Exhibit 99.1

SUPPLEMENTAL DISCLOSURES RELATING TO TELLURIAN INC.

ABOUT TELLURIAN INC.

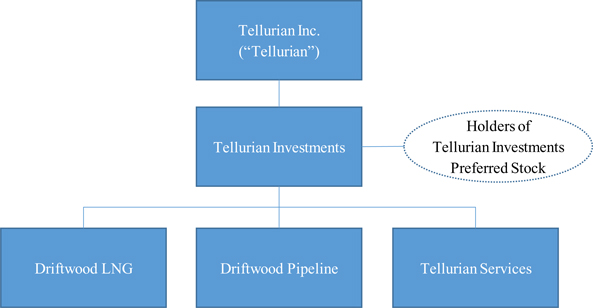

Tellurian Inc., a Delaware corporation (“we,” “us,” “our,” “Tellurian” or the “Company”), intends to create value for shareholders by developinglow-cost naturalgas-related infrastructure, profitably delivering natural gas to customers worldwide and pursuing value enhancing, complementary business lines in the energy industry. Tellurian owns all of the common stock of Tellurian Investments Inc., a Delaware corporation (“Tellurian Investments”), which indirectly owns a 100% ownership interest in each of Driftwood LNG LLC, a Delaware limited liability company (“Driftwood LNG”), and Driftwood Pipeline LLC, a Delaware limited liability company (“Driftwood Pipeline”), and directly owns a 100% membership interest in Tellurian Services LLC (f/k/a Parallax Services LLC), a Delaware limited liability company (“Tellurian Services”).

Tellurian plans to own, develop and operate natural gas liquefaction facilities, storage facilities and loading terminals (collectively, the “LNG Facilities”) and is developing a liquefied natural gas (“LNG”) terminal facility (the “Driftwood terminal”) and an associated pipeline (the “Driftwood pipeline”) in Southwest Louisiana (the Driftwood terminal and the Driftwood pipeline collectively, the “Driftwood Project”). The proposed Driftwood terminal will have a liquefaction capacity of approximately 26 million tonnes per annum, situated on approximately 1,000 acres in Calcasieu Parish, Louisiana. The proposed terminal facility will include up to twenty liquefaction trains, three full containment LNG storage tanks and three marine berths. In February 2016, Tellurian engaged Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”) to complete aFront-End Engineering and Design (“FEED”) study for the Driftwood terminal. Based on the progress of such FEED study to date, Tellurian estimates construction costs for the Driftwood terminal of approximately $500 to $600 per tonne ($13 to $16 billion) before owners’ costs, financing costs and contingencies.

Tellurian is developing the proposed Driftwood pipeline, a new96-mile large diameter pipeline which will interconnect with 14 existing interstate pipelines throughout Southwest Louisiana to secure adequate natural gas feedstock for the Driftwood terminal. The Driftwood pipeline will be comprised of48-inch,42-inch and36-inch diameter pipeline segments, and three compressor stations totaling approximately 270,000 horsepower, all as necessary to provide approximately 4.0 Bcf/d of average daily gas transportation service. In June 2016, Tellurian engaged Bechtel to complete a FEED study for the Driftwood pipeline. Based on the progress of such FEED study to date, Tellurian estimates construction costs for the Driftwood pipeline of approximately $1.6 to $2.0 billion before owners’ costs, financing costs and contingencies.

Also in June 2016, Driftwood LNG and Driftwood Pipeline commenced thepre-filing process with the U.S. Federal Energy Regulatory Commission (“FERC”). Driftwood LNG intends to file, by the end of the first quarter of 2017, an application with FERC for authorization pursuant to Section 3 of the Natural Gas Act (“NGA”) to site, construct and operate the LNG Facilities and Driftwood Pipeline simultaneously will seek authorization pursuant to Section 7 of the NGA for authorization to construct and operate interstate natural gas pipeline facilities. Each will request that FERC issue an order approving the facilities by the first quarter of 2018. Construction of the LNG and pipeline facilities would begin after FERC issues an order granting the necessary authorizations under the NGA and once all required federal, state and local permits have been obtained. The Company expects to receive all regulatory approvals and commence construction in 2018, produce first LNG in 2022 and achieve full operations in 2025.

1

In September 2016, Driftwood LNG filed an application with the U.S. Department of Energy, Office of Fossil Energy (the “DOE/FE”) seeking long-term, multi-contract authorization under Section 3 of the NGA to export, on its own behalf and as agent for others, up to 26 million tonnes per year of LNG. The application requested export authorization to countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas (“FTA countries”) for a30-year term and to countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted(“non-FTA countries”) for a20-year term. In February 2017, Driftwood LNG filed a Statement and Notice of Change in Control with the DOE/FE informing it of the merger transaction between the Company, then known as Magellan Petroleum Corporation, and Tellurian Investments. The merger closed on February 10, 2017. On February 28, 2017, the DOE/FE issued an order authorizing Driftwood LNG to export up to 26 million tonnes per year of LNG to FTA countries, on its own behalf and as agent for others, for a term of 30 years. The authorization to export LNG tonon-FTA countries is currently pending before the DOE/FE and is expected to be issued in the first quarter of 2018.

The Company was founded in 1957 and incorporated in Delaware in 1967 as Magellan Petroleum Corporation. We changed our corporate name to Tellurian Inc. shortly after completing the merger transaction with Tellurian Investments. Our common stock has been trading on the NASDAQ Stock Market since 1972. It currently trades under the ticker symbol “TELL” and as of March 13, 2017, the Company had 199,706,159 shares of common stock issued and outstanding.

Our principal executive offices are located at 1201 Louisiana Street, Suite 3100, Houston, Texas 77002, and our telephone number is(832) 962-4000. We maintain a website at http://www.tellurianinc.com. The information contained in, or that can be accessed through, our website is not part of this report.

2

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

The information in this report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, that address activities, events, or developments with respect to our financial condition, results of operations, or economic performance that we expect, believe, or anticipate will or may occur in the future, or that address plans and objectives of management for future operations, are forward-looking statements. The words “anticipate,” “assume,” “believe,” “budget,” “estimate,” “expect,” “forecast,” “initial,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will,” “would,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements relate to, among other things:

| • | our businesses and prospects; |

| • | our ability to continue as a going concern; |

| • | planned or estimated capital expenditures; |

| • | availability of liquidity and capital resources; |

| • | our ability to obtain additional financing as needed; |

| • | revenues, expenses and projected cash burn rates; |

| • | progress in developing Tellurian’s principal project and the timing of that progress; |

| • | future values of that project or other interests or rights that Tellurian holds; and |

| • | government regulations, including our ability to obtain necessary governmental permits and approvals. |

Our forward-looking statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions, expected future developments, and other factors that we believe are appropriate under the circumstances. These statements are subject to a number of known and unknown risks and uncertainties, which may cause our actual results and performance to be materially different from any future results or performance expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the following:

| • | the uncertain nature of the demand for and price of natural gas; |

| • | risks related to shortages of LNG vessels worldwide; |

| • | technological innovation which may render our anticipated competitive advantage obsolete; |

| • | risks related to a terrorist or military incident involving an LNG carrier; |

| • | changes in legislation and regulations relating to the LNG industry, including environmental laws and regulations that impose significant compliance costs and liabilities; |

3

| • | uncertainties regarding our ability to maintain sufficient liquidity and capital resources to implement our projects or otherwise continue as a going concern; |

| • | our limited operating history; |

| • | our ability to attract and retain key personnel; |

| • | risks related to doing business in, and having counterparties in, foreign countries; |

| • | our reliance on the skill and expertise of third-party service providers; |

| • | the ability of our vendors to meet their contractual obligations; |

| • | risks and uncertainties inherent in management estimates of future operating results and cash flows; |

| • | development risks, operational hazards, and regulatory approvals; and |

| • | risks and uncertainties associated with litigation matters. |

The forward-looking statements in this report speak as of the date hereof. Although we may from time to time voluntarily update our prior forward-looking statements, we disclaim any commitment to do so except as required by securities laws.

4

ORGANIZATIONAL STRUCTURE

Tellurian’s current, abbreviated corporate structure is as follows:

CAPITAL RESOURCES AND STRUCTURE

Our current capital resources consist of proceeds from issuances of common and preferred stock, including, as described below, an issuance of preferred stock to GE Oil & Gas, Inc. (“GE”), a Delaware corporation and subsidiary of General Electric Company, and an issuance of common stock to TOTAL Delaware, Inc. (“TOTAL”), a Delaware corporation and subsidiary of TOTAL S.A. On a consolidated basis, Tellurian had approximately $189,545,121 of cash and cash equivalents as of March 10, 2017. Tellurian considers cash equivalents to be short term, highly liquid investments that are both readily convertible to known amounts of cash and so near to their maturity that they present insignificant risk of changes in value because of changes in interest rates. We believe that we will have sufficient capital resources to fund our business for at least the next 12 months.

Tellurian Investments issued approximately 5.5 million shares of Tellurian Investments preferred stock to GE in November 2016 for an aggregate purchase price of $25 million. Those shares, which currently represent 4.76% of the outstanding equity securities of Tellurian Investments, are convertible at any time into either shares of a substantially similar class of Tellurian Inc. preferred stock or shares of Tellurian Inc. common stock, in each case on aone-for-one basis, subject to adjustments in certain circumstances. In connection with the preferred stock issuance to GE, we agreed to enter into a registration rights agreement with respect to the Tellurian Inc. common stock to be issued upon the conversion or exchange of the preferred stock.

5

Tellurian Investments issued approximately 35.4 million shares of its common stock to TOTAL in January 2017 for an aggregate purchase price of $207 million. In connection with that investment, we agreed that we would enter into (i) apre-emptive rights agreement pursuant to which TOTAL will be granted a right to purchase its pro rata portion of any new equity securities that Tellurian may issue to a third party on the same terms and conditions as such equity securities are offered and sold to such party, subject to certain excepted offerings and (ii) a registration rights agreement with respect to the common stock purchased by TOTAL.

As of the date of this report, neither Tellurian nor any of its subsidiaries have entered into definitive registration rights agreements with either GE or TOTAL and Tellurian has not entered into a definitivepre-emptive rights agreement with TOTAL.

6

RISK FACTORS

In addition to the other information included in this report, the following risk factors should be carefully considered when evaluating an investment in us. These risk factors and other uncertainties may cause our actual future results or performance to differ materially from any future results or performance expressed or implied in the forward-looking statements contained in this report and in other public statements we make. In addition, because of these risks and uncertainties, as well as other variables affecting our operating results, our past financial performance is not necessarily indicative of future performance.

The risk factors in this report are grouped into the following categories:

| • | Risks Relating to our Financial Matters; |

| • | Risks Relating to our Common Stock; |

| • | Risks Relating to our LNG Business; and |

| • | Risks Relating to our Business in General. |

Risks Relating to our Financial Matters

Tellurian does not expect to generate sufficient cash to pay dividends until the completion of construction of the Driftwood Project.

Tellurian’s directly and indirectly held assets consist primarily of cash held forcertain start-up and operating expenses, applications for permits from regulatory agencies relating to the Driftwood Project and certain real property interests related to that project. Tellurian’s cash flow and consequently its ability to distribute earnings is solely dependent upon the cash flow its subsidiaries receive from the Driftwood Project and the transfer of funds in the form of distributions or otherwise. Tellurian’s ability to complete the Driftwood Project, as discussed further below, is dependent upon its subsidiaries’ ability to obtain necessary regulatory approvals and raise the capital necessary to fund the development of the project.

Tellurian’s ability to pay dividends in the future is uncertain and will depend on a variety of factors, including limitations on the ability of it or its subsidiaries to pay dividends under applicable law and/or the terms of debt or other agreements, and the judgment of the board of directors or other governing body of the relevant entity. Tellurian is currently prohibited from paying dividends under the terms of the Tellurian Investments preferred stock.

Tellurian will be required to seek additional debt and equity financing in the future to complete the Driftwood Project, and may not be able to secure such financing on acceptable terms, or at all.

Because Tellurian will be unable to generate any revenue from its operations and expects to be in the development stage for multiple years, Tellurian will need additional financing to provide the capital required to execute its business plan. Tellurian will need significant funding to develop the Driftwood Project as well as for working capital requirements and other operating and general corporate purposes. See “Capital Resources and Structure” above.

There can be no assurance that Tellurian will be able to raise sufficient capital on acceptable terms, or at all. If such financing is not available on satisfactory terms, or is not available at all, Tellurian may be required to delay, scale back or eliminate the development of business opportunities, and its operations and financial condition may be adversely affected to a significant extent.

7

Debt financing, if obtained, may involve agreements that include liens on Tellurian’s assets and covenants limiting or restricting the ability to take specific actions, such as paying dividends or making distributions, incurring additional debt, acquiring or disposing of assets and increasing expenses. Debt financing would also be required to be repaid regardless of Tellurian’s operating results.

In addition, the ability to obtain financing for the proposed Driftwood Project is expected to be contingent upon, among other things, Tellurian’s ability to enter into sufficient long-term commercial agreements prior to the commencement of construction. To date, Tellurian has not entered into any definitive third-party agreements for the proposed Driftwood Project, and it may not be successful in negotiating and entering into such agreements.

Driftwood LNG, Driftwood Pipeline and Tellurian Investments have a limited operating history.

Each of Driftwood LNG, Driftwood Pipeline and Tellurian Investments was formed in 2016, and only recently commenced development. Although Tellurian’s current directors, managers and officers have prior professional and industry experience, Driftwood LNG, Driftwood Pipeline and Tellurian Investments have a limited prior operating history, track record and historical financial information upon which you may evaluate prospects.

Tellurian has not yet commenced the construction of the Driftwood Project. Accordingly, Tellurian expects to incur significant additional costs and expenses through completion of development and construction of the Driftwood Project. Tellurian expects operating losses will increase substantially in the remainder of 2017 and thereafter, and expects to continue to incur operating losses and experience negative operating cash flow through at least 2022.

Tellurian’s exposure to the performance and credit risks of counterparties under agreements may adversely affect our operating results, liquidity and access to financing.

Our LNG and natural gas marketing business will involve our entering into various purchase and sale, hedging and other transactions with numerous third parties. In such arrangements, we will be exposed to the performance and credit risks of our counterparties, including the risk that one or more counterparties fails to perform its obligation to make deliveries of commodities and/or to make payments. These risks may increase during periods of commodity price volatility. Defaults by suppliers and other counterparties may adversely affect our operating results, liquidity and access to financing.

Tellurian’s ability to generate cash is substantially dependent upon it entering into contracts with third party customers and the performance of those customers under those contracts.

Tellurian has not yet entered into, and may never be able to enter into, satisfactory commercial arrangements with third-party customers for products and services at the Driftwood Project.

Tellurian’s business strategy may change regarding how and when the proposed Driftwood Project’s export capacity is marketed. Also, Tellurian’s business strategy may change due to an inability to enter into agreements with customers or based on views regarding future prices, supply and demand of LNG, natural gas liquefaction capacity, and worldwide regasification capacity. If the efforts to market the proposed Driftwood Project are not successful, Tellurian’s business, results of operations, financial condition and prospects may be materially and adversely affected.

8

Changes in tax laws or exposure to additional income tax liabilities could have a material impact on our financial condition, results of operations and liquidity.

We are subject to income taxes as well asnon-income based taxes in the various jurisdictions in which we operate. Tax authorities may disagree with certain positions we have taken and assess additional taxes. We regularly assess the likely outcomes of these audits to determine the appropriateness of our tax provision. However, there can be no assurance that we will accurately predict the outcomes of these audits, and the actual outcomes could have a material impact on our net income or financial condition.

Changes in tax laws or tax rulings could materially impact our effective tax rate. For example, the Trump Administration has called for substantial change to fiscal and tax policies, inclusive of proposed changes to the U.S. federal tax treatment of foreign operations, the current tax depreciation system and the deductibility of interest expense in connection with comprehensive U.S. federal tax reform. If enacted, any change in law may affect our tax position, including the amount of taxes we are required to pay, and could have a significant impact on our future results of operations, profitability and financial condition, including the size of our expected net operating losses. However, until we know what changes are enacted, we will not know fully whether in total we benefit from, or are negatively affected by, the proposed changes.

Risks Relating to Our Common Stock

The price of our common stock has been and may continue to be highly volatile, which may make it difficult for shareholders to sell our common stock when desired or at attractive prices.

The market price of our common stock is highly volatile, and we expect it to continue to be volatile for the foreseeable future. Adverse events could trigger a significant decline in the trading price of our common stock, including, among others, failure to obtain necessary permits, unfavorable changes in commodity prices or commodity price expectations, adverse regulatory developments, loss of a relationship with a partner, litigation and departures of key personnel. Furthermore, general market conditions, including the level of, and fluctuations in, the trading prices of equity securities generally could affect the price of our stock. Recently, the stock markets have experienced price and volume volatility that has affected many companies’ stock prices. Stock prices for many companies have experienced wide fluctuations that have often been unrelated to the operating performance of those companies. These fluctuations may affect the market price of our common stock.

The market price of our common stock could be adversely affected by sales of substantial amounts of our common stock by us or our major shareholders.

Sales of a substantial number of shares of our common stock in the market by us or any of our major shareholders, or the perception that these sales may occur, could cause the market price of our common stock to decline. In addition, the sale of these shares in the public market, or the possibility of such sales, could impair our ability to raise capital through the sale of additional equity securities. Our insider trading policy does not prohibit our officers and directors, some of whom own substantial percentages of our outstanding common stock, from pledging shares of stock that they own as collateral for loans. In some circumstances, such pledges could result in large amounts of shares of our stock being sold in the market in a short period of time, which would be expected to have a significant adverse effect on the trading price of the common stock. In addition, in the future, we may issue shares of our common stock in connection with acquisitions of assets or businesses. If we use our shares for this purpose, the issuances could have a dilutive effect on the market value of shares of our common stock, depending on market conditions at the time of an acquisition, the price we pay, the value of the business or assets acquired, our success in exploiting the properties or integrating the businesses we acquire and other factors.

9

Risks Relating to our LNG Business

Various economic and political factors could negatively affect the development, construction and operation of LNG Facilities, including the Driftwood Project, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Commercial development of an LNG facility takes a number of years, requires substantial capital investment and may be delayed by factors such as:

| • | increased construction costs; |

| • | economic downturns, increases in interest rates or other events that may affect the availability of sufficient financing for LNG projects on commercially reasonable terms; |

| • | decreases in the price of LNG, which might decrease the expected returns relating to investments in LNG projects; |

| • | the inability of project owners or operators to obtain governmental approvals to construct or operate LNG Facilities; and |

| • | political unrest or local community resistance to the siting of LNG Facilities due to safety, environmental or security concerns. |

Our failure to execute our business plan in a timely manner could materially adversely effect our business, financial condition, operating results, liquidity and prospects.

Tellurian’s estimated costs for the Driftwood Project may not be accurate and are subject to change due to various factors.

Tellurian currently estimates that the construction costs for the Driftwood Project will be between approximately $13 and $16 billion. However, cost estimates are only an approximation of the actual costs of construction and are before owners’ costs, financing costs and contingencies. Moreover, cost estimates may change due to various factors, such as the final terms of any definitive request for services with its engineering, procurement and construction (“EPC”) service provider, as well as cost overruns, change orders, delays in construction, legal and regulatory requirements, site issues, increased component and material costs, escalation of labor costs, labor disputes, changes in commodity prices, increased spending to maintain Tellurian’s construction schedule and other factors.

Our failure to achieve our cost estimates could materially adversely effect our business, financial condition, operating results, liquidity and prospects.

If third-party pipelines and other facilities interconnected to our LNG Facilities become unavailable to transport natural gas, this could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

We will depend upon third-party pipelines and other facilities that will provide gas delivery options to our LNG Facilities. If the construction of new or modified pipeline connections is not completed on schedule or any pipeline connection were to become unavailable for current or future volumes of natural gas due to repairs, damage to the facility, lack of capacity or any other reason, our ability to meet our LNG sale and purchase agreement obligations and continue shipping natural gas from producing regions or to end markets could be restricted, thereby reducing our revenues. This could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

10

We may not be able to purchase or receive physical delivery of sufficient natural gas to satisfy our delivery obligations under our LNG sale and purchase agreements, which could have an adverse effect on us.

Under LNG sale and purchase agreements with our customers, we will be required to make available to them a specified amount of LNG at specified times. However, we may not be able to purchase or receive physical delivery of sufficient quantities of natural gas to satisfy those obligations, which may provide affected customers with the right to terminate their LNG sale and purchase agreements. Our failure to purchase or receive physical delivery of sufficient quantities of natural gas could have an adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

The construction and operation of the Driftwood Project remains subject to further approvals, and some approvals may be subject to further conditions, review and/or revocation.

The design, construction and operation of LNG export terminals is a highly regulated activity. The approval of FERC under Section 3 of the Natural Gas Act, as well as several other material governmental and regulatory approvals and permits, is required in order to construct and operate an LNG terminal. Even if the necessary authorizations initially required to operate our proposed LNG Facilities are obtained, such authorizations are subject to ongoing conditions imposed by regulatory agencies, and additional approval and permit requirements may be imposed.

Tellurian will be required to obtain governmental approvals and authorizations to implement its proposed business strategy, which includes the construction and operation of the Driftwood Project. In particular, authorization from FERC and the DOE/FE is required to construct and operate our proposed LNG Facilities. In addition to seeking approval for export to FTA countries, Tellurian will seek to obtain approval for export tonon-FTA countries. There is no assurance that Tellurian will obtain and maintain these governmental permits, approvals and authorizations, and failure to obtain and maintain any of these permits, approvals or authorizations could have a material adverse effect on its business, results of operations, financial condition and prospects.

Tellurian will be dependent on third-party contractors for the successful completion of the Driftwood Project, and these contractors may be unable to complete the Driftwood Project.

There is limited recent industry experience in the United States regarding the construction or operation of large-scale liquefaction facilities. The construction of the Driftwood Project is expected to take several years, will be confined to a limited geographic area and could be subject to delays, cost overruns, labor disputes and other factors that could adversely affect financial performance or impair Tellurian’s ability to execute its scheduled business plan.

Timely and cost-effective completion of the Driftwood Project in compliance with agreed-upon specifications will be highly dependent upon the performance of third-party contractors pursuant to their agreements. However, Tellurian has not yet entered into definitive agreements with certain of the contractors, advisors and consultants necessary for the development and construction of the Driftwood Project. Tellurian may not be able to successfully enter into such construction contracts on terms or at prices that are acceptable to it.

11

Further, faulty construction that does not conform to Tellurian’s design and quality standards may have an adverse effect on Tellurian’s business, results of operations, financial condition and prospects. For example, improper equipment installation may lead to a shortened life of Tellurian’s equipment, increased operations and maintenance costs or a reduced availability or production capacity of the affected facility. The ability of Tellurian’s third-party contractors to perform successfully under any agreements to be entered into is dependent on a number of factors, including force majeure events and such contractors’ ability to:

| • | design, engineer and receive critical components and equipment necessary for the Driftwood Project to operate in accordance with specifications and addressany start-up and operational issues that may arise in connection with the commencement of commercial operations; |

| • | attract, develop and retain skilled personnel and engage and retain third-party subcontractors, and address any labor issues that may arise; |

| • | post required construction bonds and comply with the terms thereof, and maintain their own financial condition, including adequate working capital; |

| • | adhere to any warranties the contractors provide in their EPC contracts; and |

| • | respond to difficulties such as equipment failure, delivery delays, schedule changes and failure to perform by subcontractors, some of which are beyond their control, and manage the construction process generally, including engaging and retaining third-party contractors, coordinating with other contractors and regulatory agencies and dealing with inclement weather conditions. |

Furthermore, Tellurian may have disagreements with its third-party contractors about different elements of the construction process, which could lead to the assertion of rights and remedies under the related contracts, resulting in a contractor’s unwillingness to perform further work on the relevant project. Tellurian may also face difficulties in commissioning a newly constructed facility. Any significant project delays in the development of the Driftwood Project could materially and adversely affect Tellurian’s business, results of operations, financial condition and prospects.

Tellurian’s construction and operations activities are subject to a number of development risks, operational hazards, regulatory approvals and other risks, which could cause cost overruns and delays and could have a material adverse effect on its business, results of operations, financial condition, liquidity and prospects.

Siting, development and construction of the Driftwood Project will be subject to the risks of delay or cost overruns inherent in any construction project resulting from numerous factors, including, but not limited to, the following:

| • | difficulties or delays in obtaining, or failure to obtain, sufficient debt or equity financing on reasonable terms; |

| • | failure to obtain all necessary government and third-party permits, approvals and licenses for the construction and operation of any of our proposed LNG Facilities; |

| • | failure to obtain sale and purchase agreements that generate sufficient revenue to support the financing and construction of the Driftwood Project; |

| • | difficulties in engaging qualified contractors necessary to the construction of the contemplated Driftwood Project or other LNG Facilities; |

12

| • | shortages of equipment, material or skilled labor; |

| • | natural disasters and catastrophes, such as hurricanes, explosions, fires, floods, industrial accidents and terrorism; |

| • | unscheduled delays in the delivery of ordered materials; |

| • | work stoppages and labor disputes; |

| • | competition with other domestic and international LNG export terminals; |

| • | unanticipated changes in domestic and international market demand for and supply of natural gas and LNG, which will depend in part on supplies of and prices for alternative energy sources and the discovery of new sources of natural resources; |

| • | unexpected or unanticipated need for additional improvements; and |

| • | adverse general economic conditions. |

Delays beyond the estimated development periods, as well as cost overruns, could increase the cost of completion beyond the amounts that are currently estimated, which could require Tellurian to obtain additional sources of financing to fund the activities until the proposed Driftwood Project is constructed and operational (which could cause further delays). Any delay in completion of the Driftwood Project may also cause a delay in the receipt of revenues projected from the Driftwood Project or cause a loss of one or more customers. As a result, any significant construction delay, whatever the cause, could have a material adverse effect on Tellurian’s business, results of operations, financial condition, liquidity and prospects.

Technological innovation may render Tellurian’s anticipated competitive advantage or its processes obsolete.

Tellurian’s success will depend on its ability to create and maintain a competitive position in the natural gas liquefaction industry. In particular, although Tellurian plans to construct the Driftwood Project using proven technologies that it believes provide it with certain advantages, Tellurian does not have any exclusive rights to any of the technologies that it will be utilizing. In addition, the technology Tellurian anticipates using in the Driftwood Project may be rendered obsolete or uneconomical by legal or regulatory requirements, technological advances, more efficient and cost-effective processes or entirely different approaches developed by one or more of its competitors or others, which could materially and adversely affect Tellurian’s business, results of operations, financial condition, liquidity and prospects.

Cyclical or other changes in the demand for and price of LNG and natural gas may adversely affect Tellurian’s LNG business and the performance of our customers and could lead to reduced development of LNG projects worldwide.

Tellurian’s plans and expectations regarding its business and the development of domestic LNG Facilities and projects are generally based on assumptions about the future price of natural gas and LNG and the conditions of the global natural gas and LNG markets. Natural gas and LNG prices have been, and are likely to remain in the future, volatile and subject to wide fluctuations that are difficult to predict. Such fluctuations may be caused by factors including, but not limited to, one or more of the following:

| • | competitive liquefaction capacity in North America; |

13

| • | insufficient or oversupply of natural gas liquefaction or receiving capacity worldwide; |

| • | insufficient or oversupply of LNG tanker capacity; |

| • | weather conditions; |

| • | reduced demand and lower prices for natural gas; |

| • | increased natural gas production deliverable by pipelines, which could suppress demand for LNG; |

| • | decreased oil and natural gas exploration activities, which may decrease the production of natural gas; |

| • | cost improvements that allow competitors to offer LNG regasification services or provide natural gas liquefaction capabilities at reduced prices; |

| • | changes in supplies of, and prices for, alternative energy sources such as coal, oil, nuclear, hydroelectric, wind and solar energy, which may reduce the demand for natural gas; |

| • | changes in regulatory, tax or other governmental policies regarding imported or exported LNG, natural gas or alternative energy sources, which may reduce the demand for imported or exported LNG and/or natural gas; |

| • | political conditions in natural gas producing regions; and |

| • | cyclical trends in general business and economic conditions that cause changes in the demand for natural gas. |

Adverse trends or developments affecting any of these factors could result in decreases in the price of LNG and/or natural gas, which could materially and adversely affect the performance of our customers, and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flows, liquidity and prospects.

Failure of exported LNG to be a competitive source of energy for international markets could adversely affect our customers and could materially and adversely affect our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Operations of the Driftwood Project will be dependent upon the ability of our LNG sale and purchase agreement customers to deliver LNG supplies from the United States, which is primarily dependent upon LNG being a competitive source of energy internationally. The success of our business plan is dependent, in part, on the extent to which LNG can, for significant periods and in significant volumes, be supplied from North America and delivered to international markets at a lower cost than the cost of alternative energy sources. Through the use of improved exploration technologies, additional sources of natural gas may be discovered outside the United States, which could increase the available supply of natural gas outside the United States and could result in natural gas in those markets being available at a lower cost than that of LNG exported to those markets.

14

Additionally, our liquefaction projects will be subject to the risk of LNG price competition at times when we need to replace any existing LNG sale and purchase contract, whether due to natural expiration, default or otherwise, or enter into new LNG sale and purchase contracts. Factors relating to competition may prevent us from entering into a new or replacement LNG sale and purchase contract on economically comparable terms as prior LNG sale and purchase contracts, or at all. Factors which may negatively affect potential demand for LNG from our liquefaction projects are diverse and include, among others:

| • | increases in worldwide LNG production capacity and availability of LNG for market supply; |

| • | increases in demand for LNG but at levels below those required to maintain current price equilibrium with respect to supply; |

| • | increases in the cost to supply natural gas feedstock to our liquefaction projects; |

| • | decreases in the cost of competing sources of natural gas or alternate sources of energy such as coal, heavy fuel oil, diesel, nuclear, hydroelectric, wind and solar energy; |

| • | decreases in the price ofnon-U.S. LNG, including decreases in price as a result of contracts indexed to lower oil prices; |

| • | increases in capacity and utilization of nuclear power and related facilities; |

| • | increases in the cost of LNG shipping; and |

| • | displacement of LNG by pipeline natural gas or alternate fuels in locations where access to these energy sources is not currently available. |

Political instability in foreign countries that import natural gas, or strained relations between such countries and the United States, may also impede the willingness or ability of LNG suppliers, purchasers and merchants in such countries to import LNG from the United States. Furthermore, some foreign purchasers of LNG may have economic or other reasons to obtain their LNG fromnon-U.S. markets or from our competitors’ liquefaction facilities in the United States.

As a result of these and other factors, LNG may not be a competitive source of energy in the United States or internationally. The failure of LNG to be a competitive supply alternative to local natural gas, oil and other alternative energy sources in markets accessible to our customers could adversely affect the ability of our customers to deliver LNG from the United States on a commercial basis. Any significant impediment to the ability to deliver LNG from the United States generally, or from the Driftwood Project specifically, could have a material adverse effect on our customers and on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Competition in the liquefied natural gas industry is intense, and some of Tellurian’s competitors have greater financial, technological and other resources.

Tellurian plans to operate in the highly competitive area of liquefied natural gas production and faces intense competition from independent, technology-driven companies as well as from both major and other independent oil and natural gas companies and utilities.

15

Many competing companies have secured access to, or are pursuing development or acquisition of, LNG Facilities to serve the North American natural gas market, including other proposed liquefaction facilities in North America. Tellurian may face competition from major energy companies and others in pursuing its proposed business strategy to provide liquefaction and export products and services at its proposed Driftwood Project. In addition, competitors have and are developing additional LNG terminals in other markets, which also compete with our proposed LNG Facilities. Almost all of these competitors have longer operating histories, greater name recognition, larger staffs and substantially greater financial, technical and marketing resources than Tellurian currently possesses. The superior resources that these competitors have available for deployment could allow them to compete successfully against Tellurian, which could have a material adverse effect on Tellurian’s business, results of operations, financial condition, liquidity and prospects.

There may be shortages of LNG vessels worldwide, which could have a material adverse effect on Tellurian’s business, results of operations, financial condition, liquidity and prospects.

The construction and delivery of LNG vessels requires significant capital and long construction lead times, and the availability of the vessels could be delayed to the detriment of Tellurian’s business and customers due to a variety of factors, including, but not limited to, the following:

| • | an inadequate number of shipyards constructing LNG vessels and a backlog of orders at these shipyards; |

| • | political or economic disturbances in the countries where the vessels are being constructed; |

| • | changes in governmental regulations or maritime self-regulatory organizations; |

| • | work stoppages or other labor disturbances at the shipyards; |

| • | bankruptcies or other financial crises of shipbuilders; |

| • | quality or engineering problems; |

| • | weather interference or catastrophic events, such as a major earthquake, tsunami, or fire; or |

| • | shortages of or delays in the receipt of necessary construction materials. |

Any of these factors could have a material adverse effect on Tellurian’s business, results of operations, financial condition, liquidity and prospects.

A terrorist attack, including cyberterrorism, or military incident involving an LNG carrier could result in delays in, or cancellation of, construction or closure of our proposed LNG Facilities.

A terrorist, including a cyberterrorist, incident or military incident involving an LNG carrier or LNG facility may result in delays in, or cancellation of, construction of new LNG Facilities, including our proposed LNG Facilities, which would increase Tellurian’s costs and decrease cash flows. A terrorist incident may also result in temporary or permanent closure of Tellurian’s proposed LNG Facilities, including the Driftwood Project, which could increase costs and decrease cash flows, depending on the duration of the closure. Operations at the proposed LNG Facilities, including the Driftwood Project, could also become subject to increased governmental scrutiny that may result in additional security measures at a significant incremental cost. In addition, the threat of terrorism and the impact of military campaigns may lead to continued volatility in prices for natural gas that could adversely affect Tellurian’s business and customers, including the ability of Tellurian’s suppliers or customers to satisfy their respective obligations under Tellurian’s commercial agreements.

16

Changes in legislation and regulations relating to the LNG industry could have a material adverse impact on Tellurian’s business, results of operations, financial condition, liquidity and prospects.

Future legislation and regulations, such as those relating to the transportation and security of LNG exported from our proposed LNG Facilities through the Calcasieu Ship Channel, could cause additional expenditures, restrictions and delays in connection with the proposed LNG Facilities and their construction, the extent of which cannot be predicted and which may require Tellurian to limit substantially, delay or cease operations in some circumstances. Revised, reinterpreted or additional laws and regulations that result in increased compliance costs or additional operating costs and restrictions could have a material adverse effect on Tellurian’s business, results of operations, financial condition, liquidity and prospects.

The operation of the proposed Driftwood Project may be subject to significant operating hazards and uninsured risks, one or more of which may create significant liabilities and losses that could have a material adverse effect on Tellurian’s business, results of operations, financial condition, liquidity and prospects.

The plan of operations for the proposed Driftwood Project is subject to the inherent risks associated with LNG operations, including explosions, pollution, release of toxic substances, fires, hurricanes and other adverse weather conditions, and other hazards, each of which could result in significant delays in commencement or interruptions of operations and/or result in damage to or destruction of the proposed Driftwood Project and assets or damage to persons and property. In addition, operations at the proposed Driftwood Project and vessels of third parties on which Tellurian’s operations are dependent face possible risks associated with acts of aggression or terrorism.

In 2005 and 2008, hurricanes damaged coastal and inland areas located in Texas, Louisiana, Mississippi and Alabama, resulting in disruption and damage to certain LNG terminals located in those regions. Future storms and related storm activity and collateral effects, or other disasters such as explosions, fires, floods or accidents, could result in damage to, or interruption of operations at, the Driftwood Project or related infrastructure, as well as delays or cost increases in the construction and the development of the Driftwood Project or other facilities. Changes in the global climate may have significant physical effects, such as increased frequency and severity of storms, floods and rising sea levels; if any such effects were to occur, they could have an adverse effect on our coastal operations.

Tellurian does not, nor does it intend to, maintain insurance against all of these risks and losses. Tellurian may not be able to maintain desired or required insurance in the future at rates that it considers reasonable. The occurrence of a significant event not fully insured or indemnified against could have a material adverse effect on Tellurian’s business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We will rely on third-party engineers to estimate the future capacity ratings and performance capabilities of the Driftwood Project, and these estimates may prove to be inaccurate.

We will rely on third parties for the design and engineering services underlying our estimates of the future capacity ratings and performance capabilities of the Driftwood Project. Any of our LNG Facilities, when actually constructed, may not have the capacity ratings and performance capabilities that we intend or estimate. Failure of any of our LNG Facilities to achieve our intended capacity ratings and performance capabilities could prevent us from achieving the commercial start dates under our future LNG sale and purchase agreements and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

17

Risks Relating to Our Business in General

Tellurian will be subject to risks related to doing business in, and having counterparties based in, foreign countries.

Tellurian may engage in operations or make substantial commitments and investments, or enter into agreements with counterparties, located outside the United States, which would expose Tellurian to political, governmental, and economic instability and foreign currency exchange rate fluctuations.

Any disruption caused by these factors could harm Tellurian’s business, results of operations, financial condition, liquidity and prospects. Risks associated with operations, commitments and investments outside of the United States include but are not limited to risks of:

| • | currency fluctuations; |

| • | war or terrorist attack; |

| • | expropriation or nationalization of assets; |

| • | renegotiation or nullification of existing contracts; |

| • | changing political conditions; |

| • | changing laws and policies affecting trade, taxation, and investment; |

| • | multiple taxation due to different tax structures; |

| • | general hazards associated with the assertion of sovereignty over areas in which operations are conducted; and |

| • | the unexpected credit rating downgrade of countries in which Tellurian’s LNG customers are based. |

Because Tellurian’s reporting currency is the United States dollar, any of the operations conducted outside the United States or denominated in foreign currencies would face additional risks of fluctuating currency values and exchange rates, hard currency shortages and controls on currency exchange. In addition, Tellurian would be subject to the impact of foreign currency fluctuations and exchange rate changes on its financial reports when translating its assets, liabilities, revenues and expenses from operations outside of the United States into U.S. dollars at then-applicable exchange rates. These translations could result in changes to the results of operations from period to period.

18

Tellurian Investments is a defendant in a lawsuit that could result in equitable relief and/or monetary damages that could have a material adverse effect on Tellurian’s operating results and financial condition.

Tellurian Investments and Tellurian Services, along with Tellurian director Martin Houston and an officer of Tellurian and certain entities in which each of them owned membership interests, as applicable, have been named as defendants in a recently initiated lawsuit. Although Tellurian Investments believes the plaintiffs’ claims are without merit, Tellurian Investments may not ultimately be successful and any potential liability Tellurian Investments may incur is not reasonably estimable. Moreover, even if Tellurian Investments is successful in the defense of this litigation, Tellurian Investments could incur costs and suffer both an economic loss and an adverse impact on its reputation, which could have a material adverse effect on its business. In addition, any adverse judgment or settlement of the litigation could have an adverse effect on our operating results and financial condition.

Tellurian will be subject to a number of environmental laws and regulations that impose significant compliance costs, and existing and future environmental and similar laws and regulations could result in increased compliance costs, liabilities or additional operating restrictions.

Tellurian will be subject to extensive federal, state and local environmental regulations and laws, including regulations and restrictions related to discharges and releases to the air, land and water and the handling, storage, generation and disposal of hazardous materials and solid and hazardous wastes in connection with the development, construction and operation of its LNG Facilities. These regulations and laws, which include the Clean Air Act (“CAA”), the Oil Pollution Act, the Clean Water Act (“CWA”) and theResource Conservation and Recovery Act (“RCRA”), and analogous state and local laws and regulations will restrict, prohibit or otherwise regulate the types, quantities and concentration of substances that can be released into the environment in connection with the construction and operation of our facilities. These laws and regulations, including the National Environmental Protection Act (“NEPA”), will require Tellurian to obtain and maintain permits, prepare environmental impact assessments, provide governmental authorities with access to its facilities for inspection and provide reports related to compliance. Federal and state laws impose liability, without regard to fault or the lawfulness of the original conduct, for the release of certain types or quantities of hazardous substances into the environment. As the owner and operator of the Driftwood Project, Tellurian could be liable for the costs of investigating and cleaning up hazardous substances released into the environment and for damage to natural resources. Violation of these laws and regulations could lead to substantial liabilities, fines and penalties, the denial or revocation of permits necessary for our operations, governmental orders to shut down our facilities or capital expenditures related to pollution control equipment or remediation measures that could have a material adverse effect on Tellurian’s business, results of operations, financial condition, liquidity and prospects.

In October 2015, the U.S. Environmental Protection Agency (the “EPA”) published a final rule to implement the Obama Administration’s Clean Power Plan, which is designed to reduce greenhouse gas (“GHG”) emissions from power plants in the United States. In February 2016, the U.S. Supreme Court stayed the final rule, effectively suspending the duty to comply with the rule until certain legal challenges are resolved. Other federal and state initiatives exist, are being considered or may be considered in the future to address GHG emissions through, for example, U.S. treaty commitments, direct regulation, a carbon emissions tax, or cap-and-trade programs. Such initiatives could affect the demand for or cost of natural gas or could increase compliance costs for our operations. The future of the Clean Power Plan and other GHG-related initiatives of the federal government may change under the Trump Administration.

In addition, future federal, state and local environmental legislation and regulations may impose unforeseen burdens and increased costs on Tellurian’s business that could have a material adverse effect on Tellurian’s financial results, such as regulations regarding the transportation of LNG.

A major health and safety incident relating to our business could be costly in terms of potential liabilities and reputational damage.

Tellurian will be subject to extensive federal, state and local health and safety regulations and laws. Health and safety performance is critical to the success of all areas of our business. Any failure in health and safety performance may result in personal harm or injury, penalties fornon-compliance with relevant laws and regulations or litigation, and a failure that results in a significant health and safety incident is likely to be costly in terms of potential liabilities. Such a failure could generate public concern and have a corresponding impact on our reputation and our relationships with relevant regulatory agencies and local communities, which in turn could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

19

Failure to retain and attract key executive officers, key advisors such as Tellurian’s Chairman or other skilled professional and technical employees could have an adverse effect on Tellurian’s business, results of operations, financial condition, liquidity and prospects.

The success of Tellurian’s business relies heavily on its executive officers and key advisors such as its Chairman. Should Tellurian’s executive officers be unable to perform their duties on behalf of Tellurian, or should Tellurian be unable to retain or attract other members of management, Tellurian’s business, results of operations, financial condition, liquidity and prospects could be materially impacted.

Additionally, we are dependent upon an available labor pool of skilled employees. We will compete with other energy companies and other employers to attract and retain qualified personnel with the technical skills and experience required to construct and operate our facilities and to provide our customers with the highest quality service. A shortage in the labor pool of skilled workers or other general inflationary pressures or changes in applicable laws and regulations could make it more difficult for us to attract and retain qualified personnel and could require an increase in the wage and benefits packages that we offer, thereby increasing our operating costs. Any increase in our operating costs could materially and adversely affect our business, financial condition, operating results, liquidity and prospects.

Our lack of diversification could have an adverse effect on our business, financial condition, operating results, cash flow, liquidity and prospects.

Due to our lack of asset and geographic diversification, an adverse development at the Driftwood Project, or in the LNG industry generally, would have a significantly greater impact on our financial condition and operating results than if we maintained a more diverse asset and geographic profile.

MARKET FACTORS

Tellurian expects global gas demand to increase faster than any other fossil fuel, as consumers look for more reliable sources of energy with fewer particulate and carbon emissions. The BP Energy Outlook, released in January 2017, predicts natural gas to grow at a rate of 1.7%, compounded annually, between 2015 and 2035, such that the global gas market during this time will add approximately 127 billion cubic feet per day (“bcf/d”) of demand, growing the market to approximately 464 bcf/d in total. Wood Mackenzie expects that the market could require approximately 32% of the growth in global natural gas demand to be supplied by LNG and forecasts LNG imports to grow to 551 million tonnes per annum (“mtpa”) (72 bcf/d) by 2035, from a base of 244 mtpa (32 bcf/d) in 2015, with existing and under construction facilities producing 300 mtpa (39 bcf/d) by 2035. As a result, the market could require new liquefaction facilities to supply an additional 251 mtpa of LNG to meet incremental demand. Assuming LNG delivered to the market is 85% of installed liquefaction capacity after taking into account planned and unplanned maintenance, operational outages, and fuel used during transport, we believe approximately 296 mtpa of additional liquefaction capacity will need to be constructed to meet this call on LNG, or approximately 21 mtpa per year from 2022 to 2035. The schedule of operations for Driftwood LNG, from 2022 to 2025, will only enable Driftwood LNG to provide a portion of the expected need for liquefaction facilities worldwide, and we expect Driftwood LNG will be a competitive supplier to the growing global natural gas market.

20

REGULATION

LNG terminal and pipeline facilities are subject to extensive federal, state and local statutes, rules, regulations, and laws in the United States that include, but are not limited to, the NGA, the Energy Policy Act of 2005, the Oil Pollution Act, NEPA, the CAA, the CWA, the RCRA, the Pipeline Safety Improvement Act of 2002 (“PSIA”), and the Coastal Zone Management Act (“CZMA”). These statutes cover areas related to the authorization, construction and operation of the facilities including the facilities’ discharges and releases to the air, land and water, and the handling, generation, storage and disposal of hazardous materials and solid and hazardous wastes due to the development, construction and operation of the facilities. These laws are administered and enforced by governmental agencies including FERC, the EPA, the DOE/FE, the U.S. Department of Transportation (“DOT”), and the Louisiana Department of Natural Resources. Additionally, the facilities’ construction and/or operation are subject to consultations and approvals by the Advisory Council on Historic Preservation, U.S. Army Corps of Engineers, U.S. Department of Commerce, National Marine Fisheries Services, U.S. Department of the Interior, U.S. Fish and Wildlife Service, and U.S. Department of Homeland Security.

Failure to comply with applicable federal, state, and local laws, rules, and regulations could result in substantial administrative, civil and/or criminal penalties and/or failure to secure and retain necessary authorizations.

Federal Energy Regulatory Commission

The design, construction and operation of our liquefaction facilities, the export of LNG and the transportation of natural gas are highly regulated activities. In order to site, construct and operate our LNG Facilities, we are required to obtain authorizations from FERC under Section 3 of the NGA as well as several other material governmental and regulatory approvals and permits. The Energy Policy Act of 2005 (the “EPAct”) amended Section 3 of the NGA to establish or clarify FERC’s exclusive authority to approve or deny an application for the siting, construction, expansion or operation of LNG terminals, although except as specifically provided in the EPAct, nothing in the EPAct is intended to affect otherwise applicable law related to any other federal agency’s authorities or responsibilities related to LNG terminals.

Several other material governmental and regulatory approvals and permits will be required throughout the life of our liquefaction project. Throughout the life of our proposed Driftwood Project, we will be subject to regular reporting requirements to FERC, the DOT Pipeline and Hazardous Materials Safety Administration (the “PHMSA”) and other federal and state regulatory agencies regarding the operation and maintenance of our facilities.

In 2002, FERC concluded that it would apply light-handed regulation over the rates, terms and conditions agreed to by parties for LNG terminalling services, such that LNG terminal owners would not be required to provide open-access service atnon-discriminatory rates or maintain a tariff or rate schedule on file with FERC, as distinguished from the requirements applied to FERC-regulated natural gas pipelines. The EPAct codified FERC’s policy, but those provisions expired on January 1, 2015. Nonetheless, we see no indication that FERC intends to modify its longstanding policy of light-handed regulation of LNG terminals.

21

FERC has authority to approve, and if necessary set, “just and reasonable rates” for the transportation or sale of natural gas in interstate commerce. In addition, under the NGA, our proposed pipeline will not be permitted to unduly discriminate or grant undue preference as to rates or the terms and conditions of service to any shipper, including our own marketing affiliate. FERC has the authority to grant certificates allowing construction and operation of facilities used in interstate gas transportation and authorizing the provision of services. Under the NGA, FERC’s jurisdiction generally extends to the transportation of natural gas in interstate commerce, to the sale in interstate commerce of natural gas for resale for ultimate consumption for domestic, commercial, industrial or any other use and to natural gas companies engaged in such transportation or sale. However, FERC’s jurisdiction does not extend to the production, gathering, local distribution or export of natural gas.

In general, FERC’s authority to regulate interstate natural gas pipelines and the services that they provide includes:

| • | rates and charges for natural gas transportation and related services; |

| • | the certification and construction of new facilities; |

| • | the extension and abandonment of services and facilities; |

| • | the maintenance of accounts and records; |

| • | the acquisition and disposition of facilities; |

| • | the initiation and discontinuation of services; and |

| • | various other matters. |

U.S. Department of Energy, Office of Fossil Energy Export License

Exports of natural gas to FTA countries are “deemed to be consistent with the public interest” and authorization to export LNG to FTA countries shall be granted by the DOE/FE without “modification or delay.” FTA countries which import LNG now or will do so by the end of 2017 include Canada, Chile, Colombia, Jordan, Mexico, Singapore, South Korea and the Dominican Republic. Exports of natural gas tonon-FTA countries are considered by the DOE/FE in the context of a comment period whereby interveners are provided the opportunity to assert that such authorization would not be consistent with the public interest.

Pipelines

The PSIA, which is administered by the PHMSA Office of Pipeline Safety, governs the areas of testing, education, training and communication. The PSIA requires pipeline companies to perform extensive integrity tests on natural gas transportation pipelines that exist in high population density areas designated as “high consequence areas.” Pipeline companies are required to perform the integrity tests on a seven-year cycle. The risk ratings are based on numerous factors, including the population density in the geographic regions served by a particular pipeline, as well as the age and condition of the pipeline and its protective coating. Testing consists of hydrostatic testing, internal electronic testing, or direct assessment of the piping. In addition to the pipeline integrity tests, pipeline companies must implement a qualification program to make certain that employees are properly trained. Pipeline operators also must develop integrity management programs for gas transportation pipelines, which requires pipeline operators to perform ongoing assessments of pipeline integrity; identify and characterize applicable threats to pipeline segments that could impact a high consequence area; improve data collection, integration and analysis; repair and remediate the pipeline, as necessary; and implement preventive and mitigation actions.

22

In 2009, the PHMSA issued a final rule (known as “Control Room Management/Human Factors Rule”) that became effective in 2010 requiring pipeline operators to write and institute certain control room procedures that address human factors and fatigue management.

In March 2015, the PHMSA issued a final rule amending the pipeline safety regulations to update and clarify certain regulatory requirements, including who can perform post-construction inspections on transmission pipelines. In September 2015, the PHMSA issued a rule indefinitely delaying the effective date for the amendment to the regulation regarding post-construction inspections.

In May 2015, the PHMSA issued a notice of proposed rulemaking proposing to amend gas pipeline safety regulations regarding plastic piping systems used in gas services, including the installation of plastic pipe used for gas transmission lines.

In July 2015, the PHMSA issued a notice of proposed rulemaking proposing to add a specific timeframe for operators’ notification of accidents or incidents, as well as amending the safety regulations regarding operator qualification requirements by expanding the requirements to include new construction and certain previously excluded operation and maintenance tasks, requiring a program effectiveness review and adding new recordkeeping requirements. In January 2017, the PHMSA issued a final rule adding a specific time frame for operators’ notification of accidents or incidents but delayed final action on the proposed operator qualification requirements until a later date. The final rule will be effective March 24, 2017.

In April 2016, the PHMSA issued a notice of proposed rulemaking addressing changes to the regulations governing the safety of gas transmission pipelines. Specifically, the PHMSA is considering certain integrity management requirements for “moderate consequence areas,” requiring an integrity verification process for specific categories of pipelines, and mandating more explicit requirements for the integration of data from integrity assessments to an operator’s compliance procedures. The PHMSA is also considering whether to revise requirements for corrosion control issues and to expand the definition of regulated gathering lines. These notices of proposed rulemaking are still pending at the PHMSA.

Natural Gas Pipeline Safety Act of 1968 (“NGPSA”)

Louisiana administers federal pipeline safety standards under the NGPSA, which requires certain pipelines to comply with safety standards in constructing and operating the pipelines and subjects the pipelines to regular inspections. Failure to comply with the NGPSA may result in the imposition of administrative, civil and criminal sanctions.

Other Governmental Permits, Approvals and Authorizations

The construction and operation of the Driftwood Project will be subject to additional federal permits, orders, approvals and consultations required by other federal agencies, including the DOT, Advisory Council on Historic Preservation, U.S. Army Corps of Engineers (“USACE”), U.S. Department of Commerce, National Marine Fisheries Services, U.S. Department of the Interior, U.S. Fish and Wildlife Service, the EPA and U.S. Department of Homeland Security.

Three significant permits that may apply to our Driftwood Project are the USACE Section 404 of the Clean Water Act/Section 10 of the Rivers and Harbors Act Permit, the Clean Air Act Title V Operating Permit and the Prevention of Significant Deterioration Permit, of which the latter two permits are issued by the Louisiana Department of Environmental Quality (“LDEQ”). Our Driftwood Project will also have to comply with the requirements of NEPA, including preparation of an environmental impact assessment.

23

Environmental Regulation

Our proposed Driftwood Project will be subject to various federal, state and local laws and regulations relating to the protection of the environment and natural resources, and the handling, generation, storage and disposal of hazardous materials and solid and hazardous wastes. These environmental laws and regulations, which can restrict or prohibit impacts to the environment or the types, quantities and concentration of substances that can be released into the environment, will require significant expenditures for compliance, can affect the cost and output of operations, may impose substantial administrative, civil and/or criminal penalties for non-compliance and can result in substantial liabilities.

Clean Air Act and Greenhouse Gas Requirements

The CAA and comparable state laws and regulations regulate and restrict the emission of air pollutants from many sources and also impose various monitoring and reporting requirements, among other requirements. Our proposed Driftwood Project will be subject to the federal CAA and comparable state and local laws. We may be required to incur capital expenditures for air pollution control equipment in connection with maintaining or obtaining permits and approvals pursuant to the CAA and comparable state laws and regulations.

In 2009, the EPA promulgated and finalized the Mandatory Greenhouse Gas Reporting Rule for multiple sections of the economy. This rule requires mandatory reporting of GHG emissions from stationary sources, including fuel combustion sources. In 2010, the EPA expanded the rule to include reporting obligations for LNG terminals. In addition, the EPA has defined GHG emissions thresholds that would subject GHG emissions from new and modified industrial sources to regulation if the source is subject to Prevention of Significant Development (PSD) permit requirements due to its emissions ofnon-GHG criteria pollutants. In June 2013, the Obama Administration issued its Climate Action Plan, which announced a wide-ranging set of executive actions to be implemented to cut carbon emissions in the United States. The Obama Administration also issued regulations limiting GHG emissions from new and existing fossil-fuel fired electrical generating stations (the latter is known as the Clean Power Plan). These rules are currently stayed subject to a pending court challenge and the timing, extent and impact of these initiatives remain uncertain. In addition, from time to time, Congress has considered proposed legislation directed at reducing GHG emissions and many states have already taken regulatory action to monitor and/or reduce emissions of GHGs, primarily through the development of GHG emission inventories or regional GHG cap and trade programs. It is not possible at this time to predict how future regulations or legislation may address GHG emissions and impact our business. However, future regulations and laws could result in increased compliance costs or additional operating restrictions and could have a material adverse effect on our business, financial position, operating results and cash flows.

Coastal Zone Management Act

The siting and construction of our Driftwood Project within the coastal zone may be subject to the requirements of the CZMA. The CZMA is administered by the states (in Louisiana, by the Department of Natural Resources). This program is implemented to ensure that impacts to coastal areas are consistent with the intent of the CZMA to manage the coastal areas.

24

Clean Water Act

Our proposed Driftwood Project will be subject to the federal CWA and analogous state and local laws. The CWA and analogous state and local laws regulate discharges of pollutants to water of the United States or waters of the state, including discharges of wastewater and storm water runoff and discharges of dredged or fill material into waters of the United States, as well as spill prevention, control and countermeasure requirements. Permits must be obtained prior to discharging pollutants into state and federal waters. The CWA is administered by the EPA, the USACE and by the states (in Louisiana, by the LDEQ). Additionally, the siting and construction of our Driftwood Project may potentially impact jurisdictional wetlands, which would require appropriate federal, state and/or local permits and approval prior to impacting such wetlands. The authorizing agency may impose significant direct or indirect mitigation costs to compensate for regulated impacts to wetlands. The approval timeframe may also be extended and could potentially affect project schedules.