- MTW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

The Manitowoc Company, Inc. (MTW) DEF 14ADefinitive proxy

Filed: 23 Mar 23, 4:07pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

The Manitowoc Company, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

THE MANITOWOC COMPANY, INC.

One Park Plaza

11270 West Park Place, Suite 1000

Milwaukee, Wisconsin 53224

(414) 760-4600

March 23, 2023

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Shareholders of The Manitowoc Company, Inc. to be held as a virtual meeting at www.virtualshareholdermeeting.com/MTW2023 on Tuesday, May 2, 2023, at 9:00 a.m., Central Daylight Time.

We encourage you to access and review all of the information contained in the Proxy Statement and accompanying materials before voting. The Proxy Statement and the Company’s Annual Report are available at www.proxyvote.com.

If you want to receive a paper or email copy of these documents, you must request one. There is no charge to you for requesting a copy. Please make your request for a copy as instructed below on or before April 18, 2023 to facilitate timely delivery.

The 2023 Annual Meeting of The Manitowoc Company, Inc. will be held as follows:

Meeting date: | Tuesday, May 2, 2023 |

Meeting time: | 9:00 a.m. Central Daylight Time |

Virtual meeting site: | www.virtualshareholdermeeting.com/MTW2023 |

Meeting admission: | To attend the 2023 Annual Meeting by virtual presence online, you will need your control number included on your proxy card. |

Materials available: | Proxy Statement, Proxy Card and Annual Report |

View Materials: | www.proxyvote.com |

Request materials: | Internet: www.proxyvote.com Phone: 1-800-579-1639 Email: sendmaterial@proxyvote.com |

The 2023 Annual Meeting of The Manitowoc Company, Inc. will be held for the following purposes:

Shareholders of record as of the close of business on March 1, 2023, are cordially invited to attend by virtual presence online and are entitled to vote at the 2023 Annual Meeting. However, whether or not you expect to attend the 2023 Annual Meeting by virtual presence online, you are requested to properly complete the proxy card online at www.proxyvote.com or to obtain, complete, date, sign, and promptly return a hard copy of the proxy card, which can be obtained by request through the website, toll free number or email address noted above.

By Order of the Board of Directors |

|

Jennifer L. Peterson |

Executive Vice President, General Counsel and Secretary |

Milwaukee, Wisconsin

PROXY SUMMARY

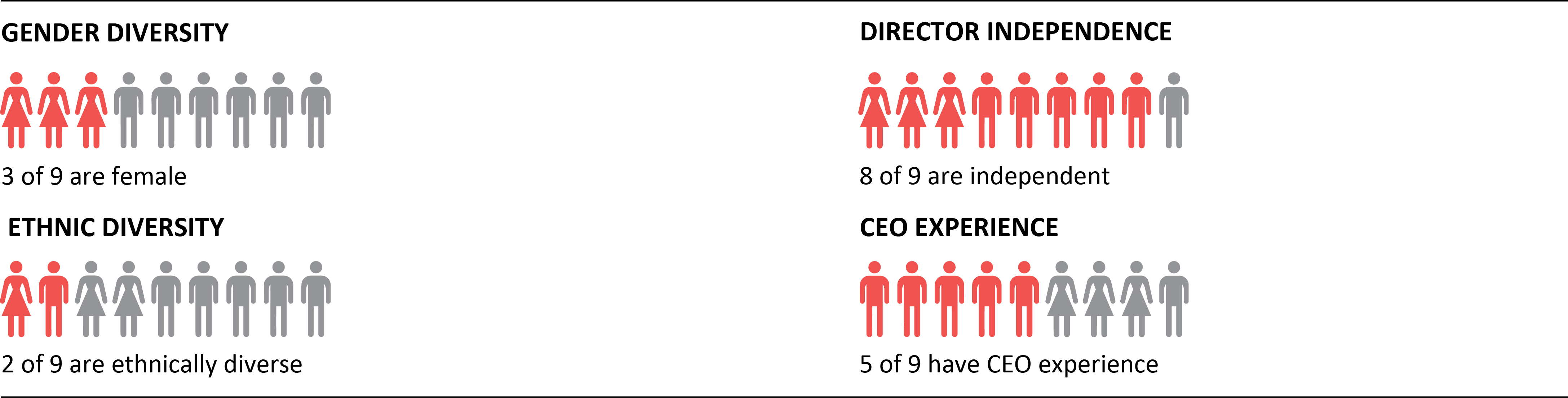

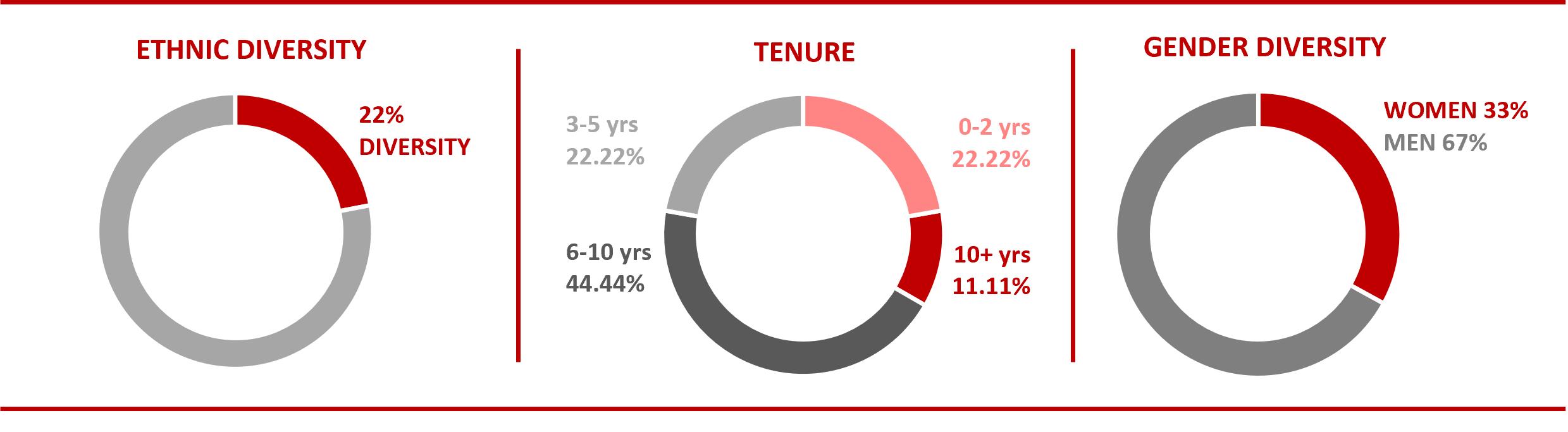

Board and Corporate Governance Highlights

Our Board represents a balance of longer-tenured members with in-depth knowledge of our business and newer members who bring valuable additional attributes, skills and experience. Eight of our nine directors are independent and provide strong oversight of our long-term strategy. We believe that directors with different backgrounds and experiences make our boardroom and the Company stronger.

The Company has always believed that strong corporate governance practices help create long-term value for our shareholders. The commitment to transparent corporate governance ensures that the Company is managed and monitored in a responsible and value-driven manner. Our Corporate Governance Guidelines, along with the charters of each of our Board Committees and the key practices of our Board of Directors, provide the framework for corporate governance at the Company.

The Corporate Governance and Sustainability Committee believes that our Board is most effective when it embodies a diverse set of viewpoints and practical experiences. The Corporate Governance Guidelines ensure that the Corporate Governance and Sustainability Committee considers the diversity of viewpoints, backgrounds, experiences, expertise, and skill sets, including diversity of age, gender identity, nationality, race, and ethnicity when identifying and recommending to the Board qualified candidates for Board membership.

Proxy Summary

To maintain an effective Board, the Corporate Governance and Sustainability Committee considers how each nominee’s particular background, experience, qualifications, attributes, and skills will contribute to the Company’s success. As shown below, the members of our Board have a range of viewpoints, backgrounds, and expertise.

Board's Attributes |

|

|

|

|

|

|

|

|

|

|

NAME |

| ANNE E. BÉLEC | ROBERT G. BOHN | ANNE M. COONEY | AMY R. DAVIS | KENNETH W. KRUEGER | ROBERT W. MALONE | C. DAVID MYERS | JOHN C. PFEIFER | AARON H. RAVENSCROFT |

AGE |

| 60 | 69 | 63 | 54 | 66 | 59 | 59 | 57 | 44 |

DIRECTOR SINCE |

| 2019 | 2014 | 2016 | 2021 | 2004 | 2021 | 2016 | 2016 | 2020 |

|

|

|

|

|

|

|

|

|

|

|

SKILLS/QUALIFICATIONS/EXPERIENCE |

|

|

|

|

|

|

|

|

|

|

BOARD OF DIRECTORS EXPERIENCE Experience as a public company board member. |

| ● | ● | ● | ● | ● | ● | ● | ● | ● |

CEO Experience as a public company CEO. |

|

| ● |

|

| ● |

| ● | ● | ● |

FINANCE AND ACCOUNTING Experience at an executive level or expertise with financial reporting, internal controls, finance companies or public accounting. |

| ● | ● | ● | ● | ● | ● | ● | ● | ● |

MANUFACTURING Experience at an executive level or expertise in managing a business or company that has significant focus on manufacturing. |

| ● | ● | ● | ● | ● | ● | ● | ● | ● |

GLOBAL EXPERIENCE Experience at an executive level overseeing international operations or working outside the U.S. |

| ● | ● | ● | ● | ● | ● | ● | ● | ● |

BUSINESS DEVELOPMENT AND STRATEGY Experience at an executive level driving strategic direction and growth of an enterprise. |

| ● | ● | ● | ● | ● | ● | ● | ● | ● |

SALES AND MARKETING Experience at an executive level with leading a sales organization or executing marketing strategies. |

| ● | ● | ● | ● |

| ● | ● | ● | ● |

TECHNOLOGY Experience at an executive level or expertise in the use of information technology or other technology to facilitate business objectives. |

| ● | ● | ● | ● | ● | ● | ● | ● |

|

GENDER DIVERSITY |

| ● |

| ● | ● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proxy Summary

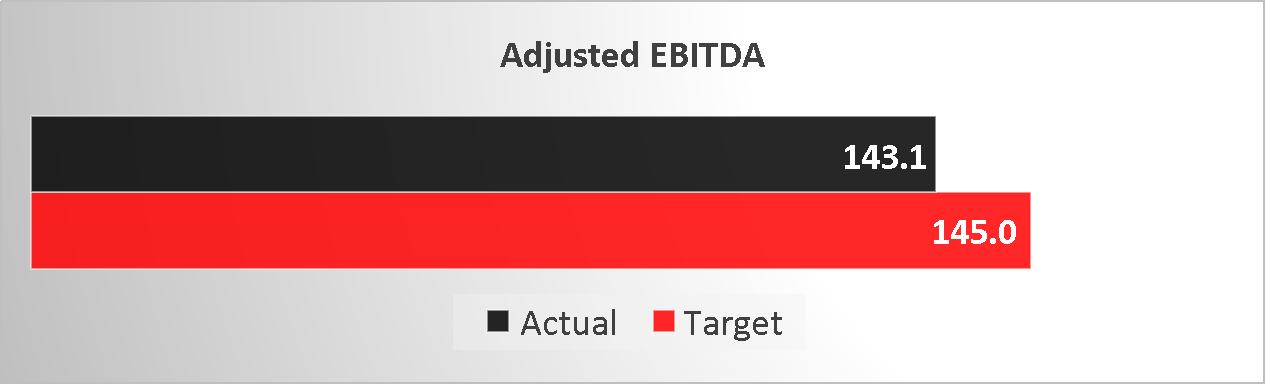

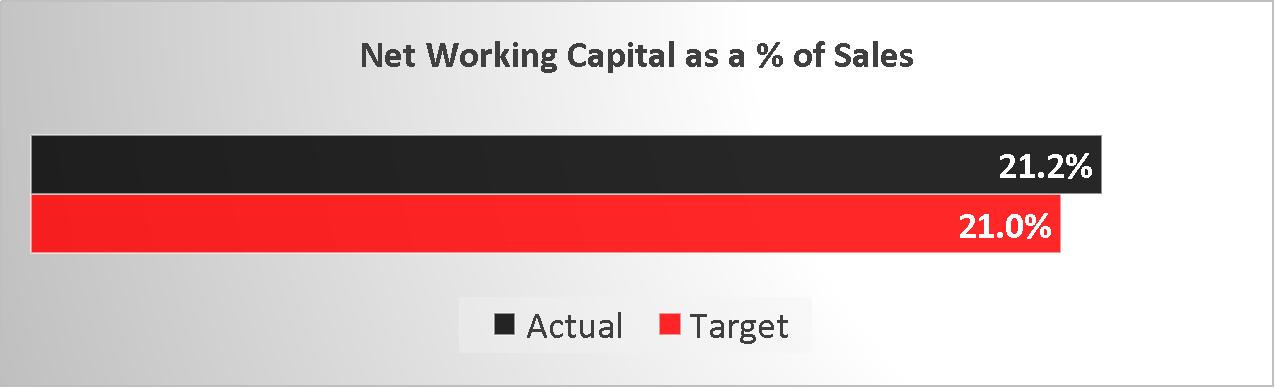

Executive Compensation Highlights

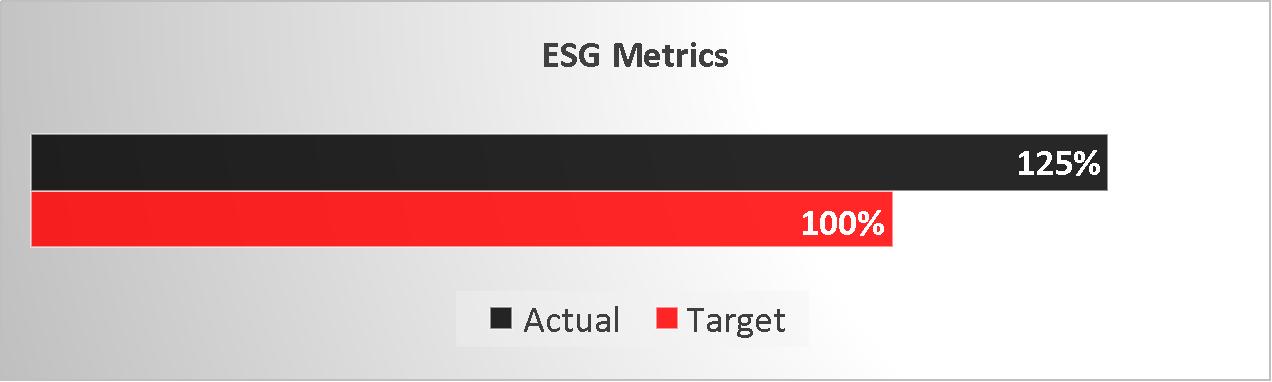

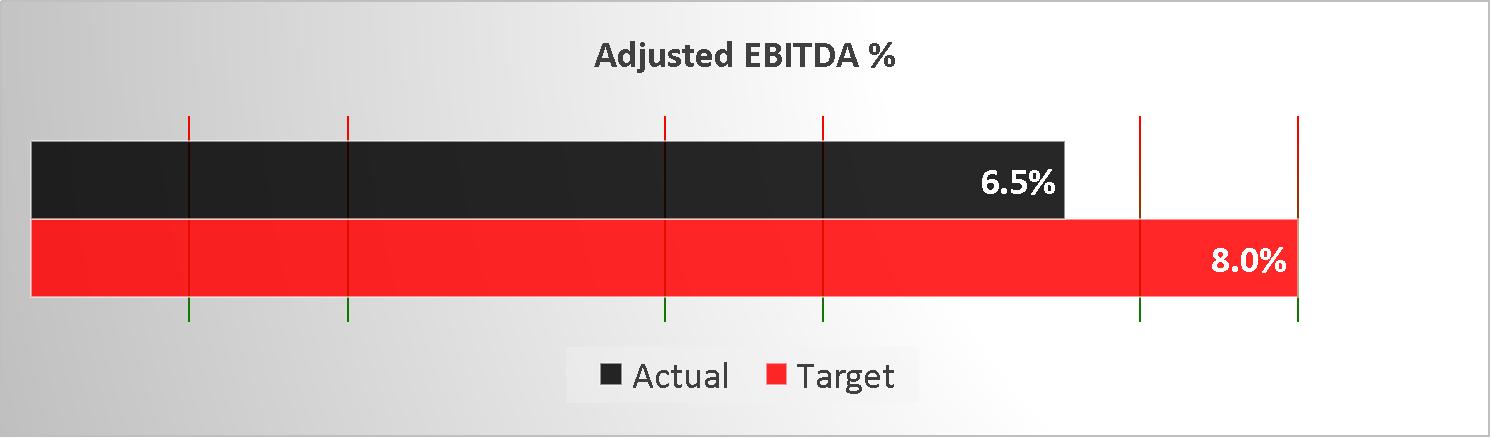

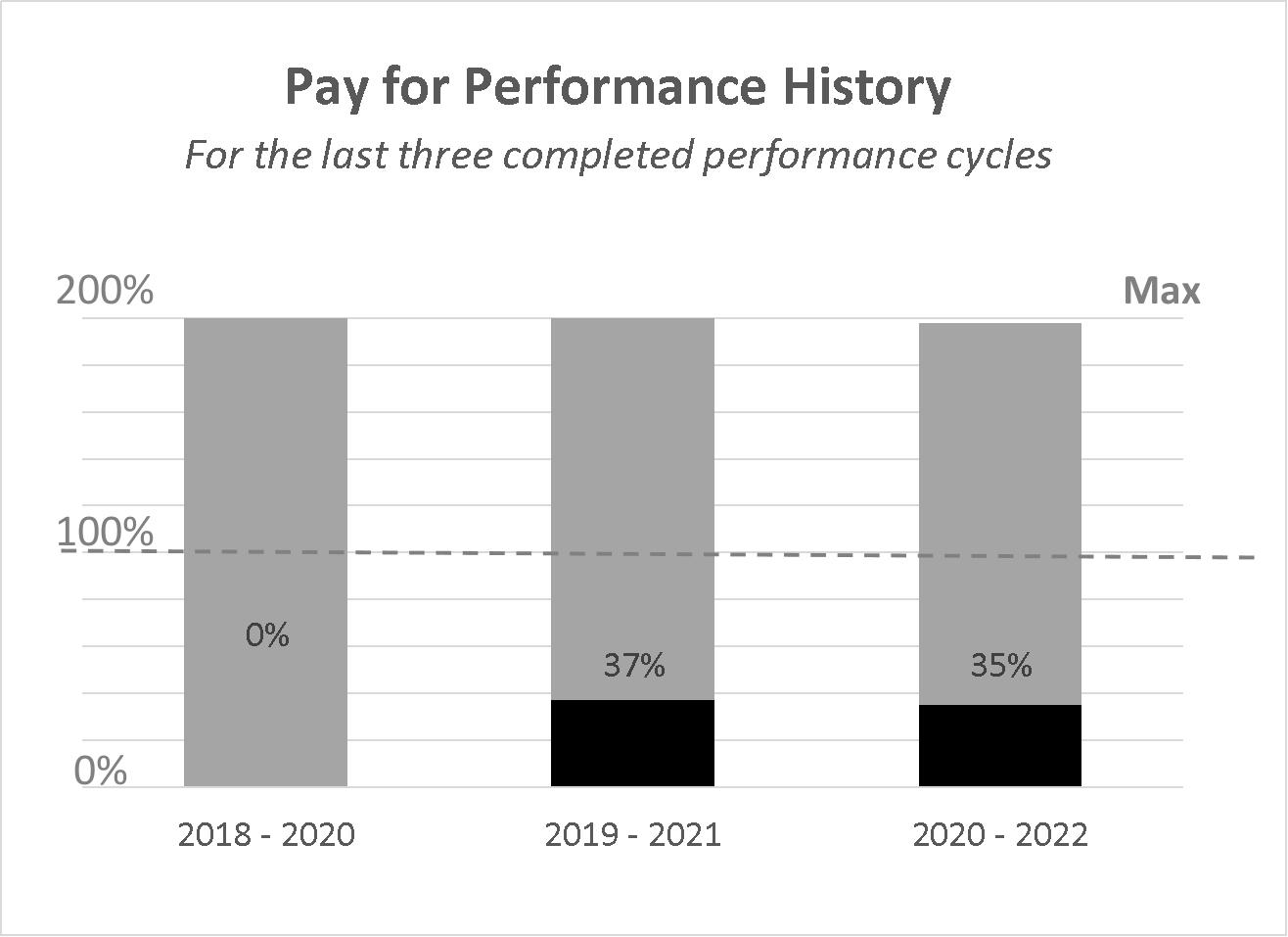

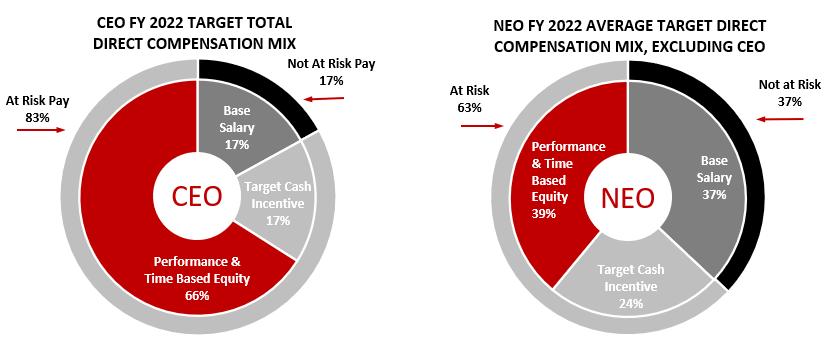

The Compensation Committee believes the executive compensation program at Manitowoc is structured to align the interests of executives with those of our shareholders. These interests are met in rewarding value creation at all stages of the business cycle and providing an increasing percentage of performance-based compensation at higher levels of executive responsibility. This performance-based compensation is both market competitive and internally equitable. Based on this philosophy, 83% of CEO pay and 63% of named executive officer pay was tied to at risk short-term and long-term incentive plans. In addition, given the expansion of the Company’s environmental, social, and governance (“ESG”) initiatives, the Compensation Committee elected to include a ESG measure in the 2022 short-term incentive plan focused on driving performance in environmental sustainability, workplace safety, and gender diversity.

In 2022, the Company experienced headwinds with higher raw material, energy, wages, logistics, and component costs due to the highly inflationary environment. Furthermore, supply chain, labor, and logistic constraints impacted the Company’s ability to produce and ship products during the year. Nevertheless, the Company nearly achieved its target financial goals while making strong gains in the Company’s objective to become more sustainable. This included achieving ISO 50001 certification, a global Energy Management Standard, at all of its manufacturing facilities and meeting its 2025 normalized Greenhouse Gas emissions reduction target three years ahead of schedule.

TABLE OF CONTENTS

1 |

| 25 | ||

1 |

| 26 | ||

1 |

| 27 | ||

1 |

| 27 | ||

Who may attend the annual meeting by virtual presence online? | 1 |

| 27 | |

What do I need to do to attend the 2023 Annual Meeting by virtual presence online? | 2 |

| 28 | |

2 |

| 28 | ||

What if I encounter technical difficulties during the 2023 Annual Meeting? | 2 |

| 46 | |

2 |

| 46 | ||

3 |

| 47 | ||

3 |

| 56 | ||

3 |

| 59 | ||

|

|

| 60 | |

5 |

| 64 | ||

5 |

|

|

| |

Proposal 2 – Ratification of the Appointment of Deloitte & Touche LLP | 9 |

| INDEX OF FREQUENTLY REQUESTED INFORMATION |

|

Proposal 3 – Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers | 10 |

| 29 | |

11 |

| 33 39 47 49 | ||

12 |

| 50 | ||

12 |

| 51 | ||

12 |

| 51 | ||

12 |

| 55 | ||

12 |

| 56 | ||

12 |

| XI. CEO Pay Ratio | 59 | |

13 |

| 60 | ||

15 |

|

|

| |

17 |

|

|

| |

18 |

|

| ||

18 |

| |||

18 |

| |||

18 |

| |||

19 |

| |||

20 |

| |||

|

|

| ||

22 |

| |||

23 |

| |||

24 |

| |||

Stock Ownership of Beneficial Owners of More than Five Percent | 24 |

| ||

THE MANITOWOC COMPANY, INC.

One Park Plaza

11270 West Park Place, Suite 1000

Milwaukee, Wisconsin 53224

(414) 760-4600

SOLICITATION AND VOTING

This Proxy Statement is furnished by the Board of Directors (the “Board of Directors” or “Board”) of The Manitowoc Company, Inc., a Wisconsin corporation (referred to in this Proxy Statement as the “Company,” “we” or “our”), to the shareholders of the Company in connection with a solicitation of proxies for use at the 2023 Annual Meeting of Shareholders (the “2023 Annual Meeting”) to be held as a virtual meeting at 9:00 a.m., Central Daylight Time, on Tuesday, May 2, 2023, and at any and all adjournments or postponements thereof. This Proxy Statement and the accompanying materials are being provided to shareholders on or about March 23, 2023.

Who can vote?

At the close of business on March 1, 2023, the record date for determining shareholders entitled to vote at the 2023 Annual Meeting, there were outstanding 35,170,221 shares of Company common stock, par value $0.01 per share (the “Common Stock”). Each share outstanding on the record date is entitled to one vote on all matters presented at the meeting.

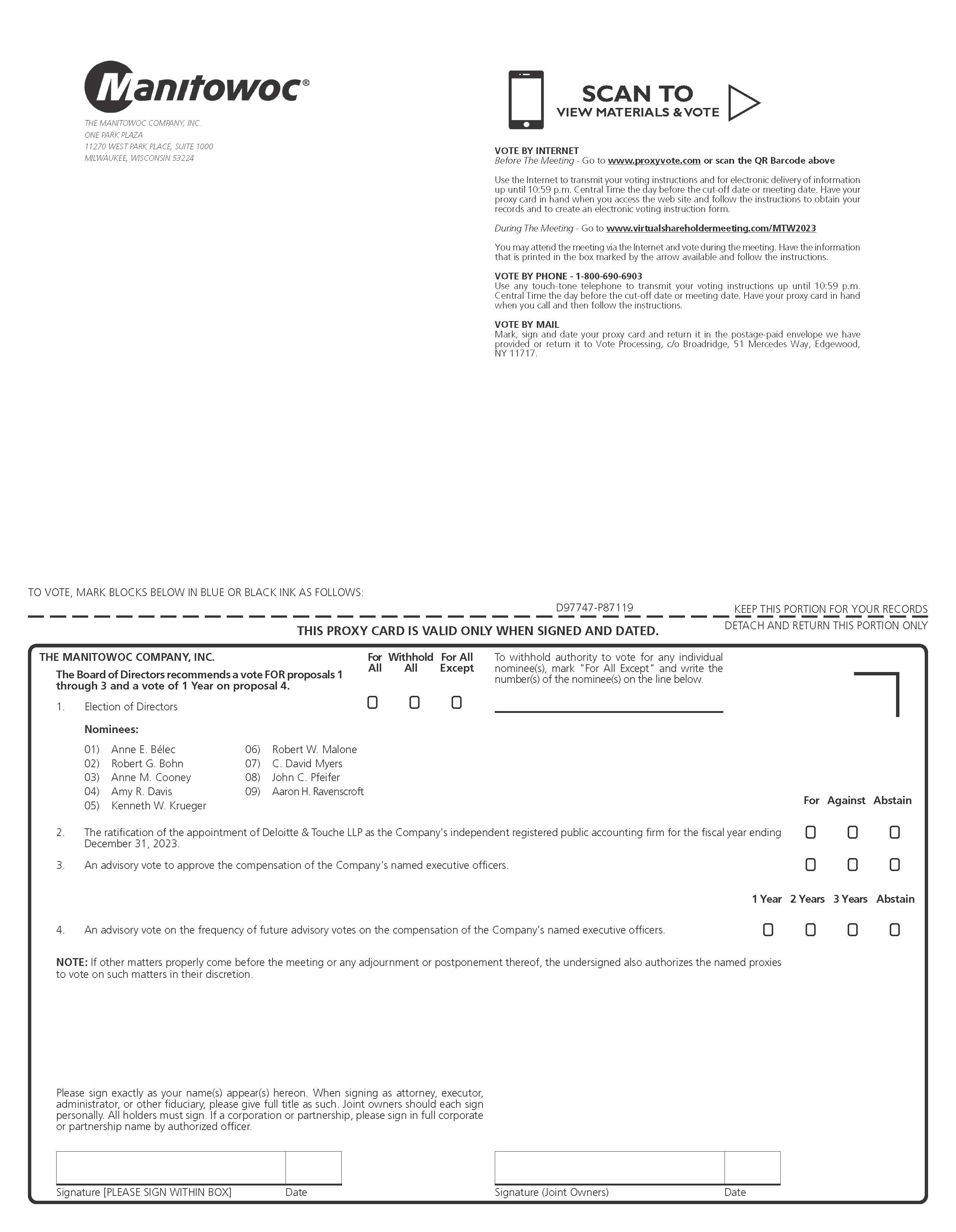

How to vote

Any shareholder entitled to vote may vote by attending the virtual meeting online or by duly executed proxy. Shareholders of record will have the option to vote by written proxy or electronically via either the internet or telephone. Instructions on how to vote are set forth in the Proxy Materials sent to shareholders. Shareholders may access and complete the proxy card online at www.proxyvote.com. In order to vote online, a shareholder will need the control number provided to the shareholder along with the Notice of Meeting. The Company is offering electronic services both as a convenience to its shareholders and as a step towards reducing costs. Shareholders not wishing to use electronic voting methods may continue to cast votes by returning their signed and dated proxy card. If you are a shareholder of record, you may attend the 2023 Annual Meeting by virtual presence online and vote your shares at www.virtualshareholdermeeting.com/MTW2023 during the meeting. You will need your control number found on your proxy card. Follow the instructions provided to cast your vote.

How to obtain meeting materials

All Proxy Materials for the 2023 Annual Meeting, including this Proxy Statement and the 2022 Annual Report to Shareholders, are available on the internet at www.proxyvote.com. All shareholders have been separately provided an “Important Notice Regarding the Availability of Proxy Materials.” As indicated in that Notice, if you want to receive a paper or email copy of these documents, you must request one. There is no charge to you for requesting a copy. Shareholders will not receive printed copies of the proxy materials unless they request them. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions in the Notice for requesting such materials. Please make your request as instructed in that Notice on or before April 18, 2023 to facilitate timely delivery.

Who may attend the annual meeting by virtual presence online?

Only shareholders of record at the close of business on the record date (March 1, 2023), or their proxy holders or the underlying beneficial owners of the Common Stock, may attend the meeting by virtual presence online by visiting www.virtualshareholdermeeting.com/MTW2023.

1

Solicitation and Voting

What do I need to do to attend the 2023 Annual Meeting by virtual presence online?

To attend the 2023 Annual Meeting by virtual presence online, please follow these instructions:

How can I participate in the 2023 Annual Meeting?

The 2023 Annual Meeting will be accessible only through the Internet. As with our 2021 and 2022 Annual Meetings, this format is being used to ensure greater participation and attendance for those shareholders, employees, and other stakeholders who are not centrally located. We have worked to offer the same participation opportunities as were provided at the in-person portion of our past meetings while further enhancing the online experience available to all shareholders regardless of their location.

You are entitled to participate in the 2023 Annual Meeting if you were a shareholder as of the close of business on March 1, 2023. The 2023 Annual Meeting will begin promptly at 9:00 a.m. Central Daylight Time. Online check-in will begin at 8:45 a.m. Central Daylight Time, and you should allow ample time for the online check-in procedures.

Whether or not you participate in the 2023 Annual Meeting, it is important that your shares be part of the voting process. The other methods by which you may vote are described above.

This year’s shareholders question and answer session will include questions submitted live during the 2023 Annual Meeting. Questions may be submitted during the 2023 Annual Meeting through www.virtualshareholdermeeting.com/MTW2023.

What if technical difficulties are encountered during the 2023 Annual Meeting?

If we experience technical difficulties during the meeting (e.g., a temporary or prolonged power outage), the Chair of our Board of Directors will determine whether the meeting can be promptly reconvened (if the technical difficulty is temporary) or whether the meeting will need to be reconvened on a later day (if the technical difficulty is more prolonged). In any of these situations, we will promptly notify shareholders of the decision via www.virtualshareholdermeeting.com/MTW2023.

If you encounter technical difficulties accessing our meeting or during the meeting, a support line will be available on the login page of the virtual meeting website.

Proxies

A proxy may be revoked at any time before it is exercised by filing a written notice of revocation with the Secretary of the Company, by delivering a duly executed proxy bearing a later date, or by voting by virtual presence online at the 2023 Annual Meeting. Attendance by virtual presence online at the 2023 Annual Meeting will not in itself constitute revocation of a proxy. The shares represented by all properly executed unrevoked proxies received in time for the 2023 Annual Meeting will be voted as specified on the proxies. Shares held for the accounts of participants in The Manitowoc

2

Solicitation and Voting

Company, Inc. 401(k) Retirement Plan (for which the proxies will serve as voting instructions for the shares) will be voted in accordance with the instructions of participants or otherwise in accordance with the terms of that Plan. If no direction is given on a properly executed unrevoked proxy, it will be voted FOR each of the nine director nominees, FOR ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023, FOR approval of the compensation of the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis and the Executive Compensation sections of this Proxy Statement, and for holding future advisory votes EVERY YEAR to approve the compensation of the Company's named executive officers.

The cost of soliciting proxies will be borne by the Company. Solicitation will be made principally by distribution via mail and the internet pursuant to the rules of the Securities and Exchange Commission (“SEC”), but also may be made by email, telephone, facsimile, or other means of communication by certain directors, executive officers, employees, and agents of the Company. The directors, executive officers, and employees will receive no compensation for these proxy solicitation efforts in addition to their regular compensation, but may be reimbursed for reasonable out-of-pocket expenses in connection with the solicitation. The Company will request persons holding shares in their names for the benefit of others or in the names of their nominees to send Proxy Materials to and obtain proxies from their principals and will reimburse such persons for their expenses in so doing.

Required Quorum

To be effective, a matter presented for a vote of shareholders at the 2023 Annual Meeting must be acted upon by a quorum (i.e., a majority of the votes entitled to be cast represented at the 2023 Annual Meeting attending by virtual presence online or by proxy). Abstentions, shares for which authority is withheld to vote for director nominees, and broker non-votes (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares as to a matter with respect to which the brokers or nominees do not have discretionary power to vote) will be considered present for the purpose of establishing a quorum. Once a share is represented at the 2023 Annual Meeting, it is deemed present for quorum purposes throughout the meeting or any adjourned or postponed meeting, unless a new record date is or must be set for any adjourned or postponed meeting.

Your Broker needs your approval to vote certain matters

We remind you that your broker may not vote your shares in its discretion in the election of directors (Proposal 1); therefore, you must vote your shares if you want them to be counted in the election of directors. In addition, your broker is also not permitted to vote your shares in its discretion regarding matters relating to executive compensation (Proposals 3 and 4). However, your broker may vote your shares in its discretion on routine matters such as the ratification of the Company’s independent registered public accounting firm (Proposal 2).

Required Vote

Proposal 1: Election of Directors. Directors are elected by a majority of the votes cast by the holders of shares entitled to vote in the election at a meeting at which a quorum is present, assuming the election is uncontested (a plurality voting standard applies in contested elections). For this purpose, a majority of votes cast means that the number of votes cast “for” a director’s election must exceed the number of votes cast “withheld” with respect to that director’s election. Any shares not voted (whether by broker non-vote or otherwise) will have no effect on the election of directors.

3

Solicitation and Voting

Pursuant to the Company’s Restated By-laws, any nominee who is a current director and who receives fewer votes cast “for” his or her election than votes cast “withheld” is required to promptly tender his or her resignation to the Chair of the Board following certification of the shareholder vote. The Corporate Governance and Sustainability Committee of the Board of Directors will promptly consider the resignation, and make a recommendation to the Board of Directors as to whether to accept or reject such resignation.

Proposal 2: Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023. The affirmative vote of a majority of the votes cast on the proposal by the holders of shares entitled to vote at the meeting at which a quorum is present is required for ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023. Any shares not voted (whether by broker non-vote or otherwise, except abstentions) have no impact on the vote. Shares of Common Stock as to which holders of shares abstain from voting will be treated as votes against ratification.

Proposal 3: Advisory vote to approve the compensation of the Company’s named executive officers. The affirmative vote of a majority of the votes cast on the proposal (assuming a quorum is present) is required to approve the advisory vote on the compensation of the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis and the Executive Compensation sections of this Proxy Statement. Abstentions and broker non-votes will not be included in the votes cast and thus will have no effect other than not providing the Company with your view on the proposal. Although the outcome of this advisory vote is not binding on the Company, the Compensation Committee and the Board of Directors will review and consider the outcome of the vote when making future compensation decisions pertaining to the Company’s named executive officers.

Proposal 4: Advisory vote on the frequency of future advisory votes on the compensation of the Company's named executive officers. The shareholders' recommendation on how often (every year, every two years, or every three years) future advisory votes on the compensation of the Company's named executive officers should be held will be the frequency receiving the greatest number of votes. Abstentions and broker non-votes will not be included in the votes cast and thus will have no effect other than not providing the Company with your view on the proposal. Although the outcome of this advisory vote is not binding on the Company, the Board of Directors will review and consider the outcome of the vote when considering how often to hold future advisory votes on the compensation of the Company's named executive officers.

The Board of Directors recommends a vote: “FOR” the election of the nine directors named in proposal 1; “FOR” the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm in proposal 2; “FOR” approval of the compensation of the Company’s named executive officers in proposal 3; and for a frequency of "EVERY YEAR" (i.e., "1 Year" on the proxy card or voting instructions) for future non-binding shareholder advisory votes to approve the compensation of the Company's named executive officers.

4

PROPOSAL 1

ELECTION OF DIRECTORS

All nine of the Company’s current directors are to be elected at the 2023 Annual Meeting. The nominees to the Board are Mses. Bélec, Cooney and Davis and Messrs. Bohn, Krueger, Malone, Myers, Pfeifer and Ravenscroft, all of whom are currently directors. Information regarding each nominee is set forth below. If elected, each individual will hold office for a one-year term expiring at the 2024 Annual Meeting of Shareholders, subject to the limit discussed in the following sentence, or until their respective successors are duly elected and qualified. Pursuant to the Company’s Corporate Governance Guidelines, when a director reaches the age of 72, the director will resign from the Board at the first annual meeting held after reaching that age.

The election of directors is determined by a majority of the votes cast, if the election is uncontested. Shares represented by proxies in the accompanying form will be voted for the election of the nominees listed below, unless a contrary direction is indicated. The nominees have indicated that they are able and willing to serve as directors. However, if any of the nominees should be unable to serve, which management does not contemplate, it is intended that the proxies will vote for the election of such other person or persons as management may recommend.

Information about the Company's Director Nominees

The following sets forth certain information, as of March 1, 2023, about the Board’s nominees for election at the 2023 Annual Meeting. All nine nominees were recommended to the Board by the Corporate Governance and Sustainability Committee.

Anne E. Bélec, 60, has been a director of the Company since 2019 and serves on the Company's Audit and Compensation Committees. She is a senior executive with over 35 years of experience in sales, marketing, and customer service. She had an extensive career at Ford Motor Company, holding successively senior positions, including Director, Global Marketing, and President and Chief Executive Officer, Volvo Cars N.A., Volvo Cars Corporation. Ms. Bélec subsequently went on to hold several additional senior executive roles in the automotive and recreational products sectors, including Vice President and Chief Marketing Officer of Navistar, Inc. and Senior Vice President, Global Brand, Communications and Parts, Accessories and Clothing at Bombardier Recreational Products, Inc. Ms. Bélec is the co-founder and presently serves as Chief Executive Officer of Mosaic Group, LLC, a firm offering outsourced marketing services for brands in Canada, the United States and globally.

Ms. Bélec's extensive experience in sales and marketing makes her qualified to serve on the Company's Board of Directors.

Robert G. Bohn, 69, has been a director of the Company since 2014 and serves on the Company’s Corporate Governance and Sustainability Committee as Chair and on the Audit Committee. He served as Chief Executive Officer of Oshkosh Corporation, a leading innovator of mission-critical vehicles and equipment, from 1997 until 2010, and as its Chair of the Board from 2000 to 2011. Mr. Bohn joined Oshkosh Corporation in 1992 as Group Vice President, and also served as its President from 1994 to 2007 and as its Chief Operating Officer from 1994 to 1997. Prior to joining Oshkosh Corporation, he held various executive positions with Johnson Controls, Inc. from 1985 to 1992. He also serves as a director of Carlisle Companies Inc. (NYSE:CSL) and Pontem Corporation (NYSE: PNTM).

Mr. Bohn’s extensive experience in growth strategy development and execution, international market development, acquisitions integration, and maximizing operational efficiency make him qualified to serve on the Company’s Board of Directors.

5

Proposal 1 Election of Directors

Anne M. Cooney, 63, has been a director of the Company since 2016 and serves on the Company’s Compensation Committee as Chair and on the Corporate Governance and Sustainability Committee. She served as President, Process Industries and Drives of Siemens Industry, Inc., a division of Siemens AG, a multinational conglomerate primarily engaged in industrial engineering, electronics, energy, healthcare, and infrastructure activities, from 2014 to her retirement in December 2018. Ms. Cooney joined Siemens in 2001 and held a variety of high-level management positions, including serving as Chief Operating Officer, Siemens Healthcare Diagnostics, a division of Siemens AG, from 2011 until 2014, and as President, Drives Technologies of Siemens Industry, Inc. from 2008 until 2011. She previously held various positions with increasing responsibility at General Electric Company and also served as Vice President, Manufacturing of Aladdin Industries, LLC. Ms. Cooney currently serves as a director of Summit Materials, Inc. (NYSE: SUM) and Wesco International, Inc. (NYSE: WCC).

Ms. Cooney brings senior management and operational experience to the Company’s Board of Directors. Her extensive background and leadership experience in various segments of large manufacturing companies make her qualified to serve on the Company’s Board of Directors.

Amy R. Davis, 54, has been a director of the Company since 2021 and serves on the Company’s Audit Committee. She has served as the Vice President and President – New Power Business of Cummins Inc. since July 2020. Ms. Davis previously served as Vice President of the global Filtration business at Cummins from June 2015 until July 2020, and as President of the Cummins Northeast distributor as an owner from 2010 until 2015.

Ms. Davis has extensive management and operational experience in the international operations of large, diversified manufacturers. Her experience in international market development, integration, and maximizing operational efficiency make her qualified to serve on the Company’s Board of Directors.

Kenneth W. Krueger, 66, has been a director of the Company since 2004, currently serves as the Non-Executive Board Chair and served as the interim President and Chief Executive Officer of the Company from October 2015 until March 2016. Mr. Krueger was the Chief Operating Officer from 2006 to 2009 and Executive Vice President from 2005 to 2006 of Bucyrus International, Inc., a global leader in mining equipment manufacturing. Mr. Krueger also was the Sr. Vice President and Chief Financial Officer from 2000 to 2005 of A. O. Smith Corporation, a global manufacturer of water heating and water treatment systems, and Vice President, Finance and Planning, Hydraulics, Semiconductor Equipment, and Specialty Controls Group from 1999 to 2000 of Eaton Corporation. Mr. Krueger also serves as a director of Douglas Dynamics, Inc. (NYSE: PLOW) and Albany International Corporation (NYSE: AIN).

Mr. Krueger has extensive financial, accounting, and operations experience. He has served as a chief financial officer and chief operating officer of publicly-traded companies and has other significant senior management experience. His experience and background in finance and accounting in a publicly-traded manufacturing company bring great focus to the Company’s accounting, auditing, and internal controls. Mr. Krueger’s operations leadership experience in the heavy manufacturing industry, coupled with his experience in accounting and finance, make him a valued adviser as a member of the Company’s Board of Directors and as the current Chair.

Robert W. Malone, 59, has been a director of the Company since 2021 and serves on the Company’s Compensation Committee. He has served as the Vice President and President – Filtration Group of Parker-Hannifin Corporation since December 2014. Mr. Malone joined Parker in 2013 serving as Vice President of Operations for the Filtration Group where he was responsible for five of the group’s divisions and the group sponsor for four of the seven global filtration platforms. Prior to Parker, Mr. Malone served as President and Chief Executive Officer for Purolator Filters with responsibility for the engineering, manufacturing, marketing, and sales of branded and private label filters to North American OEM and aftermarket customers. Prior to Purolator Filters, Mr. Malone held senior leadership positions with ArvinMeritor Light Vehicle Aftermarket and Arvin-Kayaba, LLC.

6

Proposal 1 Election of Directors

Mr. Malone has extensive management and operational experience in the international operations of large, diversified manufacturers. His experience in international market development, integration and maximizing operational efficiency makes him qualified to serve on the Company’s Board of Directors.

C. David Myers, 59, has been a director of the Company since 2016 and serves on the Company’s Audit Committee as Chair and on the Corporate Governance and Sustainability Committee. He retired as President – Building Efficiency of Johnson Controls, Inc., a global diversified technology and industrial company, in 2014 after serving in such role since 2005. Mr. Myers previously served as President and Chief Executive Officer, as well as a director, of York International Corporation, a provider of heating, ventilating, air conditioning, and refrigeration products and services, from 2004 until York was acquired by Johnson Controls in 2005. Prior thereto, he held other positions with increasing responsibility at York, including serving as President, Executive Vice President and Chief Financial Officer. Mr. Myers previously served as a Senior Manager at KPMG LLP. Mr. Myers serves as a director of The Boler Company (operating as Hendrickson International) and First American Funds. Mr. Myers formerly served on the board of Children’s Hospital of Wisconsin.

Mr. Myers brings senior management, cybersecurity expertise, accounting, and financial controls experience to the Company’s Board of Directors. The foundation of Mr. Myers’ financial controls and accounting expertise is from when he served as a senior manager at KPMG and continued through his service as Chief Financial Officer of York. His background and experience in finance, accounting, and senior management in various segments of large manufacturing companies make him qualified to serve on the Company’s Board of Directors.

John C. Pfeifer, 57, has been a director of the Company since 2016 and serves as a member of the Company’s Compensation and Corporate Governance and Sustainability Committees. He has served as the President and Chief Executive Officer for Oshkosh Corporation, a leading innovator of mission-critical vehicles and equipment since April 2, 2021. Mr. Pfeifer previously served as President and Chief Operating Officer for Oshkosh Corporation from May 5, 2020 until April 2, 2021 and as the Executive Vice President and Chief Operating Officer from May 1, 2019 until May 5, 2020, where he was responsible for the company’s business portfolio and played a vital role in shaping strategy. Mr. Pfeifer joined Oshkosh in 2019 after serving 13 years with Brunswick Corporation, most recently he was Senior Vice President of the Brunswick Corporation, and served as President of Mercury Marine, a subsidiary of the Brunswick Corporation, since 2014. Mercury Marine is a multibillion dollar global manufacturer of marine propulsion systems. Mr. Pfeifer previously served as Vice President – Global Operations for Mercury Marine from 2012 until 2014 and as President, Brunswick Marine in EMEA from 2008 until 2012. Prior to joining Brunswick in 2006 as President, Asia Pacific Group, Mr. Pfeifer held various executive level positions with increasing responsibility at ITT Corporation, a diversified manufacturer. Mr. Pfeifer serves as a director of Oshkosh Corporation (NYSE: OSK) and National Exchange Bank & Trust.

Mr. Pfeifer has extensive management and operational experience in the international operations of large, diversified manufacturers. His experience in international market development, integration, and maximizing operational efficiency make him qualified to serve on the Company’s Board of Directors.

Aaron H. Ravenscroft, 44, has served as President and Chief Executive Officer, and has been a director, of the Company since August 2020. Mr. Ravenscroft joined Manitowoc as Executive Vice President of the Mobile Cranes business in March 2016, and in August 2017, he took responsibility for the Tower Cranes business. Prior to joining Manitowoc, Mr. Ravenscroft served as a Regional Managing Director at Weir Group's Mineral division from 2013 to 2016. From 2011 to 2013, he served as President of the Process Flow Control Group at Robbins & Myers. Prior to Robbins & Myers, Mr. Ravenscroft served as Regional Vice President of the Industrial Products Group for Gardner Denver from 2008 to 2011 and a series of positions with increasing responsibility at Wabtec from 2003 to 2008. Mr. Ravenscroft started his career as a sell side stock analyst at Janney Montgomery Scott following capital goods companies from 2000 to 2003.

7

Proposal 1 Election of Directors

In addition to serving as the Company’s President and Chief Executive Officer, Mr. Ravenscroft’s deep industrial expertise qualifies him to serve on the Company’s Board of Directors.

The Board of Directors recommends a vote “FOR” the election of each of the nine above nominees.

8

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP

AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2023

The Audit Committee and the Board of Directors have appointed Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023, and ask that the shareholders ratify that appointment. A representative of Deloitte & Touche LLP is expected to be present at the 2023 Annual Meeting to respond to appropriate questions and to make a statement if he or she desires to do so. Although ratification is not required by the Company’s Restated By-laws or otherwise, the Board of Directors is submitting the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023 to its shareholders for ratification as a matter of good corporate practice and because the Board values the input of its shareholders on this matter. As previously described, a majority of the votes cast on the proposal by the holders of shares entitled to vote at the 2023 Annual Meeting is required for ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023.

If the shareholders fail to ratify the appointment of Deloitte & Touche LLP, the Audit Committee will consider it as a direction by shareholders to consider the appointment of a different independent registered public accounting firm. Nevertheless, the Audit Committee will still have the discretion to determine whom to appoint as the Company’s independent registered public accounting firm for the year ending December 31, 2023. Even if the appointment of Deloitte & Touche LLP is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company.

The Board of Directors recommends a vote “FOR” the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023.

9

PROPOSAL 3

ADVISORY VOTE TO APPROVE THE COMPENSATION OF THE COMPANY’S

NAMED EXECUTIVE OFFICERS

As explained in detail in the Compensation Discussion and Analysis and Compensation Committee Report sections of this Proxy Statement, through our executive compensation program we seek to align the interests of our executives with the interests of our shareholders and Company performance, as well as to motivate our executives to maximize long-term total returns to our shareholders. In accordance with Section 14A of the Securities Exchange Act of 1934, we are asking our shareholders to approve, on a non-binding, advisory basis, the compensation of our named executive officers. The Company holds these votes annually. We believe the 2022 actual compensation paid to the named executive officers is commensurate with the Company’s 2022 performance and is aligned with the interests of our shareholders. Accordingly, we ask your indication of support “FOR” approval of the compensation of the Company’s named executive officers as described in this Proxy Statement by voting in favor of the following resolution:

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.

Although the outcome of this advisory vote is not binding on the Company, the Compensation Committee and the Board of Directors will review and consider the outcome of the vote when making future compensation decisions pertaining to the Company’s named executive officers.

In seeking your approval of the compensation of the named executive officers, we direct you to the Compensation Discussion and Analysis section, including its Executive Summary, and the Executive Compensation section.

The Board of Directors recommends a vote “FOR” approval of the compensation of the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis and the Executive Compensation sections of this Proxy Statement.

10

PROPOSAL 4

ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON THE COMPENSATION

OF THE COMPANY'S NAMED EXECUTIVE OFFICERS

In addition to providing shareholders with the opportunity to cast an advisory vote to approve the compensation of our named executive officers, in accordance with Section 14A of the Securities Exchange Act of 1934, the Company is asking shareholders to vote, on a non-binding , advisory basis, on whether future advisory votes on the compensation of our named executive officers should be held every one, two or three years. The Company currently holds advisory votes every year to approve named executive officer compensation. After considering the appropriate interval for future advisory votes on the compensation of our named executive officers, the Board is recommending that the Company continue to hold advisory votes every year because it will allow the Company's shareholders to annually express their views on our compensation program. The Company values the annual input provided by its shareholders.

When voting on this advisory vote, shareholders should understand that they are not voting "for" or "against" the Board's recommendation to hold the advisory vote every year. Rather, shareholders have the option to recommend that such advisory vote on the compensation of our named executive officers be held every one, two or three years, or to abstain entirely from voting on the proposal. Please indicate on your proxy card or voting instruction, or by voting online, your preference as to how frequently shareholders will vote on future advisory votes on the compensation of the Company's named executive officers, as either every year (i.e., "1 Year"), every two years or every three years, or you may abstain from voting.

Similar to the advisory vote to approve named executive officer compensation, this proposal is also an advisory vote and is not binding on the Company. However, the Company values the opinions expressed by its shareholders, and will consider the outcome of the advisory votes to approve named executive officer compensation itself and on the frequency of future advisory votes when making decisions on the frequency of future votes.

We intend to hold our next advisory vote on the frequency of future shareholder advisory votes on the compensation of the Company's named executive officers at our annual meeting in 2029.

The Board of Directors recommends a vote for a frequency of "EVERY YEAR" (i.e., "1 Year" on the proxy card or voting instruction) for future shareholder advisory votes on the compensation of the Company's named executive officers.

11

Corporate Governance

CORPORATE GOVERNANCE

Corporate Governance Highlights

BOARD MEMBER REPRESENTATION:

The Company believes that strong corporate governance is critical to achieving long-term shareholder value. We are committed to governance practices and policies that serve the interests of the Company and its shareholders. The following table summarizes certain highlights of our corporate governance practices and policies:

INDEPENDENCE • All director nominees, except our Chief Executive Officer, are independent • Audit, Compensation, and Corporate Governance and Sustainability Committees composed entirely of independent directors | BEST PRACTICES • Mandatory director retirement age • The Board of Directors includes three women • The Board of Directors includes a balance of longer-tenured and newer directors • Directors are engaged in continuous education and development • None of our director nominees are "overboarded" - five do not sit on any other public company Board of Directors, one sits on one other public company Board of Directors, and three sit on two other public company Board of Directors • Share ownership guidelines for Board of Directors and executives • Published Corporate Governance Guidelines, which are reviewed and evaluated at least annually • Published Global Code of Business Conduct applicable to our Board of Directors • Each Committee of our Board of Directors has a published charter that is reviewed and evaluated at least annually • Independent members of the Board of Directors meet regularly and frequently (at least four times per year) without management present • Non-Executive Board Chair • The Board of Directors and each Board Committee conducts an annual performance self-evaluation

|

ACCOUNTABILITY • Annual election of all members of the Board of Directors • Majority voting for members of the Board of Directors • Ability to remove members of the Board of Directors without cause • No super majority voting provisions in our Amended and Restated Articles of Incorporation or Restated By-laws • Right of shareholders holding 10% or more of our stock to call special meetings • Board Chair and Chief Executive Officer roles separated | |

RISK OVERSIGHT • The Board of Directors oversees the Company's overall risk-management structure • The Audit Committee assists the Board in overseeing the enterprise risk management processes, including review of strategic, operational, financial and legal compliance risks • The Board of Directors receives regular updates regarding information technology and cybersecurity risks, including controls implemented to mitigate these risks, the results of cybersecurity exercises and response readiness assessments |

12

Corporate Governance

With the support and oversight of the Board and the Corporate Governance and Sustainability Committee, the Company continues to focus on the Company’s strategy, initiatives, risk opportunities, and related reporting with respect to significant environmental, climate change, health and safety, human rights, and corporate citizenship matters. To learn more about the Company’s sustainability efforts and to access the Company’s Annual Corporate Sustainability Reports go to the Company’s website under “Investors – Environmental & Social” at www.manitowoc.com. The Company is not including the information contained on or available through its website as a part of, or incorporating such information by reference into, this Proxy Statement.

Governance of the Company

Composition and Independence. The Board is currently comprised of nine directors. Under the Company’s Restated By-laws, the number of directors may not be less than seven or more than twelve.

The Board of Directors has determined that the following non-employee directors –Anne E. Bélec, Robert G. Bohn, Anne M. Cooney, Amy R. Davis, Kenneth W. Krueger, Robert W. Malone, C. David Myers, and John C. Pfeifer – do not have any material relationships with the Company, other than serving as directors, and that each is independent as defined in the Company’s Director Independence Criteria and under applicable law and the New York Stock Exchange (the “NYSE”) listing standards. In determining whether a director has a material relationship with the Company, in addition to reviewing applicable laws and NYSE listing standards, the Board has adopted nine Director Independence Criteria which may be viewed on the Company’s website under “Investors – Corporate Governance” at www.manitowoc.com. Any director who meets all of the nine criteria will be presumed by the Board to have no material relationship with the Company. In addition to the foregoing, in determining that Ms. Davis, Mr. Malone and Mr. Pfeifer were independent, the Board considered Ms. Davis’ role at Cummins Inc. (“Cummins”), Mr. Malone’s role at Parker-Hannifin Corporation (“Parker”) and Mr. Pfeifer’s role at Oshkosh Corporation (“Oshkosh”). Cummins and Parker are suppliers to the Company and Oshkosh is a customer of the Company, as well as a supplier. Ms. Davis has served as the Vice President and President - New Power Business of Cummins since July 2020 and previously served as Vice President of the global Filtration business at Cummins from June 2015 until July 2020. Mr. Malone has served as the Vice President and President – Filtration Group of Parker since December 2014. Mr. Pfeifer has served as the President and Chief Executive Officer of Oshkosh since April 2, 2021, and previously served as President and Chief Operating Officer of Oshkosh from May 5, 2020 until April 2, 2021 and as the Executive Vice President and Chief Operating Officer of Oshkosh from May 1, 2019 until May 5, 2020. During 2022, the Company continued commercial relationships with Cummins, Parker and Oshkosh, paying Cummins approximately $15 million for goods and services (which represented about 0.06% of Cummins’ net revenues), paying Parker approximately $4.1 million for goods and services (which represented about 0.03% of Parker’s net revenues), paying Oshkosh approximately $0.4 million for goods and services (which represented about 0.005% of Oshkosh’s net revenues), and selling Oshkosh approximately $4.6 million of goods and services (which represented about 0.06% of the Company’s net revenues). All of these transactions were conducted in arms’ length transactions in the normal and ordinary course of the Company’s business and were approved by the Audit Committee.

Aaron H. Ravenscroft, the Company’s President and Chief Executive Officer, is not an independent director.

Guidelines and Ethics. The Company has adopted Corporate Governance Guidelines to set forth internal Board policies and procedures. The Board of Directors regularly reviews and, if appropriate, revises the Corporate Governance Guidelines and other governance instruments, including the charters of its Audit, Compensation, and Corporate Governance and Sustainability Committees, in accordance with rules of the SEC and the NYSE. The Board of Directors has also adopted a Code of Conduct that includes a Global Ethics Policy that pertains to all employees, including, but not limited to, the Company’s principal executive officer, principal financial officer, principal accounting officer, and controller.

Copies of these documents are available, free of charge, on the Company’s website under “Investors – Governance” at www.manitowoc.com. Other

13

Corporate Governance

than the text of the Corporate Governance Guidelines, charters of the Audit, Compensation, and Corporate Governance and Sustainability Committees, the Code of Conduct and the Director Independence Criteria, the Company is not including the information contained on or available through its website as a part of, or incorporating such information by reference into, this Proxy Statement.

As set forth in the Corporate Governance Guidelines, all directors are strongly encouraged to attend the annual shareholder meeting of the Company. Seven of the nine directors serving at the time attended the 2022 Annual Meeting of Shareholders.

Meetings. During the year ended December 31, 2022, the Board of Directors met five times. All members of the Board attended at least 75 percent of the meetings held by the Board and the committees on which they served, except Robert G. Bohn who attended 71 percent due to conflicting schedules. As required by the Company’s Corporate Governance Guidelines, the Board met in executive session at each regular Board meeting during 2022.

Board Leadership Structure. The Board of Directors has determined that the interests of the Company and the Board of Directors are best served at this time by separating the roles of Chair of the Board and Chief Executive Officer of the Company. Among the factors considered by the Board in reaching this conclusion, the Board of Directors believes that it is important for Mr. Ravenscroft to focus solely on his responsibilities as President and Chief Executive Officer of the Company and that a Board member with a long-standing familiarity with the Company should serve as the Chair of the Board of Directors.

The Non-Executive Chair of the Board is an independent director. The Corporate Governance Guidelines provide that if the Chair of the Board is not an independent director, the chairperson of the Corporate Governance and Sustainability Committee will serve as the lead director. If for any reason the chairperson of the Corporate Governance and Sustainability Committee is unable to perform the lead director role on a temporary basis, he/she will designate the chairperson of either the Compensation Committee or the Audit Committee to assume the role of lead director on an interim basis. When a lead director is in place, the lead director has the following duties and responsibilities: (a) preside at all meetings of the Board of Directors at which the Chair of the Board is not present, including independent director sessions; (b) call independent director sessions; (c) serve as a liaison between the Chair of the Board and the independent directors; (d) review and approve the agendas for Board meetings, including the schedule of meetings; (e) meet with the Chair of the Board and Chief Executive Officer after each Board meeting to provide feedback to the Chair of the Board and Chief Executive Officer regarding the Board meeting and any other matters deemed appropriate by the independent directors; and (f) such other duties and responsibilities as the Board of Directors may request from time to time.

Committees. The Company has standing Audit, Compensation, and Corporate Governance and Sustainability Committees of the Board of Directors, currently comprised of only independent directors as follows:

COMMITTEE |

| ANNE E. BÉLEC | ROBERT G. BOHN | ANNE M. COONEY | AMY R. DAVIS | ROBERT W. MALONE | C. DAVID MYERS | JOHN C. PFEIFER |

AUDIT COMMITTEE |

| ü | ü |

| ü |

| Chair |

|

COMPENSATION COMMITTEE |

| ü |

| Chair |

| ü |

| ü |

CORPORATE GOVERNANCE AND SUSTAINABILITY COMMITTEE |

|

| Chair | ü |

|

| ü | ü |

|

|

|

|

|

|

|

|

|

14

Corporate Governance

Risk Oversight

The Board of Directors is responsible for the oversight of risk across the entire Company. This responsibility is administered more directly through the Audit Committee of the Board of Directors. As set forth in the Audit Committee Charter, one of the responsibilities of the Audit Committee is to assist the Board of Directors in fulfilling its role in the oversight of risk across the organization and the management and/or mitigation of those risks. On a regular basis in its committee meetings, the Audit Committee specifically reviews risks identified by management that could have a material adverse effect on the business, financial condition, or results of operations of the Company. Additionally, the Audit Committee works to identify the Company’s material risks and risk factors through regular meetings and discussions with senior management, the director of internal audit, and the Company’s independent auditors. Management reviews with the Audit Committee the Company’s enterprise risk management process to identify enterprise risks and mitigating strategies related to each of the Company's key business areas (i.e., market, financial, operational, reputation, competition, legal and regulatory, environmental, health and safety, product liability, public reporting, information systems, cybersecurity, employment and labor, and strategic planning) and the steps management has taken to monitor and control such risks. Appropriate members of the executive leadership team and management are responsible for management of the various risks related to each of the Company’s key business areas. During 2022, the Board of Directors and its committees also reviewed and discussed with management macroeconomic conditions, including inflation, rising interest rates and recessionary concerns, as well as ongoing global supply chain constraints, labor availability and cost pressures, logistical challenges, the COVID-19 pandemic and geopolitical events, and management's strategies and initiatives to respond to, and mitigate, any adverse impacts. The Board of Directors also receives regular updates regarding information technology and cybersecurity risks, including the controls implemented to mitigate these risks, the results of cybersecurity exercises and response readiness assessments. The Board of Directors also received a briefing on global developments in cybersecurity threats to enhance their literacy on cyber issues.

Succession Planning

Succession planning and leadership development are key priorities for the Board of Directors and management. The Board of Directors regularly reviews the Company’s succession planning activities in support of its business strategy, which includes a detailed discussion of the Company’s development programs, leadership bench, and succession plans with a focus on key positions at the senior executive level and other critical roles. The Board of Directors also has regular and direct exposure to potential future leaders at the Company through formal Board and Committee presentations and informal events.

The Board of Directors has adopted written policies and procedures regarding the review, approval, and ratification of related party transactions. For purposes of these policies and procedures:

15

Corporate Governance

Disclosure to the Audit Committee is required to be made before, if possible, or as soon as practicable after the related person transaction is affected, but in any event as soon as practicable after the executive officer, director or nominee for director becomes aware of the transaction or of a material change to such a transaction. Under the policy, the Audit Committee’s decision to approve or ratify a related person transaction is to be based on the Audit Committee’s determination that consummation of the transaction is in, or was not contrary to, the best interests of the Company. There were no related person transactions during 2022.

Corporate Governance and Sustainability Committee

The Corporate Governance and Sustainability Committee is also the Company’s nominating committee. The purpose of the Corporate Governance and Sustainability Committee is to assist the Board in its corporate governance responsibilities, including to identify individuals qualified to become Board members, to recommend to the Board for the Board’s selection director nominees and to recommend to the Board the corporate governance principles and guidelines.

The Corporate Governance and Sustainability Committee's role and responsibilities also include the following:

All members of the Corporate Governance and Sustainability Committee are independent as defined in the Company's Director Independence Criteria, applicable law, and the corporate governance listing standards of the NYSE.

The Corporate Governance and Sustainability Committee met four times during 2022.

Audit Committee

The Audit Committee's role and responsibilities include the following:

16

Corporate Governance

All members of the Audit Committee are “independent,” as defined in the Company’s Director Independence Criteria, the Audit Committee Charter, applicable law, and the corporate governance listing standards of the NYSE relating to audit committees. The Board has determined that all members of the Audit Committee are financially literate and that Messrs. Myers and Bohn are “audit committee financial experts,” as defined in the Company’s Audit Committee Charter and in the SEC regulations.

The Audit Committee met eight times during 2022. For further information, see the Audit Committee Report below.

Compensation Committee

The Compensation Committee assists the Board of Directors in fulfilling its responsibility to achieve the Company’s purpose of maximizing the long-term total return to shareholders by ensuring that executive officers, directors, and employees are compensated in accordance with the Company’s philosophy, objectives, and policies.

The Compensation Committee's role and responsibilities include the following:

All members of the Compensation Committee are “independent” as defined in the Company’s Director Independence Criteria, the Compensation Committee Charter, applicable law and the corporate governance listing standards of the NYSE relating to compensation committees. The Compensation Committee is primarily responsible for administering the Company’s executive compensation program. As such, the Compensation Committee reviews and approves all elements of the executive compensation program that cover the executive officers. Management is responsible for making recommendations to the Compensation Committee (except with respect to compensation paid to the Chief Executive Officer) and effectively implementing the executive compensation program, as established by the Compensation Committee. To assist the Compensation Committee with its responsibilities regarding the executive compensation program, the Compensation Committee currently retains Willis Towers Watson as its independent compensation consultant. The Compensation Committee considered the factors set forth in the Compensation Committee Charter and in applicable SEC and NYSE rules regarding independence, and does not believe that its retention of Willis Towers Watson has given rise to any conflict of interest.

The Compensation Committee met six times during 2022. For further information, see the Compensation Discussion and Analysis and the Compensation Committee Report below.

17

The Company believes that meaningful corporate governance should include regular conversations between our management and our shareholders. Our management team frequently meets with shareholders for conversations on a variety of topics, including but not limited to Company strategic growth initiatives, business performance, compensation, and environmental, social, and governance issues. In addition, the Company solicits input from our investment community to better understand their perception of the Company’s performance and strategy. In 2022, our management team held discussions with several top shareholders to garner their input on governance matters and practices. The Company collects the feedback from these sessions and presents it to the Board for its consideration. The Board values an active and transparent investor relations program as it believes that shareholder input strengthens its role as an informed and engaged fiduciary.

• Board of Directors • President and Chief Executive Officer • Executive Vice President and Chief Financial Officer • Other Executive Vice Presidents and Senior Vice Presidents • Investor Relations

| • Annual meetings • One-on-one meetings • Shareholder calls • Investor conferences • Meetings and tours at Manitowoc facilities • Hosting trade show tours • Earnings calls • Being accessible for shareholder inquiries |

2022 Engagement Summary

The Company is actively engaged with shareholders throughout the year where management from various departments meet with shareholders regularly to discuss a variety of topics. Highlights of our 2022 shareholder outreach are as follows:

The Board considers feedback from these conversations during its deliberations, and the Company regularly reviews and adjusts applicable corporate governance structure and executive compensation policies and practices in response to comments from our shareholders.

18

Shareholder Engagement

As we continue our efforts to build and strengthen our relationships with shareholders, we encourage you to contact us via:

Email/Call | Attend |

investor.relations@manitowoc.com Tel: 414-760-4805 | https://ir.manitowoc.com/events-and-presentations/events/default.aspx

|

Nominations of Directors

The Corporate Governance and Sustainability Committee has adopted the following policies and procedures regarding consideration of candidates for the Board.

Consideration of Candidates for the Board of Directors Submitted by Shareholders. Pursuant to the Company’s Restated By-laws and the Corporate Governance and Sustainability Committee Charter, the Corporate Governance and Sustainability Committee will only review recommendations for director nominees from any shareholder beneficially owning, or group of shareholders beneficially owning in the aggregate, at least 5% of the issued and outstanding Common Stock of the Company for at least one year as of the date that the recommendation was made (a “Qualified Shareholder”). Any Qualified Shareholder must submit its recommendation no later than 120 calendar days before the date of the Company’s Proxy Statement is released to the shareholders in connection with the previous year’s annual meeting for the recommendation to be considered by the Corporate Governance and Sustainability Committee. Any recommendation must be submitted in accordance with the policy in the Corporate Governance Guidelines captioned “Communications to the Board of Directors” (which is also described below). In considering any timely-submitted recommendation from a Qualified Shareholder, the Corporate Governance and Sustainability Committee shall have sole discretion as to whether to nominate the individual recommended by the Qualified Shareholder, except that in no event shall a candidate recommended by a Qualified Shareholder who is not “independent” as defined in the Company’s Director Independence Criteria and who does not meet the minimum expectations for a director set forth in the Company’s Corporate Governance Guidelines be recommended for nomination by the Corporate Governance and Sustainability Committee.

The Corporate Governance and Sustainability Committee did not receive, prior to the deadline noted above, any recommendations for director nominees from any Qualified Shareholder.

Consideration of Candidates for the Board of Directors who are Incumbent Directors. Prior to the expiration of the term of a director desiring to stand for re-election, the Corporate Governance and Sustainability Committee will evaluate the performance and suitability of the particular director. The evaluation may include the opportunity for other sitting directors to provide input to the Corporate Governance and Sustainability Committee or its chairperson and may include an interview of the director being evaluated. If the director being evaluated is the chairperson of the Corporate Governance and Sustainability Committee, another Corporate Governance and Sustainability Committee member will be appointed by the Corporate Governance and Sustainability Committee to lead the evaluation. The Corporate Governance and Sustainability Committee will make a recommendation to the Board for the Board’s final decision on each director seeking re-election.

Consideration of Candidates for the Board of Directors who are Non-Incumbent Directors. In the event of a vacancy in the Board of Directors, the Corporate Governance and Sustainability Committee will manage the process of searching for a suitable director. The Corporate Governance and Sustainability Committee will be free to use its judgment in structuring and carrying out the search process based on the Corporate Governance Committee’s and the Board’s perception as to what qualifications would best suit the Board’s needs for each particular vacancy. The process may include the consideration of candidates recommended by executive officers, Board members, shareholders and/or a third-party professional search firm retained by the Corporate Governance and Sustainability Committee. The Corporate Governance and Sustainability Committee has sole authority to retain (including to determine the fees and other retention terms) and terminate any third-party to be used to identify director candidates and/or

19

Shareholder Engagement

evaluate any director candidates. Any candidate should meet the expectations for directors set forth in the Company’s Corporate Governance Guidelines. Strong preference should be given to candidates who are “independent,” as that term is defined in the Company’s Director Independence Criteria and the NYSE rules, and to candidates who are sitting or former executives of companies whose securities are listed on a national securities exchange and registered pursuant to the Securities Exchange Act of 1934. The Corporate Governance and Sustainability Committee is not required to consider candidates recommended by a shareholder except as set forth in the section captioned “Consideration of Candidates for the Board of Directors Submitted by Shareholders” set forth above. If the Corporate Governance and Sustainability Committee determines to consider a candidate recommended by a shareholder, the Committee will be free to use its discretion and judgment as to what deference will be given in considering any such candidate.

Director Qualifications and Diversity. The Board of Directors appreciates the value that comes from diverse representation. In identifying candidates for the Board of Directors, the Corporate Governance and Sustainability Committee considers foremost the qualifications and experience that the Corporate Governance and Sustainability Committee believes would best suit the Board’s needs created by each particular vacancy. As part of the process, the Corporate Governance and Sustainability Committee and the Board endeavor to have a Board comprised of individuals with diverse backgrounds, viewpoints, and life and professional experiences, provided such individuals should all have a high level of management and/or financial experience and expertise. Pursuant to the Company’s Corporate Governance Guidelines, the Corporate Governance and Sustainability Committee should consider diversity of viewpoints, backgrounds, experiences, expertise, and skill sets, including diversity of age, gender identity, nationality, race, and ethnicity when identifying and recommending to the Board qualified candidates for Board membership. In this process, the Board of Directors and the Corporate Governance and Sustainability Committee do not discriminate against any candidate on the basis of race, color, national origin, gender, religion, disability, sexual orientation, or gender identity.

Communications to the Board of Directors

As set forth in the Company’s Corporate Governance Guidelines, any shareholder or interested party may communicate with the Board of Directors in accordance with the following process. If an interested party desires to communicate with the Board of Directors or any member of the Board of Directors, the interested party may send such communication in writing to the Company to the attention of our Secretary. Such communication must include the following information in order to be considered for forwarding to the Board of Directors or the applicable director:

20

Shareholder Engagement

Any communication that the Company’s Secretary determines, in his or her discretion, to be or to contain any language that is offensive or to be dangerous, harmful, illegal, illegible, not understandable, or nonsensical, may, at the option of such person, not be forwarded to the Board or any particular director. Any communication from an interested party shall not be entitled to confidential treatment and may be disclosed by the Company or by any Board member as the Company or the Board member sees fit. Neither the Company nor the Board, nor any Board member, shall be obligated to send any reply or response to the interested party, except to indicate to the interested party (but only if the interested party specifically requested such an indication) whether or not the interested party’s communication was forwarded to the Board or the applicable Board member.

21

Audit Committee Report

AUDIT COMMITTEE REPORT

In connection with its function to oversee and monitor the financial reporting process of the Company, the Audit Committee has done the following:

Based on the foregoing, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

Audit Committee |

C. David Myers, Chair |

Anne E. Bélec |

Robert G. Bohn |

Amy R. Davis |

Independent Registered Public Accounting Firm

PwC acted as the independent registered public accounting firm for the Company in the year ending December 31, 2022. A representative of PwC is expected to be present at the 2023 Annual Meeting to respond to appropriate questions.

As discussed below, in accordance with the recommendation of the Audit Committee, and at the direction of the Board of Directors, the Company appointed Deloitte & Touche LLP ("Deloitte") as its independent registered public accounting firm for the year ending December 31, 2023. As set forth in this Proxy Statement, the appointment of Deloitte is being submitted to the shareholders for ratification at the 2023 Annual Meeting. A representative of Deloitte is expected to be present at the 2023 Annual Meeting to respond to appropriate questions and to make a statement if he or she desires to do so.

Fees billed or expected to be billed by PwC for each of the last two years are listed in the following table:

YEAR ENDED DECEMBER 31 | AUDIT |

| AUDIT RELATED FEES |

| TAX |

| ALL OTHER |

| TOTAL FEES |

| |||||

2022 | $ | 2,147,000 |

| $ | — |

| $ | 94,000 |

| $ | 5,400 |

| $ | 2,246,400 |

|

2021 | $ | 2,026,000 |

| $ | — |

| $ | 35,100 |

| $ | 2,745 |

| $ | 2,063,845 |

|

Audit fees include fees for services performed to comply with the standards of the Public Company Accounting Oversight Board (United States), including the recurring audit of the Company’s consolidated financial statements. This category also includes fees for audits provided in connection with statutory filings or services that generally only the principal auditor reasonably can provide to a client, such as procedures related to consents and assistance with a review of documents filed with the SEC.

Audit related fees include fees for other audit and attest services, services provided in connection with certain agreed-upon procedures and other attestation reports, financial accounting, reporting and compliance matters, benefit plan audits, and risk and control reviews.

Tax fees primarily include fees associated with tax compliance, tax consulting, and domestic and international tax planning.

22

Audit Committee Report

All other fees primarily include fees associated with an accounting research tool.

The Company’s Audit Committee Charter requires that the Audit Committee pre-approve all non-audit services to be performed by the Company’s independent registered public accounting firm. All services performed by PwC that are encompassed in the audit related fees, tax fees, and all other fees were approved by the Audit Committee in advance in accordance with the pre-approval policy set forth in the Audit Committee Charter.

Previous Independent Registered Public Accounting Firm

On August 31, 2022, PwC was notified on behalf of the Audit Committee of the Board of Directors that it was dismissed as the Company's independent registered public accounting firm effective upon completion by PwC of its procedures on the financial statements of the Company as of and for the year ending December 31, 2022 and the filing of the related Form 10-K.

The reports of PwC on the Company's consolidated financial statements as of and for the years ended December 31, 2021 and 2020 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company's two most recent years ended December 31, 2021 and December 31, 2020 and in the subsequent interim period through August 31, 2022, there were no "disagreements" (as that term is described in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) with PwC on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which, disagreements if not resolved to the satisfaction of PwC, would have caused PwC to make reference to the subject matter of such disagreement in connection with its reports on the financial statements for such periods. In addition, during the Company's two most recent years and in the subsequent interim period through August 31, 2022, there were no "reportable events" (as that term is defined in Item 304(a)(1)(v) of Regulation S-K and the related instructions).

New Independent Registered Public Accounting Firm

On August 31, 2022, the Audit Committee of the Board of Directors appointed Deloitte as the Company's independent registered public accounting firm to audit the Company's consolidated financial statements for its year ending December 31, 2023, subject to completion of Deloitte's standard client acceptance procedures and execution of an engagement letter. Such client acceptance procedures were subsequently completed and an engagement letter was executed.