February11, 2016 New York Hosted by Janney Montgomery Scott LLP Ampco-Pittsburgh Corporation Exhibit 99.1

The Private Securities Litigation Reform Act of 1995 (the “Act”) provides a safe harbor for forward-looking statements made by or on our behalf. This information may contain forward-looking statements that reflect our current views with respect to future events and financial performance. All statements in this document other than statements of historical fact are statements that are, or could be, deemed forward-looking statements within the meaning of the Act. In this document, statements regarding future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels and plans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “intend,” “believe,” “expect,” “anticipate,” “estimate,” “project,” “forecast” and other terms of similar meaning that indicate future events and trends are also generally intended to identify forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made, are not guarantees of future performance or expectations, and involve risks and uncertainties. For Ampco-Pittsburgh, these risks and uncertainties include, but are not limited to, those described under Item 1A, Risk Factors, of Ampco-Pittsburgh’s Annual Report on Form 10-K. In addition, there may be events in the future that we are not able to predict accurately or control which may cause actual results to differ materially from expectations expressed or implied by forward-looking statements. Except as required by applicable law, we assume no obligation, and disclaim any obligation, to update forward-looking statements whether as a result of new information, events or otherwise.

Agenda Introduction to Ampco-Pittsburgh Forged and Cast Engineered Products (Union Electric Steel) Air and Liquid Processing Strategies to improve Ampco-Pittsburgh’s Financial Performance Åkers Acquisition

Ampco-Pittsburgh Corporation Today Ampco-Pittsburgh Corporation manufactures and sells highly engineered, high performance specialty metal products and customized equipment utilized by industry throughout the world.

Ampco-Pittsburgh Today (cont’d) Headquarters – Carnegie, PA, U.S. Traded on NYSE. Symbol -- AP 2014 Revenue -- $272.8 M 1,000 employees Forged and Cast Engineered Products (66% of sales) A world leader in manufacture of steel rolls 90+ years of experience Four manufacturing facilities in U.S. (pre-Åkers acquisition) Two roll manufacturing plants in China (joint ventures) One roll manufacturing plant in UK In 2015, acquired Alloys Unlimited and Processing (Ohio) Supplier of specialty tool, alloy, and carbon steel round bar Forged and cast product distribution center for quick turnaround requests Air and Liquid Products (34% of sales) Custom-designed, specialty heat exchangers, air handling systems, and centrifugal pumps Three U.S. manufacturing facilities in Virginia (2 plants) and New York

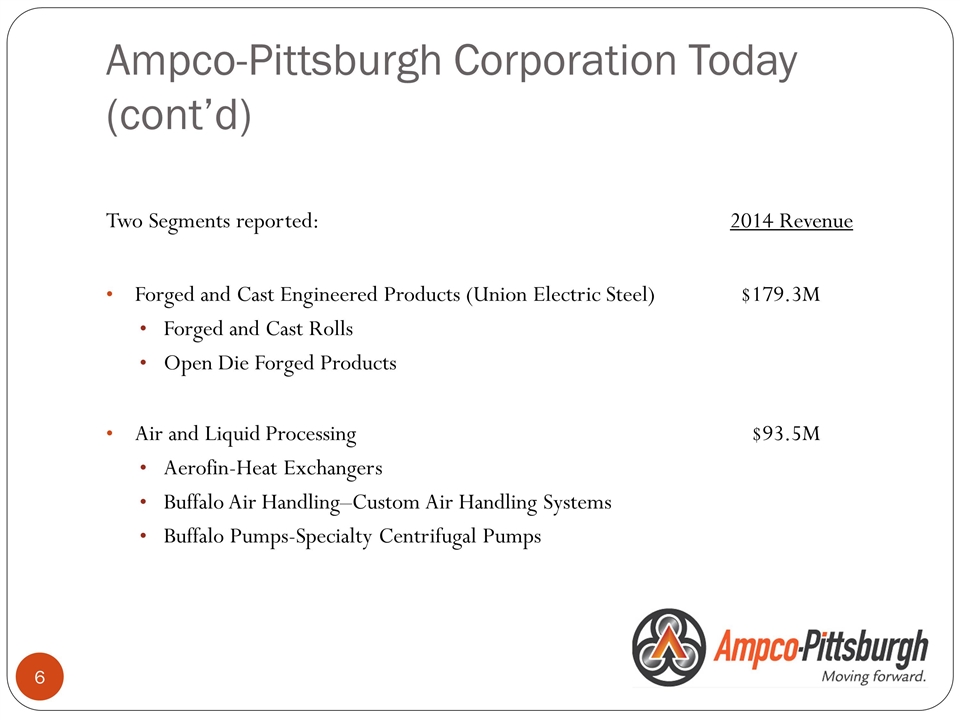

Ampco-Pittsburgh Corporation Today (cont’d) Two Segments reported: 2014 Revenue Forged and Cast Engineered Products (Union Electric Steel) $179.3M Forged and Cast Rolls Open Die Forged Products Air and Liquid Processing $93.5M Aerofin-Heat Exchangers Buffalo Air Handling–Custom Air Handling Systems Buffalo Pumps-Specialty Centrifugal Pumps

Union Electric Steel (UES)

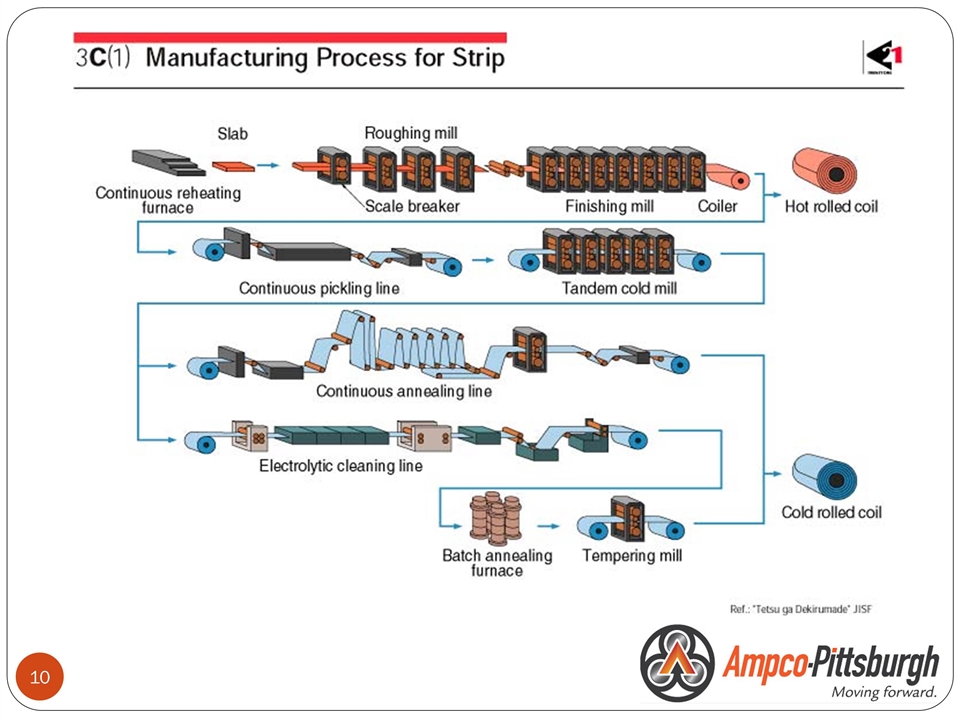

Roll Products

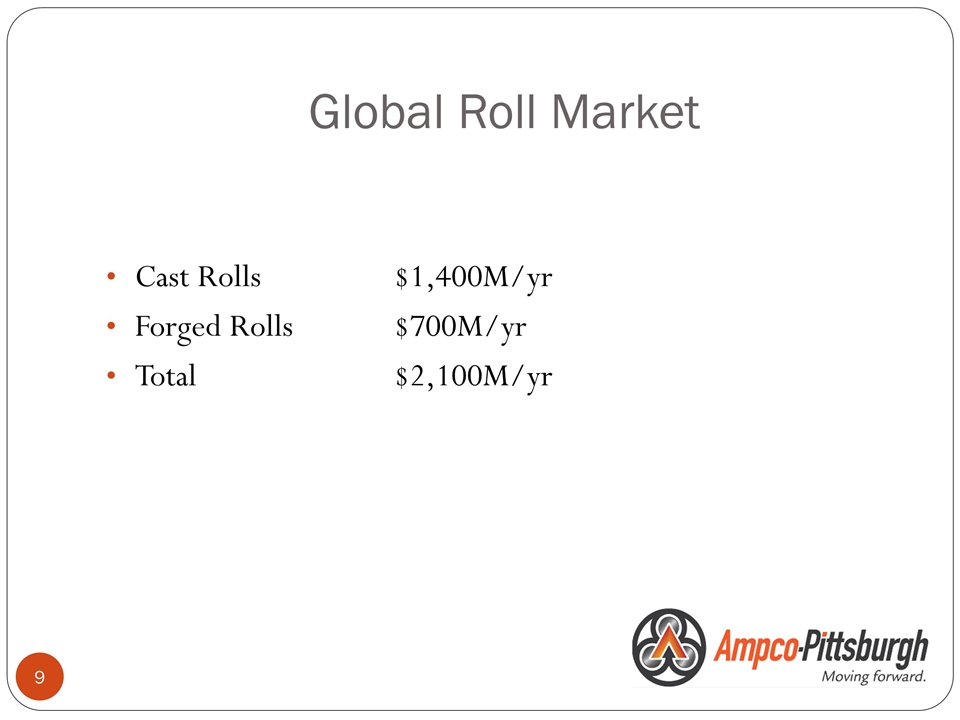

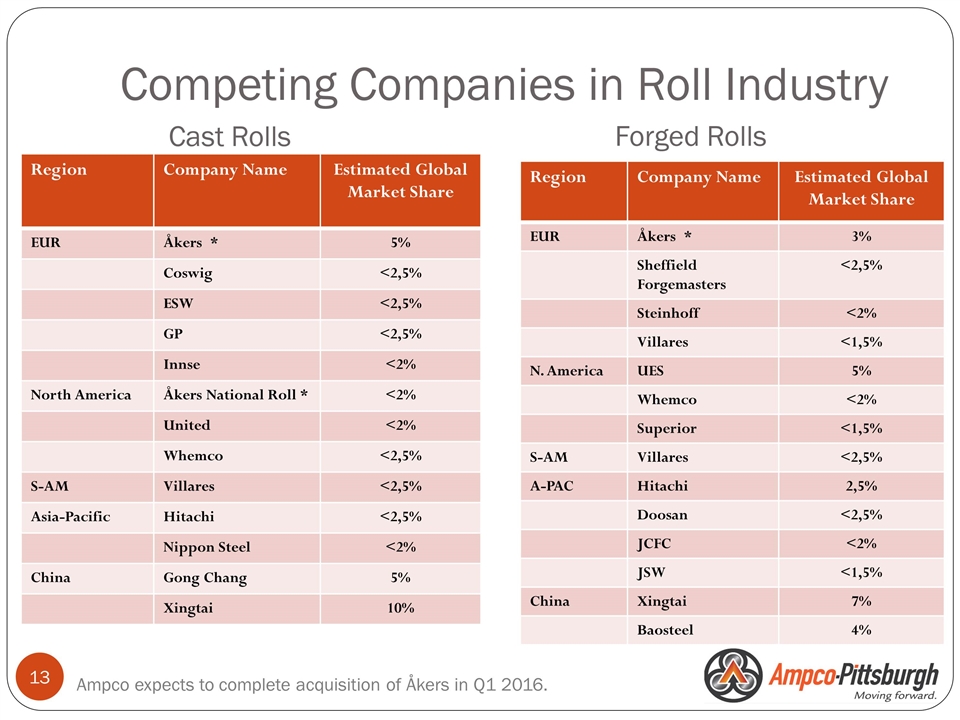

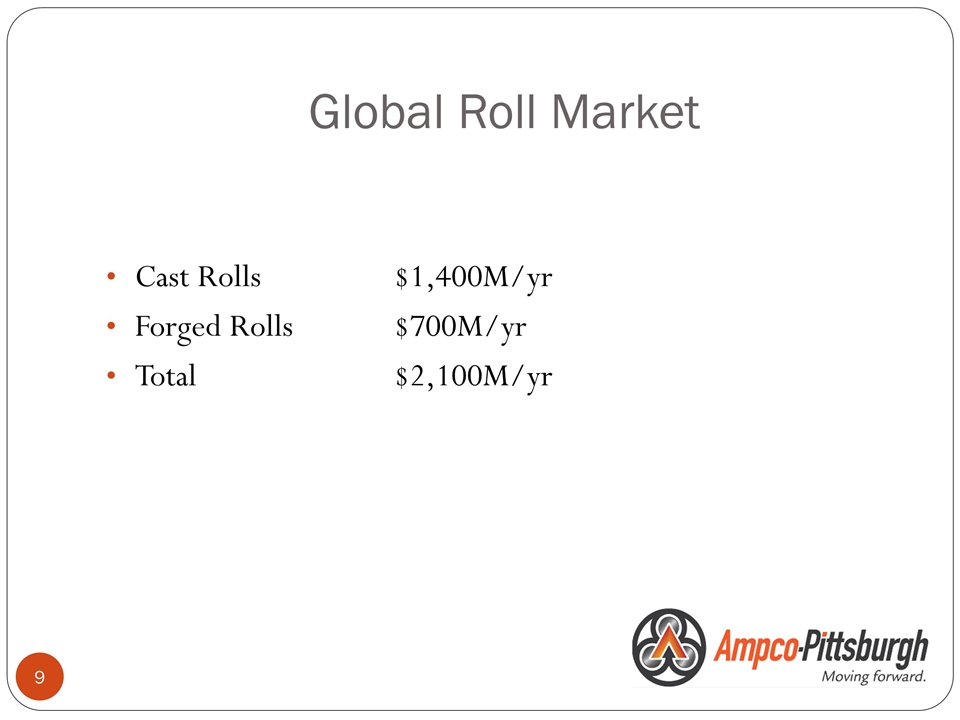

Global Roll Market Cast Rolls$1,400M/yr Forged Rolls$700M/yr Total$2,100M/yr

Rolls Staged in Hot Strip Mill

UES Locations Manufacturing Sales Office Current Sales and Manufacturing Footprint

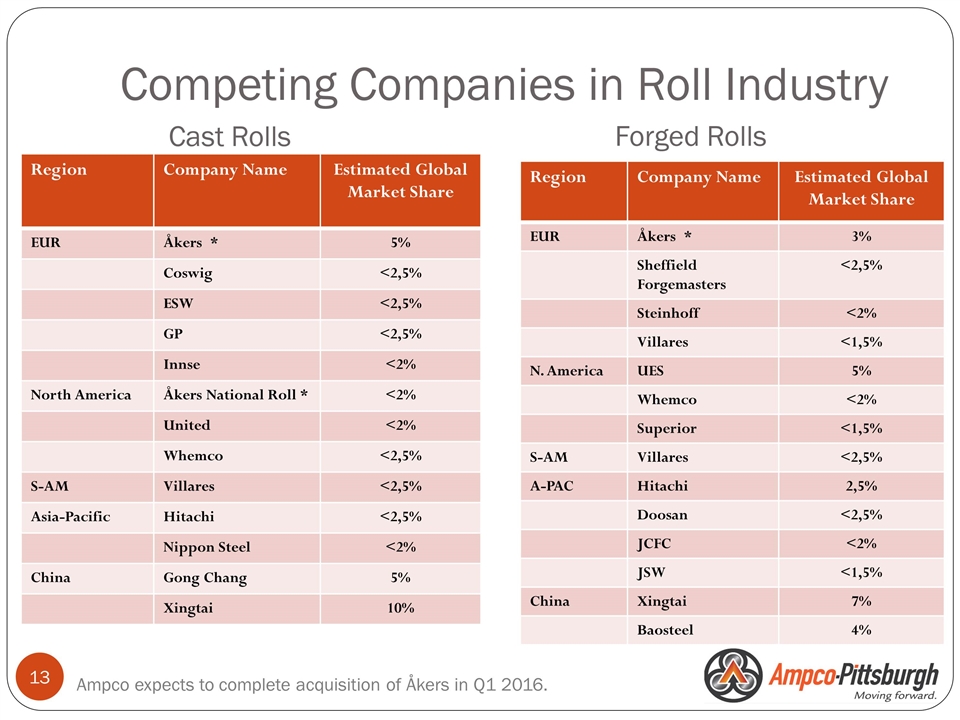

Region Company Name Estimated Global Market Share EUR Åkers * 5% Coswig <2,5% ESW <2,5% GP <2,5% Innse <2% North America Åkers National Roll * <2% United <2% Whemco <2,5% S-AM Villares <2,5% Asia-Pacific Hitachi <2,5% Nippon Steel <2% China Gong Chang 5% Xingtai 10% Region Company Name Estimated Global Market Share EUR Åkers * 3% Sheffield Forgemasters <2,5% Steinhoff <2% Villares <1,5% N. America UES 5% Whemco <2% Superior <1,5% S-AM Villares <2,5% A-PAC Hitachi 2,5% Doosan <2,5% JCFC <2% JSW <1,5% China Xingtai 7% Baosteel 4% Competing Companies in Roll Industry Cast Rolls Forged Rolls Ampco expects to complete acquisition of Åkers in Q1 2016.

Air and Liquid Processing Segment (A&LP)

Aerofin

Aerofin Products Copper spiral finned nuclear stamped coil Split-Fit® Steam heating coils

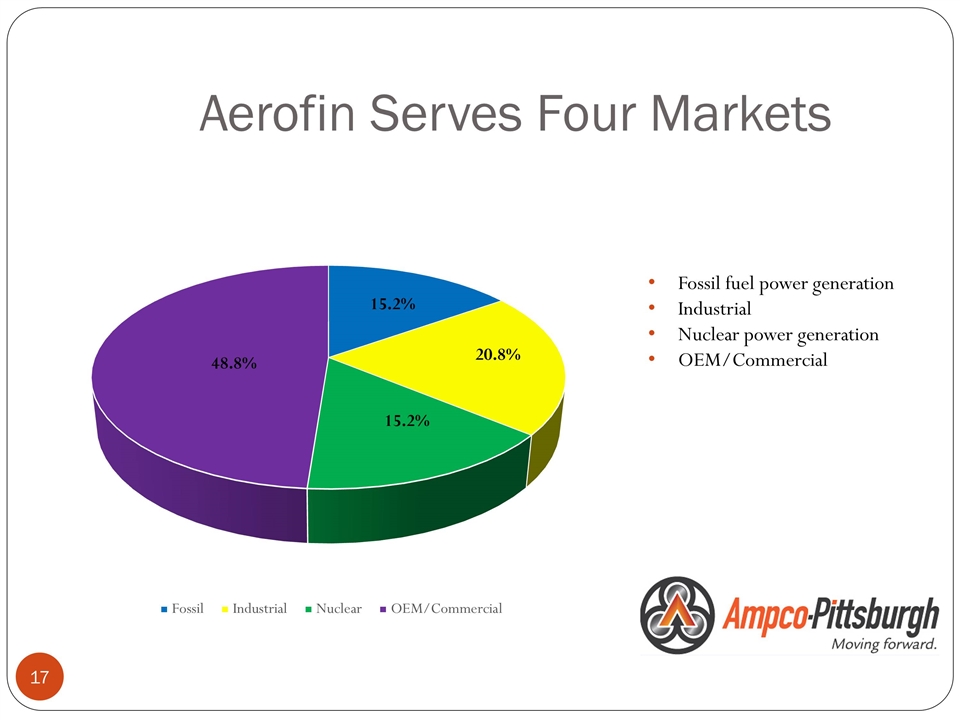

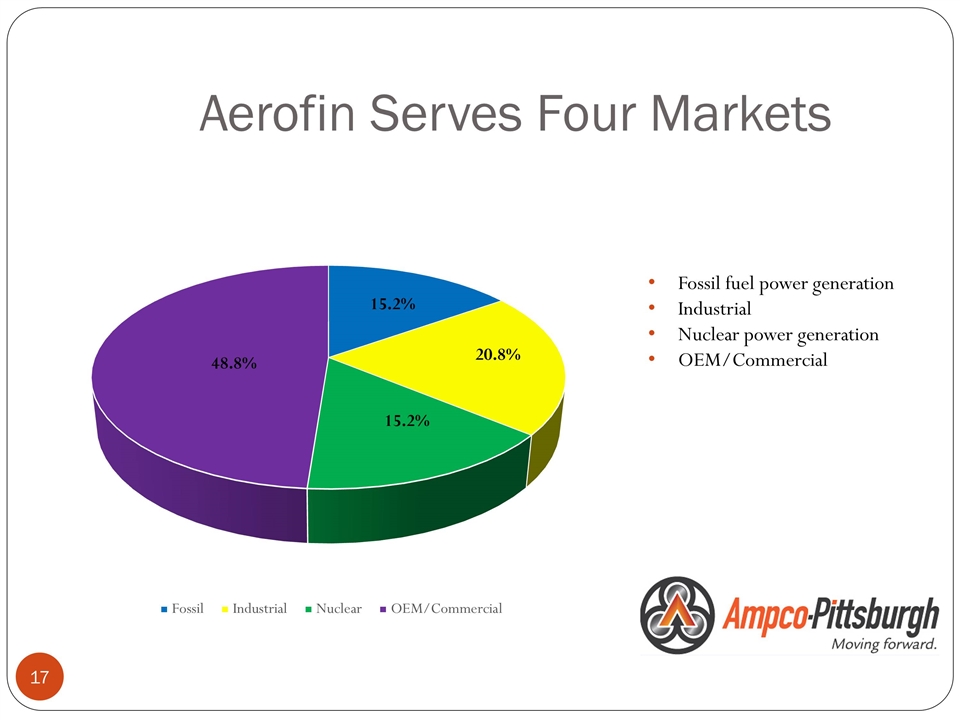

Aerofin Serves Four Markets Fossil fuel power generation Industrial Nuclear power generation OEM/Commercial

Buffalo Air Handling

Buffalo Air Handling Custom Air Handling Systems Rooftop unit at a pharmaceutical manufacturing facility Triple stacked units being installed at a research facility in Illinois Air handling unit in our manufacturing plant for a medical center in New York

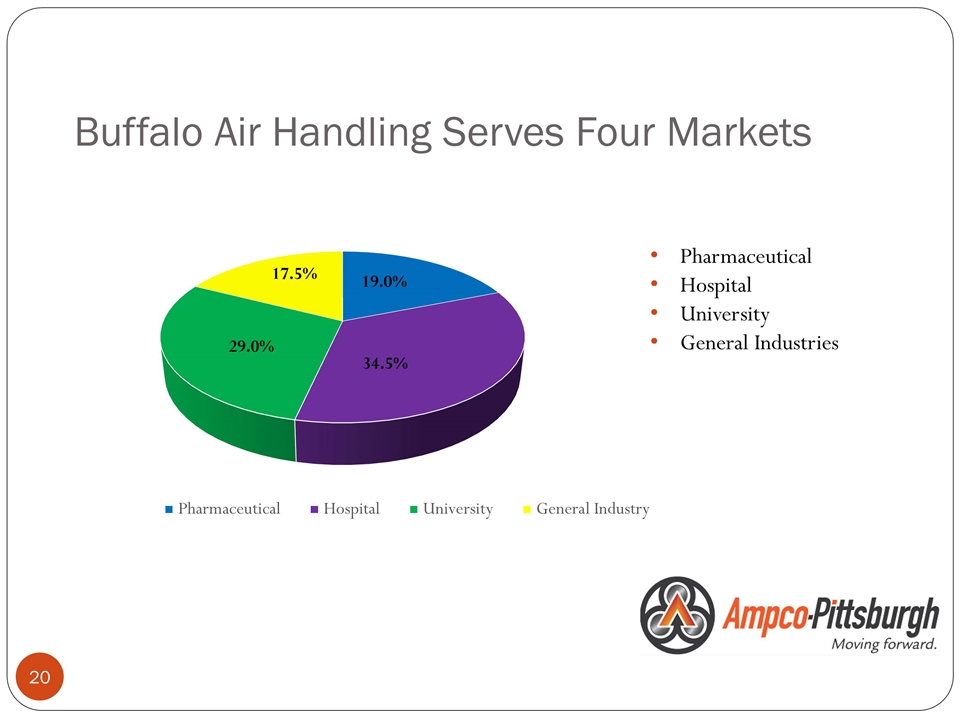

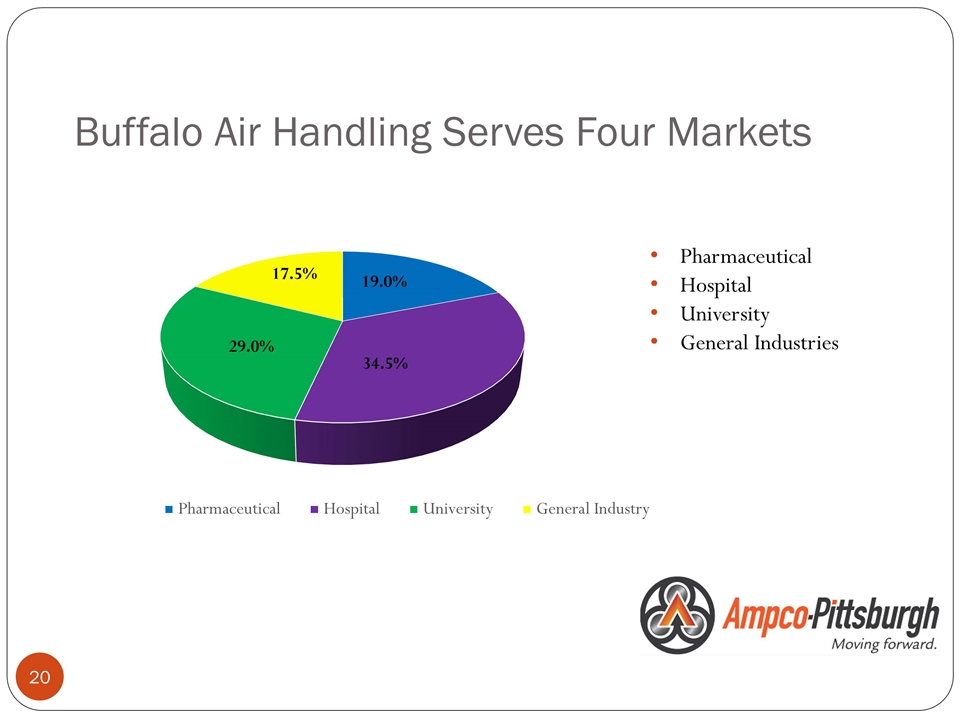

Buffalo Air Handling Serves Four Markets Pharmaceutical Hospital University General Industries

Buffalo Pumps

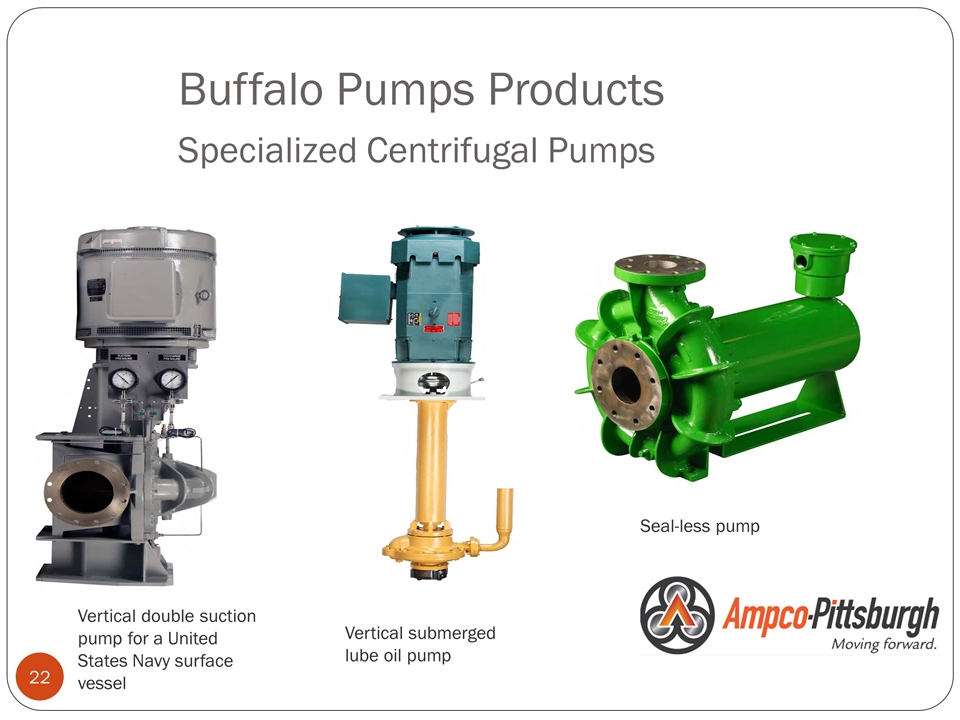

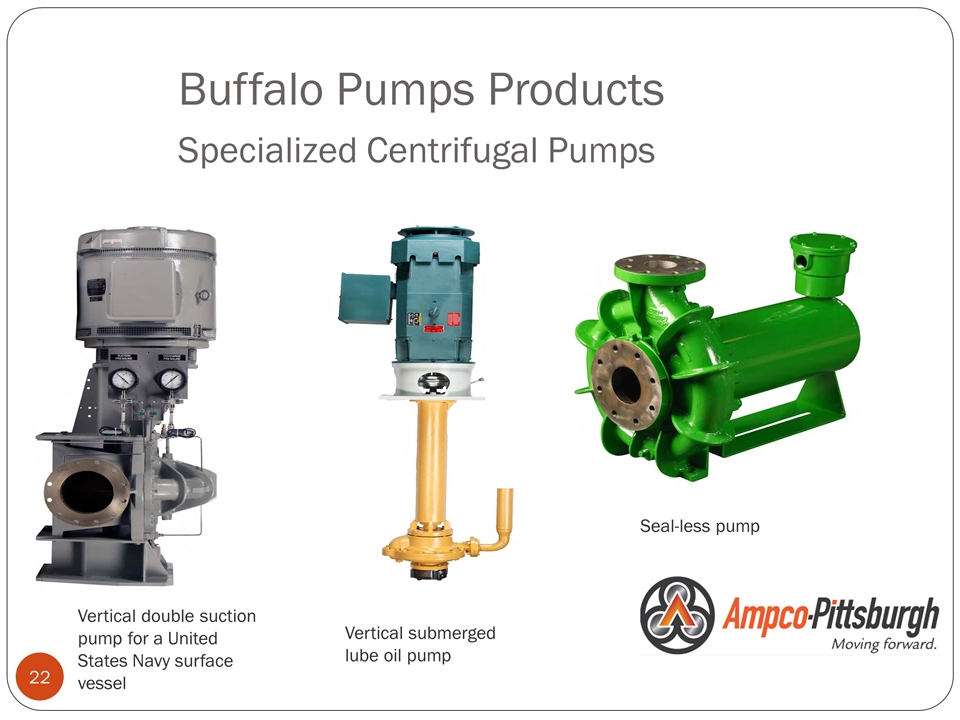

Buffalo Pumps Products Specialized Centrifugal Pumps Vertical double suction pump for a United States Navy surface vessel Vertical submerged lube oil pump Seal-less pump

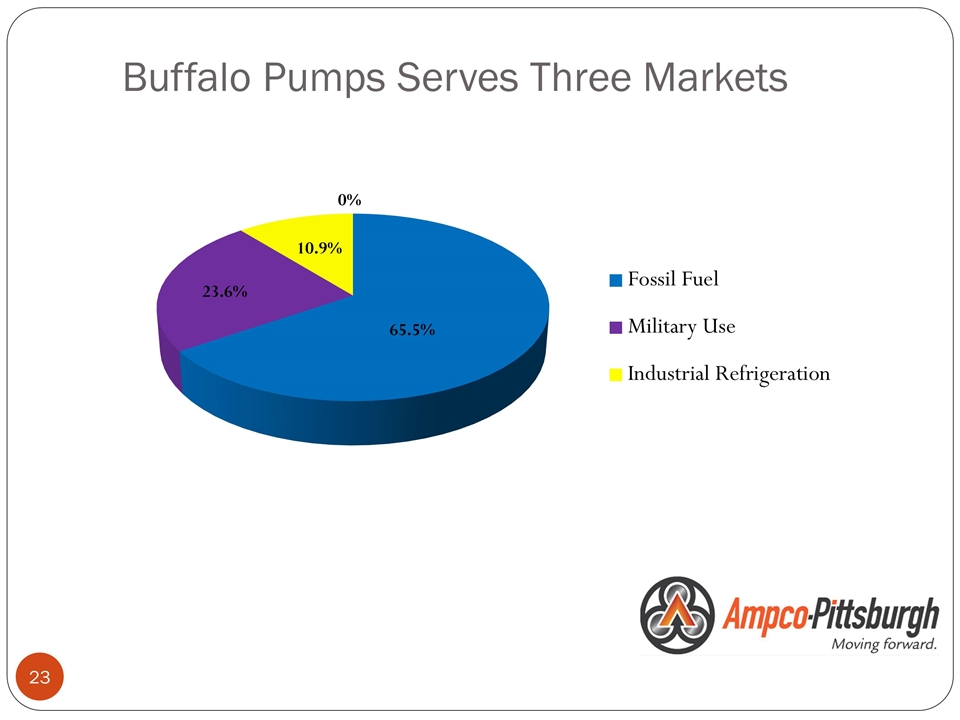

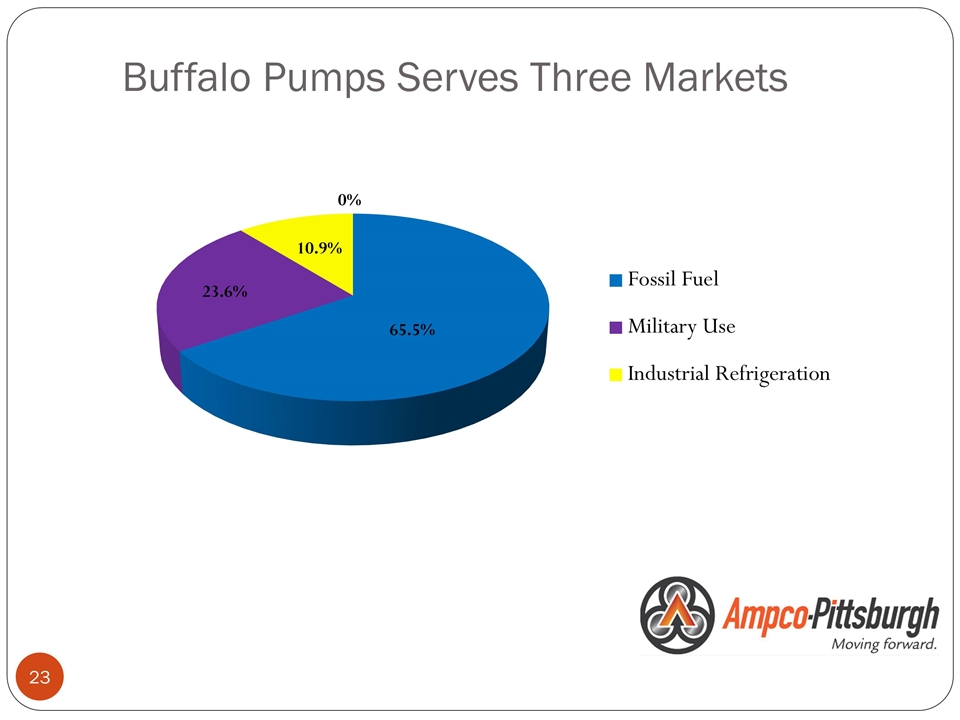

Buffalo Pumps Serves Three Markets

Strategies to Improve Ampco Performance

Ampco’s Financial Performance has Deteriorated in Recent Years Primarily Due to UES Performance Global steel market depressed since 2011 UES’s sales, margins, and profits have declined Air and Liquid Processing profitable, consistent performer, but lacks growth

Key Strategies to Improve A&LP Performance Grow revenue (market share) Reduce costs, increase margins Strengthen engineering and manufacturing capabilities Revise sales and marketing approach

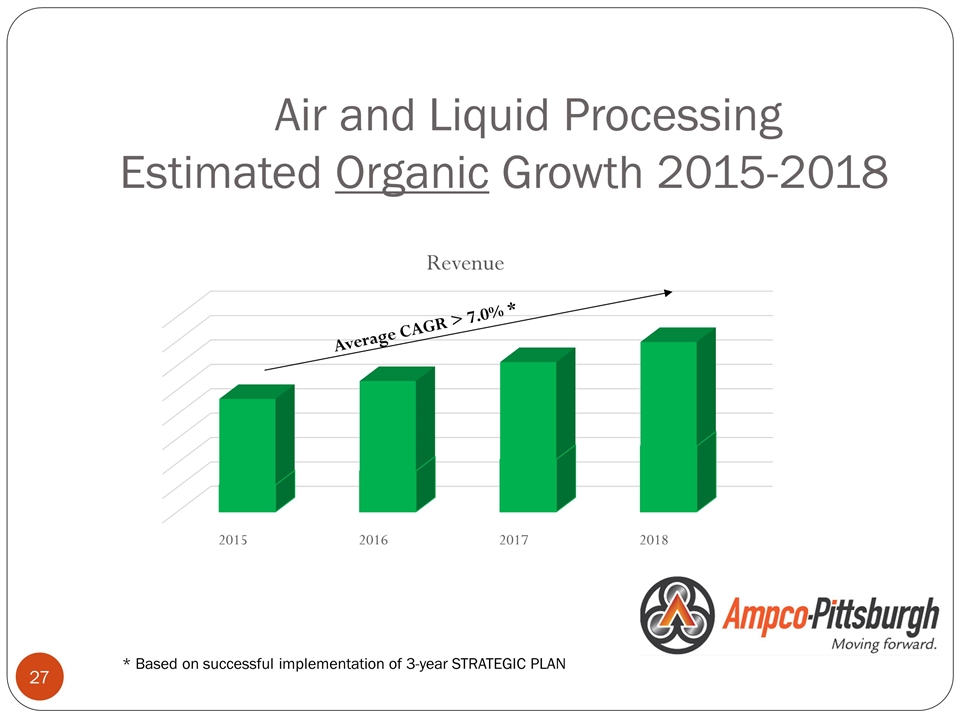

Air and Liquid Processing Estimated Organic Growth 2015-2018 * Based on successful implementation of 3-year STRATEGIC PLAN

Ampco’s Performance Historically Driven by UES UES primarily serves the steel and aluminum industries Current steel industry market conditions: 2015 global capacity utilization 65%-75% Idled capacity in North America and Europe Excess global steelmaking capacity impacting customer financial performance Cost control extended to vendor purchases Price concessions expected Emphasis on roll cost, not performance Impact of steel industry conditions on UES Volume, revenue, and margin decline No industry recovery expected until 2017

Strategies to Improve Ampco’s Financial Performance and Status: Stabilize and Optimize UES: in progress Reduce costs: completed stage 1, stage 2 in progress Achieve product diversification: initiated, revenue growing Identify and complete strategic acquisitions: in progress Revive R&D (new high performance products): in progress Fill product gaps: complete with Åkers acquisition Develop low cost alternative roll: step 1- complete with Åkers acquisition

Cost Reduction Strategy is Underway Initiated $10M corporate-wide cost reduction program in 2015 Centralized overhead functions to increase efficiency Implemented approximately 10% reduction in force (approximately 100 employees) Froze defined benefit pension plan for salaried employees Froze defined benefit pension plan, added contributory health, and reduced number of job classifications at unionized manufacturing plant in Carnegie, PA Relocated corporate headquarters to Carnegie, PA to eliminate $~500K in annual rent and related costs* *Lease on former HQ expires February 2016. All other savings will be fully realized in 2016.

Strategies to Diversify UES Product Portfolio for Growth Utilize flexible manufacturing assets to diversify and offset roll/steel industry cyclicality Optimize market pull into fracking industry and others Capitalize on opportunity to diversify into broader markets beyond fracking Research M&A opportunities Acquired Alloys Unlimited distribution center –July 2015

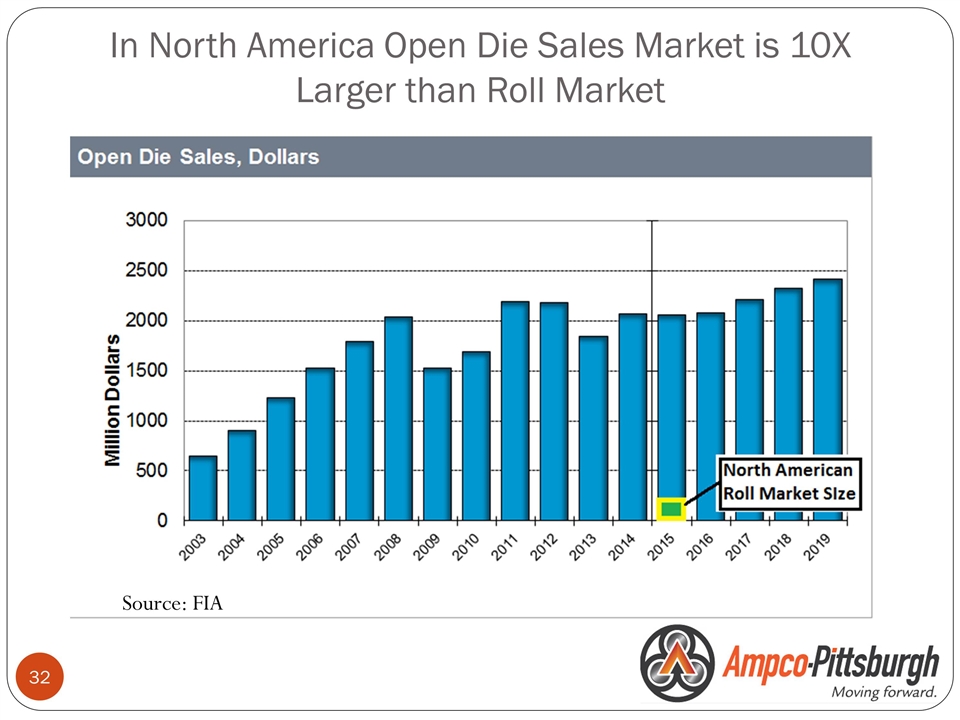

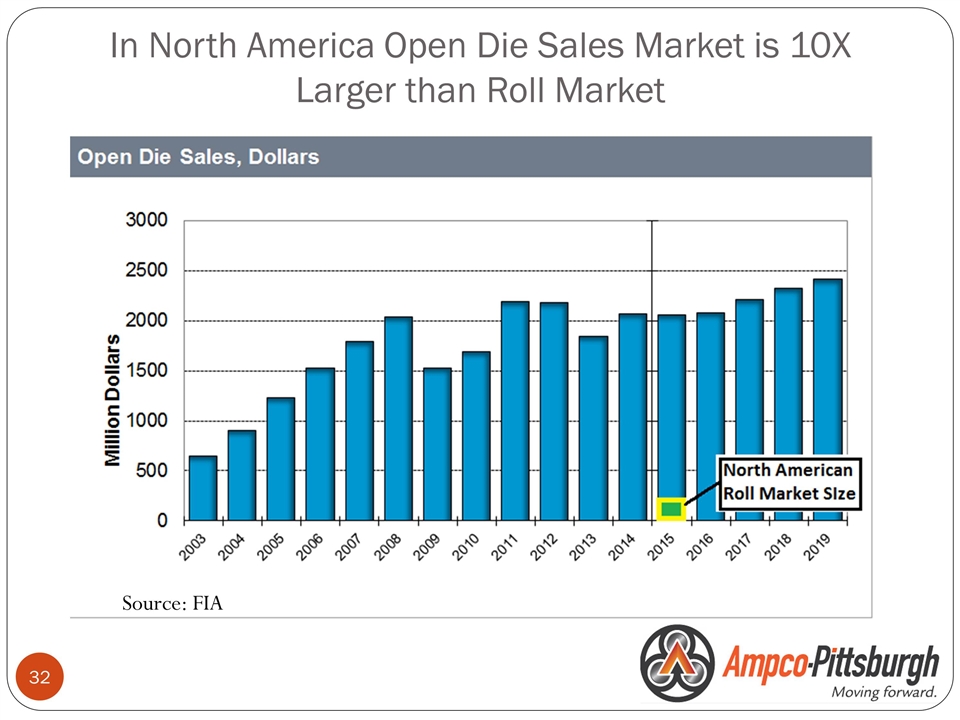

In North America Open Die Sales Market is 10X Larger than Roll Market Source: FIA

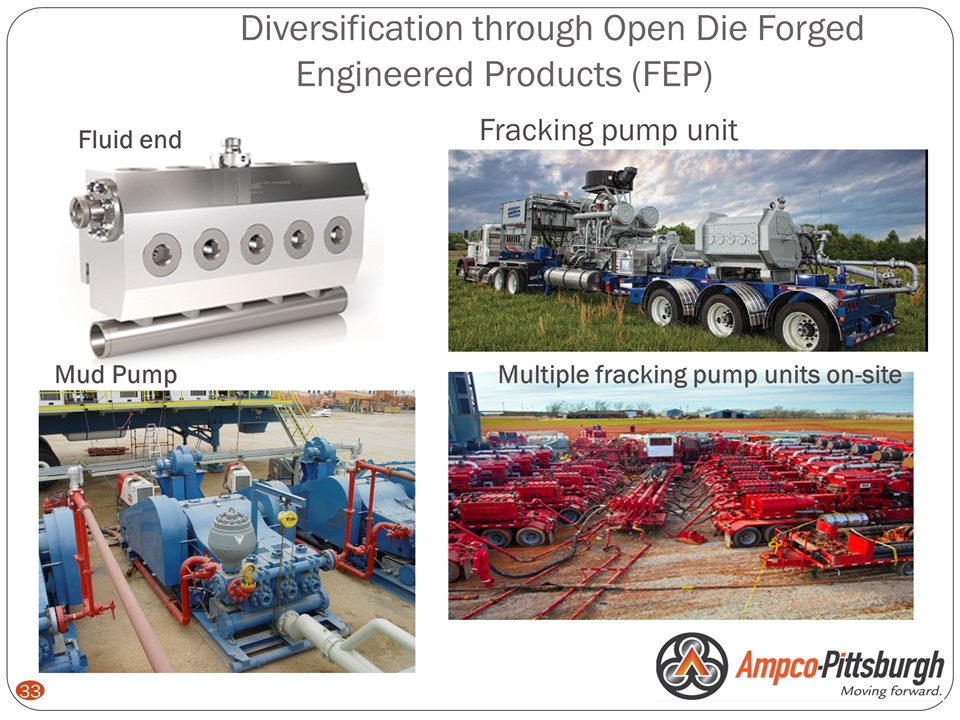

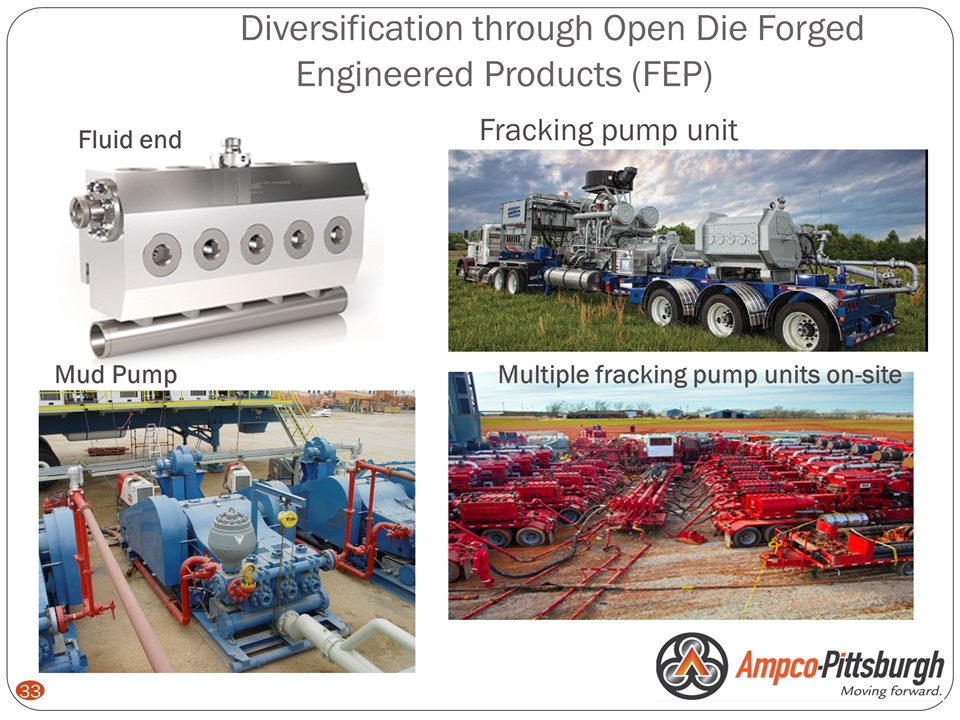

Diversification through Open Die Forged Engineered Products (FEP) Fracking pump unit Mud Pump Fluid end Multiple fracking pump units on-site

FEP Products - Bars

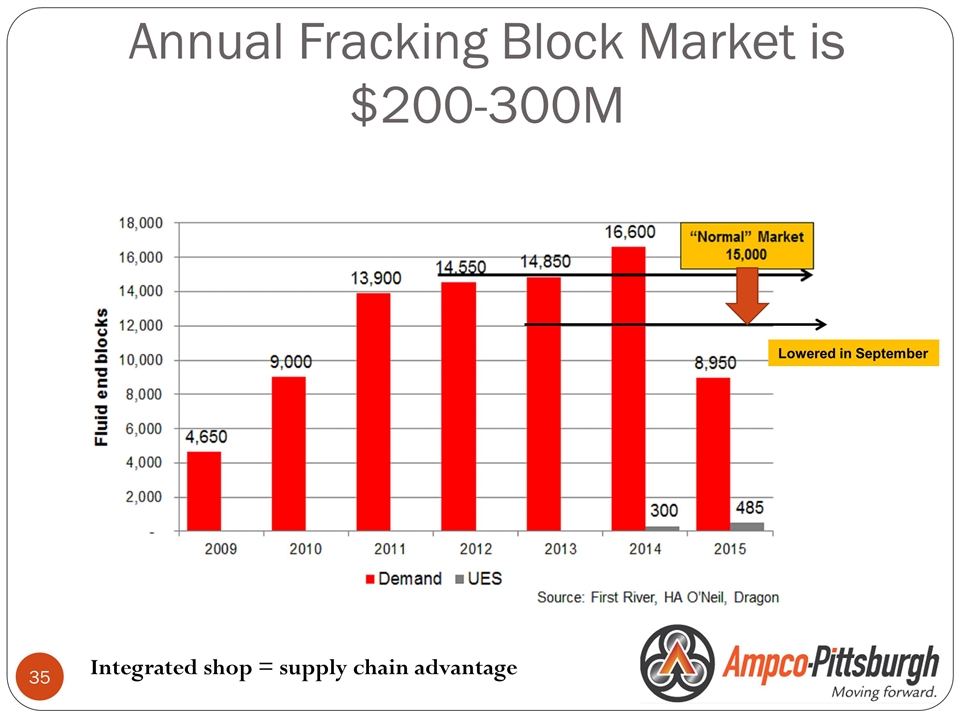

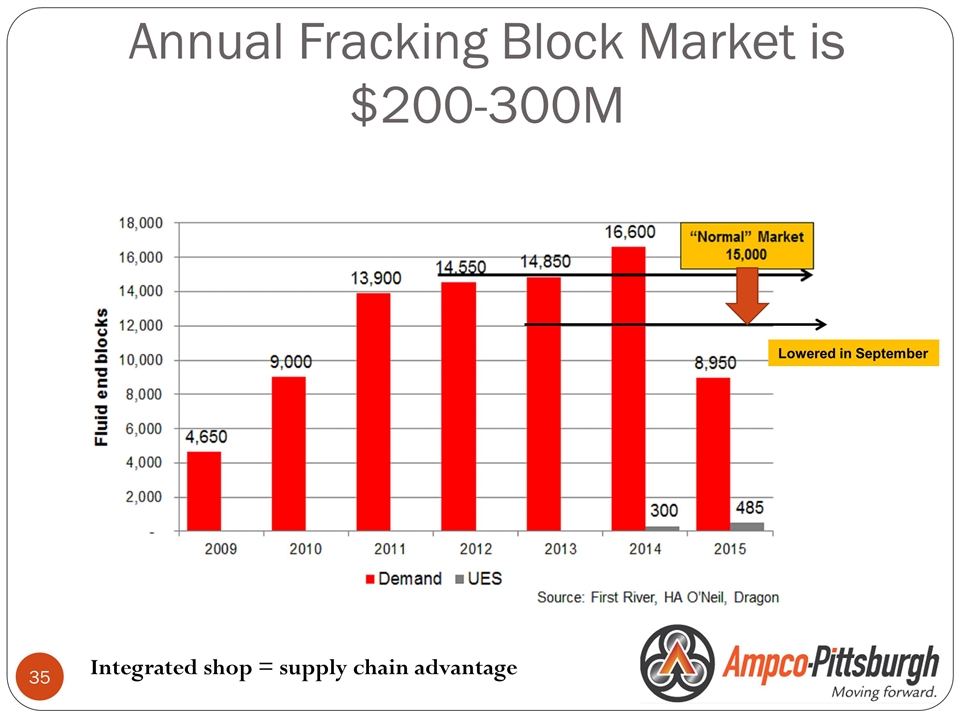

Annual Fracking Block Market is $200-300M Lowered in September Integrated shop = supply chain advantage

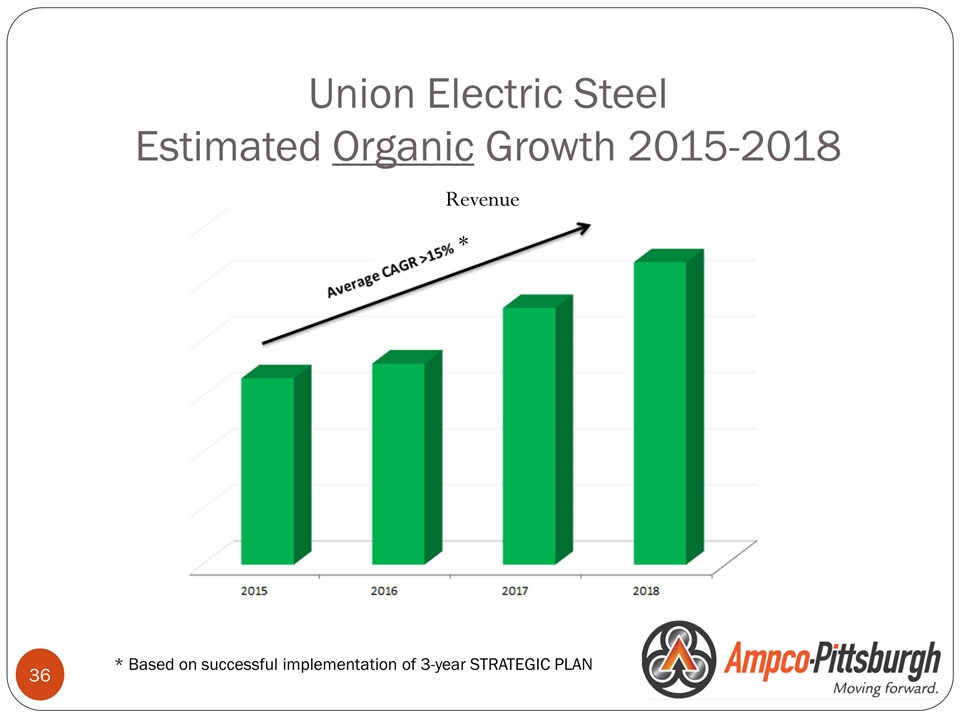

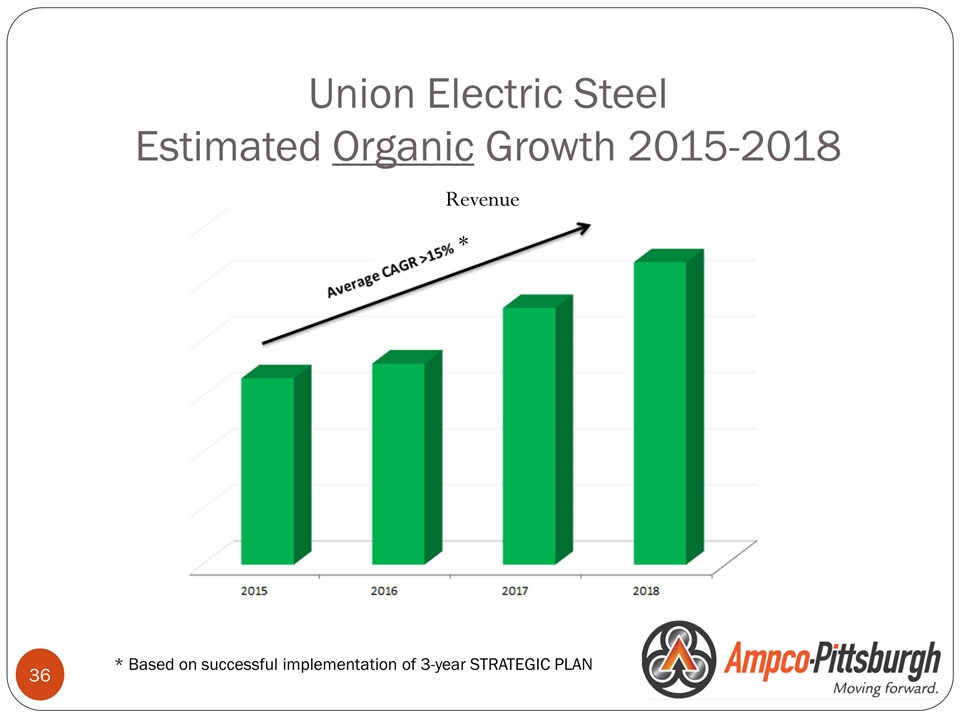

Union Electric Steel Estimated Organic Growth 2015-2018 Revenue * Based on successful implementation of 3-year STRATEGIC PLAN *

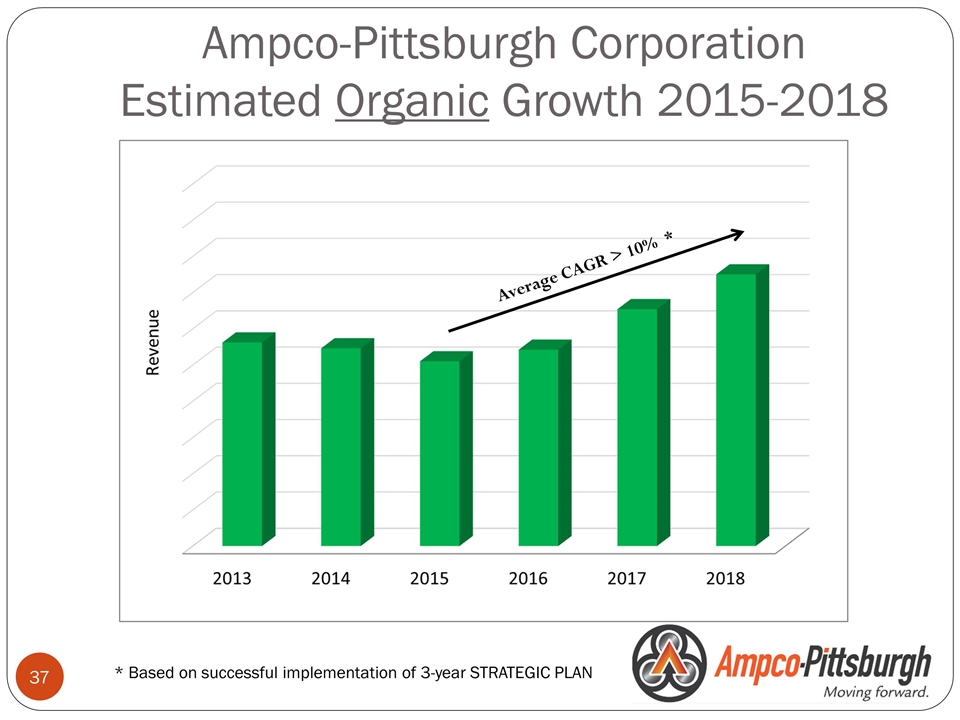

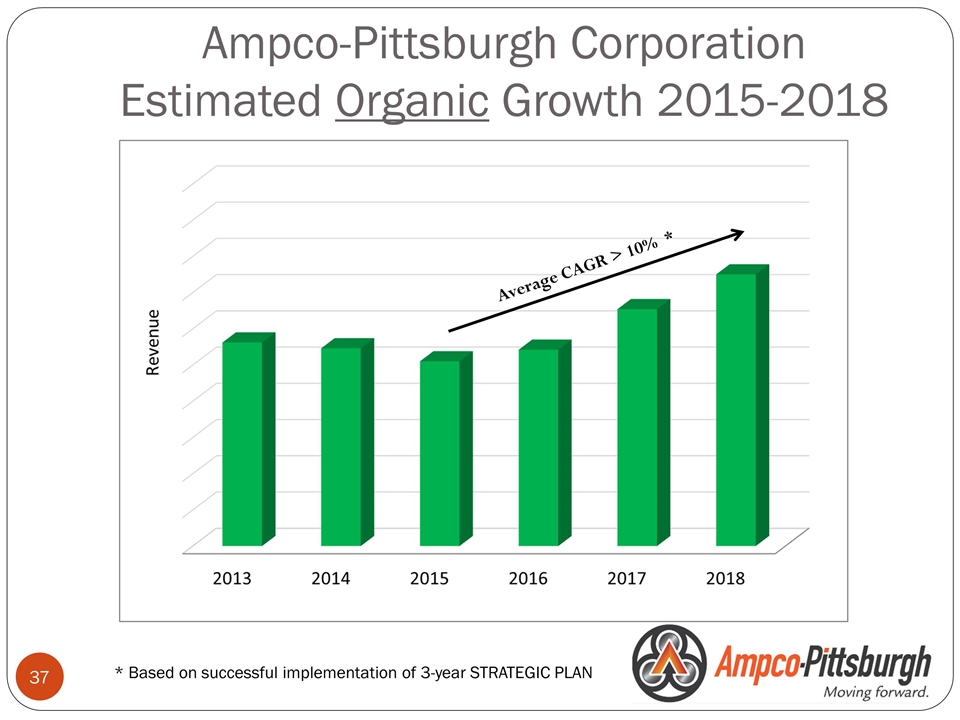

Ampco-Pittsburgh Corporation Estimated Organic Growth 2015-2018 Average CAGR > 10% * * Based on successful implementation of 3-year STRATEGIC PLAN

Strategies to Return Ampco Profitability Include Strategic Acquisitions Acquired Alloys Unlimited & Processing Company in 2015 Forged and cast product distribution center Includes short turnaround and emergency supply Acquisition of Åkers AB from Altor Fund II GP Limited expected to be completed by 3/31/2016

Åkers Acquisition

Why Acquire Åkers? Combines the two top competitors in the roll industry, both recognized for product performance, technology, and customer service Manufacturing Adds four roll production facilities, including two low-cost producers Sweden U.S. Slovenia China J-V Adds cast roll production in U.S. Adds forged roll supply to Europe Adds lower cost product alternative

Why Acquire Åkers? (cont’d) Sales/Marketing Joins complementary product lines (Ampco’s strength in forged rolls; Åkers strength in cast rolls) Creates complete product line Fills gaps in UES’s product portfolio Increases potential customer base to include all steel and aluminum mills Provides both high-performance, high quality rolls and low-cost rolls Accelerates R&D product launches Adds 14 sales offices and complement of sales personnel Transforms Ampco into more of a global competitor Adds sales office in Brazil, Germany, Turkey, Egypt and Singapore Establishes a center of strength in Asia Pacific, the world’s largest market for rolls Add service capability in U.S. (Vertical Seal in PA) – closer to customer

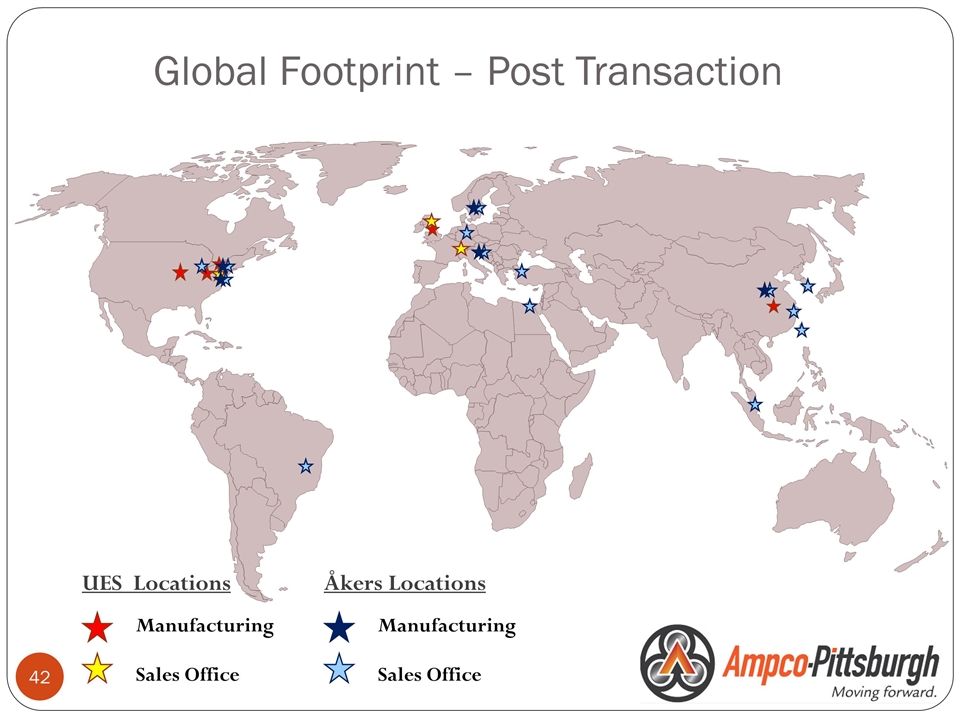

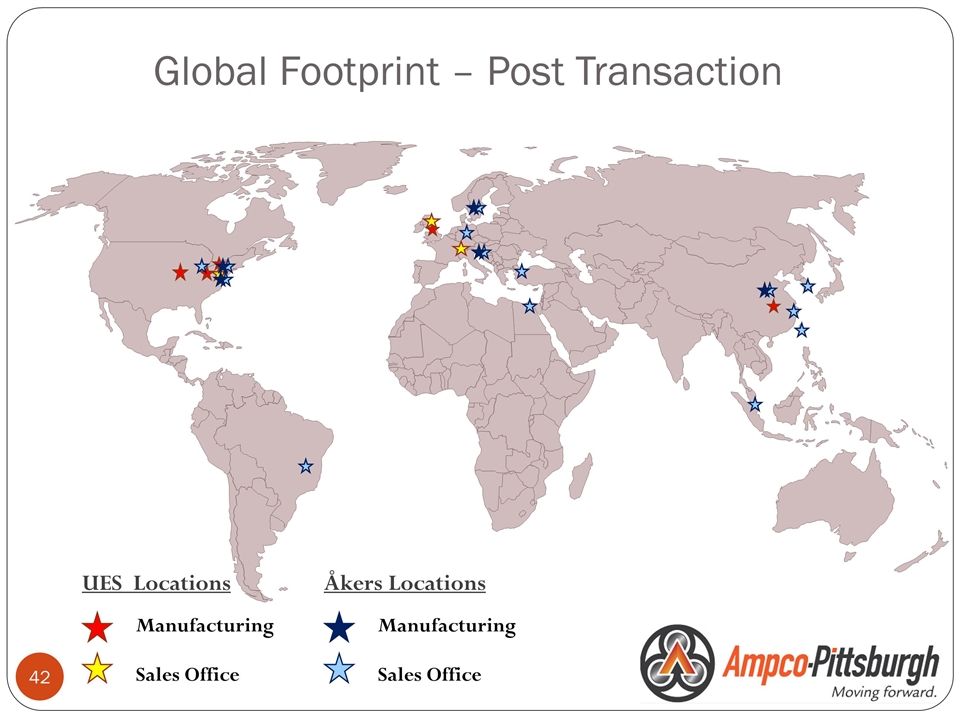

UES Locations Manufacturing Sales Office Global Footprint – Post Transaction Åkers Locations Manufacturing Sales Office

Financial Benefits of Åkers Acquisition Should contribute to stabilizing UES and improving performance of Ampco Revenue from roll business should essentially double Acquisition should be accretive in 2016 (excluding “costs”) Cost reduction and other synergies estimated to be $15M Synergies estimated to be fully realized in 12-15 months Estimated cost to realize synergies: $4 to $5M Provides potential currency “balance”

Terms of Definitive Agreement to Purchase Åkers AB Purchase price ~$80M $30M cash/borrowings -payable at closing $20M Ampco stock- estimated dilution 15% to 17% $30M notes – payable three years from closing 6.5% compound interest rate $36M to $37M at maturity

Thank you Questions Ampco-Pittsburgh Corporation