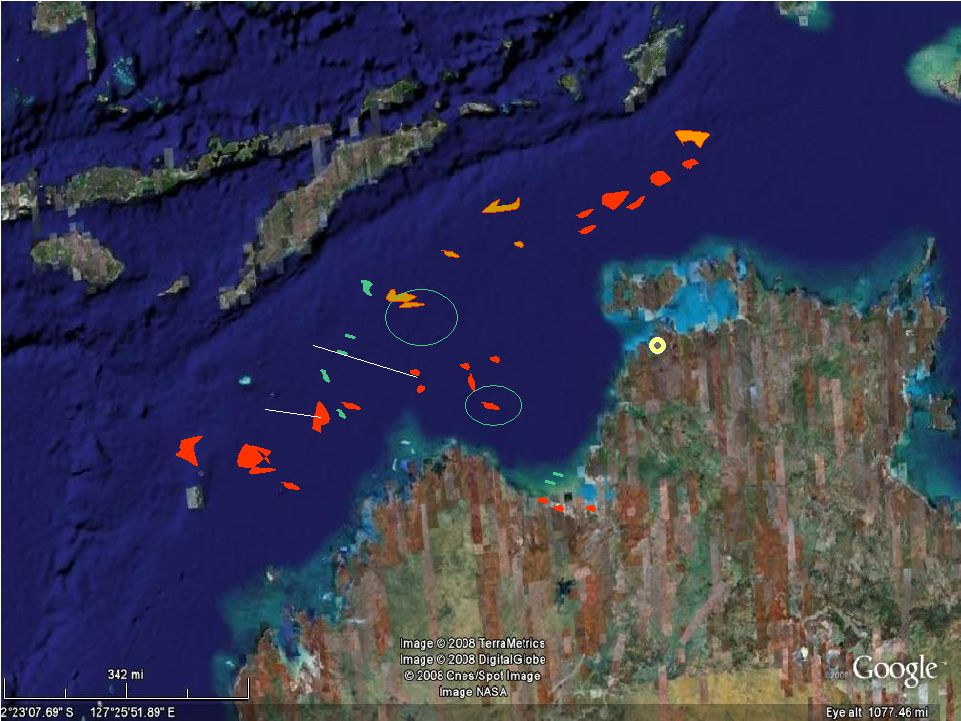

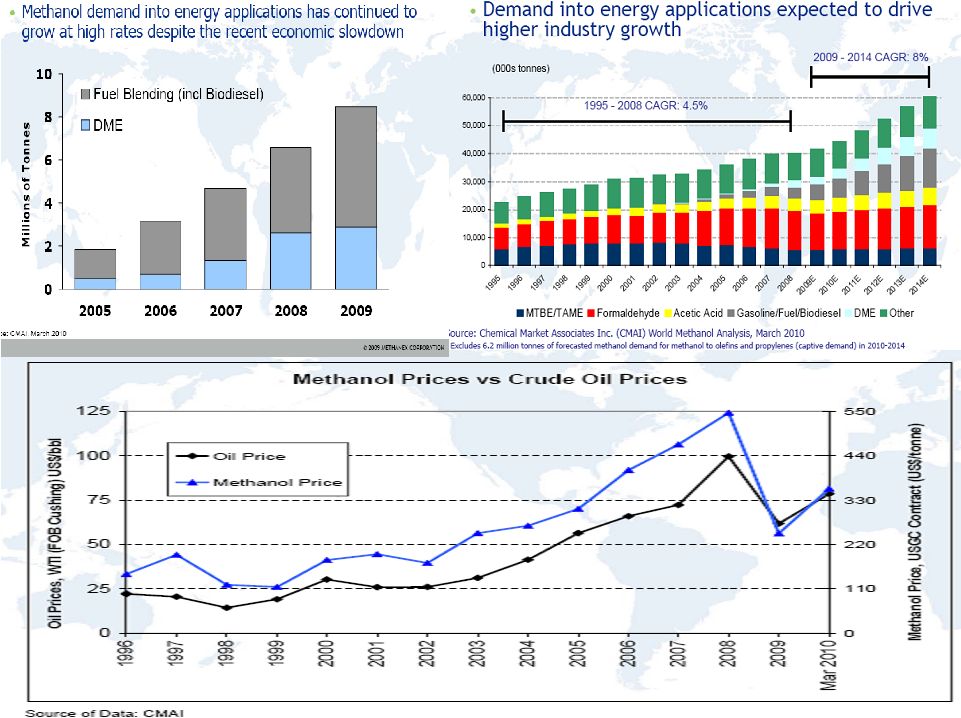

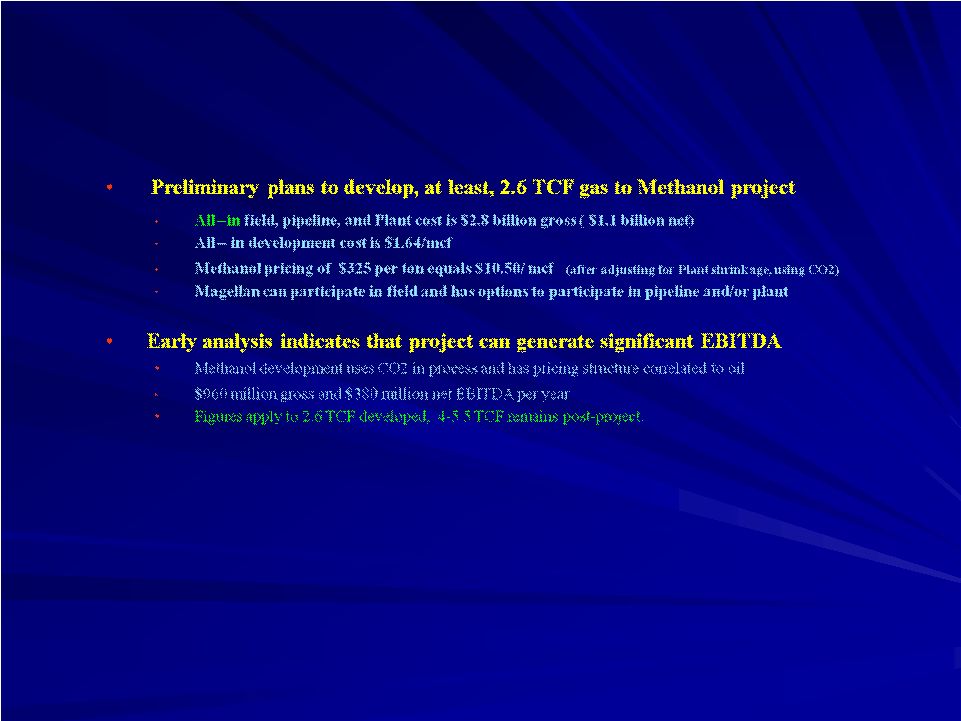

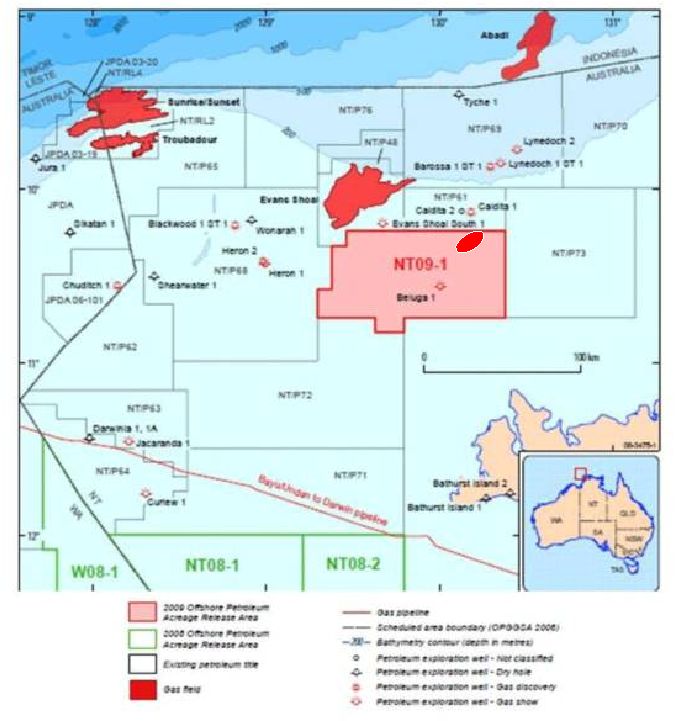

Growth Opportunity Growth Opportunity 2. Gas to Methanol development, offshore Australia Signed Agreement to acquire a 40% operating interest in the Evans Shoal field, offshore Australia with estimated gross contingent resources of 6.5 to 8 TCF (analysis dependent) and 50 mmbbls condensate. • Resource acquisition cost of $182 million equates to 5.7 cents/mcf in the ground or 33 cents/ barrel equivalent • Will pay $91 million to Santos at Closing • Contingent $45 million due on development plan approval: second contingent $45 million due at first gas • Partners are Shell (25%), Petronas (25%), and Osaka Gas (10%) Development plan addresses less than 25% of reserves • Significant Capital Project in partnership with large petrochemical companies • $3.7 billion gross including field, plant, and pipeline. $1.5 billion net or $2.00 per mcf • Methanol value yield $325 per Ton is $10.50/mmbtu at plant inlet gas (adjusted for plant shrinkage, but using CO2) Global Methanol demand expected to grow at 8% • From 2009 to 2014, demand sources from DME and MEOH fuel additive growth • Methanol demand has already increased by 250% since 1995 |