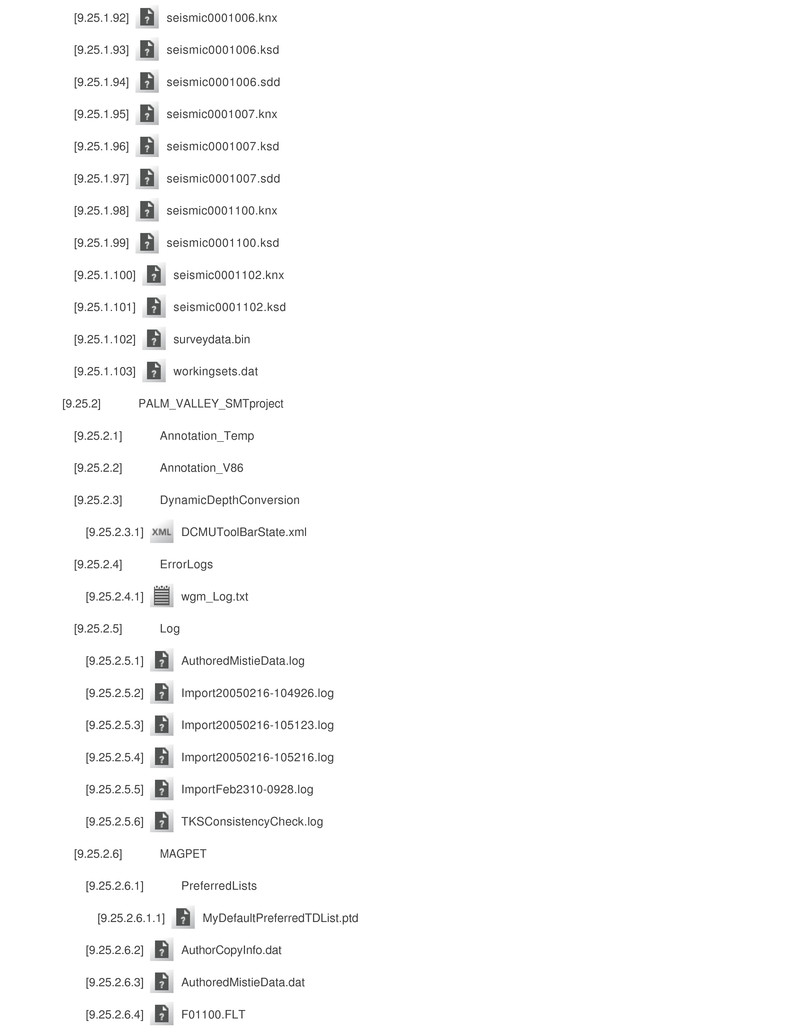

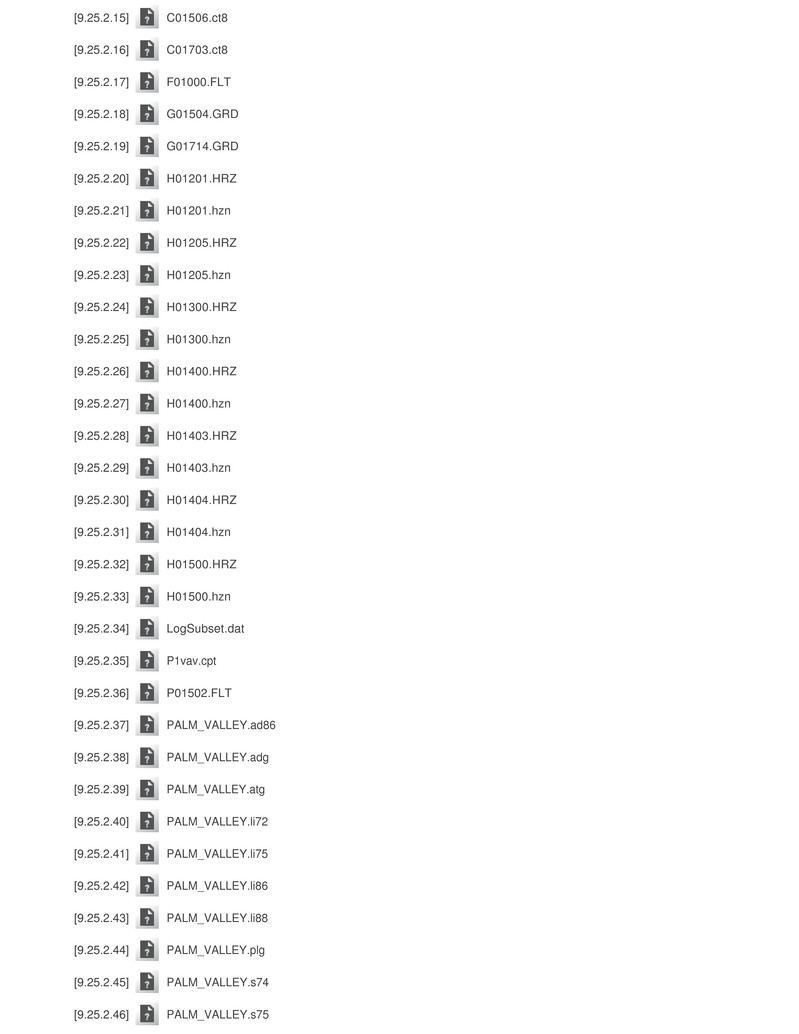

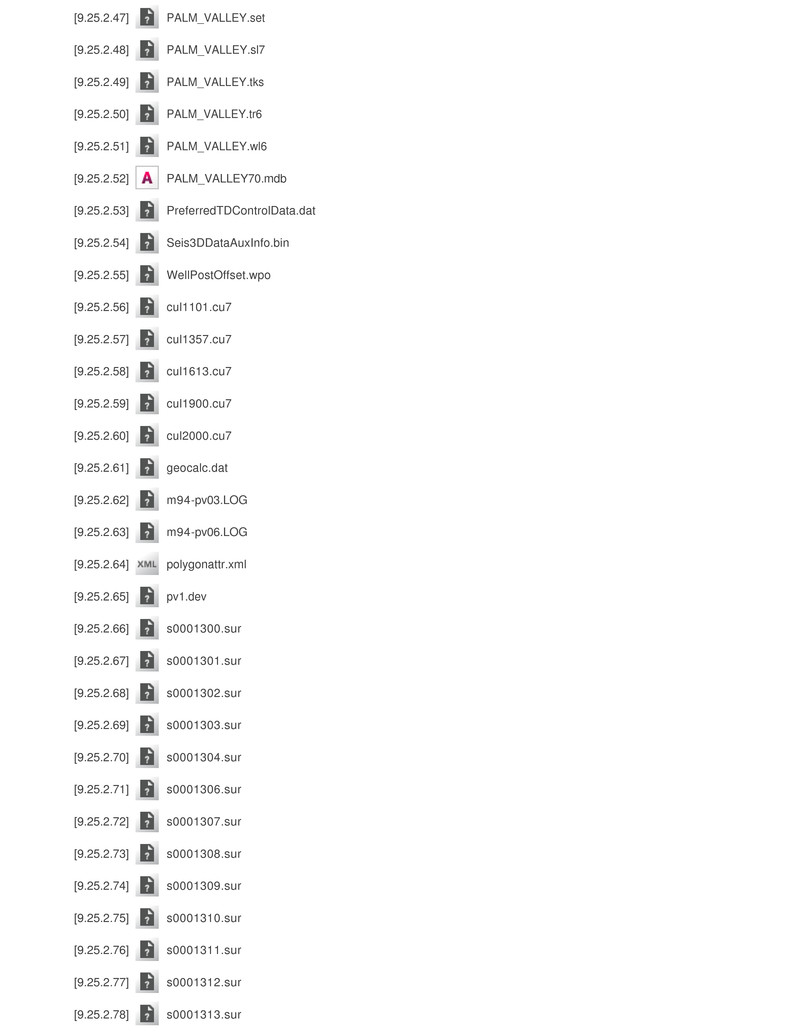

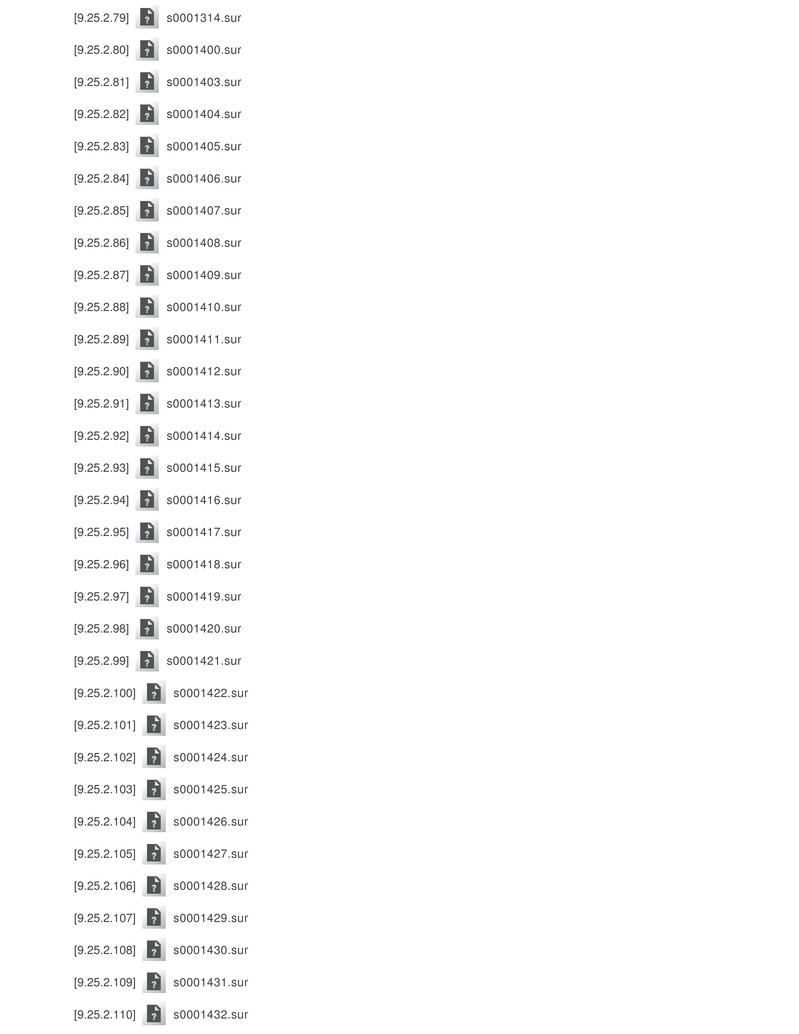

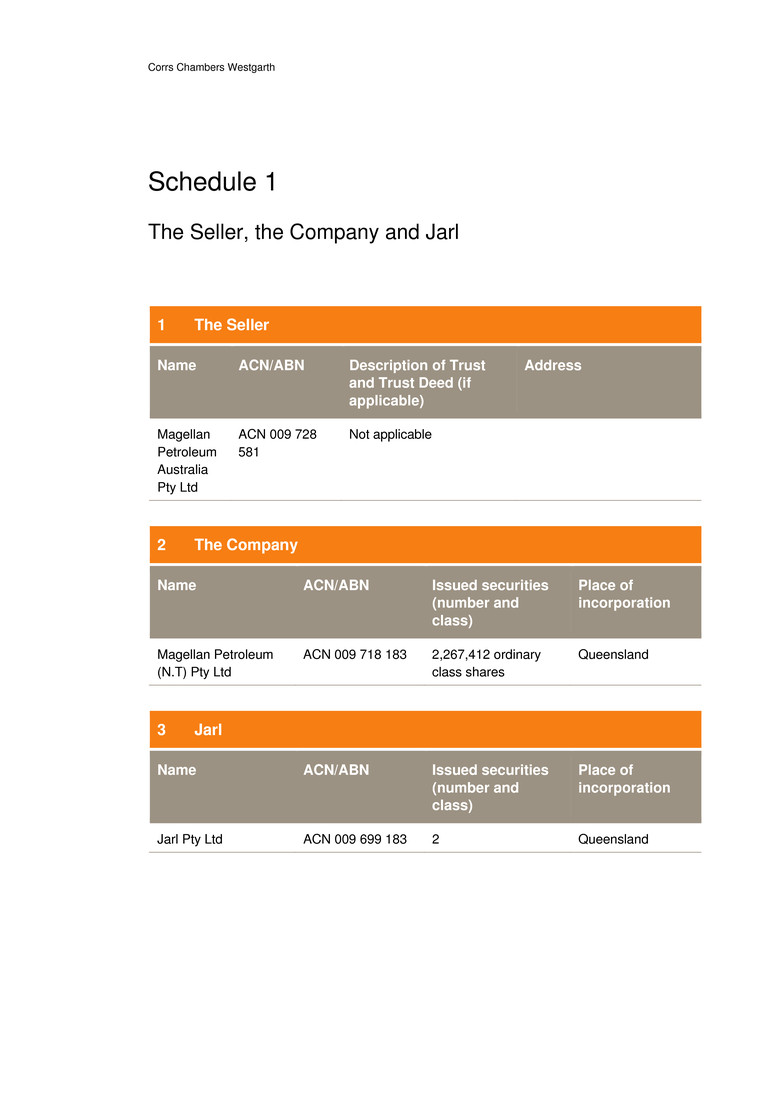

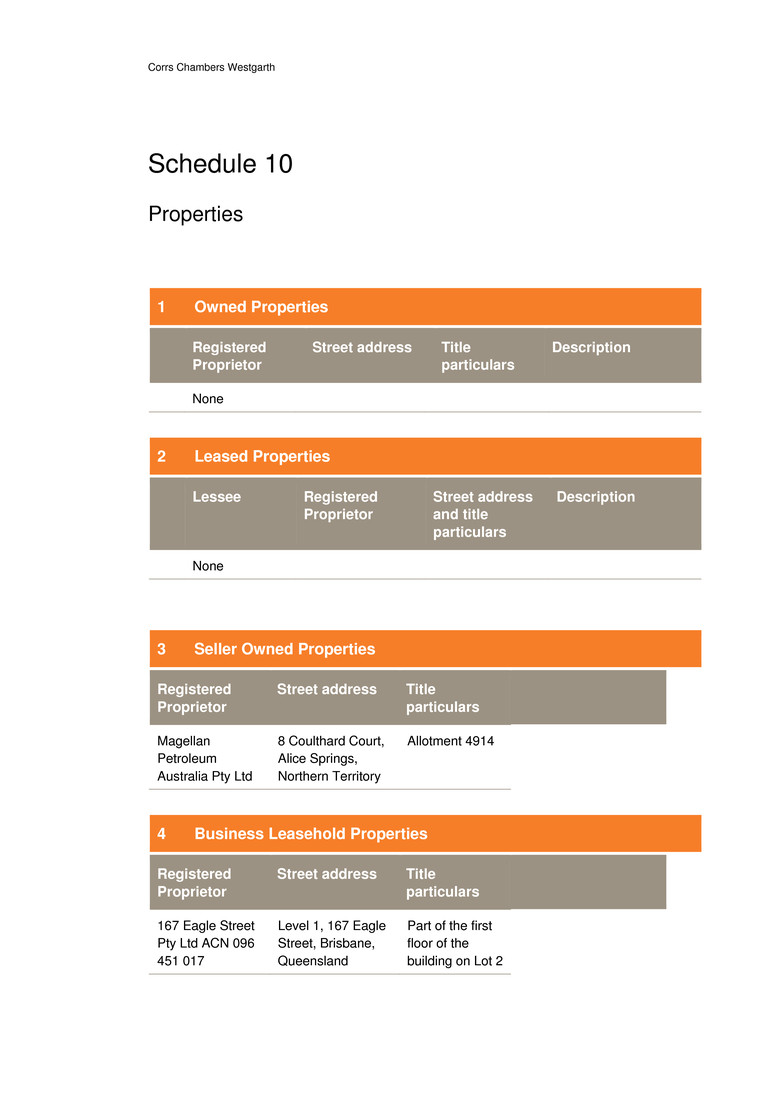

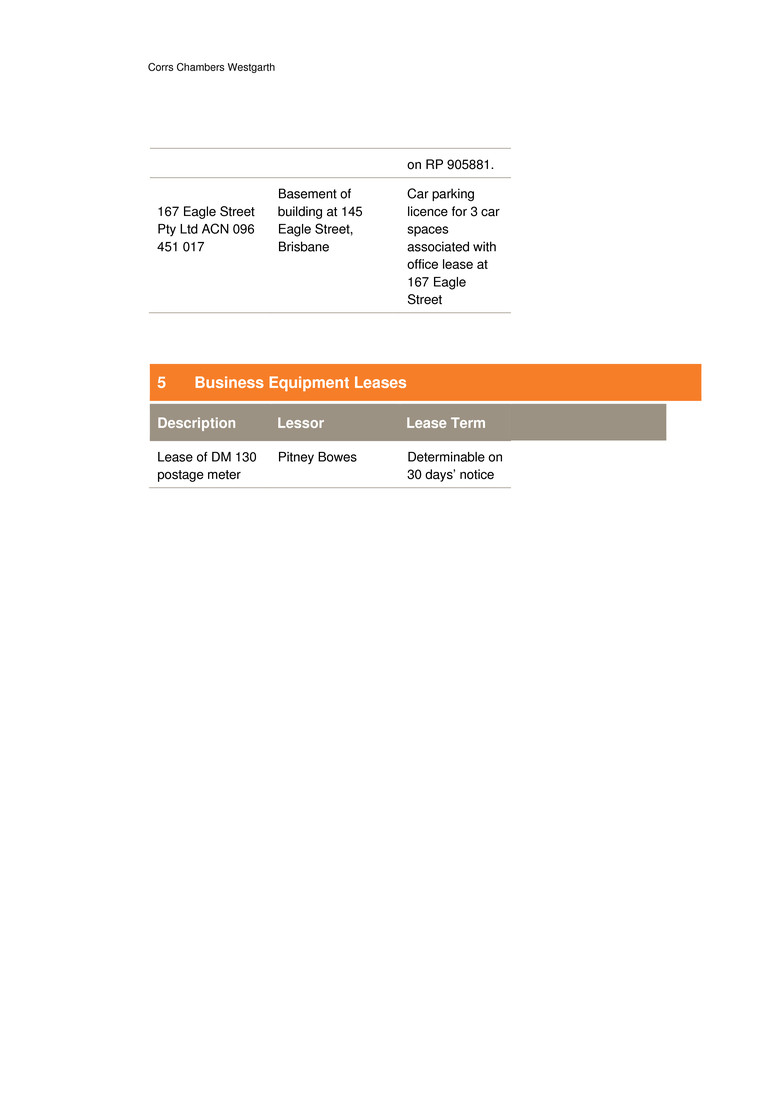

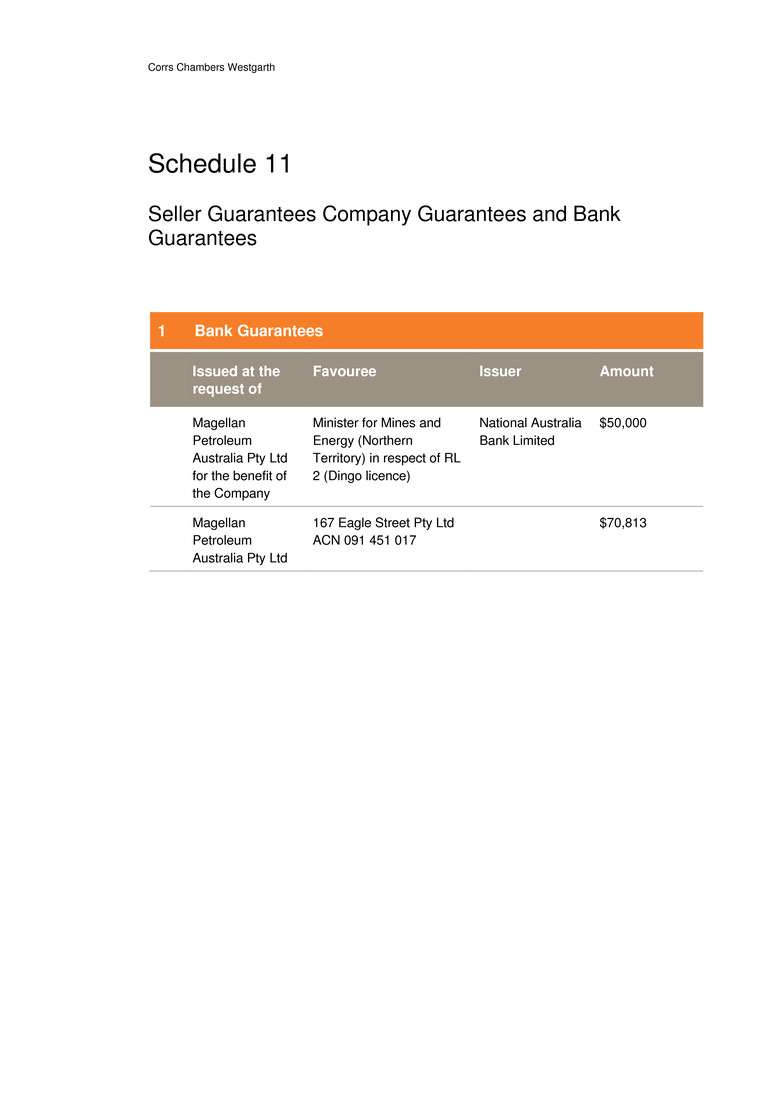

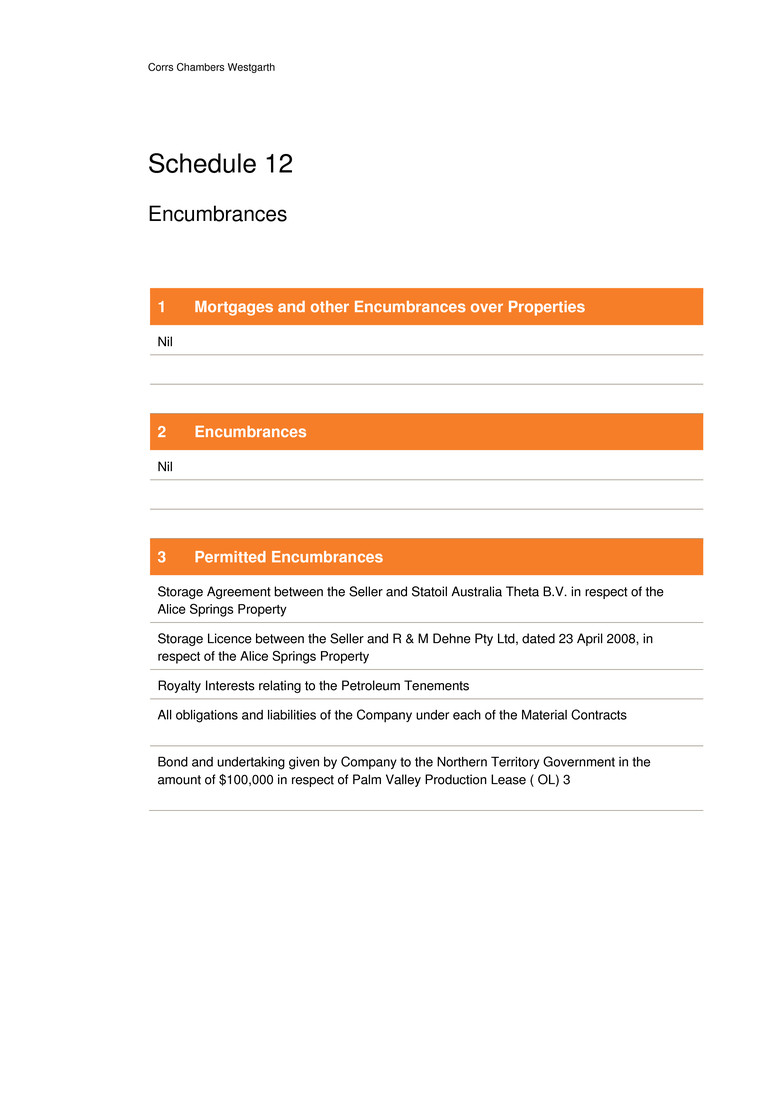

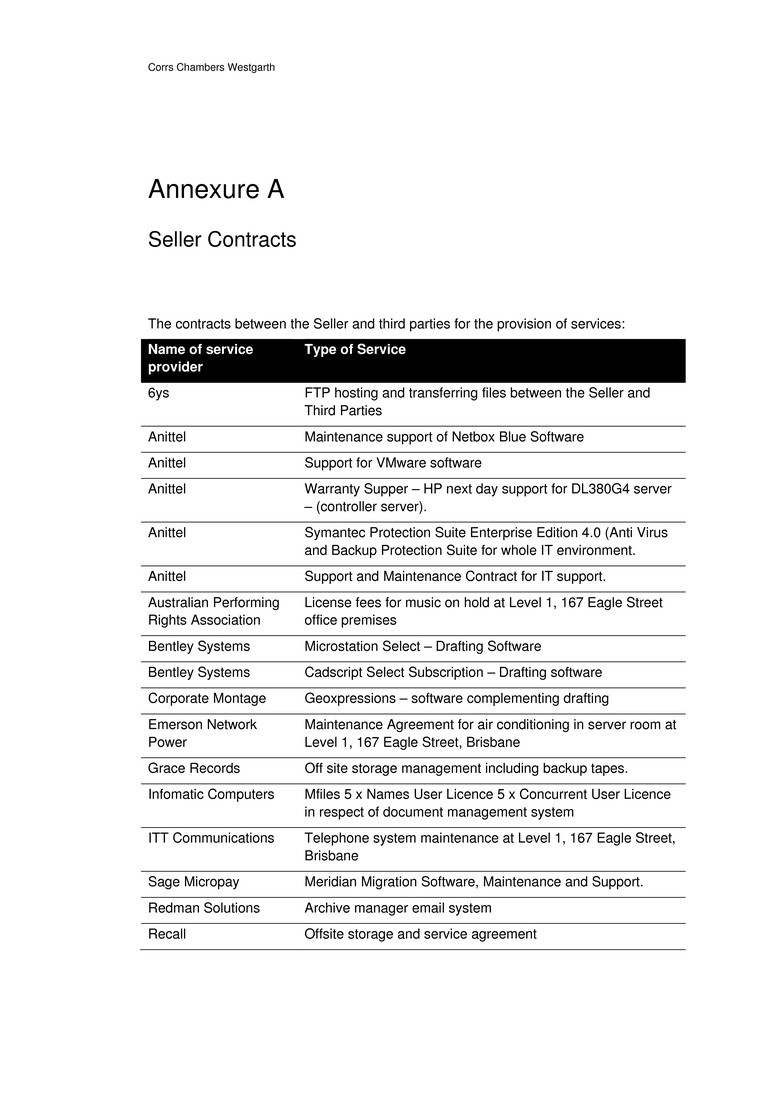

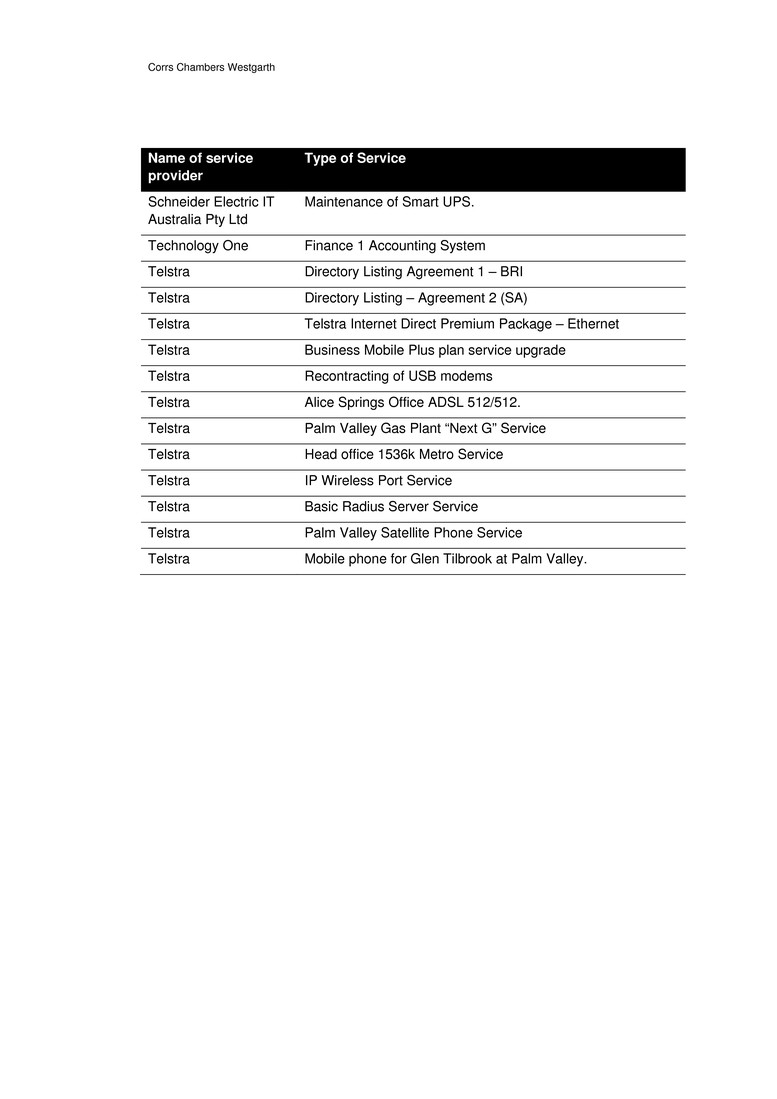

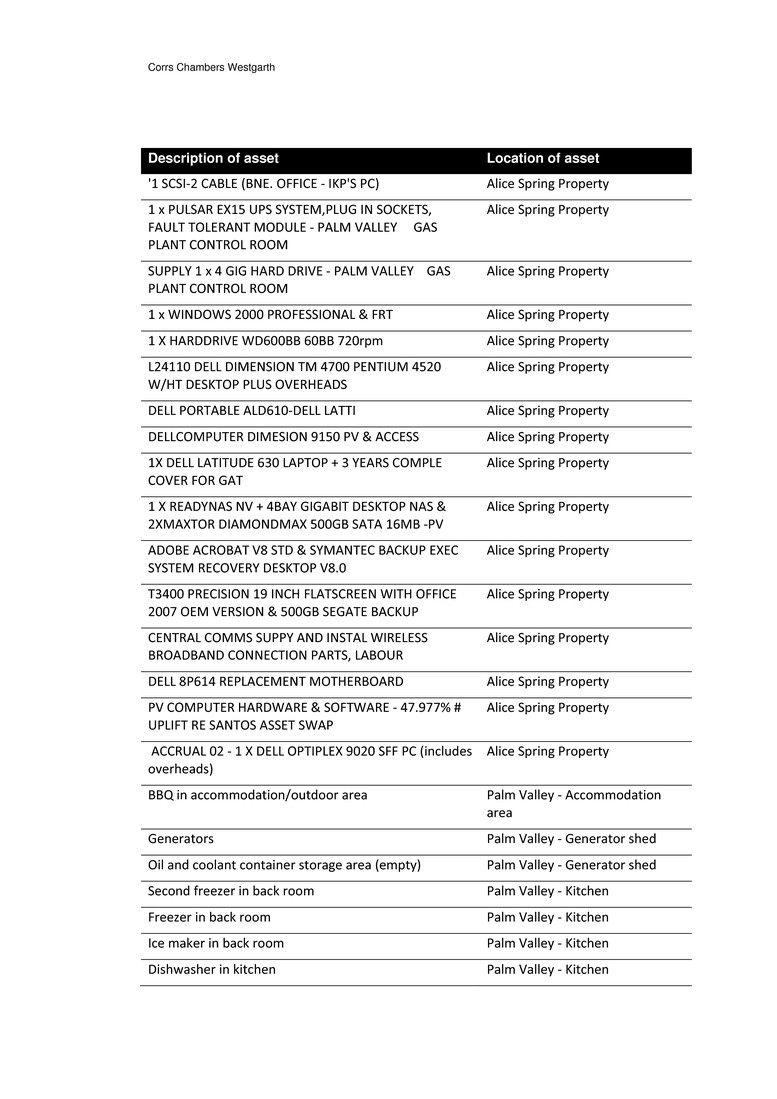

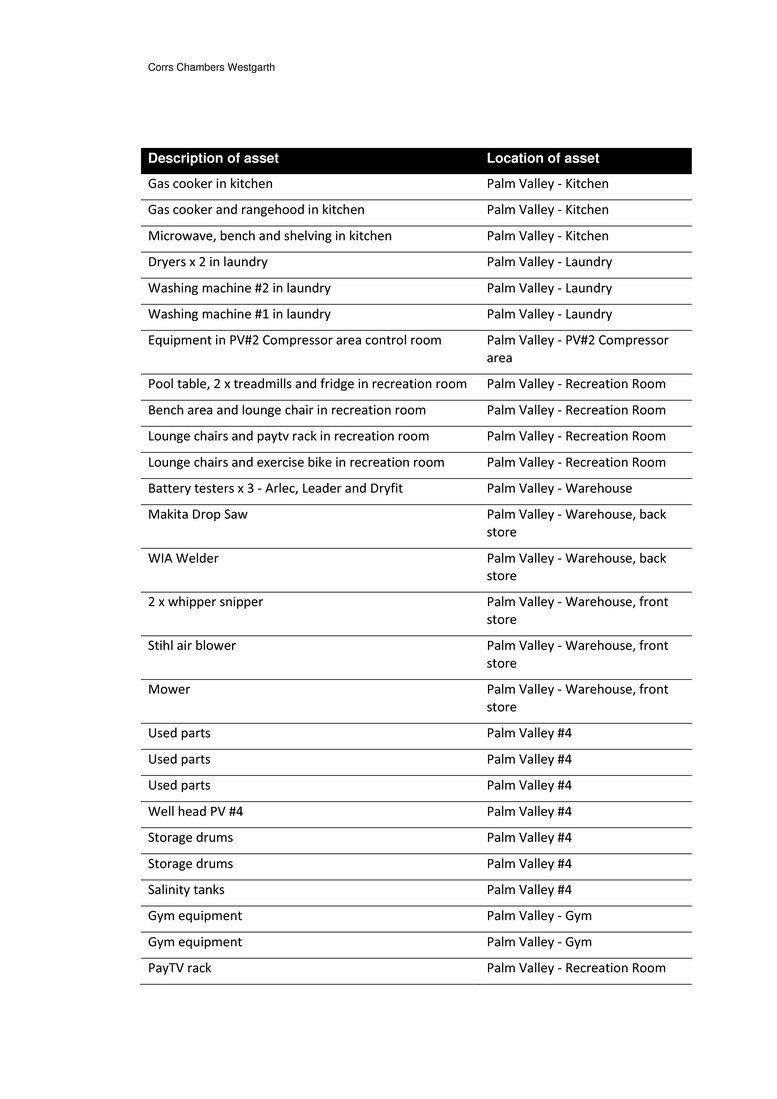

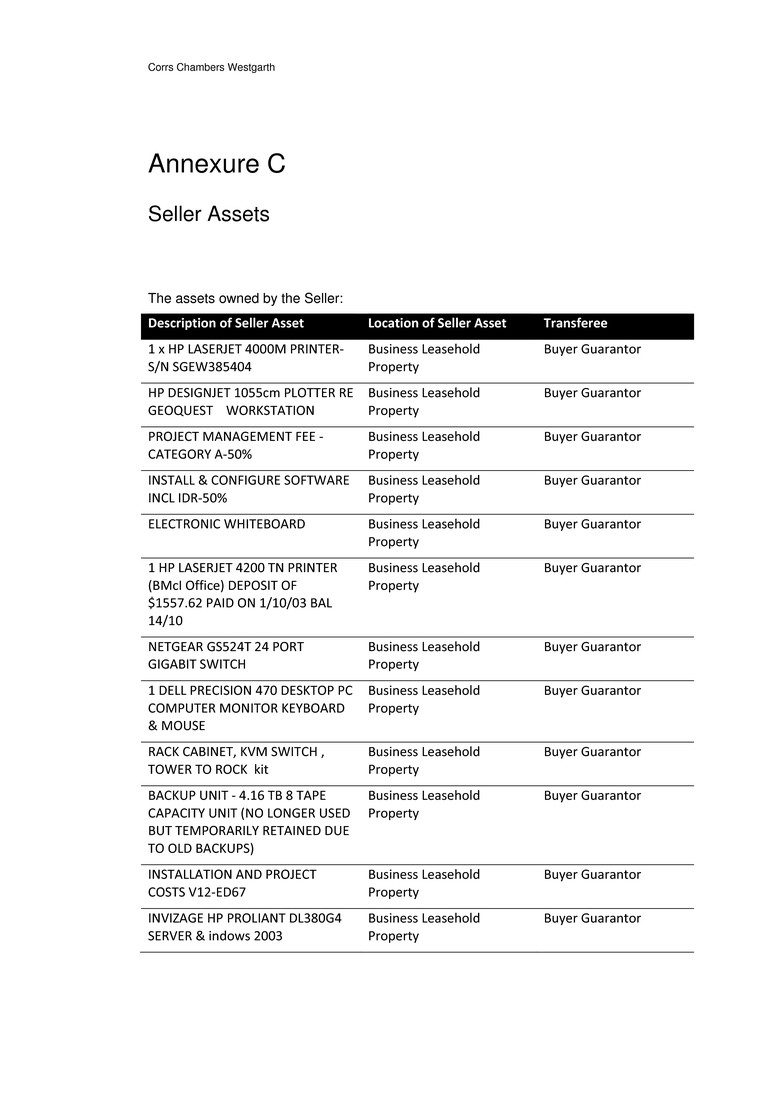

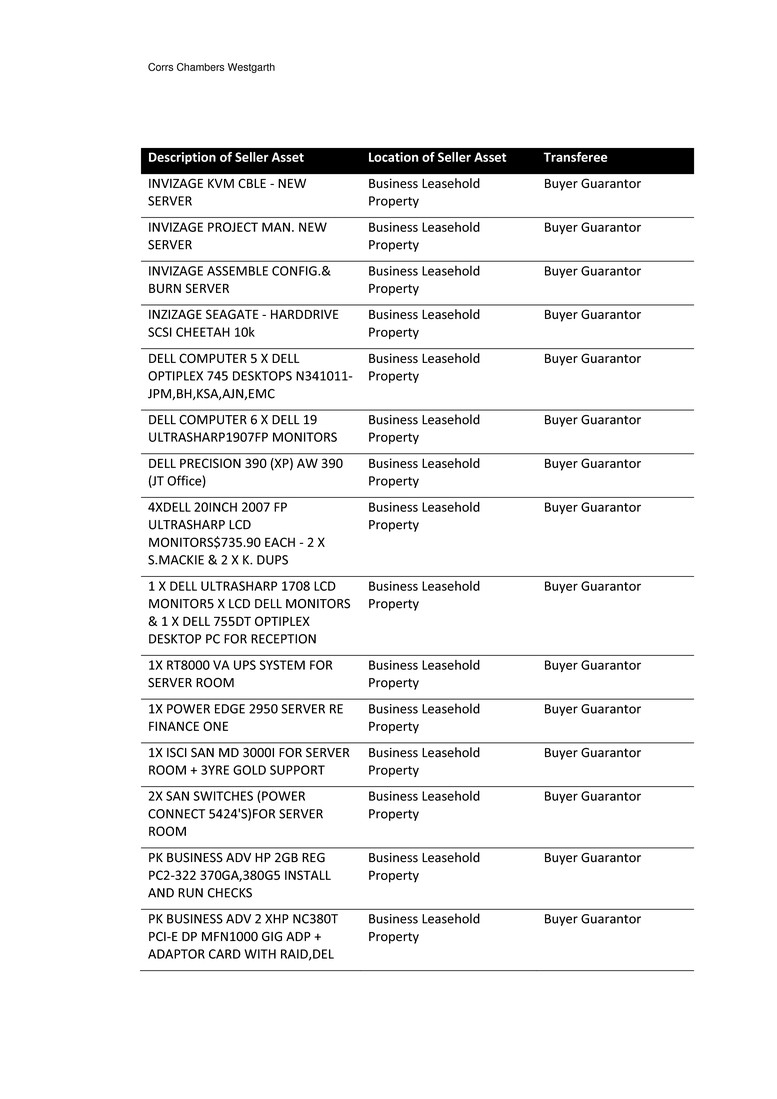

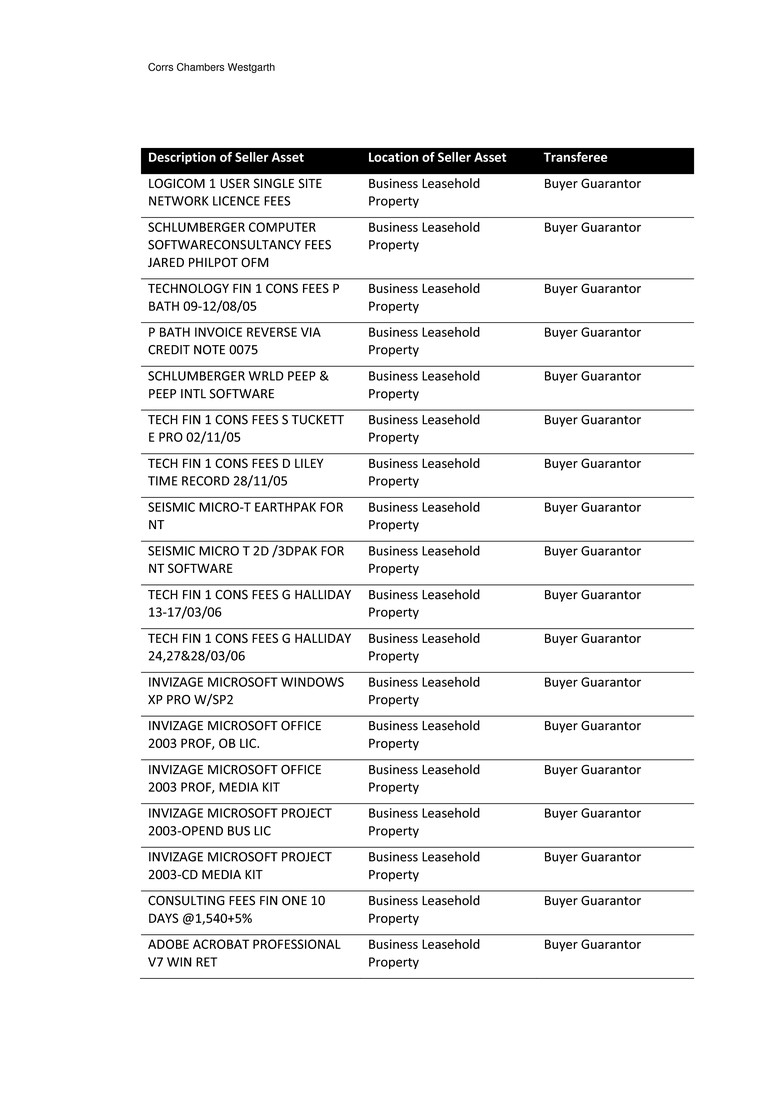

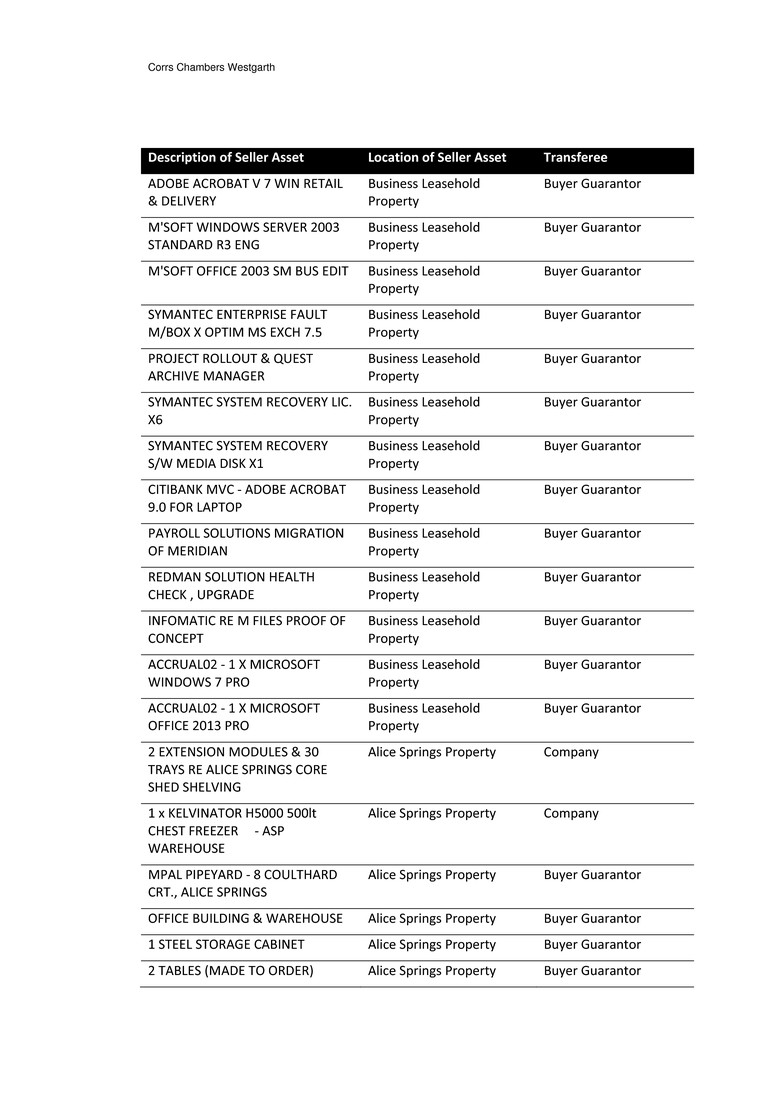

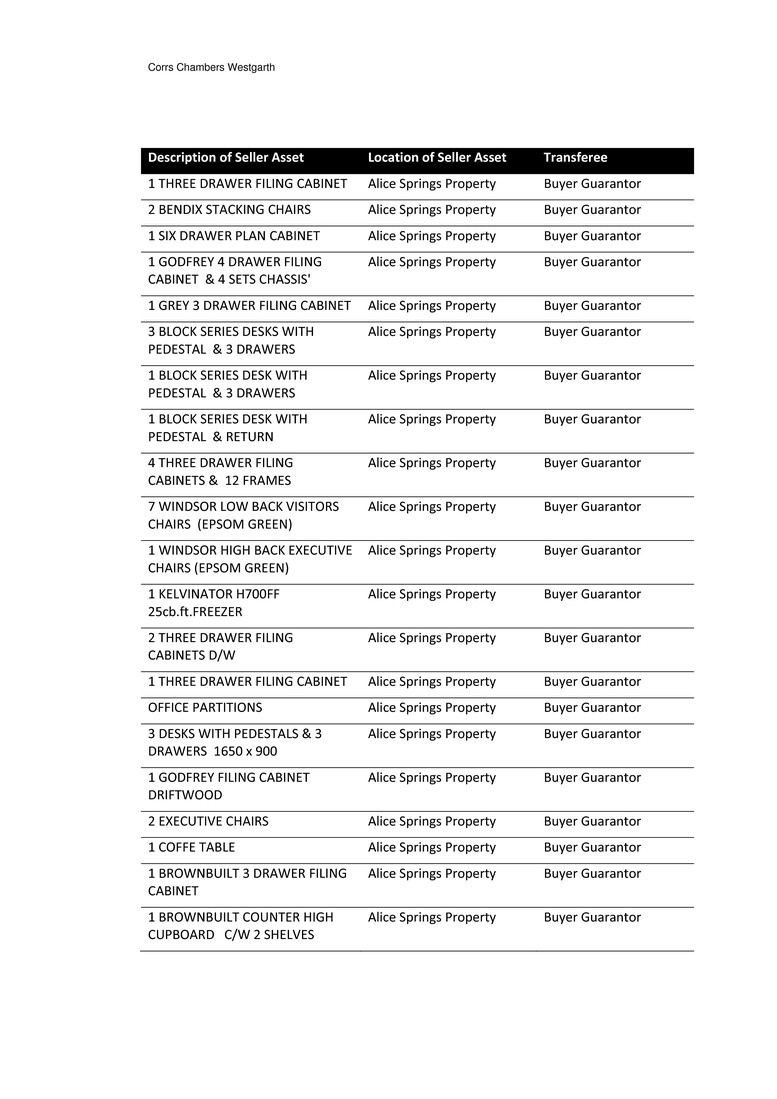

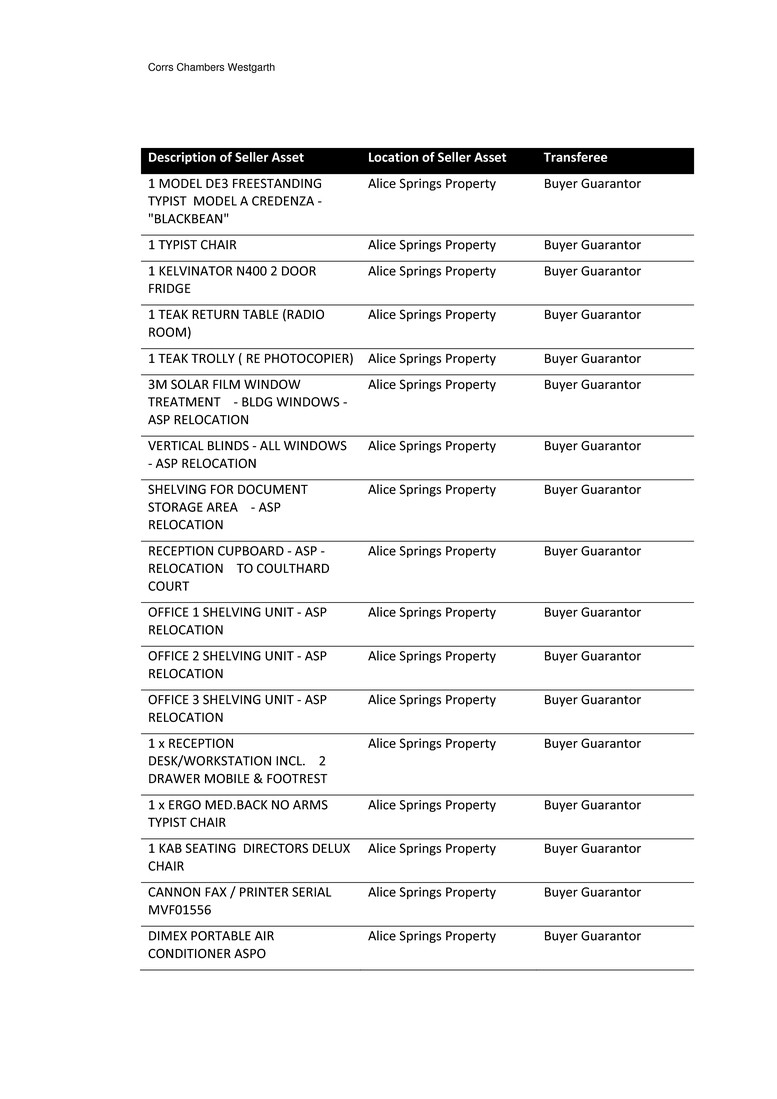

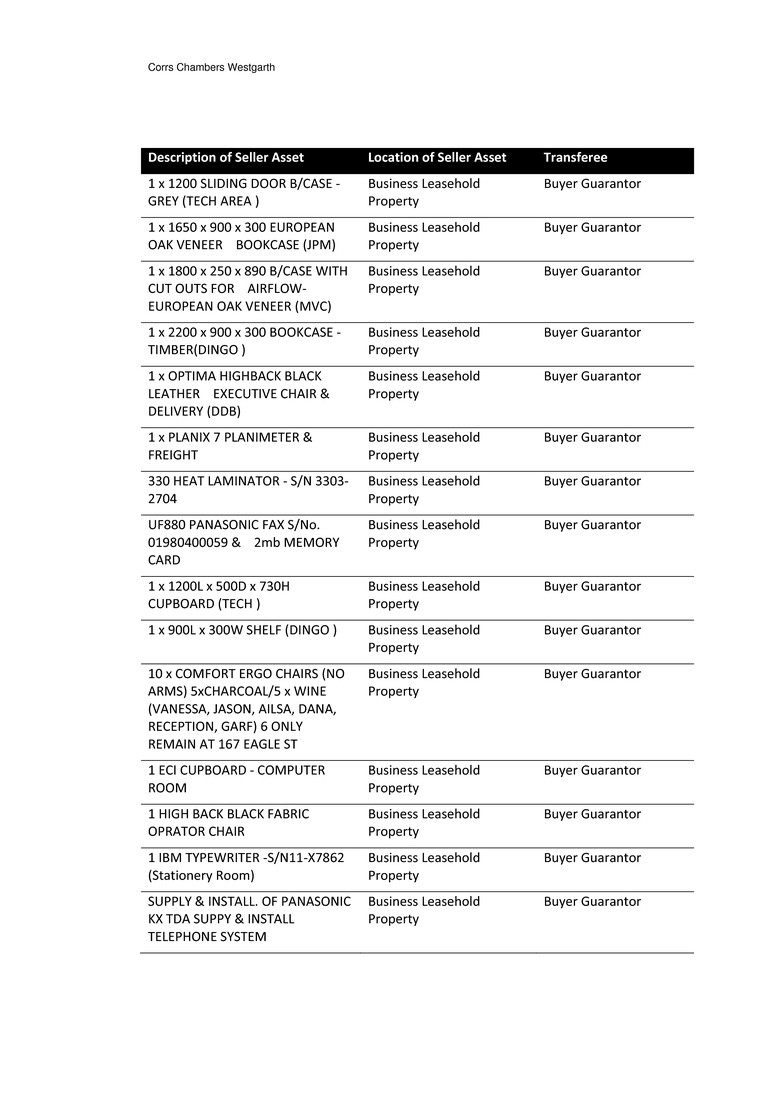

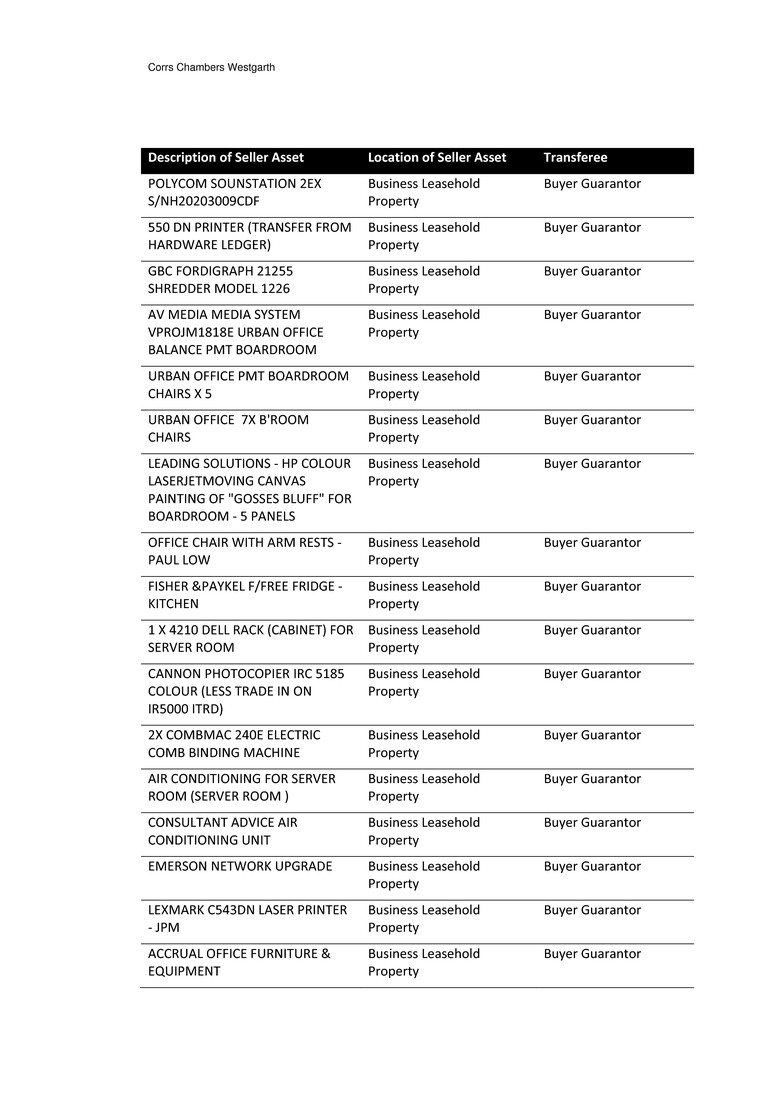

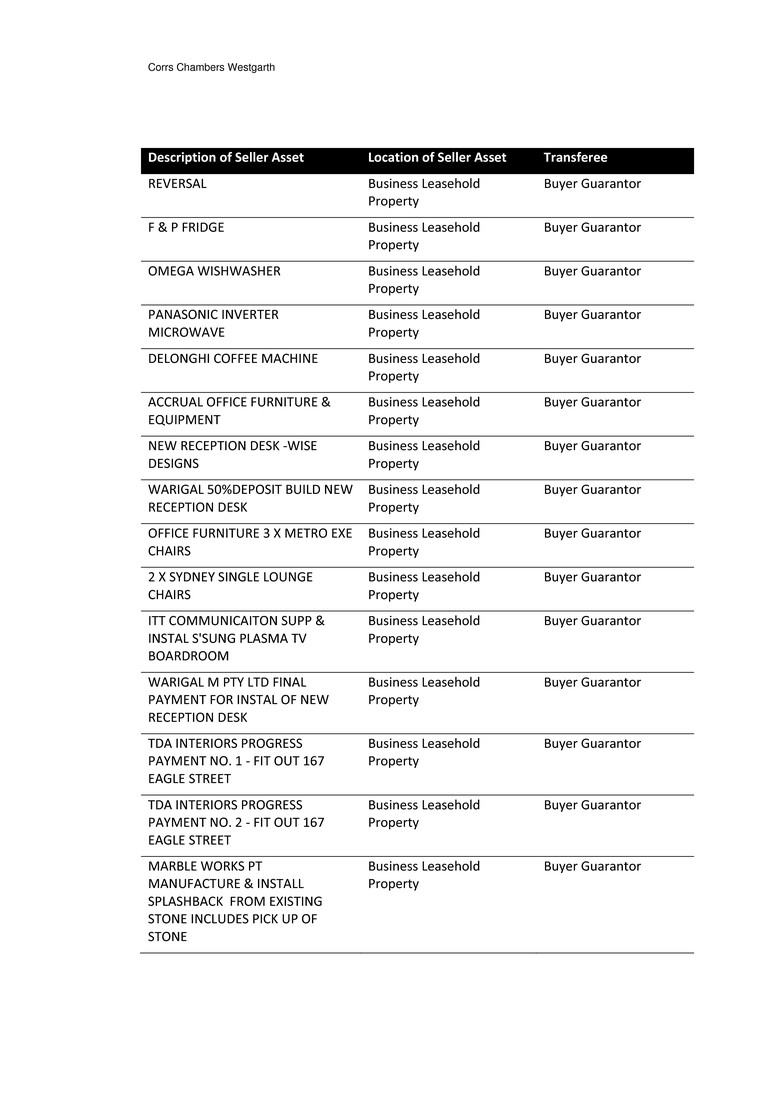

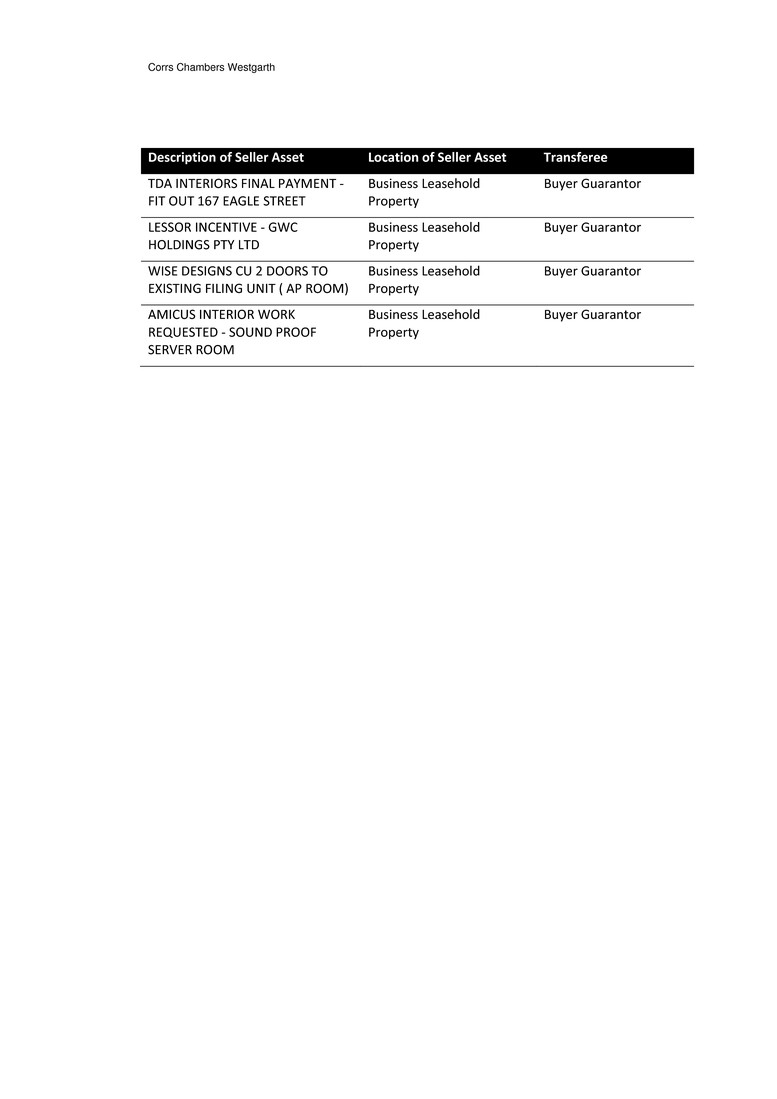

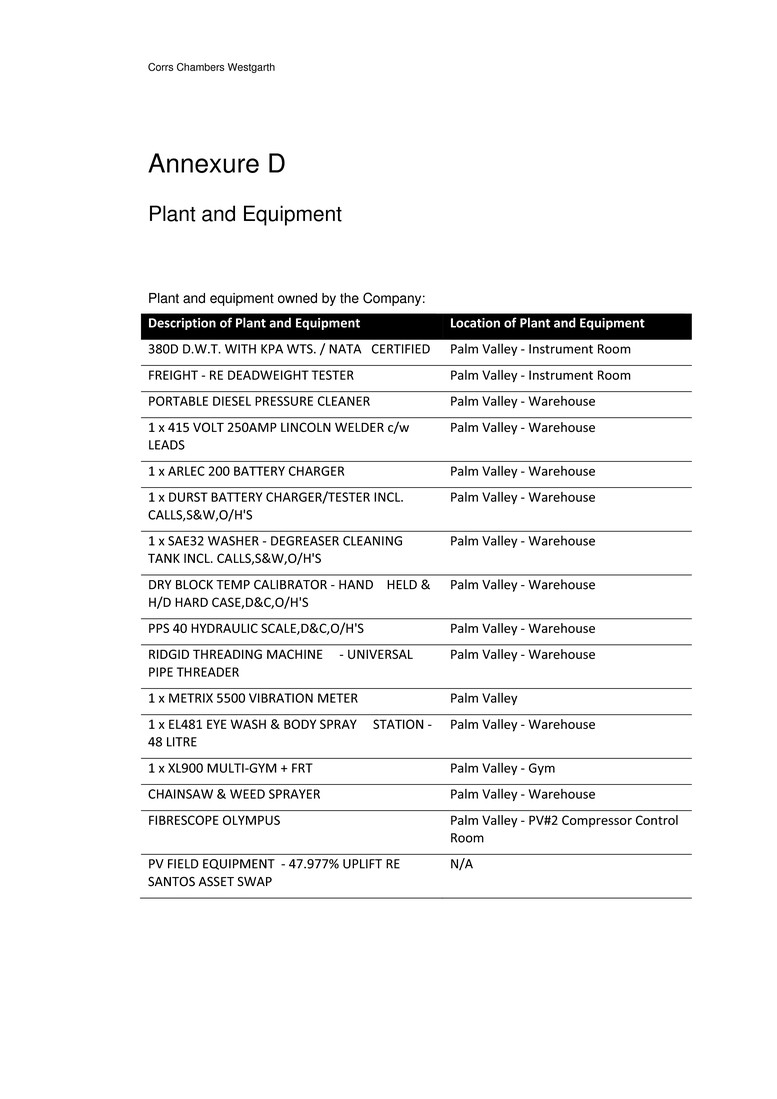

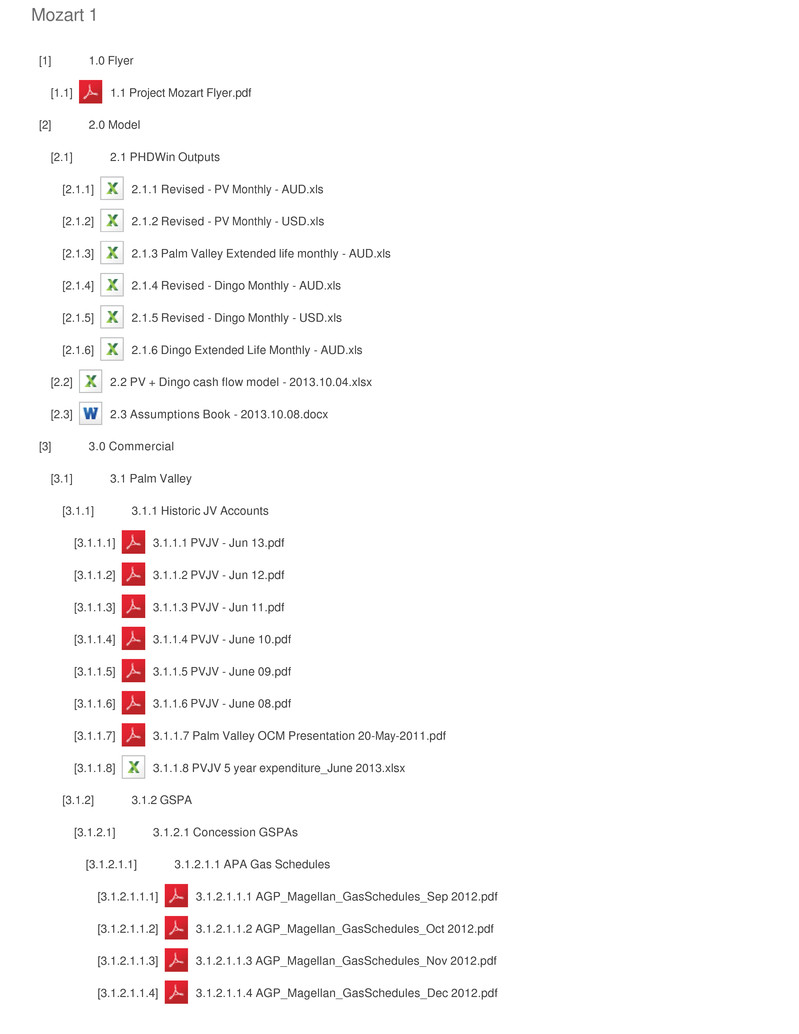

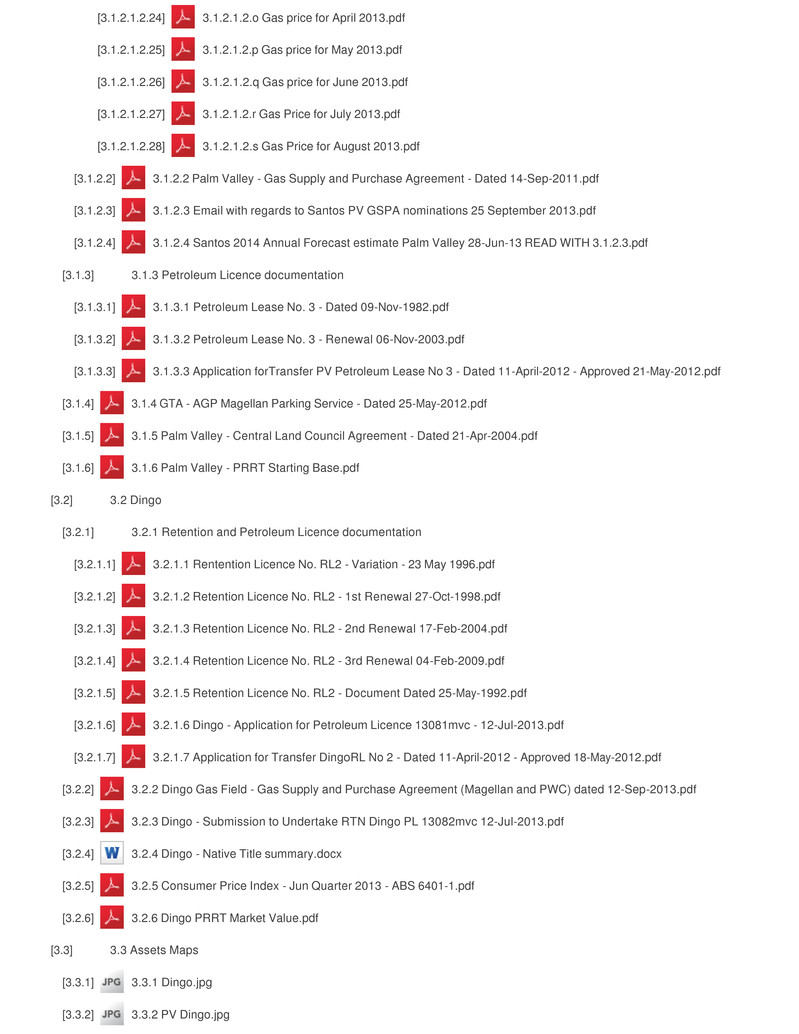

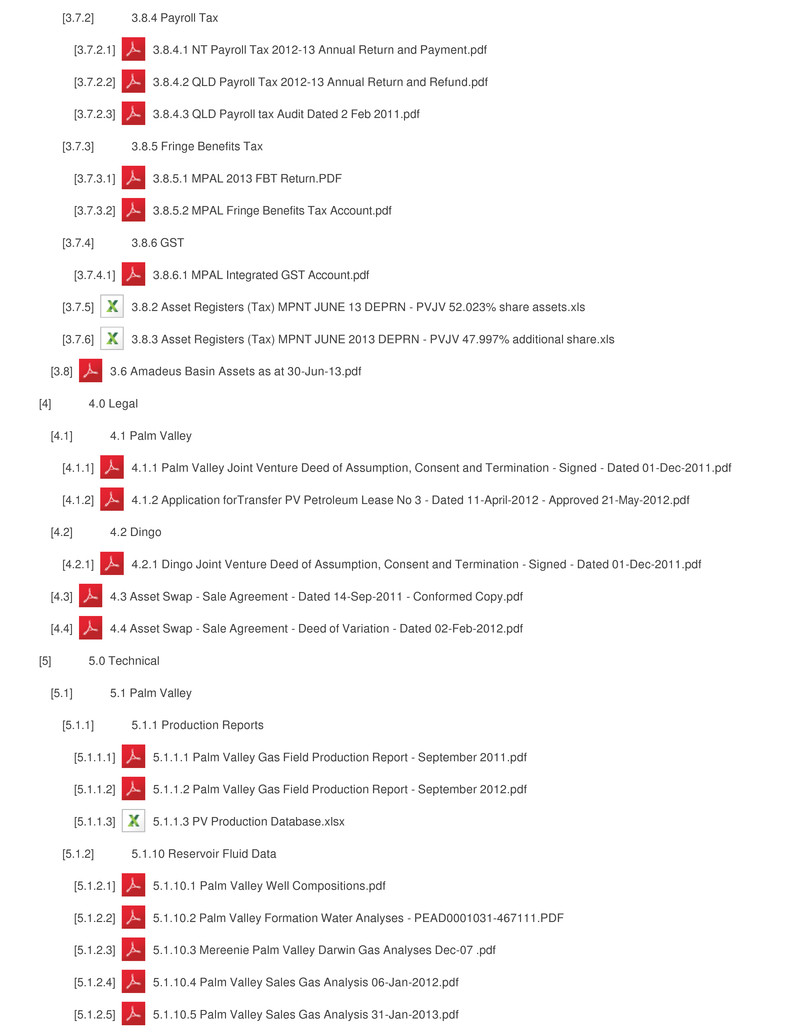

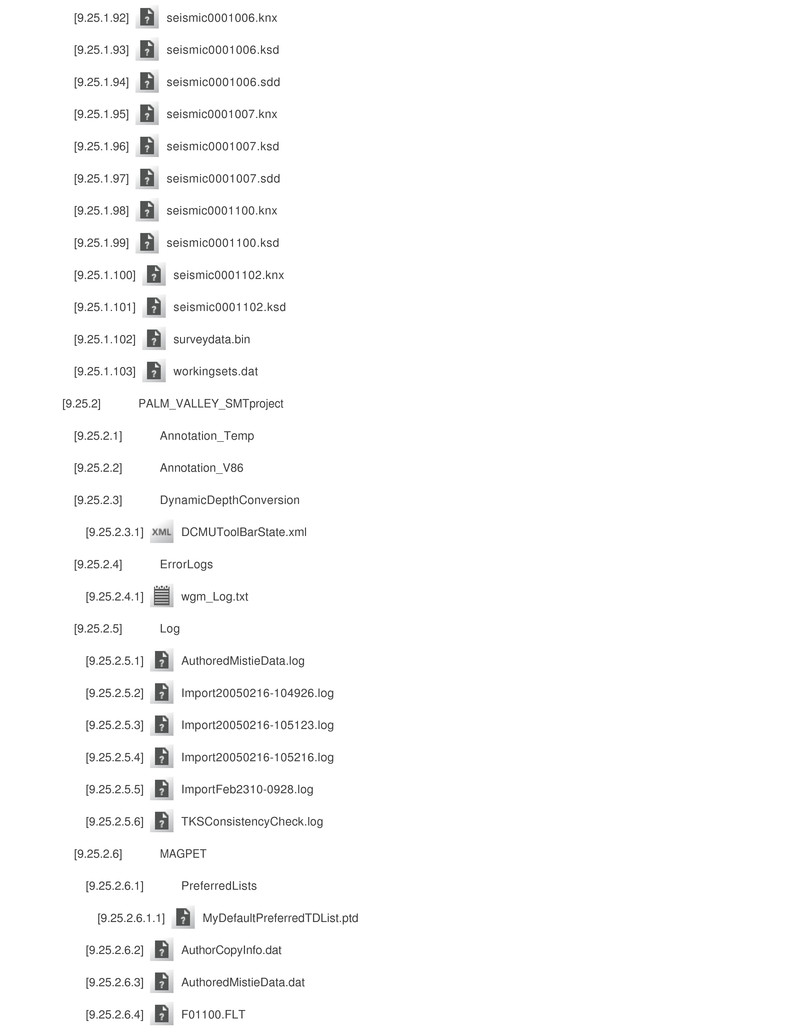

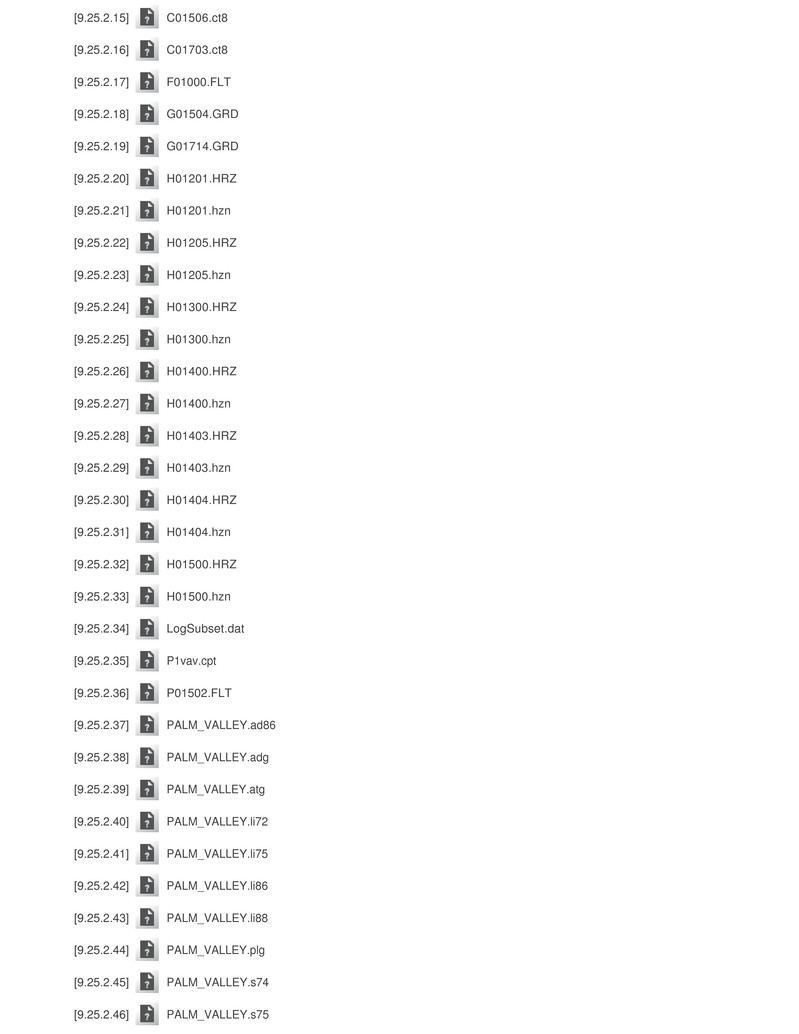

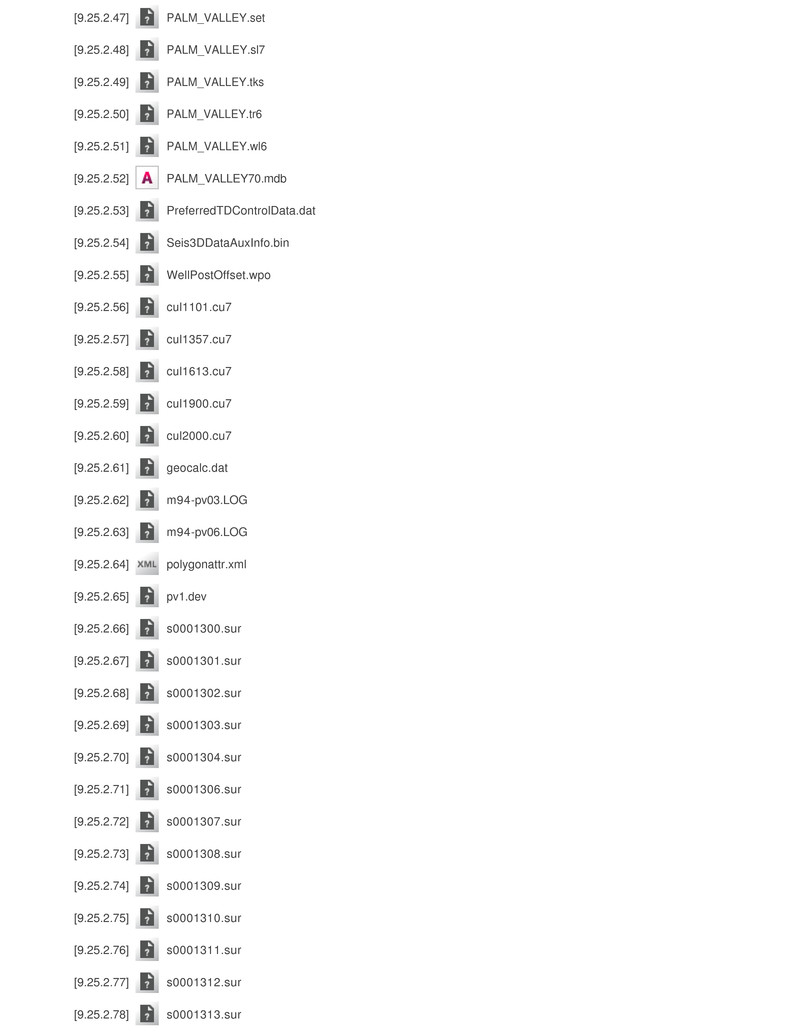

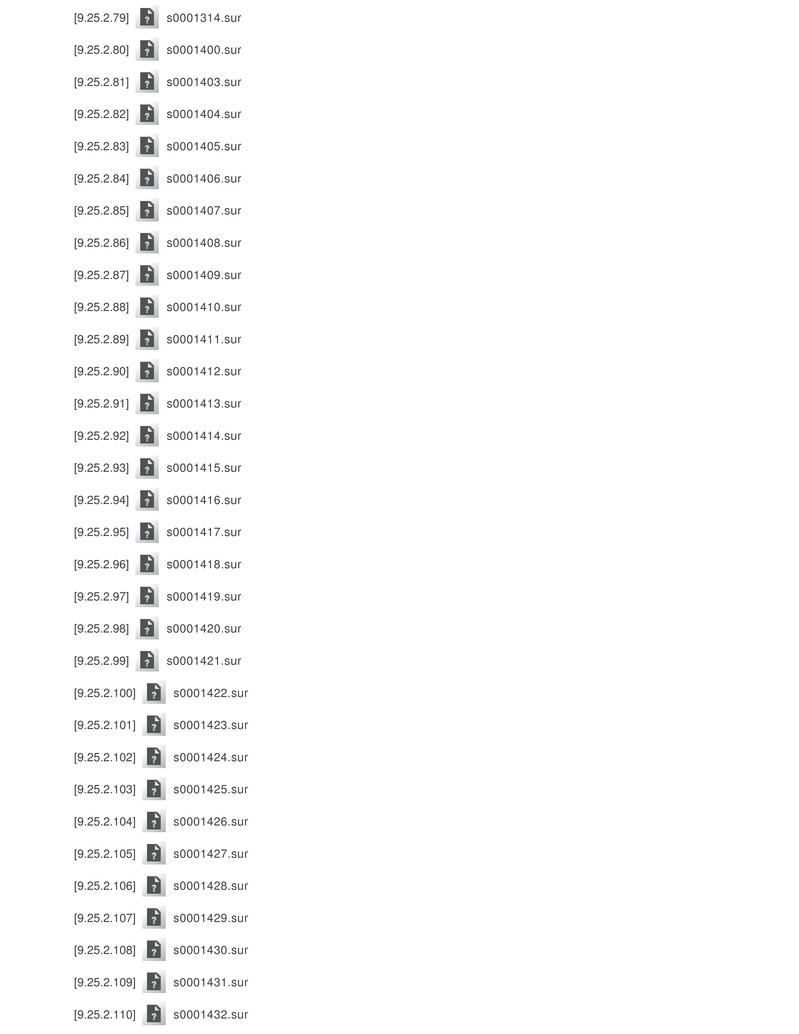

Corrs Chambers Westgarth page v Share Sale and Purchase Deed Schedule 1 – The Seller and the Company 67 Schedule 2 – Calculation of the Dingo Field Costs and Gas Price Bonus 68 Schedule 3 – Dingo Field Completion Accounts 71 Schedule 4 – Apportionment of Total Purchase Price 73 Schedule 5 – Expert Determinations 74 Schedule 6 – Completion Obligations 76 Schedule 7 – Seller Warranty Mechanics 81 Schedule 8 – Seller Warranties 91 Schedule 9 – Buyer Warranties 106 Schedule 10 – Properties 115 Schedule 11 – Bank Guarantees 117 Schedule 12 – Encumbrances 118 Schedule 13 – Related Party Debt and Receivables 119 Schedule 14 –Dingo Contracts 120 Execution 121 Annexure A - Seller Contracts 123 Annexure B – Assets 125 Annexure C – Seller Assets 129 Annexure D – Plant and Equipment 147 Annexure E – Data Room Documentation 148 Annexure F – Disclosure Letter 149 Annexure G – Deposit Banker's Undertaking 152 Annexure H – Second Instalment Banker's Undertaking 154

Corrs Chambers Westgarth page 1 Share Sale and Purchase Deed Date Parties Magellan Petroleum Australia Pty Ltd ACN 009 728 581 of Level 1, 167 Eagle Street, Brisbane, Queensland (Seller) Magellan Petroleum (N.T) Pty. Ltd. ACN 009 718 183 of Level 1, 167 Eagle Street, Brisbane, Queensland (Company) Magellan Petroleum Corporation incorporated in Delaware the United States of America, of 1775 Sherman Street, Suite 1950, Denver, CO 80203, the United States of America (Seller Guarantor Jarl Pty. Ltd. ACN 009 699 183 of Level 1, 167 Eagle Street, Brisbane, Queensland (Jarl) Central Petroleum PVD Pty. Ltd ACN 167 440 020 of 56-58 Jephson Street, Toowong, Queensland (Buyer) Central Petroleum Limited ACN 083 254 308 of 56-58 Jephson Street, Toowong, Queensland (Buyer Guarantor) Background A The Seller is the registered holder of the Sale Shares, which comprise all the issued securities in the capital of the Company and Jarl. B The Seller has agreed to sell, and the Buyer has agreed to buy, the Sale Shares on the terms set out in this Deed. Agreed terms 1 Definitions 1.1 Terms defined in this Deed In this Deed these terms have the following meanings: Accounting Expert means a chartered accountant appointed in accordance with The Institute of Arbitrators & Mediators Australia Expert Determination Rules.. Alice Springs Property 8 Coulthard Ct, Ciccone, Alice Springs, Northern Territory, Lot 04914, Town of Alice Springs of Plan

Corrs Chambers Westgarth S 75/019. ASIC The Australian Securities and Investments Commission. Assets Each of the following: (a) the Petroleum Tenements; (b) the Business Records; (c) the Plant and Equipment; (d) the Owned Properties; and (e) the assets owned by the Company, including the assets identified in the asset register set out in annexure B. but excluding the Santos Bonus Payment and all rights of the Company under clause 11 of the Santos Agreement and its related schedules. ASX ASX Limited or the securities exchange operated by it, as the context requires. Authorisation Includes an authorisation, consent, agreement, notice of non-objection, certificate, licence, permission, approval, permit or declaration or exemption from, by or with a Government Agency. Bank Guarantee Each bank guarantee described in schedule 11. Base Purchase Price The meaning given in clause 3.2. Base Rate Either: (a) the rate (expressed as a percentage yield per annum to maturity) being the arithmetic average (rounded up to the nearest four decimal places) of the buying rates published at or about 10.30 am (in Sydney) on the first day on which the relevant amount became due for payment (and on the first day of each consecutive period of 90 days, the first of which commences on the 90th day after the amount first became due for payment) on the Reuters Screen under the heading ‘BBSY’ for bills of exchange with a tenor of 90 days; or (b) if on the relevant day: (i) the rate referred to in paragraph (a) is not displayed; or (ii) the basis of the calculation of that rate is

Corrs Chambers Westgarth changed after the date of this Deed so that, in the opinion of the Payee, it ceases to reflect the cost to the Payee of the amount remaining unpaid, the rate per centum per annum determined by the Payee to be the average of the buying rates quoted to the Payee by at least three Australian banks on or about that day. The buying rates must be for bills of exchange accepted by a leading Australian bank and which have a term of 90 days. Beneficiary In the case of the Seller Guarantor, the Buyer and in the case of the Buyer Guarantor, the Seller. Board The board of directors of the Buyer Guarantor. Business The business carried on by, or on the behalf of, the Company as at the Execution Date of petroleum exploration and production. Business Day A day which is not a Saturday, Sunday or bank or public holiday in Brisbane. Business Equipment Lease The equipment leases identified at item 5 of schedule 10. Business Leasehold Property Each property described at item 4 of schedule 10. Business Property Leases The leases and licences under which the Business Leasehold Property is leased. Business Records All books, files, reports, records, correspondence, documents, data, programmes, software and other material (in whatever form stored), owned by the Company, Jarl or held by the Seller and Seller Affiliates, but only to the extent to which they relate to the Company, Jarl or the Business, including all: (a) minute books, statutory books and registers, books of account and copies of taxation and other returns and related correspondence; (b) title deeds and other documents of title and related correspondence; (c) Authorisations; (d) sales literature, market research reports, brochures and other promotional material; (e) sales and purchasing records;

Corrs Chambers Westgarth (f) lists of all regular suppliers and customers; (g) price lists, pricing models and sales and marketing materials; (h) trading and financial records; (i) contracts; (j) employee records, including those required to be kept under the Fair Work Act 2009 (Cth) and the Fair Work Regulations 2009 (Cth); (k) insurance policies and certificates of currency of insurance held by the Company and Jarl; and (l) all information with respect to the Petroleum Tenements including surveys, maps, mosaics, aerial photographs, electromagnetic tapes, electromagnetic or optical disks, sketches, drawings, memoranda, drill cores, logs of drill cores, geophysical, geological, drill maps, geochemical sampling and assay reports, notes and other relevant information and data in whatever form. Buyer Group Company The Buyer Guarantor and its subsidiaries (excluding the Company and Jarl). Buyer Guarantor Shares Fully paid ordinary shares in the Buyer Guarantor. Buyer Warranties The warranties and representations of the Buyer or Buyer Guarantor, as applicable, set out in schedule 9 (4). Central Farm-out Agreements The agreements entered into by the Buyer Guarantor and certain of the Buyer Group Companies with each of Santos QNT Pty Ltd and TOTAL GLNG Australia and its relevant subsidiaries relating to the farming out of interests in certain of the Central Petroleum Tenements to each of Santos QNT Pty Ltd and TOTAL GLNG Australia. Central Farm-out Petroleum Tenements The Central Petroleum Tenements subject to the Central Farm-out Agreements. Central Petroleum Tenements The petroleum exploration, retention or production licences, permits and authorities located in South Australia, Queensland, Northern Territory and Western Australia in which the Buyer Guarantor or any Buyer Group Company has an interest,

Corrs Chambers Westgarth including applications for such tenements. Claim Any allegation, debt, cause of action, cause, liability (whether actual, contingent or prospective), claim, demand, dispute, proceeding, suit, investigation or audit of any nature and whether present or future, fixed or unascertained, actual or contingent, arising at law, in equity, under statute or otherwise. Clear Exit Payment A payment or payments made to satisfy section 721-35 of the ITAA 1997 when an entity leaves the Seller Consolidated Group in respect of a Tax Related Liability. Company Magellan Petroleum (N.T) Pty. Ltd. ACN 009 718 183. Company Shares The 2,267,412 fully paid ordinary shares in the capital of the Company. Completion Settlement of the sale and purchase of the Sale Shares, and Seller Assets in accordance with clause 18 and Complete has a corresponding meaning. Completion Date The first Business Day following the fulfilment or waiver of all the conditions in clause 7.1 provided that the Completion Date may not occur prior to February 28, 2014. Completion Time The time immediately before Completion occurs. Condition Each condition set out in clause 7.1. Consideration Shares The number of Buyer Guarantor Shares calculated in accordance with the following formula: $15,000,000 VWAP Consolidated Group A ‘consolidated group’ or a ‘MEC group’ as those terms are defined in section 995-1 of the ITAA 1997. Contaminant Any substance, gas, liquid, chemical, mineral or other physical or biological matter that presents a risk of harm to human health or the Environment or that is controlled, prohibited or regulated from time to time by any Environmental Law, including by- products and derivatives of any such matter. Contamination The presence of any Contaminant in air, land or water at a concentration above the concentration at which it is naturally present at the same locality and

Corrs Chambers Westgarth which presents a risk of harm to human health or the Environment. Contract A contract, agreement, arrangement or commitment entered into by the Company before Completion which is not fully performed as at Completion. Control The meaning given in section 50AA of the Corporations Act. Controller The meaning given in the Corporations Act. Corporations Act The Corporations Act 2001 (Cth). Data Room Documentation All documentation listed in the data room index and supplementary indices signed by the Buyer and the Seller and bearing the date of this Deed, comprising annexure E. Deed Means this Share Sale and Purchase Deed. Deposit Banker's Undertaking Means a banker's undertaking in the amount of $1,000,000, in substantially the same form as the banker's undertaking set out in annexure G, issued by a major Australian trading bank and redeemable at a Brisbane branch.. Dingo Contracts The contracts for preliminary survey, assessment work, environmental and cultural heritage clearances in relation to the development of the Dingo Field, entered into by the Seller or a Seller Affiliate and identified in schedule 14. Dingo Field The area of retention lease (RL) 2. Dingo Field Completion Accounts The accounts to be prepared in accordance with schedule 3 for the purpose of determining the Dingo Field Costs. Dingo Field Costs The meaning in schedule 2 (1.1). Dingo GSA The meaning given in the definition of Material Contracts. Dingo Royalty Interests The royalty interests and obligations enforceable against the Company and Jarl arising under each of the following: (a) Deed of Overriding Royalty between the Company and Jarl dated 25 September 1964 as assigned in proportions to each of the following parties: (i) 0.2% to Duncan McNaughton and Mrs McNaughton;

Corrs Chambers Westgarth (ii) 0.1% to Diane Alexandria Finstrom; (iii) 0.1% to Shelia Ann Shook; (iv) 0.1% to Janet Ellen Denham; (v) 0.25% to Roy Hopkins; (vi) 0.80% to the Seller; (vii) 0.45% to Canso Oil & Gas Inc; and (viii) 1.25% to Jarl; and (b) Deed of Overriding Royalty between the Guarantor, Mildred M Hembdt and Ethel A Hembdt dated 28 December 1961; and (c) royalty payable to the Central Land Council (CLC), which is in the course of being negotiated between Company and CLC. Director A director of the Buyer Guarantor. Disclosure Letter A letter from the Seller to the Buyer which contains disclosures in respect of the Seller Warranties, comprising annexure F. Disclosure Material All: (a) Data Room Documentation; (b) information contained in this Deed; (c) information disclosed in the public filings with the United States Securities Exchange Commission for or by the Seller Guarantor in the 12 months prior to the Execution Date; and (d) information contained in the Disclosure Letter. Dispute Notice The meaning given in schedule 3 (4.1) (as applicable). Disputed Matters The meaning given in schedule 3 (4.1(a)) (as applicable). Duty Any: (a) stamp, landholder, land rich, transaction or registration duty or similar charge or impost that is assessed, levied, imposed or collected by any Government Agency; and (b) interest, penalty, charge, fine or fee or other amount of any kind assessed, charged or imposed on or in respect of any of the above.

Corrs Chambers Westgarth Effective Date Means the first calendar day following the Completion Date. Employee Entitlements The aggregate of all unpaid amounts and benefits to which any person employed by the Seller as an employee immediately prior to Completion (Employee) is entitled as at the Completion Date for amounts in the “Estimated Retrenchment Liability” and “Leave Summary and Liability” schedules as at 28 February 2014 disclosed in the Data Room Documentation, which may be amended to account for the extra days until actual Completion Date in respect of: (a) annual leave, long service leave and personal leave, accrued or arising in respect of the Employee for the period of the Employee’s employment by the Seller before Completion; and (b) termination of employment for redundancy or severance under a contract and the required notice period for such termination. Encumbrance Any: (a) interest in or right over property and anything which would at any time prevent, restrict or delay the registration of any interest in or dealing with property; and (b) Security Interest. Environment All components of the earth including: (a) land, air and water; (b) any layer of the atmosphere; (c) any organic or inorganic matter; (d) any living organism; and (e) any natural or manmade or modified features or structures, and includes ecosystems and all elements of the biosphere. Environmental Authorisation Means an Authorisation required under any Environmental Law in order for the Company to conduct the Business. Environmental Harm Means any direct or indirect alteration of the Environment that has the effect of degrading the

Corrs Chambers Westgarth Environment in breach of Environmental Laws. Environmental Law Any law concerning Environmental Matters. Environmental Matters Environmental Warranties Any of the following matters: (a) the protection of human health or the Environment; (b) Contamination; (c) the emission of Contaminants, noise, odour, vibration or electromagnetic fields; (d) the production, use, handling, storage, transportation, deposit or disposal of Contaminants; (e) conservation, heritage or natural resources; (f) threatened, endangered or other flora and fauna species; (g) town planning; or (h) climate change. The warranties provided for at schedule 8(12) Escrow Agent Means Corrs Chambers Westgarth. Execution Date The date on which the last of the parties executes this Deed. Expert In the case of a dispute under schedule 3 (4), the Accounting Expert. External Administrator A liquidator, provisional liquidator, Controller or administrator. Facility Agreement The Facility Agreement between the Buyer and Macquarie dated on or about the date of this Deed. Funds Means the funds to be provided by Macquarie to the Buyer pursuant to the Facility Agreement to the extent required by the Buyer to finance the Base Purchase Price. Gas Price Bonus The meaning in schedule 2 (2). Gas Price Bonus Discharge Payment The meaning given in schedule 2 (2(f)). Good Faith Means: (a) to cooperate for the agreed period (and if no agreement, for a reasonable period) in an

Corrs Chambers Westgarth attempt to achieve the objective; (b) compliance with honest standards of conduct; (c) compliance with standards of conduct that are reasonable having regard to the interests of the parties, and the terms of, and intention of the parties in relation to, this Deed; and (d) to not act arbitrarily or capriciously, and without the intention to do anything to impede or restrict any other party’s performance of this Deed, but excludes any: (a) fiduciary obligations; and (b) requirement to act in a manner that will or may conflict with a party’s bona fide commercial interests. Government Agency Any government, whether federal, state, territorial, local, including any administrative or judicial body, department, commission, authority, instrumentality, tribunal, regulator, agency or entity of any such government. Gross Negligence or Wilful Misconduct Means any act or failure to act (whether sole, joint or concurrent) by any person or entity that was intended to cause, or was in reckless disregard of or wanton indifference to, harmful consequences such person or entity knew, or should have known, such act or failure would have on the safety or property of another person or entity. GST Act A New Tax System (Goods and Services Tax) Act 1999 (Cth). GST Group The meaning given in the GST Law. GST Joint Venture The meaning given in the GST Law. GST Law The meaning given in the GST Act. Guaranteed Party In the case of the Seller Guarantor, the Seller and in the case of the Buyer Guarantor, the Buyer. Guarantor Each of the Seller Guarantor and the Buyer Guarantor. Head Company The Seller as the head company of the Seller Consolidated Group. Income Revenue of any type or nature in connection with the Business, the Assets, the Seller Assets or the

Corrs Chambers Westgarth Property, and includes refunds, including without limitation, any Tax or royalty refund or credit. Income Tax Act ITAA 1936 and ITAA 1977 or either of them, as applicable. Indirect Tax Law The meaning given in ITAA 1997. Insolvent The meaning given in clause 26.1(d). Insurances The meaning given in schedule 8 (17.3). Intellectual Property Rights All intellectual property rights including current and future registered and unregistered rights in respect of trade marks, trade names, logos and associated get-up, designs, patents, inventions, discoveries, circuit layouts, copyright and analogous rights, whether conferred by statute, common law or equity. ITAA 1936 The Income Tax Assessment Act 1936 (Cth). ITAA 1997 The Income Tax Assessment Act 1997 (Cth). Jarl Jarl Pty. Ltd. ACN 009 699 183. Jarl Shares The 2 fully paid ordinary shares in the capital of Jarl. Land Outgoings All local authority rates, land tax and other outgoings relating to the Alice Springs Property. Lease A lease, sublease, tenancy or other occupancy right in relation to a Leased Property. Lease Outgoings Rent, fees and other outgoings in respect of each Business Equipment Lease and the Business Property Lease. Leased Property Each property described in item 2 of schedule 10. Liabilities Means Claims, Losses, liabilities, costs or expenses of any kind and however arising, including penalties, fines and interest and including those which are prospective or contingent and those the amount of which for the time being is not ascertained or ascertainable. Listing Rules The listing rules of ASX. Loss All losses, costs, charges, damages, expenses and other liabilities arising out of or in connection with a fact, matter or circumstance, including all legal and other professional expenses incurred in connection with investigating, disputing, defending or settling any Claim, or proceeding relating to that fact, matter

Corrs Chambers Westgarth or circumstance. Macquarie Macquarie Bank Limited ABN 46 008 583 542. Material Buyer Share Issue Issue and allotment of that number of Buyer Guarantor Shares which upon issue will represent not less than 5% of the total issued shares in the Buyer Guarantor. Material Contract A Contract which may reasonably be expected to be material to the Company or to the Business, including each of : (a) Santos Agreement; (b) Gas Transportation Agreement Amadeus Gas Pipeline Magellan Petroleum (NT) Pty Ltd Parking Service between APT Pipelines (NT) Pty Limited ACN 075 733 336 and the Company dated 25 May 2012 (Parking Agreement); (c) Gas Supply and Purchase Agreement – Dingo Field between Power and Water Corporation ABN 15 947 352 360 (as buyer) and the Company (as seller) dated 12 September, 2013 (Dingo GSA); and (d) the Santos GSA. Mereenie GST Joint Venture The GST Joint Venture of which the Company was a participant, and of which Santos Limited (or a Related Body Corporate of Santos Limited) is and/or was the joint venture operator. MPA Royalty Interests Those parts or fractions of the Royalty Interests which are payable to the Seller, the Company or their Related Bodies Corporate but not including Royalty Interests payable to Jarl on account of or for distribution to third parties. Non-MPA Royalty Interests Those parts or fractions of the Royalty Interests which are payable to persons other than the Seller, the Company or their Related Bodies Corporate but including Royalty Interests payable to Jarl on account of or for distribution to persons other than the Seller, the Company or their Related Bodies Corporate. Other Group Members The Related Bodies Corporate of each of the Seller and the Company who are the other parties to the Tax Funding Agreement. Outgoings Costs and expenses of any type or nature in connection with the Business, the Assets, the Seller

Corrs Chambers Westgarth Assets, the Royalty Interests or the Property, including, and includes payments, including without limitation, the Land Outgoings, the Lease Outgoings, and any Tax or royalty payments but excluding the Dingo Field Costs. Owned Property Each property described in item 1 of schedule 10. Palm Valley Field The area within production licence (OL) 3. Palm Valley GSAs The Santos GSA, in respect of gas originating and produced from the Palm Valley Field, and each other gas supply agreement in respect of gas originating and produced from the Palm Valley Field which may be entered into by the Company, the Buyer or a Related Body Corporate of the Buyer on or after Completion. Palm Valley GST Joint Venture The GST Joint Venture of which the Company is a participant, and of which the Seller is the joint venture operator. Palm Valley Royalty Interests The royalty interests and obligations enforceable against the Company and Jarl arising under each of: (a) Deed of Overriding Royalty between the Company and Jarl dated 25 September 1964 as assigned in proportions to each of the following parties: (i) 0.2% to Duncan McNaughton and Mrs McNaughton; (ii) 0.1% to Diane Alexandria Finstrom; (iii) 0.1% to Shelia Ann Shook; (iv) 0.1% to Janet Ellen Denham; (v) 0.93750% to Hembdt Associates, LLC; (vi) 0.54375% to Canso Resources Limited; and (vii) 1.26875% to Jarl;. (b) Deed of Overriding Royalty between the Guarantor, Mildred M Hembdt and Ethel A Hembdt dated 28 December 1961; and (c) Royalty Agreement PL3 between the Company, Canso Resources Limited, Farmout Drillers NL, C.D. Resources Pty Ltd, Ampolex (PPL) Pty Limited, Santos Limited, Southern Alloys Venture Pty Limited,

Corrs Chambers Westgarth International Oil Pty Ltd and the Minister of Mines and Energy dated 12 February 1991; and (d) 2.5% royalty to Central Land Council payable pursuant to an agreement dated 9 November 1982 as increased by agreement dated 21 April 2004. Parking Agreement The meaning given in the definition of Material Contract. Payee The meaning given in clause 24.4(a). Payout Demand The meaning given in schedule 2 (2(f)). Permitted Encumbrance Means in relation to the Company: (a) each Encumbrance listed in schedule 12 (3); (b) any Encumbrance granted by the Company in connection with property sold to the Company on retention of title terms while the money secured by the retention of title is not due for payment; (c) any netting or set-off arrangement entered into by the Company in the ordinary course of its banking arrangements for the purpose of netting debit and credit balances; (d) a lien which arises by operation of law to secure the payment of Taxes or money for services performed in relation to property while the money secured by that lien is not due for payment; and (e) any Encumbrance granted by the Company in connection with: (i) a transfer of an account or chattel paper (each as defined under the PPSA); (ii) a commercial consignment as defined under the PPSA; (iii) a PPS lease as defined under the PPSA; to the extent that the transaction does not secure payment or performance of an obligation. Petroleum Tenements Retention Licence (RL) 2 (Dingo Field) and Production Licence (OL) 3 (Palm Valley) each

Corrs Chambers Westgarth administered under the Petroleum Act of the Northern Territory. Plant and Equipment Plant, equipment, vehicles, furniture, fixtures and fittings listed in the assets register in annexure D, all the plant and equipment located at the Dingo Field, and all the plant and equipment located at the Palm Valley Field for the production, gathering, treatment and export of natural gas produced at the Palm Valley Field including: (a) permanent wellhead facilities for nine producing and suspended wells; (b) a central treatment plant (CTPPV); (c) compression, separation and gas dehydration at the CTPPV; (d) flowlines between the wellhead sites and CTPPV; (e) produced water treatment and reinjection facilities in evaporation pond; (f) gas export pipeline and metering; and (g) associated civil works, power generation, camp, vehicles and workshops. PPS Register The ‘register’ as defined in the PPSA. PPSA The Personal Property Securities Act 2009 (Cth). Pre Completion Tax Event The meaning given in clause 23.2(a). Proceedings Any civil, criminal, administrative or arbitral proceedings, mediation or other form of alternative dispute resolution (whether or not held in conjunction with any civil, criminal, administrative or arbitral proceedings), in which a monetary or non- monetary claim is made. Property Each Owned Property, Leased Property, Business Leasehold Property and the Alice Springs Property. PRRTA Act The Petroleum Resource Rent Tax Assessment Act 1987 (Cth) as amended from time to time. Public Records Each of the following: (a) the company registers maintained by ASIC in relation to the Company as at 2 December 2013; (b) the Organisation and Business Names

Corrs Chambers Westgarth register maintained by ASIC in relation to the Company as at 2 December 2013; (c) the PPS Register in relation to the Company (including its Australian Company Number, name and Australian Business Number) as at 5 December 2013; (d) registers or certificates of: (i) title; (ii) permitted use; and (iii) contamination; maintained by the land titles office in the Northern Territory between 2 and 6 December 2013 in relation to the Properties; (e) the following registers in relation to the Properties: (i) Northern Territory Environment Protection Authority’s register under the Waste Management and Pollution Control Act 1998 (NT) as at 4 December 2013; (f) records or registers of any relevant Governmental Agencies in relation to the Properties between 2 and 6 December 2013 with responsibility for: (i) water and sewerage; (ii) planning; (iii) heritage; (iv) native title; (v) council rates; (vi) land tax; (vii) main roads; and (viii) electricity distribution, retailing or generation; and (g) searches of the following courts in relation to the Company conducted between 2 December and 11 December 2013: (i) the Supreme Courts of Queensland, Western Australia, New South Wales,

Corrs Chambers Westgarth Victoria, South Australia, Northern Territory, Australian Capital Territory and Tasmania; (ii) the District and County Courts (as applicable) of Queensland, Western Australia, New South Wales, Victoria, South Australia, Northern Territory, Australian Capital Territory and Tasmania; (iii) the Federal Magistrates Court; (iv) the Federal Court of Australia; and (v) the High Court of Australia. Related Body Corporate The meaning given in the Corporations Act. Related Party Debt Any debt, whether documented or not, owed by the Company or Jarl to the Seller or any Seller Affiliate, including those set out in schedule 13 (1), other than an amount owing in the ordinary course of trading on arm’s length terms which are documented in writing but does not include the Non- MPA Royalty Interests. Related Party Receivable Any debt, whether documented or not, owed to the Company or Jarl by the Seller or any Seller Affiliate, including those set out in schedule 13 (2), but does not include the Non-MPA Royalty Interests. Relative The meaning given in the Corporations Act. Released Tax Claims means all Liabilities, including counterclaims, arising from or connected with: (a) all Tax and Tax Related Liability of Seller Guarantor, Seller, Company and Jarl that: (i) arises from or relates to any actual or deemed income, profits or gains earned, received or arising before the Completion; or (ii) is attributable to any event occurring before Completion, including the payment of any Permitted Dividend; and (b) all Liabilities of Seller Guarantor and Seller for Tax Costs incurred by them or on their behalf, to the extent that those Tax Costs arise from,

Corrs Chambers Westgarth or relate to, any of the matters referred in paragraph (a), whether or not the Liabilities are or could be known to a party at the time of entering into this Deed. Replacement Seller Director Has the meaning given in clause 4.3(a). Retained Seller Contracts Has the meaning given in clause 14.3. Royalty Interests Each of the Dingo Royalty Interests and Palm Valley Royalty Interests. Royalty Termination Deeds Means the royalty termination deeds provided in Annexure I. Sale Shares Means the: (a) Company Shares; and (b) Jarl Shares. Santos Agreement The sale agreement between Santos QNT Pty Ltd, Santos Limited and the Company dated 14 September 2011, and varied by the parties to that agreement on 2 February 2012. Santos Bonus Payment All moneys payable to the Company under the Santos Agreement if production from the Mereenie field reaches stated thresholds, as payable in accordance with clause 11 of the Santos Agreement. Santos Bonus Payment Rights The Company’s right to receive the Santos Bonus payment and all rights and interests of the Company under clause 11 (and associated schedules) of the Santos Agreement. Santos Consent The meaning given in clause 7.1(a)(iii). Santos GSA The Gas Supply and Purchase Agreement between Santos Limited ABN 80 007 550 923, Santos QNT Pty Ltd ABN 33 083 077 196 (as buyers) and the Company (as seller) dated 14 September, 2011. Second Instalment The meaning given in clause 3.2(b)(ii). Second Instalment Banker's Undertaking A banker's undertaking in the amount of $1,500,000, which will form part of the Second Instalment, in substantially the same form as the banker's undertaking set out in annexure H and that cannot be drawn until on or after 15 April, 2014, and issued by a major Australian trading bank and

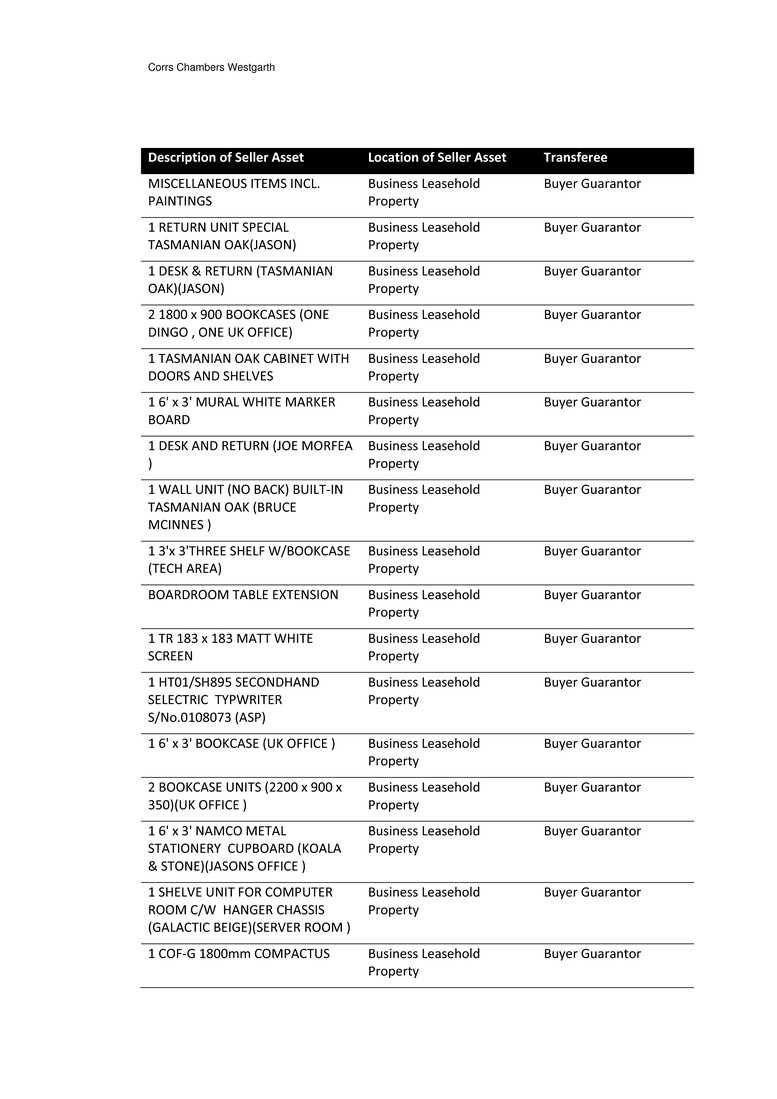

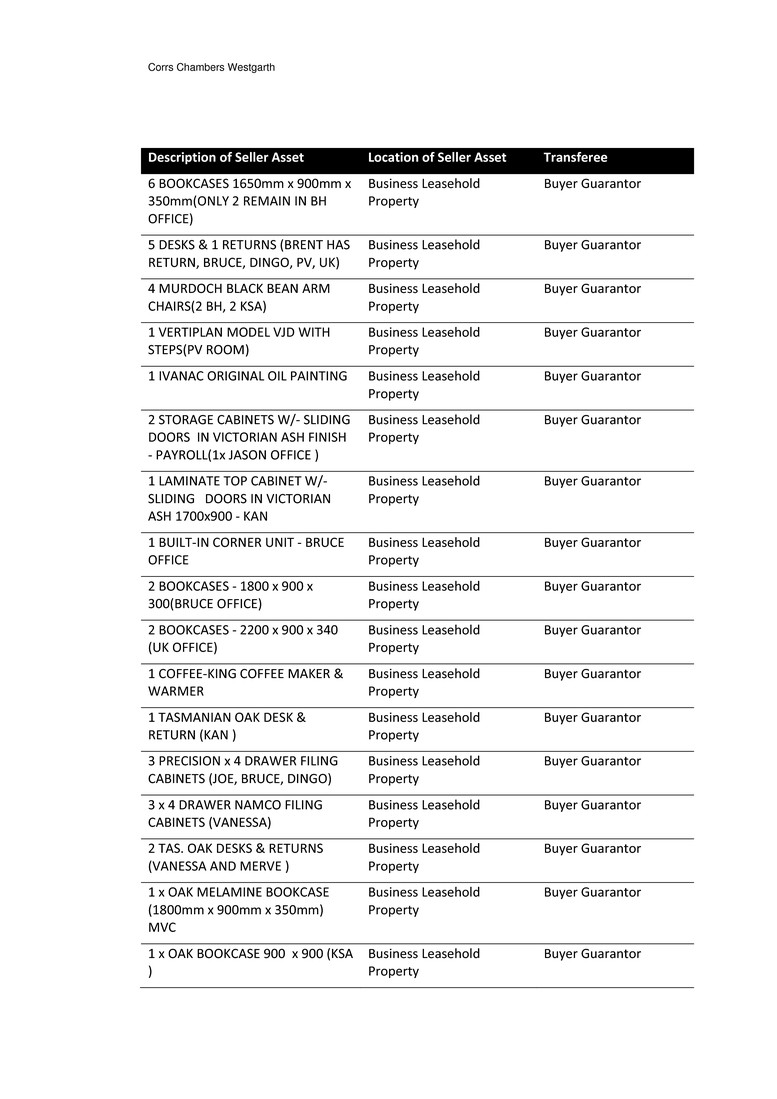

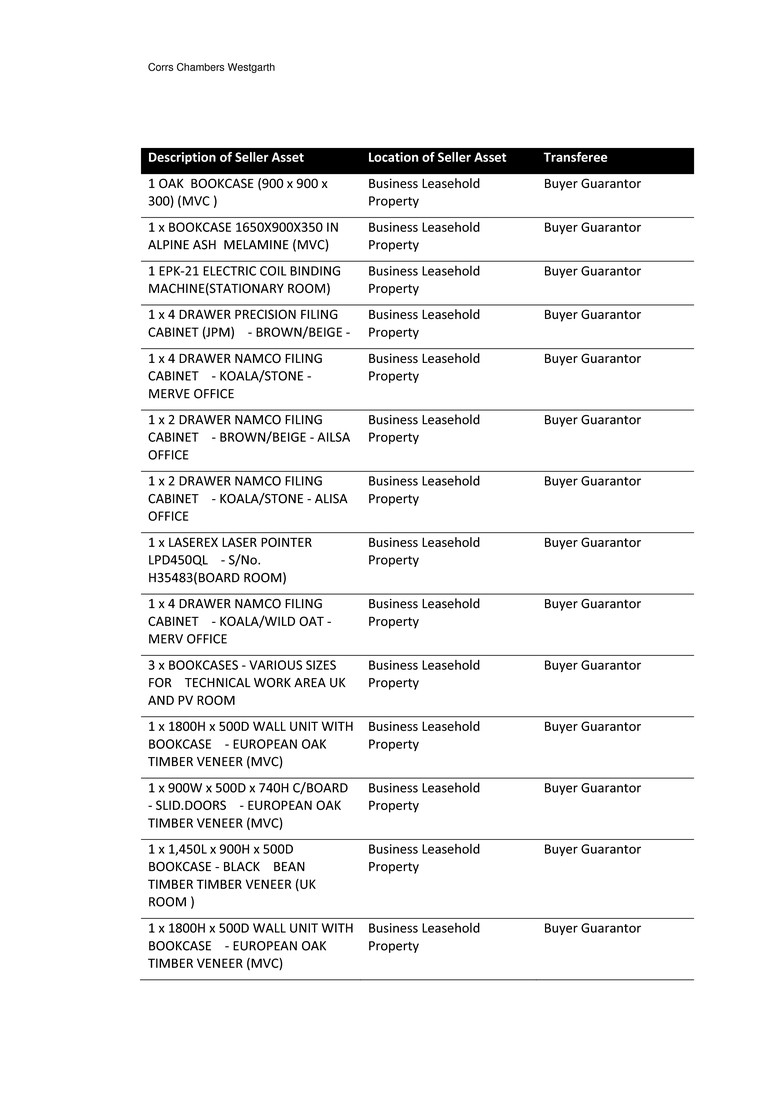

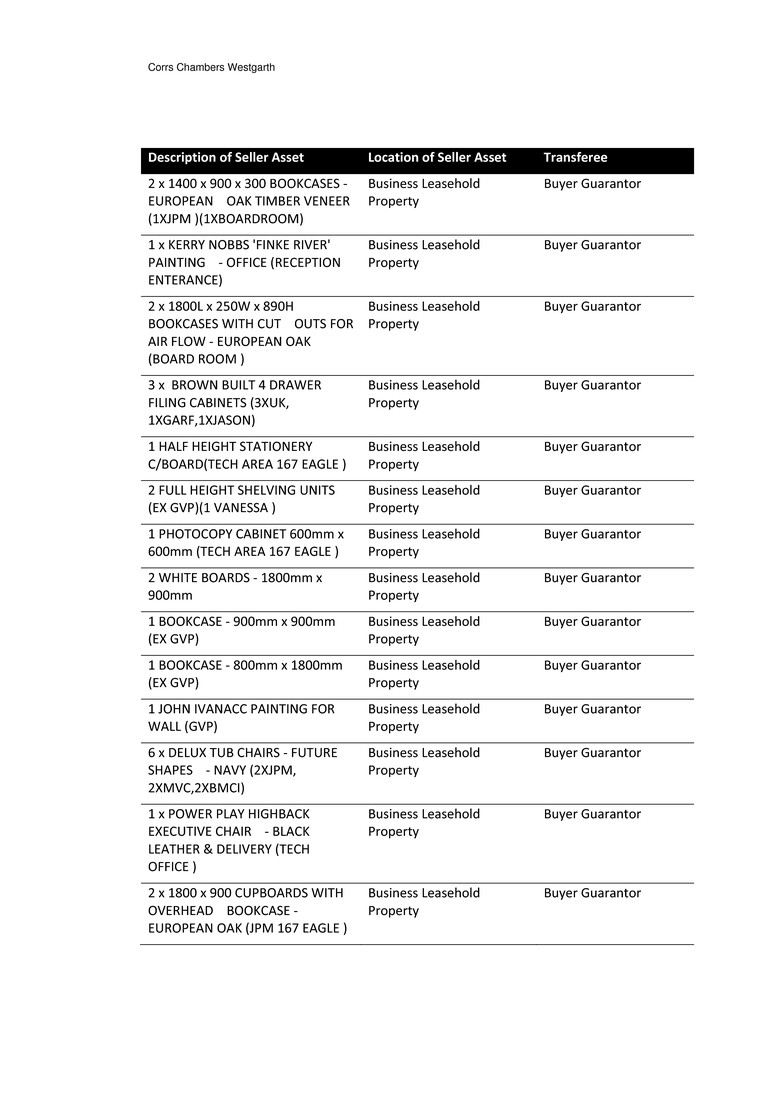

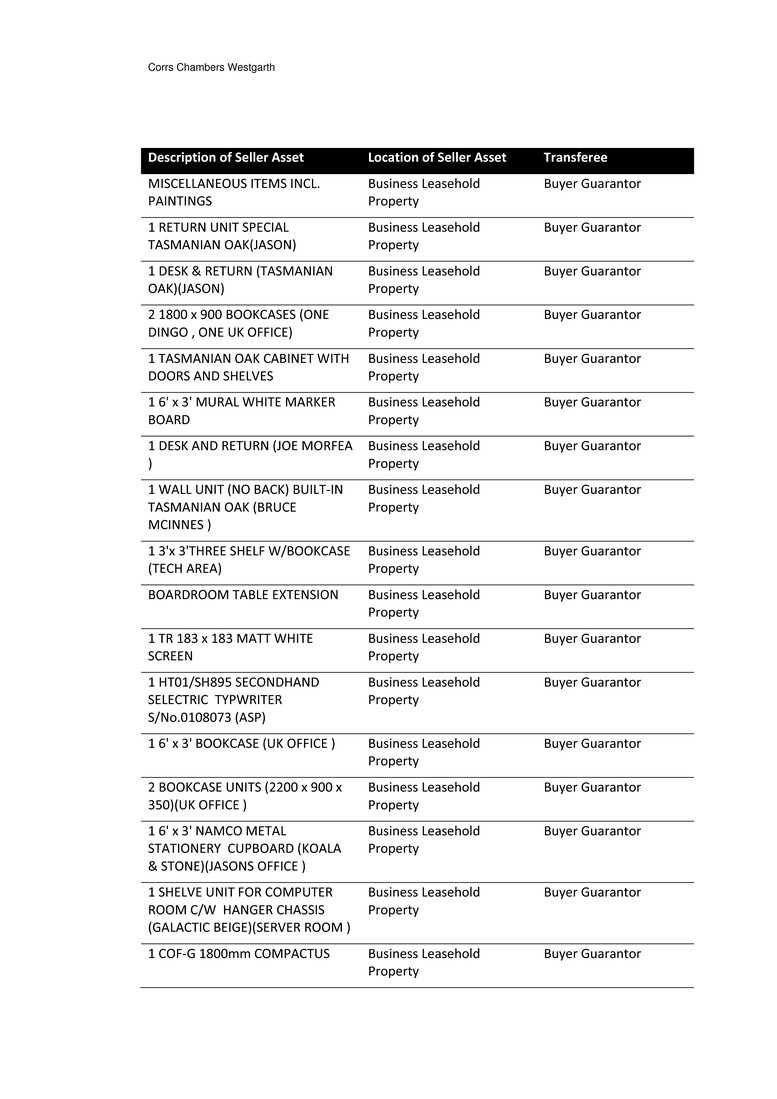

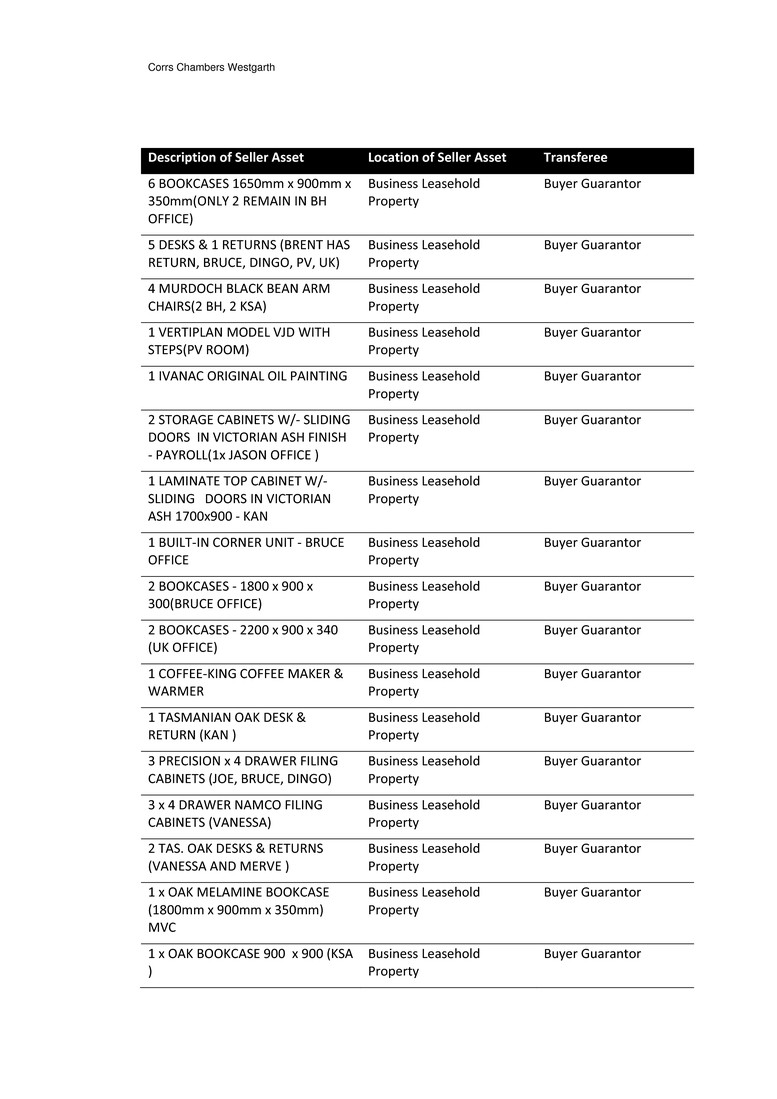

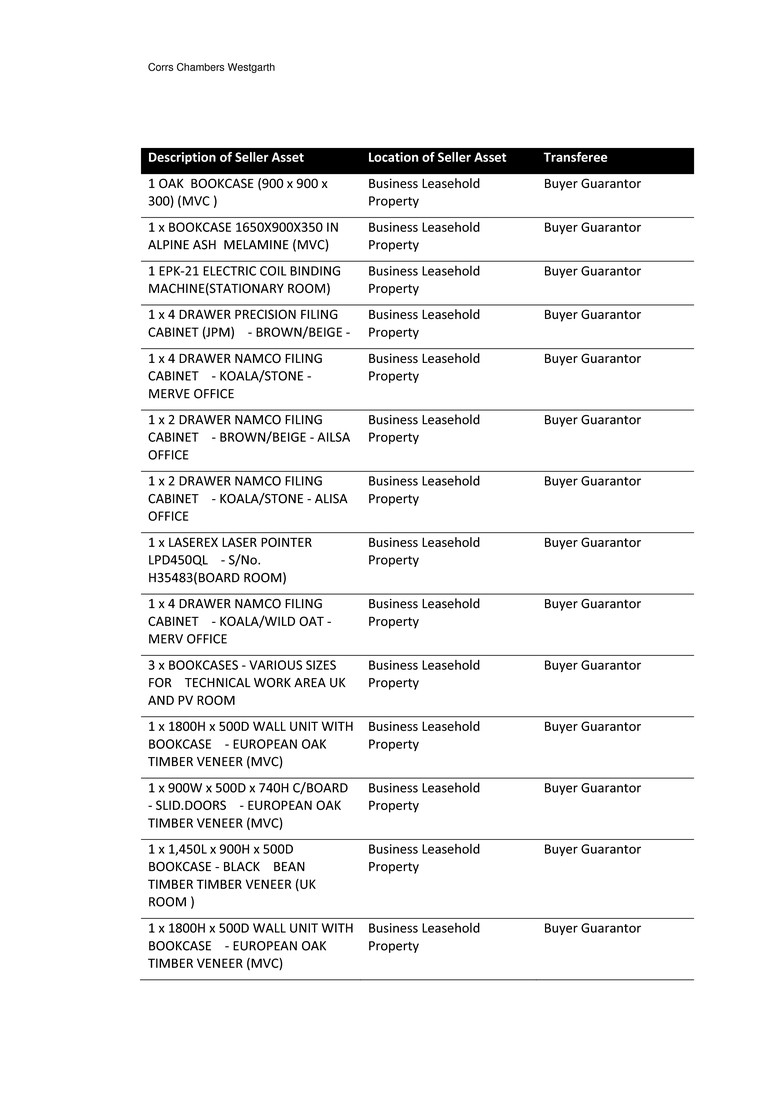

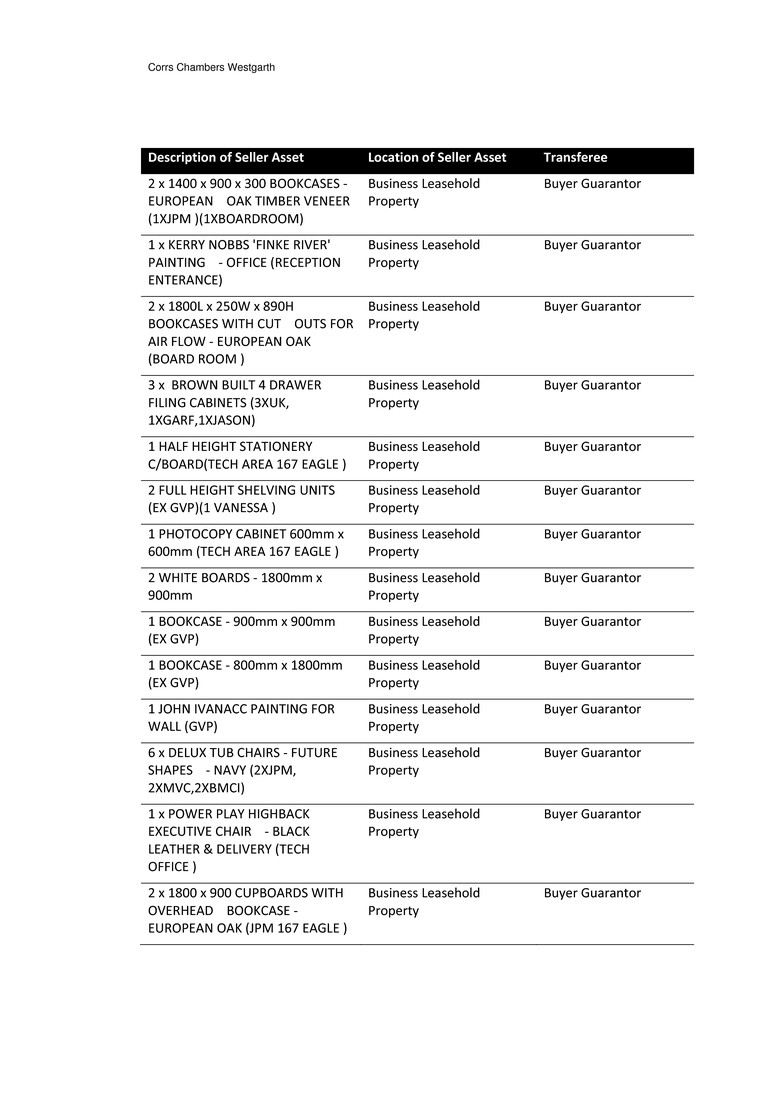

Corrs Chambers Westgarth redeemable at a Brisbane branch. Security Interest Any interest or right which secures the payment of a debt or other monetary obligation or the compliance with any other obligation, including any: (a) mortgage; (b) security interest under the PPSA; (c) retention of title to any property; and (d) right to set off or withhold payment of any deposit or other money. Seller Affiliate Each: (a) Related Body Corporate of the Seller; (b) entity Controlled by the Seller or a Related Body Corporate of the Seller; (c) officer or employee of: (i) the Seller; (ii) a Related Body Corporate of the Seller; or (iii) an entity Controlled by the Seller or a Related Body Corporate of the Seller; or (d) entity Controlled by, or a Relative of, a person referred to in paragraph (c), from time to time. Seller Assets The assets owned by the Seller and Seller Affiliates that are used in the conduct of the Business identified in annexure C. Seller Consolidated Group The Consolidated Group of which the Seller is the ‘head company’ or a ‘subsidiary member’ within the meaning given in section 995-1 of the ITAA 1997. Seller Contracts The contracts between the Seller or the Seller Affiliates and third parties that are used in the conduct of the Business identified in the contract register in annexure A. Seller Director The Director appointed to the Board in accordance with clause 4. Seller Group Names Each of the following: (a) Magellan; and

Corrs Chambers Westgarth (b) Magellan Petroleum. Seller GST Group The GST Group of which the Company is a member, and of which the Seller is the representative member. Seller Warranties The warranties and representations of the Seller set out in schedule 8. Subscription Completion The occurrence of the events at clause 5.3. TAA Taxation Administration Act 1953 (Cth). Tax Any: (a) Past, present or future tax, levy, impost, fee, charge, duty, excise, customs, royalty, rate, compulsory loan, deduction, penalty, withholding or surcharge that is assessed, levied, imposed or collected by any Government Agency; (b) unless the context requires otherwise, Duty and GST; and (c) interest, penalty, charge, fine or fee or other amount of any kind assessed, charged or imposed on or in respect of any of the above. Tax Costs All costs and expenses incurred in: (a) managing an inquiry; or (b) conducting any litigation, dispute, process, alternative dispute resolution process or similar action, in relation to a Tax, but does not include a Tax. Tax Demand A Claim by a Government Agency administering a Tax which gives rise, or is likely to give rise, to a Warranty Claim Tax Funding Agreement The Tax Funding Agreement dated 20 July 2005 between the Seller, the Company, Jarl, United Oil & Gas Co. (N.T.) Pty Ltd, Magellan Petroleum (W.A.) Pty Ltd, Magellan Petroleum (Eastern) Pty Ltd, Magellan Petroleum (Ventures) Pty Ltd and Paroo Petroleum Pty Ltd. Tax Law Any law under which Tax is assessed, levied, imposed, collected or administered, and includes the Income Tax Act. Tax Related Liability Has the meaning ascribed to that term by s 721-

Corrs Chambers Westgarth 10(2) of the ITAA 1997. Tax Return Any return relating to Tax, including any document which: (a) must be lodged with a Government Agency administering a Tax; or (b) a taxpayer must prepare and retain under a Tax Law (such as an activity statement, amended return, schedule or election and any attachments). Tax Sharing Agreement The Tax Sharing Deed dated 20 July 2005 between the Seller, the Company, Jarl, United Oil & Gas Co. (N.T.) Pty Ltd , Magellan Petroleum (W.A.) Pty Ltd , Magellan Petroleum (Eastern) Pty Ltd, Magellan Petroleum (Ventures) Pty Ltd and Paroo Petroleum Pty Ltd, as amended or acceded to from time to time. Tax Warranties The Seller Warranties in schedule 8 (18). Third Party Claim A Claim made by a person or entity (other than the parties), other than a Tax Demand, which gives rise, or is likely to give rise, to a Warranty Claim. Third Party Debt All: (a) borrowings or other indebtedness of the Company under any bank facility, overdraft, bond, note, debenture, bank guarantee facility (whether cash-backed or otherwise) or finance lease; (b) interest accrued on such borrowings or other indebtedness and all fees, expenses and penalties required to be paid to discharge such borrowings or other indebtedness; and (c) dividends or other distributions of the Company which (other than a Permitted Dividend) are declared or accrued but unpaid; but excluding: (d) Related Party Debts; and (e) trade debts of the Company incurred in the ordinary course of business. Title Warranties Each of the following Seller Warranties: (a) schedule 8 (4.1); (b) schedule 8 (4.2); and

Corrs Chambers Westgarth (c) schedule 8 (10.1) but only as it relates to the Petroleum Tenements. Total Purchase Price The meaning at clause 3.1. Trading Day Has the meaning given to that term in the Listing Rules. VWAP The arithmetic average rounded to the nearest full cent of the daily volume weighted average sale price of Buyer Guarantor Shares sold on ASX during the period of ten Trading Days on which Buyer Guarantor Shares are traded on ASX ending on the Trading Day prior to the Execution Date, calculated using the Bloomberg page “AQR” or, if that page is unavailable or has been discontinued, calculated by ASX using its standard method of calculation. Warranty Claim A Claim by the Seller, Buyer or Buyer Guarantor against the other relevant party for breach of a Buyer Warranty or Seller Warranty as applicable. 1.2 Additional definitions in schedules The schedules contain certain additional definitions. 2 Sale and purchase 2.1 Sale and purchase of Sale Shares On the Completion Date, the Seller must sell the Sale Shares to the Buyer, free from all Encumbrances (other than the Permitted Encumbrances), and the Buyer must purchase the Sale Shares for the Total Purchase Price, and otherwise on the terms set out in this Deed. 2.2 Transfer of rights of Sale Shares On the Completion Date the Seller must transfer the Sale Shares to the Buyer with all rights, including dividend rights, which are attached or accruing to them on and from the Execution Date. 2.3 Transfer of Seller Assets The Seller as legal and beneficial owner must transfer or cause the relevant Seller Affiliate to transfer the Seller Assets free from all Encumbrances (other than the Permitted Encumbrances) to the Company or the Buyer or the Buyer Guarantor (as described in annexure C) at Completion on the terms set out in this Deed. 2.4 Title and Property of Seller Assets Title to, risk and property in the Seller Assets:

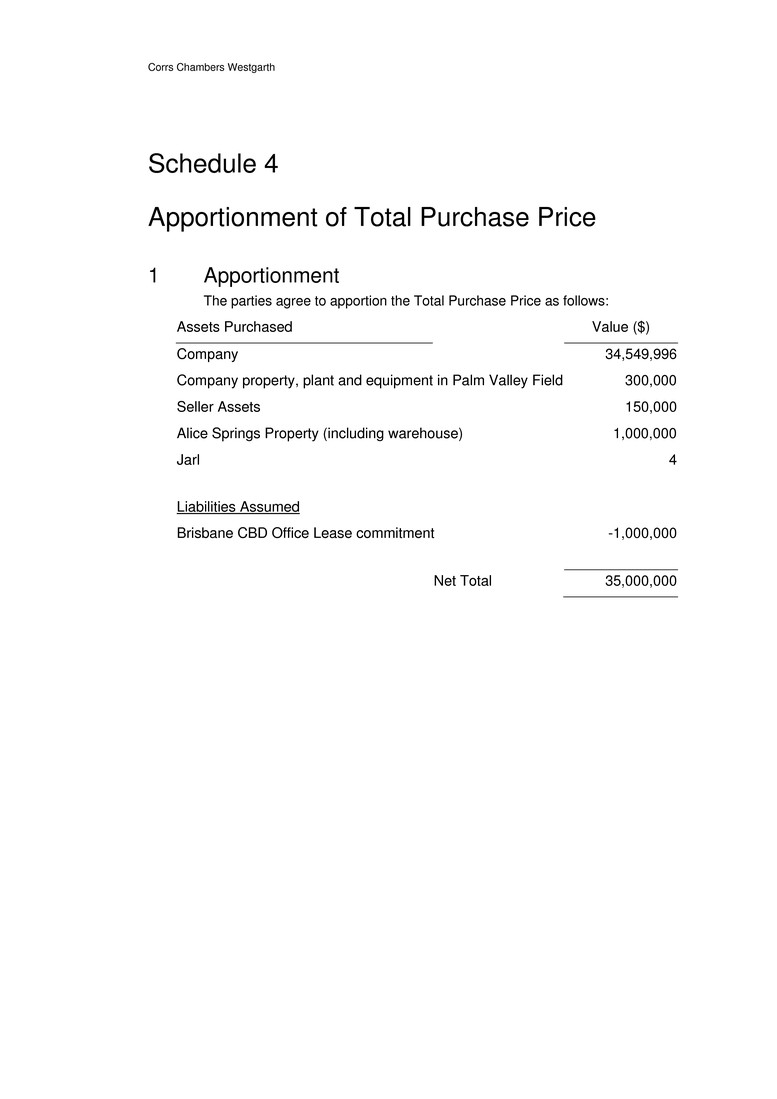

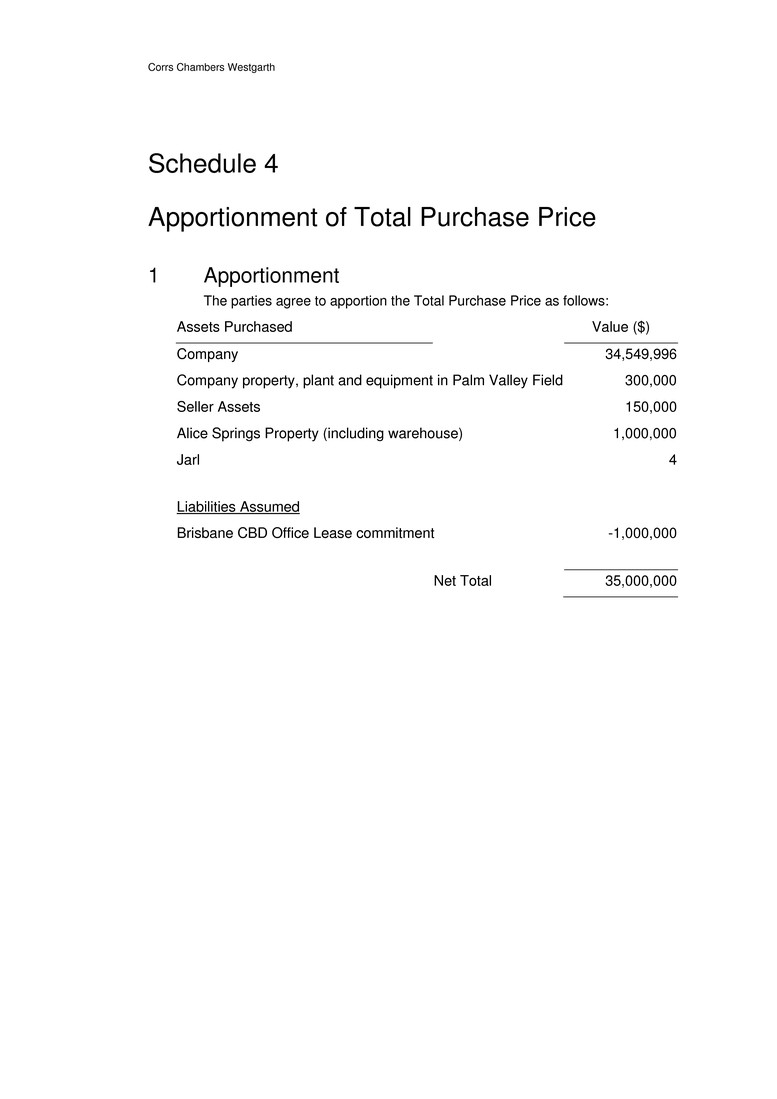

Corrs Chambers Westgarth (a) until Completion, remains solely with the Seller or the relevant Seller Affiliate; and (b) subject to the provisions in this Deed, passes to the Company or the Buyer or the Buyer Guarantor (as described in annexure C) with effect from Completion. 2.5 Apportionment of Total Purchase Price The parties agree to apportion the Total Purchase Price pursuant to schedule 4. 3 Purchase Price 3.1 The Total Purchase Price The Total Purchase Price payable by the Buyer for the Sale Shares and the Seller Assets is the aggregate of: (a) the Base Purchase Price; (b) the Consideration Shares; (c) the Dingo Field Costs; and (d) the Gas Price Bonus. 3.2 The Base Purchase Price (a) The Base Purchase Price is $20 million. (b) The Base Purchase Price must be paid by the Buyer to the Seller in the following instalments: (i) $15 million on the Completion Date; and (ii) $5 million on or before 15 April, 2014 (Second Instalment) in accordance with clause 3.6. 3.3 Additions to Base Purchase Price (a) The component of the Total Purchase Price consisting of the Dingo Field Costs shall be calculated in accordance with schedule 2 (1). (b) The Gas Price Bonus shall be calculated in accordance with schedule 2 (2). (c) On the Completion Date, the Buyer Guarantor must issue the Consideration Shares to the Seller in accordance with clause 5. 3.4 Deposit Banker's Undertaking (a) On the Execution Date, the Buyer must give two Deposit Banker's Undertakings to the Escrow Agent, to be dealt with in accordance with this clause 3.4. (b) The Escrow Agent must retain the Deposit Banker's Undertakings until their release under clause 3.4(c) , 3.4(d) , 3.4(e) or 3.4(f).

Corrs Chambers Westgarth (c) If Completion occurs, and subject to clause 3.6, the Seller is entitled absolutely to each of the Deposit Banker's Undertaking and the Buyer and Seller must cause the Escrow Agent to give each Deposit Banker's Undertaking to the Seller on 15 April 2014. (d) If this Deed is terminated due to the default of the Buyer or the Buyer Guarantor, the Escrow Agent must immediately deliver the two Deposit Banker's Undertakings to the Seller, and the Seller and Buyer must do all things required on their part to cause the Escrow Agent to do this. Forfeiture of the two Deposit Banker's Undertakings to the Seller shall be without prejudice to or limitation of any rights which a party may have either at law, in equity or under statute or under this Agreement. (e) If this Deed is terminated due to the default of the Seller or a Seller Affiliate, or due to a failure in satisfaction or waiver of a Condition (other than the Condition at clause 7.1(h)), then immediately after such termination the Escrow Agent must return the two Deposit Banker's Undertakings to the Buyer, and the Seller and Buyer must do all things required on their part to cause the Escrow Agent to do this. In the case where this Deed is terminated due to the default of the Seller or a Seller Affiliate, return of the two Deposit Banker's Undertakings to the Buyer shall be without prejudice to or limitation of any rights which a party may have either at law, in equity or under statute or under this Agreement. (f) If this Deed is terminated due to a failure in satisfaction or waiver of the Condition at clause 7.1(h), then immediately after such termination the Escrow Agent must return one of the Deposit Banker's Undertakings to the Buyer, and must deliver the other Deposit Banker’s Undertaking to the Seller and the Seller and Buyer must do all things required on their part to cause the Escrow Agent to do this. In the case where this Deed is terminated due to a failure in satisfaction or waiver of the Condition at clause 7.1(h), return of the Deposit Banker's Undertakings shall be without prejudice to or limitation of any rights which a party may have either at law, in equity or under statute or under this Agreement. (g) Each of the Seller and Buyer does what is required of it to cause the Escrow Agent to deliver or return the Deposit Banker’s Undertakings in accordance with this clause 3.4, if it does what is required of it under the deed entered into with the Escrow Agent to allow the Escrow Agent to return or deliver the Deposit Banker’s Undertakings in accordance with this clause. (h) Where the Seller receives a Deposit Banker’s Undertaking in accordance with this clause 3.4 then it may draw down or otherwise deal with that undertaking in its absolute discretion. 3.5 Adjustment Amount Any amount to be paid by the Seller to the Buyer, the Company or Jarl for breach of warranty or under any indemnity in this Deed shall when paid be deemed to represent a reduction to the Total Purchase Price.

Corrs Chambers Westgarth 3.6 Payment of Second Instalment The payment of the Second Instalment will be satisfied in accordance with this clause 3.6. (a) If Completion occurs, the two Deposit Banker's Undertakings will form part of the Second Instalment. (b) If Completion occurs, the Buyer must give the Second Instalment Banker's Undertaking on the Completion Date to the Escrow Agent. If Completion occurs, on 15 April 2014, the Escrow Agent must deliver the Deposit Banker’s Undertakings and the Second Instalment Banker's Undertakings to the Seller. (c) If Completion occurs, each of the Seller and Buyer must cause the Escrow Agent to deliver the Deposit Banker’s Undertakings and the Second Instalment Banker’s Undertakings to the Seller in accordance with this clause 3.6, and it will do so if it does what is required of it under the deed entered into with the Escrow Agent to allow the Escrow Agent to deliver the Deposit Banker’s Undertakings and the Second Instalment Banker’s Undertaking to the Seller in accordance with this clause. (d) If Completion occurs, on or before 15 April 2014, the Buyer must pay $1.5 million to the Seller. 4 Appointment of the Seller Director 4.1 Right to nominate the Seller Director On and from Subscription Completion (being the events at clause 5.3) subject to clause 4.2, and by no later than 5 Business Days after Subscription Completion, the Seller has the right, but not the obligation, to nominate as director to the Board (the Seller Director), J Thomas Wilson or such other person as approved by the nominee Board (which approval shall not be unreasonably withheld provided the nominee Board is satisfied such other person is reputable and suitably qualified). 4.2 Appointment of the Seller Director (a) The Buyer Guarantor agrees that it will, within five Business Days of receiving a signed consent to act and executed final documentation referred to in clause 4.4(a), appoint the Seller Director to the Board. (b) The Seller acknowledges any Seller Director appointed under this clause 4.2 holds office only until the next general meeting of the Buyer Guarantor and is then eligible for re-election at that meeting. (c) After the appointment of the Seller Director, the Buyer Guarantor must use all reasonable endeavours to procure that the Board: (i) ensures that the Seller Director is proposed for election as a Director at the next general meeting of shareholders of the Buyer Guarantor convened after the appointment; and

Corrs Chambers Westgarth (ii) subject to each Director's fiduciary duties and the Buyer Guarantor 's corporate governance policies, supports the election of the Seller Director at the next general meeting of shareholders of the Buyer Guarantor convened after the appointment of the Seller Director, and at all subsequent general meetings of shareholders of the Buyer Guarantor at which the Seller Director is due for re- election. 4.3 Appointment of Replacement Seller Director (a) If the Buyer Guarantor shareholders do not approve the resolution to elect the Seller Director, the Seller may nominate a replacement director of the Board (Replacement Seller Director) subject to the prior approval of the nominee Board (which approval shall not be unreasonably withheld provided the nominee Board is satisfied such person is reputable and suitably qualified). (b) If a Replacement Seller Director is nominated, clauses 4.2 and 4.3(a) will apply as if the references to “Seller Director” were to “Replacement Seller Director”. 4.4 Terms of appointment (a) Subject to clause 4.4(b), any of the Seller Director or Replacement Seller Director appointed in accordance with this clause 4 must be appointed substantially on the same terms as the most recent non- executive director appointed to the Board who signed such terms prior to the Seller Director or Replacement Seller Director's appointment, including terms of remuneration and the right to enter into a deed of access and indemnity with the Buyer Guarantor on terms substantially the same as existing deeds of access and indemnity between the Buyer Guarantor and the Director who signed such terms most recently prior to the Seller Director or Replacement Seller Director's appointment. (b) The Buyer Guarantor will reimburse the Seller Director or Replacement Seller Director, where they reside in the United States, the reasonable costs of travelling from the United States to Australia and return and accommodation, for: (i) attendance at the Buyer Guarantor's Annual General Meeting; and (ii) all other reasonable travel and accommodation costs incurred in carrying out his or her duties as a director of the Buyer Guarantor, subject to the Buyer Guarantor's chairperson's prior written approval. 4.5 Cessation of Seller Director (a) In the event the Seller or the Seller Affiliates holds in aggregate: (i) less than 22,000,000 Consideration Shares; or (ii) an amount of Buyer Guarantor Shares representing less than 5% of the total Buyer Guarantor Shares on issue from time to time,

Corrs Chambers Westgarth Seller must cause the Seller Director not to seek re-election to the Board at the next annual general meeting at which the Seller Director must retire and not stand for re-election and clauses 4.2, 4.3 and 4.4(b) shall not apply. 5 Consideration Shares 5.1 Issue On the Completion Date the Buyer must pay part of the Total Purchase Price by causing the issue by the Buyer Guarantor to the Seller of the Consideration Shares. 5.2 Constitution On issue of any of the Consideration Shares, the Seller agrees that it will be bound by the constitution of the Buyer Guarantor. 5.3 Subscription Completion At Completion, the Buyer Guarantor must: (a) issue or procure the issue to the Seller of the Consideration Shares free from all Encumbrances on the basis that they rank equally in all respects, including in respect of any rights, with Buyer Guarantor Shares on issue at the Execution Date; (b) enter the name and address of the Seller in the register of members of the Buyer Guarantor in respect of the Consideration Shares; (c) give to the Seller an extract of the minutes of a meeting of the Board, certified by the company secretary of the Buyer Guarantor as a true extract, resolving to approve: (i) the issue of the Consideration Shares to the Seller; and (ii) the update of the register of Shareholders to take account of the issue of the Consideration Shares to the Seller; and (iii) subject to receiving a signed consent to act, the appointment of the Seller Director to the Board with effect on and from the Completion Date; (d) give, at the election of the Seller, within 5 Business Days, a CHESS holding statement or an issuer-sponsored holding statement in respect of the Consideration Shares; and (e) give to the Seller a draft of the notice referred to in clause 5.5. 5.4 Quotation of Shares The Buyer Guarantor will apply to ASX for, and use all reasonable endeavours to obtain, official quotation of the Consideration Shares within one Business Day of the relevant allotment to the Seller.

Corrs Chambers Westgarth 5.5 Cleansing notice The Buyer Guarantor must provide a notice given under section 708A(5)(e)(i) of the Corporations Act which complies with the requirements of section 708A(6) of the Corporations Act to ASX within one Business Day of the date the Consideration Shares are issued to the Seller and such notice must confirm that the Buyer Guarantor has not withheld any excluded information for the purposes of section 708A(6)(e). 6 Apportionment of Expenditure and Costs 6.1 The Basic Principle The parties acknowledge and agree that: (a) All Income of the Company and Jarl relating to the period prior to and including the Completion Date shall be received by or be for the benefit of the Seller and all Outgoings of the Company and Jarl (except for those relating to the Dingo Field Costs) relating to the period prior to and including the Completion Date shall be met by the Seller. (b) All Income of the Company and Jarl relating to the period on and from the Effective Date shall be received by or be for the benefit of the Buyer and all Outgoings of the Company and Jarl relating to the period on and from the Effective Date shall be met by the Buyer. 6.2 Related Party Debts and Receivables (a) All Related Party Receivables and Related Party Debts arising on or before the Completion Date shall be offset, forgiven or cancelled on or before the Completion Date. (b) The parties shall have no claim against each other for any such actions. (c) After Completion, the Buyer and the Buyer Guarantor must ensure that the Company does not at any time seek to claim or recover any Related Party Receivable. Each of the Buyer and the Buyer Guarantor indemnifies the Seller against any such claims and liability. (d) After Completion, the Seller must not at any time seek to claim or recover any Related Party Debt. The Seller indemnifies the Buyer against any such claims and liability. (e) Notwithstanding any other provision of this Deed , on or before Completion the Company, Jarl and the Seller or relevant Seller Affiliate may set-off the aggregate of the Related Party Receivables against the aggregate of the Related Party Debts and if after that set-off, there is a positive balance in favour of the Company or Jarl as the case may be (Remainder After Set-off Amount) then the Seller or relevant Seller Affiliate and the Company or Jarl may set-off against the Remainder After Set-off Amount the amount of the Clear Exit Payment which the Company or Jarl must pay to the head company of the Seller Consolidated Group under clause 23.3(b).

Corrs Chambers Westgarth (f) The MPA Royalty Interests shall be cancelled on or before Completion but the Buyer acknowledges and agrees that the Company and Jarl shall remain liable for and must continue to pay the Non-MPA Royalty Interests on and from Completion. 6.3 Payment of the Dingo Field Costs The Dingo Field Costs component of the Total Purchase Price must be paid by the Buyer to the Seller, within ten Business Days after the acceptance of the Dingo Field Completion Accounts prepared in accordance with schedule 3. 6.4 Outgoings and Income Reconciliation (a) Within 2 months after the Completion Date the Buyer and Seller must each prepare in Good Faith, but only to the extent of the Business Records and supporting material which they respectively hold or control after Completion, and submit to the other party, separate statements (Reconciliations) with all relevant supporting material showing (including third party invoices and proof of payment): (i) Outgoings relating to the period on and from the Effective Date which were already paid before the Effective Date (Buyer Outgoings); (ii) Outgoings relating to the period prior to and including the Completion Date which remain unpaid on the Effective Date (Seller Outgoings); (iii) Income which relates to the period prior to and including the Completion Date but not paid on the Effective Date (Seller Income); and (iv) Income which relates to the period on and from the Effective Date which: (A) was already paid to the Seller or Seller Affiliates before the Effective Date; or (B) is received by the Seller or Seller Affiliates on and from the Effective Date (Buyer Income). (b) After receipt of a Reconciliation by a party (Receiving Party), the party giving the Reconciliation (Providing Party) must give all access reasonably requested by the Receiving Party to the Business Records and working papers including relevant third party invoices or payment directions which the Providing Party has or controls, to enable the Receiving Party and its representatives to review and confirm the Reconciliation given by the Providing Party. (c) The Buyer and Seller must within 15 Business Days of receiving the respective Reconciliations give notice to the other party either that it agrees with the Reconciliation or that it does not agree with the Reconciliation indicating where it does not agree.

Corrs Chambers Westgarth (d) If a party makes no response within the said 15 Business Days then it is deemed to have accepted the Reconciliation. (e) If a party raises objections to a Reconciliation then schedule 3 clauses 4.2, 4.3, 4.4 and 4.5 and schedule 5 will apply with all necessary changes as if the party in giving written notice of objections to the Reconciliation had given a Dispute Notice. (f) The combined effect of each of the Reconciliations as agreed or determined in accordance with this clause (Combined Reconciliation) shall be used to determine the Buyer Outgoings, Seller Outgoings, Seller Income and Buyer Income (g) If the Combined Reconciliation indicates that the amount of the aggregate of the Buyer Outgoings and Seller Income exceeds the aggregate of the Seller Outgoings and Buyer Income, then the Buyer must pay the amount of that excess to the Seller. (h) If the Combined Reconciliation indicates that the amount of the aggregate of the Seller Outgoings and Buyer Income exceeds the aggregate of the Buyer Outgoings and the Seller Income, then the Seller must pay the amount of that excess to the Buyer. (i) Any amount payable in accordance with this clause must be paid by the relevant party within 10 Business Days after the acceptance of the Combined Reconciliation either by agreement by the Seller and Buyer or through a determination under schedule 5. 6.5 Unreconciled Outgoings or Income (a) The parties acknowledge that not all Income and Outgoings may be identified and reconciled during the reconciliation process described in clause 6.4 (Unreconciled Outgoings or Income). (b) If either the Buyer or Seller becomes aware of any such Unreconciled Outgoings or Income, the reconciliation process described in clause 6.4 shall be conducted again in respect of Unreconciled Outgoings or Income whenever the aggregate amount of the Unreconciled Outgoings or Income exceeds $10,000. 7 Conditions to Completion 7.1 Conditions The obligations of the parties at Completion are subject to, and conditional upon the following conditions: (a) (Key Third Party Consents): receipt in writing of the consent of each of: (i) Power and Water Corporation ABN 15 947 352 360 (PWC) under the Dingo GSA to the change in control of the Company on terms

Corrs Chambers Westgarth acceptable to the Buyer and Seller (each acting reasonably) (PWC Consent); (ii) APT Pipelines (NT) Pty Limited ACN 075 733 336 (APT) under the Parking Agreement to the change in control of the Company on terms acceptable to the Buyer and Seller (each acting reasonably) (APT Consent); and (iii) Santos QNT Pty Ltd and Santos Limited to the assignment of the Santos Bonus Payment Rights from the Company to the Seller under clause 23.11 of the Santos Agreement on terms acceptable to the Seller and the Buyer (both acting reasonably) (the Santos Consent); (b) (Buyer Warranties): the Buyer Warranties being true in all material respects as at Completion; (c) (Seller Warranties): the Seller Warranties being true in all material respects as at Completion; (d) (Material Adverse Change affecting Company) after the Execution Date and on or before the Completion Date none of the following events has occurred: (i) either of the Petroleum Tenements has been cancelled, forfeited or surrendered and no replacement permit or tenement granted; (ii) the Santos GSA has been terminated; or (iii) the Dingo GSA has been terminated. (e) (Material Adverse Change affecting Buyer Guarantor): after the Execution Date and on or before the Completion Date none of the following events has occurred: (i) any of the Central Petroleum Tenements has been cancelled, forfeited or surrendered and no replacement permit or tenement granted; (ii) damage or loss to property which has a significant effect on the financial position of the Buyer Guarantor; or (iii) an event affecting the Buyer Guarantor or a Buyer Group Company, which in the reasonable opinion of the Seller would have a material adverse effect on any of the financial position of the Buyer Guarantor or the VWAP. (f) (Lohengrin): that the Company transfer all of its shares in Lohengrin Pty Ltd ACN 010 574 259 to a Seller Affiliate, other than Jarl, and provide reasonably satisfactory evidence of the transfer to the Buyer. (g) (Royalty Termination): that the Company, Jarl and the Seller (as applicable) execute the Royalty Termination Deeds. (h) (Financing) that no event beyond the Buyer or the Buyer Guarantor's reasonable control has occurred that would prevent Macquarie from

Corrs Chambers Westgarth providing the Funds to the Buyer. The Buyer and Buyer Guarantor acknowledge that they will do all things reasonably required to cause Macquarie to provide the Funds to the Buyer. A failure of a condition for provision of the Funds which condition is within the reasonable control of the Buyer or the Buyer Guarantor to satisfy shall not be an event beyond the Buyer or Buyer Guarantor’s reasonable control for the purposes of this subclause (h). (i) (Employee Entitlements) the Seller and Buyer Guarantor have negotiated in good faith and entered into a written agreement for the satisfaction and allocation between them of the Employee Entitlements. The amount which may be agreed shall be deemed to be an adjustment to the Base Purchase Price. (j) (Exit from Seller Consolidated Group) that the following have occurred: (i) the Company and Jarl pays the relevant Clear Exit Payment to the head company of the Seller Consolidated Group as required by clause 23.3(b)(i); (ii) the Company, Jarl and each other party to the Tax Sharing Agreement and Tax Funding Agreement executes and delivers to the Company and Jarl a Deed of Release of all its obligations under the Tax Sharing Agreement and Tax Funding Agreement in form and substance reasonably acceptable to the Buyer as required by clause 23.3(b)(ii); and (iii) the Seller has provided evidence satisfactory to the Buyer that the Tax Sharing Agreement has been amended to deal with any changes to the definition of the tax related liabilities in s 721-10(2) of the ITAA 1997 and in particular to deal with the liabilities in respect of items 3, 32 and 70 of the table in s 721-10(2) of the ITAA 1997 and with the separate liability which exists for any amended assessment as required by clause 23.3(b)(iii). 7.2 Obligations of parties in relation to Conditions (a) Excluding waivers, the Buyer and the Seller must each use reasonable endeavours to ensure that the Condition in clause 7.1(a) is satisfied as soon as practicable after the Execution Date. Further if required to obtain a consent the Buyer must cause to be provided an appropriate third party guarantee of the obligations of the Company under the relevant contract where the Seller or a Seller Affiliate has currently provided such a third party guarantee on substantially the same terms. (b) Excluding waivers, the Buyer and the Seller must each co-operate with each other and comply with all reasonable requests by the other for the purposes of procuring the satisfaction of any Condition and must not take any action which will hinder or prevent the satisfaction of any Condition.

Corrs Chambers Westgarth 7.3 Notice Each party agrees to: (a) notify the other parties as soon as they become aware that a Condition has been satisfied, or has, or is likely to become, incapable of being satisfied; and (b) provide to the other parties as soon as practicable any documents or other reasonable evidence that evidences the satisfaction of the Condition, or that the Condition is incapable of being satisfied. 7.4 Waiver (a) The Conditions in clause 7.1(a)(i), clause 7.1(a)(ii) and clause 7.1(i): (i) are for the benefit of both the Buyer and the Seller; and (ii) may only be waived by both: (A) the Buyer giving notice in writing to the Seller; and (B) the Seller giving notice in writing to the Buyer. (b) The Condition in clause 7.1(a)(iii) is for the sole benefit of the Seller and may be waived by the Seller giving notice in writing to the Buyer. (c) The Condition in clause 7.1(b) is for the sole benefit of the Seller and may be waived by the Seller giving notice in writing to the Buyer but any such waiver shall be without prejudice to the Seller’s rights to damage or to be indemnified for loss from a breach of the Buyer Warranties. (d) The Condition in clause 7.1(c) is for the sole benefit of the Buyer and may be waived by the Buyer giving notice in writing to the Seller but any such waiver shall be without prejudice to the Seller’s rights to damage or to be indemnified for loss from a breach of the Buyer Warranties. (e) The Condition in clause 7.1(d) is for the sole benefit of the Buyer and may be waived by the Buyer giving notice in writing to the Seller. (f) The Condition in clause 7.1(e) is for the sole benefit of the Seller and may be waived by the Seller giving notice in writing to the Buyer. (g) The Conditions in clauses 7.1(f), 7.1(g), 7.1(h) and 7.1(j) are for the sole benefit of the Buyer and may be waived by the Buyer giving notice in writing to the Seller. 8 Conduct of the Business until Completion 8.1 Conduct Subject to clause 8.2, until Completion, the Seller must ensure that: (a) the Company and Jarl manage and conduct the Business: (i) as a going concern; and

Corrs Chambers Westgarth (ii) in the ordinary course having regard to the nature of the Business and the Company and Jarl's usual practice; (b) the Company and Jarl do not, and agree not to do, any of the following except in the ordinary course of ordinary Business or except as expressly permitted under this Deed: (i) issue, allot or grant any securities or rights to receive securities; (ii) buy back, redeem or otherwise reduce or return any of its share capital or other securities, or make any offer to do so; (iii) declare or pay a dividend, or make any other distribution of its profits; (iv) amend its constitution; (v) dispose of, create any Encumbrance (other than a Permitted Encumbrance) over, grant an option over or declare itself trustee of any of its assets or undertaking; (vi) enter into any joint venture or partnership; (vii) terminate or alter any material term of, or do or omit to do anything which might result in the termination or alteration of any material term of, any contract, arrangement or commitment referred to in clause 8.1(b)(xi); (viii) institute, settle or compromise any Claim by or against it; (ix) enter into any guarantee or indemnity on behalf of any person or provide security for the obligations of any person; (x) pass any member resolution; (xi) enter into any contracts, arrangements or commitments; and (xii) incur any indebtedness or liability other than to trade creditors in the ordinary course having regard to the nature of the Business and the Company’s usual practice; (c) it, the Company and Jarl do not, and do not agree to do, any of the following, without the Buyer's prior written consent: (i) employ a new Employee, or terminate the employment of an Employee; (ii) alter the terms of employment or superannuation of, or any other benefits of, or payable to, any Employee; and (iii) create or increase any entitlement for any Employee to receive a benefit, bonus or other payment in addition to their annual remuneration; (d) the Company and Jarl do not do or permit, or agree to do or permit, anything which would or may constitute a breach of a Seller Warranty; and

Corrs Chambers Westgarth (e) the Seller, Company and Jarl promptly notifies the Buyer of any abnormal or unusual events with respect to the Business or the occurrence of any event outside the ordinary course of business. 8.2 Permitted acts (a) The Seller and the Company may do all things necessary to effect the offset, forgiveness or cancellation of the Related Party Receivables and Related Party Debts in accordance with clause 6.2. (b) Nothing in clause 8.1 restricts the Seller or the Company from doing anything: (i) that is expressly permitted in this Deed; (ii) to reasonably and prudently respond to an emergency or disaster (including a situation giving rise to a risk of personal injury or damage to property); (iii) that is necessary to meet its legal or contractual obligations; or (iv) that is approved by the Buyer in writing, such approval not to be unreasonably withheld or delayed. 9 Dingo Contracts 9.1 Dingo Contracts (a) On the Completion Date the Seller must, and must cause all relevant Seller Affiliates to, assign to the Company with effect on and from the Effective Date and the Company assumes, with effect on and from the Effective Date, all the rights and liabilities of the Seller and the relevant Seller Affiliate under the Dingo Contracts. (b) The Buyer shall indemnify and keep indemnified the Seller and the relevant Seller Affiliate against any liability arising under the Dingo Contracts on and from the Effective Date. 10 Guarantees 10.1 Bank Guarantees (a) The Buyer must on Completion cause the return to the issuing bank of each Bank Guarantee by providing to the beneficiary at the Buyer’s cost a replacement bank guarantee for the same face value and on the same terms or a cash deposit in the amount of the face value of the Bank Guarantee. (b) If not effected on Completion, the Buyer must use, and must ensure that the Company uses, all reasonable endeavours to arrange the return of each Bank Guarantee to its issuing bank as soon as practicable after Completion by offering to provide to the holder of the Bank Guarantee a replacement bank guarantee with a face value equal to the face value of

Corrs Chambers Westgarth the Bank Guarantee and on terms and conditions which are materially the same as the Bank Guarantee. 11 Notifications before Completion 11.1 Notifications by the Buyer The Buyer must give written notice to the Seller at least five Business Days before Completion of: (a) the names of each person that the Buyer requires to be appointed as a director, secretary or public officer of the Company and Jarl at Completion; (b) the address of any new registered office that the Buyer requires the Company and Jarl to adopt at Completion, together with any necessary consent signed by the occupier of the new registered office (in a form reasonably acceptable to the Seller); (c) the name of the person or firm that the Buyer requires to act as auditor of the Company and Jarl from Completion, together with a consent signed by the auditor in accordance with the Corporations Act (in a form reasonably acceptable to the Seller); (d) any proposed changes to the signatories of any bank account maintained by the Company and Jarl, together with specimen signatures of the new signatories; and (e) any existing powers of attorney granted by the Company and Jarl which the Buyer does not require to be revoked at Completion. 11.2 Notifications by the Seller The Seller must give written notice to the Buyer at least five Business Days before Completion of: (a) all Third Party Debts which will be owed by the Company and Jarl at Completion, including: (i) the total amount of those debts; (ii) details of each such debt, including: (A) the creditor to whom the debt is owed; and (B) the amount owed to them; (b) all Related Party Debts which will be cancelled, discharged or forgiven on or before Completion, including: (i) the total amount of all such Related Party Debts; and (ii) details of each such Related Party Debt, including: (A) each creditor to whom the Related Party Debt is owed; and (B) the amount owed to them.

Corrs Chambers Westgarth (c) all Related Party Receivables which will be cancelled, discharged or forgiven by the Company or Jarl on or before Completion, including: (i) details of each debtor who owes a Related Party Receivable and the amount owed by them; (ii) the total amount of all Related Party Receivables; and (d) any payment directions under clause 24.1 or nominations under clause 24.2(a) in relation to the Base Purchase Price. 12 Business Equipment Leases and Business Property Leases 12.1 Consents Prior to Completion the Seller and the Buyer Guarantor must use their respective reasonable endeavours to obtain the consent of each lessor/landlord under each: (a) Business Equipment Lease; and (b) Business Property Lease, to the assignment by the Seller or the relevant Seller Affiliate to the Buyer Guarantor, and the assumption by the Buyer Guarantor from the Seller or the relevant Seller Affiliate, of the Business Equipment Leases and the Business Property Leases, on the basis that the Seller or the relevant Seller Affiliate obtains a full discharge of all liabilities and release of all obligations under those Leases, arising on or after the Effective Date. 12.2 Right of use or occupation pending assignment (a) If any Business Equipment Lease or Business Property Lease is not assigned to the Buyer Guarantor at Completion, the Seller must, or must procure the relevant Seller Affiliate to, to the extent it lawfully can: (i) allow the Buyer Guarantor to use or occupy the property the subject of the Business Equipment Lease or Business Property Lease as licensee from Completion until the assignment is effective; and (ii) take any action reasonably necessary to ensure that the Business Equipment Lease or Business Property Lease is assigned as soon as reasonably practicable after Completion. (b) If any Business Equipment Lease or Business Property Lease is not assumed by the Buyer Guarantor at Completion, the Buyer Guarantor must on and from Completion: (i) assume, discharge and perform at its expense all the obligations of the Seller or the relevant Seller Affiliate under that Business Equipment Lease or Business Property Lease; and