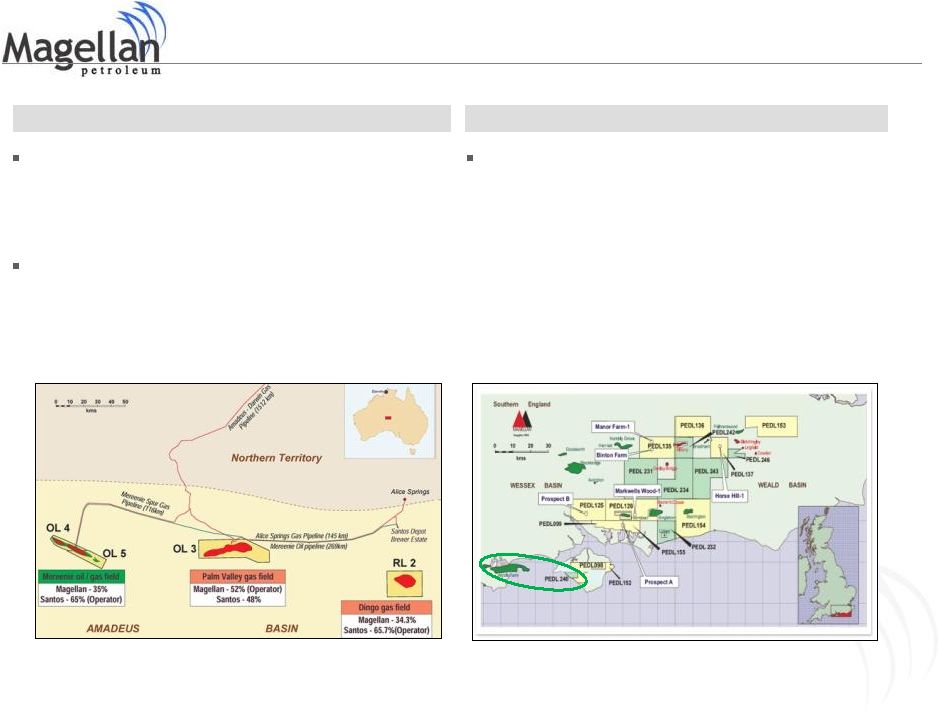

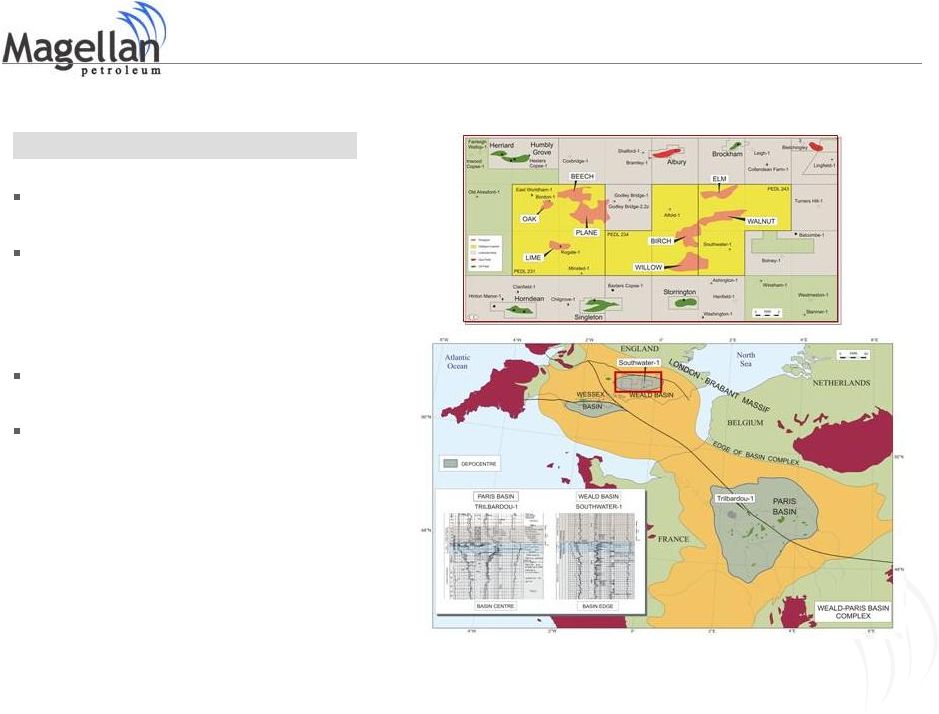

Non-GAAP Measures Disclosure Forward Looking Statements Statements in this presentation which are not historical in nature are intended to be, and are hereby identified as, forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995. These statements about Magellan and Magellan Petroleum Australia Limited (“MPAL”) may relate to their businesses and prospects, revenues, expenses, operating cash flows, and other matters that involve a number of uncertainties that may cause actual results to differ materially from expectations. Among these risks and uncertainties are the ability of MPAL, with the assistance of the Company, to successfully and timely close the Evans Shoal acquisition, the likelihood and timing of the receipt of proceeds from the Young Energy Prize S.A. private placement transaction due to conditions stipulated in the Securities Purchase Agreement dated August 6, 2010, the ability of the Company to successfully develop a strategy for methanol development, pricing and production levels from the properties in which Magellan and MPAL have interests, the extent of the recoverable reserves at those properties, the profitable integration of acquired businesses, including Nautilus Poplar LLC, the future outcome of the negotiations for gas sales contracts for the remaining uncontracted reserves at both the Mereenie and Palm Valley gas fields in the Amadeus Basin, including the likelihood of success of other potential suppliers of gas to the current customers of Mereenie and Palm Valley production. In addition, MPAL has a large number of exploration permits and faces the risk that any wells drilled may fail to encounter hydrocarbons in commercially recoverable quantities. Any forward-looking information provided in this presentation should be considered with these factors in mind. The Company assumes no obligation to update any forward-looking statements contained in this presentation whether as a result of new information, future events or otherwise. Oil and gas issuers are required to include disclosure regarding proved oil and gas reserves in certain filings made with the U.S. Securities and Exchange Commission. Proved reserves are the estimated quantities of crude oil, natural gas, and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, i.e., prices and costs as of the date the estimate is made. The SEC also permits the disclosure of probable and possible reserves which are additional reserves that are less certain to be recovered. Investors are urged to consider closely the disclosures in Magellan’s periodic filings with the SEC available from us at the company’s website www.magellanpetroleum.com Management believes that EBITDA, the non-GAAP (Generally Accepted Accounting Principles) measure indicated by an asterisk (*) used in this presentation provides investors with important perspectives into the company’s ongoing business performance. The company does not intend for the information to be considered in isolation or as a substitute for the related GAAP measures. Other companies may define the measure differently. We define EBITDA as follows: earnings before the deduction of interest expenses, taxes, depreciation and amortization. |