American Airlines Group Inc. Fourth-Quarter and Full Year 2021 Financial Results Exhibit 99.2

Certain of the statements contained in this presentation should be considered forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward- looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the company’s plans, objectives, expectations, intentions, estimates and strategies for the future, the continuing availability of borrowings under revolving lines of credit, and other statements that are not historical facts. These forward-looking statements are based on the company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth herein as well as in the company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 (especially in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors), and other risks and uncertainties listed from time to time in the company’s other filings with the Securities and Exchange Commission. In particular, the consequences of the coronavirus outbreak to economic conditions and the travel industry in general and the financial position and operating results of the company in particular have been material, are changing rapidly, and cannot be predicted. Additionally, there may be other factors of which the company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement. 2 Forward-looking statements

3 Introductory remarks Doug Parker Chairman and Chief Executive Officer

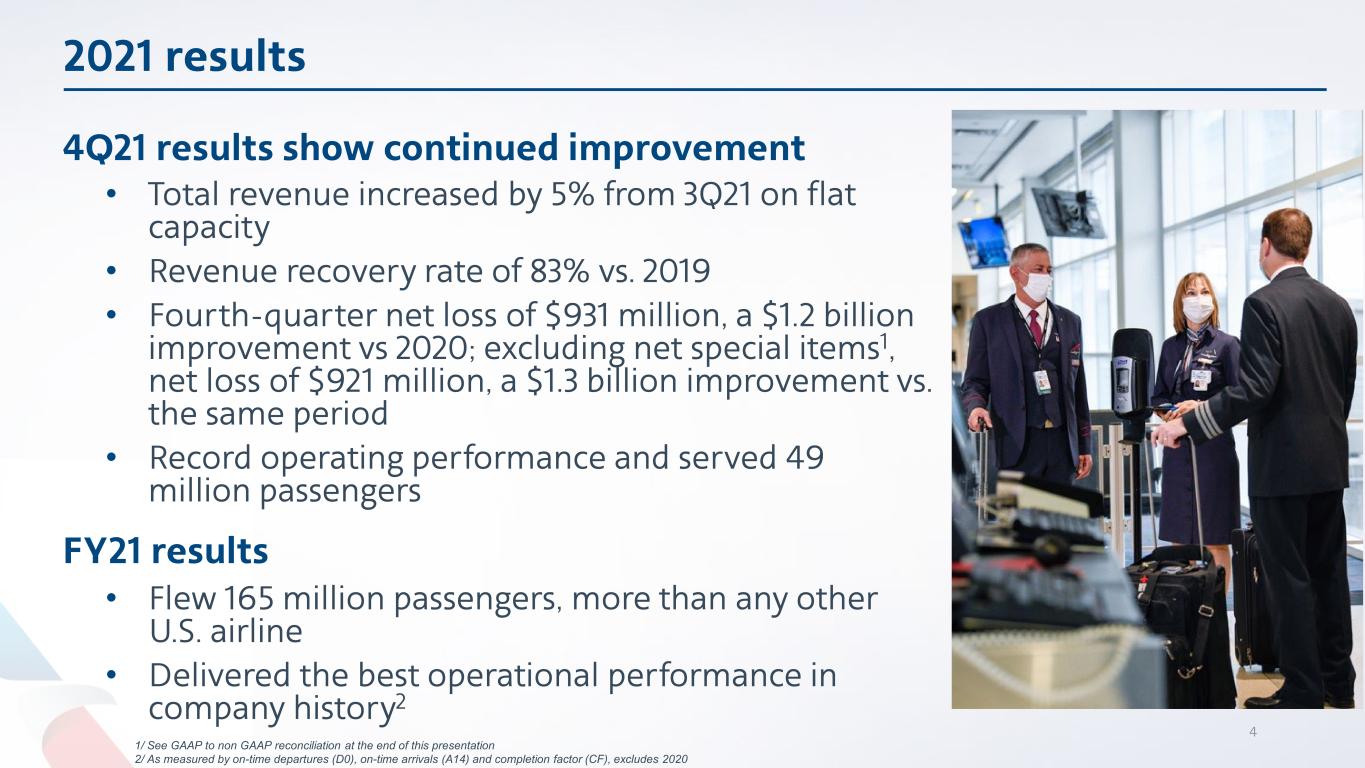

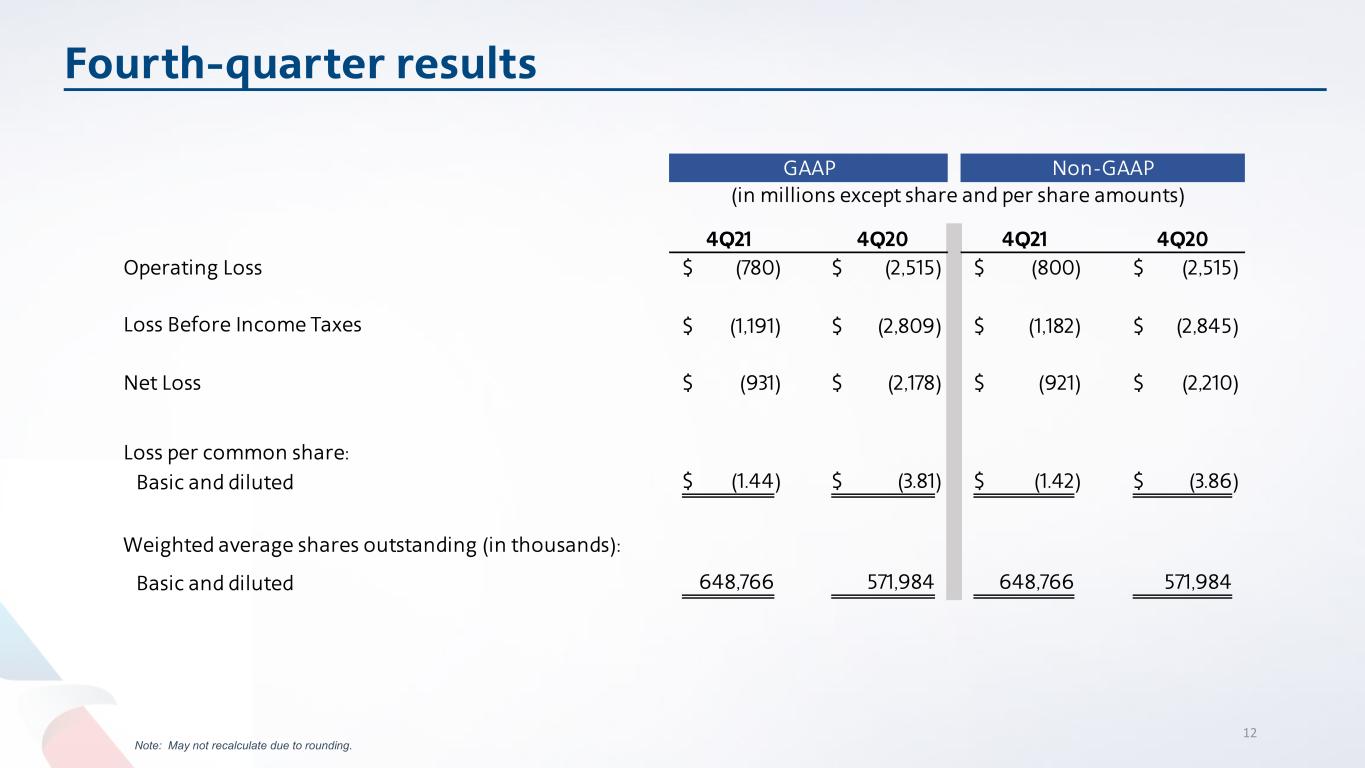

2021 results 4 4Q21 results show continued improvement • Total revenue increased by 5% from 3Q21 on flat capacity • Revenue recovery rate of 83% vs. 2019 • Fourth-quarter net loss of $931 million, a $1.2 billion improvement vs 2020; excluding net special items1, net loss of $921 million, a $1.3 billion improvement vs. the same period • Record operating performance and served 49 million passengers FY21 results • Flew 165 million passengers, more than any other U.S. airline • Delivered the best operational performance in company history2 1/ See GAAP to non GAAP reconciliation at the end of this presentation 2/ As measured by on-time departures (D0), on-time arrivals (A14) and completion factor (CF), excludes 2020

Improved operations drove record Likelihood to Recommend 51/ System data. On-time arrivals defined as A14, on-time departures defined as D0. 2/ LTR data prior to 2016 collected under a different methodology and therefore not relevant for comparison. * 2020 results were significantly impacted by Covid-19 related cancellations and are not meaningful for comparison. 2014 2015 2016 2017 2018 2019 2020* 2021 On-Time ArrivalsOn-ti a rivals1 2014 2015 2016 2017 2018 2019 2020* 2021 Completion FactorCompletion f tor1 2016 2017 2018 2019 2020* 2021 Likelihood to RecommendLikelihood to recommend2

Thanks to an amazing team

7 Commercial update Robert Isom President & Incoming CEO

Recovery timeline • Domestic leisure and short-haul international are approaching 100% recovery. • Domestic business revenue recovered to ~70% of 2019 levels in the fourth quarter. Long-haul international traffic remains challenged by COVID related restrictions. 8 Domestic Leisure Revenue Recovery timeline • Particular strength in beach/ski destinations • Expanding now as vaccinations increase Current Status Basis of early recovery path • Travel unlocks with wider vaccine distribution, relaxation of government and corporate travel restrictions • Expected to improve as omicron declines Short-Haul International • Similar trends as domestic leisure • Continued efforts by travel industry to meet entry requirements Long-Haul International Domestic Business • Requires relaxation of corporate travel restrictions • Green shoots reappearing in forward bookings ~40% of 2019 total pax revenue composition ~10% of 2019 total pax revenue composition ~30% of 2019 total pax revenue composition ~20% of 2019 total pax revenue composition

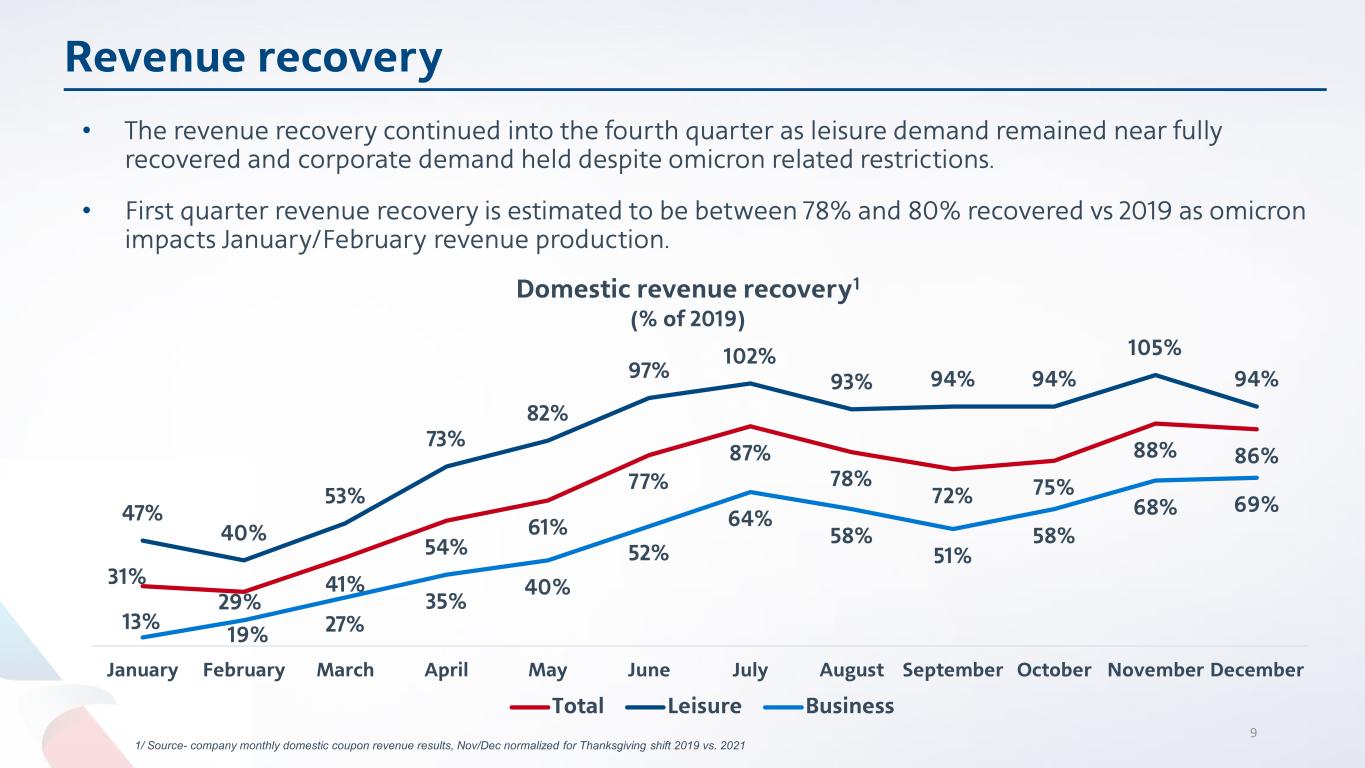

Revenue recovery 9 1/ Source- company monthly domestic coupon revenue results, Nov/Dec normalized for Thanksgiving shift 2019 vs. 2021 • The revenue recovery continued into the fourth quarter as leisure demand remained near fully recovered and corporate demand held despite omicron related restrictions. • First quarter revenue recovery is estimated to be between 78% and 80% recovered vs 2019 as omicron impacts January/February revenue production. 31% 29% 41% 54% 61% 77% 87% 78% 72% 75% 88% 86% 47% 40% 53% 73% 82% 97% 102% 93% 94% 94% 105% 94% 13% 19% 27% 35% 40% 52% 64% 58% 51% 58% 68% 69% January February March April May June July August September October November December Domestic revenue recovery1 (% of 2019) Total Leisure Business

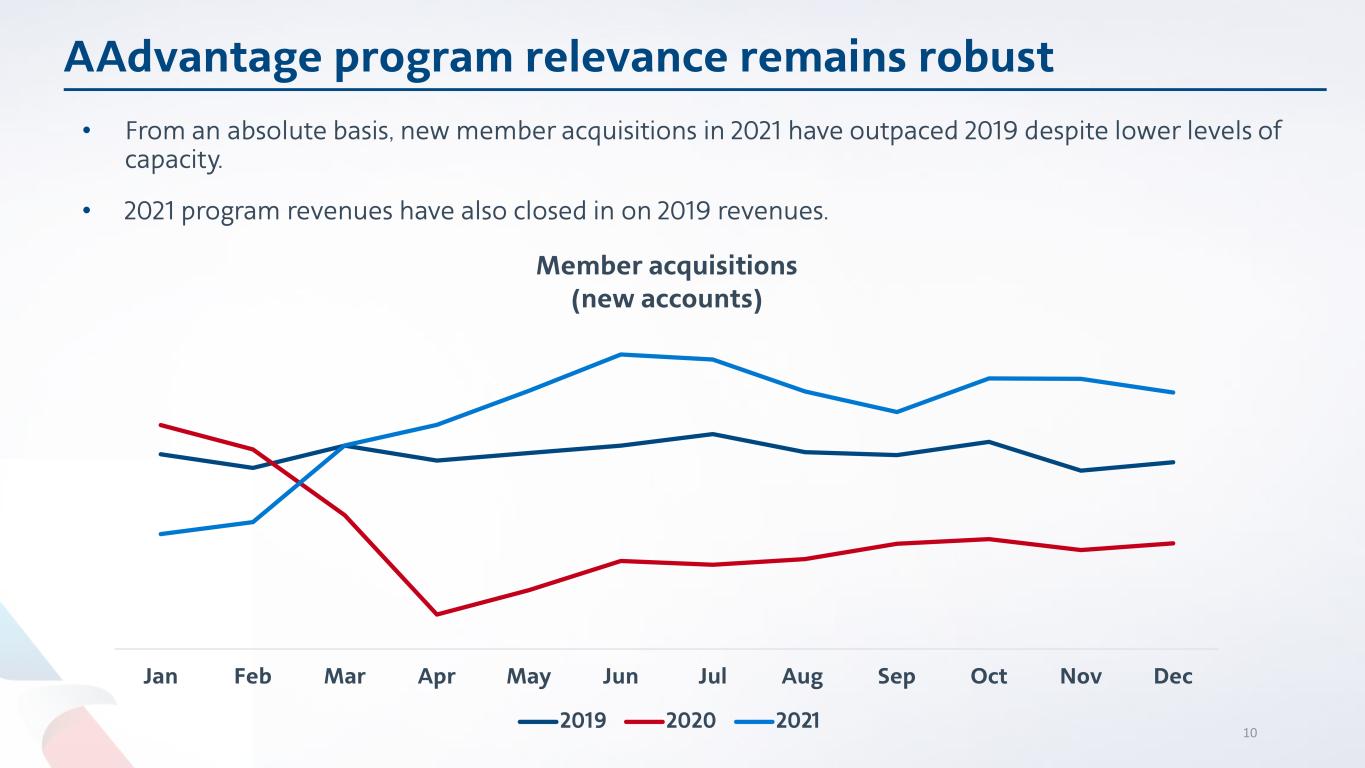

AAdvantage program relevance remains robust 10 • From an absolute basis, new member acquisitions in 2021 have outpaced 2019 despite lower levels of capacity. • 2021 program revenues have also closed in on 2019 revenues. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Member acquisitions (new accounts) 2019 2020 2021

11 Financial update Derek Kerr Chief Financial Officer

Fourth-quarter results 12 Note: May not recalculate due to rounding. 4Q21 4Q20 4Q21 4Q20 Operating Loss (780)$ (2,515)$ (800)$ (2,515)$ Loss Before Income Taxes (1,191)$ (2,809)$ (1,182)$ (2,845)$ Net Loss (931)$ (2,178)$ (921)$ (2,210)$ Loss per common share: Basic and diluted (1.44)$ (3.81)$ (1.42)$ (3.86)$ Weighted average shares outstanding (in thousands): Basic and diluted 648,766 571,984 648,766 571,984 GAAP Non-GAAP (in millions except share and per share amounts)

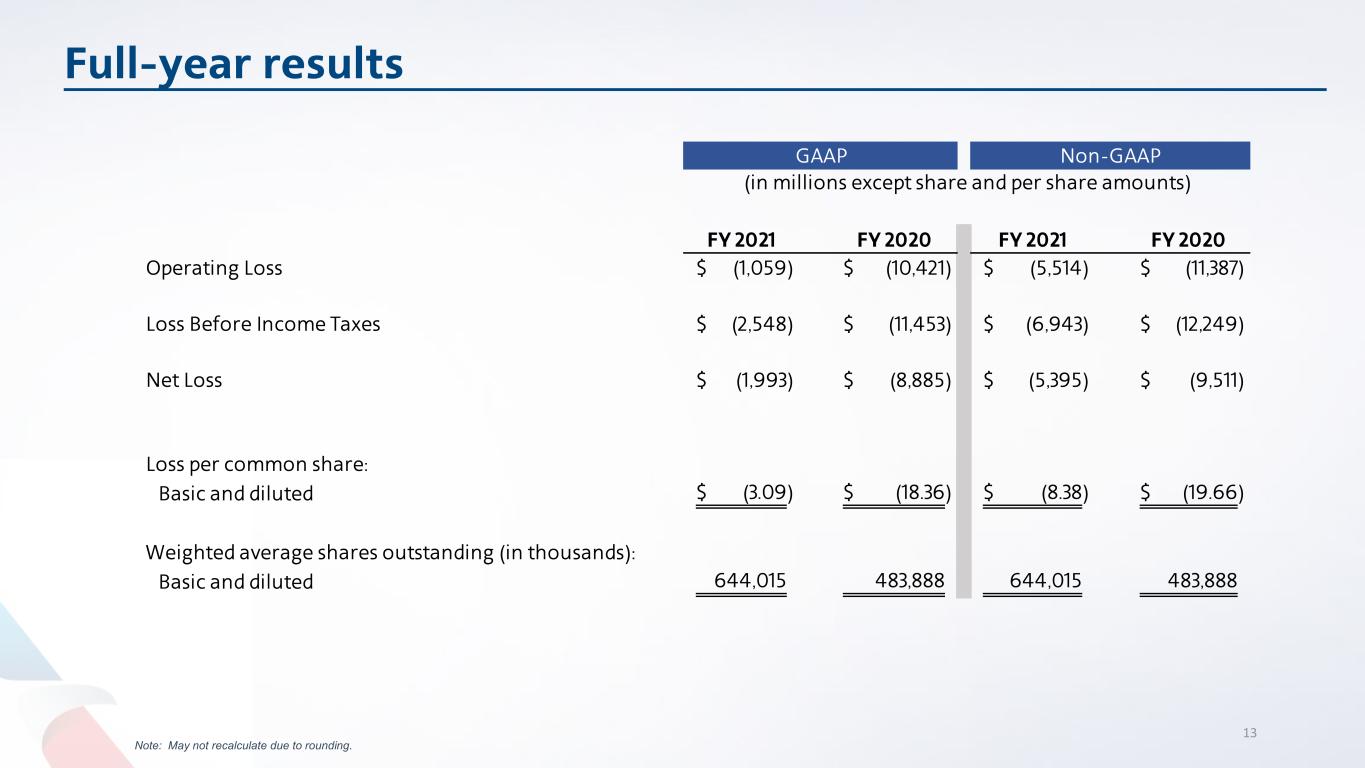

Full-year results 13 Note: May not recalculate due to rounding. FY 2021 FY 2020 FY 2021 FY 2020 Operating Loss (1,059)$ (10,421)$ (5,514)$ (11,387)$ Loss Before Income Taxes (2,548)$ (11,453)$ (6,943)$ (12,249)$ Net Loss (1,993)$ (8,885)$ (5,395)$ (9,511)$ Loss per common share: Basic and diluted (3.09)$ (18.36)$ (8.38)$ (19.66)$ Weighted average shares outstanding (in thousands): Basic and diluted 644,015 483,888 644,015 483,888 GAAP Non-GAAP (in millions except share and per share amounts)

$7 $10 $14 $14 $17 $21 $18 $16 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Total available liquidity1 (in billions) Strong liquidity position 14 • Ended 2021 with $15.8 billion of total available liquidity – the highest year-end liquidity balance in company history. 1/ Total available liquidity is defined as unrestricted cash and marketable securities plus available undrawn revolver capacity and other undrawn facilities.

Balance sheet repair 15 Accelerated deleveraging • Prepaid $950 million of spare parts term loan • Continue to target $15 billion in debt reduction by end of 2025 o Total debt1 down by $3.7B since Q2 Future priorities for excess liquidity • Pay down prepayable debt (~$13 billion) • Free up high-quality collateral • Address short end of maturity curve Strong liquidity and confidence in recovery leads to accelerated deleveraging 1/ Total debt included debt, finance leases, operating lease liability and pension obligations.

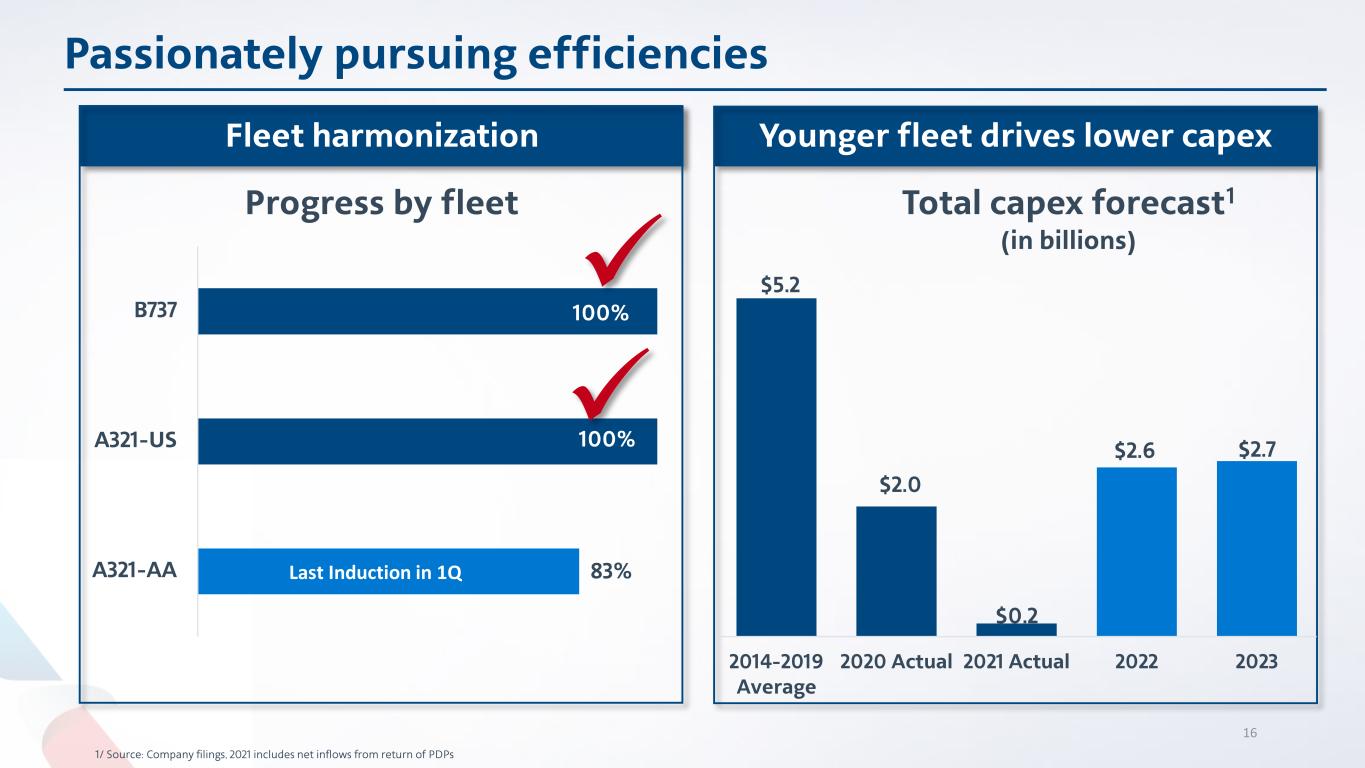

Passionately pursuing efficiencies Younger fleet drives lower capex 1/ Source: Company filings, 2021 includes net inflows from return of PDPs 16 Fleet harmonization $5.2 $2.0 $0.2 $2.6 $2.7 2014-2019 Average 2020 Actual 2021 Actual 2022 2023 Total capex forecast1 (in billions) 83% 100% 100% A321-AA A321-US B737 Progress by fleet Last Induction in 1Q

Investing in the future 17 • Dow Jones Sustainability Index • Became the only passenger airline named to the Dow Jones Sustainability North America Index • Announced SAF offtake agreement with Aemetis, bringing AAL’s total to 120 million gallons • Expanded Network • Announced redesigned loyalty program • Scheduled record setting service in New York and Boston • Added Doha to our JFK network • Expanded codeshare with JB partner Aer Lingus

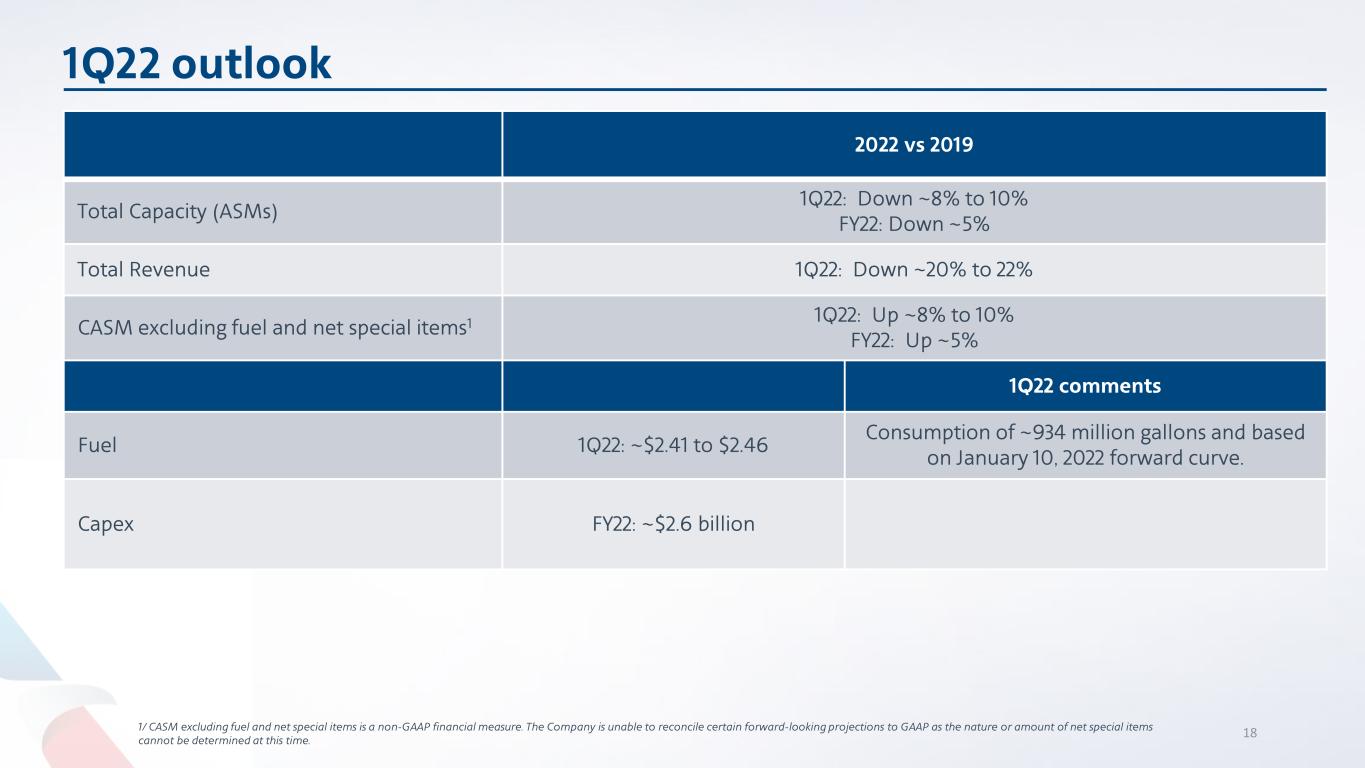

1Q22 outlook 18 2022 vs 2019 Total Capacity (ASMs) 1Q22: Down ~8% to 10% FY22: Down ~5% Total Revenue 1Q22: Down ~20% to 22% CASM excluding fuel and net special items1 1Q22: Up ~8% to 10% FY22: Up ~5% 1Q22 comments Fuel 1Q22: ~$2.41 to $2.46 Consumption of ~934 million gallons and based on January 10, 2022 forward curve. Capex FY22: ~$2.6 billion 1/ CASM excluding fuel and net special items is a non-GAAP financial measure. The Company is unable to reconcile certain forward-looking projections to GAAP as the nature or amount of net special items cannot be determined at this time.

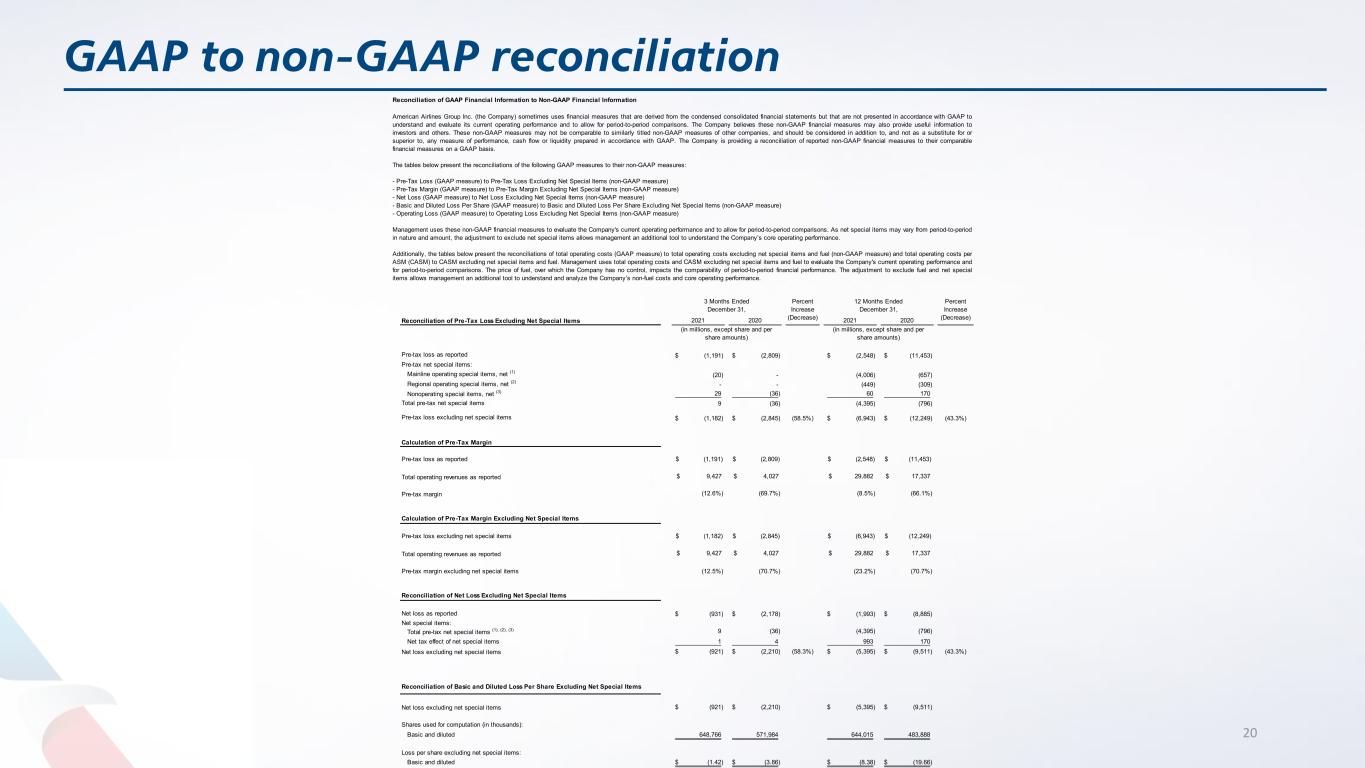

GAAP to non-GAAP reconciliation 20 Reconciliation of GAAP Financial Information to Non-GAAP Financial Information Percent Increase Percent Increase Reconciliation of Pre-Tax Loss Excluding Net Special Items 2021 2020 (Decrease) 2021 2020 (Decrease) Pre-tax loss as reported (1,191)$ (2,809)$ (2,548)$ (11,453)$ Pre-tax net special items: Mainline operating special items, net (1) (20) - (4,006) (657) Regional operating special items, net (2) - - (449) (309) Nonoperating special items, net (3) 29 (36) 60 170 Total pre-tax net special items 9 (36) (4,395) (796) Pre-tax loss excluding net special items (1,182)$ (2,845)$ (58.5%) (6,943)$ (12,249)$ (43.3%) Calculation of Pre-Tax Margin Pre-tax loss as reported $ (1,191) $ (2,809) $ (2,548) $ (11,453) Total operating revenues as reported $ 9,427 $ 4,027 $ 29,882 $ 17,337 Pre-tax margin (12.6%) (69.7%) (8.5%) (66.1%) Calculation of Pre-Tax Margin Excluding Net Special Items Pre-tax loss excluding net special items $ (1,182) $ (2,845) $ (6,943) $ (12,249) Total operating revenues as reported $ 9,427 $ 4,027 $ 29,882 $ 17,337 Pre-tax margin excluding net special items (12.5%) (70.7%) (23.2%) (70.7%) Reconciliation of Net Loss Excluding Net Special Items Net loss as reported (931)$ (2,178)$ (1,993)$ (8,885)$ Net special items: Total pre-tax net special items (1), (2), (3) 9 (36) (4,395) (796) Net tax effect of net special items 1 4 993 170 Net loss excluding net special items (921)$ (2,210)$ (58.3%) (5,395)$ (9,511)$ (43.3%) Reconciliation of Basic and Diluted Loss Per Share Excluding Net Special Items Net loss excluding net special items (921)$ (2,210)$ (5,395)$ (9,511)$ Shares used for computation (in thousands): Basic and diluted 648,766 571,984 644,015 483,888 Loss per share excluding net special items: Basic and diluted (1.42)$ (3.86)$ (8.38)$ (19.66)$ 3 Months Ended December 31, 12 Months Ended December 31, (in millions, except share and per share amounts) (in millions, except share and per share amounts) American Airlines Group Inc. (the Company) sometimes uses financial measures that are derived from the condensed consolidated financial statements but that are not presented in accordance with GAAP to understand and evaluate its current operating performance and to allow for period-to-period comparisons. The Company believes these non-GAAP financial measures may also provide useful information to investors and others. These non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies, and should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with GAAP. The Company is providing a reconciliation of reported non-GAAP financial measures to their comparable financial measures on a GAAP basis. The tables below present the reconciliations of the following GAAP measures to their non-GAAP measures: - Pre-Tax Loss (GAAP measure) to Pre-Tax Loss Excluding Net Special Items (non-GAAP measure) - Pre-Tax Margin (GAAP measure) to Pre-Tax Margin Excluding Net Special Items (non-GAAP measure) - Net Loss (GAAP measure) to Net Loss Excluding Net Special Items (non-GAAP measure) - Basic and Diluted Loss Per Share (GAAP measure) to Basic and Diluted Loss Per Share Excluding Net Special Items (non-GAAP measure) - Operating Loss (GAAP measure) to Operating Loss Excluding Net Special Items (non-GAAP measure) Management uses these non-GAAP financial measures to evaluate the Company's current operating performance and to allow for period-to-period comparisons. As net special items may vary from period-to-period in nature and amount, the adjustment to exclude net special items allows management an additional tool to understand the Company’s core operating performance. Additionally, the tables below present the reconciliations of total operating costs (GAAP measure) to total operating costs excluding net special items and fuel (non-GAAP measure) and total operating costs per ASM (CASM) to CASM excluding net special items and fuel. Management uses total operating costs and CASM excluding net special items and fuel to evaluate the Company's current operating performance and for period-to-period comparisons. The price of fuel, over which the Company has no control, impacts the comparability of period-to-period financial performance. The adjustment to exclude fuel and net special items allows management an additional tool to understand and analyze the Company’s non-fuel costs and core operating performance.

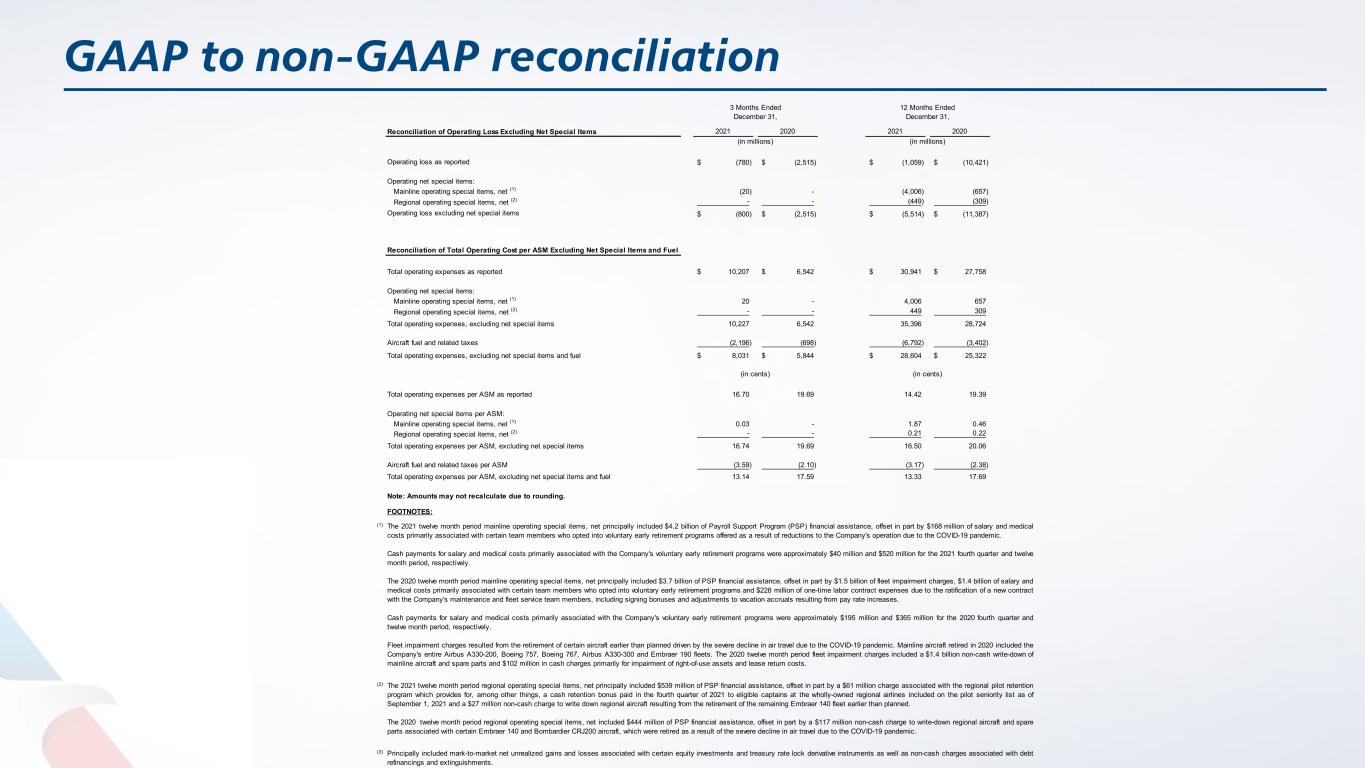

GAAP to non-GAAP reconciliation Reconciliation of Operating Loss Excluding Net Special Items 2021 2020 2021 2020 Operating loss as reported (780)$ (2,515)$ (1,059)$ (10,421)$ Operating net special items: Mainline operating special items, net (1) (20) - (4,006) (657) Regional operating special items, net (2) - - (449) (309) Operating loss excluding net special items (800)$ (2,515)$ (5,514)$ (11,387)$ Reconciliation of Total Operating Cost per ASM Excluding Net Special Items and Fuel Total operating expenses as reported 10,207$ 6,542$ 30,941$ 27,758$ Operating net special items: Mainline operating special items, net (1) 20 - 4,006 657 Regional operating special items, net (2) - - 449 309 Total operating expenses, excluding net special items 10,227 6,542 35,396 28,724 Aircraft fuel and related taxes (2,196) (698) (6,792) (3,402) Total operating expenses, excluding net special items and fuel 8,031$ 5,844$ 28,604$ 25,322$ Total operating expenses per ASM as reported 16.70 19.69 14.42 19.39 Operating net special items per ASM: Mainline operating special items, net (1) 0.03 - 1.87 0.46 Regional operating special items, net (2) - - 0.21 0.22 Total operating expenses per ASM, excluding net special items 16.74 19.69 16.50 20.06 Aircraft fuel and related taxes per ASM (3.59) (2.10) (3.17) (2.38) Total operating expenses per ASM, excluding net special items and fuel 13.14 17.59 13.33 17.69 Note: Amounts may not recalculate due to rounding. FOOTNOTES: (1) (2) (3) The 2021 twelve month period mainline operating special items, net principally included $4.2 billion of Payroll Support Program (PSP) financial assistance, offset in part by $168 million of salary and medical costs primarily associated with certain team members who opted into voluntary early retirement programs offered as a result of reductions to the Company's operation due to the COVID-19 pandemic. Cash payments for salary and medical costs primarily associated with the Company's voluntary early retirement programs were approximately $40 million and $520 million for the 2021 fourth quarter and twelve month period, respectively. The 2020 twelve month period mainline operating special items, net principally included $3.7 billion of PSP financial assistance, offset in part by $1.5 billion of fleet impairment charges, $1.4 billion of salary and medical costs primarily associated with certain team members who opted into voluntary early retirement programs and $228 million of one-time labor contract expenses due to the ratification of a new contract with the Company's maintenance and fleet service team members, including signing bonuses and adjustments to vacation accruals resulting from pay rate increases. Cash payments for salary and medical costs primarily associated with the Company's voluntary early retirement programs were approximately $195 million and $365 million for the 2020 fourth quarter and twelve month period, respectively. Fleet impairment charges resulted from the retirement of certain aircraft earlier than planned driven by the severe decline in air travel due to the COVID-19 pandemic. Mainline aircraft retired in 2020 included the Company's entire Airbus A330-200, Boeing 757, Boeing 767, Airbus A330-300 and Embraer 190 fleets. The 2020 twelve month period fleet impairment charges included a $1.4 billion non-cash write-down of mainline aircraft and spare parts and $102 million in cash charges primarily for impairment of right-of-use assets and lease return costs. Principally included mark-to-market net unrealized gains and losses associated with certain equity investments and treasury rate lock derivative instruments as well as non-cash charges associated with debt refinancings and extinguishments. The 2021 twelve month period regional operating special items, net principally included $539 million of PSP financial assistance, offset in part by a $61 million charge associated with the regional pilot retention program which provides for, among other things, a cash retention bonus paid in the fourth quarter of 2021 to eligible captains at the wholly-owned regional airlines included on the pilot seniority list as of September 1, 2021 and a $27 million non-cash charge to write down regional aircraft resulting from the retirement of the remaining Embraer 140 fleet earlier than planned. The 2020 twelve month period regional operating special items, net included $444 million of PSP financial assistance, offset in part by a $117 million non-cash charge to write-down regional aircraft and spare parts associated with certain Embraer 140 and Bombardier CRJ200 aircraft, which were retired as a result of the severe decline in air travel due to the COVID-19 pandemic. (in cents) (in cents) 3 Months Ended December 31, (in millions) 12 Months Ended December 31, (in millions)

22