NASDAQ: MPET April 2012 Building Shareholder Returns by Maximizing the Potential of Currently Held Assets

STRICTLY PRIVATE & CONFIDENTIAL 1 Forward Looking Statements Our disclosure and analysis in this report contain forward-looking information that involves risks and uncertainties. Our forward-looking statements express our current expectations or forecasts of possible future results or events, including projections of future performance, statements of management’s plans and objectives, future contracts, and forecasts of trends and other matters. Forward-looking statements speak only as of the date of this report, and we undertake no obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur. You can identify these statements by the fact that they do not relate strictly to historic or current facts and often use words such as “anticipate”, “estimate”, “expect”, “believe”, “will likely result”, “outlook”, “project” and other words and expressions of similar meaning. No assurance can be given that the results in any forward-looking statements will be achieved and actual results could be affected by one or more factors, which could cause them to differ materially. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Among these risks and uncertainties are: (1) the ability of Magellan and Santos to complete and implement the terms of the asset swap in the Amadeus Basis and the related gas sales agreement; (2) whether the Company can successfully achieve cost savings while delivering revenue growth; (3) whether the workovers, recompletions and other drilling at Poplar will result in increased production and cash generation and/or will otherwise successfully assist in the development of Poplar; and (4) the production levels from the properties in which Magellan, through its subsidiaries, have interests, the recoverable reserves at those properties and the prices that will ultimately be applied to the sale of such reserves. For a more complete discussion of the risk factors that may apply to any forward looking statements you are directed to the discussion presented in Item 1A of the Company’s Form 10-K for the year ended June 30, 2011. Any forward-looking information provided in this report should be considered with these factors in mind. Magellan assumes no obligation to update any forward-looking statements contained in this report, whether as a result of new information, future events or otherwise. Non-GAAP Measures Disclosure Management believes that EBITDAX, the non-GAAP (Generally Accepted Accounting Principles) measure used in this presentation provides investors with important perspectives into the company’s ongoing business performance. The company does not intend for the information to be considered in isolation or as a substitute for the related GAAP measures. Other companies may define the measure differently. We define EBITDAX as follows - earnings before the deduction of interest expenses, taxes, depreciation and amortization, exploration, non-cash compensation, and foreign exchange gain/expense.

STRICTLY PRIVATE & CONFIDENTIAL 2 …executing a turnaround strategy focused on maximizing the value of existing oil and gas assets in the United States, Australia, and the United Kingdom Magellan Is…

STRICTLY PRIVATE & CONFIDENTIAL 3 Pro forma cash and equivalents of approximately $45 million More than 10 MMBoe net proved reserves Several near-term opportunities to significantly increase reserves 22,000 net unitized acres covering Poplar Dome, the largest geologic structure in the western Williston Basin, Montana Rationalization of Australian natural gas assets generates long-term stable revenue with potential upside Long-term potential from onshore UK and off-shore Australia projects Lower fixed operating costs in FY131; most capex discretionary Experienced management team Investment Considerations 1. June 30 fiscal year end.

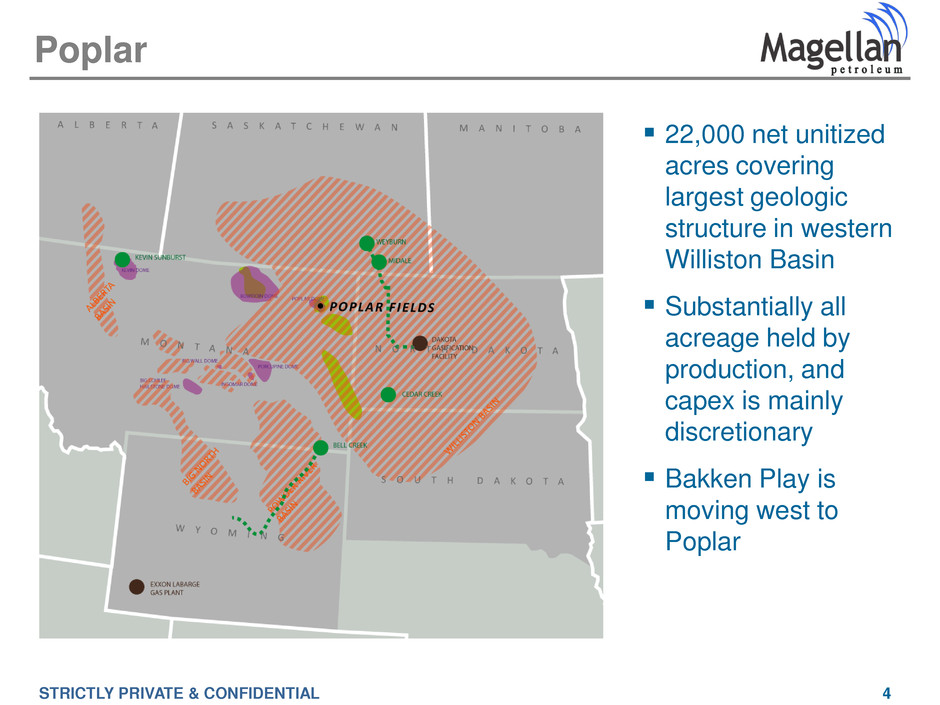

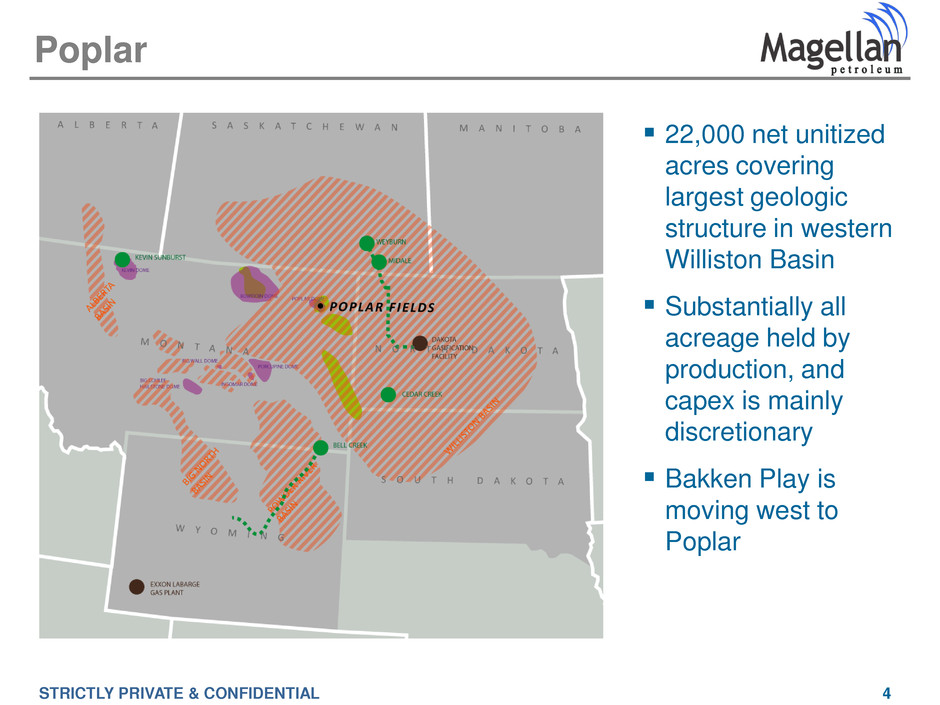

STRICTLY PRIVATE & CONFIDENTIAL 4 22,000 net unitized acres covering largest geologic structure in western Williston Basin Substantially all acreage held by production, and capex is mainly discretionary Bakken Play is moving west to Poplar Poplar

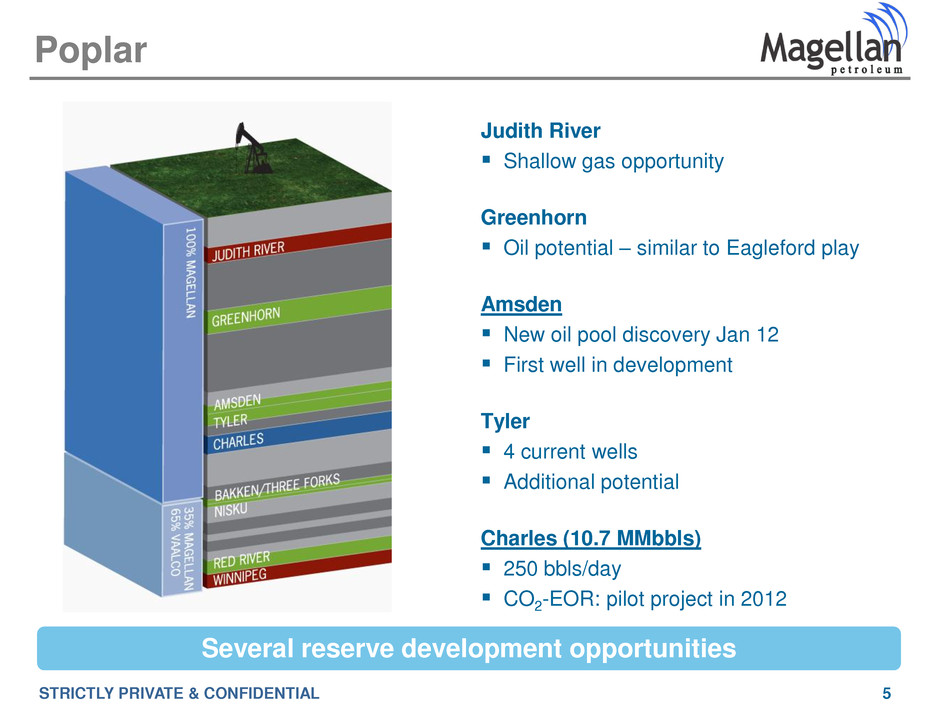

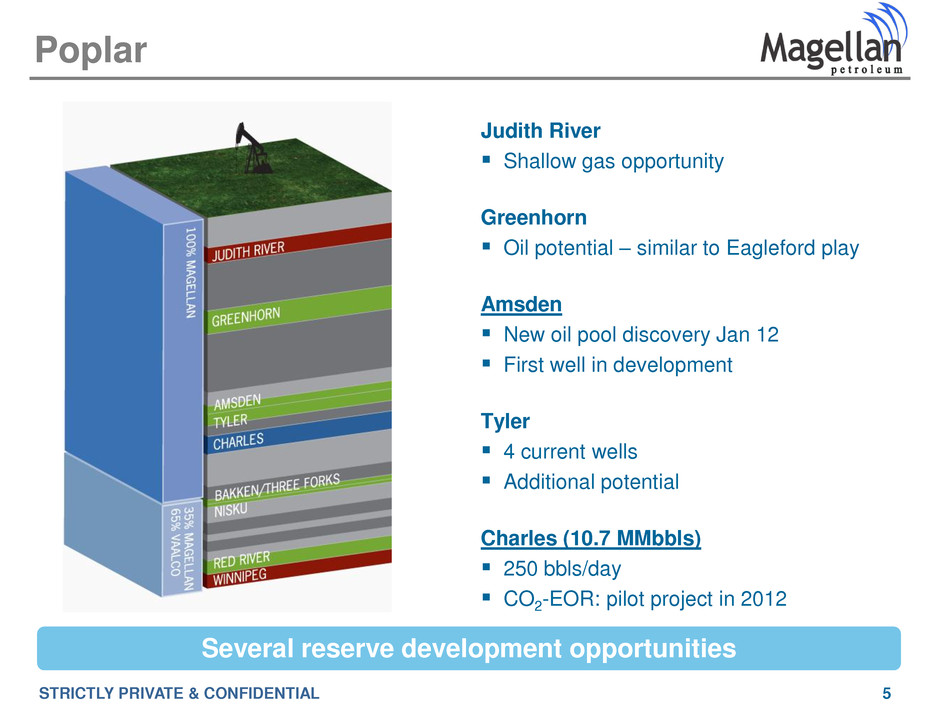

STRICTLY PRIVATE & CONFIDENTIAL 5 Judith River Shallow gas opportunity Greenhorn Oil potential – similar to Eagleford play Amsden New oil pool discovery Jan 12 First well in development Tyler 4 current wells Additional potential Charles (10.7 MMbbls) 250 bbls/day CO2-EOR: pilot project in 2012 Poplar Several reserve development opportunities

STRICTLY PRIVATE & CONFIDENTIAL 6 Evidence points to Charles formation being a prime candidate for CO2 enhanced oil recovery program Offers the potential to increase reserves from current 10 MMbbls to 40 to 60 MMbbls Initial miscibility tests confirm oil from Charles formation has requisite miscibility for successful CO2 enhancement Project assessment milestones: – Laboratory tests ongoing until June 2012 – Physical injectivity test in May 2012 – 5 well pilot project to start in FY13 Poplar – CO2 Enhanced Oil Recovery

STRICTLY PRIVATE & CONFIDENTIAL 7 VAALCO farm-out in Sep 2011 to explore and develop deeper formations at Poplar – 100% carry for 3 wells in 2012 – 35% interest in all wells to Magellan Objective and rationale: – Prove up reserves and value of deeper formations of Poplar, with limited capital exposure through the exploration phase – Remain focused on Charles and shallower formations – Benefit from VAALCO’s horizontal well drilling expertise Timing: – First well drilled in Q1 and completion operations will be completed by June - preliminary results encouraging – Second well to be commenced as a horizontal well to test Bakken/Three Forks in July 2012 Poplar – VAALCO Production Program

STRICTLY PRIVATE & CONFIDENTIAL 8 Transaction signed in Sep 2011; currently pending completion Significant milestone of Magellan’s turnaround strategy Allows Magellan to materially lower Australian operating costs Continued exposure to favorable Australian gas prices Main transaction terms: – Gain 100% ownership of Palm Valley and Dingo, two natural gas fields with potential for approximately 50 Bcf of reserves – Sell interest in Mereenie oil and gas field – Receive A$25 million in proceeds plus certain post closing adjustments – Enter into 15 year sale agreement for Palm Valley’s total reserves – Retain opportunity to earn up to A$17.5 million in bonus payments from Mereenie Australian Asset Swap

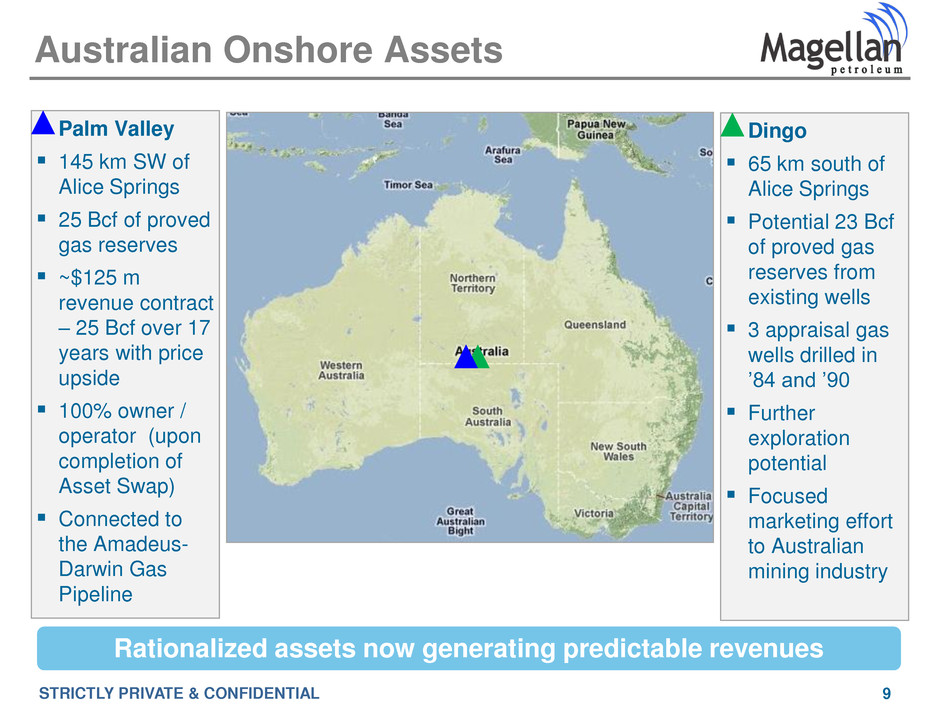

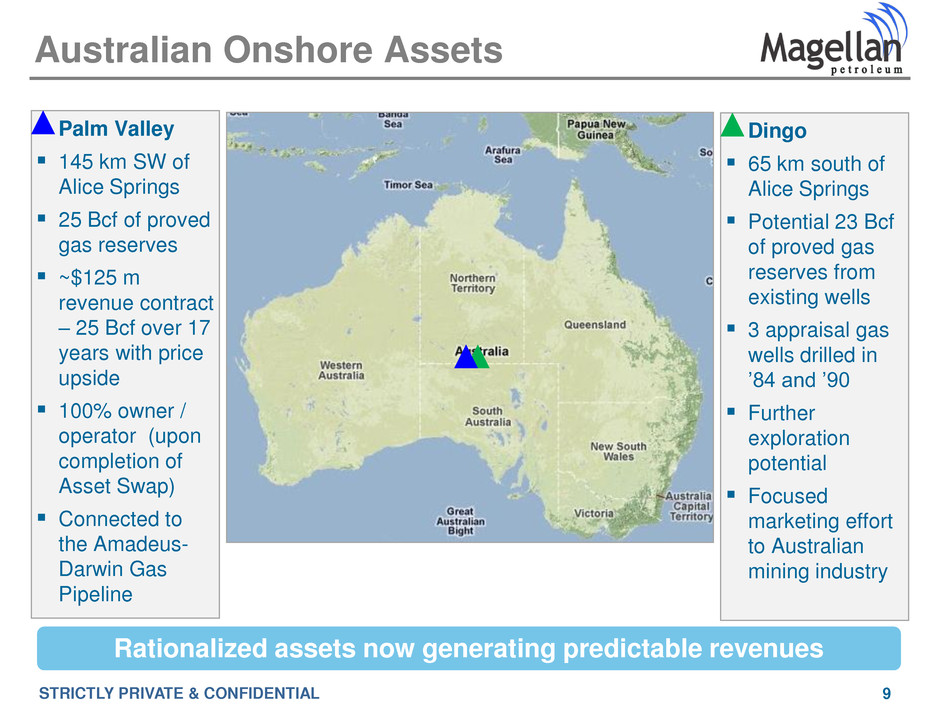

STRICTLY PRIVATE & CONFIDENTIAL 9 Palm Valley 145 km SW of Alice Springs 25 Bcf of proved gas reserves ~$125 m revenue contract – 25 Bcf over 17 years with price upside 100% owner / operator (upon completion of Asset Swap) Connected to the Amadeus- Darwin Gas Pipeline Australian Onshore Assets Rationalized assets now generating predictable revenues Dingo 65 km south of Alice Springs Potential 23 Bcf of proved gas reserves from existing wells 3 appraisal gas wells drilled in ’84 and ’90 Further exploration potential Focused marketing effort to Australian mining industry

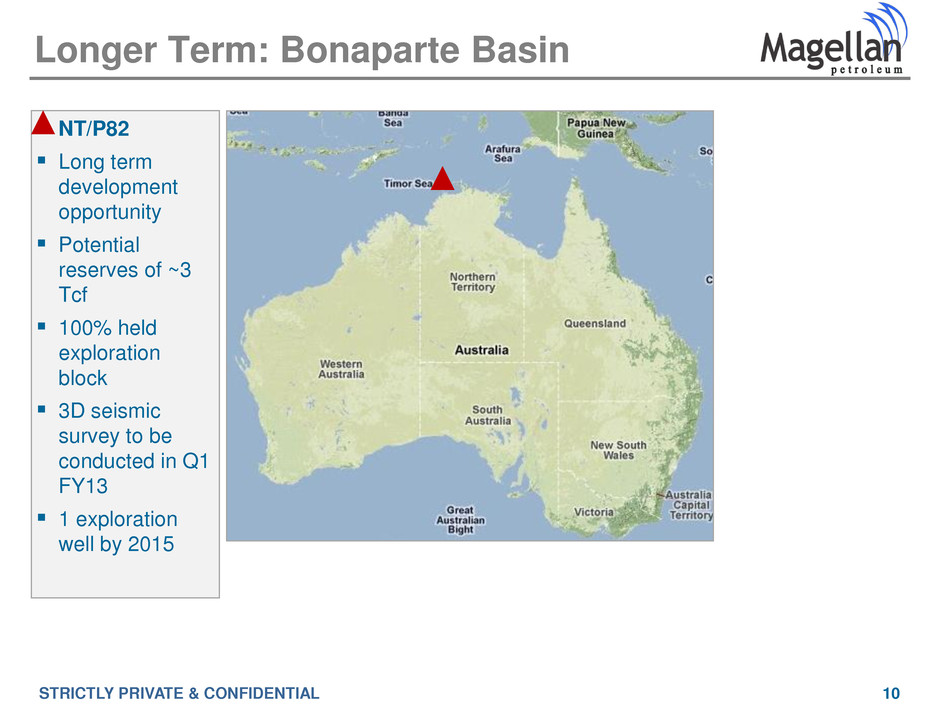

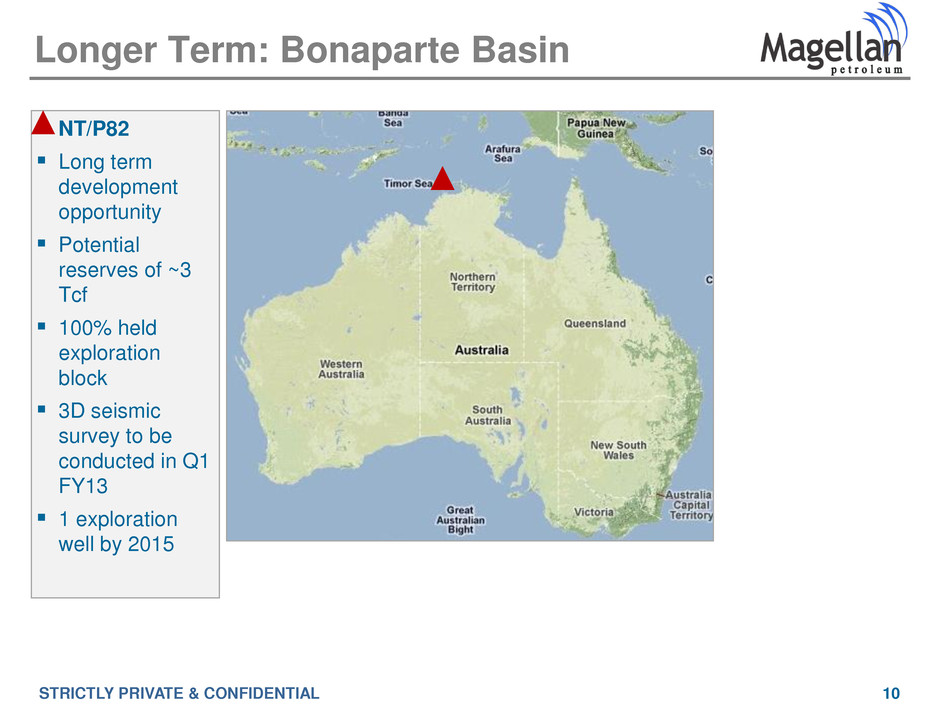

STRICTLY PRIVATE & CONFIDENTIAL 10 Longer Term: Bonaparte Basin NT/P82 Long term development opportunity Potential reserves of ~3 Tcf 100% held exploration block 3D seismic survey to be conducted in Q1 FY13 1 exploration well by 2015

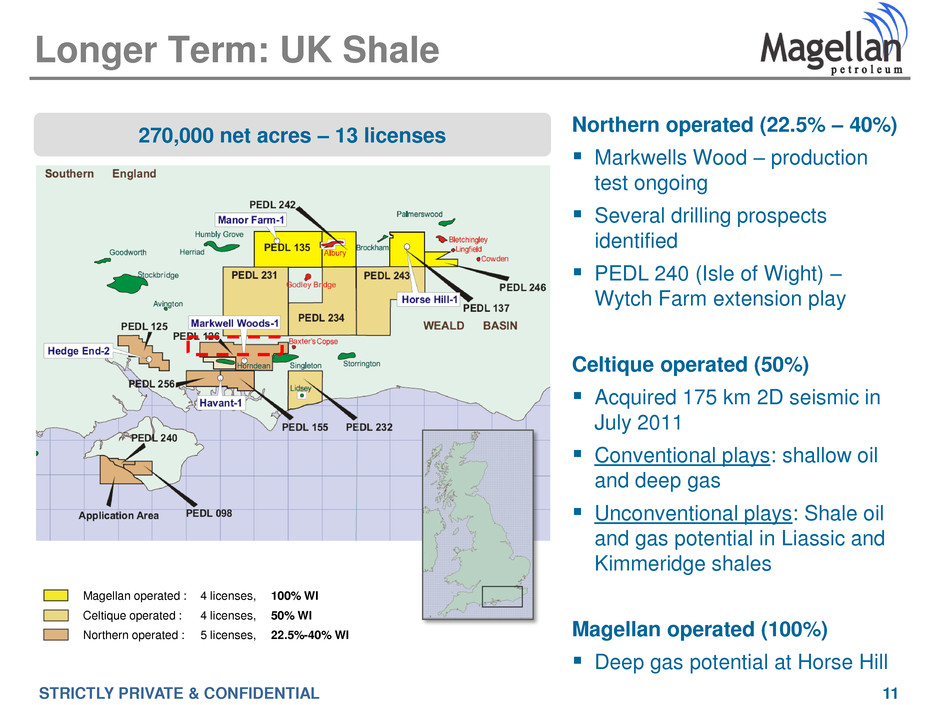

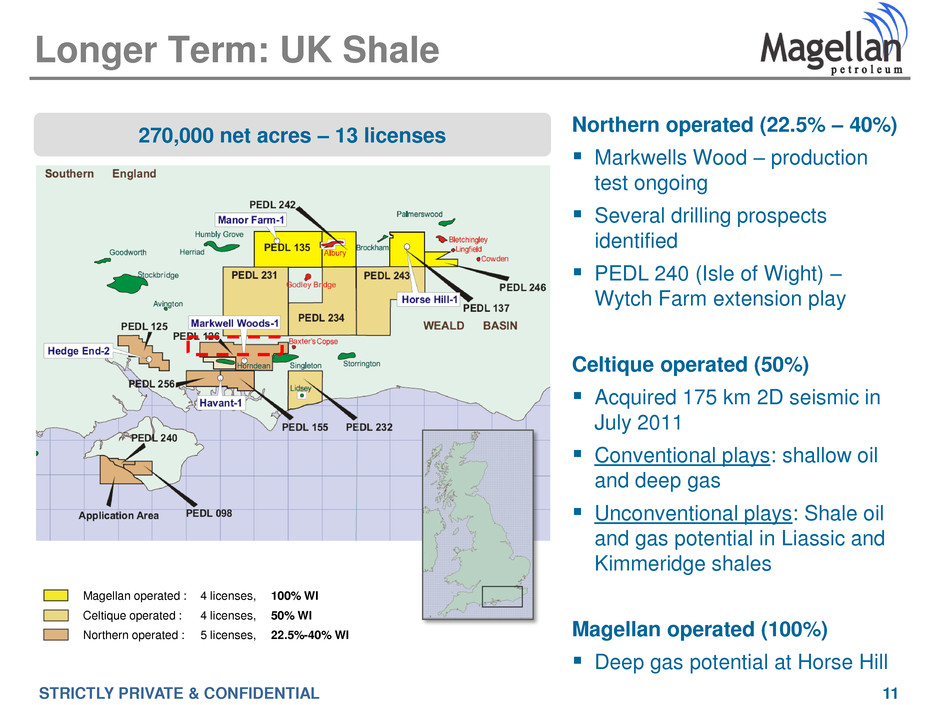

STRICTLY PRIVATE & CONFIDENTIAL 11 Northern operated (22.5% – 40%) Markwells Wood – production test ongoing Several drilling prospects identified PEDL 240 (Isle of Wight) – Wytch Farm extension play Celtique operated (50%) Acquired 175 km 2D seismic in July 2011 Conventional plays: shallow oil and deep gas Unconventional plays: Shale oil and gas potential in Liassic and Kimmeridge shales Magellan operated (100%) Deep gas potential at Horse Hill 270,000 net acres – 13 licenses Longer Term: UK Shale Magellan operated : 4 licenses, 100% WI Celtique operated : 4 licenses, 50% WI Northern operated : 5 licenses, 22.5%-40% WI

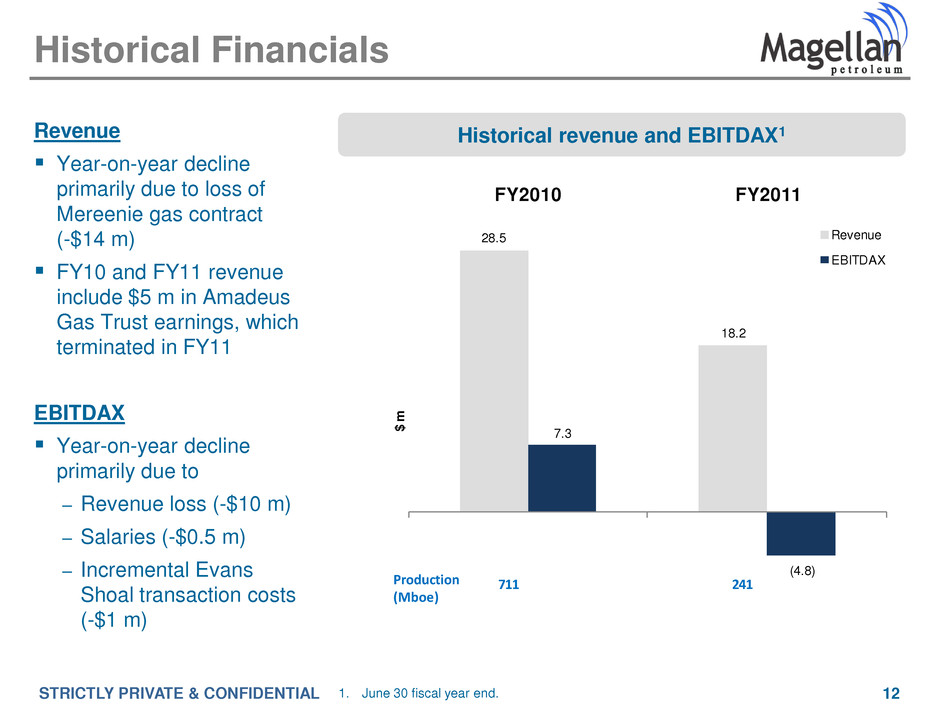

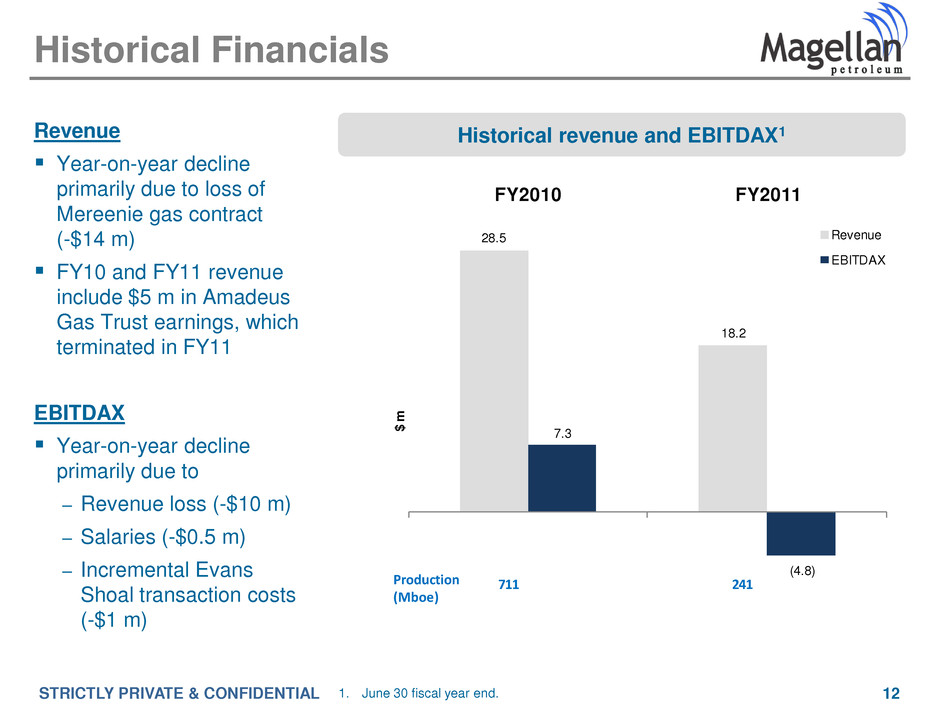

STRICTLY PRIVATE & CONFIDENTIAL 12 Revenue Year-on-year decline primarily due to loss of Mereenie gas contract (-$14 m) FY10 and FY11 revenue include $5 m in Amadeus Gas Trust earnings, which terminated in FY11 EBITDAX Year-on-year decline primarily due to – Revenue loss (-$10 m) – Salaries (-$0.5 m) – Incremental Evans Shoal transaction costs (-$1 m) Historical revenue and EBITDAX1 Historical Financials 28.5 18.2 7.3 (4.8) FY2010 FY2011 $ m Revenue EBITDAX Production (Mboe) 711 241 1. June 30 fiscal year end.

STRICTLY PRIVATE & CONFIDENTIAL 13 Oil production sales volumes 58 Mbbls Natural gas production sales volumes 357 MMcf Consolidated sales volumes 118 MBoe Revenue $6.9 million EBITDAX $(4.7) million Cash and equivalents (Dec. 31) $21.4M1 FY12 First Half Financial Highlights 1. Prior to A$25 million net proceeds from Australian asset swap.

STRICTLY PRIVATE & CONFIDENTIAL 14 12-Month revenue enhancement opportunities Replacement gas contract for Palm Valley Increased Charles production Amsden potential production VAALCO potential production 12-Month operating cost savings Lower Palm Valley operating costs Eliminated Mereenie operating costs Reduced corporate consulting expenses Australian stock exchange listing expenses Poised for Improved Cash Flow

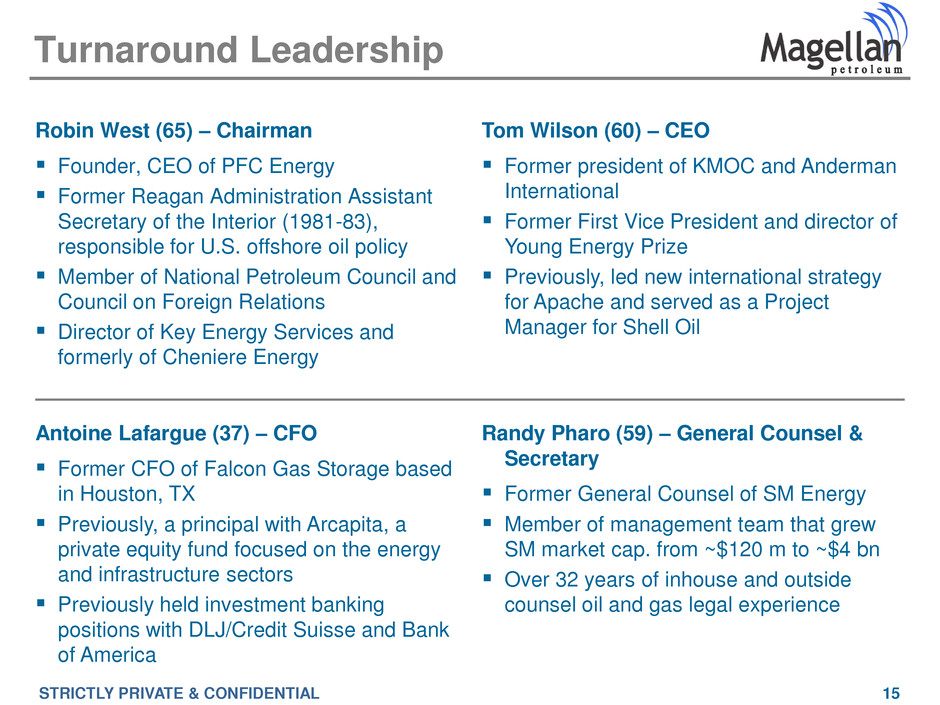

STRICTLY PRIVATE & CONFIDENTIAL 15 Robin West (65) – Chairman Founder, CEO of PFC Energy Former Reagan Administration Assistant Secretary of the Interior (1981-83), responsible for U.S. offshore oil policy Member of National Petroleum Council and Council on Foreign Relations Director of Key Energy Services and formerly of Cheniere Energy Turnaround Leadership Tom Wilson (60) – CEO Former president of KMOC and Anderman International Former First Vice President and director of Young Energy Prize Previously, led new international strategy for Apache and served as a Project Manager for Shell Oil Randy Pharo (59) – General Counsel & Secretary Former General Counsel of SM Energy Member of management team that grew SM market cap. from ~$120 m to ~$4 bn Over 32 years of inhouse and outside counsel oil and gas legal experience Antoine Lafargue (37) – CFO Former CFO of Falcon Gas Storage based in Houston, TX Previously, a principal with Arcapita, a private equity fund focused on the energy and infrastructure sectors Previously held investment banking positions with DLJ/Credit Suisse and Bank of America

STRICTLY PRIVATE & CONFIDENTIAL 16 Pro forma cash and equivalents of approximately $45 million More than 10 MMBoe net proved reserves Several near-term opportunities to significantly increase reserves 22,000 net unitized acres covering Poplar Dome, the largest geologic structure in the western Williston Basin, Montana Rationalization of Australian natural gas assets generates long-term stable revenue with potential upside Long-term potential from onshore UK and off-shore Australia projects Lower fixed operating costs in FY131; most capex discretionary Experienced management team Investment Considerations 1. June 30 fiscal year end.